- Search Menu

- Browse content in A - General Economics and Teaching

- Browse content in A1 - General Economics

- A11 - Role of Economics; Role of Economists; Market for Economists

- A13 - Relation of Economics to Social Values

- A14 - Sociology of Economics

- Browse content in C - Mathematical and Quantitative Methods

- Browse content in C0 - General

- C02 - Mathematical Methods

- Browse content in C1 - Econometric and Statistical Methods and Methodology: General

- C10 - General

- C11 - Bayesian Analysis: General

- C12 - Hypothesis Testing: General

- C13 - Estimation: General

- C14 - Semiparametric and Nonparametric Methods: General

- C15 - Statistical Simulation Methods: General

- C18 - Methodological Issues: General

- Browse content in C2 - Single Equation Models; Single Variables

- C21 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions

- C22 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

- C23 - Panel Data Models; Spatio-temporal Models

- Browse content in C3 - Multiple or Simultaneous Equation Models; Multiple Variables

- C32 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes; State Space Models

- C38 - Classification Methods; Cluster Analysis; Principal Components; Factor Models

- Browse content in C4 - Econometric and Statistical Methods: Special Topics

- C45 - Neural Networks and Related Topics

- Browse content in C5 - Econometric Modeling

- C50 - General

- C51 - Model Construction and Estimation

- C52 - Model Evaluation, Validation, and Selection

- C53 - Forecasting and Prediction Methods; Simulation Methods

- C55 - Large Data Sets: Modeling and Analysis

- C58 - Financial Econometrics

- Browse content in C6 - Mathematical Methods; Programming Models; Mathematical and Simulation Modeling

- C61 - Optimization Techniques; Programming Models; Dynamic Analysis

- C62 - Existence and Stability Conditions of Equilibrium

- C65 - Miscellaneous Mathematical Tools

- Browse content in C7 - Game Theory and Bargaining Theory

- C70 - General

- C72 - Noncooperative Games

- C73 - Stochastic and Dynamic Games; Evolutionary Games; Repeated Games

- C78 - Bargaining Theory; Matching Theory

- Browse content in C8 - Data Collection and Data Estimation Methodology; Computer Programs

- C81 - Methodology for Collecting, Estimating, and Organizing Microeconomic Data; Data Access

- Browse content in C9 - Design of Experiments

- C91 - Laboratory, Individual Behavior

- C92 - Laboratory, Group Behavior

- C93 - Field Experiments

- Browse content in D - Microeconomics

- Browse content in D0 - General

- D03 - Behavioral Microeconomics: Underlying Principles

- Browse content in D1 - Household Behavior and Family Economics

- D10 - General

- D11 - Consumer Economics: Theory

- D12 - Consumer Economics: Empirical Analysis

- D14 - Household Saving; Personal Finance

- D15 - Intertemporal Household Choice: Life Cycle Models and Saving

- D18 - Consumer Protection

- Browse content in D2 - Production and Organizations

- D20 - General

- D21 - Firm Behavior: Theory

- D22 - Firm Behavior: Empirical Analysis

- D23 - Organizational Behavior; Transaction Costs; Property Rights

- D24 - Production; Cost; Capital; Capital, Total Factor, and Multifactor Productivity; Capacity

- D25 - Intertemporal Firm Choice: Investment, Capacity, and Financing

- Browse content in D3 - Distribution

- D30 - General

- D31 - Personal Income, Wealth, and Their Distributions

- Browse content in D4 - Market Structure, Pricing, and Design

- D40 - General

- D43 - Oligopoly and Other Forms of Market Imperfection

- D44 - Auctions

- D47 - Market Design

- D49 - Other

- Browse content in D5 - General Equilibrium and Disequilibrium

- D50 - General

- D51 - Exchange and Production Economies

- D52 - Incomplete Markets

- D53 - Financial Markets

- Browse content in D6 - Welfare Economics

- D60 - General

- D61 - Allocative Efficiency; Cost-Benefit Analysis

- D62 - Externalities

- Browse content in D7 - Analysis of Collective Decision-Making

- D70 - General

- D71 - Social Choice; Clubs; Committees; Associations

- D72 - Political Processes: Rent-seeking, Lobbying, Elections, Legislatures, and Voting Behavior

- D73 - Bureaucracy; Administrative Processes in Public Organizations; Corruption

- D74 - Conflict; Conflict Resolution; Alliances; Revolutions

- D78 - Positive Analysis of Policy Formulation and Implementation

- Browse content in D8 - Information, Knowledge, and Uncertainty

- D80 - General

- D81 - Criteria for Decision-Making under Risk and Uncertainty

- D82 - Asymmetric and Private Information; Mechanism Design

- D83 - Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

- D84 - Expectations; Speculations

- D85 - Network Formation and Analysis: Theory

- D86 - Economics of Contract: Theory

- D87 - Neuroeconomics

- Browse content in D9 - Micro-Based Behavioral Economics

- D90 - General

- D91 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making

- D92 - Intertemporal Firm Choice, Investment, Capacity, and Financing

- Browse content in E - Macroeconomics and Monetary Economics

- Browse content in E0 - General

- E00 - General

- E03 - Behavioral Macroeconomics

- Browse content in E1 - General Aggregative Models

- E17 - Forecasting and Simulation: Models and Applications

- Browse content in E2 - Consumption, Saving, Production, Investment, Labor Markets, and Informal Economy

- E20 - General

- E21 - Consumption; Saving; Wealth

- E22 - Investment; Capital; Intangible Capital; Capacity

- E23 - Production

- E24 - Employment; Unemployment; Wages; Intergenerational Income Distribution; Aggregate Human Capital; Aggregate Labor Productivity

- Browse content in E3 - Prices, Business Fluctuations, and Cycles

- E30 - General

- E31 - Price Level; Inflation; Deflation

- E32 - Business Fluctuations; Cycles

- E37 - Forecasting and Simulation: Models and Applications

- Browse content in E4 - Money and Interest Rates

- E40 - General

- E41 - Demand for Money

- E42 - Monetary Systems; Standards; Regimes; Government and the Monetary System; Payment Systems

- E43 - Interest Rates: Determination, Term Structure, and Effects

- E44 - Financial Markets and the Macroeconomy

- E47 - Forecasting and Simulation: Models and Applications

- Browse content in E5 - Monetary Policy, Central Banking, and the Supply of Money and Credit

- E50 - General

- E51 - Money Supply; Credit; Money Multipliers

- E52 - Monetary Policy

- E58 - Central Banks and Their Policies

- Browse content in E6 - Macroeconomic Policy, Macroeconomic Aspects of Public Finance, and General Outlook

- E60 - General

- E61 - Policy Objectives; Policy Designs and Consistency; Policy Coordination

- E62 - Fiscal Policy

- E63 - Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization; Treasury Policy

- E64 - Incomes Policy; Price Policy

- E65 - Studies of Particular Policy Episodes

- E66 - General Outlook and Conditions

- Browse content in E7 - Macro-Based Behavioral Economics

- E71 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on the Macro Economy

- Browse content in F - International Economics

- Browse content in F0 - General

- F02 - International Economic Order and Integration

- Browse content in F1 - Trade

- F14 - Empirical Studies of Trade

- Browse content in F2 - International Factor Movements and International Business

- F21 - International Investment; Long-Term Capital Movements

- F22 - International Migration

- F23 - Multinational Firms; International Business

- Browse content in F3 - International Finance

- F30 - General

- F31 - Foreign Exchange

- F32 - Current Account Adjustment; Short-Term Capital Movements

- F33 - International Monetary Arrangements and Institutions

- F34 - International Lending and Debt Problems

- F36 - Financial Aspects of Economic Integration

- F37 - International Finance Forecasting and Simulation: Models and Applications

- F38 - International Financial Policy: Financial Transactions Tax; Capital Controls

- Browse content in F4 - Macroeconomic Aspects of International Trade and Finance

- F40 - General

- F41 - Open Economy Macroeconomics

- F42 - International Policy Coordination and Transmission

- F43 - Economic Growth of Open Economies

- F44 - International Business Cycles

- F47 - Forecasting and Simulation: Models and Applications

- Browse content in F5 - International Relations, National Security, and International Political Economy

- F51 - International Conflicts; Negotiations; Sanctions

- Browse content in F6 - Economic Impacts of Globalization

- F63 - Economic Development

- F65 - Finance

- Browse content in G - Financial Economics

- Browse content in G0 - General

- G00 - General

- G01 - Financial Crises

- G02 - Behavioral Finance: Underlying Principles

- Browse content in G1 - General Financial Markets

- G10 - General

- G11 - Portfolio Choice; Investment Decisions

- G12 - Asset Pricing; Trading volume; Bond Interest Rates

- G13 - Contingent Pricing; Futures Pricing

- G14 - Information and Market Efficiency; Event Studies; Insider Trading

- G15 - International Financial Markets

- G17 - Financial Forecasting and Simulation

- G18 - Government Policy and Regulation

- G19 - Other

- Browse content in G2 - Financial Institutions and Services

- G20 - General

- G21 - Banks; Depository Institutions; Micro Finance Institutions; Mortgages

- G22 - Insurance; Insurance Companies; Actuarial Studies

- G23 - Non-bank Financial Institutions; Financial Instruments; Institutional Investors

- G24 - Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

- G28 - Government Policy and Regulation

- G29 - Other

- Browse content in G3 - Corporate Finance and Governance

- G30 - General

- G31 - Capital Budgeting; Fixed Investment and Inventory Studies; Capacity

- G32 - Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

- G33 - Bankruptcy; Liquidation

- G34 - Mergers; Acquisitions; Restructuring; Corporate Governance

- G35 - Payout Policy

- G38 - Government Policy and Regulation

- G39 - Other

- Browse content in G4 - Behavioral Finance

- G40 - General

- G41 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making in Financial Markets

- Browse content in G5 - Household Finance

- G50 - General

- G51 - Household Saving, Borrowing, Debt, and Wealth

- G52 - Insurance

- G53 - Financial Literacy

- Browse content in H - Public Economics

- H0 - General

- Browse content in H1 - Structure and Scope of Government

- H11 - Structure, Scope, and Performance of Government

- H19 - Other

- Browse content in H2 - Taxation, Subsidies, and Revenue

- H22 - Incidence

- H24 - Personal Income and Other Nonbusiness Taxes and Subsidies; includes inheritance and gift taxes

- H25 - Business Taxes and Subsidies

- H26 - Tax Evasion and Avoidance

- Browse content in H3 - Fiscal Policies and Behavior of Economic Agents

- H31 - Household

- Browse content in H4 - Publicly Provided Goods

- H40 - General

- H41 - Public Goods

- Browse content in H5 - National Government Expenditures and Related Policies

- H50 - General

- H52 - Government Expenditures and Education

- H53 - Government Expenditures and Welfare Programs

- H54 - Infrastructures; Other Public Investment and Capital Stock

- H55 - Social Security and Public Pensions

- H56 - National Security and War

- H57 - Procurement

- Browse content in H6 - National Budget, Deficit, and Debt

- H63 - Debt; Debt Management; Sovereign Debt

- Browse content in H7 - State and Local Government; Intergovernmental Relations

- H70 - General

- H72 - State and Local Budget and Expenditures

- H74 - State and Local Borrowing

- H75 - State and Local Government: Health; Education; Welfare; Public Pensions

- Browse content in H8 - Miscellaneous Issues

- H81 - Governmental Loans; Loan Guarantees; Credits; Grants; Bailouts

- Browse content in I - Health, Education, and Welfare

- Browse content in I1 - Health

- I11 - Analysis of Health Care Markets

- I12 - Health Behavior

- I13 - Health Insurance, Public and Private

- I18 - Government Policy; Regulation; Public Health

- Browse content in I2 - Education and Research Institutions

- I22 - Educational Finance; Financial Aid

- I23 - Higher Education; Research Institutions

- I28 - Government Policy

- Browse content in I3 - Welfare, Well-Being, and Poverty

- I30 - General

- I38 - Government Policy; Provision and Effects of Welfare Programs

- Browse content in J - Labor and Demographic Economics

- Browse content in J0 - General

- J00 - General

- Browse content in J1 - Demographic Economics

- J11 - Demographic Trends, Macroeconomic Effects, and Forecasts

- J12 - Marriage; Marital Dissolution; Family Structure; Domestic Abuse

- J13 - Fertility; Family Planning; Child Care; Children; Youth

- J15 - Economics of Minorities, Races, Indigenous Peoples, and Immigrants; Non-labor Discrimination

- J16 - Economics of Gender; Non-labor Discrimination

- J18 - Public Policy

- Browse content in J2 - Demand and Supply of Labor

- J20 - General

- J21 - Labor Force and Employment, Size, and Structure

- J22 - Time Allocation and Labor Supply

- J23 - Labor Demand

- J24 - Human Capital; Skills; Occupational Choice; Labor Productivity

- J26 - Retirement; Retirement Policies

- J28 - Safety; Job Satisfaction; Related Public Policy

- Browse content in J3 - Wages, Compensation, and Labor Costs

- J30 - General

- J31 - Wage Level and Structure; Wage Differentials

- J32 - Nonwage Labor Costs and Benefits; Retirement Plans; Private Pensions

- J33 - Compensation Packages; Payment Methods

- J38 - Public Policy

- Browse content in J4 - Particular Labor Markets

- J41 - Labor Contracts

- J44 - Professional Labor Markets; Occupational Licensing

- J45 - Public Sector Labor Markets

- J46 - Informal Labor Markets

- J49 - Other

- Browse content in J5 - Labor-Management Relations, Trade Unions, and Collective Bargaining

- J51 - Trade Unions: Objectives, Structure, and Effects

- J52 - Dispute Resolution: Strikes, Arbitration, and Mediation; Collective Bargaining

- Browse content in J6 - Mobility, Unemployment, Vacancies, and Immigrant Workers

- J61 - Geographic Labor Mobility; Immigrant Workers

- J62 - Job, Occupational, and Intergenerational Mobility

- J63 - Turnover; Vacancies; Layoffs

- J64 - Unemployment: Models, Duration, Incidence, and Job Search

- J65 - Unemployment Insurance; Severance Pay; Plant Closings

- J68 - Public Policy

- Browse content in J7 - Labor Discrimination

- J71 - Discrimination

- Browse content in J8 - Labor Standards: National and International

- J88 - Public Policy

- Browse content in K - Law and Economics

- Browse content in K1 - Basic Areas of Law

- K12 - Contract Law

- Browse content in K2 - Regulation and Business Law

- K22 - Business and Securities Law

- K23 - Regulated Industries and Administrative Law

- Browse content in K3 - Other Substantive Areas of Law

- K31 - Labor Law

- K32 - Environmental, Health, and Safety Law

- K34 - Tax Law

- K35 - Personal Bankruptcy Law

- Browse content in K4 - Legal Procedure, the Legal System, and Illegal Behavior

- K42 - Illegal Behavior and the Enforcement of Law

- Browse content in L - Industrial Organization

- Browse content in L1 - Market Structure, Firm Strategy, and Market Performance

- L10 - General

- L11 - Production, Pricing, and Market Structure; Size Distribution of Firms

- L13 - Oligopoly and Other Imperfect Markets

- L14 - Transactional Relationships; Contracts and Reputation; Networks

- L15 - Information and Product Quality; Standardization and Compatibility

- Browse content in L2 - Firm Objectives, Organization, and Behavior

- L21 - Business Objectives of the Firm

- L22 - Firm Organization and Market Structure

- L23 - Organization of Production

- L24 - Contracting Out; Joint Ventures; Technology Licensing

- L25 - Firm Performance: Size, Diversification, and Scope

- L26 - Entrepreneurship

- L29 - Other

- Browse content in L3 - Nonprofit Organizations and Public Enterprise

- L33 - Comparison of Public and Private Enterprises and Nonprofit Institutions; Privatization; Contracting Out

- Browse content in L4 - Antitrust Issues and Policies

- L43 - Legal Monopolies and Regulation or Deregulation

- L44 - Antitrust Policy and Public Enterprises, Nonprofit Institutions, and Professional Organizations

- Browse content in L5 - Regulation and Industrial Policy

- L51 - Economics of Regulation

- Browse content in L6 - Industry Studies: Manufacturing

- L66 - Food; Beverages; Cosmetics; Tobacco; Wine and Spirits

- Browse content in L8 - Industry Studies: Services

- L81 - Retail and Wholesale Trade; e-Commerce

- L85 - Real Estate Services

- L86 - Information and Internet Services; Computer Software

- Browse content in L9 - Industry Studies: Transportation and Utilities

- L92 - Railroads and Other Surface Transportation

- L94 - Electric Utilities

- Browse content in M - Business Administration and Business Economics; Marketing; Accounting; Personnel Economics

- Browse content in M0 - General

- M00 - General

- Browse content in M1 - Business Administration

- M12 - Personnel Management; Executives; Executive Compensation

- M13 - New Firms; Startups

- M14 - Corporate Culture; Social Responsibility

- M16 - International Business Administration

- Browse content in M2 - Business Economics

- M20 - General

- M21 - Business Economics

- Browse content in M3 - Marketing and Advertising

- M30 - General

- M31 - Marketing

- M37 - Advertising

- Browse content in M4 - Accounting and Auditing

- M40 - General

- M41 - Accounting

- M42 - Auditing

- M48 - Government Policy and Regulation

- Browse content in M5 - Personnel Economics

- M51 - Firm Employment Decisions; Promotions

- M52 - Compensation and Compensation Methods and Their Effects

- M54 - Labor Management

- Browse content in N - Economic History

- Browse content in N1 - Macroeconomics and Monetary Economics; Industrial Structure; Growth; Fluctuations

- N10 - General, International, or Comparative

- N12 - U.S.; Canada: 1913-

- Browse content in N2 - Financial Markets and Institutions

- N20 - General, International, or Comparative

- N21 - U.S.; Canada: Pre-1913

- N22 - U.S.; Canada: 1913-

- N23 - Europe: Pre-1913

- N24 - Europe: 1913-

- N25 - Asia including Middle East

- N27 - Africa; Oceania

- Browse content in N3 - Labor and Consumers, Demography, Education, Health, Welfare, Income, Wealth, Religion, and Philanthropy

- N32 - U.S.; Canada: 1913-

- Browse content in N4 - Government, War, Law, International Relations, and Regulation

- N43 - Europe: Pre-1913

- Browse content in N7 - Transport, Trade, Energy, Technology, and Other Services

- N71 - U.S.; Canada: Pre-1913

- Browse content in N8 - Micro-Business History

- N80 - General, International, or Comparative

- N82 - U.S.; Canada: 1913-

- Browse content in O - Economic Development, Innovation, Technological Change, and Growth

- Browse content in O1 - Economic Development

- O11 - Macroeconomic Analyses of Economic Development

- O12 - Microeconomic Analyses of Economic Development

- O13 - Agriculture; Natural Resources; Energy; Environment; Other Primary Products

- O16 - Financial Markets; Saving and Capital Investment; Corporate Finance and Governance

- O17 - Formal and Informal Sectors; Shadow Economy; Institutional Arrangements

- Browse content in O2 - Development Planning and Policy

- O23 - Fiscal and Monetary Policy in Development

- Browse content in O3 - Innovation; Research and Development; Technological Change; Intellectual Property Rights

- O30 - General

- O31 - Innovation and Invention: Processes and Incentives

- O32 - Management of Technological Innovation and R&D

- O33 - Technological Change: Choices and Consequences; Diffusion Processes

- O34 - Intellectual Property and Intellectual Capital

- O35 - Social Innovation

- O38 - Government Policy

- Browse content in O4 - Economic Growth and Aggregate Productivity

- O40 - General

- O43 - Institutions and Growth

- Browse content in O5 - Economywide Country Studies

- O53 - Asia including Middle East

- Browse content in P - Economic Systems

- Browse content in P1 - Capitalist Systems

- P16 - Political Economy

- P18 - Energy: Environment

- Browse content in P2 - Socialist Systems and Transitional Economies

- P26 - Political Economy; Property Rights

- Browse content in P3 - Socialist Institutions and Their Transitions

- P31 - Socialist Enterprises and Their Transitions

- P34 - Financial Economics

- P39 - Other

- Browse content in P4 - Other Economic Systems

- P43 - Public Economics; Financial Economics

- P48 - Political Economy; Legal Institutions; Property Rights; Natural Resources; Energy; Environment; Regional Studies

- Browse content in Q - Agricultural and Natural Resource Economics; Environmental and Ecological Economics

- Browse content in Q0 - General

- Q02 - Commodity Markets

- Browse content in Q3 - Nonrenewable Resources and Conservation

- Q31 - Demand and Supply; Prices

- Q32 - Exhaustible Resources and Economic Development

- Browse content in Q4 - Energy

- Q40 - General

- Q41 - Demand and Supply; Prices

- Q42 - Alternative Energy Sources

- Q43 - Energy and the Macroeconomy

- Browse content in Q5 - Environmental Economics

- Q50 - General

- Q51 - Valuation of Environmental Effects

- Q53 - Air Pollution; Water Pollution; Noise; Hazardous Waste; Solid Waste; Recycling

- Q54 - Climate; Natural Disasters; Global Warming

- Q56 - Environment and Development; Environment and Trade; Sustainability; Environmental Accounts and Accounting; Environmental Equity; Population Growth

- Browse content in R - Urban, Rural, Regional, Real Estate, and Transportation Economics

- Browse content in R0 - General

- R00 - General

- Browse content in R1 - General Regional Economics

- R10 - General

- R11 - Regional Economic Activity: Growth, Development, Environmental Issues, and Changes

- R12 - Size and Spatial Distributions of Regional Economic Activity

- Browse content in R2 - Household Analysis

- R20 - General

- R21 - Housing Demand

- R23 - Regional Migration; Regional Labor Markets; Population; Neighborhood Characteristics

- Browse content in R3 - Real Estate Markets, Spatial Production Analysis, and Firm Location

- R30 - General

- R31 - Housing Supply and Markets

- R32 - Other Spatial Production and Pricing Analysis

- R33 - Nonagricultural and Nonresidential Real Estate Markets

- R38 - Government Policy

- Browse content in R4 - Transportation Economics

- R41 - Transportation: Demand, Supply, and Congestion; Travel Time; Safety and Accidents; Transportation Noise

- Browse content in R5 - Regional Government Analysis

- R51 - Finance in Urban and Rural Economies

- Browse content in Z - Other Special Topics

- Browse content in Z1 - Cultural Economics; Economic Sociology; Economic Anthropology

- Z11 - Economics of the Arts and Literature

- Z13 - Economic Sociology; Economic Anthropology; Social and Economic Stratification

- Advance articles

- Editor's Choice

- Author Guidelines

- Submission Site

- Open Access

- About The Review of Financial Studies

- Editorial Board

- Advertising and Corporate Services

- Journals Career Network

- Self-Archiving Policy

- Dispatch Dates

- Terms and Conditions

- Journals on Oxford Academic

- Books on Oxford Academic

Article Contents

1. an inconvenient void, 2. launching a call for new research on climate finance, 3. contributions to the climate finance research program, 4. where does climate finance research go from here, 5. one final remark, acknowledgement, climate finance.

- Article contents

- Figures & tables

- Supplementary Data

Harrison Hong, G Andrew Karolyi, José A Scheinkman, Climate Finance, The Review of Financial Studies , Volume 33, Issue 3, March 2020, Pages 1011–1023, https://doi.org/10.1093/rfs/hhz146

- Permissions Icon Permissions

Climate finance is the study of local and global financing of public and private investment that seeks to support mitigation of and adaptation to climate change. In 2017, the Review of Financial Studies launched a competition among scholars to develop research proposals on the topic with the goal of publishing this special volume. We describe the competition, how the nine projects featured in this volume came to be published, and frame their findings within what we view as a broader climate finance research program.

Climate finance is defined by the United Nations Framework Convention on Climate Change (UNFCCC) to be “local, national, or transnational financing—drawn from public, private, and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.” It is about investments that governments, corporations, and households have to undertake to transition the world’s economy to a low-carbon path, to reduce greenhouse gas concentrations levels, and to build resilience of countries to climate change. The European Commission estimates that energy and infrastructure investments, mainly from the private sector, would have to rise to 2.8% of European Union gross domestic product (GDP) from 2% today (or an additional |${\$}$| 376 billion annually) to reduce EU net greenhouse gas emissions to zero by midcentury. 1 Estimates for decarbonizing power generation in the United States are comparable. Absent mitigation and adaptation, a major scientific report issued by thirteen U.S. federal agencies in November 2018 predicted that the potential damage from the consequences of climate change would knock as much as 10% off the size of the U.S. economy by century’s end. 2

These large estimates only coarsely encapsulate the significant risks of global warming for firm profits, capital markets, and household wealth. Many sectors, ranging from energy, food, and insurance to real estate, are directly impacted by risks generated by a potential price on carbon, adverse shocks to agricultural productivity, or exposures to rising sea levels, to name a few. Underlying these concerns are difficult questions regarding the distribution of damages from global warming, how society should price and mitigate risks from global emissions, and whether capital markets—to the extent that they can assess and price these exposures—can raise such large sums and potentially help households and institutions hedge climate change risks.

Answers to these questions in turn depend on expectations that agents in the economy hold. A case in point is that ongoing worries by some in the private sector about wavering commitments to the Paris Climate Agreement goals have prompted efforts to mobilize, such as the Climate Finance Leadership Initiative and the newly launched Principles for Responsible Banking. 3 Such sustainable investing initiatives have the potential to influence the cost of capital for high carbon emissions companies even in the case of explicit carbon taxes. Raising the trillions necessary over the coming decades to address global warming will also no doubt rely on financial innovations.

Even though questions such as pricing and hedging of risks, the formation of expectations, and financial innovations are natural ones for financial economists to tackle, little research has been published to date in our top finance journals. The award of 2018’s Nobel Prize in Economics to William Nordhaus for his work on integrated assessment models for climate change going back to the mid-1970s (for example, Nordhaus 1977 ) reminds us of the missed research opportunity for financial economists to assess the risks associated with climate change as a global externality ( Nordhaus 2019 ).

The current volume represents the effort of the Review to remedy this dearth of research on climate finance. It was a problem that the editorial team of the Review recognized back in 2016. To this end, the editors, with the support of the Society for Financial Studies, launched a competition in 2017 using a novel editorial protocol—a Registered Reports (RR) format—that drew 106 submissions from scholars around the world on the topic. This competition paralleled in structure another one focused on the similarly under-researched topic of fintech that was published in the Review in May 2019 (see Goldstein, Jiang, and Karolyi 2019 ).

The idea behind RRs, a peer-reviewed editorial protocol developed in the cognitive sciences by the journal Cortex , is simple. Authors submit for review a research plan that designs an experiment, outlines the data to be collected, and describes potential interpretations of what findings may come; expert reviewers judge the proposed plan on its merit and not on the basis of the findings. Further, editors offer in-principle acceptance of the submission before final results are known. While the primary goal of RRs is to eliminate disincentives to publish negative or non-results and to mitigate publication bias, the editors of the Review believed this would be the ideal editorial protocol for a topic as controversial as that of climate change and global warming. 4 Not only would it allow for the truth about the potential economic consequences of climate change for financial markets to come to the fore, but it might provide the incentives needed to draw out hesitant scholars who might be inclined to take on new research on climate finance.

We, as the editors of this special volume, needed to secure additional support beyond that of the Society to make this competition work. Major financial support came from Norges Bank Investment Management for the preliminary project proposal workshop at Columbia University (November 2017) and for a conference co-hosted by Imperial College Business School in London (October 2018) at which the findings would be unveiled. We also received additional support from the Program for Economic Research at Columbia University, the Brevan Howard Centre at Imperial University, and two of the Prince of Wales’s charities, Accounting for Sustainability (A4S) and the University of Cambridge Institute for Sustainability Leadership (CISL).

The editorial team assembled a twenty-three-person scientific council of reviewers to help review the proposals among the first pass of 106 submissions and the finalists who were to be invited to the Columbia University workshop, at which a number of them served as discussants. 5 We also drew on dozens of additional anonymous reviewers who participated in one or more of the three rounds of reviews that each of the ultimately nine successful proposals survived.

In the remainder of this editorial, we will outline how the research competition evolved and what we received, and then lay out the findings on climate finance that this special volume represents within what we view going forward as a broader climate finance research agenda.

Our call for proposals was launched on January 31, 2017. We purposefully allowed a short five-month window for proposals to come forward with a deadline of July 30, 2017, in order that the competitive process would feature bona-fide proposals true to the goals of the RR process.

In the call for proposals, we asked for research on a number of questions, including: (i) linking trends in global temperatures to firm and industry cash flows; (ii) modeling valuations of vulnerable sectors to a warming climate; (iii) agency, governance, and general incentive problems that might distort corporate climate risk management; (iv) the risks of stranded assets for energy- and carbon-intensive firms and industries; (v) the building of hedge portfolios of climate state variables; and (vi) understanding a firm’s climate risk exposures based on sparse corporate disclosures or environmental ratings by public/private agencies.

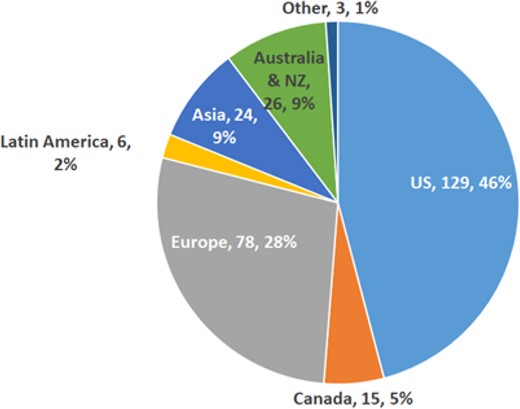

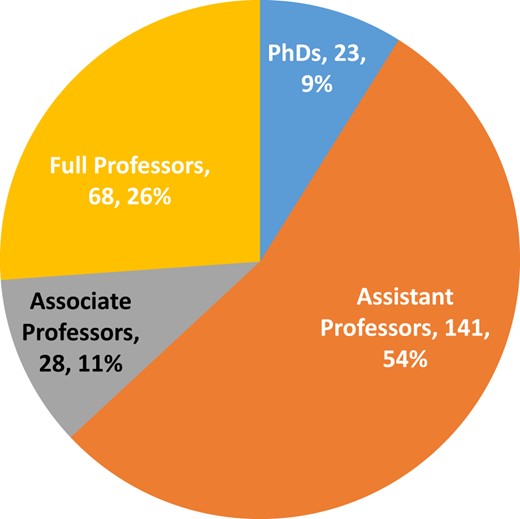

Our expectations about what might come forward were modest given that there were so few available working papers dealing with such questions. Remarkably, we received 106 proposals from 281 scholars affiliated with 183 different universities, government agencies, banks, and private firms from around the world. Many of those scholars are from outside North America. Figure 1 shows that only 46% (129) of the scholars on the proposal teams are domiciled in the United States and only 5% (14) are from Canada. Figure 2 demonstrates that it was younger scholars that revealed an appetite for climate finance research; 63% of the contributing scholars were either assistant professors (141) or Ph.D. students (23).

Composition of authors among RFS climate finance proposals submitted by geographic location

This figure reports the country of domicile of affiliated academic institution for the 409 authors among the 106 RFS climate finance proposals received by July 30, 2017, to the open call issued on January 31, 2017.

Composition of authors among RFS climate finance proposals by academic rank

This figure reports the rank of the 281 authors among the 106 RFS climate finance proposals received by July 30, 2017, to the open call issued on January 31, 2017.

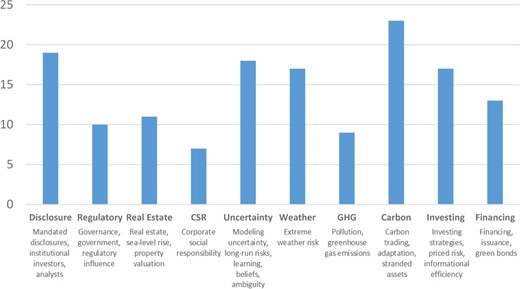

Figure 3 shows that the largest number of proposals fell into what we called the category of “Carbon,” which focused on carbon trading, adaptation, and stranded assets. This was not unexpected, as climate economics as a line of inquiry had already delved into this area. 6 The next largest category of submissions was under “Disclosure,” which examines mandated disclosures, the study of attitudes and actions of institutional investors and analysts; followed by “Investing,” which focuses on investing strategies, priced risk factors, and informational efficiency; “Uncertainty,” which examines modeling uncertainty, long-run risks, learning, beliefs, and ambiguity; and finally, “Weather,” which emphasized extreme weather risk.

Topic areas featured among the RFS climate finance Registered Reports proposals

This figure reports the topic areas among eight major topic areas among the 106 climate finance proposals received by July 30, 2017, to the open call issued on January 31, 2017.

The final nine papers that make up this special issue on climate finance reflect the diversity of the topics addressed in the submissions. They ask questions and use tools that have been emphasized by financial economists and show how finance can contribute to the discussion on the impact of climate change. We frame these contributions along the lines of what we view as a reasonable climate finance research agenda going forward.

3.1 Uncertain social cost of carbon

There has been considerable work and controversy surrounding the choice of discount rates in the climate economics literature on the social cost of carbon. Gollier (2013) provides a useful review. Financial economics has emphasized the importance of the Arrow-Debreu insight that discounting of payoffs should be state-contingent. Barnett, Brock, and Hansen (2019) combine asset pricing methods and decision theory to estimate the social cost of carbon. They point out that this estimation must face both the uncertain impact of climate on human welfare and the uncertainty concerning models that describe the transmission mechanism of human activity to climate.

Barnett, Brock, and Hansen (2019) nest influential models in the literature, such as those of Nordhaus (1977) and Weitzman (2009) . They show that the interaction of these two sources of uncertainty is multiplicative, such that the impact on the social cost of carbon is substantial when each component is important. They also show that the presence of ambiguity aversion and aversion to model misspecification can substantially increase the estimates of the social cost of carbon. Their methodology shows how one can effectively integrate simplified models developed by physical scientists with tractable models of the economic damage caused by climate change.

3.2 Hedging climate risks

While Barnett, Brock, and Hansen (2019) demonstrate how asset pricing approaches can inform even developed topics in academic research on climate change, Engle et al. (2019) show how traditional portfolio approaches can raise new topics such as how to hedge climate risks. They use another standard tool of asset pricing, namely that of mimicking portfolios, to build portfolios that are hedged against innovations in climate change news. They start by constructing a series of innovations on views on climate change using textual analysis of newspapers and then use the mimicking portfolio approach to build climate-change-news hedge portfolios. Engle et al. (2019) then show that the mimicking portfolios they construct can successfully hedge the innovations in climate change news using a number of out-of-sample performance tests. To the extent climate change news is a good proxy for underlying climate change risks, their mimicking portfolio approach can serve as a hedge against climate change risks.

This work harkens back to a large finance literature on economic tracking portfolios and macroeconomic variables such as GDP. An interesting avenue for future research would then focus on the extent to which temperature or other climate variables such as droughts can be economically tracked using the returns of stock portfolios.

3.3 Efficiency of capital markets and climate change

Given the macroeconomic impact of climate change, asset prices should be particularly sensitive to the exposure of their cash flows to climate risks. Murfin and Spiegel (2019) use a data set of recent residential real estate transactions matched with property level elevation and tidal data to ask whether house prices reflect differential sea level rise risk. In particular, they are able to separate the impact of sea level rise as distinct from the hedonic value of property elevation by using the pace of land subsidence and rebound as a source of variation in the expected pace of regional relative sea level rise. In contrast to the work of Bernstein, Gustafson, and Lewis (2019) or Baldauf, Garlappi, and Yannelis (2019) , their findings indicate limited price effects, perhaps due to optimism about sea level rise or the possibilities of mitigation and bailouts.

Baldauf, Garlappi, and Yannelis (2019) use transactions data to measure the effect of flooding projections of individual homes and local measures of beliefs about climate change on house prices. They document that houses projected to be underwater in believer counties sell at a discount when compared with houses in denier counties, suggesting substantial difference-in-beliefs across locations. In contrast to Murfin and Spiegel (2019) , Baldauf, Garlappi, and Yannelis (2019) emphasize the importance in beliefs about climate risk to how or if it is priced. Also, the National Oceanic and Atmospheric Administration (NOAA) data they use ignores land rebound and subsidence but accounts for local and regional tidal variability and variation in property risk due to protective land topography between a property and the nearest shoreline.

These two papers directly address an important and wide-ranging debate on the efficiency of capital markets in pricing risks associated with climate change. And whereas regulatory discussions on market efficiency have mostly focused on the “stranded asset issue” (or energy corporations’ exposures to potential carbon taxes), these papers point to more general vulnerabilities of other asset classes to climate change risks such as agricultural output from droughts ( Hong, Li, and Xu 2019 ) or even aggregate stock market performance ( Bansal, Kiku, and Ochoa 2016 ).

3.4 Beliefs and climate change risks

Beliefs play a crucial role in financing new technologies for climate mitigation and in determining prices of assets that are sensitive to climate change. Hence, characterizing the beliefs of investors and of key insiders of corporations such as CEOs is crucial to the efficient markets debate when it comes to pricing of climate change risks.

Three papers in this issue deal directly with the impact of beliefs. Choi, Gao, and Jiang (2019) seek to measure the impact of abnormally high local temperature on beliefs about climate change. They document that Google search volume for “global warming” in different cities around the world increases when the local temperature is abnormally high, indicating that attention to the topic increases at those times. In addition, by examining trading volume and returns in the stock markets of those cities during these events, retail, but not institutional, investors sell carbon-intensive stocks, and carbon-intensive firms underperform firms with low emissions.

Although institutional investors do not react to abnormal local temperature, Alok, Kumar, and Wermers (2019) document that professional money managers overreact to large climatic disasters that happen close to them, underweighting disaster-zone stocks to a much greater degree than distant mutual fund managers. They also document that this overreaction can be costly to fund investor performance.

Krueger, Sautner, and Starks (2019) survey global institutional investors on perceptions related to climate risk. They find that although institutional investors rank climate risk down the ranks relative to financial, legal, and operational risks, they still regard them to be important. The investors also believe these risks already affect firms they invest in. In addition, many investors report that they do take actions related to climate risks. Risk management and engagement are considered preferable to divestment. Krueger, Sautner, and Starks (2019) also found that these institutional investors believe that equity valuations in some sectors do not fully reflect climate risks.

3.5 Damage functions

A crucial input for analysis of climate change risks is the causal impact of higher temperatures on economic activity, what is called the distribution of damages. A large economics literature finds that years with abnormally higher temperatures (due to exogenous weather fluctuations) lead to lower economic activity in less developed countries. The literature argues that one can use these estimates to extrapolate the likely impact of 2 |$^{o}$| Celsius increases on output holding fixed any adaptations ( Dell, Jones, and Olken 2014 ; Schenkler and Roberts 2009). This analysis is subject to two caveats: (i) adaption in the long run should lessen the shock; (ii) climate scientists emphasize that short-term temperature variations are not a reliable gauge of long-run climate change, particularly if there are tipping points in damage functions.

Addoum, Ng, and Ortiz-Bobea (2019) extend this literature to account for the effects of temperature on establishment sales by building a detailed panel of temperature exposures for economic establishments across the United States to estimate how location-specific temporary temperature shocks affect establishment-level sales and productivity. They find that the population average effects on sales and productivity of these shocks are close to zero, indicating that establishments are able to accommodate these temporary shocks. This conclusion is subject to a caveat that long-run changes in temperature can and do lead to a rise in extreme weather risks. So extrapolating from short-term temperature changes is also potentially problematic for this reason. This study suggests that companies in developed countries are less likely to be affected by extreme temperature, at least on average.

3.6 Short-termism and corporate emissions

Given that corporations and insiders (CEOs) ultimately need to make investments to address climate change, two traditional corporate finance issues loom large: agency problems associated with corporate short-termism and financing constraints. Even absent the issues of externalities, agency and financial constraint consideration can result in a less than first-best level of investment to address climate change.

To this end, Shive and Forster (2019) use data on greenhouse gas emissions to show that independent private firms are less likely to pollute or incur Environmental Protection Agency (EPA) penalties than public firms. These results suggest that ownership structure, and hence agency and horizon considerations, may affect the climate change impact of firms. It would be interesting to further link emissions to real innovations as measured by patents geared toward climate change risks.

The taxonomy that we have laid out above is not a bad place to start as far as advancing the climate finance agenda. However, there are several other areas not covered by our set of nine papers that we think researchers should also tackle.

We see an important open question about the modeling and sharing of extreme weather risks. Extreme weather risks, such as the impact of Hurricane Sandy in 2012 on New York City property prices or the impact of the 2018 California wildfires on the Pacific Gas & Electric bankruptcy, are a reminder that climate change risks need not be confined to long horizons. Scientists predict that climate change will lead to more frequent and ever more extreme weather risks. Remote sensing (primarily through satellite or drone imaging) and machine learning can potentially help companies and society manage these risks.

Financial economists can use these tools to characterize the loss distributions using insurance data for floods or fires. These distributions in turn can depend on locational decisions by households and firms, technology decisions (such as by means of fire suppression or building codes) in terms of mitigating the damage of disasters, and the underlying weather processes themselves. Modeling these interactions and how they contribute to tail risks would be valuable for managers and policy makers.

Beyond modeling these loss distributions, the insurance and mortgage industries play critical roles in facilitating risk-sharing and extending credit in the aftermath of extreme weather events. Recent work by Ouazad and Kahn (2019) shows that mortgages in areas adversely affected by hurricanes are more likely to be securitized. This evidence is suggestive of the important role played by the finance industry in helping households manage climate risks.

A second major research push should focus on divestment, stranded assets, and the consequences for financial stability. Energy companies have become the new “sin stocks” facing divestment campaigns and lawsuits from shareholders alleging misleading disclosures regarding the costs of climate change. These divestment and legal campaigns are similar to what tobacco companies faced a generation ago and have the potential to influence the cost of capital of these companies (see, among others, Heinkel, Kraus, and Zechner 2001 ; Hong and Kacperczyk 2009 ). Recent work by Bolton, and Kacperczyk (2019) documents that institutions might indeed already be screening out companies of high carbon exposure based on similar considerations.

Such a divestment scenario in conjunction with lawsuits and lobbying for potential regulation would lead to significant stranded asset risk. Given the importance of the energy sector, this could be just the kind of systemic or financial stability type of event raised by outgoing Bank of England governor Mark Carney (2015) . Modeling this stranded asset risk requires integrating analyses of lobbying and regulation into otherwise standard asset pricing or corporate finance frameworks and would be extremely interesting.

A third research initiative is on the impact of climate change on municipal finance. Cities are increasingly affected by severe weather events. Even abnormal precipitation can cost millions to clean up and stretch already limited city budgets. Ratings agencies are considering incorporating climate change resilience measures into municipal bond ratings. How to measure resilience of municipalities and the impact of this resilience on municipal bond prices would be valuable. There is some preliminary evidence that municipal bonds have begun responding to some of these potential risks ( Painter Forthcoming ).

A fourth research agenda should focus on the impediments to corporate and financial innovation related to climate change. Despite numerous papers in climate economics, there is surprisingly little on corporate adaptation to climate change via innovations. The few notable exceptions include Miao and Popp (2014) , who address how droughts lead to more patent activity geared toward drought-resistant crops. Given the rich literatures in corporate finance on the determinants of corporate innovation and patent activity, a focus on the subset of patents associated with adaptation to climate change and the determinants or impediments to such adaptations would be valuable. To fund these corporate innovations, there will no doubt also have to be financial innovations. Some of these innovations, such as green bonds, are gradually emerging ( Flammer 2018 ; Baker, Bergstresser, Serafeim, and Wurgler 2018 ), and the nature and impact of such innovations will be worthy topics of future study.

Even though we financial economists are late to the game, we hope that this climate finance issue illustrates that there are many important questions where financial economists are naturally suited given their toolkit and interests. We are confident that the engagement of the broader academic finance community on these issues will no doubt lead to valuable contributions to improving the usefulness of the finance field to help society address perhaps unprecedented risks from climate change in the upcoming years.

This editorial is written for a special issue of the Review of Financial Studies focused on climate finance. The authors served as the editors of the special issue of papers, which was curated using a Registered Reports editorial format. The papers were presented at a workshop event in November 2017 at Columbia University and at a conference hosted by Imperial College London in October 2018. The presentations by the authors and the comments from plenary discussions at the workshop and conference were valuable in shaping the views shared in this editorial. We thank Norges Bank Investment Management (NBIM) and the Norwegian Finance Initiative (NFI) for substantial financial support and the invaluable advice of Wilhelm Mohn and Carine Smith Ihenacho of NBIM without which the workshop and conference events could not have happened. We thank the Program in Economic Research at Columbia University, Stephanie Cohen, and Sophia Johnson for help with the workshop. We thank Franklin Allen, Jaswinder Gil, and the Imperial College Business School’s Brevan Howard Centre for Financial Analysis for help with the London conference. Comments on this editorial are gratefully acknowledged from Jawad Addoum, Shashwat Alok, Darwin Choi, Jessica Fries, Lorenzo Garlappi, Itay Goldstein, Matt Linn, Justin Murfin, Sophie Shive, Matt Spiegel, Alexis Wegerich, and Zacharias Sautner. We finally thank the members of the Scientific Review Committee who agreed to help with this initiative as well as Charlie Donovan, Jessica Fries, Hannah Brockfield, Andrew Voysey, Nina Seega, and Yazid Sharaiha. Editorial assistance was gratefully received from Managing Editor Jaclyn Einstein and Dawoon Kim. Of course, all errors in the editorial remain the responsibility of the authors.

1 See “EU’s 2050 Climate Plan Sees Benefits of Up to 2% of GDP,” Euractiv , November 28, 2018. See also the joint letter to Commissioner Miguel Arias Canete from ministers from ten EU countries charting a “credible and detailed path” to net-zero emissions by 2050.

2 See “U.S. Climate Report Warns of Damaged Environment and Shrinking Economy,” New York Times , November 23, 2018.

3 According to the International Energy Agency, spending on renewable power such as wind, solar and biomass projects slipped 1% in real terms to |${\$}$| 304 billion in 2018, the lowest level since 2014 (“Falling Renewables Investment Stalls Paris Climate Goals,” Financial Times , May 14, 2019). Former mayor Michael Bloomberg, the UN Secretary-General’s Special Envoy for Climate Action, together with former SEC chairperson Mary Schapiro, announced the Climate Summit for the 74th UN General Assembly in September 2019. The UN Environment Program’s Finance Initiative launches the Principles for Responsible Banking at the same UN General Assembly.

4 The concept was outlined on May 3, 2013, in an editorial by Chambers and Della Sala (2013) , entitled “Journal Cortex Launches Registered Reports.” Further details are in Chambers et al. (2014) . Our editors are grateful to Chris Chambers for his advice early in planning in 2016, as well as helpful discussions with Brian Nosek of the Center for Open Science, which tracks all publications across disciplines using RR formats, and Rob Bloomfield and Christian Leuz of the Journal of Accounting Research , which published its own RR special volume in 2018.

5 We want to thank our committee including Ravi Bansal, Patrick Bolton, Francesca Cornelli, Magnus Dalhquist, Robert Engle, Xavier Gabaix, Stefano Giglio, Michael Goldtsein, Valentin Haddad, Lars Hansen, Leonid Kogan, Ralph Kojien, Per Krusell, Robert Litterman, Christopher Sims, David Sraer, Heather Tookes, Rossen Valkanov, Jessica Wachter, Jiangmin Xu, Jialin Yu, and Motohiro Yogo.

6 According to the Social Sciences Research Network (SSRN), there are 772 working papers posted (as of July 20, 2019) that fall under the topic area of “carbon trading” and another 45 under “stranded assets,” and the vast majority of those were posted before 2019.

Addoum, J. M. , Ng D. T. , and Ortiz-Bobea A. . 2019 . Temperature shocks and earnings news . Review of Financial Studies , this issue.

Google Scholar

Alok, S. , Kumar N. , and Wermers R. . 2019 . Do fund managers misestimate climatic disaster risk? Review of Financial Studies , this issue.

Baker, M. , Bergstresser D. , Serafeim G. , and Wurgler J. . 2018 . Financing the response to climate change: The pricing and ownership of U.S. green bonds . NBER Working Paper no. w25194 .

Google Preview

Baldauf, M. , Garlappi L. , and Yannelis C. . 2019 . Does climate change affect real estate prices? Only if you believe in it . Review of Financial Studies , this issue.

Bansal, R. , Kiku D. , and Ochoa M. . 2016 . Price of long-run temperature shifts in capital markets . NBER Working Paper no. w22529 .

Barnett, M. , Brock W. A. , and Hansen L. P. . 2019 . Pricing uncertainty induced by climate change . Review of Financial Studies , this issue.

Bernstein, A. , Gustafson M. T. , and Lewis R. . 2019 . Disaster on the horizon: The price effect of sea level rise . Journal of Financial Economics , forthcoming.

Bolton, P. , and Kacperczyk M. T. . 2019 . Do investors care about carbon risk? Columbia University and Imperial College London Business School Working Paper . Available at SSRN 3398441 .

Carney, M. 2015 , September 29 . Breaking the tragedy of the horizon: Climate change and financial stability . Speech given at Lloyd’s of London .

Chambers, C. D. , and Della Sala S. . 2013 . Splitting the review process into two stages: Journal Cortex launches Registered Reports . Retrieved May 14, 2015 , at https://www.elsevier.com/editors-update/story/peer-review/spliting-the-review-process-into-two-stages .

Chambers, C. D. , Feredoes E. , and Muthukumaraswamy S. D. . 2014 . Instead of “playing the game” it is time to change the rules: Registered Reports at AIMS Neuroscience and beyond . AIMS Neuroscience 1 : 4 – 17 .

Choi, D. , Gao Z. , and Jiang W. , 2019 . Attention to global warming . Review of Financial Studies , this issue.

Dell, M. , Jones B. F. , and Olken B. A. . 2014 . What do we learn from the weather? The new climate-economy literature . Journal of Economic Literature 52 : 740 – 98 .

Engle, R. F. III, , Giglio, S. Kelly, B. T. Lee, H. and Stroebel, J. , 2019 . Hedging climate change news . Review of Financial Studies , this issue.

Flammer, C. 2018 . Corporate green bonds . Boston University Working Paper .

Goldstein, I. , Jiang W. , and Karolyi G. A. . 2019 . To fintech and beyond . Review of Financial Studies 32 : 1647 – 61 .

Gollier, C. 2013 . Pricing the planet’s future: The economics of discounting in an uncertain world . Princeton, NJ : Princeton University Press .

Heinkel, R. , Kraus A. , and Zechner J. , J., 2001 . The effect of green investment on corporate behavior . Journal of Financial and Quantitative Analysis 36 : 431 – 49 .

Hong, H. , and Kacperczyk M. . 2009 . The price of sin: The effects of social norms on markets . Journal of Financial Economics 93 : 15 – 36 .

Hong, H. , Li F. W. , and Xu J. . 2019 . Climate risks and market efficiency . Journal of Econometrics 208 : 265 – 81 .

Krueger, P. , Sautner Z. , and Starks L. T. . 2019 . The importance of climate risks for institutional investors . Review of Financial Studies , this volume.

Miao, Q. , and Popp, D. 2014 . Necessity as the mother of invention: Innovative responses to natural disasters . Journal of Environmental Economics and Management 68 : 280 – 95 .

Murfin, J. , and Spiegel M. . 2019 . Is the risk of sea level rise capitalized in residential real estate? Review of Financial Studies , this issue.

Nordhaus, W. D. 1977 . Economic growth and climate: The carbon-dioxide problem . American Economic Review 67 : 341 – 46 .

Nordhaus, W. D. 2019 . Climate change: The ultimate challenge for economics . American Economic Review 109 : 1991 – 2014 .

Ouazad, A. , and Kahn, M. E. 2019 . Mortgage finance in the face of rising climate risk . NBER Working Paper no. w26322 .

Painter, M. Forthcoming. An inconvenient cost: The effects of climate change on municipal bonds . Journal of Financial Economics .

Schlenker, W. , and Roberts M. J. . Nonlinear temperature effects indicate severe damages to U.S. crop yields under climate change . Proceedings of the National Academy of Sciences 106 : 15594 – 98 .

Weitzman, M. L. 2009 . On modeling and interpreting the economics of catastrophic climate change . Review of Economics and Statistics 91 : 1 – 19 .

Email alerts

Citing articles via.

- Recommend to your Library

Affiliations

- Online ISSN 1465-7368

- Print ISSN 0893-9454

- Copyright © 2024 Society for Financial Studies

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Institutional account management

- Rights and permissions

- Get help with access

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

We use cookies. Read more about them in our Privacy Policy .

- Accept site cookies

- Reject site cookies

Finance for climate action: scaling up investment for climate and development

Humanity is at a crossroads – a moment of great risk and great opportunity. One path leads to attractive growth and development; the other to great difficulties and destruction. As shown by each successive report from the Intergovernmental Panel on Climate Change, climate change is occurring at a faster pace than previously anticipated, the impacts and damage are greater than foreseen, and the time for remedial action is rapidly narrowing.

This report of the Independent High-Level Expert Group on Climate Finance is intended to provide a framework for finance for climate action, covering the overall needs for the comprehensive approach embodied in the Paris Agreement and UNFCCC. All the elements are necessary and urgent and most of the actions must start now; it is the science and the world’s perilous condition that set the urgency and timing.

The logic of this paper follows from the logic of delivering on the goals of the Paris Agreement and the Glasgow Pact. The first part focuses on the purpose and necessary investment and actions, drawing on earlier work on the analysis of investments. The second part is about the scale and nature of the different forms of finance that are necessary and how they complement each other. The final part is on how the framework and the key elements described can be taken forward through our systems for international collaboration.

Main messages

- Acting on climate is about transforming our economies, particularly our energy systems, through investing in net zero, adaptation, resilience and natural capital. Achieving this transformation will not be easy. It requires strong investment and innovation, and the right scale of finance of the right kind and at the right time.

- The failure to deliver the climate finance commitment of $100 billion per year by 2020 made by developed countries at successive COPs has eroded trust. The world needs a breakthrough and a new roadmap on climate finance that can mobilise the $1 trillion per year in external finance that will be needed by 2030 for emerging markets and developing countries (EMDCs) other than China.

- A major, rapid and sustained investment push is needed to drive a strong and sustainable recovery out of current and recent crises, transform economic growth, and to deliver on shared development and climate goals.

- The key investment priorities must encompass transformation of the energy system, respond to the growing vulnerability of developing countries to climate change, and restore the damage to natural capital and biodiversity.

- Country/sector platforms driven by countries can bring together key stakeholders around a purposeful strategy, scaling up investments, tackling obstacles or binding constraints, ensuring a just transition and mobilising finance, especially private finance.

- The scale of the investments needed in EMDCs over the next five years and beyond will require a debt and financing strategy that tackles festering debt difficulties, especially those of poor and vulnerable countries, and that leads to a major expansion of both domestic and international finance, public and private, concessional and non-concessional.

This report was prepared by the Independent High-Level Expert Group on Climate Finance, co-chaired by Dr Vera Songwe and Professor Lord Nicholas Stern, at the request of the Egyptian Presidency of COP27, the UK Presidency of COP26 and the UN Climate Change High Level Champions for COP26 and COP27 .

Sign up to our newsletter

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 17 June 2022

Integrating sustainability into climate finance by quantifying the co-benefits and market impact of carbon projects

- Jiehong Lou ORCID: orcid.org/0000-0003-4606-7756 1 ,

- Nathan Hultman ORCID: orcid.org/0000-0003-0483-2210 1 ,

- Anand Patwardhan 1 &

- Yueming Lucy Qiu ORCID: orcid.org/0000-0001-9233-4996 1

Communications Earth & Environment volume 3 , Article number: 137 ( 2022 ) Cite this article

7248 Accesses

7 Citations

13 Altmetric

Metrics details

- Climate-change mitigation

- Interdisciplinary studies

- Sustainability

High-quality development rooted in low-carbon growth, new jobs, energy security, and environmental quality will be a critical part of achieving multiple sustainable development goals (SDGs). Doing this will require the dramatic scaling up of new climate finance while maximizing co-benefits across multiple outcomes, including for local communities. We developed a comprehensive methodology to identify different levels of local co-benefits, followed by an econometric analysis to assess how the market values co-benefits through the clean development mechanism. We find that projects with a likelihood of delivering the highest co-benefits received a 30.4% higher price compared to projects with the lowest co-benefits. Project quality indicators such as the Gold Standard, in conveying higher likelihood of co-benefits, conferred a significant price premium between 6.6% and 29%. Our methodology of aligning co-benefits with SDGs and the results of co-benefits valued by the markets indicate approaches to bolstering social and political support for climate finance.

Similar content being viewed by others

Implementing the material footprint to measure progress towards Sustainable Development Goals 8 and 12

Manfred Lenzen, Arne Geschke, … Heinz Schandl

Pervasive over-crediting from cookstove offset methodologies

Annelise Gill-Wiehl, Daniel M. Kammen & Barbara K. Haya

A sustainable development pathway for climate action within the UN 2030 Agenda

Bjoern Soergel, Elmar Kriegler, … Alexander Popp

Introduction

We live in a world that is affected by climate change, that has finite resources, and that calls for global efforts to achieve a sustainable low-carbon future, where carbon benefits should be aligned with broader development goals 1 . Those diverse economic and development benefits created from climate actions, such as improving air quality, empowering women, improving farmers’ livelihoods, or creating local jobs, often are termed “co-benefits.” In many development contexts, and in many specific communities, these co-benefits are concrete and near-term, and are often seen as more directly valuable than carbon benefits. The co-benefits approach, therefore, could motivate action on climate change 2 and incentivize political support 3 by engaging a broader range of stakeholders 4 . In the context of sustainable development goals (SDGs), climate action is more than just one of the 17 SDGs, it has been shown to have strong synergies and trade-offs with other SDGs 4 , 5 , 6 , 7 , 8 , 9 , 10 , 11 . Clearly, a comprehensive understanding of the co-benefits aligned with SDGs presents potential to achieve climate change mitigation and non-climate objectives.

On the path to a low-carbon, sustainable growth transition, climate finance is a crucial aspect of achieving both climate and sustainable development goals—particularly through enabling large-scale investments in reducing greenhouse gas emissions and adapting to the adverse effects of climate change 12 , 13 . However, how the climate finance market values co-benefits remains poorly understood. This can bias policies 14 , 15 or otherwise limit the mobilization of climate finance, especially private finance 16 , potentially reducing the real co-benefits delivered to local communities.

Current research on integrating sustainability criteria or co-benefits into sustainable investing has faced several challenges. First, while it is fairly simple to calculate the cost of projects, the co-benefits are much harder to measure or estimate because these benefits are often intangible or non-monetary (such as health co-benefits). Second, standards to measure these bottom-up or distributed co-benefits are undefined and inconsistent. Third, there is a lack of globally comprehensive reporting and assessments for the different co-benefits that map on to the different SDGs. Due to inadequate co-benefit data disclosure standards and performance metrics, these scattered and inconsistent approaches further prevent researchers from assessing the presence, extent, and determinants of co-benefits 17 .

While the challenge of leveraging much larger amounts of climate finance is broadly recognized, only partial answers have been provided by previous research. Some qualitative research seeks to identify co-benefits of climate finance projects by a multiple-dimension–multiple-indicator methodology, ranging from simple project checklists 18 , 19 , to a more complicated method of extracting co-benefit-related information and building up a profile of co-benefits for each project for comparison 20 , 21 , 22 , 23 , 24 , 25 , to the most complicated method of multi-attributive assessment with a combination of indicators of qualitative, semi-quantitative, and quantitative natures 26 , 27 , 28 , 29 , 30 , 31 . These methodologies help elucidate the benefits but largely are blind to interactions between projects and market actors, particularly how much market actors value co-benefits. Another research strand evaluates co-benefits quantitatively but limits the scope to specific, easily measured and comparable categories, such as environmental indicators (e.g., CO 2 , SO 2 , etc.) or socioeconomic indicators (e.g., income, employment, etc.) 32 , 33 , 34 , 35 .

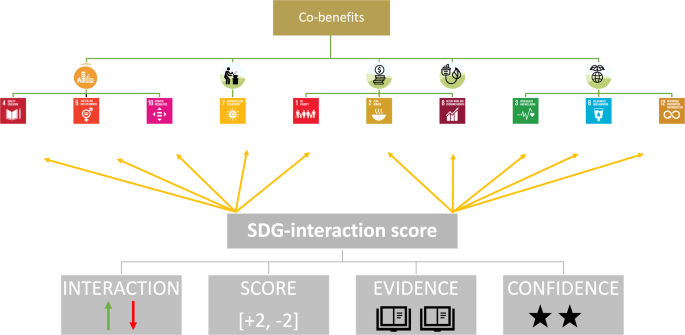

While research has expanded quickly—particularly on developing co-benefit indicators and specific, measurable outcomes—there remains less understanding of the extent to which the presence of co-benefits, especially at the local level, is valued by investors. To address this gap, we first develop an analytical framework to categorize SDGs and local co-benefits (Fig. 1 ). We test this framework using econometric analysis of how co-benefits are valued by market actors in an application of climate finance: using historical experience with a similar, real-world experiment, the clean development mechanism (CDM). As the major international carbon offset mechanism under the Kyoto Protocol 36 , the CDM was designed to lead to significant emission reductions that would both lower the cost of climate mitigation in developed countries and contribute to sustainable development in the host countries. It therefore provides a helpful historical experience that can illuminate connections between investor preferences and policy goals to support development outcomes and emissions reductions, with its nearly 8000 projects across 105 host countries, each of which generated tradable quantities of emissions reductions called certified emissions reductions (CERs). The link between the CDM and local co-benefits has been studied at some length via case studies and other qualitative approaches but assessments based on empirical data have been sparse 37 . To carry out this research, we also refine and improve data on the CDM from an existing database, by adding Emission Reduction Purchase Agreement (ERPA) dates and buyers’ sectoral information and profit status for each project. Our dataset provides the most comprehensive listing of buyers and sellers in the CDM market.

Images from: UNFCCC COP23 and United Nations.

We first establish five broad goals of co-benefits as indicated in the upper layer. Each of these five broad goals is associated with one or more SDG goals (second layer). We then produce an SDG-interaction score for each SDG, based on the specific project. Interaction components can be either positive and negative, which leads to aggregate positive and negative scores. We support the scores with evidence from the literature and confidence level assigned by the authors.

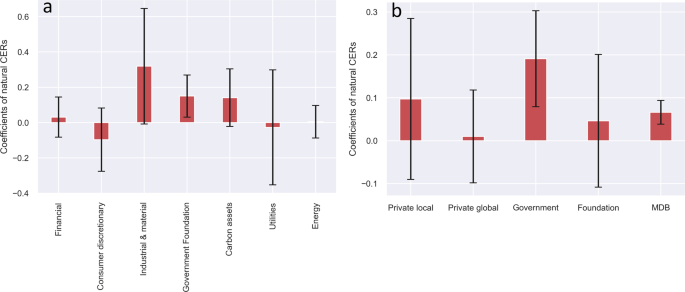

By focusing on local co-benefits, this research highlights the importance of valuing co-benefits where projects are located, and how these projects deliver impacts on local communities. Accordingly, for this paper we ask two questions: (1) do potential co-benefits from CDM projects encourage buyers to pay more as reflected in the credit price? and (2) do CDM projects with external certification deliver a price premium based on their guaranteed co-benefits? To answer the question of whether co-benefits encourage a premium, we conduct an econometric analysis of CER prices for 2259 projects for the co-benefits based on a new SDG and co-benefits analytical framework. We find that a project with a likelihood of delivering the highest co-benefits received a 30.4% higher credit price compared to projects with the lowest co-benefits. To answer the second question of whether externally certified projects deliver a price premium, we add an investigation of the so-called the Gold Standard (GS) certification for CDM credits, which focuses on sustainable development benefits. We then perform another econometric analysis of a group of 2195 regular CDM projects and 64 “Gold Standard”-certified CDM projects through a combined technique of exact matching, propensity score matching, and regression adjustment. Our results show that project quality indicators such as the Gold Standard, by conveying higher likelihood of local co-benefits, conferred a significant price premium in the range of 6.6–29%. This paper adds to our understanding of the link between investors and co-benefits from climate or carbon benefits via the CDM, which is essential for unlocking potential climate finance from the private sector. The compelling evidence from our analysis illustrates the crucial importance of rooting co-benefits with the carbon benefits. It further adds to the discussion of the importance of co-benefits in mobilizing broader stakeholder engagement—two important components of which are the local communities and climate finance investors assessed in this paper.

Assessing co-benefit valuation through an SDG co-benefit framework

The first approach we take is to assess market price premiums of co-benefits, as reflected in the CER prices for projects with different kinds of co-benefits. To do this, we develop a two-layer framework for categorizing the overall local co-benefits of carbon projects (Fig. 1 and Supplementary Fig. 1 ). The first layer captures the five categories of local co-benefits, while the second layer captures broader SDG dimensions. For this research, we focus on project components that only have a local focus on local co-benefits. We adopted a methodology of analyzing SDG benefits from McCollum (2018) 38 and the IPCC special report on Global Warming of 1.5 °C 39 . We then assess the co-benefits of projects in a more quantified way. We used a systematic literature review to assess and score SDG targets and then linked those to the potential CDM co-benefits 37 . Detailed steps and methods of this framework are summarized in the “Methods” section and also the Supplementary Note 1 .

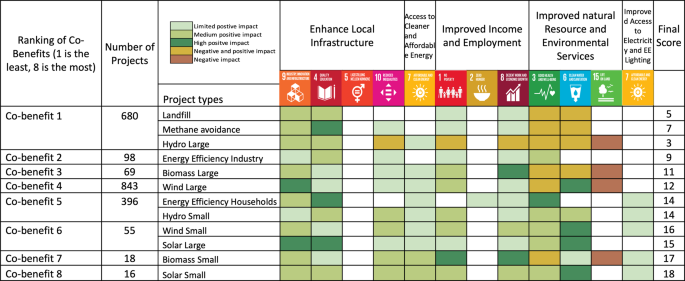

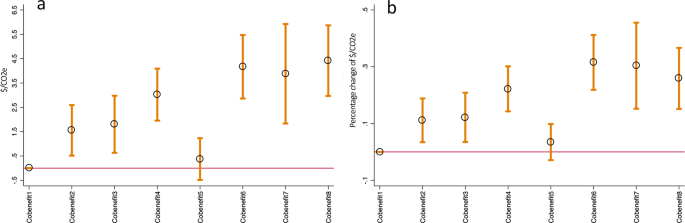

Using this framework, we grouped 2195 projects into eight levels of co-benefits (Fig. 2 ) and sorted the level of co-benefits delivered into ranked categories. The framework was derived from an extensive structured literature review as described in Hultman, Lou, and Hutton (2020) 37 . A detailed table of this SDG framework with all the supporting literature can be found in Supplementary Table 1 .

Images from: United Nations.

This figure illustrates different levels of potential local impacts from CDM projects as drawn from the literature. Green shaded colors indicate limited, medium, and high positive impacts. The yellow color points to the projects which might have both positive and negative impacts on the local communities. The red color indicates potential negative impacts. The higher score the co-benefit gets in the final score columns, the larger value of the co-benefit.