How To Write A Business Plan (2024 Guide)

Updated: Aug 20, 2022, 2:21am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

On LegalZoom's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

How To Sell Clothes Online In 2024

2024 SEO Checklist

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is staff writer at Forbes Advisor, specializing in testing and reviewing marketing software with a focus on CRM solutions, payment processing solutions, and web design software. Before joining the team, she was a content producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and holds an MSc in international marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine and the founder of ProsperBull, a financial literacy program taught in U.S. high schools.

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

How to Write a Nonprofit Business Plan in 12 Steps (+ Free Template!)

The first step in starting a nonprofit is figuring out how to bring your vision into reality. If there’s any tool that can really help you hit the ground running, it’s a nonprofit business plan!

With a plan in place, you not only have a clear direction for growth, but you can also access valuable funding opportunities.

Here, we’ll explore:

- Why a business plan is so important

- The components of a business plan

- How to write a business plan for a nonprofit specifically

We also have a few great examples, as well as a free nonprofit business plan template.

Let’s get planning!

What Is a Nonprofit Business Plan?

A nonprofit business plan is the roadmap to your organization’s future. It lays out where your nonprofit currently stands in terms of organizational structure, finances and programs. Most importantly, it highlights your goals and how you aim to achieve them!

These goals should be reachable within the next 3-5 years—and flexible! Your nonprofit business plan is a living document, and should be regularly updated as priorities shift. The point of your plan is to remind you and your supporters what your organization is all about.

This document can be as short as one page if you’re just starting out, or much longer as your organization grows. As long as you have all the core elements of a business plan (which we’ll get into below!), you’re golden.

Why Your Nonprofit Needs a Business Plan

While some people might argue that a nonprofit business plan isn’t strictly necessary, it’s well worth your time to make!

Here are 5 benefits of writing a business plan:

Secure funding and grants

Did you know that businesses with a plan are far more likely to get funding than those that don’t have a plan? It’s true!

When donors, investors, foundations, granting bodies and volunteers see you have a clear plan, they’re more likely to trust you with their time and money. Plus, as you achieve the goals laid out in your plan, that trust will only grow.

Solidify your mission

In order to sell your mission, you have to know what it is. That might sound simple, but when you have big dreams and ideas, it’s easy to get lost in all of the possibilities!

Writing your business plan pushes you to express your mission in the most straightforward way possible. As the years go on and new opportunities and ideas arise, your business plan will guide you back to your original mission.

From there, you can figure out if you’ve lost the plot—or if it’s time to change the mission itself!

Set goals and milestones

The first step in achieving your goals is knowing exactly what they are. By highlighting your goals for the next 3-5 years—and naming their key milestones!—you can consistently check if you’re on track.

Nonprofit work is tough, and there will be points along the way where you wonder if you’re actually making a difference. With a nonprofit business plan in place, you can actually see how much you’ve achieved over the years.

Attract a board and volunteers

Getting volunteers and filling nonprofit board positions is essential to building out your organization’s team. Like we said before, a business plan builds trust and shows that your organization is legitimate. In fact, some boards of directors actually require a business plan in order for an organization to run!

An unfortunate truth is that many volunteers get taken advantage of . With a business plan in place, you can show that you’re coming from a place of professionalism.

Research and find opportunities

Writing a business plan requires some research!

Along the way, you’ll likely dig into information like:

- Who your ideal donor might be

- Where to find potential partners

- What your competitors are up to

- Which mentorships or grants are available for your organization

- What is the best business model for a nonprofit like yours

With this information in place, not only will you have a better nonprofit business model created—you’ll also have a more stable organization!

Free Nonprofit Business Plan Template

If you’re feeling uncertain about building a business plan from scratch, we’ve got you covered!

Here is a quick and simple free nonprofit business plan template.

Basic Format and Parts of a Business Plan

Now that you know what a business plan can do for your organization, let’s talk about what it actually contains!

Here are some key elements of a business plan:

First of all, you want to make sure your business plan follows best practices for formatting. After all, it’ll be available to your team, donors, board of directors, funding bodies and more!

Your nonprofit business plan should:

- Be consistent formatted

- Have standard margins

- Use a good sized font

- Keep the document to-the-point

- Include a page break after each section

- Be proofread

Curious about what each section of the document should look like?

Here are the essential parts of a business plan:

- Executive Summary: This is your nonprofit’s story—it’ll include your goals, as well as your mission, vision and values.

- Products, programs and services: This is where you show exactly what it is you’re doing. Highlight the programs and services you offer, and how they will benefit your community.

- Operations: This section describes your team, partnerships and all activities and requirements your day-to-day operations will include.

- Marketing : Your marketing plan will cover your market, market analyses and specific plans for how you will carry out your business plan with the public.

- Finances: This section covers an overview of your financial operations. It will include documents like your financial projections, fundraising plan , grants and more

- Appendix: Any additional useful information will be attached here.

We’ll get into these sections in more detail below!

How to Write a Nonprofit Business Plan in 12 Steps

Feeling ready to put your plan into action? Here’s how to write a business plan for a nonprofit in 12 simple steps!

1. Research the market

Take a look at what’s going on in your corner of the nonprofit sector. After all, you’re not the first organization to write a business plan!

- How your competitors’ business plans are structured

- What your beneficiaries are asking for

- Potential partners you’d like to reach

- Your target donors

- What information granting bodies and loan providers require

All of this information will show you what parts of your business plan should be given extra care. Sending out donor surveys, contacting financial institutions and connecting with your beneficiaries are a few tips to get your research going.

If you’re just getting started out, this can help guide you in naming your nonprofit something relevant, eye-catching and unique!

2. Write to your audience

Your business plan will be available for a whole bunch of people, including:

- Granting bodies

- Loan providers

- Prospective and current board members

Each of these audiences will be coming from different backgrounds, and looking at your business plan for different reasons. If you keep your nonprofit business plan accessible (minimal acronyms and industry jargon), you’ll be more likely to reach everyone.

If you’d like, it’s always possible to create a one page business plan AND a more detailed one. Then, you can provide the one that feels most useful to each audience!

3. Write your mission statement

Your mission statement defines how your organization aims to make a difference in the world. In one sentence, lay out why your nonprofit exists.

Here are a few examples of nonprofit mission statements:

- Watts of Love is a global solar lighting nonprofit bringing people the power to raise themselves out of the darkness of poverty.

- CoachArt creates a transformative arts and athletics community for families impacted by childhood chronic illness.

- The Trevor Project fights to end suicide among lesbian, gay, bisexual, transgender, queer, and questioning young people.

In a single sentence, each of these nonprofits defines exactly what it is their organization is doing, and who their work reaches. Offering this information at a glance is how you immediately hook your readers!

4. Describe your nonprofit

Now that your mission is laid out, show a little bit more about who you are and how you aim to carry out your mission. Expanding your mission statement to include your vision and values is a great way to kick this off!

Use this section to highlight:

- Your ideal vision for your community

- The guiding philosophy and values of your organization

- The purpose you were established to achieve

Don’t worry too much about the specifics here—we’ll get into those below! This description is simply meant to demonstrate the heart of your organization.

5. Outline management and organization

When you put together your business plan, you’ll want to describe the structure of your organization in the Operations section.

This will include information like:

- Team members (staff, board of directors , etc.)

- The specific type of nonprofit you’re running

If you’re already established, make a section for how you got started! This includes your origin story, your growth and the impressive nonprofit talent you’ve brought on over the years.

6. Describe programs, products and services

This information will have its own section in your nonprofit business plan—and for good reason!

It gives readers vital information about how you operate, including:

- The specifics of the work you do

- How that work helps your beneficiaries

- The resources that support the work (partnerships, facilities, volunteers, etc!)

- If you have a membership base or a subscription business model

Above all, highlight what needs your nonprofit meets and how it plans to continue meeting those needs. Really get into the details here! Emphasize the work of each and every program, and if you’re already established, note the real impact you’ve made.

Try including pictures and graphic design elements so people can feel your impact even if they’re simply skimming.

7. Create an Executive Summary

Your Executive Summary will sit right at the top of your business plan—in many ways, it’s the shining star of the document! This section serves as a concise and compelling telling of your nonprofit’s story. If it can capture your readers’ attention, they’re more likely to read through the rest of the plan.

Your Executive Summary should include:

- Your mission, vision and values

- Your goals (and their timelines!)

- Your organization’s history

- Your primary programs, products and services

- Your financing plan

- How you intend on using your funding

This section will summarize the basics of everything else in your plan. While it comes first part of your plan, we suggest writing it last! That way, you’ll already have the information on hand.

You can also edit your Executive Summary depending on your audience. For example, if you’re sending your nonprofit business plan to a loan provider, you can really focus on where the money will be going. If you’re trying to recruit a new board member, you might want to highlight goals and impact, instead.

8. Write a marketing plan

Having a nonprofit marketing plan is essential to making sure your mission reaches people—and that’s especially true for your business plan.

If your nonprofit is already up and running, detail the work you’re currently doing, as well as the specific results you’ve seen so far. If you’re new, you’ll mostly be working with projections—so make sure your data is sound!

No matter what, your Marketing Plan section should market research such as:

- Beneficiary information

- Information on your target audience/donor base

- Information on your competitors

- Names of potential partners

Data is your friend here! Make note of market analyses and tests you’ve run. Be sure to also document any outreach and campaigns you’ve previously done, as well as your outcomes.

Finally, be sure to list all past and future marketing strategies you’re planning for. This can include promotion, advertising, online marketing plans and more.

9. Create a logistics and operations plan

The Operations section of your business plan will take the organizational information you’ve gathered so far and expand the details! Highlight what the day-to-day will look like for your nonprofit, and how your funds and resources will make it possible.

Be sure to make note of:

- The titles and responsibilities of your core team

- The partners and suppliers you work with

- Insurance you will need

- Necessary licenses or certifications you’ll maintain

- The cost of services and programs

This is the what and how of your business plan. Lean into those details, and show exactly how you’ll accomplish those goals you’ve been talking about!

10. Write an Impact Plan

Your Impact Plan is a deep dive into your organization’s goals. It grounds your dreams in reality, which brings both idealists and more practically-minded folks into your corner!

Where your Executive Summary lays out your ambitions on a broader level, this plan:

- Clarifies your goals in detail

- Highlights specific objectives and their timelines

- Breaks down how you will achieve them

- Shows how you will measure your success

Your Impact Plan will have quite a few goals in it, so be sure to emphasize which ones are the most impactful on your cause. After all, social impact is just as important as financial impact!

Speaking of…

11. Outline the Financial Plan

One of the main reasons people want to know how to write a nonprofit business plan is because of how essential it is to receiving funding. Loan providers, donors and granting bodies will want to see your numbers—and that’s where your Financial Plan comes in.

This plan should clearly lay out where your money is coming from and where it will go. If you’re just getting started, check out what similar nonprofits are doing in order to get realistic numbers. Even if you’re starting a nonprofit on a tight budget , every bit of financial information counts!

First, map out your projected (or actual) nonprofit revenue streams , such as:

- Expected membership contributions

- Significant donations

- In-kind support

- Fundraising plan

Then, do the same with your expenses:

- Startup costs

- Typical bills

- Web hosting

- Membership management software

- Subscription

- Costs of programs

If your nonprofit is already up and running, include your past accounting information. Otherwise, keep working with those grounded projections!

To make sure you have all of your information set, include documents like:

- Income statement

- Cash flow statement

- Balance sheet

This information comes together to show that your nonprofit can stay above water financially. Highlighting that you can comfortably cover your operational costs is essential. Plus, building this plan might help your team find funding gaps or opportunities!

12. Include an Appendix

Your appendix is for any extra pieces of useful information for your readers.

This could be documents such as:

- Academic papers about your beneficiaries

- Publications on your nonprofit’s previous success

- Board member bios

- Organizational flow chart

- Your IRS status letter

Make sure your additions contribute to your nonprofit’s story!

Examples of Business Plans for Nonprofits

Here are two great examples of nonprofit business plans. Notice how they’re different depending on the size of the organization!

Nonprofit Recording Co-op Business Plan

This sample nonprofit business plan shows what a basic plan could look like for a hobbyists’ co-op. If your nonprofit is on the smaller, more local side, this is a great reference!

What we like:

- Details on running a basic membership model

- Emphasis on what it means to specifically be a sustainable cooperative

- A list of early milestones, such as hitting their 100th member

- Clarification that all recordings will be legal

Nonprofit Youth Services Business Plan

This sample nonprofit business plan is for a much larger organization. Instead of focusing on the details of a membership model, it gets deeper into programs and services provided.

What we like

- The mission is broken down by values

- A detailed look at what each program provides

- A thorough sales plan

- Key assumptions are included for the financial plan

How to Create a Nonprofit Business Plan With Confidence

We hope this sheds some light on how creating a nonprofit business plan can help your organization moving forward! Remember: you know what you want for your organization. A business plan is simply a tool for making those dreams a reality.

Is a membership program part of your business plan? Check out WildApricot ’s award-winning membership management software!

With our 60-day free trial , you’ll have all the time you need to fall in love with what we have to offer.

Related Organizational Management Articles

30 Free Nonprofit Webinars for April 2024

Managing Human Resources for Nonprofits

Engaging Association Members in Advocacy Initiatives: 3 Tips

The Membership Growth Report:

Benchmarks & insights for growing revenue and constituents.

How to Create a Profit and Loss Forecast

Angelique O'Rourke

7 min. read

Updated October 27, 2023

An income statement, also called a profit and loss statement (or P&L), is a fundamental tool for understanding how the revenue and expenses of your business stack up.

Simply put, it tells anyone at-a-glance if your business is profitable or not. Typically, an income statement is a list of revenue and expenses, with the company’s net profit listed at the end (check out the section on income statement examples below to see what it looks like).

Have you ever heard someone refer to a company’s “bottom line”? They’re talking about the last line in an income statement, the one that tells a reader the net profit of a company, or how profitable the company is over a given period of time (usually quarterly or annually) after all expenses have been accounted for.

This is the “profit” referred to when people say “profit and loss statement,” or what the “p” stands for in “P & L.” The “loss” is what happens when your expenses exceed your revenue; when a company is not profitable and therefore running at a loss.

As you read on, keep in mind that cash and profits aren’t the same thing. For more on how they’re different, check out this article .

What’s included in an income statement?

The top line of your profit and loss statement will be the money that you have coming in, or your revenue from sales. This number should be your initial revenue from sales without any deductions.

The top line of your income statement is really just as important as the bottom line; all of the direct costs and expenses will be taken out of this beginning number. The smaller it is, the smaller the expenses have to be if you’re going to stay in the black.

If you’re writing a business plan document and don’t yet have money coming in, you might be wondering how you would arrive at a sales number for a financial forecast. It’s normal for the financials of a business plan to be your best educated guess at what the next few years of numbers will be. No one can predict the future, but you can make a reasonable plan.

Check out this article about forecasting sales for more information.

Direct costs

Direct costs, also referred to as the cost of goods sold, or COGS, is just what it sounds like: How much does it cost you to make the product or deliver the service related to that sale? You wouldn’t include items such as rent for an office space in this area, but the things that directly contribute to the product you sell.

For example, to a bookstore, the direct cost of sales is what the store paid for the books it sold; but to a publisher, its direct costs include authors’ royalties, printing, paper, and ink. A manufacturer’s direct costs include materials and labor. A reseller’s direct costs are what the reseller paid to purchase the products it’s selling.

If you only sell services, it’s possible that you have no direct costs or very low direct costs as a percentage of sales; but even accountants and attorneys have subcontractors, research, and photocopying that can be included in direct costs.

Here’s a simple rule of thumb to distinguish between direct costs and regular expenses: If you pay for something, regardless of whether you make 1 sale or 100 sales, that’s a regular expense. Think salaries, utilities, insurance, and rent. If you only pay for something when you make a sale, that’s a direct cost. Think inventory and paper reports you deliver to clients.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Gross margin

Gross margin is also referred to as gross profit. This number refers to the difference between the revenue and direct costs on your income statement.

Revenue – Direct Costs = Gross Margin

This number is very important because it conveys two critical pieces of information: 1.) how much of your revenue is being funneled into direct costs (the smaller the number, the better), and 2.) how much you have left over for all of the company’s other expenses. If the number after direct costs is smaller than the total of your operating expenses, you’ll know immediately that you’re not profitable.

Operating expenses

Operating expenses are where you list all of your regular expenses as line items, excluding your costs of goods sold.

So, you have to take stock of everything else your company pays for to keep the doors open: rent, payroll, utilities, marketing—include all of those fixed expenses here.

Remember that each individual purchase doesn’t need its own line item. For ease of reading, it’s better to group things together into categories of expenses—for example, office supplies, or advertising costs.

Operating income

Operating income is also referred to as EBITDA, or earnings before interest, taxes, depreciation, and amortization. You calculate your operating income by subtracting your total operating expenses from your gross margin.

Gross Margin – Operating Expenses = Operating Income

Operating income is considered the most reliable number reflecting a company’s profitability. As such, this is a line item to keep your eye on, especially if you’re presenting to investors . Is it a number that inspires confidence?

This is fairly straightforward—here you would include any interest payments that the company is making on its loans. If this doesn’t apply to you, skip it.

Depreciation and amortization

These are non-cash expenses associated with your assets, both tangible and intangible. Depreciation is an accounting concept based on the idea that over time, a tangible asset, like a car or piece of machinery, loses its value, or depreciates. After several years, the asset will be worth less and you record that change in value as an expense on your P&L.

With intangible assets, you’ll use a concept called amortization to write off their cost over time. An example here would be a copyright or patent that your business might purchase from another company. If the patent lasts for 20 years and it cost your company $1 million to purchase the patent, you would then expense 1/20th of the cost every year for the life of the patent. This expense for an intangible asset would be included in the amortization row of the income statement.

This will reflect the income tax amount that has been paid, or the amount that you expect to pay, depending on whether you are recording planned or actual values. Some companies set aside an estimated amount of money to cover this expected expense.

Total expenses

Total expenses is exactly what it sounds like: it’s the total of all of your expenses, including interest, taxes, depreciation, and amortization.

The simplest way to calculate your total expenses is to just take your direct costs, add operating expenses, and then add the additional expenses of interest, taxes, depreciation, and amortization:

Total Expenses = Direct Costs + Operating Expenses + Interest + Taxes + Depreciation + Amortization

Net profit, also referred to as net income or net earnings, is the proverbial bottom line. This is the at-a-glance factor that will determine the answer to the question, are you in the red? You calculate net profit by subtracting total expenses from revenue:

Net Profit = Revenue – Total Expenses

Remember that this number started at the top line, with your revenue from sales. Then everything else was taken out of that initial sum. If this number is negative, you’ll know that you’re running at a loss. Either your expenses are too high, you’re revenue is in a slump, or both—and it might be time to reevaluate strategy.

- Income statement examples

Because the terminology surrounding income statements is variable and all businesses are different, not all of them will look exactly the same, but the core information of revenue minus all expenses (including direct costs) equals profit will be present in each one.

Here is an income statement from Nike, to give you a general idea:

An income statement from Nike .

As you can see, while Nike uses a variety of terms to explain what their expenses are and name each line item as clearly as possible, the takeaway is still the bottom line, their net income.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

- What’s included in an income statement?

Related Articles

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

5 Min. Read

How to Highlight Risks in Your Business Plan

6 Min. Read

How to Forecast Sales for a Subscription Business

2 Min. Read

How to Use These Common Business Ratios

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

How to Build a Profit Plan for Your Business

By Eric Dickmann

February 6, 2023

In order to achieve business goals, a profit plan is crucial. It serves as a financial roadmap for the company. However, with competing demands, it can be challenging to begin. Market demand and competitive factors, along with seasonal cash-flow changes, can be unpredictable.

To build a profit plan, start by understanding your business goals. Get all key stakeholders involved to align the plan with those goals. Decide on key metrics to track and what tools to use for tracking. Ensure you're relying on relevant and legitimate data sources. Everyone should agree on the validity of the numbers. Analytical tools can help track and measure progress against goals.

What is a Profit Plan?

A profit plan is a detailed financial plan that outlines a company's strategies and goals for generating revenue and managing expenses in order to achieve a specific level of profitability. The profit plan typically includes a detailed budget that outlines projected revenues and expenses, as well as a forecast of the company's cash flow, balance sheet, and income statement. The profit plan is an essential tool for any business, as it helps managers make informed decisions about how to allocate resources, invest in growth opportunities, and manage risk. It also serves as a roadmap for the company's financial future, providing a framework for monitoring performance and making adjustments as necessary. A typical profit plan will include the following components:

- Revenue Projections: This includes estimates of sales, pricing, and volume for the coming year.

- Cost Projections: This includes estimates of all direct and indirect costs associated with producing and delivering goods and services, such as labor, materials, overhead, and marketing expenses.

- Cash Flow Analysis: This includes projections of cash inflows and outflows, as well as a plan for managing cash reserves.

- Balance Sheet Projections: This includes estimates of the company's assets, liabilities, and equity over the coming year.

- Income Statement Projections: This includes estimates of the company's revenue, expenses, and net income for the coming year.

By creating a comprehensive profit plan, a business can set realistic goals and targets, monitor progress toward those goals, and make informed decisions about how to allocate resources and manage risk. It can also help to identify potential areas for improvement and optimization, which can ultimately help the business to achieve greater profitability and success over time.

Benefits of a Profit Plan

A formal profit plan prepares a company for possible challenges and ensures maximum profit. CPAsNet noted that profit plans are beneficial to:

- Help owners achieve their financial goals

- Improve and measure performance

- Establish a framework for making decisions

- Educate and motivate key employees

Building a Profit Plan for Your Business

It is important to consider profit when making plans for your business because profit is the ultimate goal of any business. Without profit, a business cannot sustain itself, pay its employees, or invest in growth and development. Profit is also a key indicator of a business's success and can attract investors and potential partners. By considering profit in their plans, business owners can make informed decisions about pricing, marketing, and investment strategies that will help them maximize their revenue and achieve their goals. Ultimately, profit is the lifeblood of any business, and considering it in every decision is crucial for long-term success.

Profit doesn’t happen by itself. Look over your processes and envision how you want it all to unfold. Here are some suggested steps to consider when making your plan:

- Set a Profit Goal- Set clear targets and make a plan for how you should get there. A target profit gives your business a set of goals to work throughout the year. Consider the number of units sold with its fixed and variable cost. When it comes to expected profit, slightly underestimate rather than overestimate.

- Create a Budget- Make a detailed budget plan. Have a look at financing options for your business. Set a potential plan B in case “things” happen. Estimate just how much you perceive your business is going to spend in a certain amount of time.

- List Expenses- Be sure to write down every single expense the business makes during its operations. It lets you know where you are spending too much. Use costing sheets to track all cost associated with each product. In this way, you can calculate the gross profit.

- Calculate the Profit Margin- A margin is what keeps you in business. It is equal to the gross profit divided by the revenue and multiplied by 100. It will vary per industry, but according to The Corporate Finance Institute , a 10% net profit margin is considered average.

- Keep the Costs Down- Entrepreneurs don’t need to spend a lot of money. Find smart ways to start with less money. Set a margin that covers your costs including overhead. Make a realistic budget to help you achieve your goals.

The best way to start profit planning is to understand your business goals. Then make a detailed budget plan based on those goals. List down the income and expenses and keep your costs down as much as possible. The higher the profit margin, the more it can sustain your business and put you on the road to success.

It's time to grow your company!

Learn how a fractional CMO can help your business grow!

Contact us today to learn more about our Virtual CMO advisory service.

Eric Dickmann

About the author

Eric Dickmann is the Founder / CMO of The Five Echelon Group, host of the weekly podcast "The Virtual CMO" and YouTube series "Work-Life" and a fractional CMO for a variety of small and midsize companies. An executive leader with over 30 years of experience in marketing, product development, and digital transformation, he has worked with large, global companies and small startups to develop and execute marketing strategies to bring innovative products to the market.

You might also like

Is Your Business Struggling to Make a Profit?

What is profit planning, ways to increase profit for your business.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

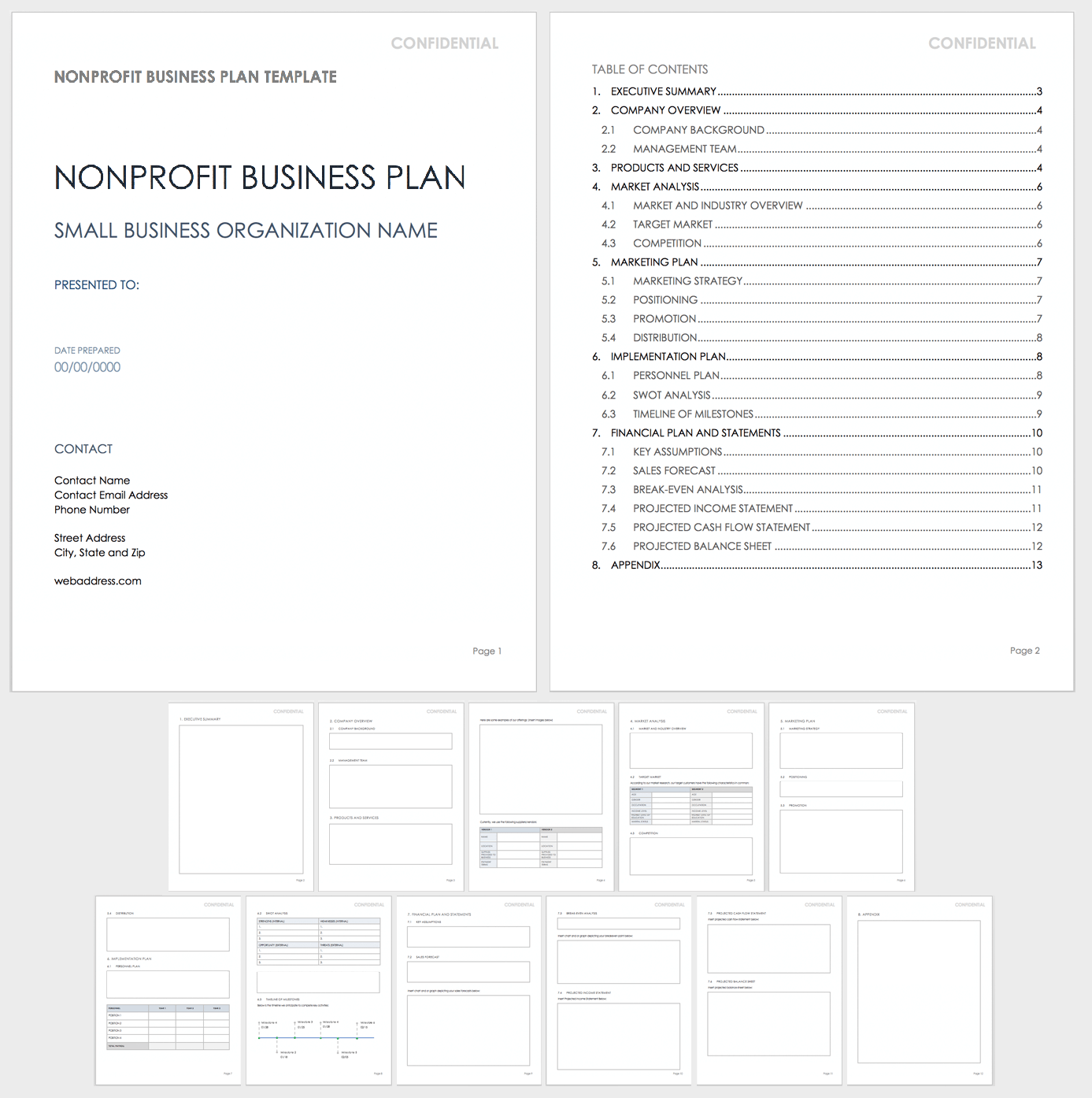

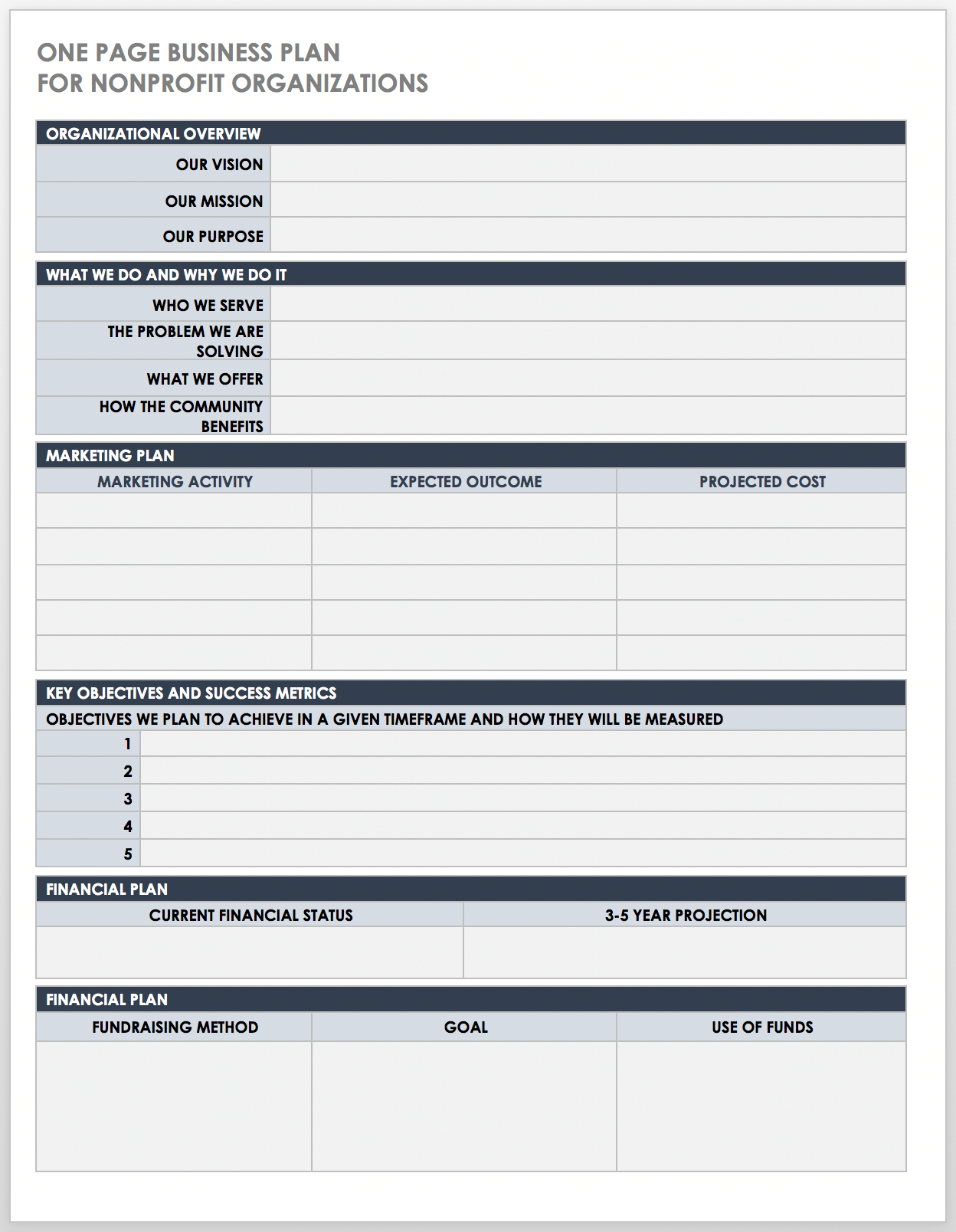

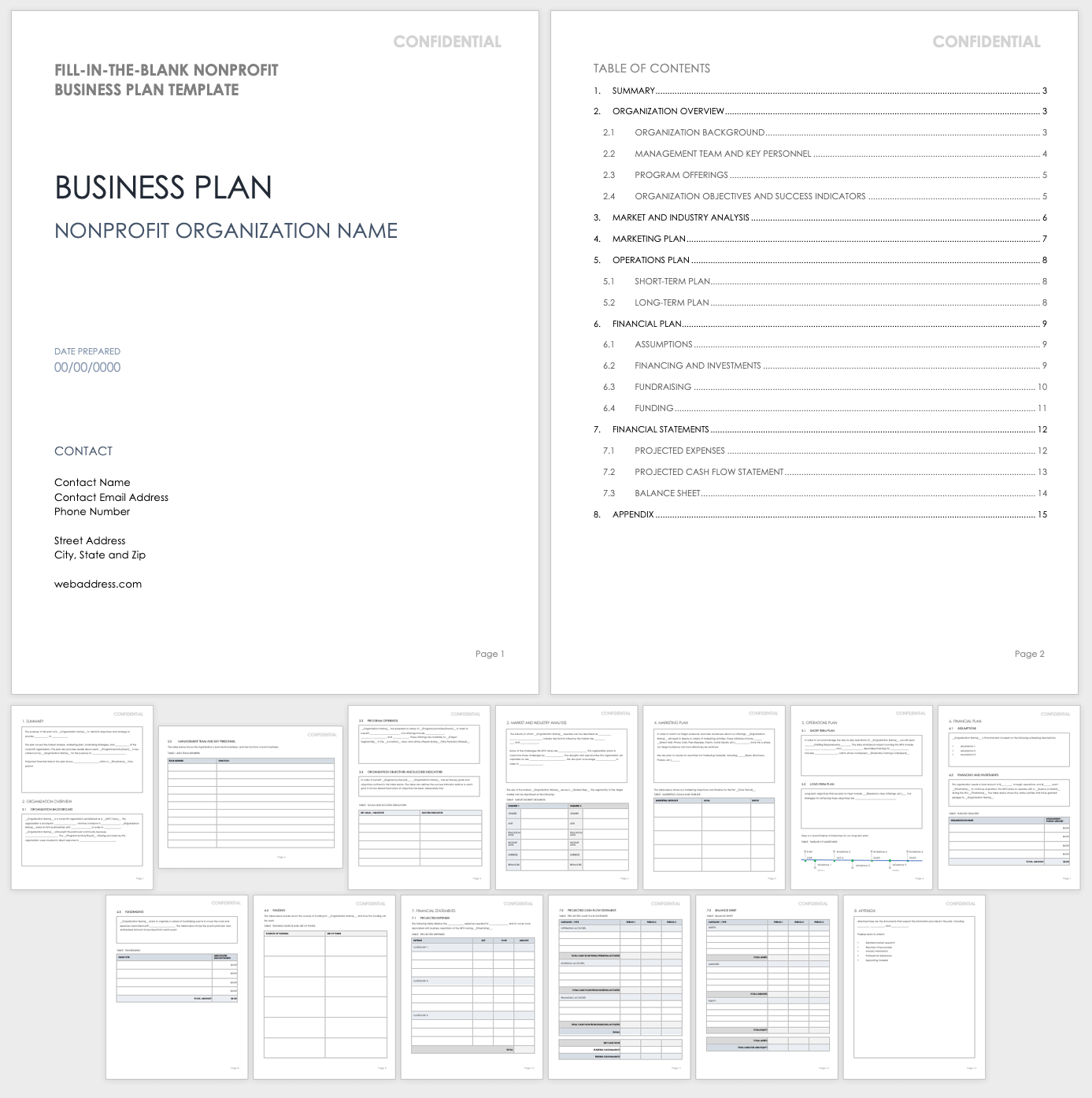

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

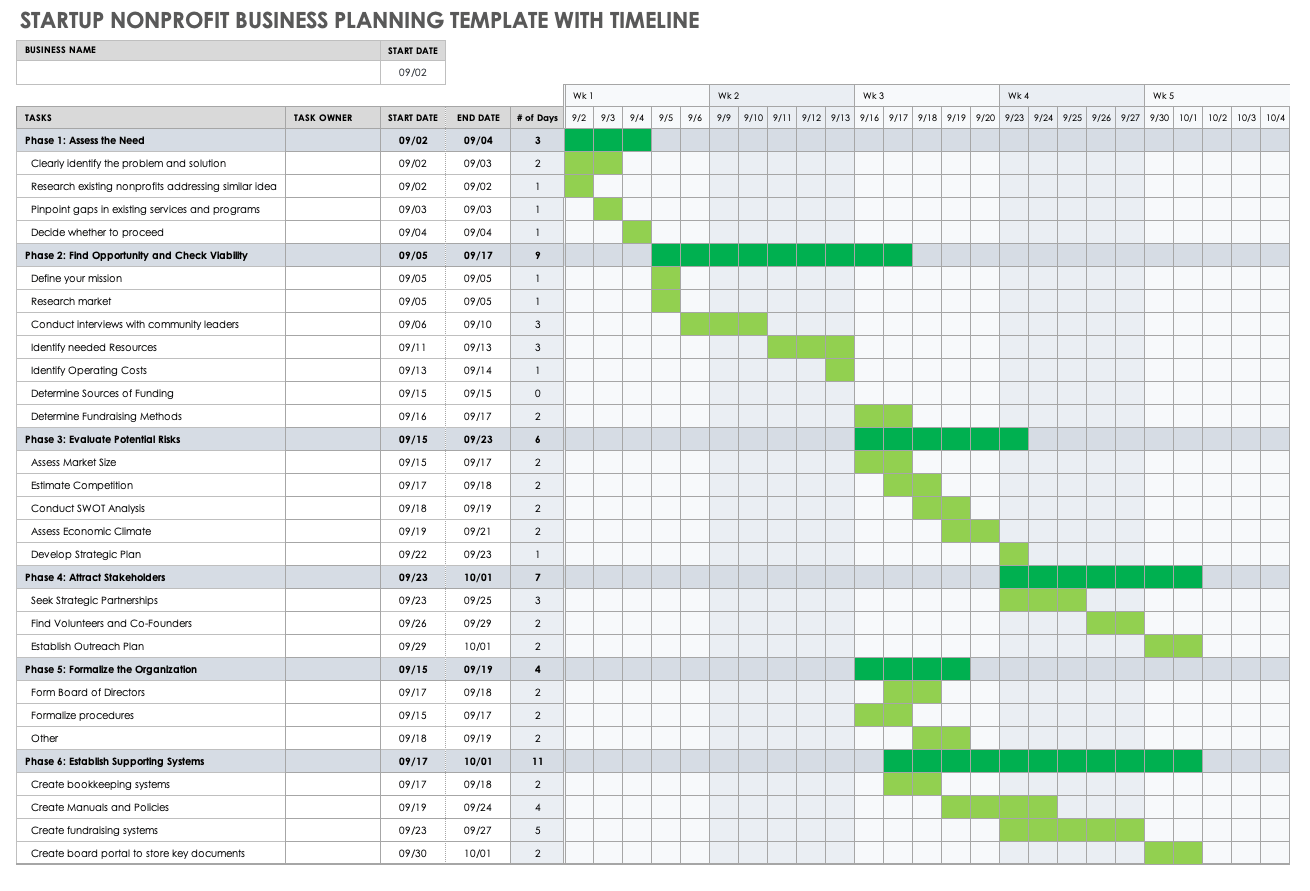

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

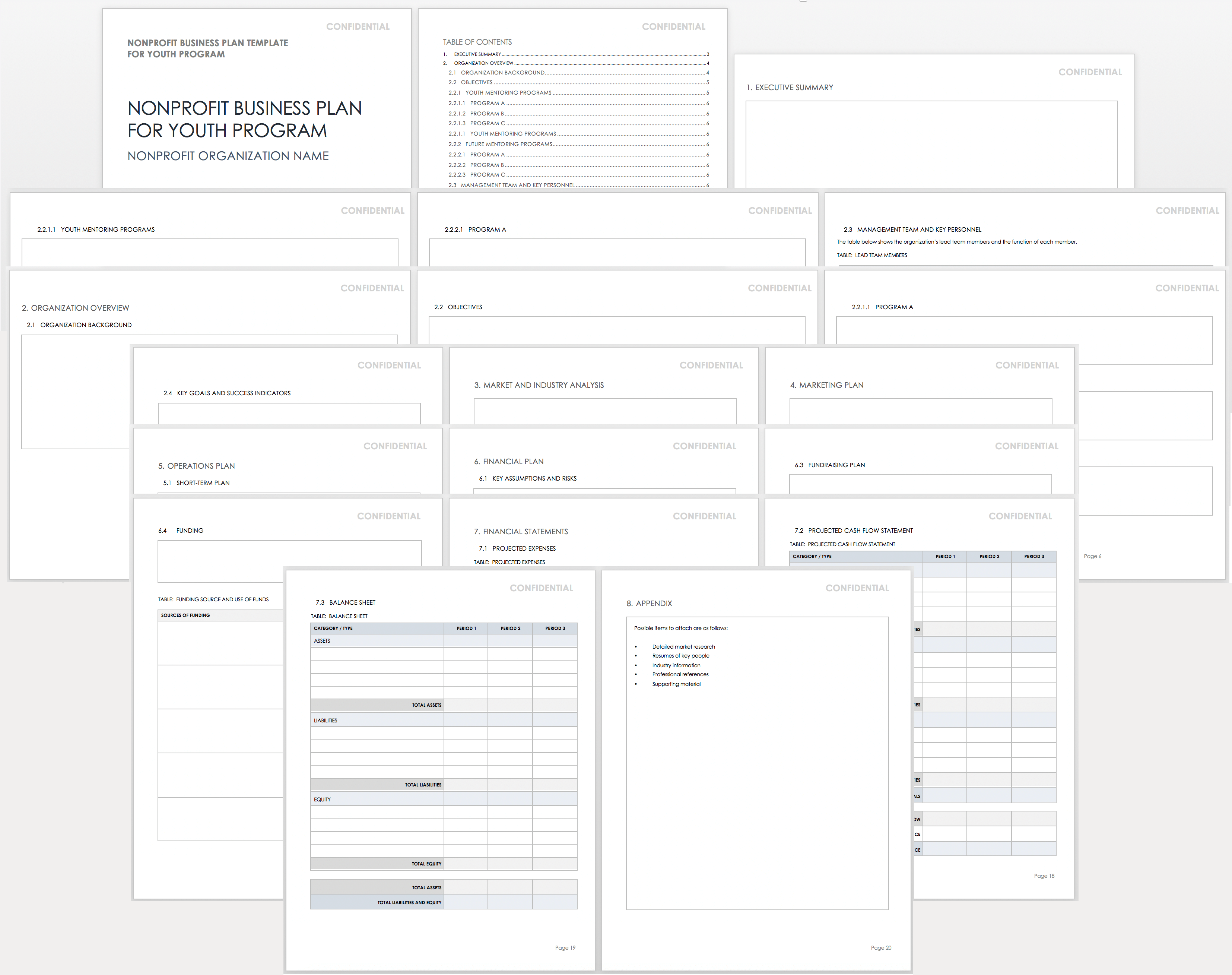

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

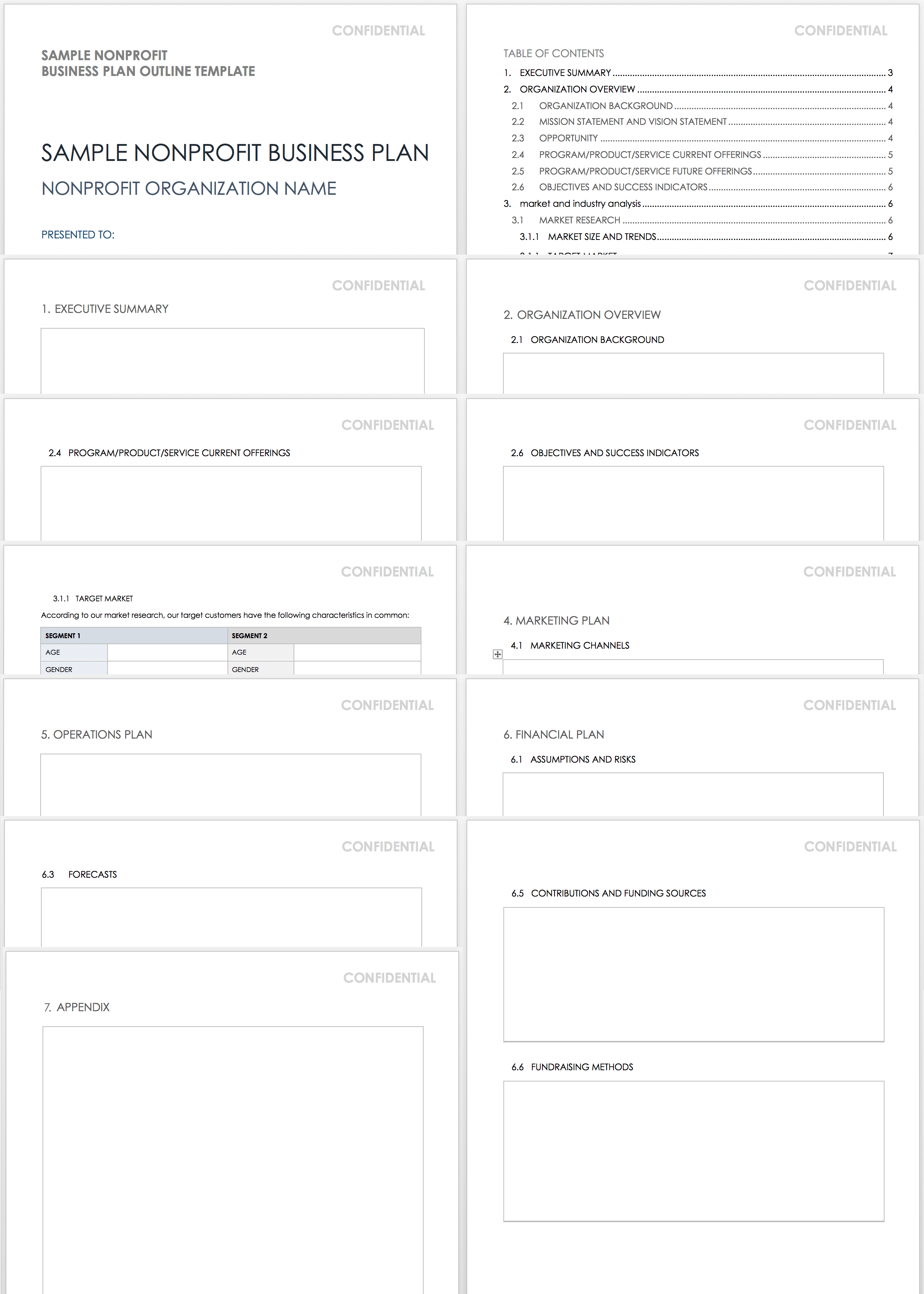

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

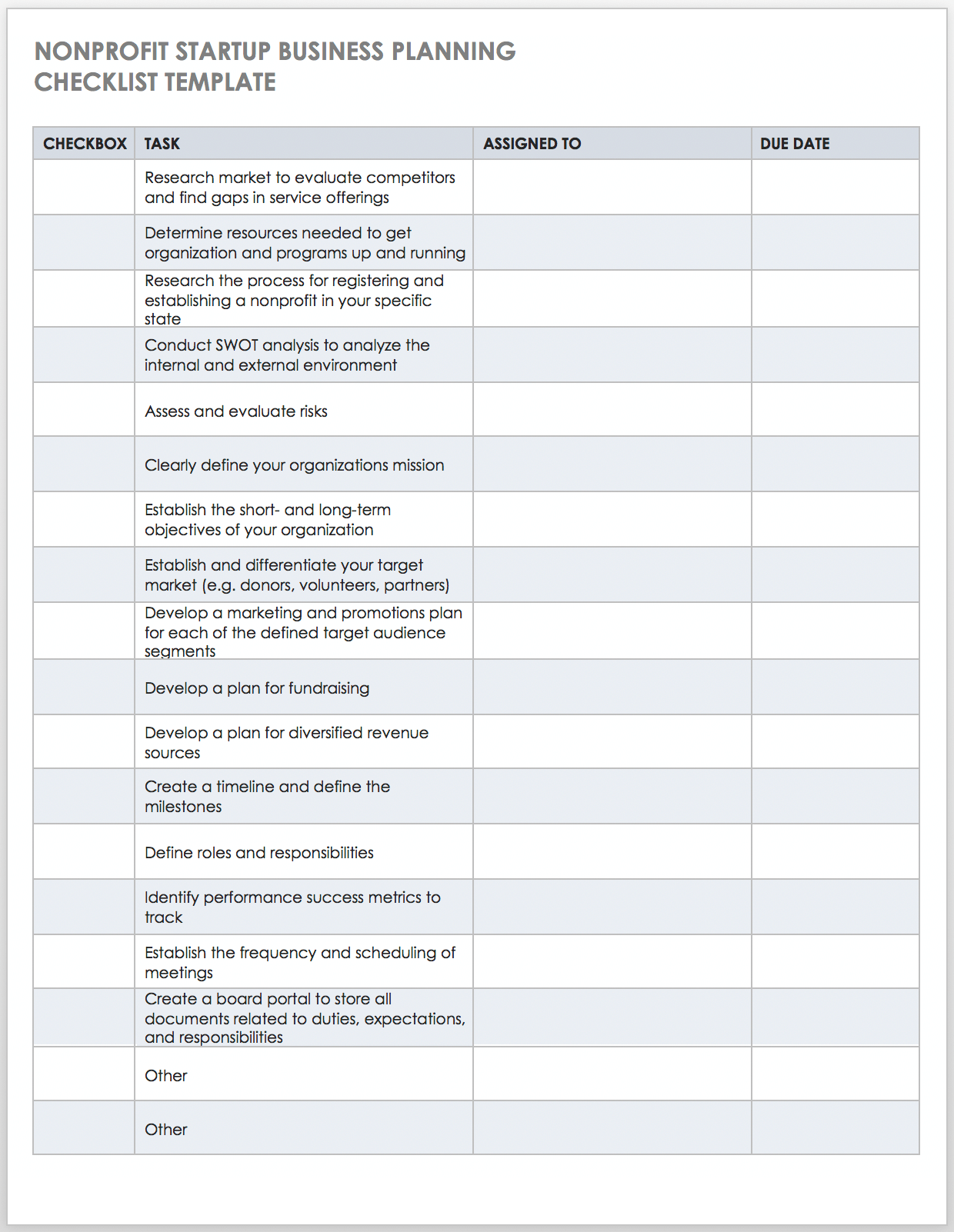

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.

Download Nonprofit Startup Business Planning Checklist Template

Tips to Create Your Nonprofit Business Plan

Your nonprofit business plan should provide your donors, volunteers, and other key stakeholders with a clear picture of your overarching mission and objectives. Below, we share our top tips for ensuring that your plan is attractive and thorough.

- Develop a Strategy First: You must aim before you fire if you want to be effective. In other words, develop a strategic plan for your nonprofit in order to provide your team with direction and a roadmap before you build your business plan.

- Save Time with a Template: No need to start from scratch when you can use a customizable nonprofit business plan template to get started. (Download one of the options above.)

- Start with What You Have: With the exception of completing the executive summary, which you must do last, you aren’t obligated to fill in each section of the plan in order. Use the information you have on hand to begin filling in the various parts of your business plan, then conduct additional research to fill in the gaps.

- Ensure Your Information Is Credible: Back up all the details in your plan with reputable sources that stakeholders can easily reference.

- Be Realistic: Use realistic assumptions and numbers in your financial statements and forecasts. Avoid the use of overly lofty or low-lying projections, so stakeholders feel more confident about your plan.

- Strive for Scannability: Keep each section clear and concise. Use bullet points where appropriate, and avoid large walls of text.

- Use Visuals: Add tables, charts, and other graphics to draw the eye and support key points in the plan.

- Be Consistent: Keep the voice and formatting (e.g., font style and size) consistent throughout the plan to maintain a sense of continuity.

- Stay True to Your Brand: Make sure that the tone, colors, and overall style of the business plan are a true reflection of your organization’s brand.

- Proofread Before Distribution: Prior to distributing the plan to stakeholders, have a colleague proofread the rough version to check for errors and ensure that the plan is polished.

- Don’t Set It and Forget It: You should treat your nonprofit business plan as a living document that you need to review and update on a regular basis — as objectives change and your organization grows.

- Use an Effective Collaboration Tool: Use an online tool to accomplish the following: collaborate with key personnel on all components of the business plan; enable version control for all documents; and keep resources in one accessible place.

Improve Your Nonprofit Business Planning Efforts with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Write a Business Plan For a Nonprofit Organization + Template

Creating a business plan is essential for any business, but it can be especially helpful for nonprofits. A nonprofit business plan allows you to set goals and track progress over time. It can also help you secure funding from investors or grant-making organizations.

A well-crafted business plan not only outlines your vision for the organization but also provides a step-by-step process of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article will provide an overview of the key elements that every nonprofit founder should include in their business plan.

Download the Ultimate Nonprofit Business Plan Template

What is a Nonprofit Business Plan?

A nonprofit business plan is a formal written document that describes your organization’s purpose, structure, and operations. It is used to communicate your vision to potential investors or donors and convince them to support your cause.

The business plan should include information about your target market, financial projections, and marketing strategy. It should also outline the organization’s mission statement and goals.

Why Write a Nonprofit Business Plan?

A nonprofit business plan is required if you want to secure funding from grant-making organizations or investors.

A well-crafted business plan will help you:

- Define your organization’s purpose and goals

- Articulate your vision for the future

- Develop a step-by-step plan to achieve your goals

- Secure funding from investors or donors

- Convince potential supporters to invest in your cause

Entrepreneurs can also use this as a roadmap when starting your new nonprofit organization, especially if you are inexperienced in starting a nonprofit.

Writing an Effective Nonprofit Business Plan

The key is to tailor your business plan to the specific needs of your nonprofit. Here’s a quick overview of what to include:

Executive Summary

Organization overview, products, programs, and services, industry analysis, customer analysis, marketing plan, operations plan, management team.

- Financial Plan

The executive summary of a nonprofit business plan is a one-to-two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your nonprofit organization

- Provide a short summary of the key points of each section of your business plan.

- Organize your thoughts in a logical sequence that is easy for the reader to follow.

- Include information about your organization’s management team, industry analysis, competitive analysis, and financial forecast.

This section should include a brief history of your nonprofit organization. Include a short description of how and why you started it and provide a timeline of milestones the organization has achieved.

If you are just starting your nonprofit, you may not have a long history. Instead, you can include information about your professional experience in the industry and how and why you conceived your new nonprofit idea. If you have worked for a similar organization before or have been involved in a nonprofit before starting your own, mention this.

You will also include information about your chosen n onprofit business model and how it is different from other nonprofits in your target market.

This section is all about what your nonprofit organization offers. Include information about your programs, services, and any products you may sell.

Describe the products or services you offer and how they benefit your target market. Examples might include:

- A food bank that provides healthy meals to low-income families

- A job training program that helps unemployed adults find jobs

- An after-school program that helps kids stay out of gangs

- An adult literacy program that helps adults learn to read and write

Include information about your pricing strategy and any discounts or promotions you offer. Examples might include membership benefits, free shipping, or volume discounts.

If you offer more than one product or service, describe each one in detail. Include information about who uses each product or service and how it helps them achieve their goals.

If you offer any programs, describe them in detail. Include information about how often they are offered and the eligibility requirements for participants. For example, if you offer a job training program, you might include information about how often the program is offered, how long it lasts, and what kinds of jobs participants can expect to find after completing the program.

The industry or market analysis is an important component of a nonprofit business plan. Conduct thorough market research to determine industry trends, identify your potential customers, and the potential size of this market.

Questions to answer include:

- What part of the nonprofit industry are you targeting?

- Who are your competitors?

- How big is the market?

- What trends are happening in the industry right now?

You should also include information about your research methodology and sources of information, including company reports and expert opinions.

As an example, if you are starting a food bank, your industry analysis might include information about the number of people in your community who are considered “food insecure” (they don’t have regular access to enough nutritious food). You would also include information about other food banks in your area, how they are funded, and the services they offer.

For each of your competitors, you should include a brief description of their organization, their target market, and their competitive advantage. To do this, you should complete a SWOT analysis.

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a helpful tool to assess your nonprofit’s current position and identify areas where you can improve.

Some questions to consider when conducting a SWOT analysis include:

- Strengths : What does your nonprofit do well?

- Weaknesses : What areas could your nonprofit improve?

- Opportunities : What trends or changes in the industry could you take advantage of?

- Threats : What trends or changes in the industry could hurt your nonprofit’s chances of success?

After you have identified your nonprofit’s strengths, weaknesses, opportunities, and threats, you can develop strategies to improve your organization.

For example, if you are starting a food bank, your SWOT analysis might reveal that there is a need for more food banks in your community. You could use this information to develop a marketing strategy to reach potential donors who might be interested in supporting your organization.

If you are starting a job training program, your SWOT analysis might reveal that there is a need for more programs like yours in the community. You could use this information to develop a business plan and marketing strategy to reach potential participants who might be interested in enrolling in your program.

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, if you are starting a job training program for unemployed adults, your target audience might be low-income adults between the ages of 18 and 35. Your customer analysis would include information about their needs (e.g., transportation, childcare, job readiness skills) and wants (e.g., good pay, flexible hours, benefits).

If you have more than one target audience, you will need to provide a separate customer analysis for each one.

You can include information about how your customers make the decision to buy your product or use your service. For example, if you are starting an after-school program, you might include information about how parents research and compare programs before making a decision.

You should also include information about your marketing strategy and how you plan to reach your target market. For example, if you are starting a food bank, you might include information about how you will promote the food bank to the community and how you will get the word out about your services.

Develop a strategy for targeting those customers who are most likely to use your program, as well as those that might be influenced to buy your products or nonprofit services with the right marketing.

This part of the business plan is where you determine how you are going to reach your target market. This section of your nonprofit business plan should include information about your marketing goals, strategies, and tactics.

- What are your marketing goals? Include information about what you hope to achieve with your marketing efforts, as well as when and how you will achieve it.

- What marketing strategies will you use? Include information about public relations, advertising, social media, and other marketing tactics you will use to reach your target market.

- What tactics will you use? Include information about specific actions you will take to execute your marketing strategy. For example, if you are using social media to reach your target market, include information about which platforms you will use and how often you will post.

Your marketing strategy should be clearly laid out, including the following 4 Ps.

- Product/Service : Make sure your product, service, and/or program offering is clearly defined and differentiated from your competitors, including the benefits of using your service.

- Price : How do you determine the price for your product, services, and/or programs? You should also include a pricing strategy that takes into account what your target market will be willing to pay and how much the competition within your market charges.

- Place : Where will your target market find you? What channels of distribution will you use to reach them?

- Promotion : How will you reach your target market? You can use social media or write a blog, create an email marketing campaign, post flyers, pay for advertising, launch a direct mail campaign, etc.

For example, if you are starting a job training program for unemployed adults, your marketing strategy might include partnering with local job centers and adult education programs to reach potential participants. You might also promote the program through local media outlets and community organizations.

Your marketing plan should also include a sales strategy, which includes information about how you will generate leads and convert them into customers.

You should also include information about your paid advertising budget, including an estimate of expenses and sales projections.

This part of your nonprofit business plan should include the following information:

- How will you deliver your products, services and/or programs to your target market? For example, if you are starting a food bank, you will need to develop a system for collecting and storing food donations, as well as distributing them to the community.

- How will your nonprofit be structured? For example, will you have paid staff or volunteers? How many employees will you need? What skills and experience will they need to have?

- What kind of facilities and equipment will you need to operate your nonprofit? For example, if you are starting a job training program, you will need space to hold classes, as well as computers and other office equipment.

- What are the day-to-day operations of your nonprofit? For example, if you are starting a food bank, you will need to develop a system for accepting and sorting food donations, as well as distributing them to the community.

- Who will be responsible for each task? For example, if you are starting a job training program, you will need to identify who will be responsible for recruiting participants, teaching classes, and placing graduates in jobs.

- What are your policies and procedures? You will want to establish policies related to everything from employee conduct to how you will handle donations.

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is the section of the business plan where you elaborate on the day-to-day execution of your nonprofit. This is where you really get into the nitty-gritty of how your organization will function on a day-to-day basis.

This section of your nonprofit business plan should include information about the individuals who will be running your organization.

- Who is on your team? Include biographies of your executive director, board of directors, and key staff members.

- What are their qualifications? Include information about their education, work experience, and skills.

- What are their roles and responsibilities? Include information about what each team member will be responsible for, as well as their decision-making authority.

- What is their experience in the nonprofit sector? Include information about their work with other nonprofits, as well as their volunteer experiences.

This section of your plan is important because it shows that you have a team of qualified individuals who are committed to the success of your nonprofit.

Nonprofit Financial Plan

This section of your nonprofit business plan should include the following information:

- Your budget. Include information about your income and expenses, as well as your fundraising goals.

- Your sources of funding. Include information about your grants, donations, and other sources of income.

- Use of funds. Include information about how you will use your income to support your programs and operations.

This section of your business plan is important because it shows that you have a clear understanding of your organization’s finances. It also shows that you have a plan for raising and managing your funds.

Now, include a complete and detailed financial plan. This is where you will need to break down your expenses and revenue projections for the first 5 years of operation. This includes the following financial statements:

Income Statement

Your income statement should include:

- Revenue : how will you generate revenue?

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, what is the net income or loss?

Sample Income Statement for a Startup Nonprofit Organization

Balance sheet.

Include a balance sheet that shows what you have in terms of assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Nonprofit Organization

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Income : All of the revenue coming in from clients.

- Expenses : All of your monthly bills and expenses. Include operating, marketing and capital expenditures.

- Net Cash Flow : The difference between income and expenses for each month after they are totaled and deducted from each other. This number is the net cash flow for each month.

Using your total income and expenses, you can project an annual cash flow statement. Below is a sample of a projected cash flow statement for a startup nonprofit.

Sample Cash Flow Statement for a Startup Nonprofit Organization

Fundraising plan.

This section of your nonprofit business plan should include information about your fundraising goals, strategies, and tactics.

- What are your fundraising goals? Include information about how much money you hope to raise, as well as when and how you will raise it.

- What fundraising strategies will you use? Include information about special events, direct mail campaigns, online giving, and grant writing.

- What fundraising tactics will you use? Include information about volunteer recruitment, donor cultivation, and stewardship.

Now include specific fundraising goals, strategies, and tactics. These could be annual or multi-year goals. Below are some examples:

Goal : To raise $50,000 in the next 12 months.

Strategy : Direct mail campaign

- Create a mailing list of potential donors

- Develop a direct mail piece

- Mail the direct mail piece to potential donors

Goal : To raise $100,000 in the next 24 months.

Strategy : Special event

- Identify potential special event sponsors

- Recruit volunteers to help with the event

- Plan and execute the special event

Goal : To raise $250,000 in the next 36 months.

Strategy : Grant writing

- Research potential grant opportunities

- Write and submit grant proposals

- Follow up on submitted grants

This section of your business plan is important because it shows that you have a clear understanding of your fundraising goals and how you will achieve them.

You will also want to include an appendix section which may include:

- Your complete financial projections

- A complete list of your nonprofit’s policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- A list of your hard assets and equipment with purchase dates, prices paid and any other relevant information

- A list of your soft assets with purchase dates, prices paid and any other relevant information

- Biographies and/or resumes of the key members of your organization

- Your nonprofit’s bylaws

- Your nonprofit’s articles of incorporation

- Your nonprofit’s most recent IRS Form 990

- Any other relevant information that may be helpful in understanding your organization

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your nonprofit organization. It not only outlines your vision but also provides a step-by-step process of how you are going to accomplish it. Sometimes it may be difficult to get started, but once you get the hang of it, writing a business plan becomes easier and will give you a sense of direction and clarity about your nonprofit organization.

Finish Your Nonprofit Business Plan in 1 Day!

Other helpful articles.

How to Write a Grant Proposal for Your Nonprofit Organization + Template & Examples

How To Create the Articles of Incorporation for Your Nonprofit Organization + Template

How to Develop a Nonprofit Communications Plan + Template

How to Write a Stand-Out Purpose Statement + Examples

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”