What is a Video Essay? The Art of the Video Analysis Essay

I n the era of the internet and Youtube, the video essay has become an increasingly popular means of expressing ideas and concepts. However, there is a bit of an enigma behind the construction of the video essay largely due to the vagueness of the term.

What defines a video analysis essay? What is a video essay supposed to be about? In this article, we’ll take a look at the foundation of these videos and the various ways writers and editors use them creatively. Let’s dive in.

Watch: Our Best Film Video Essays of the Year

Subscribe for more filmmaking videos like this.

What is a video essay?

First, let’s define video essay.

There is narrative film, documentary film, short films, and then there is the video essay. What is its role within the realm of visual media? Let’s begin with the video essay definition.

VIDEO ESSAY DEFINITION

A video essay is a video that analyzes a specific topic, theme, person or thesis. Because video essays are a rather new form, they can be difficult to define, but recognizable nonetheless. To put it simply, they are essays in video form that aim to persuade, educate, or critique.

These essays have become increasingly popular within the era of Youtube and with many creatives writing video essays on topics such as politics, music, film, and pop culture.

What is a video essay used for?

- To persuade an audience of a thesis

- To educate on a specific subject

- To analyze and/or critique

What is a video essay based on?

Establish a thesis.

Video analysis essays lack distinguished boundaries since there are countless topics a video essayist can tackle. Most essays, however, begin with a thesis.

How Christopher Nolan Elevates the Movie Montage • Video Analysis Essays

Good essays often have a point to make. This point, or thesis, should be at the heart of every video analysis essay and is what binds the video together.

Related Posts

- Stanley Kubrick Directing Style Explained →

- A Filmmaker’s Guide to Nolan’s Directing Style →

- How to Write a Voice Over Montage in a Script →

interviews in video essay

Utilize interviews.

A key determinant for the structure of an essay is the source of the ideas. A common source for this are interviews from experts in the field. These interviews can be cut and rearranged to support a thesis.

Roger Deakins on "Learning to Light" • Video Analysis Essays

Utilizing first hand interviews is a great way to utilize ethos into the rhetoric of a video. However, it can be limiting since you are given a limited amount to work with. Voice over scripts, however, can give you the room to say anything.

How to create the best video essays on Youtube

Write voice over scripts.

Voice over (VO) scripts allow video essayists to write out exactly what they want to say. This is one of the most common ways to structure a video analysis essay since it gives more freedom to the writer. It is also a great technique to use when taking on large topics.

In this video, it would have been difficult to explain every type of camera lens by cutting sound bites from interviews of filmmakers. A voice over script, on the other hand, allowed us to communicate information directly when and where we wanted to.

Ultimate Guide to Camera Lenses • Video essay examples

Some of the most famous video essayists like Every Frame a Painting and Nerdwriter1 utilize voice over to capitalize on their strength in writing video analysis essays. However, if you’re more of an editor than a writer, the next type of essay will be more up your alley.

Video analysis essay without a script

Edit a supercut.

Rather than leaning on interview sound bites or voice over, the supercut video depends more on editing. You might be thinking “What is a video essay without writing?” The beauty of the video essay is that the writing can be done throughout the editing. Supercuts create arguments or themes visually through specific sequences.

Another one of the great video essay channels, Screen Junkies, put together a supercut of the last decade in cinema. The video could be called a portrait of the last decade in cinema.

2010 - 2019: A Decade In Film • Best videos on Youtube

This video is rather general as it visually establishes the theme of art during a general time period. Other essays can be much more specific.

Critical essays

Video essays are a uniquely effective means of creating an argument. This is especially true in critical essays. This type of video critiques the facets of a specific topic.

In this video, by one of the best video essay channels, Every Frame a Painting, the topic of the film score is analyzed and critiqued — specifically temp film score.

Every Frame a Painting Marvel Symphonic Universe • Essay examples

Of course, not all essays critique the work of artists. Persuasion of an opinion is only one way to use the video form. Another popular use is to educate.

- The Different Types of Camera Lenses →

- Write and Create Professionally Formatted Screenplays →

- How to Create Unforgettable Film Moments with Music →

Video analysis essay

Visual analysis.

One of the biggest advantages that video analysis essays have over traditional, written essays is the use of visuals. The use of visuals has allowed video essayists to display the subject or work that they are analyzing. It has also allowed them to be more specific with what they are analyzing. Writing video essays entails structuring both words and visuals.

Take this video on There Will Be Blood for example. In a traditional, written essay, the writer would have had to first explain what occurs in the film then make their analysis and repeat.

This can be extremely inefficient and redundant. By analyzing the scene through a video, the points and lessons are much more clear and efficient.

There Will Be Blood • Subscribe on YouTube

Through these video analysis essays, the scene of a film becomes support for a claim rather than the topic of the essay.

Dissect an artist

Essays that focus on analysis do not always focus on a work of art. Oftentimes, they focus on the artist themself. In this type of essay, a thesis is typically made about an artist’s style or approach. The work of that artist is then used to support this thesis.

Nerdwriter1, one of the best video essays on Youtube, creates this type to analyze filmmakers, actors, photographers or in this case, iconic painters.

Caravaggio: Master Of Light • Best video essays on YouTube

In the world of film, the artist video analysis essay tends to cover auteur filmmakers. Auteur filmmakers tend to have distinct styles and repetitive techniques that many filmmakers learn from and use in their own work.

Stanley Kubrick is perhaps the most notable example. In this video, we analyze Kubrick’s best films and the techniques he uses that make so many of us drawn to his films.

Why We're Obsessed with Stanley Kubrick Movies • Video essay examples

Critical essays and analytical essays choose to focus on a piece of work or an artist. Essays that aim to educate, however, draw on various sources to teach technique and the purpose behind those techniques.

What is a video essay written about?

Historical analysis.

Another popular type of essay is historical analysis. Video analysis essays are a great medium to analyze the history of a specific topic. They are an opportunity for essayists to share their research as well as their opinion on history.

Our video on aspect ratio , for example, analyzes how aspect ratios began in cinema and how they continue to evolve. We also make and support the claim that the 2:1 aspect ratio is becoming increasingly popular among filmmakers.

Why More Directors are Switching to 18:9 • Video analysis essay

Analyzing the work of great artists inherently yields a lesson to be learned. Some essays teach more directly.

- Types of Camera Movements in Film Explained →

- What is Aspect Ratio? A Formula for Framing Success →

- Visualize your scenes with intuitive online shotlist software →

Writing video essays about technique

Teach technique.

Educational essays designed to teach are typically more direct. They tend to be more valuable for those looking to create art rather than solely analyze it.

In this video, we explain every type of camera movement and the storytelling value of each. Educational essays must be based on research, evidence, and facts rather than opinion.

Ultimate Guide to Camera Movement • Best video essays on YouTube

As you can see, there are many reasons why the video essay has become an increasingly popular means of communicating information. Its ability to use both sound and picture makes it efficient and effective. It also draws on the language of filmmaking to express ideas through editing. But it also gives writers the creative freedom they love.

Writing video essays is a new art form that many channels have set high standards for. What is a video essay supposed to be about? That’s up to you.

Organize Post Production Workflow

The quality of an essay largely depends on the quality of the edit. If editing is not your strong suit, check out our next article. We dive into tips and techniques that will help you organize your Post-Production workflow to edit like a pro.

Up Next: Post Production →

Showcase your vision with elegant shot lists and storyboards..

Create robust and customizable shot lists. Upload images to make storyboards and slideshows.

Learn More ➜

- Pricing & Plans

- Product Updates

- Featured On

- StudioBinder Partners

- The Ultimate Guide to Call Sheets (with FREE Call Sheet Template)

- How to Break Down a Script (with FREE Script Breakdown Sheet)

- The Only Shot List Template You Need — with Free Download

- Managing Your Film Budget Cashflow & PO Log (Free Template)

- A Better Film Crew List Template Booking Sheet

- Best Storyboard Softwares (with free Storyboard Templates)

- Movie Magic Scheduling

- Gorilla Software

- Storyboard That

A visual medium requires visual methods. Master the art of visual storytelling with our FREE video series on directing and filmmaking techniques.

We’re in a golden age of TV writing and development. More and more people are flocking to the small screen to find daily entertainment. So how can you break put from the pack and get your idea onto the small screen? We’re here to help.

- Making It: From Pre-Production to Screen

- What is Poor Things About — Plot and Themes Explained

- Best Free TV Scripts Online (with PDF Downloads)

- What is an Anagram — The Art of Writing Word Puzzles

- What is a Color Palette — How to Use Them in Visual Arts

- What Was the First Movie With Sound — Film History 101

- 100 Facebook

- 0 Pinterest

How to do a Video Essay: The Video Essay Process

- Plan, Prepare & Create

Storyboarding

- Finding, Filming & Editing

- References & Credits

- The Video Essay Process

This section will give an introductory overview of the stages required to create a video essay. Video essayers advice is to start simple and work through each stage of the video production process. Visit the Resources page of this guide for more.

Identify what is your argument? What is it that you want to communicate to the viewer? Write this down in a few sentences, refer and modify it as required.

Watch Video Essays

Watch a selection of video essays, read blogs and web pages from video essayers and decide what type of video essay you would like to create. Start simple.

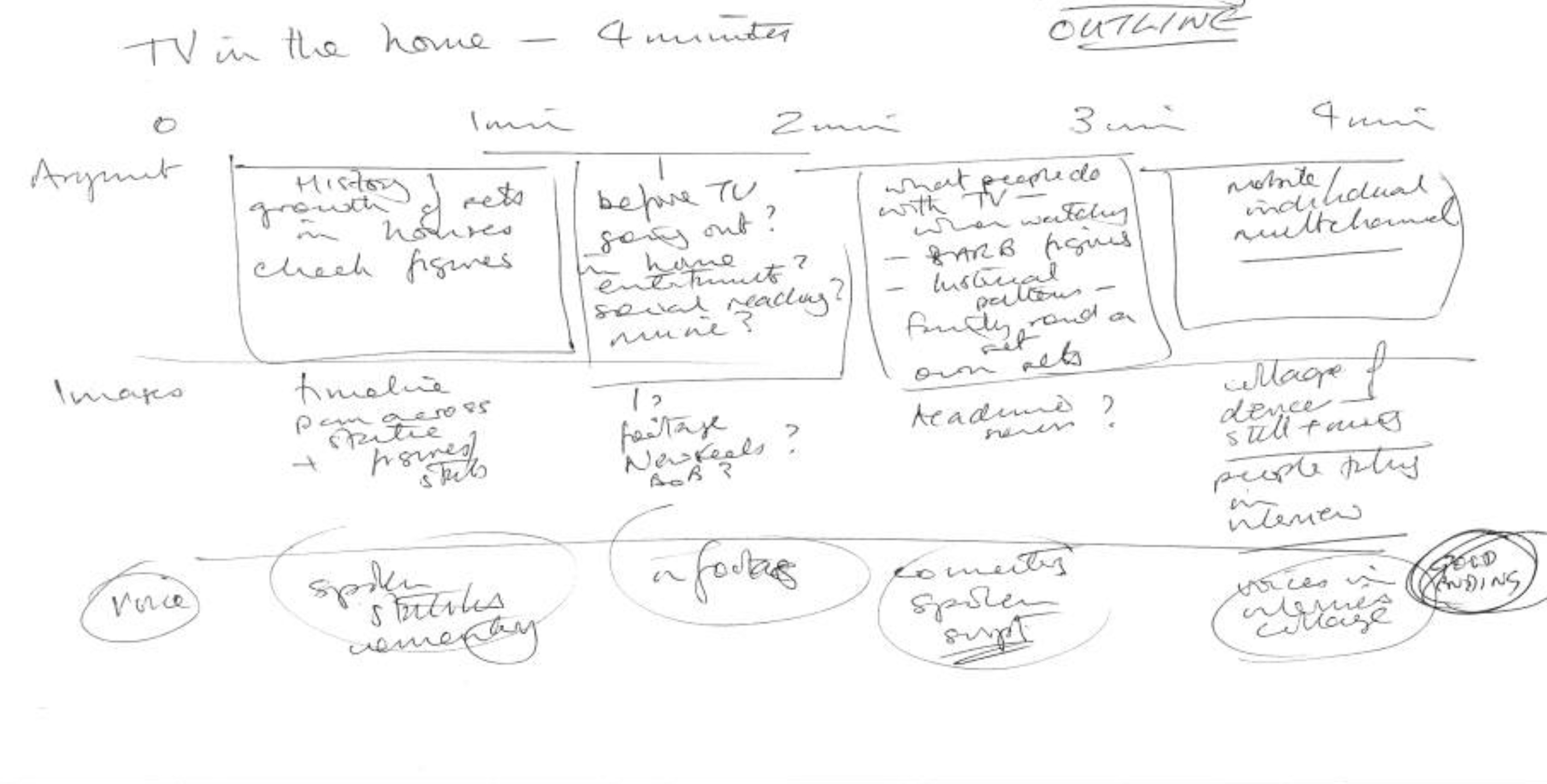

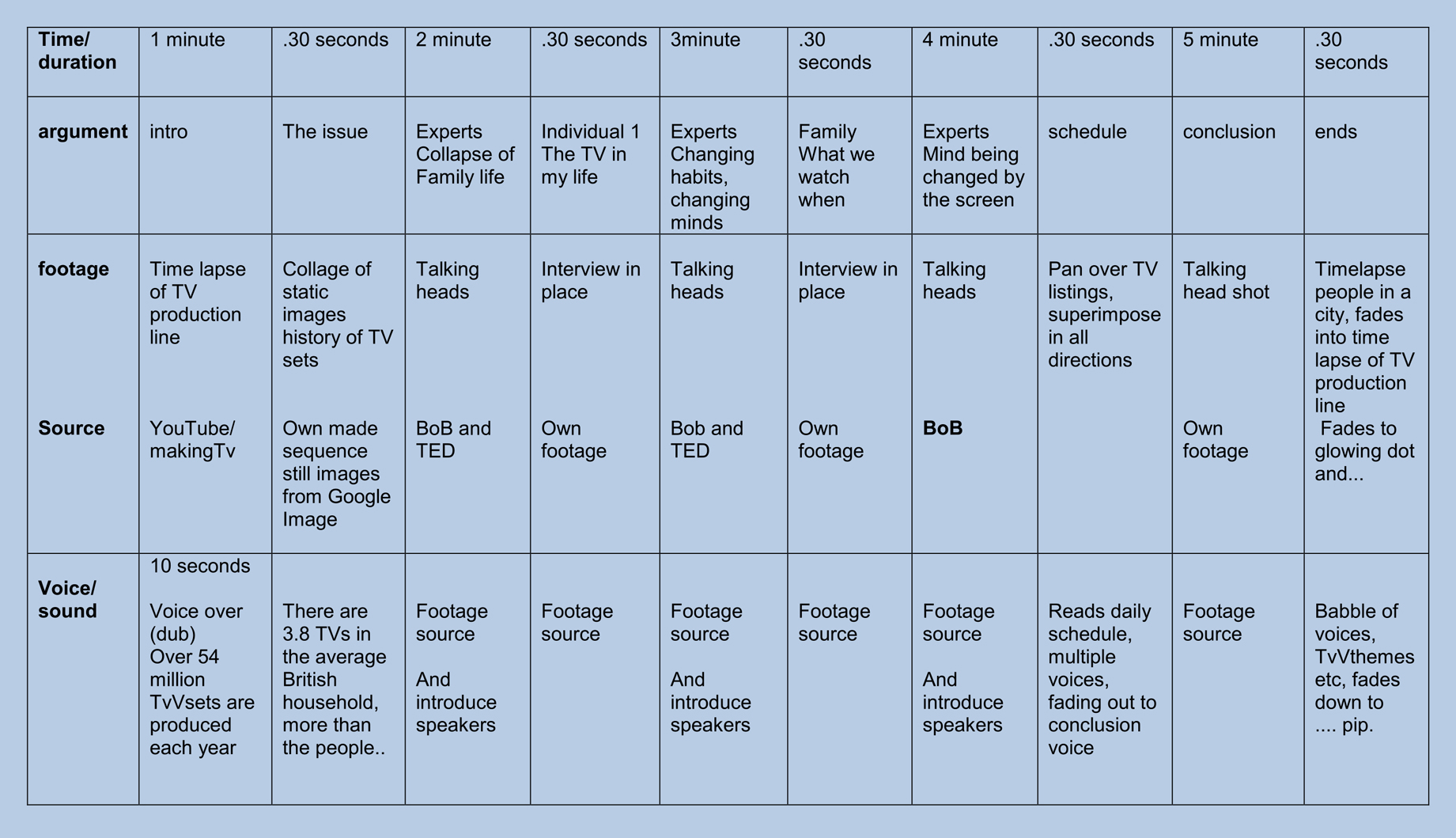

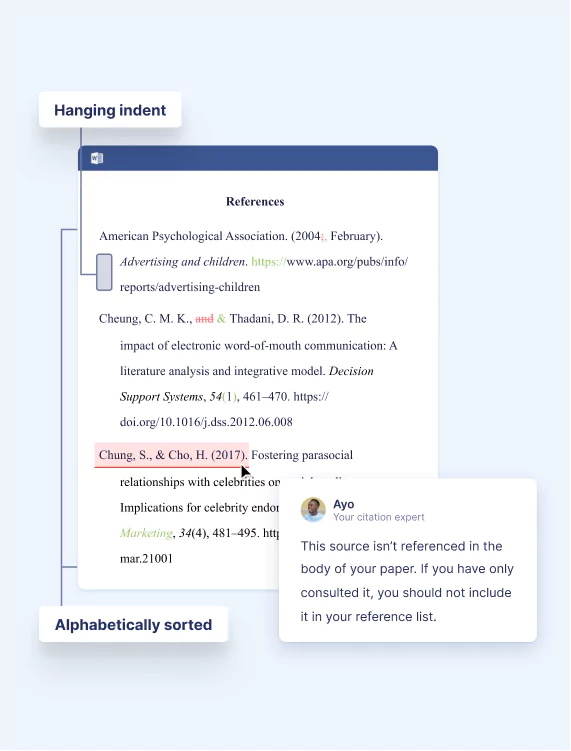

A storyboard is a detailed outline (similar to an outline in a written essay) that helps you to organise and visualise the video essay as to what is on the screen, text, media, message and transitions between shots.

Storyboards assist in determining the length, message and meaning of the video essay and help save time with editing and post production processes.

- Free Storyboard Templates

Collect & Edit

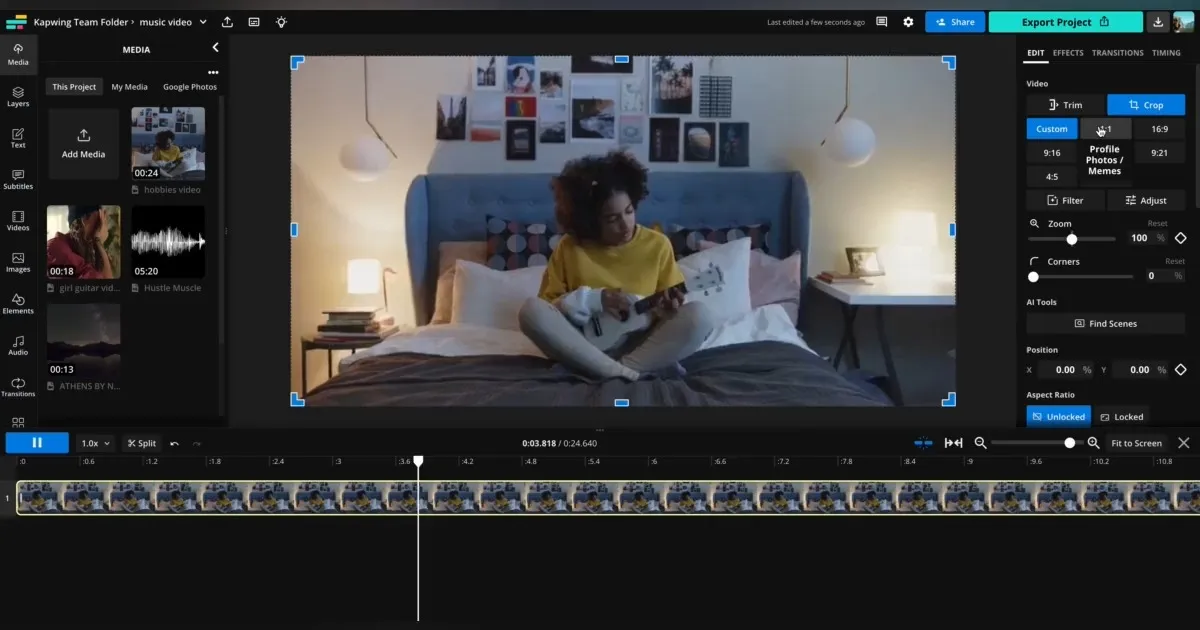

Collect video material as downloads, ripping DVDs, screen grabs, mobile phone footage and create voice-overs. Use research skills to find information and statements to support your argument. Maintain a standard of quality and manage your videos by naming conventions and storage.

Use editing software and experiment with available functionality to enhance and support your argument. Add a voice-over, sound effects, music and other aspects of multimodality. Be sure to include references and credits to all sources used in creating the video essay.

Revisit elements of your video essay and modify as required.

Visit the Resources page of this guide for more.

- Where to find video and how to capture it

- Video Editing Basics - iMovie

- Software Guides

References & Credits

References to cite sources used in the Video Essay. Referencing is a formal, systematic way of acknowledging sources that you have used in your video essay. It is imperative that you reference all sources used (including videos, stills, music, sfx) and apply the correct formatting so that references cited can be easily traced. The referencing style used at ECU is the APA style, 6th ed. 2010. Refer to the ECU Referencing Library Guide for accurate citation in APA style.

Production credits Individuals: acknowledgement of individuals and their role in the production. Purpose: A statement for internal use, e.g. “This video was produced for [course name] at [institution’s name] in [semester, year]”

- Referencing Library Guide

- << Previous: What is a Video Essay?

- Next: Modes, MultiModality & Multiliteracies >>

- What is a Video Essay?

- Modes, MultiModality & Multiliteracies

- A Pedagogy of Multiliteracies

- Modes Of Multimodality

- Video Essay Journals

- Video Essay Channels

- Weblinks to Video Essay Resources

- Weblinks to Creative Commons Resources

- Titles in the Library

- Referencing & Copyright

- Marking Rubric

- Last Updated: Aug 28, 2023 2:57 PM

- URL: https://ecu.au.libguides.com/video-essay

Edith Cowan University acknowledges and respects the Noongar people, who are the traditional custodians of the land upon which its campuses stand and its programs operate. In particular ECU pays its respects to the Elders, past and present, of the Noongar people, and embrace their culture, wisdom and knowledge.

- Learning Tips

- Exam Guides

- School Life

How to Write a Video Essay: A Step-by-Step Guide and Tips

- by Joseph Kenas

- January 5, 2024

- Writing Tips

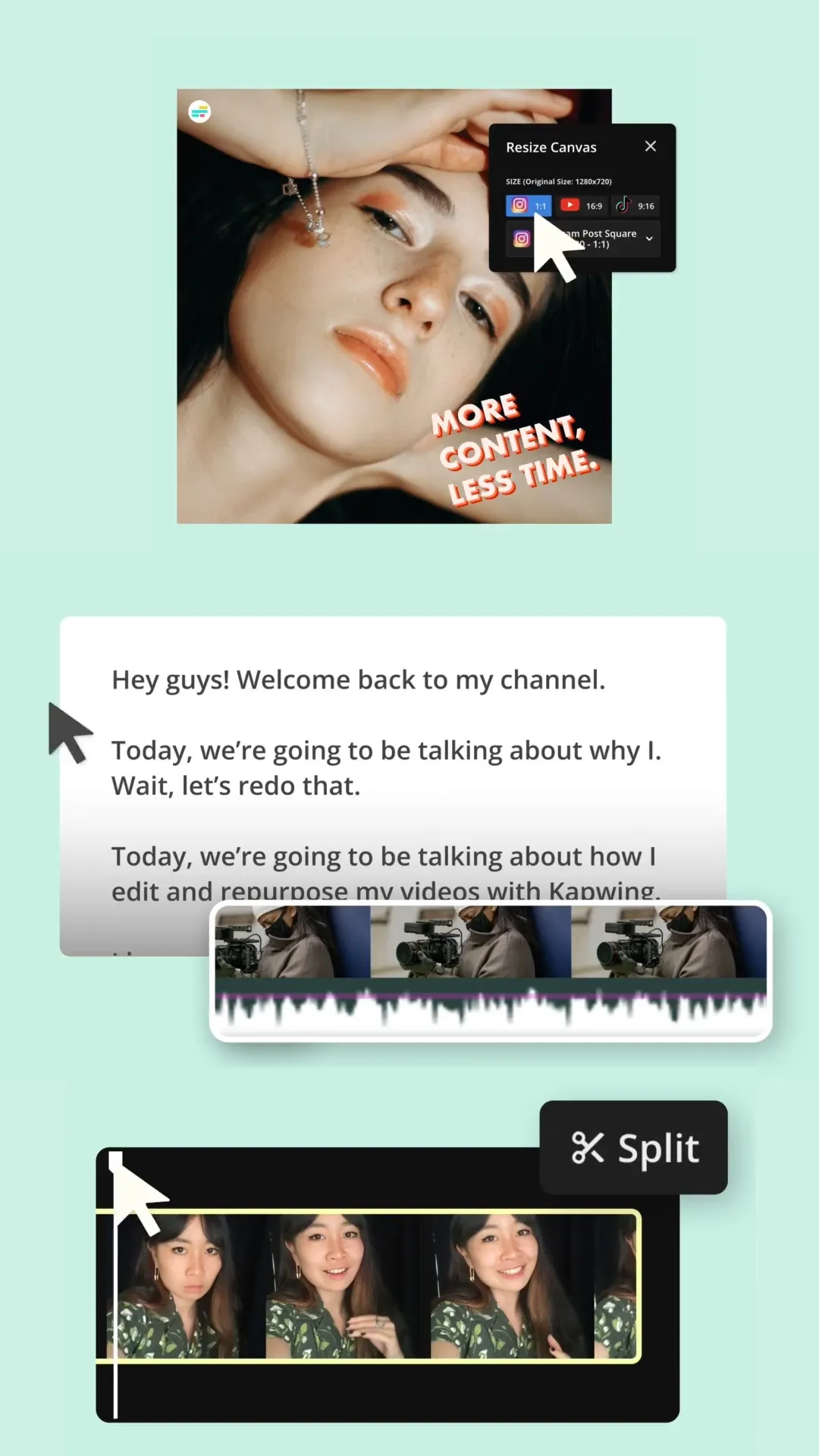

The video essay has become an increasingly popular way of presenting ideas and concepts in the age of the internet and YouTube. In this guide, we present a step-by-step guide on how to write a video essay and tips on how to make it.

While it is easy to write a normal essay, the structure of the video essay is a bit of a mystery, owing to the newness of the term.

However, in this article, we are going to define what is a video essay, how to write a video essay, and also How to present a video essay well in class.

What is a Video Essay?

A video essay is a video that delves into a certain subject, concept, person, or thesis. Video essays are difficult to characterize because they are a relatively new form, yet they are recognized regardless. Simply, video essays are visual compilations that try to persuade, educate, or criticize.

These days, there are many creatives making video essays on topics like politics, music, movies, and pop culture.

With these, essays have become increasingly popular in the era of video media such as Youtube, Vimeo, and others.

Video essays, like photo and traditional essays, tell a story or make a point.

The distinction is that video essays provide information through visuals.

When creating a video essay, you can incorporate video, images, text, music, and/or narration to make it dynamic and successful.

When you consider it, many music videos are actually video essays.

Since making videos for YouTube and other video sites has grown so popular, many professors are now assigning video essays instead of regular essays to their students. So the question is, how do you write a video essay script?

Steps on How to Write a Video Essay Script

Unscripted videos cost time, effort, and are unpleasant to watch. The first thing you should do before making a video writes a script, even if it’s only a few lines long. Don’t be intimidated by the prospect of writing a script. All you need is a starting point.

A video script is important for anyone who wants to film a video with more confidence and clarity. They all contain comparable forms of information, such as who is speaking, what is said, where, and other important details.

While there are no precise criteria that a video essay must follow, it appears that most renowned video essayists are adhering to some steps as the form gets more popular and acknowledged online.

1. Write a Thesis

Because a video essayist can handle a wide range of themes, video analysis essays lack defined bounds. The majority of essays, on the other hand, begin with a thesis.

A thesis is a statement, claim, theme, or concept that the rest of the essay is built around. A thesis might be broad, including a variety of art forms. Other theses can be quite detailed.

A good essay will almost always have a point to express. Every video analysis essay should have a central idea, or thesis, that ties the film together.

2. Write a Summary

Starting with a brief allows you and your team to document the answers to the most pressing project concerns. It ensures that everyone participating in the video production is on the same page.

This will avoid problems of mixing ideas or getting stuck when you are almost completing the project.

3. Choose a Proper Environment and Appropriate Tools

When it comes to writing your script, use any tool you’re familiar with, such as pen and paper. Also, find a writing atmosphere that is relaxing for you, where you can concentrate and be creative.

Consider what you don’t have to express out loud when you’re writing. Visual elements will be used to communicate a large portion of your content.

4. Use a Template

When you don’t have to reinvent the process every time you sit down, you get speed and consistency.

It’s using your cumulative knowledge of what works and doing it over and over again. Don’t start with a blank page when I sit down to create a script- try to use an already made template.

5. Be Conversational

You want scripts that use language that is specific and targeted. Always avoid buzzwords, cliches, and generalizations. You want your audience to comprehend you clearly without rolling their eyes.

6. Be Narrative

Make careful to use a strong story structure when you’re trying to explain anything clearly. Ensure your script has a beginning, middle, and end, no matter how short it is. This will provide a familiar path for the viewers of your video script.

7. Edit Your Script

Make each word work for a certain position on the page when you choose your words.

They must serve a purpose.

After you’ve completed your first draft, go over your script and review it.

Then begin editing, reordering, and trimming. Remove as much as possible.

Consider cutting it if it isn’t helping you achieve your goal.

8. Read Your Script Loudly

Before recording or going on in your process, it’s recommended to read your script aloud at least once. Even if you won’t be the one reading it, this is a good method to ensure that your message is clear. It’s a good idea to be away from people so you may practice in peace.

Words that flow well on paper don’t always flow well when spoken aloud. You might need to make some adjustments based on how tough certain phrases are to pronounce- it’s a lot easier to change it now than when recording.

9. Get Feedback

Sometimes it is very difficult to point out your mistakes in any piece of writing. Therefore, if you want a perfect video essay script, it is advisable to seek feedback from people who are not involved in the project.

Keep in mind that many will try to tear your work apart and make you feel incompetent. However, it can also be an opportunity to make your video better.

The best way to gather feedback is to assemble a group of people and read your script to them. Watch their facial reaction and jot own comments as you read. Make sure not to defend your decisions. Only listen to comments and ask questions to clarify.

After gathering feedback, decide on what points to include in your video essay. Also, you can ask someone else to read it to you so that you can listen to its follow.

A video essay can be a good mode to present all types of essays, especially compare and contrast essays as you can visually contrast the two subjects of your content.

How to make a Good Video from your Essay Script

You can make a good video from your script if you ask yourself the following questions;

- What is the video’s purpose? What is the purpose of the video in the first place?

- Who is this video’s intended audience?

- What is the subject of our video? (The more precise you can be, the better.)

- What are the most important points to remember from the video?- What should viewers take away from it?

If the context had multiple characters, present their dialogues well in the essay to bring originality. If there is a need to involve another person, feel free to incorporate them.

How to Present a Video Essay Well in Class

- Write down keywords or main ideas in a notecard; do not write details- writing main ideas will help you remember your points when presenting. This helps you scan through your notecard for information.

- Practice- in presentations it is easy to tell who has practiced and who hasn’t. For your video essay to grab your class and professor’s attention, practice is the key. Practice in front of your friends and family asking for feedback and try to improve.

- Smile at your audience- this is one of the most important points when presenting anything in front of an audience. A smiley face draws the attention of the audience making them smile in return thus giving you confidence.

- Walk to your seat with a smile- try not to be disappointed even if you are not applauded. Be confident that you have aced your video presentation.

Other video presentations tips include;

- Making eye contact

- Have a good posture

- Do not argue with the audience

- Look at everyone around the room, not just one audience or one spot

- Rember to use your hand and facial expressions to make a point.

Joseph is a freelance journalist and a part-time writer with a particular interest in the gig economy. He writes about schooling, college life, and changing trends in education. When not writing, Joseph is hiking or playing chess.

4 Easy Steps On How To Make A Video Essay

Just like photo essays and traditional essays, video essays tell a story or make a point. The only difference is that it presents the information or story in video form.

However, how to make a video essay is a general question in today’s time. As the development of technology and easy access to the internet has changed the traditional method of narrating a story through written essays has to be video essays. It is quite easy to connect with people through videos as compared to written essays as you can attract them in both express and implied ways. It has risen as an effective and efficient mode of presenting the information.

Thus, this blog will help you understand how to make a video essay proficiently and the significance of making such an essay. Let’s start by discussing what a video essay is.

What is a video essay?

Table of Contents

The essay is a short formal piece of writing to express one’s thoughts, stories, arguments, and so on. Video essay means narrating the content of an essay in a video through pictures, text, music or narration, etc.

This is why it is a bit challenging to make a videos essay as compared to writing a traditional essay. Hence, the importance of learning how to make a video essay arises.

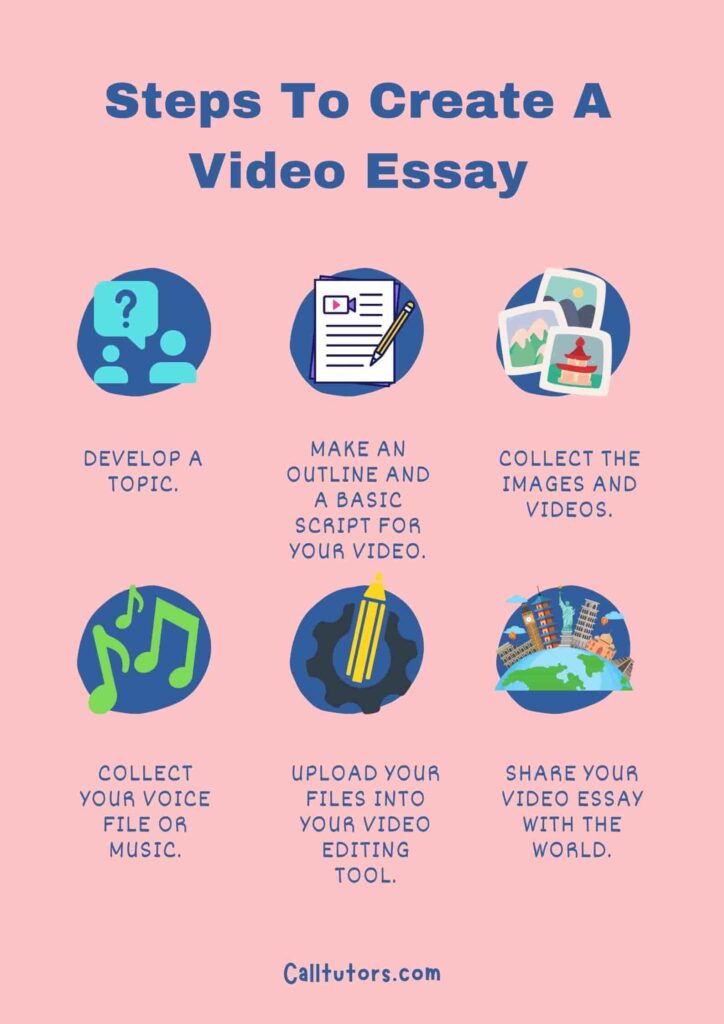

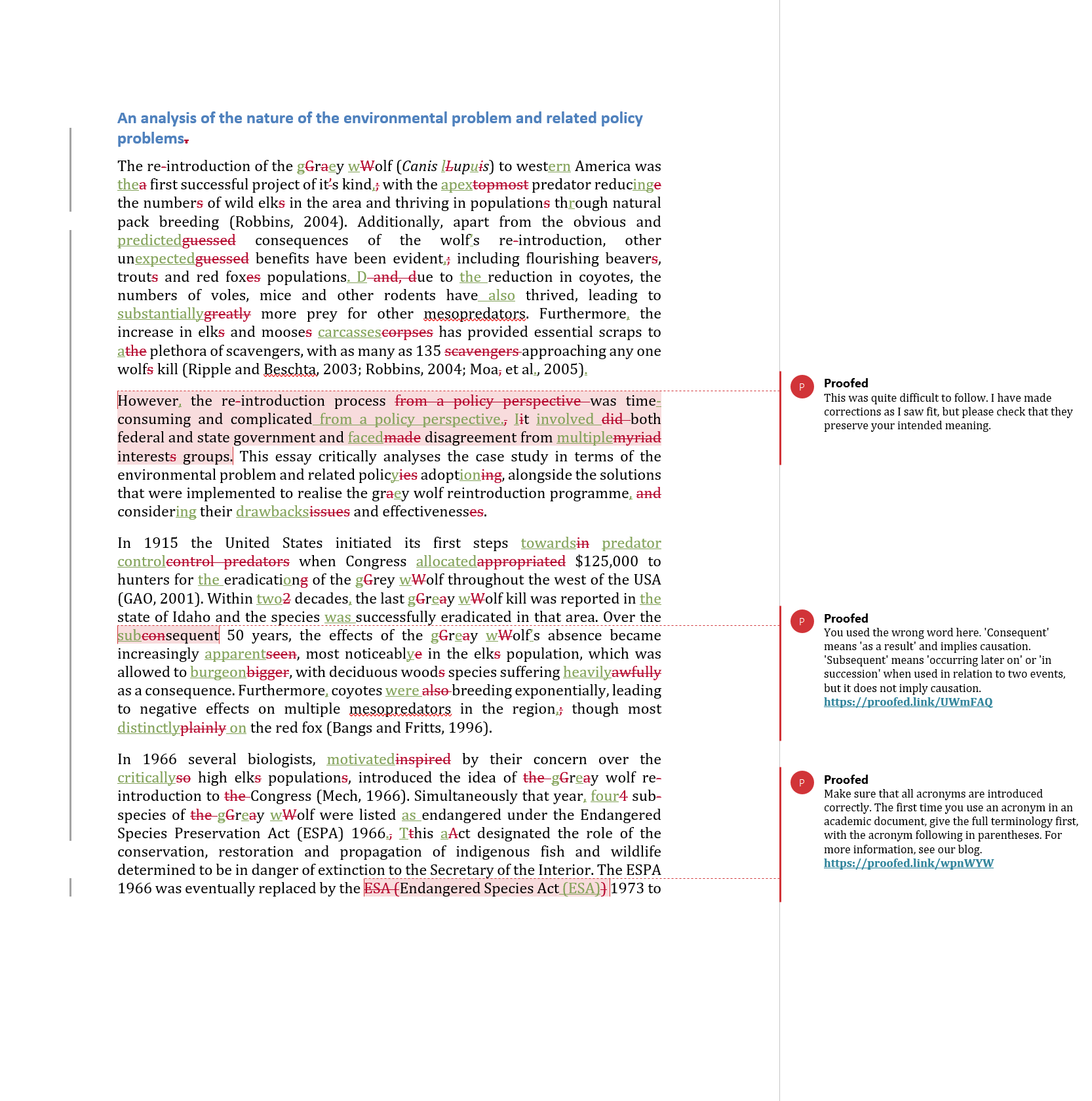

The following picture shows the steps that will help you get going with your project.

How to make a video essay?

Following are the steps involved in how to make a video essay:

1. Contemplate your topic wisely

- The first and the foremost step in how to make a video essay is to choose a topic for your essays. You can’t jump on to other steps before finalizing your topic. Your topic must address a brief content of the essay. Since it’s a videos essay therefore you have to decide a catchy title with a view to attract and allure your audience.

- While contemplating a topic for the essay you should always keep in mind that the product or content is the second thing but the title is the first thing to tell the audience about the essay.

2. Create a script and structure

- After deciding a topic now you have to create a story from your idea. Since video essays work as written essays, therefore you have to build a story on your idea in an interesting way.

- As in a written essay you have to build a structure and outline to present your story, likewise in a video essay you have to drive a video in three stages beginning, middle, and end.

- This step is very mandatory and has to be observed very cautiously. Create your narration or pictures, text beforehand so that you narrate the actual story in the perfect format.

- As soon as you will make your outline then you can write your script in an efficient and effective manner. Writing a story is an art so make it worth watching.

3. Decide the right clips and images

- By now you have decided your title, outline, and structure for your video essay. Now the next step in how to make a video essay is to choose the right clips and images to tell the story in the best manner.You can create clip by selecting the most relevant parts of your footage and trimming them down to fit your story’s pacing and structure. Additionally, consider using images that help illustrate your points or add visual interest to the video.

- Since this is the best advantage of a videos essay that you can use pictures and clips to share your views so you also have to make the best use of them accordingly.

- Always use only those pictures, clips, and texts which directly suggest your point of view or argument or your experience and so forth.

- To choose the most suitable clips and texts and images you must have a rich library of the same. The rich library will help you to find exactly what you need and want to support each and every point you make and to rebut the point you want to rebut. Conclusively, you will craft a better video.

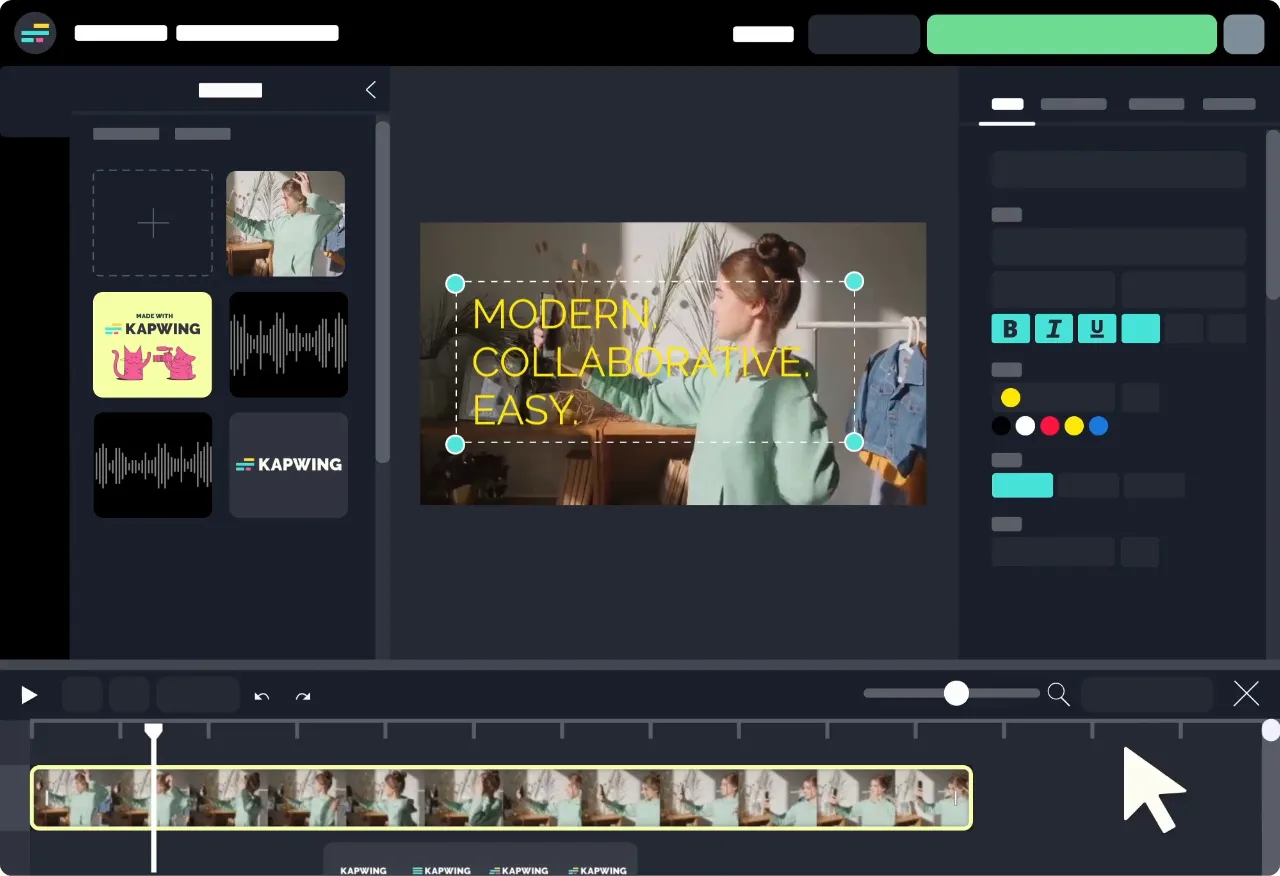

4. Edit the video into a single essay

- You have everything ready to go and you are only left to collect and merge all the chosen images and footage into a single video to give it a form of narration.

- While editing your video essay you can use any tools related to editing the videos as there are several videos editing too . It will help you to garnish your video in an attractive manner. You can make changes in the video while remembering your targeted audiences.

How long should a video essay be?

A 10-minute video essay that is clear, focused, stylish, and well-crafted is much better than a 60-minute video essay that is loose, vague, obvious, and thrown together. Thus, concerning traditional written essays, the following are the idea of the expected length of a video essay:

Bonus Point

What are the best video editors.

Following are the best video editors that are free of cost:

(i) Lightworks: It is the best free choice for those who want to create professional-quality movies or videos without spending a penny.

(ii) Hitfilm express: It is also free-to-use video editing software. This software adjusts color balance, trim clips, and exports your projects in different video formats.

(iii) Movie Maker Online: It is a video editor that runs in your browser. to edit a video, you have to upload an unusual vertical project timeline where you can crop clops and add filters or transition effects.

(iiii) Canva: Canva is renowned for offering tens of thousands of templates in every format imaginable for use on every publishing platform. The features that make Canva video editor a fun, special, and effective tool include real-time collaboration, self-recording plus screen recording that is ideal for classes, training, and webinars, pre-licensed audio tracks, content planner, and publisher, as well as brand kit and colors. Canva’s video editor is also accessible on your browser (for online editing), desktop download (if you want offline editing), and mobile (iOS and Android).

If you are well versed with this blog, then sure, you know how to make a video essay efficiently and effectively.

Video Essay As Form Of Marketing

The video essay is the latest popular style of essay in which a short video is made to narrate a story or anything as per the genre of the essay. That is why it has emerged as an effective tool of marketing as now companies can sell advertises their products through video essays instead of advertisement videos. This is more efficient than traditional advertisements because it does not directly intend to do marketing. Instead, it depicts the importance of the product through pictures, video clips or story narration, etc. But all this is possible only when you know how to make a video essay.

Quick Links

- The Complete List Of Cause And Effect Essay Topics

- How To Write An Essay Plan?

With the emergence of technology and awareness of technology in people, the method of academics has completely changed and video essay is one of the modern aspects. In video essays, You can create clip by selecting the most relevant parts of your footage and trimming them down to fit your story’s pacing and structure. Additionally, consider using images that help illustrate your points or add visual interest to the video. It has also become a tool of digital marketing owing to its advantages. But all this is possible only when you know how to make video essays and all the guidelines thereto. It will help to make a good video essay.

Hope you have found out from the above information how to make a video essay, but if you still have any doubts, then you can help from our experts through essay writing help , write essay for me in a very short period, and how to write my essay in an easy way.

What Makes A Video Essay Great?

According to Max Marriner, intellectual accessibility, genuine or hard-hitting evidence, and an engaging host are key formulas for making a good video essay.

Who Made The First Video Essay?

Mathew Turner created a viral youtube essay arguing that Daniel LaRusso, the young hero of the 1984 film, The Karate Kid, was actually the movie’s villain. You first need to know the story behind the video he posted to youtube.

How Do You Structure A Video Essay?

The video essay will have the same features as an essay; an introduction, argument, discussion, and conclusion. Students should be enabled to approach the development of the video essay in the same way as their academic essays; research, write, plan, prepare, edit, and submit.

Similar Articles

Top 19 Tips & Tricks On How To Improve Grades?

Do you want to improve your grades? If yes, then don’t worry! In this blog, I have provided 19 tips…

How To Study For Final Exam – 12 Proven Tips You Must Know

How To Study For Final Exam? Studying for the final exam is very important for academic success because they test…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

We use cookies to improve your browsing experience and to personalise content for you. See our privacy and cookie policy .

Home Resources Free Guides Video Essays Guide

Video Essays Guide

Introductory guide to video essays., drawing on the inspiring work of pioneering educators and researchers engaging with this creative method, this guide aims to offer a research-led introduction for students, teachers and researchers approaching the video essay for the first time..

Introduction to Video Essays

Studying and researching film through film

A research-led introduction for students, teachers and researchers approaching the video essay for the first time.

Finding Coherence Across Journals

Guidelines and criteria for making, curating and publishing video essays

A look at the existing guidelines for the production and evaluation of video essays.

How To Make Video Essay Guides

Preproduction, Production, Postproduction

Considerations for planning, making and editing a video essay.

Copyright Considerations

How copyright law regulates the creative reuse of existing materials

Understanding the basic principles of copyright law when producing or using creative works.

Dissemination

A selected list of journals and websites where you can publish video essays.

Video essays as creative assessment method at SOAS, University of London

Reducing the uncertainty around creative assessment methods.

About this guide

Authors's biographies, list of references and contact details

Launch Event

An online event organised by Learning on Screen in collaboration with SOAS, University of London.

Scripting Video Essays: How to Write a Great Narrative

There are many ways in which you can write video essays. Some have argued that video essays are a new trend in the world of creative writing. There is so much emphasis on developing a story from visuals, photographs, videos, and music to tell an enduring tale or lesson in this day and age.

So, if you want to join the video essay bandwagon as an artist, expert, researcher, or student, you must know how to write them first before creating them.

Writing a narrative video essay is a great way to share your ideas with the world. Narrative essays let you not only say something meaningful but also show it. A good narrative video essay is also about the art of visual storytelling.

But first, if you are wondering what exactly is a video essay. Let’s address it first.

What is a Video Essay?

A video essay is a form of a documentary-like video narrative film using film footage, video clips, and graphics to discuss an issue or topic. Academics and artists can typically use video essays to discuss their research.

In addition to blog posts and magazine articles, video essays are a new type of storytelling in the digital world. They take one idea and meticulously construct a narrative on how it came to be, how it’s been used/applied, or what it means.

In its most popular form (one person talking head), a video essay is made up of between 3-7 minutes in length and usually presents one concept or topic.

It often looks at a film and demonstrates how it is engaging in meaning or does not. The video essay can also emphasize the acts performed by actors or directors, such as performance, staging, and editing techniques.

But today, it is not fixated to film subjects only. You can also expand your visual stories about anything under the sun like history, politics, science, technology, etc. Just choose an idea and proceed with your essay writing.

Here is an excellent example of the best video essays – Example: Best Video Essays by Vox

How do you Create a Narrative in your Video Essay?

To create a compelling video essay, you must know how to write an essay with a video component to produce a compelling story. A good video essay should have the following qualities:

- It should be insightful, thought-provoking, or informative.

- It should be argumentative and practice critical thinking

- It should be visual, formal, and well-structured.

- It should help the viewer understand and appreciate a topic/situation from various angles.

- It should inspire viewers through findings, vocabulary, and plot.

The best video essays also use candid footage and demonstrate the use of nonfiction or documentary filmmaking techniques . And the main reason why people gravitate towards narrative essays is that they let you show your ideas visually to your viewers.

How to Write a Video Essay Script?

Many people are starting to make video essays as a way of presenting their own thoughts and experiences. The problem is that these videos do not have any actual narration, leaving the viewer lost trying to understand what’s happening.

But to write a grand narrative, you must follow the following stages:

Brainstorming ideas is the first stage. At this stage, you should list a few interesting concepts in an organized way. You may want to use the topic form like: “A Case for Video Essays” or “How to Create a Story Using Text and Images?” So, while ideating, follow these:

- Begin by picking a topic ( mostly what you are passionate about).

- Think about your point of view and audience.

- Set up the background and context for your essay or story (the “what”).

- Reveal the turning point in your story (the “why”).

- Provide evidence to support your account of events (the “where”)

- Discuss how the incident relates to broader social concerns (the “what now?”).

Research is the next stage of writing a video essay. The moment you decide to make a video essay, you should have enough information about the topic. The more information and research you do in the ideation stage, the easier it will be for you as a writer and speaker to share your knowledge with the audience. Research may include:

- Finding out facts from books, interviews, or research papers.

- Finding out relevant video footage of the person, place, or event.

- Getting access to the video footage of a particular event (e.g., presidential speeches).

- Find audio or video files on the Internet and transcribe them into text format (e.g., podcasts, interviews).

- THE ESSAY STRUCTURE:

Because the video essay is still relatively new, there are no definitive rules about structure and genre for these films. But still, we should adhere to some basic rules while constructing the script structure. Your structure is the most crucial stage for a crackling narrative.

The essentials of a great narrative essay structure are as follows :

- First, create a rough outline from your research material.

- Think about a compelling opening line with a single line answer to the question of the essay

- Begin with questions, then answer in a way to create an argument.

- The Argument then leads to the next question.

- The emotion and Tone of the script should be formal, thought-provoking, insightful, and informative, supported by relevant visual reference.

- The essay must represent a single point of view.

- But it should be a well-reasoned perspective.

- It must have the writer or creator’s personal touch.

- Good writing is about the economy of words articulated to the point.

- Don’t forget to mention the What is the Takeaway for the audience.

- Don’t make it lengthy. Video essays are also about documenting or reviewing videos. So the script should not eat it all.

- Once you have structured the script, go back to the beginning and review your work.

Once you have prepared a rough draft of your essay, read it out loud and find the rhythm in the story. Is it telling the theme visually? Rewrite and get the tone right. Your first few scripts may not be satisfactory. Don’t worry about that. It is a learning process.

- WRITING THE FINAL DRAFT:

Now, once you have gotten all the ideas into a script, you will be eager to write the final draft. At this stage, make sure to follow the following tips:

- Make sure every line is comprehensible so that viewers can easily understand your point of view without missing anything important in it.

- Proofread and make sure that you don’t leave any unfinished work or broken sentences in the video essay structure.

- Check the length of the video essay and make sure to follow the minimum requirements.

- Once you are done with the script, check for the formatting of your work.

- Spend extra time on a great narration that helps explain your content effectively and concisely.

- Get a clear idea about what you want to say so that you know what kind of images to use in the final draft of your essay and how they should be arranged.

- Conclude the essay by providing the audience with everything they need to know about your subject.

For a compelling narrative, the first thing to do is identify what makes the story you are trying to tell unique and why an audience wants to learn about it.

Related Question:

Are Video Essays Popular Today?

Though the concept was coined in the mid-1990s, it has only become popular in the last five years or so. As of now, a considerable amount of video essays and short films are uploaded on Youtube. Some have even garnered millions of views. The prominent mentions are the Nerdwriter, and Every Frame is a Painting.

check out – Best Video Essays of last year

How Long Does a Video Essay Take to Write?

If you are writing a long video essay, it can take you a considerable amount of time. However, if you aim to create a short film covering one event, it can be done in a day or two.

But, you may take time if you don’t have the research material in your hand.

Final words:

The video essay became popular because it is a way to engage with the writer rather than just “watching” them talk about something. But, to make a great narrative, you have to research a lot and put in your best efforts.

We hope this write-up has helped you create a great video essay. Happy writing!

Newbie Film School

Recent Content

What To Study To Become A VFX Artist?

Unlock the secrets of becoming a VFX artist by blending creativity, technical expertise, and practical skills. Discover the different streams of VFX, study at institutions or learn independently, and...

8 Tips For Shooting Your Own Videos On YouTube

When it comes to shooting your YouTube videos as a content creator, what are some crucial information you must keep in mind? Here are the tips for shooting your own videos on YouTube

Creative Arts Toolkit

The video essay, what is a video essay.

A video essay – like a written essay – develops an argument on a defined topic, working as a kind of argument, explanation, discussion. The topic will have been either given to you (e.g. as a set essay question) or developed by you in negotiation with your tutor.

The video essay is linear, time-based, and requires a complex interplay of developing ideas and gathered material. It uses:

- moving image visual elements;

- spoken word commentary and/or caption cards, subtitles, etc.

A video essay is not a simple collage or montage of material. It works partly by juxtaposition, by placing images in sequence and using them as ‘reveals’, but it is also structured by a ‘presence’ and ‘intervening consciousness’ – an essay author, in other words – that directs the viewer’s attention and takes them on a thought-provoking journey.

In short, a video essay is a kind of persuasive storytelling, presenting a viewpoint and the evidence for it, telling a convincing story about it. To be done well, it needs to be:

- planned in detail;

- fully documented;

- storyboarded

Do not just present a random sequence of materials which vaguely refer to a topic: that is not a video essay and is a sure route to assignment failure.

And overview of the process

A video essay uses ‘footage’ sourced from libraries, archives, or other collections (BoB: Box of Broadcasts, YouTube, ted: torrent episode downloader, etc.) which is carefully selected and edited, and which:

- incorporates ‘talking head’ sections where the author (or others) speak to the camera in original shots made for the purpose;

- uses captions, subtitles and/or other on-screen text to comment on images, to add to them, to subvert them;

- incorporates panning, tracking over, or zooming in and out of static images to reveal detail;

- uses transitions to manage time, maintain interest and interconnect the extracts, excerpts and commentaries.

In many ways a video essay is a semi-documentary form and requires many of the same kind of strategies. It means identifying a topic and gathering material, working with that material to develop, refine and understand the idea more fully, working from a clear vision of how the final sequence will be.

This is no mean task and should certainly never be seen as an ‘easy option’ in comparison to traditional essay work.

How long should a video essay be?

This is a bit of a ‘how long is a piece of string’ question and there is no hard and fast answer. However, it is worth thinking about the following:

- Many students who attempt the video essay format are unrealistic in their ambitions, proposing pieces of work which are an hour in length, or even longer. Be sensible: to produce an effective video essay of even a few minutes requires a considerable amount of work. The aim is not to make a feature film.

- A 10 minute video essay that is sharp, focused, stylish, and well crafted is far better than a 60 minute video essay that is loose, vague, obvious and thrown together.

So, in relation to a traditional written essay, the following might offer an idea of expected equivalent length:

- for a 1500-2000 word essay, think in terms of a video essay of 8-10 minutes in length

- for a 2000-2500 word essay, think in terms of a video essay of 10-15 minutes in length

- for a 4000-6000 word essay, think in terms of a video essay of 15-20 minutes in length

Of course, these are only guidelines, and in each case you would also need to submit appropriate supporting documentation, including scripts, storyboards, research folder, and assets list/bibliography (see below).

Storyboarding: essential for a successful outcome

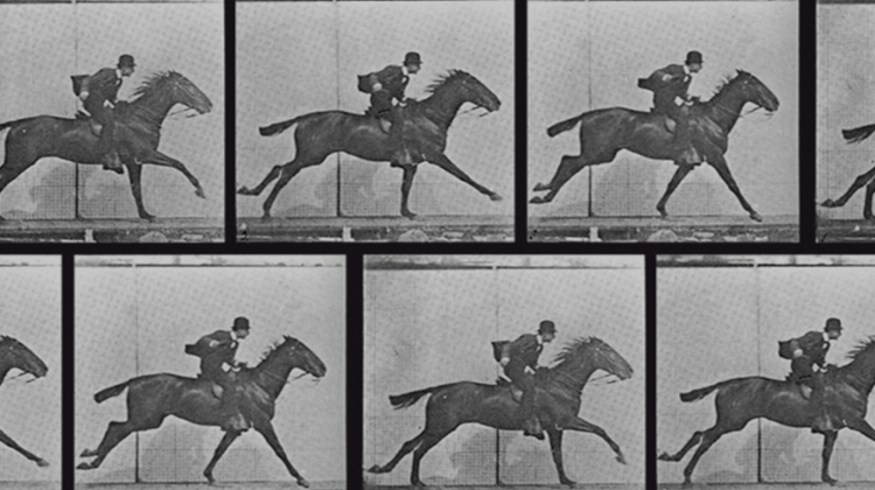

A video essay requires conceptual thinking and organization, record keeping, documentation. To this end it needs some sort of storyboarding as an integral part of shaping ideas and materials. Effective storyboarding underpins the conceptual planning and the creative realisation of the video essay.

At its simplest a storyboard is a way of working with time-based sequences ‘off-line’ in either a conceptual, inventive state, dreaming up the sequence, or in a tighter, more organised, planning state to control resources, pre-visualise outcomes, identify and solve problems before they arise. Working ‘off-line’ like this is both cheaper and clearer than trying to work direct to the machine.

Storyboards are used extensively in the media industries to communicate and share ideas. They enable the invention and planning of things which are inherently visual, and they enable groups to work together to a shared end. They are also used analytically, as a tool for developing an understanding of, say, the customer experience, or as a way of identifying key parts of a flow or sequence.

There are three stages of storyboard which play a key role in developing a video essay:

The first (see figure 1) provides a quick overview or outline: it is sketchy and easily changed or discarded. It might be very untidy and – to those other than yourself – hard to read. It is still extremely valuable documentation.

Figure 1: Stage 1 storyboard: sketchy at this stage, and perhaps only you can read it… but it’s good enough to talk through ideas with a tutor at an early tutorial

The second (see figure 2) is concerned with ‘managing assets’. It involves timing any existing video sections and building them in to the video essay sequence. The storyboard now includes a clearer and finer grain of time, and it is accompanied by an asset list which shows the filename, start- and end-point (from time code), etc., of all materials to be used. You will also be identifying ‘gaps’ in the assets – and looking for material that will fill those gaps.

Figure 2: Stage 2 storyboard: much clearer now, more detailed, and the kind of plan that shows confidence, knowledge, a distinct way forward

The third is a production list ready for the editing sequence, acting as a checklist of media assets, with commentaries about edit transitions, timing, and so on. This final storyboard may ‘steal’ screen dumps from the materials and is worked up to a visual ‘look’n’feel’ condition. It might even exist as a semi-animated sequence that checks out timing and related issues (in animation this would be called an animatic, here it may be a mock-up in Powerpoint) bur it is still not ‘carved in stone’. The storyboard is a guide to intentions rather than a finished instruction list.

Sourcing the Video Essay

Accompanying the Stage 3 storyboard is a complete asset list. This is effectively a Bibliography and should be thought of as such. It should use the Harvard or Author-Date system and will include some ‘rejected’ material (with reasons for rejection) as well as material used.

Some examples

There are some fascinating experiments in the video essay format on the blog hosting website Tumblr:

- http://videoessays.tumblr.com/ [accessed 30 August 2015]

Some other examples worth looking at include:

- HuesForAlice (2007) ‘The Big Brother State’. YouTube. Available at: http://www.youtube.com/watch?v=jJTLL1UjvfU&feature=autoplay&list=PL72CC64E20549FE72&index=21&playnext=1 [accessed 21 July 2016]

- mwesch (2007) ‘The Machine is Us/ing Us (Final Version)’. YouTube. Available at: http://www.youtube.com/watch?v=6gmP4nk0EOE&feature=view_all&list=PL72CC64E20549FE72&index=1 [accessed 21 July 2016]

Suggested further reading

- Biemann, U. (2003) Stuff It: the Video Essay in the Digital Age . Dusseldort: Springer Verlag.

- Faden, E. (2009) ‘A Manifesto For Critical Media’. Mediascape: UCLA’s Journal of Cinema and Media Studies . (Fall) Available at: http://www.tft.ucla.edu/mediascape/Spring08_ManifestoForCriticalMedia.html [accessed 21 July 2016]

How can we improve this article? If you would like a reply, please provide your email address.

Captcha: + = Verify Human or Spambot ?

Visual Rhetoric

Video essay resource guide.

PAR 102 (M-Th, 9 AM- 5 PM) Fine Arts Library Media Lab (same hours as FAL) PCL Media Lab (same hours as PCL)

About video essays

What are they.

“The video essay is often described as a form of new media, but the basic principles are as old as rhetoric: the author makes an assertion, then presents evidence to back up his claim. Of course it was always possible for film critics to do this in print, and they’ve been doing it for over 100 years, following more or less the same template that one would use while writing about any art form: state your thesis or opinion, then back it with examples. In college, I was assured that in its heart, all written criticism was essentially the same – that in terms of rhetorical construction, book reviews, music reviews, dance reviews and film reviews were cut from the same cloth, but tailored to suit the specific properties of the medium being described, with greater emphasis given to form or content depending on the author’s goals and the reader’s presumed interest.”

Matt Zoller Seitz on the video essay .

what makes a good video essay?

Tony Zhou on how to structure a video essay

Kevin B. Lee on what makes a video essay “ great “

why should we use them? what are their limits?

Kevin B. Lee’s experimental/artistic pitch for video essays

Kevin B. Lee’s mainstream pitch for video essay

“Of all the many developments in the short history of film criticism and scholarship, the video essay has the greatest potential to challenge the now historically located text-based dominance of the appraisal and interpretation of film and its contextual cultures…”

Andrew McWhirter argues that t he video essay has significant academic potential in the Fall 2015 issue of Screen

“Importantly, the [new] media stylo does not replace traditional scholarship. This is a new practice beyond traditional scholarship. So how does critical media differ from traditional scholarship and what advantages does it offer? First, as you will see with the works in this issue, critical media demonstrates a shift in rhetorical mode. The traditional essay is argumentative-thesis, evidence, conclusion. Traditional scholarship aspires to exhaustion, to be the definitive, end-all-be-all, last word on a particular subject. The media stylo, by contrast, suggests possibilities-it is not the end of scholarly inquiry; it is the beginning. It explores and experiments and is designed just as much to inspire as to convince…”

Eric Fadden’s “ A Manifesto for Critical Media “

Adam Westbrook’s “ The Web-Video Problem: Why It’s Time to Rethinking Visual Storytelling from the Bottom Up “

Video essayists and venues

Matt Zoller Seitz (various venues) A writer and director by trade, Zoller Seitz is nonetheless probably best known as a prominent American cultural critic. He’s made over 1000 hours of video essays and is generally recognized as a founder of the video essay movement in high-brow periodicals. A recognized expert on Wes Anderson, Zoller Seitz is also notable because he often mixes other cinematic media (especially television) into his analysis, as in the above example, which doubles as an experiment in the absence of voiceover.

Various contributors, Press Play Co-founded by Matt Zoller Seitz and Ken Cancelosi, Press Play (published by Indiewire) is one of the oldest high-brow venues for video essays about television, cinema, and other aspects of popular culture.

Various contributors, Keyframe (A Fandor online publication) Fandor’s video essay department publishes work from many editors (what many video essayists call themselves) on and in a range of topics and styles. Check it out to get an idea of all that things a video essay can do!

Various contributors, Moving Image Source A high-brow publication for video essays.

Tony Zhou, Every Frame a Painting The master of video essays on filmic form, Tony’s arguments are clean, simple, and well-evidenced. Look to Tony as an example of aggressive and precise editing and arrangement. He’s also an excellent sound editor–pay attention to his choices and try out some of his sound-mixing techniques in your essay.

Adam Johnston, Your Movie Sucks (YMS) Although an excellent example of epideictic film rhetoric, this channel is a great example of what not to do in this assignment (write a movie review, gush about how good/bad you think a movie is, focus on motifs or narrative content instead of film form as the center of your argument). What you can learn from Adam is a lot about style. Adam’s delivery, pacing, and editing all work together to promote a mildly-disinterested-and-therefore-credible ethos through a near-monotone, which I’ll affectionately dub the “Daria” narratorial ethos.

Adam Westbrook, delve.tv Adam Westbrook is part of an emerging group of professional video essayists and delve.tv is his version of a visual podcast. Using the video essay form, Adam has developed a professional public intellectual ethos for himself through skillful overlay of explanation/interpretation and concept. Check out Westbrook’s work as a really good example of presenting and representing visual concepts crucial to an argument. He’s a master at making an argument in the form of storytelling, and he uses the video essay as a vehicle for that enterprise.

:: kogonada (various venues) If you found yourself wondering what the auteur video essay might look like, :: kogonada is it. I like to call this “expressionist” video essay style. Kogonada is the ultimate minimalist when it comes to voiceover/text over–its message impossibly and almost excessively efficient. Half of the videos in his library are simple, expertly-executed supercuts , highlighting how heavily video essays rely on the “supercut” technique to make an argument. Crafting an essay in this style really limits your audience and may not be a very good fit for the constraints of assignment (very “cutting edge,” as we talked about it in class), but you will probably draw inspiration from ::kogonada’s distinct, recognizable style, as well as an idea of what a video essay can do at the outer limits of its form.

Lewis Bond, Channel Criswell Narrating in brogue-y Northern English, Bond takes his time, releasing a very carefully-edited, high-production video essay once every couple of months. He’s a decent editor, but I feel his essays tend to run long, and I feel rushed by his narration at times. Bond also makes a useful distinction between video essays and analysis/reviews on his channel–and while most of his analysis/reviews focus on film content (what you don’t want to imitate), his video essays stay pretty focused on film technique (what you do). Hearing the same author consciously engage in two different modes of analysis might help you better understand the distinction between the two, as well.

Jack Nugent, Now You See It Nugent’s brisk, formal analysis is both insightful and accessible–a good example of what it takes to secure a significant following in the highly-competitive Youtube marketplace. [That’s my way of slyly calling him commercial.] Nugent is especially good at pairing his narration with his images. Concentrate and reflect upon his simple pairings as you watch–how does Nugent help you process both sets of information at the pacing he sets?

Evan Puschak, The Nerdwriter Nerdwriter is a great example the diversity of topics a video essay can be used to craft an argument about. Every week, Puschak publishes an episode on science, art, and culture. Look at all the different things Puschak considers visual rhetoric and think about how he’s using the video essay form to make honed, precisely-executed arguments about popular culture.

Dennis Hartwig and John P. Hess, FilmmakerIQ Hartwig and Hess use video essays to explain filmmaking technique to aspiring filmmakers. I’ve included the channel here as another example of what not to do in your argument, although perhaps some of the technical explanations that Hartwig and Hess have produced might help you as secondary sources. Your target audience (someone familiar on basic film theory trying to better understand film form) is likely to find the highly technical, prescriptive arguments on FilmIQ boring or alienating. Don’t focus on technical production in your essay (how the film accomplishes a particular visual technique using a camera); rather, focus on how the audience interprets the end result in the film itself; in other words, focus on choices the audience can notice and interpret–how is the audience interpreting the product of production? How often is the audience thinking about/noticing production in that process?

Kevin B. Lee (various venues) A good example of the older, high-brow generation of video essayists, Kevin’s collection of work hosted on his Vimeo channel offers slow, deliberate, lecture-inspired readings of film techniques and form. Note the distinct stylistic difference between Kevin’s pacing and someone like Zhou or Lewis. How does delivery affect reception?

Software Guides

How to access Lynda tutorials (these will change your life)

Handbrake and MakeMKV (file converters)

Adobe Premiere (video editing)

Camtasia (screen capture)

File management

Use your free UTBox account to upload and manage your files. Make sure you’ve got some sort of system for tracking and assembling everything into your video editing software. UTBox has a 2 terabyte limit (much higher than Google Drive) and is an excellent file management resource for all sorts of academic work.

Adobe Premiere saves versions with links to your video files, so it’s imperative that you keep your video files folder in the same place on every machine you open it up on. That’s why I keep all my video files in a big folder on box that I drop on the desktop of any machine I’m working on before I open my premiere files. The Adobe Premiere project walkthrough has more details on this.

Where to find video and how to capture it

About fair use . Make sure your composition complies with the Fair Use doctrine and familiarize yourself with the four criteria.

The best place to capture images is always from a high-resolution DVD or video file . The first place you should go to get the film is the library– see instructions for searching here .

To import the video and audio from your DVD or video file into your video editing software (like Premiere), you will first need to use a software to convert it to an .mkv. See instructions on how to do that here .

Camtasia tutorials . Camtasia is a program that allows you to capture anything that’s going on on your screen . This is a critical tool for this assignment as you decide what kind of interface you want to present to your reader in your video essay. Camtasia also allows you to capture any high-quality video playing on your desktop without licensing restrictions.

You can also use Clip Converter to capture images and sound from pre-existing YouTube videos , and it may be a little faster and easier than Camtasia. I suggest converting things into .mkv before putting them into your video editor, regardless of where you get the material from.

Film theory and criticism

- /r/truefilm’s reading and viewing guide

Leave a Reply Cancel reply

You must be logged in to post a comment.

Paper Editing Services

Maximize your paper’s potential with clear and effective writing.

Expert paper editors polish your writing to reflect the work you put into it. Professional paper editing will:

- Ensure your arguments are judged on merit

- Lift the quality of your paper as a whole

- Make you stand out from your peers

Proofreading & Editing

Personalized editing with human expertise, revisions within 12 hours, 100% happiness or a refund or re-edit.

Get your paper back, free of language errors and inconsistencies

Standard paper Proofreading & Editing is perfect if you’re confident about your writing but need a second pair of eyes to catch:

- Spelling and grammar errors

- Inconsistencies in dialect

- Overuse of passive voice

- Subjective or inflated language

For a more comprehensive edit, you can add one or multiple add-on editing services that fit your needs.

Add-on services

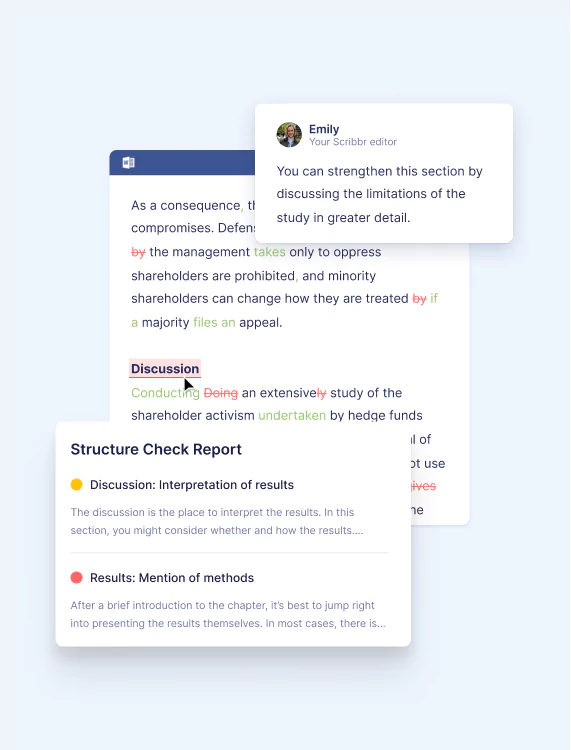

Customize your editing package to get the help you need, structure check, clarity check, paper formatting, citation editing.

Ensures sections and chapters are structured and focused and your writing is free of redundancies.

- Through in-text feedback, your editor will help:

- Organize and focus individual chapters and sections

- Eliminate repetitive and redundant information

- Perfect transitions between sentences and paragraphs

- Align titles and headings with the section’s content

You’ll also receive a personalized Structure Check Report meant to help you identify missing elements in each chapter or section and prioritize improvements.

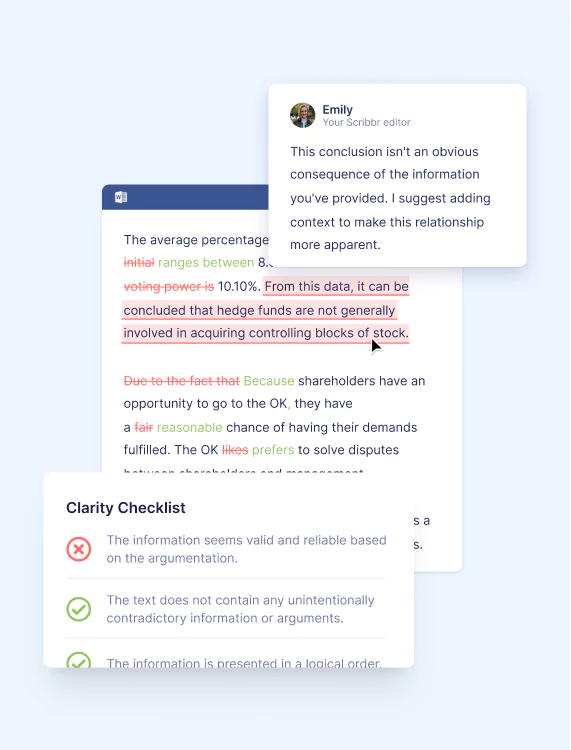

Ensures ideas are presented clearly, your arguments are consistent, and your audience can follow along.

Through in-text comments and checklists, your editor will:

- Make sure your text tells a clear and logical story

- Check that you’ve clearly presented concepts, ideas, and key terms

- Make sure your key takeaways and conclusions are front and center

- Highlight contradictions within the text

- Ensure you’re keeping your audience’s needs in mind

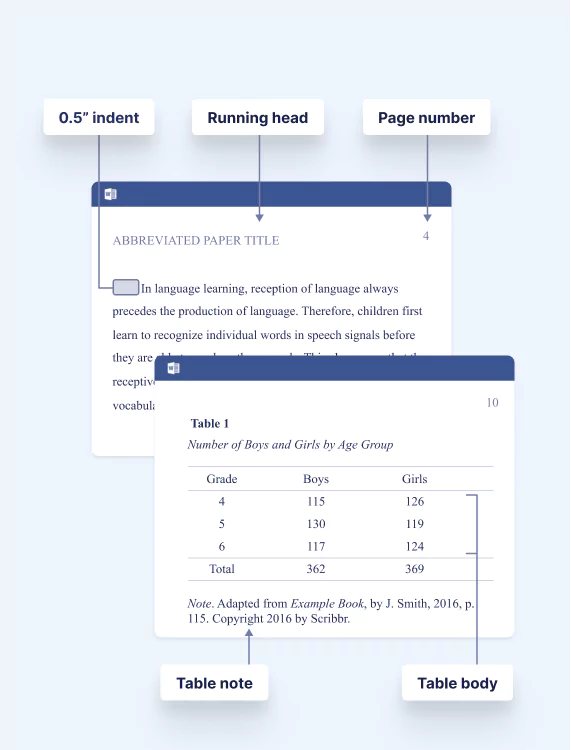

Ensures a professional look and feel of your document that meets your formatting requirements.

Your formatting expert will apply the 7th edition APA Style guidelines to all elements in your paper, including:

- Margins, spacing, and indentation

- Body text and headings

- Page numbers

- Abstract and keywords

- Explanatory footnotes

Ensures your citations and references are consistent and meet your style guide’s requirements.

Your citation expert will:

- Format your reference page (margins, indents, spacing)

- Edit citations and references to your style guide’s requirements

- Provide feedback on incomplete citations and references

- Cross-check citations with references for inconsistencies

We’re familiar with all common citation styles, including APA, MLA, Harvard, Vancouver, and Chicago.

Get matched to the perfect editor - or editing team

At Scribbr, you can rest assured that only the best editors will work on your paper.

All our 800+ editors have passed the challenging Scribbr Academy, which has a passing rate of only 2%.

We handpick your editor on several criteria, including field of study and document type. And we’ll even expand your team with citation and formatting experts if needed.

I have a doctorate in biology and studied a range of life science subjects. I specialize in editing academic texts.

I researched at Harvard, taught English with a Fulbright in Peru, and earned a master's from Johns Hopkins.

I have a PhD in German studies, an MS in library science, and extensive experience teaching undergraduate students.

I have a bachelor's in electrical engineering and a master's in psychology and am pursuing a PhD in neuroscience.

I am an ESL teacher and academic editor with a research background in the humanities, arts, and culture.

I am an academic editor and book reviewer. I am familiar with many style guides and have edited over 6 million words.

Maximize your paper's potential with expert editing

Select your currency

“Hoped for the best and got it!”

“I needed to have a paper proofread that was going to be published. Because English is not my native language, I was unsure about the text’s linguistic quality. I’m all the more grateful that B. & K. from Scribbr took care of my request very professionally, thoughtfully, and above all, quickly. It couldn’t have gone better!”

How it works

Stay in control throughout the paper editing process, upload any time.

Upload your document and easily select the pages that need editing. Next, choose your turnaround time and services and explain your situation and needs to the editor.

Stay in the loop

After placing your order you can keep track of our progress. From finding your perfect editor to potential hand-overs to formatting or citation experts.

Revise and submit

You’ll receive back your document with tracked changes and feedback as well as a personal letter from your editor. The last step is submitting your work with confidence!

Scribbr & academic integrity

Scribbr is committed to protecting academic integrity. Our proofreading service, our AI writing tools ( plagiarism checker , paraphrasing tool , grammar checker , summarizer, Citation Generator ) as well as our free Knowledge Base content are designed to help students produce quality academic papers.

We make every effort to prevent our software from being used for fraudulent or manipulative purposes.

Your questions, answered.

At Scribbr, we promise to make every customer 100% happy with the service we offer. Our philosophy: Your complaint is always justified – no denial, no doubts.

Our customer support team is here to find the solution that helps you the most, whether that’s a free new edit or a refund for the service.

The fastest turnaround time is 12 hours.

You can upload your document at any time and choose between three deadlines:

Yes, in the order process you can indicate your preference for American, British, or Australian English .

If you don’t choose one, your editor will follow the style of English you currently use. If your editor has any questions about this, we will contact you.

Yes, regardless of the deadline you choose, our editors can proofread your document during weekends and holidays.

Example: If you select the 12-hour service on Saturday, you will receive your edited document back within 12 hours on Sunday.

Your editor is on stand-by and ready to start editing your paper.

Get in touch, with real people.

We answer your questions quickly and personally from 9:00 to 23:00 CET

- Start live chat

- Email [email protected]

- Call +1 (510) 822-8066

- WhatsApp +31 20 261 6040

Knowledge Base

Finishing your paper with scribbr’s top-rated guides.

Research paper

Writing a Research Paper Conclusion

How to write academic paragraphs.

Research process

Developing Strong Research Questions

Methodology

How to Write a Literature Review

How to Make a Video Essay & Understand the Art of Visual Storytelling

The video essay is considered a powerful medium wherein the art of filmmaking with a depth of critical analysis to compelling ideas or arguments combined. Scholars and storytellers commonly use it, but anyone who wants to create it can do so in just a few minutes. So, let us not wait any longer as we set a stage for you to embark on a storytelling journey through a camera lens, where your ideas will come to life in a captivating and thought-provoking manner. In this guide, we will delve into how to make a video essay and learn more about it, so keep reading and remember information to become knowledgeable about it.

Part 1. What Is a Video Essay - Know More about Video Essay

Part 2. how to make a video essay using the general process everyone should know, part 3. how to edit a video essay after preparing the content on your pc, part 4. faqs on how to create a video essay.

What is a video essay? Video essay is a unique form of visual storytelling that blends the elements of traditional filmmaking with the intellectual rigor of critical analysis. It is a medium where the creator uses the power trifecta, which is the video, audio, and text, to convey their ideas, arguments, or narratives. Also, it covers multiple subjects, such as dissecting themes in a film and exploring historical events or cultural phenomena. The creators provide a dynamic platform to engage their audiences, often offering a fresh perspective on a topic or encouraging viewers to think more deeply.

The other video essay definition is the systematic process that combines creative and analytical skills. Commonly, video essay creation features voiceovers or on-screen text, supported by carefully selected visuals, music, and sound effects when necessary. With these elements, you can create a harmony to communicate the central message effectively, which can be thought-provoking, informative, persuasive, or purely artistic, making them a versatile medium for expression.

Generally, making a video essay is an iterative process, and each step requires careful consideration and creativity. With practice and dedication, you are harnessing the power of this medium to convey your ideas effectively to your audience in meaningful ways. So, if you want to know how to create a video essay, here are the steps you can follow.

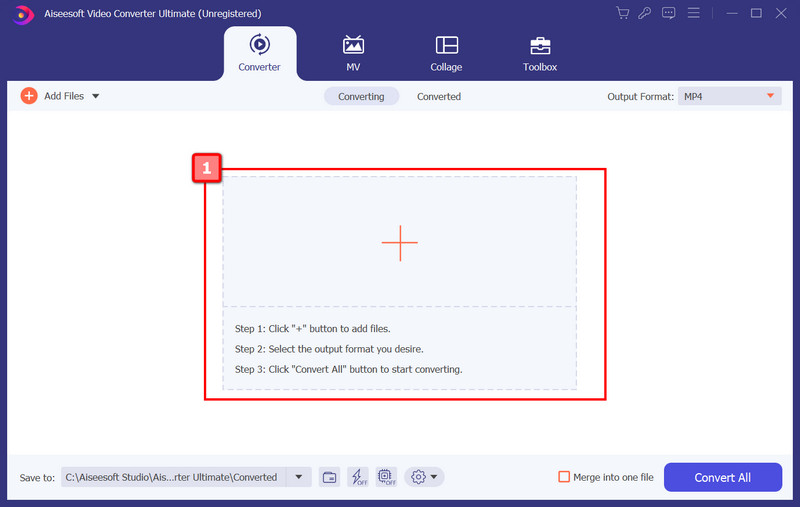

Now that you know how to do a video essay, let's go to the next important part: editing. With Aiseesoft Video Converter Ultimate , you will not have a hard time processing the videos, such as merging videos, trimming, adding subtitles, adding effects, etc. Imagine having all the necessary video editing features for creating the best video essay in a single tool; that is what this app is all about. Even if you are inexperienced in video editing or processing, you can follow the steps below that teach you how to process it.

How should I start my video essay?

Start your video essay with a compelling introduction that grabs the viewer's attention. Also, you could use an interesting fact, a thought-provoking quote, or a relevant anecdote to draw your audience in.

What is included in a video essay?

A video essay typically includes video clips, images, audio, and narration. It presents an augment or explores a specific topic using visual and auditory elements to support your topic. Research, analysis, and creativity are vital components of a video essay.

How long does a video essay take?

The length of a video essay can vary widely, ranging from a few minutes to over an hour. The duration will always depend on the complexity of the topic, the depth of analysis, and the intended audience. If you have a very long video, the engagement with others might be too low. We suggest cutting or trimming the video into several parts if needed.

Can I edit my video essay on my phone?

You can use many video editing apps on your phone to edit video essays easily. If you are an Android user, we suggest you explore the Vid. Fun, and if you are an iOS user, maximize the potential of iMovie on iOS.

How to write a video essay?

Writing a video essay involves a combination of scripting, planning, and creativity. So before you start creating, you must select a precise topic that allows you to have an in-depth analysis but is broad enough to appeal. Research, develop a strong thesis statement, create an outline, and write a compelling script. Remember to review your manuscript multiple times and edit it for clarity, coherence, and flow.

Definitely! You are now ready to create a video essay with the help of the video essay maker we have added here. Always remember to be confident when you are shooting a video on camera, and if you are taking a voice-over, be clear on your point and do not hesitate to take retakes when needed. We hope this article helps you do the video essay you need!

What do you think of this post?

Rating: 4.9 / 5 (based on 314 votes) Follow Us on

Learn how to create a captivating ASMR video that induces relaxation and a tingling experience. Plus, we added tools you can use and software to edit ASMR videos.

How to create a captivating lyrics video to enhance your music? Discover the best lyric video maker and step-by-step guide in this article.

Learning to make a video meme that captures humor and relatability online is easier and can be explored now. Read this article to get creative with your video meme.

Video Converter Ultimate is excellent video converter, editor and enhancer to convert, enhance and edit videos and music in 1000 formats and more.

- Retrieve Registration Code

- Contact Support Team

Get Our Newsletter

Exclusive discounts for subscribers only!

About Aiseesoft | Privacy | Support | Resource | Affiliate | Contact us Copyright © 2024 Aiseesoft Studio. All rights reserved.

- How It Works

- Prices & Discounts

Step-by-Step Guide: Mastering the Video Essay for College Applications

Table of contents

Have you made up your mind about the college you want to attend yet? If so, the next step is to start the application process. In this stage, you may be required to record an introductory video to tell the admissions committee a little about yourself.

Most colleges are now veering from traditional written essays to video essays as part of the application process. Therefore, you need to master the art of writing an effective video essay that you’ll use to record your college application video.

In this blog post, we’ll show you how to write a winning video essay for college applications to take you a step closer to admission.

What is a video essay?

A video essay is a 2-5 minute video recording that allows students to showcase their personality and convince the admission committee to accept them into the college. It’s an innovative way for prospective students to show their creativity and communication skills beyond the traditional written application.

Since they are visual, video essays allow candidates to express themselves and make a lasting impression. They can cover a wide range of topics, such as the student’s background, values, interests, and experiences.

Compelling video essays allow college applicants to differentiate themselves from the competition and increase their chances of securing a place at their dream institution.

What makes a good video essay?

A good video essay should reflect your authentic voice, personal experiences, and future aspirations. It should showcase your ability to express your ideas clearly while also providing a glimpse into your character and personality. Creativity, storytelling, and attention to detail are all essential components, as they paint a vivid picture of who you are.

How long should my video essay be?

The ideal length of a video essay depends on the specific requirements of the college. Most colleges will require you to keep it 2-3 minutes long. However, it’s important to pay close attention to the guidelines of the college you’re applying to. And remember, quality is key over quantity.

9-step guide to writing a video essay for college applications

A video essay is your chance to make a lasting impression as to why you are a good fit for the college. So, it’s important to know how to craft the perfect one.

What should be included in a college application video?

A college application essay and personal statement should focus on your background, experiences, and passions. Consider your personal story and how it sets you apart. Also, identify what aspects about you would contribute to the college's community and your long-term goals after finishing your studies at the college.

Here’s how you can write a video essay in nine steps, along with useful examples.

Step #1 - Select a suitable topic