- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Analytical Credit Risk Case Studies

Our credit and risk specialists leverage Credit Analytics, our suite of cutting-edge analytical models to provide you with credit risk insights and real-life case studies on the topics that are important to you and your business.

- on this page

Market Volatility

Customer risk, supply chain, industry assessment, transfer pricing.

We’ve recently experienced some of the most extraordinary events in our lifetime, a full year of the Russia-Ukraine conflict, global monetary interventions to fight one of the most significant inflations in recent history, and a continuing threat from global COVID containment policies that continue to disrupt supply chains today.

It goes without saying that the importance of monitoring and embedding macroeconomic factors into credit risk assessments is critical.

Read the results from our recent research where we assessed the credit risk of 22 industry sectors (Corporates and Banks) in the United States and compare historical trends based on the probability of default score generated by the RiskGauge™ Model, with forecasted trends based on this score conditioned with macroeconomic scenarios.

READ THE FULL REPORT

The Continued Evolution of Credit Risk in the European Union and the United Kingdom

Anticipate the Unknown: Insights to Turn Market Risks into Business Opportunities

European Industries Most Impacted by the Russia-Ukraine War from a Probability of Default Perspective

A Fundamentals Approach to Detect Early Signs of Private Company Credit Deterioration

Go Beyond Fundamentals to Uncover Early Signs of Private Company Credit Deterioration

Credit Score Implications of Russia-Ukraine War

Silicon Valley Bank: Uncovering Regional Bank Stress with Equity-Driven Credit Models

It’s different this time: a banking rhyme, how to assess risk appetite in trade credit, bed bath and bankruptcy using quantitative credit models to predict corporate defaults.

Christopher & Banks Corporation – tracking the early-warning signals of credit risk

Default Insights: Avianca Holdings S.A. - Tracking the early warning signals of credit risk

SAS AB Tracking the early-warning signals of credit risk

Car rental industry’s credit risk: a bouncy ride during the pandemic

Understanding Drivers of Credit Risk: Differences and Similarities in the Credit Risk Assessment of a Non-Financial Corporation via a PD Scoring Model

Tracking Credit Risk of a Major U.S. Retailer

In the past, only large financial institutions have ventured into deploying credit risk automation and workflow systems due to the volume of resources and investments required and the need to lock down processes. However, it is not uncommon today, to meet with a corporate credit risk officer who is looking to discuss the options, benefits, and risks of automating customer onboarding and credit risk management and monitoring processes.

Read about the risks and opportunities of credit risk automation here.

READ THE BLOG

Data That Delivers: Automating the Credit Risk Workflow

Machine Learning and Credit Risk Modelling

Managing Credit Risk Automation during Economic Uncertainty

Get a deeper view of your credit risk exposure.

Continuous financial health management of suppliers, minimizing counterparty risk in supply chains, gauging supply chain risk in volatile times, covid-19’s wake-up call for supply chain credit risk.

SEE THE FULL BLOG

Corporate Credit Risk Macroeconomic Recovery Projections Post-COVID-19

In the U.S., continuous government stimulus payments and efficient vaccine rollouts have further revived both supply and demand for goods and services. However, although public companies began publishing financial reports for the second quarter of 2021, the results did not show the full extent of the global recovery, due to the intrinsic lag effect of financial performance.

To help navigate these transition times, we used our Macro-Scenario model to analyze how the credit risk of public and private firms in the U.S. may change under different macroeconomic projections.

Highlights include:

- The degree of economic recovery in different industries is mostly driven by the characteristics of post COVID-19 positive macroeconomic projections.

- Energy, industrial products, and construction materials, as well as retail and media industries, exhibit the best recovery over the Q1 2022 outlook when compared with the baseline scenario.

- The real estate and construction materials industries also show strong recovery and transition in credit risk.

The Bankruptcy Outlook and a Trifecta of Factors: Global Risk, Inflation, Rising Rates

COVID-19: Company Fundamental Scars and the Path to Recovery in Asian Economies

Corporate Credit Risk Trends in Developing Markets An Expected Credit Loss ECL Perspective

Corporate Credit Risk Trends in Developing Markets: A Probability of Default Perspective

Uncertainties Impact Credit Risk in the European Union and the UK

How to Take Control of Intercompany Financing

A large accounting firm automates its credit assessments for transfer pricing, successfully navigating the complexity of intercompany financing, law firm leverages scorecard approach to support transfer pricing engagements.

Case Studies In Credit Analysis

This page is a digest about this topic. It is a compilation from various blogs that discuss it. Each title is linked to the original blog.

Become our partner!

Please fill in this Google form. The team will be in contact.

Get matched with over 155K angels and 50K VCs worldwide. We use our AI system and introduce you to investors through warm introductions! Submit here and get %10 discount

FasterCapital will become the technical cofounder to help you build your MVP/prototype and provide full tech development services. We cover %50 of the costs per equity. Submission here allows you to get a FREE $35k business package.

We build, review, redesign your pitch deck, business plan, financial model, whitepapers, and/or others!

We help large projects worldwide in getting funded. We work with projects in real estate, construction, film production, and other industries that require large amounts of capital and help them find the right lenders, VCs, and suitable funding sources to close their funding rounds quickly!

We help you study your market, customers, competitors, conduct SWOT analyses and feasibility studies among others!

We provide a full online sales team and cover %50 of the costs. Get a FREE list of 10 potential customers with their names, emails and phone numbers.

We work with you on content marketing, social media presence, and help you find expert marketing consultants and cover 50% of the costs.

Search based on keywords:

- institutional investors (22)

- financial obligations (11)

- case study (9)

- potential risks (9)

1.Case Studies in Credit Analysis [Original Blog]

Credit analysis, often described as both an art and a science, lies at the heart of responsible lending practices. In the intricate world of finance, loan officers play a pivotal role in evaluating the creditworthiness of borrowers. It's a multifaceted task that involves assessing financial data, risk factors, and economic conditions. In this section, we delve into the fascinating realm of credit analysis by exploring real-world case studies . These case studies offer valuable insights from various perspectives , shedding light on the challenges, strategies, and successes of credit analysis.

1. The Entrepreneurial Endeavor: Imagine a budding entrepreneur seeking a substantial loan to launch a promising startup. In this case study, we witness the loan officer's dilemma of assessing a venture with limited financial history. It's a delicate balance between supporting innovation and minimizing risk. By scrutinizing the entrepreneur's business plan, industry trends, and market research , the loan officer must make a well-informed decision .

2. Navigating Economic Uncertainty: Economic downturns are inevitable, and loan officers must adapt their credit analysis techniques accordingly. We examine a case where a loan officer faces the challenge of evaluating a borrower during a recession. The analysis involves assessing the borrower's ability to weather economic storms, with a focus on cash flow, contingency plans, and risk mitigation strategies .

3. The real Estate conundrum : Real estate loans are a significant part of credit analysis, and they come with their own set of complexities. In this case, we explore the intricacies of evaluating a borrower's request for a mortgage. Factors like property valuation, down payment, and credit history intertwine to determine the loan's feasibility.

4. The balance of Risk and reward : Credit analysis is about balancing risk and reward . This case study delves into a situation where a loan officer is presented with a high-risk, high-reward opportunity. By examining the borrower's financial stability, collateral, and risk tolerance , the loan officer must weigh the potential returns against the inherent risks .

5. The importance of Due diligence : Mistakes in credit analysis can be costly. We examine a scenario where a loan officer discovers discrepancies in a borrower's financial statements after approval. This highlights the critical role of post-approval due diligence in mitigating potential losses and ensuring the integrity of the lending process .

6. The Regulatory Landscape: Credit analysis isn't just about assessing borrowers; it also involves navigating a complex web of regulations. In this case, we explore how loan officers must stay abreast of changing regulatory requirements , ensuring compliance while maintaining efficient lending processes.

7. Data-Driven Decision Making: Credit analysis has evolved with the advent of big data and advanced analytics. We discuss a case where predictive modeling and data analytics assist loan officers in making more accurate lending decisions . This showcases the importance of leveraging technology to enhance the credit analysis process .

In these case studies, we gain a deeper understanding of the intricate world of credit analysis. It's a discipline that demands a blend of financial acumen, risk assessment, and a keen eye for detail. Loan officers , armed with these insights, navigate the complexities of credit analysis to foster responsible lending practices that benefit both borrowers and financial institutions .

Case Studies in Credit Analysis - Credit analysis: Unveiling the Art of Credit Analysis with Loan Officers

2.Case Studies in Credit Loss Provision [Original Blog]

To illustrate the practical application of credit loss provision , let's examine a few case studies :

1. Case Study 1: Bank A has a diversified lending portfolio with exposure to various industries. It adopts a statistical modeling approach to estimate credit loss provision. By analyzing historical data , macroeconomic indicators, and borrower-specific information, the bank predicts credit losses with a high degree of accuracy. This allows Bank A to maintain optimal provisioning levels and demonstrate strong risk management practices .

2. Case Study 2: Bank B primarily lends to small and medium-sized enterprises (SMEs). The bank faces challenges in obtaining comprehensive data on SME borrowers, leading to data gaps and limited historical loss information. To address this, Bank B collaborates with credit bureaus and industry associations to gather relevant data. The bank also applies judgmental adjustments and qualitative assessments to estimate credit loss provision . This proactive approach helps Bank B maintain prudent provisioning levels despite data limitations .

These case studies highlight the importance of data quality , model sophistication, and expert judgment in credit loss provision estimation. Banks need to tailor their approach based on portfolio characteristics, data availability, and regulatory requirements .

Case Studies in Credit Loss Provision - Analyzing Credit Loss Provision in Credit Risk Measurement

3.Case Studies of Credit Migration Patterns in Different Industries [Original Blog]

Examining case studies of credit migration patterns in different industries provides real-world examples of how credit migration analysis can help financial institutions manage risk effectively . Let's explore some industry-specific case studies :

1. Banking Industry:

- In the aftermath of the 2008 financial crisis, many banks experienced significant credit rating downgrades, leading to increased credit migration risk.

- Financial institutions had to strengthen their risk management practices and tighten credit standards to mitigate potential losses .

- Case studies from the banking industry highlight the importance of proactive risk management and the impact of macroeconomic factors on credit migration patterns .

2. Energy Sector :

- The energy sector is prone to credit migration risks due to its exposure to commodity price volatility , regulatory changes, and technological advancements .

- Case studies in the energy sector shed light on the importance of monitoring industry-specific factors and managing credit exposure to mitigate potential risks .

- Financial institutions need to consider the long-term sustainability and creditworthiness of energy sector borrowers to effectively manage credit migration risks.

3. Retail Industry:

- The retail industry faces unique challenges, such as changing consumer preferences , e-commerce disruption, and economic fluctuations .

- Case studies in the retail industry highlight the importance of closely monitoring industry dynamics and adapting risk management strategies accordingly.

- Financial institutions need to assess the financial health and creditworthiness of retail borrowers to effectively manage credit migration risks.

Key points :

- Case studies provide real-world examples of credit migration patterns in different industries .

- Case studies highlight the importance of proactive risk management and industry-specific factors .

- Banking, energy, and retail industries showcase the diverse challenges and risk management approaches.

Case Studies of Credit Migration Patterns in Different Industries - Analyzing Credit Migration Patterns for Effective Risk Management

4.Case Studies on Credit Spreads and Flat Yield Curves [Original Blog]

Analyzing historical data is a crucial aspect of understanding the relationship between credit spreads and flat yield curves. By examining case studies, we can gain valuable insights into how these two factors are interconnected and their implications for the financial markets . This section will delve into various perspectives on this topic, shedding light on the significance of credit spreads and flat yield curves in different scenarios .

1. Historical Context: To comprehend the link between credit spreads and flat yield curves, it is essential to consider the historical context. Looking back at past instances where credit spreads widened while yield curves flattened can provide valuable lessons. For example, during the 2008 financial crisis, credit spreads widened significantly as investors demanded higher compensation for taking on credit risk. Simultaneously, the yield curve flattened due to expectations of economic downturn and central bank interventions . This case study highlights how credit spreads and flat yield curves often coincide during periods of market stress .

2. Risk Perception: Analyzing historical data allows us to understand how changes in risk perception impact credit spreads and yield curves. When investors perceive higher levels of risk in the economy or specific sectors, they demand higher yields on bonds issued by those entities, leading to wider credit spreads. At the same time, a flattening yield curve may indicate that investors anticipate slower economic growth or potential recessionary conditions. By examining historical instances where risk perception played a significant role, such as during the dot-com bubble burst in the early 2000s, we can gain insights into how credit spreads and flat yield curves reflect market sentiment .

3. Liquidity Conditions: Historical data also reveals how liquidity conditions influence credit spreads and yield curves. During periods of tight liquidity, such as the global financial crisis or sovereign debt crises , credit spreads tend to widen as investors become more cautious about lending money. Additionally, a flat yield curve may emerge as central banks implement monetary policies aimed at injecting liquidity into the system. The European debt crisis serves as an example, where widening credit spreads and a flattening yield curve reflected concerns about the liquidity of certain European countries .

4. Sector-Specific Analysis: Examining historical data on credit spreads and flat yield curves across different sectors can provide valuable insights into sector-specific risks. For instance, during the oil price collapse in 2014, energy companies faced significant credit spread widening due to concerns about their ability to service debt amidst declining revenues. Simultaneously, a flattening yield curve indicated market expectations of slower economic growth. By analyzing such sector-specific case studies , investors can better understand how credit

Case Studies on Credit Spreads and Flat Yield Curves - Credit spreads: The Link between Credit Spreads and Flat Yield Curves

5.Case Studies on Credit Exposure in Volatile Markets [Original Blog]

In today's ever-changing market landscape, businesses face a multitude of risks, and one of the most critical is credit exposure. Credit exposure refers to the potential loss a company may face if its counterparties fail to fulfill their financial obligations. In volatile markets, where uncertainties and fluctuations are the norm, credit exposure becomes even more pronounced and can have a significant impact on a company's financial health .

To gain a deeper understanding of credit exposure in volatile markets, it is essential to examine real-life case studies that highlight the challenges and strategies employed by industry players. These case studies provide invaluable insights into how companies navigate market risk and mitigate potential losses . Let's delve into some notable examples and explore the key takeaways :

1. Case Study: XYZ Corporation 's Credit Exposure in the Oil and Gas Industry

- XYZ Corporation, a major player in the oil and gas industry, faced a significant credit exposure during a period of extreme market volatility . As oil prices plummeted, several of XYZ's counterparties became financially distressed, putting the company at risk of substantial losses .

- To manage this credit exposure, XYZ Corporation implemented a comprehensive risk management framework. They conducted thorough due diligence on their counterparties, analyzing their financial stability and creditworthiness. Additionally, XYZ diversified its portfolio by engaging with multiple suppliers and customers, reducing its dependency on any single entity .

- The key takeaway from this case study is that proactive risk management and diversification are crucial in mitigating credit exposure . By conducting thorough assessments of counterparties and diversifying their portfolio, companies can minimize their vulnerability to market fluctuations .

2. Case Study : ABC Bank 's Credit Exposure in the Mortgage Market

- ABC Bank , a leading financial institution, faced a significant credit exposure during the 2008 global financial crisis. As the mortgage market collapsed, ABC Bank 's exposure to subprime mortgages threatened its financial stability .

- In response, ABC Bank implemented stringent risk management practices . They reassessed their risk models and conducted stress tests to evaluate the potential impact of a market downturn. Furthermore, ABC Bank actively communicated with its borrowers, offering assistance programs to mitigate defaults and foreclosures.

- This case study highlights the importance of robust risk modeling and effective communication in managing credit exposure. By regularly reassessing risk models and engaging with borrowers during times of market turmoil, companies can better anticipate and address potential credit risks .

3. Case Study: DEF Corporation 's Credit Exposure in the Technology Sector

- DEF Corporation, a technology company, faced credit exposure in a volatile market due to its reliance on a single major customer. When the customer experienced financial difficulties, DEF Corporation found itself exposed to significant potential losses .

- To mitigate this risk, DEF Corporation actively pursued diversification strategies. They expanded their customer base by targeting new market segments and actively sought partnerships and collaborations with other companies. By reducing their dependency on a single customer, DEF Corporation was able to minimize their credit exposure.

- This case study highlights the importance of diversification in managing credit exposure. By actively seeking new customers and forming strategic partnerships, companies can reduce their reliance on individual counterparties and mitigate the potential impact of market volatility .

These case studies provide valuable insights into the challenges faced by companies in managing credit exposure in volatile markets. By implementing proactive risk management practices, conducting thorough due diligence on counterparties, diversifying portfolios, reassessing risk models, and engaging with borrowers, companies can navigate market risk more effectively. As the market continues to evolve, it is crucial for businesses to learn from these experiences and adapt their strategies to ensure their long-term financial viability.

Case Studies on Credit Exposure in Volatile Markets - Market risk: Credit Exposure in a Volatile Market: Navigating Market Risk

6.Case Studies: Credit Risk Exposure Analysis [Original Blog]

Real-life case studies provide valuable insights into credit risk exposure analysis. This section presents case studies from different industries and sectors, illustrating the application of credit risk analysis techniques and the implications of credit risk exposure .

9.1 Case Study 1: Banking Sector

- analysis of credit risk exposure in a commercial banking context

- Evaluation of credit risk management strategies in response to changing market conditions

9.2 Case Study 2: Energy Sector

- Assessing credit risk exposure in the energy sector

- Impact of fluctuating oil prices on credit risk in the energy industry

9.3 Case Study 3: Emerging Markets

- Analysis of credit risk exposure in emerging markets

- Role of political and economic factors in determining credit risk exposure

Case Studies: Credit Risk Exposure Analysis - Understanding Credit Risk Exposure Analysis in the World of Defaults

7.Assessing Bond Ratings and Credit Analysis [Original Blog]

Bond ratings, assigned by credit rating agencies, provide insights into the creditworthiness of bond issuers. understanding bond ratings and credit analysis is essential for evaluating the risk associated with a bond. Here are some key points to consider:

6.1 Credit Rating Agencies: Credit rating agencies such as Standard & Poor's, Moody's, and Fitch play a crucial role in assessing the creditworthiness of bond issuers . These agencies assign ratings based on various evaluation criteria, including financial strength, industry outlook , and regulatory environment .

Example: Let's say you are evaluating a corporate bond rated AAA by a reputable credit rating agency . This rating suggests a high level of creditworthiness and indicates that the issuer is very likely to meet its debt obligations .

6.2 Credit Analysis: Conducting credit analysis involves a detailed examination of the issuer's financial statements , industry outlook, and other relevant factors to determine the risk associated with the bond. Credit analysts use various tools and models to assess the issuer's ability to repay its debts and assign appropriate ratings .

Example: Suppose you are considering investing in a bond issued by a small technology startup. Through credit analysis, you discover that the startup has a limited operating history, high debt levels , and uncertain revenue projections . These factors may indicate a higher risk of default and prompt you to reconsider your investment decision .

Assessing Bond Ratings and Credit Analysis - A Comprehensive Guide to Evaluating Bonds

8.Understanding the Importance of Credit Analysis for Institutional Investors [Original Blog]

Credit analysis is a fundamental component of the investment process for institutional investors. While individual investors may focus on factors such as returns and risk tolerance, institutional investors have a fiduciary duty to protect the financial interests of their clients or beneficiaries. This means they must carefully evaluate the creditworthiness of potential investments and assess the associated risks .

The consequences of poor credit analysis can be severe for institutional investors . A default or downgrade of a significant investment can lead to substantial losses and tarnish the reputation of the investor. Therefore, institutional investors must employ a systematic and rigorous approach to credit analysis to mitigate these risks.

9.Real-life Examples of Successful Credit Analysis by Institutional Investors [Original Blog]

Real-life case studies provide valuable insights into successful credit analysis by institutional investors. Let's explore two examples highlighting different approaches and outcomes:

1. Example 1: XYZ Pension Fund

The XYZ Pension Fund, one of the largest pension funds in the country, successfully conducted credit analysis on a large multinational corporation. The fund's credit analysis team employed a comprehensive approach, considering various factors such as financial strength, credit ratings , industry outlook, and management quality .

By closely analyzing the issuer's financial statements , the team identified improving profitability, strong cash flow generation, and a solid balance sheet . The issuer also had a favorable credit rating from multiple rating agencies, reflecting its strong creditworthiness. Furthermore, the team conducted in-depth industry research and macroeconomic analysis , which indicated a positive outlook for the issuer's sector.

The XYZ Pension Fund's credit analysis team also closely evaluated the issuer's management team and corporate governance practices. They found that the issuer had a proven track record , a clear strategic vision, and effective risk management systems in place.

Based on their thorough credit analysis, the XYZ Pension Fund decided to invest a significant portion of its portfolio in the issuer's debt securities. The investment performed well over time, generating consistent income and enabling the pension fund to meet its long-term obligations .

2. Example 2: ABC Insurance Company

The ABC Insurance Company conducted credit analysis on a regional utility company as part of its investment portfolio management. The company's credit analysis team took a forward-looking approach, considering industry and macroeconomic factors , as well as market and liquidity risks .

During their industry analysis, the team identified emerging technological disruptions, regulatory uncertainties, and changing consumer preferences as significant risk factors for the utility industry. They also considered macroeconomic factors , such as increasing interest rates and environmental concerns , which could affect the issuer's creditworthiness.

The credit analysis team conducted a thorough assessment of the issuer's risk management framework and found certain gaps in its ability to manage technology-related risks and changing customer expectations. They also noted limited liquidity in the utility company's debt securities, which could pose challenges during unfavorable market conditions .

Considering the identified risks and market dynamics, the ABC Insurance Company decided to reduce its exposure to the utility company's debt securities, thus mitigating potential losses in the event of adverse developments .

These case studies illustrate the importance of comprehensive credit analysis in helping institutional investors make informed investment decisions and manage risks effectively.

In conclusion, credit analysis is a crucial element in the investment process for institutional investors, helping them evaluate an issuer's creditworthiness and assess potential risks . By analyzing financial statements, credit ratings, industry and macroeconomic factors, management quality, market and liquidity risks, and ESG factors, institutional investors can make informed investment decisions and protect their clients' or beneficiaries' financial interests. Real-life case studies further exemplify the importance of thorough credit analysis in generating successful investment outcomes .

Real life Examples of Successful Credit Analysis by Institutional Investors - A Crucial Element in Credit Analysis for Institutional Investors

10.Types of Institutional Investors and Their Role in Credit Analysis [Original Blog]

Institutional investors encompass a wide range of entities, each with their own specific objectives and constraints. Pension funds, for example, are primarily concerned with generating sufficient returns to meet their long-term obligations to retirees. Insurance companies, on the other hand, focus on balancing their investment portfolios to ensure they have adequate liquidity to pay policyholders' claims.

Regardless of their specific objectives, all institutional investors engage in credit analysis to assess the creditworthiness of potential investments. They evaluate various factors such as the issuer's financial strength, industry outlook, management quality, and market risks before making an investment decision .

11.Key Factors in Credit Analysis for Institutional Investors [Original Blog]

1. Financial Strength: Institutional investors carefully analyze an issuer's financial statements to assess its ability to meet its financial obligations. key financial ratios such as leverage, liquidity, and profitability provide insights into an issuer's financial health .

2. Credit Ratings: Credit ratings assigned by reputable rating agencies, such as Standard & Poor's, Moody's, and Fitch, play an essential role in credit analysis . Ratings provide an independent assessment of an issuer's creditworthiness, helping institutional investors gauge the risks involved.

3. Industry and Macroeconomic Factors: Institutional investors analyze the industry in which the issuer operates and consider macroeconomic factors that could impact its performance. Understanding industry dynamics and economic trends helps investors evaluate an issuer's ability to withstand economic downturns or industry disruptions .

4. Management Quality: The competence and integrity of an issuer's management team are crucial factors in credit analysis. Institutional investors assess management's track record, strategic vision, and corporate governance practices to evaluate the issuer's ability to manage risks effectively.

5. Market and Liquidity Risks: Institutional investors analyze market and liquidity risks associated with an investment. Market risk refers to the potential loss from adverse movements in interest rates, foreign exchange rates , or equity markets. Liquidity risk , on the other hand, pertains to an issuer's ability to meet its financial obligations in a timely manner .

6. Environmental, Social, and Governance (ESG) Factors: Institutional investors are increasingly considering ESG factors in their credit analysis. They assess an issuer's environmental impact, social responsibility, and governance practices to identify potential risks and opportunities. integrating ESG factors helps investors align their investments with sustainability goals and avoid companies with significant ESG-related risks.

Key Factors in Credit Analysis for Institutional Investors - A Crucial Element in Credit Analysis for Institutional Investors

12.The Role of Financial Statements in Credit Analysis [Original Blog]

Financial statements are a crucial source of information for institutional investors conducting credit analysis. These statements provide insights into an issuer's profitability, cash flow generation , and financial position. Key financial statements include the income statement, balance sheet, and cash flow statement .

1. Income Statement: The income statement reflects an issuer's revenue, expenses, and net income over a specific period. Institutional investors assess revenue growth, profit margins, and recurring income streams to evaluate an issuer's ability to generate cash flows .

2. Balance Sheet: The balance sheet provides a snapshot of an issuer's financial position at a specific point in time. Institutional investors analyze the issuer's assets, liabilities, and shareholders' equity to assess its solvency, liquidity, and leverage.

3. Cash Flow Statement: The cash flow statement outlines an issuer's cash inflows and outflows over a specific period. Institutional investors focus on the operating cash flow , as it indicates an issuer's ability to generate cash from its core operations and meet its financial obligations .

The Role of Financial Statements in Credit Analysis - A Crucial Element in Credit Analysis for Institutional Investors

13.Evaluating Industry and Macroeconomic Factors in Credit Analysis [Original Blog]

Industry and macroeconomic factors are crucial considerations in credit analysis. Institutional investors examine the industry in which an issuer operates and evaluate macroeconomic factors to assess the potential risks and opportunities associated with an investment.

1. Industry Analysis: Institutional investors analyze the competitive dynamics, regulatory environment, and long-term prospects of the industry in which the issuer operates. They consider factors such as market structure, barriers to entry, and competitive positioning to evaluate an issuer's ability to generate consistent cash flows .

2. Macroeconomic Analysis: Institutional investors assess macroeconomic factors that could impact an issuer's creditworthiness, such as GDP growth, inflation rates, and interest rates . Understanding the broader economic context helps investors gauge an issuer's sensitivity to economic fluctuations and adjust their investment decisions accordingly.

3. Cyclical vs. Non-cyclical Industries: Institutional investors differentiate between cyclical and non-cyclical industries . Cyclical industries, such as automotive or construction, are more susceptible to economic downturns, while non-cyclical industries , including healthcare or utilities, tend to be more resilient during economic downturns .

4. Industry-specific Risk Factors: Institutional investors consider industry-specific risk factors that could impact an issuer's creditworthiness. For example, regulatory changes, technological disruptions, or shifts in consumer preferences can significantly affect certain industries and, consequently, an issuer's ability to honor its financial obligations .

By evaluating industry and macroeconomic factors , institutional investors gain a comprehensive understanding of an issuer's operating environment and identify potential risks and opportunities.

Evaluating Industry and Macroeconomic Factors in Credit Analysis - A Crucial Element in Credit Analysis for Institutional Investors

14.Assessing Management and Corporate Governance in Credit Analysis [Original Blog]

Management quality and corporate governance practices are critical factors influencing an issuer's creditworthiness. Institutional investors carefully assess an issuer's management team, its track record, and corporate governance practices to determine the issuer's ability to manage risks effectively.

1. Management Track Record: Institutional investors evaluate the management team's experience, expertise, and past performance. They consider factors such as the team's ability to execute strategies, adapt to industry changes, and navigate challenging economic conditions .

2. Strategic Vision: Institutional investors assess the issuer's strategic vision and its alignment with long-term industry trends. They analyze whether the issuer's management has a clear roadmap for growth, innovation, and sustainable value creation .

3. Corporate Governance: Institutional investors examine an issuer's corporate governance practices, such as board composition, independence, and oversight mechanisms. Transparent and effective corporate governance reduces the risk of management misbehavior, fraud, or conflicts of interest.

4. Risk Management: Institutional investors evaluate an issuer's risk management framework , including its policies, processes, and risk appetite. They assess whether the issuer has appropriate risk mitigation strategies in place to proactively manage emerging risks .

Assessing management quality and corporate governance practices helps institutional investors build confidence in an issuer's ability to withstand challenges, implement effective risk management measures, and honor its financial obligations .

Assessing Management and Corporate Governance in Credit Analysis - A Crucial Element in Credit Analysis for Institutional Investors

15.Understanding the Impact of Market and Liquidity Risks on Credit Analysis [Original Blog]

Market and liquidity risks are significant considerations for institutional investors in credit analysis. These risks arise from potential fluctuations in interest rates , foreign exchange rates , and equity markets, as well as a lack of market liquidity for certain securities .

1. interest Rate risk : Institutional investors assess an issuer's exposure to interest rate risk, which arises from changes in market interest rates . Higher interest rates can increase an issuer's borrowing costs and impact its financial performance, while lower interest rates can lead to refinancing benefits and lower debt servicing costs.

2. foreign Exchange risk : Institutional investors evaluate the impact of foreign exchange rate fluctuations on an issuer's creditworthiness, especially for globally diversified investments. Exchange rate movements can affect an issuer's competitiveness, profitability, and ability to service foreign currency-denominated debt .

3. Equity Market Risk: Institutional investors consider the potential impact of equity market fluctuations on an issuer's creditworthiness, especially for companies with significant equity ownership . Severe declines in equity values can result in deteriorating creditworthiness and increase the risk of default for leveraged issuers.

4. Liquidity Risk: Institutional investors analyze an issuer's liquidity risk, which refers to its ability to meet short-term funding requirements. Lack of liquidity can make it challenging for an issuer to honor its financial obligations , resulting in downgrades or defaults.

Understanding and quantifying these market and liquidity risks is crucial for institutional investors to assess an issuer's resilience and financial flexibility in different market conditions .

Understanding the Impact of Market and Liquidity Risks on Credit Analysis - A Crucial Element in Credit Analysis for Institutional Investors

16.Incorporating Environmental, Social, and Governance (ESG) Factors in Credit Analysis [Original Blog]

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in credit analysis. Institutional investors recognize that ESG risks can have a material impact on an issuer's creditworthiness and long-term financial performance.

1. Environmental Factors: Institutional investors assess an issuer's environmental impact, including its carbon footprint, resource consumption, and waste management practices . They consider how environmental risks , such as climate change or regulatory requirements , can affect an issuer's operations, reputation, and ability to raise capital.

2. Social Factors: Institutional investors evaluate an issuer's social responsibility practices, including its treatment of employees, suppliers, and communities. They consider factors such as labor practices, employee diversity, product safety, and community engagement to identify potential risks and reputational issues .

3. Governance Factors: Institutional investors examine an issuer's corporate governance practices, including board independence, executive compensation, and shareholder rights . Effective corporate governance reduces the risk of fraud, mismanagement, and conflicts of interest.

Incorporating ESG factors in credit analysis enables institutional investors to identify investment opportunities that align with sustainability goals, avoid companies with significant ESG-related risks, and promote positive change through their investments .

Incorporating Environmental, Social, and Governance \(ESG\) Factors in Credit Analysis - A Crucial Element in Credit Analysis for Institutional Investors

17.Assessing Industry and Market Factors in Credit Analysis [Original Blog]

Assessing industry and market factors is a critical component of credit strength analysis , as these factors can significantly impact a borrower's ability to meet their financial obligations. Industry trends, market conditions, and competitive dynamics influence a borrower's revenue potential, profitability, and overall credit risk .

When assessing industry and market factors , lenders should consider:

1. Industry outlook: Evaluating the current and future outlook of the borrower's industry helps lenders assess the potential risks and opportunities associated with extending credit.

2. Market competition : Examining the competitive landscape helps lenders gauge the borrower's market position and their ability to compete effectively.

3. Economic indicators: Analyzing macroeconomic indicators, such as GDP growth, inflation rates, and interest rates , helps lenders understand the broader economic environment and its potential impact on the borrower's creditworthiness.

By thoroughly assessing industry and market factors, lenders can gain a comprehensive understanding of the borrower's credit risk and make informed lending decisions .

Assessing Industry and Market Factors in Credit Analysis - Advanced Techniques for Credit Strength Analysis

18.The Importance of Financial Ratios in Credit Analysis [Original Blog]

1. Understanding a company's creditworthiness is a crucial aspect of financial analysis for lenders and investors alike. To assess a borrower's ability to repay debts and evaluate the risk associated with granting credit, various methods can be employed. One such method is the use of financial ratios , which provide valuable insights into a company's financial health. These ratios help in determining the chances of default and the overall creditworthiness of a borrower. Let's delve deeper into the importance of financial ratios in credit analysis .

2. One commonly used financial ratio in credit analysis is the Debt-to-Equity ratio . This ratio compares a company's total debt to its total equity and sheds light on the company's financing structure. A high debt-to-equity ratio indicates that the company relies heavily on borrowed funds, which may increase its risk of default. On the other hand, a lower debt-to-equity ratio suggests a healthier financial position, making the company less vulnerable to financial distress .

3. The Current ratio is another essential financial ratio used in credit analysis. This ratio determines a company's short-term liquidity by comparing its current assets to its current liabilities. A higher current ratio indicates that the company has enough liquid assets to cover its short-term obligations. Lenders typically prefer a higher current ratio, as it signifies a borrower's ability to meet its financial obligations promptly.

4. Alongside the Current Ratio, the Quick Ratio is also valuable in credit analysis. The Quick Ratio measures a company's ability to settle immediate liabilities without relying on the sale of inventory. By excluding inventory from current assets , it provides a more conservative estimate of liquidity. A higher quick ratio implies that the company can swiftly meet its obligations without having to rely heavily on selling inventory, which may indicate a more stable financial position .

5. Efficiency ratios, such as the accounts Receivable Turnover ratio and Inventory Turnover Ratio, are also crucial in credit analysis . These ratios help evaluate how efficiently a company manages its assets and converts them into cash. High turnover ratios demonstrate effective management, indicating that the company can convert its accounts receivable and inventory into cash quickly. On the other hand, low turnover ratios may indicate potential issues, such as slow collection of receivables or obsolete inventory .

6. Lastly, profitability ratios play a significant role in credit analysis. Ratios like Return on Assets, Return on Equity, and gross Profit margin provide insights into a company's profitability and ability to generate sufficient income to cover debts. Lenders often prefer borrowers with consistent profitability, as it ensures the company's ability to meet financial obligations .

Understanding these financial ratios and their implications is essential for lenders to make informed decisions when granting credit. By analyzing a borrower's financial statements and calculating these ratios, lenders can get a comprehensive picture of a company's creditworthiness. However, it's crucial to consider these ratios in conjunction with other factors, such as industry standards, market conditions, and management quality , to make a holistic credit assessment.

In conclusion, financial ratios hold great significance in credit analysis, providing valuable insights into a company's financial health, liquidity, efficiency, and profitability. By utilizing these ratios, lenders can assess the creditworthiness and risk associated with granting credit to a borrower. So next time you evaluate a company's credit strength, make sure to delve into their financial ratios for a comprehensive assessment.

The Importance of Financial Ratios in Credit Analysis - Advanced Techniques for Credit Strength Analysis 2

19.Incorporating Qualitative Factors in Credit Analysis [Original Blog]

In addition to quantitative metrics, credit analysts also consider qualitative factors when assessing the credit strength of an individual or a company. These qualitative factors provide valuable insights that cannot be captured solely through numerical analysis. By incorporating qualitative factors into credit analysis , analysts can gain a more comprehensive understanding of the borrower's creditworthiness and make more informed lending decisions. In this section, we will explore some key qualitative factors that analysts often examine during credit analysis .

1. Management Quality: The quality of a borrower's management team plays a crucial role in determining the creditworthiness of a company. Analysts evaluate the experience, track record, and competence of the management team to assess their ability to effectively steer the company towards profitability and manage financial risks . For example, a company with a strong and experienced management team is more likely to navigate through challenging economic conditions successfully.

2. Industry Outlook: The industry in which a borrower operates can significantly impact its creditworthiness. Analysts consider the current and future outlook of the borrower's industry to gauge the potential risks and opportunities. For instance, an industry experiencing rapid technological advancements may pose risks to companies that fail to adapt, while industries with stable demand and growth prospects may be more favorable for credit analysis .

3. Competitive Position: Understanding a borrower's competitive position within its industry is vital for credit analysis . Analysts assess factors such as market share, barriers to entry, and competitive advantages to determine the borrower's ability to generate sustainable revenues and maintain profitability. A company with a strong competitive position is more likely to withstand market pressures and repay its debts.

4. Corporate Governance: Effective corporate governance practices are essential for mitigating risks and ensuring the long-term viability of a borrower. Analysts evaluate the borrower's corporate governance framework, including board composition, transparency, and accountability, to assess the risk of potential governance failures. A company with robust corporate governance practices is generally seen as more creditworthy.

5. Regulatory Environment: The regulatory landscape in which a borrower operates can significantly impact its creditworthiness. Analysts consider the regulatory framework governing the borrower's industry and assess the potential risks and compliance costs associated with these regulations. Changes in regulations may affect a borrower's ability to operate profitably or meet its financial obligations .

6. Economic Factors: Economic conditions, both at the macro and micro levels, influence the creditworthiness of borrowers. Analysts evaluate factors such as economic growth, inflation rates, unemployment levels, and interest rates to assess the potential impact on a borrower's financial health. For example, a borrower operating in an industry highly sensitive to economic fluctuations may face increased credit risks during economic downturns.

Incorporating these qualitative factors alongside quantitative analysis enables credit analysts to develop a holistic view of a borrower's creditworthiness. By considering the bigger picture, analysts can better identify potential risks and make more accurate credit assessments. While quantitative metrics provide a solid foundation for credit analysis , qualitative factors add depth and context, resulting in a more robust credit strength analysis.

Incorporating Qualitative Factors in Credit Analysis - Advanced Techniques for Credit Strength Analysis 2

20.The Importance of Analyzing Payment History in Credit Analysis [Original Blog]

Analyzing the payment history of an individual or business is a crucial aspect of credit analysis. It provides valuable insights into the borrower's financial behavior and their ability to manage debt responsibly. By examining payment history , lenders can assess the likelihood of timely repayments and make informed decisions about extending credit. In this section, we will explore why analyzing payment history is essential and discuss some examples, tips, and case studies that highlight its significance.

Examining payment history allows lenders to evaluate the borrower's past performance in meeting their financial obligations . It provides a comprehensive view of how consistently and promptly they have made payments on previous loans, credit cards, and other debts. A positive payment history indicates that the borrower has a track record of fulfilling their obligations on time, increasing their creditworthiness. On the other hand, a history of late payments , defaults, or delinquencies raises concerns about the borrower's ability to manage debt effectively.

For example, consider a borrower who consistently makes timely payments on their credit card for several years. This demonstrates their financial responsibility and suggests that they are likely to continue making payments on time in the future. Conversely, if a borrower has a history of missed or late payments , it raises red flags about their reliability and may indicate a higher risk of default.

Tips for analyzing payment history :

1. Review the frequency and consistency of payments: Look for patterns in the borrower's payment behavior. Do they consistently make payments on time, or are there frequent delays or missed payments ? Consistency is a positive indicator of financial responsibility .

2. Consider the type of credit: Different types of credit carry varying levels of risk . Analyze payment history across different credit lines, such as mortgages, auto loans, and credit cards , to assess the borrower's ability to manage different types of debt.

3. Look for any derogatory marks: Check for any negative information, such as late payments , defaults, or collections. These derogatory marks can significantly impact the borrower's creditworthiness and may require further investigation.

Case study :

In a credit analysis for a small business loan , the lender examines the payment history of the applicant. They discover that the business has consistently made timely payments on their existing loans and suppliers. This positive payment history indicates the business's ability to manage its finances effectively and increases the lender's confidence in extending credit.

In conclusion, analyzing payment history is a crucial step in credit analysis. It provides valuable insights into the borrower's financial behavior and helps lenders assess their creditworthiness. By reviewing payment patterns, considering the type of credit, and looking for derogatory marks, lenders can make informed decisions about extending credit. Understanding the importance of payment history empowers lenders to mitigate risks and ensure responsible lending practices .

The Importance of Analyzing Payment History in Credit Analysis - Analyzing Payment History for Effective Credit Analysis 2

Join our community on Social Media

Join our +30K followers of investors , mentors , and entrepreneurs !

Edward Bodmer – Project and Corporate Finance

Resolving BS in Project Finance

Project Finance Credit Analysis Examples

Project finance models can be used for credit analysis or for structuring or for both. On this page I show some examples of credit analysis in project finance models. In the case of credit analysis, the amount and the terms of debt are given. Using the given amount of debt, different downside cases can be evaluated to see if the debt can be repaid. I have included a couple of examples of how project finance models can be in credit analysis.

Project Finance Model for Methane Plant

The project finance file that you can download demonstrates how to use a model to evaluate credit analysis in the context of project finance. The model includes a bridge loan and alternative prospective capital investments in two phases. The credit analysis and the model includes currency risk because the bridge loan is in local currency whilst the revenues are received through a contract that is fixed in USD. This means different inflation rates must be forecast and evaluated as well as the other variables. If you are interested in currency risk, this may be a file to review. An excerpt from the model demonstrates how you can use a dropdown box for different scenarios and evaluate the DSCR, LLCR and PLCR in different currencies.

Example of Credit Analysis in Project Finance Model with Methane Plant and Currency Risk

Credit Analysis with Mini-Perm and Toll Road

In the case of a Mini-perm where the loan has a maturity date and may not be able to be re-financed, credit analysis can be performed with a model. In this case, you can assume that the mini-perm converts to a cash flow sweep. Then you can evaluate whether how low the cash flow can fall and a the loan can still be repaid. An illustration of how modelling can be used in the context of a tollroad model is demonstrated in the model. In this model you can lower the level of traffic and evaluate whether the loan can be repaid after the sweep period.

This project finance model in the mini-perm is set-up so that you first design the structure of the debt repayments with DSCR or debt to capital targets from assumed cash flows. Then you press a check box and run the model for risk analysis. This means the debt structure is fixed and you evaluate if the project switches to a cash sweep after the mini-perm matures. The risk analysis tests how low variables such as traffic volumes and toll rates can be pushed down before it is impossible to fully repay the loan by the end of the project life.

Credit Analysis in the Context of Project Finance Model with Mini-perm Loan and Cash Sweep

Credit Analysis with Merchant Model

The third example of credit analysis is a project finance model is a case for a merchant electricity plant. The summary page in this model shows how you can compare the historic margin earned from merchant prices with the margins in the financial model. You can evaluate the level of the merchant prices with the prices assumed in the model.

Merchant Plant Model and Credit Analysis in Project Finance Model

Sensitivity Analysis with Model in Developing Country

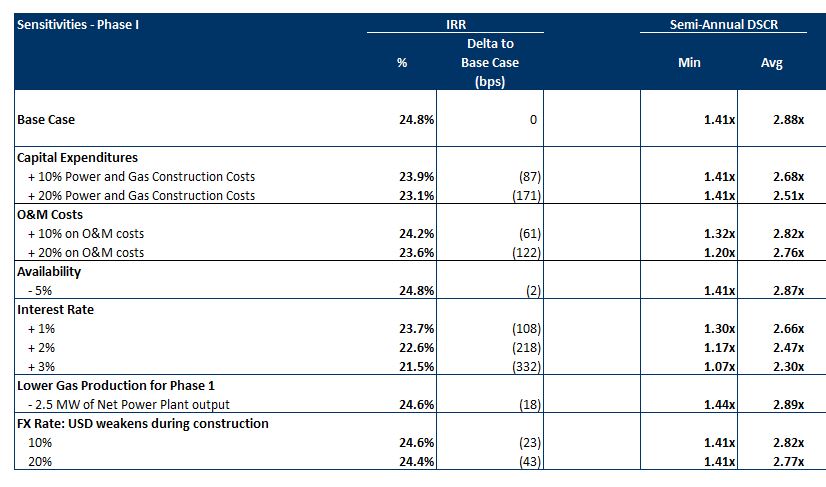

As with other cases, I have included excerpts of an actual model. If you send me an e-mail at [email protected] I may have some actual models that you can use in benchmarking. The excerpt below shows sensitivity that was part of an electricity plant model. Note the very high equity IRR in each of the scenarios. Also note that none of the scenarios produced much reduction at all in the DSCR. Finally note that the LLCR and the PLCR not presented.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Private Equity Forum PE

Private Credit Case Study

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

I've got a pair of case studies coming up in the next two weeks for private credit funds. These funds are both large ($25B+) and I'm interviewing for the direct lending groups. Anyone have any insight on what a case study would entail, how to differentiate myself, etc.? I know the format of one, they will give it to me and give me a couple of days for the model/writeup, and then I'll have to present. Any pointers would be very helpful.

I went through the process last year and am currently working in the space, albeit at a smaller fund. I think the case study itself in terms of format is pretty straight-forward: get a CIM , build a model and do a write-up highlighting business overview, customers, suppliers, go-to-market, industry/competitive landscape, investment merits, key risks & mitigants. Then show sensitivity tables around your model.

PM me, happy to answer more specific questions and/or review your case study when it's in draft.

hi, not sure if are still checking this forum. but I have a case study for a direct lending group next week. trying my luck here to see if you could give any advice. thx

@DCHEN475 - Direct Lending Case study prep- I can help

What sensitivity models would you show? Or do you mean have 3 differnet cases - management, base and downside?

Pretty much in line with what jckund already mentioned.

I haven't done a take-home case study, but for the 90min to 3h case studies on the day you usually get a CIM and sometimes some additional information such as filings or research reports and as a first step build a standard model. Income statement (there was quite some focus on revenue build in one of the case studies) and then just the usual CF + debt schedule, similiar to what you see in LBO case studies, excl. the returns. You'll have to include the usual credit metrics such as leverage DSCR among others and often have to model some downside case / sensitivities as well.

Once I had to do a write up in line with what was mentioned above by jckund (two pages given the time constraint but covering the main points) and the other time I had to discuss the model and explain the rationale of my forecasting and assumptions as well as my general model structure.

All in all pretty standard, especially if you have also done some PE interview prep and know your LBOs .

Also, have a look at this thread ( https://www.wallstreetoasis.com/forums/specialty-lending-gstpg-any-insi… ) which I found quite helpful re lending.

Lending Case Study ( Originally Posted: 11/30/2016 )

I have been invited to a super day with Wells Fargo Commercial Real Estate team, and I have been informed that I will have to do an in-person one hour case study on the credit worthiness of a particular company. Does anyone have any advice on what I can expect from this?

bump bump it up

I have a case study next week with a direct lending / private debt fund - 2 hours long, followed by a 1-hour presentation.

It's my first case study/interview, and as per the comments above, the model will probably be your usual CF + debt schedule , with credit metrics. But how do you decide what kind of debt structure and what pricing to use?

Is there anything else from the model to help you determine whether it's a good debt investment besides the credit metrics (obviously you would use the IM for the other stuff like market/competitive environment, etc.)

In terms of other credit metrics, forget IRR and MOIC, you're going to want to look at FCCR, total leverage, debt service, coverage ratio, etc, other than credit metrics if you have a built in revolver be aware of when it is drawn and be able to explain the reasoning behind it and be able to talk working capital

Besides the financials you will definitely be given a CIM ,I'm sure they will expect you to figure out where you would invest in the cap structure as well ex. senior, unitranche, mezz. Read up on a debt primer for more info if you're unsure, but all else being equal you're looking at a credit investment meaning your interest and principal is capped, you want to be paid back in full so you have to look for an investment that's recessionary resistant, recurring revenue vs project based work, diverse customer base that is sticky, strong value proposition as to why the company exists and how it is diversified, strong margins, revenue visibility, etc

I'd echo the focus on credit stats vs. equity IRRs / MOIC and be prepared to speak to key assumptions you made about the debt structure including overall leverage through senior and subordinated notes, debt pricing and especially scheduled amortization.

Traditional bank lenders participating in the senior debt typically need to have scheduled amortization of ~40% of the loan for the first 5 years (5/5/5/10/15 is a common amortization schedule). However, if you can use an investment fund for the senior debt you can get much lower amortization (I've sen 1-2% annually). This change in scheduled debt amortization will have a huge impact on the company's overall cash flow profile.

Also factors like goodwill amortization or an existing NOL can create large tax shields that can lower the cash taxes the company pays. Cash taxes are often included in the FCCR formula so definitely something to have on your radar for the model / presentation as FCCR is one of the most important metrics to analyze as a credit investor.

In terms of assuming the leverage levels and pricing you can look at what public comparable companies' debt structure looks like and try to match up their total leverage levels and overall cost of debt to triangulate on your assumption for leverage and interest rates. Also, you are going to want your FCCR in your presented case to be above 1.0x at the very least - so make sure you build in some cushion to that to show you aren't over-leveraging the company.

When rank to you have to be to not do all this bitch work to get a job in DL? I don’t think VPs and above looking to move have to build models, etc. how does the headhunter / recruiting process work at this stage?

PM me if anyone needs help with an upcoming case study. Happy to help..

Hi! Do you have any precedent private credit case studies you'd be willing to share or tips on how best to prepare for one?

I did a case for a shop that a buddy of mine worked at and they asked for a 3 statement with returns on certain debt tranches (mezz with penny warrants attached). Anyone have a similar experience?

Yup went through the exact same

100%. Interviewed for GS' direct lending arm many years ago and theirs was similar but much less complex. No mezz or that much deep tranche modeling. Simple RCF / 1st lien loan model for a given CIM .

hey can you PM me, have a question!

Blanditiis in accusantium quod optio dicta. Aut deleniti adipisci voluptas et omnis eveniet et ut. Sint voluptate quia quis sit numquam. Esse laudantium ipsum maiores quia et consectetur. Quidem repellendus totam optio voluptatem quia. Mollitia impedit numquam non nostrum repellendus ut itaque in.

Provident eos eos nisi. Laudantium facilis sit quisquam culpa deserunt. Consequatur ea omnis sit autem. Maxime et deleniti nihil quidem mollitia eveniet cum. Enim id consectetur quia consectetur perspiciatis.

Et id dolore dolor ad omnis nihil eaque. Voluptates dolores qui non sed ut dolores vel et. Rerum quas illo eaque est voluptatem minus laboriosam. Perspiciatis nobis eos hic vitae. Molestiae sequi omnis saepe alias aspernatur. Fuga accusamus quo ea optio in.

Ab eos illum culpa optio. Placeat qui non rerum excepturi nisi ut et eos. Consequatur sed et sit est. Id praesentium dolorem quasi aut. Ex nulla aut sunt voluptas quos.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Want to Vote on this Content?! No WSO Credits?

Already a member? Login

Trending Content

Career Resources

- Financial Modeling Resources

- Excel Resources

- Download Templates Library

- Salaries by Industry

- Investment Banking Interview Prep

- Private Equity Interview Prep

- Hedge Fund Interview Prep

- Consulting Case Interview Prep

- Resume Reviews by Professionals

- Mock Interviews with Pros

- WSO Company Database

WSO Virtual Bootcamps

- Mar 29 WSO NYC Happy Hour: Fri 3/29, 6.30-9p, 5th And Mad Bar Mar 29 - 30 6:30PM EDT

- Mar 30 Investment Banking Interview Bootcamp 10:00AM EDT

- Apr 06 Private Equity Interview Bootcamp 10:00AM EDT

- Apr 13 Financial Modeling & Valuation Bootcamp Apr 13 - 14 10:00AM EDT

- Apr 20 Investment Banking Interview Bootcamp 10:00AM EDT

Career Advancement Opportunities

March 2024 Private Equity

Overall Employee Satisfaction

Professional Growth Opportunities

Total Avg Compensation

“... there’s no excuse to not take advantage of the resources out there available to you. Best value for your $ are the...”

Leaderboard

- Silver Banana

- Banana Points

“... I believe it was the single biggest reason why I ended up with an offer...”

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Business

Credit Analysis Case Study Example

Type of paper: Case Study

Topic: Business , Finance , Information , Company , Accounting , Money , Taxes , Thinking

Words: 1400

Published: 01/09/2020

ORDER PAPER LIKE THIS

Credit Analysis

The special purpose financial statements are financial statements that are only limited to specific users. They are prepared using a special purpose structure to meet the special needs of particular users of a financial statement. Addition their use are limited and are not prepared for the general public. Special purpose statements are in most cases prepared for the internal users such as management and there are these made for the specific users such as banks and government. For instance, those financial statements that are prepared for tax purposes are prepared in accordance to the regulatory framework. Therefore, the special purpose financial statement are different in sense that they are prepared with compliance to a particular framework that is different from general purpose financial statements.

Question 1b

The special purpose financial statement is important to the lender because they are simplified and contain information that explains the financial statement. This information helps the lender to be able to analyze and interpret the financial situation of the firm. To be specific, this type of financial statements helps the lender to conduct the credit analysis that derives various types of debt that are incurred by the firm. Thus, the lender is able to determine the probability of repayment of debt on speculated time and in full. Therefore, the analysis of financial statements is done to considerably guide in a decision to not to or extend credit by the lender.

The financial statements provided by the Boat Builder Ltd are not accurate enough to depict the true financial position of a firm. It is essential to remember that the financial statement represents the past performance of the business. Thus the financial statements provided by this firm cannot accurately portray the true financial position of the business. The financial statements are not appropriate because they are not sufficient, that is, no income statement and cash flow statement that offers substantial information to compute the ratios.

The ratios that can be computed to illustrate the financial position are not sufficient enough to give the correct analysis of the business. There is ignorance in accounting assumptions such that the expenditures in the statement of financial performance are not differentiated into consumed and incurred expenditure in that period. This violates the assumption of accounting period. The financial statements are also prone to errors such as mistake in applying GAAPs and deliberately misstatement of numbers. The misstatement of numbers may be as a result of misapplying accounting rules as false booking accounting.

As a lender I would rank may concern as the following;

Insufficient financial statements

Lack of a well prepared income statement and cash flow statement can be ranked as the first concern because they provide a vital role in computing ratios that portrays a financial performance of the business. The lender is more concerned to know how the business is operating and the certainty the firm can experience in paying back the money lend. Cash flow statement derives the ratios that are significant in determining whether to lend money or not. For instance cash flow to capital expenditure ratio can be used to determine the financial flexibility of a business. That is, the higher the ratios the more vulnerable for a company to experience financial flexibilities.

Financial statements are prone to errors

The financial statement errors are also vital in the decision making of lending out money. If the accountants are not more careful and do not comply with the accounting principles, there are high chances of a firm to incur significant losses. Therefore, as a lender I would always avoid transacting with such business because I would end up experiencing band dept.

The ignoring of accounting assumptions

Failure to make distinction between the expenditure incurred and expenditure consumed in particular period can result into incorrect expenditure that can be carried forward into the nest financial year. Such concern can be considered to more applicable for lenders in their decision making. This is because time and certainty of information is disrupted.

As a lender is would like to ask certain questions, which are related to my concern, to the owner of the business so I can be able to know the credit worthy of the business. Such questions are as follows How can the proprietor or the accountant provide relevant information that can assist in determination of the firm to expand its equity basis?

As a lender, how can I determine the effectiveness and efficiency in management that can enhance profitability of the business?

How is the flexibility of the financial in the firm that determines the dependency of the firms’ external sources of funds? How much the firm does relies on the external funds?

How does the firm ensure that it does not violate the accounting principles and assumptions?

How does the provided information support the financial statement for easy understanding of the components?

On the first question, the decision carried by the management to expand the equity basis can only be solved by computing the return on equity ratio. The computation of this ratio involves the combination of the balance sheet items and the earning items. The ratio is given by; net income / (common equity + preferred equity). Therefore, the income statement has to be modified to derive the net income. To calculate the net income, expenses are deducted from the gross profit, revenue is added and then the tax deductions are made. Therefore, the firm must provide additional information to assist in computing this net income.

The next question concerns the financial flexibility of the business that is crucial to the lender so as to determine the effectiveness in generating the substantial cash to pay the bills. If a firm cannot be able to generate substantial cash to pay the bills the firm is not therefore vulnerable for lending out funds. For the businesses that are capital intensive the significant ratio is the cash flow to capital expenditures, which is given as; Cash flow from operating / capital expenditure. To be able to compute the ratio the accountant has to carry out modification in the financial statement of the firm. The modification involves preparing cash flow statement that can be used to derive the cash flow from operating amount that is needed to compute the ratio. After the determining the ratio, the lender will be able to determine the risks of the business. This is because a firm that depends on external sources of funds operates on greater risks than a business that can retrench when new capital becomes prohibitively expensive or scarce.

The concern on to reduce errors in the financial statements should be solved by introducing an auditing team that can reduce errors in the statement and provide accurate documents. Modification such as modifying income statement and adding the cash flow statement should be considered. The accounting assumptions should also be followed to ensure that consumed expenditures and incurred expenditure are differentiated to be carried forward effectively in the next financial period.

In order to be able to understand the financial statements, the substantial information has to be added along the financial statements. Thus the modification to be made involves adding the supporting notes that explains the components of the financial statements. In addition the accounting policies must be sufficient enough to explain the basis under which the financial statements have been prepared. In conclusion, all these questions will assist to modify the financial statements and provide sufficient information that can accurately determine the real position of the business.

Cite this page

Share with friends using:

Removal Request

Finished papers: 2485

This paper is created by writer with

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages