Essay on Blockchain

The advent of the internet is a blessing to mankind. It has now become an integral part of our lives. Internet is required in everything that we do either it is education, traveling, shopping, health, etc. There are several applications of the internet and they are used in different sectors. The use of these applications and technologies reduces the workload and makes the work easier. Blockchain technology has also emerged because of the advent of computers and the internet. This technology came into the limelight after the discovery of cryptocurrency named Bitcoin.

Short and Long Essay on Blockchain in English

This topic is a very interesting topic for students of higher classes and college students. A long elaborated essay on this topic has been provided below. I hope that might aid the students in getting an idea to write an essay on this topic. Moreover, I think that it might be good for all the readers to know about this emerging technology.

10 Lines Essay on Blockchain (100-120 Words)

1) Blockchain is a newer technology that became popular with the emergence of Bitcoin.

2) This technology is used to store data and information.

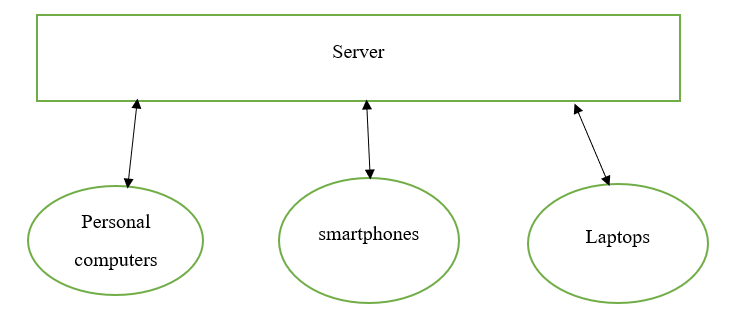

3) Blockchain is a decentralized system which means no single authority is responsible for managing it.

4) In 2008, Blockchain technology was pushed forward by Satoshi Nakamoto.

5) In this technology, there are different blocks containing information.

6) All the blocks are interconnected and hence it is named Blockchain technology.

7) This technology is highly safe and secured.

8) Any change in the record can be easily identified in this technology.

9) The working and maintenance of Blockchain require huge energy.

10) In Blockchain, if the private key is lost then it is impossible to gain access again.

2000 Words Long Essay- Blockchain : The Distributed Ledger System

Introduction

Blockchain technology is the most discussed topic at present on different forums in the world. Many of us might be familiar with this topic and its details, but there are many among us who would have heard the name of this topic for the first time. It is an interesting topic and we will be discussing Blockchain, its working, origin, types, pros and cons and future scope in the essay provided below.

What is meant by Blockchain?

Blockchain in simple terms is regarded as the record-keeping technology and has been popular after the advent of Bitcoin. This technology is also linked with banking and investment firms. The information regarding different transactions and details of credit and debit are noted down by us and are termed as records. This is the procedure of maintaining the records manually and the manual records are stated as the ledger. The process of maintaining the record of information and data in form of databases that are stored electronically on the computer system is called Blockchain. It can also be regarded as a digital ledger.

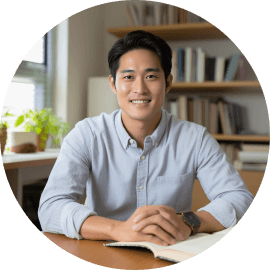

Blockchain is the system of recording and storing information in such a way that it cannot be edited or hacked. Every computer connected to this system has access to the data and information recorded in the Blockchain. It is not managed and controlled by any single person or authority but is decentralized. Thus, the technology is also stated as the distributed ledger system.

Origin of Blockchain Technology

The idea of the protocol of Blockchain at first was suggested by Cryptographer David Chaum in the year 1982. He proposed this idea in his dissertation work on “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups”. Stuart Haber and W. Scott Stornetta were first to start working on the concept of blockchain in the year 1991. Later there were many attempts made to carry forward this concept.

The concept of Blockchain came into reality in the year 2008 and the credit for inventing this technology goes to Satoshi Nakamoto. He named this technology Block and Chain i.e. it was of two words in his original paper but later the technology was named Blockchain a single word in the year 2016. This technology came into existence after the advent of cryptocurrency called Bitcoin. Nakamoto wanted to create a Bitcoin ledger as a decentralized system that can easily be assessed by the people connected to the system.

How Blockchain Works?

- The information is stored in different blocks that are linked in a sequence and thus this technology is termed Blockchain. Every block in the Blockchain has a limited storage capacity for storing data and information. The blocks, after becoming full with the information, are linked with the other blocks and the information starts being stored in the new blocks.

- The Blockchain is made up of different blocks containing information. Every block in the Blockchain has its own data, cryptographic hash that is unique to every block and the hash of the previous block.

- The hash of the previous block present in every block helps in linking the blocks together to form a Blockchain. The only block that does not have any hash of the previous block is the genesis block. It is formed initially and thus does not have any hash of previous blocks.

- Any attempt to edit data and information stored in blocks results in changing the hash of the block. Thus, change in the hash of one block lead to changes in other linked blocks too. In this way, the change can be easily detected. This causes disruption of data of all blocks in a Blockchain.

- The Blockchain can be assessed by different people linked to this system. The people connected to this system through their computers are termed nodes. Miners among them are the people who are connected to this system and verify the information that is newly added to the blocks. Thereafter, the data is noted and stored in the blocks.

- The information stored in the Blockchain can easily be assessed by the computers linked in the network but the privacy of the data will be maintained throughout this process.

- The information in Blockchain is updated after every ten minutes interval.

Attributes of Blockchain

There are certain features that are specific to the Blockchain technology and are enlisted below:

- A Decentralized Technology- The records of the several transactions and information can be made in excel sheets on computers but there is a difference in the collection of information in Blockchain. The information stored in different blocks in a Blockchain is not only managed by a single person or authority. Every user in the network has a copy of the information on their computers and thus no modification can be made by anyone.

- No Need for Third-Party- There is no any need for a third party to be involved in any kind of interaction between two parties. The interaction and transactions can easily be done by using Blockchain technology.

- Change of Data in the Blocks is Impossible- Any kind of change in the data stored in the blocks is impossible. It is because the change in data of one block results in changing the hash of all subsequent blocks. Therefore, the change in the data stored in the blocks is nearly impossible.

- Change Can Be Detected Easily- The attempt to change information in the blocks can easily be detected by the other users in the network.

Classification of Blockchain Technology

The Blockchain technology network can be broadly be classified into four types of networks and that are stated below:

- Public Blockchain- The public Blockchain is a chain of information that has no restrictions for its access. Any user in the network needs no permission to access the history of Blockchain or carry out any kind of transaction. The information can easily be transferred and accessed by people all around the world on this type of network of Blockchain without any prior permission. Bitcoin Blockchain is an example of a public blockchain.

- Private Blockchain- This type of Blockchain network needs permission for accessing the information. This type of Blockchain network cannot be joined by anyone without the permission of the owner. The digital ledger in this type of Blockchain is shared among only the trusted members. This type of network is usually managed by different organizations and enterprises.

- Hybrid Blockchain- This type of Blockchain network refers to the mixture of the attributes of both centralized and decentralized blockchains. The working of the hybrid blockchain depends upon the percentage of centralization and decentralization.

- Sidechains- This is the network of blockchain that executes parallel to the primary blockchain. The side chains work independently from the primary blockchain.

Need of Blockchain

The advent of the internet and different technologies has resulted in several digital technologies in the world. Blockchain is a new and emerging concept in society but is becoming popular at a very fast pace. Earlier when there was no such technology the records and information were noted and maintained in the written format by the people. There was a maximum chance of errors when the data was noted manually. Moreover, the data and information could easily be edited easily that later gave rise to corruption.

There is a dire need for a technology like a blockchain that will ensure the security of the recorded data with full transparency. This will also help in gaining the trust of people and they can access the information in the blocks without any kind of fear of cheating. The copy of the transaction is available on all the computers linked with the blockchain network and this validates the security of the transactions. This technology is preferred by the banks for the process of money transfers, storing records, and different technical works.

Benefits of Blockchain

- The blockchain enables us in getting accurate data on which people can easily rely upon. The private records in blockchains will only be shared with the members of the network who have been granted access by us.

- The transactions that are recorded in the blocks cannot be altered by anybody and any change can easily be detected by the users in the network. This states that this technology is very secure.

- The use of blockchain technology helps in the removal of third-party involvement in transaction and record-keeping processes. There will be no extra charge incurred for the transactions by blockchain technology.

- The data and information can be saved without wasting unwanted time and effort thus blockchain is an efficient technology.

Limitations of Blockchain Technology

- The verification of transactions in blockchain requires huge power or electricity.

- The private key in the blockchain secures Bitcoins and thus it must be kept secret. The knowledge of the private key to the third party means revealing about the Bitcoins to them. Thus, it is necessary to protect these keys from becoming exposed to third parties. These keys if once lost cannot be backed up and money secured in them also gets lost.

- The records and transactions in the blockchains are distributed ledger i.e. it is present on every computer of every user in the network. Any transaction without verification of all the members cannot be entered into the blocks. The verification of the transaction from a large number of users requires time and thus it is a time taking process. This results in a lowering of the transaction speed.

How is Blockchain Essential for Operating Bitcoin?

Bitcoin is a digital currency and it is managed by the Blockchain. There is no authority that is meant for operating the crypto currencies. The transaction of every Bitcoin is stored in the blockchains. Further, the options of the digital currency are distributed on the computers in the network. This facilitates the operating of Bitcoins without the involvement of any kind of central authority. The data of the transactions of Bitcoins are stored in the blocks of the blockchain. This is a risk-free and secure option for operating Bitcoin.

Blockchain Wallet- This is a digital or E-wallet service that is provided by the blockchain company. It enables the users of the blockchain network to store and manage, transfer, and trade cryptocurrencies. The wallet s well provided with the security features that help in reducing the chances of online fraud and thefts.

Applications of Blockchain Technology

- Development of Smart Contacts- Different parties signs contract or agreement for the exchange of services and products in businesses. This happens mainly on paper that is mainly prone to different types of errors and frauds. The development of new technology called smart contacts in blockchains ease this work and help it in making it more secure. This technology performs everything exactly like that takes place on paper. The difference is only that it is digital and can be executed by the user. Moreover, there is no risk of editing data in the blockchain. Thus smart contact can be used for carrying out different financial agreements, storing property documents, crowdfunding, healthcare transactions, etc. Every detail from manufacturing to delivery in the process of exchange of products is maintained by the smart contract.

- Voting and Elections- The process of elections in the nation are carried out manually and thus there are maximum chances of occurrence of errors. The news of some frauds in the elections is very common during the elections in the nation. The introduction of smart contact if introduced in the system of voting and election might reduce the chances of the occurrence of such errors and frauds. This will also help in conducting free and fair elections in the nation.

- Reduce the Chance of Cyber Crimes- The chances of cybercrime are very common nowadays with the fast pace of digitalization. Many people every now and ten are becoming the victim of cyber frauds because while doing online transactions the details are stolen by the hackers. Blockchain technology helps in digitizing the documents that can facilitate the users in doing online transactions and interactions.

- Prevent Copying of Original Contents- The information and articles on different topics are available easily on the websites. This information is many times copied and used by people without the permission of the author of the article. Blockchain technology facilitates the authors to prevent the copyright of their written articles by registering their work online in smart contracts with full privacy. There will be no chances of editing or copying the work of the authors and the authority of the content will be totally restricted in the hands of the owner.

Blockchain is an emerging technology and its use at present is limited only to the crypto currency. This technology is also said to be useful in different sectors in the coming future. It is being tested for the same in different sectors in several countries of the world. It is brought into use in the banking and commerce sectors in different countries. This technology is becoming popular at a very fast pace and there are many fields where it can bring revolutionary changes. The advent of such technology is dire of need in coming future. I have tried to explain the blockchain in a very simple way in form of a long essay. I hope that you will find it interesting and love reading about this new technology.

Read Also :

- Essay on Internet of Things (IoT)

- Essay on Hyperloop

- Essay on Growing Trends of Privatization

- Essay on One Nation One Election

- Essay on Online Schooling- Can it be the Future of Education?

- Essay on E-Diplomacy

FAQs: Frequently Asked Questions on Blockchain

Ans. Blockchain is a system of recording and storing the data with no chance of editing or hacking the information.

Ans. The banking sector is using blockchain technology in India.

Ans. The United States of America USA is the leading country in the world in blockchain technology.

Ans. Japan was the first country in the world to embrace blockchain technology.

Related Posts

Essay on digital india, cashless india essay, essay on child is father of the man, essay on causes, effects and prevention of corona virus, essay on dr. sarvepalli radhakrishnan, durga puja essay, essay on summer vacation, essay on my plans for summer vacation, essay on holiday.

What is blockchain?

Blockchain is one of the major tech stories of the past decade. Everyone seems to be talking about it—but beneath the surface chatter there’s not always a clear understanding of what blockchain is or how it works. Despite its reputation for impenetrability, the basic idea behind blockchain is pretty simple. And it has major potential to change industries from the bottom up .

Blockchain is a technology that enables the secure sharing of information. Data, obviously, is stored in a database. Transactions are recorded in an account book called a ledger. A blockchain is a type of distributed database or ledger—one of today’s top tech trends —which means the power to update a blockchain is distributed between the nodes, or participants, of a public or private computer network. This is known as distributed ledger technology, or DLT. Nodes are incentivized with digital tokens or currency to make updates to blockchains.

Get to know and directly engage with senior McKinsey experts on blockchain

Michael Chui is a partner at the McKinsey Global Institute and is based in McKinsey’s Bay Area office, where Marie-Claude Nadeau is a senior partner.

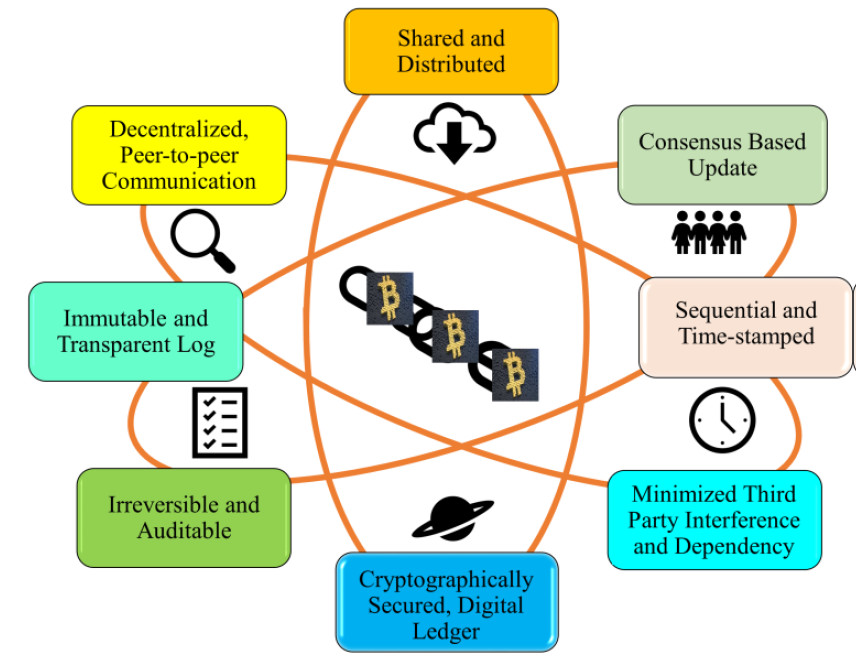

Blockchain allows for the permanent, immutable, and transparent recording of data and transactions. This, in turn, makes it possible to exchange anything that has value, whether that is a physical item or something less tangible.

A blockchain has three central attributes . First, a blockchain database must be cryptographically secure. That means in order to access or add data on the database, you need two cryptographic keys: a public key, which is basically the address in the database, and the private key, which is a personal key that must be authenticated by the network.

Next, a blockchain is a digital log or database of transactions, meaning it happens fully online.

And finally, a blockchain is a database that is shared across a public or private network. One of the most well-known public blockchain networks is the Bitcoin blockchain . Anyone can open a Bitcoin wallet or become a node on the network. Other blockchains may be private networks. These are more applicable to banking and fintech , where people need to know exactly who is participating, who has access to data, and who has a private key to the database. Other types of blockchains include consortium blockchains and hybrid blockchains, both of which combine different aspects of public and private blockchains.

Research from the McKinsey Technology Council suggests that by 2027, up to 10 percent of global GDP could be associated with blockchain-enabled transactions. But in the world of blockchain, what is real and what is just hype? And how can companies use blockchain to increase efficiency and create value? Read on to find out.

Learn more about McKinsey’s Financial Services Practice .

How does blockchain work?

A deeper dive may help in understanding how blockchain and other DLTs work .

When data on a blockchain is accessed or altered, the record is stored in a “block” alongside the records of other transactions. Stored transactions are encrypted via unique, unchangeable hashes, such as those created with the SHA-256 algorithm. New data blocks don’t overwrite old ones; they are appended together so that any changes can be monitored. And since all transactions are encrypted, records are immutable—so any changes to the ledger can be recognized by the network and rejected.

These blocks of encrypted data are permanently “chained” to one another, and transactions are recorded sequentially and indefinitely, creating a perfect audit history that allows visibility into past versions of the blockchain.

When new data is added to the network, the majority of nodes must verify and confirm the legitimacy of the new data based on permissions or economic incentives, also known as consensus mechanisms . When a consensus is reached, a new block is created and attached to the chain. All nodes are then updated to reflect the blockchain ledger.

In a public blockchain network , the first node to credibly prove the legitimacy of a transaction receives an economic incentive. This process is called “mining.”

Here’s a theoretical example to help illustrate how blockchain works. Imagine that someone is looking to buy a concert ticket on the resale market. This person has been scammed before by someone selling a fake ticket, so she decides to try one of the blockchain-enabled decentralized ticket exchange websites that have been created in the past few years. On these sites, every ticket is assigned a unique, immutable, and verifiable identity that is tied to a real person. Before the concertgoer purchases her ticket, the majority of the nodes on the network validate the seller’s credentials, ensuring that the ticket is in fact real. She buys her ticket and enjoys the concert.

What is proof of work and how is it different from proof of stake?

Remember the idea of consensus mechanisms mentioned earlier? There are two ways blockchain nodes arrive at a consensus: through private blockchains, where trusted corporations are the gatekeepers of changes or additions to the blockchain, or through public, mass-market blockchains.

Most public blockchains arrive at consensus by either a proof-of-work or proof-of-stake system . In a proof-of-work system, the first node, or participant, to verify a new data addition or transaction on the digital ledger receives a certain number of tokens as a reward. To complete the verification process, the participant, or “miner,” must solve a cryptographic question. The first miner who solves the puzzle is awarded the tokens.

Originally, people on various blockchains mined as a hobby. But because this process is potentially lucrative , blockchain mining has been industrialized. These proof-of-work blockchain-mining pools have attracted attention for the amount of energy they consume.

In September 2022, Ethereum, an open-source cryptocurrency network, addressed concerns around energy usage by upgrading its software architecture to a proof-of-stake blockchain. Known simply as “the Merge,” this event is seen by cryptophiles as a banner moment in the history of blockchain. With proof-of-stake, investors deposit their crypto coins in a shared pool in exchange for the chance to earn tokens as a reward. In proof-of-stake systems, miners are scored based on the number of native protocol coins they have in their digital wallets and the length of time they have had them. The miner with the most coins at stake has a greater chance to be chosen to validate a transaction and receive a reward.

Introducing McKinsey Explainers : Direct answers to complex questions

How can businesses benefit from blockchain.

Research suggests that blockchain and DLTs could create new opportunities for businesses by decreasing risk and reducing compliance costs, creating more cost-efficient transactions, driving automated and secure contract fulfillment, and increasing network transparency. Let’s break it down further:

- Reduced risk and lower compliance costs . Banks rely on “know your customer” (KYC) processes to bring customers on board and retain them. But many existing KYC processes are outdated and drive costs of as much as $500 million per year, per bank. A new DLT system might require once-per-customer KYC verification, driving efficiency gains, cost reduction, and improved transparency and customer experience.

- Cost-efficient transactions. Digitizing records and issuing them on a universal ledger can help save significant time and costs. In a letter-of-credit deal, for example, two companies opted for a paperless solution and used blockchain to trade nearly $100,000 worth of butter and cheese. By doing so, a process that previously took up to ten days was reduced to less than four hours—from issuing to approving the letter of credit.

- Automated and secure contract fulfillment. Smart contracts are sets of instructions coded into tokens issued on a blockchain that can self-execute under specific conditions. These can enable automated fulfillment of contracts. For example, one retailer wanted to streamline its supply-chain-management efforts, so it began recording all processes and actions, from vendor to customer, and coding them into smart contracts on a blockchain. This effort not only made it easier to trace the provenance of food for safer consumption but also required less human effort and improved the ability to track lost products.

Learn more about McKinsey’s Financial Services Practice .

How are blockchain, cryptocurrency, and decentralized finance connected?

Blockchain enables buyers and sellers to trade cryptocurrencies online without the need for banks or other intermediaries.

All digital assets, including cryptocurrencies, are based on blockchain technology. Decentralized finance (DeFi) is a group of applications in cryptocurrency or blockchain designed to replace current financial intermediaries with smart contract-based services. Like blockchain, DeFi applications are decentralized, meaning that anyone who has access to an application has control over any changes or additions made to it. This means that users potentially have more direct control over their money.

What else can blockchain be used for?

Cryptocurrency is only the tip of the iceberg. Use cases for blockchain are expanding rapidly beyond person-to-person exchanges, especially as blockchain is paired with other emerging technology.

Examples of other blockchain use cases include the following:

- With blockchain, companies can create an indelible audit trail through a sequential and indefinite recording of transactions. This allows for systems that keep static records (of land titles, for example) or dynamic records (such as the exchange of assets).

- Blockchain allows companies to track a transaction down to its current status. This enables companies to determine exactly where the data originated and where it was delivered, which helps to prevent data breaches.

- Blockchain supports smart contracts, which are programs that trigger transactions automatically upon fulfillment of contract criteria.

What are some concerns around the future of blockchain?

While blockchain may be a potential game changer , there are doubts emerging about its true business value . One major concern is that for all the idea-stage use cases, hyperbolic headlines, and billions of dollars of investment, there remain very few practical, scalable use cases of blockchain.

One reason for this is the emergence of competing technologies. In the payments space, for example, blockchain isn’t the only fintech disrupting the value chain—60 percent of the nearly $12 billion invested in US fintechs in 2021 was focused on payments and lending. Given how complicated blockchain solutions can be—and the fact that simple solutions are frequently the best —blockchain may not always be the answer to payment challenges.

Looking ahead, some believe the value of blockchain lies in applications that democratize data, enable collaboration, and solve specific pain points. McKinsey research shows that these specific use cases are where blockchain holds the most potential, rather than those in financial services.

How might blockchain evolve over time?

In the next five years, McKinsey estimates that there will be two primary development horizons for blockchain:

- Growth of blockchain as a service (BaaS). BaaS is a cloud-based service that builds digital products for DLT and blockchain environments without any setup requirements for infrastructure. This is currently being led by Big Tech companies.

- Interoperability across blockchain networks and outside systems. Increased interoperability will mean that disparate blockchain networks and external systems will be able to view, access, and share one another’s data while maintaining integrity. Hardware standardization and scalable consensus algorithms will enable cross-network use cases—such as the Internet of Things on blockchain infrastructure.

These trends will be enabled partly because of increased pressure from regulators and consumers demanding greater supply chain transparency, and partly because of economic uncertainty, as consumers seek out independent, centrally regulated systems. And large corporations launching successful pilots will build confidence for consumers and other organizations.

Potential growth could be inhibited by a few factors: for one, several well-known applications have inherently limited scalability, including energy or infrastructure requirements. Further, uncertainty about regulatory or governance developments could keep consumers shy—for instance, if there is a lack of clarity on who will enforce smart contracts. And, finally, the unresolved threat of cyberattacks remains a fear for potential blockchain users.

What do NFTs have to do with blockchain?

Nonfungible tokens (NFTs) are minted on smart-contract blockchains such as Ethereum or Solana. NFTs represent unique assets that can’t be replicated—that’s the nonfungible part—and can’t be exchanged on a one-to-one basis. These assets include anything from a Picasso painting to a digital lolcat meme. Because NFTs are built on top of blockchains, their unique identities and ownership can be verified through the ledger. With some NFTs, the owner receives a royalty every time the NFT is traded.

The NFT market is extremely volatile : in 2021, one NFT created by the digital artist Mike Winkelmann, also known as Beeple, was sold at Christie’s for $69.3 million. But NFT sales have shrunk dramatically since summer 2022.

How secure is blockchain?

Blockchain has been called a “ truth machine .” While it does eliminate many of the issues that arose in Web 2.0, such as piracy and scamming, it’s not the be-all and end-all for digital security. The technology itself is essentially foolproof, but, ultimately, it is only as noble as the people using it and as good as the data they are adding to it.

A motivated group of hackers could leverage blockchain’s algorithm to their advantage by taking control of more than half of the nodes on the network. With this simple majority, the hackers have consensus and thus the power to verify fraudulent transactions.

In 2022, hackers did exactly that, stealing more than $600 million from the gaming-centered blockchain platform Ronin Network. This challenge, in addition to the obstacles regarding scalability and standardization, will need be addressed. But there is still significant potential for blockchain, both for business and society.

For a more in-depth exploration of these topics, see McKinsey’s “ Blockchain and Digital Assets ” collection. Learn more about McKinsey’s Financial Services Practice —and check out blockchain-related job opportunities if you’re interested in working at McKinsey.

Articles referenced include:

- “ McKinsey Technology Trends Outlook 2022 ,” August 24, 2022

- “ Forward Thinking on tech and the unpredictability of prediction with Benedict Evans ,” April 6, 2022, Janet Bush and Michael Chui

- “ Seven technologies shaping the future of fintech ,” November 9, 2021, Dick Fong, Feng Han, Louis Liu, John Qu, and Arthur Shek

- “ CBDC and stablecoins: Early coexistence on an uncertain road ,” October 11, 2021, Ian De Bode, Matt Higginson , and Marc Niederkorn

- “ Blockchain and retail banking: Making the connection ,” June 7, 2019, Matt Higginson , Atakan Hilal, and Erman Yugac

- “ Blockchain 2.0: What’s in store for the two ends—semiconductors (suppliers) and industrials (consumers)? ,” January 18, 2019, Gaurav Batra, Rémy Olson, Shilpi Pathak, Nick Santhanam, and Harish Soundararajan

- “ Blockchain’s Occam problem ,” January 4, 2019, Matt Higginson , Marie-Claude Nadeau , and Kausik Rajgopal

- “ Blockchain explained: What it is and isn’t, and why it matters ,” September 28, 2018

Want to know more about blockchain?

Related articles.

Blockchain’s Occam problem

Blockchain beyond the hype: What is the strategic business value?

Blockchain explained: What it is and isn’t, and why it matters

Annual Report Menu

Annual Report 2021

Federal Reserve Bank of St. Louis

The Blockchain Revolution: Decoding Digital Currencies

By David Andolfatto and Fernando M. Martin

- Introduction

Few people took notice of an obscure white paper published in 2009 titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by a pseudonymous Satoshi Nakamoto. The lack of fanfare at the time is hardly surprising given that innovations in the way we make payments are not known to generate tremendous amounts of excitement, let alone inspire visions of a revolution in finance and corporate governance. But just over a decade later, the enthusiasm for cryptocurrencies and decentralized finance spawned by Bitcoin and blockchain technology has grown immensely and shows no signs of abating.

Because cryptocurrencies are money and payments systems, they have naturally drawn the interest of central banks and regulators. The Federal Reserve Bank of St. Louis was the first central banking organization to sponsor a public lecture on the topic: In March 2014, presenters outlined the big picture of cryptocurrencies and the blockchain by discussing its possibilities and pitfalls. Since that time, the Bank’s economists and research associates have published numerous articles and explainers on these topics, all of which are freely available to the general public. This essay represents a continuation of our effort to help educate the public and offer our perspective of the phenomenon as central bankers and economists.

Understanding how cryptocurrencies work “under the hood” is a challenge for most people because the protocols are written in computer code and the data are managed in an esoteric mathematical structure. To be fair, it’s difficult to understand any technical language (e.g., legalese, legislation and regulation). Because we are not technical experts in this space, we spend virtually no time discussing the technology in detail. For an accessible introduction to the technology, see Fabian Schär and Aleksander Berentsen’s “ Bitcoin, Blockchain, and Cryptoassets: A Comprehensive Introduction ,” MIT Press, 2020. What we offer instead is an overview of cryptocurrencies and blockchain technologies, explaining the spirit of the endeavor and how it compares with traditional operations.

In this essay, we explore four key areas:

- Money, digital money and payments

- Cryptocurrencies, blockchain and the double-spend problem of digital money

- Understanding decentralized finance

- The makeup of a central bank digital currency

- Money, Digital Money and Payments

It is sometimes said that money is a form of social credit. One can think of this idea in the following way: When people go to work, they are in effect providing services to the community. They are helping to make others’ lives better in some way and, by engaging in this collective effort, make their own lives better as well.

In small communities, individual consumption and production decisions can be debited and credited, respectively, in a sort of communal ledger of action histories. This is because it is relatively easy for everyone to monitor and record individual actions. A person who has produced mightily for the group builds social credit. Large social credit balances can be “spent” later as consumption (favors drawn from other members of the community).

In large communities, individual consumption and production decisions are difficult to monitor. In communities the size of cities, for example, most people are strangers. Social credit based on a communal record-keeping system does not work when people are anonymous. See Narayana Kocherlakota’s “ The Technological Role of Fiat Money ,” Federal Reserve Bank of Minneapolis, Quarterly Review , 1998. Producers are rewarded for their efforts by accumulating money balances in wallets or bank accounts. Accumulated money balances can then be spent to acquire goods and services (or assets) from other members of the community, whose wallets and bank accounts are duly credited in recognition of their contributions. In this manner, money—like social credit—serves to facilitate the exchange of goods and services.

The monetary object representing this social credit may exist in physical or nonphysical form. In the United States, physical cash takes the form of small-denomination Federal Reserve bills and U.S. Treasury coins. Cash payments are made on a peer-to-peer (P2P) basis, for example, between customer and merchant. No intermediary is required for clearing and settling cash payments. As the customer debits his or her wallet, cash is credited to the merchant’s cash register, and the exchange is settled. Hardly any time is spent inspecting goods and money in small-value transactions. Some trust is required, of course, in the authority issuing the cash used in transactions. While that authority is typically the U.S. government, there is no law preventing households and businesses from accepting, say, foreign currency, gold or any other object as payment.

When people hear the word “money,” they often think of cash. But, in fact, most of the U.S. money supply consists of digital dollars held in bank accounts. The digital money supply is created as a byproduct of commercial bank lending operations and central bank open market operations. Digital money is converted into physical form when depositors choose to withdraw cash from their bank accounts. Most people hold both forms of money. The reasons for preferring one medium of exchange over the other are varied and familiar.

Digital dollar deposits in the banking system are widely accessible by households and businesses. This digital money flows in and out of bank accounts in the form of credits and debits whenever a party initiates a purchase. Unlike with cash, making payments with digital money has traditionally required the services of a trusted intermediary. A digital money payment is initiated when a customer sends an encrypted message instructing his or her bank to debit the customer’s account and credit the merchant’s account with an agreed-upon sum. This debit-credit operation is straightforward to execute when both customer and merchant share the same bank. The operation is a little more complicated when the customer and merchant do not share the same bank. In either case, clearing and settling payments boils down to an exercise in secure messaging and honest bookkeeping.

- Cryptocurrencies, Blockchain and the Double-Spend Problem of Digital Money

One can think of cryptocurrencies as digital information transfer mechanisms. If the information being transferred is used as an everyday payment instrument, it fulfills the role of money. In this case, a cryptocurrency can be thought of as a money and payments system.

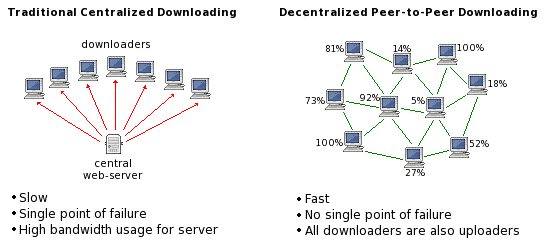

Every money and payments system relies on trust. The difference between cryptocurrencies and conventional money and payments systems lies in where this trust is located. In contrast to conventional systems, no delegated legal authority is responsible for managing and processing cryptocurrency information. Instead, the task is decentralized and left open to “volunteers” drawn from the community of users, similar in spirit to how the internet-based encyclopedia Wikipedia is managed. These volunteers—called miners—work to update and maintain a digital ledger called the blockchain. The protocols that govern the read-write privileges associated with the blockchain are enshrined in computer code. Users trust that these rules are not subject to arbitrary changes and that rule changes (if any) will not benefit some individuals at the expense of the broader community. Overall, users must trust the mathematical structure embedded in the database and the computer code that governs its maintenance.

Managing a digital ledger without a delegated accounts manager is not a trivial problem to solve. If just anyone could add entries to a public ledger, the result likely would be chaos. Malevolent actors would be able to debit an account and credit their own at will. Or they could create social credit out of thin air, without having earned it. In the context of money and payments systems, these issues are related to the so-called double-spend problem.

To illustrate the double-spend problem, consider the example of a dollar stored in a personal computer as a digital file. It is easy for a customer to transfer this digital file to a merchant on a P2P basis, say, by email. The merchant is now in possession of a digital dollar. But how can we be sure that the customer did not make a copy of the digital file before spending it? It is, in fact, a simple matter to make multiple copies of a digital file. The same digital file can then be spent twice (hence, a double-spend). The ability to make personal copies of digital money files would effectively grant each person in society his or her own money printing press. A monetary system with this property is not likely to function well.

Physical currency is not immune from the double-spend problem, but paper bills and coins can be designed in a manner to make counterfeiting sufficiently expensive. Because cash is difficult to counterfeit, it can be used more or less worry-free to facilitate P2P payments. The same is not true of digital currency, however. The conventional solution to the double-spend problem for digital money is to delegate a trusted third party (e.g., a bank) to help intermediate the transfer of value across accounts in a ledger. Bitcoin was the first money and payments system to solve the double-spend problem for digital money without the aid of a trusted intermediary. How?

The Digital Village: Communal Record-Keeping

The cryptocurrency model of communal record-keeping resembles the manner in which history has been recorded in small communities, including in networks of family and friends. It is said that there are no secrets in a small village. Each member of the community has a history of behavior, and this history is more or less known by all members of the community—either by direct observation or through communications. The history of a small community can be thought of as a virtual database living in a shared (or distributed) ledger of interconnected brains. No one person is delegated the responsibility of maintaining this database—it is a shared responsibility.

Among other things, such a database contains the contributions that individuals have made to the community. As we described above, the record of these contributions serves as a reputational history on which individuals can draw; the credit they receive from the community can be considered a form of money. There is a clear incentive to fabricate individual histories for personal gain—the ability to do so would come at the expense of the broader community in the same way counterfeiting money would. But open, shared ledgers are very difficult to alter without communal consensus. This is the basic idea behind decentralized finance, or DeFi.

Governance via Computer Code

All social interaction is subject to rules that govern behavior. Behavior in small communities is governed largely by unwritten rules or social norms. In larger communities, rules often take the form of explicit laws and regulations. At the center of the U.S. money and payments system is the Federal Reserve, which was created in 1913 through an act of Congress. The Federal Reserve Act of 1913 specifies the central bank’s mandates and policy tools. There is also a large body of legislation that governs the behavior of U.S. depository institutions. While these laws and regulations create considerable institutional inertia in money and payments, the system is not impervious to change. When there is sufficient political support—feedback from the American people—changes to the Federal Reserve Act can be made. The Humphrey-Hawkins Act of 1978 , for example, provided the Fed with three mandates: stable prices, maximum employment and moderate long-term interest rates. And the Dodd-Frank Act of 2010 imposed stricter regulations on financial firms following the financial crisis in 2007-09.

Because cryptocurrencies are money and payments systems, they too must be subject to a set of rules. In 2009, Satoshi Nakamoto brought forth his aforementioned white paper, which laid out the blueprint for Bitcoin. This blueprint was then operationalized by a set of core developers in the form of an open-source computer program governing monetary policy and payment processing protocols. Adding, removing or modifying these “laws” governing the Bitcoin money and payments system is virtually impossible. Relatively minor patches to the code to fix bugs or otherwise improve performance have been implemented. But certain key parameters, like the one that governs the cap on the supply of bitcoin, are likely impervious to change.

Concerted attempts to change the protocol either fail or result in breakaway communities called “forks” that share a common history with Bitcoin but otherwise go their separate ways. Proponents of Bitcoin laud its regulatory system for its clarity and imperviousness, especially relative to conventional governance systems in which rules are sometimes vague and subject to manipulation.

Bitcoin: Beyond the Basics

Learn about the structure and fundamentals of Bitcoin in this Timely Topics podcast with St. Louis Fed economist David Andolfatto. During the 16-minute episode , Andolfatto examines how distributed ledgers work and explains the mining process. This podcast was released Aug. 27, 2018.

How Blockchain Technology Works

As with any database management system, the centerpiece of operations is the data itself. For cryptocurrencies, this database is called the blockchain. One can loosely think of the blockchain as a ledger of money accounts, in which each account is associated with a unique address. These money accounts are like post office boxes with windows that permit anyone visiting the post office to view the money balances contained in every account. Beyond viewing the balances, one can also view the transaction histories of every monetary unit in the account (i.e., its movement from account to account over time since it was created). These windows are perfectly secured. It is important to note that many cryptocurrency users hold their funds via third parties to whom they relinquish control of their private keys. If an intermediary is hacked and burgled, one’s cryptocurrency holdings may be stolen. This has nothing to do with security flaws in the cryptocurrency itself—but with the security flaws of the intermediary. While anyone can look in, no one can access the money without the correct password. This password is created automatically when the account is opened and known only by the person who created the account (unless it is voluntarily or accidentally disclosed to others). The person’s account name is pseudonymous (unless voluntarily disclosed). These latter two properties imply that cryptocurrencies (and cryptoassets more generally) are digital bearer instruments. That is, ownership control is defined by possession (in this case, of the private password). It is worth noting that large-denomination bearer instruments are now virtually extinct. Today, bearer instruments exist primarily in the form of small-denomination bills and metal coins issued by governments. For this reason, cryptocurrencies are sometimes referred to as “digital cash.”

As with physical cash, no permission is needed to acquire and spend cryptoassets. Nor is it required to disclose any personal information when opening an account. Anyone with access to the internet can download a cryptocurrency wallet—software that is used to communicate with the system’s miners (the aforementioned volunteer accountants). The wallet software simultaneously generates a public address (the “location” of an account) and a private key (password). Once this is done, the front-end experience for consumers to initiate payment requests and manage money balances is very similar to online banking as it exists today. Of course, if a private key is lost or stolen, there is no customer service department to call and no way to recover one’s money.

Cryptocurrencies have become provocative and somewhat glamorous, but their unique and key innovation is how the database works. The management of money accounts is determined by a set of regulations (computer code) that determines who is permitted to write to the database. The protocols also specify how those who expend effort to write to the database—essentially, account managers—are to be rewarded for their efforts. Two of the most common protocols associated with this process are called proof-of-work (PoW) and proof-of-state (PoS). The technical explanation is beyond the scope of this essay. Suffice it to say that some form of gatekeeping is necessary—even if the effort is communal—to prevent garbage from being written to the database. The relevant economic question is whether these protocols, whatever they are, can process payments and manage money accounts more securely, efficiently and cheaply than conventional centralized finance systems.

Native Token

Recording money balances requires a monetary unit. This unit is sometimes referred to as the native token. From an economic perspective, a cryptocurrency’s native token looks like a foreign currency, albeit one whose monetary policy is governed by a computer algorithm rather than the policymakers of that country. Much of the excitement associated with cryptocurrencies seems to stem from the prospect of making money through capital gains via currency appreciation relative to the U.S. dollar (USD). (To see how the prices of bitcoin and ethereum, another cryptocurrency, have changed over the past decade, see the FRED charts below.) It seems to have less to do with the promise of the underlying record-keeping technology stressed by Nakamoto’s white paper. To be sure, the price of a financial security can be related to its underlying fundamentals. It is not, however, entirely clear what these fundamentals are for cryptocurrency or how they might generate continued capital gains for investors beyond the initial rapid adoption phase. Moreover, while the supply of a given cryptocurrency such as Bitcoin may be capped, the supply of close substitutes (from the perspective of investors, not users) is potentially infinite. Thus, while the total market capitalization of cryptocurrencies may continue to grow, this growth may come more from newly created cryptocurrencies and not from growth in the per-unit price of any given cryptocurrency, such as Bitcoin. See David Andolfatto and Andrew Spewak’s “ Whither the Price of Bitcoin? ” Federal Reserve Bank of St. Louis, Economic Synopses , 2019.

SOURCE: Coinbase, retrieved from FRED (Federal Reserve Economic Data).

NOTE: Gray shaded areas indicate U.S. recessions. For more data from Coinbase, see these series .

In any case, conceptually, there is a distinction to be made between the promise of a cryptocurrency’s underlying technology and the market price of its native token. Bitcoin (BTC) as a payments system could, in principle, function just as well at any given BTC/USD exchange rate.

Cryptocurrency Applications

Cryptocurrencies designed to serve as money and payments systems have continued to struggle in their quest for adoption as an everyday medium of exchange. Their main benefit to this point—at least for early adopters—has been as a long-term store of value. But their exchange rate volatility makes them highly unsuitable as domestic payment instruments, given that prices and debt contracts are denominated in units of domestic currency. While year-over-year returns can be extraordinary, it is not uncommon for a cryptocurrency to lose most of its value over a relatively short period of time. How a cryptocurrency might perform as a domestic payments system when it is also the unit of account remains to be seen. El Salvador recently adopted bitcoin as its legal tender, and people will be watching this experiment closely. Legal tender is an object that creditors cannot legally refuse as payment for debt. While deposits are claims to legal tender (they can be converted into cash on demand), they also constitute claims against all bank assets in the event of bankruptcy.

A use case touted early in Bitcoin history was its potential to serve as a vehicle currency for international remittances. One of the attractive attributes of Bitcoin is that anyone with access to the internet can access the Bitcoin payments system freely and without permission. For example, a Salvadoran working in the United States can convert his or her USD into BTC at an online exchange and send BTC to a relative in El Salvador in minutes for (usually) a relatively low fee, compared with sending money through conventional channels.

As with any tool, bitcoin may be used for good or ill purposes. Because BTC is a permissionless bearer instrument (like physical cash), it may become a popular way to finance illegal activities, terrorist organizations and money laundering operations. Recently, it has been used in ransomware attacks, in which nefarious agents blackmail hapless victims and demand payment in bitcoin, thereby bypassing the banking system.

But possibly the most attractive characteristic of Bitcoin is that it operates independently of any government or concentration of power. Bitcoin is a decentralized autonomous organization (DAO). Its laws and regulations exist as open-source computer code living on potentially millions of computers. The blockchain is beyond the (direct) reach of government interference or regulation. There is no physical location for Bitcoin. It is not a registered business. There is no CEO. Bitcoin has no (conventional) employees. The protocol produces a digital asset, the supply of which is, by design, capped at 21 million BTC. Participation is voluntary and permissionless. Large-value payments can be made across accounts quickly and cheaply. It is not too difficult to imagine how these properties can be attractive to many people.

Policy Considerations of Cryptocurrency

To a central bank, a cryptocurrency looks very much like a foreign currency. From this perspective, there is nothing revolutionary here. Foreign currency is sometimes seen as a threat by governments. This is not the case for the United States, since the U.S. dollar remains the world’s reserve currency, but many other countries often take measures to discourage the domestic use of foreign currency. Citizens may be prohibited, for example, from holding foreign currency or opening accounts in foreign banks. Because cryptocurrencies are freely available and permissionless, it would likely be considerably more difficult to enforce cryptocurrency controls. The cryptocurrency option may also serve to constrain domestic monetary and fiscal policies—in particular, by imposing a more stringent limit on the amount of seigniorage (i.e., the “printing” of more money to finance government spending).

A dominant foreign currency may cause another problem: As it turns out, it is often cheaper to issue debt denominated in a dominant foreign currency. The problem with this activity is that when the domestic currency depreciates, debtors may have trouble repaying, and a financial crisis may ensue. When that dominant foreign currency is the U.S. dollar, the central bank of a foreign country can sometimes find relief by borrowing dollars from the Federal Reserve through a currency-swap line. But if debt instruments are denominated in cryptocurrency, there is no negotiating with the DAO of that cryptocurrency. Because this is the case, domestic regulators might want to regulate the practice of issuing cryptocurrency-denominated debt more stringently, if the practice ever became sufficiently widespread to pose significant systemic risk.

- Understanding Decentralized Finance

Decentralized finance broadly refers to financial activities that are based on a blockchain. Unlike conventional or traditional finance that relies on intermediaries and centralized institutions, DeFi relies on so-called smart contracts. The removal of those intermediaries in transactions between untrusted parties would significantly reduce costs and grant the parties more control over the terms of such agreements. Still, intermediaries oftentimes play meaningful roles beyond verification and enforcement, which means they would not altogether disappear. Here, we examine some of these concepts to explain what DeFi means and implies. For a more extensive review, see Fabian Schär’s “ Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets ,” Federal Reserve Bank of St. Louis, Review , 2021; also see an analysis by Sara Feenan et al. in “ Decentralized Financial Market Infrastructures: Evolution from Intermediated Structures to Decentralized Structures for Financial Agreements ,” The Journal of FinTech , 2021.

What Are the Benefits and Challenges of Decentralized Finance?

DeFi allows parties to engage in financial transactions without the need for intermediaries. In this short video, St. Louis Fed economist Fernando Martin looks at how DeFi works with smart contracts and digital tokens.

What Are Smart Contracts?

A smart contract is a computer program designed to execute an agreed-upon set of actions. The concept was first introduced in the mid-1990s by Nick Szabo, who proposed vending machines as a primitive example: A vending machine is a mechanism that dispenses a product in exchange for a listed amount of coins (or bills); anyone with a sufficient amount of money can participate in this exchange. See Nick Szabo’s “ Smart Contracts ” (1994) and “ The Idea of Smart Contracts ” (1997). The key idea is that contractual terms, once agreed upon, are not renegotiable and are therefore automatically executed in the future. In economic theory, so-called Arrow-Debreu securities have the same property. Smart contracts allow interested parties to engage in secure financial transactions without the participation of third parties. As we explain below, their application goes beyond conventional financial transactions.

Ethereum is a blockchain with smart contract capability that was released in 2015. In this case, smart contracts are a type of account, with their own balance and the capability to interact with the network. Rather than being controlled by a user, smart contracts run as programmed, with their code and data residing at a specific address on the Ethereum blockchain. Other platforms may implement smart contracts in different ways. For example, Hyperledger allows for confidential transactions, whereas Ethereum, a public network, does not. Bitcoin is also able to handle a variety of smart contracts.

Like cryptocurrencies, smart contracts overcome security and transparency concerns in transactions between untrusted parties, without the need for a trusted third party. In fact, smart contracts aim to do away with intermediaries such as brokers, custodians and clearinghouses.

Consider a collateralized loan as an example. In traditional finance, a borrower seeks a bank to lend funds or a broker to find potential lenders. The parties then agree on the terms of the loan: interest rate, maturity, type and value of collateral, etc. The borrower’s collateral is placed in escrow. If the borrower fulfills the terms of the contract, the collateral is released and full ownership rights are returned. If the borrower defaults, the collateral is used to fulfill the contract (e.g., repay the remaining principal, interest and penalties). There are many parties involved in this transaction: financial intermediaries, appraisers, loan servicers, asset custodians, and others.

In a smart contract, the entire agreement is specified as part of the computer program and is stored on a blockchain. The program contains the terms of the loan, as well as the specific actions it will take based on compliance (e.g., the transfer of collateral ownership in the event of default). Since the blockchain handles the faithful execution of the contract, there is no need to involve any parties beyond the borrower and lender.

Asset Tokenization

The example above illustrates an important wrinkle: It may not be possible for all the elements and actions of a contract to be handled by the blockchain—particularly when it comes to collateral. If collateral is not available as an asset in the native protocol (i.e., the specific blockchain where the smart contracts exist), then, as in traditional finance, the contract necessitates a third party to provide escrow services. Naturally, this exposes the contract to counterparty risk. One solution to this problem is asset tokenization.

Asset tokenization consists of converting the ownership of an asset into digital tokens, each representing a portion of the property. If the asset exists in physical form (e.g., a house), then tokenization allows the asset to exist in a blockchain and be used for various purposes (e.g., as collateral). An important issue is how to enforce property rights stored in the blockchain for assets that exist in the physical world. This is an ongoing challenge for DeFi and one that may never be fully resolved.

Tokens also have a variety of nonfinancial applications. For example, they may grant owners voting rights to an organization. This allows for the decentralized control of institutions within a blockchain, as we describe below. Another popular application is the creation of nonfungible tokens (NFTs), which provide ownership of a digital image created and “signed” by an artist. Although the image could in principle be replicated countless times, there is only one version that is verifiably authentic. The NFT serves as a certificate of authenticity in the same way that artists’ signatures ensure paintings are originals and not copies. The advantage of an NFT is the security provided by the blockchain—signatures can be forged, whereas the authenticity of the NFT is validated by a decentralized communal consensus algorithm.

Decentralized Autonomous Organization

Smart contracts could transform the way we organize and control institutions. Applications may range from investment funds to corporations and perhaps even the provision of public goods and services.

A decentralized autonomous organization, or DAO, is an organization represented by a computer code, with rules and transactions maintained on a blockchain. Therefore, DAOs are governed by smart contracts. A popular example is MakerDAO, the issuer of the stablecoin Dai, whose stakeholders use tokens to help govern decisions over protocol changes.

The concept of governance refers to the rules that balance the interests of different stakeholders of an institution. For example, a corporation’s stakeholders may include shareholders, managers, creditors, customers, employees, the government and the general public, among others. The board of directors typically plays the critical role in corporate governance. One of the main issues corporate governance is designed to mitigate is agency problems: when managers do not act in the best interest of shareholders. But governance extends beyond regulating internal matters and may, for example, manage the role of a corporation inside a community or relative to the environment.

DAOs may be created for ongoing projects, such as a DeFi entity, or for specific and limited purposes, such as public works. Because they offer an alternative governance model by encoding rules in a smart contract, they replace the traditional top-down structure with a decentralized consensus-based model. Two prominent examples—the decentralized exchange Uniswap and the borrowing and lending platform Aave—started out in the traditional way, by having their respective development teams in charge of day-to-day operations and development decisions. They eventually issued their own tokens, which distributed governance to the wider community. With varying details, holders of governance tokens may submit development proposals and vote on them.

Centralized and Decentralized Exchanges

Currently, the most popular way in which cryptoassets are traded is through a centralized exchange (CEX), which works like a traditional bank or a broker: A client opens an account by providing personal identifiable information and depositing funds. With an account, the client can trade cryptoassets at listed prices in the exchange. The client does not own these assets, however, as the exchange acts as a custodian. Hence, clients’ trades are recorded on the exchange’s database rather than on a blockchain. Binance and Coinbase are CEXs that offer accessibility to users. However, since they stand between users and blockchains, they need to overcome the same trust and security issues as traditional intermediaries.

Decentralized exchanges (DEXs), on the other hand, rely on smart contracts to enable trading among individuals on a P2P basis, without intermediaries. Traders using DEXs keep custody of their funds and interact directly with smart contracts on a blockchain.

One way to implement a DEX is to apply the methods from traditional finance and rely on order books. These order books consist of lists of buy and sell orders for a specific security that display the amounts being offered or bid on at each price point. CEXs also work in this way. The difference with DEXs is that the list and transactions are handled by smart contracts. Order books can be “on-chain” or “off-chain,” depending on whether the entire operation is handled on the blockchain. In the case of off-chain order books, typically only the final transaction is settled on the blockchain.

Order-book DEXs may suffer from slow execution and a lack of liquidity. That is, buyers and sellers may not find adequate counterparties, and individual transactions may affect prices too much. DEX aggregators alleviate this problem by collecting the liquidity of various DEXs, which increases the depth of both sides of the market and minimizes slippage (i.e., the difference between the intended and executed price of an order).

An automated market maker (AMM) is another way to solve the liquidity problem in DEXs. Market makers are also derived from traditional finance, where they play a central role in ensuring adequate liquidity in securities markets. AMMs create liquidity pools by rewarding users who “deposit” assets in the smart contract, which then can be used for trades. When a trader proposes an exchange of two assets, the AMM provides an instant quote based on the relative availability (i.e., liquidity) of each asset. When the liquidity pools are sufficiently large, trades are easy to fulfill and slippage is minimized. Automated market makers are currently the dominant form of DEXs, because they resolve the liquidity problem better than alternative mechanisms and thus provide speedier and cheaper transactions.

What Are Stablecoins?

As we described earlier, cryptocurrencies are subject to extreme exchange rate volatility, which makes them highly unsuitable as payment instruments. A stablecoin is a cryptocurrency that ties its value to an asset outside of its control, such as the U.S. dollar. Some stablecoins stabilize their value by pegging to the U.S. dollar, backed with non-U.S. dollar assets; Dai, for example, pegs its value to a senior tranche of other cryptoassets. See Dankrad Feist’s “ On Supply and Demand for Stablecoins ,” 2021. To accomplish this, the stablecoin must effectively convince its liability holders that its liabilities can be redeemed on demand (or on short notice) for U.S. dollars at par (or at some other fixed exchange rate). The purpose of this structure is to render stablecoin liabilities more attractive as payment instruments. Pegging to the U.S. dollar is attractive to people living in the U.S. because the U.S. dollar is the unit of account. Those outside the U.S. may be attracted to the product because the U.S. dollar is the world’s reserve currency. This structure serves to increase demand for the stablecoin. But why would someone want to make U.S. dollar payments using a stablecoin instead of a regular bank account?

The answer ultimately rests on which product offers its clients the services they desire at a price they find attractive. A stablecoin is likely to be attractive at the wholesale level, where firms would be able to make USD payments at each point in an international supply chain without the need for conventional banking arrangements. Stablecoins market themselves as leveraging blockchain technology to deliver safer and more efficient account management and payment processing services. These efficiency gains can then be passed along to customers in the form of lower fees. A more cynical view ascribes these purported lower costs to regulatory arbitrage (i.e., sidestepping certain costs by relocating the transaction outside of the regulatory environment), rather than technological improvements in database management.

A Primer on Stablecoins

Stablecoins are cryptocurrencies that tie their value to an outside asset. In this short video, St. Louis Fed economist Fernando Martin takes a deep dive into stablecoins and how they have characteristics that are similar to money market mutual funds.

Financial Stability Concerns

U.S. dollar-based stablecoins are similar to money market funds that peg the price of their liabilities to the U.S. dollar. They also look very much like banks without deposit insurance . As the financial crisis of 2007-09 showed, even money market funds are subject to runs when the quality of their assets is questioned. Unless a U.S. dollar-based stablecoin is backed fully by U.S. dollar reserves (it needs an account at the Federal Reserve for this) or by U.S. dollar bills (the maximum denomination is $100, so this seems unlikely), it is potentially prone to a bank run. If a stablecoin cannot dispose of its assets at fair or normal prices, it may fail to raise the U.S. dollars it needs to meet its par redemption promise in the face of a wave of redemptions. In such an event, the stablecoin would turn out to be not so stable.

If the adverse consequences of a stablecoin run were limited to the owners of stablecoins, then standard consumer protection legislation would be sufficient. But regulators also are concerned about the possibility of systemic risk. Consider, for example, the commercial paper market, where firms regularly borrow money on a short-term basis to fund operating expenses. Then consider a stablecoin (or any money market fund) with large holdings of commercial paper. A stablecoin run in this case may compel a fire sale of commercial paper to raise the funds needed to meet the wave of redemptions. This fire sale would likely have adverse economic consequences for firms that make regular use of the commercial paper market: As commercial paper prices decline, the value of commercial paper as collateral falls, and firms may find it more difficult to borrow the funds they normally access with ease. If the fire sale spills over into other securities markets, credit conditions may tighten significantly and lead to the usual woes experienced in an economic recession (missed payments, worker layoffs, etc.). These events are sufficiently difficult for a central bank to handle when the entities involved are domestic money market funds. The problem is compounded if the stablecoin is an unregulated “offshore” DAO. Will offshore stablecoins that are “too big to fail” be able to take advantage of the implicit insurance provided by central bank lender-of-last-resort operations? If so, this would be an example of how the private benefits of DeFi arise from regulatory arbitrage and not from an inherent technological advantage. This possibility presents a significant challenge for national and international regulators.

On the other hand, it may be possible for stablecoins to be rendered “run-proof” by employing smart contracts to design more resilient financial structures. For example, real-time communal monitoring of balance sheet positions is a possibility—a feature that could shine light on what are traditionally opaque financial structures. The opacity of financial structures is not necessary to explain bank runs. For example, the canonical model of bank runs assumes the existence of transparent balance sheets. See Douglas Diamond and Philip Dybvig’s “ Bank Runs, Deposit Insurance, and Liquidity ,” The Journal of Political Economy , 1983. Furthermore, because redemption policies can potentially manifest themselves as computer code, their design can be made more elaborate (state-contingent) and credible (contractual terms that can be credibly executed and not reversed). These features can potentially render stablecoins run-proof in a manner that is not possible with conventional banking arrangements.

Regulators and Stablecoins

The regulatory concerns with stablecoins are similar to age-old concerns with the banking industry. Banks are in the business of creating money and do so by issuing deposit liabilities that promise a fixed (par) exchange rate against U.S. dollar bills and dollar credits held in Federal Reserve accounts. Lower-yielding liabilities are used to acquire higher-yielding assets. Because commercial banks normally hold only a very small fraction of their assets in the form of reserves, they are called fractional reserve banks. Since the introduction of federal deposit insurance, retail-level bank runs have been practically nonexistent. Banks also have access to the Federal Reserve’s emergency lending facilities. These privileges are matched by a set of regulatory constraints on bank balance sheets (both assets and liabilities) and other business practices.

Some stablecoin issuers would undoubtedly like to base their business models on those of banks or prime institutional money market funds. The motivation is clear: Issuing low-cost liabilities to finance high-yielding assets can be a profitable business. (Until, of course, something goes wrong. Then, regulators and policymakers face blame for permitting such structures to exist in the first place.) This business model naturally involves non-negligible risk and could make for a potentially unstable stablecoin. As stablecoins with these properties interact with off-chain financial activity, they introduce risks that may spill over to other markets and, therefore, prompt some form of regulation.

Other stablecoin issuers are likely to focus on delivering payment services, which can be accomplished by holding only safe assets. These stablecoins would be more akin to government money market funds. Stablecoins that submit to government regulations may be permitted to hold only the safest of securities (e.g., U.S. Treasury securities). If they could, they might even hold only interest-bearing reserves, thereby becoming “narrow banks.” The business model in these cases would be based on generating profits through transaction-processing fees and/or net interest margins enhanced by what stablecoin users would hope to be a wafer-thin capital requirement.

- The Makeup of a Central Bank Digital Currency

The Board of Governors of the Federal Reserve System, in its recent paper “ Money and Payments: The U.S. Dollar in the Age of Digital Transformation ,” defines a central bank digital currency (CBDC) as a “digital liability of the Federal Reserve that is widely available to the general public.” This essentially means allowing the general public to open personal bank accounts at the central bank. How might a CBDC work?

Today, only financial institutions defined as depository institutions by the Federal Reserve Act and a select number of other agencies (including the federal government) are permitted to have accounts at the Federal Reserve. These accounts are called reserve accounts. The money balances that depository institutions hold in their reserve accounts are called bank reserves. The money account held by the federal government at the Federal Reserve is called the Treasury General Account. In a sense, a CBDC already exists, but only at the wholesale level and only for a small group of agencies. The question is whether to make it more broadly accessible and, if so, how.

What Is a Central Bank Digital Currency?

Economist David Andolfatto notes that there is more than one model for a central bank digital currency. In this short video, he explains how those models vary and highlights one big difference between a CBDC and traditional bank deposits: how they are insured.

As explained above, the general public already has access to a digital currency in the form of digital deposit liabilities issued by depository institutions. Most households and businesses have checking accounts with private banks. The general public also has access to a central bank liability in the form of physical currency (cash). While banks are obligated to redeem their deposit liabilities for cash on demand, deposits are not legally central bank or government liabilities. To put it another way, CBDC is (or would presumably be made) legal tender, while bank deposits represent claims to legal tender.

Federal Deposit Insurance

Bank accounts in the United States are presently insured up to $250,000 by the Federal Deposit Insurance Corp. From a political-economic point of view, bank deposits at the retail level are a de facto government liability. Moreover, given the role of the Federal Reserve as lender of last resort, one could make a case that large-value bank deposits are also a de facto government liability. To the extent this is so, the legal status of CBDC versus bank money may not be important as far as the ultimate safety of money accounts is concerned.

The Question of Counterparty Risk