- Implementation

- Integration

- Optimization

- Wealth & Asset Management

- Banking and Credit Unions

- Consumer Goods and Retail

- Case Studies

A Customer Experience Case Study: Lemonade

RevOps , or revenue operations, is a strategy for businesses to align revenue-enhancing teams and activities while improving the customer journey. When discussing RevOps, the emphasis is usually on overcoming silos and having departments such as marketing, sales, and customer service working seamlessly. However, it's equally beneficial from the customer's point of view. The insurance company Lemonade is an instructive case study to illustrate best practices for optimizing the customer experience.

How Lemonade is Disrupting the Insurance Industry

Lemonade is an innovative insurance company, founded in 2015, that offers products such as homeowners, renters, life, and pet insurance. Lemonade has similar services as other insurance companies but has radically changed the customer experience. Here are some features that set Lemonade apart.

- • Strong branding. Lemonade has carved out a distinct niche for itself. Clearly targeted towards tech-savvy younger customers, it promises "Insurance built for the 21st century."

- • Personalized service. One of the qualities that distinguish Lemonade from other insurance companies is the level of personalized service. Maya, the company's chatbot, makes it easy for website visitors to get information and sign up. Maya takes visitors through a questionnaire that guides them to the most appropriate services and provides quick quotes. Another chatbot, named Jim, handles payouts.

- • Flat fee. Pricing is often confusing for insurance customers. Lemonade also appeals to millennials and other younger customers, who tend to have less experience with insurance policies. The company takes a flat fee of 20% from their customers' premiums, which is simple and straightforward. As they point out, their fee structure also eliminates a conflict of interest with customers. The flat rate, combined with their Giveback program (see below), means that Lemonade doesn't lose money by paying claims.

- • Giveback program. When customers sign up for insurance, they choose a nonprofit to support. At the end of the year, any unclaimed money from an account is donated to the nonprofit. Lemonade Giveback provides customers with the satisfaction that they're performing a social good, something that's extremely relevant to millennials. A Deloitte Global Millennial Survey revealed that 42% of millennials would start patronizing a business with a positive impact on society, while 38% would stop supporting a business with a negative impact.

A Data-Driven Approach

Source: Lemonade is disrupting insurance. The incumbents will have to respond Lemonade vs Traditional Insurance Companies: Customer Experience

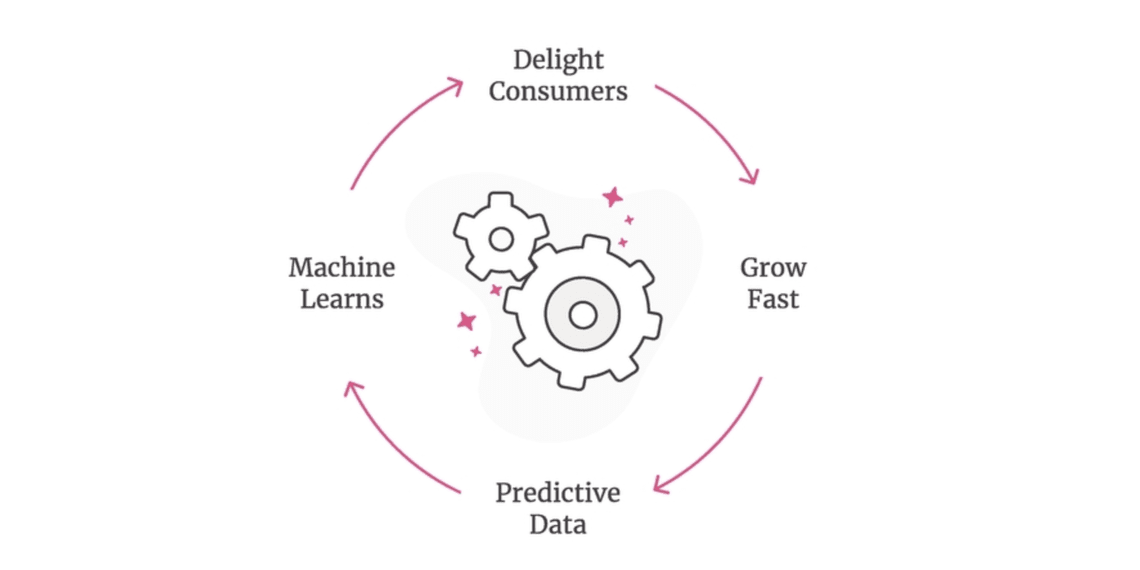

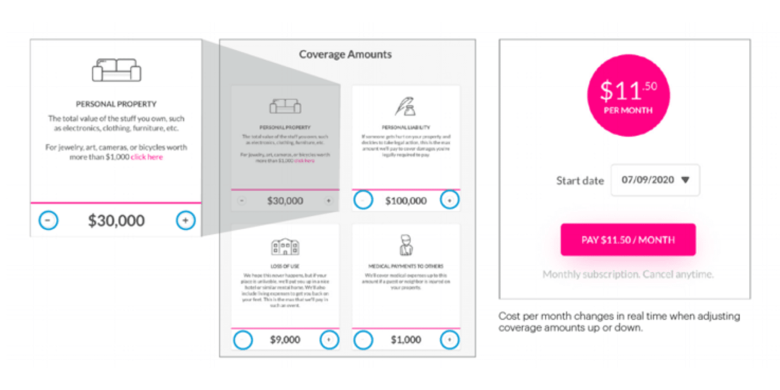

Lemonade claims that it collects 100x more data points per customer compared to other companies. In a blog post, Lemonade describes how collecting and studying data are helping to improve its loss ratio . This is the ratio of losses to premiums. As the article explains, a very high loss ratio isn't sustainable for an insurance company, while a very low one is profitable for the business but not good for customers. Lemonade's system of charging a flat rate and donating leftover funds to charity allows it to maintain a stable loss ratio.

One of Lemonade's taglines is to turn insurance "from a necessary evil to a social good." The Giveback program plays a big role in this. But what does this really mean for the average customer? Let's explore if (or how) the customer experience differs with Lemonade when compared to traditional insurance companies.

Do Everything Online

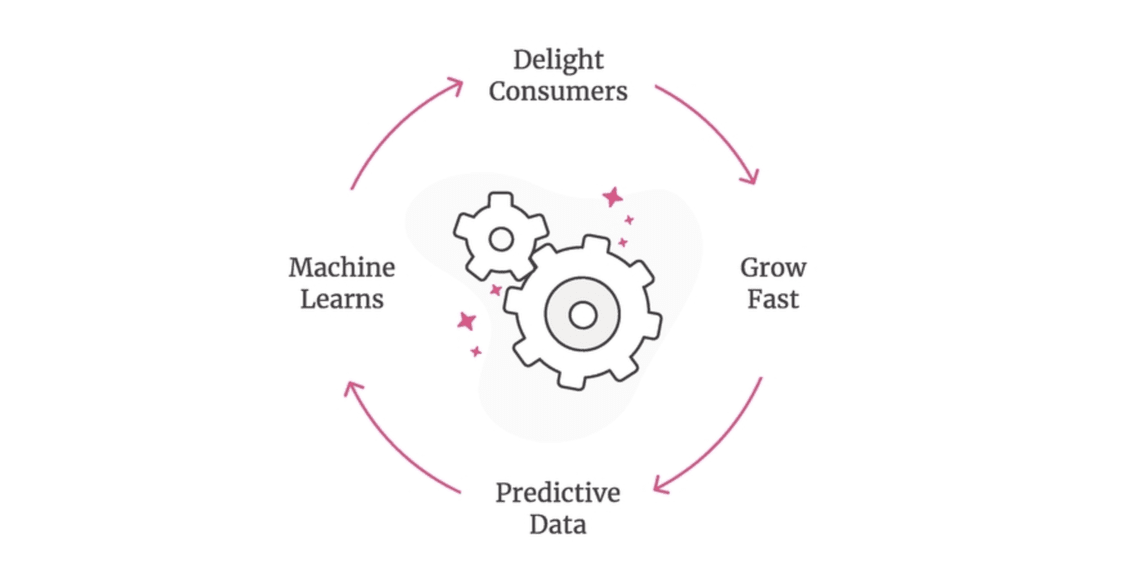

At a time when 73% of millennials prefer to shop online using their phones (the figures are 2x higher for Zoomers, or Generation Z), Lemonade has perfectly tapped into this target market. The traditional process for getting insurance information requires the user to contact an agent, fill out a form, and wait for a quote. With Lemonade, the process is streamlined to be much faster and more convenient. The system's built-in AI (Maya the chatbot) provides personalized service without the user having to talk to a live agent.

What really sets Lemonade's customer service apart is the way it seamlessly transitions customers from one function to another. A new user is presented with information tailored to their buyer persona as they see comparisons of data so they can choose the best service. They can just as easily access claims processing when needed. All of this is automated, without the need to wait on hold or fill out complicated forms.

For a thorough review of the UX advantages of Lemonade's landing page, see A UX Review of Lemonade Insurance in Less Than 5 Minutes .

Image Source: Lemonade

Fast Payments

Another distinctive customer experience feature of Lemonade is guaranteeing fast payments without any paperwork. As with the application process, customers can complete everything online. Claims are approved in seconds.

Easy to Switch

Lemonade targets customers who already have insurance as well as people buying it for the first time. Their "Check Prices and Switch" guides users through the process. As with other tasks on the site, Maya the chatbot guides users through a series of questions to highlight the advantages of switching to Lemonade.

Mobile Apps

Speed and convenience are supported by mobile apps that customers can download. Customers can set up and manage their policies on their mobile devices.

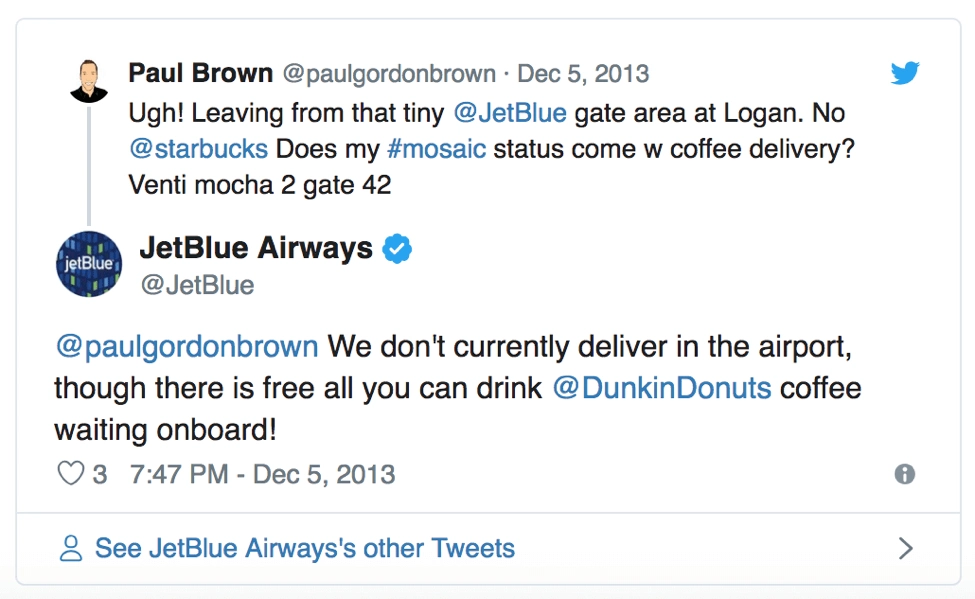

Active on Social Media

Another way Lemonade taps into its millennial customers is by providing news and policy information on social media. Their twitter account is frequently updated. They're also active on Facebook and Instagram. Social posts aren't simply ads for insurance, but links to news items and timely blog posts.

Lemonade posts stories that are educational and helpful to its audience. For example, a recent post addresses concerns that renters may have about eviction and suggests resources to help. This type of post isn't directly related to Lemonade's services, but it establishes them as a useful source of information.

What Lemonade Has Accomplished

Is Lemonade actually disrupting insurance and stealing customers from more established companies? The Motley Fool, in the article, Can Lemonade Disrupt the Insurance Market? shares some impressive facts.

- • While 50% of renters are under 30, only 37% get renter's insurance. Lemonade is targeting this largely untapped market.

- • Customers who signed up with Lemonade three years ago have increased their spending on renter's insurance by 56%.

- • Between 2017 and 2019, Lemonade increased the number of premiums sold from $9 million to $16 million.

While the article goes on to question whether Lemonade can succeed at converting older and more affluent customers, in our opinion this innovative model will prove to be a clear competitive advantage for Lemonade.

Lessons From Lemonade

Here are some lessons that businesses in any sector can take from Lemonade.

- • Long-standing products and services can be marketed in a new and fresh way.

- • Target specific demographics (e.g. Lemonade targets millennials and renters).

- • Today's customers appreciate speed and efficiency.

- • Provide simple and personalized services. AI tools such as chatbots can help improve the customer experience.

- • Use automation tools to collect and analyze data.

Related Blog

Case Study: FinServ Company Increased Sales Effectiveness

A Customer Experience Case Study: Wealthsimple

Case Study: ShipHero Scales with Learners.ai

to receive more sales insights, analysis, and perspectives from Learners.ai

The growth engine: Superior customer experience in insurance

The difference between great and poor customer service has always been clear, and businesses on the wrong end of this spectrum usually pay a price. This is as true for insurance as it is for any other customer-facing business. Today, the consequences of subpar service are amplified by the speed and reach of social media. One poorly handled claim, one mistake captured on a smart phone, can escalate quickly into a brand-damaging crisis. This is just one reason firms across all industries should increase their focus on providing great customer experience.

Providing a strong customer experience is not just about reducing the risk of customer service mishaps. It is increasingly a way for companies in competitive markets to distinguish their brands. The airline industry is a good point of comparison with insurance. Both are highly regulated and highly competitive, and carriers in both industries find it increasingly difficult to differentiate their products without lowering prices. Airlines all use the same planes, serve similar food, and match prices. Personal lines insurance is becoming similarly transparent. Due to the Internet, aggregators, and social media, shoppers know more than ever about coverage, prices, and services.

China insurance: How insurers can improve customer experience where it matters

A number of airlines now see customer service as one of the few remaining ways to stand out from the crowd and are reaping the benefits. The three US airlines with the highest customer satisfaction ratings have profits that are way above the industry average. Another major carrier is raising prices—moderately—on the expectation that customers will pay more for great on-time stats and more reliable baggage-handling.

Can insurers follow this example and avoid competing on price until profits are shaved to zero? McKinsey’s global research across industries shows that improving the customer experience can do far more to drive profitable growth than raising advertising spending or lowering prices. Some executives may still see insurance as a low-engagement, disintermediated category, but analytics prove that in an industry where profits are highly concentrated, leading carriers are delivering customer experiences that inspire loyalty and attract new customers frustrated by their experiences with their current carriers.

For example, in the past five years, US auto insurance carriers that have provided customers with consistently best-in-class experiences have generated two to four times more growth in new business and about 30 percent higher profitability than firms with an inconsistent customer focus, in part because satisfied customers are 80 percent more likely to renew their policies than unsatisfied customers (Exhibit 1).

On the path to profitable growth

Delivering a superior customer experience takes more than developing a mobile app or adding call center staff. It requires significant investments, relentless improvements, and collaboration across customer channels and business functions, from distribution and underwriting to claims handling.

Many insurers look at each customer touchpoint, from visiting the website to calling an agent, as a discrete event. But customers see those events as steps in a single journey to meet an important need, such as protecting themselves and their families or recovering from an accident.

Improving customer satisfaction can be an engine of profitable growth, but it demands a common vision and new levels of coordination across historically strong organizational silos. Establishing cross-functional, multichannel customer experiences should be a CEO and board-level priority.

In this context, digital tools are unlocking new opportunities for insurers. For example, since more than 80 percent of shoppers now touch a digital channel at least once throughout their shopping journey, carriers can find new ways to engage customers efficiently and effectively with personalized messages, and improve speed, service, and consistency to raise satisfaction.

A number of commercial lines carriers are using digital tools to improve journeys. Many commercial insurance buyers value online interfaces with self-service features and the ability to track the status of interactions in real time instead of having to make inquiries by phone, email, or through their brokers.

Advances like these require coordinating multichannel interactions with an overarching view of business value. Quick, cosmetic fixes are likely to fall short, while costly changes do not always deliver strong returns. One carrier spent a significant sum upgrading its telephone system to reduce the average wait time from 40 to 20 seconds, but barely improved its customer feedback. Another touted its “superior service” in a national ad campaign—and saw an immediate decline in its customer satisfaction scores, perhaps because reality did not live up to higher expectations. Delivering a superior customer experience depends on the full range of pricing, products, and services.

Barriers to superior customer experience

The main reason so many companies fail to improve customer journeys is that understanding what customers value is not an easy task. Identifying what drives customer satisfaction and translating it into operational performance improvements requires deep customer insights, solid analytics, and modeling the most important customer journeys, with cross-functional ownership and multichannel, end-to-end management.

A typical insurance carrier today delivers customer experiences via separate functions (marketing, distribution, underwriting, claims), using a website, sales call center, service department, and so on, most managed by different executives with different goals and metrics. This structure may have its purposes, but it overlooks the fact that from the customer perspective, the experience is often a single journey. Customers are unlikely to draw a sharp distinction between an agent and a claims adjuster—both represent the insurer in the event of an accident.

Would you like to learn more about our Financial Services Practice ?

So how can insurers overcome these barriers and deliver exceptional customer experiences? The first step is to align on what type of experience they want to deliver. Experts disagree on some fundamental elements of this issue. Some believe that fewer customer touchpoints are better, 1 1. “The Effortless Experience: Conquering the New Battleground for Customer Loyalty,” Rick Delisi, Matthew Dixon, Nick Toman; Penguin. while others say more interactions create more opportunities to add value and build loyalty.

Both can be correct, of course, depending on particular customer segments and the specific journeys they are on. Customers with more complex insurance needs might want a higher-touch approach during sales and onboarding, for example, while younger customers might prefer digital-only, self-driven experiences that include advice but remain non-intrusive and available on demand. Also, the more value there is at stake in a claim, the more time customers are willing to spend in live interactions during the first notice of loss. For example, many carriers overlook the fact that speed of resolution is as important as employees’ courtesy, empathy, knowledge, and professionalism. In McKinsey’s research into repairable auto claims in the US, five qualities were key to driving customer satisfaction:

employee courtesy

ease of communicating with the insurer

employee knowledge and professionalism

transparency and ease of the process

the speed of the claim settlement

In a finding that may surprise industry executives, settlement amount ranked only 12th, behind ease of tracking claim status and flexibility in scheduling the appraisal. In other words, most of the policyholders surveyed cared more about service than payment, especially when the claim size was relatively small.

Transforming the customer experience in insurance

Understanding what customers want is paramount in building a better customer experience. But real transformations are achieved when carriers take a comprehensive approach to customer journeys and how their organization works.

Only a holistic process can deliver tangible and sustained improvements. There are four core elements to a successful approach to excellence in customer experience: inspiration, insights, improvements, and institutionalization.

Inspiration: Create a comprehensive vision for a customer-centric business and operating model with clear targets.

Insights: Develop customer insights and link customer satisfaction to operational key performance indicators and business impact (such as churn and cross-selling).

Improvement: Radically redesign customer journeys from start to finish, using digital elements as the standard.

Institutionalization: Build customer-centricity into the organization, changing culture and processes from the front line to the C-suite.

Each element can yield a better experience, but the full impact is seen only when the four are pulled together. For example, making improvements without insights can mean allocating resources to features that customers deem unimportant. Vision without institutionalization may mean missing objectives, because change did not stick with the front line.

Inspiration

A customer-centric transformation begins with an overarching vision exemplified by senior leaders and modeled throughout the organization. CEOs listening in to live call center phone calls or serving coffee to their customers are nice, powerful touches. But the real value of a customer-centric culture is unlocked when employees rally behind a common purpose that drives them to go beyond their regular standard of work.

Customer-centric organizations go the extra mile, demonstrating that customer satisfaction is not just a metric on a dashboard but an inspiration. One global bank improved new product sales and cross-sell numbers and raised consumer and small business customer satisfaction scores, by rewarding branch employees for being friendly, valuing customers’ time, knowing the details of their business with the bank, and making sure customers’ needs were met before concluding transactions.

Measurements are important, of course, and each function may pursue different objectives (e.g., avoiding errors to reduce cancelations, maximizing ease of doing business for brokers and agents), yet each objective must be consistent with the brand promise and tangible across all functions.

Improvements in customer experience result from a clear understanding of customer needs and their implications from an operational standpoint. Most customer-centric processes also improve efficiency, but large investment decisions demand a clear articulation of costs and benefits, such as how much value an innovation adds from the customer’s point of view and how much of a competitive edge it provides. In other words, customer satisfaction initiatives should be grounded in facts, not gut feelings. Many companies typically rely on two tools to assess customer satisfaction, both with shortcomings:

Top-down metrics: All insurers periodically measure customer satisfaction. Many do so on a differentiated basis—by division, for example. Those may be good starting points, but they rarely provide clear indications as to where and how to make improvements. Customer satisfaction scores need to be linked to operational metrics and economic value to highlight how to address customer needs. Likewise, recommendation scores may not reflect true customer satisfaction. In some industries, improving the customer rating may barely increase the likelihood of renewing a subscription or buying a new product, while in insurance, a similar jump can be a differentiator.

Internal surveys: Surveying internal leaders is a good way to generate ideas for improvements, but these leaders tend to focus on technical shortcomings and may not rank other nuances in interactions the way customers do.

Increasing customer satisfaction goes hand-in-hand with operationally relevant customer intelligence. For example, market research needs to reveal not just customers’ satisfaction with individual touchpoints, but also the overall drivers of satisfaction, including brand, product, price, and service, and how they contribute to business success, including policy renewal and cross-selling.

Research should determine which operational drivers and expected service levels lead to satisfaction in each journey (Exhibit 3). This type of research helps carriers understand which journeys and drivers are truly important for customers but still unsatisfactory, and what service levels customers expect, making it possible to quantify acceptable waiting times in the call center, for example. This level of detail helps carriers avoid investing in areas that would not differentiate them from the competition.

Insurers can also gain valuable insights—and avoid trying to solve the wrong problems—by comparing how customers describe their experiences with actual company data. In other words, if customer complaints about long call-center wait times do not match reality, then the problem might have more to do with communication and not necessarily be solved by adding call center staff. Repeating this kind of research pragmatically but on a regular basis can shed light on changing customer expectations and point out opportunities to improve journeys.

Improvement

Insights from research help insurers decide where to invest, but effectively redesigning customer journeys also requires discipline. Journeys can be optimized according to a five step structure. An effective process usually requires a cross-functional team with members from sales, operations, IT, and other areas:

Step 1 —Break down the journey using customer perspective as a central focus.

Step 2 —Map the journey against current internal operations.

Step 3 —Call out the “wow moments” and pain points, such as unnecessary wait times or delays in communication.

Step 4 —Prioritize pain points based on what matters most to customers.

Step 5 — Radically redesign the journey to address the pain points and focus on customer needs.

The first step is often the most difficult—bringing customers into the room with the team to reveal what their real emotional journey looks like and rapidly testing ideas for improvement before taking them too far. Analogously, digital tools now support much faster prototyping cycles, which accelerate the time to market and improve the carrier’s ability to keep tailoring the customer experience. Embedding behavioral research can also reveal which types of interactions customers prefer and how best to influence behavior.

The key to growth in US life insurance

Improvements must be seen as a continuous process. Carriers should plan for successive rounds of innovation, especially in digital, where expectations rise rapidly. All changes should be tested quickly with real customers, and not every lever must be in place before testing begins: they can be piloted and implemented in stages, and many incremental improvements are possible without lengthy preparations or IT infrastructure overhauls.

Institutionalization

Sustained improvements in customer satisfaction are possible only if the entire company—from top executives to the front line—is aligned around the effort and the rollout is rapid. McKinsey has found that five best practices increase the chances of success:

strong executive ownership and a clear mandate for cross-functional journey owners to drive change across the organization

central measurement architecture that continuously reports customer intelligence to the relevant operational KPIs, allowing feedback and improvement

lean management practices with regular performance dialogues about customer satisfaction between top management and operational leaders

proactive change management with compelling “change stories,” recognition from top management, regular interaction with real customers to gather feedback, and new approaches to attracting customer-centric talent

training to give employees new skills, and “navigators” and “champions” to carry the change to individual departments and make it stick

Many companies do well by starting with one or two small, rapid pilots to demonstrate impact and generate knowledge. They then use the momentum to scale up the improvements across the company, rolling out three or four customer journey categories at a time, with organizational owners for each. A strong central team uses a standardized methodology and identifies synergies between customer journeys, such as in service and claims call centers, and identifies the skills required for success in individual areas. Every team has clear objectives in terms of customer satisfaction with regard to the best competitor. Recruiting profiles and human resources policies are aligned with the new way of working.

Taking action

Insurers need to invest human and financial resources in customer-centricity to build and maintain a competitive edge. Best-in-class players have already made some of these investments and are reaping cascading benefits.

For example, a large carrier aiming to redesign its auto claims processes set out to reduce call center waiting time. However, using a consistent journey methodology and insights from measurement, they found that waiting time was not a major pain point for the customer. Changing call center routing to ensure a single point of contact for the customer mattered much more, especially when severe accidents occurred. An agile, cross-functional team redesigned the claims journey and tested it quickly, demonstrating significant impact: customer satisfaction improved by 50 percent and call center inquiries (follow-ups) fell by over 80 percent—with no additional net cost.

Another large incumbent aimed to radically redesign its claims process from the customer perspective, relying heavily on digital to dramatically improve delivery. The company provided customers with an app to allow them to make self-service remote damage assessments. It also offered customers a digital connection to the repair network that included rules-based prioritization to guide customers to the shops closest to their work or office location. In addition to a positive impact on the customer experience, the efficiency gains yielded almost 30 percent savings, not to mention the potential improvement in loss ratio due to greater accuracy (Exhibit 4).

The opportunities for insurers to differentiate themselves through stronger customer experience are huge and growing. The fundamental challenge many companies face is getting the organization moving. There is no time to wait. In the digital era, consumer power is rising. Carriers that cling to product-, function-, or channel-centric views risk falling behind as market leaders build deeper relationships with customers and capture ever-larger shares of the market.

For carriers with the resolve to see their business through the eyes of the customer, each interaction becomes a way to live up to their brand promise; functions come together in new ways across customer journeys; and technology and digital become accelerators.

Transforming any large organization is difficult, of course, but the value at stake is significant. The adage is still valid: “You don’t earn loyalty in a day. You earn loyalty day by day.”

Download the PDF of this report here (PDF–344KB).

For the European version of this report, see The growth engine: Superior customer experience in insurance (PDF–316KB).

Tanguy Catlin is a principal in McKinsey’s Boston office, Ewan Duncan is a director in the Seattle office, Harald Fanderl is a principal in the Munich office, and Johannes-Tobias Lorenz is a director in the Düsseldorf office.

The authors wish to thank Simone Gammeri, Sascha Lehmann, and Philipp Schaumburg for their contributions to this article.

Explore a career with us

Related articles.

The key to growth in US life insurance: Focus on the customer

Small commercial insurance: A bright spot in the US property-casualty market

Transforming into an analytics-driven insurance carrier

Brought to you by:

Lemonade: Delighting Insurance Customers with AI and Behavioural Economics - A Disruptive InsurTech Business Model for Outstanding Customer Experience and Cost-Effective Service Excellence

By: Wolfgang Ulaga, Ziv Carmon, Laura Heely

This case explores InsurTech start-up Lemonade's disruptive new business model aimed at creating and delivering a 'shockingly great user experience' around a 'lovable brand' - in an industry plagued…

- Length: 12 page(s)

- Publication Date: Jul 1, 2020

- Discipline: Marketing

- Product #: IN1673-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

This case explores InsurTech start-up Lemonade's disruptive new business model aimed at creating and delivering a 'shockingly great user experience' around a 'lovable brand' - in an industry plagued by low customer satisfaction. The digital disruptor leverages principles of behavioural economics to address conflicts of interest and mistrust which prevail in the existing industry. It uses digital technologies to automate, accelerate and manage an impressive amount of work - with few employees - thereby reducings customer effort and , increasing customer satisfaction to achieve cost-effective service excellence. The effortless experience is aggressively priced and relies on a flexible subscription-based pricing model. Artificial intelligence (AI), data and machine learning are key in the race to achieving data parity with incumbents. The case culminates in Lemonade's filing for an initial public offering (IPO) and asks where growth should come from next: incremental improvements, further expansion across the United States, global expansion beyond Germany and the Netherlands, or from new types of property.

Learning Objectives

This versatile case allows students to explore how digital disruption is impacting the insurance industry and understand the digital transformation of the customer experience (CX). They deep dive into the key building blocks and performance metrics of Lemonade's innovative business model, with a special emphasis on AI, data and machine learning. It allows a discussion of how principles of behavioural economics come to life in an insurance setting and beyond, and demonstrates a hands-on approach to the design of the CX and customer-journey mapping in a digital context, such as job-to-be-done analyses, means-end laddering, and service blueprinting.

Jul 1, 2020 (Revised: Feb 27, 2023)

Discipline:

Industries:

Insurance industry

IN1673-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

5 Customer Service Best Practices in the Insurance Industry

Author: Simon Black | Date: 02/02/2024

While outstanding customer service is a key ingredient of success in any line of business, there are some industries where the stakes are especially high — and insurance is a prime example.

In insurance, not only must customer support agents in the contact centre provide a professional, friendly, and timely service, they must also be proficient at dealing with the complexities of high-value claims processes, all while being aware of potentially fraudulent activities.

The impact of customer service on success in the insurance industry cannot be understated, especially considering:

- 96% of customers in a survey claimed that customer service was an important factor in their consumer decisions and brand loyalty.¹

- Satisfied customers are 80% more likely to renew their insurance policies.²

In this article, we’ll outline five insurance customer service best practices that can help you deliver outstanding support in your contact centre, ensuring that your customers stick around for the long term.

Ensure your agents care about high-quality service

While technology, tools, and processes all play a central role in delivering an outstanding service in the insurance sector, customer support is ultimately about people. Without the right customer service agents in place, you’ll struggle to deliver a service that meets your customers’ needs.

Customer support agents are a key link between your customer base and your business. In your customers’ eyes, they are your business — and the service they receive will have a direct impact on their opinion of your company as a whole. Hiring the right contact centre agents is a critical first step in ensuring high-quality service for your insurance customers, leading to:

- Improved customer satisfaction

- More loyal customers and higher retention rates

- A reputation as an insurance company that puts customers first

Effective recruitment often requires a good deal of time, resources, and money, but it’s a step you simply cannot afford to cut corners on. While this is true regardless of the industry you operate in, it is particularly important in an industry as complex and high-value as insurance.

Provide comprehensive training

If hiring the right agents is the first critical step, supporting them through comprehensive insurance training is the second. Without the latter, you’ll undo all your hard work in the former.

With most insurance contact centres experiencing high levels of agent churn, onboarding and up-skilling new agents is a constant challenge. With complex and detailed insurance processes, training new agents to the point where they can confidently and accurately deal with customer interactions can take weeks or even months, leading to resource challenges and reduced performance across the contact centre.

Effective onboarding and training should equip insurance contact centre agents with the ability to:

- Handle industry, policy, claims and company-specific queries, ensuring they have the knowledge to answer customer questions and solve issues

- Navigate the complexities of the insurance industry confidently

- Be able to navigate internal processes seamlessly even when handling challenging interactions

- Use various tech platforms and tools that work with the agent rather than against them

Without comprehensive training, agents easily become overwhelmed, resulting in poor service and dissatisfied customers. From the agents’ side, being ill-equipped for the job can be extremely stressful and demotivating, leading to higher turnover rates.

Training shouldn’t be seen as a one-off event as part of the onboarding process. Systems and process training should be balanced with soft skills learning and career development sessions. Agents will feel more engaged if they receive ongoing guidance and support that is tailored to their needs, allowing them to close skills gaps and improve on areas for development. This is particularly important in an industry like insurance, where adhering to regulatory compliance and risk management is crucial, but being able to engage contact centre agents is also a key factor in the success of the business and the customer experience.

Technology can play a key role here — not only in delivering training activities but also in supporting agents during interactions with customers. Take scripting, for example — a technology that directs agents through the customer conversation, allowing them to focus on one topic at a time.

Scripting not only allows agents to focus on delivering an outstanding service, it also minimises the need for formal training, acting instead as an in-work learning tool that guides them to become more proficient at their job.

Scripting can be tricky to get quite right. Here’s a blog on scripting best practices that could help give you that edge on your competitors.

Offer omnichannel support

With the need to balance adherence to complex process and regulatory requirements with delivering a memorable service, insurance companies that take a flexible, but efficient and technology driven customer-centric approach to customer services will gain an advantage over those that don’t. One example is offering omnichannel support.

We live in a world of choice, where customers can contact a business in multiple different ways, including:

- Over the phone.

- Live chat via a website.

- Social media and online community platforms.

- Self-help support via online forums, videos, etc.

Each mode of communication offers something different. Some customers feel comfortable using one mode but not another. In limiting your customer support to just one mode of communication, you force some customers to contact you in a way that is confusing, uncomfortable, or even impossible.

By taking an omnichannel approach to customer support in your insurance contact centre, you enable customers to choose what works for them, leading to:

- A more personalised customer service experience.

- Increased customer satisfaction and loyalty.

- Increased agent productivity — live chat can be conducted with multiple customers at once.

- Reduced overheads — some channels allow customers to resolve issues without talking directly to an agent, i.e. community forums or chatbots.

Again, technology has a key role to play in making omnichannel support work. The right software allows businesses to integrate different channels and legacy systems, uniting cross-channel data without disrupting the agent or customer experience.

Reveal the true voice of your customer – across 100% of interactions

See why industry leading Insurance firms are using speech analytics

Identify areas for improvement

Understanding performance, checking QA and identifying areas for improvement is critical to providing a consistently excellent standard of support. The insurance industry has to strike a balance between delivering a good experience, despite the difficult nature of the calls and aligning to QA expectations and guidance.

Insurance businesses operate in a highly regulated environment with constantly changing rules and guidance. Companies need to provide reassurance not just internally but also to customers and regulators that compliance is being monitored accurately and that immediate action can be taken where needed.

This means that many insurance QA teams spend the majority of their time analysing calls rather than being able to utilise their expertise to drive proactive improvements before they become large-scale issues. The good news is that modern technology is now making it easier than ever to assess QA, customer interactions and fine-tune performance.

With the right software, customer support managers and QA teams can ensure that 100% of customer-agent interactions are monitored and analysed, guiding better outcomes with the following functionality:

- Contact centre quality monitoring.

- Automatic alerts that flag when potential compliance breaches or fraud alerts are identified.

- Efficient dashboards that empower agents and leadership teams to make the right decisions.

Through industry-leading speech and voice analytics, insurance customer calls can be automatically transcribed and analysed to identify speech patterns, key words, and even the emotion and intent behind the language used.

This provides customer support managers with powerful insights relating not only to customer sentiment and agent performance but also to the wellbeing and mood of call centre staff. Ultimately, this helps to pinpoint areas of improvement and provide the right support at the right time — for both customers and agents.

Worried about call centre agent turnover? Check out our guide on ways you can reduce that and improve job satisfaction among your employees.

Deploy cutting-edge software

Technology is the driving force behind almost all of the best practices we’ve discussed in this article, with the latest platforms providing all the functionality you need to strengthen your customer service.

But in a market crowded with new technology and software, choosing the right platform can be a tricky decision. In an industry as complex and unique as insurance, it pays to choose a software provider that understands and caters to your specific needs.

The right software will enhance the customer journey, simplify internal processes, and provide powerful insights, allowing your customer support team to understand their performance and identify areas for improvement.

Beyond features, the right software provider will have provable experience helping customer support teams — and particularly those in the insurance industry — achieve better results.

Since deploying our AI-driven platform, one of our insurance contact centre clients not only reported an improvement in the customer journey and a dramatic reduction in call handling times but also found the agent churn rate decreased too. They were able to up-skill agents 70% faster than standard training methods as processes are held within the Awaken platform rather than having to train the agent on individual processes. Agents are taking an active role in call handling within a few days as opposed to a few weeks.

Take the first step to enhancing insurance customer service

At Awaken, we have a proven track record of supporting high-performance insurance contact centres and customer support teams. With decades of contact centre experience among our ranks, we designed our software to be flexible, powerful, and cost-effective.

Our AI-powered software streamlines support processes, provides unparalleled insights into performance, and helps you provide a superior experience for both customers and agents alike, with features like:

- Real-Time Agent Assist

- Real-Time Agent Guidance

- Conversational Analytics

We also understand the unique challenges that agents in insurance companies face — everything from high-stakes calls about complex insurance products, to regulatory compliance and fraud detection. That’s why we’ve built a system packed with features that help insurance providers deliver exceptional support.

If you’d like to see how Awaken could help enhance your customer service and simplify the insurance claims process, book a demo today.

- Why Customer Service is Important: 16 Data-Backed Facts to Know | HubSpot

- Analyzing Your Data to Improve Insurance Customer Experience | Aluance Digital Services

Customer Experience Strategy

Health Insurance from the Outside In

Through our Customer Experience Strategy Development Framework, we determined the most critical interactions, or “Moments of Truth,” customers have with their health insurance carrier. This new way of thinking informed us on how health plans fit into individual’s lives during stressful and emotional life changing events.

The end result was a Customer Experience Strategy that included tactical initiatives and a roadmap to deliver a simpler, more personalized customer experience.

This project has been so successful, people have gone, well, a little nutty. When our client was having a bad day, we left her a candy bar with a special note.

She said we made her day. That made ours .

Executive Summary

Andrew Reise Consulting was engaged by a large health plan to develop a Customer Experience strategy and roadmap for the Retail Under 65 segment. With the Affordable Care Act, the health insurance landscape is quickly evolving and becoming much more consumer centric as there is a shift from group plans to direct purchase plans. National individual membership is projected to grow from 15% to 29% by the year 2017. Our client wanted to use Customer Experience as a differentiator to compete in the new consumer-centric marketplace. The strategy was focused on first understanding the company brand promise and corporate strategy, and identifying customer needs and expectations through consumer research, data and voice of customer tools such as personas. We then determined the most critical interactions, or Moments of Truth, customers have with their health insurance carrier. The end result was a Customer Experience Strategy with recommendations, tactical initiatives, and a roadmap to deliver a simpler, more personalized customer experience resulting in happier customers, lower costs, and increased membership.

Business Challenge

The health insurance industry is rapidly transforming to sell to an individual market and will be more competitive than ever. Traditional models focused on group coverage will not work in this new landscape. Customer expectations are being set by other companies such as Amazon, Southwest Airlines, and Zappos, and health insurance is at the bottom of all industries in Customer Experience rankings. In addition, with federal, state and private exchanges coming online, plans will offer very similar benefit plans at the same price. More than ever, health plans must leverage their Brand and Customer Service focus to differentiate on this level playing field. Payers have a tremendous opportunity to not only make things better for their customers, but capture market share along the way. Designing the right experience can also lead to lower admin and medical costs. Transforming the enterprise to the consumer focus needed for success is a long, challenging journey, involving multiple partners in the ecosystem such as providers, brokers, and pharmacies. However, it is quickly becoming the new normal to compete in the new age of healthcare.

How Andrew Reise Helped

Andrew Reise was engaged to lead a cross functional team, in partnership with consumers at key points, to develop the strategy and roadmap. We focused on all aspects of the customer lifecycle, from the time consumers become aware of their insurance options and start shopping, through the time they make a purchase and start using their health insurance, to the time of possible departure. Andrew Reise used our Customer Experience Strategy Development Framework to facilitate the strategy development with the cross-functional team, looking outside in and putting the customer at center-stage.

Creating the Customer Experience Strategy

Andrew Reise worked with functional leaders across the enterprise, including representatives from Sales, Marketing, Web, Social, Customer Service, Operations and Market Research. Andrew Reise consultants facilitated multiple workshops and interviews with various subject matter experts and stakeholders. The work was broken down into the following areas.

1. North Star

It is our fundamental belief that the Customer Experience strategy must align with the corporate strategy and company’s brand promise. Executive interviews were conducted to understand the vision for the company, what is communicated internally to employees and what expectations are set with customers. A project mission statement was then developed to ensure alignment.

2. Customer Insights

In addition to analyzing existing industry and market research, we interviewed brokers, completed mystery shopping and conducted in-depth interviews with customers to better understand their needs, wants and expectations of a health insurance company. This provided consumer insights to guide our work and also highlighted the most critical customer touch points.

3. Customer Lifecycle Mapping (current state)

An end-to-end customer lifecycle (DISCOVER-SHOP-BUY-USE-DEPART) was developed to provide an outside-in perspective of current customer interactions with the company. This exercise identified existing pain points and opportunities including visiting the web site to get a quote, receiving an explanation of benefits and calling customer service about a claim. The result was a clear understanding of pain points and gaps in how they interact with customers today.

4. Moment of Truth

The next step was to identify which interactions were the most important to address first. The process of analyzing voice of customer data, talking to consumers, interviewing employees and documenting customer touch points allowed us to identify the most critical customer interactions, or Moments of Truth, that influence a customer’s decision to purchase, stay or leave. This allowed us to focus our attention in areas that will have the biggest impact from a customer and company perspective when making experience enhancements and recommendations.

5. Future State Ideation

We then had to come up with creative solutions to solve the pain points. A group of cross-industry experts, consumers and health plan SMEs were assembled to ideate new experience solutions for each Moment of Truth. Customer personas were used to look at each Moment of Truth from different consumer types and over 200 ideas were generated. Each participant voted on the best ideas, which were incorporated into the future experience design recommendations.

6. Strategic Themes

- Transform into a customer-centric organization

- Deliver at critical customer interaction points, or Moments of Truth

- Personalize and simplify the complex ecosystem

- Facilitate transition across channels

7. Strategic Initiatives

In order to make the customer experience strategy achievable, detailed tactical initiatives were identified, scored and prioritized based on benefit to company and customer. Some initiatives were quick hits, which could be implemented in less than 90 days, and others were longer term. Initiatives addressed foundational capabilities such as developing a customer-centric culture, establishing governance and creating a CX scorecard. Other initiatives focused heavily on delivering a seamless, simple experience for each Moment of Truth, and better understanding consumers in order to provide a more tailored, personalized approach across sales, marketing and service.

Read Our Latest Experience Insights

The Evolution of Contact Centers: Top Six Trends for 2024

Mastering Quality Management: Unlocking the Seven Domains of Excellence

Staffing and Operational Metrics: The Far-Reaching Impact of Quality Programs

Want to elevate your business' experiences.

Guide insurance customers to safety and well-being

Research report.

- Accenture's global Insurance Consumer Study provides a view of consumer preferences and trends in the insurance industry.

- We suggest a fresh look at how to meet the needs of generational segments, who have differing views on technology-enabled insurance services.

- Insurers can also offer usage- and behavior-based insurance to better personalize and target offerings, meeting consumer demand for better value.

- It's also time to re-evaluate the role of humans in insurers' digital ecosystems, to restore trust and better engage consumers.

The future of insurance

The future of insurance depends on exploring new models of doing business to ensure relevance. Business models that capitalize on the benefits technology can bring for insurers while meeting a changing set of consumer demands will help insurers not only to remain relevant, but to grow. A recent Accenture insurance survey of 47,810 respondents across 28 global markets points to three key areas where C-suite leaders can take action to address these insurance trends.

#1 Re-evaluate digital services with a generational lens

In our research, clear differences in generational appetites for digital offers emerged. Take a fresh look at your consumer digital strategy.

#2 Personalize consumer offers

Offer usage- and behavior-based insurance to better personalize and target offerings, meeting consumer demand for better value.

#3 Restore trust with digital and human interaction

The right human + machine mix restores consumer trust and better engages them.

Proactively rethinking their business helps insurers get closer to consumers as many show willingness to consider alternative distribution channels.

Addressing generational consumer differences

Technology is a lifeline to increasingly digital insurance consumer segments. COVID-19 accelerated the transition to digital in 2020 across all demographic groups. However, clear differences in generational appetites for digital offers emerged. Our research into insurance consumers revealed the following insights.

Millennial and younger consumers , age 18-34 express greater interest in digital offerings that help them make safer, healthier, and more sustainable choices. Insurers will need to work with ecosystem partners to create and participate in digital platform offerings that help them succeed with this segment. From fitness devices that track and encourage healthier habits, to companies that offer coaching in nutrition or stress reduction, insurers have a wealth of partners to choose from to help their customers. And with a growth of an additional $1.3 trillion in market value in global health and wellness by 2024, ecosystem investments are well worth it.

This same demographic (age 18-34) values sustainability. Insurers are already well positioned on this with 71% of Millennial and younger consumers saying they see their insurers delivering on ethical and sustainable business practices. More than two-thirds (67%) say they want digital experiences that encourage sustainable travel and shopping practices.

Consumers age 55+ are slowly becoming more comfortable with digital insurer interactions. They show increasing preference for digital claims, with 71% saying they would like the internet chat/video insurance claim process to replace the traditional in-office claim process—an increase of 3%.

Approximately 7 out of 10 (69%) consumers would share significant data on their health, exercise and driving habits in exchange for lower prices from their insurers, an increase of 19% from two years ago.

Offering personalized insurance per habits and usage

Consumers say they are more willing to offer personal data in exchange for more personalized pricing, offers, and discounts. They are increasingly demanding to be charged based on behavior and habits—and they’re willing to allow insurers to collect and use their data in exchange for that value. Consumers are being pragmatic and protective with their data, however. They say they will only share data for incentives; they show no increased willingness to share data without those incentives.

Approximately 7 out of 10 consumers (69%) would share significant data on their health, exercise and driving habits in exchange for lower prices from their insurers, an increase of 19% from two years ago. More consumers (66%) would also share significant data for personalized services to prevent injury and loss—up 54% from two years ago.

of consumers who can drive expect to drive less in the long-term than they did before the pandemic.

In the auto insurance space, consumers look for personalized offers in the form of usage-based or "pay-as-you-drive" auto insurance. Twenty-nine percent of consumers who can drive expect to drive less in the long-term than they did before the pandemic. They will expect their rates and plans to reflect their new habits.

Consumers are being pragmatic and protective with their data. They say they will share data for better value; they show no increased willingness to share data without an incentive.

Trust and engagement in a human + machine world

Achieving the right balance between digital and human interaction matters more than ever. For example, while consumers are interacting more and more in the digital realm, particularly during COVID-19, they still view human touchpoints as more trustworthy than digital touchpoints when they are in need. Almost half (49%) say they place a lot of trust in a human advisor in an office when making an insurance claim, while only 12% say the same of automated service over phone/web/email, and just 7% say the same of a chatbot.

Training and skilling an insurance workforce that works well with digital tools will be essential for success. Insurance can be an emotionally complex business for consumers—they need the freedom to choose methods of interaction most comfortable for them.

Of insurance consumers trust a human advisor when making a claim.

Of insurance consumers trust an automated phone/web/email service when making a claim.

Of insurance consumers trust a chatbot when making a claim.

Innovate for resilience and new insurance revenue

What matters to your insurance customer.

There’s no doubt that the effects of technology are disruptive. But insurers can harness that disruption to better connect with consumers for positive business impact.

New models of doing business that capitalize on how technology helps insurers meet changing consumer demands are essential. Consider with your team how those models may be applied based on your existing book of business and unique market positioning.

By focusing on the areas our research highlights as important for insurers’ growth and relevance, you can lead your team into the future of insurance now.

We're here to help.

SENIOR MANAGING DIRECTOR – GLOBAL INSURANCE LEAD

Managing Director – Insurance, Accenture Song

Todd Staehle is the Global Insurance Lead for Accenture Song. His role focuses on developing truly human customer experiences for insurance brands.

Intelligent underwriting

Fuel the future of insurance through technology

Insurance Technology Vision

Related capabilities, life insurance services, p&c insurance services.

A Major Health Insurance Company Builds Unified, Cross-Functional Teams Across Sales and Customer Service to Support Major Customer Accounts

A major southeastern U.S. health insurance company is on a mission to improve the health and well-being of citizens in their state and to be the model for transforming the health system through an unwavering commitment to quality, affordability, and exceptional experience. To reach those goals, they must reach more customers, provide them excellent customer experiences and deepen their relationships with more services.

- Build a unified cohesive “pod” – cross-functional teams that pull from sales, customer service and support functions to support major accounts

- Improve internal teamwork and collaboration

- Reduce silos and blame

- Improve internal and external service interactions

When the company reorganized part of its sales and customer service organizations into a new “pod” structure to support its largest, most strategic clients, the goals were to provide an excellent and cohesive customer experience, deepen internal and external partnerships, and boost sales. However, it was a challenge to get these cross-functional teams to work together as a cohesive, mutually supportive unit aligned behind shared objectives. People struggled to find their roles within the pods and to understand and support the roles of others. Team members continued to operate within silos when the organization needed them working shoulder-to-shoulder to advance excellent client engagements and mutually beneficial wins.

After experiencing an Integrity Service® workshop firsthand, a buying committee member recommended the program to help assist the teams in overcoming their challenges so they could realize the original goals of the reorganization. She built enthusiasm and buy-in for the solution through meetings and one-on-one discussions, gaining the support to pilot the program with two of the pods.

The change effort kicked off with pre-work for the teams followed by a half-day Integrity Service workshop facilitated by an Integrity Solutions master trainer. Over the next 7 weeks, the teams met with their managers and an Integrity Solutions facilitator in small groups for an hour to discuss the practical application of the Integrity Service skills and the impact those skills were having internally and externally. Each of these Zoom meetings focused on a particular subset of the skills, with prep work sent in advance. As opposed to the typical “role play” exercises found in other programs, these “real play” exercises allowed participants to work through actual issues and get immediate, tangible value from the experience.

The pod leaders and organizational development partners report that the Integrity Service implementation has already created value for the organization, including improving teamwork, collaboration and morale as well as enhancing sales success.

The project leaders highlight the phased learning and “real play” approach as key to the initiative’s impact. The weekly calls saw high engagement from participants and managers alike, and all found these calls to be extremely valuable.

Now that the Integrity Service skills are integral to the way the company does business, their teams are aligned behind a shared mindset that has bridged service and selling and is enabling them to deliver greater value to their customers. They attribute a number of positive results since the implementation to the new skills and attitudes developed through this initiative, including:

- increased customer retention

- expanded lines of coverage with existing accounts

- increased new business as a result of greater collaboration and creativity

- improved internal and external relationships

The company is in process of expanding Integrity Service to the other major accounts teams.

TESTIMONIALS

“Our customer service team has gone from siloed to unstoppable! Our people are excited to use the skills and tools from the program which have breathed new life into the team. Integrity Service has become an integral part of how we do business” – Client Success Lead

“We’re already seeing an impact in terms of building our business. It’s amazing and speaks volumes for the power of Integrity Service. We’re retaining customers more effectively and adding additional lines of coverage. This will help our business and I’m very excited about it.”

“Improvement have been seen both internally and externally. Their customers feel it, the same band is producing the sound. This process has sparked some creatively in the way that they are thinking about customers and presenting to them. They actually pull out the GVALHI card and walk through each step and describe how they used it to pitch different ideas to their clients. They ended up winning an important case, that was otherwise dead to us, because of that.”

“It’s a powerful process that generates results you can see right away. As the weeks went on, people applied the skills more and more, individual confidence improved and overall interactions became more productive and collegial. ”

Share This Post:

For more information about this Success Story Contact:

Patty Gaddis

Vice President, Client Development

- Case Studies

Insurance Client Managed Services – Case Study

The client is a large insurance provider of valuable insurance coverages and services to home and auto owners, as well as business owners.

Company Description

The client is a large insurance provider of valuable insurance coverages and services to home and auto owners, as well as business owners. Leveraging a large-scale internal and partially external-facing web application, they serve their customers daily with extensive functionality. To achieve other internal processes, they keep numerous background programs that shift data where it can be further harnessed and analyzed. This sophisticated infrastructure enables the client not only to efficiently manage policy issuance, claims processing, and customer interactions but also to extract valuable insights from the data generated. The integration of these background programs ensures a seamless flow of information, contributing to the client’s ability to make informed decisions, enhance operational efficiency, and ultimately provide top-notch services to their diverse customer base.

The client needed to revitalize their core application for their customers and employees to increase productivity. This required an additional effort from experts to learn their systems and maintain their current operations so they could execute this initiative separately.

Our challenge was to absorb as much knowledge of their architecture as possible to transform our team into mirrors of themselves. With so many applications, all with different purposes, grasping and orchestrating the workflows as naturally as the client was paramount. Full-scope awareness was needed to ensure there was minimal effort while delivering on requirements. The sooner we became familiar with the territory, the quicker we would ramp up to clockwork.

Project Goals

- Learn client systems and applications.

- Improve functionality to increase maintainability.

- Document processes to add learned insight.

- Remediate existing issues.

- Append necessary functionality of the client’s current application.

Our strategy we employed was to build a team that the client could recognize as their own and have that team engage with the business stake holders often to keep in parallel with their goals. One unit of the team is determined to keep the intricacies of the day-to-day business in motion; the other unit is to enhance their applications and ensure evolution of business needs are met with equal development. Like incremental code changes to steadily progress these systems, we continuously, sprint after sprint, learned new facets of their business which only added to our tooling and reasoning when approaching tasks whether it be support or development.

Innovations

As mentioned above, one of our goals was to improve upon maintainability. When approaching a series of work items, our team sought to create additions to the client’s codebase that emphasized scalability and removal of limitations. One such improvement was to implement a way to migrate several stored procedures and surrounding code to utilize new extended columns that not only fixed an impassable truncation issue but did so in the least invasive way possible.

In using feature flags, new stored procedures in parallel with old, and new columns we corrected a boundary that as the system grew the values of essential fields were being truncated for one of their lines of business.

Another accomplishment that gave the client’s userbase a useful feature was our team’s implementation of stored payment methods. Putting this in place meant end users could keep their preferred selections of payment method, adding convenience to transactions with the client.

Core Technologies

To accomplish our goals, we leveraged several technologies.

- ASP.NET Core

- ASP.NET Framework

- Classic ASP

- Azure Function Apps

Their core application, due to several years of life cycles, required all these technologies to work together in unison. Some portions such as the client-side were written in VB.NET and Classic ASP while the server-side portions consisted of C#, VB.NET which retrieved data through services referencing their DB2 mainframe and MS SQL databases.

Many times, solutioning a work item called upon a combination of these technologies, where modifications, such as updating a stored procedure, meant also adjusting the .NET code to accommodate the change and ensuring regressive testing was successful. This integrated approach ensured that changes in one aspect of the system were seamlessly reflected throughout, maintaining the overall integrity and functionality of the application. Collaborative problem-solving became a cornerstone of our workflow, as we adeptly navigated the intricate interdependencies between technologies, swiftly adapting to evolving project requirements. This holistic perspective not only streamlined our development process but also fortified the robustness of the entire system, contributing to the overall success of our projects.

Consisting of .NET full stack engineers, we all brought extensive experience to the equation. Though split into two units, each with its unique objectives, we seamlessly collaborated to provide a comprehensive and integrated solution, ensuring a wide coverage of value for the client. Our collective expertise in front-end and back-end development, database management, and system architecture allowed us to tackle diverse challenges efficiently. By fostering a culture of open communication and knowledge-sharing, we leveraged the strengths of each unit to create a cohesive and synergistic team. This collaborative approach not only enhanced our productivity but also enriched the final deliverables, demonstrating the effectiveness of a unified, multidisciplinary team in achieving client success.

Though important to keep in our purview, Primary Key Indicators (PKI) were metrics we assured through collaboration and improvisation. We applied Agile concepts and methodology to how we conducted our implementations. By always seeking ways to alleviate blockers and keep the team thriving, we kept the development momentum going and our metrics reflected this.

Our client saw a drastic reduction in ticket counts and corrections to issues that had long caused problems. No matter how small the incident was our team determined the root cause to eliminate future tickets. The more we resolved the more our service snowballed into streamlined support for their business which ultimately resulted not only in an unhindered effort towards their roadmap but also an ever-increasing, stabilizing set of applications left better than before.

In conclusion, this case study highlights the successful collaboration between our team and the insurance client, showcasing our commitment to delivering innovative solutions and exceptional service. Through a dedicated effort to absorb the intricacies of the client’s architecture, our team has effectively mirrored the client’s expertise, ensuring seamless delivery of services and support. This partnership demonstrates our ability to tackle complex challenges and deliver tangible results, reinforcing our position as a leader in providing top-tier managed services. We look forward to continuing our relationship with the client, driving further advancements, and contributing to their ongoing success in the dynamic insurance sector.

Get In Touch With Us

Would you like to discuss how Xorbix Technologies, Inc. can help with your enterprise IT needs.

Sora by OpenAI: Transforming Text into Video

OpenAI has introduced Sora, a tool that transforms text prompts into video content, much like its predecessor DALL-E but for moving images instead of static ones.

Informatica Migration for Big Data Workflows

Informatica, a leading data integration platform, has been a cornerstone for our client’s big data workflows.

OpenAI API Integration: A Complete Guide

OpenAI and ChatGPT have become widely recognized terms, captivating audiences globally with their applications in Artificial Intelligence.

One Inc ClaimsPay Integration

One Inc’s ClaimsPay integration is our major Midwest headquartered Insurance provider client’s ambitious electronic payment integration project.

Insurance Case Studies: The Ultimate Guide

How do you show your prospects exactly what your company can do for them? With a case study. Insurance case studies provide buyers with the solid facts, figures and performance examples they need to make a purchasing decision.

What Is a Case Study?

A case study is a powerful marketing tool that is often used in the middle or bottom of the sales funnel, to help buyers develop a preference for your offering. Case studies increase buying confidence and validate the buying decision. They prove that your product or service performs as promised.

Case studies change the conversation from telling to showing. Instead of just telling prospects how great your brand is, you can show prospects exactly what your brand is capable of achieving. This gives prospects a more concrete understanding of what to expect and enables them to step into the shoes of a satisfied customer.

The Elements of a Case Study

An effective case study contains key elements that align with the buyer’s journey:

- Who is the customer? If you don’t have permission to name the customer, describe the customer by industry, size and other relevant details.

- What problem were they trying to solve? When B2B buyers are shopping for a product, they’re trying to solve a specific problem. Identify this problem so other prospects with similar problems can relate. Sometimes, there’s more than one problem.

- What other solutions did they consider? B2B buyers usually consider multiple options before deciding. This is a key part of the process, and including the details can help emphasize why your company stood out.

- Why did they choose your solution? State exactly what your company offered that other competitors couldn’t.

- What was the implementation process like? Switching B2B vendors can be a major undertaking. Describe the process so your prospects will know what to expect. Of course, you want to put your company in a positive light and focus on the positives, but you can include hiccups that occurred in the process and how you handled them. Prospects know that things don’t always go perfectly according to plan, and this shows that you’re competent and able to overcome any barriers that arise.

- How has the company benefited? In the beginning of the case study, you described the client’s problem. Now touch back on this and show how the problem has been solved. Include specific information about how the company has benefited from your product or service. For example, how much time or money has the client saved? How are they better prepared? How have you helped increase their revenues?

- What are the key takeaways for others in a similar situation? Convince prospects that they should follow the client’s example and partner with your company. Summarize your argument with key takeaways from the case study.

Case Study Dos and Don’ts

To squeeze the most value from your case study, you need to follow some best practices.

- Don’t just list bulleted facts. You might be able to pull a list of bulleted facts from your case study to use in other types of content, such as social media posts, but your actual case study should be at least two pages long to tell the story in a meaningful way.

- Do use names. Your case study will carry a lot more weight if the featured customer is named. You can also use anonymous case studies, but they are not quite as credible.

- Do appeal to emotions. Think of your case study as a story. You’re showing your prospects what it’s like to work with your company, so you need to build a narrative. This is also a good place to build an emotional argument by showing how your company can help clients deal with pain points and reduce problems.

- Don’t make your case study longer than it needs to be. Your prospects are busy, and they probably won’t have time to read an overly verbose document. Provide enough information to create a compelling story, but don’t get bogged down with unnecessary details. An effective case study will often be around two pages.

- Do include quotes. You can say that your company is great, but it sounds more convincing if one of your customers says it. The featured customer may be willing to provide you with quotes and their logo to include in your case study. As a bonus, this is also free publicity for them.

- Do get permission. If you’re naming a customer, you will need to secure their permission and allow them the opportunity to review and approve the final piece before it is used. Be sure to save their written approval in case questions arise in the future.

Case Studies Should Be Part of Your Content Library

Creating a case study can take some time and effort, but they are worth it.

According to the 2022 Edelman Trust Barometer , 63% of people worry business leaders are trying to mislead people with false or exaggerated statements. If you just say that your company can help people solve their problems, your prospects might not believe you. You need to build credibility, and a case study that provides concrete examples can help.

A case study is also a fantastic way to differentiate yourself from your competition. As mentioned earlier, case studies are often used in more advanced stages of the customer journey, when prospects are already familiar with your company and need information that’s going to guide their purchasing decision. You want to create preference for your company so you can close the sale, and a case study can help you do that.

Your Case Study Can Convert Leads for Years

Some content has a short life, but not case studies. Although creating a case study will require some effort, once you have it, you can use it for as long as you continue to offer the featured products and services, and the featured company is still a customer.

- Feature your case study on your website. You can create a landing page for your case study or case studies so prospects can find them easily. They can be offered as instant downloads or you can generate leads by gating them with a form.

- Promote your case study in social media posts. Spread the word about your case study on social media. You can always just write a post and link to the case study, but also consider designing graphics for the case study. A LinkedIn carousel post is another great way to highlight your case study on social media.

- Encourage prospects to download the study as a call to action in your blog posts . This is a practical way to encourage your audience to learn more about your company.

- Link to case studies in email nurturing campaigns . If you’re nurturing a prospect that has downloaded other content, a case study link can entice additional engagement.