- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

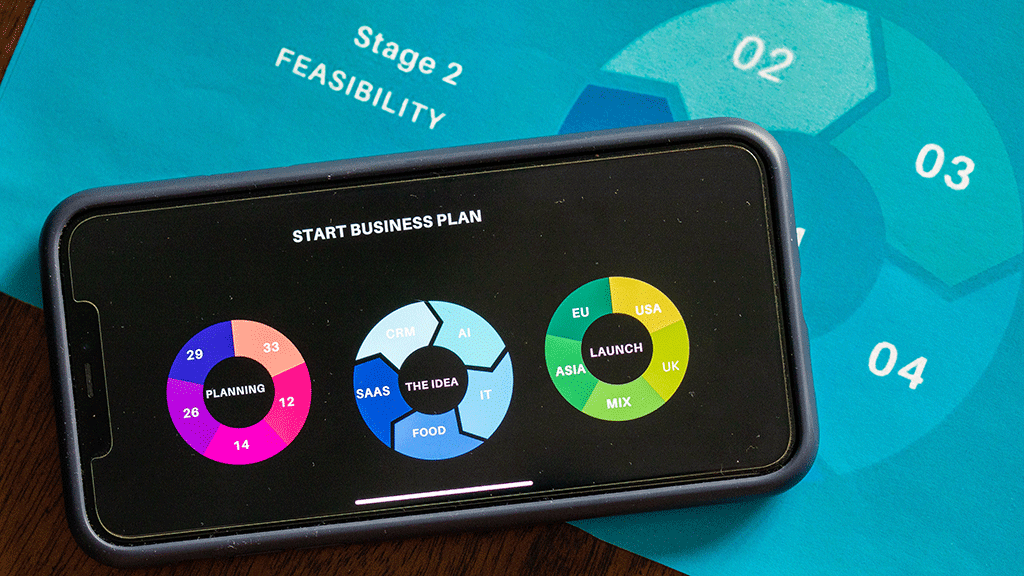

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Financial Feasibility Study: How to Ensure Your Business Project’s Success

JAN.19, 2023

Imagine you have a brilliant business idea that you’re convinced will be a huge success. You’ve spent countless hours researching the market, developing a solid business plan , and creating a detailed marketing strategy. But before you invest your time, energy, and money into this venture, have you ever stopped to ask yourself: “Is this idea really worth the investment?” That’s where a financial feasibility study comes in!

What is a Financial Feasibility Study?

Simply put, financial feasibility can be defined as the process of evaluating the financial aspects of a proposed project or business venture to determine its potential for success by diving deep into the nitty-gritty details of costs, revenues, market demand, and competition. It’s like a financial health checkup for your idea.

For example, let’s say you’re considering opening a new restaurant .

During the financial feasibility study, you’ll need to examine the costs of opening the restaurant, such as the cost of equipment, rent, and staff, as well as projected revenue from sales. You’ll also need to consider any potential risks, such as changes in consumer tastes or a downturn in the economy. By evaluating all these factors, you’ll be able to determine if opening the restaurant is a financially viable option.

Importance of a Financial Feasibility Study

Have you ever wondered why some businesses succeed while others fail? One of the key factors that can determine the success or failure of a business is its financial feasibility.

But why is it so important to conduct a financial feasibility study before embarking on a project?

The importance of a financial feasibility study cannot be overstated, especially any entity that is planning to undertake a project, investment or venture. This type of study is a comprehensive examination of a proposed project’s potential financial performance, including an analysis of costs and revenue. Additionally, the study would take into account factors such as the size of the market, competition, and pricing strategy to estimate the potential revenue.

The importance of a financial feasibility study report can be summarized as follows:

1. Spotting red flags

A financial feasibility study helps to identify potential financial risks and challenges associated with a proposed project, investment or venture, allowing decision-makers to take necessary measures to mitigate or avoid these risks before they become a problem, ensuring the success of the project.

2. Assessing profit potential

A financial feasibility study helps to determine the financial viability and profitability of a proposed project, investment or venture, by analyzing the costs, revenue potential, and overall financial performance. This information can help to make informed business decisions that can maximize returns and increase profitability.

3. Roadmap to success

A financial feasibility study provides a detailed financial plan and budget for a proposed project, investment or venture, which can be used as a roadmap to guide its development and implementation, ensuring that resources are allocated effectively and efficiently, leading to the success of the project.

4. Unlocking new opportunities

Financial institutions and investors often require a financial feasibility study as part of the funding application process. A well-conducted financial feasibility study can increase the chances of obtaining funding for a proposed project, investment or venture, unlocking new opportunities for growth and expansion.

By conducting a financial feasibility study, you’ll be able to determine whether your venture has what it takes to succeed. It’s a crucial tool for decision-makers, such as investors, entrepreneurs, and business owners, as it allows them to understand the financial implications of proceeding with a project.

Objectives of financial aspect in a feasibility study

The financial aspect of a feasibility study is a crucial step in determining the economic viability of a proposed project or investment. It’s like a financial roadmap that guides the decision-making process and helps stakeholders understand the potential costs and benefits of the project. The main objectives of financial aspect in feasibility study are to:

1. Project Costs

Estimation of total costs.

In order to accurately project the costs of the project, the study should include all one-time and ongoing expenses such as equipment, materials, labor, and other miscellaneous expenses. Additionally, contingencies or unexpected costs that may arise during the project should be identified and budgeted for in the cost estimation.

Consideration of contingencies and unexpected costs

Contingencies are unforeseen events that may occur during the course of the project, such as unanticipated delays, cost overruns, or changes in project scope. Unexpected costs are expenses that have not been included in the original project budget, but may arise during the project such as repairs, maintenance, or additional services required to complete the project.

The financial feasibility study should consider these costs and include a contingency budget to ensure that the project has enough financial resources to cover any unexpected or additional expenses that may occur.

2. Project Revenues

Estimation of projected revenues.

The financial feasibility study should estimate the projected revenues that the project is expected to generate. The study should also consider the potential market size, competition, pricing strategies, and any other factors that may affect the project’s revenue potential.

Analysis of revenue streams

The financial feasibility study should identify and analyze all potential revenue streams for the project such as sales of goods or services, rental income, royalties, or any other income sources. It should also evaluate the potential for future revenue growth, as well as any risks or uncertainties that may impact the project’s revenue potential.

3. Determine Profitability

Calculation of key financial metrics (npv, irr, payback period).

The financial feasibility study should calculate key financial metrics such as the net present value (NPV), internal rate of return (IRR), and payback period (PP) to determine the profitability of the project.

- Net Present Value (NPV) is a measure of the net value of an investment, taking into account the time value of money. A positive NPV indicates that the investment is expected to generate more value than it costs.

- Internal Rate of Return (IRR) is the rate of return at which the NPV of an investment is zero. A higher IRR indicates a more profitable investment.

- Payback Period (PP) is the amount of time it takes for an investment to generate enough cash flow to recover its initial cost. A shorter payback period indicates a more attractive investment.

Analysis of profitability

Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period (PP) are three important financial metrics that are used to assess the profitability of a project.

- NPV helps to determine whether the project is expected to generate more value than it costs,

- IRR is an indicator of how profitable the project is by measuring the rate of return, and

- PP measures how quickly the initial investment will be recovered.

Together, these metrics provide a comprehensive picture of the project’s profitability and help to make informed decisions about whether to proceed with the project or not.

4. Cash Flow Analysis

Projection of expected cash flow.

The financial feasibility study should project the expected cash flow generated by the project and analyze the impact on the liquidity and financial position of the company. This includes financial projection of cash inflows and outflows, and analyzing the net cash flow over time.

Analysis of impact on liquidity and financial position

The financial feasibility study should analyze the impact of the project’s cash flow on the liquidity and financial position of the company by evaluating the potential impact on the company’s ability to meet its financial obligations, such as debt repayment, and assessing the company’s overall financial health.

5. Risks and Uncertainties

Identification of potential risks and uncertainties.

The financial feasibility study should identify any potential risks or uncertainties that could impact the financial performance of the project. This includes:

- Market risks like changes in consumer demand, competition, or economic conditions,

- Operational risks like the potential for delays, cost overruns, or technical difficulties,

- Financial risks like the potential for changes in interest rates, currency exchange rates, or credit conditions, and

- Other risks that could affect the project.

Analysis of impact on financial performance

The financial feasibility study should analyze the potential impact of risks and uncertainties on the project’s financial performance by evaluating the potential effect on costs, revenues, and profitability, as well as identifying any potential mitigation strategies or contingency plans to minimize the impact of risks and uncertainties.

Overall, the feasibility study components in the financial aspect provide a comprehensive and accurate assessment of the economic viability of the proposed project or investment.

Difference between a feasibility study and a financial model

While both financial feasibility study and financial model are important tools used in the planning and evaluation of projects and businesses, they serve distinct purposes and provide different types of information. This table compares and contrasts the key differences between a feasibility study and a financial model.

Unlock the Potential of Your Project with OGSCapital’s Proven Expertise in Financial Feasibility Studies and More

Are you ready to take your business to the next level? At OGSCapital , we understand the importance of conducting a comprehensive feasibility study in order to make informed decisions about your business ventures. That’s why our team of expert consultants has a proven track record of providing a wide range of top-notch feasibility studies that includes financial feasibility studies, hotel feasibility studies , real estate feasibility studies , and more for businesses just like yours.

But what sets us apart from the competition? It’s our dedication to understanding your business goals and objectives and tailoring our approach to meet your specific needs. We bring a wealth of experience and knowledge to the table and provide a detailed analysis of all potential costs, revenues, profitability, and risks, as well as identifying funding sources and evaluating the return on investment for stakeholders.

But our services don’t stop there. We also offer a full suite of business planning services including business plan development, business continuity planning , pitch deck preparation , buy-side due diligence services , ICO whitepaper development and ICO consulting , confidential information memorandum , and private placement memorandum .

Don’t trust your business to just anyone. Choose the proven experts at OGSCapital and let us help you unlock the potential of your project. Contact Us Today to schedule a consultation and experience the OGSCapital difference for yourself.

1. Why is financial study important in feasibility study?

A financial feasibility study is a crucial part of a feasibility study to evaluate the potential financial viability of a proposed project or venture. It includes analyzing projected revenue, expenses, return on investment and identifying financial risks. “ How to do a feasibility study ” is an exciting journey of research, analysis, and decision-making. It helps to determine if a project is worth pursuing.

2. What is the purpose of a financial feasibility study?

The purpose of an economic and financial feasibility study is to provide a comprehensive and accurate assessment of the economic viability of a proposed project or investment. Financial analysts or feasibility study consultants like us at OGSCapital use financial modeling, market research, and industry analysis to provide a detailed and accurate picture of the project’s financial viability. At OGSCapital, we offer a wide range of feasibility studies and business planning services to help clients make informed decisions and achieve their goals.

Contact us today to know more and schedule a consultation with our experts!

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

11.3 Conducting a Feasibility Analysis

Learning objectives.

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

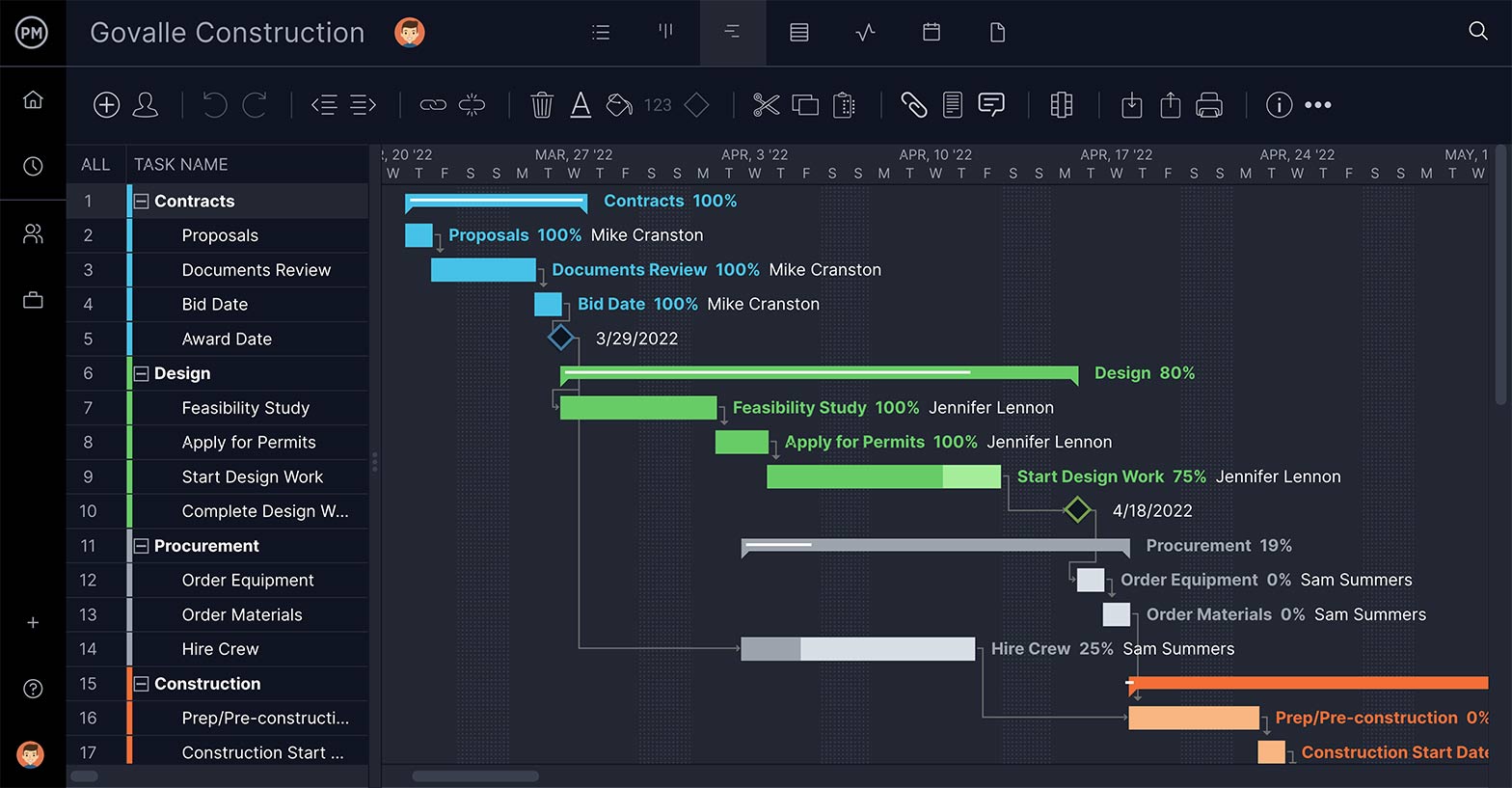

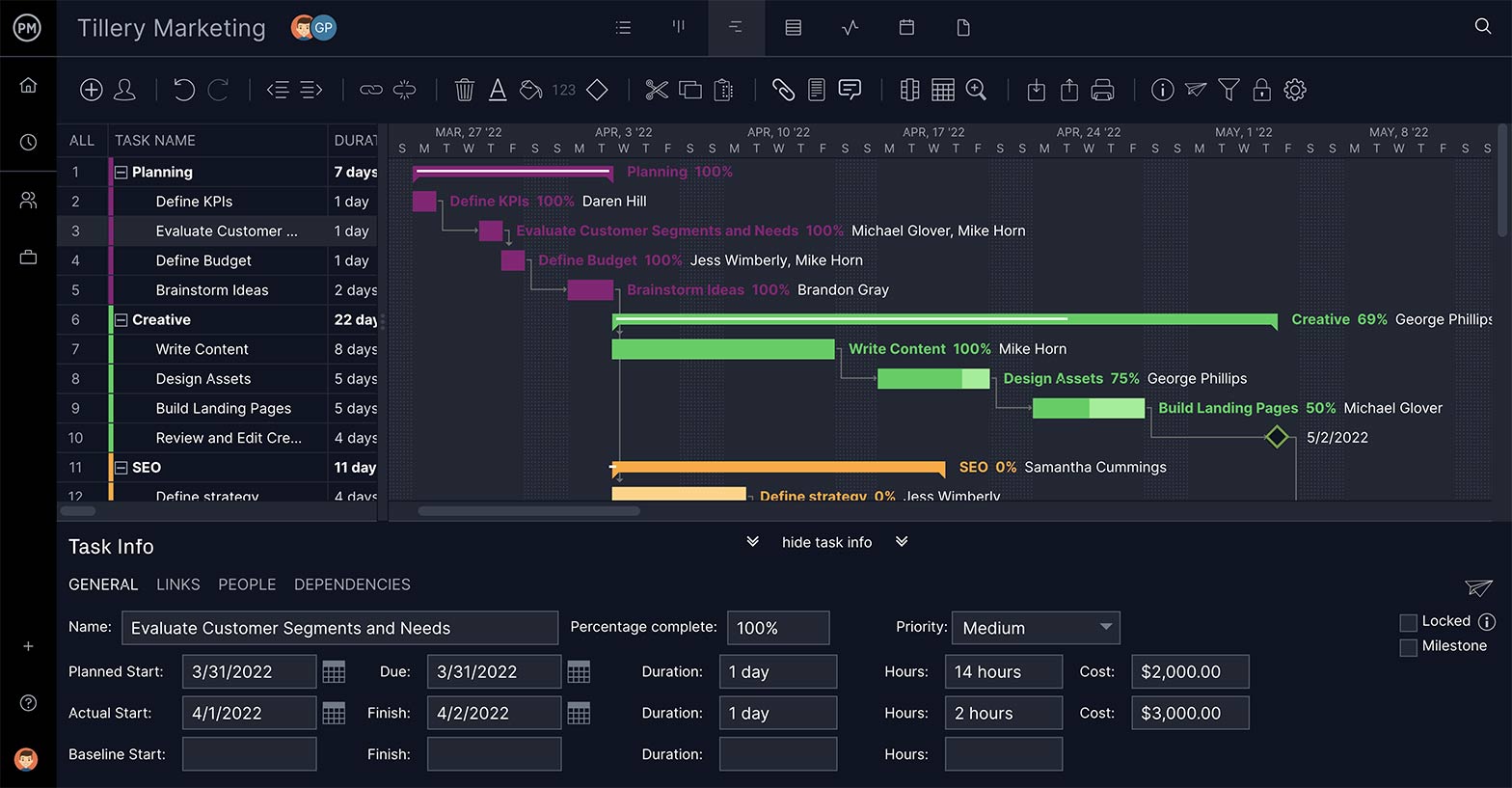

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan ). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12 . The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. 46

Financial Feasibility Analysis

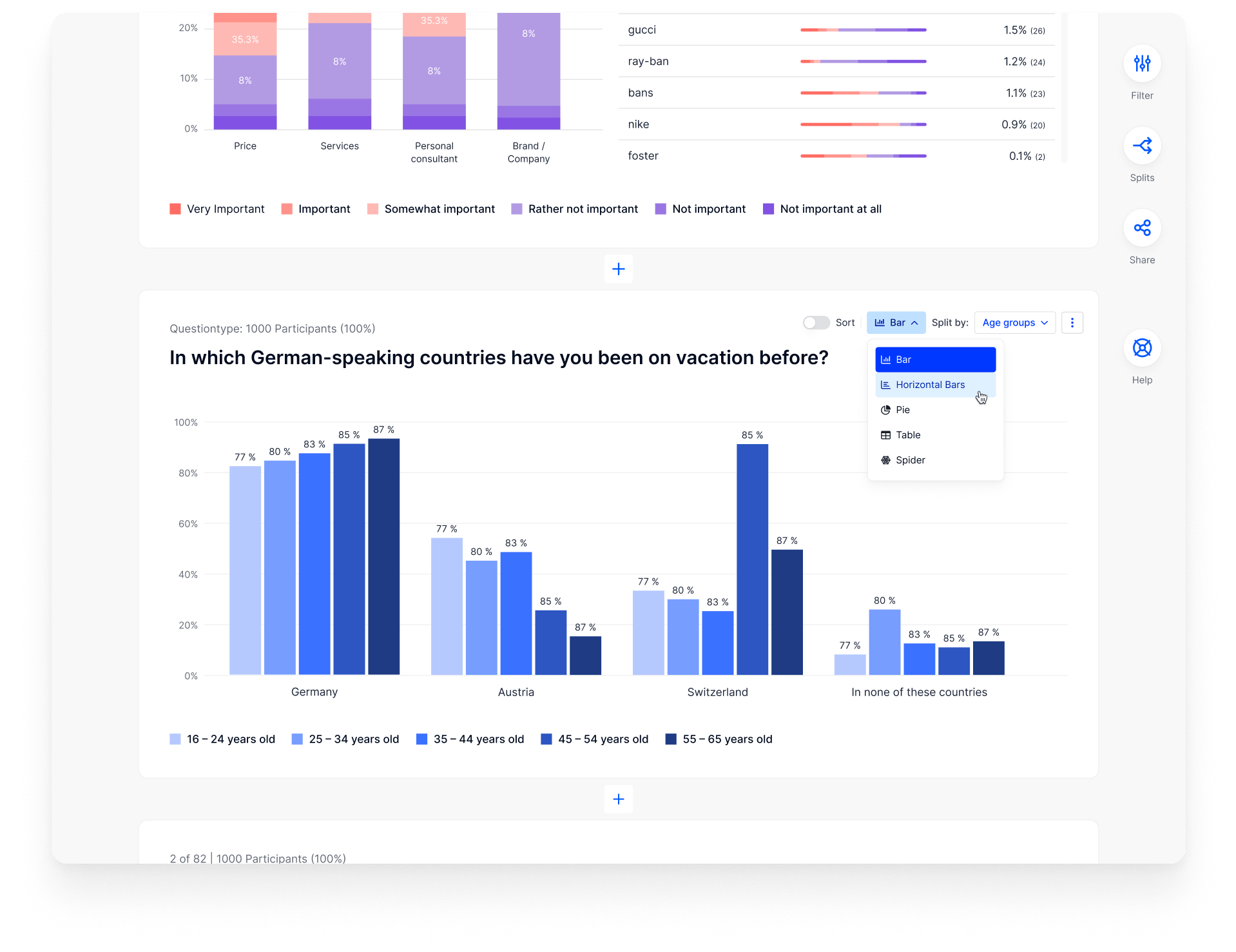

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13 .

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

Another critical part of planning for new business owners is to understand the breakeven point , which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss. 47 Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity. The financial concepts and statements introduced here are discussed fully in Entrepreneurial Finance and Accounting .

Market Feasibility Analysis

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 11.14 . You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM) , that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM) .

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

Are You Ready?

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

Work It Out

Location feasibility.

You’re considering opening a boutique clothing store in downtown Atlanta. You’ve read news reports about how downtown Atlanta and the city itself are growing and undergoing changes from previous decades. With new development taking place there, you’re not sure whether such a venture is viable. Outline what steps you would need to take to conduct a feasibility study to determine whether downtown Atlanta is the right location for your planned clothing store.

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision . This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

What Can You Do?

Love beyond walls.

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls (www.lovebeyondwalls.org), an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?

- 46 Ulrich Kaiser. “A primer in Entrepreneurship – Chapter 3 Feasibility analysis” University of Zurich Institute for Strategy and Business Economics . n.d. https://docplayer.net/7775267-A-primer-in-entrepreneurship-chapter-3-feasibility-analysis.html

- 47 In a preliminary financial model and business plan, startup costs should be allocated, as they are intended for one-time investments in development; pre-launch costs and other necessary expenses will not carry over once the product/solution has launched.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-3-conducting-a-feasibility-analysis

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

What Is a Feasibility Study and How to Conduct It? (+ Examples)

Appinio Research · 26.09.2023 · 28min read

Are you ready to turn your project or business idea into a concrete reality but unsure about its feasibility? Whether you're a seasoned entrepreneur or a first-time project manager, understanding the intricate process of conducting a feasibility study is vital for making informed decisions and maximizing your chances of success.

This guide will equip you with the knowledge and tools to navigate the complexities of market, technical, financial, and operational feasibility studies. By the end, you'll have a clear roadmap to confidently assess, plan, and execute your project.

What is a Feasibility Study?

A feasibility study is a systematic and comprehensive analysis of a proposed project or business idea to assess its viability and potential for success. It involves evaluating various aspects such as market demand, technical feasibility, financial viability, and operational capabilities. The primary goal of a feasibility study is to provide you with valuable insights and data to make informed decisions about whether to proceed with the project.

Why is a Feasibility Study Important?

Conducting a feasibility study is a critical step in the planning process for any project or business. It helps you:

- Minimize Risks: By identifying potential challenges and obstacles early on, you can develop strategies to mitigate risks.

- Optimize Resource Allocation: A feasibility study helps you allocate your resources more efficiently, including time and money.

- Enhance Decision-Making: Armed with data and insights, you can make well-informed decisions about pursuing the project or exploring alternative options.

- Attract Stakeholders: Potential investors, lenders, and partners often require a feasibility study to assess the project's credibility and potential return on investment.

Now that you understand the importance of feasibility studies, let's explore the various types and dive deeper into each aspect.

Types of Feasibility Studies

Feasibility studies come in various forms, each designed to assess different aspects of a project's viability. Let's delve into the four primary types of feasibility studies in more detail:

1. Market Feasibility Study

Market feasibility studies are conducted to determine whether there is a demand for a product or service in a specific market or industry. This type of study focuses on understanding customer needs, market trends, and the competitive landscape. Here are the key elements of a market feasibility study:

- Market Research and Analysis: Comprehensive research is conducted to gather market size, growth potential , and customer behavior data. This includes both primary research (surveys, interviews) and secondary research (existing reports, data).

- Target Audience Identification: Identifying the ideal customer base by segmenting the market based on demographics, psychographics, and behavior. Understanding your target audience is crucial for tailoring your product or service.

- Competitive Analysis : Assessing the competition within the market, including identifying direct and indirect competitors, their strengths, weaknesses, and market share.

- Demand and Supply Assessment: Analyzing the balance between the demand for the product or service and its supply. This helps determine whether there is room for a new entrant in the market.

2. Technical Feasibility Study

Technical feasibility studies evaluate whether the project can be developed and implemented from a technical standpoint. This assessment focuses on the project's design, technical requirements, and resource availability. Here's what it entails:

- Project Design and Technical Requirements: Defining the technical specifications of the project, including hardware, software, and any specialized equipment. This phase outlines the technical aspects required for project execution.

- Technology Assessment: Evaluating the chosen technology's suitability for the project and assessing its scalability and compatibility with existing systems.

- Resource Evaluation: Assessing the availability of essential resources such as personnel, materials, and suppliers to ensure the project's technical requirements can be met.

- Risk Analysis: Identifying potential technical risks, challenges, and obstacles that may arise during project development. Developing risk mitigation strategies is a critical part of technical feasibility.

3. Financial Feasibility Study

Financial feasibility studies aim to determine whether the project is financially viable and sustainable in the long run. This type of study involves estimating costs, projecting revenue, and conducting financial analyses. Key components include:

- Cost Estimation: Calculating both initial and ongoing costs associated with the project, including capital expenditures, operational expenses, and contingency funds.

- Revenue Projections: Forecasting the income the project is expected to generate, considering sales, pricing strategies, market demand, and potential revenue streams.

- Investment Analysis: Evaluating the return on investment (ROI), payback period, and potential risks associated with financing the project.

- Financial Viability Assessment: Analyzing the project's profitability, cash flow, and financial stability to ensure it can meet its financial obligations and sustain operations.

4. Operational Feasibility Study

Operational feasibility studies assess whether the project can be effectively implemented within the organization's existing operational framework. This study considers processes, resource planning, scalability, and operational risks. Key elements include:

- Process and Workflow Assessment: Analyzing how the project integrates with current processes and workflows, identifying potential bottlenecks, and optimizing operations.

- Resource Planning: Determining the human, physical, and technological resources required for successful project execution and identifying resource gaps.

- Scalability Evaluation: Assessing the project's ability to adapt and expand to meet changing demands and growth opportunities, including capacity planning and growth strategies.

- Operational Risks Analysis: Identifying potential operational challenges and developing strategies to mitigate them, ensuring smooth project implementation.

Each type of feasibility study serves a specific purpose in evaluating different facets of your project, collectively providing a comprehensive assessment of its viability and potential for success.

How to Prepare for a Feasibility Study?

Before you dive into the nitty-gritty details of conducting a feasibility study, it's essential to prepare thoroughly. Proper preparation will set the stage for a successful and insightful study. In this section, we'll explore the main steps involved in preparing for a feasibility study.

1. Identify the Project or Idea

Identifying and defining your project or business idea is the foundational step in the feasibility study process. This initial phase is critical because it helps you clarify your objectives and set the direction for the study.

- Problem Identification: Start by pinpointing the problem or need your project addresses. What pain point does it solve for your target audience?

- Project Definition: Clearly define your project or business idea. What are its core components, features, or offerings?

- Goals and Objectives: Establish specific goals and objectives for your project. What do you aim to achieve in the short and long term?

- Alignment with Vision: Ensure your project aligns with your overall vision and mission. How does it fit into your larger strategic plan?

Remember, the more precisely you can articulate your project or idea at this stage, the easier it will be to conduct a focused and effective feasibility study.

2. Assemble a Feasibility Study Team

Once you've defined your project, the next step is to assemble a competent and diverse feasibility study team. Your team's expertise will play a crucial role in conducting a thorough assessment of your project's viability.

- Identify Key Roles: Determine the essential roles required for your feasibility study. These typically include experts in areas such as market research, finance, technology, and operations.

- Select Team Members: Choose team members with the relevant skills and experience to fulfill these roles effectively. Look for individuals who have successfully conducted feasibility studies in the past.

- Collaboration and Communication: Foster a collaborative environment within your team. Effective communication is essential to ensure everyone is aligned on objectives and timelines.

- Project Manager: Designate a project manager responsible for coordinating the study, tracking progress, and meeting deadlines.

- External Consultants: In some cases, you may need to engage external consultants or specialists with niche expertise to provide valuable insights.

Having the right people on your team will help you collect accurate data, analyze findings comprehensively, and make well-informed decisions based on the study's outcomes.

3. Set Clear Objectives and Scope

Before you begin the feasibility study, it's crucial to establish clear and well-defined objectives. These objectives will guide your research and analysis efforts throughout the study.

Steps to Set Clear Objectives and Scope:

- Objective Clarity: Define the specific goals you aim to achieve through the feasibility study. What questions do you want to answer, and what decisions will the study inform?

- Scope Definition: Determine the boundaries of your study. What aspects of the project will be included, and what will be excluded? Clarify any limitations.

- Resource Allocation: Assess the resources needed for the study, including time, budget, and personnel. Ensure that you allocate resources appropriately based on the scope and objectives.

- Timeline: Establish a realistic timeline for the feasibility study. Identify key milestones and deadlines for completing different phases of the study.

Clear objectives and a well-defined scope will help you stay focused and avoid scope creep during the study. They also provide a basis for measuring the study's success against its intended outcomes.

4. Gather Initial Information

Before you delve into extensive research and data collection, start by gathering any existing information and documents related to your project or industry. This initial step will help you understand the current landscape and identify gaps in your knowledge.

- Document Review: Review any existing project documentation, market research reports, business plans, or relevant industry studies.

- Competitor Analysis: Gather information about your competitors, including their products, pricing, market share, and strategies.

- Regulatory and Compliance Documents: If applicable, collect information on industry regulations, permits, licenses, and compliance requirements.

- Market Trends: Stay informed about current market trends, consumer preferences, and emerging technologies that may impact your project.

- Stakeholder Interviews: Consider conducting initial interviews with key stakeholders, including potential customers, suppliers, and industry experts, to gather insights and feedback.

By starting with a strong foundation of existing knowledge, you'll be better prepared to identify gaps that require further investigation during the feasibility study. This proactive approach ensures that your study is comprehensive and well-informed from the outset.

How to Conduct a Market Feasibility Study?

The market feasibility study is a crucial component of your overall feasibility analysis. It focuses on assessing the potential demand for your product or service, understanding your target audience, analyzing your competition, and evaluating supply and demand dynamics within your chosen market.

Market Research and Analysis

Market research is the foundation of your market feasibility study. It involves gathering and analyzing data to gain insights into market trends, customer preferences, and the overall business landscape.

- Data Collection: Utilize various methods such as surveys, interviews, questionnaires, and secondary research to collect data about the market. This data may include market size, growth rates, and historical trends.

- Market Segmentation: Divide the market into segments based on factors such as demographics, psychographics , geography, and behavior. This segmentation helps you identify specific target markets.

- Customer Needs Analysis: Understand the needs, preferences, and pain points of potential customers . Determine how your product or service can address these needs effectively.

- Market Trends: Stay updated on current market trends, emerging technologies, and industry innovations that could impact your project.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to identify internal and external factors that may affect your market entry strategy.

In today's dynamic market landscape, gathering precise data for your market feasibility study is paramount. Appinio offers a versatile platform that enables you to swiftly collect valuable market insights from a diverse audience.

With Appinio, you can employ surveys, questionnaires, and in-depth analyses to refine your understanding of market trends, customer preferences, and competition.

Enhance your market research and gain a competitive edge by booking a demo with us today!

Book a Demo

Target Audience Identification

Knowing your target audience is essential for tailoring your product or service to meet their specific needs and preferences.

- Demographic Analysis: Define the age, gender, income level, education, and other demographic characteristics of your ideal customers.

- Psychographic Profiling: Understand the psychographics of your target audience, including their lifestyle, values, interests, and buying behavior.

- Market Segmentation: Refine your target audience by segmenting it further based on shared characteristics and behaviors.

- Needs and Pain Points: Identify your target audience's unique needs, challenges, and pain points that your product or service can address.

- Competitor's Customers: Analyze the customer base of your competitors to identify potential opportunities for capturing market share.

Competitive Analysis

Competitive analysis helps you understand the strengths and weaknesses of your competitors, positioning your project strategically within the market.

- Competitor Identification: Identify direct and indirect competitors within your industry or market niche.

- Competitive Advantage: Determine the unique selling points (USPs) that set your project apart from competitors. What value can you offer that others cannot?

- SWOT Analysis for Competitors: Conduct a SWOT analysis for each competitor to assess their strengths, weaknesses, opportunities, and threats.

- Market Share Assessment: Analyze each competitor's market share and market penetration strategies.

- Pricing Strategies: Investigate the pricing strategies employed by competitors and consider how your pricing strategy will compare.

Leveraging the power of data collection and analysis is essential in gaining a competitive edge. With Appinio , you can efficiently gather critical insights about your competitors, their strengths, and weaknesses. Seamlessly integrate these findings into your market feasibility study, empowering your project with a strategic advantage.

Demand and Supply Assessment

Understanding supply and demand dynamics is crucial for gauging market sustainability and potential challenges.

- Market Demand Analysis: Estimate the current and future demand for your product or service. Consider factors like seasonality and trends.

- Supply Evaluation: Assess the availability of resources, suppliers, and distribution channels required to meet the expected demand.

- Market Saturation: Determine whether the market is saturated with similar offerings and how this might affect your project.

- Demand Forecasting: Use historical data and market trends to make informed projections about future demand.

- Scalability: Consider the scalability of your project to meet increased demand or potential fluctuations.

A comprehensive market feasibility study will give you valuable insights into your potential customer base, market dynamics, and competitive landscape. This information will be pivotal in shaping your project's direction and strategy.

How to Conduct a Technical Feasibility Study?

The technical feasibility study assesses the practicality of implementing your project from a technical standpoint. It involves evaluating the project's design, technical requirements, technological feasibility, resource availability, and risk analysis. Let's delve into each aspect in more detail.

1. Project Design and Technical Requirements

The project design and technical requirements are the foundation of your technical feasibility study. This phase involves defining the technical specifications and infrastructure needed to execute your project successfully.

- Technical Specifications: Clearly define the technical specifications of your project, including hardware, software, and any specialized equipment.

- Infrastructure Planning: Determine the physical infrastructure requirements, such as facilities, utilities, and transportation logistics.

- Development Workflow: Outline the workflow and processes required to design, develop, and implement the project.

- Prototyping: Consider creating prototypes or proof-of-concept models to test and validate the technical aspects of your project.

2. Technology Assessment

A critical aspect of the technical feasibility study is assessing the technology required for your project and ensuring it aligns with your goals.

- Technology Suitability: Evaluate the suitability of the chosen technology for your project. Is it the right fit, or are there better alternatives?

- Scalability and Compatibility: Assess whether the chosen technology can scale as your project grows and whether it is compatible with existing systems or software.

- Security Measures: Consider cybersecurity and data protection measures to safeguard sensitive information.

- Technical Expertise: Ensure your team or external partners possess the technical expertise to implement and maintain the technology.

3. Resource Evaluation

Resource evaluation involves assessing the availability of the essential resources required to execute your project successfully. These resources include personnel, materials, and suppliers.

- Human Resources: Evaluate whether you have access to skilled personnel or if additional hiring or training is necessary.

- Material Resources: Identify the materials and supplies needed for your project and assess their availability and costs.

- Supplier Relationships: Establish relationships with reliable suppliers and consistently assess their ability to meet your resource requirements.

4. Risk Analysis

Risk analysis is a critical component of the technical feasibility study, as it helps you anticipate and mitigate potential technical challenges and setbacks.

- Identify Risks: Identify potential technical risks, such as hardware or software failures, technical skill gaps, or unforeseen technical obstacles.

- Risk Mitigation Strategies: Develop strategies to mitigate identified risks, including contingency plans and resource allocation for risk management.

- Cost Estimation for Risk Mitigation: Assess the potential costs associated with managing technical risks and incorporate them into your project budget.

By conducting a thorough technical feasibility study, you can ensure that your project is technically viable and well-prepared to overcome technical challenges. This assessment will also guide decision-making regarding technology choices, resource allocation, and risk management strategies.

How to Conduct a Financial Feasibility Study?

The financial feasibility study is a critical aspect of your overall feasibility analysis. It focuses on assessing the financial viability of your project by estimating costs, projecting revenue, conducting investment analysis, and evaluating the overall financial health of your project. Let's delve into each aspect in more detail.

1. Cost Estimation

Cost estimation is the process of calculating the expenses associated with planning, developing, and implementing your project. This involves identifying both initial and ongoing costs.

- Initial Costs: Calculate the upfront expenses required to initiate the project, including capital expenditures, equipment purchases, and any development costs.

- Operational Costs: Estimate the ongoing operating expenses, such as salaries, utilities, rent, marketing, and maintenance.

- Contingency Funds: Allocate funds for unexpected expenses or contingencies to account for unforeseen challenges.

- Depreciation: Consider the depreciation of assets over time, as it impacts your financial statements.

2. Revenue Projections

Revenue projections involve forecasting the income your project is expected to generate over a specific period. Accurate revenue projections are crucial for assessing the project's financial viability.

- Sales Forecasts: Estimate your product or service sales based on market demand, pricing strategies, and potential growth.

- Pricing Strategy: Determine your pricing strategy, considering factors like competition, market conditions, and customer willingness to pay.

- Market Penetration: Analyze how quickly you can capture market share and increase sales over time.

- Seasonal Variations: Account for any seasonal fluctuations in revenue that may impact your cash flow.

3. Investment Analysis

Investment analysis involves evaluating the potential return on investment (ROI) and assessing the attractiveness of your project to potential investors or stakeholders.

- Return on Investment (ROI): Calculate the expected ROI by comparing the project's net gains against the initial investment.

- Payback Period: Determine how long it will take for the project to generate sufficient revenue to cover its initial costs.

- Risk Assessment: Consider the level of risk associated with the project and whether it aligns with investors' risk tolerance.

- Sensitivity Analysis: Perform sensitivity analysis to understand how changes in key variables, such as sales or costs, affect the investment's profitability.

4. Financial Viability Assessment

A financial viability assessment evaluates the project's ability to sustain itself financially in the long term. It considers factors such as profitability, cash flow, and financial stability.

- Profitability Analysis: Assess whether the project is expected to generate profits over its lifespan.

- Cash Flow Management: Analyze the project's cash flow to ensure it can cover operating expenses, debt payments, and other financial obligations.

- Break-Even Analysis: Determine the point at which the project's revenue covers all costs, resulting in neither profit nor loss.

- Financial Ratios: Calculate key financial ratios, such as debt-to-equity ratio and return on equity, to evaluate the project's financial health.

By conducting a comprehensive financial feasibility study, you can gain a clear understanding of the project's financial prospects and make informed decisions regarding its viability and potential for success.

How to Conduct an Operational Feasibility Study?

The operational feasibility study assesses whether your project can be implemented effectively within your organization's operational framework. It involves evaluating processes, resource planning, scalability, and analyzing potential operational risks.

1. Process and Workflow Assessment

The process and workflow assessment examines how the project integrates with existing processes and workflows within your organization.

- Process Mapping: Map out current processes and workflows to identify areas of integration and potential bottlenecks.

- Workflow Efficiency: Assess the efficiency and effectiveness of existing workflows and identify opportunities for improvement.

- Change Management: Consider the project's impact on employees and plan for change management strategies to ensure a smooth transition.

2. Resource Planning

Resource planning involves determining the human, physical, and technological resources needed to execute the project successfully.

- Human Resources: Assess the availability of skilled personnel and consider whether additional hiring or training is necessary.

- Physical Resources: Identify the physical infrastructure, equipment, and materials required for the project.

- Technology and Tools: Ensure that the necessary technology and tools are available and up to date to support project implementation.

3. Scalability Evaluation

Scalability evaluation assesses whether the project can adapt and expand to meet changing demands and growth opportunities.

- Scalability Factors: Identify factors impacting scalability, such as market growth, customer demand, and technological advancements.

- Capacity Planning: Plan for the scalability of resources, including personnel, infrastructure, and technology.

- Growth Strategies: Develop strategies for scaling the project, such as geographic expansion, product diversification, or increasing production capacity.

4. Operational Risk Analysis

Operational risk analysis involves identifying potential operational challenges and developing mitigation strategies.

- Risk Identification: Identify operational risks that could disrupt project implementation or ongoing operations.

- Risk Mitigation: Develop risk mitigation plans and contingency strategies to address potential challenges.

- Testing and Simulation: Consider conducting simulations or testing to evaluate how the project performs under various operational scenarios.

- Monitoring and Adaptation: Implement monitoring and feedback mechanisms to detect and address operational issues as they arise.

Conducting a thorough operational feasibility study ensures that your project aligns with your organization's capabilities, processes, and resources. This assessment will help you plan for a successful implementation and minimize operational disruptions.

How to Write a Feasibility Study?

The feasibility study report is the culmination of your feasibility analysis. It provides a structured and comprehensive document outlining your study's findings, conclusions, and recommendations. Let's explore the key components of the feasibility study report.

1. Structure and Components

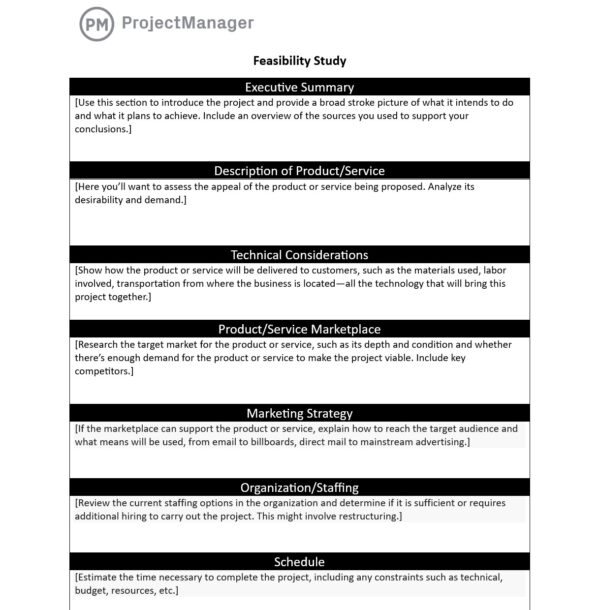

The structure of your feasibility study report should be well-organized and easy to navigate. It typically includes the following components:

- Executive Summary: A concise summary of the study's key findings, conclusions, and recommendations.

- Introduction: An overview of the project, the objectives of the study, and a brief outline of what the report covers.

- Methodology: A description of the research methods , data sources, and analytical techniques used in the study.

- Market Feasibility Study: Detailed information on market research, target audience, competitive analysis, and demand-supply assessment.

- Technical Feasibility Study: Insights into project design, technical requirements, technology assessment, resource evaluation, and risk analysis.

- Financial Feasibility Study: Comprehensive information on cost estimation, revenue projections, investment analysis, and financial viability assessment.

- Operational Feasibility Study: Details on process and workflow assessment, resource planning, scalability evaluation, and operational risks analysis.

- Conclusion: A summary of key findings and conclusions drawn from the study.

Recommendations: Clear and actionable recommendations based on the study's findings.

2. Write the Feasibility Study Report

When writing the feasibility study report, it's essential to maintain clarity, conciseness, and objectivity. Use clear language and provide sufficient detail to support your conclusions and recommendations.

- Be Objective: Present findings and conclusions impartially, based on data and analysis.

- Use Visuals: Incorporate charts, graphs, and tables to illustrate key points and make the report more accessible.

- Cite Sources: Properly cite all data sources and references used in the study.

- Include Appendices: Attach any supplementary information, data, or documents in appendices for reference.

3. Present Findings and Recommendations

When presenting your findings and recommendations, consider your target audience. Tailor your presentation to the needs and interests of stakeholders, whether they are investors, executives, or decision-makers.

- Highlight Key Takeaways: Summarize the most critical findings and recommendations upfront.

- Use Visual Aids: Create a visually engaging presentation with slides, charts, and infographics.

- Address Questions: Be prepared to answer questions and provide additional context during the presentation.

- Provide Supporting Data: Back up your findings and recommendations with data from the feasibility study.

4. Review and Validation

Before finalizing the feasibility study report, conducting a thorough review and validation process is crucial. This ensures the accuracy and credibility of the report.

- Peer Review: Have colleagues or subject matter experts review the report for accuracy and completeness.

- Data Validation: Double-check data sources and calculations to ensure they are accurate.

- Cross-Functional Review: Involve team members from different disciplines to provide diverse perspectives.

- Stakeholder Input: Seek input from key stakeholders to validate findings and recommendations.

By following a structured approach to creating your feasibility study report, you can effectively communicate the results of your analysis, support informed decision-making, and increase the likelihood of project success.

Feasibility Study Examples

Let's dive into some real-world examples to truly grasp the concept and application of feasibility studies. These examples will illustrate how various types of projects and businesses undergo the feasibility assessment process to ensure their viability and success.

Example 1: Local Restaurant

Imagine you're passionate about opening a new restaurant in a bustling urban area. Before investing significant capital, you'd want to conduct a thorough feasibility study. Here's how it might unfold:

- Market Feasibility: You research the local dining scene, identify target demographics, and assess the demand for your cuisine. Market surveys reveal potential competitors, dining preferences, and pricing expectations.

- Technical Feasibility: You design the restaurant layout, plan the kitchen setup, and assess the technical requirements for equipment and facilities. You consider factors like kitchen efficiency, safety regulations, and adherence to health codes.

- Financial Feasibility: You estimate the initial costs for leasing or purchasing a space, kitchen equipment, staff hiring, and marketing. Revenue projections are based on expected foot traffic, menu pricing, and seasonal variations.

- Operational Feasibility: You create kitchen and service operations workflow diagrams, considering staff roles and responsibilities. Resource planning includes hiring chefs, waitstaff, and kitchen personnel. Scalability is evaluated for potential expansion or franchising.

- Risk Analysis: Potential operational risks are identified, such as food safety concerns, labor shortages, or location-specific challenges. Risk mitigation strategies involve staff training, quality control measures, and contingency plans for unexpected events.

Example 2: Software Development Project

Now, let's explore the feasibility study process for a software development project, such as building a mobile app:

- Market Feasibility: You analyze the mobile app market, identify your target audience, and assess the demand for a solution in a specific niche. You gather user feedback and conduct competitor analysis to understand the competitive landscape.

- Technical Feasibility: You define the technical requirements for the app, considering platforms (iOS, Android), development tools, and potential integrations with third-party services. You evaluate the feasibility of implementing specific features.

- Financial Feasibility: You estimate the development costs, including hiring developers, designers, and ongoing maintenance expenses. Revenue projections are based on app pricing, potential in-app purchases, and advertising revenue.

- Operational Feasibility: You map out the development workflow, detailing the phases from concept to deployment. Resource planning includes hiring developers with the necessary skills, setting up development environments, and establishing a testing framework.

- Risk Analysis: Potential risks like scope creep, technical challenges, or market saturation are assessed. Mitigation strategies involve setting clear project milestones, conducting thorough testing, and having contingency plans for technical glitches.

These examples demonstrate the versatility of feasibility studies across diverse projects. Whatever type of venture or endeavor you want to embark on, a well-structured feasibility study guides you toward informed decisions and increased project success.

In conclusion, conducting a feasibility study is a crucial step in your project's journey. It helps you assess the viability and potential risks, providing a solid foundation for informed decision-making. Remember, a well-executed feasibility study not only enables you to identify challenges but also uncovers opportunities that can lead to your project's success.

By thoroughly examining market trends, technical requirements, financial aspects, and operational considerations, you are better prepared to embark on your project confidently. With this guide, you've gained the knowledge and tools needed to navigate the intricate terrain of feasibility studies.

How to Conduct a Feasibility Study in Minutes?

Speed and precision are paramount for feasibility studies, and Appinio delivers just that. As a real-time market research platform, Appinio empowers you to seamlessly conduct your market research in a matter of minutes, putting actionable insights at your fingertips.

Here's why Appinio stands out as the go-to tool for feasibility studies:

- Rapid Insights: Appinio's intuitive platform ensures that anyone, regardless of their research background, can effortlessly navigate and conduct research, saving valuable time and resources.

- Lightning-Fast Responses: With an average field time of under 23 minutes for 1,000 respondents, Appinio ensures that you get the answers you need when you need them, making it ideal for time-sensitive feasibility studies.

- Global Reach: Appinio's extensive reach spans over 90 countries, allowing you to define the perfect target group from a pool of 1,200+ characteristics and gather insights from diverse markets.

Get free access to the platform!

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

12.03.2024 | 29min read

What is Sentiment Analysis? Guide, Tools, Uses, Examples

08.03.2024 | 20min read

What is Behavioral Segmentation? Definition, Types, Examples

06.03.2024 | 32min read

What is a Control Group? Definition, Uses, Examples

- Search Search Please fill out this field.

What Is a Feasibility Study?

Understanding a feasibility study, how to conduct a feasibility study.

- Feasibility Study FAQs

The Bottom Line

- Business Essentials

Feasibility Study

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

A feasibility study is a detailed analysis that considers all of the critical aspects of a proposed project in order to determine the likelihood of it succeeding.

Success in business may be defined primarily by return on investment , meaning that the project will generate enough profit to justify the investment. However, many other important factors may be identified on the plus or minus side, such as community reaction and environmental impact.

Although feasibility studies can help project managers determine the risk and return of pursuing a plan of action, several steps should be considered before moving forward.

Key Takeaways

- A company may conduct a feasibility study when it's considering launching a new business, adding a new product line, or acquiring a rival.

- A feasibility study assesses the potential for success of the proposed plan or project by defining its expected costs and projected benefits in detail.

- It's a good idea to have a contingency plan on hand in case the original project is found to be infeasible.

Investopedia / Lara Antal

A feasibility study is an assessment of the practicality of a proposed plan or project. A feasibility study analyzes the viability of a project to determine whether the project or venture is likely to succeed. The study is also designed to identify potential issues and problems that could arise while pursuing the project.

As part of the feasibility study, project managers must determine whether they have enough of the right people, financial resources, and technology. The study must also determine the return on investment, whether this is measured as a financial gain or a benefit to society, as in the case of a nonprofit project.

The feasibility study might include a cash flow analysis, measuring the level of cash generated from revenue versus the project's operating costs . A risk assessment must also be completed to determine whether the return is enough to offset the risk of undergoing the venture.

When doing a feasibility study, it’s always good to have a contingency plan that is ready to test as a viable alternative if the first plan fails.

Benefits of a Feasibility Study

There are several benefits to feasibility studies, including helping project managers discern the pros and cons of undertaking a project before investing a significant amount of time and capital into it.

Feasibility studies can also provide a company's management team with crucial information that could prevent them from entering into a risky business venture.

Such studies help companies determine how they will grow. They will know more about how they will operate, what the potential obstacles are, who the competition is, and what the market is.

Feasibility studies also help convince investors and bankers that investing in a particular project or business is a wise choice.

The exact format of a feasibility study will depend on the type of organization that requires it. However, the same factors will be involved even if their weighting varies.

Preliminary Analysis

Although each project can have unique goals and needs, there are some best practices for conducting any feasibility study:

- Conduct a preliminary analysis, which involves getting feedback about the new concept from the appropriate stakeholders

- Analyze and ask questions about the data obtained in the early phase of the study to make sure that it's solid

- Conduct a market survey or market research to identify the market demand and opportunity for pursuing the project or business

- Write an organizational, operational, or business plan, including identifying the amount of labor needed, at what cost, and for how long

- Prepare a projected income statement, which includes revenue, operating costs, and profit

- Prepare an opening day balance sheet

- Identify obstacles and any potential vulnerabilities, as well as how to deal with them

- Make an initial "go" or "no-go" decision about moving ahead with the plan

Suggested Components

Once the initial due diligence has been completed, the real work begins. Components that are typically found in a feasibility study include the following:

- Executive summary : Formulate a narrative describing details of the project, product, service, plan, or business.

- Technological considerations : Ask what will it take. Do you have it? If not, can you get it? What will it cost?

- Existing marketplace : Examine the local and broader markets for the product, service, plan, or business.

- Marketing strategy : Describe it in detail.

- Required staffing : What are the human capital needs for this project? Draw up an organizational chart.

- Schedule and timeline : Include significant interim markers for the project's completion date.

- Project financials .

- Findings and recommendations : Break down into subsets of technology, marketing, organization, and financials.

Examples of a Feasibility Study

Below are two examples of a feasibility study. The first involves expansion plans for a university. The second is a real-world example conducted by the Washington State Department of Transportation with private contributions from Microsoft Inc.

A University Science Building

Officials at a university were concerned that the science building—built in the 1970s—was outdated. Considering the technological and scientific advances of the last 20 years, they wanted to explore the cost and benefits of upgrading and expanding the building. A feasibility study was conducted.

In the preliminary analysis, school officials explored several options, weighing the benefits and costs of expanding and updating the science building. Some school officials had concerns about the project, including the cost and possible community opposition. The new science building would be much larger, and the community board had earlier rejected similar proposals. The feasibility study would need to address these concerns and any potential legal or zoning issues.

The feasibility study also explored the technological needs of the new science facility, the benefits to the students, and the long-term viability of the college. A modernized science facility would expand the school's scientific research capabilities, improve its curriculum, and attract new students.

Financial projections showed the cost and scope of the project and how the school planned to raise the needed funds, which included issuing a bond to investors and tapping into the school's endowment . The projections also showed how the expanded facility would allow more students to be enrolled in the science programs, increasing revenue from tuition and fees.

The feasibility study demonstrated that the project was viable, paving the way to enacting the modernization and expansion plans of the science building.

Without conducting a feasibility study, the school administrators would never have known whether its expansion plans were viable.

A High-Speed Rail Project

The Washington State Department of Transportation decided to conduct a feasibility study on a proposal to construct a high-speed rail that would connect Vancouver, British Columbia, Seattle, Washington, and Portland, Oregon. The goal was to create an environmentally responsible transportation system to enhance the competitiveness and future prosperity of the Pacific Northwest.

The preliminary analysis outlined a governance framework for future decision-making. The study involved researching the most effective governance framework by interviewing experts and stakeholders, reviewing governance structures, and learning from existing high-speed rail projects in North America. As a result, governing and coordinating entities were developed to oversee and follow the project if it was approved by the state legislature.

A strategic engagement plan involved an equitable approach with the public, elected officials, federal agencies, business leaders, advocacy groups, and indigenous communities. The engagement plan was designed to be flexible, considering the size and scope of the project and how many cities and towns would be involved. A team of the executive committee members was formed and met to discuss strategies, lessons learned from previous projects and met with experts to create an outreach framework.

The financial component of the feasibility study outlined the strategy for securing the project's funding, which explored obtaining funds from federal, state, and private investments. The project's cost was estimated to be between $24 billion to $42 billion. The revenue generated from the high-speed rail system was estimated to be between $160 million and $250 million.

The report bifurcated the money sources between funding and financing. Funding referred to grants, appropriations from the local or state government, and revenue. Financing referred to bonds issued by the government, loans from financial institutions, and equity investments, which are essentially loans against future revenue that needs to be paid back with interest.

The sources for the capital needed were to vary as the project moved forward. In the early stages, most of the funding would come from the government, and as the project developed, funding would come from private contributions and financing measures. Private contributors included Microsoft Inc., which donated more than $570,000 to the project.

The benefits outlined in the feasibility report show that the region would experience enhanced interconnectivity, allowing for better management of the population and increasing regional economic growth by $355 billion. The new transportation system would provide people with access to better jobs and more affordable housing. The high-speed rail system would also relieve congested areas from automobile traffic.

The timeline for the study began in 2016 when an agreement was reached with British Columbia to work together on a new technology corridor that included high-speed rail transportation. The feasibility report was submitted to the Washington State land Legislature in December 2020.

What Is the Main Objective of a Feasibility Study?

A feasibility study is designed to help decision-makers determine whether or not a proposed project or investment is likely to be successful. It identifies both the known costs and the expected benefits.

In business, "successful" means that the financial return exceeds the cost. In a nonprofit, success may be measured in other ways. A project's benefit to the community it serves may be worth the cost.

What Are the Steps in a Feasibility Study?

A feasibility study starts with a preliminary analysis. Stakeholders are interviewed, market research is conducted, and a business plan is prepared. All of this information is analyzed to make an initial "go" or "no-go" decision.

If it's a go, the real study can begin. This includes listing the technological considerations, studying the marketplace, describing the marketing strategy, and outlining the necessary human capital, project schedule, and financing requirements.

Who Conducts a Feasibility Study?

A feasibility study may be conducted by a team of the organization's senior managers. If they lack the expertise or time to do the work internally it may be outsourced to a consultant.

What Are the 4 Types of Feasibility?

The study considers the feasibility of four aspects of a project:

Technical: A list of the hardware and software needed, and the skilled labor required to make them work.

Financial: An estimate of the cost of the overall project and its expected return.

Market: An analysis of the market for the product or service, the industry, competition, consumer demand, sales forecasts, and growth projections

Organizational: An outline of the business structure and the management team that will be needed.

Feasibility studies help project managers determine the viability of a project or business venture by identifying the factors that can lead to its success. The study also shows the potential return on investment and any risks to the success of the venture.

A feasibility study contains a detailed analysis of what's needed to complete the proposed project. The report may include a description of the new product or venture, a market analysis, the technology and labor needed, as well as the sources of financing and capital. The report will also include financial projections, the likelihood of success, and ultimately, a go-or-no-go decision.

Washington State Department of Transportation. " Ultra-High-Speed Rail Study ."

Washington State Department of Transportation. " Cascadia Ultra High Speed Ground Transportation Framework for the Future ."

Washington State Department of Transportation. " Ultra-High-Speed Rail Study: Outcomes ."

Washington State Department of Transportation. " Ultra-High-Speed Ground Transportation Business Case Analysis ." Page ii.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1084171152-8445a490b5894f0a9bb588dbfc2ac22d.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Prepare a Financial Feasibility Study

by Jim Woodruff

Published on 3 Mar 2019

When business owners have an idea about a new project, they first conduct a feasibility study to determine its viability. A complete feasibility study would examine the market, analyze the technical and production issues, analyze the economic factors and include the preparation of a financial analysis.

Managers prepare feasibility studies to identify the positive and negative issues before making an investment of time and money.

Purpose of a Financial Feasibility Study

Financial feasibility focuses specifically on the financial aspects of the study. It assesses the economical viability of a proposed venture by evaluating the startup costs, operating expenses, cash flow and making a forecast of future performance.

The results from a financial feasibility study determine whether the proposed project is financially possible and make a projection on the rate of return on invested capital.

The preparation of a financial feasibility study has three parts:

- Determining the startup costs.

- Preparing a profit plan and making cash flow projections.

- Assessing the return on invested capital.

Identify the Startup Costs

The first step in the preparation of a financial feasibility analysis is to identify the costs needed to start the project. Typical startup costs are as follows:

- Purchases for land and buildings.

- Acquisition of equipment.

- Licenses and permits.

- Deposits required for office space leases.