Gurukul of Excellence

Classes for Physics, Chemistry and Mathematics by IITians

Join our Telegram Channel for Free PDF Download

Case Study Questions for Class 9 Science Chapter 14 Natural Resources

Case Study/Passage Based Questions:

Question 1:

At present the primary nutrient which limits the agricultural yield is nitrogen (N). Some plants are capable to produce more N 2 than they consume. These plants show symbiotic relationship with N 2 -fixing bacteria such as Rhizobium. These bacteria produce root nodules in leguminous plants and convert atmospheric N 2 into nitrogenous compounds. Rhizobium bacteria are gram negative bacteria, which show host specificity and fix N 2 in the presence of a red pigment called leghaemoglobin. It protects nitrogen fixing enzyme nitrogenase from oxygen.

(i) Which of the following statements is incorrect? (A) Leghaemoglobin functions as oxygen scavenger during N 2 -fixation. (B) Enzyme nitrogenase, which is required to fix atmospheric N 2 is active in the presence as well as absence of oxygen. (C) N, P and K are referred to as critical elements for crop plants as they easily become deficient in soil due to higher plant requirement and repeated cultivation. (D) The coordinated activities of the legume and Rhizobium bacteria depend on chemical interactions between the symbiotic partners.

(ii) Read the given statements and select the correct answer. Statement 1: Rhizobium bacteria can also live freely in the soil and cany out N 2 -fixation by themselves. Statement 2: Such Rhizobium bacteria are called free-living N 1 -fixing bacteria. (A) Both statements 1 & 2 are true and statement 2 is the correct explanation of statement 1. (B) Both statements 1 & 2 are true but statement 2 is not the correct explanation of statement-1 (C) Statement 1 is true and statement 2 is false. (D) Both statements 1 and 2 are false.

Download CBSE Books

Exam Special Series:

- Sample Question Paper for CBSE Class 10 Science (for 2024)

- Sample Question Paper for CBSE Class 10 Maths (for 2024)

- CBSE Most Repeated Questions for Class 10 Science Board Exams

- CBSE Important Diagram Based Questions Class 10 Physics Board Exams

- CBSE Important Numericals Class 10 Physics Board Exams

- CBSE Practical Based Questions for Class 10 Science Board Exams

- CBSE Important “Differentiate Between” Based Questions Class 10 Social Science

- Sample Question Papers for CBSE Class 12 Physics (for 2024)

- Sample Question Papers for CBSE Class 12 Chemistry (for 2024)

- Sample Question Papers for CBSE Class 12 Maths (for 2024)

- Sample Question Papers for CBSE Class 12 Biology (for 2024)

- CBSE Important Diagrams & Graphs Asked in Board Exams Class 12 Physics

- Master Organic Conversions CBSE Class 12 Chemistry Board Exams

- CBSE Important Numericals Class 12 Physics Board Exams

- CBSE Important Definitions Class 12 Physics Board Exams

- CBSE Important Laws & Principles Class 12 Physics Board Exams

- 10 Years CBSE Class 12 Chemistry Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Physics Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Maths Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Biology Previous Year-Wise Solved Papers (2023-2024)

- ICSE Important Numericals Class 10 Physics BOARD Exams (215 Numericals)

- ICSE Important Figure Based Questions Class 10 Physics BOARD Exams (230 Questions)

- ICSE Mole Concept and Stoichiometry Numericals Class 10 Chemistry (65 Numericals)

- ICSE Reasoning Based Questions Class 10 Chemistry BOARD Exams (150 Qs)

- ICSE Important Functions and Locations Based Questions Class 10 Biology

- ICSE Reasoning Based Questions Class 10 Biology BOARD Exams (100 Qs)

✨ Join our Online JEE Test Series for 499/- Only (Web + App) for 1 Year

✨ Join our Online NEET Test Series for 499/- Only for 1 Year

Leave a Reply Cancel reply

Join our Online Test Series for CBSE, ICSE, JEE, NEET and Other Exams

Editable Study Materials for Your Institute - CBSE, ICSE, State Boards (Maharashtra & Karnataka), JEE, NEET, FOUNDATION, OLYMPIADS, PPTs

Discover more from Gurukul of Excellence

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

CBSE Expert

Case Study Questions of Chapter 14 Natural Resources PDF Download

Case study Questions on Class 9 Science Chapter 14 are very important to solve for your exam. Class 9 Science Chapter 14 Case Study Questions have been prepared for the latest exam pattern. You can check your knowledge by solving case study-based questions for Class 9 Science Chapter 14 Natural Resources

In CBSE Class 9 Science Paper, Students will have to answer some questions based on Assertion and Reason. There will be a few questions based on case studies and passage-based as well. In that, a paragraph will be given, and then the MCQ questions based on it will be asked.

Natural Resources Case Study Questions With answers

Here, we have provided case-based/passage-based questions for Class 9 Science Chapter 14 Natural Resources

Case Study/Passage-Based Questions

Question 1:

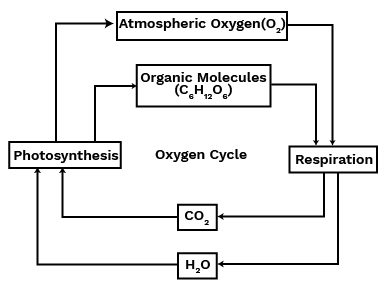

Oxygen is a very abundant element on our Earth. It is found in the elemental form in the atmosphere to the extent of 21%. It also occurs extensively in the combined form in the Earth’s crust as well as also in the air in the form of carbon dioxide. In the crust, it is found as the oxides of most metals and silicon, and also as carbonate, sulphate, nitrate and other minerals. It is also an essential component of most biological molecules like carbohydrates, proteins, nucleic acids and fats (or lipids).

When we talk of the oxygen-cycle, we are mainly referring to the cycle that maintains the levels of oxygen in the atmosphere. Oxygen from the atmosphere is used up in three processes, namely combustion, respiration and in the formation of oxides of nitrogen. Oxygen is returned to the atmosphere in only one major process, that is, photosynthesis. And this forms the broad outline of the oxygen-cycle in nature.

Though we usually think of oxygen as being necessary to life in the process of respiration, it might be of interest to you to learn that some forms of life, especially bacteria, are poisoned by elemental oxygen. In fact, even the process of nitrogen-fixing by bacteria does not take place in the presence of oxygen.

(1) How much oxygen is present in our atmosphere?

Answer: (b) 21 %

(2) Identify the correct statement

Statement 1 – Oxygen is also an essential component of most biological molecules.

Statement 2 – Oxygen is returned to the atmosphere through process called photosynthesis

Statement 3 – Oxygen -cycle maintains the levels of oxygen in the atmosphere.

Statement 4 – Our atmosphere have 21 % oxygen.

(b) Both 2 & 3

(c) Both 1 & 4

(d) All of the above

Answer: (d) All of the above

(3) Oxygen from the atmosphere is used up in three main processes,

(a) Combustion

(b) Respiration

(c) Formation of oxides of nitrogen

(4) By which process Oxygen is returned to the atmosphere

(a) Respiration

(b) Photosynthesis

(c) Photolysis

(d) None of the above

Answer: (b) or (c)

(5) Write the molecular formula of oxygen?

Answer: Molecular formula of oxygen is: O2

Hope the information shed above regarding Case Study and Passage Based Questions for Class 9 Science Chapter 14 Natural Resources with Answers Pdf free download has been useful to an extent. If you have any other queries about CBSE Class 9 Science Natural Resources Case Study and passage-based Questions with Answers, feel free to comment below so that we can revert back to us at the earliest possible

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Download India's best Exam Preparation App Now.

Key Features

- Revision Notes

- Important Questions

- Previous Years Questions

- Case-Based Questions

- Assertion and Reason Questions

No thanks, I’m not interested!

Case Study Questions Class 9 Science Improvement in Food Resources

Case study questions class 9 science chapter 15 improvement in food resources.

CBSE Class 9 Case Study Questions Science Improvement in Food Resources. Important Case Study Questions for Class 9 Exam. Here we have arranged some Important Case Base Questions for students who are searching for Paragraph Based Questions Improvement in Food Resources.

At Case Study Questions there will given a Paragraph. In where some Questions will made on that respective Case Based Study. There will various types of marks will given 1 marks, 2 marks, 3 marks or 4 marks.

CBSE Case Study Questions Class 9 Science – Improvement in Food Resources

Different crops require different climatic conditions, temperature and photoperiods for their growth and completion of their life cycle. Photoperiods are related to the duration of sunlight. Growth of plants and flowering are dependent on sunlight. As we all know, plants manufacture their food in sunlight by the process of photosynthesis. There are some crops, which are grown in rainy season, called the kharif season from the month of June to October, and some of the crops are grown in the winter season, called the Rabi season from November to April. Paddy, soyabean, pigeon pea, maize, cotton, green gram and black gram are kharif crops, whereas wheat, gram, peas, mustard, linseed are Rabi crops.

In India there has been a four times increase in the production of food grains from 1952 to 2010 with only 25% increase in the cultivable land area. This increase in production been achieved through the practices involved in farming, we can divide it into three stages. The first is the choice of seeds for planting. The second is the nurturing of the crop plants. The third is the protection of the growing and harvested crops from loss. Thus, the major groups of activities for improving crop yields can be classified as: • Crop variety improvement • Crop production improvement • Crop protection management.

(1) What is kharif season period?

(a) June to July

(b) June to October

(c) June to November

(d) June to December

(2) What is Rabi season period?

(a) November to April

(b) November to March

(c) November to February

(d) November to January

(3) Plants manufacture their food in sunlight by the process called __________

(a) Photosynthesis

(b) Photoperiod

(c) Photolysis

(d) None of the above

(4) Enlist the names of Kharif crops.

(5) Enlist the names of Rabi crops.

(4) Kharif crops

Paddy, soyabean, pigeon pea, maize, cotton, green gram and black gram

(5) Rabi crops

Wheat, gram, peas, mustard, linseed are.

Cattle husbandry is done for two purposes— milk and draught labour for agricultural work such as tilling, irrigation and carting. Indian cattle belong to two different species, Bosindicus , cows, and Bosbubalis , buffaloes. Milk-producing females are called milch animals (dairy animals), while the ones used for farm labour are called draught animals.

Milk production dependson the duration of the lactation period, meaning the period of milk production after the birth of a calf. So, milk production can be increased by increasing the lactation period. Exotic or foreign breeds (for example, Jersey, Brown Swiss) are selected for long lactation periods, while local breeds (for example, Red Sindhi, Sahiwal) show excellent resistance to diseases. The two can be cross-bred to get animals with both the desired qualities.

Proper cleaning and shelter facilities for cows and buffaloes are required for humane farming, for the health of the animals and for production of clean milk as well. The food requirements of dairy animals are of two types: (a) maintenance requirement, which is the food required to support the animal to live a healthy life, and (b) milk producing requirement, which is the type of food required during the lactation period.

Cattle suffer from a number of diseases. The diseases, besides causing death, reduce milk production. The external parasites live on the skin and mainly cause skin diseases. The internal parasites like worms, affect stomach and intestine while flukes damage the liver.

(1) Identify the exotic breed of cow

(a) Red Sindhi

(b) Sahiwal

(c) Brown Swiss

(d) All of the above

(2) Identify the correct statements

Statement 1 – Milk production depends on the duration of the lactation period.

Statement 2 – Exotic or foreign breeds are selected for long lactation periods.

Statement 3 – Local breeds show excellent resistance to diseases.

Statement 4 – Animals used for farm labour are called draught animals.

(a) Both 1 & 2

(c) Both 3 & 4

(3) Milk-producing females are termed as

(a) Milch animals

(b) Dairy animals

(c) Draught animals

(d) Both a & b

(4) Enlist any two Indian cattle species.

(5) What are the food requirements of dairy animals?

(4) Indian cattle belong to two different species

- Bosindicus – cows. • Bosbubalis – buffaloes.

(5) The food requirements of dairy animals are of two types

- Maintenance requirement – which is the food required to support the animal to live a healthy life. • Milk producing requirement -which is the type of food required during the lactation period.

Poultry farming is undertaken to raise domestic fowl for egg production and chicken meat. Improved poultry breeds are developed and farmed to produce layers for eggs and broilers for meat. The cross-breeding programmes between Indian (indigenous, for example, Aseel) and foreign (exotic, for example, Leghorn) breeds for variety improvement are focused on to develop new varieties for the following desirable traits— number and quality of chicks; dwarf broiler parent for commercial chick production; summer adaptation capacity/ tolerance to high temperature; low maintenance requirements; reduction in the size of the egg-laying bird with ability to utilise more fibrous cheaper diets formulated using agricultural by-products.

Broiler chickens are fed with vitamin-rich supplementary feed for good growth rate and better feed efficiency. Care is taken to avoid mortality and to maintain feathering and carcass quality. They are produced as broilers and sent to market for meat purposes. For good production of poultry birds, good management practices are important. The housing, nutritional and environmental requirements of broilers are somewhat different from those of egg layers. The daily food requirement for broilers is protein rich with adequate fat. The level of vitamins A and K is kept high in the poultry feeds. Poultry fowl suffer from a number of diseases caused by virus, bacteria, fungi, parasites, as well as from nutritional deficiencies. Appropriate vaccination can prevent the occurrence of infectious diseases and reduce loss of poultry during an outbreak of disease.

(1) Identify the incorrect statements

Statement 1 – Broiler chickens are fed with vitamin-rich supplementary feed for good growth.

Statement 2 – The level of vitamins A and K is kept high in the poultry feeds

Statement 3 – The level of vitamins A and K is kept low in the poultry feeds

Statement 4 – Improved poultry breeds are developed and farmed to produce layers for eggs and broilers for meat.

(2) Poultry breeds which are produce for eggs are termed as _________

(b) Broilers

(c) Indigenous

(3) Poultry breeds which are produce for meat are termed as _________

(4) What are the objectives of cross-breeding programme in Indian and Exotic breed.?

(5) Enlist the name of Indian and Exotic breed.

(4) The cross-breeding programmes between Indian (indigenous, for example, Aseel) and foreign (exotic, for example, Leghorn) breeds for variety improvement are focused on to develop new varieties for the following desirable traits— number and quality of chicks; dwarf broiler parent for commercial chick production; summer adaptation capacity/ tolerance to high temperature; low maintenance requirements; reduction in the size of the egg-laying bird with ability to utilise more fibrous cheaper diets formulated using agricultural by-products.

(5) Indigenous or Indian breed – for example, Aseel

Foreign or Exotic – for example, Leghorn

Honey is widely used and therefore bee keeping for making honey has become an agricultural enterprise. Since bee-keeping needs low investments, farmers use it as an additional income generating activity. In addition to honey, the beehives are a source of wax which is used in various medicinal preparations. The local varieties of bees used for commercial honey production are Apisceranaindica , commonly known as the Indian bee, A. dorsata, the rock bee and A. florae, the little bee. An Italian bee variety, A. mellifera, has also been brought in to increase yield of honey.

The Italian bees have high honey collection capacity. They sting somewhat less. They stay in a given beehive for long periods, and breed very well. For commercial honey production, bee farms or apiaries are established. The value or quality of honey depends upon the pasturage, or the flowers available to the bees for nectar and pollen collection. In addition to adequate quantity of pasturage, the kind of flowers available will determine the taste of the honey.

(1) Which species of bee is commonly known as the Indian bee?

(a) Apisceranaindica

(b) Apisdorsata

(c) Apismellifera

(d) Apis florae

(2) Which species of bee is commonly known as the rock bee?

(3) Which species of bee is commonly known as the little Bee?

(4) Identify the correct statements

Statement 1 – Beehives are a source of wax which is used in various medicinal preparations.

Statement 2 – Apisceranaindica is commonly known as the Indian bee

Statement 3 – Apisdorsata is known as the rock bee

Statement 4 -The quality of honey depends upon the flowers available for nectar and pollen collection.

(b) Both 3 & 4

(5) Enlist the local varieties of bees used for commercial honey production.

(5) The local varieties of bees used for commercial honey production

- Apisceranaindica , commonly known as the Indian bee

- Apisdorsata , the rock bee.

- Apis florae, the little bee.

Fish is a cheap source of animal protein for our food. Fish production includes the finned true fish as well as shellfish such as prawns and molluscs. There are two ways of obtaining fish. One is from natural resources, which is called capture fishing. The other way is by fish farming, which is called culture fishery. The water source of the fish can be either seawater or fresh water, Fishing can thus be done both by capture and culture of fish in marine and freshwater ecosystems

Popular marine fish varieties include pamphlet, mackerel, tuna, sardines, and Bombay duck. Marine fish are caught using many kinds of fishing nets from fishing boats. Some marine fish of high economic value are farmed in seawater. This includes finned fishes like mullets, bhetki, and pearl spots, shellfish such as prawns mussels and oysters as well as seaweed. Oysters are also cultivated for the pearls they make. As marine fish stocks get further depleted, the demand for more fish can only be met by such culture fisheries, a practice called mariculture.

Fresh water resources include canals, ponds, reservoirs and rivers. Brackish water resources, where seawater and fresh water mix together. Most fish production from these resources is through aquaculture.

(1) Fish obtaining from natural resources are termed as _______

(a) Capture fishing

(b) Culture fishing.

(c) Marine fishing.

(d) Freshwater fishing.

(2) Which of the following are marine fish varieties

(a) Pamphlet

(b) Mackerel

(3) Oysters are cultivated for

(a) Perales

(c) Seaweeds

Statement 1 – Fish is a source of animal protein for our food.

Statement 2 – Oysters are also cultivated for the pearls.

Statement 3 – There are two ways of obtaining fish – Natural resources & Fish farming.

Statement 4 – Pamphlet is the popular marine fish varieties.

(5) Enlist the varieties of fishes.

(5) Varieties of fishes are given below,

• Pamphlet • Mackerel • Tuna • Sardines • Bombay duck 0

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

NCERT Solutions for Class 9 Science Chapter 14 Natural Resources

Chapter 14 Natural Resources Class 9 Science NCERT Solutions

Contact form.

Extra Questions for Class 9 Science Chapter 14 Natural Resources

Extra questions for Class 9 Science Chapter 14 Natural Resources with answers is given below. Our subject expert prepared these solutions as per the latest NCERT textbook. These questions will be helpful to revise the all topics and concepts. CBSE Class 9 extra questions are the most simple and conceptual questions that are prepared by subject experts for the students to study well for the final exams. By solving these extra questions, students can be very efficient in their exam preparations.

Natural Resources Class 9 Science Extra Questions and Answers

Very short answer questions.

1: What is the role of respiration in oxygen cycle? Answer: Oxygen enters in the living world through the process of respiration, i.e., it oxidises the food material (glucose molecule) and produces energy and carbon dioxide.

2: Name the gases which cause greenhouse effect. Answer: Greenhouse effect is caused by carbon dioxide, Chlorofluorocarbons (CFCs) nitrogen oxide and methane.

3: Name some biologically important organic compounds that contain both oxygen and nitrogen. Answer: Proteins, amino acids and nucleic acids.

4: Name the compound, which is responsible for the depletion of ozone layer in the atmosphere. Answer: Chlorofluorocarbons (CFCs)

5: Which part of solar radiation is absorbed by ozone layer? Answer: Ultraviolet radiation 6: What do you mean by biotic component? Answer: The biotic component means the living organisms, which are present in environment.

7: What do you mean by air pollution? Answer: An increase in the content of harmful or undesirable substances (pollutants) in the air, is called air pollution.

8: Air is also called “breath of life’. Why? Answer: Air is called breath of life because it contains oxygen, which is required by all living organisms for respiration.

9: Which winds bring rain in most parts of India? Answer: The South-West or North-East monsoons.

10: State the harmful effects of ultraviolet rays. Answer: Ultraviolet rays cause cancer and cataract-like diseases to living organisms.

11: Which non-living component of the Earth determine biodiversity of an area? Answer: Water is the determinant of biodiversity of an area.

12: State two factors, which are responsible for polluting water. Answer: Municipal sewage and discharge from industries are responsible for polluting water.

13: What is soil? Answer: Soil is the outermost layer of our Earth, called the crust, which forms the upper surface of land and supports plant growth.

14: What is top soil? How is it responsible for the biodiversity in an area? Answer: It is the topmost layer of the soil that contains humus and living organisms in addition to the soil particles. The quality of top soil is an important factor that decides biodiversity in that area.

15: What are the main substances of biogeochemical cycles? Answer: Its main substances are carbon (C), nitrogen (N), oxygen (O) and water 16: Which group of plants contains nitrogen fixing bacteria in their roots? Answer: Leguminous plants such as cereals, pea, bean, etc.

17: Name two organisms, which play vital role in nitrogen fixation.

Answer: The organisms, which play vital role in nitrogen fixation are (i) Rhizobium and blue-green algae, help in fixation of free atmospheric nitrogen. (ii) Nitrosomonas and Nitrobacter are nitrifying bacteria, which convert ammonia to nitrite and then nitrite to nitrates. 18: Why step farming is common on hills? Answer: Step farming is common on hills because it slows down the speed of rain water, stops soil erosion and increases water absorption by the soil.

19: Soil formation is done by both biotic and abiotic factors. List the names of these factors by classifying them as biotic and abiotic. Answer: (i) Abiotic factors of soil formation: Sun, water, wind, etc. (ii) Biotic factors of soil formation: herbs, lichens, mosses, microorganisms, etc.

20: Write full form of CFCs. Answer: Chlorofluorocarbons

21: State one use of ozone. Answer: It protects the Earth from harmful radiations like high energy ultraviolet radiations

22: State the role of symbiotic bacteria in nitrogen cycle of nature. Answer: Plants are unable to take atmospheric nitrogen directly. Symbiotic bacteria convert the atmospheric nitrogen into water soluble nitrates, which are easily utilised by plants.

23: Name any one method by which water helps in soil formation. Answer: In physical weathering, water and high temperature cause expansion and contraction of rocks, facilitating their breakdown. As a result forming soil.

24: In which region, the ozone layer is present in the atmosphere? Answer: Ozone layer is present in stratosphere region of the atmosphere.

25: Where the hole in ozone layer have recently detected? Answer: The hole in ozone layer have recently detected over Antarctica.

26: Why the Earth is called as ‘Blue Planet’? Answer: The Earth is called as ‘Blue Planet’ because it is covered with 75% of water.

27: State the process by which carbon enters in the living system. Answer: Respiration is the process by which carbon enters in the living system in the form of carbon dioxide.

28: Name the component of air, which is most essential for living organisms. Answer: Oxygen is the component of air, which is most essential for living organisms.

29: Give two examples where water can be found in the frozen form on the Earth. Answer: Water is found frozen in the ice-caps at two poles and on snow-covered mountains.

30: Why terrestrial life forms require freshwater? Answer: Terrestrial life forms require freshwater because their body cannot tolerate high amount of dissolved salts in saline water.

31: Name two fossil fuels, which are responsible for air pollution. Answer: Coal and petroleum are responsible for air pollution.

32: What do you mean by thermal pollution? Answer: Thermal pollution is increase in temperature of water-bodies due to addition of hot water or hot effluent into it.

33: Give any two effects of soil erosion. Answer: Two effects of soil erosion are (i) Desertification (ii) Reduction in soil futility

34: What is combustion? Answer: Combustion is a process of burning of fossil fuels, to provide energy for various needs like cooking, transportation and industrial processes.

35: Name the process by which oxygen is replenished in nature. Answer: Oxygen is replenished in nature through photosynthesis.

36: What is ozone hole? Answer: Ozone hole is the depletion of ozone gas in ozone layer, as present over Antarctica.

37: Name two freshwater resources, which provide freshwater for human use. Answer: The two freshwater resources, which provide fresh water for human use are: (i) Groundwater (ii) Surface water (ponds, lakes, streams, etc.)

38: What is the direction of air in coastal areas during the day? Answer: During the day, the direction of air current or wind is from sea to land.

39: Which particles form the nuclei for condensation of water vapours in the atmosphere? Answer: Dust and smoke particles.

40: Name the two acids that are present in acid rain. Answer: Two acids present in acid rain are: (i) Nitric acid (ii) Sulphuric acid

Short Answer Type Questions

1: What is lithosphere? Answer: The outer crust of the Earth is called the lithosphere.

2: What is hydrosphere? Answer: The water available on the earth’s surface as well as underground water comprise together as hydrosphere. Water covers 75% of the Earth’s surface.

3: What is atmosphere? Answer: The envelope of air that surrounds the earth is called atmosphere.

4: List the four zones of the atmosphere. Answer: Four zones of atmosphere are:

- Tropospshere

- Stratosphere

- Mesospshere

- Thermospshere

5: What is biosphere?

Answer: This life-supporting zone of the Earth where the atmosphere, the hydrosphere and the lithosphere interact and make life possible, is known as the biosphere. It accommodates several types of living organisms which remain dependent on natural resources. The biosphere ranges between 6km, above sea level and 10kms below sea.

6: How is our atmosphere different from the atmosphere on Venus and Mars?

Answer: Earth’s atmosphere is quite different from the atmosphere present on Venus and Mars. The atmosphere of the earth consists of Nitrogen(79%), Oxygen(20%), small fraction of carbon dioxide and other gases which make it suitable for living. The atmosphere of Venus or Mars has carbon dioxide as the major component (95-97%)

7: How does the atmosphere act as a blanket?

Answer: The atmosphere acts as a blank due to its following functions:

- It plays an important role in temperature control. It maintains the average temperature of the earth fairly constant during the course of whole year.

- It prevents the sudden increase in temperature during the daylight hours.

- During the night, it slows down the escape of heat into outer space.

8: What causes winds?

Answer: Uneven heating of the earth’s surface and water surface causes winds. On heating up the air rises up creating a low pressure region. Air travels from high pressure region to low pressure region forming winds. In addition the rotation of the Earth and the presence of mountain ranges in the paths of the wind also influence to winds.

9: Which gets heated faster land or water? Answer: Land

10: Define air-pollution? Answer: An increase in the content of these harmful substances in air is called air pollution.

11: List any three human activities that you think would lead to air pollution.

Answer: Three human activities leading to air pollution are:

- Rapid urbanization and industrialization.

- Deforestation

- Burning of fuels like coal and petroleum.

- Burning of coal in thermal power plants.

12: Name two diseases caused due to an increased content of pollutants in the air produced due to the burning of fossil fuels. Answer: Bronchitis, asthma, lung cancer.

13: What is smog?

Answer: Smoke + Fog = Smog. The presence of unburnt hydrocarbons in air when mixed with condensed water vapours forms a thick layer called smog. It lowers the visibility during winter season and is an indication of air pollution.

14: How do fossil fuel cause air pollution?

Answer: The fossil fuels like coal and petroleum contain traces of nitrogen and sulphur. When these fuels are burnt, nitrogen and sulphur too are burnt and this produces different oxides of nitrogen and sulphur. These oxides of nitrogen and sulphur are poisonous and can cause respiratory problems. These oxides when mix with rain water give rise to acid water due to formation of nitric and sulphuric acids.

15: What are the effects of acid rain?

Answer: Effects of acid rain are:

- Acidification of soil reduces fertility of soil.

- Destroys aquatic life and pollutes water resources.

- Causes irritation to eyes and skins of human beings and cattle.

- Causes corrosion to buildings, bridges, statues etc.

16: What are biogeochemical cycles? Names two examples.

Answer: Biogeochemical cycles are the cyclic pathways through which chemical substances move through biotic environment (biosphere) and abiotic environment (lithosphere, atmosphere and hydrosphere) components of the earth. A few example of biogeochemical cycles are:

- Water Cycle

- Nitrogen Cycle

- Carbon Cycle

- Oxygen cycle

17: In which regions is soil erosion very difficult to revert? Answer: The regions with bare vegetation, mountains and hilly regions, soil erosion is very difficult to reverse.

Long answer Type Questions

1: How are clouds formed?

Answer: Due to various weather phenomena (e.g. uneven heating of land and water bodies on the earth surface), warm and cold convection of air currents generate. Water vapours which are also present in air due to evaporation also rise up. Since air cools down on rising, it leads to condensation of water vapours present in it. Thus vapours condense onto a tiny salt particles called condensation nuclei which form clouds.

Broadly clouds formed are of four types:

- Nimbostratus: (Nimbus means rain). These clouds carry thick precipitation or rains.

- Altostratus: These clouds form a foggy, gray and dull weather look.

- Cirrostratus: these clouds form fluffy cotton like pattern.

- Cirrus: These are high-level clouds seen during fair weather.

2: Meenakshi saw reduction in greenish layer of lichens at the bark of trees at the biology garden of the school. The garden was few metres away from diesel generator placed for electricity backup. She immediately informed the school authorities to check the pollution level of diesel and kerosene used in the generator.

(a) How reduction in Lichens layer is related to pollution? (b) What measures should be taken by school authorities to check the reduction? (c) What qualities are shown by Meenakshi by informing school about the Lichens?

Answer: (a) Lichens are found to be very sensitive to the levels of contaminants like sulphur dioxide in the air. Diesel and Kerosene contain traces of nitrogen and sulphur which for deadly oxides when mixed in air.

(b) School authorities should check the pollution level and quality of fuel used in diesel generator. They should also replace the generator with a better which does not pollute the environment. The generator should be place away from the school premises to avoid inhalation of smoke from it.

(c) She is concerned about air pollution and showed her social responsibility to keep the environment clean and pollution free.

3: Why do organisms need water? OR Why is water essential for life? OR Water is known as ‘A Wonder Liquid’. Justify this statement by giving any two reasons.

Answer: Water is an essential part for living organisms:

- Most of the biochemical processes involve water e.g. photosynthesis takes water as one of the raw material to prepare food.

- The major component of blood is water (plasma) which helps in transportation of food and excretory substances.

- Water is used as part of food as a source of energy.

- Water in sweat cools down the body temperature. Similarly water as transpiration loss in plants controls temperature of the plant as well as it helps in ascent of sap.

- Water is used in many activities like drinking, food preparation, irrigation, power generation and industries.

- Water is an essential medium for aquatic life. Amphibians also need water to carry out reproduction.

- Water is a universal solvent hence it is used in medicines and a many chemical reactions takes place when dissolved in water.

- Water makes up 70% of body weight of human beings and it carries out various metabolic activities in all animals.

4: What is meant by depletion of ozone layer? Mention one important feature of ozone in atmosphere. Identify the factors responsible for the formation of ozone hole.

Answer: The part of atmosphere, at height 320 km above sea level, there is a 5km thick ozone layer. This layer acts as a shield/blanket which absorbs UV radiations from sunlight. Thus it saves biotic life on the earth from the harmful effects UV radiation.

Over Antarctica, there is declining of ozone layer thickness and hole is seen. If depletion of ozone layer dwindles further, it would have severe consequences on the lives of living beings.

Following are the main chemicals responsible for the destruction of ozone layer: 1. chlorofluorocarbons (CFCs) 2. halogens (used in fire extinguishers) 3. methane and nitrous oxide

CFCs used as propellants in aeroplanes and coolant in refrigeration are the most damaging, which catalytically destroy ozone and convert it into oxygen.

Value Based Questions

1. It has been made mandatory to install rain water harvesting system and solar water heater in all buildings in urban areas, (i) What is the rationale when rain water already passes into drains? (ii) Why are solar water heaters being installed when electric geezers are available?

Answer: (i) Rain water passed into drain does not enter the ground but is taken out of the urban area and poured into a water body at quite a distance with or without treatment. However, ground water is being withdrawn everywhere for drinking, industrial and irrigation purposes. As a result, the level of ground water is going down and arid conditions are being faced in many areas. In rain water harvesting, rain water from a building is passed directly into ground, dug wells or water pumps. This recharges ground water.

(ii) Installation of solar water heaters is a method of saving electricity which is always in short supply due to rapid urbanisation, Industrialisation and intensive agriculture. Coal/gas based power plants are adding CO 2 to the atmosphere causing global warming. Saving electricity is now an important social responsibility.

2. (i) Sheela saw blue-green algae forming bloom in the village pond, (ii) Fish, which was previously abundant was no-where to be seen. (iii) The pond is giving a stink. Water of the pond is not even fit for cattle. Some of the cattle who were taken to the pond for drinking and bathing have fallen sick, (iv) What explanation will Sheela give for this to the villagers.

Answer: (i) Bloom forming algae occur in a pond only when the quality of pond water has deteriorated due to pollution. Blue-green algae secrete toxins that are harmful to animals and humans,

(ii) Fish must have died due to deficiency of oxygen in pond water. Oxygen deficiency occurs when there is excess of organic matter (organic loading). The aerobic decomposers consume the dissolved oxygen. This is followed by anaerobic decomposition of organic matter. It produces sulphides and other sludge producing substances. Blue-green algae can grow under such circumstances.

(iii) Stink comes from anaerobic breakdown products of organic matter. The toxins released by blue-green algae further deteriorate the quality of water causing sickness and skin rashes in animals and humans.

(iv) Sheela could explain to the villagers that deterioration of pond has been due to excess fertilizers used by them in their fields. Rain wash brought these fertilizers into the pond. There was initial spurt in the growth of plants due to this. The phenomenon is called eutrophication. Excess plant matter slowly caused organic loading of water that reduced its oxygen content, killing the fish and other aquatic animals. So fertilizers should be used very judiciously in the fields.

3. (i) Carbon dioxide concentration in the atmosphere has reached more than 390 ppm (ii) The Antarctic and arctic waters are becoming acidic causing thinning of animal shells. (iii) Polar ice is melting, (iv) Some low lying islands have submerged in sea.

(a) What are the reasons behind all these changes occurring on earth? (b) Suggest a mechanism to control the same and if possible to reverse the trend.

Answer: (a) The reason for these global changes is faulty recycling of carbon dioxide. More of carbon dioxide is being produced than its consumption in photosynthesis due to

- Excess combustion of fossil fuels in industries, power houses, automobiles, homes and other places,

- Reduced intake of CO 2 by plants due to deforestation,

- Higher amounts of CO 2 entering the atmosphere not only increases its atmospheric concentration but also the concentration of dissolved CO 2 in water, especially in colder seas. This is making colder waters acidic. The acidity is thinning the shells of many marine animals.

- CO 2 is a green house gas which is causing global warming. Rise in global temperature is melting snow over poles. This is raising the level of sea water slowly. It was already submerged some low lying islands.

(b) Suggestions:

- Large scale tree plantation in all vacant areas,

- Reduced felling of forest trees.

- Reducing consumption of fossil fuel by reducing dependence on thermal power plants, increasing efficiency of automobiles and switching over to alternate technologies that do not consume fossil fuels.

4. On a school trip to an industrial estate, students found that the marble used in the office buildings of most factories has lost its shine and become pitted.

(i) What is the reason of marble pitting (ii) Can this factor cause harm to vegetation as well ? (iii) Suggest way to prevent this.

Answer: (i) Pitting and discolouring of marble is due to corrosive action of dry or wet acid rain, comprising sulphur dioxide and nitrogen oxides, emitted during combustion of fossil fuels in industries. The acid reacts with insoluble calcium carbonate of marble and converts it into soluble calcium sulphate and calcium nitrate.

(ii) Yes, Acid rain can also cause harm to vegetation by (a) Direct action of acid over plants causing death of leaves, (b) Solubilisation of essential minerals and their leaching leaving only toxic minerals in the soil.

(c) Use of wet scrubbers to remove acidic gases from the industrial emissions.

Talk to our experts

1800-120-456-456

- Natural Resources Class 9 Notes CBSE Science Chapter 14 (Free PDF Download)

- Revision Notes

CBSE Class 9 Science Chapter 14 - Natural Resources Revision Notes - Free PDF Download

The notes of Natural Resources Class 9 are all about the natural resources of the environment. These are land, air and water. The lithosphere is the solid outermost layer of the earth’s crust. The hydrosphere is the water that is found on the surface of the earth. Also, Class 9 Science Ch 14 notes describes that the atmosphere is the air that covers the earth like a blanket and protects it from harmful radiations. Lastly, the biosphere is the region that has all the biotic and abiotic elements. Therefore, types of natural resources according to Class 9 Science Chapter 14 notes are forest, minerals, animals, air, soil, water and soil. Download the free PDF now.

Vedantu is a platform that provides free CBSE Solutions (NCERT) and other study materials for students. They can download Class 9 Maths NCERT Solutions to help you to r evise complete syllabus and score more marks in your examinations.

Download CBSE Class 9 Science Revision Notes 2023-24 PDF

Also, check CBSE Class 9 Science revision notes for All chapters:

Access Class 9 Science Chapter 14 – Natural resources in 30 Minutes

Natural Resources:

Materials given commonly on earth that can be utilized by living creatures are named to be regular assets. These are the land, the water and the air. The strong peripheral layer of the world's hull is known as the lithosphere. The water that is found on the world's surface, as groundwater, is known as the hydrosphere. The air that covers the entire Earth like a sweeping is known as the air. The district on earth involving both biotic and abiotic segments is called the biosphere.

The Breath Of Life: Air:

Air is a combination of gases like nitrogen, oxygen, carbon dioxide and water fumes. Nitrogen is utilized to create various natural atoms like proteins. Nitrogen is fixed in plants and is moved to creatures through natural way of life. Oxygen is utilized by plants and creatures during the time spent breathing. The burning of non-renewable energy sources likewise requires oxygen. Carbon dioxide is utilized by plants during the time spent photosynthesis. Numerous marine creatures use carbonates broken down in ocean water to make their shells.

The role of the atmosphere in climate control – Atmosphere covers the Earth like a blanket. It prevents the sudden increase of temperature due to sun in the day and also prevents the steady escape of heat from Earth to outer space. The absence of atmosphere on the moon makes the temperature vary from $-{{190}^{\circ }}C$ to ${{110}^{\circ }}C$.

The movement of air: winds - During the day, the air above the land in coastal locations heats up more quickly and rises. As the air rises, a region of low-pressure forms, and air from the sea moves into it. Winds are created by the movement of air from one place to another. The wind would be blowing from the sea to the land during the day. Because soil cools faster than water, the air above the ground cools faster at night.

Rain - During the day, water bodies heat up and evaporate into the atmosphere. The vapour cools as it rises. The vapour condenses into small water droplets, which fall as rain as a result of the precipitation process. The prevailing wind patterns determine rainfall patterns.

Air pollution - Air pollution is the contamination of the air with chemicals, smoke, dust particles, and disease-causing agents. When fossil fuels are burned, distinct nitrogen and sulphur oxides are produced, which dissolve in rain and cause acid rain. The amount of hydrocarbons produced by the combustion of fossil fuels likewise grows. When there are large levels of pollutants present, visibility is reduced. Breathing air contaminated with any of these pollutants on a regular basis raises the risk of allergies, cancer, and heart disease.

Water: A Wonder Liquid:

Water can be found on the surface of the Earth, underground, and as water vapour in the atmosphere. The maximum amount of water available is salty marine water. The majority of the freshwater on the planet is in the form of frozen ice. Water is necessary for plant and animal survival because cellular functions take place in a water media. Dissolved substances are transferred from one portion of the body to another. As a result, in order to survive, organisms must maintain the level of water bodies. The amount of water available determines not just the number of individuals of each species that can survive in a given area, but also the diversity of life there.

Water pollution - Water pollution is defined as the introduction of undesired elements into bodies of water. Fertilizers, pesticides, sewage, chemicals, and detergents are examples of undesirable substances. The amount of dissolved oxygen reduces when the temperature of the water rises owing to pollution. Aquatic creatures get their oxygen from dissolved oxygen. Many aquatic organisms die when the amount of dissolved oxygen in the water is reduced.

Mineral Riches In The Soil:

Another vital natural resource that sustains life is soil. Soil is made up of particles of soil, humus, and living creatures. In between the soil particles, there is also some water in the form of droplets or air. The soil is made up of the sun, water, wind, and living beings. Uneven rock contraction and expansion splits and breaks them down into smaller soil particles. Frozen water lodged in rock fractures and breaks the boulders, turning them into soil. Lichens that grow on the surface of rocks emit chemicals that break down the rocks and turn them into soil. River water breaks down hard rocks into soil particles. Rocks are eroded and sand particles are carried by strong winds.

Humus is a type of soil that contains pieces of decomposed biological creatures. Because it causes the soil to become more porous and allows water and air to permeate deep underground, it is a crucial element in determining the soil structure. The topsoil is the soil's top layer, which contains humus and live creatures in addition to the soil particles.

Soil pollution - Soil contamination is the addition of pollutants that have a negative impact on soil fertility. The usage of fertilisers resulted in the extinction of many beneficial microorganisms and a reduction in soil fertility. Deforestation has resulted in the erosion of the soil's top most productive layer. Soil erosion was also caused by animal overgrazing. Wind and water can also carry fine soil particles away.

Biogeochemical Cycles:

The transfer of matter and energy between the biotic and abiotic components of the biosphere takes place constantly and thus makes the ecosystem dynamic but stable. These transfers take place through various cycles explained below.

Water Cycle:

The entire method wherein water evaporates and falls at the land as rain and later flows again into the ocean thru rivers is called the water cycle. Water is able to dissolve a big variety of substances. As water flows via or over rocks containing soluble minerals a number of them get dissolved withinside the water. Thus, rivers deliver many vitamins from the land to the ocean, and those are utilized by marine organisms. A diagrammatic representation has been shown below.

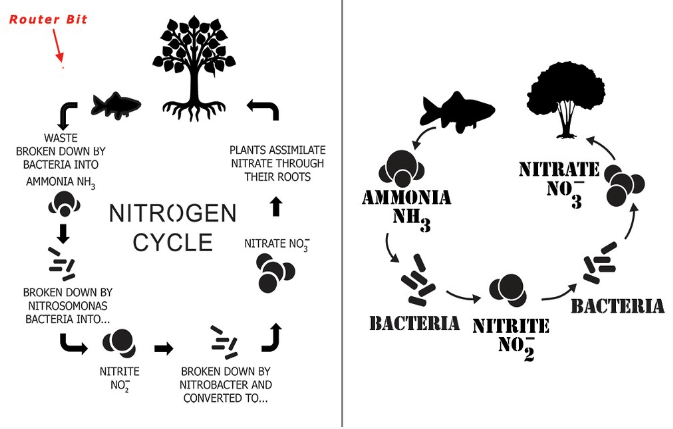

Nitrogen Cycle:

The nitrogen cycle is the method through which nitrogen is transformed among its diverse chemical forms. This transformation may be finished via each organic and bodily technique. Important techniques withinside the nitrogen cycle encompass fixation, ammonification, nitrification, and denitrification. Nitrogen makes up to seventy-eight percentage of the earth’s environment.

The percentage of nitrogen withinside the environment is maintained through the nitrogen cycle. Plants and animals can't make use of atmospheric nitrogen quite simply. It must be constant via way of means of a few organisms referred to as nitrogen fixers. Nitrogen-solving microorganisms like Rhizobium stays in symbiotic affiliation withinside the root nodules of sure leguminous plants. These microorganisms convert atmospheric nitrogen into ammonia, which is applied quite simply via way of means of plants.

Nitrogen-solving microorganisms alongside unfastened residing microorganisms withinside the soil gain ninety percentage of nitrogen fixation. During lightening, the excessive temperatures and pressures created withinside the air convert nitrogen into oxides of nitrogen. These oxides dissolve in water to offer nitric and nitrous acids and fall on land at the side of rain.

Plants convert those nitrates and nitrites into amino acids. Ammonification is the technique with the aid of which soil microorganisms decompose useless natural dependents and launch ammonia into the soil. Nitrification is the technique with the aid of using which ammonia is transformed into nitrites and nitrates. Denitrification is the technique with the aid of using which nitrates are transformed into atmospheric nitrogen. A diagrammatic representation has been shown below.

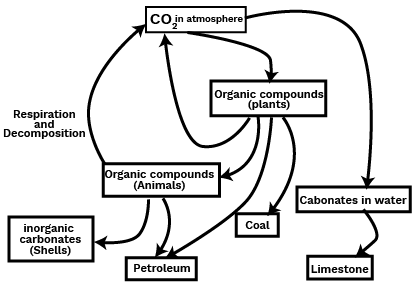

Carbon Cycle:

Carbon takes place withinside the elemental shape as diamonds and graphite. The carbon cycle begins off evolved in plants. Plants use carbon dioxide withinside the ecosystem to synthesize glucose withinside the presence of daylight via means of the procedure of photosynthesis.

Living matters ruin those glucose molecules to supply strength and launch carbon dioxide via respiration. The burning of fuels for numerous wishes like heating, cooking, transportation and commercial strategies provides carbon dioxide to the ecosystem. A diagrammatic representation has been shown below.

Oxygen Cycle:

Oxygen from the environment is used up in 3 processes, particularly combustion, respiratory and withinside the formation of oxides of nitrogen. Oxygen is lower back to the environment in best one predominant procedure this is photosynthesis. A diagrammatic representation has been shown below.

The Greenhouse Effect:

Some gases save you from the break out of warmth from the earth. A boom in the proportion of such gases withinside the environment could cause the common temperatures to boom globally and that is referred to as the inexperienced residence effect. CO 2 is one of the inexperienced residence gases. A boom withinside the CO 2 content material withinside the environment could cause extra warmth to be retained with the aid of using the environment and result in worldwide warming.

Ozone layer:

The ozone layer is found in the stratosphere , one of the layers of the atmosphere. Each molecule of ozone is made from 3 oxygen atoms. It is toxic however it prevents dangerous radiations from accomplishing on the earth’s surface, wherein they'll harm many lifestyles . Chlorofluorocarbon compounds (CFCs) outcomes withinside the depletion of the ozone layer.

Chapter 14 Science Class 9 Notes: A Brief Overview

The main topics included in the natural resource Chapter 14 Class 9 notes are rain, water and its pollution, Greenhouse effect, Biogeochemical cycles, Ozone layer and its depletion. In the following Natural Resources Class 9 Notes, let us gain knowledge about rain and its formation.

As you will see in Class 9th Science Chapter 14 notes, the evaporation and condensation of water are called rain. It is caused by the water cycle.

Class 9 Ch 14 Science notes tell us about the formation of acid rain. Acid rain is produced by the release of various gases such as S0 2 and N0 2 which is released from fuels and vehicles. They dissolve in rain and form sulphuric and nitric acid.

The Class 9 th Natural Resources notes also give us a lesson about water. Water is one of the renewable resources. It is very important for the physiological activities of animals and plants. It is presented in two forms which are surface water and groundwater.

Class 9th Chapter 14 Science Notes: Water Pollution

A change in the biological, chemical and physical properties of water which affects aquatic lives and also makes the water unfit for use or consumption is called water pollution. The main causes of water pollution are:

Removing desirable substances such as oxygen from water.

A water temperature change.

Ch 14 Science Class 9 notes have the details of water pollution explained for you along with proper illustrations.

Notes of Ch 14 Science Class 9: Greenhouse Effect

Greenhouse gases like methane, carbon dioxide and nitrogen oxide are present in the atmosphere to stop the heat falling on the Earth and not absorb it. Hence, this keeps it warm and this phenomenon is called the greenhouse effect. That is how Science Class 9 Chapter 14 notes help you to get to know the meaning of the greenhouse effect.

Ozone Layer

The notes of Chapter 14 Class 9 Science tell us that there are three molecules of oxygen that form ozone and hence form a layer in the stratosphere. It also acts as a protective shield and prevents harmful radiations that try to reach the earth. CFCs react with ozone and break ozone which is known as ozone depletion.

Class 9 Ch 14 Science Notes: Biogeochemical Cycles

An interaction between the abiotic and biotic components of biosphere make a system and such flows result in the formation of a cycle which is called a biogeochemical cycle.

Some Of The Cycles Are Mentioned In The Ch 14 Class 9 Science Notes Are:

1. water cycle.

Water-cycle is the process by which water evaporates and as a result, falls on the land as water. The rain flows back to sea with the help of rivers and such a cycle is called the water cycle. The steps included in the water cycle are:

Evaporation

Transpiration

Respiration

Precipitation

2. Nitrogen Cycle

The process by which nitrogen passes from the atmosphere to organisms and soil and returns back into the atmosphere is known as the nitrogen cycle. The processes included in the nitrogen cycle are:

Nitrogen Fixation

Nitrification

Ammonification

Denitrification

3. Carbon Cycle

The process in which carbon moves from the atmosphere to earth is called the carbon cycle. The processes involved in the carbon cycle are:

Photosynthesis

Respiration

Decomposition

4. Oxygen Cycle

The process by which oxygen is released in the atmosphere, and carbon dioxide is taken in by the plants from the atmosphere is called the oxygen cycle. Oxygen cycle includes:

Photosynthesis

Why Choose Vedantu?

The language of the materials as prepared by Vedantu is quite easy and student-friendly. The main aim of these notes is that students learn in an effective way. Thus, the quality of the content is particularly focussed upon. Vedantu has experts of the field with years of experience. So you can trust the study material to be completely in alignment with the syllabus as prepared by the board.

FAQs on Natural Resources Class 9 Notes CBSE Science Chapter 14 (Free PDF Download)

1. What are mineral resources? Mention the types.

The natural substances that have chemical and physical properties, as well as the chemical composition, are called mineral resources. Types of it are undiscovered resources, reserves and identified resources.

2. How do forests play a major role in maintaining the water cycle?

Water vapour in the atmosphere directly depends on the transpiration of water present in the leaves. Water stored in a watershed is influenced by forests. Thus, the forest plays an important role in maintaining the water cycle.

3. What are natural resources notes?

CBSE offers notes for chapter 14 of class 9 Science and students can access them through the link-Notes For Class 9 science. The main aim of the notes is to simplify both answers and concepts and so, natural resources are defined as the abundant stock of air, water, soil, minerals, and all living organisms present on the Earth. These resources are useful in supporting life and meeting the needs of people. Specifically, coal, oil, soil, animals, birds, etc. constitute the different natural resources on the planet.

4. What is the greenhouse effect?

Chapter 14 of class 9 in Science is about natural resources. Other concepts like biogeochemical cycles, ozone layer and its depletion, etc. are taught to students in detail. One such concept is the greenhouse effect. CBSE notes define the greenhouse effect as a process through which radiations coming from the sun’s rays are absorbed by the greenhouse gases like CO2 and do not get reflected back into outer space. In short, it is actually the heating of the Earth’s surface. To know more students can refer to the vedantu app also.

5. How does the atmosphere act as a blanket?

This answer is explained with the concept that air is a bad conductor of heat and the atmosphere is full of air. This air contains gases, dust particles, and other things. This prevents the flow of heat in air resulting in a balanced temperature. During the day, the atmosphere prevents the sudden increase in temperature, and at night, it traps the heat by slowing down its escape to maintain an average temperature. The ozone layer also helps in this process.

6. What is the idea conveyed in chapter 14 of class 9 Science?

This chapter covers all the basics and details regarding natural resources. The ideas conveyed in this chapter are purely done to make students aware and understand these resources and their present condition on Earth. Natural resources are very important as they help in maintaining an average temperature, and contain very important gases for sustaining life on Earth. All these ideas are conveyed to the students through this chapter and CBSE notes make it easier for them through its organized structure.

7. How are revision notes for chapter 14 of Science for class 9 students beneficial?

The chapter on Natural resources contains various concepts like the greenhouse effect, biogeochemical cycles, ozone layer, etc. By using notes for learning this chapter, students can save a lot of their time, as every concept is given in crisp details covering each point related to the topic. The language used in the explanation is easy to follow and thus, students can learn the chapter in an efficient way. The material can be trusted as they are created by professional experts. The notes can be downloaded free of cost from the vedantu website (vedantu.com).

STUDY MATERIALS FOR CLASS 9

Class 9 Science Case Study Questions Chapter 15 Improvement in Food Resources

- Post author: studyrate

- Post published:

- Post category: class 9th

- Post comments: 0 Comments

Case study Questions in Class 9 Science Chapter 15 are very important to solve for your exam. Class 9 Science Chapter 15 Case Study Questions have been prepared for the latest exam pattern. You can check your knowledge by solving Class 9 Science Case Study Questions Chapter 15 Improvement in Food Resources

Join our Telegram Channel, there you will get various e-books for CBSE 2024 Boards exams for Class 9th, 10th, 11th, and 12th.

In CBSE Class 9 Science Paper, Students will have to answer some questions based on Assertion and Reason. There will be a few questions based on case studies and passage-based as well. In that, a paragraph will be given, and then the MCQ questions based on it will be asked.

Improvement in Food Resources Case Study Questions With Answers

Here, we have provided case-based/passage-based questions for Class 9 Science Chapter 15 Improvement in Food Resources

Case Study/Passage-Based Questions

Case Study 1: Honey is widely used and therefore beekeeping for making honey has become an agricultural enterprise. Since bee-keeping needs low investments, farmers use it as an additional income-generating activity. In addition to honey, the beehives are a source of wax that is used in various medicinal preparations. The local varieties of bees used for commercial honey production are Apisceranaindica, commonly known as the Indian bee, A. dorsata, the rock bee, and A. florae, the little bee. An Italian bee variety, A. mellifera, has also been brought in to increase the yield of honey.

The Italian bees have a high honey collection capacity. They sting somewhat less. They stay in a given beehive for long periods and breed very well. For commercial honey production, bee farms or apiaries are established. The value or quality of honey depends upon the pasturage, or the flowers available to the bees for nectar and pollen collection. In addition to an adequate quantity of pasturage, the kind of flowers available will determine the taste of the honey.

(1) Which species of bee is commonly known as the Indian bee?

(a) Apisceranaindica

(b) Apisdorsata

(c) Apismellifera

(d) Apis florae

Answer: (a) Apisceranaindica

(2) Which species of bee is commonly known as the rock bee?

Answer: (b) Apisdorsata

(3) Which species of bee is commonly known as the little Bee?

Answer: (d) Apis florae

(4) Identify the correct statements

- Statement 1 – Beehives are a source of wax which is used in various medicinal preparations.

- Statement 2 – Apisceranaindica is commonly known as the Indian bee

- Statement 3 – Apisdorsata is known as the rock bee

- Statement 4 -The quality of honey depends upon the flowers available for nectar and pollen collection.

(a) Both 1 & 2

(b) Both 3 & 4

(d) All of the above

Answer: (d) All of the above

(5) Enlist the local varieties of bees used for commercial honey production.

Answer: The local varieties of bees used for commercial honey production Apisceranaindica, commonly known as the Indian bee Apisdorsata, the rock bee. Apis florae, the little bee.

Case Study 2: The chapter “Improvement in Food Resources” focuses on the various methods and techniques used to enhance food production and improve the quality of food resources. It explores the importance of agriculture in meeting the growing food demands of the increasing population. The chapter covers topics such as crop production, crop protection, animal husbandry, and the significance of various agricultural practices. It emphasizes the need for sustainable agricultural practices, including organic farming, integrated pest management, and the use of biotechnology in improving crop yield and quality. The chapter also highlights the importance of storage and preservation techniques to minimize food wastage. By implementing efficient and sustainable methods in food production and resource management, we can ensure food security and meet the nutritional needs of the population.

What is the focus of the chapter “Improvement in Food Resources”? a) Enhancing food production and improving the quality of food resources b) Exploring the nutritional needs of the population c) Studying the impact of climate change on agriculture d) Analyzing the challenges faced in food distribution Answer: a) Enhancing food production and improving the quality of food resources

Which agricultural practice is aimed at minimizing the use of synthetic chemicals and promoting environmentally friendly farming? a) Organic farming b) Genetically modified crops c) Traditional farming d) Hydroponics Answer: a) Organic farming

What is the importance of sustainable agricultural practices? a) Maximizing resource extraction b) Meeting the nutritional needs of the population c) Ensuring food security and minimizing environmental impact d) Increasing crop yield through intensive farming Answer: c) Ensuring food security and minimizing environmental impact

What is the significance of storage and preservation techniques in food resources? a) Minimizing food wastage b) Enhancing the nutritional content of food c) Improving crop yield d) Expanding agricultural land Answer: a) Minimizing food wastage

What is the role of biotechnology in improving food resources? a) Increasing the diversity of crops b) Enhancing crop yield and quality c) Reducing the need for irrigation d) Promoting organic farming practices Answer: b) Enhancing crop yield and quality

Hope the information shed above regarding Case Study and Passage Based Questions for Class 9 Science Chapter 15 Improvement in Food Resources with Answers Pdf free download has been useful to an extent. If you have any other queries about CBSE Class 9 Science Improvement in Food Resources Case Study and passage-based Questions with Answers, feel free to comment below so that we can revert back to us at the earliest possible By Team Study Rate

You Might Also Like

Mcq questions of class 9 social science history chapter 4 forest society and colonialism with answers, class 9 mcq questions for chapter 5 the fundamental unit of life with answers, class 9 history case study questions chapter 2 socialism in europe and the russian revolution, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

myCBSEguide

- Social Science

- Class 9 Social Science...

Class 9 Social Science Case Study Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

If you’re seeking Class 9 Social Science Case Study Questions, you’ve come to the correct spot. Students can use Class 9 Social Science Case Study Questions to help them answer a variety of questions about the Class 9 Social Science case study.

The CBSE Board has included case study questions in Class 9 Social Science examination pattern. As a result, it becomes an indispensable study tool.

The need for a student-friendly app to explain and facilitate the understanding of the social sciences subject has been felt for a long. Especially for students who do not have a strong foundation in Class 9 Social Science. With myCBSEguide , class 9 social science students now have a place where they can find resources that are student-friendly, interesting and easy to understand.

Class 9 Social Science Case Study questions are intended to assess student’s abilities to apply their learning to practical scenarios. You’ll need to employ your critical thinking and problem-solving skills to come up with the best solution. Class 9 Social Science case study questions are designed to test your knowledge and help you improve your skills.

Class 9 Social Science Case Study Questions Samples

myCBSEguide has identified the essential themes connected to CBSE case study questions for Class 9 Social Science that every student should be aware of following a comprehensive examination of CBSE Sample Papers and Marking Scheme. Students in Class 9 Social Science will benefit from this information in understanding the changes in the Class 9 Social Science. For a better understanding and analysis, students should refer to the example of Class 9 Social Science case study questions attached below:

Class 9 Social Science Case Study Question 1

Read the source given below and answer the questions that follow: On the morning of 14 July 1789, the city of Paris was in a state of alarm. The king had commanded troops to move into the city. Rumours spread that he would soon order the army to open fire upon the citizens. Some 7,000 men and women gathered in front of the town hall and decided to form a peoples’ militia. They broke into a number of government buildings in search of arms. Finally, a group of several hundred people marched towards the eastern part of the city and stormed the fortress-prison, the Bastille, where they hoped to find hoarded ammunition. In the armed fight that followed, the commander of the Bastille was killed and the prisoners released – though there were only seven of them. Yet the Bastille was hated by all because it stood for the despotic power of the king. The fortress was demolished and its stone fragments were sold in the markets to all those who wished to keep a souvenir of its destruction. The days that followed saw more rioting both in Paris and the countryside. Most people were protesting against the high price of bread. Much later, when historians looked back upon this time, they saw it as the beginning of a chain of events that ultimately led to the execution of the king in France, though most people at the time did not anticipate this outcome. Answer the following MCQs by choosing the most appropriate option:

On 14th July, 1789 the people of the ________ estate attacked the Bastille prison and freed all the prisoners signalling the start of the _________.

- first, civil war

- fourth, Russian war

- second, movement

- third, revolution

Which of the following statement is incorrect?

- The Bastille was the fortress-prison.

- The Bastille stood for the democratic power of the king.

- On the morning of 14 July 1789, the people of Paris stormed Bastille

- All are correct

In the question given below, there are two statements marked as Assertion (A) and Reason (R). Read the statements and chose the correct option: Assertion (A): The people of France storm the Bastille. Reason (R): They were hopeful to find King Louis XIV and commander of the Bastille there.

- Both A and R are correct and R is the correct explanation of A.

- Both A and R are correct but R is not the correct explanation of A.

- A is correct but R is wrong.

- Both A and R are wrong.

What was the immediate cause of rioting in Paris?

- Atrocities by the commander

- The high price of bread

- The killing of women and children

- All of these

Answer Key:

- (d) third, revolution

- (b) The Bastille stood for the democratic power of the king. [Explanation: The Bastille stood for the despotic power of the king.]

- (c) A is correct but R is wrong. [Explanation: The people of France stormed the fortress-prison, the Bastille because they were hopeful to find hoarded ammunition there.]

- (b) high price of bread

Class 9Social Science Case Study Question 2

Read the extracts and answer the question that follows:

The Himalayas, geologically young and structurally fold mountains stretch over the Himalayas northern borders of India. These mountain ranges run in a west-east direction from the Indus to the Brahmaputra. The Himalayas represent the loftiest and one of the most rugged mountain barriers of the world. They form an arc, which covers a distance of about 2,400 Km. Their width varies from 400 Km in Kashmir to 150 Km in Arunachal Pradesh. The altitudinal variations are greater in the eastern half than those in the western half. The Himalaya consists of three parallel ranges in its longitudinal extent. A number of valleys lie between these ranges. The northern most range is known as the Great or Inner Himalayas. It is the most continuous range consisting of the loftiest peaks with an average height of 6,000 metres. It contains all the prominent Himalayan peaks.

The folds of Great Himalayas are asymmetrical in nature. The core of this part of Himalayas is composed of granite. It is perennially snow bound, and a number of glaciers descend from this range.

- The Great or Inner Himalayas is also known as?

- Give two features of the folds of Great Himalayas.

- Give two features of the Inner Himalayas.

- The Great or Inner Himalayas is also known as the ‘Himadri’.

- (Any two relevant points)

- The folds of Great Himalayas are asymmetrical in nature.

- The core of this part of Himalayas is composed of granite.

- It is perennially snow bound, and a number of glaciers descend from this range.

- Features of the Inner Himalayas:

- It is the most continuous range consisting of the loftiest peaks with an average height of 6,000 metres.

- It contains all the prominent Himalayan peaks.

Class 9 Social Science Case Study Question 3

Read the source given below and answer the questions that follow: In Pakistan, General Pervez Musharraf led a military coup in October 1999. He overthrew a democratically elected government and declared himself the ‘Chief Executive’ of the country. Later he changed his designation to President and in 2002 held a referendum in the country that granted him a five-year extension. Pakistani media, human rights organisations and democracy activists said that the referendum was based on malpractices and fraud. In August 2002 he issued a ‘Legal Framework Order’ that amended the Constitution of Pakistan. According to this Order, the President can dismiss the national and provincial assemblies. The work of the civilian cabinet is supervised by a National Security Council which is dominated by military officers. After passing this law, elections were held to the national and provincial assemblies. So Pakistan has had elections, elected representatives have some powers. But the final power rested with military officers and General Musharraf himself. Clearly, there are many reasons why Pakistan under General Musharraf should not be called a democracy. People may have elected their representatives to the national and provincial assemblies but those elected representatives were not really the rulers. They cannot take the final decisions. The power to take final decision rested with army officials and with General Musharraf, and none of them were elected by the people. This happens in many dictatorships and monarchies. They formally have an elected parliament and government but the real power is with those who are not elected. In a few countries, the real power was with some external powers and not with locally elected representatives. This cannot be called people’s rule. Answer the following MCQs by choosing the most appropriate option:

What is the meaning of Referendum?

- Direct vote in which the entire electorate is asked to either accept or reject a particular proposal

- A form of government in which the rulers are elected by the people

- A system where the majority or elected representatives are allowed to take decisions on behalf of all the people

In the question given below, there are two statements marked as Assertion (A) and Reason (R). Read the statements and chose the correct option: Assertion (A): Pakistan not considered a democratic country even after having elections Reason (R): Despite elections to the national and provincial assemblies, the final powers rested with General Musharraf and military officers.

- Both A and R are true and R is the correct explanation of A.

- Both A and R are true but R is not the correct explanation of A.

- A is wrong but R is correct.

After the passage of the ________, elections were held to the national and state assemblies.

- Military rule

- Legal Framework Order

- Both (b) and (c)

Does the given source explain the significance of which feature of democracy?

- Democracy must be based on a free and fair election

- In a democracy, the final decision-making power must rest with those elected by the people

- In a democracy, each adult citizen must have one vote

- Democratic government rules within limits set by constitutional law and citizens’ rights

- (a) Direct vote in which the entire electorate is asked to either accept or reject a particular proposal

- (a) Both A and R are true and R is the correct explanation of A.

- (c) Legal Framework Order

- (b) In a democracy, the final decision-making power must rest with those elected by the people

Steps to Master Class 9 Social Science Case Study Questions

Class 9 Social Science case study questions can be daunting, but there are some strategies you can use to ace them. There is no one-size-fits-all answer to Class 9 social science case study questions. The best way to solve a social science case study will vary depending on the specific case in question. However, there are some general tips that can be followed in order to improve your chances of success while answering class 9 social science case study questions.

- First, make sure to read the question carefully and understand what is being asked. It is often helpful to re-read the question after gathering all of your information.