- Search Search Please fill out this field.

- Money Market Vs. Capital Market: An Overview

The Money Market

The capital market.

- Frequently Asked Questions

The Bottom Line

- Investing Basics

Money Market Vs. Capital Market: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/ChristinaMajaski-5c9433ea46e0fb0001d880b1.jpeg)

Money Market Vs. Capital Market: An Overview

The money market and the capital market are not single institutions but two broad components of the global financial system.

- The money market is the trade in short-term debt. It is a constant flow of cash between governments, corporations, banks, and financial institutions, borrowing and lending for a term as short as overnight and no longer than a year.

- The capital market encompasses the trade in both stocks and bonds. These are long-term assets bought by financial institutions, professional brokers, and individual investors.

Together, the money market and the capital market comprise a large portion of what is known as the financial market.

The money market is a good place for individuals, banks, other companies, and governments to park cash for a short period of time, usually one year or less. It exists so that businesses and governments that need cash to operate can get it quickly at a reasonable cost, and so that businesses that have more cash than they need can put it to use.

Key Takeaways

- The money market is a short-term lending system. Borrowers tap it for the cash they need to operate from day to day. Lenders use it to put spare cash to work.

- The capital market is geared toward long-term investing. Companies issue stocks and bonds to raise money to grow their businesses. Investors buy them to share in that growth.

- The money market is less risky than the capital market while the capital market is potentially more rewarding.

The returns are modest but the risks are low. The instruments used in the money markets include deposits , collateral loans, acceptances, and bills of exchange. Institutions operating in the money markets include the Federal Reserve, commercial banks, and acceptance houses.

When a company or government issues short-term debt, it's usually to cover routine operating expenses or supply working capital, not for capital improvements or large-scale projects.

About Liquidity

The money market plays a key role in ensuring that banks, other companies, and governments maintain the appropriate level of liquidity on a daily basis, without falling short and needing a more expensive loan and without hoarding excess cash that isn't earning interest.

Individual investors may use the money markets to invest their savings in a safe and accessible place. Many choices are available, including mutual funds that focus on state money market funds, municipal funds, and U.S. Treasury funds. Many of the government funds are tax-free. A money-market fund also can be opened at most banks.

The capital market is where stocks and bonds are traded. Its movements from hour to hour are constantly monitored and analyzed for clues as to the health of the economy at large, the status of every industry in it, and the consensus for the short-term future.

The overriding goal of the companies institutions that enter into the capital markets is to raise money for their long-term purposes, which usually come down to expanding their businesses and increasing their revenues. They do this by issuing stock shares and by selling corporate bonds.

Primary and Secondary

The capital market is roughly divided into a primary market and a secondary market. A company that issues a round of stock or a new bond places it in the primary market for sale directly to investors or institutions. If and when those buyers decide to sell their shares or bonds, they do so on the secondary market. The original issuer of those stocks or bonds does not immediately benefit from their resale, although companies certainly have an interest in the price of their stock shares rising over time.

The capital market is by nature riskier than the money market and has greater potential gains and losses.

What are four examples of money market instruments?

Examples of money market instruments include certificates of deposit (CDs), commercial paper, Treasury bills (T-bills), and banker's acceptances.

What are the types of capital markets?

Capital markets can be broken down into primary and secondary markets. The primary market is where stocks and bonds are first issued to investors. The secondary market, on the other hand, is where securities that have already been issued are traded between investors.

What are 3 types of capital market?

Capital markets can include the stock market, the bond market, and the forex market . Each of these markets trade a different asset class.

The money market and capital market are often talked about. Together, they make up a large chunk of the global financial market.

The money market is where short-term financial instruments with a holding period of a year or less are traded. It essentially works as a short-term lending and borrowing platform for its participants, with investors in this market either gaining access to funds or earning interest on them. The capital market is also a venue where people make money but has different characteristics. In this market, there are entities that issue shares, bonds, or other long-term securities to raise capital and grow their businesses, and those who invest in these instruments, hoping to turn a profit.

The key distinguishing factors are time and rewards. Money markets are made up of short-term investments carrying less risk, whereas capital markets are more geared toward the longer term and offer greater potential gains and losses.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1716915775-f8eaede2a04b4b62a8c475e6c1e54929.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Money Market Vs. Capital Market: A Comprehensive Comparison

Both the money market and the capital market are crucial components of the financial system, playing pivotal roles in the mobilization of funds. At a mere glance, they might seem interchangeable, but they have distinctive functions, characteristics, and roles in the economy. Here, we’ll delve deep into their differences, outlining the salient features of each and contrasting their unique characteristics.

Disclaimer: We are not promoting any entity or service listed in the article below. Instead, this article will act as an educational platform on the terminologies as it is.

What is the Money Market?

The money market is a subset of the financial market where short-term financial assets are bought and sold. These assets typically have maturities of less than one year. The main goal of the money market is to provide a mechanism for organizations and governments to manage their short-term liquidity needs.

Key Instruments in the Money Market:

- Treasury Bills: These are short-term debt instruments issued by governments.

- Commercial Paper: A short-term obligation issued by corporations.

- Certificates of Deposit (CDs): Offered by banks, they have specific maturity dates and fixed interest.

- Repurchase Agreements: Essentially, short-term loans—usually overnight.

What is the Capital Market?

The capital market is where long-term securities such as stocks and bonds are traded. This market exists to make capital available for businesses and government entities for periods exceeding one year.

Key Instruments in the Capital Market:

- Stocks or Shares: Represent ownership in a company.

- Bonds : Long-term loan certificates issued by companies or governments.

- Debentures: Like bonds but often without collateral.

- Convertible Securities: Can be converted into stock.

Read: 3 Differences and Similarities Between Bonds and Sukuk You Need to Know

Contrasting Features: Money Market Vs. Capital Market

Duration of investments.

- Money Market: Focused on short-term financial assets, usually with a maturity of less than a year.

- Capital Market: Concerned with long-term investments, often extending beyond one year.

Returns on Investment

- Money Market: Typically, returns are lower given the lower risk and short duration.

- Capital Market: Potential for higher returns, but accompanied by higher risks.

Market Instruments

- Money Market: Treasury bills, commercial paper, CDs, and repurchase agreements are dominant.

- Capital Market: Stocks, bonds, debentures, and convertible securities are prevalent.

- Money Market: High liquidity, given the short maturity of its instruments.

- Capital Market: Less liquid when compared to the money market due to longer investment horizons.

Risk Factor

- Money Market: Generally perceived as less risky.

- Capital Market: Higher inherent risks due to market volatilities and longer durations.

Role in the Economy

Both the money market and capital market serve different but complementary roles in bolstering the economy.

- Money Market: It supports liquidity management, ensuring businesses and governments meet their short-term obligations. By doing so, it instills confidence in the financial system.

- Capital Market: Vital for economic growth. It channels long-term resources to enterprises and governmental entities, facilitating infrastructural developments, business expansions, and technological advancements.

Influencing Factors

Factors Impacting Money Market and Capital Market

Both markets, although distinct in nature, are influenced by a variety of external and internal factors.

- Economic Indicators: These include GDP growth rates, unemployment rates, inflation rates, and more. A robust economic environment tends to bolster both markets, albeit in different ways.

- Monetary Policy: Central banks wield considerable influence. Interest rate decisions, for instance, directly impact the money market and have ripple effects on the capital market.

- Global Events: Geopolitical issues, wars, pandemics, or international economic crises can swing both markets.

- Regulatory Environment: The framework set by regulatory bodies can facilitate or hinder the smooth functioning of these markets.

Regulatory Bodies

Given the significance of both the money market and the capital market, they are closely watched by regulatory entities.

- Money Market: In many countries, central banks or monetary authorities oversee the money market, ensuring liquidity and stability.

- Capital Market: Typically regulated by securities commissions or equivalent bodies, their role is to protect investors, maintain fair markets, and ensure transparency.

Investor Profile

The type of investor and their objectives can differ markedly between the two markets.

- Money Market: Ideal for conservative investors or those seeking short-term parking places for their funds. Examples include corporations with excess funds, banks, and financial institutions.

- Capital Market: Attracts a broader range of investors, from individual retail investors to large institutional entities. The potential for higher returns lures those with medium to long-term investment horizons.

Interrelationship Between the Two

Despite their differences, the money market and capital market are not isolated silos. They interact and influence each other in various ways.

- Liquidity Flow: The money market’s liquidity can often flow into the capital market, especially when short-term returns are not attractive enough.

- Interest Rate Movements: As mentioned, central banks’ decisions on interest rates directly impact the money market, which in turn can influence long-term interest rates and sentiments in the capital market.

- Investor Confidence: A stable money market can boost investor confidence, making them more willing to invest in riskier, long-term capital market instruments.

Final Thoughts

While the money market and capital market serve distinct functions, they are two sides of the same coin in the financial realm. Understanding the intricacies of each, their interrelationship, and their role in the broader economy is essential for policymakers, investors, and anyone keen on financial literacy.

In the constantly evolving world of finance, staying informed and educated on these markets can pave the way for better investment decisions and a more comprehensive grasp of the global economic landscape.

Please click here and visit our academy to read more about Islamic Finance-related topics.

Also, feel free to sign up for our free sharia stock screening service at musaffa.com .

Disclaimer: Important information

Share this:

Related articles.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

UPSC Coaching, Study Materials, and Mock Exams

Enroll in ClearIAS UPSC Coaching Join Now Log In

Call us: +91-9605741000

Financial Market : Money Market and Capital Market

Last updated on December 29, 2023 by Alex Andrews George

The topic of discussion of this post is Indian Financial Market. We will see what money market and capital market are.

We shall also look into the details of sub-topics like call money, treasury bill, shares, debentures, put/call options etc.

We hope this post to throw light on the various aspects of capital market, particularly related with shares and stock market. Clear IAS™ plan to cover this topic as an article series, breaking the details into 2-3 parts. Let’s first have a quick overview.

Table of Contents

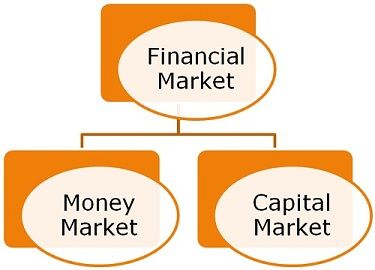

Financial Market

Fund raising by business units.

Business units have to raise short-term as well as long-term funds to meet their working and fixed capital requirements from time to time. From where would they get funds from? Ans : From investors or lenders.

Surplus money flows from the investors or lenders to the businessmen for the purpose of production or sale of goods and services. So, we find two different groups, one who invest money or lend money and the others, who borrow or use the money.

Main functions of financial market

Let us now see the main functions of financial market. (a) It provides facilities for interaction between the investors and the borrowers. (b) It provides pricing information resulting from the interaction between buyers and sellers in the market when they trade the financial assets. (c) It provides security to dealings in financial assets. (d) It ensures liquidity by providing a mechanism for an investor to sell the financial assets. (e) It ensures low cost of transactions and information.

Join Now: NCERT Foundation Course

Classification of Financial Market

A financial market consists of two major segments: (a) Money Market; and (b) Capital Market. While the money market deals in short-term credit, the capital market handles the medium term and long-term credit.

Financial Market Classification

Money market..

- Call Money.

- Treasury Bill .

- Commercial Paper.

- Certificate of Deposit.

- Trade bill.

Capital Market.

- Primary Market : IPOs, Book Building, Private Placements.

- Secondary Market : Equity Market , Debt Market, Commodity Market, Futures and Options Market. (Secondary Market can be basically divided into two – spot market and forward market. Forward market has two divisions – futures and options/derivatives. Again, there are two types of options – put option and call option.)

- Mutual Funds.

- Fixed Deposits, Savings Deposits, Post Office savings.

Money Market

The money market is a market for short-term funds, which deals in financial assets whose period of maturity is upto one year. It should be noted that money market does not deal in cash or money as such but simply provides a market for credit instruments such as bills of exchange, promissory notes, commercial paper, treasury bills, etc. These financial instruments are close substitute of money. These instruments help the business units, other organisations and the Government to borrow the funds to meet their short-term requirement.

The Indian money market consists of Reserve Bank of India, Commercial banks, Co-operative banks, and other specialised financial institutions. The Reserve Bank of India is the leader of the money market in India. Some Non-Banking Financial Companies (NBFCs) and financial institutions like LIC, GIC, UTI, etc. also operate in the Indian money market.

To read more click here .

Capital Market

Money market and capital market : a comparison.

References : NOS and CBSE.

Join Now: UPSC Prelims cum Mains Course

Take a Test: Analyse Your Progress

Aim IAS, IPS, or IFS?

About Alex Andrews George

Alex Andrews George is a mentor, author, and social entrepreneur. Alex is the founder of ClearIAS and one of the expert Civil Service Exam Trainers in India.

He is the author of many best-seller books like 'Important Judgments that transformed India' and 'Important Acts that transformed India'.

A trusted mentor and pioneer in online training , Alex's guidance, strategies, study-materials, and mock-exams have helped many aspirants to become IAS, IPS, and IFS officers.

Reader Interactions

March 2, 2017 at 8:18 pm

Under Organised Money Market we take: Banking Sector and Sub Market which is both properly regulated by RBI. In Banking Sector (operation b/w bank and customer) there is need for dealing in cash or money as it is the medium for transaction b/w customer and bank. But in this article it clearly says “It should be noted that money market does not deal in cash or money …” Please explain how this is possible???

January 9, 2019 at 2:18 pm

The money market is where financial instruments with high liquidity and very short maturities are traded. It is used by participants as a means for borrowing and lending in the short term, with maturities that usually range from overnight to just under a year. But you told that in money market no money/cash, please through a light on this confusion.

August 3, 2019 at 10:15 am

The both questions are same.The answer to the question goes like,in Money Market,the amount denomination is quite high which can not be traded in cash .There are specific instruments of money market such as T-bill,CPs, COD etc.There is no physical transaction of cash.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don’t lose out without playing the right game!

Follow the ClearIAS Prelims cum Mains (PCM) Integrated Approach.

Join ClearIAS PCM Course Now

UPSC Online Preparation

- Union Public Service Commission (UPSC)

- Indian Administrative Service (IAS)

- Indian Police Service (IPS)

- IAS Exam Eligibility

- UPSC Free Study Materials

- UPSC Exam Guidance

- UPSC Prelims Test Series

- UPSC Syllabus

- UPSC Online

- UPSC Prelims

- UPSC Interview

- UPSC Toppers

- UPSC Previous Year Qns

- UPSC Age Calculator

- UPSC Calendar 2024

- About ClearIAS

- ClearIAS Programs

- ClearIAS Fee Structure

- IAS Coaching

- UPSC Coaching

- UPSC Online Coaching

- ClearIAS Blog

- Important Updates

- Announcements

- Book Review

- ClearIAS App

- Work with us

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Talk to Your Mentor

Featured on

and many more...

- Diff. Between In Commerce

- Money Market Vs Capital Market

Difference between Money Market and Capital Market

A financial market is a place where buyers and seller come together to trade in financial assets such as bonds, stocks, derivatives, currencies and commodities. The main objective of a financial market is to fix prices for global trade, increase capital and transfer risk and liquidity.

Thought the financial market has various components; the two most important components are the money market and capital market. In the money market, only short-term liquid financial instruments are exchanged. Whereas, in the capital market, only long term securities are dealt with.

Capital Market plays a significant role in the growth of a country’s economy as it provides a platform for mobilising the funds. Similarly, the money market holds a range of operational characteristics. This article will explain the difference between money market and capital market.

What is the Money Market?

A random course of financial institutions, bill brokers, money dealers, banks, etc., wherein dealing on short-term financial tools are being settled is referred to as Money Market. These markets are also called wholesale markets.

In India, money markets serve an essential objective of providing liquid cash to borrowers and fund providers for a small period of time, while keeping a balance between the supply and demand short-term funds. The important money market instruments in India today cover call money, commercial papers, certificates of deposit, treasury bills, and forward rate agreements.

Money Market is a disorganised market, so the dealing is done off the public exchange market, i.e. Over The Counter (OTC), within two bodies by using email, fax, online and phones, etc. It supports the industries to accomplish their working capital demand by circulating short-term funds in the economy.

Also, explore: Functions of Capital Market

What is Capital Market?

A kind of financial market where the company or government securities are generated and patronised with the intention of establishing long-term finance to coincide the capital necessary is called Capital Market.

In this market, the buyers use funds for longer-term investment. The nature of the capital market is risky markets. Therefore, it is not used for short-term funds investment. Most of the investors obtain the capital markets to preserve for education or retirement.

This article is a ready reckoner for all the students to learn the Difference Between Money Market and Capital Market.

Top 10 Differences between Money Market and Capital Market

Explore: Capital Accounts of Partners

Features of Money Market

A few general money market features are:

- It is fund-term market funds.

- It’s maturity period up to one year.

- It trades with assets that can be transformed into cash easily.

- All the transactions take place through phone, email, text, etc.

- Broker not required for the transaction

- The components of a money market are the Commercial Banks, Non-banking financial companies and Central Bank, etc.

Features of Capital Market

Important features of the capital market are:

- Unites entrepreneurial borrowers and savers

- Deals with long-term investments.

- Agents are required.

- It is controlled by government rules and regulations.

- Deals in both commercial and non-commercial securities.

- Foreign Investors.

5 Types of Money Markets

Money market instruments have different securities, which can be utilised for short term borrowings. A few different types of market money are:

- Call Money- It portrays a short term loan with maturities term starting from one day to fourteen days, and it can be repaid on demand.

- Treasury Bill- It is the oldest and traditional money market instrument and is practised across the globe. The instrument is declared by the Government and does not have to pay any interest. This is available at a discounted rate at the time of issue.

- Ready Forward Contract (Repo)- The word repo is acquired from the phrase “repurchase agreement”. It is an agreement that specifies the sale and purchase of an asset. In India, this agreement is prepared between different banks and sometimes between bank and RBI for short term loans.

- Money Market Mutual Fund- This is the alternative name for liquid funds and are the lowest risk debt funds.

- Interest Rate Swaps- This is the latest money market instruments in India. Here, two parties sign an agreement, where one decides to pay a fixed rate of interest, and the other pays a floating rate of interest.

Types of Capital Market

The Capital Market instrument involves both the auction market and dealer market. It is classified into two sections: Primary Market and Secondary Market.

- Primary Market: Here, fresh contracts are given to the people for the subscription purpose.

- Secondary Market: The securities that have already been issued are exchanged among investors.

Also see: Difference between Primary Market and Secondary Market

Money Market Examples

Since they are extremely liquid in nature, the money market recovery period is restricted to one year. A few examples of Money Market are:

- Trade Credit

- Commercial Paper

- Certificate of Deposit

- Treasury Bills

Capital Market Examples

The capital market circulates the capital in the economy among the user and the suppliers of money.

The maturity period is more than one year or sometimes it is incurable (no maturity).

- Euro issues

The above mentioned concept elucidates in detail the ‘Difference Between Money Market and Capital Market’ for Commerce students. To know more, stay tuned to BYJU’S.

Frequently Asked Questions

Do money market funds have fees, who has the best money market.

- Sallie Mae: 2.30% Annual Pension Yield (APY)

- Marcus by Goldman Sachs: 2.25% APY

- FNBO Direct: 2.25% APY

What Are The Types Of Capital Markets?

Give 4 examples of capital markets.

- Stocks and bonds

- Treasury bills

- Foreign exchange

Give 4 Examples Of Money Markets

- Certificates of Deposit (CDs)

- Interbank loans

- Treasury bills (T-bills)

- Short-term securities loans

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

nice explanation. Its very easy to understand

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Personal Finance

Money markets vs. capital markets: key differences.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Money markets and capital markets make the financial world go ’round.

In the money markets, governments, banks, and others buy and sell short-term debt—and individual investors own bank accounts , certificates of deposit (CDs), money market accounts, money market funds, and similar assets. And in the capital markets, investors trade stocks , bonds , and other assets.

Looking to enhance your investment strategy with expert financial guidance? WiserAdvisor can connect you with a licensed advisor who can align with your unique requirements.

Money market in brief

As the International Monetary Fund explains , money markets enable banks, investors, and others to make short-term, relatively safe investments that provide governments, banks, and others access to short-term, low-cost funds. The money market as a whole “is considered one of the safest corners of the financial universe,” says the Financial Industry Regulatory Authority (FINRA), which oversees U.S. stockbrokers.

Assets that are bought and sold in the money markets include money market mutual funds, bank-to-bank loans, CDs, Treasury bills, and commercial paper (short-term IOU debt issued by financial institutions and big corporations).

When it comes to the money markets, many investors may be quite familiar with money market mutual funds. Someone who invests in a money market mutual fund is buying into a pool of short-term debt assets such as CDs and Treasury bills. Although money market mutual funds aren’t insured by the federal government, they’re viewed as one of the safest investments available.

Capital market in brief

When investors hold assets such as stocks and bonds, whether individually or through a mutual fund or exchange traded fund (ETF) , they’re participating in the capital markets.

Familiar venues for trading stocks in the capital markets include the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. Each weekday, investors trade billions of shares of stock of publicly traded companies on the NYSE, the world’s largest stock exchange, and the Nasdaq, which focuses on companies in the tech sector.

Typically, brokerage firms handle stock trades on behalf of institutional and individual investors. Trades normally happen electronically.

Why money markets and capital markets are important to our economy

Money markets and capital markets are important to our economy because they serve as the backbone of the financial system, says Daniel Milan , founder and managing partner of Cornerstone Financial Services in Southfield, Mich.

Money markets account for trillions of dollars in assets. For example, U.S. money market funds—mutual funds that invest in short-term debt—held $5.45 trillion in assets as of the week ending July 12, 2023, the I nvestment Company Institute reported .

Meanwhile, capital markets in the U.S. finance over 70% of economic activity in the U.S., according to the Securities Industry and Financial Markets Association (SIFMA). These markets “help people with ideas become entrepreneurs and help small businesses grow into big companies. They also give folks … opportunities to save and invest for our futures,” according to the Federal Reserve Bank of St. Louis.

Differences between money markets and capital markets

While money markets and capital markets both involve investing, they’re more different than they are alike.

“They serve different purposes and carry different risk levels. Money markets are typically shorter-term and carry less risk but offer less potential reward. Capital markets are typically longer-term and offer greater risk but potential for greater rewards,” Milan explains.

Money markets vs. capital markets

Here is a side-by-side comparison of money markets and capital markets.

Which is a better investment?

From an investment perspective, neither money markets nor capital markets are better than the other,

Milan says. Whether one type is preferable to the other depends on factors such as your financial goals and tolerance for investment risk.

Alternatives to money markets and capital markets

Money markets and capital markets aren’t only places to invest money. Among the alternatives are:

- Real estate

- Collectibles such as artwork, coins, and wine

- Investments in privately owned companies like tech startups

- Commodities such as oil, gas, and precious metals

Keep in mind that while alternative investments can diversify your portfolio, they also can come with a high level of risk.

Frequently asked questions (FAQs)

What are three types of capital market.

Among the types of capital market are stock markets, bond markets, and foreign exchange markets.

What are four examples of money market instruments?

Money market instruments include money market accounts, money market funds, CDs, and Treasury bills.

Can money market accounts lose money?

Money market accounts are insured up to $250,000 by either the Federal Deposit Insurance Corp. (FDIC) or National Credit Union Administration (NCUA). Because they’re insured, someone who holds a money market account typically won’t lose money. However, fees, inflation, and other negative factors can eat away at cash kept in a money market account.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

- About the New York Fed

- Bank Leadership

- Diversity and Inclusion

- Communities We Serve

- Board of Directors

- Disclosures

- Ethics and Conflicts of Interest

- Annual Financial Statements

- News & Events

- Advisory Groups

- Vendor Information

- Holiday Schedule

At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve.

Introducing the New York Innovation Center: Delivering a central bank innovation execution

Do you have a request for information and records? Learn how to submit it.

Learn about the history of the New York Fed and central banking in the United States through articles, speeches, photos and video.

- Markets & Policy Implementation

- Reference Rates

- Effective Federal Funds Rate

- Overnight Bank Funding Rate

- Secured Overnight Financing Rate

- SOFR Averages & Index

- Broad General Collateral Rate

- Tri-Party General Collateral Rate

- Desk Operations

- Treasury Securities

- Agency Mortgage-Backed Securities

- Reverse Repos

- Securities Lending

- Central Bank Liquidity Swaps

- System Open Market Account Holdings

- Primary Dealer Statistics

- Historical Transaction Data

- Monetary Policy Implementation

- Agency Commercial Mortgage-Backed Securities

- Agency Debt Securities

- Repos & Reverse Repos

- Discount Window

- Treasury Debt Auctions & Buybacks as Fiscal Agent

- INTERNATIONAL MARKET OPERATIONS

- Foreign Exchange

- Foreign Reserves Management

- Central Bank Swap Arrangements

- Statements & Operating Policies

- Survey of Primary Dealers

- Survey of Market Participants

- Annual Reports

- Primary Dealers

- Standing Repo Facility Counterparties

- Reverse Repo Counterparties

- Foreign Exchange Counterparties

- Foreign Reserves Management Counterparties

- Operational Readiness

- Central Bank & International Account Services

- Programs Archive

- Economic Research

- Consumer Expectations & Behavior

- Survey of Consumer Expectations

- Household Debt & Credit Report

- Home Price Changes

- Growth & Inflation

- Equitable Growth Indicators

- Multivariate Core Trend Inflation

- New York Fed DSGE Model

- New York Fed Staff Nowcast

- R-star: Natural Rate of Interest

- Labor Market

- Labor Market for Recent College Graduates

- Financial Stability

- Corporate Bond Market Distress Index

- Outlook-at-Risk

- Treasury Term Premia

- Yield Curve as a Leading Indicator

- Banking Research Data Sets

- Quarterly Trends for Consolidated U.S. Banking Organizations

- Empire State Manufacturing Survey

- Business Leaders Survey

- Supplemental Survey Report

- Regional Employment Trends

- Early Benchmarked Employment Data

- INTERNATIONAL ECONOMY

- Global Economic Indicators

- Global Supply Chain Pressure Index

- Staff Economists

- Visiting Scholars

- Resident Scholars

- PUBLICATIONS

- Liberty Street Economics

- Staff Reports

- Economic Policy Review

- RESEARCH CENTERS

- Applied Macroeconomics & Econometrics Center (AMEC)

- Center for Microeconomic Data (CMD)

- Economic Indicators Calendar

- Financial Institution Supervision

- Regulations

- Reporting Forms

- Correspondence

- Bank Applications

- Community Reinvestment Act Exams

- Frauds and Scams

As part of our core mission, we supervise and regulate financial institutions in the Second District. Our primary objective is to maintain a safe and competitive U.S. and global banking system.

The Governance & Culture Reform hub is designed to foster discussion about corporate governance and the reform of culture and behavior in the financial services industry.

Need to file a report with the New York Fed? Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

The New York Fed works to protect consumers as well as provides information and resources on how to avoid and report specific scams.

- Financial Services & Infrastructure

- Services For Financial Institutions

- Payment Services

- Payment System Oversight

- International Services, Seminars & Training

- Tri-Party Repo Infrastructure Reform

- Managing Foreign Exchange

- Money Market Funds

- Over-The-Counter Derivatives

The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment services, advancement of infrastructure reform in key markets and training and educational support to international institutions.

The New York Fed provides a wide range of payment services for financial institutions and the U.S. government.

The New York Fed offers the Central Banking Seminar and several specialized courses for central bankers and financial supervisors.

The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress.

- Community Development & Education

- Household Financial Well-being

- Fed Communities

- Fed Listens

- Fed Small Business

- Workforce Development

- Other Community Development Work

- High School Fed Challenge

- College Fed Challenge

- Teacher Professional Development

- Classroom Visits

- Museum & Learning Center Visits

- Educational Comic Books

- Economist Spotlight Series

- Lesson Plans and Resources

- Economic Education Calendar

We are connecting emerging solutions with funding in three areas—health, household financial stability, and climate—to improve life for underserved communities. Learn more by reading our strategy.

The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality.

- Request a Speaker

- International Seminars & Training

- Governance & Culture Reform

- Data Visualization

- Economic Research Tracker

- Markets Data APIs

- Terms of Use

Mastering Business Knowledge: Your MBA Notes Companion

Money Market vs. Capital Market: Key Differences Unveiled

State the difference between money market and capital market.

Here, we outline the key distinctions between them:

Money Market

The money market is a fundamental component of the financial system, facilitating short-term borrowing and lending activities through easily tradable and low-risk financial instruments.

These instruments encompass Treasury Bills, Certificates of Deposit (CDs) , and Commercial Paper. The money market is a valuable tool for individuals, businesses, and governments to manage short-term

financial requirements and optimize cash flow effectively. It is distinguished by the safety and liquidity of its instruments, making them attractive for preserving capital and providing rapid access to funds.

Moreover, the money market operates under rigorous regulatory oversight to ensure market integrity and safeguard the interests of investors, and it significantly contributes to overall financial stability.

Capital Market

The capital market is a financial marketplace where long-term financial instruments such as stocks and bonds are traded.

It serves as a platform for corporations and governments to secure long-term financing for diverse projects and offers investors the chance to make long-term investments.

Regulatory oversight is in place to guarantee transparency and safeguard the interests of investors, and the capital market plays a pivotal role in stimulating economic growth and development.

Purpose and Investment Horizon

Money Market: Money markets deal primarily with short-term financial instruments and securities, typically featuring one year or less maturities. They serve as the hub for short-term borrowing and lending, liquidity management, and the allocation of funds into low-risk, highly liquid assets.

Capital Market: Capital markets, in contrast, are oriented toward long-term investments. They facilitate trading long-term securities, such as stocks and bonds, with maturities exceeding one year. Capital markets are instrumental in helping businesses secure long-term capital for expansion and growth.

Types of Financial Instruments

Money Market: Money market instruments include Treasury bills, certificates of deposit (CDs), commercial paper, repurchase agreements (repos), and short-term government and corporate bonds.

Capital Market: Capital market instruments encompass stocks (equity securities), bonds (debt securities), and other long-term financial instruments like preferred shares and mortgage-backed securities.

Risk and Return Profile

Money Market: Financial instruments are generally regarded as low-risk investments, offering relatively modest returns. Investors in money markets prioritize the security of their principal amount over the potential for high yields.

Capital Market: Capital market investments involve higher levels of risk but also present the possibility of greater returns. The risk-return trade-off tends to be more pronounced in the capital market.

Participants

Money Market: Participants include banks, financial institutions, corporations, government entities, and individual investors. These stakeholders utilize money market instruments for short-term financing needs and effective cash management.

Capital Market: Participants include individuals, institutional investors (such as mutual funds, pension funds, and insurance companies), and corporations. These entities engage in long-term investments to achieve wealth accumulation and portfolio diversification goals.

Regulatory Framework

Money Market: Money markets are subject to regulations that ensure the safety and liquidity of the instruments traded within them. Government securities often play a significant role in money markets and are typically perceived as highly secure.

Capital Market: Capital markets are also subject to regulatory oversight, with a greater emphasis on transparency and investor protection. Stock exchanges and regulatory bodies oversee securities trading in the capital market.

Money markets revolve around short-term, low-risk, and highly liquid instruments. In contrast, capital markets revolve around long-term securities with elevated risk potential and the prospect of greater returns. Both markets are vital to the broader financial landscape, addressing different financial needs and objectives.

Comparison between Table : Money Markets Vs Capital Markets

In summary, grasping the distinctions between money and capital markets is essential for informed financial decision-making. The money market caters to short-term, low-risk financial needs.

In contrast, the capital market is geared towards long-term wealth accumulation, offering the prospect of higher returns along with increased risk.

Your choice should align with your financial objectives and investment horizon, so decide prudently based on your unique circumstances and goals.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Key Differences

Know the Differences & Comparisons

Difference Between Money Market and Capital Market

Capital Market plays a crucial role in the development of the economy because it provides channels for mobilization of funds. On the other hand, money market possesses a range of operational features. The article presented to you explains the difference between money market and capital market in tabular form.

Content: Money Market Vs Capital Market

Comparison chart, definition of money market.

An unorganised arena of banks, financial institutions, bill brokers, money dealers, etc. wherein trading on short-term financial instruments is being concluded is known as Money Market. These markets are also known by the name wholesale market.

Trade Credit, Commercial Paper, Certificate of Deposit, Treasury Bills are some examples of the short-term debt instruments. They are highly liquid (cash equivalents) in nature, and that is why their redemption period is limited to one year. They provide a low return on investment, but they are quite safe trading instruments.

Money Market is an unsystematic market, and so the trading is done off the exchange, i.e. Over The Counter (OTC) between two parties by using phones, email, fax, online, etc. It plays a major role in the circulation of short-term funds in the economy. It helps the industries to fulfil their working capital requirement.

Definition of Capital Market

A type of financial market where the government or company securities are created and traded for the purpose of raising long-term finance to meet the capital requirement is known as Capital Market.

The securities which are traded include stocks, bonds, debentures, euro issues, etc. whose maturity period is not limited up to one year or sometimes the securities are irredeemable (no maturity). The market plays a revolutionary role in circulating the capital in the economy between the suppliers of money and the users. The Capital Market works under full control of Securities and Exchange Board to protect the interest of the investors.

The Capital Market includes both dealer market and auction market. It is broadly divided into two major categories: Primary Market and Secondary Market.

- Primary Market : A market where fresh securities are offered to the public for subscription is known as Primary Market.

- Secondary Market : A market where already issued securities are traded among investors is known as Secondary Market.

Key Differences Between Money Market and Capital Market

The following points are substantial, as far as the difference between money market and capital market is concerned:

- The place where short-term marketable securities are traded is known as Money Market. Unlike Capital Market, where long-term securities are created and traded is known as Capital Market.

- Capital Market is well organised which Money Market lacks.

- The instruments traded in money market carry low risk, hence, they are safer investments, but capital market instruments carry high risk.

- The liquidity is high in the money market, but in the case of the capital market, liquidity is comparatively less.

- The major institutions that work in money market are the central bank, commercial bank, non-financial institutions and acceptance houses. On the contrary, the major institutions which operate in the capital market are a stock exchange, commercial bank, non-banking institutions etc.

- Money market fulfils short-term credit requirements of the companies such as providing working capital to them. As against this, the capital market tends to fulfil long-term credit requirements of the companies, like providing fixed capital to purchase land, building or machinery.

- Capital Market Instruments give higher returns as compared to money market instruments.

- Redemption of Money Market instruments is done within a year, but Capital Market instruments have a life of more than a year as well as some of them are perpetual in nature.

Video: Capital Vs Money Market

The main aim of the financial market is to channelize the money between parties in which Money Market and Capital Market help by taking surplus money from the lenders and giving them to the borrower who needs it. Millions of transactions take place around the world on a daily basis.

Both of them work for the betterment of the global economy. They fulfil the long term and short term capital requirements of the individual, firms, corporate and government. They provide good returns which encourage investments.

You Might Also Like:

SHAHABAZ AHAMED KHAN says

September 30, 2015 at 9:36 am

stanley kamau says

July 14, 2017 at 10:33 am

Nice and easy to understand summary. Very informative indeed

November 13, 2016 at 8:11 pm

Good summary. I like the site.

Muhammad Afzal says

July 17, 2017 at 10:49 am

Excellent one. A very informative & brief description of Financial Market.

Surbhi S says

July 17, 2017 at 12:45 pm

Thanks to all the readers, for appreciatng the articles, it means a lot to us, keep reading.

HARDIK NAVIN MISTRY says

September 10, 2017 at 2:29 pm

Brilliantly explained, keep it up.

December 24, 2017 at 8:43 pm

well explained, hope no hidden details.

February 21, 2018 at 12:07 am

Thanks for the in-depth analysis. I’ll appreciate if I get a copy of the above material and all other related materials for a dummy like me. Thank you.

Prince says

July 12, 2018 at 8:32 pm

The detail and analytic academic resource that is assisting for better understanding of the desired topic in different perspective of the learning.

August 19, 2018 at 8:27 pm

It is good and easy to understand but we want more than 8 difference to write for 14 marks

November 1, 2018 at 3:45 pm

Good and easy to understand summary .I like it.

karthik raja s says

November 16, 2018 at 10:20 am

this answer please send to my email id in pdf model

super comparison and explanation

thanking you

Mamuda Isa Jibril says

July 7, 2019 at 5:11 pm

Thanks very well and understandable summary

Zumya Sultana says

January 31, 2023 at 8:37 am

Thanks for sharing this summary. It is a very well easily this description and a good summary. Easily understanding.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

AP®︎/College Macroeconomics

Course: ap®︎/college macroeconomics > unit 4.

- Demand curve for money in the money market

- Equilibrium nominal interest rates in the money market

- Lesson summary: the money market

The money market: foundational concepts

- Changes in the money market

- (Choice A) A

- (Choice B) B

- (Choice C) C

- (Choice D) D

- (Choice E) E

Browse Course Material

Course info.

- Prof. Gary Gensler

Departments

- Sloan School of Management

As Taught In

- Information Technology

- Artificial Intelligence

Learning Resource Types

Fintech: shaping the financial world, class 9: trading & capital markets.

- Download video

- Download transcript

Lecture Slides

Class 9 Lecture Slides: Trading and Capital Markets (PDF)

Required Readings

‘ How Robinhood Changed an Industry ’ John Divine, US News (October 17, 2019)

‘ Charles Schwab and the New Broker Wars ’ Daren Fonda, Barron’s (October 4, 2019)

‘ Robo-Advisors: Product vs. Platform ’ Henry O’Brien, The Startup (June 10, 2019)

Optional Readings

‘ The Death of Brokerage Fees Was 50 Years in the Making ’ Stephen Mihm, Bloomberg (January 3, 2020)

‘ 8 Best Robo-Advisors of 2020 ’, Eric Rosenberg, The Balance (November 20, 2019)

Study Questions / Issues to Prepare

- How did online brokers emerge during an earlier stage of FinTech development? How were Robinhood and this era’s FinTech startups able to further disrupt the brokerage world?

- How are robo-advisors transforming the provision of retail asset management services? How has Big Finance—incumbent asset managers and banks—reacted?

- What are FinTech trends and applications affecting trading, asset management & capital market infrastructure?

You are leaving MIT OpenCourseWare

- Arts & Humanities

- Communications

- Public Relations

money and capital markets - Allama Iqbal Open University

Related documents

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

Here's why Avenue Capital's Marc Lasry expects only one rate cut this year

Posted: April 8, 2024 | Last updated: April 8, 2024

Avenue Capital CEO Marc Lasry joins 'Closing Bell' to discuss the potential of a Fed rate cut, treasury yields, and investing in the market.

More for You

A data specialist shares the 2-page résumé that got him a $300,000 job at Google — and explains 3 details he got right on it.

20 actors who passed up iconic roles

How to Fix Loose Outlets

‘Death cleaning’ isn’t morbid, it’s the healthiest thing you can do

4 Chain Restaurants With The Absolute Best Chicken Pot Pie And 4 With The Worst

5 Netflix movies to watch when the kids have gone to bed

Mystery As Navy Fires Commander of Biomedical Lab

My Millennial Mind Is Literally On Fire After Learning That These Everyday Items Were Staples In Most Gen X And Boomer Homes

The most memorable movie character deaths

The Fix-All Ingredient That'll Get Super Glue Off Most Surfaces

Giant lake suddenly returns 130 years after vanishing

16 Popular Pizza Chains, Ranked Worst to Best

'Curb Your Enthusiasm' Finale Gets Rave Reviews

I moved from the US to Ireland. Here are 11 things that surprised me most.

19 Easy Ways to Fall Back Asleep After Waking Up in the Middle of the Night

Long COVID leaves telltale traces in the blood, finds new study

Horror Movies Where the Monster Isn’t the Scariest Thing

Kikkoman Finally Settles the Debate: This Is Where You Should Store Your Soy Sauce

Harvard psychologist shares 9 toxic phrases 'gaslighters' always use—and how to respond

This new 'blended-wing' plane looks like a military stealth bomber and just got the green light to fly after decades of development

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

15 men brought to military enlistment office after mass brawl in Moscow Oblast

Local security forces brought 15 men to a military enlistment office after a mass brawl at a warehouse of the Russian Wildberries company in Elektrostal, Moscow Oblast on Feb. 8, Russian Telegram channel Shot reported .

29 people were also taken to police stations. Among the arrested were citizens of Kyrgyzstan.

A mass brawl involving over 100 employees and security personnel broke out at the Wildberries warehouse in Elektrostal on Dec. 8.

Read also: Moscow recruits ‘construction brigades’ from Russian students, Ukraine says

We’re bringing the voice of Ukraine to the world. Support us with a one-time donation, or become a Patron !

Read the original article on The New Voice of Ukraine

Recommended Stories

Republicans () are killing a tax cut.

In a flip of the usual priorities, Senate Republicans seem likely to kill a set of tax cuts that have already passed the House and are broadly popular. Here's why.

Mock Draft Monday with PFF's Trevor Sikkema: Cowboys fill needs, Vikings and Broncos land QBs

We continue our 'Mock Draft Monday' series with PFF's Trevor Sikkema joining Matt Harmon the pod. Sikkema provides his five favorite picks from his latest mock draft as well as his least favorite pick. The PFF draft expert also shares what goes into his methodology when crafting a mock, especially as inch even closer to night one of the draft.

Andrew Siciliano, face of 'Red Zone Channel,' and others out at NFL Network, per report

NFL Network is laying off four of its most popular and talented on-air personalities.

Rashee Rice didn't learn from the past, maybe other NFL players will learn from Rice

Rashee Rice should have taken a lesson from recent history.

2024 Toyota Land Cruiser Preview: Pricing, fuel economy and everything else we know

Everything we know about the all-new 2024 Toyota Land Cruiser, including its price, fuel economy, hybrid power specs and more.

Stephen Strasburg retires after years of injury struggles and months-long standoff with Nationals

Stephen Strasburg made eight starts after signing a $245 million contract in 2019.

Royals owner's wife warns team could move to Kansas after ballpark funding proposal voted down

Marny Sherman, the wife of Kansas City Royals owner John Sherman, warned that Missouri could lose both the Royals and Kansas City Chiefs after a stadium funding proposal was voted down.

Rashee Rice apologizes for 'my part' in crash while injured couple reportedly lawyer up

Rice reportedly owned the Corvette and leased the Lamborghini involved in the crash.

Vontae Davis, former NFL star, found dead in Miami home at age 35

Davis published a children's book about his life in 2019

Why gas prices in California ‘have gone ballistic'

California's gas prices have surged more than the rest of the nation as the state grapples with less output from its refineries.

US economy has Wall Street 'borderline speechless' after blowout March jobs report

The March jobs report was the latest piece of economic data to surprise Wall Street analysts and send stocks rallying.

USWNT captain Lindsey Horan and Alex Morgan issue statement after Korbin Albert apologizes for anti-LGBTQ content

Morgan alluded to some "hard conversations" with Albert over the past week.

Welcome to MLB: Padres rookie strikes out on pitch to helmet, which ump got wrong

Graham Pauley has had better at-bats.

With Kentucky job opening up, Dan Hurley laughs off question about leaving UConn after second straight title win

Hurley wasn't the only one to take his name out of consideration with UK's John Calipari reportedly on his way out the door.

Nike reportedly says it is testing new uniform options as MLB shifts blame, teams complain

MLB had to approve the Nike-designed uniforms before Fanatics produced them.

Trump legal news brief: Judge hands Trump another defeat, blocking ‘fishing expedition’ subpoena to NBC over Stormy Daniels documentary

Judge Juan Merchan blocks an attempt by former President Donald Trump to force NBCUniversal to hand over information about the release of its recent documentary about adult film star Stormy Daniels.

Astros' Ronel Blanco makes MLB history, goes 14 straight innings without allowing a hit

With his second start this spring, Ronel Blanco has recorded the best start to a season in at least 63 years.

MLB and players' union exchange barbs over pitch clock after brutal run of pitcher injuries

It's not a good time to be a pitcher right now. Shane Bieber and Spencer Strider both have damaged elbows.

WrestleMania 40 Night 2 results, grades, analysis: Cody Rhodes defeats Roman Reigns to win the Undisputed WWE Universal title

WrestleMania 40 wrapped on Sunday night in truly spectacular fashion, delivering an action-packed card from start to finish, including a main event that will perhaps go down as the greatest in professional wrestling history.

Edmunds bought a Fisker Ocean, warns others not to make the same mistake

Edmunds bought a Fisker Ocean and details the highs and lows of ownership while warning others not to make the same mistake.

Elektrostal, Moscow Oblast, Russia

Elektrostal, located in the Moscow Oblast of Russia, has a rich and intriguing history that intertwines with the political landscape and geography of the region.

Elektrostal, with a current estimated population of approximately 160,000 residents, is a major industrial city situated in the eastern part of Moscow Oblast. The city's name translates to "Electro Steel," which reflects its historical association with the steel industry. Elektrostal's population has experienced significant growth over the years, particularly during the industrialization period of the Soviet Union.

The city's history can be traced back to the early 20th century when it was established as a planned settlement. In 1916, the Russian government made the decision to construct a large metallurgical plant in the region due to the availability of natural resources, such as iron ore and coal, as well as its proximity to Moscow. This marked the beginning of Elektrostal's industrial development, which would have a profound impact on its growth and identity.

During the Russian Revolution and subsequent establishment of the Soviet Union, Elektrostal, like many other industrial cities, played a crucial role in supporting the country's industrialization efforts. The city's steel plant became an integral part of the Soviet economy, contributing to the growth of heavy industry and the modernization of the nation. The political environment during this time heavily influenced the development of Elektrostal, as the centralized Soviet government prioritized industrial production and the advancement of the working class.

Throughout the 20th century, Elektrostal continued to expand and evolve. The city saw significant developments in infrastructure, housing, and social services to accommodate the needs of its growing population. Residential areas, schools, hospitals, and cultural institutions were established to provide for the well-being of the city's inhabitants. Additionally, the steel plant underwent modernization and expansion, leading to increased production capacity and employment opportunities.

However, the political environment of the Soviet Union also had its drawbacks. The centrally planned economy, which prioritized industrial output, often neglected environmental considerations. As a result, Elektrostal, like many other industrial cities, faced issues related to pollution and environmental degradation. Efforts were made to mitigate these problems over time, with the implementation of stricter environmental regulations and the introduction of cleaner production technologies.

The geographical location of Elektrostal also influenced its history and development. Situated in the Moscow Oblast, the city benefited from its proximity to the capital city. This allowed for easy transportation of goods and resources, as well as access to a wider range of cultural and educational opportunities. The region's favorable climate, with warm summers and cold winters, also played a role in shaping the city's lifestyle and economy.

In recent decades, Elektrostal has undergone further transformations. With the dissolution of the Soviet Union in 1991, the city experienced a shift from a planned economy to a market-oriented system. This transition brought both opportunities and challenges, as Elektrostal had to adapt to the new economic realities while preserving its industrial heritage.

Today, Elektrostal continues to be an important industrial hub, with the steel plant remaining a major employer in the region. However, the city has also diversified its economy, attracting investments in sectors such as manufacturing, electronics, and engineering. Efforts have been made to enhance the quality of life for residents, with the development of recreational areas, parks, and cultural events.

- Today’s average mortgage rates

Average mortgage interest rates

What to know about mortgage rates, where mortgage rates are headed in 2024, picking a mortgage term and type, what affects mortgage rates, calculate your monthly mortgage payment, expert tips for the best mortgage rates, steady motion in mortgage market: mortgage interest rates today for april 8, 2024.

30-year fixed mortgage rates have remained high close to 7% over the last few weeks. Here's what homebuyers should know.

Katherine Watt

Katherine Watt is a CNET Money writer focusing on mortgages, home equity and banking. She previously wrote about personal finance for NextAdvisor. Based in New York, Katherine graduated summa cum laude from Colgate University with a bachelor's degree in English literature.

Laura Michelle Davis

Laura is a professional nitpicker and good-humored troubleshooter with over 10 years of experience in print and digital publishing. Before becoming an editor with CNET, she worked as an English teacher, Spanish medical interpreter, copy editor and proofreader. She is a fearless but flexible defender of both grammar and weightlifting, and firmly believes that technology should serve the people. Her first computer was a Macintosh Plus.

CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. If you buy through our links, we may get paid.

- 30-year fixed-rate 7.02% (+0.09)

- 15-year fixed-rate 6.44% (+0.07)

- 30-year fixed-rate jumbo 7.20% (+0.09)

- 5/1 ARM 6.60% (-0.14)

- 10-year fixed-rate 6.37% (+0.03)

- 30-year fixed-rate refinance 6.97% (+0.05)

- 15-year fixed-rate refinance 6.48% (+0.07)

- 10-year fixed refinance 6.37% (+0.03)

Today's rates

Today’s average mortgage rates.

If you’re in the market for a home, here are today’s mortgage rates compared to last week’s.

Mortgage rates change every day. Experts recommend shopping around to make sure you’re getting the lowest rate. By entering your information below, you can get a custom quote from one of CNET’s partner lenders.

About these rates: Like CNET, Bankrate is owned by Red Ventures. This tool features partner rates from lenders that you can use when comparing multiple mortgage rates.

Over the last few years, high inflation and the Federal Reserve’s aggressive interest rate hikes pushed up mortgage rates from their record lows around the pandemic. Since last summer, the Fed has consistently kept the federal funds rate at 5.25% to 5.5% . Though the central bank doesn’t directly set the rates for mortgages , a high federal funds rate makes borrowing more expensive, including for home loans.

Mortgage rates change daily, but average rates have been moving between 6.5% and 7.5% since late last fall. Today’s homebuyers have less room in their budget to afford the cost of a home due to elevated mortgage rates and steep home prices. Limited housing inventory and low wage growth are also contributing to the affordability crisis and keeping mortgage demand down.

Mortgage forecasters base their projections on different data, but most housing market experts predict rates will move toward 6% by the end of 2024. Ultimately, a more affordable mortgage market will depend on how quickly the Fed begins cutting interest rates. Most economists predict that the Fed will start lowering interest rates later this summer.

Since mortgage rates fluctuate for many reasons -- supply, demand, inflation , monetary policy and jobs data -- homebuyers won’t see lower rates overnight, and it’s unlikely they’ll find rates in the 2% range again.

“We are expecting mortgage rates to fall to around 6.5% by the end of this year, but there’s still a lot of volatility I think we might see,” said Daryl Fairweather , chief economist at Redfin.

Every month brings a new set of inflation and labor data that can change how investors and the market respond and what direction mortgage rates go, said Odeta Kushi , deputy chief economist at First American Financial Corporation. “Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates,” Kushi said.

Here’s a look at where some major housing authorities expect average mortgage rates to land.

When picking a mortgage, consider the loan term, or payment schedule. The most common mortgage terms are 15 and 30 years, although 10-, 20- and 40-year mortgages also exist. You’ll also need to choose between a fixed-rate mortgage, where the interest rate is set for the duration of the loan, and an adjustable-rate mortgage. With an adjustable-rate mortgage, the interest rate is only fixed for a certain amount of time (commonly five, seven or 10 years), after which the rate adjusts annually based on the market’s current interest rate. Fixed-rate mortgages offer more stability and are a better option if you plan to live in a home in the long term, but adjustable-rate mortgages may offer lower interest rates upfront.

30-year fixed-rate mortgages

The average 30-year fixed mortgage interest rate is 6.97%, which is an increase of 8 basis points from one week ago. (A basis point is equivalent to 0.01%.) A 30-year fixed mortgage is the most common loan term. It will often have a higher interest rate than a 15-year mortgage, but you’ll have a lower monthly payment.

15-year fixed-rate mortgages

The average rate for a 15-year, fixed mortgage is 6.38%, which is an increase of 5 basis points from the same time last week. Though you’ll have a bigger monthly payment than a 30-year fixed mortgage, a 15-year loan usually comes with a lower interest rate, allowing you to pay less interest in the long run and pay off your mortgage sooner.

5/1 adjustable-rate mortgages

A 5/1 ARM has an average rate of 6.56%, an increase of 5 basis points compared to a week ago. You’ll typically get a lower introductory interest rate with a 5/1 ARM in the first five years of the mortgage. But you could pay more after that period, depending on how the rate adjusts annually. If you plan to sell or refinance your house within five years, an ARM could be a good option.

While it’s important to monitor mortgage rates if you’re shopping for a home, remember that no one has a crystal ball. It’s impossible to time the mortgage market, and rates will always have some level of volatility because so many factors are at play.

“Mortgage rates tend to follow long-date Treasury yields, a function of current inflation and economic growth as well as expectations about future economic conditions,” says Orphe Divounguy , senior macroeconomist at Zillow Home Loans.

Here are the factors that influence the average rates on home loans.

- Federal Reserve monetary policy: The nation’s central bank doesn’t set interest rates, but when it adjusts the federal funds rate, mortgages tend to go in the same direction.

- Inflation: Mortgage rates tend to increase during high inflation. Lenders usually set higher interest rates on loans to compensate for the loss of purchasing power.

- The bond market: Mortgage lenders often use long-term bond yields, like the 10-Year Treasury, as a benchmark to set interest rates on home loans. When yields rise, mortgage rates typically increase.

- Geopolitical events: World events, such as elections, pandemics or economic crises, can also affect home loan rates, particularly when global financial markets face uncertainty.

- Other economic factors: The bond market, employment data, investor confidence and housing market trends, such as supply and demand, can also affect the direction of mortgage rates.

Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means. CNET’s mortgage calculator below can help homebuyers prepare for monthly mortgage payments.

Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever. It’s always a good time to save for a down payment and improve your credit score to help you secure a competitive mortgage rate when the time is right.

- Save for a bigger down payment: Though a 20% down payment isn’t required, a larger upfront payment means taking out a smaller mortgage, which will help you save in interest.

- Boost your credit score: You can qualify for a conventional mortgage with a 620 credit score, but a higher score of at least 740 will get you better rates.

- Pay off debt: Experts recommend a debt-to-income ratio of 36% or less to help you qualify for the best rates. Not carrying other debt will put you in a better position to handle your monthly payments.

- Research loans and assistance: Government-sponsored loans have more flexible borrowing requirements than conventional loans. Some government-sponsored or private programs can also help with your down payment and closing costs.

- Shop around for lenders: Researching and comparing multiple loan offers from different lenders can help you secure the lowest mortgage rate for your situation.

Recommended Articles

Compare current mortgage rates in april 2024, how the federal reserve impacts mortgage rates, compare 30-year mortgage rates for april 2024, how to calculate your monthly mortgage payment, best mortgage lenders in april 2024, how much house can i afford, how to get a mortgage with no down payment, how to get preapproved for a mortgage, and why it’s so important, 10-year mortgage rates for april 2024, compare 15-year mortgage rates for april 2024, 20-year interest rates for april 2024, 13 homebuyer mistakes you shouldn’t make. trust us, how to negotiate mortgage rates, is it better to build or buy a house.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers.

CNET Money is an advertising-supported publisher and comparison service. We’re compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Therefore, this compensation may impact where and in what order affiliate links appear within advertising units. While we strive to provide a wide range of products and services, CNET Money does not include information about every financial or credit product or service.

IMAGES

VIDEO

COMMENTS

The money market is less risky than the capital market while the capital market is potentially more rewarding. The returns are modest but the risks are low. The instruments used in the money ...

The CML defines the locus all mean-variance efficient risky portfolios. The CML is composed of all possible combinations of the market portfolio (m) and the risk-free asset (rf). The expected return of any risky portfolio on the CML is: E (Rp) = rf + {[E (Rm) - rf] / m} p. Borrowing and Lending at the Risk-free rate.

Both the money market and capital market serve different but complementary roles in bolstering the economy. Money Market: It supports liquidity management, ensuring businesses and governments meet their short-term obligations. By doing so, it instills confidence in the financial system. Capital Market: Vital for economic growth.