BforB Business Blog

Market Economy Examples: Case Studies, Countries, and Success Stories

A market economy is an economic system in which the production, distribution, and pricing of goods and services are determined by the forces of supply and demand. It is characterized by private ownership of means of production, individual decision-making, and a focus on efficiency and productivity.

One example of a market economy is the mixed economy of New Zealand. This country operates with a market-based system while also allowing for government intervention in certain sectors such as healthcare and welfare. The government in New Zealand plays a role in ensuring that its citizens have access to essential services and resources.

In a market economy, producers and consumers interact in a free market, where prices are determined based on supply and demand. The motive of producers is to maximize profits by producing goods and services that meet the needs and wants of consumers. Consumers, on the other hand, have the freedom to choose what to buy and where to spend their money.

One of the key characteristics of a market economy is the absence of government control over pricing and production. Unlike in a command economy, where the government has centralized decision-making authority, in a market economy, production and pricing decisions are made by individual producers and consumers. This allows for competition and innovation, as producers are motivated to provide the best products at competitive prices to attract consumers.

Market economies have proven to be successful in many countries around the world. They have been associated with higher levels of economic growth and prosperity. However, it is important to note that market economies are not without their challenges. Income inequality, lack of access to basic necessities for some individuals, and the potential for market failures are all issues that need to be addressed in order to ensure a fair and equitable society.

🔔 Understanding Market Economies

A market economy is an economic system in which the production and distribution of goods and services are primarily determined through the interactions of buyers and sellers in competitive markets.

In a market economy, individuals and businesses own and control the means of production. They decide what to produce and how much to produce based on their own interests and the demands of consumers. The government’s role is limited to establishing the rules of the market and enforcing property rights.

Market economies rely on the price mechanism to connect producers and consumers. Prices are determined by supply and demand, and they serve as the signals that guide resource allocation. When the demand for a good or service is high, prices rise, indicating that more production is needed. On the other hand, when demand is low, prices fall, prompting producers to reduce production.

In 2021, the top 25 nations with the most market-oriented economies, according to the Index of Economic Freedom, were mainly developed countries such as Hong Kong, Singapore, New Zealand, and Switzerland. These countries have relatively low government intervention and high levels of economic freedom.

Benefits of Market Economies

- Efficiency: Market economies are generally more efficient than planned economies. The profit motive encourages producers to allocate resources efficiently and produce goods and services that consumers demand.

- Wealth creation: Market economies have been historically successful in creating wealth for nations and individuals. The ability to own and acquire property, invest, and innovate has resulted in increased productivity and economic growth.

- Choice and competition: Market economies offer consumers a wide range of choices and foster competition among producers, leading to better quality products and lower prices.

Differences between Market, Command, and Mixed Economies

In a command economy, such as the one in North Korea, the government exercises extensive control over the allocation of resources and the production of goods and services. The government determines what is produced, how much is produced, and how it is distributed. Individual choice and private ownership are limited.

In mixed economies, such as Canada, both the private sector and the government play a significant role in economic decision-making. The government provides certain public goods and services, such as healthcare and education, while leaving other economic activities to the market.

Market economies have proven to be the most effective method for creating wealth and providing citizens with the goods and services they need. While there may be occasional market failures and shortages, market mechanisms and competition generally lead to efficient outcomes.

🔔 Market Economy Case Studies

Market economies are characterized by the presence of free markets, where goods and services are exchanged based on supply and demand. In this system, individuals and businesses make decisions about what to produce, how to produce, and how to distribute goods and services. The market economy is defined by private ownership of property and assets, and wealth is generated through market transactions.

New Zealand

New Zealand is often cited as a successful example of a market economy. The country shifted from a heavily regulated economy to a more market-oriented one in the 1980s. As a result, New Zealand experienced significant economic growth, improved productivity, and increased living standards. The government implemented reforms to reduce trade barriers, deregulate industries, and promote competition. This allowed the market to allocate resources efficiently and incentivized businesses to innovate and adapt to market conditions.

Sweden is another example of a market economy that combines free markets with a strong welfare state. While the Swedish government provides healthcare, education, and social security services, the majority of the economy is driven by market forces. Swedish citizens enjoy a high standard of living, and the country is known for its innovation and high-tech industries. The government plays a role in regulating and ensuring that markets are fair and competitive, but businesses are largely privately owned and operated.

China’s transition from a planned economy to a market economy has been one of the most significant economic transformations in recent history. The government implemented economic reforms in the late 1970s, allowing market forces to play a larger role in the country’s economy. This shift resulted in rapid economic growth and lifted hundreds of millions of people out of poverty. While the government retains control over key sectors and industries, such as banking and energy, China’s market-oriented reforms have unleashed the entrepreneurial spirit and productive capabilities of its population.

Market economy case studies provide valuable insights into how free markets can contribute to economic growth, innovation, and improved living standards. New Zealand, Sweden, and China are examples of countries that have successfully implemented market-oriented reforms to stimulate their economies. While each country has its own unique approach and challenges, the common denominator is the emphasis on market mechanisms and the role of the private sector in driving economic activity.

🔔 Successful Market Economies

In a market economy, the revision and work is driven by the common motive of profit, with individuals and businesses making decisions based on supply and demand.

Many nations have embraced market economies, reducing or eliminating central planning and allowing the free market to determine prices and production. These countries have seen success in various industries.

One example of a successful market economy is New Zealand. In the 1980s, the government-owned industries were privatized, and market forces were allowed to dictate decision-making. As a result, New Zealand experienced economic growth and reduced shortages in various sectors.

Consumers in New Zealand also benefited from a free-market economy. Without government interference, businesses were able to meet the needs of consumers more efficiently and at competitive prices.

Healthcare Systems

Another example of successful market economies is seen in the healthcare systems of many countries. In a market-based healthcare system, the production and pricing of healthcare services are determined by supply and demand.

Market economies in healthcare allow for competition among providers, leading to a greater variety of services and lower prices for consumers. When healthcare decisions are driven by market forces, resources are allocated efficiently and based on consumer preferences.

Market economies also incentivize innovation and technological advancements in healthcare, as providers strive to attract consumers and gain a competitive edge.

Mixed Economies

It’s important to note that not all successful economies operate solely on free-market principles. Many countries have mixed economies, which combine elements of both market and command economies.

In mixed economies, the government plays a role in regulating certain industries, providing public goods, and addressing market failures. However, the majority of production and decision-making is left to the market forces.

Examples of successful mixed economies include countries like the United States and Germany, where a balance is struck between government intervention and free-market principles.

Defining Success

The definition of success in market economies can vary depending on the economist and their perspective. Some economists may focus on GDP growth, while others may prioritize income equality or environmental sustainability.

Overall, successful market economies are characterized by efficient allocation of resources, high economic growth, innovation, and improved living standards for their citizens.

In conclusion, market economies have proven to be successful in many countries when the decision-making is driven by market forces and business incentives. Whether operating on a free-market or mixed economy approach, the top market economies have seen significant economic and social advancements.

🔔 Market Economies vs. Planned Economies

Market economies and planned economies are two different systems for organizing and managing economic activities within a country. While market economies rely on free-market principles and individual decision-making, planned economies are centrally controlled by the government.

Defining Characteristics of Market Economies

In a market economy, the production, distribution, and pricing of goods and services are primarily determined by the interactions of buyers and sellers in the marketplace. The government’s role is typically limited to ensuring fair competition, protecting property rights, and enforcing contracts. Some defining characteristics of market economies include:

- Allocation of resources based on supply and demand

- Private ownership of businesses and property

- Freedom for individuals to make economic decisions

- Prices determined by market forces

- Profit motive driving economic activity

Defining Characteristics of Planned Economies

In a planned economy, the government controls the means of production and makes decisions about what goods and services should be produced, how they should be produced, and to whom they should be distributed. Some defining characteristics of planned economies include:

- Centralized control over economic activities

- Government ownership of businesses and property

- Government setting production goals and timetables

- Prices and allocation of resources determined by government planning

- Emphasis on collective goals and equitable distribution

Comparison of Market Economies and Planned Economies

Market economies and planned economies differ in several key aspects:

- Decision-Making: In market economies, decisions are made by individuals and businesses based on supply and demand. In planned economies, decisions are made by the government according to its goals and priorities.

- Ownership: Market economies emphasize private ownership, allowing individuals and businesses to own and operate their assets. In planned economies, the government owns and controls major industries and resources.

- Pricing: Market economies rely on the free-market system to determine prices based on supply and demand. In planned economies, the government sets prices and determines the allocation of resources.

- Efficiency: Market economies generally promote efficiency by allowing competition and the pursuit of profit. Planned economies focus on meeting the needs of the society as a whole, prioritizing social welfare over individual profit.

Examples of Market Economies

Most countries in the world have market economies to some extent. Some examples of countries with market economies include:

- United States

- United Kingdom

Examples of Planned Economies

Planned economies have been less common historically, but there have been several notable examples in the past:

- Soviet Union (until its dissolution in 1991)

- China (until economic reforms in the late 1970s)

- North Korea

In summary, market economies and planned economies represent two different approaches to economic organization. Market economies rely on individual decision-making, private ownership, and market forces to allocate resources and determine prices. Planned economies, on the other hand, are centrally controlled by the government, with decisions made at the national level according to planned goals and priorities.

🔔 Examples of Planned Economies

In contrast to market economies, which are driven by supply and demand, planned economies are systems where the government controls most aspects of economic activities. Here are some examples of planned economies:

1. Command Economy

In a command economy, the government directs all economic activities. It decides on production levels, resource allocation, and pricing. Examples of command economies include North Korea and Cuba.

2. Socialist Economy

Socialist economies have a central planning structure where the government determines production and distribution. They aim to address social inequalities through resource redistribution. Countries like China and Vietnam have socialist economies.

3. Mixed Economy with Central Planning

Some countries combine elements of both planned and market economies. While they still have a central planning structure, they also allow for some market forces in decision-making. China, for example, has transitioned from a purely planned economy to a mixed economy.

4. Former Soviet Union and Eastern Bloc

During the Cold War, several countries in the Soviet Union and Eastern Bloc operated under planned economies. The government controlled all aspects of production, and resources were distributed based on the needs defined by the government rather than consumer demand.

5. War-Time Economy

During periods of war, some countries adopt a planned economy to efficiently allocate resources for the war effort. This involves central planning and directing resources towards military production rather than consumer goods. Examples include the United States during World War II.

6. Ancient and Pre-Modern Planned Economies

In ancient and pre-modern times, some civilizations operated planned economies. For example, the Inca Empire in South America organized production and distribution based on the needs of society as a whole.

In summary, planned economies differ from market economies in terms of the central planning structure, pricing, decision-making, and ownership of property. While market economies rely on the invisible hand of supply and demand, planned economies aim to address social inequalities through government control and resource redistribution.

🔔 Comparing Market and Planned Economies

When it comes to economic systems, there are two primary models that countries operate under: market economies and planned economies. These two methods of organizing an economy have significant differences in terms of decision-making, resource allocation, and the role of the government. Let’s explore the contrasting features of these systems.

Market Economies

In a market economy, decisions about production, distribution, and pricing are primarily determined by the interactions of supply and demand. Here, individuals and businesses are free to engage in economic activities based on their self-interest. This means that the government’s role is typically limited to creating and enforcing regulations that ensure fair competition and protect property rights.

Market economies allow for the free movement of goods, services, and labor. Prices are determined by supply and demand, and they serve as signals that guide producers and consumers in their decision-making. Producers respond to higher demand by increasing supply, leading to a better allocation of resources and increased productivity. In contrast, if demand decreases, producers reduce supply accordingly.

One notable feature of market economies is the role of competition in driving efficiency. Companies are forced to improve their products and services in order to attract and retain customers. This constant drive for innovation and efficiency is a key driver of economic growth.

It’s important to note that market economies don’t guarantee equal outcomes for all citizens. The distribution of wealth and resources can vary significantly, depending on factors such as skills, education, and luck. Some individuals may thrive and accumulate wealth, while others may struggle to meet basic needs.

Planned Economies

In a planned economy, also known as a command economy, the government takes a more central role in making economic decisions. The government determines what goods and services are produced, how they are distributed, and at what prices. This system is characterized by centralized planning, where a central authority, such as the government, dictates production quotas and allocates resources.

Planned economies aim to address the inequalities and inefficiencies that can arise in free-market economies. By controlling the means of production, the government can redistribute wealth and ensure access to essential goods and services for all citizens, regardless of their ability to pay.

However, planned economies have their challenges. The lack of price signals and competition can lead to inefficiencies, limited choice, and shortages of goods and services. The central planning authorities may not accurately anticipate consumer demand, resulting in overproduction of certain goods and shortages of others. The lack of incentives for producers to innovate can also lead to stagnation and lower overall productivity.

While market and planned economies represent two extreme ends of the economic spectrum, most countries operate under mixed economies. These are systems that combine elements of both market and planned approaches. The specific balance between market forces and government intervention varies from country to country.

For example, countries like the United States and New Zealand have market economies with limited government intervention, while countries like Sweden and Norway have mixed economies with a more significant role for the government in areas such as healthcare and social welfare.

The defining method of managing an economy, whether market or planned, has a significant impact on a country’s economic growth, prosperity, and overall well-being. It’s important to recognize the strengths and weaknesses of both approaches when considering which system is most suitable for a particular country or situation.

🔔 Lessons from Market Economy Success Stories

A market economy is an economic system in which decisions regarding production, distribution, and consumption of goods and services are guided by the forces of supply and demand in free and competitive markets.

There are several success stories of market economies around the world that provide valuable lessons for other nations. These success stories demonstrate the benefits of a market economy in promoting economic growth, innovation, and efficiency. Here are some key lessons we can learn from these success stories:

1. The role of competition

In a market economy, competition is a driving force that leads to better products, lower prices, and increased efficiency. Successful market economies emphasize competition and create a level playing field for businesses to compete. This encourages innovation and ensures that resources are allocated efficiently.

2. The importance of property rights

Property rights are crucial for a market economy to function effectively. It provides individuals and businesses with the incentive to invest, innovate, and create wealth. Ensuring strong and enforceable property rights creates a sense of security and encourages long-term investment and economic growth.

3. The role of prices

Prices play a crucial role in a market economy. They provide information about the scarcity of goods and services and help allocate resources efficiently. In a market economy, prices are determined by the interaction of supply and demand. This price mechanism guides consumers and producers in making economic decisions.

4. The power of consumer sovereignty

In a market economy, consumers have the power to choose what they want to consume. This drives producers to satisfy consumer demands and ensures that resources are used efficiently. Consumer sovereignty is a key characteristic of market economies and is essential for economic growth and prosperity.

5. The benefits of free trade

Market economies thrive on free trade. Allowing the free flow of goods and services across borders encourages specialization, increases competition, and expands consumer choice. Successful market economies have embraced free trade and have seen the benefits of connecting with the global marketplace.

6. The role of entrepreneurship

Entrepreneurship is a driving force in market economies. Entrepreneurs identify opportunities, take risks, and create new businesses and jobs. Market economies provide an environment that fosters entrepreneurship and rewards innovation. Supporting entrepreneurship is essential for economic growth and prosperity.

In conclusion, the success stories of market economies demonstrate the effectiveness of free-market systems in creating wealth, promoting innovation, and improving living standards. By embracing competition, ensuring property rights, relying on prices, empowering consumers, embracing free trade, and supporting entrepreneurship, nations can achieve economic success and prosperity.

About BforB

The BforB Business Model is based on the concept of referral-based networking. Where small, intimate, and tightly knit teams drive strong relationships between each other based on a great understanding and deep respect for what each member delivers through their business, expanding those networks to neighboring groups.

Focused on strengthening micro, small, and medium business , BforB is the right place for you if you are looking:

- For a great environment to build deep relationships with people across many industries;

- To drive business growth through trusted relationships and quality referrals and introductions;

- To identify strategic alliances for your business to improve profitability;

- To dramatically improve your skills in pitching, networking, and selling exactly what you do;

- To grow your business, achieve and exceed your goals, and increase cash in the bank.

Case Studies in Business Economics, Managerial Economics, Economics Case Study, MBA Case Studies

Ibs ® case development centre, asia-pacific's largest repository of management case studies, mba course case maps.

- Business Models

- Blue Ocean Strategy

- Competition & Strategy ⁄ Competitive Strategies

- Core Competency & Competitive Advantage

- Corporate Strategy

- Corporate Transformation

- Diversification Strategies

- Going Global & Managing Global Businesses

- Growth Strategies

- Industry Analysis

- Managing In Troubled Times ⁄ Managing a Crisis ⁄ Product Recalls

- Market Entry Strategies

- Mergers, Acquisitions & Takeovers

- Product Recalls

- Restructuring / Turnaround Strategies

- Strategic Alliances, Collaboration & Joint Ventures

- Supply Chain Management

- Value Chain Analysis

- Vision, Mission & Goals

- Global Retailers

- Indian Retailing

- Brands & Branding and Private Labels

- Brand ⁄ Marketing Communication Strategies and Advertising & Promotional Strategies

- Consumer Behaviour

- Customer Relationship Management (CRM)

- Marketing Research

- Marketing Strategies ⁄ Strategic Marketing

- Positioning, Repositioning, Reverse Positioning Strategies

- Sales & Distribution

- Services Marketing

- Economic Crisis

- Fiscal Policy

- Government & Business Environment

- Macroeconomics

- Micro ⁄ Business ⁄ Managerial Economics

- Monetary Policy

- Public-Private Partnership

- Entrepreneurship

- Family Businesses

- Social Entrepreneurship

- Financial Management & Corporate Finance

- Investment & Banking

- Business Research Methods

- Operations & Project Management

- Operations Management

- Quantitative Methods

- Leadership,Organizational Change & CEOs

- Succession Planning

- Corporate Governance & Business Ethics

- Corporate Social Responsibility

- International Trade & Finance

- HRM ⁄ Organizational Behaviour

- Innovation & New Product Development

- Social Networking

- China-related Cases

- India-related Cases

- Women Executives ⁄ CEO's

- Effective Executive Interviews

- Video Interviews

Executive Brief

- Movie Based Case Studies

- Case Catalogues

- Case studies in Other Languages

- Multimedia Case Studies

- Textbook Adoptions

- Customized Categories

- Free Case Studies

- Faculty Zone

- Student Zone

Economics case studies

Covering micro as well as macro economics, some of IBSCDC's case studies require a prior understanding of certain economic concepts, while many case studies can be used to derive the underlying economic concepts. Topics like Demand and Supply Analysis, Market Structures (Perfect Competition, Monopoly, Monopolistic, etc.), Cost Structures, etc., in micro economics and national income accounting, monetary and fiscal policies, exchange rate dynamics, etc., in macro economics can be discussed through these case studies.

Browse Economics Case Studies By

Sub-Categories

- Government and Business Environment

- Micro / Business / Managerial Economics

- Public Private Partnership

- Aircraft & Ship Building

- Automobiles

- Home Appliances & Personal Care Products

- Minerals, Metals & Mining

- Engineering, Electrical & Electronics

- Building Materials & Construction Equipment

- Food, Diary & Agriculture Products

- Oil & Natural Gas

- Office Equipment

- Banking, Insurance & Financial Services

- Telecommunications

- e-commerce & Internet

- Transportation

- Entertainment

- Advertising

- IT and ITES

- Leisure & Tourism

- Health Care

- Sports & Sports Related

- General Business

- Business Law, Corporate Governence & Ethics

- Conglomerates

Companies & Organizations

- China Aviation Oil Corp

- De Beers and Lev Leviev

- Goldman Sachs

- Gordon Brown

- Iliad Group, France Telecom

- Lehman Brothers

- Merrill Lynch

- Mittal Arcelor

- Morgan Stanley

- Northern Rock

- Temasek Holdings

- Wachovia Wells Fargo

- Dominican Republic

- Netherlands

- North America

- Saudi Arabia

- South Africa

- South Korea

- United Kingdom

- United Arab Emirates

- United States

Recently Bought Case Studies

- SSS�s Experiment: Choosing an Appropriate Research Design

- Differentiating Services: Yatra.com�s �Click and Mortar�Model

- Wedding Services Business in India: Led by Entrepreneurs

- Shinsei Bank - A Turnaround

- Accenture�s Grand Vision: �Corporate America�s Superstar Maker�

- Tata Group�s Strategy: Ratan Tata�s Vision

- MindTree Consulting: Designing and Delivering its Mission and Vision

- Coca-Cola in India: Innovative Distribution Strategies with 'RED' Approach

- IndiGo�s Low-Cost Carrier Operating Model: Flying High in Turbulent Skies

- Evaluation of GMR Hyderabad International Airport Limited (GHIAL)

- Ambuja Cements: Weighted Average Cost of Capital

- Walmart-Bharti Retail Alliance in India: The Best Way Forward?

- Exploring Primary and Secondary Data: Lessons to Learn

- Global Inflationary Trends: Raising Pressure on Central Banks

- Performance Management System@TCS

- Violet Home Theater System: A Sound Innovation

- Consumer�s Perception on Inverters in India: A Factor Analysis Case

- Demand Forecasting of Magic Foods using Multiple Regression Analysis Technique

- Saturn Clothing Company: Measuring Customer Satisfaction using Likert Scaling

New Case Studies In Economics

- The Sri Lankan Economic Crisis � What Went Wrong?

- Crude Oil Market and the Law of Supply

- Understanding Crude Oil Demand

- The `C` Factor: Cement Industry in India � Unhealthy Oligopoly & Controls

- Venezuela`s Macroeconomic Crisis: An Enduring Ordeal of Worsening Economy with Alarming Inflation

- Guwahati Molestation Case: Professional Responsibility Vs Moral Ethics

- The Renaissance of the South Africa Music Industry

- EU BREAK-UP?

- The Cyprus Bailout - Is the European Zone Failing?

- Global Financial Crisis and ITS Impact on Real and Financial Sectors in India

Best Selling Case Studies In Economics

- Perfect Competition under eBay: A Fact or a Factoid?

- Mexican Telecom Industry: (Un)wanted Monopoly?

- Mobile Telephony in India: Would Cheaper Rates Bring More Profits?

- US Financial Crisis: The Fall of Lehman Brothers

- Executive Pay Package: A Study of Demand and Supply

- OPEC: The Economics of a Cartel (A)

- OPEC The Economics of a Cartel (B)

- OPEC: The Economics of a Cartel (C)

- Comparative Cost Advantage and the American Outsourcing Backlash

- Global Oil Prices: Demand Side vs Supply Side Factors

Video Inerviews

Case studies on.

- View all Casebooks »

Course Case Mapping For

- View All Course Casemaps »

- View all Video Interviews »

- Executive Briefs

- Executive Inerviews

- View all Executive Briefs »

Executive Interviews

- View All Executive Interviews »

Contact us: IBS Case Development Centre (IBSCDC), IFHE Campus, Donthanapally, Sankarapally Road, Hyderabad-501203, Telangana, INDIA. Mob: +91- 9640901313, E-mail: [email protected]

Connect with Us

- Entertainment

- Gadgets Review

- Government Schemes

- Make Money Online

- Product Review

- Uncategorized

Solving Case Study in Economics: A Complete Guide

case study in economics

Case studies are invaluable in economics education, providing students with real-world scenarios to apply theoretical concepts and analytical skills. However, solving a case study in economics requires a structured approach that combines research, critical thinking, and a deep understanding of economic principles. This post presents a comprehensive guide on effectively solving a case study in economics , ensuring a thorough analysis and a grasp of practical implications.

Understanding the Case Study

Read carefully: .

Begin by reading the case study thoroughly. Pay attention to the details, context, and objectives presented. Identify the main issues, stakeholders, and the economic concepts at play.

Define the Problem:

Clearly define the economic problem or challenge presented in the case study. What are the fundamental problems that ought to be handled? Understanding the problem is crucial before proceeding with analysis.Identify the central economic problem or challenge that the case study presents. This could involve issues related to demand and supply, market structures, externalities, government interventions, or any other economic concept.

Gathering Relevant Information

Research: .

Conduct thorough research to gather additional information relevant to the case study. This may involve exploring economic theories, statistical data, and industry trends. Reliable sources such as academic journals, government reports, and reputable news outlets are valuable.

Identify Variables:

Identify the variables affecting the situation presented in the case study. These could include economic indicators, market conditions, government policies, etc.

Read also: How Trademark Registration Can Help in Business

Applying Economic Concepts

Use relevant theories: .

Apply relevant economic theories and concepts to analyze the case study. Consider concepts like supply and demand, elasticity, market structure, cost analysis, and utility theory, depending on the case context.

Quantitative Analysis:

If applicable, use quantitative methods such as calculations, graphs, and charts to illustrate your analysis. These tools can help visualize economic relationships and trends.

Data Interpretation

Cause and effect:.

Identify the cause-and-effect relationships driving the economic situation in the case study. Analyze how changes in one variable can impact others and lead to specific outcomes.

Consider Alternatives:

Explore solutions or strategies to address the issues presented. Consider the possible benefits and drawbacks of each option.

Making Recommendations

Informed decisions: .

Based on your analysis, make informed recommendations for addressing the challenges outlined in the case study in economics. Your recommendations should be rooted in economic theories and supported by your gathered data.

Justify Your Recommendations:

Clearly explain the rationale behind your recommendations. How will they positively impact the stakeholders involved? Justify your choices with economic logic.

Read also: Best Practices for Workday Financial Management Integration

Tips for Success

Practice: .

The more case studies you solve, the more comfortable you’ll become with the process. Practice hones your analytical skills and enables you to apply economic concepts effectively.

Collaborate:

Engage in discussions with peers or instructors. Collaborative analysis can offer diverse perspectives and deepen your understanding of the case.

Real-World Context:

Relate the case study to real-world economic scenarios. Understanding the practical implications of your analysis adds depth to your recommendations.

Stay Updated:

Case study in economics is a dynamic field. Stay updated with current economic trends, policy changes, and market developments to enhance the relevance of your analysis.

Read the Case Thoroughly

Begin by reading the case study attentively. Familiarize yourself with the context, characters, and economic issues presented. Take notes as you read to highlight key information and identify the main problems.

Apply Relevant Economic Concepts

Next, apply the economic concepts and theories you’ve learned in your coursework to the identified problem. Consider how concepts like elasticity, opportunity cost, marginal analysis, and cost-benefit analysis can be applied to the situation.

Collect Data and Information

Gather relevant data and information that can support your analysis. This may include statistical data, market trends, historical information, and other relevant sources that substantiate your arguments.

Analyze and Evaluate

Conduct a thorough analysis of the situation. Identify the factors contributing to the problem and evaluate their impact. Use graphs, charts, and diagrams to represent your analysis and provide clarity visually.

Explore Alternatives

Generate possible solutions or alternatives to address the identified problem. Consider the pros and cons of each solution, keeping in mind economic feasibility, ethical implications, and potential outcomes.

Apply Economic Theories

When formulating solutions, apply economic theories and principles that align with the situation. For instance, if you’re dealing with a market failure, explore how government intervention or corrective measures can be applied based on economic theories like externalities or public goods.

Quantitative Analysis

If applicable, perform quantitative analysis using relevant mathematical or statistical tools. This could involve calculating elasticity break-even points or analyzing cost structures to support your recommendations.

Justify Your Recommendations

Ensure that your solutions are well-justified and backed by solid economic reasoning. Explain how each solution addresses the problem and aligns with economic theories.

Consider Real-World Constraints

Acknowledge any real-world constraints that might affect the implementation of your recommendations. This could include budgetary limitations, political considerations, or social factors.

Solving an case study in economics writing is an enriching experience that bridges theory and practice. It requires a structured approach, from understanding the case to making well-informed recommendations. By thoroughly analyzing the economic concepts, interpreting data, and applying relevant theories, you can arrive at strategic solutions that align with economic principles.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related News

How to migrate from Wix to WordPress – Ultimate Guide

7 Best Team Collaboration Tools for Remote & In-Person

You may have missed.

How to Personalize Custom Boxes for Special Occasions?

How to Fix NVIDIA GeForce Experience Error Code 0x0003

Style Mastery: Essential Tips for Every Woman’s Occasion

Creating High-Performance Teams for Success

Health and Insurance Bridging the Gap of Technology

UBO Verification: Understand the Ultimate Beneficial Owners

The Role of Government in Market Economies

Course Number 1195

Course Overview and Objectives

This course is about one question: What is the proper role of the government in the market economy? We study the role of government as it plays out in the real world, using vivid case studies from many countries, decades, and policy angles. At the same time, we align these cases with a rigorous theoretical framework that clarifies the circumstances under which government intervention in the market can improve outcomes.

The goal of this course is to deepen your insight into and influence on the debate over economic policy. Private-sector managers are better able to position their organizations, both defensively and offensively, if they understand why and how governments act. Moreover, exceptional private-sector leaders are now widely expected to provide informed, intelligent leadership on the policy issues at the heart of this course.

Career Focus

The course is designed for students who aim to lead private-sector institutions of systemic importance, influence public debates over government policy, or occupy policymaking positions at some point in their careers. The skills and knowledge it develops, however, are increasingly valuable to the broad range of businesses, non-profit organizations, and civil society institutions whose activities intersect with government policy.

Course Structure

The course opens with a case on why a hypothetical competitive market economy can be used as a starting point for analyzing what role government should play. Market economies are miraculous when at their best: flexible, decisive, and self-correcting.

But markets are not always at their best, and the first module of the course confronts major real-world departures from this hypothetical starting point. These departures mean that government policy can improve the efficiency of the economy, in principle making all individuals better off. Policy areas addressed here include antitrust regulation, environmental protection, education, health care, and fiscal and monetary policy.

We may want the government to do more than remove inefficiencies, so the second module tackles questions of economic justice and their implications for the government's role. In particular, in this module we study central debates over the taxation of individuals and firms, the provision of economic assistance, and the determination of the boundaries of policy.

As this summary shows, the cases we discuss take us step-by-step through a rigorous conceptual framework that provides the intellectual backbone for the course. At the same time, each case gives us a chance to examine an important policy area in some depth. Accompanying each case are a set of core concepts and suggested readings. The core concepts represent fundamental insights into the role of government, so an understanding of them can substantially increase one's ability to analyze a given policy decision. The suggested supplemental readings are starting points for pursuing areas of particular interest in greater detail. They include many foundational pieces of scholarship, as well as newer and less scholarly works that shed light on these issues.

Course Administration

Course grades will be based on class participation (50%) and a short paper (50%). For the paper, students will apply the tools and ideas from the course to prepare, with one or two partners if they wish, an analysis of a government policy problem of their choice. The course is designed so that the time required to prepare the paper is comparable to the time a student would devote to a final exam. Throughout the term, Professor Weinzierl will be available to meet with students by appointment. To arrange a meeting, please contact his assistant, Deannah Blemur, at [email protected] .

Copyright © 2022 President & Fellows of Harvard College. All Rights Reserved.

- Research & Outlook

Commodity Markets: Evolution, Challenges, and Policies

Commodity markets are integral to the global economy. Understanding what drives developments of these markets is critical to the design of policy frameworks that facilitate the economic objectives of sustainable growth, inflation stability, poverty reduction, food security, and the mitigation of climate change. This study is the first comprehensive analysis examining market and policy developments for all commodity groups, including energy, metals, and agriculture, over the past century. It finds that, while the quantity of commodities consumed has risen enormously, driven by population and income growth, the relative importance of commodities has shifted over time, as technological innovation created new uses for some materials and facilitated substitution among commodities. The study also shows that commodity markets are heterogeneous in terms of their drivers, price behavior, and macroeconomic impact on emerging markets and developing economies, and that the relationship between economic growth and commodity demand varies widely across countries, depending on their stage of economic development. Policy frameworks that enable countercyclical macroeconomic responses have become increasingly common—and beneficial. Other policy tools have had mixed outcomes.

PRAISE FOR THE BOOK

"Discussions in commodity-exporting emerging markets are often based on ideas with little empirical and analytical support. This book, based on vigorous research, is a great contribution to improve our understanding of these economies. It provides robust empirical evidence including a long-term perspective on commodity prices. It also contains very thoughtful policy analysis, with implications for resilience, macroeconomic policies, and development strategies. It will be a key reference for scholars as well as policy makers."

-- José De Gregorio, Dean of the School of Economic and Business, Universidad de Chile, Former Minister of Economy, Mining and Energy, and Governor of the Central Bank of Chile

" Commodity Markets: Evolution Challenges and Policies is a broad-ranging analysis of just about everything you have ever wanted to know about commodity markets. It has a broad sweep of commodity prices and production (primarily energy, metals, and agricultural commodities) over the past century, carefully documenting and rigorously analyzing the important difference in experiences across different groups of commodities. It is comprehensive in its historical coverage but also addresses contemporary issues such as an insightful analysis of the impact of the COVID19 pandemic and the Ukraine war on commodity prices. It draws out the impact of shocks, technology, and policy as drivers of demand and supply for a range of different commodities. This book is essential reading for anyone interested in the drivers of commodity prices and production over the last century and the implications for future trends."

-- Warwick McKibbin, Distinguished Professor of Economics and Public Policy, Director of the Centre for Applied Macroeconomic Analysis, Director of Policy Engagement at the Australian Research Centre of Excellence in Population Ageing Research, Australian National University

"A sound understanding of commodity markets is more essential than ever in light of the Covid-19 pandemic, the war in Ukraine, and the transition from fossil fuels to renewable energy commodities. This volume offers an excellent, comprehensive, and timely analysis of the wide range of factors that affect commodity markets. It carefully surveys historical and likely future trends in commodity supply, demand, and prices, and offers detailed policy proposals to avoid the havoc that turbulent commodity markets can cause on the economies of commodity exporters and importers."

-- Rick Van der Ploeg, Research Director of Oxford Centre for Analysis of Resource Rich Economies, University of Oxford

"Commodity prices tend to be seen as an aggregate, especially when they periodically move upward together. While these aggregate movements are important, this excellent and well-researched volume emphasizes the heterogeneity of commodity markets and the differing economic forces that act upon them. Heterogeneity calls for differentiated and tailored policy tools that take into account the specificities of markets, a message that analysts and policy makers would do well to heed."

-- Ravi Kanbur, T.H. Lee Professor of World Affairs, International Professor of Applied Economics and Management, Cornell University

"Commodity markets are complex and constantly evolving. This insightful and well-structured study of all the ins and outs of commodity markets is a valuable addition to the literature for understanding how these markets function and their impacts on the global economy. As the war in Ukraine and the COVID-19 pandemic continue to have substantial impacts on commodity prices and supply chains, this incredibly timely study offers analysts and policy makers a firm foundation for making better predictions and developing more effective policy responses."

-- Abdolreza Abbassian, Former FAO Senior Economist, and G20-AMIS Secretary

"I wish I had this book earlier in my career! Commodity Markets: Evolution, Challenges, and Policies provides an insightful analysis of the dynamics of commodity markets and their implications on the broader economy. A must-read for anyone interested in commodity markets. "

-- Xiaoli Etienne, Associate Professor and Idaho Wheat Commission Endowed Chair in Commodity Risk Management, University of Idaho

"While many African countries were spared the ravages of the Covid-19 pandemic, their economies suffered because commodity prices collapsed. Since then, the war in Ukraine has affected developing countries thousands of miles away because the price of oil, gas, and food have spiked. Commodity markets not only receive the impact of global shocks, but they transmit them to commodity-dependent countries around the world. This book lucidly explains how these shocks affect commodity markets and, in turn, how fluctuations in these markets affect developing economies. As the world deals with climate change and the energy transition, these findings will become even more important."

-- Shanta Devarajan, Professor of the Practice of International Development, Georgetown University

"This book brings into one place otherwise scattered information on the evolution of commodity markets, causes and impacts of price shocks, and the drivers and implications of commodity demand. These are issues of great importance to policy makers, particularly in commodity-dependent developing countries. Three major events that have recently affected commodity markets, namely, the energy transition, the COVID-19 pandemic, and the war in Ukraine, highlight the vulnerability of commodity-dependent countries to price shocks. This book should be a source of inspiration for these countries as they attempt to move away from the commodity dependence trap that has afflicted them for so long. I strongly recommend this book to colleagues working on the topic."

-- Janvier Nkurunziza, Officer in Charge, Commodities Branch, United Nations Conference on Trade and Development

" Commodity Markets: Evolution, Challenges, and Policies will provide the J.P. Morgan Center for Commodities with the comprehensive textbook we have always wanted to write. Currently, the vast majority of commodity-related textbooks are dominated by trading issues, with a limited focus on market fundamentals. As a result, our instructors typically rely on a wide mix of articles, book chapters, and case studies for their respective courses. By providing a comprehensive detailed coverage of these issues, this book fills a major gap in the literature."

-- Tom Brady, Executive Director, J.P. Morgan Center for Commodities, University of Colorado Denver

OTHER BOOKS ON THE GLOBAL ECONOMY

Falling Long-Term Growth Prospects: Trends, Expectations, and Policies (March 2023)

The Long Shadow of Informality: Challenges and Policies (May 2021)

Global Productivity: Trends, Drivers, and Policies (July 2020)

Global Waves of Debt: Causes and Consequences (December 2019)

A Decade After the Global Recession (November 2019)

Inflation in Emerging and Developing Economies (November 2018)

- Key Downloads Full report | Foreword | Summary

- All Charts Zip file (4.2 MB)

- Presentation East Asia Outreach (PDF)

Media Inquiries

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Note that the Economics 103 Case Studies are meant to supplement the course material by giving you experience applying Economic concepts to real world examples. While they are beyond the level you will be tested on, they are useful for students who want a stronger grasp of the concepts and their applications.

Note that this case study is difficult if you do not print the diagrams, or reproduce them on graph paper. If you are unable to print, we recommend reviewing the solutions to ensure you understand the general lessons presented.

In 2016 rental vacancy rates dropped to as low as 0.6% in Greater Victoria. When compared to the national average of 3.3% it is clear why many media channels and individuals were calling it a ‘housing crisis’. Students were especially hit hard by these low vacancies, with some international students at Camoson college having to return home when they couldn’t find a place to stay. Using our competitive market model, let’s examine some of the factors that played into this crisis and policies that could be used to fix it.

Read more about the Victoria Housing crisis.

Below is a representation of the Victoria Housing Market.

1. Label Figure CS3 a. with the Equilibrium price and quantity, and label supply and demand curves as either renters or landlords.

If supply is equal to demand there should be no vacancy, but we know that a 0% vacancy rate would be an extremely difficult market for renters.

2. Explain why a housing market at equilibrium could still have a vacancy rate of 4%.

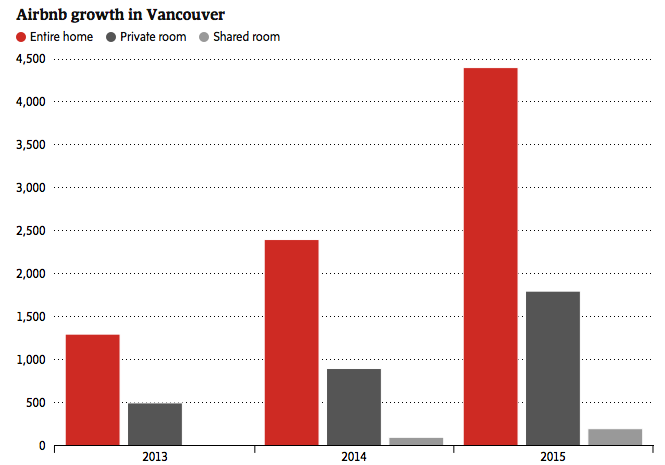

One factor that has been blamed for the housing crisis is Airbnb. Airbnb describes itself as an online marketplace and hospitality service, enabling people to list or rent short-term lodging including vacation rentals, apartment rentals, homestays, hostel beds, or hotel rooms, with the cost of lodging set by the property owner. City councillors have targeted these short term rentals, saying that many landlords have opted to Airbnb their home, rather than rent out longer term. The growth of Airbnb in Vancouver has been shown below.

3. Assume 3000 landlords decide to switch from renting to Airbnb, show the impact of the changes on Figure CS3 b. Label the new equilibrium price and quantity.

Note that Airbnb has been adamant that short-term rentals have had a neglible impact on the housing market, citing that in Vancouver only 320 hosts rent out thier properties often enough to make more money that long term rentals. That represents only 0.11% of the total housing units. In Victoria, that would mean only 25 units are affected by short-term rentals.

Tom Davidoff , a University of B.C. business professor, said t he general public frequently looks at the fact that Airbnb is popular in expensive neighbourhoods and concludes that it is Airbnb that drives up rents there. But, he said, those neighbourhoods were expensive anyway and the impact of Airbnb taking a certain slice of the available stock is minimal.

Read more about Airbnb’s supposed impact on the market.

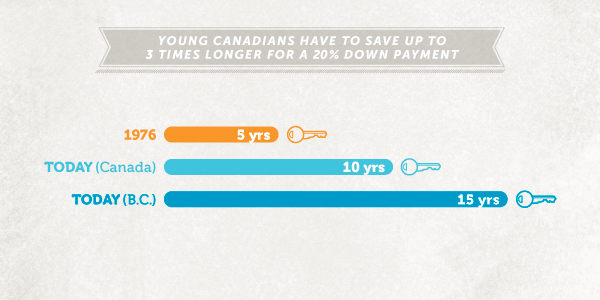

Another factor that has had an impact on the rental market is the inability of many young Canadians to buy homes. Not only have house prices skyrocketed, but more are burdened by student loans out of university. It is estimated that it takes 3 times longer (15 years) to save enough to have a 20% downpayment on a house than it did in 1976. This reduction in Canadians mortgaging a home has caused an increasing amount to enter the market.

Read more about the increasing squeeze on millennials.

4. Assume 9000 new renters enter the market instead of mortgaging homes, show the impact of the changes on Figure CS3 b. Explain the impact of both the shock from Airbnb and the shock from less housing buyers on equilibrium price and quantity. Do the shocks work together or oppose one another?

In the housing market, prices are slow to adjust, landlords cannot simply raise prices immediately under the Residential Tenancy Act. Landlords can only raise prices when negotiating a new contract. This causes many unjustified evictions from landlords as they want to charge the new equilibrium price. In the short-term, prices stay relatively the same causing shortages or surplus.

5. Assume price remains at the original equilibrium , calculate the magnitude of the shortage or surplus of housing that results. Explain the impact this shortage will have the behaviour of landlords.

The British Columbia government unveiled a $500-million affordable-housing plan targeted at communities that have struggled with a shortage of low-cost housing. Premier Christy Clark announced her government’s commitment to fund 68 new projects to help address the crisis

Read more about the governments response to the housing crisis.

6. Assume the government wants to bring price back to it’s original level, if it costs $50,000 to increase the number of rental units by one, how much will this cost the government?

Groups have criticized the government response, saying that they have ignored many other avenues that could more easily increase the supply of affordable housing.

7. Read the Executive Summary of the Alliance of BC Students White Paper on Student Housing.

What is the ABCS proposing that could help decrease price in the market? How would this affect supply and/or demand?

In this case study we have shown how microeconomic concepts of supply and demand can be used to understand current events in the news. Do you have a story you think would make a good case study? Contact [email protected] to propose your story.

Principles of Microeconomics Copyright © 2017 by University of Victoria is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

- Browse All Articles

- Newsletter Sign-Up

EmergingMarkets →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Economic Perspectives on Government pp 17–45 Cite as

Markets, Market Failure and the Role of Government

- Keith Dowding 5 &

- Brad R. Taylor 6

- First Online: 10 July 2019

373 Accesses

Part of the book series: Foundations of Government and Public Administration ((FGPA))

This chapter introduces Pareto efficiency as the key normative concept of welfare economics and describes the conditions under which we expect efficiency or market failure. We pay particular attention to the existence of externalities and show how these can, but do not always, cause markets to fail. Whenever there is market failure it is conceptually possible for government to intervene in order to improve outcomes. Government failure also occurs, however, and so such intervention is not always practical. When considering imperfect alternatives, we must engage in comparative institutional analysis.

- Pareto efficiency

- Market competition

- Market failure

- Externalities

- Government failure

- Coase theorem

- Asymmetric information

This is a preview of subscription content, log in via an institution .

Buying options

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

In the standard analysis, the tax is levied on the production of the good itself. As Plott ( 1966 ) points out, the tax should instead be levied on the output of the externality (i.e. the pollution) or on the resource which causes the pollution. This provides the right incentives for firms to change their production process to remove externalities rather than simply reducing production. Since it does not alter the central points we wish to make in this chapter, we will use the simpler case of taxes imposed on the output of a good.

Inframarginal externalities can in some cases be inefficient in the sense that net benefits would be increased by moving from equilibrium to a much smaller or greater level of output, even though marginal changes would cause inefficiency (Buchanan and Stubblebine 1962 : 374).

Akerlof, G. A. (1970). The market for ‘lemons’: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488–500.

Article Google Scholar

Alchian, A. A. (1950). Uncertainty, evolution, and economic theory. Journal of Political Economy, 58, 211–221.

Booth, P. (2008). Market failure: A failed paradigm. Economic Affairs, 28, 72–74.

Buchanan, J. M., & Stubblebine, W. C. (1962). Externality. Economica, 29, 371–384.

Cheung, S. N. (1973). The fable of the bees: An economic investigation. Journal of Law and Economics, 16, 11–33.

Coase, R. H. (1937). The nature of the firm. Economica, 4, 386–405.

Coase, R. H. (1960). The problem of social cost. Journal of Law and Economics, 3, 1–44.

Coase, R. H. (1992). The institutional structure of production. American Economic Review, 82, 713–719.

Google Scholar

Colander, D. (2007). Retrospectives: Edgeworth’s hedonimeter and the quest to measure utility. Journal of Economic Perspectives, 21, 215–226.

Demsetz, H. (1969). Information and efficiency: Another viewpoint. Journal of Law and Economics, 12, 1–22.

Friedman, D. D. (1990). Price theory: An intermediate text (2nd ed.). Cincinnati: South-Western University Press.

Friedman, M. (1953). The methodology of positive economics. In Essays in positive economics (pp. 3–47). Chicago: University of Chicago Press.

Hayek, F. A. (1945). The use of knowledge in society. American Economic Review, 35, 519–530.

Hayek, F. A. (1948). The meaning of competition. In Individualism and economic order (pp. 92–106). Chicago: University of Chicago Press.

Hicks, J. R. (1939). The foundations of welfare economics. Economic Journal, 49, 696–712.

Kaldor, N. (1939). Welfare propositions of economics and interpersonal comparisons of utility. Economic Journal, 49, 549–552.

Keech, W. R., & Munger, M. C. (2015). The anatomy of government failure. Public Choice, 164, 1–42.

Meade, J. E. (1952). External economies and diseconomies in a competitive situation. Economic Journal, 62, 54–67.

Munger, M. C. (2011). Euvoluntary or not, exchange is just. Social Philosophy and Policy, 28, 192–211.

Okun, A. M. (2015). Equality and efficiency: The big tradeoff . Washington, DC: Brookings Institution Press.

Pareto, V. (1906). Manuale di economia politica . Milan: Società Editrice Libraria.

Pigou, A. (1920). The economics of welfare . London: Macmillan.

Plott, C. R. (1966). Externalities and corrective taxes. Economica, 33, 84–87.

Schumpeter, J. A. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle . Cambridge, MA: Harvard University Press.

Smith, A. (1776). An inquiry into the nature and causes of the wealth of nation . Oxford: Clarendon Press.

Book Google Scholar

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87, 355–374.

Stigler, G. J. (1961). The economics of information. Journal of Political Economy, 69, 213–225.

Download references

Author information

Authors and affiliations.

School of Politics and International Relations, Australian National University, Canberra, ACT, Australia

Keith Dowding

School of Commerce, University of Southern Queensland, Springfield, QLD, Australia

Brad R. Taylor

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Keith Dowding .

Rights and permissions

Reprints and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter.

Dowding, K., Taylor, B.R. (2020). Markets, Market Failure and the Role of Government. In: Economic Perspectives on Government. Foundations of Government and Public Administration. Palgrave Pivot, Cham. https://doi.org/10.1007/978-3-030-19707-0_2

Download citation

DOI : https://doi.org/10.1007/978-3-030-19707-0_2

Published : 10 July 2019

Publisher Name : Palgrave Pivot, Cham

Print ISBN : 978-3-030-19706-3

Online ISBN : 978-3-030-19707-0

eBook Packages : Political Science and International Studies Political Science and International Studies (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

6.3 Market Failure

Learning objectives.

- Explain what is meant by market failure and the conditions that may lead to it.

- Distinguish between private goods and public goods and relate them to the free rider problem and the role of government.

- Explain the concepts of external costs and benefits and the role of government intervention when they are present.

- Explain why a common property resource is unlikely to be allocated efficiently in the marketplace.

Private decisions in the marketplace may not be consistent with the maximization of the net benefit of a particular activity. The failure of private decisions in the marketplace to achieve an efficient allocation of scarce resources is called market failure . Markets will not generate an efficient allocation of resources if they are not competitive or if property rights are not well defined and fully transferable. Either condition will mean that decision makers are not faced with the marginal benefits and costs of their choices.

Think about the drive that we had you take at the beginning of this chapter. You faced some, but not all, of the opportunity costs involved in that choice. In particular, your choice to go for a drive would increase air pollution and might increase traffic congestion. That means that, in weighing the marginal benefits and marginal costs of going for a drive, not all of the costs would be counted. As a result, the net benefit of the allocation of resources such as the air might not be maximized.

Noncompetitive Markets

The model of demand and supply assumes that markets are competitive. No one in these markets has any power over the equilibrium price; each consumer and producer takes the market price as given and responds to it. Under such conditions, price is determined by the intersection of demand and supply.

In some markets, however, individual buyers or sellers are powerful enough to influence the market price. In subsequent chapters, we will study cases in which producers or consumers are in a position to affect the prices they charge or must pay, respectively. We shall find that when individual firms or groups of firms have market power, which is the ability to change the market price, the price will be distorted—it will not equal marginal cost.

Public Goods

Some goods are unlikely to be produced and exchanged in a market because of special characteristics of the goods themselves. The benefits of these goods are such that exclusion is not feasible. Once they are produced, anyone can enjoy them; there is no practical way to exclude people who have not paid for them from consuming them. Furthermore, the marginal cost of adding one more consumer is zero. A good for which the cost of exclusion is prohibitive and for which the marginal cost of an additional user is zero is a public good . A good for which exclusion is possible and for which the marginal cost of another user is positive is a private good .

National defense is a public good. Once defense is provided, it is not possible to exclude people who have not paid for it from its consumption. Further, the cost of an additional user is zero—an army does not cost any more if there is one more person to be protected. Other examples of public goods include law enforcement, fire protection, and efforts to preserve species threatened with extinction.

Free Riders

Suppose a private firm, Terror Alert, Inc., develops a completely reliable system to identify and intercept 98% of any would-be terrorists that might attempt to enter the United States from anywhere in the world. This service is a public good. Once it is provided, no one can be excluded from the system’s protection on grounds that he or she has not paid for it, and the cost of adding one more person to the group protected is zero. Suppose that the system, by eliminating a potential threat to U.S. security, makes the average person in the United States better off; the benefit to each household from the added security is worth $40 per month (about the same as an earthquake insurance premium). There are roughly 113 million households in the United States, so the total benefit of the system is $4.5 billion per month. Assume that it will cost Terror Alert, Inc., $1 billion per month to operate. The benefits of the system far outweigh the cost.

Suppose that Terror Alert installs its system and sends a bill to each household for $20 for the first month of service—an amount equal to half of each household’s benefit. If each household pays its bill, Terror Alert will enjoy a tidy profit; it will receive revenues of more than $2.25 billion per month.

But will each household pay? Once the system is in place, each household would recognize that it will benefit from the security provided by Terror Alert whether it pays its bill or not. Although some households will voluntarily pay their bills, it seems unlikely that very many will. Recognizing the opportunity to consume the good without paying for it, most would be free riders. Free riders are people or firms that consume a public good without paying for it. Even though the total benefit of the system is $4.5 billion, Terror Alert will not be faced by the marketplace with a signal that suggests that the system is worthwhile. It is unlikely that it will recover its cost of $1 billion per month. Terror Alert is not likely to get off the ground.

The bill for $20 from Terror Alert sends the wrong signal, too. An efficient market requires a price equal to marginal cost. But the marginal cost of protecting one more household is zero; adding one more household adds nothing to the cost of the system. A household that decides not to pay Terror Alert anything for its service is paying a price equal to its marginal cost. But doing that, being a free rider, is precisely what prevents Terror Alert from operating.

Because no household can be excluded and because the cost of an extra household is zero, the efficiency condition will not be met in a private market. What is true of Terror Alert, Inc., is true of public goods in general: they simply do not lend themselves to private market provision.

Public Goods and the Government

Because many individuals who benefit from public goods will not pay for them, private firms will produce a smaller quantity of public goods than is efficient, if they produce them at all. In such cases, it may be desirable for government agencies to step in. Government can supply a greater quantity of the good by direct provision, by purchasing the public good from a private agency, or by subsidizing consumption. In any case, the cost is financed through taxation and thus avoids the free-rider problem.

Most public goods are provided directly by government agencies. Governments produce national defense and law enforcement, for example. Private firms under contract with government agencies produce some public goods. Park maintenance and fire services are public goods that are sometimes produced by private firms. In other cases, the government promotes the private consumption or production of public goods by subsidizing them. Private charitable contributions often support activities that are public goods; federal and state governments subsidize these by allowing taxpayers to reduce their tax payments by a fraction of the amount they contribute.

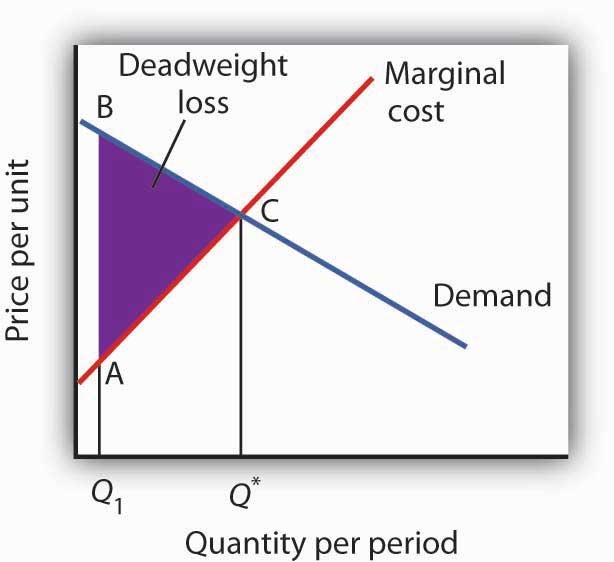

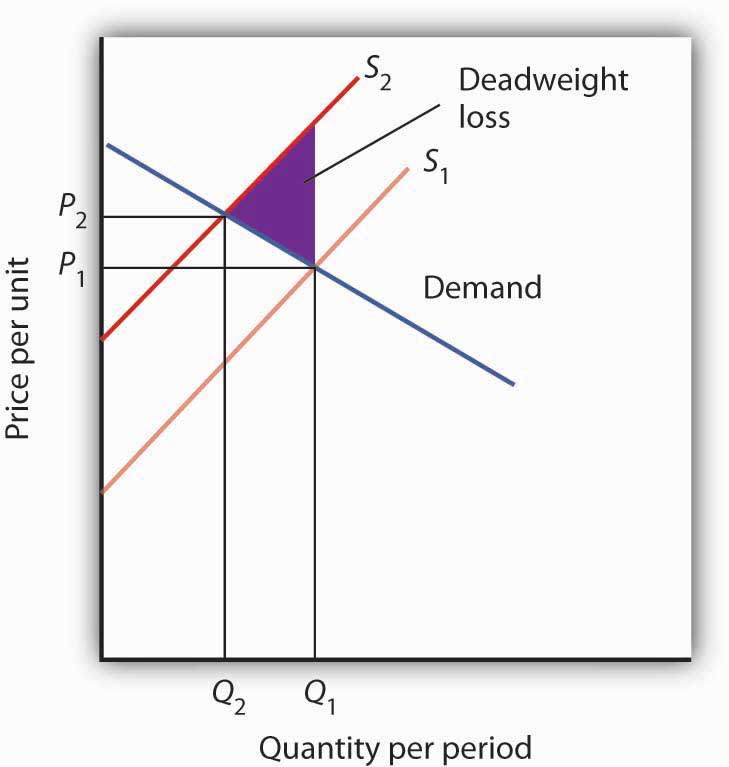

Figure 6.15 Public Goods and Market Failure

Because free riders will prevent firms from being able to require consumers to pay for the benefits received from consuming a public good, output will be less than the efficient level. In the case shown here, private donations achieved a level of the public good of Q 1 per period. The efficient level is Q *. The deadweight loss is shown by the triangle ABC.

While the market will produce some level of public goods in the absence of government intervention, we do not expect that it will produce the quantity that maximizes net benefit. Figure 6.15 “Public Goods and Market Failure” illustrates the problem. Suppose that provision of a public good such as national defense is left entirely to private firms. It is likely that some defense services would be produced; suppose that equals Q 1 units per period. This level of national defense might be achieved through individual contributions. But it is very unlikely that contributions would achieve the correct level of defense services. The efficient quantity occurs where the demand, or marginal benefit, curve intersects the marginal cost curve, at Q *. The deadweight loss is the shaded area ABC; we can think of this as the net benefit of government intervention to increase the production of national defense from Q 1 up to the efficient quantity, Q *.

Note that the definitions of public and private goods are based on characteristics of the goods themselves, not on whether they are provided by the public or the private sector. Postal services are a private good provided by the public sector. The fact that these goods are produced by a government agency does not make them a public good.

External Costs and Benefits

Suppose that in the course of production, the firms in a particular industry generate air pollution. These firms thus impose costs on others, but they do so outside the context of any market exchange—no agreement has been made between the firms and the people affected by the pollution. The firms thus will not be faced with the costs of their action. A cost imposed on others outside of any market exchange is an external cost .

We saw an example of an external cost in our imaginary decision to go for a drive. Here is another: violence on television, in the movies, and in video games. Many critics argue that the violence that pervades these media fosters greater violence in the real world. By the time a child who spends the average amount of time watching television finishes elementary school, he or she will have seen 100,000 acts of violence, including 8,000 murders, according to the American Psychological Association. Thousands of studies of the relationship between violence in the media and behavior have concluded that there is a link between watching violence and violent behaviors. Video games are a major element of the problem, as young children now spend hours each week playing them. Fifty percent of fourth-grade graders say that their favorite video games are the “first person shooter” type 1 .

Any tendency of increased violence resulting from increased violence in the media constitutes an external cost of such media. The American Academy of Pediatrics reported in 2001 that homicides were the fourth leading cause of death among children between the ages of 10 and 14 and the second leading cause of death for people aged 15 to 24 and has recommended a reduction in exposure to media violence (Rosenberg, M., 2003). It seems reasonable to assume that at least some of these acts of violence can be considered an external cost of violence in the media.

An action taken by a person or firm can also create benefits for others, again in the absence of any market agreement; such a benefit is called an external benefit . A firm that builds a beautiful building generates benefits to everyone who admires it; such benefits are external.

External Costs and Efficiency

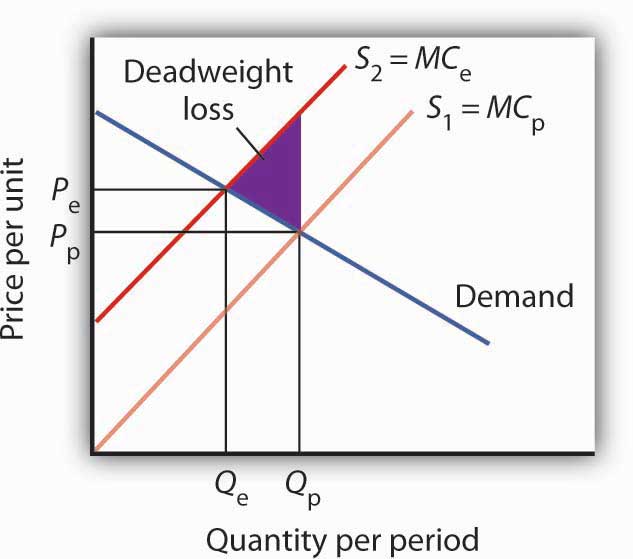

Figure 6.16 External Costs

When firms in an industry generate external costs, the supply curve S 1 reflects only their private marginal costs, MC P . Forcing firms to pay the external costs they impose shifts the supply curve to S 2 , which reflects the full marginal cost of the firms’ production, MC e . Output is reduced and price goes up. The deadweight loss that occurs when firms are not faced with the full costs of their decisions is shown by the shaded area in the graph.

The case of the polluting firms is illustrated in Figure 6.16 “External Costs” . The industry supply curve S 1 reflects private marginal costs, MC p . The market price is P p for a quantity Q p . This is the solution that would occur if firms generating external costs were not forced to pay those costs. If the external costs generated by the pollution were added, the new supply curve S 2 would reflect higher marginal costs, MC e . Faced with those costs, the market would generate a lower equilibrium quantity, Q e . That quantity would command a higher price, P e . The failure to confront producers with the cost of their pollution means that consumers do not pay the full cost of the good they are purchasing. The level of output and the level of pollution are therefore higher than would be economically efficient. If a way could be found to confront producers with the full cost of their choices, then consumers would be faced with a higher cost as well. Figure 6.16 “External Costs” shows that consumption would be reduced to the efficient level, Q e , at which demand and the full marginal cost curve ( MC e ) intersect. The deadweight loss generated by allowing the external cost to be generated with an output of Q p is given as the shaded region in the graph.

External Costs and Government Intervention