Giving Up Your Inheritance: Assignment

As you probably already know, California allows you to disclaim your interest in an inheritance. Disclaiming an inheritance is simply the same as refusing an inheritance. If you disclaim your inheritance, it will be as if you “predeceased” the decedent, and the assets will be treated as though another person inherited them. In California, you can also make what is called an “assignment” if you do not want or need an inheritance. An assignment works differently from a disclaimer. Below is more about assigning inheritance.

What Is an Assignment of Inheritance?

If you receive an inheritance that you do not need or want, or if you receive an inheritance that you would prefer someone else receive, you can make an “assignment.” An assignment occurs when you transfer all or part of your inheritance to someone else.

The person making an assignment is known as an “assignor,” and the person receiving it is known as the “assignee.” Generally, an assignment is like a gift by the assignor to the assignee.

There are legal steps to be taken for an assignment to happen. An assignment is not an informal transfer. After all, transferring your inheritance to another person goes against what your deceased loved one designated or what California law requires based on familial relationships. Assignments are executed in writing and delivered to the executor of the estate. An assignment must be filed with the probate court before the transfer can be done.

If you are thinking of assigning your inheritance, you need to note that assignments create tax issues for both the assignor and assignee. Indeed, some tax issues can be avoided with an assignment, but you’d need to speak to a lawyer or tax advisor to determine the tax implications that apply to your case.

Reasons for Assignment

People assign assets for various reasons. The following are some of the reasons why people assign their interest in an inheritance;

- To avoid gift tax if they don’t plan to use the money themselves

- To exchange their inheritance for an immediate cash payment from a third party

- To give a share in the estate to an accidentally omitted beneficiary

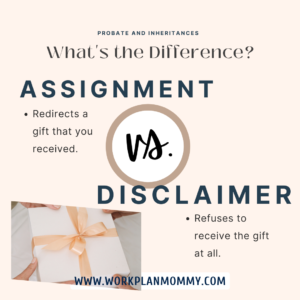

Assignment vs. Disclaimer

As already mentioned, assignments are different from disclaimers. Firstly, when it comes to assignment, you inherit the property and then assign it. On the other hand, you do not get any share of the inheritance with a disclaimer.

Secondly, if you assign your inheritance, you can choose who gets it. You can assign your inheritance to anyone you want. On the other hand, when you disclaim your inheritance, you have no direct say in who gets it. If you disclaim an inheritance, the beneficiary or heir next in line will likely inherit it.

Lastly, there is no time frame for assignment, whereas you generally have nine months for a disclaimer.

Because there is no time frame for assignment, people who don’t want or need their inheritance, who accidentally pass the required nine months for a disclaimer, usually end up assigning their inheritance.

In conclusion, it is crucial to note that you cannot undo an assignment. In other words, transferring your inheritance rights is an irrevocable act.

Contact The Probate Guy

When it comes to assignments and disclaimers, making the right decision is easiest when you have the support of a skilled attorney. Contact the experienced and dedicated California probate attorney , Robert L. Cohen – The Probate Guy – to schedule a telephonic consultation.

More on Probate

- What Are the Benefits of Choosing a Probate Lawyer Near Me?

- Can You Use Alternative Dispute Resolution for Probate Issues?

- Burden of Proof in Will Contests

- Tips for Dealing With a Manipulative Estate Executor

- Can Lottery Winnings Be Inherited?

- February 2024

- January 2024

- December 2023

- November 2023

- Estate Planning

- Living Wills

I love being a probate attorney. I love helping people through a very difficult time in their lives with the probate process. My practice focuses solely on probate matters. My job is to complete the probate process as efficiently and painlessly for my clients as possible. I have found that paying the upfront costs of probate adds unneeded stress, so I will advance all of the fees and costs for the probate. No money is required to complete the probate. I will be reimbursed at the end of the case when you receive your inheritance. Call me NOW to discuss your case for free.

to submit an obituary

For information on submitting an obituary, please contact Lake County Record-Bee by phone at (707) 900-2010, or email at [email protected] or fax at 707-263-1706.

Email is the preferred method of sending obituaries. The text should be in the body of the email. Photos are accepted by email, in a .jpg format. Obituaries that appear in the Lake County Record-Bee can also appear in the Clear Lake Observer American.

Assignments, disclaimers and powers of…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to print (Opens in new window)

- Entertainment

Things To Do

Assignments, disclaimers and powers of appointment can alter the distribution of a decedent’s estate, each can alter the distribution of a decedent’s estate.

First, what is and who can make an assignment? A person who has a vested — legally enforceable — interest in a decedent’s estate can “assign” – i.e., transfer – part or all of their interest to another. Generally, an inheritance vests upon the decedent’s death. An assignment is a gift by the assignor making the assignment to the assignee receiving the assigned interest. Assignments create tax issues for both the assignor and assignee.

For example, consider an unmarried father who dies intestate — without a will or trust – and is survived by a son and a daughter — his heirs. Prior to settling dad’s estate, the son decides to give his one-half share to his sister and signs and notarizes an assignment of inheritance rights. The assignment is then filed with the Court. Dad’s estate, less expenses and debts, is distributed entirely to the daughter.

If an interest in real property inherited from a parent is assigned then the parent child exclusion from reassessment — for local real property taxes — only applies to the interest(s) belonging to the child(ren) who do not assign their interest(s). There is no reassessment exclusion for any transfers between siblings.

Assignments, however, almost never apply to a beneficiary’s interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary’s creditors.

Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance. You cannot force someone to receive a gift or an inheritance. To be valid disclaimers must satisfy the following requirements: be unconditional, be in writing, and be timely (i.e., generally, within nine months of the transfer), and, when real property is involved, also be filed with the county recorder where the real property lies. Unlike assignments, the person disclaiming their interest cannot say who receives the disclaimed interest. A disclaimer is not a gift by the person disclaiming. Lastly, one cannot have accepted any benefits from the property being disclaimed, such as the income from an income producing asset.

The person disclaiming their gift or inheritance is treated as if they had predeceased the person who made the gift. We see who is then entitled to inherit.

For example, a decedent’s trust leaves a share of the decedent’s trust estate to a named beneficiary and otherwise, if he does not survive to inherit, to the beneficiary’s descendants by right of representation. The beneficiary survives and timely disclaims. The beneficiary’s living descendants would then inherit by right of representation.

Unlike assignments and disclaimers, powers of appointment are created within a person’s estate planning, e.g., a trust or will, for future use. A power of appointment allows the power holder to say who receives a gift/distribution from a trust or an estate. The power of appointment is either a limited power that allows gifting to certain persons or is a general power that allows gifting to anyone at all, including the power holder, the power holder’s estate and the power holder’s creditors. Powers of appointment are used for a variety of estate planning reasons.

For example, a husband’s and wife’s joint estate planning may give the spouse who survives a limited power of appointment over the deceased spouse’s separate trust estate. The limited power of appointment might allow the deceased spouse’s estate to be divided equally or unequally amongst the deceased spouse’s children as the surviving spouse sees fit after the deceased spouse’s death.

Anyone who wants to proceed with making an assignment, a disclaimer or exercise of a power of appointment should consult a qualified attorney. There are tax and other issues to discuss and drafting requirements to these legal instruments that benefit from the expertise of a qualified attorney.

Dennis A. Fordham, Attorney, is a State Bar-Certified Specialist in estate planning, probate and trust law. His office is at 870 S. Main St., Lakeport, Calif. He can be reached at [email protected] and 707-263-3235.

More in Things To Do

How Kacey Musgraves opened herself back up to love

‘One Life’ a true tale of Holocaust hero

Travel | Airfares have dropped. Here’s why they could go even lower in 2024

How ‘Frida’ director Carla Gutierrez rediscovered material about the iconic Mexican artist

- [email protected]

- 858-208-8900 | FREE 30 Min Consultation

Disclaiming vs. Assigning Inheritance: Explained by San Diego Trust Lawyer

The difference between disclaiming your inheritance and assigning it

If you disclaim your share of a person’s estate, the heir next in line will inherit it. When writing their will, people can name alternate heirs. When you disclaim your interest in the inheritance, that share will go the person who was listed as the alternate heir or it will go to the next heir in line if the person died intestate . The point to note here is that you can’t choose who gets your share after you disclaim it.

If you assign your share, you get to choose who gets it. You can assign your share to anybody you want. Some tax issues are avoided, but you would need to talk to an experienced San Diego trust lawyer and/or tax advisor to find out what tax implications apply to your case. Assignments are sometimes used by people who owe money to someone or by people who on government benefits. Their inheritance could disqualify them for those benefits, but in the long run it wouldn’t be as beneficial as the government aid.

Why would anyone disclaim their inheritance?

There are actually many reasons why someone would want to pass up their interest in an inheritance. Here are just a few situations when a person would want to disclaim their share:

- To reduce the size of their estate and avoid estate taxes

- To pass the gift on to the next heir in line with less hassle and no gift tax

- To avoid disqualification from state or federal programs such as SSI or Medicaid

- To save their share from being seized by their creditors (if the heir is facing personal bankruptcy)

Why would someone assign their interest in the estate to someone else:

- To avoid gift tax if they don’t intent to use the money themselves

- To give some share in the estate to an accidentally omitted heir

- To exchange their inheritance for an immediate cash payment from a third party

How do you disclaim/assign your inheritance?

Disclaiming your interest in inheritance needs to be done in writing, naming your details, the details of your benefactor and the extent of your inheritance. The disclaimer should be delivered to the executor or the personal representative within 9 months of the benefactor’s death (or 9 months after you turn 21 if you became the heir as a minor). It is crucial that you don’t receive any benefits from the estate before disclaiming it. When the executor of the estate or the trustee of the trust files tax returns, it is reported that there has been a disclaimer.

Assignments are also executed in writing and delivered to the executor of the estate or the trustee of the trust. No time frame for assignment – that is why people who accidentally pass the required 9 months for a disclaimer end up assigning their interest. The person inherits the property and then assigns, whereas with the disclaimer, the person cannot have any distribution of the inheritance. There are tax implications, but again, you need to seek guidance from a San Diego trust lawyer or a tax professional.

Make an informed choice with a San Diego trust lawyer by your side

Transferring your inheritance rights is an irrevocable act and making the right choice the right way is easiest when you have the support of a knowledgeable and experienced San Diego trust lawyer. You need to be well informed of the implications and consequences of your actions, so that you carry out your intentions as planned. Every case is unique and the relative advantages and disadvantages of various options differ from one case to another. That’s why you’re advised to seek professional help. If you would like a legal consult (without attorney-client privilege), feel free to book your no-cost 30-min. case review at the Law Offices of Irina Sherbak. Call us right away at 858-208-8900!

Tell us about your experience with fee waivers in probate court!

Small estates: how does assignment of property work.

When a person dies, they are called a decedent. A decedent leaves property behind. That property needs to be passed on to those who will inherit it. If a person has a small estate, then a shortened process, called assignment of property, can be used instead of the probate administration process.

Read this article to learn about how to use the assignment of property process. You can use our Do-It-Yourself Settling a Small Estate tool to create the forms you will need for this process. Read the article An Overview of Small Estate Processes to learn more about the other ways a small estate can be distributed.

What is In an Estate?

The property a decedent leaves behind that can be distributed through the assignment process could include:

- Real estate (houses and other buildings, land and the things attached to it)

- Personal property (furniture, cars, and other things not attached to land)

- Bank accounts and cash

- Stocks and bonds

- Debts owed to the person

Some of the property is not part of the estate, which means it cannot be distributed through the assignment process. The estate does not usually include:

- Jointly owned property,

- Insurance policies,

- Retirement accounts, or

- Trusts that are not established by a will

Jointly Owned Property

Jointly owned property is property owned by more than one person. It is generally not included in an estate. Examples of jointly owned personal property are if you and the decedent are both listed on the title of a car or if you have joint bank accounts. When the decedent died, you automatically have full ownership of that property, so it is not part of the estate. You may want to take a copy of the decedent’s death certificate to the bank or Secretary of State (SOS) to remove the decedent’s name from the account or car title.

However, sometimes joint ownership is more complex. If you own real property with the decedent, or if you own any type of property with the decedent and someone else, ownership can be hard to understand after a death. Read the article Jointly Owned Property to learn more about this, or use the Guide to Legal Help to find a lawyer or legal services in your area.

Small Estates

In order to use the assignment process, a decedent’s estate must be small. Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies on or after February 21, 2024, an estate must be valued at $28,000 or less to be small. If a person died in 2023 through and including February 20, 2024 an estate must be valued at $27,000 or less. If a person died in 2022, an estate must be valued at $25,000 or less. If a person died in 2020 or 2021, an estate must be valued at $24,000 or less. If a person died in 2019 or 2018, an estate must be valued at $23,000 or less.

Assignment of Property

Assignment of property is the small estate process you must use if the decedent had real property. However, even if there was no real property, you may choose to use assignment of property if an estate is small. This is the only small estate process where a Probate Judge reviews and approves the division of property.

To use this process, you must know all the property and the heirs the decedent had, and have information about the funeral or burial expenses. You must also be an heir or the person who paid the funeral bill.

You must list all real property and personal property with the value of each. You can estimate real property’s market value by doubling its State Equalized Value (SEV). You can find the SEV on property tax bills or assessments for the property. You can also find it on most county or municipality websites.

The value of the property in the estate is its market value. Any liens or loans on property will not be deducted when determining if the estate falls into the small estates amount. There is a separate calculation to determine the fees that the court will charge to file the petition. This is called the inventory fee. You are allowed to deduct the value of the mortgage or other liens on real property when you determine the inventory value. You are not allowed to make any deductions from the value of personal property.

To estimate the value of personal property, think about how much you would ask for it at a yard sale or if you were selling it online.

Who Will Inherit?

After funeral and burial expenses have been paid, the court will order any remaining property to be divided among the heirs. The inheritance formula determines which heirs inherit property, and how much of the property each person will get. If there is a surviving spouse, that person inherits all the property.

If there is no surviving spouse, any property will be given or paid to direct descendants of the decedent, starting with the decedent’s children. If all of the decedent’s children are still alive, they will split the property equally. If a child died before the decedent, that person’s children will split the share equally. If the decedent had a grandchild who should inherit, but they died before the decedent, the grandchild's children will split the shares equally. If inheriting children or grandchildren die before the decedent with no living children of their own, the line of inheritance stops there. Their share will be divided between the remaining descendants.

If there are no living descendants of the decedent, the property will be split between the decedent’s parents equally. If only one parent is still living, that parent inherits all the property. If both parents died before the decedent, the property will go to their descendants, starting with the decedent’s siblings. The same rules of representation mentioned above apply.

If an inheriting sibling died before the decedent, that person’s child(ren) will split their share of the property equally. The same is true if an inheriting niece or nephew died before the decedent. If inheriting siblings, nieces, or nephews die before the decedent with no living children of their own, the line of inheritance stops there. Their share will be divided between the remaining heirs.

If no descendants of the decedent’s parents are living, the property is divided among the decedent’s grandparents. Half of the property will go to the decedent’s paternal grandparents, and the other half will go to the maternal grandparents. If only one maternal or paternal grandparent is living, they will take the full half of the property. If both grandparents on one side died before the decedent, their half of the property goes to their descendants, starting with the decedent’s aunts and uncles. The same rules of representation mentioned above apply.

If an inheriting aunt or uncle died before the decedent did, that person’s children will split the share of the property equally. The same is true if an inheriting cousin died before the decedent. If inheriting aunts, uncles, or cousins die before the decedent with no living children of their own, the line of inheritance stops there. Their share will be divided between the remaining heirs.

There are other rules too, including special rules if an heir dies after the decedent does. You can use our Do-It-Yourself Settling a Small Estate tool to help you figure out who will inherit and what share each heir will receive. You may also want to talk to a lawyer if you have questions about this. You can use the Guide to Legal Help to find legal services in your area.

Survivorship and the 120-Hour Rule

Survivorship affects inheritance rights of heirs and devisees. In Michigan, a person must live more than 120 hours after a decedent dies for that person’s survivorship rights to take effect. Generally, anyone who dies during the first 120 hours after a decedent’s death is considered to have predeceased (died before) the decedent and they lose their interest in the decedent’s property. The 120-hour rule is not followed if:

- A will, deed, title, or trust addresses simultaneous deaths or deaths in a common disaster;

- A will, deed, title, or trust states a person is not required to survive for a certain amount of time or it specifies a different survival period;

- The rule would affect interests protected by Michigan law; or

- The rule would cause a failure or duplication in distributing property.

Notice to Decedent’s Creditors

This process does not include any notice to creditors . If a creditor tries to collect a debt within 63 days of when the order is issued by the court, the person who got the property will have to pay the debt, up to the amount or value of the property the person got. This does not apply if the decedent’s spouse or minor children got the property. For example, if the decedent’s brother got $1,000, a creditor the decedent owed $500 could get the $500 from him. If the decedent had owed the creditor $1,500, the brother wouldn’t have to pay more than $1,000 to the creditor. If the decedent’s spouse or minor child got the property, they would not have to pay the creditor anything.

The Process

To start this process, file a Petition for Assignment with the probate court in the county where the decedent lived. If the decedent lived outside Michigan, file the Petition for Assignment in the county where the decedent had real property. You can use our Do-It-Yourself Settling a Small Estate tool to create this petition.

After you complete the form, print two copies. Date and sign both copies. The Do-It-Yourself Settling a Small Estate tool will prepare a Testimony to Identify Heirs, but not all courts require it. Not all courts require a certified copy of the death certificate. You might want to check the probate court’s website or call and ask before you go to court to file the documents. You can find contact information for the court on the right side of this page if you have selected a county.

You will need to file the following documents with the probate court:

- Both copies of the petition

- The Testimony to Identify Heirs (if your court requires it)

- A copy of the death certificate

- Proof that the funeral and burial expenses have been paid or a bill showing the amount owed

There is a $25 filing fee. There is also an inventory fee. It is based on the value of property in the estate. If the property in the estate has no value, the inventory fee is $5. For example, if the decedent had a house that was worth less than the amount of the mortgage, the value of the estate could be zero. You can use the inventory fee calculator on the Michigan One Court of Justice website to see how much the inventory fee will be.

The petition is reviewed by a probate court judge. If everything is correct when you file the Petition and Order, the judge will sign it. You may be able to get your certified copy of the Order Assigning Assets on the day you file it. You need the Order Assigning Assets to distribute the property in the estate.

There is a fee to get a certified copy of the Order Assigning Assets. The fee to get a certified copy varies, but it is usually $15 to $20. You need a certified copy of the order to transfer the property in the estate. You may want to get more than one certified copy when you file the petition. Some courts charge less for extra certified copies if you get them at the same time.

The court will order the funeral and burial expenses be paid or reimbursed to whoever paid them. This means all paid and unpaid funeral expenses will be deducted from the value of the estate when determining if it is a small estate. If there is no cash available, something may have to be sold to pay those expenses.

Distributing the Property

Once the judge has signed the Order Assigning Assets, you will be able to distribute the property in the estate to the heirs. The Do-It-Yourself Settling a Small Estate tool will tell you the shares each person is entitled to, but some things (like cars) cannot easily be divided. Decide how to divide the existing property so everyone gets the share they deserve.

Transferring Money from Bank or Credit Union Accounts

If the decedent had bank or credit union accounts that were not jointly owned with another person, take the certified copy of the order to the bank to close the account. The bank should release the money to the heir or heirs by writing a check or money order.

Transferring a Vehicle

If the decedent had a vehicle, the surviving spouse or heir must complete a Certification from the Heir to a Vehicle . If you use our Do-It-Yourself Settling a Small Estate tool, you will get a completed certification form for each vehicle you are transferring.

Take it to the Office of the SOS with a copy of the death certificate. If you have a copy of the vehicle title, take that, too.

Transferring Real Property

If the decedent had real property, you will need to record a certified copy of the order to transfer the property. Take the order to the register of deeds for the county where the property is. Check the county’s website or call the local register of deeds office to find out how much the filing fee is.

You should not have to pay a transfer tax. Transfer tax is based on how much is paid for the property. Nothing was paid for this property when it transferred because the decedent died.

When the property is transferred, its value may “uncap.” The amount property tax can increase in a year is limited while the property is owned by the same person. When the property is transferred to another person, the property tax will be adjusted to the property’s current market value. You can learn more about property taxes on the State of Michigan’s Treasury Department website .

If the property was the decedent’s principal residence, it probably had a Homestead Tax Exemption attached to it. Under Michigan law, if you own your home you do not have to pay certain taxes on it.

If the person inheriting the property will be living there, they need to fill out a Principal Residence Exemption Affidavit . If whoever is getting the property is not going to live there but plans to continue owning it, they need to fill out a Request to Rescind a Principal Residence Exemption .

One of these forms must be filed with the city or township where the property is located within 90 days after the decedent’s death. If it is not filed, additional taxes and fees will be charged.

You may not have to file the Request to Rescind a Principal Residence Exemption for up to three years if the property is listed for sale during that time. If you are selling real estate in this situation, you may want to talk to a real estate agent or a lawyer.

If you have a low income, you may qualify for free legal services. Whether you have a low income or not, you can use the Guide to Legal Help to find lawyers in your area. If you are not able to get free legal services but can’t afford high legal fees, consider hiring a lawyer for part of your case instead of the whole thing. This is called limited scope representation. To learn more, read Limited Scope Representation (LSR): A More Affordable Way to Hire a Lawyer . To find a limited scope lawyer, follow this link to the State Bar of Michigan lawyer directory . This link lists lawyers who offer limited scope representation. You can narrow the results to lawyers in your area by typing in your county, city, or zip code at the top of the page. You can also narrow the results by topic by entering the kind of lawyer you need (divorce, estate, etc.) at the top of the page.

Work. Plan. Mommy.

Simplifying estate, business, and death planning.

Assignments vs. Disclaimers: What is the difference between an assignment and a disclaimer for probate?

Probate and Administration

Assignments vs. Disclaimers: What is the difference between an assignment and a disclaimer?

In contrast to a disclaimer, an assignment is when a person directs his or her inheritance or power of appointment to someone else. A disclaimer, on the other hand, is a person’s unwillingness to exercise any power over an inheritance or power of appointment.

In other words, with an assignment, you direct what happens and with a disclaimer you refuse to ever receive any control over an asset.

However, what are the practical uses for disclaimers and assignments and why do they matter for probate?

(Legal disclaimer: Yes, I am an attorney, but, no, I am not your attorney. Nothing in this post or on this site is legal advice. Nothing in this post or on this site creates an attorney-client relationship. This information is merely educational and informative. You should discuss your facts and circumstances with a licensed attorney in your jurisdiction.)

What is an Assignment?

Let’s talk about assignments in terms of gifts.

If mom gives you a sweater for Christmas, and you choose to regift it, you have assigned that sweater to someone else.

Your regift is redirecting the sweater away from you and to someone else specific –assigning it to someone else.

An assignment, unlike a disclaimer, which I will further discuss below, is your choice to actually give away the power that you have over an item, asset, or right to someone else.

You had 100% rights to the sweater when your mother gave it to you. When you relinquish that sweater to someone else, that other person now has all of your rights. Now, that person has 100% rights to the sweater, and you don’t.

Partial Assignments

If, on the other hand, you don’t want to completely give something away, you might make a partial assignment.

Perhaps you let your sister borrow the sweater. She has the power to use and wear the sweater for a limited amount of time, but you are still the owner.

Assignments and Probate Estates

Assignments and partial assignments are especially important in estates and probate.

Assignments are your opportunity to correct a wrong, to direct an asset to someone else, or to even make a gift for tax purposes.

In other cases, it might be your opportunity to get out from under an asset that you don’t want to be saddled with.

If, for example, your parents leave you and your siblings the childhood home, perhaps you want nothing to do with it.

In that case, you might assign your portion of the childhood home to your siblings so you don’t have to deal with renovations, sales, or other issues.

Or, perhaps you received a gift that you weren’t properly supposed to receive. Perhaps, you are an ex-spouse whose deceased ex-spouse never updated his or her estate plan.

If you are an ex-spouse who now receives the family assets when they should go to the children, you might assign your ill-gotten inheritance to the children.

RELATED POST: Estate Planning and Divorce

However, be careful with assignments. Assignments might carry tax concerns. If you have tax concerns about receiving a gift, then maybe you are better off with a disclaimer. I’ll talk more about taxes and assignments below, but first, let’s explore what a disclaimer is.

What is a disclaimer?

Unlike an assignment, a disclaimer is your complete relinquishment of control over an asset. A disclaimer not only relinquishes the asset, but it also relinquishes your power to direct where the asset goes.

You don’t get to decide who receives it or how they use it. No conditions; no strings.

To be effective, a disclaimer must be qualified meaning that it must be in writing, properly received, delivered, and made within a proper period of time. ( https://www.investopedia.com/terms/q/qualifieddisclaimer.asp )

What does a disclaimer actually look like? Let’s go back to the gift analogy.

Take that sweater your mom gave you, for example. If, instead of giving it to a friend, you simply leave it by the road with a “free” sign, you disclaim it.

You leave it for anyone to take without any strings attached.

For legal purposes, you never exercise any control over it at all. You refuse to even receive it, wear it, or take it home.

You don’t direct it to anyone. You simply take your hands off the proverbial wheel and leave it for someone else to make the decisions.

Partial Disclaimer

Unlike a partial assignment, where you might grant a limited license in an asset, there is no such thing as a partial disclaimer where you retain some rights. You could disclaim a partial interest, but a disclaimer refuses to receive a gift at all.

When you disclaim an item, you irrevocably give up all right, title, interest, and control over the asset. You can’t get it back; you can’t choose where it goes, and you can’t decide what someone does with it.

Disclaimers and Probate

If you receive an inheritance, and you want to disclaim it, your state will dictate what happens to the asset.

Although a disclaimer does not leave the asset up for grabs for anyone in the world like in the sweater example, you do have to know that a disclaimer relinquishes your control over the inheritance.

In many states, a disclaimed inheritance passes to the next intestate heirs.

What does that mean?

In the event of a disclaimer, in probate or an estate, you don’t simply leave the asset to the person of your choosing (an assignment), instead, you leave it for the next person in line.

Take that house your parents gave you, for example. If you want to disclaim your interest in the house instead of dealing with it, your disclaimer leaves it to your children or heirs rather than your siblings.

If you want the house or the asset to go to a specific person, sign an assignment. If you want the house or asset to go to the next person in line without any tax consequences, then sign a disclaimer.

In some cases, those people might be one and the same. But, I have seen plenty of people sign a disclaimer thinking that they were passing the asset to a specific person only to find out that they relinquished the asset and the control over the asset to someone completely different.

Regardless, a disclaimer may still be right for you if you have tax concerns.

Assignments, Disclaimers, and Taxes

Beyond the ability to control who receives an asset, the biggest concern about disclaimers and assignments are taxes.

No, I am not a tax attorney, and no, nothing here is tax advice. However, you should know that each decision has tax consequences.

Tax Consequences of an Assignment

An assignment, like I already mentioned, is your ability to continue to exercise control over the direction of an asset.

Like a ball that you catch and throw to the next person, an assignment is treated as though you received the asset and then gave it to someone else.

You received the sweater, then you gave it to someone else. You received the house, then you gave it to your siblings.

An assignment, for tax purposes, is treated as a gift. Because you had control over the asset and then gave it to someone else, you are treated as having not only received the inheritance (and any corresponding tax liability) but also having made a gift.

Making a gift has its own tax consequences. Your gift may eat into your annual exclusion, your lifetime unified credit, or even your estate taxes.

Assignments and Charities

If you make that assignment to a qualified charity, foundation, NGO, or 501(c)3, on the other hand, you might not only receive the asset but also the deduction.

For the most part, gifts to qualified charities are tax deductible.

Therefore, for some, signing an assignment as a part of an inheritance is a strategic way to receive a tax-free, stepped-up asset and then take an enormous tax deduction.

RELATED POST: What’s the big deal about stepped-up cost basis?

A disclaimer would have completely different tax consequences, on the other hand.

Disclaimers and Taxes

Because a disclaimer is your “hot potato” moment, your avoidance of receiving the gift, or your taking the hands off the wheel of power and control, for tax purposes, you never receive a disclaimed asset.

For tax purposes, you are never treated as having received the asset (the gift or inheritance) if you properly execute a legitimate disclaimer (IRS LINK FOR TIMELY DISCLAIMER).

A qualified disclaimer for tax purposes must meet the following criteria:

- (1) The disclaimer must be irrevocable and unqualified:

- (2) The disclaimer must be in writing ;

- (3) The writing must be delivered to the person specified in paragraph (b) (2) of this section within the time limitations specified in paragraph (c)(1) of this section;

- (4) The disclaimant must not have accepted the interest disclaimed or any of its benefits; and

- (5) The interest disclaimed must pass either to the spouse of the decedent or to a person other than the disclaimant without any direction on the part of the person making the disclaimer.

https://www.law.cornell.edu/cfr/text/26/25.2518-2#:~:text=(1)%20Requirements.,(2)%20Delivery.

Therefore, the IRS completely ignores proper disclaimers. No gift received; no gift made.

Contrastingly, other government entities may not ignore disclaimers. Disclaimers may be a problem for people who receive state or federal benefits.

Disclaimers and Government Benefits

If you receive state or federal means-tested benefits, disclaimers are generally prohibited.

The government will not generally allow you to intentionally deprive yourself of a valuable asset just so you can keep your insurance, aid, or stipends.

For this reason, not everyone is eligible to sign a disclaimer. And, a gift made to a person who receives means-tested government benefits might just be a horrible way for them to lose their insurance or other needed benefits.

RELATED POST: Supplemental Needs Trusts: How to care for your special needs child.

Even small gifts of a few thousand dollars, an interest in a home, or other assets might be just enough for someone to lose their Medicaid while not providing enough assets to actually provide care.

Sometimes well-meaning grandparents will leave cash gifts to grandchildren and completely destroy a grandchild’s state health benefits.

Most of the time, a disclaimer will not correct the situation. In those instances, the grandchild may not be legally eligible to sign a disclaimer due to the state and federal restrictions against disclaimers for means-tested benefits.

However, in the event a disclaimer is available, no taxes will be owed.

Disclaimers and Charitable Gifts

You should also know, however, if your disclaimer does cause the asset to pass to a charitable recipient, while you receive no tax burden for receiving the gift, you also will receive no tax benefit for making a gift.

Because you never had control over the asset, you didn’t have the right to direct it to anyone else. Therefore, you didn’t give it away. You didn’t make a charitable gift.

If you want a deduction, then an assignment will not be the proper course of action for you!

Why would you use an assignment or disclaimer for probate?

In some instances people receive inheritances or gifts that they don’t want either for personal or tax reasons.

In those cases, they may simply want to give it to someone else or not receive it at all.

If someone receives a gift and wants it to go to a specific individual, then he or she should sign an assignment. However, he or she should also understand the tax consequences of assignments.

In the same way, if a person receives a gift and simply wants nothing to do with it, then he or she might rather sign a disclaimer. While disclaimers provide no power or control, they also have no tax consequences if done correctly.

Which one is right for you depends on your facts, circumstances, benefits, intestate heirs, and even your tax status.

That’s why you should always consult with a reputable attorney (and probably a CPA) before you sign a disclaimer or assignment. You wouldn’t want to have unnecessary tax consequences or watch the family home pass to some stranger.

Meet with an attorney to determine whether a disclaimer or an assignment is right for you.

Complete your estate planning online!

You are busy, and you do all your business online anyway. why should estate planning be any different.

- Indiana residents contact me here .

- Complete the intake form you receive directly to your inbox.

- Set up an online consultation.

- We do the rest!

- Business Succession Planning

- Legacy and Estate Planning California

- Planned Giving

- Special Needs Planning

- Trust and Probate Administration

- BUSINESS SUCCESSION PLANNING

- CALIFORNIA LEGACY AND ESTATE PLANNING

- PLANNED GIVING

- TRUST AND PROBATE ADMINISTRATION

- SPECIAL NEEDS PLANNING

- Testimonial

A General Assignment of Assets to one’s Living Trust can help avoid a Probate.

Re-titling assets, like stock and bonds, from one’s name into one’s living trust is necessary to avoiding an unnecessary probate of such assets if held outside of the trust. Sometimes people fail to transfer some or all of their intended trust assets into their trust. A general assignment of assets to one’s living trust provides an important safeguard. Let’s examine what a general assignment is and how it helps to fund one’s trust and avoid a probate with the help of a Lake County probate attorney:

A general assignment of assets transfers ownership on a wide variety of assets as the name implies. An all encompassing general assignment is regularly used by estate planners to transfer all types of financial assets (excluding tax deferred retirement accounts) and personal property (such as the contents of one’s home) into the trust. It is a half-step towards actually re-titling the securities and the financial accounts into the name of the trustee. Nevertheless, the settlor should still proceed to contact the banks, brokerages, and stock transfer agents (as relevant) to formally transfer legal title into the name of the trustee. But, in the event that the formal legal title is not transferred prior to death, the general assignment can be used to obtain a court order to transfer legal title into the trust.

In Kucker v. Kucker , (2011), 192 CA 4 th , 90, the Court of Appeal reversed a trial court decision wherein the trial court disallowed a petition to transfer stocks into a trust based on a general assignment of all assets by the settlor to the trustee. The Court of Appeal agreed with the petitioner that a general assignment of all or substantially all of the settlor’s assets into one’s trust does cause the stocks to be owned by the trustee. An otherwise unnecessary probate was thus avoided thanks to a general assignment by the settlor.

Similarly, a declaration of trust by a settlor to hold certain assets listed on a schedule of pledged assets attached to a trust document can likewise be used to accomplish the same result. Most attorneys use a schedule of initial trust assets and a general assignment to reinforce one-another. Moreover, unlike the general assignment, the schedule of trust assets will also include the real estate – together with a full legal description — for the same reason. That is, if a trust transfer deed is not properly executed prior to the settlor’s death, then the schedule of initial trust assets to a declaration of trust can be used to petition the court to transfer legal title into the trust without a probate.

While the general assignment and the declaration of trust are important safeguards against the failure to formally transfer title to trust assets while the settlor is still alive and competent, such safeguards are just safeguards. The better course of action is to see that one’s real estate, stocks and bonds, and financial accounts (and other trust assets) are properly titled in the name of the trustee of one’s trust. After all, filing a court petition entails further expenses and delay in the administration of the trust that can be avoided.

The information contained in this website is for general information purposes only. The information is provided by the Law Office of Dennis Fordham. and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of Law Office of Dennis Fordham. We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, Law Office of Dennis Fordham takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

We respect your privacy. We will not sell or rent your information to anyone. The information you provide us will be used to communicate the status of your business with our firm.

“Serving Lake and Mendocino Counties for nineteen years, the Law Office of Dennis Fordham focuses on legacy and estate planning, trust and probate administration, and special needs planning. We are here for you. 870 South Main Street Lakeport, California 95453-4801. Phone: 707-263-3235.”

Practice Areas

- Legacy and Estate Planning

Upcoming Events

Why a Trust and Not a Will? Seminar

Community Event Announcement

Please call if you want to be notified of our next upcoming seminar.

Event Sign Up

Stay current on news & events. we’ll never share your address..

- Enter Email

© 2024 Dennis A. Fordham All Rights Reserved

- E-Newsletter

- Scholarship

- Giving Back

- Incapacity Planning

- Powers of Attorney

- Prenuptial Agreements

- Legal Representation for Trustees

- Legal Representation for Beneficiaries

- Trust Administration

- Conservatorships

- Business Planning

- Attorneys & Staff

- Resources + Events

- No-Cost Consultation

- California Satellite Offices

How to Transfer Business Interests into a Trust

After you create a trust, your next step is to transfer your assets into your trust. But what if you own a business interest? Should you transfer that into your trust too? Transferring business interests into a trust can be complicated, but here’s an overview of the basics.

Why Transfer Business Interests into a Trust?

Some people who create a trust choose to transfer their business interests into it for the following reasons:

- Avoiding Probate: Just like any other asset, business interests that exceed the California probate threshold can trigger a lengthy, expensive, and public probate proceeding. Assets that are placed in a trust do not need to be probated.

- Incapacity Planning: A trust ensures that your business can continue operating not only upon your death, but also if you become incapacitated due to an accident or illness. If your business interests are placed in a trust and you become incapacitated, your successor trustee can immediately take over your duties to keep your business operating during your absence.

What to Know Before Transferring Assets

Before transferring your business interests into a trust, you should always consult an experienced estate planning attorney . Depending on what kind of business interest you own, they can help ensure that this transfer won’t violate a corporation’s bylaws, an LLC operating agreement, or a shareholders’ buy-sell agreement.

Your attorney can also draft a trust that specifically grants the trustee powers to manage your business. Each type of business interest has its own requirements so working with an attorney is key to avoiding any potential missteps.

How to Transfer a Business Interest into a Trust

The process for transferring your business interest into a trust varies depending on what kind of business interest you own and how it was set up. Here are a few of the most common types.

Sole Proprietorship

In a sole proprietorship, you are the only business owner. Because of this, you do not need the agreement or permission of anyone else to transfer your business interest into your trust. You would simply assign your business assets and interests into the trust. This is accomplished with an Assignment of Interest agreement. Just like it sounds, this agreement assigns your interests into your trust so that it becomes a trust asset.

Corporations

If you own stock or shares in a corporation, you should contact the corporation and fill out any necessary documents to transfer your stock or shares to a trust. Often this document is called an “Assignment of Stock”. Submit this document to the corporation and have them file it.

Next, the corporation will re-issue you new stock documents listing the trust as the owner. Check with your corporation on any additional terms or conditions when making trust transfers.

LLC or General or Limited Partnership

When it comes to a Limited Liability Company (LLC) or a general or limited partnership, you may own a complete or only a partial interest in the business. You’ll want to first review the terms and conditions of your LLC or partnership agreement to review the requirements for transferring your portion into a trust. If there are other partners, they may need to vote on and approve the change.

Next, seek counsel from your attorney on the best way to transfer your portion of the business into your trust. This will vary, depending on how your business was set up. For an LLC, you may need to execute an “Assignment of Interest”, notify your partners, and sign a document agreeing to the change. For a partnership, you may need to change your partnership ownership certificate to you as the owner of the share.

When transferring business interests into a trust, an experienced estate planning attorney can provide legal advice on how to best achieve your goals. If you have any questions about transferring business interests into a trust, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.

Download our Free “Estate Planning Essentials” eBook

Taking the time to create a comprehensive estate plan is critical for everyone. We have helped many clients develop personalized estate plans. Whether you already have an estate plan that you would like to update or you would like to create your first estate plan, we can help. Download our free "Estate Planning Essentials" eBook to get started.

Related posts

More from daniel hunt law.

- Estate Planning

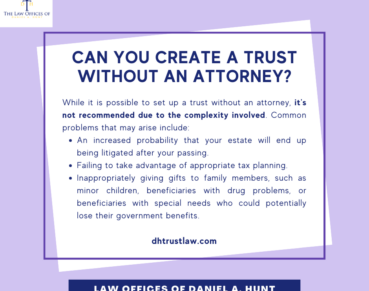

Can You Set Up a Trust Without an Attorney?

Will vs Trust in California

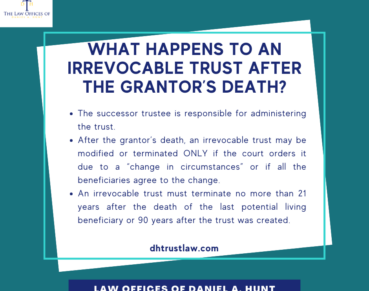

What Happens to an Irrevocable Trust When the Grantor Dies?

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- CHARITABLE CONTRIBUTIONS

Gifting of a Remainder Interest in a Home

- Individual Income Taxation

- Personal Financial Planning

- Estate Planning

One of the first decisions taxpayers must make when planning their estates is what to do with the principal home. With the changing and sometimes downtrodden real estate market, this can be a difficult and time-consuming task for heirs, particularly if they do not reside in the same state and have no desire to keep or maintain the home. Homes can be on the market for months or sometimes years depending on their location, condition, and asking price. Often, heirs need to sell the home within nine months to provide the liquidity to pay estate taxes and any final costs associated with administering the estate. They may have to absorb a large reduction in the sales price to expedite the sale. One solution is to have the taxpayer gift a remainder interest in the home to a qualified Sec. 501(c)(3) charity. Benefits to the taxpayer include (1) an income tax benefit for the charitable deduction of the remainder interest; (2) the value of the home will be out of the taxable estate; (3) the taxpayer can continue to reside in the home for the rest of his or her life; and (4) the taxpayer will relieve the heirs of the burden of selling the home.

Gifting a remainder interest requires the property ownership to be divided into two separate interests: a life estate and a remainder interest. A life estate gives the holder the power to retain ownership until death. If the taxpayer is married, the life estate can be structured to last until the second spouse’s death. A remainder interest gives the holder the right to take ownership when the life estate has ended. The home will need to be appraised at the time of the gift to determine the value of both the life estate and the remainder interest. The IRS has published tables that are used to value the life interest in the property. The difference between the appraised value and the life interest is the remainder interest. This latter amount qualifies as a charitable deduction that the taxpayer could use to offset taxable income, subject to the limits for charitable contributions.

In determining the value of the charitable remainder interest for purposes of the deduction, straight-line depreciation is taken into account if the property is depreciable. However, for estate and gift tax purposes, the value of a charitable remainder interest is determined without taking depreciation into account. For a description and an example of how to determine the value of a charitable remainder interest in a personal residence for charitable deduction purposes, see Regs. Sec. 1.170A-12(b).

Only remainder interests in personal residences and farms are eligible under this provision (Sec. 170(f)(3)(B)(i)). A personal residence does not have to be the taxpayer’s principal residence to qualify, so the taxpayer can take a deduction for a vacation home. A farm is broadly defined to include any land used by the taxpayer or his or her tenant for the production of crops, fruits, or other agricultural products or for the sustenance of livestock and the improvements on the land (Regs. Sec. 1.170-7(b)(4)).

The gifting of a remainder interest is not recommended on debt-encumbered property because it could result in undesirable tax consequences to both the donor and the charity. In this situation, possible solutions would be to transfer the debt to another property or to pay off any underlying mortgage prior to making the gift. Although ownership transfers at death, the donor is still responsible for paying the real estate taxes, property insurance, and maintenance expenses of the home during his or her lifetime.

This type of planning is especially beneficial for an individual with multiple properties who wishes to make a substantial lifetime charitable donation. It enables the individual to provide a home for his or her spouse or beneficiaries in the form of a life interest. When the life interest terminates, the property goes directly to the charity that received the remainder interest. This relieves both the donor and his or her beneficiaries of the burden of selling the property and paying any capital gain or estate taxes.

Increasingly, universities are benefiting from gifts of a remainder interest in houses and land. The university typically sells the donated property in order to support its programs and initiatives. Conservation groups such as public or private land trusts are another type of recipient of remainder interests when the donor is gifting farmland or property near a river or lake. Clearly, gifting with a remainder interest can be tailored to suit many types of individual needs while reaping tax benefits and fulfilling philanthropic interests.

A $10.7 million compensation deduction miss

Short-term relief for foreign tax credit woes, irs rules that conversion of llc not a debt modification, a look at revised form 8308, state responses to federal changes to sec. 174.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

Sale and Assignment of LLC Membership Interests

Transfers from Member to Member or to Non-Member Third Parties by David J. Willis J.D., LL.M.

Introduction

This article addresses legal points to consider when conveying a membership interest in a limited liability company from one individual to another. It does not address the initial issuance of such interests when the LLC is formed, nor sales of membership interests by an existing LLC to incoming members.

Additionally, this article addresses absolute assignments (full and final transfers) rather than collateral assignments (made only as security for a loan) which are a different topic entirely.

Assignments of this type may follow the execution of a letter of intent which provides for a due-diligence period. This article does not cover the contents of such an LOI but does address issues that should be considered by a prospective assignee in conducting due diligence. An LOI will often make reference to specific due diligence steps that a buyer will be permitted to take.

After covering definitions and applicable law, we will turn to principal points that should be considered in negotiating and drafting an assignment of LLC membership interest.

APPLICABLE LAW

Relevant statutory definitions.

Applicable law is found in the Business Organizations Code (“BOC”) which includes the following definitions in Section 1.002:

(7) “Certificated ownership interest” means an ownership interest of a domestic entity represented by a certificate issued in bearer or registered form.

(32) “Fundamental business transaction” means a merger, interest exchange, conversion, or sale of all or substantially all of an entity’s assets.

(35)(A) “Governing authority” means a person or group of persons who are entitled to manage and direct the affairs of an entity under this code and the governing documents of the entity, except that if the governing documents of the entity or this code divide the authority to manage and direct the affairs of the entity among different persons or groups of persons according to different matters, “governing authority” means the person or group of persons entitled to manage and direct the affairs of the entity with respect to a matter under the governing documents of the entity or this code.

(41) “Interest exchange” means the acquisition of an ownership or membership interest in a domestic entity as provided by Subarticle B, Article 10. The term does not include a merger or conversion.

(46) “Limited liability company” means an entity governed as a limited liability company under Title 3 or 7. The term includes a professional limited liability company.

(53) “Member” means: (A) in the case of a limited liability company, a person who has become, and has not ceased to be, a member in the limited liability company as provided by its governing documents or this code. . . .

(54) “Membership interest” means a member’s interest in an entity. With respect to a limited liability company, the term includes a member’s share of profits and losses or similar items and the right to receive distributions, but does not include a member’s right to participate in management.

(64) “Ownership interest” means an owner’s interest in an entity. The term includes the owner’s share of profits and losses or similar items and the right to receive distributions. The term does not include an owner’s right to participate in management.

(69-b) “Person” means an individual or a corporation, partnership, limited liability company, business trust, trust, association, or other organization, estate, government or governmental subdivision or agency, or other legal entity, or a protected series or registered series of a domestic limited liability company or foreign entity.

(87) “Uncertificated ownership interest” means an ownership interest in a domestic entity that is not represented by an instrument and is transferred by: (A) amendment of the governing documents of the entity; or (B) registration on books maintained by or on behalf of the entity for the purpose of registering transfers of ownership interests.

A well-drafted assignment of LLC membership interest will be mindful of and consistent with these statutory terms.

Statute Authorizing Membership Assignments

Foundational to the idea of a sale and assignment of LLC membership interest is the legal authority to enter into such a transaction in the first place. This is found in BOC Section 101.108:

Sec. 101.108. ASSIGNMENT OF MEMBERSHIP INTEREST.

(a) A membership interest in a limited liability company may be wholly or partly assigned.

(b) An assignment of a membership interest in a limited liability company: (1) is not an event requiring the winding up of the company; and (2) does not entitle the assignee to: (A) participate in the management and affairs of the company; (B) become a member of the company; or (C) exercise any rights of a member of the company.

Consent by other members is required. BOC Section 101.103(s) states that a “person who, after the formation of a limited liability company, acquires directly or is assigned a membership interest in the company or is admitted as a member of the company without acquiring a membership interest becomes a member of the company on approval or consent of all of the company’s members.” BOC Section 101.105 states that a “limited liability company, after the formation of the company, may: (1) issue membership interests in the company to any person with the approval of all of the members of the company. . . .”

An additional consent requirement is found in BOC Section 101.356(c) which provides that, for the most part, “a fundamental business transaction of a limited liability company, or an action that would make it impossible for a limited liability company to carry out the ordinary business of the company, must be approved by the affirmative vote of the majority of all of the company’s members.”

Accordingly, it is advisable to accompany an assignment of membership interest with a special meeting of members that approves and ratifies the change. One or more LLC resolutions may be produced as well. All affected parties (and their spouses, even if non-members) should sign off.

What category of property is an LLC membership interest?

BOC Section 101.106 addresses the nature of an LLC membership interest:

(a) A membership interest in a limited liability company is personal property.

(a-1) A membership interest may be community property under applicable law.

(a-2) A member’s right to participate in the management and conduct of the business of the limited liability company is not community property.

(b) A member of a limited liability company or an assignee of a membership interest in a limited liability company does not have an interest in any specific property of the company.

The characterization of an LLC membership interest as personal property is important because it also signifies what it is not . For instance, it is not a real property interest even though the LLC may own real estate. It is not a negotiable instrument subject to the Uniform Commercial Code (found in Texas Business & Commerce Code Section 3.201 et seq.). Nor is a small-business LLC membership interest usually considered to be a security subject to state and federal securities laws: “An interest in a partnership or limited liability company is not a security unless it is dealt in or traded on securities exchanges or in securities markets, [and the company agreement] expressly provide[s] that it is a security . . . or it is an investment company security.” Tex. Bus. & Com. Code Sec. 8.103(c).

The foregoing applies regardless of whether the membership interest is considered certificated or uncertificated.

Statutory Qualifications for LLC Membership

The BOC addresses qualifications and requirements for LLC membership in Section 101.102:

(a) A person may be a member of or acquire a membership interest in a limited liability company unless the person lacks capacity apart from this code.

(b) A person is not required, as a condition to becoming a member of or acquiring a membership interest in a limited liability company, to:

(1) make a contribution to the company; (2) otherwise pay cash or transfer property to the company; or (3) assume an obligation to make a contribution or otherwise pay cash or transfer property to the company.

(c) If one or more persons own a membership interest in a limited liability company, the company agreement may provide for a person to be admitted to the company as a member without acquiring a membership interest in the company.

Rights and Duties of an Assignee

BOC Sec. 101.109. RIGHTS AND DUTIES OF ASSIGNEE OF MEMBERSHIP INTEREST BEFORE MEMBERSHIP.

(a) A person who is assigned a membership interest in a limited liability company is entitled to:

(1) receive any allocation of income, gain, loss, deduction, credit, or a similar item that the assignor is entitled to receive to the extent the allocation of the item is assigned; (2) receive any distribution the assignor is entitled to receive to the extent the distribution is assigned; (3) require, for any proper purpose, reasonable information or a reasonable account of the transactions of the company; and (4) make, for any proper purpose, reasonable inspections of the books and records of the company.

(b) An assignee of a membership interest in a limited liability company is entitled to become a member of the company on the approval of all of the company’s members.

(c) An assignee of a membership interest in a limited liability company is not liable as a member of the company until the assignee becomes a member of the company.

BOC Sec. 101.110. RIGHTS AND LIABILITIES OF ASSIGNEE OF MEMBERSHIP INTEREST AFTER BECOMING MEMBER.

(a) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is:

(1) entitled, to the extent assigned, to the same rights and powers granted or provided to a member of the company by the company agreement or this code; (2) subject to the same restrictions and liabilities placed or imposed on a member of the company by the company agreement or this code; and (3) except as provided by Subsection (b), liable for the assignor’s obligation to make contributions to the company.

(b) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is not obligated for a liability of the assignor that:

(1) the assignee did not have knowledge of on the date the assignee became a member of the company; and (2) could not be ascertained from the company agreement.

It is important to note that these statutory rights and duties are subject to “restrictions and liabilities” that may be imposed by the company agreement.

PRELIMINARY CONSIDERATIONS

The company agreement.

When considering a transfer of LLC membership, it is important to first check the company agreement (operating agreement) to determine if there are buy-sell provisions or a right-of-first-refusal clause that must be worked through before the membership interest can be assigned. company agreements often require that before a sale and assignment of a membership interest can occur, the interest must first be offered pro rata to the other members, and/or to the company itself, before a transfer may be made to a person who is not currently a member. Unless waived, such provisions may be accompanied by an offer period of (for example) 10, 30, or 60 days.

Buy-sell and right-of-first-refusal provisions exist so that existing LLC members do not unwillingly find themselves in business with someone they do not know.

Non-Member Spouses

Are non-member spouses involved? Like real estate, personal property in Texas is presumed to be community property. A frequent error in transfers of LLC membership interest is failure to secure the signature of an assignor-seller’s non-member spouse. The result is that the entire interest may not have been conveyed, at least not in Texas. This is no different than if a grantee in a deed accepts the conveyance without requiring execution by the grantor’s spouse; since community property is presumed, the transfer may be incomplete if the spouse does not sign off, at least in a pro forma capacity.

To say that omitting the signature of a non-member spouse can drive subsequent disputes would be an understatement. Even though BOC Section 101.108 provides that a non-member spouse of an assignee may not assert control over the company, the potential for awkward and potentially disastrous disruption remains. Consider the case of a withdrawing member who is contemplating divorce but has not yet revealed this to other members who may want to buy his LLC membership interest. Will the assignment get tangled up in the parties’ divorce?

As is the case in transfers of real estate, it is common for sellers of an LLC membership interest to argue that the spouse should not be required to sign the assignment because the property transferred is a business asset rather than a part of the homestead. Real estate lawyers hear such excuses all the time. Other reasons may be given (“My wife is in China”). None of these excuses should be allowed to carry any weight unless the membership interest has been lawfully converted into separate property by a written partition agreement according to Section 4.102 et seq. of the Family Code.

What will be the accounting consequences? Is timing an issue?

There will likely be accounting consequences as a result of transferring an LLC membership interest. BOC Section 101.201 partially addresses this issue, stating “The profits and losses of a limited liability company shall be allocated to each member of the company on the basis of the agreed value of the contributions made by each member, as stated in the company’s records. . . .” This rule will apply unless the members collectively agree otherwise.

Attention should be given to the effective date of the assignment, since the transfer date may have more than one level of significance. It is advisable to select an effective date or record date for the assignment that facilitates easier calculation of profits and losses, or at least does not unduly complicate that calculation.

Will the membership interest pass a due-diligence inspection?

The issues referred to above are part of a larger group of due-diligence considerations that may concern a prospective buyer, which brings us to the due-diligence checklist in the next section.

DUE DILIGENCE BY THE ASSIGNEE-BUYER

Due diligence checklist.

The following is a partial list of items that should be of concern to a prospective assignee-buyer of an LLC Membership Interest:

(1) Valuation. Most small-business assignments of LLC membership interest occur among insiders who are already acquainted with the company’s assets, liabilities, management, and operations. For potential assignees who do not fall in this category, the question of valuation arises—not just valuation of the membership interest itself but valuation of the LLC as a whole, since the two are effectively inseparable.

Several articles could be written on how to evaluate and appraise a business; suffice it to say that there should be some rational basis for the asking price that can be independently confirmed by looking at the company’s finances and assets. Certain numbers will be hard (real property and bank accounts) and others will be soft (marketing strategy, proprietary information, and value of the brand).

If assets include real properties, an evaluation of value may include appraisals by licensed appraisers or the less-formal alternative of a broker price opinion (BPO). It is impressive if a real estate investment firm has an inventory of 30 rental properties; it is less so if half the properties are drowning in deferred maintenance. Numbers guys may be satisfied with financials and a spreadsheet; traditionalists will want to physically inspect the properties as part of the due-diligence process.

(2) Good Standing. It is important to verify that the LLC and the assignor (if a registered entity) are in good standing with the secretary of state and the comptroller. If not, they do not have the legal capacity to do business, which could potentially make execution of an LLC membership assignment invalid.

(3) Core LLC Documents. A prospective assignee-buyer will want to see core LLC documents including the certificate of formation; the certificate of filing (the secretary of state’s approval); the minutes of the first organizational meeting of members along with subsequent minutes of special meetings (if any) and annual meetings; company resolutions or grants of authority; the company agreement, as currently amended or restated; and any membership certificates that may have been issued (or at least a record of same).

Also: where are the official LLC records kept? Who is responsible for keeping them, and is access readily available? Is there a company book, i.e., a binder containing these? Failure of an LLC to keep organized and complete records is a warning sign for a potential assignee. This is true regardless of and aside from any statutory requirements for LLC record keeping.

A vital object of an assignee’s investigation should be the company agreement. The company agreement is essentially a partnership agreement among LLC members, so it will directly bind a prospective assignee . Is it valid? Is it a legal document of substance or is it a three-page printout from the internet that is not even relevant to Texas? Are provisions of the company agreement compatible with the intentions and goals of the assignee? What limitations does the company agreement impose (for example, restrictions on transfer of membership interests)? Can one easily re-sell the membership interest or are there hoops to jump through?

(4) Managers. It is operationally important to determine if the LLC is member-managed or manager-managed and, if the latter, to identity of the managers. Can the assignee work with these persons? Are they professional and competent? What is their track record?

(5) Member List . LLCs are required to keep current lists of members, their respective interests in the company, and a list of all contributions to the company. BOC Sections 101.501(a)(1)-(7). Fellow members of a smaller LLC are effectively your partners in the enterprise. It is good to know to know something about them.

(6) Contracts and Agreements with Third Parties. Any agreements with third parties that affect control, management, or operation of the LLC should be examined. Examples would be contracts with vendors or a property management agreement with a third-party management company. Is the LLC currently part of a joint venture with a different group of investors?

(7) Voting Agreements. These may or may not exist. Any one or more of the members may enter into voting agreements (including but not limited to proxies and pledges) that can affect control of the entity.

(8) Federal Tax Returns. Tax returns are important to verify how the LLC is taxed and how ownership is reported to the IRS. Tax returns and LLC records should be consistent in this respect. It is a good idea for a prospective assignee to have a CPA review the company’s tax returns.