- HR & Payroll

What is Capital Budgeting? Process, Methods, Formula, Examples

‘Expansion and Growth’ are the two common goals of an organization's operations. In case a company does not possess enough capital or has no fixed assets , this is difficult to accomplish. It is at this point that capital budgeting becomes essential.

The capital budget is used by management to plan expenditures on fixed assets. As a result of the budgets, the company's management usually determines which long-term strategies it can invest in to achieve its growth goals. For instance, management can decide if it needs to sell or purchase assets for expansion to accomplish this.

The purpose of capital budgeting is to make long-term investment decisions about whether particular projects will result in sustainable growth and provide the expected returns.

We shall learn about Capital Budgeting and all the details related to it in this article:

- What is Capital Budgeting in detail

- Features of capital budgeting

- Understanding capital budgeting and how it works

- Techniques/Methods of capital budgeting with Examples

- Process of capital budgeting

- Factors affecting capital budgeting

- Limitations of capital budgeting

What is Capital Budgeting?

Capital Budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. Using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners.

Capital asset management requires a lot of money; therefore, before making such investments, they must do capital budgeting to ensure that the investment will procure profits for the company. The companies must undertake initiatives that will lead to a growth in their profitability and also boost their shareholder’s or investor’s wealth.

Features of Capital Budgeting

Capital Budgeting is characterized by the following features:

- There is a long duration between the initial investments and the expected returns.

- The organizations usually estimate large profits.

- The process involves high risks.

- It is a fixed investment over the long run.

- Investments made in a project determine the future financial condition of an organization.

- All projects require significant amounts of funding.

- The amount of investment made in the project determines the profitability of a company.

Understanding Capital Budgeting

While companies would like to take up all the projects that maximize the benefits of the shareholders, they also understand that there is a limitation on the money that they can employ for those projects. Therefore, they utilize capital budgeting strategies to assess which initiatives will provide the best returns across a given period. Owing to its culpability and quantifying abilities, capital budgeting is a preferred way of establishing if a project will yield results.

To measure the longer-term monetary and fiscal profit margins of any option contract, companies can use the capital-budgeting process. Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. Under certain conditions, the internal rate of return (IRR) and payback period (PB) methods are sometimes used instead of net present value (NPV) which is the most preferred method. If all three approaches point in the same direction, managers can be most confident in their analysis.

How Capital Budgeting Works

It is of prime importance for a company when dealing with capital budgeting decisions that it determines whether or not the project will be profitable. Although we shall learn all the capital budgeting methods, the most common methods of selecting projects are:

- Payback Period (PB)

- Internal Rate of Return (IRR) and

- Net Present Value (NPV)

It might seem like an ideal capital budgeting approach would be one that would result in positive answers for all three metrics, but often these approaches will produce contradictory results. Some approaches will be preferred over others based on the requirement of the business and the selection criteria of the management. Despite this, these widely used valuation methods have both benefits and drawbacks.

Investing in capital assets is determined by how they will affect cash flow in the future, which is what capital budgeting is supposed to do. The capital investment consumes less cash in the future while increasing the amount of cash that enters the business later is preferable.

Keeping track of the timing is equally important. It is always better to generate cash sooner than later if you consider the time value of money. Other factors to consider include scale. To have a visible impact on a company's final performance, it may be necessary for a large company to focus its resources on assets that can generate large amounts of cash.

In smaller businesses , a project that has the potential to deliver rapid and sizable cash flow may have to be rejected because the investment required would exceed the company's capabilities.

The amount of work and time invested in capital budgeting will vary based on the risk associated with a bad decision along with its potential benefits. Therefore, a modest investment could be a wiser option if the company fears the risk of bankruptcy in case the decisions go wrong.

Sunk costs are not considered in capital budgeting. The process focuses on future cash flows rather than past expenses .

Techniques/Methods of Capital Budgeting

In addition to the many capital budgeting methods available, the following list outlines a few by which companies can decide which projects to explore:

#1 Payback Period Method

It refers to the time taken by a proposed project to generate enough income to cover the initial investment. The project with the quickest payback is chosen by the company.

Example of Payback Period Method:

An enterprise plans to invest $100,000 to enhance its manufacturing process. It has two mutually independent options in front: Product A and Product B. Product A exhibits a contribution of $25 and Product B of $15. The expansion plan is projected to increase the output by 500 units for Product A and 1,000 units for Product B.

Here, the incremental cash flow will be calculated as:

(25*500) = 12,500 for Product A

(15*1000) = 15,000 for Product B

The Payback Period for Product A is calculated as:

Product A = 100,000 / 12,500 = 8 years

Now, the Payback Period for Product B is calculated as:

Product B = 100,000 / 15,000 = 6.7 years

This brings the enterprise to conclude that Product B has a shorter payback period and therefore, it will invest in Product B.

Despite being an easy and time-efficient method, the Payback Period cannot be called optimum as it does not consider the time value of money. The cash flows at the earlier stages are better than the ones coming in at later stages. The company may encounter two projections with the same payback period, where one depicts higher cash flows in the earlier stages/years. In such as case, the Payback Period may not be appropriate.

A similar consideration is that of a longer period, potentially bringing in greater cash flows during a payback period. In such a case, if the company selects the projects based solely on the payback period and without considering the cash flows, then this could prove detrimental for the financial prospects of the company.

#2 Net Present Value Method (NPV)

Evaluating capital investment projects is what the NPV method helps the companies with. There may be inconsistencies in the cash flows created over time. The cost of capital is used to discount it. An evaluation is done based on the investment made. Whether a project is accepted or rejected depends on the value of inflows over current outflows.

This method considers the time value of money and attributes it to the company's objective, which is to maximize profits for its owners. The capital cost factors in the cash flow during the entire lifespan of the product and the risks associated with such a cash flow. Then, the capital cost is calculated with the help of an estimate.

Example of Net Present Value (with 9% Discount Rate ):

For a company, let’s assume the following conditions:

Capital investment = $10,000

Expected Inflow in First Year = $1,000

Expected Inflow in Second Year = $2,500

Expected Inflow in Third Year = $3,500

Expected Inflow in Fourth Year = $2,650

Expected Inflow in Fifth Year = $4,150

Discount Rate = 9%

Net Present Value achieved at the end of the calculation is:

With 9% Discount Rate = $18,629

This indicates that if the NPV comes out to be positive and indicates profit. Therefore, the company shall move ahead with the project.

#3 Internal Rate of Return (IRR)

IRR refers to the method where the NPV is zero. In such as condition, the cash inflow rate equals the cash outflow rate. Although it considers the time value of money, it is one of the complicated methods.

It follows the rule that if the IRR is more than the average cost of the capital, then the company accepts the project, or else it rejects the project. If the company faces a situation with multiple projects, then the project offering the highest IRR is selected by them.

We shall assume the possibilities exhibited in the table here for a company that has 2 projects: Project A and Project B.

Here, The IRR of Project A is 7.9% which is above the Threshold Rate of Return (We assume it is 7% in this case.) So, the company will accept the project. However, if the Threshold Rate of Return would be 10%, then it would be rejected as the IRR would be lower. In that case, the company will choose Project B which shows a higher IRR as compared to the Threshold Rate of Return.

#4 Profitability Index

This method provides the ratio of the present value of future cash inflows to the initial investment. A Profitability Index that presents a value lower than 1.0 is indicative of lower cash inflows than the initial cost of investment. Aligned with this, a profitability index great than 1.0 presents better cash inflows and therefore, the project will be accepted.

Assuming the values given in the table, we shall calculate the profitability index for a discount rate of 10%.

So, Profitability Index with 10% discount = $15,807/$10,000 = 1.5807

As per the rule of the method, the profitability index is positive for the 10% discount rate, and therefore, it will be selected.

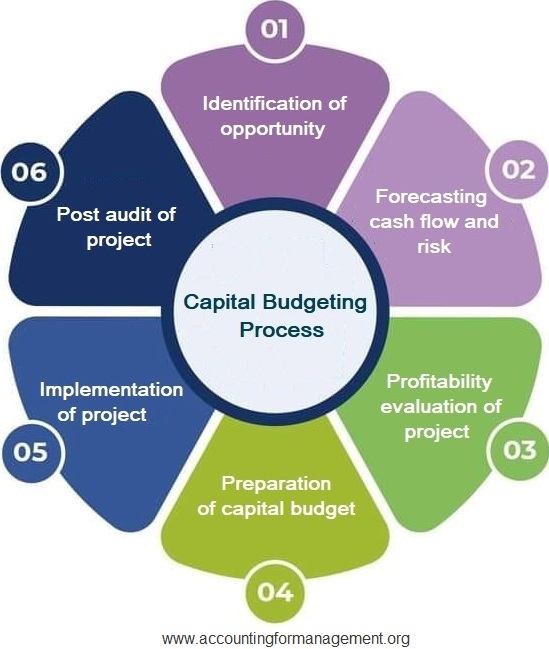

Process of Capital Budgeting

The process of Capital Budgeting involves the following points:

Identifying and generating projects

Investment proposals are the first step in capital budgeting. Taking up investments in a business can be motivated by a number of reasons. There could be the addition or expansion of a product line. An increase in production or a decrease in production costs could also be suggested.

Evaluating the project

It mainly consists of selecting all criteria necessary for judging the need for a proposal. In order to maximize market value, it has to match the company's mission. It is crucial to consider the time value of money here.

In addition to estimating the benefits and costs, you should weigh the pros and cons associated with the process. There could be a lot of risks involved with the total cash inflows and outflows. This needs to be scrutinized thoroughly before moving ahead.

Selecting a Project

Since there is no ‘one-size-fits-all’ factor, there is no defined technique for selecting a project. Every business has diverse requirements and therefore, the approval over a project comes based on the objectives of the organization.

After the project has been finalized, the other components need to be attended to. These include the acquisition of funds which can be explored by the finance department of the company. The companies need to explore all the options before concluding and approving the project. Besides, the factors like viability, profitability, and market conditions also play a vital role in the selection of the project.

Implementation

Once the project is implemented, now come the other critical elements such as completing it in the stipulated time frame or reduction of costs. Hereafter, the management takes charge of monitoring the impact of implementing the project.

Performance Review

This involves the process of analyzing and assessing the actual results over the estimated outcomes. This step helps the management identify the flaws and eliminate them for future proposals.

Factors Affecting Capital Budgeting

So far in the article, we have observed how measurability and accountability are two primary aspects that achieve the center stage through capital budgeting. However, while on the path to accomplish a competent capital budgeting process, you may come across various factors that may affect it.

Let us move on to observing the factors that affect the capital budgeting process.

Objectives of Capital Budgeting

The following points present the objectives of the capital budgeting:

- Capital Expenditure Control : Organizations need to estimate the cost of investment as it allows them to control and manage the required capital expenditures.

- Selecting Profitable Projects : The company will have to select the most appropriate project from the multiple possibilities in front of it.

- Identification of Source of funds : The businesses need to locate and select the most viable and apt source of funds for long-term capital investment. It needs to compare the various costs like the costs of borrowing and the cost of expected profits.

Limitations of Capital Budgeting

Although capital budgeting provides a lot of insight into the future prospects of a business, it cannot be termed a flawless method after all. In this section, we learn about some of the limitations of capital budgeting.

It is a simple technique that determines if an enhanced value of a project justifies the required investment. The primary reason to implement capital budgeting is to achieve forecasting revenue a project may possibly generate. The problem could be the estimate itself. All the upfront costs or the future revenue are all only estimates at this point. An overestimation or an underestimation could ultimately be detrimental to the performance of the business.

Time Horizon

Usually, capital budgeting as a process works across for long spans of years. While the shorter duration forecasts may be estimated, the longer ones are bound to be miscalculated. Therefore, an expanded time horizon could be a potential problem while computing figures with capital budgeting.

Besides, there could be additional factors such as competition or legal or technological innovations that could be problematic.

The payback period method of capital budgeting holds a lot of relevance, especially for small businesses. It is a simple method that only requires the business to repay in the predecided timeframe. However, the problem it poses is that it does not count in the time value of money. This is to say that equal amounts (of money) have different values at different points in time.

Discount Rates

The accounting for the time value of money is done either by borrowing money, paying interest, or using one’s own money. The knowledge of discount rates is essential. The proper estimation and calculation of which could be a cumbersome task.

Even if this is achieved, there are other fluctuations like the varying interest rates that could hamper future cash flows. Therefore, this is a factor that adds up to the list of limitations of capital budgeting.

How can Deskera Help Your Business?

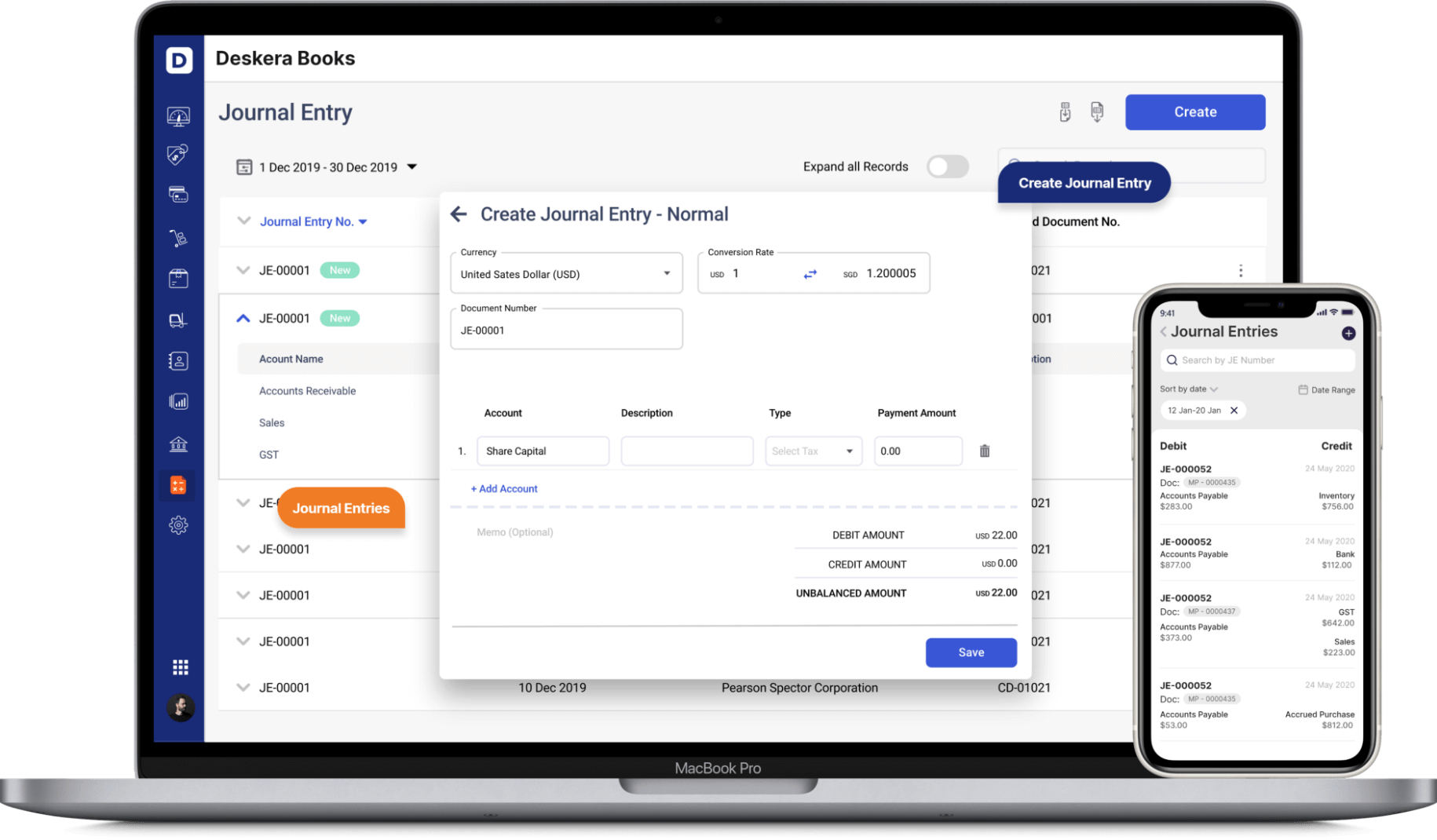

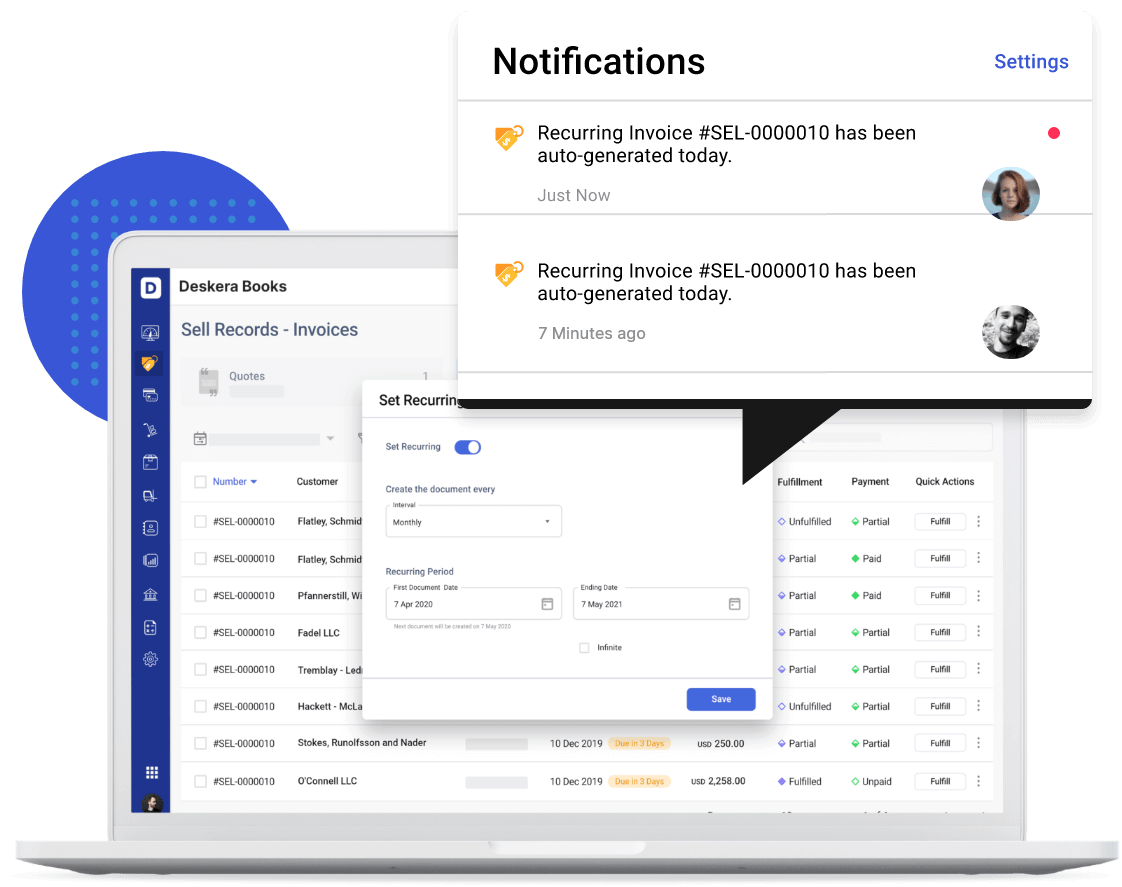

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow and budgeting for your business.

One of its usability lies in creating invoices on behalf of your business which can then be sent out immediately. Through Deskera books, a payment link can also be attached with your invoice. This payment link will have many options available like Stripe, VIM, PayPal and more being constantly added to the Deskera platform.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement , Balance Sheet , and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

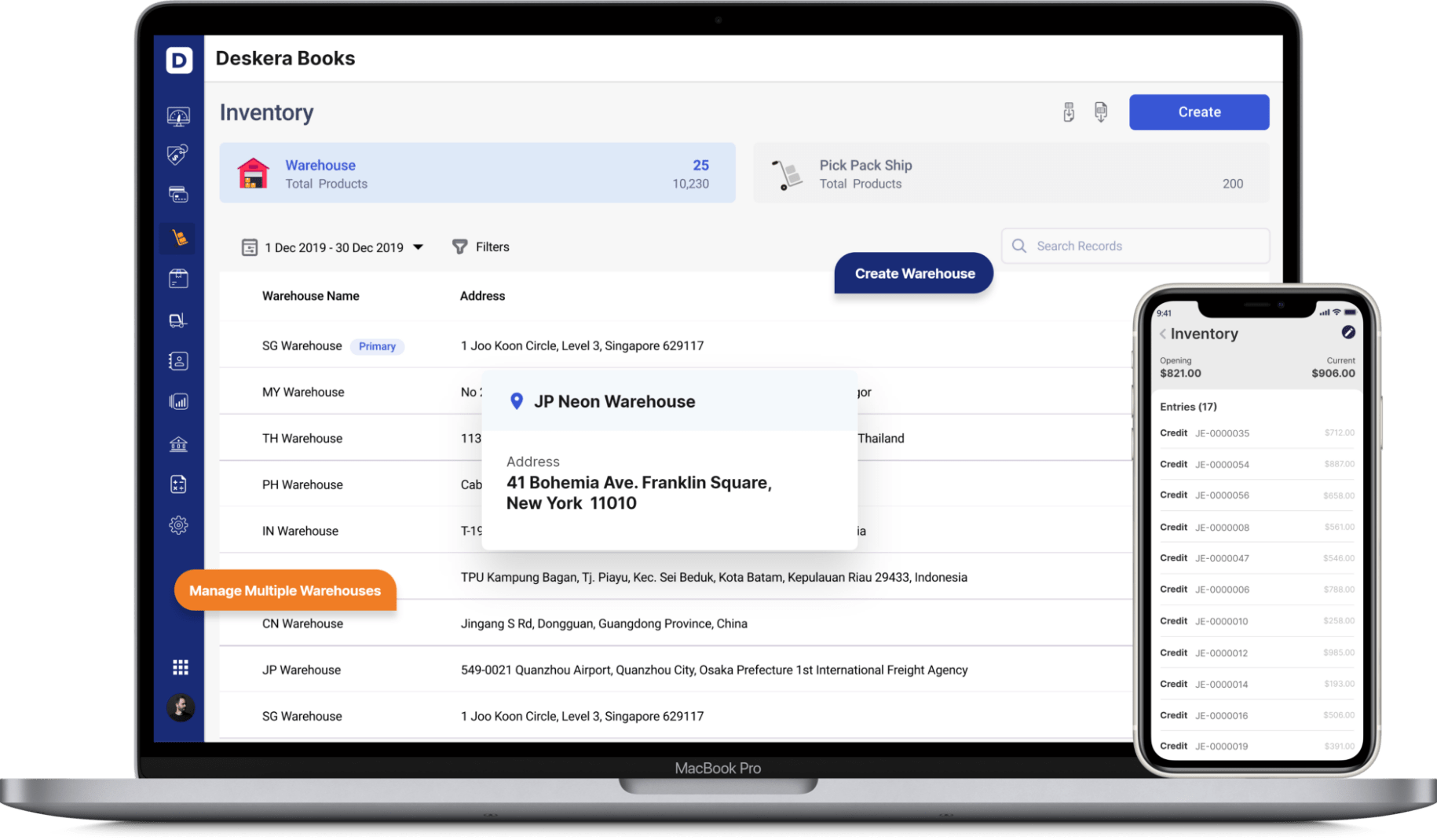

Deskera can also help with your inventory management , customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People . Your employees can view their payslips, apply for time off, and file their claims and expenses online.

Key Takeaways

Before we wrap up the post, let us peep into the important points with context to Capital Budgeting:

- Capital Budgeting is defined as the process by which a business determines which fixed asset purchases are acceptable and which are not.

- Capital budgeting leads to calculating the profitable capital expenditure.

- Determining if replacing any existing fixed assets would yield greater returns is a part of capital budgeting

- Selecting or denying a given project is based on its merits.

- The process of capital budgeting requires calculating the number of capital expenditures.

- An assessment of the different funding sources for capital expenditures is needed.

- Payback Period, Net Present Value Method, Internal Rate of Return, and Profitability Index are the methods to carry out capital budgeting.

- The process of capital budgeting involves the steps like Identifying the potential projects, evaluating them, selecting and implementing the projects, and finally reviewing the performance for future considerations.

- Capital return, accounting methods, structures of capital, availability of funds, and working capital are some of the factors that affect the process of capital budgeting.

Related Links

Guide to Understanding Accounts Receivable Days (A/R Days)

Everything You Need to Know About Professional Tax in Andhra Pradesh

Andhra Pradesh forms XXVI Letter of Appointment

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

Justifying Investments With the Capital Budgeting Process

For a business manager, choosing what to invest in should not be an exercise of instinct. With capital budgeting methods, managers can appraise various projects simultaneously, with the end result indicating which one will have the highest impact on company value.

By David Bradshaw

David is an expert in planning asset acquisitions, managing projects of up to $100m across the financial, real estate and consumer space.

Executive Summary

- The funds that businesses have to invest are finite by nature, yet there are always ample opportunities for how to invest them. The capital budgeting formula allows managers to allocate scarce capital to such investments in the most value accretive manner.

- Money also has a time value component to it. $1.00 now is worth more than $1.00 received in five years' time. Why? Because the money received now can be invested and grown within that five-year time scale.

- Ascertain exactly how much is needed for investment in the project

- Calculate the annual cash flows received from the project

- At the end of the project's life (if there is one), what will be the residual value of the asset?

- Using the weighted average cost of capital, cash flows are discounted to determine their value in today's terms

- If an NPV for a project is positive, it means that the project generates value, because it returns more than it costs. Yet this value should be stress tested, by applying sensitivity analysis to the project's inputs

- When purchasing a portfolio of assets, an NPV analysis provides an aggregate view of its total value. With relevant stress tests made on the cash flow and discount rate assumptions, a valuable tool is then gained for pricing negotiations with the seller.

- For new business units that are being launched inside a company, the first financial step is often accountancy-based budgeting. Augmenting this with capital budgeting will help to demonstrate whether the new venture will actually generate value for the parent.

- Be sure to account for all sources of cash flow from a project. Aside from revenues and expenses, large projects may impact cash flows from changes in working capital, such as accounts receivable, accounts payable, and inventory. Calculating a meaningful and accurate residual or terminal value is also critical.

- Don't blindly assume that a seller's projections are gospel.

- Net income is not a cash flow.

- Be careful not to overestimate a residual or terminal value. Using an ambitious, but unrealistic, IPO target as a residual value could be the game changer between a positive and negative NPV.

The funds available to be invested in a business either as equity or debt, also known as capital, are a limited resource. Accordingly, managers must make careful choices about when and where to invest capital to ensure that it is used wisely to create value for the firm. The process of making these decisions is called capital budgeting . This is a very powerful financial tool with which the investment in a capital asset, a new project, a new company, or even the acquisition of a company, can be analyzed and the basis (or cost justification) for the investment defined and illustrated to relevant stakeholders.

Essentially, capital budgeting allows the comparison of the cost/investment in a project versus the cash flows generated by the same venture. If the value of the future cash flows exceeds the cost/investment, then there is potential for value creation and the project should be investigated further with an eye toward extracting this value.

Far too often, business managers use intuition or “gut feel” to make capital investment decisions. I have heard managers say, “It just feels like the best move is to expand operations by building a new and better factory.” Or perhaps they jot down a few thoughts and prepare a “back of an envelope” financial analysis. I have seen investors decide to invest capital based on the Payback Period or how long they think it will take to recover the investment (with everything after being profit). All of these methods alone are a recipe for disaster. Investing capital should not be taken lightly and should not be made until a full and thorough analysis of the costs (financial and opportunity) and outcomes has been prepared and evaluated.

In this article, I will describe the objectives of capital budgeting, delineate the steps used to prepare a capital budget, and provide examples of where this process can be applied in the day to day operations of a business.

The Capital Budgeting Process and the Time Value of Money

The capital budgeting process is rooted in the concept of time value of money , (sometimes referred to as future value/present value) and uses a present value or discounted cash flow analysis to evaluate the investment opportunity.

Essentially, money is said to have time value because if invested—over time—it can earn interest. For example, $1.00 today is worth $1.05 in one year, if invested at 5.00%. Subsequently, the present value is $1.00, and the future value is $1.05.

Conversely, $1.05 to be received in one year’s time is a Future Value cash flow. Yet, its value today would be its Present Value, which again assuming an interest rate of 5.00%, would be $1.00.

The problem with comparing money today with money in the future is that it’s an apples to oranges comparison. We need to compare both at the same point in time. Likewise, the difficulty when investing capital is to determine which is worth more: the capital to be invested now, or the value of future cash flows that an investment will produce. If we look at both in terms of their present value we can compare values.

Net Present Value

The specific time value of money calculation used in Capital Budgeting is called net present value (NPV) . NPV is the sum of the present value (PV) of each projected cash flow, including the investment, discounted at the weighted average cost of the capital being invested (WACC) .

If upon calculating a project’s NPV, the value is positive, then the PV of the future cash flows exceeds the PV of the investment. In this case, value is being created and the project is worthy of further investigation. If on the other hand the NPV is negative, the investment is projected to lose value and should not be pursued, based on rational investment grounds.

Preparing a Capital Budgeting Analysis

To illustrate the steps in capital budgeting analysis, we will use a hypothetical example of the purchase of a truck to be used by AAA Trucking for making local, short haul deliveries. AAA plans to acquire the truck, use it for 4 years and the sell it for fair value on the resale market. It plans to use the sales proceeds as a down payment on a more modern replacement truck. It estimates the WACC at 14.00%.

Step 1: Determine the total amount of the investment.

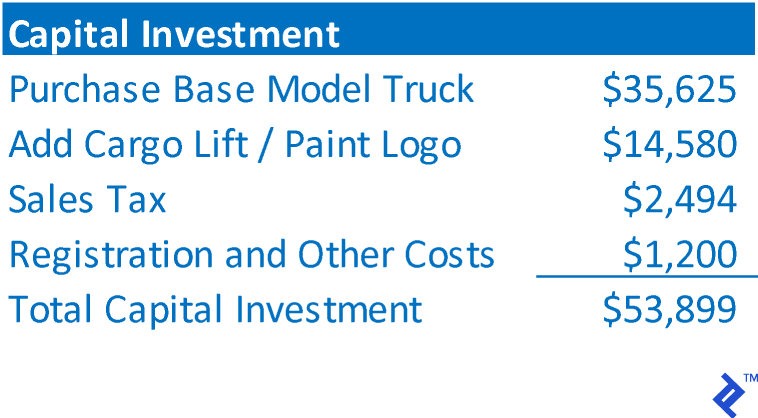

The total investment represents the total cost of the asset being acquired, or the total investment necessary to fund the project. In the case of AAA, that would consist of:

Step 2: Determine the cash flows the investment will return.

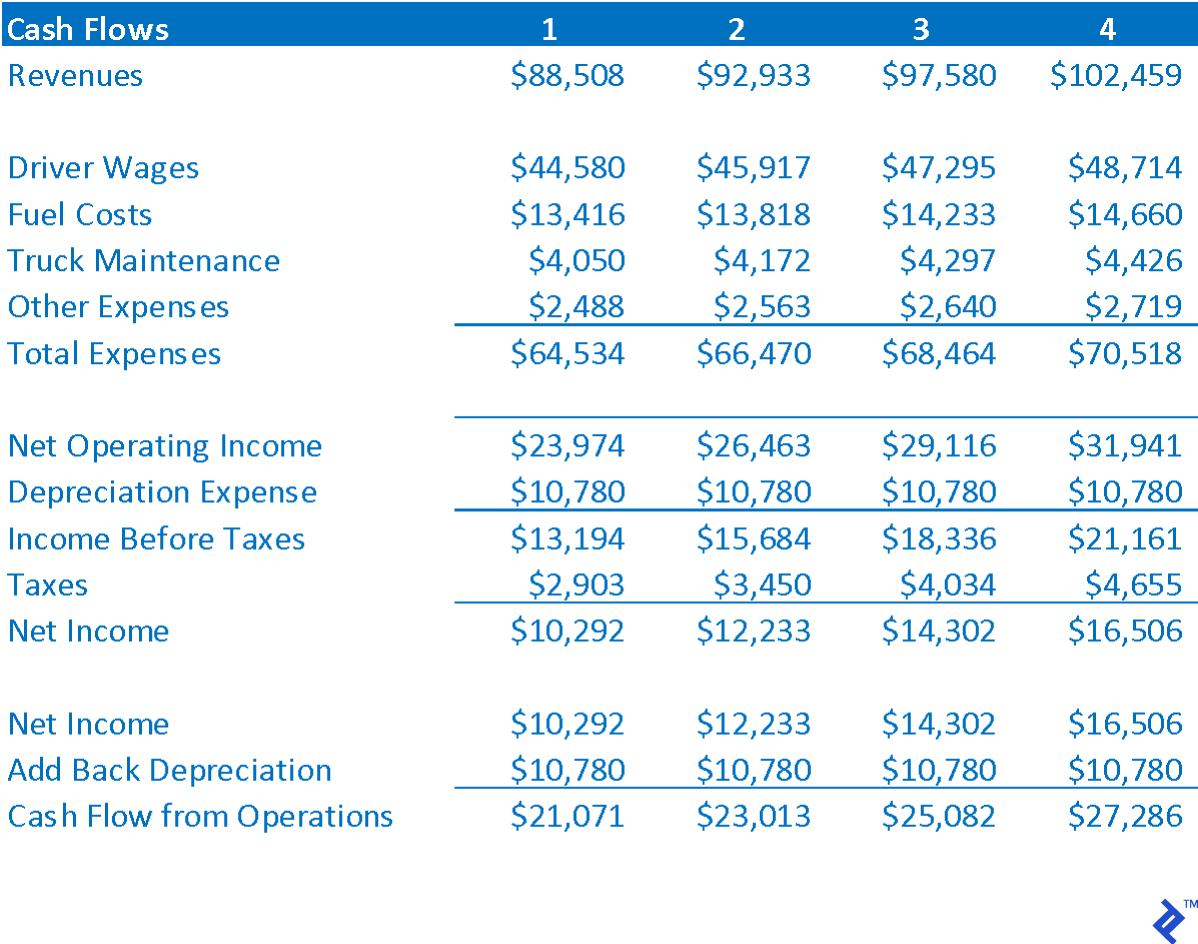

This step consists of determining the net cash flows that the investment will return, NOT the accounting earnings. Typically, investment cash flows will consist of projecting an income statement for the project. For AAA’s new truck, it has projected the following:

Step 3: Determine the residual/terminal value

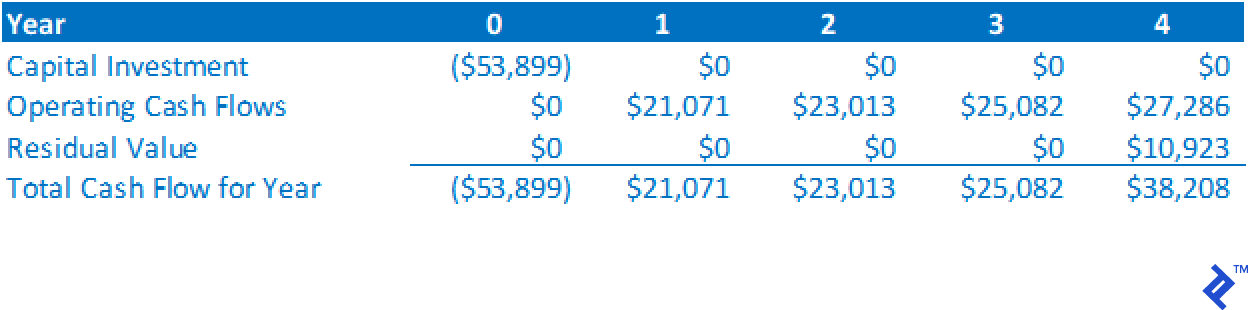

Capital Budgeting requires there to be a finite number of future cash flows. In the case of AAA, it plans to sell the truck in four years time, thus the future cash flows are inherently finite in nature anyway. In such cases, the residual value is equal to the net sales proceeds to be received from disposition of the asset. (If the asset will be scrapped, this value can be 0)

Some investments do not have a projected ending. For example, if the investment is the initiation of a new business unit, it is likely that the business is assumed to continue indefinitely into the future. So in order to truncate the future cash flows and have a finite timeline to evaluate the cash flows and calculate the NPV, it is often assumed that such a venture is sold and the final cash flow is a residual value. This would be in a similar manner to how a financial investor would appraise deals it is investing in

However, another way to allow for continuing operations is to calculate a terminal value . A terminal value assumes that the cash flow in the final year of the projection will continue at that level indefinitely into the future. To calculate the terminal value, the last cash flow is divided by the discount rate. Using AAA cash flows and discount rate, a terminal value would be $27,286 ÷ 14.00% = $194,900. This terminal value is a proxy for all cash flows that will occur beyond the scope of the projection. Again, a terminal value is used only when the true operations of the investment are expected to continue indefinitely into the future.

Step 4: Calculate the annual cash flows of the investment

Calculating the annual cash flows is completed by incorporating the values from Steps 1 to 3 into a timeline. Cash outflows are shown as negative values, and cash inflows are shown as positive values. By aligning cash flows with the periods in which they occur and adding each periods’ cash flows together, the annual cash flow amounts can be determined.

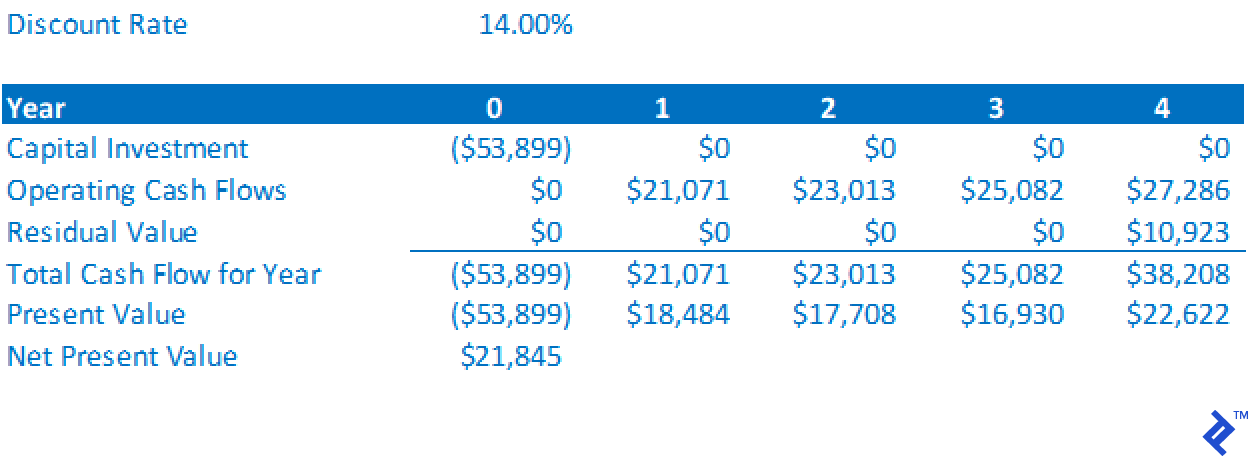

Step 5: Calculate the NPV of the cash flows

The NPV is the sum of the PV of each year’s cash flow. To calculate the PV of each year’s cash flow, the following formula is used:

PV of Cash Flow = Cash Flow ÷ (1 + Discount Rate) Year

Below is the NPV for AAA’s new truck investment.

The NPV is positive, therefore AAA has determined that the project will return value in excess of the investment amount and is worth further investigation. To put it bluntly, it is spending money to make more money, which is a fundamental catalyst for business growth.

Step 6: Run a sensitivity analysis

While a positive NPV on a base case projection is an indication that the project is worth further consideration, it should not be the sole basis for proceeding with an investment. Recall that all of the values in the analysis are based on projections, a process that itself is a complicated art. Therefore if a positive NPV is returned, don’t pop open champagne just yet; instead, start stress testing your work. Various “what if” analyses should be run. For instance, in our capital budgeting example involving AAA:

- What if the actual cost of the truck is greater than $53,899?

- What if the operating cash flows are less than anticipated?

- What if the residual value is overstated?

- What if the WACC is higher than estimated?

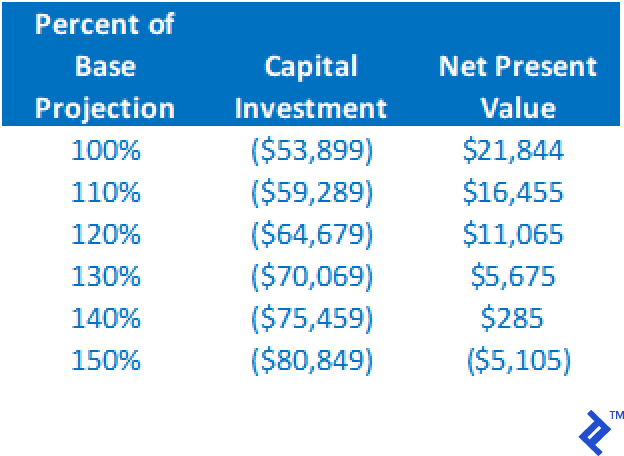

Below is a summary table of the impact to the NPV through altering the capital investment cost and holding all other assumptions the same. Note that an increase to 140% of the baseline estimate still results in a positive NPV.

NPV will reduce as the residual value decreases, but we can see from this analysis that even if the residual value drops to $0, holding all other assumptions constant, the NPV is still positive.

From just these two analyses, we can see the project is quite stable and robust. Even with errors in the base projections of these two variables, the project still warrants further consideration via a positive NPV.

By running various scenarios to determine the impact on NPV, the risk of the project is better defined. If the alternate outcomes continue to provide a positive NPV, the greater the confidence level one will have in making the investment.

NPV vs. IRR

As I have discussed previously , NPV as used in capital budgeting does not provide a return on investment value. NPV is simply describing whether or not the project provides sufficient returns to repay the cost of the capital used in the project. If a project’s return on investment is desired, then internal rate of return (IRR) is the calculation required. Essentially, IRR is the discount rate that will make the NPV equal exactly $0. It is the rate of return that is directly indicated by the project’s cash flows.

Capital Budgeting Applications

A capital budget can be used to analyze almost any type of investment from the purchase of a piece of capital equipment, to investing in expanded operations, to starting a new business, to purchasing existing business operations.

When Acquiring a Portfolio of Assets

When I worked at GE Commercial Finance, I held a role in business development (BD). My focus was on acquiring portfolios of existing commercial real estate and equipment loans from other lenders in our market space. Using the asking price for the portfolio, the cash flows from the loans and the return rate required (as a discount rate), the NPV could be determined. Further, by running sensitivity on the asking price (investment size), we could determine the price range within which the purchase could be justified. The key to this valuation was allowing the BD director to know what the ROI would be on the purchase at alternative prices, and the absolute maximum price that could be paid and still return an acceptable ROI. When I implemented this process, it improved purchase negotiations as the director could negotiate price in real time without the need to pause negotiations to rerun the numbers.

When Projecting Operations for New Ventures

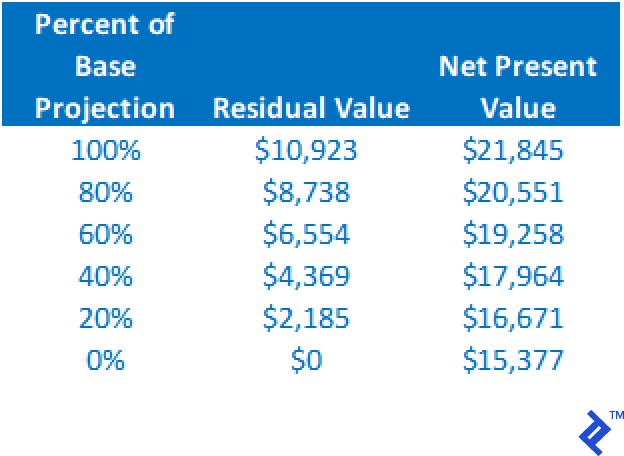

Several consulting clients have asked me to project operational performance for new business ventures. Using capital budgeting techniques, the financial feasibility of the new venture can be determined. One client had developed a proprietary fitness equipment product, the capital budgeting analysis for that company is shown below. As operations were expected to continue beyond the 5-year projection, a terminal value was used in the analysis.

The sensitivity analysis showed that the NPV remained positive, so long as the capital investment was less than $2.6 million, and cash flow could drop to 87% of projected levels (with all other factors held constant).

Successful Capital Budgeting Rules to Follow

The key to capital budgeting is the accuracy of the projected cash flows. The total investment is often easy. However, making sure to account for all sources of cash flow can be all-encompassing. In addition to revenues and expenses, large projects may impact cash flows from changes in working capital, such as accounts receivable, accounts payable and inventory. Calculating a meaningful and accurate residual or terminal value is also important.

In my experience, failed attempts at using capital budgeting came from not using detailed projections of project cash flows. I worked with one company who attempted to evaluate the purchase of another company by using the target’s projected income statement as the sole basis of operating cash flows. It used net income, which is NOT cash flow. Further, it completely ignored the impact to cash flow from changes in working capital. Lastly it did not accurately allow for a residual value. This all seriously understated cash flow, leading to an apparent value (investment amount) less than the seller would accept, and which ultimately was less than the fair market value of the company.

One should also be careful not to overestimate a residual or terminal value. I have seen projections for starting a new venture where the residual value was the anticipated value to be received upon taking the company public. The IPO value was far above a reasonable amount, and without the high residual value the NPV would be negative. Placing too much of the NPV value in the residual can be a mistake.

The greater the amount of an investment, the greater the risk of error. Key to preparing a successful capital budgeting analysis is finding someone with the expertise and experience to calculate accurate and reasonable cash flows. If a business does not have a person like this on hand, it does become more of a passion play and less an exercise in critical business judgement.

Understanding the basics

What do you mean by capital budgeting.

Capital budgeting is the process of determining how to allocate (invest) the finite sources of capital (money) within an organization. There is usually a multitude of potential projects from which to choose, hence the need to budget appropriately

What is the process of capital budgeting?

It involves assessing the potential projects at hand and budgeting their projected cash flows. Once in place, the present value of these cash flows is ascertained and compared between each project. Typically, the project that offers the highest total net present value is selected, or prioritized, for investment.

How do you calculate net present value?

Net present value (NPV) requires the projected cash flows from a project to be calculated and then discounted back to present day using the weighted average cost of capital. When added back to the negative cost of investment, this will provide the overall NPV

What does the IRR tell you?

Internal rate of return (IRR) is the discount rate created by a set of cash flows that will goal seek to an NPV of 0. Hence, it is the isolate return on investment of a project

David Bradshaw

Lake Saint Louis, MO, United States

Member since April 27, 2018

About the author

World-class articles, delivered weekly.

Subscription implies consent to our privacy policy

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal ® community.

Capital Budget: Understanding The Role and Process in Financial Management

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Capital Budget Definition

A “capital budget” refers to the process of planning and managing a company’s long-term investments and expenditures. It includes the budgeting for acquiring and upgrading tangible assets like property, plants, technology, or equipment, with the aim of generating profits in the future.

Importance of Capital Budgeting

Capital budgeting plays a vital role in the strategic operations of a business, affecting various aspects of a corporation’s activities including its overall financial health and competitiveness. Backed by comprehensive data analysis, it enables companies to make informed decisions regarding sizable and often long-term investments.

Aligning Investments With Business Strategy

From a corporate strategy viewpoint, capital budgeting is essential as it aligns the organization's long-term investments with its strategic goals. When a company decides to invest in a project, it is effectively allocating a chunk of its resources toward that endeavor. Through the capital budgeting process, the business can ascertain that the project is in line with the company's larger strategic objectives. It allows the firm to create a roadmap to guide its financial decisions and to ensure its capital is deployed in ways most beneficial for its long-term growth.

Ensuring Financial Health

Capital budgeting is also directly linked to a company's financial health. It offers a framework for evaluating the profitability and financial implications of potential investments. For instance, capital budgeting techniques like Net Present Value (NPV) or Internal Rate of Return (IRR) can help gauge the profitability of a proposed project. This is crucial because such investments often entail significant financial commitments. Failure to generate expected returns can severely impact a company's financial stability. Therefore, proper capital budgeting reduces these risks, helping maintain a robust financial profile for the company.

Enhancing Competitiveness

Last but not least, capital budgeting contributes to the company's competitiveness. In a marketplace where every business tries to gain an edge over its rivals, the ability to effectively manage capital often makes the difference between success and failure. Companies that make wise investment decisions can enjoy superior technologies, more efficient processes, or better products, thus gaining a competitive edge. In other words, effective capital budgeting can lead to a company enhancing its market position. On the contrary, poor capital budgeting decisions may result in significant losses, eventually affecting the company's competitive position.

Hence, the role and significance of capital budgeting to a company cannot be overstated. Not only does it align the organization's investments with business strategy but also ensures its financial health and enhances its competitiveness.

Steps involved in Capital Budgeting

In a typical capital budgeting process, several distinct but interconnected steps are undertaken. These include identifying project proposals, conducting risk assessment, forecasting cash flow, and finally, making project selections.

Project Proposals

Project proposals form the very bedrock of capital budgeting. The first step requires identifying potential investment opportunities or projects. These could range from proposals for expanding existing operations to the introduction of new products or services. Additionally, in a rapidly changing business environment, proposals for adopting cutting-edge technology to stay competitive could also make a spot.

Risk Assessment

Once a list of project proposals is ready, each proposal is subjected to rigorous risk assessment. This is crucial as any investment involves a certain degree of risk. Companies look to gauge the potential risks associated with pursuing a project. This could include understanding operational risks, competition risks, market volatility, and potentially, regulatory changes. Tools and techniques such as sensitivity analysis, simulation models, and scenario testing are commonly used for this.

Cash Flow Forecasting

Then, the potential cash flows for each project are forecasted. Cash flow forecasting is a critical step in the capital budgeting process as it involves quantifying the return a project is expected to generate over its lifetime. Cash inflows and outflows are estimated and then discounted to calculate the net present value (NPV), which plays a significant role in determining the viability of a project. Other methods can also be used, such as the Internal Rate of Return (IRR) or the payback period.

Project Selection

Finally, based on the findings from risk assessment and cash flow forecasting, a decision is made about which projects to proceed with. Projects are ranked based on factors like NPV, risk levels, and strategic importance. Decision makers consider these factors and select the optimal mix of projects that maximizes return while staying within the firm's risk tolerance levels. This final step complements the company's overall strategic planning to drive growth and profitability.

Methods Used in Capital Budgeting

Capital budgeting decisions revolve around making the best choices to achieve maximum returns from investments. Hence, understanding various techniques becomes pivotal. Four of the most practical and used techniques are Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index.

Net Present Value (NPV)

Simply put, NPV calculates the present value of future cash flows associated with an investment, given an assumed discount rate. The discounted cash flows are then reduced from the initial investment to get the NPV. NPV focuses on future earnings, taking into account inflation and risk factors, making it one of the most preferred methods in capital budgeting. A positive NPV implies that the investment surpasses the cost of capital and is considered a good investment.

Internal Rate of Return (IRR)

IRR is a discount rate that makes the NPV of an investment zero. It outlines the expected growth a project is supposed to provide. If the IRR exceeds the required return rate, the project can be pursued. High IRR is indicative of high returns and vice versa. IRR serves as a benchmark for companies to compare the profitability of various projects.

Payback Period

The payback period approach calculates the time within which the initial investment would be recovered. A shorter payback period is generally preferable as it means quicker recovery. The main disadvantage is that it does not consider the time value of money, and hence, could offer a misleading picture when it comes to long-term projections.

Profitability Index

Lastly, the profitability index, also known as the benefit-cost ratio, is the ratio of payoff to investment. It is calculated by dividing the present value of future cash flows by the initial investment cost. If the profitability index is greater than 1, the project is considered profitable. However, much like the payback period, it overlooks the total benefit of a project.

Each of these techniques has its own merits and demerits. Deciding which method to use depends on the nature of the project, the strategic goals of the company, and the preferences of the decision-makers.

Risk Analysis in Capital Budgeting

In assessing and managing risk and uncertainty in capital budgeting, two major analysis systems are utilized: sensitivity analysis and scenario analysis.

Sensitivity Analysis

Sensitivity analysis, in essence, is a technique used to predict the outcome of a decision given a set of variables. During capital budgeting, this analysis is used to understand how the variability in the output of a model (or system) can be apportioned, qualitatively or quantitatively, to different sources of variation.

In the context of capital budgeting, sensitivity analysis allows for an assessment of risk through a 'what if’ analysis of each potential capital project's parameters such as sales, costs, and lifespan, among others. By altering one variable at a time while keeping others constant, the impact on the project's net present value (NPV) or internal rate of return (IRR) can be determined, thereby identifying the most "sensitive" variables.

Scenario Analysis

In contrast, scenario analysis examines the impact of a change in a set of variables on a capital budgeting decision. It takes a more holistic view and alters several variables at once to create different scenarios which represent different conditions such as best-case scenario, worst-case scenario, and the most likely scenario under normal conditions.

For instance, a worst-case scenario would be developed by assuming low revenue growth, high cost inflation, and a short project lifespan. These scenarios are then used to observe the influence on the project’s profitability measures such as net present value, payback period or profitability index.

Both sensitivity and scenario analyses play key roles in aiding decision-makers effectively understand and manage the levels of risk and uncertainty in capital budgeting decisions. By meticulously evaluating these analyses, businesses can safeguard their capital investments against adverse outcomes, and align their strategies with their risk-bearing capacity.

Role of Discount Rate in Capital Budgeting

Capital budgeting decisions hinge heavily on the discount rate that is used to measure the present value of cash flows. Think of the discount rate as an interest rate: if you're looking forward for five years, for instance, you're not just counting the cash you're expecting but also taking into account the interest you could earn during that period.

The Net Present Value (NPV) — one of the most popular metrics in capital budgeting — uses the discount rate in its calculations. NPV helps determine the potential profitability of an investment by comparing the present value of cash inflows with the present value of cash outflows.

How Discount Rate Influences NPV

NPV is calculated using the formula:

NPV = Σ {Net inflow during the period t / (1 + r)^t)} - Initial Investment ,

where t is the time of the cash flow, r is the discount rate (required rate of return), Σ is the sum of all cash flows of the project.

A higher discount rate results in a lower NPV, and vice versa, holding all else constant. This relationship is vital: it means that the value of a potential investment is highly sensitive to the discount rate.

Choosing the Right Discount Rate

Choosing an appropriate discount rate is critical because it radically impacts the net present value calculation, and therefore, the investment decision.

The discount rate often used is the firm's weighted average cost of capital (WACC). This rate reflects the average rate of return the company must pay to finance its assets. Using the WACC as the discount rate is suitable when the proposed project has a similar risk profile to the company's current operations.

However, if the risk profile of the proposed project differs from the company's average risk profile, it might be better to use a different discount rate.

In conclusion, assessing the correct discount rate to use in capital budgeting is critical as it significantly impacts the decision-making process. A miscalculation or misjudgment can lead to either missed investment opportunities or potential financial losses. Keeping this in mind, investors and financial managers must thoroughly understand the role of the discount rate in capital budgeting.

Capital Budgeting Decision-Making

When a corporation is presented with potential projects or investments, it has to employ capital budgeting analysis techniques to determine whether the investments are viable or not. Capital allocation decisions are crucial since they have long-term effects on a firm’s fundamental operations and financial stability.

Decision Criteria

The decision criteria for capital budgeting encompass net present value (NPV), internal rate of return (IRR), payback period, profitability index (PI), and discounted payback period.

- Net Present Value (NPV): This technique involves calculating the present value of cash inflows and then subtracting the present value of cash outflows. Typically, a project is considered viable if it yields a positive NPV.

- Internal Rate of Return (IRR): IRR is the discount rate that makes the NPV of all cash flows equal to zero. The project is accepted if its IRR is greater than the required rate of return.

- Payback Period: This is the time taken to recover the initial investment. A project with a shorter payback is often preferred.

- Profitability Index (PI): This measures the ratio of payoff to investment of a proposed project. A PI greater than 1 is preferable.

- Discounted Payback Period: Unlike payback period, it takes the time value of money into account and calculates the time required to recover investment in dollar terms.

Trade-offs in Project Selection

Capital budgeting often involves trade-offs when choosing the most profitable project among potentially viable alternatives. Executives must consider elements like potential returns, the associated risk, the time required for return realization, and the project’s impact on the company's strategic positioning. Also, limited resources often compel a company to choose between numerous feasible projects, making trade-offs inevitable.

Dealing with Conflicting Results from Different Methods

It is usual to get inconsistent outcomes when employing different capital budgeting techniques. For example, a project with a high NPV might not necessarily have a short payback period. Similarly, a project with positive NPV can have an IRR less than the cost of capital.

In such circumstances, companies must decide which assessment tool is the most fitting for their situation. Generally, it is advisable to go with NPV as it directly relates to the shareholder's wealth. However, the final decision lands on various factors like management bias, organizational capability, and project risk.

The capital budgeting decision-making process is a crucial tool for organizations. The trade-offs, decision criteria, and the conflicting outcomes make it a complex process, yet its significance in wealth creation and the firm's profitability is undeniable.

These techniques, however, serve as guides— they don't guarantee the success of a project. Other factors such as the economic environment, political stability, and unforeseen fluctuations in industry trends could affect a project's outcomes. Therefore, financial managers must not only rely on these tools but also consider external contingencies and scenarios.

Capital Budgeting and Corporate Social Responsibility

The role of capital budgeting in corporate social responsibility (CSR) has increasingly become vital in contemporary business concepts. This relationship is defined by the keen focus on how organizations incorporate social and environmental factors while deciding on investment proposals.

Considering Social and Environmental Impacts

In the modern economy, organizations aren't solely guided by profit-making principles. The adoption of CSR means that firms are also responsible for the society and environment they operate in. Therefore, when engaging in capital budgeting, it is crucial to factor the potential environmental and social impact of prospective investments.

For example, when considering an investment proposal for a manufacturing plant expansion, an organization needs to look beyond the projected profits and assess the effects of such an expansion on the local community and environment.

This might mean considering potential pollution levels the expansion might produce and how this could impact the communities living nearby. Conversely, it could also mean assessing the positive impact the expansion may have on local employment levels. By incorporating such aspects into their capital budgeting process, organizations can actively pursue their CSR goals.

Profit and CSR Balance

Although it is essential for an organization to consider the environmental and social impacts in their capital budgeting process, striking a balance between CSR and profitability can often be a complex task. Not all projects with high CSR value can deliver promising financial returns.

To strike a balance, organizations must identify and prioritize projects that maximally align with their CSR objectives while maintaining a reasonable profit margin. The practice ensures a win-win situation, where both the firm and the society it operates in reap the benefits.

In conclusion, capital budgeting plays an integral role in supporting CSR initiatives. It allows organizations to plan and implement their projects while considering their social and environmental roles. Moving forward, firms are expected to continue integrating CSR into their capital budgeting process, judging investment propositions not just through a financial lens but also through social and environmental perspectives.

Capital Budgeting in Practice

Share this article with a friend:, about the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

Capital Budgeting: What Is It and Best Practices

“Capital” is a popular term in the world of finance. The word on its own usually refers to a company’s available funds, such as its retained earnings or available credit or owner’s capital. When a company spends or invests its capital on a long-term asset, like a piece of machinery, it’s called “capital spending,” and the machinery is a “capital asset.” Further, the process of evaluating how best to invest a company’s capital, by making “capital expenditures,” is called “capital budgeting.” All of these “capital” terms share two common dogmas: that capital is finite and capital expenditures should be prioritized to get the most bang for the buck. The world of finance provides frameworks and tools to help business leaders objectively determine which capital projects to pursue or prioritize. This article explores different methods of capital budgeting, best practices and steps in the process — because capital spending is too important to rely on gut instinct.

What Is Capital Budgeting?

Capital budgeting is the process of analyzing, evaluating and prioritizing investment in large-scale projects that typically require significant amounts of funds, such as the purchase of a new facility, fixed assets or real estate. Capital budgeting provides an objective means of determining the best way to use capital to increase the value of a business and is useful to companies of all sizes and industries. Consider these scenarios that call for capital budgeting:

- Should a large automobile manufacturer build a new factory to make electric vehicles or buy a company that already specializes in building them?

- Should a midsize retailer invest in automated inventory control software?

- Should a small restaurant owner buy a second pizza oven?

These examples challenge decision-makers to determine whether their spending will bring enough future benefits to their businesses. Business managers often have to weigh multiple projects that are competing for the same investment funds, which means the decision needs to be based on some kind of ranking rather than a simple yes or no. Capital budgeting is a structured way to approach these questions by incorporating the expected cash outlays and inflows, and to help manage the financial risks involved in these capital-intensive and strategically important projects.

Key Takeaways

- Capital budgeting is the process of determining whether a large-scale project is worth the investment and will increase a company’s value.

- Using a formal process for capital budgeting increases the likelihood of better outcomes.

- Some capital budgeting methods are somewhat subjective, while others are based on financial formulas.

- High-quality data increases the usefulness of capital budgeting.

Capital Budgeting Explained

Capital budgeting is a type of financial management that focuses on the cash flow implications of making an investment, rather than resulting profits (to avoid complicating calculations with accounting conventions, such as depreciation). It involves estimating the amount and timing of cash outflow — money that leaves the business to pay for a purchase or investment, such as new equipment — and cash inflow, or new sources of cash that come into the company, such as increased sales revenue made possible by the increased output from the new equipment. In some cases, a reduction in cash outflows can be considered a cash inflow for capital budgeting purposes — for example, when a new piece of equipment reduces the cost to produce a product. Different capital projects can be evaluated by comparing their amounts of cash outflow and cash inflow.

Two important concepts that underlie many capital budgeting methods are opportunity cost and the time value of money. Both apply due to the long-term nature of most capital projects.

Opportunity cost can be described as the value of the road not taken. Assuming that capital funds are not infinite, the opportunity cost represents benefits that are forgone by choosing one investment over the next best one. A simple example is choosing to keep cash sitting in a cookie jar, rather than in an interest-bearing bank account. The forgone interest income that could be earned is the opportunity cost of keeping cash in the cookie jar. Opportunity cost is especially relevant in capital budgeting when evaluating one project against another and is used to determine a “hurdle,” or minimum target return, that a capital project must meet.

The time value of money is a financial concept that considers the potential rate of return on an investment and the reduction in purchasing power over time caused by inflation. Its essential precept is that a dollar today is more valuable than that dollar will be at some point in the future. In other words, the farther into the future, the less valuable the dollar. Time value of money is based on the idea that if a person had a dollar today, they could invest and grow it based on some investment rate, so they’d have more than a dollar at the end of the investment term. If instead they opted to get that dollar in the future, they’d forgo that investment growth. Capital budgeting also includes a focus on the timing of the cash flows to reflect the time value of money.

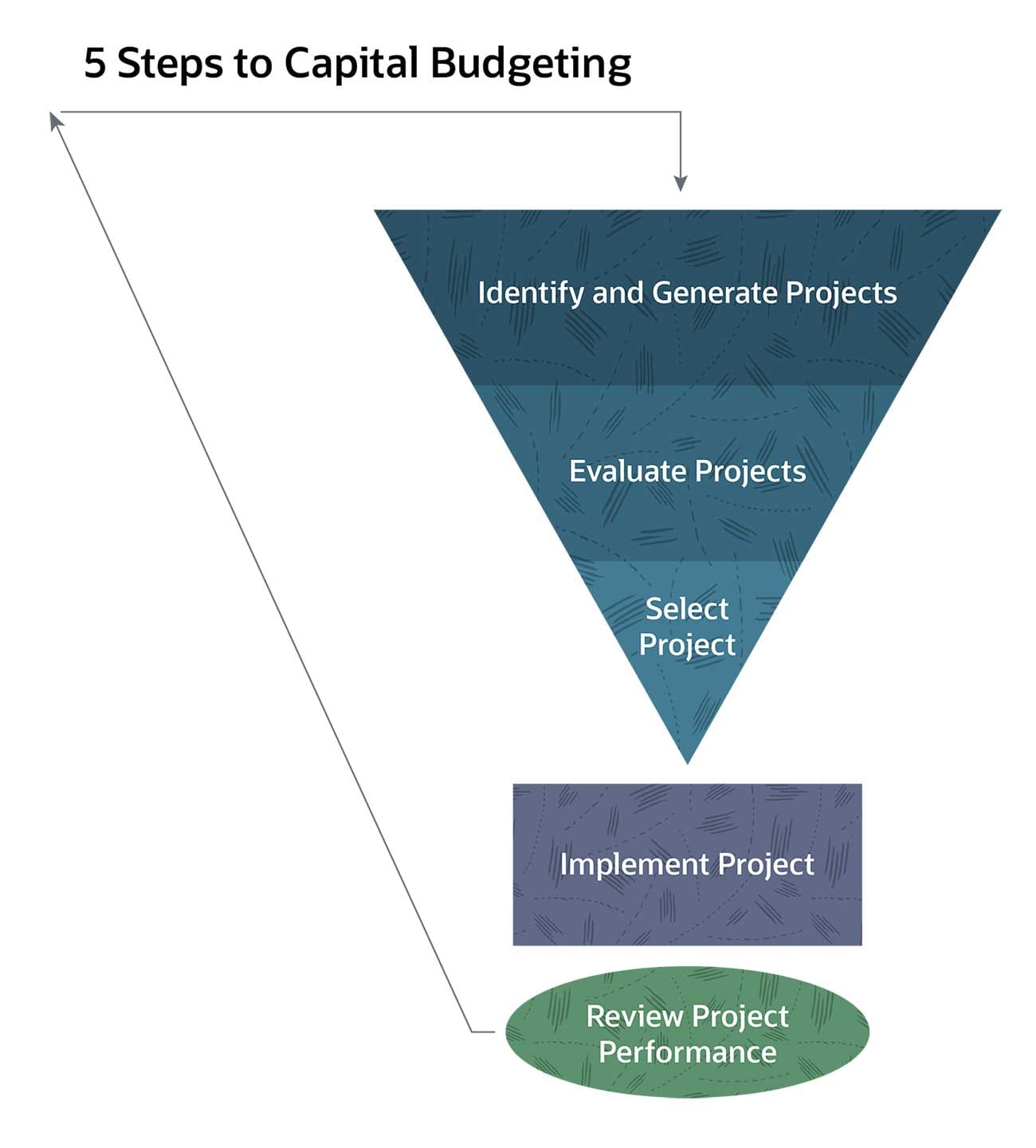

Capital Budgeting Steps

How a company manages the capital budgeting process depends on its organizational structure. Some large organizations have a capital budgeting committee who oversees all capital projects. In small and midsize businesses, capital budgeting decisions are made by the owner or a small group of executives, often supported by analysis from their accountants. In all cases, it’s important to keep the company’s strategic goals in mind before jumping into the first of five steps that govern the process.

- Identifying and generating projects. Gather ideas and proposals, which can come from anywhere in the organization. It’s helpful to have a procedure for submission, which may include using templates, but always require cash flow, cost and benefit estimates. It’s common for a growing business to have many proposals competing for available funds.

- Evaluating the projects. This step focuses on establishing the feasibility of the various proposals, beginning with screening to ensure that they contain all the right information and that the sponsor has done their due diligence. It’s common to require proposals to be vetted and reviewed by different areas of the company, obtaining endorsements from accounting, sales or operations managers prior to submission. Another part of project evaluation involves establishing the criteria to be used to assess the proposals, such as tolerable risk, hurdle rates and spending thresholds. Criteria are at management’s discretion, with the goal of increasing the company’s value.

- Selecting a project. Proposals are analyzed, and then those that meet the evaluation criteria and are considered a good business move are given the green light. The timing and priority of competing projects often play a part in selection, especially in situations where proposals exceed the company’s available funding or bandwidth for execution.

- Implementing a project. Once a proposal is approved, an implementation plan is developed. This plan describes key factors for accomplishing the project, such as how it will be funded and methods of tracking cash flows. It also sets a project timeline, including various milestones and a target end date. Additionally, the implementation plan identifies key personnel involved in the project, authority levels and a process for escalation of exceptions, such as delays or budget overages.

- Review project performance. The final step in the capital budgeting process is to review the actual results of the project compared with the approved proposal. It’s a good idea to do this at predetermined implementation milestones as well as at the end of the project. Learning from one project can help inform future capital projects.

Ranking Projects With Capital Budgeting

Keeping in mind the goal of maximizing business value, it’s important to invest a business’s capital wisely. This requires business leaders to prioritize capital projects because it’s unlikely that any organization can, or should, undertake every proposal. Ranking projects is one way to objectively prioritize which projects to approve, defer or reject. Ranking narrows down viable alternatives and is part of step 3 in the five-step capital budgeting process described in the previous section. There are several methods a business can use to value capital projects and develop a ranking, as outlined in the next section.

Capital Budgeting Methods

Businesses can choose to use one or more types of capital budgeting methods, described below, to help value and evaluate capital projects. The methods serve to eliminate projects that fall short of a company’s minimum performance thresholds. They are also helpful in comparing competing projects and developing rankings.

Payback Period

This method focuses on how quickly a company recoups its capital investment. It compares the initial cash outflow to the subsequent cash inflows to determine the point in time when the project has “paid for itself.” The payback period approach does not place a value on a project; instead, it concludes that a project might take a specific amount of time to pay back the initial investment. Shorter payback periods are preferable to longer ones. This method’s advantage is its simplicity, but there are two main drawbacks: One, payback period isn’t a complete model because the calculations cut off once the project is paid back and, two, it ignores project profitability and terminal values, such as salvage prices for equipment at the end of the project life.

Discounted Payback Period

This method is an improved version of the payback period method because it also reflects the time value of money, which always decreases as the years pass. To account for this, cash flows in future periods are “discounted” so as to revalue them in present value terms. As a result, the discounted cash flows are less than the non-discounted cash flows, which causes the discounted payback period to be longer than the non-discounted payback period. This difference between the discounted method and non-discounted period increases when the payback period is longer or the discount rate is higher. The discount rate can be a company’s cost of capital or its required internal rate of return. The advantage of this method is that it more accurately calculates the payback period reflecting the time value of money. However, the discounted payback period maintains the disadvantages of ignoring periods beyond payback and terminal values.

Net Present Value Analysis

The net present value (NPV) of a project represents the excess of cash inflows beyond cash outflows. It adjusts both incoming and outgoing streams for the time value of money, using a discount rate. The end result of NPV is a monetary value that can be positive or negative, with a positive value adding to a firm’s value and a negative value reducing it. Clearly, projects with a larger, positive NPV are preferred over those with smaller or negative NPVs, assuming the projects have similar levels of risk. NPV is applied to the entire life of a project, including any terminal values. NPV is a common standard for capital budgeting because it reflects value from the entire project and adjusts for the time value of money. Challenges of using NPV include the complexity of the calculation and the reliance on selecting the appropriate discount rate. NPV calculations change significantly depending on whether the discount rate is based on a company’s cost of capital (its all-in borrowing rate), its internal cost of capital (akin to an opportunity cost), a specific rate of return expected by external investors or an internally generated threshold rate of return.

Profitability Index

The profitability index is a technique that calculates the cash return per dollar invested in a capital project. This index is calculated by dividing the NPV of all the cash inflows by the NPV of all the outflows. Projects with an index less than 1 are typically rejected, since, by definition, the sum of the project cash inflows is less than the project’s initial investment when the time value of money is factored in. Conversely, projects with an index greater than 1 are ranked and prioritized. The profitability index is helpful to determine which capital projects make sense to greenlight, especially when analyzing several projects drawing on a fixed amount of investment capital. However, the profitability index is less useful for projects with a high amount of sunk costs — money already spent and irretrievable — and for comparing projects with different life terms.

Equivalent Annuity Method

The equivalent annuity method is a way to evaluate the NPV of capital projects that are mutually exclusive and have different project lengths. It does this by creating an annual average to smooth out the individual discounted cash flows. The first step in this method is to calculate the NPVs of each cash flow over the life of the projects. Projects with positive, higher equivalent annual annuity are preferred. The equivalent annuity method is especially helpful when evaluating different proposed capital projects with varying life terms. However, a disadvantage is that the underlying calculations to derive the average assume that projects can be repeated into perpetuity, which is unlikely to be the case.

Internal Rate of Return

The internal rate of return (IRR) method looks to find the discount rate that causes a project’s NPV to be zero. That’s a mouthful. More simply, this method generates a yield percentage on a project, rather than a dollar value. The percentage is the embedded rate that causes the total of all the discounted cash inflows and outflows to be even. Capital projects that have a higher IRR are typically selected first, all else being equal. Additionally, a company might compare the IRR to its cost of capital or to an internal threshold in order to determine whether to undertake a capital project. IRR is a helpful way to compare projects against each other and against a required hurdle rate. However, a primary disadvantage of IRR is that it doesn’t reflect a project’s size or impact on a business’s overall value.

Modified Internal Rate of Return (MIRR)

This method is an extension of the IRR. It also calculates a yield percentage on a project when the NPV is zero, but in a more complex and accurate way. The MIRR uses different rates for discounting cash inflows than for cash outflows when calculating the NPV. Cash inflows are discounted using a company’s reinvestment rate, and the cash outflows, like the initial capital investment, are calculated using the company’s financing rate. Using a reinvestment rate for cash inflows tends to be more realistic than using a single rate for both financing and reinvestment, as in NPV and IRR. It also gives a better comparison for projects of different sizes. However, the use of multiple discount rates also makes calculating the MIRR more difficult.

Constraint Analysis

Constraint analysis is a criterion used in capital budgeting to help select capital projects based on operational or market limitations. Unlike the quantitative methods previously described, this approach looks at company processes, such as product manufacturing, and determines which stages of the process make the most sense for investment. A key concept in constraint analysis is identifying bottlenecks — pinch points in the process that would make downstream investments of no use. For example, if a dine-in only restaurant had a finite number of tables, it might not make sense to invest in more kitchen equipment, since sales are constrained by the number of diners. A constraint analysis might indicate that priority be given to an investment in expanding the dining area instead. The advantage of this approach is that it helps a business avoid undertaking projects that may not increase profitability. However, identifying constraints can be challenging and somewhat subjective.

Cost Avoidance Analysis

Cost avoidance analysis draws on the concept of opportunity cost to approach capital-budgeting decisions. Using this method, a business evaluates capital projects using an estimate of costs that can be eliminated in the future by undertaking the project. For example, investing in automated accounting software could negate a company’s need to hire additional bookkeepers in the future. Capital projects that avoid more costs than others are prioritized first. Quantifying capital projects using cost-avoidance analysis is challenging since it is a theoretical exercise — if the correct capital decision is made, the costs never materialize and never hit a financial statement.

Real Options Analysis

Many times, business leaders must make capital budgeting decisions with imperfect information due to uncertainties about future conditions, especially since capital projects tend to be long-term in nature. Consider the cyclical disruptions in technology that present challenges or opportunities for capital projects in that industry. The real options analysis attempts to determine a value for a capital project’s flexibility. It does this as an extension of NPV, using probability estimates and assuming changes in the discounted cash flows for project adjustments, such as asset choice, investment timing, growth options and abandonment. Consider a manufacturing capital project that is altered halfway through the project life because different, cheaper raw materials became available. The real options method is helpful because it reflects dynamic changes a project might offer over its life, beyond a simple, static “go/no-go” approach. However, it can become extraordinarily complex depending on the number of uncertainties considered.

Which Method Should Your Business Use?

The capital budgeting methods discussed above all have advantages and disadvantages. Some are computational while others are more qualitative and process-oriented. Determining which approach to use is really a matter of the specific situation, the sophistication of the person or team evaluating a project and the company’s objective. In addition, the size of the capital spending relative to the available funds might make more sophisticated analysis appropriate. In other cases, simpler methods can be beneficial when time is of the essence. In practice, a company might use several of the techniques.

Capital Budgeting Best Practices

Capital spending deals with big-ticket items and projects with long lives, so it’s important to fine-tune the capital budgeting process as much as possible. Some best practices to consider include:

- Focus on cash flows. Use cash flows, rather than net income , for modeling capital projects. Incorporate cash flows from all sources, including changes in working capital , such as increases and reductions in accounts receivable and accounts payable.

- Be conservative with estimates. This means tempering enthusiasm for the benefits of a project when estimating potential cash inflows and taking more of a worst-case viewpoint when estimating cash outflows.

- Project timing carefully. The time value of money is an important concept for capital budgeting, so it follows that projecting the timing of cash flow as precisely as possible is a priority.

- Ignore certain costs. Exclude certain costs, such as tax, amortization , depreciation and financing costs, to keep capital budgeting calculations purely focused on the impact of the capital project.

- Establish a procedural framework. Set up clear accountability and responsibility for capital projects. This includes procedures to track costs, schedules and quality in a controlled environment.

- Incorporate review. Knowledge gained from past proposals and capital budgeting cycles can improve future projects. It’s helpful to conduct a formal review and document findings at various stages of a project as well as at its end.

Capital Budgeting Limitations

While capital budgeting is a necessary process to help a company estimate and evaluate its options for capital spending, it is inherently limited by the compound effect of estimates. Predicting any one of these variables is a challenge; when they are put together, the effect can lead to misleading information and suboptimal decision-making. Capital budget shortcomings can occur due to:

- Incorrect cash flow estimates. Over- or underestimating the cash flow into or out of the company can cause capital projects to be incorrectly accepted or rejected.

- Inaccurate timing estimates. The timing of cash flow is almost as important as the amount of the cash flow. The longer a project’s term, the more difficult these estimates can be, which can have a significant impact on NPV calculations.

- Determining the right rates. Choosing the right discount rates for capital budgeting is not always as easy as it sounds. It may take a bit of calculating to determine a company’s true cost of capital and financing rate. Even setting a hurdle rate — the least acceptable rate of return on an investment — may not be so simple. Using an incorrect discount rate can upend many of the common capital budget methods.

NetSuite Has All Your Budgeting and Financial Planning Needs in One Place

The capital budgeting process helps business leaders make better informed decisions about how to invest their company’s capital. The quality of the data used in the process is important to ensure the best analyses are made. NetSuite Planning and Budgeting can help. The automated, collaborative tool offers complex modeling features that can help elevate the most investment-worthy capital budgeting proposals at the front end of the process. In addition, the software can help track actual project cash inflows and outflows against the estimates as the project is implemented. It also reduces budgeting cycling time and improves the accuracy of forecasts.