MBA Knowledge Base

Business • Management • Technology

Home » Management Case Studies » Case Study: Kellogg’s Business Strategy

Case Study: Kellogg’s Business Strategy

Kellogg’s is the world’s largest cereal maker since 1906 and is located in the United States. Kellogg’s products has become a part of the delicious mornings for the people around the world since a century. Its business is operated in two segments: Kellogg’s North America and Kellogg’s International. 66% of the revenue to the company comes from North America region which consists of the Canada and the United States. The remaining 34% comes from the Kellogg’s international market which consists of Europe (20%), Latin America (8%) and Asia Pacific (6%). The products vary from ready-to-eat cereals to convenience foods such as cereal bars, cookies, toaster pastries, crackers, frozen waffles, snacks and veggie foods. Obesity and Health & Wellness is the primary concern for people in the world today. Kellogg’s has invested on this trend by introducing many health focused products like Kellogg’s ®, Pop-Tarts ®, Cheez-It ®, Mini-Wheats ®, Nutri-Grain ®, Rice Krispies ®, Keebler ®, Special K ®, Chips Deluxe ®, Famous Amos ®, Morningstar Farm ®, Sandies ®, Eggo ®, Austin ®, Club ®, Murray ®, Kashi ®, Bear Naked ®, Gardenburger ®,All-Bran ®,and Stretch Island ®. The demand for its products came from the continuous advertising since 1906. The main competitors are General foods, Quaker Oats, General Mills and Ralston-Purina. It started out in Battle Creek, Michigan with 44 employees which eventually has grown into a multinational company with 30,000 employees. The manufacturing of its products is taking place in 18 countries and selling them over 180 countries successfully with the implementation of intelligent strategies and leadership .

Key Success Factors of Kellogg’s

The main key factors for Kellogg’s Success are it perceived to have a healthy image when compared to other daily breakfasts and snacks like chocolates and crisps. They made the products convenient enough so that they can be carried anywhere easily. They offer a range of cereal bars which are quite useful for people on the morning rush. Few Kellogg’s products are really versatile as mom’s can give them as a snack between breakfast and lunch to their kids. Sodium content in the food is a major issue that the company has to deal with. Kellogg’s are trying to develop products with less salt content and including more amount of fruits in the bars and cereals for people with health concerns. They have created a high level of brand awareness in the people which allowed them to win the customer loyalty. They have designed various products since a century for all age groups from children’s to adults. Innovation has influenced Kellogg’s market to a greater extent. Introducing new products according to the changing markets and tastes of people from time to time has made Kellogg’s to win the customers. They offered the products at a lower price which made an average household to afford, hence retaining the customers at large. Kellogg’s market its products itself. It do not manufacture cereals for any other company who sells them under their own brand. All these factors added for the company to run successfully and become the world market leaders in the highly competitive market.

Kellogg’s Business Strategy

Kellogg’s aim was to be the food company of choice and also make customers understand the importance of a balanced lifestyle which can be achieved by their products. The mission is “to drive sustainable growth through the power of the people and brands by better serving the needs of customers, consumers and communities.” Based on their vision and mission they crafted their strategy to achieve aims and objectives with the power of position and brand image. Kellogg’s targeted various groups of people and deigned the products accordingly to attract their mind sets. ‘Balanced Lifestyle’ is the broad strategic objective of the company. It implemented these strategies by some tactical plans like supporting the physical activity among all age groups and to sponsor these activities with the use of companies resources, the communication of the balance diet to consumers using the cereal packs, and also introduction of food labelling which would allow consumers to understand the balanced diet content of their products. Kellogg’s has introduced the recommended Guideline Daily Amounts (GDA) to their packaging labels. This allowed the customer to have a knowledge of the amount of nutrients in take in a serving of Kellogg’s food. Their strategy is to attract customers by encouraging them to take part in the swimming programs organised by the company in relationship with the Amateur Swimming association (ASA). Kellogg’s has sponsored almost 1.8 million awards every year to the swimmers. This idea of teaming up with ASA has helped the company to reinforce its brand image. It also has started many community programs and breakfast clubs to create awareness of their products in people. By all these activities it shows that the company is trying to create a good CSR image in the industry. Kellogg’s believed that if consumers are given proper information about their products, they can retain them. So, they chose various methods to communicate their objectives to the world such as using cartoon characters, and also through effective advertising. It also distributed nutrition magazines for the employees to make them better understand about the objectives.

Market Research

It is seen that Kellogg’s consumers buying behavior is mostly dependent on the company’s focus towards customers and how well they treat them rather than manufacturing, pricing or merchandising of the products. Consumers tend to purchase the products which are more healthy. Hence they want to know all the available information about the products they want to buy or consume. The product’s information, beliefs, intentions and attitudes of the customers influence the decision process . So Kellogg’s has to perform a market research on whether the consumers buy their products based on the label information or not. The visual inspection of the product or the experience of purchasing the product play a major role in the decision making of the consumer. Advertising and promotion of the product might as well have a greater impact on the buying pattern. It is difficult enough to understand the consumer behavior within the borders of a single country. Understanding and serving the needs of consumers from different countries can be daunting. The values, behaviors and attitudes of the consumers vary greatly across the world. Kellogg’s must design the marketing programs and products according to the peoples needs. For example, in the United Kingdom where most people eat cereal regularly for their breakfast, Kellogg’s should try persuading consumers to buy their brand rather than a competitors brand. In France, however where most people prefer croissants and coffee or no breakfast at all, it should advertise to convince people to eat cereal for breakfast and in India, where many consumers eat heavy fried breakfasts and skip meal all together, the company should make attempts to convince the buyers to shift to a lighter, more nutritious breakfast diet.

Customer Focus and Retention Strategy

There is a huge discussion in the EU market about the food nutrition and labeling and the negative media image produced about the products of the company. The Kellogg’s products are criticized by food standard agency (FSA) as red products and junk food. They said that the company is trying to show their products healthier than they actually are. These statements and actions of FSA has not only affected the overall business and its image but also the consumer attitude towards the products.

To cover up the damage caused due to the labeling issue by FSA, Kellogg’s Should determine the customer’s needs and convert them into requirements. In order to fulfill them, it should fully understand the current and future needs of the customers, identify the customers, determine their key product characteristics, identify and assess market competition, identify opportunities and weakness , define financial and future competitive advantages , ensure that it has sufficient knowledge about the regulatory requirements, identify the benefits to be achieved from exceeding compliance and also identify their role in the protection of community interests. Kellogg’s can start launching some new products aimed at the health conscious consumers. They can start selling them for a lowest price in the market and satisfy them with a good value products for every penny they spend. They can concentrate more on three groups of people like individuals, families and supermarkets who wanted to have a healthy diet. They can focus more on health conscious people from age group from 25-50 by promising them healthy diet with their products. By the introduction of these products in the market they can show the customers that Kellogg’s is being paid attention to what they want and how important their health is to the company. They can start collecting information from consumers and people by conducting surveys about what kind of products they are actually looking for and based on that they can prepare them and position them to win the competitive advantage. So the only mantra to attract the customers again and to cover up the loss created by FSA is obsessive customer attention. Even though making health conscious customers happy might affect the short term profits, yet it helps to acquire a loyal customer base which pays off in the future. Making these products available at all consumer stores and super markets at a lower retail price might assist in building up the brand image yet again. Advertisements play a crucial role in winning the brand image and loyalty of the customers. If the company tries to create an awareness about the product and the low price buying strategy, it would encourage the consumers to buy them that results in the greater sales of the product.

Awareness of changing dynamics of the consumer market will definitely help Kellogg’s to gain a competitive edge in the cereal industry. The increasing trend of health consciousness and the changing tastes can be known time to time by extensive market research. The feed back from consumers and the surveys conducted will allow the company to learn about their drawbacks and work up on them. It enables the business to minimize price sensitivity, improve profitability , differentiate itself from the competition , improve its image in the eyes of customer, achieve a maximum number of advocates for the company, increases customer satisfaction and retention, enhance its reputation, improve staff morale , ensure products and services are delivered right ‘first time’, increase employee satisfaction and retention, encourage employee participation, increase productivity and reduce costs, create a reputation for being caring customer-oriented company, foster internal customer / supply relationships and also bring about continuous improvements to the operation of the company.

Related Posts:

- Case Study: Tesco's US Grocery Market Entry

- Case Study of FedEx: Leveraging Information Technology to Grow Business

- Case Study of Cemex: Incorporating IT into Business

- Business Model Analysis of Starbucks

- Case Study of Fedex: Using Marketing Channels to Create Value for Customers

- Case Study: The Rise and Fall of Enron

- Case Study: L'Oreal International Marketing Strategy

- Case Study: The Body Shop's Ruby Ad Campaign

- Case Study on Corporate Governance: Enron Scam

- Case Study of Procter and Gamble (P&G): Structure and Culture

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Directory Global directory

- Logins Product logins

- Support Support & training

- Contact Contact us

Talent Insights

Based on empirical research with more than 2,400 stand-out lawyers around the world, firms can now examine what action needs to be taken to nurture, retain and attract top talent.

Featured event

Jan 23, 2023

The 30th Annual Marketing Partner Forum

Related posts.

How to integrate ESG risks into the enterprise’s overall risk management

Why ESG is so important when choosing a project’s location in Latin America

Erosion in the rule of law creates potential corporate governance gaps & increases risks for management

More insights.

The 2023 COO & CFO Forum: A bifurcated recovery and the potential road ahead

Stellar Performance 2023: Retaining your firm’s most valued associates

How the Legal Services Corporation is analyzing court data to increase access to justice

- Harvard Business School →

- Faculty & Research →

- December 2017 (Revised March 2018)

- HBS Case Collection

Kellogg Company/eighteen94 capital

- Format: Print

- | Language: English

- | Pages: 19

About The Author

David E. Bell

Related work.

- Faculty Research

- Kellogg Company/eighteen94 capital By: David Bell, Damien McLoughlin and Natalie Kindred

“Simplify and stabilise”: Kellogg Company’s journey to supply chain sustainability

In the second of two blogs ( read the first one here ), Charlotte Durrant, Sedex Marketing Communications Manager, reflects on key learnings from the keynote speech by Alistair Hirst, SVP Global Supply Chains at Kellogg Company, at the Sedex Conference 2016.

Kellogg Company have an organisation of 33,000 people, and Alistair Hirst has 20,000 in supply chain – that’s just his direct employees. When looking at their extended supply it becomes a significantly larger number. At the Sedex Conference Hirst outlined how, “ one of the things that I have learned is that if I don’t have a stable base to build on, then I know whatever I’m doing isn’t going to be sustainable. Simplifying can help you stabilise and vice versa .”

Hirst described the breadth of Kellogg Company’s operations – producing 1,600 foods in 20 countries, which it markets in 180 countries. This breadth makes transparency hugely important. Hirst said: “ Sustainability is no longer just about reducing your greenhouse emissions or energy footprint – it’s your end-to-end supply chain. We have a responsibility – whether it’s tier 1, tier 2, tier 3 or 4 supply chain – to understand what it going on throughout that whole supply chain .“

“ Business has a role to play, and it creates markets and opportunities, especially in the developing world for small farmers to improve their livelihoods. And our customers expect that. Everything we’re doing is being driven by our consumer and our customer. We don’t do it just because we think it’s a good idea, we know our consumers – particularly millennials – want to know where their food comes from. They want to buy from companies that have the same moral compass that they do .”

Hirst described the four things he thinks Kellogg Company needs to be to make sure it has a stable supply chain:

- Resilient : “ We need to be resilient against short term supply shocks, to react quickly, to get supply at short notice .”

- Predicable: “ We need to predict longer term supply shocks, particularly around climate change, and what we can do to get ahead of it .”

- Rich data or predictive analytics: “ There’s more data in the world than there’s ever been, but are we using it to predict what could be happening in the future? Predictive analytics can be a big enabler to stabilise the supply chain .”

- Partnership s: “ There’s no way Kellogg can do this on our own, we have to choose the partners who can help us be successful and get the positive outcomes we’re looking for. We work with the World Bank, with Sedex, with SGS; multiple organisations to help understand our supply chain and our sustainability agenda .”

Hirst then outlined four things that Kellogg Company is currently working on in its supply chain:

- Climate Smart Agriculture : “ Is about increasing productivity and crop resilience and reducing greenhouse gas emission. Kellogg Company is partnering with 15,000 farmers by 2020 to work on these practices .”

- Climate and Natural Resource Conservation : “ Two areas we’re particularly interested in are water availability and soil health, because without those crops cannot grow and we can’t be productive .”

- Human Rights: “ A huge issue for us. We have our global code of ethics which our suppliers are expected to comply with .”

- Reputation : “ We know our reputation is a fragile thing. When information can travel round the world instantaneously, your reputation can be good today and before I’ve finished speaking it can be trashed around the world. This is where audits come in, I love audits. We need audits for continuous improvement – ‘a commitment made is a commitment delivered’ in the Kellogg’s supply chain .”

Hirst stressed the importance of clear metrics in responsible sourcing and gave some key examples of targets Kellogg Company is working towards. He also talked about the difficulty of measuring and meeting these targets: “ this is hard – our supply chain is constantly changing, but we don’t change our target, it stays the same whatever, we keep moving forward .”

He then noted three examples that Kellogg Company are proud of:

- Kellogg’s Origins: The company has been working with UK farmers to increase biodiversity and take children from inner-city schools to see where their food comes from.

- Thai rice: Kellogg Company has been working closely with the Thai government since 2008 to grow long grain rice in Thailand, in order to ensure resilience of supply. Last year they got the first commercial crop into the business. The Thai government says it’s the first time a public-private partnership has worked in this agro-space and Kellogg Company has created a market for the Thai farmers which gives them more security.

- Quinoa growers in Bolivia: Kellogg Company helps farmers with crop husbandry to keep their organic certificate, which is critical for their livelihoods. There is no electricity on the farms, so they also invested in solar power which allows the farmers to irrigate the fields and light their homes at night.

Our customers want to buy real food, they care about where it comes from and who grows it, that we care about the planet. Simplify the work, stabilise the supply base, support the people, communities and environment where we work and source. But never forget, we’re still a business, we have to have front and centre: consumer and customer .

Hirst also talked about the power of partnerships. He described how, in his view, “ supply chains are too simplistic and linear in this VUCA world – we operate in supply webs now – and a spider rarely goes across its web in a straight line .”

More case studies

- Sustainable Agriculture

- Thriving Forests

- Safer Chemicals

- Sustainable Energy

- Green Freight

/ Resource

Science based targets: Kellogg’s case study

Published: February 23, 2019 by Science based targets initiative

Project Gigaton, Sustainable Agriculture

This case study explores how the Kellogg Company committed to a 15% reduction in emissions (ton of CO2e per ton of food produced) by 2020 from a 2015 base-year (scopes 1 & 2). Kellogg's also committed to: - reduce absolute value chain emissions by 20% from 2015-2030 (scope 3). - a long-term target of a 65% absolute reduction in emissions by 2050 from a 2015 base-year (scopes 1 & 2) and to reduce absolute value chain emissions by 50% from 2015-2050 (scope 3). You can view an interview about Kellogg's process at: https://sciencebasedtargets.org/case-studies-2/case-study-kellogg/.

Related Content

Ag retail helps farmers conserve profitably, measuring financial outcomes of ag conservation, tsc: sustainable animal feed guide, optimizing fertilizer use, model safer food additives policy, webinar: setting science-based targets, webinar: how business is taking on climate change, 5 pillars of leadership for safer chemicals, safer food through institutional commitment, safer food through supply chain transparency, safer food through informing consumers, safer food through public commitment, safer food through safer food additives, safer food packaging, chemicals in food packaging and handling equipment, toxic chemicals can enter food through packaging, how companies can approach clean food packaging, a safer supply chain: managing food contaminants, what is perchlorate and what can you do about it, panera bread case study, food additives: who is promising what, greenblue: sustainable materials management, design for recycled content guide, retail supplier resources: agriculture, most popular, how agriculture affects us all, 77 west wacker: driving ee in class a buildings, industrial assessment centers' database, testing for heavy metals: food, food ingredients, mit center for transportation and logistics, energy savings achieved by manufacturing companies, the world's largest pork producer is breaking sustainability barriers, ghg quantification standard for organizations, fuel-saving technologies for trucks, new tactics to meet 2020 deforestation goals, glec framework for logistics emissions methodologies, build a sustainability plan 101: introduction.

Learn how to use the site

Watch Tutorial

Thanks for subscribing to our newsletter!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras fermentum ultrices varius. Vivamus cursus turpis sed finibus ultricies. Nullam id mauris accumsan tellus facilisis eleifend. Vivamus sed lorem sit amet nisi gravida maximus. Suspendisse consequat auctor lacus et laoreet. In hac habitasse platea dictumst. Praesent ultricies elit sagittis felis lobortis, nec aliquam arcu gravida.

The Experience

- Inclusion and Belonging

- Global Opportunities

- Career Impact

- History & Legacy

- Kellogg Convocation

Degree Programs

- Full-Time MBA

- Evening & Weekend MBA

- Executive MBA

- Master in Management

- Certificate Program for Undergraduates

- Which Program is Right for Me?

- Academic Calendars

Executive Education

- Online Programs

- Programs for Individuals

- Nonprofit Programs

- Programs for Groups

- The Kellogg Advantage

- Contact Executive Education

- Request a Brochure

- Find a Program

News + Stories

- Alumni Network

- Applying to Kellogg

- Career Journeys

- Global Impact

- Inclusion & Belonging

- Student Stories

- Kellogg Magazine

- Kellogg Insight

- See All News + Stories

Academics + Research

- Faculty Directory

- Academic Departments

- Research Centers

- Research + Books

- Case Studies

- Faculty Recruiting

- Faculty Teaching Awards

- Data Analytics

- Entrepreneurship

- Family Business

- Leadership & Organizations

- Social Impact

- Full-Time MBA Admissions

- Evening & Weekend MBA Admissions

- Executive MBA Admissions

- Master in Management Admissions

- PhD / Doctoral Admissions

- Undergraduate Certificate Admissions

- Admissions Events

- Financial Aid Office

- Log into my account portal

- Companies + Recruiters

Take Action

- Faculty & Research Overview

- Departments

- Kellogg Insight Magazine

Cases Published

The Brand Hopper

All Brand Stories At One Place

Case Study | Launching Kellogg’s Cornflakes in India

Case Study | Launching Kellogg’s Cornflakes in India 10 min read

“ Mothers know what they want and when; we can’t push our offering to them without giving them a reason they value, ” the Head of Marketing at Kellogg’s India clarified. The Kellogg’s cornflakes marketing team was struggling to find an appropriate positioning platform for the brand to increase sales and ensure brand growth. The brand was globally accepted but its journey in India has been bumpy. They had struggled to find a suitable place in consumer’s heart and mind, and again they were rethinking the growth strategy. Let’s delve into the classic case study of Kellogg’s launch in India and the valuable lessons it departs.

Table of Contents

Breakfast Market in India

The breakfast cereal market in India was pegged at Rs. 12 billion in 2014, an almost 15% growth from Rs. 10.4 billion in 2013, and was expected to grow at a CAGR of 13% over the five-year period. Due to increased health consciousness among consumers, hot cereals and muesli were the fastest growing product categories. Among hot cereals, oats had gained the highest popularity registering a 33% growth in 2014.

Cereal was not a popular breakfast item for Indians, and hence, the market was dominated by international brands from Kellogg’s and Pepsico. Bagry’s India Ltd and Mohan Meakin were the only two Indian players in the market. Kellogg’s India Ltd had the first-mover advantage and was the undisputed market leader with 37% value share in 2014.2 Regional players had a competitive edge over bigger brands because of their robust distribution network. Competition also stemmed from other FMCG chains that did not necessarily have packaged breakfast as their core product offering, for example, ready-to-eat players like MTR and Britannia with its range of ready-to-cook upma, porridge, and poha. These products provided consumers with healthy options that were not just quick but also healthy.

Consumer Behavior Towards Breakfast

India did not have the culture of breakfast. A typical, average middle-class Indian family did not have breakfast on a regular basis like their western counterparts. Breakfast was always combined with lunch—“Brunch” as it was popularly called. Breakfast habits (brunch) in India, for the most part, were inclined towards hot, cooked regional items, like flattened rice flakes (chivda/poha) in western and central India, whole wheat grits (dalia) and parathas in northern India along with traditional regional staples such as idli or dosa in the south. In the earlier days, women prepared fresh breakfast for the family. Serving ready-to-eat meals were not part of the cultural norm and such options were also not widely available.

However with urbanization, dual-working households, and lifestyle changes, there was a greater need for convenience. This was also coupled with increasing disposable income and health consciousness. Increasing awareness of health and susceptibility of Indians towards lifestyle ailments like heart disease and diabetes yielded a greater demand for value-added healthy breakfast options.

Hence, consumers, especially in urban areas, preferred a quick-fix breakfast and cereals would fit the bill. The influence of Western lifestyles and “eating out” trends also played a significant role in opening the gateway for experimenting with different tastes and varying eating preferences. This transition from traditional to modern breakfast took place among young Indians (24–35 years), mostly from dual income families. Choice of breakfast options was induced by personal factors like time constraint, work timings, social groups, and family members.

Kellogg’s Entry in India

In the late 1980s, ready-to-eat cereal giant and market leader, Kellogg’s had reached peak sales occupying a 40% market share in the US. The company had its presence in 18 countries and over 20 plants worldwide with annual sales of over $ 6 billion. However, in the 1990s, competition got tougher and Kellogg’s began to struggle when its nearest rival when General Mills introduced Cheerios brand. There was little room for growth in core markets; therefore, the company started looking beyond its traditional American and European countries as a potential cereal-consuming market.

India was a lucrative target market with population of over 950 million, out of which 250 million were middle class and untapped. In 1991, India went through an economic liberalization and removed the barriers to international trade. Three years later, Kellogg’s decided to invest $ 65 million towards launching its number one brand, Corn Flakes, in India. “ Even if Kellogg’s had 2% market share at 18 million consumers they would have a larger market than US itself , ” said Bhagirat B Merchant, Director of Bombay Stock Exchange in 1994.

Positioning at Launch

Globally, Kellogg’s cornflakes were positioned on the “fun and taste” platform, and they emphasized on the crispiness of its flakes. When Kellogg’s entered the Indian market in 1994, it positioned itself to families/households on the health platform, thus emphasizing on the nutritional benefits of the cereal. They tried to communicate to consumers that traditional Indian breakfast options were not as healthy, and hence, cornflakes were a good choice. This was done based on the insight that Indians consumers were not habituated to cereals as a breakfast item and needed to be educated to create acceptance and liking for not just the brand but cereal as a category.

Kellogg’s kicked off its India entry with three variants of breakfast cereal: Corn Flakes, Wheat Flakes, and Rice Flakes, packaged with an emphasis on the crispiness of its flakes compared to local cereals. These cereals were best served with cold milk without adding sugar. The tagline to reinforce the positioning was- “ Jaago jaise bhi, lo Kellogg’s hi ” (“No matter how you start your day, start it with Kellogg’s”). However, the proposition did not find much credibility with households. Average Indian did not pay much importance to iron/vitamin intake.10 The nutritional benefit was not a differentiated and strong enough proposition for Indians to change their habits and move away from traditional items as they considered their food to be equally or more nutritious.

The initial sales were impressive but Kellogg’s knew that this was a result of one-off purchases. Cereals were a new item for the Indian consumer and after the initial excitement wore off, repeat purchases were few. Another barrier to repeat purchase was the high price. A 500 grams box of corn flakes was almost 30% costlier than its nearest competitor. Indians did not find value in spending so much for an expensive breakfast and often the leftovers from the previous day were cooked or served differently for breakfast next day. In certain households, corn flakes were reserved as a Sunday or special occasions treat.

Also, the emphasis on crispy flakes failed in India as consumers were used to hot milk which made cornflakes soggy. This further diluted the Kellogg’s brand promise. On the heels of continuous unimpressive sales, Kellogg’s realized that their breakfast option was diametrically opposite to what generations of Indians have been eating. The typical Indian breakfast was still hot, home-made, heavy-as-a-meal, and savory rather than sweet. What Kellogg’s was offering was ready-to-eat, best served with cold milk, and bland unless you add a sweetener.

In early 1996, defending the company’s products, Managing Director, Avronsart said, “ Kellogg’s India is not here to change breakfast eating habits. What the company proposes is to offer consumers around the world a healthy, nutritious, convenient, and easy-to-prepare alternative in the breakfast eating habit. It was not just a question of providing a better alternative to traditional breakfast eating habits but also developing a taste for grain-based foods in the morning ”.

Indian consumers did not perceive the Kellogg’s differentiators relevant. They were not looking for thicker and crispier flakes with iron and vitamin. They sought basic health and taste which their traditional food and other competitor brands were also fulfilling.

Repositioning and Product Extensions

Kellogg’s saw that Indian households were difficult to target and moved their focus to kids with the launch of two of its highly successful international brands, Chocos in September 1996 and Frosties in April 1997. Chocos were wheat scoops coated with chocolate, while Frosties had sugar frosting on individual flakes. Frosties addressed the shortcomings of plain cereals because they were ready sweetened which sweeten the milk when it is added to the bowl. Both these variants were not positioned as breakfast items but as snack items on the proposition of fun and taste combined with health. Now the mother was urged to give Chocos as a mid-meal snack to fulfil nutrition requirement.

These variants found feet in the market and targeting kids helped. However, in 1998, Kellogg’s again tried targeting families and households by “Indianizing” its cereal range with the “Mazza” brand. Mazza cereals were available in fusion of local flavours like mango-elaichi, coconut-kesar and rose. The variant did not work. Mazza was more to do with the taste of the product and many consumers thought these were too outlandish.

In 1999, Kellogg’s began offering fortified cereals. The “Iron Shakti” cornflakes positioned on the nutrient value of cornflakes and addressed iron deficiency in children. The nutrition platform was more focused and relevant here as no other brand or product spoke of iron supplement. This became the differentiator and sales increased by 17%. Making the brand and proposition sound Indian by using words like “Iron Shakti” and “Calcium Shakti” gave it a local feel. This approach was more successful than the brand’s previous attempt to imply that the traditional Indian breakfast was not nutritious—messaging which made the Indian housewife rather indignant. The proposition this time was a nutritious and fun breakfast for kids coupled with goodness of iron (which mothers worry about).

Besides positioning, Kellogg’s also changed the communication. It removed the rooster which had an integral association with Kellogg’s globally from all its advertisements in India. The promotions focused on inducing product trial by targeting schools across the country. In March 1996, the company gave out specially designed 50 gm packs to shoppers at select retail stores, and door-to-door sampling exercise offering one-serve sachets to housewives in the city.

However, the company knew that very few Indians had breakfast and they could grow only by growing the category. In 1997, they launched the “Kellogg Breakfast Week” in Mumbai, Delhi, and Chennai, a community-oriented initiative to create and increase awareness. The campaign focused on making people aware about the prevention of anemia, an iron deficiency disorder, and conducted a series of nutrition workshops to educate individuals and families.

As the brand had sub-segmented the market and offered specific customized variants to each with the relevant proposition, its agency, JWT, wanted to identify the triggers that enabled customers to move towards this category. Their research suggested that though Kellogg’s was positioned to kids, they were consumed by the entire family. They also found that healthy afternoon snacking was a large consumer need. Lastly, women in India were becoming more health conscious and desperately wanted to get into shape.

Using these insights, Kellogg’s launched Kellogg’s multi-grain, fortified cornflakes targeted to adult taste buds. Advertisements also began showing adults eating the cereal, rather than focusing on children alone. The assault on the afternoon-snack segment was led by Chocos. This brand was already popular with children, who were their key consumers for “4 pm munches”. The launch communication offered the Chocos variant as a nutritious substitute for chips and other junk food.

Special K: Get into Shape

In 2008, Kellogg’s launched their $1.5 billion “Special K” brand as a weight management cereal targeted at women (25–44 years) who wanted to keep in shape. It was positioned as a low-calorie weight control meal. This was again not categorized as breakfast item but a complete meal. Consultants pointed out that Kellogg’s’ brand extension strategy helped to increase its relevance across categories. It was a player in the Rs 500-crore weight management market and the Rs 750- crore convenience foods market, apart from the Rs 250-crore breakfast cereal market (which, in turn, was part of the Rs 2,000-crore health foods segment).

The marketing team knew that as against other markets, Kellogg’s not only adapted its portfolio to match Indian needs but also made changes to their global positioning to appeal to Indian consumers. Indian market is diverse and unique, and expects the offerings to fit their life pattern. The marketing head at Kellogg’s had recently read an article that incorrect positioning was the reason behind 80% brand failures. Kellogg’s have been relooking at their 5-year strategy as they have always wanted to be confident on the delivering the promise they have made to its consumers.

Also Read: Case Study | Launching And Establishing Oreo in India

To read more content like this, subscribe to our newsletter

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

A Case Study on “Fitbit: Find Your Reason” Marketing Campaign

A Case Study on “P&G: Thank You, Mom” Brand Campaign

Case Study – Burger King: Subservient Chicken Brand Campaign

Terms and Conditions

- Search for:

Home Resources Case studies Kellogg

Receive your free benchmark : Take part in the 2020 survey 2020 Benchmark request

Kellogs launched K Partners Advantage at our Supplier Day. K Partners Advantage is the culmination of crossfunctional feedback, external benchmarking, supplier segmentation and stakeholder input into the design, planning and governance of a re-energised SRM programme. T he approach moves us beyond traditional performance management and scorecards, and it was further enabled by globalising roles (and the programme) for scale, and organising work under the umbrella of ‘supplier engagement and development’ (SE&D). SE&D encompasses SRM, supplier diversity and responsible sourcing. It provides a ready way to integrate and connect suppliers to strategies, processes, goals, and activities more effectively, and with mutual benefits.

"We can be agile and deliver value for the business with the right partners, as we will be focusing on the future and growth, in addition to the urgent here and now.” Shelly van Treeck

Kellogg cpo.

For further information on how we can help your organisation supplier management programme, please contact us at [email protected]

Reports and Publications

Case studies, newsletter sign-up, stay connected on linkedin, lang: en_us, enjoy customer of choice benefits.

Find out what your key suppliers really think of you and how to become their customer of choice.

Find out more

Stay in touch

2020 global srm research report - supplier management at speed..

Now in its 12th year, this year we have seen an increase of 29% in the number of companies responding compared to 2019. In addition, the proportion of respondents at CPO/EVP level or equivalent has increased to over 50%. Learn how now, more than ever before, procurement has the opportunity to make the case for SRM to ensure organisations don’t just survive but thrive.

Sign up below to get our insight emails direct to your inbox.

- News & Analysis on the Bakery and Snacks Industries

Levelling the playing field: Kellogg’s feels the brunt of social media to remove chemicals from its kiddies’ cereals sold in the US

22-Apr-2024 - Last updated on 23-Apr-2024 at 11:54 GMT

- Email to a friend

Despite Kellogg’s promise to remove artificial colors and flavors from its cereals by the end of 2018, Hari said the Battle Creek-headquartered company has yet to fully follow through on its commitment.

To highlight this discrepancy, she points to Kellogg’s Foot Loops and Apple Jacks sold in the US that still contain artificial colors that are “derived from petroleum – a crude oil product”, which may cause hyperactivity in children and can disrupt the immune system. It requires a warning label when included in food products sold in the EU.

Moreover, ingredients like butylated hydroxytoluene (BHT) – a “risky preservative linked to cancer in some animal studies as an endocrine disruptor that interferes with hormones” – maintains its presence in the US’ variants, but not in other editions sold with countries that strictly regulate food ingredients.

“In 2015, Kellogg’s announced plans to remove artificial colors and artificial flavors from their cereals by the end of 2018. It’s now 2024 and Kellogg’s still sells several cereals with artificial colors and flavors in America, all of which target young children,” wrote Hari in the petition directed at the breakfast cereal giant.

Outraged: why should American children continue to be exposed to them unnecessarily

“As a mother of two young children, I am outraged that an American food company like Kellogg’s can sell safer versions of their cereals without artificial food dyes and BHT overseas,” Hari told Bakery&Snacks.

Many of these additives are currently at the center of a storm in the US. Like a domino run gaining pace, several states have joined the the brewing skirmish to wrest control of food additive regulation from the feds. Watch this space for updated information.

“The artificial dyes that Kellogg’s uses in the US require a warning label in Europe that states they may have an adverse effect on activity and attention in children.

“Kellogg’s made the commitment to remove these dyes in 2015 but they utterly failed on their promise by creating several new artificially dyed cereals targeting small children in the past few years such as Baby Shark, Unicorn, Disney’s Little Mermaid, Elf on the Shelf and Peeps. Their most iconic children’s cereals, like Froot Loops and Apple Jacks, still contain artificial dyes.”

Kellogg’s is not the only company within Hari’s sights, having raised similar concerns about General Mills’ Cheerios, which has been found to contain chlormequat, a toxic chemical linked to infertifility and delayed puberty, and classified as ‘one of the top Dirty Dozen food additives to avoid’ by the Environmental Working Group (EWG).

These findings have prompted calls from organizations like the American Academy of Pediatrics for their removal from children's food products.

“The American Academy of Pediatrics (AAP) issued a policy statement in 2018 warning that some chemicals found in food colorings, preservatives, and packaging materials may harm children’s health and best be avoided,” Jason Karp, founder of HumanCo – a mission-driven holding company that invests in and builds brands focused on healthier living – and his lawyer Alex Spiro penned in an open letter to Gary Pilnick, chairman and CEO of WK Kellogg Company.

“Artificial colors have been banned in countries like Norway and Austria, and the UK has imposed a voluntary ban. They may be contaminated with carcinogens and cause an increase in hyperactivity in children. Artificial colors add absolutely no nutritional value and are used solely for aesthetic purposes.”

It can be done

Hari said she’s not asking Kellogg’s to start from scratch, as the producer has removed these ingredients from its Froot Loops and Unicorn Cereals sold in Europe and Australia.

“They don't need to reinvent the wheel as they already make these cereals overseas without these ingredients,” she told this site.

“The simple fact that Kellogg’s doesn’t use these ingredients elsewhere is proof that they are not needed and that Kellogg’s knows of the health implications.”

“Kellogg’s lied to the public and this is why I started the petition,” added Hari.

“There is a groundswell of support happening now because of Jason Karp’s legal demand letter to Kellogg’s and the petition has quickly grown to over 80,000 signatures.

“Furthermore, we’re in touch with several lawmakers and AG offices around the country.” In fact, “the Mayor of Miami just retweeted Jason’s letter to Kellogg’s and my graphics showing the side by side comparisons for Fruit Loops.”

“We will continue growing this campaign until Kellogg’s follows through on the commitment it made back in 2015,” said Hari.

“Shortly after receiving Jason’s legal letter, Kellogg’s requested a meeting.

“We hope Kellogg’s uses this meeting as an opportunity to be a celebrated leader in the cereal industry by announcing the removal of artificial food dyes and BHT, while setting an honest date for their removal.

“American children deserve the same safe cereals that other countries enjoy. If Kellogg's has already found a way to make their cereals without these controversial chemicals, why should American children continue to be exposed to them unnecessarily?”

Hari welcomed the opportunity to get across her message, noting “it’s important for families to hold these companies accountable. Social media gives a voice to consumers and when consumers have been lied to by giant and iconic corporations such as Kellogg's, it can hold their feet to the fire.”

On her website, Hari claims that together with her ‘Food Babe Army’, she’s ‘been able to force some multibillion dollar food companies to change for the better, including Kraft, Chick-fil-A, Chipotle, Subway, General Mills, Panera Bread, Anheuser-Busch, and Starbucks’.

WK Kellogg & Co had not responded to a request for comment before going to print.

A pilot study of chlormequat in food and urine from adults in the United States from 2017 to 2023

Temkin, AM, Evans S, Spyropoulos DD, et al

J Expo Sci Environ Epidemiol (2024)

doi.org/10.1038/s41370-024-00643-4

Related news

Related products

More delicious. More functional. All gluten-free.

Content provided by ADM | 17-Apr-2024 | Case Study

While public opinion of gluten has softened in recent times, consumers continue to adopt lifestyle diets that avoid or remove gluten-rich products. And...

Discover Premium Berry Ingredients from Fruit d’Or

Content provided by Fruit D'or | 09-Apr-2024 | Product Catalog

Fruit d'Or has supplied premium cranberries and wild blueberries to global commercial bakeries for over 20 years. Rooted in the philosophy of "better...

How Bakeries Improve Cost Efficiencies, Naturally

Content provided by Lesaffre | 09-Apr-2024 | White Paper

Bakeries today must do more with less, even as goals creep higher and higher. There’s less time, less staff, and less budget. But quality can’t decrease....

Bakery solves bread resilience problem with Ultra Fresh® Premium 330i

Content provided by Corbion | 08-Mar-2024 | Case Study

Too many commercial bakeries experience the same problem: they conquer the shelf life issue but at a cost to product texture and quality

Related suppliers

- Fruit D'or

- Kemin Food Technologies

- Kemin Human Nutrition and Health

- More delicious. More functional. All gluten-free. ADM | Download Case Study

- Discover Premium Berry Ingredients from Fruit d’Or Fruit D'or | Download Product Catalog

- How Bakeries Improve Cost Efficiencies, Naturally Lesaffre | Download Technical / White Paper

- Bakery solves bread resilience problem with Ultra Fresh® Premium 330i Corbion | Download Case Study

- Enhance Food Safety with the Interceptor DF Fortress Technology, Inc. | Watch Product Presentation

- GET GREEN FASTER: Low-CI Dextrose/Glucose Syrups Green Plains Inc. | Download Data Sheet

On-demand webinars

- Is clean label still trending? Webinar

- Free-From Webinar

- Food for Kids Webinar

- Personalised Nutrition: Tapping into data for healthier diets Webinar

- Food as Medicine Webinar

- Plant-based under the Microscope Webinar

Promotional Features

BakeryandSnacks

- Advertise with us

- Apply to reuse our content

- Press Releases – Guidelines

- Contact the Editor

- Report a technical problem

- Why Register?

- Whitelist our newsletters

- Editorial calendar

- Expert Advisory Panel

Kellogg divests Russian operations to local snacks maker Chernogolovka

- Medium Text

Sign up here.

Reporting by Granth Vanaik and Deborah Sophia; Editing by Shounak Dasgupta

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Gucci-owner kering posts 10% drop in q1 sales on sluggish chinese demand.

French luxury group Kering reported a 10% drop in first-quarter sales on Tuesday, dragged down by a slowdown at its star label Gucci, which suffered from weakness in Asia while undergoing a design overhaul.

- FLW Value Calculator

- The FLW Standard

Case Studies

- Tools & Resources

- The Food Waste Atlas

- News & Updates

- About the FLW Protocol

Kellogg Company: Food Waste in Global Manufacturing Operations

Posted on September 13, 2017 - Manufacturing

ABOUT KELLOGG COMPANY

At Kellogg Company, we are driven to enrich and delight the world through foods and brands that matter. Kellogg is the world’s leading cereal company; second-largest producer of cookies and crackers; a leading producer of savory snacks; and a leading North American frozen foods company. Kellogg is a member of the World Business Council for Sustainable Development (WBCSD), part of the United Nations (UN) Global Compact, and is incorporating the UN Sustainable Development Goals (SDGs) in all that we do. Corporate Responsibility is part of our essence, instilled more than a century ago by our company’s founder W.K. Kellogg.

WHY IS KELLOGG COMPANY MEASURING FOOD LOSS AND WASTE (FLW)?

As a global food company, we believe we have a significant role to play in helping end hunger, achieve food security, improve nutrition, and promote sustainable agriculture (UN SDG 2). We will do our part to halve per capita global food waste at the retail and consumer level and to reduce food losses along the production and supply chains, including post-harvest losses, by 2030 (UN SDG 12.3).

To support these efforts, Kellogg was one of the first U.S.-based companies to join Champions 12.3 and to become a U.S. Food Loss and Waste 2030 Champion. Kellogg also co-leads the climate-smart agriculture project of the WBCSD and supports its Statement of Ambition, which includes making 50 percent more food available and strengthening the climate resilience of food communities. See our Food Waste Position Statement for more information.

During our first generation of sustainability commitments from 2005 to 2016, Kellogg significantly reduced waste (of all types) sent to landfill. In late 2016, we set a new 2020 goal to reduce total waste generated by our plants. Food waste represents the largest component of our waste stream and therefore the greatest opportunity for reduction. We estimate that reducing food waste within our facilities represents approximately $30 million in potential cost savings, based on the cost of raw materials, confirming the clear financial benefit of measuring (and reducing) food loss and waste.

We believe leftover or unwanted materials should be viewed as valuable assets rather than “waste” and sent to landfill as a last resort. Our ultimate goal is therefore to prevent food from being wasted in the first place and that any edible surplus food is donated to people in need. In cases where this is not appropriate, we send it to be used as animal feed. We follow the U.S. EPA Food Recovery Hierarchy, sending to landfill only as a last resort when there are no other viable options.

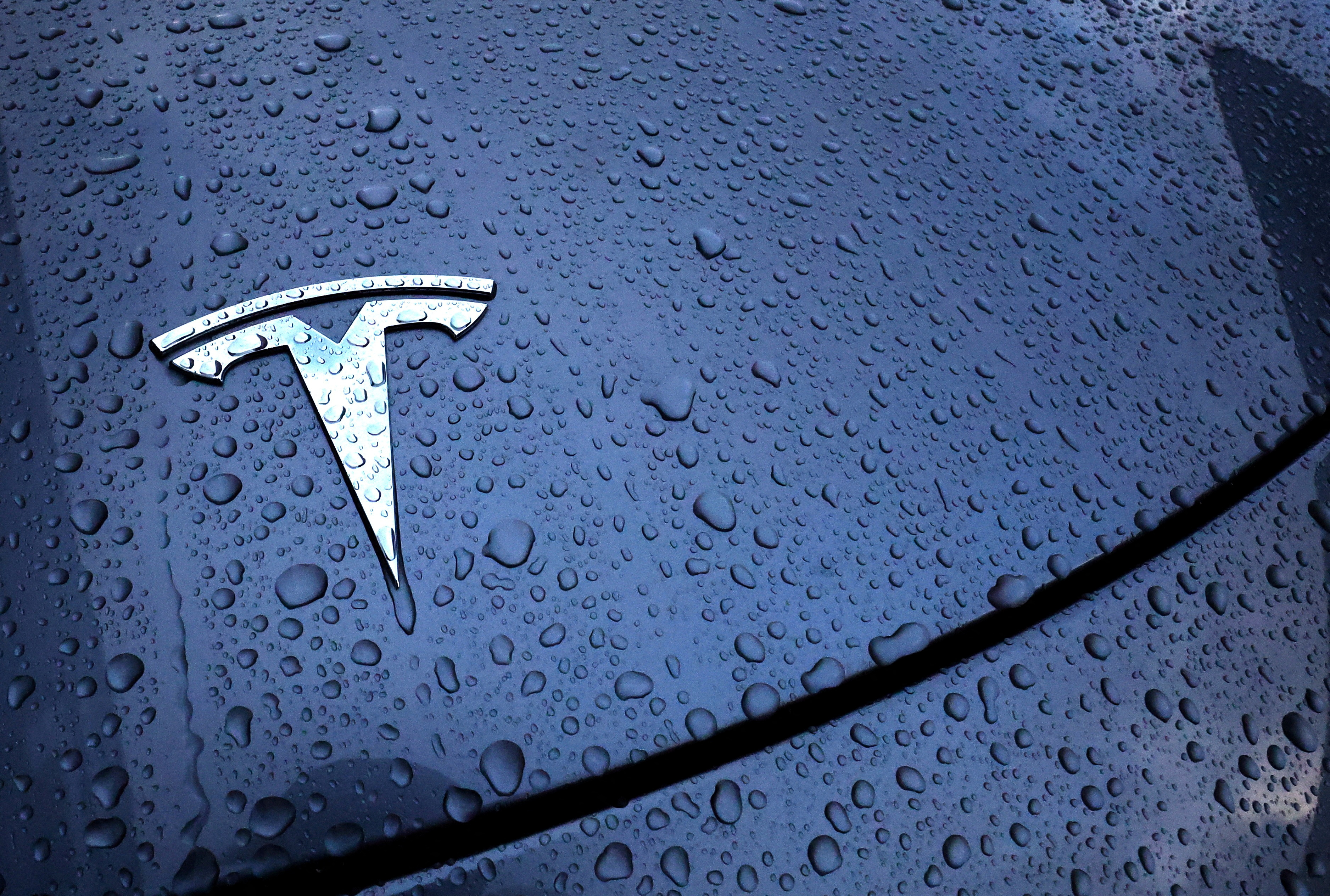

WHAT HAS BEEN YOUR EXPERIENCE WITH USING THE FLW STANDARD ?

We have found the FLW Standard to be very helpful because it provides consistent language to use when talking about food waste and standard ways to measure and report. We used the FLW Standard to report our 2016 food waste by destination in our Corporate Responsibility Report (see page 25). This 2016 data will serve as the baseline against which we will continue to report.

The table below shows how we meet the requirements of the FLW Standard . Additional information about our food loss and waste reporting methodology and its alignment with the standard is provided below and shared on our website .

WHAT CHALLENGES IN MEASURING FOOD LOSS AND WASTE HAVE YOU ENCOUNTERED AND HOW DID YOU OVERCOME THEM?

In 2015, we used the draft FLW Standard to expand our tracking of measurable food waste to eight destinations outlined by the standard, including animal feed, biobased materials/biochemical processing, codigestion/anaerobic digestion, composting, controlled combustion (incineration), land application, landfill, and sewer/wastewater treatment.

Our first challenge was to identify which Kellogg facilities needed new ways to record food waste data in our internal tracking system and to split apart food waste that was previously being reported in a combined fashion. For example, a facility may have been reporting total waste incinerated for many years, but we were now asking it to report food waste incinerated separate from general waste incinerated.

Our second and biggest challenge has been estimating food waste sent to certain destinations, especially for sewer/wastewater treatment. We were able to use the concentration of our effluent at certain facilities using suspended solids, biological oxygen demand (BOD), and chemical oxygen demand (COD) to estimate the amount of food present in our effluent. We then extrapolated this to all of our global facilities based on effluent volumes and the types of products made at each location. Additional details are provided in the Methodology section.

WHAT ACTION HAS KELLOGG COMPANY TAKEN AS A RESULT OF MEASURING ITS FOOD LOSS AND WASTE?

We have been measuring our waste since 2005 and are working to meet our commitments to also reduce food waste in three important ways:

- FARMS: Working to eliminate post-harvest loss so that more of the food which is grown is consumed.

We are working with partners to develop and promote post-harvest loss reduction practices in major ingredients relevant to Kellogg by developing sustainable agriculture programs with smallholder farmers in India, Bangladesh, South Africa, Thailand, Philippines, and other countries that promote and improve post-harvest loss reduction. Please see our Corporate Responsibility Report for additional details.

- MAKING OUR FOOD: Working to eliminate food waste in our processes, capturing it instead to feed people in need, and when that use is not appropriate, ensuring it is used for animal feed.

We are committed to reducing by 2020 total waste in our facilities by 15 percent per metric tonne of food produced. We set this target after achieving a 68 percent waste-to-landfill reduction from 2005 to 2016. In 2016, only approximately 1.5 percent of our food waste went to landfill, which is why we are focused on looking beyond “landfill diversion” to reduce in total the amount of food waste (as well as other materials). This moves our focus up the food recovery hierarchy toward elimination and reuse.

- REACHING OUT TO CONSUMERS: Working to standardize food date labels and educate consumers on whether food is safe to consume, as well as delivering tips and packaging innovation to help them reduce unnecessary food waste.

We are working with the industry to standardize food date labels that clearly communicate whether food is safe to consume, which helps consumers reduce their food waste. We are also increasing the use of resealable packaging in some of our cereals and granolas, snacks, and frozen foods to help further reduce consumer-level food waste.

- COMMUNITIES: Using our global signature cause platform Breakfasts for Better Days™ to assure our food also goes to help those in need due to either natural disasters or chronic hunger in communities around the world.

We are committed to fighting hunger and feeding potential through our global signature cause platform Breakfasts for Better Days™ with a goal to create 3 billion “Better Days” for people around the world by 2025. We are doing this in five ways: donating food to people in need, expanding kids’ breakfast programs, improving the livelihoods of farming families and communities, enabling our employees to be involved through volunteering events, and engaging citizens in the food security conversation, as well as other Breakfast for Better Days™ initiatives.

WHAT IS INCLUDED IN THE SCOPE OF THIS FLW INVENTORY?

The following figure visually represents the scope of Kellogg Company’s food waste inventory, using the FLW Standard . All destinations are included within the scope of this FLW inventory; however, food waste only goes to those destinations marked with a green check.

HOW DOES THIS INVENTORY MEET THE FLW STANDARD’S REQUIREMENTS?

The table below provides a summary of how this FLW inventory meets the eight reporting and accounting requirements contained in the FLW Standard.

ABOUT THE METHODOLOGY

About the authors.

This case study was submitted by Erin Augustine (Kellogg Company) with input and review by Liz Goodwin, Brian Lipinski, JP Leous, and Kai Robertson (representatives of WRI), as well as FLW Protocol Steering Committee representative Dalma Smogyi of the World Business Council for Sustainable Development.

ABOUT THE FOOD LOSS AND WASTE PROTOCOL

The Food Loss & Waste Protocol (FLW Protocol)—a multistakeholder partnership—has developed the global Food Loss and Waste Accounting and Reporting Standard for quantifying food and/or associated inedible parts removed from the food supply chain—commonly referred to as “food loss and waste” (FLW). World Resources Institute (WRI) serves as the FLW Protocol’s secretariat.

For questions, please contact [email protected].

Published: August 2017

Stay In Touch and Informed

Sign up to stay updated on the latest FLW news, case studies, tools, and training events.

- *First Name

- *Country Afghanistan Åland Islands Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia, Plurinational State of Bonaire, Sint Eustatius and Saba Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo, the Democratic Republic of the Cook Islands Costa Rica Côte d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Heard Island and McDonald Islands Holy See (Vatican City State) Honduras Hong Kong Hungary Iceland India Indonesia Iran, Islamic Republic of Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey Jordan Kazakhstan Kenya Kiribati Korea, Democratic People's Republic of Korea, Republic of Kuwait Kyrgyzstan Lao People's Democratic Republic Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macao Macedonia, the former Yugoslav Republic of Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia, Federated States of Moldova, Republic of Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestine, State of Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Poland Portugal Portugal Qatar Réunion Romania Russian Federation Rwanda Saint Barthélemy Saint Helena, Ascension and Tristan da Cunha Saint Kitts and Nevis Saint Lucia Saint Martin (French part) Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Maarten (Dutch part) Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia and the South Sandwich Islands South Sudan Spain Sri Lanka Sudan Suriname Svalbard and Jan Mayen Swaziland Sweden Switzerland Syrian Arab Republic Taiwan, Province of China Tajikistan Tanzania, United Republic of Thailand Timor-Leste Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States United States Minor Outlying Islands Uruguay Uzbekistan Vanuatu Venezuela, Bolivarian Republic of Viet Nam Virgin Islands, British Virgin Islands, U.S. Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe

Bold Next Steps

in october 2023, kellogg company finalized the separation of its north american cereal business, resulting in two independent, public companies – kellanova and wk kellogg co.

Looking for your favorite cereals?

Our cereals, our recipes, contact wk kellogg co.

Looking for your favorite snacks & foods?

Contact kellanova.

Privacy Notice

Accessibility, terms of use, do not sell or share my personal information, © 2023 wk kellogg co.

© 2023 Kellanova

Cookie preferences.

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

This docket was last retrieved on April 22, 2024. A more recent docket listing may be available from PACER .

Use the links below to access additional information about this case on the US Court's PACER system. A subscription to PACER is required.

Access this case on the New York Southern District Court's Electronic Court Filings (ECF) System

- Search for Party Aliases

- Associated Cases

- Case File Location

- Case Summary

- Docket Report

- History/Documents

- Related Transactions

- Check Status

Disclaimer: Justia Dockets & Filings provides public litigation records from the federal appellate and district courts. These filings and docket sheets should not be considered findings of fact or liability, nor do they necessarily reflect the view of Justia.

Why Is My Information Online?

Subscribe to Justia's Free Newsletters featuring summaries of federal and state court opinions .

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

IMAGES

COMMENTS

The Kellogg Company was founded in 1898 when founder W. K. Kellogg and his brother, Dr. John Harvey Kellogg, accidentally flaked wheat berry—a mistake that would result in the recipe for Kellogg's Corn Flakes. The company, which is headquartered in Battle Creek, Michigan, now operates in 180 countries, providing ready-to-eat cereals and other food products.

Kellogg Company (also known as Kellogg's) is a multinational food manufacturing company. Kellogg produces cereal and convenience foods, including cookies, breakfast cereals, frozen waffles, and vegetarian foods. ... Case Studies Supplier Engagement Case Study - H&M Group H&M Group is a global fashion and design company, present in 79 markets ...

Kellogg's is the world's largest cereal maker since 1906 and is located in the United States. Kellogg's products has become a part of the delicious mornings for the people around the world since a century. Its business is operated in two segments: Kellogg's North America and Kellogg's International. 66% of the revenue to the company ...

Customers — Likewise, the company's retail customers recognize the importance of ESG initiatives and are eager to partner on Better Days Promise. For example, Kellogg's collaborated with a retailer to launch Kellogg's InGrained™, a program that helps rice farmers reduce climate impact. Another retail partner, recognized Kellogg's ...

Case Study | Modern Workplace and PC Revive The Kellogg Company is a manufacturer and marketer of ready-to-eat cereals and convenience meals. Based across EMEA, US and Asia, Kellogg's products are manufactured in 18 countries and sold in over 180. The Kellogg Company wanted to transform their European business and introduce tools across

Abstract. With 33,000 employees and revenues of $13 billion in 2016, Kellogg Company was the world's largest producer of branded packaged cereal and a leader in branded convenience foods. Founded in 1906 and based in Michigan, the company had a proud history of product and marketing innovation starting with its first product, Kellogg's ...

Kellogg's subsequent expansion into Latin America, Europe, Asia Pacific, was a major milestone for the organization. This marked the point at which their program truly became global and allowed them to unite as one global company — Kellogg leaders and teams could finally publicly recognize one another, regardless of their location. With a ...

Hirst described the breadth of Kellogg Company's operations - producing 1,600 foods in 20 countries, which it markets in 180 countries. This breadth makes transparency hugely important. Hirst said: " Sustainability is no longer just about reducing your greenhouse emissions or energy footprint - it's your end-to-end supply chain.

Case tracker: Provides overview on case including industry, format, and concepts tested . 2 . Status bar: Includes ratings for quant intensity and structure (1 = lo, 10 = highest), as well as industry logo, case format, and concepts tested . 3 . Guide to interviewer: Contains the overview of the case and allows users to determine

This case study explores how the Kellogg Company committed to a 15% reduction in emissions (ton of CO2e per ton of food produced) by 2020 from a 2015 base-year (scopes 1 & 2). - reduce absolute value chain emissions by 20% from 2015-2030 (scope 3). - a long-term target of a 65% absolute reduction in emissions by 2050 from a 2015 base-year ...

In 1898, W. K. Kellogg and his brother Dr John Harvey Kellogg were trying to make granola. The attempt failed but resulted in them accidentally flaking wheat berry. W.K. kept experimenting until he successfully flaked corn, and created the delicious recipe for Kellogg's Corn Flakes. By 1906, W.K had opened the Battle Creek Toasted Corn Flake ...

A Case Study ABOUT KELLOGG COMPANY At Kellogg Company, we are driven to enrich and delight the world through foods and brands that matter. Kellogg is the world's leading cereal company; second-largest producer of cookies and crackers; a leading producer of savory snacks;

2023. Disney and the Big Business of Make-Believe: From Silent Movies to the Streaming Wars. Amanda Starc, Craig Garthwaite, Theo Anderson. More Cases. Kellogg School faculty is an esteemed group of scholars and practitioners, and members provide a rich source of international experience in professional management problems and practices.

Kellogg's subsequent expansion into Latin America, Europe . and Asia Pacific was a major milestone for the organisation. This marked the point at which their programme truly became global and allowed them to unite as one global company - Kellogg leaders and teams could finally publicly recognise one another, regardless of their location.

Kellogg's Entry in India. In the late 1980s, ready-to-eat cereal giant and market leader, Kellogg's had reached peak sales occupying a 40% market share in the US. The company had its presence in 18 countries and over 20 plants worldwide with annual sales of over $ 6 billion. However, in the 1990s, competition got tougher and Kellogg's ...

SRM aims to underpin growth at Kellogg. While Kellogg Company had had a supplier relationship management programme for more than 15 years, given marketplace changes and in the spirit of continuous improvement, we decided that we could drive greater end-to-end value through a broader supplier engagement and development approach.

"In 2015, Kellogg's announced plans to remove artificial colors and artificial flavors from their cereals by the end of 2018. It's now 2024 and Kellogg's still sells several cereals with artificial colors and flavors in America, all of which target young children," wrote Hari in the petition directed at the breakfast cereal giant.

Dec 22 (Reuters) - Kellogg Co (K.N) said on Thursday it has decided to divest its operations in Russia to local snacks and drinks maker Chernogolovka as the company joins a long list of Western ...

At Kellogg Company, we are driven to enrich and delight the world through foods and brands that matter. Kellogg is the world's leading cereal company; second-largest producer of cookies and crackers; a leading producer of savory snacks; and a leading North American frozen foods company. ... This case study was submitted by Erin Augustine ...

In October 2023, Kellogg Company finalized the separation of its North American cereal business, resulting in two independent, public companies - Kellanova and WK Kellogg Co. Looking for your favorite cereals? Visit WK Kellogg Co. Our Cereals Our Recipes Contact WK Kellogg Co.

Kellogg products are manufactured in 18 countries and marketed in over 180 countries. In 2012, Kellogg became the world's second-largest snack food company (after PepsiCo) by acquiring the Pringles potato crisps brand from Procter & Gamble. We spoke to Kellogg's Senior Sustainability Manager, Amy Braun, about Kellogg's science-based targets.

This bespoke self-climbing formwork system achieved an impressive maximum framing speed of six days per fl oor, with an average speed of seven days per fl oor. The 12 concrete columns and central core are supported by the 3.5-meter-thick raft over piled foundations. It took 48 hours to pour 8,000 cubic meters of concrete for the raft.

Landon Kellogg and Christi Kellogg: Defendant: Johnson & Johnson Consumer Inc. Case Number: 1:2024cv03043: Filed: April 22, 2024: Court: US District Court for the Southern District of New York: Nature of Suit: Personal Inj. Prod. Liability: Cause of Action: 28 U.S.C. § 1332 pl Diversity-Product Liability: Jury Demanded By: Plaintiff

This paper examines the history and social life of the underground public spaces in three Moscow Metro stations just north of Red Square and the Kremlin: Okhotny Ryad, Tverskaya, and Ploshchad Revolyutsii stations. Moscow's subway originated from two motivations: to improve the public transit system and to revitalize Moscow's centre instead ...