The Official Journal of the Pan-Pacific Association of Input-Output Studies (PAPAIOS)

- Open access

- Published: 09 May 2020

Tax structure and economic growth: a study of selected Indian states

- Yadawananda Neog ORCID: orcid.org/0000-0002-3578-0460 1 &

- Achal Kumar Gaur 1

Journal of Economic Structures volume 9 , Article number: 38 ( 2020 ) Cite this article

49k Accesses

26 Citations

3 Altmetric

Metrics details

The present study examines the long-run and short-run relationship between tax structure and state-level growth performance in India for the period 1991–2016. The analysis in this paper is based on the model of Acosta-Ormaechea and Yoo ( 2012 ), and for the verification of the relationship between taxation and economic growth the panel regression method is used. With the use of 14 Indian states data, Panel Pool mean group estimation indicates that income tax and commodity–service tax have negative effects whilst property and capital transaction tax have a significant positive effect on state economic growth. This study finds ‘U’ shape relationship between tax structure and growth performance. Based on the analysis, we conclude that for faster growth of Indian states, policymakers should give more focus on property taxes along with the reduction in income taxes.

1 Introduction

The study on the potential association between tax structure and growth performance has gathered a great deal of attention from policymakers, academicians and regulatory circles for several reasons. First, the developing and emerging economies require a large volume of tax revenues for the smooth and efficient functioning of the state at both the national and sub-national levels. Globalization has laid down the foundation for Goods and Service Tax (GST) in many developing countries (Mcnabb 2018 ). Due to competition, developing countries are also facing the difficulties to maintain existing tax revenues (Bird and Zolt 2011 ). Second, tax collection and structure of it create distortionary impacts in the economy through tax burden. Thus, the positive and negative impact of tax made the ‘tax–growth’ relationship more complex and the structure of taxation has a definite role in the development process of an economy.

In a budget constraint economy like India, investigation of tax–growth relationship enables us to formulate the suitable policy measure for the more inclusive and equitable growth process. The budget crisis is usually resolved through the cut-down of public spending or/and an increase in tax revenues (Macek 2014 ). Rapid reduction in spending or increase in taxes is harmful to long-run growth performance. Thus, the concern of the government lies with the problem of fiscal consolidation with sustainable growth performance where tax policies are vital.

Empirical evidence on the impact of tax structure on growth performance is not conclusive. India has adopted the Goods and Service Tax (GST) policy in 2017 intending to raise indirect tax collections and transform the indirect tax structure into a single market to avoid tax evasions and double taxation. GST is regarded as one of the major tax policy changes in independent India and economists are an optimist about its impact on revenue generations and growth performance. But this policy is not the only policy that shaped in independent India; other major policy changes also take place after independence. Footnote 1 Tax Reform Committee (TRC) report of 1991 regarded one of the productive and structured policy recommendations in the recent decade. At the state level, sales tax reform in the form of Value Added Tax (VAT) in 2005 becomes a fruitful policy initiative. However, the tax collections in both national and sub-national level are still low as compared to the international standards. Changes in tax policy also change in the tax structure in the economy and India witnessed these changes at both levels of governments. Recent studies proved that the changes in tax structure have decisive implication in the growth performance through work–leisure behaviour, investment decisions and overall productivity (Arnold et al. 2011 ; Gemmell et al. 2011 ; Macek 2014 ; Mdanat et al. 2018 ; Durusu-Ciftci 2018 ). In India, very few empirical studies are available which analyse the impact of these changes in tax structure on growth performance and this study will be first to investigate tax–growth nexus in India with the use of state-level data.

This analysis primarily concerned with tax structure rather than to tax levels (usually measured as a tax–GDP ratio). The main advantage of tax structure analysis is that it provides revenue-neutral tax policy changes which remove the difficulties related with the question of how aggregate tax revenue changes relates with expenditure changes (Arnold et al. 2011 ). The empirical results from linear panel regression suggest us that property and capital transection tax are positively affecting the state’s growth performance, where commodity and service tax effect negatively. However, the non-linear panel regression indicates that the positive effect is only visible for property taxes at a higher level where the negative effect of commodity and service taxes becomes positive after a threshold point. The effect of income tax is not significant in long run irrespective of panel regression models.

The structure of the paper is as follows: Sect. 2 deals with the theoretical framework and empirical literature, followed by a brief description of data and methodology in Sect. 3 . Empirical results and discussion are presented in Sect. 4 and our last Sect. 5 is for conclusions and recommendations.

2 Theoretical framework and empirical literature

Growth literature very recently acknowledges the role of taxation in the growth process of an economy. Until recently, growth models are more concerned with the steady-state process and exogenous changes. On the theoretical ground, taxation does not have any impact on growth (Myles 2000 ). Development of endogenous growth models creates the space for fiscal policy especially tax policy in determining the growth performance. Barro ( 1990 ), King and Rebello ( 1990 ) and Jones et al. ( 1993 ) were the pioneer in this regard. Tax level and tax structure have an impact on the saving behaviour of the household and investment in human capital. On the other hand, the firm also changes its investment decisions and innovations following tax policies (Johansson et al. 2008 ). These decisions and incentives in the accumulation of physical and human capital create the ‘Growth’ disparities amongst the countries and state economies.

A large body of literature available on “Tax-Growth” relationship is mostly dedicated to cross-country settings (Martin and Fardmanesh 1990 ; Karras 1999 ; Myles 2000 ; Tosun and Abizadeh 2005 ; Johansson et al. 2008 ; Vartia et al. 2008 ; Arnold 2011 ; Szarowska 2013; Macek 2014 ; Stoilova 2017 ; Safi et al. 2017 ; Durusu-Ciftci 2018 ) that investigates the effect of tax policy on economic performance. Income and corporation taxes are the major tax instruments for the governments irrespective of the level of developments of a country. The formation of tax structure with these two taxes has many implications in the growth performance. The study made by Arnold et al. ( 2011 ), Macek ( 2014 ) and Dackehag and Hansson ( 2012 ) has explored the negative relation of income and corporation tax with growth performance. Vartia et al. ( 2008 ) find the negative impact of corporation tax for OECD countries. If we consider the average and marginal tax rate, marginal tax is very influential than to average tax rate in investment decisions and labour supply. Empirical studies prove that marginal tax has a negative relation with growth, which indicate raising of marginal tax rate is associated with compromises with growth performance (Padovano and Galli 2001 ; Lee and Gordon 2005 ; Poulson and Kaplani 2008 ). Studies also established that other type of taxes also has a significant impact on growth performance, like consumption tax (Johansson et al. 2008 ; Durusu-Ciftci 2018 ), GST and Payroll (Tosun and Abizadeh 2005 ), property tax (Xing 2011 ), labour tax (Szarowska 2014 ), sales tax (Ojede and Yamarik 2012 ), excise (Reynolds 2006 ), etc.

However, looking at the single country’s perspective, we find very little evidence on the same. Stockey and Rebelo ( 1995 ) with the use of the endogenous growth model study the role of tax reforms on U.S. growth performance. They have found that tax reforms have very minor implication with economic outcomes. There are several studies exist for US economy where they empirically try to establish the link between tax and growth. Atems ( 2015 ) finds the spatial spillover effect of income taxes on the growth of 48 contiguous states. On the other hand, Ojede and Yamarik ( 2012 ) have not found any kind of impact of income taxes on growth in these states. Their panel pool mean group estimation indicates that property and sales tax has detrimental consequences in development. With the use of data for the U.S. covering the period of 1912–2006, Barro and Redlick ( 2009 ) find that average marginal income taxes were halting the economic growth. However, they have provided an interesting argument that in wartime, the tax does not have any kind of relation with growth. In search of an answer to the question that whether corporate tax rise destroys jobs in the U.S., Ljungqvist and Smolyansky ( 2016 ) use firm-level data for the period 1970–2010. The main conclusion of the paper is that a rise in corporate tax is not good for employment and income and has very little impact on economic activity. Using the error correction model, Mdanat et al. ( 2018 ) find for Jordan that income tax, corporation tax and personal tax negatively impact the growth. They suggest that irrespective of tax collection, the prime focus of the government should be social justice of the people. Dladla and Khobai ( 2018 ) also find similar results for South Africa where income taxes are coming out to be negative. For the case of Italy, Federici and Parisi ( 2015 ) used the 880 firms’ data and results show that corporation tax is bad for investments with the consideration of both effective average and marginal taxes rates.

Looking at the literature, the empirical relationship of tax structure with growth performance is still unclear for India. This study attempts to fill the gap by examining the effect of tax policy on economic performance in an emerging economy such as India at the state level. Second, with the use of panel Pool Mean Group (PMG) estimator which assumes slope homogeneity in the long run and heterogeneity in the short run, we can incorporate the dynamic behaviour of the variables which will be new to tax structure–growth study in India. Third, the tax–growth nexus may show a non-linear relationship due to the threshold effect. We consider this non-linearity in our panel regression model which will be a contribution to the existing literature.

3 Data and methodology

To study the effect of tax policy on economic performance in India, we employed three models and included each tax instruments in the models separately to avoid the problem of Multicollinearity. Following the works of Arnold et al. ( 2011 ) and Acosta-Ormaechea and Yoo ( 2012 ), the tax structure is measured by the share of individual tax to the total state tax revenues. We investigate the tax–growth relationship with the following equation.

Here, Y it is the growth rate of Per capita net state domestic product (NSDP), SGI is the state gross investment as a percentage of state domestic product, TAX is one of the tax shares (Property, Commodity & Services and Income), Tax Burden Footnote 2 is the ratio of total tax revenues to state domestic product and ϵ is the error term. Per the work of Acosta-Ormaechea and Yoo ( 2012 ), this study is more concerned with the impact of tax structure on growth rate rather than level effect. In model 1, we include property tax share, and in model 2 and model 3, we incorporate commodity & service tax and income tax, respectively. By following the approach of Arnold et al. ( 2011 ), we include total tax burden as a control variable which will reduce the biases that may occur from correlation in between tax mix and tax burden. We also included Secondary Enrollment Rate as a proxy variable for human capital in our model, but the inconsistent and insignificant results make us drop the variable from the final estimation model.

In search of a possible non-linear relationship, we introduce a separate panel regression by introducing the square of each tax share into the models.

If the coefficient of α 3 significant and carries an opposite sign to α 2 , then we can conclude that there is a non-linear relationship exist.

In this study, we included 14 Indian states for the period 1991 to 2016 and excluded North-Eastern states due to their relatively small tax revenue collections. Data have been taken from the Centre for Monitoring Indian Economy (CMIE) and Handbook of Statistics on the Indian States, published by Reserve Bank of India. The states that are included in this study are Andhra Pradesh (undivided), Footnote 3 Assam, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Karnataka, Kerala, Maharashtra, Punjab, Tamil Nadu, Orissa, Rajasthan and West Bengal. All the states are included in model 1 and model 2. For model 3, due to the data availability, we include only seven states Footnote 4 namely Andhra Pradesh, Assam, Gujarat, Karnataka, Kerala, Maharashtra, and West Bengal.

The selection of the study period is primarily driven by the argument provided by Rao and Rao ( 2006 ) that after the market-oriented economic reform of 1991, more systematic and long-term goal-oriented tax reforms were initiated in state level for India. The economic reform also brings rapid growth in India and it becomes very interesting to look at the tax–growth nexus after the economic reform. The second restriction related to the use of long data span is the availability of data for each tax head for each of the states under this study.

3.1 Unit root

Pool Mean Group (PMG) specification is very fruitful and widely used model to capture the dynamic behaviour of policy variables. This model is very powerful as it can investigate both I (0) and I (1) variables in a single autoregressive distributive lag (ARDL) model setup. A necessary condition in the ARDL model is that the model cannot deal with the I(2) variables. Thus, the investigation of stationarity becomes a compulsion. We used popular panel unit root tests like LLC (Levin et al. 2002 ), the IPS (Im et al. 2003 ), the ADF-Fisher Chi square (Maddala and Wu 1999 ) and PP-Fisher Chi square (Choi 2001 ) in this study.

3.2 Panel PMG model

The Mean Group (MG) estimator was developed by Pesaran and Smith ( 1995 ) to solve the issue of bias related to heterogeneous slopes in dynamic panels. Traditional panel models like instrumental variables’ estimator of Anderson and Hsiao ( 1981 , 1982 ) and Arellano and Bond ( 1991 ) may produce inconsistent results in a dynamic panel framework (Pesaran et al. 1999 ). MG estimator takes the average value of every cross-section and provides the long-run estimate for ARDL or PMG. On the other hand, Pooled Mean Group (PMG) estimator developed by Pesaran et al. ( 1999 ) assumes slope homogeneity in the long run but heterogeneous slopes in the short run for cross-section units. Dynamic Fixed Effect (DFE) also works like PMG and restricts cointegrating vector to be equal across all panels and restricts the speed of adjustment to be equal.

Under these assumptions, PMG is more efficient estimator than to MG and DFE estimator. The prime requirement for PMG estimator is that T should be sufficiently large to N. Panel ARDL or PMG works through maximum likelihood. Our basic PMG begins with the following equation.

Here, x it is the vector explanatory variables and y i is the lag dependent variable. X it allows the inclusion of both I (0) and I (1) variables. State fixed effect is captured through μ i . Above equation can be re-parameterized to ARDL format.

ɸ i measures the state-specific speed of adjustment and known as Error Correction Term. Β i is the vector of long-run relationships and α ij and θ ij are the vectors of short-run dynamic relationships. Pesaran et al. ( 1999 ) did not provide any statistical test for checking long-run relationship but it can be concluded form sign and magnitude of Error Correction Term (ECT). If it is negative and less than − 2, a long-run relationship can be established.

4 Results and discussion

Panel unit root test results from Table 1 suggest that in the case of Model 1 & 2, the Growth rate of Per Capita Net State Domestic Product (PC-NSDP), Property tax and commodity taxes are stationary at level. Gross investment and total tax revenue share to GDP are stationary at the 1st difference in all models and income tax share is also stationary at the same order.

5 PMG model results

We have reported MG, PMG and DFE estimation in the Tables 2 and 3 . The Hausman test indicates that the PMG model is the best model for our data than to MG model. Negative and significant error correction terms in all the models show the long-run relationship in between variable. One major issue related to the tax–growth equation is the problem of endogeneity of the variables. As growth in per capita GDP is our dependent variables, there is a possibility that tax collections behave along with business cycles. Therefore, we tested the weak/strong exogeneity of the tax variables through the correlation analysis between business cycles and tax shares. Business cycles have been calculated using the Hodrick-Prescott (HP) Filter. We have found that all the tax instruments are very weakly related to the business cycles movement and thus, we conclude that variables are not truly endogenous.

The speed of adjustment in PMG model 1, 2 and 3 are 78.9%, 78.4% and 79.6%, respectively. For the sake of completeness, we have reported MG and DFE Footnote 5 model results also. But we are more concerned with the results of PMG estimator as Hausman test suggested that PMG is a better model than to MG. The sign of the property tax is positive and significant in the long run as well as in the short run. Results are in line with the findings of Acosta-Ormaechea and Yoo ( 2012 ). Property tax generally considered a good revenue source for state and municipal governments for providing economic and social services in the city. This tax is also able to establish cost–benefit linkages and feasible decisions for the citizens. The positive impact of property taxes indicates that the revenue generation and productive utilization of these revenues exceed the distortionary effect in these states. As we expected, the tax burden is negatively associated with growth performance in both long run and short run. The relationship is showing the distortionary effect of the tax collection in the state economy. In all models, gross investment enhancing the growth in per capita SDP in the long run. Signs are readily justified as enlargement of capital formation has a positive impact on output and employment which channelized to the development outcomes (Swan 1956 , Solow 1956 ).

Commodity and service taxes are negatively related to the growth in per-capita SDP in the long run as well as in short run and findings are similar to the work of Ojede and Yamarik ( 2012 ). Footnote 6 This tax now comes under the Goods & Services taxes, but in the pre-GST period, commodity and service taxes are reducing growth in per capita NSDP. Commodity taxes are indirect taxes and state own tax revenues mostly come from indirect taxes. As indirect taxes, it has certain disadvantages like inflationary pressure in the economy and regressive to the poor section of the society. Our results also support the same hypothesis that increased commodity tax share is harmful. In India, commodity and service tax includes central sale tax, state excise duty, vehicle tax, goods & passenger tax, electricity duty and entertainment tax. Central sale tax was imposed on interstate trade of commodities which is now transformed to Inter-State GST (IGST). According to Das ( 2017 ), if the IGST rate is high to the Revenue Neutral Rate, it will harm the aggregate demand in the economy through the reduction of disposable income. Heavy vehicle and passenger tax collections are creating an abysmal environment for industrial activities. The tax burden variable is also carrying a negative sign in both long run and short run and magnitude is very similar to model 1. Income tax share has become insignificant and positive in the long run and negative insignificant in the short run.

After examining the linear relationships, we extended our analysis to the examination of a non-linear relationship with the use of PMG estimation model. The result from Tables 4 and 5 indicates the existence of a non-linear relationship between tax structure and growth performance for Indian states. The linear coefficient for property taxes has now become negative and the square of it turns out to be positive. Thus, the property taxes show a ‘U’-shaped relationship with states’ growth performance which implies that a rise in property taxes is bad for growth initially and after a threshold point, it becomes growth enhancing. The threshold point for property taxes is 1.88 which indicates that more than 80.77% observation is more than to threshold point.

In the case of commodity and service taxes, both the linear and non-linear coefficients are significant with different signs. However, the coefficient magnitudes are abnormally large and this is due to the inclusion of both linear and quadratic terms into the single equation. The small commodity and service taxes are very bad for the state economy, whereas the large amount of it shows a positive relation. The threshold point for this tax is 4.45 which implies that 79.95% observation lies above the threshold. This is a very interesting result as high commodity and service taxes could lead to high inflation in the economy and high inflation regarded as atrocious for growth. Further investigation of these findings is highly recommendable. As like linear panel regression, the income tax shows no relation in our non-linear regression model also. However, the short-run coefficient for income tax is significant and shows a negative relationship. Income tax is considered to be distortionary tax to the economy in the presence of income and substitution effect (Kotlan 2011 ). Income tax mostly impacts the savings of the households and labour supply which is regarded as an engine of growth.

6 Conclusions and recommendations

In this study, we try to find out the long-run and short-run relationship between different tax structure and economic growth in states of India. Empirical evidence from linear regression suggests that the property tax enhancing growth and commodity & service taxes reduce it. The non-linear regression validates these findings for property taxes where high property taxes are good for growth. In the case of commodity & service taxes, the results become opposite after the threshold point and affecting the growth negatively. Interestingly, we do not find any significant impact of income taxes on growth in both linear and non-linear regressions in the long run.

As far as the total tax burden is concerned, negative relation with the growth performance is verified and results are in line with Arnold et al. ( 2011 ). The negative effect of commodity and service taxes in the short run is expected to be neutralized through the implementation of GST in India. Promotion of growth performance at the state level concerning income taxes is also very crucial. Income tax has a direct effect on individuals and their saving and investment behaviour. On the other side, tax revenues should be placed in productive investments. With the spending, the government can promote inclusive growth, equality and efficiency in the economy.

The most promising path emerged through this study for long-run growth performance in Indian states is to lower the total tax burden and shifting from income and commodity taxes to property tax for revenue generations. The conclusion may be debatable on various grounds as the studied variables do not take into account institutional quality, administrative efficiency in tax collection, fiscal balance and condition of the states and existence of informal sectors. Future research can be done to incorporate these issues.

Availability of data and materials

Dataset analysed in this study is available from the corresponding author on reasonable request.

One can see the writings of Rao and Rao ( 2006 ) for brief discussion.

This is the proxy for total tax burden in the economy with certain limitations. It does not include informal economy and expenditure policies.

Telangana state was established in 2014. We merged the data of Andhra Pradesh and Telangana to achieve aggregate data for undivided Andhra Pradesh.

Data for Income tax are available for ten states, but inclusion of these states made the model inconsistent due to huge fluctuations in tax revenue collections.

Most of the coefficients of PMG and DFE are in similar range and smaller than to MG estimator. This is due to MG estimator only takes the information of each state time series to estimate long-run and short-run coefficients.

They use sale tax, where our study takes aggregate revenue for commodity and services. However, inference can be drawn as sale tax and is one of the dominant contributors in total commodity and service tax revenue in India.

Abbreviations

Net state domestic product

Goods and service tax

Foreign direct investments

- Pool mean group

Dynamic fixed effect

Auto-regressive distributed lag

The organization for economic co-operation and development

Anderson TW, Hsiao C (1981) Estimation of dynamic models with error components. J Am Stat Assoc 76(375):598–606

Article Google Scholar

Anderson TW, Hsiao C (1982) Formulation and estimation of dynamic models using panel data. J Econom 18(1):47–82

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM et al (2011) Tax policy for economic recovery and growth. Econ J 121:59–80. https://doi.org/10.1111/j.1468-0297.2010.02415.x

Atems B (2015) Another look at tax policy and state economic growth: the long and short run of it. Econ Lett 127(1):64–67

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Politic Econ Univ Chicago Press 98(5):103–126

Barro RJ, Redlick CJ (2009) Macroeconomic effects from government purchases and taxes, ADB economics working paper series, No. 232

Bird RM, Zolt EM (2011) Dual income taxation: a promising path to tax reform for developing countries. World Dev 39(10):1691–1703

Choi I (2001) Unit root tests for panel data. J Int Money Fin. 20:249–272

Dackehag M, Hansson A (2012) Taxation of income and economic growth : an empirical analysis of 25 rich OECD countries

Das S (2017) Some concerns regarding the goods and services tax. Econ Polit Wkly 52(9)

Dladla K, Khobai H (2018) The impact of taxation on economic growth in South Africa, MPRA Paper No. 86219, 1–15

Durusu-çiftçi D, Gökmenoğlu KK, Yetkiner H (2018). The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Economic systems. Elsevier BV. https://doi.org/10.1016/j.ecosys.2018.01.001

Federici D, Parisi V (2015) Do corporate taxes reduce investments? Evidence from Italian firm level panel data. Cogent Econ Finance 3:1–14. https://doi.org/10.1080/23322039.2015.1012435

Gemmell N, Kneller R, Sanz I (2011) The timing and persistence of fiscal policy impacts ongrowth: evidence from OECD countries. Econ J 121(550):33–58

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics. 115:53–74

Johansson Å et al (2008) Taxation and economic. Growth. https://doi.org/10.1787/241216205486OECD

Jones L, Manuelli R, Rossi P (1993) Optimal taxation in models of endogenous growth. J Polit Econ 101(3):485–517

Karras G (1999) Taxes and growth: testing the neoclassical and endogenous growth models. Contemporary Econ Policy. 17(2):177–188

King R, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126-50

Kotlán I, Machová Z, Janíčková L (2011) Vliv zdanění na dlouhodobý ekonomický růst. Politická ekonomie. 5:638–658

Lee Y, Gordon RH (2005) Tax structure and economic growth. J Public Econ 89(5–6):1027–1043. https://doi.org/10.1016/j.jpubeco.2004.07.002

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics. 108(1):1–24

Ljungqvist A, Smolyansky M (2016). To cut or not to cut? On the impact of corporate taxes on employment and income, Finance and economics discussion series 2016–006. Washington: Board of Governors of the Federal Reserve System, http://dx.doi.org/10.17016/FEDS.2016.006

Macek R (2014) The impact of taxation on economic growth: case study of OECD countries. Rev Econ Perspect. 14(4):309–328. https://doi.org/10.1515/revecp-2015-0002

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Martin R, Fardmanesh M (1990) Fiscal variables and growth: a cross-sectional analysis. Public Choice 64:239–251

Mcnabb K (2018) Tax structures and economic growth: new evidence from the government revenue dataset. J Int Dev 30:173–205. https://doi.org/10.1002/jid.3345

Mdanat MF et al (2018) Tax structure and economic growth in Jordan, 1980–2015. EuroMed J Bus 13(1):102–127. https://doi.org/10.1108/EMJB-11-2016-0030

Myles GD (2000) Taxation and economic growth. Fiscal Studies. 21(1):141–168. https://doi.org/10.1016/0264-9993(93)90021-7

Ojede A, Yamarik S (2012) Tax policy and state economic growth : the long-run and short-run of it, Economics Letters. Elsevier BV, 116, No.2, pp. 161–165. https://doi.org/10.1016/j.econlet.2012.02.023

Ormaechea AS, Yoo J (2012) Tax composition and growth: a broad cross-country perspective. IMF Working Papers. https://doi.org/10.5089/9781616355678.001

Padovano F, Galli E (2001) Tax rates and economic growth in the OECD countries (1950–1990). Econ Inq 39(1):44–57

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econometrics. 68:79–113

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc. 94:621–634

Poulson BW, Kaplani JG (2008) State income taxes and economic growth. Cato J 28(1):53–71

Google Scholar

Rao MGR, Rao RK (2006) Trends and issues in tax policy and reform in India. INDIA POLICY FORUM

Reynolds S (2006) The impact of increasing excise duties on the economy. Working Paper Series 58069. PROVIDE Project

Saafi S, Mohamed MBH, Farhat A (2017) Untangling the causal relationship between tax burden distribution and economic growth in 23 OECD countries: fresh evidence from linear and non-linear Granger causality. Eur J Comp Econ. 14(2):265–301

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Stoilova D (2017) Tax structure and economic growth: evidence from the European Union. Contaduría y Administración. 62:1041–1057. https://doi.org/10.1016/j.cya.2017.04.006

Stokey NL, Rebelo S (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Swan TW (1956) Economic growth and capital accumulation. Econ Record 32:334–361. https://doi.org/10.1111/j.1475-4932.1956.tb00F434

Szarowska I (2014) Effects of taxation by economic functions on economic growth in the European Union. MPRA Paper No. 59781

Tosun MS, Abizadeh S (2005) Economic growth and tax components: an analysis of tax changes in OECD. Appl Econ 37:2251–2263. https://doi.org/10.1080/00036840500293813

Vartia L (2008) How do taxes affect investment and productivity ? An industry-level analysis of OECD countries. OECD Economics Department Working Papers 656

Xing J (2011) Does tax structure affect economic growth? Empirical evidence from OECD countries, Centre for Business Taxation, WP 11/20

Download references

Acknowledgements

Authors like to acknowledge the anonymous referee for his/her valuable comments.

Not applicable.

Author information

Authors and affiliations.

Department of Economics, Banaras Hindu University, Varanasi, India

Yadawananda Neog & Achal Kumar Gaur

You can also search for this author in PubMed Google Scholar

Contributions

Both the authors’ handled the data, analysed and contribute their part to write the manuscript. Both authors read and approved the final manuscript.

Corresponding author

Correspondence to Yadawananda Neog .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 1 , 2 , 3 , 4 and 5 .

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Neog, Y., Gaur, A.K. Tax structure and economic growth: a study of selected Indian states. Economic Structures 9 , 38 (2020). https://doi.org/10.1186/s40008-020-00215-3

Download citation

Received : 26 November 2019

Revised : 16 March 2020

Accepted : 29 April 2020

Published : 09 May 2020

DOI : https://doi.org/10.1186/s40008-020-00215-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Tax structure

Advertisement

Goods and Services Tax (GST) Implementation in India: A SAP–LAP–Twitter Analytic Perspective

- Original Research

- Published: 26 January 2022

- Volume 23 , pages 165–183, ( 2022 )

Cite this article

- Arun Kumar Deshmukh ORCID: orcid.org/0000-0003-1839-1364 1 ,

- Ashutosh Mohan 1 &

- Ishi Mohan 2

19k Accesses

15 Citations

1 Altmetric

Explore all metrics

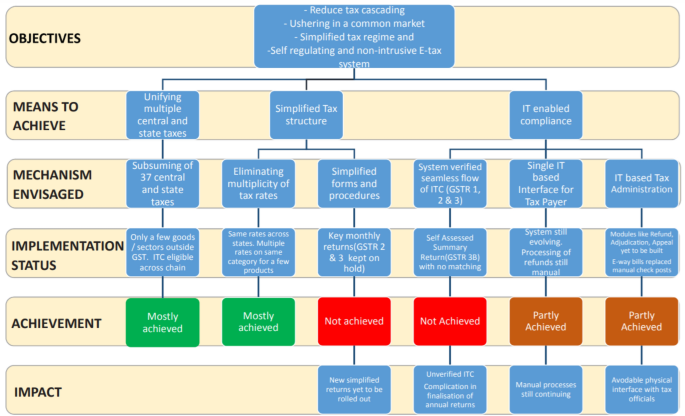

In a federal structure, India's determination to much-needed fiscal reforms has been widely applauded at its face value when she relinquished her previous complex and inefficient tax regime to embrace the long-awaited Goods and Services Tax (GST). It has been a significant economic move post-independence and requires validation of facts after its introduction. The present study aims to present a general macroeconomic analysis of the extent to which the adoption of GST has improved existing tax administration and resultant general economic well-being of a democratic political economy like India in light of innovation implementation theoretical perspective. Further, the study tried to determine how the stakeholders perceived such big-bang reform even after the three years of its adoption. The study attempted to assess to what extent the adoption of GST has indeed influenced the economy in general and citizens and/or consumers in particular while using a case-based qualitative inquiry. The present research applied the situation–actor–process; learning–action–performance analysis framework for the case analysis. The facts reveal that India has observed a tremendous increase in tax base vis-à-vis revenue collection. Yet, some efforts are desired to improve the low tax to GDP ratio, skewed GST payers base, negative stakeholders’ perception of GST (revealed through Twitter sentiment analysis), and the evil of tax evasion. The other merits realized by the economy are presented as benefits to the consumers, MSMEs, improved ease of doing business ranking, and foster make-in-India and AatmanirbharBharat move by the government.

Similar content being viewed by others

Twitter Based Sentiment Analysis of GST Implementation by Indian Government

Analysis of barriers in implementation of Goods and Service Tax (GST) in India using interpretive structural modelling (ISM) approach

Manoranjan Kumar, Akhilesh Barve & Devendra K. Yadav

The Impact of Zakat Distribution

Avoid common mistakes on your manuscript.

Introduction

The economic reforms in India after the 1990s pushed her growth as a globally integrated nation with remarkable improvements in terms of regulatory efficacy, macroeconomic stability, and geopolitical constancy (World Bank, 2019 ). Besides China in the Asian continent, India emerged as one of the fastest-growing economies in the last few decades (Paul & Mas, 2016 ). Fortifying the topsy-turvy yet relatively sustained growth story, India has witnessed phenomenal indirect tax reform (Chikermane, 2018 ) in the past three decades and demonstrated economic resilience by embarking upon another breakthrough in July 2017. According to the experts, after liberalizing the Indian economy in 1991, the Goods and Services Tax (henceforth GST) is a significant taxation turnaround by the Indian government (Jha, 2019 ; Siddiqui, 2018 ). India has traversed a long path to embrace GST as an excellent and long-awaited indirect tax reform aimed at one nation, one tax, and one market (GST Council, 2020a ). The global experience revealed that GST has made the business processes more efficient than ever by simplifying the tax structure and reducing the number of state and central levies (Nutman et al., 2021 ). GST is an indirect and destination-based tax. It appears to have influenced the consumers indirectly and directly impacted the businesses (Fernando & Chukai, 2018 ); however, its ripple effect is being felt across the three core sectors of the economy (Jha, 2019 ).

The complexities and inefficiencies of previous tax regimes in India (Roychowdhury, 2012 ) compelled the authorities to convert the decade-long discussion into reality. The shortcomings were primarily characterized by cascading turnover taxes between the center and states in the federal structure, making the regime less comprehensive (Rao & Chakraborty, 2010 ). The central and state levies had some inherent limitations, such as central taxes could not cover the value addition in goods outside the manufacturing stage, including a few listed services (Deloitte, 2020 ; Roychowdhury, 2012 ). To transform the indirect taxation system, GOI had introduced the long-awaited Goods and Services Tax or GST in July 2017. Sensing its magnificence, FICCI ( 2021 ) called it a big bang economic reform after independence. Despite all merits and demerits of the Indian GST implementation, little understanding exists of its influence on the economy (Kir, 2021 ) in general from the perspective of the stakeholders. Also, a little understanding was observed in the existing body of knowledge, particularly on innovation implementation in the emerging Indian public policy domain even though GST roll-out to be a process innovation in the economic system. It calls for research in the identified field about how fruitful was the introduction and implementation of GST in the economy and the response patterns of the stakeholders.

The present study aims to analyze the extent to which the implementation of GST has improved exiting indirect tax administration and the general economic state of a democratic political economy like India. The way stakeholders have perceived such big-bang economic reform after three years. A theoretical perspective of innovation implementation was applied, citing the context and knowledge gaps concerning a public policy measure in a developing economy. Thus, it attempts to answer two diverse research questions (RQs):

RQ1. How has the implementation of GST affected India's general economic scenario? and

RQ2. How have various stakeholders perceived the new tax regime?

The nature of the research questions asked determines the epistemological ground for the research (Saunders et al., 2019 ). The core aspect of questions mentioned above predominantly belongs to the interpretive paradigm, which requires selecting appropriate methods justifying constructivist ontology (Saunders et al., 2019 ). The SAP–LAP analysis-backed qualitative case-based inquiry meets the methodological and contextual requirements.

The study is organized in various sections and sub-sections comprising a literature review about GST, innovation implementation, and SAP–LAP analysis followed by research methods comprising how SAP–LAP analysis is performed with its framework to answer the above research questions. The result and discussion section elaborates the detailed analysis and interpretation of individual components of the SAP–LAP framework concerning GST implementation.

Review of Literature

This section presents a literature review about GST and indirect taxes, innovation implementation, and SAP–LAP analysis under three sub-sections followed by motivation for this research and gap analysis.

Literature on GST and Indirect Taxes

In public finance, taxes are usually collected as significant revenue sources as direct and indirect taxes. The taxes paid directly by the public, such as corporate income tax, income tax, wealth tax, are referred to as direct taxes. In contrast, indirect tax is essentially consumption-based tax such as value-added tax or VAT, service tax, and customs. The revenues from indirect taxes are shared jointly by the central and state government and some local bodies in the federal structure. In contrast, direct taxes are the central government's subject matter. France implemented GST in 1954, and the same was followed by over 100 countries, including several emerging economies such as Brazil, China, and now India (Kir, 2021 ), after observing its demonstrated success across the globe. Economists noted that a country's development hinges upon the mobilization of tax revenue (Dabla-Norris et al., 2017 ; Schlotterbeck, 2017 ). It is pertinent to ensure stable tax revenues to meet the significant budgetary heads such as healthcare, infrastructure, and education. The increasing tax revenue leads to economic growth and development (Besley and Persson, 2009 ; Gaspar et al., 2016 ; Milios, 2021 ). Also, enhancing tax collection is crucial (Akitoby et al., 2018 ; Fenochietto & Pessino, 2013 ) to attain the Sustainable Development Goals (SDGs) propounded by United Nations. Therefore, an economy is expected to have an efficient tax policy and administration. However, the tax structure differs across the continents and countries (Besley & Persson, 2009 ; Fenochietto & Pessino, 2013 ). Sindzingre ( 2007 ) pinpointed that Asian developmental states do not rely on high levels of taxation, which is characterized by their capacity to commit and intervene credibly in policies directed toward growth rather than a tax.

Research by Onaolapo et al. ( 2013 ) revealed that the adoption of value-added tax showed a statistically significant influence on revenue generation in the Nigerian context. The study also pinpointed the need for dedicated and integrated efforts from the stakeholders to improve VAT collections. The study also analyzed how value-added tax impacted revenue generation in Nigeria. They asserted that the consumption-based taxes should be assessed on different considerations such as administrative feasibility, relative revenue potential, voluntary compliance, for better implementation. These considerations also equally apply to GST implementation.

Some of the cross-sectional studies with panel data and case studies were conducted to analyze the impact of socio-political determinants, tax policy, economic dynamics, and economic structure in an economy (Garg, 2019 ; Kir, 2021 ; Kulkarni, & Apsingekar, 2021 ). Plenty of studies unveiled the relationship among factors influencing the revenue outcome while highlighting the complexities in separating the relevant determinants (Crandall & Kidd, 2006 ; Dom, 2018 , 2019 ). The study conducted by Gupta ( 2007 ) explored the relationship between economic development and the structure of the tax revenue realization in developing countries and asserted a positive correlation between per capita GDP and revenue.

Research by Dabla-Norris et al. ( 2017 ) evaluated the firm performance changes due to the tax compliance burden in 21 countries using VAT and corporate tax rates to control tax policy. Investigating the effect of tax policy changes on revenues, the study also emphasized on an association between policy reforms and revenue growth in the emerging economies (Akitoby et al., 2018 ) and maintained that policy reforms can be increased with the rising rate of indirect tax, changing the type of tax being levied, and decreasing level of exemptions. The studies measuring the impact of VAT found mixed results as some observed growth in the revenue (Ebeke et al., 2016 ; Schlotterbeck, 2017 ) while others found it insignificant (Ngoma & Krsic, 2017 ). Some studies emphasized how socio-political factors determine the extent of revenue collected relative to GDP and asserted that the Gini coefficient was negatively correlated with the revenue collections (Fenochietto & Pessino, 2013 ). Nonetheless, not enough literature could be located in the Indian context expounding implementing a tax administration policy and associated indicators.

The early research analyzing the impact of GST implementation on the Indian economy was limited and utilized only nascent and generic indicators (Bindal & Gupta, 2018 ; Dash, 2017 ; Mishra, 2018 ) to demonstrate whether GST has attained the desired outcome after implementation. The other studies were highly sectoral and regional (Garg, 2019 ; Kulkarni & Apsingekar, 2021 ). In addition, expounding the situation after the implementation of GST, The New Indian Express ( 2021 ), in its report on GST, mentioned that the government's bonafide intentions back GST yet, technical glitches and design-related flaws caused ineffective execution during its early phase. The technical malfunction also caused fake invoicing by some business enterprises. Despite all advantages, some significant implementation flaws include technical glitches, frequent changes in the rules, malfunction of input tax credit claim system, multiple tax slabs and frequent changes in items covered under these slabs, etc. (Financial Express, 2019 ; The New Indian Express, 2021 ). Many businesses have to confront multiple litigations due to a lack of clarity on various rules and their varied interpretations in different states. This aroused interest in conducting the study to unearth several theoretical and practical learnings that may lead to future research.

Having cited the above literature, the researchers observed a lack of primary and secondary literature linking indirect tax reform in an economy and its economic impact. The studies cited primarily belong to tertiary literature, which was used to establish the viewpoint. However, due to the nascent stage of GST implementation in India, it becomes difficult to deploy quantitative panel data analysis. Therefore, the study analyzed GST implementation in the economy using a factual SAP–LAP qualitative framework and Twitter sentiment analysis using the stakeholders' perception mapping. It was an exploratory inquiry to advance understanding of a less explored phenomenon with an innovation implementation-led theoretical perspective.

Literature on Innovation Implementation

Considering GST as a process innovation in a macroeconomic context, the present research cited relevant studies to analyze the status of GST after three years of implementation. The previous research on innovation implementation revolves primarily around the organizational contexts (Chung et al., 2017 ; Damanpour & Schneider, 2006 ; Dhir et al., 2020 ; Malaviya & Wadhwa, 2005 ; Singh et al., 2021a , b ), with a slight possibility for being adapted in the context of an economy. An economy akin to an enterprise needs to constantly innovate its key processes to sustain and be competitive in a contemporary environment characterized by ever-changing technology and handling of economic operations (Chung et al., 2017 ; Krawczyk-Sokolowska et al., 2021 ). Emerging economies such as India possess numerous possibilities for innovation on several fronts including the micro- and macro-level (Dhir et al., 2020 , 2021 ). Past studies have shown that innovation keeps the system competitive and is necessary to propel superior performance (Birkinshaw et al., 2008 ; Dhir et al., 2021 ).

Nevertheless, assessing the innovation-specific outcomes is intriguing in a system at both levels. It can be analyzed with its apparent characteristics, such as the effectiveness of implementation and point of innovation itself in terms of benefits derived from it (Klein & Sorra, 1996 c.f. Chung et al., 2017 ). It is asserted that approximately two-thirds of the innovations go unsuccessful and pose a financial burden on the system (Altuwaijria & Khorsheed, 2012 ). The entities implementing the invention are bound to fail to attain desired benefits due to failure of innovation or implementation (Chung et al., 2017 ).

The introduction of GST in India is a process innovation of continuous nature, depending heavily upon the principles of appropriateness, accessibility, and affordability (Fannin, 2016 ). Also, Singh and Dhir ( 2021 ) pointed that studies addressing innovation implementation focused on specific organizational contexts, including manufacturing (Dwivedi et al., 2019 ; Jamwal et al., 2019 ), Entrepreneurship (Parameswar et al., 2019 ; Singh et al., 2019 ), health (Birken et al., 2015 ; Pradhan et al., 2019 ), transportation (Shankar et al., 2019 ), financial inclusion (Malik et al., 2019 ), and ERP implementation (Nagpal et al., 2019 ). However, studies cited in the public policy domain were scanty (Singla & Hooda, 2018 ; Sushil, 2008 ; Sushil, 2019 , Suri & Sushil, 2012 ; Suri & Sushil, 2008 ). The extant literature in this field further revealed that most of the studies on innovation implementation were conducted in the developed economies and, therefore, exhibit the strategies adopted in that context, which cannot be replicated in the emerging economy scenario (Singh et al., 2021a , b ). The key differences must be thoroughly analyzed due to contextual variations in terms of demographics, infrastructural, regulatory policies, etc., for ensuring implementation of the innovation (Dhir et al., 2020 ).

Further, from the theoretical standpoint, the implementation of innovation literature has widely used dynamic capability theory to examine how the organization can adapt its knowledge base in response to environmental changes (Teece et al., 1997 ; Teece, 2018 c.f. Singh et al., 2021a , b ). The effectiveness of such implementation can be measured using the degree to which the desired outcomes are realized (Singh et al., 2021a , b ). According to Piening ( 2011 ), the implementation of an innovation, technology, or practice necessitates the creation of new routines for desired outcomes, as was the case of GST, where the government revamped all previous processes (routine). The system continuously tracks the systemic and process-related flaws in GST implementation such as technical glitches, erroneous input-tax credit claim mechanism, multiple tax slabs with frequently changing specified items. (The New Indian Express, 2021 ). The studies primarily adopted dynamic capability theory (Teece et al., 1997 ), the resource-based view (Chichkanov et al., 2021 ), grounded theory (Deloitte, 2020 ), etc., to understand the implementation. Yet, studies in public policy-related aspects are limited in numbers (Singla & Hooda, 2018 ), requiring further investigation to analyze the same. Thus, the previous literature revealed some significant research gaps in innovation implementation comprising context gap and knowledge or theory gap. The present research aims at bridging such gaps in the context of GST implementation using an SAP–LAP framework to investigate the degree to which the GST implementation as a process innovation in public policy has impacted the general state of the economy.

Literature on SAP–LAP Analysis

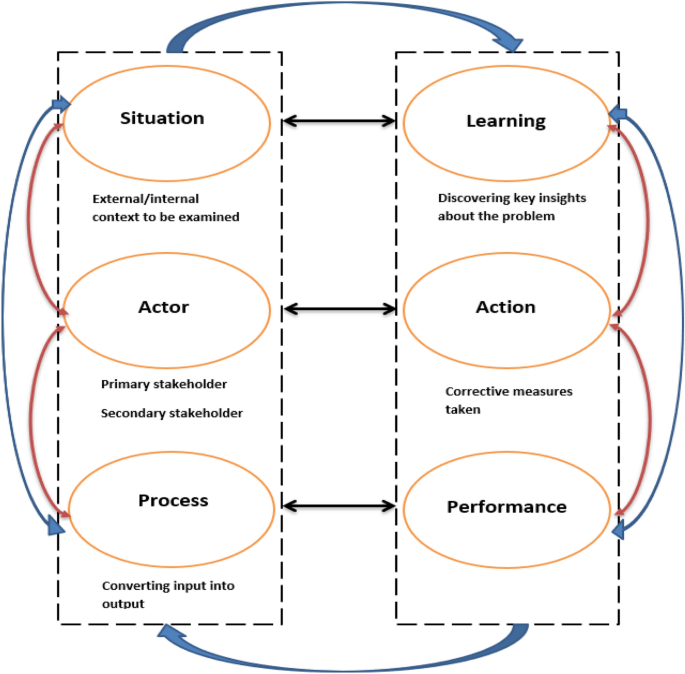

The SAP–LAP framework for analysis was initially developed by Sushil ( 2000 ) and Sushil ( 2001a ). The present study uses the SAP–LAP framework (Fig. 1 ) to analyze the pre- and post-GST implementation scenario to evaluate the system's efficacy and suggest enhancements. Several scholars in the past applied SAP–LAP analysis tools to study such situations and developed valuable solutions. The selected pioneering and prominent studies are presented in Table 1 , which exhibits the cross-context and cross-concept use of the technique.

Source : adapted from Sushil, 2014

SAP- LAP Framework.

The study utilizes a case-based review approach to analyze India's indirect taxation policy framework and associated indicators. The analysis is performed with an interpretive method known as SAP–LAP (situation, actor, process and learning, action, performance) framework developed by Sushil ( 2000 ). The SAP–LAP method was widely used by the researchers in case-based studies (Anand et al., 2018 ; Charan, 2012 ; Chavan et al., 2019 ; Kanda & Deshmukh, 2007 ; Anand et al., 2018 ; Naik & Srivastava, 2017 ; Pramod & Banwet, 2010 ; Sushil, 2019 ; Suri & Sushil, 2008 ). As described by Sushil ( 2009 ), “SAP–LAP is a generic framework which can be used in various contexts, such as problem-solving, change management, be used as generalized statements for the similar cases in the future by proper synthesis” (p. 11). SAP–LAP application has not been limited to the business verticals only but applied the least in the public policy domain (Chand et al., 2018 ; Chavan et al., 2019 ; Suri & Sushil, 2008 ).

3. Research Methods

The paper focuses on exploring the present state of GST implementation in India by the government on completing its three years. The paper follows SAP–LAP framework-based qualitative design. The study used a step-by-step approach to review extant literature to understand how the past scholars have conceptualized and theorized such a phenomenon. To critically examine the initiatives about indirect taxation and GST mainly, the authors reviewed the publications of the GST Network, Central Board of Indirect Taxes & customs (CBIC), National Institution for Transforming India (NITI) Aayog, World Bank, International Monitory Fund (IMF), and relevant policy documents. An attempt was made to pinpoint the gaps and plausible implications on business and society by using the excerpts from literature and discussing with experts and stakeholders affected by GST implementation. Since the emphasis was on assuming the implementation at the last mile beside the experts, the opinions of retailers complying with GST and consumers who are indirectly paying it were considered. The existing framework gaps were recorded through 30 experts, 200 retailers, and 1000 customers. The key criterion for selecting the respondents was their direct and/or indirect involvement in GST-related regulation or compliance.

More so, to add a qualitative dimension to the SAP–LAP-based research and gauge the sentiments of different stakeholders on completion of its three years of GST, the authors have added analyses of tweets, especially as part of the situation analysis and learning synthesis. The study performs the Twitter analysis of the posts containing #GST and its associated sentiment analysis to identify how the stakeholders, including the business community vis-à-vis the common public on social media platforms, perceived the roll-out and the implementation of GST in India by the government. The researchers performed the data scrapping from Twitter with basic Tweepy (Application Programming Interface or API). The application software used in the process was NVivo (NCapture tool). It enables capturing the tweets using a #hashtag across the timelines. For this research, the restriction kept was the tweets with #GST from India. The present study captured one week's random tweets after completing three years for analysis. The purpose was to see the polarity of the sentiments after three years of GST roll-out in a random data scrapping.

SAP–LAP Analysis Framework

The SAP–LAP framework for analysis was initially developed by Sushil ( 2000 ). The expansion of the acronym SAP–LAP refers to a situation that indicates the internal and/or external environment. The external environment may include social, technological, economic, political, and natural environmental factors. In comparison, the internal environment may consist of organization-specific factors such as resources, capabilities, employees, organizational structure, and design. When considering India as an entity for analysis under this framework, the introduction of GST can be taken as a constituent of a situation aspect, and its macroeconomic, socio-political, technological impacts can be considered as the external consequences. Further, keeping the temporal orientation into account, the situation can be referred to as what has happened? what is going on? and what is expected?

The actors in the framework are people, agents, or stakeholders directly or indirectly related to the case situation under consideration. They either influence the condition or are affected by the situation. The stakeholders involved are the government, including the finance ministry, administrators, and policymakers in the GST network, business owners or managers, customers or the general public. It is indeed a highly complex web of actors in one of the largest democracies like India. The third aspect in the framework processes refers to how the situation-specific input transforms into output due to the courses of action initiated by the 'actors.' The actors enjoy the freedom of choice to transform a situation and bring about a change in the situation hand. In this context, the GST collection process, refund or input credit process, audit process, taxpayer complaint resolution process, GST council reform process, etc., are examples of various processes involved. The key actors are expected to strengthen and optimize the strategies to enhance the situation continuously.

The interaction and synthesis of the situation–actor–process framework guide the learning–action–performance framework (Sushil, 2000 , 2019 ). The first alphabet in the LAP framework stands for learning, which refers to a thorough comprehension of the core issues, problems, and challenges of SAP. It can be referred to as an outcome of the meticulous investigation of the individual components vis-à-vis the collective interplay of SAP. The learning component usually includes the generalizable output for execution or insights on specific situations or objectives. The action is all about converting the learning insights into practice to eradicate the existing systemic deficiencies. It may emphasize enhancing the current processes by improving efficiency and effectiveness.

Moreover, the action component of the framework helps in the development of some actionable policies or guidelines. The action taken will impact the performance, which can be observed through enhanced productivity, efficiency, effectiveness, higher profitability in general and better fiscal discipline, and resultant higher revenue generation in particular. It can be inferred that how flexibility in the system improves the overall performance (Evans & Bahrami, 2020 ; Sushil, 2019 ) and, as a result, how India ranks better in terms of governance, ease of doing business, and systemic transparency by applying the SAP–LAP analysis.

Results and Discussion

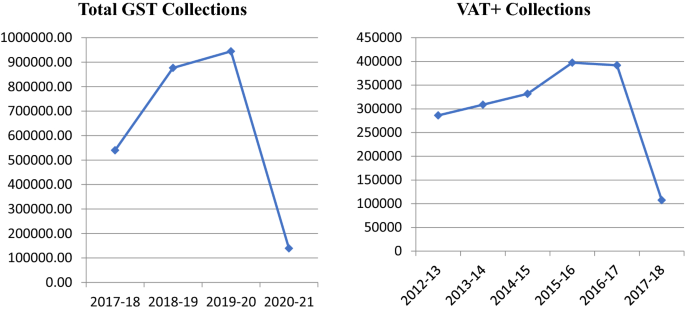

Low taxes-to-gdp ratio.

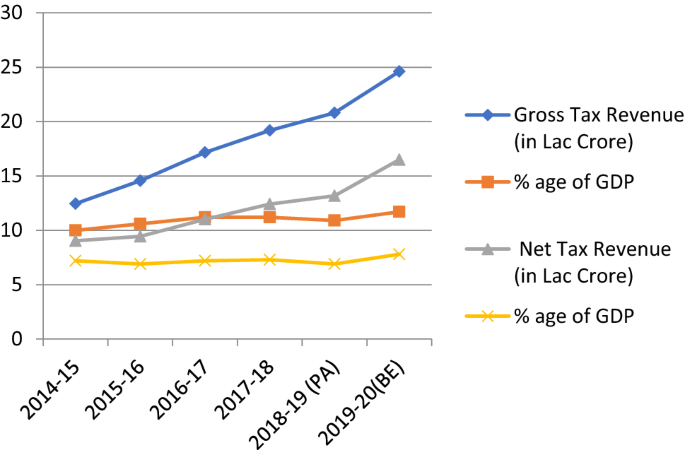

The World Bank statistics (2017–2019) on taxes as a percent of GDP reveals that India needs to increase its share of taxes in GDP at par with most of its developing counterparts. It further reported that the developed countries' ratio is greater than 10 percent compared to India’s 7.8 percent (Table 2 ) and far below the OECD average of 34% (The Economic Times, 2020 , January). This ratio indicates how well a government can finance its expenditure, reducing the borrowing. The higher proportion shows faster economic development as it enhances the government's ability to finance the expenditure.

The data obtained from the official sources were analyzed and compared with the previous tax regime to answer the first research question. The analysis is presented in Table 2 and Fig. 2 revealing the government's fiscal parameters, taxes as a percent of GDP. The answer to the second research question is addressed in the upcoming sub-section nested in case-based SAP–LAP analysis.

Source compiled from the data accessed from https://www.indiabudget.gov.in

Taxes as a percent of GDP in Post-GST Era.

Table 2 exhibits the gross and net tax revenue from 2014–2015 to 2019–2020 and their share in GDP for the corresponding year. The above data highlighted the rising revenue vis-à-vis is rising cost of collection and a corresponding reduction in the net figures from 2017 to 2018, which can be attributed to the GST implementation. In 2018–2019, the gross tax to GDP ratio was 10.9, indicating a 16 percent fall in tax revenue from the budget estimates. The reduction is due to a shortfall in GST collection (Financial Express, 2019 ). The revenue growth also corresponds to the contribution of GDP figure, which hovers between 6 and 8% for net tax revenue, far below expectations. It indicates the need for further improvement to enhance the tax revenue collections.

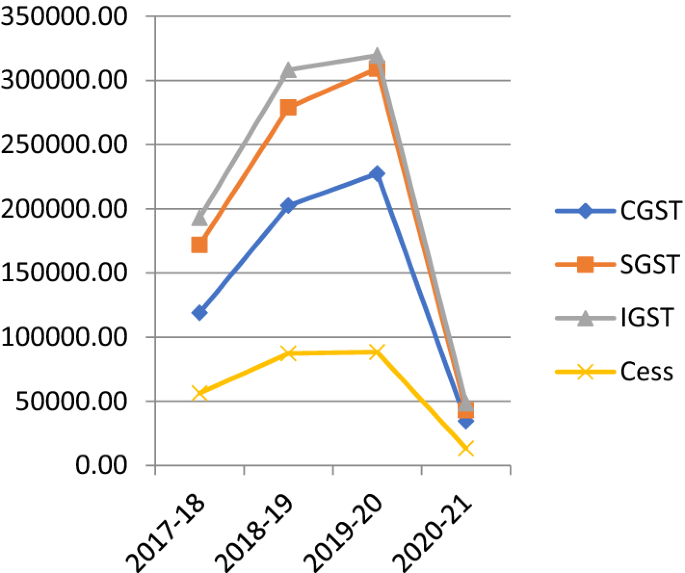

Component-Wise GST Collection

Figure 3 depicts the component-wise GST collections in the three fiscals from July 1, 2017, to June 2020. In India, the GST council divided GST into three components: Central GST or CGST, State GST or SGST, Integrated GST or IGST. The CGST represents the share of the central government, SGST indicates the state government’s claim, whereas IGST is collected on inter-state movement of goods and/or delivery of services. As shown in Fig. 3 , the collection of IGST is highest among all across the three years, followed by SGST, CGST and cess. The cess is a minor component charged along with GST in India.

Source Compiled by authors using GOI data

Component-wise GST Revenue collection.

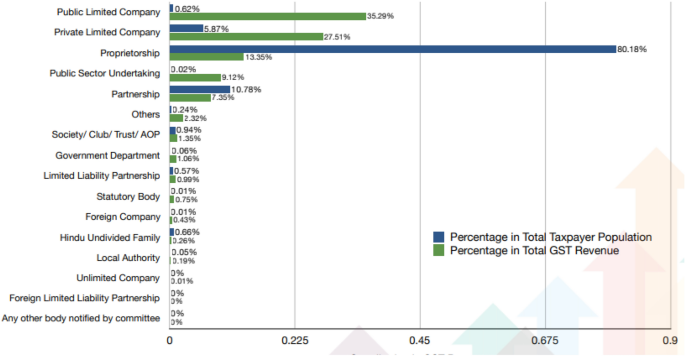

Lopsided GST Payers

The recent analysis on the contribution of various business forms in the total GST collection (Fig. 4 ) reveals that 62.8% of GST revenue comes from public and private limited companies, accounting for a meager 5.89% of the total taxpayer population. The remaining 94.11% of taxpayers contribute 37.2% of the total GST revenue. The proprietorship business holds a significant population with a GST contribution of 13.35%. The other considerable contributors are public sector undertakings (PSUs) and partnership firms. The data unfold several interesting insights for the policymakers on future policy decisions.

Source : www.gst.gov.in

GST Contribution from Different Forms of Business.

Presently, GST implementation is still in its infancy and needs several policy-level improvements to keep taxation inefficiencies and evasion at bay. The authorities should first prioritize solving the significant contributors' problem so that the flow of revenue remains unperturbed and then shift to increasing the tax base keeping the macroeconomic indicators into consideration. It will gradually enhance the efficiency and effectiveness of the indirect taxation system.

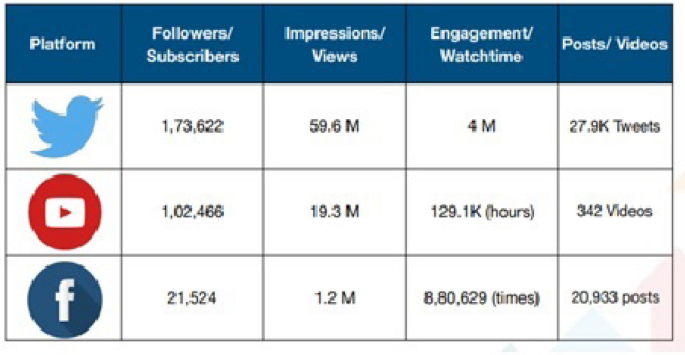

Grasp of Twitter Data

Besides the quantitative studies in the public policy domain, researchers started exploring the qualitative data generated through social media due to its ability to help decision-makers understand the acceptance of the particular policy by different stakeholders (Singh et al., 2020 ). Also, the policymakers have begun to recognize their social media presence and the responses of users and subscribers (Fig. 5 ). Several scholars such as Das and Kolya ( 2017 ), Durán-Vaca, and Ballesteros-Ricaurte ( 2019 ), and Das et al. ( 2020 ) have attempted to study the influence of the taxation-related aspects using social media analytics. Another study by Shakeel and Karwal ( 2016 ) examined the Indian union budget sentiment analysis 2016–2017. Das and Kolya ( 2017 ), Singh et al. ( 2019 ), and Das et al. ( 2020 ) primarily analyzed the Twitter data to understand the sentiment of the general public concerning GST. The startup ecosystem in India was thoroughly investigated by Singh et al. ( 2020 ) using Twitter analytics. Such studies revealed the rising trend of research using social network-based qualitative data. To assess the acceptance level of a particular phenomenon, researchers have a wide variety of choices to gather data such as interviews, surveys, and observation. However, whether positive or negative, collecting data objectively is challenging to infer. On the other hand, the data extracted from social networks reveal the polarity of likes and/or dislikes.

Source GST Council (2020b)

GST on social media.

The widely used social network-based sentiment analysis tool is Twitter analytics. It utilizes Natural Language Processing (NLP) to identify and extract personal information from multiple documents. It is capable of automatic massive tweet classification to generate positive, negative, or neutral polarity according to the language used in the text (Durán-Vaca, & Ballesteros-Ricaurte, 2019 ). It helps in knowing the emotion or opinion of the audience about the underlying subject. It is also evident through the social media statistics displayed on the official website of GST in Fig. 5 that the majority of the subscribers/followers comes from Twitter, followed by YouTube and Facebook.

As revealed in Table 3 , the sentiment analysis output indicated that a total of 1056 tweets were finally considered for analysis using NVivo. Most responses, i.e., 704 tweets, are either very negative or moderately pessimistic, while only 352 are recorded positively. Such sentiments are revealed based on the words used by the users in their tweets. Nineteen thousand one hundred ninety-seven negative comments were used to analyze the coding of terms indicated in the table. In contrast, only 7775 positive words were used concerning GST, resulting in various stakeholders' low sentiment index for GST. It also indicated that such responses might be due to a lack of awareness and reactive ones resulting from resistance to change in the transition.

The sectoral analysis showed that MSMEs face several challenges in adapting to the GST, which must be considered. As reported by experts and taxpayers, some other challenges associated with GST are long time lag in refunds, adaption and development of IT ecosystem, especially by the MSMEs, inability of the system to curb tax evasion, etc. As part of the situation analysis, the above issues and challenges require the concerned actors' action to improve.

In a federal structure, taxes are the subject matter of the union and the states. Therefore, while counting the actors, both are considered and referred to as the ‘government’ in general for the analysis. The other actors in this context are the business executives engaged in the compliance referred to here as ‘business’ and the customers who are paying the taxes indirectly and the society at large. In this tri-partite arrangement, the government is the prime actor while the latter are the complying parties. A systemic change in the name of GST necessitates the active involvement of prime actors in process design that attracts minimal resistance from the affected ones and manages the innovation implementation effectively.

The appropriation of GST is such that both center and state share equally. According to existing arrangements, for instance, if the tax rate is 18%, 9% CGST will go to the central government, whereas 9% SGST will be credited to state government accounts for intra-state transactions. On the other hand, inter-state transactions are dealt with under integrated GST or IGST in which the destination state and the central government share the revenue as mentioned above. Due to the complexity of transactions, especially when multiple states are involved in the trades, sometimes calls for more robust processes to deal with the input credit-related issues. The role of actors from government, both center and state, has become more prominent in resolving such matters. The problems related to revenue sharing and compensation to conditions during the COVID-19 pandemic intensified, for which the authorities are developing a robust mechanism. As a prime-mover, the Goods & Services Tax Council or GST Council-a constitutional body to regulate the various aspects of GST and its nationwide implementation plays a pivotal role. The Union Finance Minister of India chairs the council, and other members include the Union State Minister of Finance or Taxation of all the states. GST council along with the CBIC has played a significant role in the implementation process of GST in India.

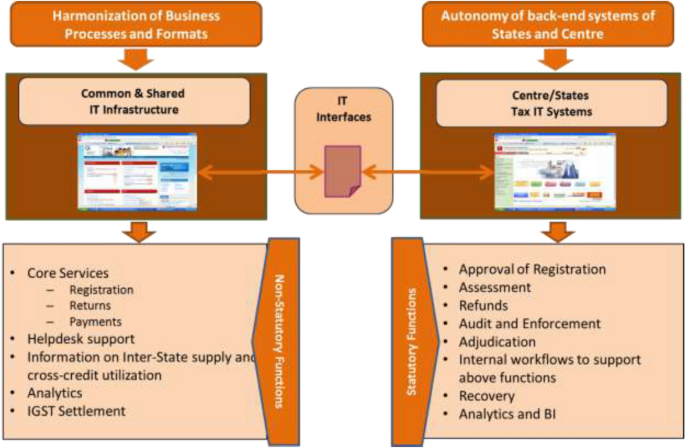

The government has taken several interventions and initiatives to improve the implementation process of GST in India. GST is the most extensive indirect tax reform in India's history, which required the integration of a nationwide diverse taxation portfolio into a single taxation system. Goods and Service Tax Network or GSTN was created to enable building a platform to meet various stakeholders' GST-related needs and smoothly facilitate the complex transaction. All the GST processes are covered under the highly diverse responsibilities of GSTN. They range from GST system application design, development and operation to IT infrastructure procurement, ensuring systemic resilience against failure and disaster, helpdesk setup and procedures, training and capacity building, backend system assessment for all the states and union territories, etc. (Fig. 6 ). Precisely, GSTN is designed to provide guidance and direction on policies and governance principles.

Source GST Council Knowledge Resources

Distribution of Work under GST.

Initially, GSTN was set up as a private company by the government but later acquired a majority stake. It provides three front-end services to the taxpayers: registration, payment, and return. The front-end solution is also assigned to develop a backend IT module for all the states/Union Territories. Infosys is selected as a Managed Service Provider or MSP for this project. A total of 73 IT/ITeS and fintech companies and one commissioner of commercial taxes (Karnataka) are impaneled as GST Suvidha Providers or GSPs to provide solutions across the nation. The role of these GSPs is to develop applications to be used by taxpayers who can facilitate interaction with GSTN. Figure 6 exhibits the work allocation under GST.

Besides process-related general measures expounded earlier, some of the specific issues addressed by the actors (primarily the government) are being highlighted as—a gradual increase in the coverage and the scope of GST in the form of inclusion and exclusion of commodities and services; revision in the coverage of various base rates keeping the consumer sensitivity into account. Likewise, the mechanism for dividing IGST collection between center and state is being negotiated by the central and the state government in the various meetings of the GST council. Accordingly, the center is working out the long-pending due to states (The Economic Times, 2020 ).

Since the government is generating the lion's share of GST revenue (63% approx.) from the public and private sector companies, their significant attention is toward resolving issues they are confronting first. The government is also developing ways to formalize the informal sectors to enhance the tax base (GST Council, 2020b ) to tame lopsided GST payers. In addition to this, the government needs a mechanism that can facilitate to meaningfully engage the stakeholders on such policy matters, which will create awareness and bust the myths being spread associated with the new fiscal policy instruments such as GST.

A detailed analysis of the situation presents several issues and challenges associated with the GST implementation, prevailing even after 3 years. Some of the critical challenges are presented in this section.

Need for More Robust IT System

For easy and speedy compliance, IT holds a significant role to play. Many companies, especially the MSMEs in the unorganized sector, lack adequate IT infrastructure. It calls for an efficient IT system for user-friendly tax administration. Presently, GSTN is serving as a particular purpose vehicle to facilitate the businesses in this, yet more selective support is desired.

Need for Skilled Human Resources

Even after three years of implementation of GST, the country is facing an acute scarcity of skilled workforce in IT and accounting. India has an adequate number of IT professionals, but a shortage of qualified accountants can help businesses deal with the new compliance norms.

Ambiguity in GST Provisions

GST subsumed 17 different levies to ease the compliance and remove the cascading effect in taxation. The system needs clarity on several aspects such as precise categorization of goods and services, and tax rates for various goods and services are yet to be fixed. Every next GST council meet comes up with newer agenda for dealing. Moreover, the shift from origin-based to destination-based taxation was not easy to implement in India's largest markets. Now, taxes are being collected based on the consumption of goods and services irrespective of their place of production, which caused a loss of revenue for industrial states. The council resolved that the central government would compensate such a loss of revenue for the initial few years. Also, there has been a demand from several pressure groups to bring high revenue items such as petrol, petroleum products, and alcohol under the ambit of GST, which is still under discussion.

Tackling the RNR Conundrum

It is challenging for the government to balance inflation and net revenue loss to attain an optimal revenue-neutral rate or RNR. RNR is referred to as a rate at which the government's revenue through the new tax regime (GST in this case) will be equal to the preceding taxation regime. It directly affects the fiscal policy and inflation rate (Kumar et al., 2018 ). The higher RNR causes a loss of competitive edge for India domestically vis-à-vis globally (Bhattacharya, 2017 cited from Kumar et al., 2018 ). The higher cost will push inflation and, in turn, badly affect the purchasing power. Narula ( 2016 ) asserted that RNR is one of the most significant GST implementation challenges and maintains that the government should ensure no revenue loss while adopting to a new taxation regime.

Lack of Awareness Among the Stakeholders

The Twitter sentiment analysis revealed that many stakeholders perceived the roll-out of GST negatively. One of the reasons could have been the lack of proper awareness about the new tax regime. Lourdunathan and Xavier ( 2017 ) suggested that India, a democratic country, should clarify its citizens about the recent amendments. Due to a lack of awareness, the citizens sometimes pay more taxes than required, especially in the rural areas and subsequent knowledge of which leads them to wear a negative perception of the tax regime.

After thoroughly analyzing the situation and the process, discussing the actions initiated to improve GST implementation is pertinent. The government of India, through GST council and CBIC backed by GSTN, has ensured the following changes.

Flexibility and Simplification of Compliances

The authorities have allowed taxpayers to comply during the transition by extending the deadline for filing returns and reconciliation by introducing the simplified return filing system and the nationwide e-way bill. The AI-based chatbot GITA or GST Interactive Technical Assistant trains the taxpayers' interaction easily and speedily. This way, the website visitors can interact and settle their issues without much workforce involvement after the introduction of the facility in June 2020.

Relief to MSMEs

The extension in registration threshold limit, introduction and extension of composition scheme to service providers have been taken well by the taxpayers, which proved to be a significant relief measure for MSMEs. Moreover, offering speedy solutions to the MSMEs' issues, GoI has already constituted a Group of Ministers (GoM) that thematically takes account of the situation in this regard. In another move, it was decided by the government that GSTN would provide free accounting and billing software to small taxpayers.

Rationalization of GST Rates

The rates of GST were decided considering the nature of commodities. Some of the entities classified as necessities were suitably reviewed and moved from the high tax bracket (18–28%) to the low-tax bracket, which several stakeholders took as a welcome move. In the 36th meeting of the GST Council in July 2019, the rate rationalization moves to emphasize and promote clean energy by council. The council decided to reduce the GST rates on electric vehicles from 12 to 5% and charger/charging stations from 18 to 5%.

Mobilization of Revenue

A Group of Ministers or GoM was constituted to study the revenue trend and assess the underlying reasons behind structural patterns influencing the revenue collection in some states. It would include looking at plausible reasons behind the deviation of the revenue collection targets from basic assumptions.

E-Way Bill System for Efficient Compliance