- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Choose the Right Forecasting Technique

- John C. Chambers,

- Satinder K. Mullick,

- Donald D. Smith

What every manager ought to know about the different kinds of forecasting and the times when they should be used.

To handle the increasing variety and complexity of managerial forecasting problems , many forecasting techniques have been developed in recent years. Each has its special use, and care must be taken to select the correct technique for a particular application. The manager as well as the forecaster has a role to play in technique selection; and the better they understand the range of forecasting possibilities, the more likely it is that a company’s forecasting efforts will bear fruit.

- JC John C. Chambers is director of operations research at Corning Glass Works. He has previously been affiliated with the Ford Motor Company, North American Aviation, and Ernst and Ernst. His interests center on strategic planning for new products and development of improved forecasting methods.

- SM Satinder K. Mullick is project manager in the Operations Research Department at CGW. He has previously been affiliated with Larsen and Toubro Ltd., India; Bohner and Koehle Maschinenfabrik, West Germany; and Johns Hopkins University. He specializes in strategic and tactical planning for new products.

- DS Donald D. Smith was a senior project leader in the Operations Research Department at CGW, with specific interests in the area of time series analysis and econometrics.

Partner Center

Marketing forecasting — definition, components, and best methods

Marketing uses a significant portion of company budgets. According to a Gartner report , it represents an average of 9.5% of company spending. So before you invest all that money, you need to know which campaigns are most likely to be successful.

Marketing forecasting helps predict which campaigns will yield the highest ROI. This post will guide you through the basics.

What is a marketing forecast?

Benefits of marketing forecasting, components of a marketing forecast.

- Methods for marketing forecasting

A marketing forecast is a comprehensive data analysis to predict the potential success of specific marketing efforts. The purpose is to ensure that a company focuses on the proper marketing and advertising activities across channels and spends its time and money wisely.

Stakeholders and executives need to know that marketing resources are well-spent. That's why, according to The CMO Survey , 8.9% of the average marketing budget is spent on marketing analytics — and will likely keep growing. Marketing forecasting, as an analytical tool, has several advantages.

- Better planning. Marketing projections demonstrate where you’ll probably have more success or failure. Predictions of poor performance can inspire innovation and guide you toward better strategies.

- Easier decision-making. When managers have data, there’s less room for debate about which marketing strategies will work best. Decisions are made on facts rather than hunches, so teams can work confidently.

- Better budgeting and scheduling. It’s easier to allocate resources to specific tactics or channels once you’ve made researched-based calculations.

- Healthier risk management. While marketing forecasts are only a strategic estimate, they can help avoid catastrophes — or help take corrective action when necessary. When you’ve done your homework, there are fewer surprises.

https://main--bacom-blog--adobecom.hlx.page/blog/fragments/definitive-guide-to-marketing-metrics-analytics

There are three considerations that make a marketing forecast effective — the data, the market size under consideration, and your target audience.

1. Accurate data

Accurate forecasts matter. Overestimating success leads to wasted time and effort and a warehouse full of overstock. Underestimating leaves you unprepared to meet demand. To get a helpful outlook on your marketing campaigns, start with accurate data.

First, know your marketing goals and the time and money you can devote to them. If you can only afford a six-month email campaign, then center your marketing projections around that. Keep your options open but be sure to measure what you can realistically achieve.

Next, gather any general statistics and reports you already have available. Consider:

- Third-party data like Google Trends, government statistics, and industry trends and reports

- Company data like past sales reports, competitive intelligence, and customer feedback If your ecommerce site is equipped with good analytics software, you should be able to gather valuable customer insights to help in your forecasting.

2. Market size

Market size is the number of customers to whom you can potentially sell your product. The total addressable market (TAM) is the total potential revenue for a specific product. To get the TAM, multiply the total number of potential customers by your price.

The key is identifying your real customers and what they’re genuinely willing to spend. Don’t take a top-down approach — looking at the total market size and assuming you can easily capture a small percentage. Instead, take a bottom-up approach by showing how your product can reach a specific audience.

Marketing forecasts also help reveal market potential , which is your room for growth. Larger economic trends can drive people to buy — or not. For example, rising gas prices might make it more likely for people to buy your new mopeds. Before committing to a new opportunity, consider natural volatility and sales cycles so you don’t lean too far into a momentary trend.

3. Target audience

Position your product within your market by segmenting the target audience. Building buyer personas is the best way to do this.

A buyer persona is a general sketch of a specific type of customer. It allows you to synthesize audience data and put a face to it. You also can craft a view of your ideal customer. Drafting fictional buyers for different demographics and verticals is an art form, but once you dial it in, you’ll dramatically improve your marketing projections.

Remember that buyer personas should not be static. They are dynamic profiles you hone in over time. Your target audience is apt to change, so factor in what would make them buy at various times. Look for triggers that prompt customers to act.

Marketing forecast data sources

In addition to the hard data you source from your customer data platform (CDP) or other relationship management software, you can collect key insights to inform your marketing forecast from the people with the most experience with your products.

Executive opinion

Asking leadership what they think about a product’s viability and the possible success of specific strategies is a simple place to start. Chief officers often have the most at stake and are intimately acquainted with past performance and challenges. Executives regularly meet with regional marketing managers and share perspectives on what’s working and what strategies they think might create the greatest impact.

Customer or channel surveys

Create customer surveys to test how the market will react to specific products or messaging. Marketers can survey a particular distribution channel, like customers at a retail or online store, or they might target a particular market segment, like middle-aged American males.

Use those surveys to inform your marketing forecast. But remember, while these surveys accurately depict market interest , they don’t necessarily predict sales .

Sales force composite

Because sales reps pitch and sell the product daily, they can offer helpful estimates about future growth. A sales force composite is a survey of the entire sales team to project sales or marketing results.

Salespeople can sometimes be overly optimistic but their opinion is valuable — especially for short-term forecasts. A sales force composite can show how a product or a marketing strategy will succeed in different regions.

Expert opinions

Expert third-party opinions can provide helpful insights as well. But simply soliciting the opinion of a group of experts doesn’t necessarily lead to accurate or helpful conclusions. It’s best to use this method in tandem with quantitative research.

Methods for marketing forecasts

There are several techniques marketers can use to make projections, including qualitative surveys, historical research and projection, and cause-and-effect analysis. The best approach is to use as many methods as possible and then weigh the results against each other.

Delphi technique

The Delphi technique questions anonymous expert panelists over a series of rounds and averages the final round results. It’s more controllable and more accurate than a traditional expert group interview.

Correlation technique

Studying the correlation between different variables is a more sophisticated marketing forecast method. At its simplest, it traces a market factor against marketing performance, usually with a scatter plot graph. You can draw a correlation where trends move in the same direction.

For example, you might study whether CTA clicks go up over time in relation to an email campaign or how many views your product video gets with the support of a Facebook ad.

The correlation technique gets challenging when you factor in multiple trends simultaneously. And remember that correlation does not equal causation — trends can be helpful, but consider other factors and techniques as well.

Time series technique

The time series forecasting method uses various techniques to look at historical patterns in marketing and apply them to upcoming periods. For example, if the company saw a steady 4% increase in website traffic in the past year, marketing can expect the trend to continue. If you notice rates decelerating or accelerating steadily over time, you can factor that in too.

The challenge is that markets are not always stable. Seasonal and cyclical trends affect numbers, but so do unpredictable fluctuations. Use adjustments to account for volatility. For example, a moving average works with the rate of change for several past periods. Exponential smoothing is a moving average that weighs the last period more heavily.

Response model technique

Response models take advantage of direct customer input. Noting customers’ responses to past marketing campaigns can help predict how they’ll react to future efforts. For example, it can gauge what customers are willing to pay for a product.

You can segment customers into categories — demographics, social networks, or how long they’ve been a customer — and then split test or test multiple strategies on different segments at once.

For example, you might split a target audience into three groups and offer a discount to one segment, a buy-one-get-one-free offer to the second, and nothing to the third. Analyzing the results will help you see which offer makes the most sense for your audience in general.

Remember to keep the variables simple. The more options you add, the more complicated and less accurate your analysis becomes.

Access all your marketing forecasting data in one place

Marketing forecasting can better predict which campaigns meet your audience’s needs and your company’s financial goals to yield the most significant ROI.

Once you’ve identified which metrics and data meet your needs, you will need a platform to collect and analyze them. With all your customer data in one easy-to-use platform, you can use any marketing forecasting method to predict which campaigns will be the most efficient.

Adobe Campaign connects big databases and your broader marketing ecosystem, including point-of-sale systems, ecommerce platforms, and offline programs. It helps you understand your market and who your customers are. You can analyze all that data in one place and make better marketing forecasts that lead to stronger sales.

Watch the demo video to learn more about how Adobe Campaign can help you create accurate marketing forecasts that prove your strategies, win budget, and set your team up for success.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

16.3 Forecasting

Learning objectives.

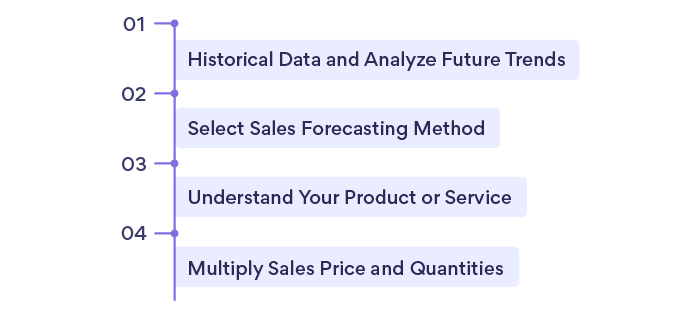

- List steps in the forecasting process.

- Identify types of forecasting methods and their advantages and disadvantages.

- Discuss the methods used to improve the accuracy of forecasts.

Creating marketing strategy is not a single event, nor is the implementation of marketing strategy something only the marketing department has to worry about. When the strategy is implemented, the rest of the company must be poised to deal with the consequences. As we have explained, an important component is the sales forecast, which is the estimate of how much the company will actually sell. The rest of the company must then be geared up (or down) to meet that demand. In this section, we explore forecasting in more detail, as there are many choices a marketing executive can make in developing a forecast.

Accuracy is important when it comes to forecasts. If executives overestimate the demand for a product, the company could end up spending money on manufacturing, distribution, and servicing activities it won’t need. The software developer Data Impact recently overestimated the demand for one of its new products. Because the sales of the product didn’t meet projections, Data Impact lacked the cash available to pay its vendors, utility providers, and others. Employees had to be terminated in many areas of the firm to trim costs.

Underestimating demand can be just as devastating. When a company introduces a new product, it launches marketing and sales campaigns to create demand for it. But if the company isn’t ready to deliver the amount of the product the market demands, then other competitors can steal sales the firm might otherwise have captured. Sony’s inability to deliver the e-Reader in sufficient numbers made Amazon’s Kindle more readily accepted in the market; other features then gave the Kindle an advantage that Sony is finding difficult to overcome.

The marketing leader of a firm has to do more than just forecast the company’s sales. The process can be complex, because how much the company can sell will depend on many factors such as how much the product will cost, how competitors will react, and so forth—in fact, much of what you have already read about in preparing a marketing strategy. Each of these factors has to be taken into account in order to determine how much the company is likely to sell. As factors change, the forecast has to change as well. Thus, a sales forecast is actually a composite of a number of estimates and has to be dynamic as those other estimates change.

A common first step is to determine market potential , or total industry-wide sales expected in a particular product category for the time period of interest. (The time period of interest might be the coming year, quarter, month, or some other time period.) Some marketing research companies, such as Nielsen, Gartner, and others, estimate the market potential for various products and then sell that research to companies that produce those products.

Once the marketing executive has an idea of the market potential, the company’s sales potential can be estimated. A firm’s sales potential is the maximum total revenue it hopes to generate from a product or the number of units of it the company can hope to sell. The sales potential for the product is typically represented as a percentage of its market potential and equivalent to the company’s estimated maximum market share for the time period. As you can see in Figure 16.8 “A Marketing Plan Timeline Illustrating Market Potential, Sales, and Costs” , companies sell less than potential because not everyone will make a decision to buy their product: some will put off a decision; others will buy a competitor’s product; still others might make do with a substitute product. In your budget, you’ll want to forecast the revenues earned from the product against the market potential, as well as against the product’s costs.

Forecasting Methods

Forecasts, at their basic level, are simply someone’s guess as to what will happen. Each estimate, though, is the product of a process. Several such processes are available to marketing executives, and the final forecast is likely to be a blend of results from more than one process. These processes are judgment techniques and surveys, time series techniques, spending correlates and other models, and market tests.

Judgment and Survey Techniques

At some level, every forecast is ultimately someone’s judgment. Some techniques, though, rely more on people’s opinions or estimates and are called judgment techniques . Judgment techniques can include customer (or channel member or supplier) surveys, executive or expert opinions, surveys of customers’ (or channel members’) intentions or estimates, and estimates by salespeople.

Customer and Channel Surveys

In some markets, particularly in business-to-business markets, research companies ask customers how much they plan to spend in the coming year on certain products. Have you ever filled out a survey asking if you intend to buy a car or refrigerator in the coming year? Chances are your answers were part of someone’s forecast. Similarly, surveys are done for products sold through distributors. Companies then buy the surveys from the research companies or do their own surveys to use as a starting point for their forecasting. Surveys are better at estimating market potential than sales potential, however, because potential buyers are far more likely to know they will buy something—they just don’t know which brand or model. Surveys can also be relatively costly, particularly when they are commissioned for only one company.

Sales Force Composite

A sales force composite is a forecast based on estimates of sales in a given time period gathered from all of a firm’s salespeople. Salespeople have a pretty good idea about how much can be sold in the coming period of time (especially if they have bonuses riding on those sales). They’ve been calling on their customers and know when buying decisions will be made.

Estimating the sales for new products or new promotions and pricing strategies will be harder for salespeople to estimate until they have had some experience selling those products after they have been introduced, promoted, or repriced. Further, management may not want salespeople to know about new products or promotions until these are announced to the general public, so this method is not useful in situations involving new products or promotions. Another limitation reflects salespeople’s natural optimism. Salespeople tend to be optimistic about what they think they can sell and may overestimate future sales. Conversely, if the company uses these estimates to set quotas, salespeople are likely to reduce their estimates to make it easier to achieve quota.

Salespeople are more accurate in their near-term sales estimates, as their customers are not likely to share plans too far into the future. Consequently, most companies use sales force composites for shorter-range forecasts in order to more accurately predict their production and inventory requirements. Konica-Minolta, an office equipment manufacturer, has recently placed a heavy emphasis on improving the accuracy of its sales force composites because the cost of being wrong is too great. Underestimated forecasts result in some customers having to wait too long for deliveries for products, and they may turn to competitors who can deliver faster. By contrast, overestimated forecasts result in higher inventory costs.

Executive Opinion

Executive opinion is exactly what the name implies: the best-guess estimates of a company’s executives. Each executive submits an estimate of the company’s sales, which are then averaged to form the overall sales forecast. The advantages of executive opinions are that they are low cost and fast and have the effect of making executives committed to achieving them. An executive-opinion-based forecast can be a good starting point. However, there are disadvantages to the method, so it should not be used alone. These disadvantages are similar to those of the sales force composites. If the executives’ forecast becomes a quota upon which their bonuses are estimated, they will have an incentive to underestimate the forecast so they can meet their targets. Organizational factors also come into play. A junior executive, for example, is not likely to forecast low sales for a product that his or her CEO is pushing, even if low sales are likely to occur.

Expert Opinion

Expert opinion is similar to executive opinion except that the expert is usually someone outside the company. Like executive opinion, expert opinion is a tool best used in conjunction with more quantitative methods. As a sole method of forecasting, however, expert opinions are often very inaccurate. Just consider how preseason college football rankings compare with the final standings. The football experts’ predictions are usually not very accurate.

Time Series Techniques

Time series techniques examine sales patterns in the past in order to predict sales in the future. For example, with a trend analysis , the marketing executive identifies the rate at which a company’s sales have grown in the past and uses that rate to estimate future sales. For example, if sales have grown 3 percent per year over the past five years, trend analysis would assume a similar 3 percent growth rate next year.

A simple form of analysis such as this can be useful if a market is stable. The problem is that many markets are not stable. A rapid change in any one of a market’s dynamics is likely to result in wide swings in growth rates. Just think about auto sales before, during, and after the government’s Cash for Clunkers program. What sold the previous month could not account for the effects of the program. Consequently, if an executive were to have estimated auto sales based on the rate of change for the previous period, the estimate would have been way off.

Figure 16.10

The federal government’s Cash for Clunkers program resulted in a significant short-term increase in new car sales and filled junkyards with thousands of clunkers!

ashley.adcox – Field Of Clunkers Pt. II – CC BY-NC-ND 2.0.

The Cash for Clunkers program was an unusual situation; many products may have wide variations in demand for other reasons. Trend analysis can still be useful in these situations but adjustments have to be made to account for the swings in rates of change. Two common adjustments are the moving average , whereby the rate of change for the past few periods is averaged, and exponential smoothing , a type of moving average that puts more emphasis on the most recent period.

Correlates and Other Models

A number of more sophisticated models can be useful in forecasting sales. One fairly common method is a correlational analysis , which is a form of trend analysis that estimates sales based on the trends of other variables. For example, furniture-company executives know that new housing starts (the number of new houses that are begun to be built in a period) predict furniture sales in the near future because new houses tend to get filled up with new furniture. Such a correlate is considered a leading indicator , because it leads, or precedes, sales. The Conference Board publishes an Index of Leading Indicators, which is a single number that represents a composite of commonly used leading indicators. Some of these leading indicators are housing starts, wholesale orders, orders for durable goods (items like refrigerators, air conditioning systems, and other long-lasting consumer products), and even consumer sentiment, or how consumers think the economy is doing.

Response Models

Some companies create sophisticated statistical models called response models , which are based on how customers have responded in the past to marketing strategies. JCPenney, for example, takes previous sales data and combines it with customer data gathered from the retailer’s Web site. The models help JCPenney see how many customers are price sensitive and only buy products when they are on sale and how many customers are likely to respond to certain offers. The retailer can then estimate the sales for products by market segment based on the offers and promotions directed at those segments.

Market Tests

A market test is an experiment in which the company launches a new offering in a limited market in order to gain real-world knowledge of how the market will react to the product. Since there isn’t any historical data on how the product has done, response models and time-series techniques are not effective. A market test provides some measure of sales in response to the marketing plan, so in that regard, it is like a response model, just based on limited data. The demand for the product can then be extrapolated to the full market. However, remember that market tests are visible to your competitors, and they can undertake actions, such as drastic price cuts, to skew your results.

Figure 16.11

HEB uses Waco, Texas, as a test market, combining data from its loyalty program with sales data to see who buys what and at what price.

Wikimedia Commons – CC BY-SA 3.0.

The grocery chain HEB uses Waco, Texas, as a test site. HEB has a loyalty program that enables it to collect lots of data on its customers. When HEB wants to test market a new product, the firm does it in Waco, where individual customer data can be combined with sales data. Testing in Waco tells HEB who is likely to buy the product and at what price, information that makes extrapolating to their larger market more accurate.

Building Better Forecasts

At best, a forecast is a scientific estimate, but really, a forecast is still just a sophisticated guess. Still, there are steps that can enhance the likelihood of success. The first step is to commit to accuracy. At Konica-Minolta, regional vice presidents are rewarded for being accurate and punished for being wrong about their forecasts, no matter what the direction of them is. As we mentioned earlier, underestimating is considered by Konica-Minolta leadership to be just as bad as overestimating sales.

We’ve also mentioned how salespeople and managers will lower estimates if the estimates are used to set quotas. Using forecasts properly is another factor that can improve forecasting accuracy. But there are other ways to make forecasts more accurate. These begin with picking the right methods for your business.

Pick the Right Method(s) for Your Business and Your Decision

Some products have very short selling cycles; others take a long time to produce and sell. What is appropriate for a fast-moving consumer good like toothpaste is not appropriate for a durable good like a refrigerator. A response model might work for Crest toothpaste in the short term, but longer-term forecasts might require a sophisticated time-series technique. By contrast, Whirlpool might find, for example, that channel surveys are better predictors of refrigerator sales over the long term.

Use Multiple Methods

Since forecasts are estimates, the more estimates generated from various methods, the better. For example, combining expert opinions with a trend analysis could help you understand not only what is happening but also why. Every forecast results in decisions, such as the decision to hire more people, add manufacturing capacity, order supplies, and so forth. In addition, practice makes perfect, as they say. The more forecasts you have to make and resulting decisions you have to live with, the better you will get at forecasting.

Use Many Variables

Forecasting for smaller business units first can result in greater accuracy. For example, JCPenney may estimate sales by region first, and then roll that information up into a national sales forecast. By forecasting locally, more variables can be considered, and with more variables comes more information, which should help the accuracy of the company’s overall sales forecast. Similarly, JCPenney may estimate sales by market segment, such as women over age fifty. Again, forecasting in a smaller segment or business unit can then enable the company to compare such forecasts to forecasts by product line and gain greater accuracy overall.

Use Scenario-Based Forecasts

One forecast is not enough. Consider what will happen if conditions change. For example, how might your forecast change if your competitors react strongly to your strategy? How might it change if they don’t react at all? Or if the government changes a policy that makes your product tax free? All of these factors will influence sales, so the smart executive considers multiple scenarios. While the executive may not expect the government to make something tax free, scenarios can be created that consider favorable government regulation, stable regulation, and negative regulation, just as one can consider light competitive reaction, moderate reaction, or strong reaction.

Track Actual Results and Adjust

As time goes on, forecasts that have been made should be adjusted to reflect reality. For example, Katie Scallan-Sarantakes may have to do an annual forecast for Scion sales, but as each month goes by, she has hard sales data with which to adjust future forecasts. Further, she knows how strongly competition has reacted and can adjust her estimates accordingly. So, even though she may have an annual forecast, the forecast changes regularly based on how well the company is doing.

Key Takeaway

A forecast is an educated guess, or estimate, of sales in the future. Accuracy is important because so many other decisions a firm must make depend on the forecasts. When a company forecasts sales, it has to consider market potential and sales potential. Many methods of forecasting exist, including expert opinion, channel and customer surveys, sales force composites, time series data, and test markets.

Better forecasts can be obtained by using multiple methods, forecasting for various scenarios, and tracking actual data (including sales) and adjusting future forecasts accordingly.

Review Questions

- Which forecasting method would be most accurate for forecasting sales of hair-care products in the next year? How would your answer change if you were forecasting for the next month? For home appliances?

- What is the role of expert opinion in all forecasts?

- How can forecasting accuracy be improved?

Principles of Marketing Copyright © 2015 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

- Perspectives

- Best Practices

- Inside Amplitude

- Customer Stories

- Contributors

Marketing Forecasting 101: Using Analytics for Future Insights

Use marketing forecasting to predict future performance and optimize your product and marketing strategies accordingly.

Marketing forecasting is how companies make educated predictions about their future performance within their specific target markets . By using market research and historical data, marketers can make forecasts about demands and trends that will help them better predict sales.

The forecasting process helps you understand the effectiveness of your marketing strategies and puts you in a better position to optimize your efforts going forward. By understanding the strengths and weaknesses of your campaigns, you can better predict what will work and what techniques to omit altogether.

- Marketing forecasting is how companies make data-driven predictions about future events within their sector.

- Predicting future trends

- Optimizing marketing activity

- Reducing customer churn

- Acting proactively instead of reactively

- More accurate budgeting

- Better control over your inventory

- Better employee allocation based on your needs

- Techniques such as correlational analysis, predictive analytics, and conducting customer surveys give you the information you need to perfect your forecasting.

- Typical marketing forecasting involves an eight-step process that includes plotting your revenue cycle, analyzing your customer data, and taking action on the insights you’ve uncovered.

What is marketing forecasting?

A marketing forecast helps businesses conduct trend analysis by predicting future market characteristics, sales data, and the growth rate within their sector . Forecasting means you replace guesswork with an empirical, data-focused approach to planning. There are several different types of forecasting techniques that allow businesses to obtain data using both qualitative and quantitative methods.

Businesses use behavioral analytics , market research, historical data, and forecasting methods to make predictions on things like:

- Predicted customer behaviors throughout the user journey

- Number of leads likely generated within a period

- Rate of leads moving through the sales funnel

- Effectiveness of different marketing campaigns and channels in acquiring new customers

- Market potential of the product : how much potential revenue your product or service will likely generate within a specific market.

- Future sales numbers and revenue impact

- Impact on critical product metrics around acquisition, retention, and monetization

A marketing forecast takes all of these predictions and consolidates them into one analysis, allowing your business to get a complete picture of the future. These insights enable you to carry out more strategic planning, knowing you have all the necessary information.

Main benefits of marketing forecasting

Your marketing forecast is foundational to your marketing plan and product forecast. It helps you understand how your marketing and product roadmaps will perform, so you can strategically plan your future and guide your team’s decision-making.

Several benefits come from taking this approach:

Insight into future trends

Trend forecasting involves using market and consumer data to predict how customer behaviors and purchasing habits will likely shift over time. Predicting future trends in the market helps you outpace your competitors during times of change.

There are several different types of trend forecasting patterns that you can analyze, such as constant and linear patterns in data. For example, you can predict when demand for certain products will likely rise or fall and prepare accordingly. Trend forecasting also provides you insights to predict shifting customer behaviors and expectations. You can use this knowledge to adjust your marketing or product strategy .

More targeted marketing activity

You can use predictive customer analytics to understand user behavior and forecast which behaviors will likely have higher conversion rates. These insights will help you craft more effective messaging, refine your pricing and packaging, and increase your cross-sell and upsells.

A predictive analytics tool like Amplitude Audiences leverages algorithms that make connections between specific behaviors and conversion. For example, you might find that people who arrive on your landing page from social media ads are more likely to sign up for a free trial. You might invest more heavily in your social media marketing efforts with this insight.

Forecasting helps you understand which marketing channels will be most effective based on trends, market data, and user behavior .

Increase customer retention

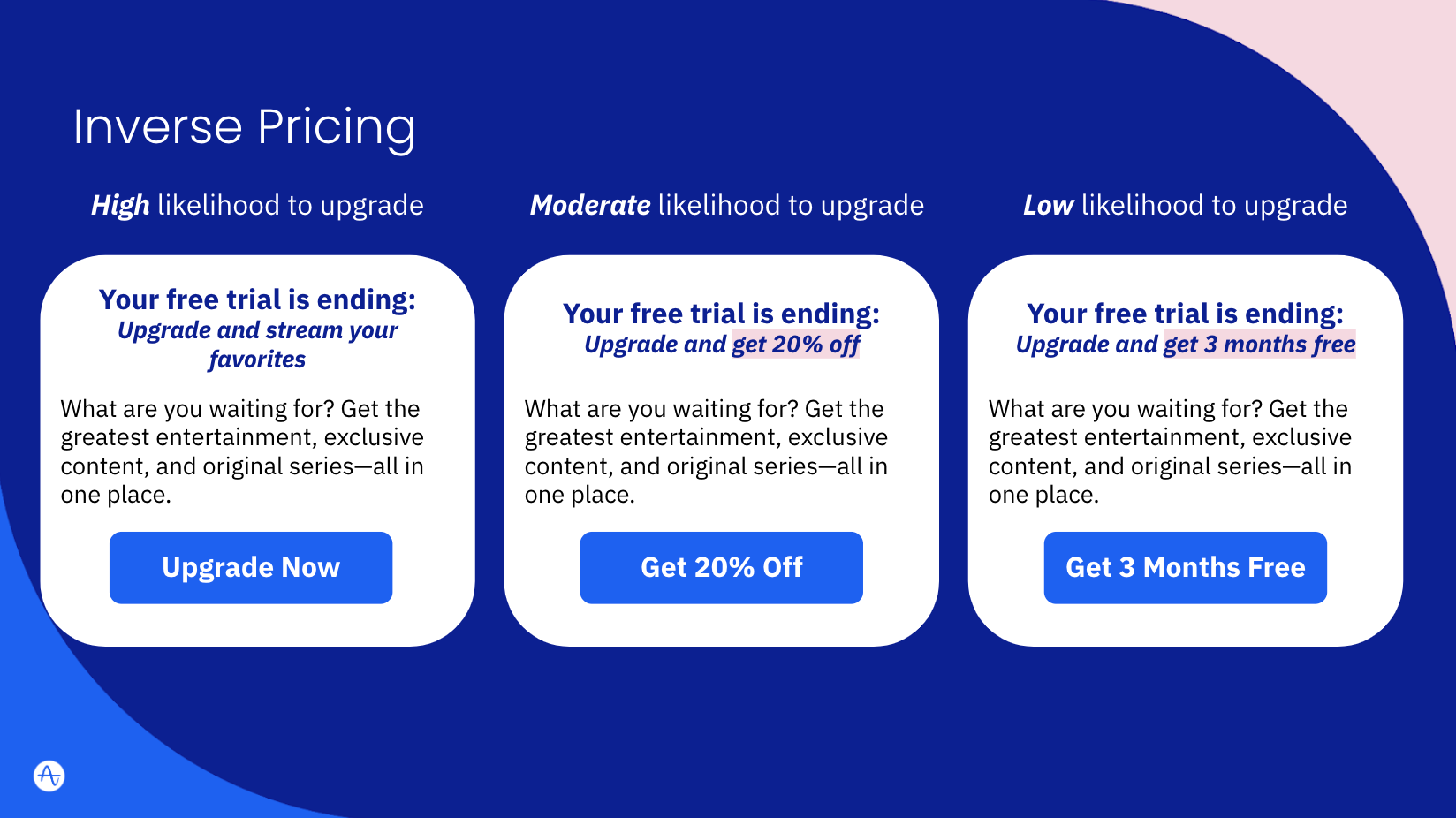

Another benefit of utilizing predictive analytics is the ability to target customers who are at risk of churning through churn rate cohort analysis . Once you’ve identified these at-risk customers, you can experiment with the most effective marketing campaigns to increase retention and boost loyalty. For example, you might employ inverse pricing—offering customers with a high likelihood of churning a larger discount or incentive.

In this inverse pricing example, a streaming company might offer customers with a low likelihood of upgrading a larger incentive than those with a high likelihood of upgrading.

Proactive vs. reactive planning

Predicting and planning for several possible scenarios helps you be more proactive in your approach. Implementing contingency plans allows you to build more resilience to otherwise unexpected events. These could be external or internal events such as shifts in economic trends, changes in customer sentiments, technological advancements, or losing customers to competitors.

Precise budgeting

You can better allocate funds to different areas of your business through budget forecasting. Look at your sales forecasts and check them against your expense forecasts for both the short and long term. This way, you can budget smarter for different costs like:

- MarTech tools

- Paid advertising

- Marketing campaigns

- Product launch events

- Engineering and product costs

Deciding to invest in things like developing new products, hiring more employees, or boosting digital marketing efforts can be risky. But understanding what your company’s financial situation will look like further down the line helps remove a lot of the uncertainty.

Better inventory management

For ecommerce businesses, inventory forecasting ensures you have the right supply to meet customer demand across your digital channels. Ecommerce inventory management involves tracking the location, amount, pricing, and mix of available inventory. By basing your orders on an accurate forecast, you don’t have to worry about over or under-ordering products for your online store.

Read the Ultimate Guide to Analytics for Ecommerce to learn how to further optimize your online business.

More accurate employee allocation

HR forecasting ensures you have the right number of employees to meet business and customer needs, leading to a better customer experience .

For example, if you have an ecommerce business, you might forecast a spike in sales during the holidays and need extra customer service representatives to respond to inquiries. Or perhaps you plan on hosting a marketing event for your B2B SaaS tool’s new product launch and forecast an increase in inbound sales requests from prospects and customers.

Common marketing forecasting techniques

Predicting what will happen in the future might sound tricky, but you can use several techniques to obtain accurate forecasts. Each one will give you different insights and metrics, but a mixture gives you a more comprehensive picture of what you’re trying to predict.

Analyzing correlations

Correlational analysis helps you understand the relationships between your customers and your product. Through your analysis, you might find that certain features you implement in your platform have positive or negative effects on your customer experience.

This information provides product managers with the knowledge of what aspects of their product line contribute to (or hinder) customer retention or engagement, which helps them optimize their products for growth.

You can also analyze correlations related to your marketing efforts. You might find that customer cohorts acquired through referral programs tend to have a higher customer lifetime value (CLV) than those from social media campaigns and optimize accordingly.

Predictive analytics

With Audiences’ Predictions , you can build cohorts based on specific attributes or behaviors that will help you identify product and marketing tweaks to improve conversion. Predictive analytics can help you:

- Personalize your marketing messaging

- Choose the right pricing for your target audience

- Cross-sell and upsell based on historical data to increase CLV

- Use inverse pricing techniques to develop the most effective actions for different audiences based on how likely they are to perform the desired actions.

Seeking executive and expert opinions

These are simple knowledge-based opinions you can obtain from well-informed executives in your company and external experts in your industry. While they may not have hard numbers to “prove” their opinions, their extensive experience lends much weight to their views and can be helpful in forecasting.

For this approach to be accurate, opinions must be collected and analyzed using tried and tested qualitative methods. One example could be thematic analysis, where you extract common themes from raw qualitative data, such as interview transcripts.

Conducting customer surveys

Customer surveys involve carrying out research with potential customers about new products or finding out how your current customers feel about your existing products. You can collect information directly from your current and potential customers to help you:

- Understand customer intent

- Collect demographic data about your target customers

- Get an idea of their preferred price range

Once you have the raw data, you can analyze it to get a feel for your customers’ sentiments. You should then use those sentiments in your marketing forecast. If 90% of your customers say they love your new product, sales will likely be high.

Gathering information from your sales team

Your sales team is at the front of your marketing activities. They have insight from their daily experiences into how your products perform, the effectiveness of your marketing activities, and your customer sentiment. You can collect this information by conducting interviews and surveys or hosting focus groups.

One limitation is that your sales team can only provide information about your existing products and current marketing efforts. However, you can use the information they give you and insights from your sales funnel to understand how other marketing efforts will work. For example, if customers respond well to a specific ad for a soon-to-be-updated product, you know you should use a similar ad when you roll out the new version. Yes, the new product and ad don’t exist yet, but your salespeople can still offer valuable insights.

Implementing time series techniques

Time series techniques look at sales patterns over various periods. You can use them to uncover patterns over the past month, quarter, or year that will predict future sales. For example, if there was a 3% growth in sales every year for the past three years, it’s safe to assume that the next year will see similar growth.

It’s helpful to know what will happen in a specific period to make more strategic product and marketing decisions that will help you acquire a larger market share. For example, you can predict how many items you’ll sell through your ecommerce channels or how many customers will upgrade to the premium version of your digital product.

How to conduct a marketing forecast

Even though there are several different forecasting tools that companies can use to carry out their analysis, there is a basic methodology to be followed:

- Plot out the stages of your revenue cycle. Track a customer’s typical journey from start to purchase using customer journey analytics . This gives you foundational knowledge about your customer journey.

- Identify the leads that you would like to track. Pick a few high-value customer cohorts whose journey you want to optimize. These are market segments you identified as most valuable to you during your market research.

- Obtain information on how every customer experiences their lifecycle. If you’re an ecommerce company, use metrics like conversion rate and cart abandonment rate to understand the percentage of online store visitors who make a purchase and those who place items in their cart but never complete their purchase.

- Determine the number of leads who will move through your sales funnel in a given period. If you’re a B2B SaaS company, knowing the number of leads will give you a rough idea of how many new customers you can expect, which offers you a great start to your forecast. You can determine the number of leads by looking at your recent sales funnel trends and talking to your sales team.

- Model the flow of new and current leads through each customer journey stage. Once you’ve gathered all the information from the previous steps, you can plot out the typical journey of a customer lifecycle. This helps you make better predictions based on tried and tested customer experiences.

- Make predictions based on behavioral customer data . Using insights from past customer behavior, a tool like Audiences can predict future behaviors using AI and machine learning technology.

- Analyze your results and finalize your marketing forecast. With this information, you’re in a stronger position to predict future sales, trends, and general consumer behavior.

- Take action on your insights. Forecasting what will happen in the future is only helpful if you take action. Use your predictions to test new marketing campaigns, product personalizations, pricing strategies, and more.

Learn how you can leverage the power of predictive analytics with a personalized Audiences consultation . Or see how customers are behaving in your digital product today with a free Amplitude account .

- What is Ecommerce Inventory Management? , Big Commerce

- What Is Trend Forecasting? , Chron

- Customer Acquisition vs. Retention , Invesp

About the Author

More best practices.

Discover the insights of 300+ marketing professionals on the essential tools, resources, and skills for success.

- · Brandwatch Academy

- Forrester Wave

Brandwatch Consumer Research

Formerly the Falcon suite

Formerly Paladin

Published October 17 th 2023

10 Essential Methods for Effective Consumer and Market Research

When it comes to understanding the world around you, market research is an essential step.

We live in a world that’s overflowing with information. Sifting through all the noise to extract the most relevant insights on a certain market or audience can be tough.

That’s where market research comes in – it’s a way for brands and researchers to collect information from target markets and audiences.

Once reliant on traditional methods like focus groups or surveys, market research is now at a crossroads. Newer tools for extracting insights, like social listening tools, have joined the array of market research techniques available.

Here, we break down what market research is and the different methods you can choose from to make the most of it.

What is market research, and why is it critical for you as a marketer?

Market research involves collecting and analyzing data about a specific industry, market, or audience to inform strategic decision-making. It offers marketers valuable insights into the industry, market trends, consumer preferences, competition, and opportunities, enabling businesses to refine their strategies effectively.

By conducting market research, organizations can identify unmet needs, assess product demands, enhance value propositions, and create marketing campaigns that resonate with their target audience.

This practice serves as a compass, guiding businesses in making data-driven decisions for successful product launches, improved customer relationships, and a stronger positioning in the business landscape.

For marketers and insights professionals, market research is an indispensable tool. It helps them make smarter decisions and achieve growth and success in the market.

These 10 market research methods form the backbone of effective market research strategies.

Continue reading or jump directly to each method by tapping the link below.

- Focus groups

- Consumer research with social media listening

- Experiments and field trials

- Observation

- Competitive analysis

- Public domain data

- Buy research

- Analyze sales data

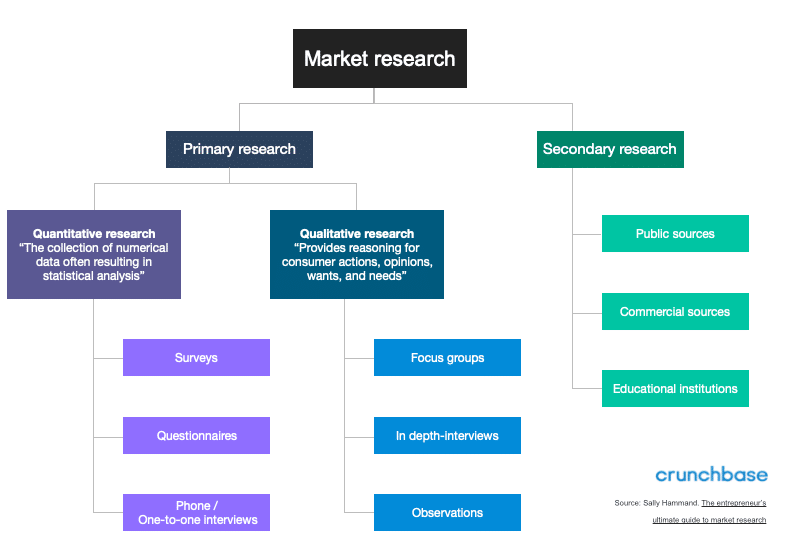

Use of primary vs secondary market research

Market research can be split into two distinct sections: primary and secondary. These are the two main types of market research.

They can also be known as field and desk, respectively (although this terminology feels out of date, as plenty of primary research can be carried out from your desk).

Primary (field) research

Primary market research is research you carry out yourself. Examples of primary market research methods include running your own focus groups or conducting surveys. These are some of the key methods of consumer research. The ‘field’ part refers to going out into the field to get data.

Secondary (desk) research

Secondary market research is research carried out by other people that you want to use. Examples of secondary market research methods include studies carried out by researchers or financial data released by companies.

10 effective methods to do market research

The methods in this list cover both areas. Which ones you want to use will depend on your goals. Have a browse through and see what fits.

1. Focus groups

It’s a simple concept but one that can be hard to put into practice.

You bring together a group of individuals into a room, record their discussions, and ask them questions about various topics you are researching. For some, it’ll be new product ideas. For others, it might be views on a political candidate.

From these discussions, the organizer will try to pull out some insights or use them to judge the wider society’s view on something. The participants will generally be chosen based on certain criteria, such as demographics, interests, or occupations.

A focus group’s strength is in the natural conversation and discussion that can take place between participants (if they’re done right).

Compared to a questionnaire or survey with a rigid set of questions, a focus group can go off on tangents the organizer could not have predicted (and therefore not planned questions for). This can be good in that unexpected topics can arise; or bad if the aims of the research are to answer a very particular set of questions.

The nature of the discussion is important to recognize as a potential factor that skews the resulting data. Focus groups can encourage participants to talk about things they might not have otherwise, and others might impact the group. This can also affect unstructured one-on-one interviews.

In survey research, survey questions are given to respondents (in person, over the phone, by email, or via an online form). Questions can be close-ended or open-ended. As far as close-ended questions go, there are many different types:

- Dichotomous (two choices, such as ‘yes’ or ‘no’)

- Multiple choice

- Rating scale

- Likert scale (common version is five options between ‘strongly agree’ and ‘strongly disagree’)

- Matrix (options presented on a grid)

- Demographic (asking for information such as gender, age, or occupation)

Surveys are massively versatile because of the range of question formats. Knowing how to mix and match them to get what you need takes consideration and thought. Different questions need the right setup.

It’s also about how you ask. Good questions lead to good analysis. Writing clear, concise questions that abstain from vague expressions and don’t lead respondents down a certain path can help your results reflect the true colors of respondents.

There are a ton of different ways to conduct surveys as well, from creating your own from scratch or using tools that do lots of the heavy lifting for you.

3. Consumer research with social media listening

Social media has reached a point where it is seamlessly integrated into our lives. And because it is a digital extension of ourselves, people freely express their opinions, thoughts, and hot takes on social media.

Because people share so much content on social media and the sharing is so instant, social media is a treasure trove for market research. There is plenty of data to monitor , tap into, and dissect.

By using a social listening tool, like Consumer Research , researchers can identify topics of interest and then analyze relevant social posts. For example, they can track brand mentions and what consumers are saying about the products owned by that brand. These are real-world consumer research examples.

View this post on Instagram A post shared by Brandwatch (@brandwatch)

Social media listening democratizes insights, and is especially useful for market research because of the vast amount of unfiltered information available. Because it’s unprompted, you can be fairly sure that what’s shared is an accurate account of what the person really cares about and thinks (as opposed to them being given a subject to dwell on in the presence of a researcher).

You might like

Your complete social listening guide.

Learn how to get started with social listening

4. Interviews

In interviews, the interviewer speaks directly with the respondent. This type of market research method is more personal, allowing for communication and clarification, making it good for open-ended questions. Furthermore, interviews enable the interviewer to go beyond surface-level responses and investigate deeper.

However, the drawback is that interviews can be time-intensive and costly. Those who opt for this method will need to figure out how to allocate their resources effectively. You also need to be careful with leading or poor questions that lead to useless results. Here’s a good introduction to leading questions .

5. Experiments and field trials

Field experiments are conducted in the participants’ environment. They rely on the independent variable and the dependent variable – the researcher controls the independent variable in order to test its impact on the dependent variable. The key here is to establish whether there’s causality.

For example, take Hofling’s experiment that tested obedience, conducted in a hospital setting. The point was to test if nurses followed authority figures (doctors) and if the authority figures’ rules violated standards (The dependent variable being the nurses, the independent variable being a fake doctor calling up and ordering the nurses to administer treatment.)

According to Simply Psychology , there are key strengths and limitations to this method.

The assessment reads:

- Strength: Behavior in a field experiment is more likely to reflect real life because of its natural setting, i.e., higher ecological validity than a lab experiment.

- Strength: There is less likelihood of demand characteristics affecting the results, as participants may not know they are being studied. This occurs when the study is covert.

- Limitation: There is less control over extraneous variables that might bias the results. This makes it difficult for another researcher to replicate the study in exactly the same way.

There are also massive ethical implications for these kinds of experiments and experiments in general (especially if people are unaware of their involvement). Don’t take this lightly, and be sure to read up on all the guidelines that apply to the region where you’re based.

6. Observation

Observational market research is a qualitative research method where the researcher observes their subjects in a natural or controlled environment. This method is much like being a fly on the wall, but the fly takes notes and analyzes them later. In observational market research, subjects are likely to behave naturally, which reveals their true selves.

They are not under much pressure. However, if they’re aware of the observation, they can act differently.

This type of research applies well to retail, where the researcher can observe shoppers’ behavior by day of the week, by season, when discounts are offered, and more. However, observational research can be time-consuming, and researchers have no control over the environments they research.

7. Competitive analysis

Competitive analysis is a highly strategic and specific form of market research in which the researchers analyze their company’s competitors. It is critical to see how your brand stacks up to rivals.

Competitive analysis starts by defining the product, service, brand, and market segment. There are different topics to compare your firm with your competitors. It could be from a marketing perspective: content produced, SEO structure, PR coverage, and social media presence and engagement. It can also be from a product perspective: types of offerings, pricing structure. SWOT analysis is key in assessing strengths, weaknesses, opportunities, and threats.

We’ve written a whole blog post on this tactic, which you can read here .

8. Public domain data

The internet is a wondrous place. Public data exists for those strapped for resources or simply seeking to support their research with more data. With more and more data produced every year, the question about access and curation becomes increasingly prominent – that’s why researchers and librarians are keen on open data.

Plenty of different types of open data are useful for market research: government databases, polling data, “fact tanks” like Pew Research Center, and more.

Furthermore, APIs grant developers programmatic access to applications. A lot of this data is free, which is a real bonus.

9. Buy research

Money can’t buy everything, but it can buy research. Subscriptions exist for those who want to buy relevant industry and research reports. Sites like Euromonitor, Statista, Mintel, and BCC Research host a litany of reports for purchase, oftentimes with the option of a single-user license or a subscription.

This can be a massive time saver, and you’ll have a better idea of what you’re getting from the very beginning. You’ll also get all your data in a format that makes sense, saving you effort in cleaning and organizing.

10. Analyze sales data

Sales data is like a puzzle piece that can help reveal the full picture of market research insights. Essentially, it indicates the results. Paired with other market research data, sales data helps researchers better understand actions and consequences. Understanding your customers, their buying habits, and how they change over time is important.

This research will be limited to customers, and it’s important to keep that in mind. Nevertheless, the value of this data should not be underestimated. If you’re not already tracking customer data, there’s no time like the present.

Choosing the right market research method for your strategy

Not all methods will be right for your situation or your business. Once you’ve looked through the list and seen some that take your fancy, spend more time researching each option.You’ll want to consider what you want to achieve, what data you’ll need, the pros and cons of each method, the costs of conducting the research, and the cost of analyzing the results.

Get it right, and it’ll be worth all the effort.

Former Brandwatch Employee

Share this post

Brandwatch bulletin.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

New: Consumer Research

Make the world your focus group.

With Brandwatch Consumer Research, you can turn billions of voices into valuable insights.

More in marketing

How to market your sustainability as a brand in 2024.

By Emily Smith Mar 18

The Swift Effect: What Brands Can Learn from Taylor Swift

By Emily Smith Feb 29

How B2B Brands Can Benefit from Social Listening

By Ksenia Newton Feb 23

7-Step Guide: Choosing the Right Social Media Monitoring Tool for You

By Emily Smith Feb 20

We value your privacy

We use cookies to improve your experience and give you personalized content. Do you agree to our cookie policy?

By using our site you agree to our use of cookies — I Agree

Falcon.io is now part of Brandwatch. You're in the right place!

Existing customer? Log in to access your existing Falcon products and data via the login menu on the top right of the page. New customer? You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Paladin is now Influence. You're in the right place!

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution. Want to access your Paladin account? Use the login menu at the top right corner.

- Entrepreneurs

- News About Crunchbase

- New Features

- Partnerships

The Types of Market Research [+10 Market Research Methods]

- Market research

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Market research can help startups understand where they should be placing their resources and time. It can tell you everything from how people are perceiving your company, as well as which features to drop or continue developing. And while there are plenty of ways to conduct market research, not every market research method is right for every situation.

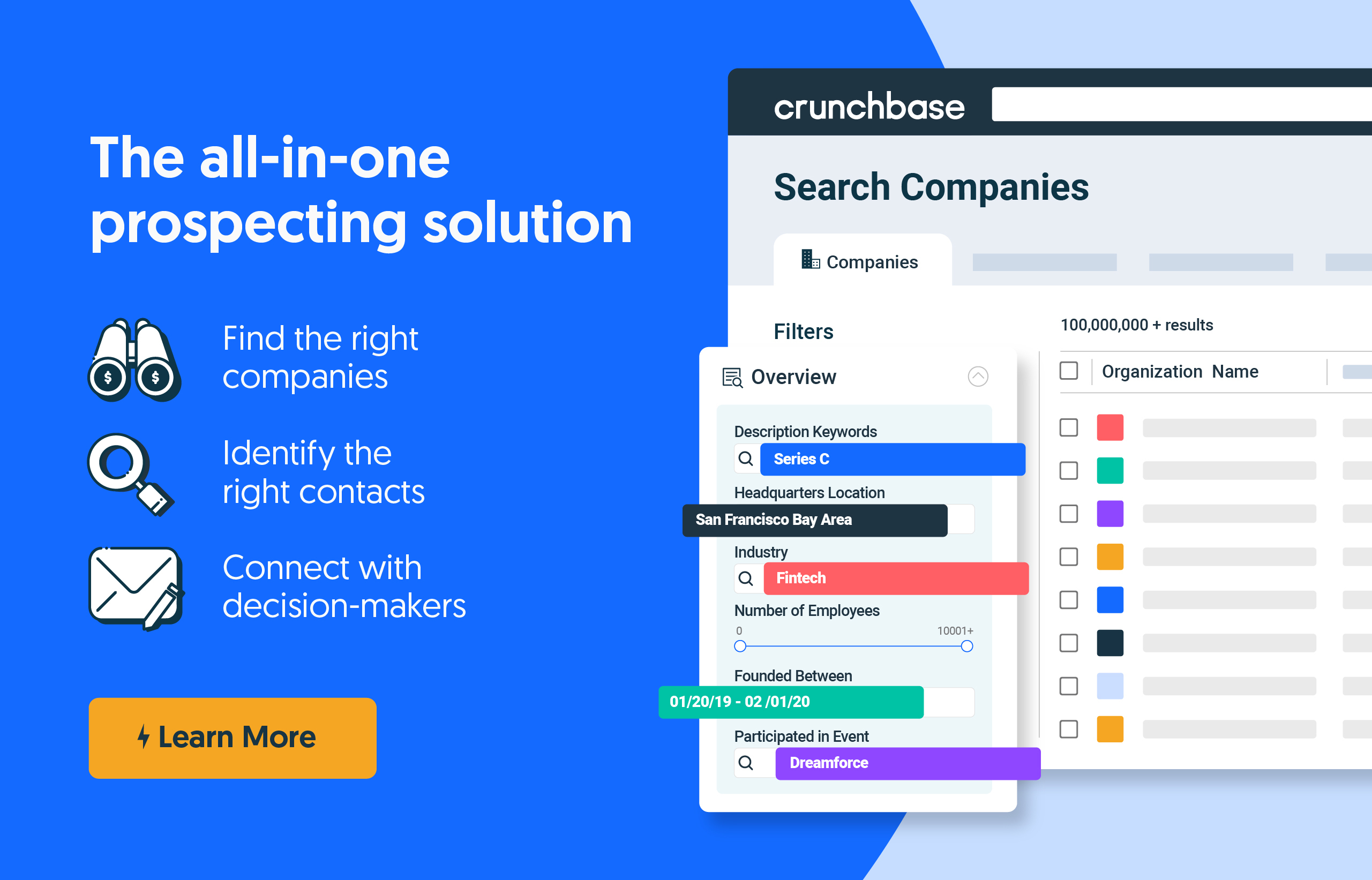

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Market research can help play a major role in developing your product, marketing, and overall business strategy. Understanding the different market research methods can be the difference between wasting months of engineering time or exceeding your ambitious revenue targets.

We review the types of market research as well as the market research methods you can pursue based on your primary objectives and business goals.

The 2 types of market research

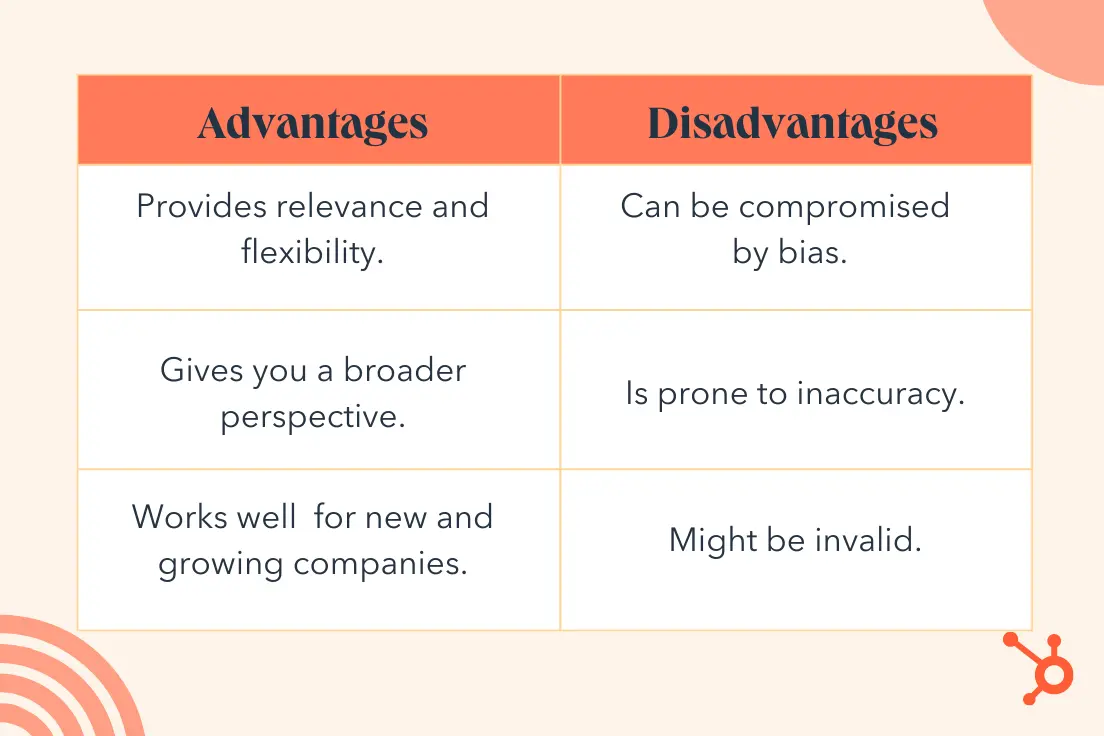

All market research falls under two distinct categories: primary research and secondary research.

Primary research looks at any data you collect yourself (or someone you pay). It encompasses analyzing current sales, metrics, and customers. It also takes into account the effectiveness of current practices, while taking competitors into account.

Secondary research looks at data that has already been published by others. It includes reports and studies from other companies, government organizations, and others in your industry.

10 market research methods

The type of data you need will decide which market research technique to use. Here are the most commonly used market research methods:

Primary research methods

These primary research methods will help you identify both qualitative and quantitative data. Qualitative data is information that cannot be measured while qualitative data is taken from a large sample size and is a statistically significant mathematical analysis.

1. Interviews

Great for: expert advice

Consisting of one-on-one discussions, interviews are a great source of qualitative data. You can either perform interviews by telephone, video conference, or face-to-face. Interviews are great for an in-depth look for target audience insights.

In-depth interviews are great when expert advice is needed or when discussing highly complex or sensitive topics. Interviews are usually 10 to 30 minutes long with 25 to 75 respondents.

Great for: understanding brand awareness, satisfaction and loyalty analysis, pricing research, and market segmentation .

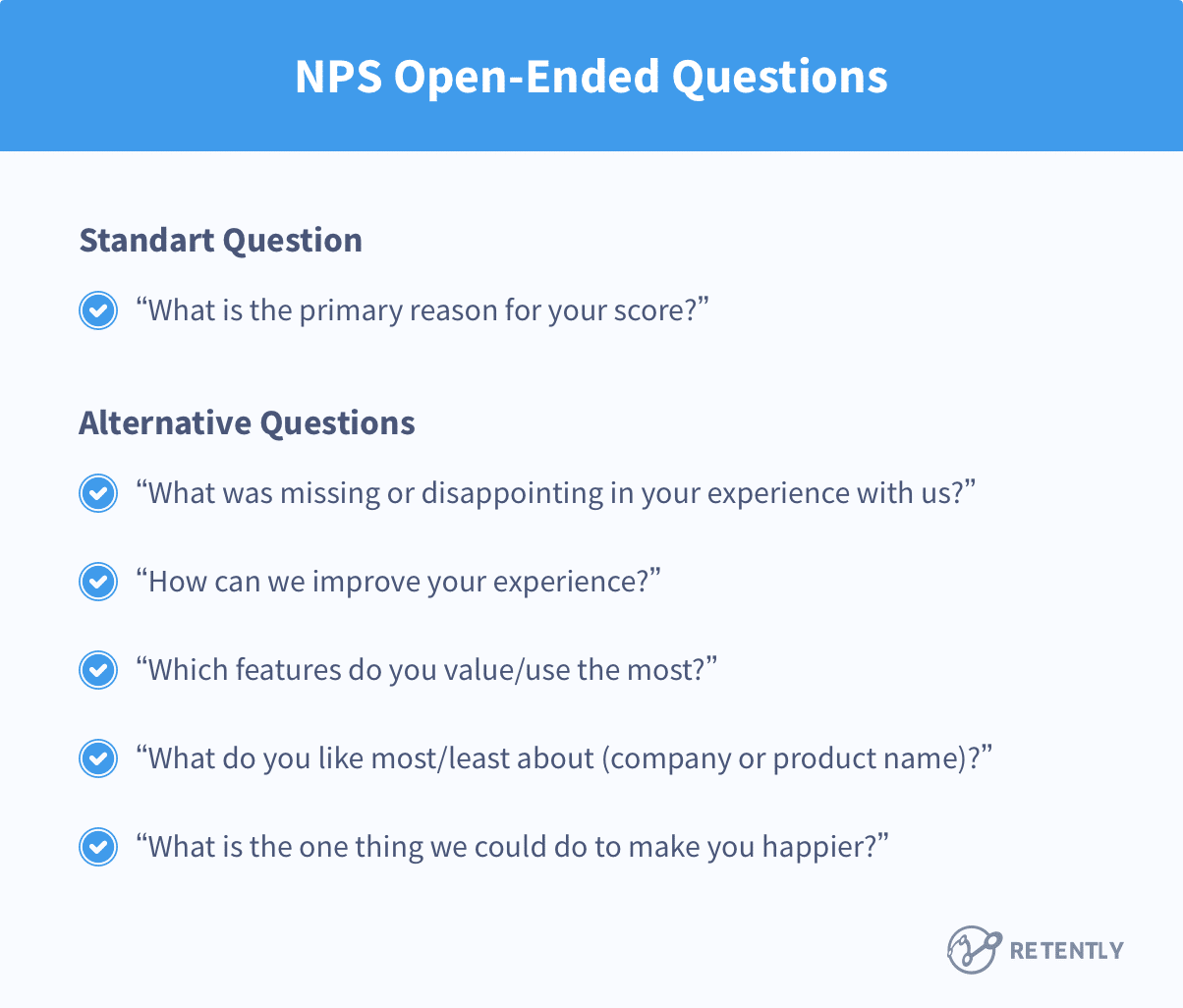

One of the most commonly used market research methods, Surveys are an easy way to understand your target audience and allow you to test a large sample size to determine if findings are true across a larger segment of your customers.

3. Questionnaires

Great for: Customer feedback and satisfaction surveys (NPS surveys), and when you want more detail on your target audience and customer base.

Do not confuse questionnaires for surveys ! While surveys are aggregated for statistical analysis, questionnaires are a set of written questions used for collecting information.

Questionnaires are used to collect information rather than draw a conclusion. Surveys can include a questionnaire, but a survey must aggregate and analyze the responses to the questions.

When writing questionnaires for market research, keep the number of questions in mind.

In one study, SurveyMonkey found that questionnaires with 40 questions have about a 10% lower response rate than questionnaires with 10 questions . The more questions, the less likely people will finish your questionnaire.

4. Focus groups

Great for: Price testing, advertising concepts, product/messaging testing

Even with the rise of big data, focus groups have remained an integral part of how companies build their products, strategy, and messaging. Focus groups are intentionally compromised by a group of purposefully selected individuals. Above all, the collaborative setting ensures that members of the group are able to interact and influence each other.

Typically these open and interactive groups are composed of around five to 12 screened individuals . Make sure that your participants are diverse so you can get a range of opinions and you have enough representation from several segments of your market.

Many smaller startups will conduct DIY focus groups and will use video conferencing technology, which is one of the most cost-effective and time-efficient market research methods.

This is a great resource to see some good questions to ask your focus groups as well as what topics focus groups should touch on.

5. User groups

Great for: Feature testing, UX and web design feedback

User groups are used to gather UX data and provide insight for website design. User groups usually meet regularly to discuss their experience with a product, while researchers capture their comments.

Here’s a great guide on how to format questions for user groups .

6. Test markets

Great for: Testing new marketing campaigns

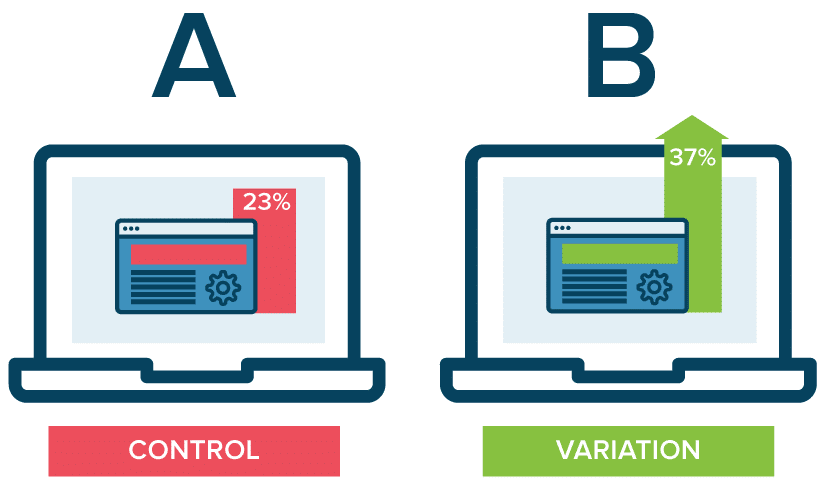

Test markets represent a larger market. Using a test group as well as a control group can show you the success of a new landing page, messaging copy, or CTA button. We particularly like the free version of Google Optimize to get quantitative data on how your experiment is performing based on a specific goal.

Secondary research methods

Secondary research can help establish a starting point prior to diving into more expensive primary research techniques. While there is a lot of data on the web regarding basic statistics, you may have to purchase a distinct data provider for a more in-depth look at your market.

Crunchbase Pro and Marketplace partners are a great and inexpensive way to start your secondary research directly on Crunchbase.com.

7. Competitor benchmarks

Great for: Understanding your revenue, churn, operating costs, sales, profit margin, and burn rate.

Competitor benchmarks are the most valuable and widely used of the secondary research methods. Moreover, competitor benchmarks measure specific growth metrics or key performance indicators in comparison to business within the same industry and of a similar size.

You can use Crunchbase Pro to find how much companies in a certain industry are raising and who are the leading players with our global coverage on companies ranging from pre-seed to late-stage. So, as one of the most informative of the market research methods, competitive benchmarks are a great way to inform your business strategy.

Free Crunchbase registered users have access to revenue estimates as well as web traffic data.

8. Sales data

Great for: Understanding your audience and where to place marketing efforts.

Taking a look at internal sales data not only reveals profitability but also helps market researchers segment customer trends.

However, taking a look at competitive sales data is a great way to make sure that you’re meeting the numbers you should be targeting as well as capturing the full potential of the market

9. Government publications and statistics

Great for: General demographic information and larger trends

The U.S. Census Bureau is a great resource of national demographic data. You can also review patents as a preview of industry trends and future innovation.

Also, you can find additional data and research from Data.gov , The World Bank , as well as the Pew Research Center to help inform your market research decisions.

10. Commercial data

Great for: Greater insight into industry trends and reports

If you’re interested in purchasing secondary market research, commercial data is available. For comprehensive reports, Mintel and IBISWorld are both traditional market research companies that provide commercial data.

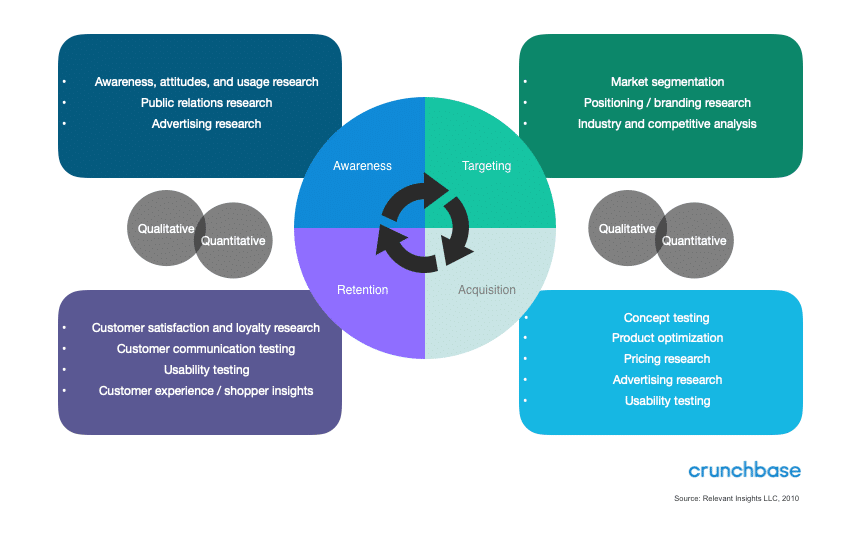

Additionally, to choose which type of market research method is best for your goal, follow this graph from Relevant Insights. Begin with the metric you’re trying to move and then backtrack into a targeted market research method.

How can Crunchbase help with my market research?

Crunchbase gives market researchers flexible access to Crunchbase’s complete company data. Innovative teams and leaders in market research rely on Crunchbase’s live company data to build powerful internal databases and research insights in respective industries. Learn more about how Crunchbase can help you with your market research .

- Originally published March 14, 2019, updated April 26, 2023

You may also like

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Eastern Europe Industry Review: Russia-Connected SPACs, New VC Darlings, Food Delivery Disruption

By Adrien Henni, Chief Editor, East-West Digital News

Women In Russian VC: How Gender Stereotypes Hinder Investment

Daria Zharkova, Senior Research Manager at Dsight

The all-in-one prospecting solution

- Find the right companies

- Identify the right contacts

- Connect with decision-makers

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Financial Forecasting Methods to Predict Business Performance

- 21 Jun 2022

Much of accounting involves evaluating past performance. Financial results demonstrate business success to both shareholders and the public. Planning and preparing for the future, however, is just as important.

Shareholders must be reassured that a business has been, and will continue to be, successful. This requires financial forecasting.

Here's an overview of how to use pro forma statements to conduct financial forecasting, along with seven methods you can leverage to predict a business's future performance.

What Is Financial Forecasting?

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This involves guesswork and assumptions, as many unforeseen factors can influence business performance.

Financial forecasting is important because it informs business decision-making regarding hiring, budgeting, predicting revenue, and strategic planning . It also helps you maintain a forward-focused mindset.

Each financial forecast plays a major role in determining how much attention is given to individual expense items. For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details. However, if your forecast is concerned with a business’s future, such as a pending merger or acquisition, it's important to be thorough and detailed.

Access your free e-book today.

Forecasting with Pro Forma Statements

A common type of forecasting in financial accounting involves using pro forma statements . Pro forma statements focus on a business's future reports, which are highly dependent on assumptions made during preparation, such as expected market conditions.

Because the term "pro forma" refers to projections or forecasts, pro forma statements apply to any financial document, including:

- Income statements

- Balance sheets

- Cash flow statements

These statements serve both internal and external purposes. Internally, you can use them for strategic planning. Identifying future revenues and expenses can greatly impact business decisions related to hiring and budgeting. Pro forma statements can also inform endeavors by creating multiple statements and interchanging variables to conduct side-by-side comparisons of potential outcomes.

Externally, pro forma statements can demonstrate the risk of investing in a business. While this is an effective form of forecasting, investors should know that pro forma statements don't typically comply with generally accepted accounting principles (GAAP) . This is because pro forma statements don't include one-time expenses—such as equipment purchases or company relocations—which allows for greater accuracy because those expenses don't reflect a company’s ongoing operations.

7 Financial Forecasting Methods

Pro forma statements are incredibly valuable when forecasting revenue, expenses, and sales. These findings are often further supported by one of seven financial forecasting methods that determine future income and growth rates.

There are two primary categories of forecasting: quantitative and qualitative.

Quantitative Methods

When producing accurate forecasts, business leaders typically turn to quantitative forecasts , or assumptions about the future based on historical data.

1. Percent of Sales

Internal pro forma statements are often created using percent of sales forecasting . This method calculates future metrics of financial line items as a percentage of sales. For example, the cost of goods sold is likely to increase proportionally with sales; therefore, it’s logical to apply the same growth rate estimate to each.

To forecast the percent of sales, examine the percentage of each account’s historical profits related to sales. To calculate this, divide each account by its sales, assuming the numbers will remain steady. For example, if the cost of goods sold has historically been 30 percent of sales, assume that trend will continue.

2. Straight Line

The straight-line method assumes a company's historical growth rate will remain constant. Forecasting future revenue involves multiplying a company’s previous year's revenue by its growth rate. For example, if the previous year's growth rate was 12 percent, straight-line forecasting assumes it'll continue to grow by 12 percent next year.

Although straight-line forecasting is an excellent starting point, it doesn't account for market fluctuations or supply chain issues.

3. Moving Average

Moving average involves taking the average—or weighted average—of previous periods to forecast the future. This method involves more closely examining a business’s high or low demands, so it’s often beneficial for short-term forecasting. For example, you can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most commonly applied to future stock prices, it’s also used to estimate future revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts.

4. Simple Linear Regression

Simple linear regression forecasts metrics based on a relationship between two variables: dependent and independent. The dependent variable represents the forecasted amount, while the independent variable is the factor that influences the dependent variable.

The equation for simple linear regression is:

Y = Dependent variable (the forecasted number)

B = Regression line's slope

X = Independent variable

A = Y-intercept

5. Multiple Linear Regression

If two or more variables directly impact a company's performance, business leaders might turn to multiple linear regression . This allows for a more accurate forecast, as it accounts for several variables that ultimately influence performance.