How to Write a Comparison Essay on Two Different Stories

26 sep 2017.

When a teacher or professor asks you to compare two stories, this gives you the opportunity to experience the works in a new way. You can look closely at how a writer’s style conveys what is at stake in the story and the way each story connects with the reader. This close assessment will also help you discover what you appreciate in fiction. Knowing some of the components to evaluate in these stories will help you build your comparison essay.

Explore this article

- Compare Plots

- Examine Characters

- Consider Point of View

- Evaluate Writing Styles

1 Compare Plots

You can discuss the plot, which is what happens in each story. Even with many similarities, stories will vary in what actually takes place. For example, in one story the main character may take a trip and experience many setbacks before discovering her true desires, but in the other story the character may stay home and review his past to make himself stronger. Since someone reading your essay may not know the stories, starting the body of your essay with a discussion of these plot differences and similarities will also help ground the reader in each story, says Jeffrey Nealon and Susan Searls Giroux, authors of “The Theory Toolbox: Critical Concepts for the Humanities, Arts, and Social Sciences.”

2 Examine Characters

Another option is to compare the main characters. Look at dialogue, interactions and the decisions they make. You can also evaluate how believable each character seems and whether or not you relate to that character. Look at the side characters in the stories as well. Each character should seem believable and have a role in the story. You might choose to mention if a character doesn’t have a role in moving the story forward, such as evaluating if the story would remain the same if the character were there or not. Discussing these findings will help you compare how well characters work in each story, explains Janet Burroway in “Imaginative Writing.”

3 Consider Point of View

You can also compare the point of view the writers use to tell their stories. Whether each story’s narration comes from a first-person, second-person, or third-person point of view impacts the story, and this might provide an interesting comparison for the stories. For example, one story might have a first-person narrator, making you feel close to the characters. In comparison, a third-person story might create distance between you and the characters, making you feel less involved.

4 Evaluate Writing Styles

Take time to discuss each writer's style throughout the story, evaluating concepts such as level of difficulty and your own enjoyment in reading the story. Consider the writers’ skills and how well they pull their stories together. You may like one writer better than the other, and Janet Burroway suggests you can discuss the reasons for this.

- 1 Purdue Online Writing Lab: Essay Writing

- 2 The Theory Toolbox: Critical Concepts for the Humanities, Arts, and Social Sciences; Jeffrey Nealon and Susan Searls Giroux

- 3 Imaginative Writing; Janet Burroway

About the Author

Kate Beck started writing for online publications in 2005. She worked as a certified ophthalmic technician for 10 years before returning to school to earn a Masters of Fine Arts degree in writing. Beck is currently putting the finishing touches on a novel.

Related Articles

How to Write an Explication of a Short Story

The Difference Between Discursive & Argumentative Essays

Criteria for Judging Short Stories

What is a Personal Narrative?

How to Write a Comic Book

How to Compare and Contrast Two Books

How to Write a Book Summary for 5th Graders

How to Write an Evaluation Essay on TV Shows

How to Write a Thesis Statement for an Article Critique

How to Write a Conclusion for a Literary Analysis Essay

How to Write a Critique Letter

Advanced Writing Techniques

Is a Narrative Essay Different From a Short Story?

How to Write a Critical Analysis of a Short Story

How to Write a Book Report in the 6th Grade

"West Side Story" Teaching Ideas

Can People Who Are Total Opposites Have a Compatible...

How to Write a Historical Narrative

How do I Write a Story in the 4th Grade?

How to Moderate Between Two Arguing Friends

Regardless of how old we are, we never stop learning. Classroom is the educational resource for people of all ages. Whether you’re studying times tables or applying to college, Classroom has the answers.

- Accessibility

- Terms of Use

- Privacy Policy

- Copyright Policy

- Manage Preferences

© 2020 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Based on the Word Net lexical database for the English Language. See disclaimer .

How to Compare Two Stories

Do you have two stories and don’t understand how they work together?

Welcome to this Mometrix lesson on comparing two stories!

To compare two stories, we need to consider their similarities and differences pertaining to main ideas , themes , tone , characters , greater contributions, inspirations, opinions, etc. This is an important skill to have when reading because it stretches your thinking and your brain’s ability to remember key points of one story and assess how those points may be similar in a different context. Practicing this skill is actually really fun and helps to bring reading to life. It allows for your readings, or interpretations, of different texts to go beyond just one, uncovering multiple levels hidden in each text.

If you’ve watched our video on how to compare and contrast , then you know that a great way to compare two things is to create a list. The first side of the list should consist of key things you noticed in the first story, and the second side of the list should consist of how the second story lines up with what you noticed in the first.

Comparison #1

Let’s look at an off-the-wall but simple example first. Let’s compare Alice’s Adventures in Wonderland with Harry Potter . For the first side of our list, we’ll look at Alice in Wonderland :

Alice’s Adventures in Wonderland The story centers around a young child It deals with magical elements There are darker themes at play in the novel Heavy themes of loss of innocence and coming of age Many fantastical features and animated creatures The child is not being led by an adult, rather by her imagination and by trial and error Focus on an alternate reality

For the second side of our list, we’ll look at Harry Potter :

Harry Potter The story also centers around a young child, really, young children There is a heavy influence of sorcery throughout the novels It also deals with darker themes, loss of innocence, and coming of age Many fantastical creatures Kids are being led Focus on an alternate reality

Comparison #2

A more complex example might be if you wanted to compare Walt Whitman’s Leaves of Grass with Emily Dickinson’s poem “#1400 – What Mystery Pervades a Well!”

To do this comparison you might note what Whitman uses:

Leaves of Grass Nature Grass Man’s curiosity Man’s divine connection with nature

On the other side of your list, you might note about Dickinson’s poem:

“#1400 – What Mystery Pervades a Well!” She also uses nature Personification of grass and of a well Themes concerning the divinity of man and nature You might also note her inclination towards man’s disconnect with nature

Again, this is a little more complex of an example, but even without knowing the references, you can still see that there are clear similarities between the two texts. With this list of information, you could easily write multiple pages for an essay comparing these two texts.

With either of the examples presented, you could write a well-informed essay, if you needed to, comparing and contrasting two stories. Even if not for writing an essay, comparing two stories, no matter how seemingly unrelated like in our first example, is great practice for stretching your mind to see similarities that might otherwise be overlooked.

Thanks for joining us, today. Until next time!

Return to Reading Comprehension Videos

by Mometrix Test Preparation | This Page Last Updated: July 26, 2023

- How It Works

- Topic Generator

- United States

- View all categories

Comparison of Two Short Stories

Introduction

Is your time best spent reading someone else’s essay? Get a 100% original essay FROM A CERTIFIED WRITER!

The story Sun-Powered Car is about Malcolm a newspaper reporter in a TV station; despite twenty-five years of working he has not received any promotion this makes him depressed about the job he is doing. As he walks into a restaurant for dinner he gets the site of Ned and two of his sons who are driving an old car with a solar panel on top. Malcolm talks to talks to the waitress about Ned inventing the solar-powered car. Malcolm is thinking that this was an amazing idea and could hit the news headlines (Robert, 122). It is only after he talks to Ned that he is told that the car is not solar-driven but his son pedaled. Whereas, Homework is about Jason a school boy who is constantly arguing with his parents whether he should do his homework or not, Jason complains that the homework is boring while the parents insist that it is important that he does the homework for it will impact his life positively. A discussion comes up on who of Jason's parents had a tough upbringing. When the argument ceases Jason's parents order snacks and food from the robot servant they then set up hologram play. In the end Jason gives in to the parents' demands grounding and yells he accepts to do the homework. He fixes a cable to his head and the homework is downloaded to the brain.

This essay compares and contrasts the setting, point of view and the themes in the two short stories.

Setting: The short story Sun-powered car the actions are taking place in a small town at dinner. Malcolm stops to have lunch where he meets the farmer Ned and also the waitress Helen. Whereas, the action in homework takes place in their house and Jason's father and mother get mad at him for failing to do his homework. The two stories have some similarities in setting. Sun-powered car story is most probably in our time zone but the homework story may be in the future, this is because at the end of the story Jason is working on his homework by downloading the work to his brain for two minutes while parents are watching a hologram and being served with snacks by a robot servant. The settings are slightly different because in Homework there is an internal conflict in the house, whereas in Sun powered car the action takes place in an outside setting where Malcolm meet some strangers.

The point of view: The short story sun-powered car is written in the third person same as the story homework. The stories are easy to compare because both of the stories remain in one point of view. The author is telling from Malcolm's point of view in the first story and in the second story it is told in Jason's point of view. There is someone telling us about the thoughts and experiences, even though we hear the stories from Jason's and Malcolm's point of view.

Theme: Both of the short stories have related themes, in sun-powered car the theme is a sun-powered car which is special. It describes how little things can be discovered in regular working days and there positive implications. The short story Homework's main theme is about the boy's homework. The main theme is how the family in the future lives with the irony when Jasons parents stating that it is much harder a child in their young ages when they are sitting watching a hologram play and getting served by a robot, they are actually lazy. Jason also talks that it is harder to be a child in his time too, he complains about his homework when all that he only has to do is to insert a cable into his head and wait for few minutes while his work is being downloaded in his brain, which seems lazier and so the theme can be the extent of laziness we may end as in the future.

The Characters: Malcolm the main character in Sun-Powered Car is depressed and has given up his dream of sitting on anchor chair. Ned though a farmer is credited with inventing a unique car. Hellen the waiter knows Neds very well.

Jason the main character in Homework he does not want to do his homework and prefers to play with his dog. Jasons father is mad because the son cannot do the homework while the mother is just complaining about the same issue. While Malcolm seems to be hardworking in Sun Powered Car Jason and his father are lazy and don't like working. The secondary characters Jason's mother and Ned are a bit passive though Ned speaks at the end of the story more while Jasonsmother at the beginning. Thereare similarities in the aspects of conflicts. In the Sun-powered car there is aconflict between Malcolm and himself and his job when he doesn't get promoted. In the short story Homework the conflict is about Jason(Helen, 55). He does not want to do his homework, does not listen to his parents when they tell him to do the same.

Resolution: Malcolm's day in Sun Powered Car turns out to be better than he had anticipated because he gets a new story that he can use. The car is not solar-driven, the fact that his son will be trampling on pedals makes it fancy. The ending is good since Ned is less depressed at the story ends. The resolution in Homework is that Jason has to do his homework while the mother and the father will carry on with their stuff. The twist comes when Jason has to download homework to his brain, yet he considers it terrible. The discussion by parents about childhood upbringing ends up us.

The Dialogue: there are a lot of similarities in the dialogue used in both of the stories as they talk directly to one another. In the sun-powered car dialogue is used when Malcolm orders, when Malcolm talks to Ned and when the waitress talks. Malcolm in the sun-powered car talks a lot; this is to make the story lively and not boring. In Homework the story is mostly dialogue. Jason and his father converse a lot about the homework and they are comparing how it is to be a kid in their time, and comparing it with when Jason's father was a child.

Works cited

Robert B. R, 2009 the classical revenge pg 122

Helen S, 2007HOMEWORK

Cite this page

Comparison of Two Short Stories. (2021, Mar 05). Retrieved from https://proessays.net/essays/comparison-of-two-short-stories

so we do not vouch for their quality

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Stopping by Woods on a Snowy Evening: Poem Analysis

- Research Paper Example on The Yellow Wallpapers by Charlotte Perkins

- Book Analysis Essay on the Kingdom of Matthias: A Story of Sex and Salvation

- Myths, Supernatural Powers, and Cultural Parallels: Ancient Sumerians and Greeks - Essay Sample

- Essay Sample on Romeo & Juliet: Love Amidst a Corrupt & Chaotic Society

- A Doll House: A Play of Marriage, Secrets and Forging - Essay Sample

- Edouard Glissant: A French Writer's Journey in Colonial Reality - Essay Sample

Liked this essay sample but need an original one?

Hire a professional with VAST experience and 25% off!

24/7 online support

NO plagiarism

Submit your request

Sorry, but it's not possible to copy the text due to security reasons.

Would you like to get this essay by email?

Interested in this essay?

Get it now!

Unfortunately, you can’t copy samples. Solve your problem differently! Provide your email for sample delivery

You agree to receive our emails and consent to our Terms & Conditions

Sample is in your inbox

Avoid editing or writing from scratch! Order original essay online with 25% off. Delivery in 6+ hours!

Compare And Contrast Essay Guide

Compare And Contrast Essay Examples

Last updated on: Nov 20, 2023

Good Compare and Contrast Essay Examples For Your Help

By: Barbara P.

Reviewed By: Jacklyn H.

Published on: Mar 22, 2023

Are you ready to challenge your critical thinking skills and take your writing to the next level? Look no further than the exciting world of compare and contrast essays!

As a college student, you'll have the unique opportunity to delve into the details and differences of a variety of subjects. But don't let the pressure of writing the perfect compare-and-contrast essay weigh you down.

To help guide you on this journey, we've got some great compare-and-contrast essay examples. It will make the writing process not only manageable but also enjoyable. So grab a pen and paper, and let's get started on this exciting adventure!

On this Page

Good Compare and Contrast Essay Examples

A compare and contrast essay is all about comparing two subjects. Writing essays is not always easy, but it can be made easier with help from the examples before you write your own first. The examples will give you an idea of the perfect compare-and-contrast essay.

We have compiled a selection of free compare-and-contrast essay examples that can help you structure this type of essay.

SAMPLE COMPARE AND CONTRAST ESSAY EXAMPLE

COMPARE AND CONTRAST ESSAY INTRODUCTION EXAMPLE

BOOK COMPARE AND CONTRAST ESSAY

CITY COMPARE AND CONTRAST ESSAY

CATS & DOGS COMPARE AND CONTRAST ESSAY

SCIENCE & ART COMPARE AND CONTRAST ESSAY

E-BOOKS & HARDBACK BOOKS COMPARE AND CONTRAST ESSAY

HOMESCHOOLING BOOKS COMPARE AND CONTRAST ESSAY

PARENTING STYLES COMPARE AND CONTRAST ESSAY

CONVENTIONAL AND ALTERNATIVE MEDICINE COMPARE AND CONTRAST ESSAY

Don't know how to map out your compare and contrast essay? Visit this link to learn how to perfectly outline your essay!

Compare and Contrast Essay Examples University

Compare and contrast paper is a common assignments for university students. This type of essay tells the reader how two subjects are the same or different from each other. Also, show the points of comparison between the two subjects.

Look at the example that is mentioned below and create a well-written essay.

COMPARE AND CONTRAST ESSAY EXAMPLE UNIVERSITY

Compare and Contrast Essay Examples College

COMPARE AND CONTRAST ESSAY EXAMPLE COLLEGE

Compare and Contrast Essay Examples High School

Compare and contrast essays are often assigned to high school students to help them improve their analytical skills .

In addition, some teachers assign this type of essay because it is a great way for students to improve their analytical and writing skills.

COMPARE AND CONTRAST ESSAY EXAMPLE HIGH SCHOOL

COMPARE AND CONTRAST ESSAY EXAMPLE 9TH GRADE

Check out the video below to gain a quick and visual comprehension of what a compare and contrast essay entails.

Compare and Contrast Essay Examples Middle school

In middle school, students have the opportunity to write a compare-and-contrast essay. It does not require an expert level of skills, but it is still a way to improve writing skills.

Middle school students can easily write a compare-and-contrast essay with a little help from examples. We have gathered excellent examples of this essay that you can use to get started.

COMPARE AND CONTRAST ESSAY EXAMPLE MIDDLE SCHOOL

COMPARE AND CONTRAST ESSAY EXAMPLES 5TH GRADE

Literary Analysis Compare and Contrast Essay Examples

The perfect way to inform readers about the pros and cons of two subjects is with a comparison and contrast essay.

It starts by stating the thesis statement, and then you explain why these two subjects are being compared in this essay.

The following is an example that you can use for your help.

LITERARY ANALYSIS COMPARE AND CONTRAST ESSAY EXAMPLE

Tough Essay Due? Hire Tough Writers!

Compare and Contrast Essay Conclusion Example

The conclusion of an essay is the last part, in which you wrap up everything. It should not include a story but rather summarize the whole document so readers have something meaningful they can take away from it.

COMPARE AND CONTRAST ESSAY CONCLUSION EXAMPLE

Struggling to think of the perfect compare-and-contrast essay topic ? Visit this link for a multitude of inspiring ideas.

Compare and Contrast Essay Writing Tips

A compare and contrast essay presents the facts point by point, and mostly, the argumentative essay uses this compared-contrasted technique for its subjects.

If you are looking for some easy and simple tips to craft a perfectly researched and structured compare and contrast essay, we will not disappoint you.

Following are some quick tips that you can keep in mind while writing your essay:

- Choose the essay topic carefully.

- Research and brainstorm the points that make them similar and different.

- Create and add your main statement and claim.

- Create a Venn diagram and show the similarities and differences.

- Choose the design through which you will present your arguments and claims.

- Create compare and contrast essay outline. Use either the block method or the point-by-point structure.

- Research and add credible supporting evidence.

- Transitioning is also important. Use transitional words and phrases to engage your readers.

- Edit, proofread, and revise the essay before submission.

Create captivating essays effortlessly!

In conclusion, writing a compare and contrast essay can be an effective way to explore the similarities and differences between two topics. By using examples, it is possible to see the different approaches that can be taken when writing this type of essay.

Whether you are a student or a professional writer, these examples can provide valuable insight to enhance your writing skills. You can also use our AI-powered essay typer to generate sample essays for your specific topic and subject.

However, if you don’t feel confident in your writing skills, you can always hire our professional essay writer.

5StarEssays.com offer comprehensive essay writing service for students across the globe. Our experts are highly trained and qualified, making sure all of your essays will meet academic requirements while receiving top grades.

Don't wait - take advantage of our 50% introductory discount today and get ahead of the game with us!

Frequently Asked Questions

How do i write a compare and contrast essay.

Here are some steps that you should follow and write a great essay.

- Begin by brainstorming with a Venn diagram.

- Create a thesis statement.

- Develop an outline.

- Write the introduction.

- Write the body paragraphs.

- Write the conclusion.

- Proofreading.

How do you start a compare and contrast essay introduction?

When writing a compare and contrast essay, it is important to have an engaging introduction that will grab the reader's attention. A good way to do this would be by starting with a question or fact related to the topic to catch their interest.

What are some good compare and contrast essay topics?

Here are some good topics for compare and contrast essay:

- E-books or textbooks.

- Anxiety vs. Depression.

- Vegetables and fruits.

- Cinnamon vs. sugar.

- Similarities between cultural and traditional fashion trends.

How long is a compare and contrast essay?

Usually, a compare and contrast essay would consist of five paragraphs but there are no hard and fast rules regarding it. Some essays could be longer than five paragraphs, based on the scope of the topic of the essay.

What are the two methods for arranging a comparison and contrast essay?

The two ways to organize and arrange your compare and contrast essay. The first one is the Point-by-Point method and the second one is the Block method.

Dr. Barbara is a highly experienced writer and author who holds a Ph.D. degree in public health from an Ivy League school. She has worked in the medical field for many years, conducting extensive research on various health topics. Her writing has been featured in several top-tier publications.

Was This Blog Helpful?

Keep reading.

- Compare and Contrast Essay - A Complete Guide With Topics & Examples

- Compare and Contrast Essay Topics: 100+ Fresh New Ideas

- Compare and Contrast Essay Outline - Template & Examples

People Also Read

- poetry writing

- demonstration speech ideas

- expository essay outline

- history research paper topics

- how to write an expository essay

Burdened With Assignments?

Advertisement

- Homework Services: Essay Topics Generator

© 2024 - All rights reserved

2000+ SATISFIED STUDENTS

95% Satisfaction RATE

30 Days Money-back GUARANTEE

95% Success RATE

Privacy Policy | Terms & Conditions | Contact Us

© 2024 5StarEssays.com. All rights reserved.

LOGIN TO YOUR ACCOUNT

- LOG IN Processing...

SIGN UP TO YOUR ACCOUNT

- Your phone no.

- Password Password must be minimum 8 characters.

- Confirm Password

- I have read Privacy Policy and agree to the Terms and Conditions .

- SIGN UP Processing...

FORGOT PASSWORD

- SEND PASSWORD

- Grades 6-12

- School Leaders

FREE Pi Day Worksheets! News, Vocab, Fractions, and More ✨

34 Compelling Compare and Contrast Essay Examples

Topics cover education, technology, pop culture, sports, animals, and more.

Do your writers need some inspiration? If you’re teaching students to write a compare and contrast essay, a strong example is an invaluable tool. This round-up of our favorite compare and contrast essays covers a range of topics and grade levels, so no matter your students’ interests or ages, you’ll always have a helpful example to share. You’ll find links to full essays about education, technology, pop culture, sports, animals, and more. (Need compare-and-contrast essay topic ideas? Check out our big list of compare and contrast essay topics! )

What is a compare and contrast essay?

- Education and parenting essays

- Technology essays

- Pop culture essays

- Historical and political essays

- Sports essays

- Lifestyle essays

- Healthcare essays

- Animal essays

When choosing a compare and contrast essay example to include on this list, we considered the structure. A strong compare and contrast essay begins with an introductory paragraph that includes background context and a strong thesis. Next, the body includes paragraphs that explore the similarities and differences. Finally, a concluding paragraph restates the thesis, draws any necessary inferences, and asks any remaining questions.

A compare and contrast essay example can be an opinion piece comparing two things and making a conclusion about which is better. For example, “Is Tom Brady really the GOAT?” It can also help consumers decide which product is better suited to them. Should you keep your subscription to Hulu or Netflix? Should you stick with Apple or explore Android? Here’s our list of compare and contrast essay samples categorized by subject.

Education and Parenting Compare and Contrast Essay Examples

Private school vs. public school.

Sample lines: “Deciding whether to send a child to public or private school can be a tough choice for parents. … Data on whether public or private education is better can be challenging to find and difficult to understand, and the cost of private school can be daunting. … According to the most recent data from the National Center for Education Statistics, public schools still attract far more students than private schools, with 50.7 million students attending public school as of 2018. Private school enrollment in the fall of 2017 was 5.7 million students, a number that is down from 6 million in 1999.”

Read the full essay: Private School vs. Public School at U.S. News and World Report

Homeschool vs. Public School: How Home Schooling Will Change Public Education

Sample lines: “Home schooling, not a present threat to public education, is nonetheless one of the forces that will change it. If the high estimates of the number of children in home schools (1.2 million) is correct, then the home-schooling universe is larger than the New York City public school system and roughly the size of the Los Angeles and Chicago public school systems combined. … Critics charge that three things are wrong with home schooling: harm to students academically; harm to society by producing students who are ill-prepared to function as democratic citizens and participants in a modern economy; and harm to public education, making it more difficult for other parents to educate their children. … It is time to ask whether home schooling, charters, and vouchers should be considered parts of a broad repertoire of methods that we as a society use to educate our children.”

Read the full essay: Homeschool vs. Public School: How Home Schooling Will Change Public Education at Brookings

Which parenting style is right for you?

Sample lines: “The three main types of parenting are on a type of ‘sliding scale’ of parenting, with permissive parenting as the least strict type of parenting. Permissive parenting typically has very few rules, while authoritarian parenting is thought of as a very strict, rule-driven type of parenting.”

Read the full essay: What Is Authoritative Parenting? at Healthline

Masked Education? The Benefits and Burdens of Wearing Face Masks in Schools During the Pandemic

Sample lines: “Face masks can prevent the spread of the virus SARS-CoV-2. … However, covering the lower half of the face reduces the ability to communicate. Positive emotions become less recognizable, and negative emotions are amplified. Emotional mimicry, contagion, and emotionality in general are reduced and (thereby) bonding between teachers and learners, group cohesion, and learning—of which emotions are a major driver. The benefits and burdens of face masks in schools should be seriously considered and made obvious and clear to teachers and students.”

Read the full essay: Masked Education? The Benefits and Burdens of Wearing Face Masks in Schools During the Pandemic at National Library of Medicine

To Ban or Not: What Should We Really Make of Book Bans?

Sample lines: “In recent years, book bans have soared in schools, reaching an all-time high in fall 2022. … The challenge of balancing parent concerns about ‘age appropriateness’ against the imperative of preparing students to be informed citizens is still on the minds of many educators today. … Such curricular decision-making should be left to the professionals, argues English/language arts instructional specialist Miriam Plotinsky. ‘Examining texts for their appropriateness is not a job that noneducators are trained to do,’ she wrote last year, as the national debate over censorship resurged with the news that a Tennessee district banned the graphic novel Maus just days before Holocaust Remembrance Day.”

Read the full essay: To Ban or Not: What Should We Really Make of Book Bans? at Education Week

Technology Compare and Contrast Essay Examples

Netflix vs. hulu 2023: which is the best streaming service.

Sample lines: “Netflix fans will point to its high-quality originals, including The Witcher , Stranger Things , Emily in Paris , Ozark , and more, as well as a wide variety of documentaries like Cheer , The Last Dance , My Octopus Teacher , and many others. It also boasts a much larger subscription base, with more than 222 million subscribers compared to Hulu’s 44 million. Hulu, on the other hand, offers a variety of extras such as HBO and Showtime—content that’s unavailable on Netflix. Its price tag is also cheaper than the competition, with its $7/mo. starting price, which is a bit more palatable than Netflix’s $10/mo. starting price.”

Read the full essay: Netflix vs. Hulu 2023: Which is the best streaming service? at TV Guide

Kindle vs. Hardcover: Which is easier on the eyes?

Sample lines: “In the past, we would have to drag around heavy books if we were really into reading. Now, we can have all of those books, and many more, stored in one handy little device that can easily be stuffed into a backpack, purse, etc. … Many of us still prefer to hold an actual book in our hands. … But, whether you use a Kindle or prefer hardcover books or paperbacks, the main thing is that you enjoy reading. A story in a book or on a Kindle device can open up new worlds, take you to fantasy worlds, educate you, entertain you, and so much more.”

Read the full essay: Kindle vs. Hardcover: Which is easier on the eyes? at Books in a Flash

iPhone vs. Android: Which is better for you?

Sample lines: “The iPhone vs. Android comparison is a never-ending debate on which one is best. It will likely never have a real winner, but we’re going to try and help you to find your personal pick all the same. iOS 17 and Android 14—the latest versions of the two operating systems—both offer smooth and user-friendly experiences, and several similar or identical features. But there are still important differences to be aware of. … Owning an iPhone is a simpler, more convenient experience. There’s less to think about. … Android-device ownership is a bit harder. … Yet it’s simultaneously more freeing, because it offers more choice.”

Read the full essay: iPhone vs. Android: Which is better for you? at Tom’s Guide

Cutting the cord: Is streaming or cable better for you?

Sample lines: “Cord-cutting has become a popular trend in recent years, thanks to the rise of streaming services. For those unfamiliar, cord cutting is the process of canceling your cable subscription and instead, relying on streaming platforms such as Netflix and Hulu to watch your favorite shows and movies. The primary difference is that you can select your streaming services à la carte while cable locks you in on a set number of channels through bundles. So, the big question is: should you cut the cord?”

Read the full essay: Cutting the cord: Is streaming or cable better for you? at BroadbandNow

PS5 vs. Nintendo Switch

Sample lines: “The crux of the comparison comes down to portability versus power. Being able to migrate fully fledged Nintendo games from a big screen to a portable device is a huge asset—and one that consumers have taken to, especially given the Nintendo Switch’s meteoric sales figures. … It is worth noting that many of the biggest franchises like Call of Duty, Madden, modern Resident Evil titles, newer Final Fantasy games, Grand Theft Auto, and open-world Ubisoft adventures like Assassin’s Creed will usually skip Nintendo Switch due to its lack of power. The inability to play these popular games practically guarantees that a consumer will pick up a modern system, while using the Switch as a secondary device.”

Read the full essay: PS5 vs. Nintendo Switch at Digital Trends

What is the difference between Facebook and Instagram?

Sample lines: “Have you ever wondered what is the difference between Facebook and Instagram? Instagram and Facebook are by far the most popular social media channels used by digital marketers. Not to mention that they’re also the biggest platforms used by internet users worldwide. So, today we’ll look into the differences and similarities between these two platforms to help you figure out which one is the best fit for your business.”

Read the full essay: What is the difference between Facebook and Instagram? at SocialBee

Digital vs. Analog Watches—What’s the Difference?

Sample lines: “In short, digital watches use an LCD or LED screen to display the time. Whereas, an analog watch features three hands to denote the hour, minutes, and seconds. With the advancement in watch technology and research, both analog and digital watches have received significant improvements over the years. Especially in terms of design, endurance, and accompanying features. … At the end of the day, whether you go analog or digital, it’s a personal preference to make based on your style, needs, functions, and budget.”

Read the full essay: Digital vs. Analog Watches—What’s the Difference? at Watch Ranker

AI Art vs. Human Art: A Side-by-Side Analysis

Sample lines: “Art has always been a reflection of human creativity, emotion, and cultural expression. However, with the rise of artificial intelligence (AI), a new form of artistic creation has emerged, blurring the lines between what is created by human hands and what is generated by algorithms. … Despite the excitement surrounding AI Art, it also raises complex ethical, legal, and artistic questions that have sparked debates about the definition of art, the role of the artist, and the future of art production. … Regardless of whether AI Art is considered ‘true’ art, it is crucial to embrace and explore the vast possibilities and potential it brings to the table. The transformative influence of AI art on the art world is still unfolding, and only time will reveal its true extent.”

Read the full essay: AI Art vs. Human Art: A Side-by-Side Analysis at Raul Lara

Pop Culture Compare and Contrast Essay Examples

Christina aguilera vs. britney spears.

Sample lines: “Britney Spears vs. Christina Aguilera was the Coke vs. Pepsi of 1999 — no, really, Christina repped Coke and Britney shilled for Pepsi. The two teen idols released debut albums seven months apart before the turn of the century, with Britney’s becoming a standard-bearer for bubblegum pop and Aguilera’s taking an R&B bent to show off her range. … It’s clear that Spears and Aguilera took extremely divergent paths following their simultaneous breakout successes.”

Read the full essay: Christina Aguilera vs. Britney Spears at The Ringer

Harry Styles vs. Ed Sheeran

Sample lines: “The world heard our fantasies and delivered us two titans simultaneously—we have been blessed with Ed Sheeran and Harry Styles. Our cup runneth over; our bounty is immeasurable. More remarkable still is the fact that both have released albums almost at the same time: Ed’s third, Divide , was released in March and broke the record for one-day Spotify streams, while Harry’s frenziedly anticipated debut solo, called Harry Styles , was released yesterday.”

Read the full essay: Harry Styles versus Ed Sheeran at Belfast Telegraph

The Grinch: Three Versions Compared

Sample lines: “Based on the original story of the same name, this movie takes a completely different direction by choosing to break away from the cartoony form that Seuss had established by filming the movie in a live-action form. Whoville is preparing for Christmas while the Grinch looks down upon their celebrations in disgust. Like the previous film, The Grinch hatches a plan to ruin Christmas for the Who’s. … Like in the original Grinch, he disguises himself as Santa Claus, and makes his dog, Max, into a reindeer. He then takes all of the presents from the children and households. … Cole’s favorite is the 2000 edition, while Alex has only seen the original. Tell us which one is your favorite.”

Read the full essay: The Grinch: Three Versions Compared at Wooster School

Historical and Political Compare and Contrast Essay Examples

Malcolm x vs. martin luther king jr.: comparison between two great leaders’ ideologies .

Sample lines: “Although they were fighting for civil rights at the same time, their ideology and way of fighting were completely distinctive. This can be for a plethora of reasons: background, upbringing, the system of thought, and vision. But keep in mind, they devoted their whole life to the same prospect. … Through boycotts and marches, [King] hoped to end racial segregation. He felt that the abolition of segregation would improve the likelihood of integration. Malcolm X, on the other hand, spearheaded a movement for black empowerment.”

Read the full essay: Malcolm X vs. Martin Luther King Jr.: Comparison Between Two Great Leaders’ Ideologies at Melaninful

Contrast Between Obama and Trump Has Become Clear

Sample lines: “The contrast is even clearer when we look to the future. Trump promises more tax cuts, more military spending, more deficits and deeper cuts in programs for the vulnerable. He plans to nominate a coal lobbyist to head the Environmental Protection Agency. … Obama says America must move forward, and he praises progressive Democrats for advocating Medicare for all. … With Obama and then Trump, Americans have elected two diametrically opposed leaders leading into two very different directions.”

Read the full essay: Contrast Between Obama and Trump Has Become Clear at Chicago Sun-Times

Sports Compare and Contrast Essay Examples

Lebron james vs. kobe bryant: a complete comparison.

Sample lines: “LeBron James has achieved so much in his career that he is seen by many as the greatest of all time, or at least the only player worthy of being mentioned in the GOAT conversation next to Michael Jordan. Bridging the gap between Jordan and LeBron though was Kobe Bryant, who often gets left out of comparisons and GOAT conversations. … Should his name be mentioned more though? Can he compare to LeBron or is The King too far past The Black Mamba in historical rankings already?”

Read the full essay: LeBron James vs. Kobe Bryant: A Complete Comparison at Sportskeeda

NFL: Tom Brady vs. Peyton Manning Rivalry Comparison

Sample lines: “Tom Brady and Peyton Manning were largely considered the best quarterbacks in the NFL for the majority of the time they spent in the league together, with the icons having many head-to-head clashes in the regular season and on the AFC side of the NFL Playoffs. Manning was the leader of the Indianapolis Colts of the AFC South. … Brady spent his career as the QB of the AFC East’s New England Patriots, before taking his talents to Tampa Bay. … The reality is that winning is the most important aspect of any career, and Brady won more head-to-head matchups than Manning did.”

Read the full essay: NFL: Tom Brady vs. Peyton Manning Rivalry Comparison at Sportskeeda

The Greatest NBA Franchise Ever: Boston Celtics or Los Angeles Lakers?

Sample lines: “The Celtics are universally considered as the greatest franchise in NBA history. But if you take a close look at the numbers, there isn’t really too much separation between them and their arch-rival Los Angeles Lakers. In fact, you can even make a good argument for the Lakers. … In 72 seasons played, the Boston Celtics have won a total of 3,314 games and lost 2,305 or a .590 winning mark. On the other hand, the Los Angeles Lakers have won 3,284 of 5,507 total games played or a slightly better winning record of .596. … But while the Lakers have the better winning percentage, the Celtics have the advantage over them in head-to-head competition.”

Read the full essay: The Greatest NBA Franchise Ever: Boston Celtics or Los Angeles Lakers? at Sport One

Is Soccer Better Than Football?

Sample lines: “Is soccer better than football? Soccer and football lovers have numerous reasons to support their sport of choice. Both keep the players physically fit and help to bring people together for an exciting cause. However, soccer has drawn more numbers globally due to its popularity in more countries.”

Read the full essay: Is Soccer Better Than Football? at Sports Brief

Lifestyle Choices Compare and Contrast Essay Examples

Mobile home vs. tiny house: similarities, differences, pros & cons.

Sample lines: “Choosing the tiny home lifestyle enables you to spend more time with those you love. The small living space ensures quality bonding time rather than hiding away in a room or behind a computer screen. … You’ll be able to connect closer to nature and find yourself able to travel the country at any given moment. On the other hand, we have the mobile home. … They are built on a chassis with transportation in mind. … They are not built to be moved on a constant basis. … While moving the home again *is* possible, it may cost you several thousand dollars.”

Read the full essay: Mobile Home vs. Tiny House: Similarities, Differences, Pros & Cons at US Mobile Home Pros

Whole Foods vs. Walmart: The Story of Two Grocery Stores

Sample lines: “It is clear that both stores have very different stories and aims when it comes to their customers. Whole Foods looks to provide organic, healthy, exotic, and niche products for an audience with a very particular taste. … Walmart, on the other hand, looks to provide the best deals, every possible product, and every big brand for a broader audience. … Moreover, they look to make buying affordable and accessible, and focus on the capitalist nature of buying.”

Read the full essay: Whole Foods vs. Walmart: The Story of Two Grocery Stores at The Archaeology of Us

Artificial Grass vs. Turf: The Real Differences Revealed

Sample lines: “The key difference between artificial grass and turf is their intended use. Artificial turf is largely intended to be used for sports, so it is shorter and tougher. On the other hand, artificial grass is generally longer, softer and more suited to landscaping purposes. Most homeowners would opt for artificial grass as a replacement for a lawn, for example. Some people actually prefer playing sports on artificial grass, too … artificial grass is often softer and more bouncy, giving it a feel similar to playing on a grassy lawn. … At the end of the day, which one you will choose will depend on your specific household and needs.”

Read the full essay: Artificial Grass vs. Turf: The Real Differences Revealed at Almost Grass

Minimalism vs. Maximalism: Differences, Similarities, and Use Cases

Sample lines: “Maximalists love shopping, especially finding unique pieces. They see it as a hobby—even a skill—and a way to express their personality. Minimalists don’t like shopping and see it as a waste of time and money. They’d instead use those resources to create memorable experiences. Maximalists desire one-of-a-kind possessions. Minimalists are happy with duplicates—for example, personal uniforms. … Minimalism and maximalism are about being intentional with your life and belongings. It’s about making choices based on what’s important to you.”

Read the full essay: Minimalism vs. Maximalism: Differences, Similarities, and Use Cases at Minimalist Vegan

Vegetarian vs. Meat Eating: Is It Better To Be a Vegetarian?

Sample lines: “You’ve heard buzz over the years that following a vegetarian diet is better for your health, and you’ve probably read a few magazine articles featuring a celeb or two who swore off meat and animal products and ‘magically’ lost weight. So does ditching meat automatically equal weight loss? Will it really help you live longer and be healthier overall? … Vegetarians appear to have lower low-density lipoprotein cholesterol levels, lower blood pressure and lower rates of hypertension and type 2 diabetes than meat eaters. Vegetarians also tend to have a lower body mass index, lower overall cancer rates and lower risk of chronic disease. But if your vegetarian co-worker is noshing greasy veggie burgers and fries every day for lunch, is he likely to be healthier than you, who always orders the grilled salmon? Definitely not!”

Read the full essay: Vegetarian vs. Meat Eating: Is It Better To Be a Vegetarian? at WebMD

Healthcare Compare and Contrast Essay Examples

Similarities and differences between the health systems in australia & usa.

Sample lines: “Australia and the United States are two very different countries. They are far away from each other, have contrasting fauna and flora, differ immensely by population, and have vastly different healthcare systems. The United States has a population of 331 million people, compared to Australia’s population of 25.5 million people.”

Read the full essay: Similarities and Differences Between the Health Systems in Australia & USA at Georgia State University

Universal Healthcare in the United States of America: A Healthy Debate

Sample lines: “Disadvantages of universal healthcare include significant upfront costs and logistical challenges. On the other hand, universal healthcare may lead to a healthier populace, and thus, in the long-term, help to mitigate the economic costs of an unhealthy nation. In particular, substantial health disparities exist in the United States, with low socio-economic status segments of the population subject to decreased access to quality healthcare and increased risk of non-communicable chronic conditions such as obesity and type II diabetes, among other determinants of poor health.”

Read the full essay: Universal Healthcare in the United States of America: A Healthy Debate at National Library of Medicine

Pros and Cons of Physician Aid in Dying

Sample lines: “Physician aid in dying is a controversial subject raising issues central to the role of physicians. … The two most common arguments in favor of legalizing AID are respect for patient autonomy and relief of suffering. A third, related, argument is that AID is a safe medical practice, requiring a health care professional. … Although opponents of AID offer many arguments ranging from pragmatic to philosophical, we focus here on concerns that the expansion of AID might cause additional, unintended harm through suicide contagion, slippery slope, and the deaths of patients suffering from depression.”

Read the full essay: Pros and Cons of Physician Aid in Dying at National Library of Medicine

Animals Compare and Contrast Essay Examples

Compare and contrast paragraph—dogs and cats.

Sample lines: “Researchers have found that dogs have about twice the number of neurons in their cerebral cortexes than what cats have. Specifically, dogs had around 530 million neurons, whereas the domestic cat only had 250 million neurons. Moreover, dogs can be trained to learn and respond to our commands, but although your cat understands your name, and anticipates your every move, he/she may choose to ignore you.”

Read the full essay: Compare and Contrast Paragraph—Dogs and Cats at Proofwriting Guru via YouTube

Giddyup! The Differences Between Horses and Dogs

Sample lines: “Horses are prey animals with a deep herding instinct. They are highly sensitive to their environment, hyper aware, and ready to take flight if needed. Just like dogs, some horses are more confident than others, but just like dogs, all need a confident handler to teach them what to do. Some horses are highly reactive and can be spooked by the smallest things, as are dogs. … Another distinction between horses and dogs … was that while dogs have been domesticated , horses have been tamed. … Both species have influenced our culture more than any other species on the planet.”

Read the full essay: Giddyup! The Differences Between Horses and Dogs at Positively Victoria Stilwell

Exotic, Domesticated, and Wild Pets

Sample lines: “Although the words ‘exotic’ and ‘wild’ are frequently used interchangeably, many people do not fully understand how these categories differ when it comes to pets. ‘A wild animal is an indigenous, non-domesticated animal, meaning that it is native to the country where you are located,’ Blue-McLendon explained. ‘For Texans, white-tailed deer, pronghorn sheep, raccoons, skunks, and bighorn sheep are wild animals … an exotic animal is one that is wild but is from a different continent than where you live.’ For example, a hedgehog in Texas would be considered an exotic animal, but in the hedgehog’s native country, it would be considered wildlife.”

Read the full essay: Exotic, Domesticated, and Wild Pets at Texas A&M University

Should Zoos Be Banned? Pros & Cons of Zoos

Sample lines: “The pros and cons of zoos often come from two very different points of view. From a legal standard, animals are often treated as property. That means they have less rights than humans, so a zoo seems like a positive place to maintain a high quality of life. For others, the forced enclosure of any animal feels like an unethical decision. … Zoos provide a protected environment for endangered animals, and also help in raising awareness and funding for wildlife initiatives and research projects. … Zoos are key for research. Being able to observe and study animals is crucial if we want to contribute to help them and repair the ecosystems. … Zoos are a typical form of family entertainment, but associating leisure and fun with the contemplation of animals in captivity can send the wrong signals to our children.”

Read the full essay: Should Zoos Be Banned? Pros & Cons of Zoos at EcoCation

Do you have a favorite compare and contrast essay example? Come share in the We Are Teachers HELPLINE group on Facebook .

Plus, if you liked these compare and contrast essay examples check out intriguing compare and contrast essay topics for kids and teens ..

You Might Also Like

80 Intriguing Compare and Contrast Essay Topics for Kids and Teens

Android vs. iPhone? Capitalism vs. communism? Hot dog vs. taco? Continue Reading

Copyright © 2023. All rights reserved. 5335 Gate Parkway, Jacksonville, FL 32256

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Comparing and contrasting in an essay | Tips & examples

Comparing and Contrasting in an Essay | Tips & Examples

Published on August 6, 2020 by Jack Caulfield . Revised on July 23, 2023.

Comparing and contrasting is an important skill in academic writing . It involves taking two or more subjects and analyzing the differences and similarities between them.

Instantly correct all language mistakes in your text

Upload your document to correct all your mistakes in minutes

Table of contents

When should i compare and contrast, making effective comparisons, comparing and contrasting as a brainstorming tool, structuring your comparisons, other interesting articles, frequently asked questions about comparing and contrasting.

Many assignments will invite you to make comparisons quite explicitly, as in these prompts.

- Compare the treatment of the theme of beauty in the poetry of William Wordsworth and John Keats.

- Compare and contrast in-class and distance learning. What are the advantages and disadvantages of each approach?

Some other prompts may not directly ask you to compare and contrast, but present you with a topic where comparing and contrasting could be a good approach.

One way to approach this essay might be to contrast the situation before the Great Depression with the situation during it, to highlight how large a difference it made.

Comparing and contrasting is also used in all kinds of academic contexts where it’s not explicitly prompted. For example, a literature review involves comparing and contrasting different studies on your topic, and an argumentative essay may involve weighing up the pros and cons of different arguments.

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

As the name suggests, comparing and contrasting is about identifying both similarities and differences. You might focus on contrasting quite different subjects or comparing subjects with a lot in common—but there must be some grounds for comparison in the first place.

For example, you might contrast French society before and after the French Revolution; you’d likely find many differences, but there would be a valid basis for comparison. However, if you contrasted pre-revolutionary France with Han-dynasty China, your reader might wonder why you chose to compare these two societies.

This is why it’s important to clarify the point of your comparisons by writing a focused thesis statement . Every element of an essay should serve your central argument in some way. Consider what you’re trying to accomplish with any comparisons you make, and be sure to make this clear to the reader.

Comparing and contrasting can be a useful tool to help organize your thoughts before you begin writing any type of academic text. You might use it to compare different theories and approaches you’ve encountered in your preliminary research, for example.

Let’s say your research involves the competing psychological approaches of behaviorism and cognitive psychology. You might make a table to summarize the key differences between them.

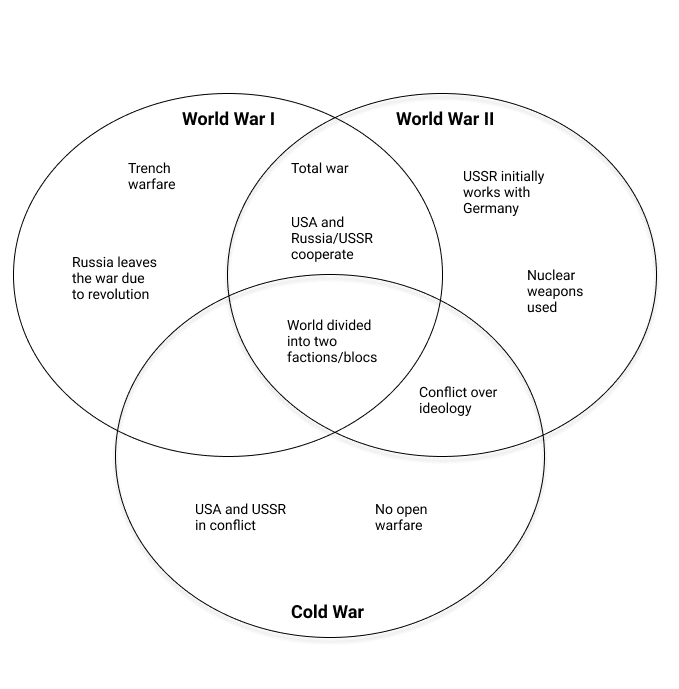

Or say you’re writing about the major global conflicts of the twentieth century. You might visualize the key similarities and differences in a Venn diagram.

These visualizations wouldn’t make it into your actual writing, so they don’t have to be very formal in terms of phrasing or presentation. The point of comparing and contrasting at this stage is to help you organize and shape your ideas to aid you in structuring your arguments.

When comparing and contrasting in an essay, there are two main ways to structure your comparisons: the alternating method and the block method.

The alternating method

In the alternating method, you structure your text according to what aspect you’re comparing. You cover both your subjects side by side in terms of a specific point of comparison. Your text is structured like this:

Mouse over the example paragraph below to see how this approach works.

One challenge teachers face is identifying and assisting students who are struggling without disrupting the rest of the class. In a traditional classroom environment, the teacher can easily identify when a student is struggling based on their demeanor in class or simply by regularly checking on students during exercises. They can then offer assistance quietly during the exercise or discuss it further after class. Meanwhile, in a Zoom-based class, the lack of physical presence makes it more difficult to pay attention to individual students’ responses and notice frustrations, and there is less flexibility to speak with students privately to offer assistance. In this case, therefore, the traditional classroom environment holds the advantage, although it appears likely that aiding students in a virtual classroom environment will become easier as the technology, and teachers’ familiarity with it, improves.

The block method

In the block method, you cover each of the overall subjects you’re comparing in a block. You say everything you have to say about your first subject, then discuss your second subject, making comparisons and contrasts back to the things you’ve already said about the first. Your text is structured like this:

- Point of comparison A

- Point of comparison B

The most commonly cited advantage of distance learning is the flexibility and accessibility it offers. Rather than being required to travel to a specific location every week (and to live near enough to feasibly do so), students can participate from anywhere with an internet connection. This allows not only for a wider geographical spread of students but for the possibility of studying while travelling. However, distance learning presents its own accessibility challenges; not all students have a stable internet connection and a computer or other device with which to participate in online classes, and less technologically literate students and teachers may struggle with the technical aspects of class participation. Furthermore, discomfort and distractions can hinder an individual student’s ability to engage with the class from home, creating divergent learning experiences for different students. Distance learning, then, seems to improve accessibility in some ways while representing a step backwards in others.

Note that these two methods can be combined; these two example paragraphs could both be part of the same essay, but it’s wise to use an essay outline to plan out which approach you’re taking in each paragraph.

If you want to know more about AI tools , college essays , or fallacies make sure to check out some of our other articles with explanations and examples or go directly to our tools!

- Ad hominem fallacy

- Post hoc fallacy

- Appeal to authority fallacy

- False cause fallacy

- Sunk cost fallacy

College essays

- Choosing Essay Topic

- Write a College Essay

- Write a Diversity Essay

- College Essay Format & Structure

- Comparing and Contrasting in an Essay

(AI) Tools

- Grammar Checker

- Paraphrasing Tool

- Text Summarizer

- AI Detector

- Plagiarism Checker

- Citation Generator

Some essay prompts include the keywords “compare” and/or “contrast.” In these cases, an essay structured around comparing and contrasting is the appropriate response.

Comparing and contrasting is also a useful approach in all kinds of academic writing : You might compare different studies in a literature review , weigh up different arguments in an argumentative essay , or consider different theoretical approaches in a theoretical framework .

Your subjects might be very different or quite similar, but it’s important that there be meaningful grounds for comparison . You can probably describe many differences between a cat and a bicycle, but there isn’t really any connection between them to justify the comparison.

You’ll have to write a thesis statement explaining the central point you want to make in your essay , so be sure to know in advance what connects your subjects and makes them worth comparing.

Comparisons in essays are generally structured in one of two ways:

- The alternating method, where you compare your subjects side by side according to one specific aspect at a time.

- The block method, where you cover each subject separately in its entirety.

It’s also possible to combine both methods, for example by writing a full paragraph on each of your topics and then a final paragraph contrasting the two according to a specific metric.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Caulfield, J. (2023, July 23). Comparing and Contrasting in an Essay | Tips & Examples. Scribbr. Retrieved March 11, 2024, from https://www.scribbr.com/academic-essay/compare-and-contrast/

Is this article helpful?

Jack Caulfield

Other students also liked, how to write an expository essay, how to write an argumentative essay | examples & tips, academic paragraph structure | step-by-step guide & examples, what is your plagiarism score.

- Save your essays here so you can locate them quickly!

- Minnie Wright

- Protagonist

- Black And White Films

- Susan Glaspell

A comparison of two short stories 5 Pages 1208 Words

The two short stories used in this comparison are " A Jury of Her Peers" by Susan Glaspell and The Sniper" by Liam O'Flaherty. Both stories deal with killing and death. Why would anyone want to kill another human being no matter what the reason? I will show the similarities and differences in the characters motivation for killing, the settings in which the killing takes place and the plots of each story. The characters motivation between the two stories is different, yet each character ends up killing a family member for diverse reasons. In these two stories the characters kill because they each made that choice. They didn't really have to kill anyone. In " A Jury of Her Peers" Minnie Wrights motivation for killing her husband was to escape her feelings of isolation and loneliness. Minnie was once a young woman who was pleasant, loveable, and friendly young woman. But after she got married, she became unhappy, lonely, and unfriendly. Her problems of isolation and loneliness were represented by several changes in her behavior. Two major changes were in her quilting and her birds care. Her quilting when it was noticed that all her squares were sewn neatly except for one. Then the birdcage when it looked like it was dealt with in a very rough manner and the bird found dead in a piece of silk. In " The Sniper" the protagonist who was a Republican sniper gave few physical characteristics and very little insight of his personality only by describing the look in his eyes. At one point you would have thought he was a risk taker; this is shown when he makes the decision to smoke a cigarette even though he knows it is too risky. He also seemed to be intelligent because after lighting his cigarette shots were fired from the roof next to him. He remained calm and determined to complete his mission before the sun rose. In which he did by using trickery. Additionally, the settings were to me th ...

Continue reading this essay Continue reading

Page 1 of 5

More Essays:

Two Short Stories

Introduction.

This essay seeks to compare and contrast two short stories with regard to the plot, content, and use of literary terms as portrayed by their respective authors. White angel by Michael Cunningham, has its setting in the early sixties, and introduces us to a time when music was the highly praised and valued for its relaxing nature. It depicts the fascinations of a young teen and his indulgence in drugs leading to his demise. Temporary Matter deals with a temporary state of tension brought about by a long kept grudge between a man and his wife. The plots unfold as we learn the source of the problems in each story. They are both told around a family setting, and are both centered on the idea of loses that come with the death of a family member.

The writer of ‘White Angel’ tells us the story of two brothers, Carlton, aged sixteen and bobby, aged nine, who both secretly decide to indulge in drugs on a regular basis. The setting is put in the sixties where, as the author puts it, music played sang of love. The characters are often seen indulging in some form of musical entertainment at different instances within the plot, like when the father is in his workshop playing his clarinet or as Isabel cooks dinner. The author also lets us in on a regularly occurring party in which music is played to set the mood. As such we can say that the author specifically chose the sixties period with the intention of setting a calmly subtle mood. Attention is drawn to the venue where the boys hide their bottle of alcohol.

A cherub placed in the cemetery guards this secret meeting place where the boys usually hide themselves during the day as their parents work. Carlton is the more influential brother being a teenager, and he encourages his younger brother to take drugs which he said would set them free from worrying. Carlton even emphasizes that the acid tablets he takes were for clarity of vision as Vicks was for decongestion of the nose. In the plot, the parents are merely lenient; they don’t seem to offer a strict hand or some form of discipline for Carlton. His mother, Isabel, is said to bear a grudge towards the menacing boy for doing drugs and roaming every so often without saying where he goes when he goes. Carlton’s drug indulgence is astonishing to say the least, and his friends come across as drug users too. This is brought out at the party before the tragic death that haunts this family as the teens walk into the house in a cloud of dope smoke and half-mast eyes. The story comes to a close with the horrible death of Carlton in their living room as the party goes on.

The suspicion is that Carlton had sneaked into the cemetery momentarily to do drugs while the party was outside on their backyard unraveling the mystery of a flying saucer. He is said to have come running from the direction of the cemetery and runs into the glass door smashing it into many pieces, at which point one piece of glass drives into his neck eventually killing him. The family gets crashed by this tragedy, leaving the family distraught as the mother withdraws and keeps away from the rest of the family.

The author uses a first person narration where Bobby is seen to be telling the story at different times. This can be seen at different instances where Bobby comes across something he sees that he does not understand and his perception is what the reader gets to experience. The author uses onomatopoeia in describing some of the different sounds, such as the hum of the music, and the door thumping. There is some alluding to the use of fantasy, where we are shown the two brothers in the cemetery after the drugs they take, have taken effect and they are fantasizing about flying to New York and living the good life in their future.

The short story ‘A Temporary Matter’ by Jumpha Lahiri starts ordinarily, where Shoba, is opening received electricity notice saying electricity would be interrupted from eight to nine o’clock in the evening so as to allow for some maintenance to be carried out. This is the temporary matter depicted as the title of the story. The setting of the story is based in their lavish apartment where Shukumar, is seen to be the one cooking dinner, while the wife engages more in her vocation. The plot slowly unfolds bringing the idea that all is not well in this family of two. This is seen when Shukumar’s thoughts are brought into the story. He is seen to look at his wife and judge her appearance as she was in the present, and compare it to how she looked some few months back. The writer uses dialogue between the two characters to bring out conflict. They set their individual spaces within the house where each goes to carry on their vocational activities separately.

Shakumar is the one who finally brings out the reason behind the conflict. He takes the reader back to six months before the present time and tells of the events that occurred, which lead to the tension that is between the couple. While away at a conference, his wife goes into early labor and ends up losing their child. Since that incident, the relationship between the two had changed drastically with Shoba working more hours at work. The first day the lights go off, the couple is forced to have their dinner together, unlike other nights when they eat separately, over the light of candles. The darkness somehow makes it easier for them to communicate as Shoba suddenly suggests they play a game, where they share secrets they had kept from each other. The same ritual continues for four nights and it is on this last night, the couple is seen to share a bed for the first time in months. On the fifth night they share their final confessions where Shoba tells Shukumar that she had been looking for an apartment and would be moving out at any time. Shukumar is shocked and this is when he tells her that he had flown back from the conference earlier than he had said and had had the privilege of holding their baby boy before he had been cremated. The couple had decided not to know the sex of the baby until it was born, and so this confession is a huge shock for Shoba, but in a way, also brings them together. The story ends with the couple being seen to be brought together by the confessions they had both shared as they are seen weeping together, because of all that they now knew.

The writer uses a sequence of related events to generate the plot in each story. Conflict is used is ‘A Temporary Matter’ to foreshadow the strange turn of events. It is the intention of the writer to involve the reader emotionally as the plot unfolds, generating suspense and climax (Microsoft Corporation). In Jhumpa’s story, Shoba has held a grudge for a long time since losing her child. She sets the stage for communication before breaking the ice. Shukumar responds in kind when she suggests she is leaving him. This is brought to an anticlimax when the couple learns the shocking truth from their confessions. Their indifferences ironically bring them together as the story comes to a conclusion.

We can see the authors’ literary genius throughout the short story. Firstly, she develops characters with their descriptions creating human attributes in the mind of the reader and showing us their surrounding by the setting used by the author. A Temporary Matter is for instance set in a quite neighborhood that one can only imagine to be a suburb. The evening walks are characteristic of suburbs and rich neighborhoods with neatly manicured lawns and street walks. The extravagant nature of Shoba at the start of their relationship also goes to support this argument. We feel a change of moods as the writer narrates of a time when Shoba would neatly arrange their pantry and store food, utility items and money for emergencies. It in some way foreshadows her plan to live a separate life. Her loss of focus and devotion as Shukumar’s wife also foreshadows their breakup.

People also viewed:

Frankenstein and sense and sensibility contrasting between odysseus and aeneas jazz instrumentalists stan getz abraham, moses and david.

How to Compare Two Novels in Comparative Essay

Sam Edwards/Getty Images

- Writing Essays

- Writing Research Papers

- English Grammar

- M.Ed., Education Administration, University of Georgia

- B.A., History, Armstrong State University

At some point in your literature studies, probably just about the time you get really good at finding the theme of a novel and coming up with a sound analysis of a single literary piece, you will be required to compare two novels.

Your first task in this assignment will be to develop a good profile of both novels. You can do this by making a few simple lists of traits that might be comparable. For each novel, identify a list of characters and their roles in the story or important characteristics, and any important struggles, time periods, or major symbols (like an element of nature).

You may also attempt to come up with book themes that could be comparable. Sample themes would include:

- Man versus nature (is each main character battling the elements?)

- Individual versus society (does each main character feel like an outsider?)

- Struggle between good and evil (are your characters involved in good v. evil scenarios?)

- Coming of age (do the main characters experience a tough lesson that makes them grow?)

Your assignment will most likely give you direction as to whether you should find specific characters, story characteristics, or overall themes to compare. If it is not that specific, don't worry! You actually have a little more leeway.

Comparing Two Novel Themes

The teacher's goal when assigning this paper is to encourage you to think and analyze. You no longer read for a surface understanding of what happens in a novel; you are reading to understand why things happen and what the deeper meaning behind a character is a setting or an event. In short, you are expected to come up with an interesting comparative analysis.

As an example of comparing novel themes, we will look at The Adventures of Huckleberry Finn and The Red Badge of Courage . Both of these novels contain a "coming of age" theme since both have characters who grow a new awareness through tough lessons. Some comparisons you could make:

- Both characters have to explore the notion of "civilized behavior" in the societies where they exist.

- Each main character has to question the behavior of his male role models and his male peers.

- Each main character leaves his childhood home and encounters challenges.

To craft an essay about these two novels and their similar themes, you would create your own list of similarities like those above, using a list, chart, or a Venn diagram .

Sum up your overall theory about how these themes are comparable to create your thesis statement . Here is an example: "Both characters, Huck Finn and Henry Fleming, embark on a journey of discovery, and each boy finds new understanding when it comes to traditional notions about honor and courage."

You will use your common characteristic list to guide you as you create body paragraphs .

Comparing Main Characters in Novels

If your assignment is to compare the characters of these novels, you would make a list or Venn diagram to make more comparisons:

- Both characters are young men

- Both question society's notion of honor

- Both witness behavior that makes them question their role models

- Both have a nurturing female influence

- Both question their former beliefs

Comparing two novels is not as difficult as it sounds at first. Once you generate a list of traits, you can easily see an outline emerging.

- How to Find the Theme of a Book or Short Story

- Top Conservative Novels

- Preparing for Final Exams

- Write a Compare and Contrast Essay

- 10 Steps to Writing a Successful Book Report

- How to Study for a Test or Final

- How to Write a Great Book Report

- Beef Up Critical Thinking and Writing Skills: Comparison Essays

- How to Write a Character Analysis

- 5 Novel Setting Maps for Classic American Literature

- 20 Book Activities to Try With Grades 3-5

- Using Graphic Organizers for Special Education

- 10 Classic Novels for Teens

- How to Study for a Multiple Choice Exam

- 50 General Book Club Questions for Study and Discussion

- How to Keep a Reading Log or Book Journal

IMAGES

VIDEO

COMMENTS

By looking closely at how a writer's style conveys what is at stake and how each story connects with you, you can discover what you appreciate in fiction.

Compare two short stories where the characters face difficult situations We are comparing the stories 'Flight' by Doris Lessing and 'Your shoes' by Michele Roberts. They both deal with the issue of daughters leaving home and how it affects the whole family. In 'Flight', the granddad is affected most severely but in 'Your Shoes ...

To compare two stories, we need to consider their similarities and differences pertaining to main ideas, themes, tone, characters, greater contributions, inspirations, opinions, etc. This is an important skill to have when reading because it stretches your thinking and your brain's ability to remember key points of one story and assess how ...