6 Powerful Tips for Crafting Outstanding Investor PowerPoint Presentations

In today's competitive business landscape, effectively communicating your company's potential to investors is crucial for securing funding and driving growth. Investor PowerPoint presentations play a significant role in conveying your vision, business model, financials, and growth prospects in a visually appealing and engaging manner. A well-prepared and compelling presentation can capture investors' attention and convince them to invest in your business.

This guide provides you with powerful tips and best practices for crafting outstanding investor PowerPoint presentations. By following these guidelines, you will be better equipped to create a presentation that clearly communicates your business's potential, showcases your achievements, and highlights the key information investors are looking for. This will ultimately increase your chances of securing investment and driving your business toward success.

Key Information Investors Look For

When creating investor PowerPoint presentations , it's essential to understand what information investors are typically looking for to make well-informed decisions. By focusing on these key aspects, you can ensure that your presentation effectively addresses investors' concerns and interests.

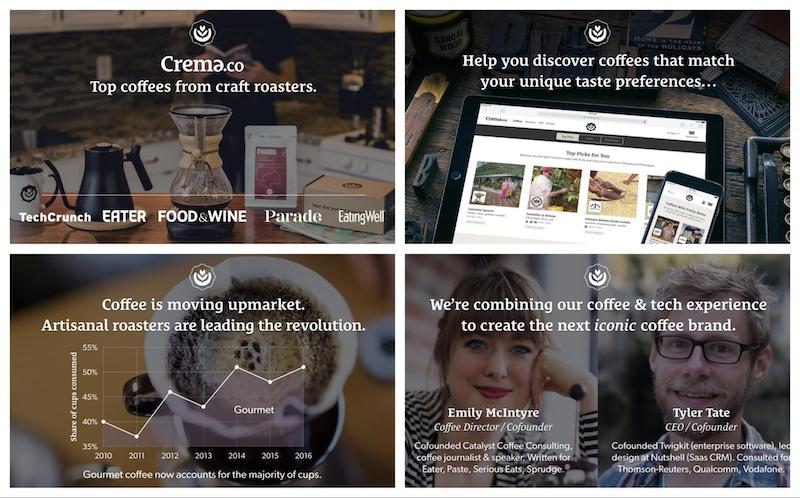

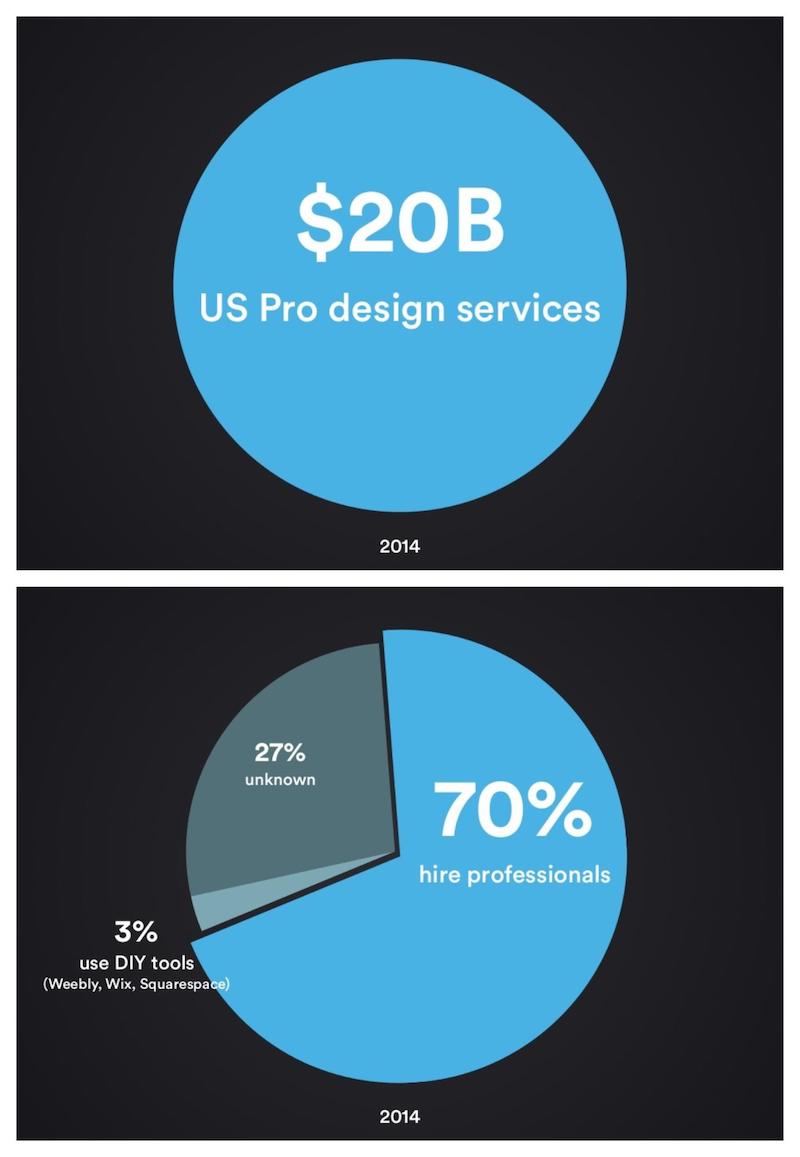

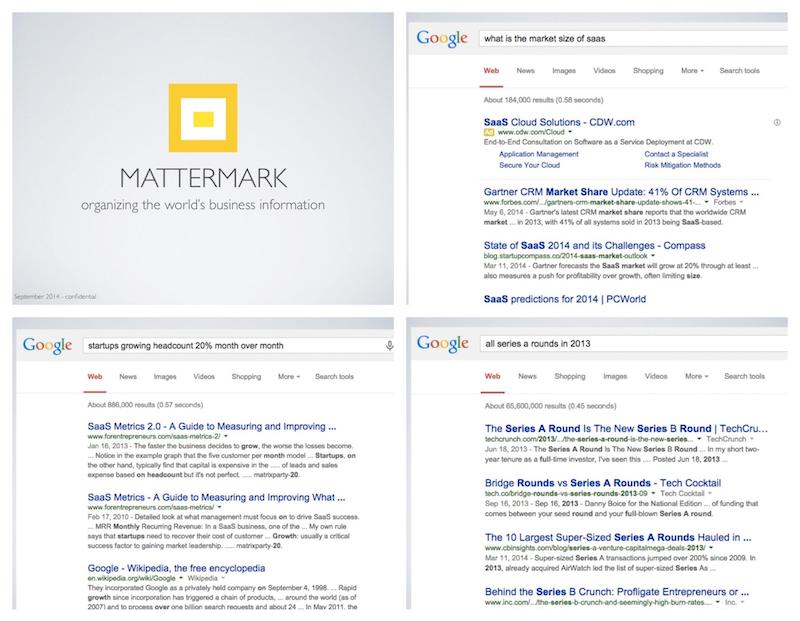

- Business Model and Market Opportunities: Investors need a clear understanding of your business model and market opportunities. This includes information about market saturation, market shares, and the overall size and growth potential of the industry. Additionally, they will want to know about your competitors, their strengths and weaknesses, and how you plan to differentiate your product or service. Any regulatory requirements or outstanding major lawsuits that could impact your business should also be addressed.

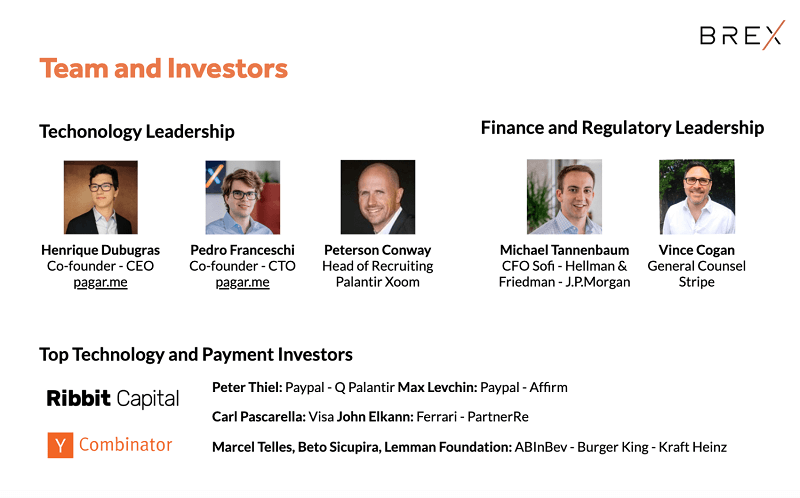

- Management Team and Key Employees: Investors want to meet the management team and recognize key employees. Including short CVs or bios in your PowerPoint presentations can help investors understand the team's capabilities, track record, and how they plan to lead the company to success.

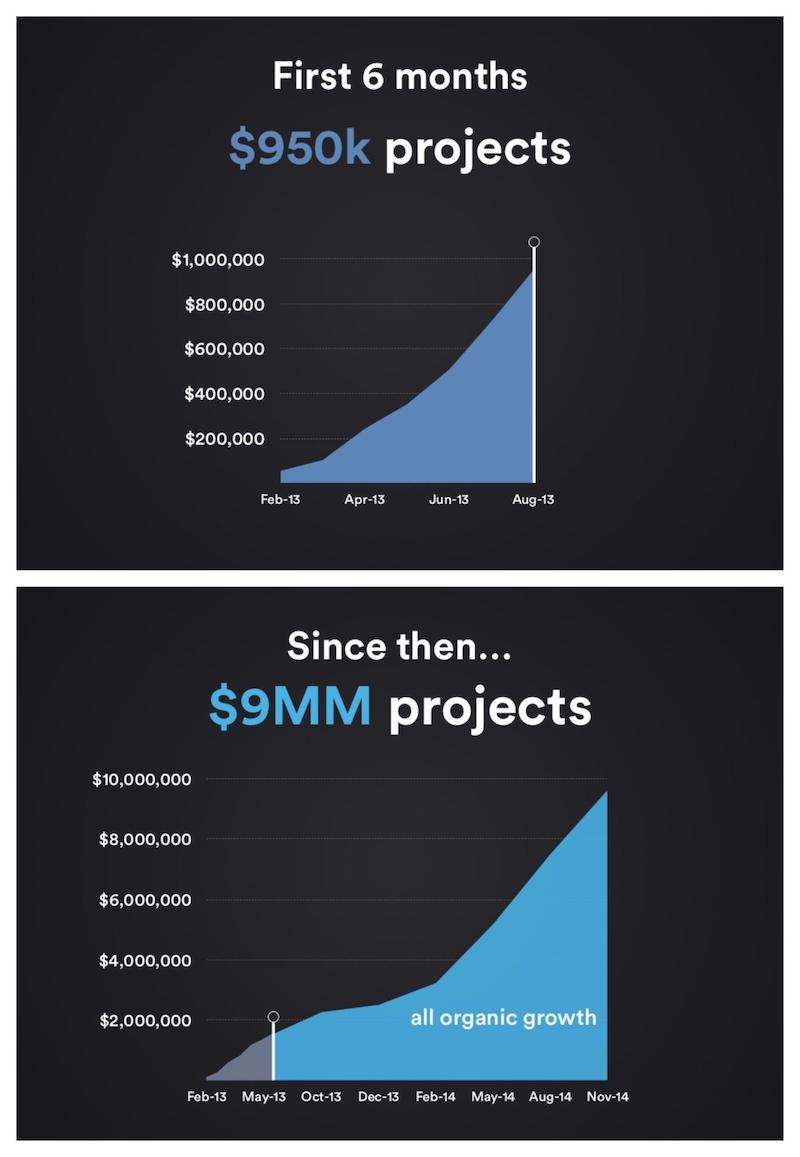

- Financials and Key Metrics: Your investor PowerPoint presentations should include key financial data such as revenue, profit margins, working capital, debt position, and cash flow. Industry-specific key metrics, such as customer acquisition cost, lifetime value of a customer, and churn rate, should also be presented. These metrics help investors assess your company's financial performance and potential.

- Growth Prospects and Potential Returns: Investors want to see that your company has strong growth prospects and the potential to generate significant returns. Be sure to outline your growth plans and how you intend to achieve them in your investor PowerPoint presentations.

By incorporating these key aspects into your investor PowerPoint presentations, you can effectively address the information investors are most interested in and increase your chances of securing the funding you need.

Crafting a Compelling Story

A successful investor PowerPoint presentation tells a captivating story that highlights your business model, market opportunities, and investment benefits. By weaving together a compelling narrative, you can better engage your audience and provide a memorable context for the information you present. Here's how to craft a compelling story for your investor PowerPoint presentations:

- Start with a Strong Opening: Begin your presentation by clearly stating the problem your business is solving or the opportunity it is addressing. This sets the stage for your story and immediately captures your audience's attention.

- Showcase Your Business's Journey: Provide a brief overview of your company's history, including major milestones and achievements. This helps build credibility and demonstrates your team's ability to execute their vision.

- Highlight Your Unique Value Proposition: Clearly articulate what sets your product or service apart from the competition. Focus on the unique aspects of your business that give you a competitive advantage and support your success.

- Share Customer Success Stories: Including testimonials or case studies from satisfied customers can humanize your business and make your story more relatable. This also provides evidence of the value your product or service delivers to its users.

- Present Your Future Vision: Outline your company's goals and objectives for the future, and explain how you plan to achieve them. This demonstrates your ambition and commitment to growth, creating excitement and anticipation among investors.

- End with a Clear Call-to-Action: Conclude your investor PowerPoint presentation by summarizing the key points of your story and clearly stating what you want from investors. Be specific about the amount of funding you need and how it will be used to help your business achieve its goals.

By crafting a compelling story in your investor PowerPoint presentations, you can create an emotional connection with your audience and leave a lasting impression that can significantly impact their decision to invest in your business.

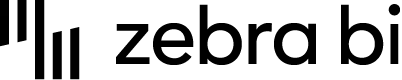

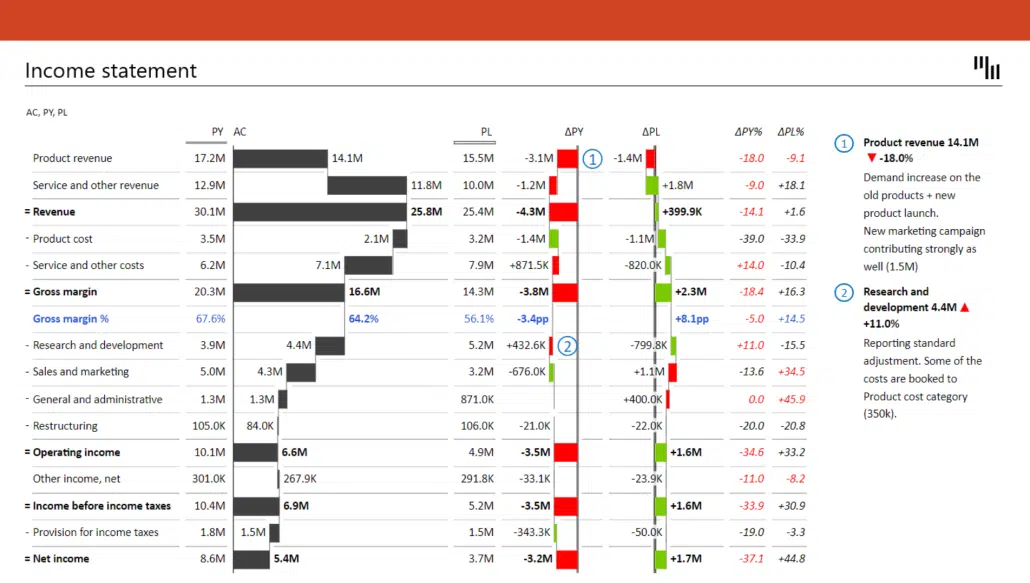

Want to skip all the fuss and create a professional PowerPoint side deck with only a few clicks?

Try Zebra BI for Office and supercharge your slide deck with powerful visuals.

Keeping It Focused and Simple

Investor PowerPoint presentations should be concise and easy to understand, allowing investors to quickly grasp the essential information about your business. By keeping your presentation focused and simple, you can ensure that your audience remains engaged and retains the key points you want to convey. Here are some tips for maintaining focus and simplicity in your investor PowerPoint presentations:

- Prioritize Key Points: Identify the most crucial aspects of your business that investors need to understand, and prioritize those points in your presentation. By concentrating on the most relevant information, you can avoid overwhelming your audience with excessive detail.

- Use clear and concise language: Present your ideas using straightforward, concise language. Avoid jargon and complex terms that confuse your audience. Remember, not all investors will have an in-depth knowledge of your industry, so it's essential to make your presentation accessible to everyone.

- Limit the Number of Slides: Aim for a concise presentation with a limited number of slides. A general rule of thumb is to have no more than 10-15 slides for a typical investor PowerPoint presentation. This helps you maintain a focused narrative and ensures you don't lose your audience's attention.

- Keep Visuals Uncluttered: Use clean, minimalistic visuals that clearly illustrate your points without distracting from the message. Avoid cluttered slides with too much text or too many images. Instead, opt for simple charts, graphs, and images that effectively convey your message.

- Highlight One Idea per Slide: To keep your presentation focused, present only one main idea per slide. This approach ensures that each concept is given adequate attention and makes it easier for your audience to follow along and digest the information.

- Rehearse and Refine: Practice delivering your investor PowerPoint presentation and refine it based on feedback from peers or advisors. This process helps you identify areas where you can simplify or clarify your message, ensuring that the final version is as focused and easy to understand as possible.

By keeping your investor PowerPoint presentations focused and simple, you can effectively communicate your business's key information and make a strong impression on your audience, increasing your chances of securing investment.

Utilizing Visuals Effectively

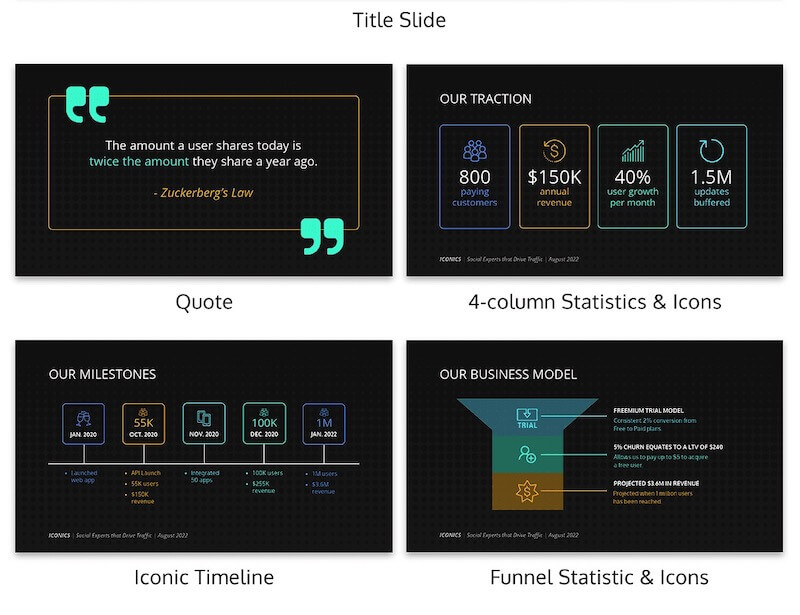

Visuals play a crucial role in making investor PowerPoint presentations more engaging and impactful. When used effectively, visuals can illustrate complex ideas, support your narrative, and emphasize key points. Here are some tips for utilizing visuals effectively in your investor PowerPoint presentations:

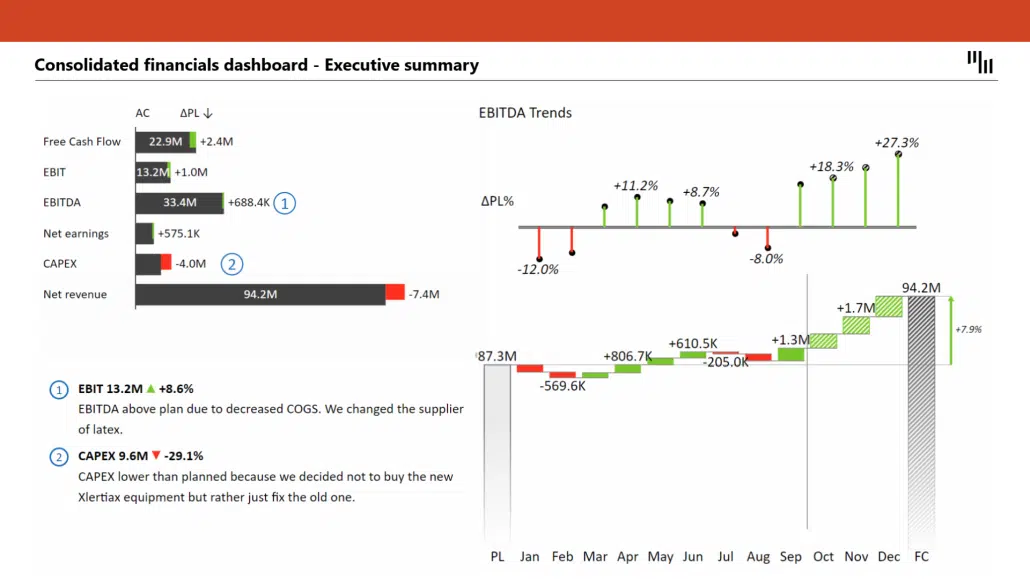

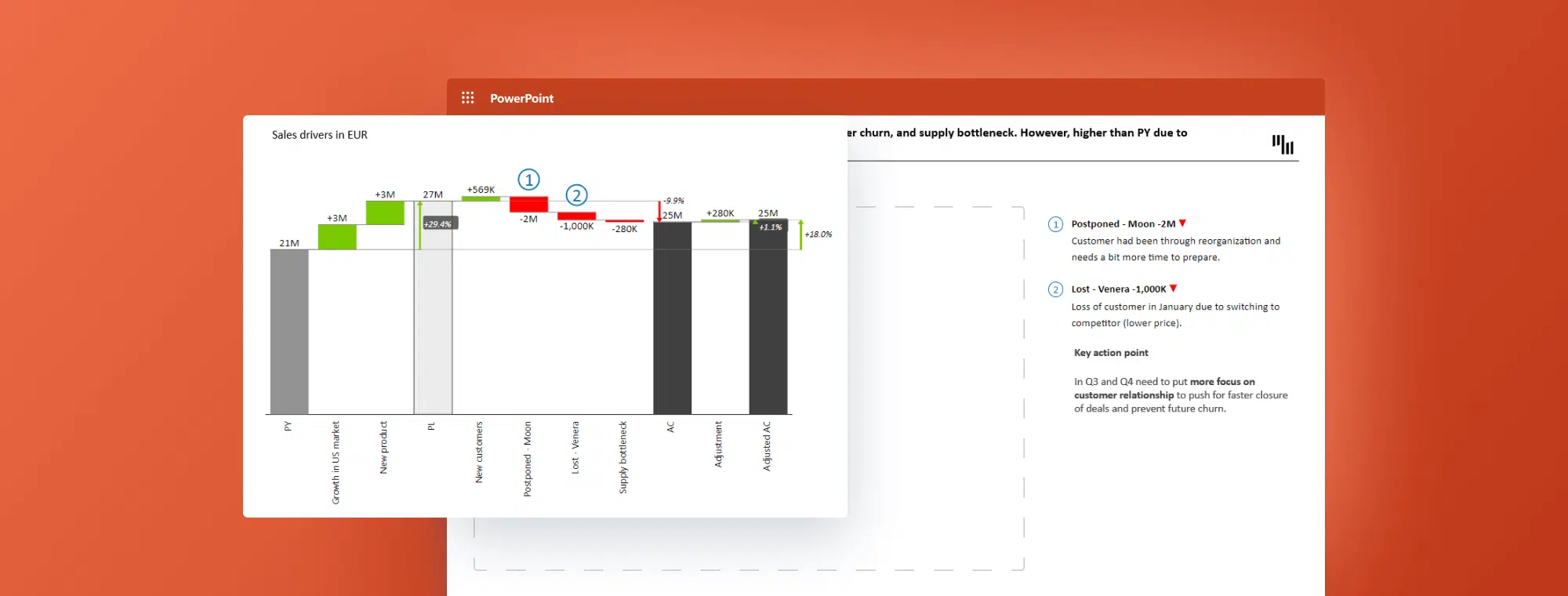

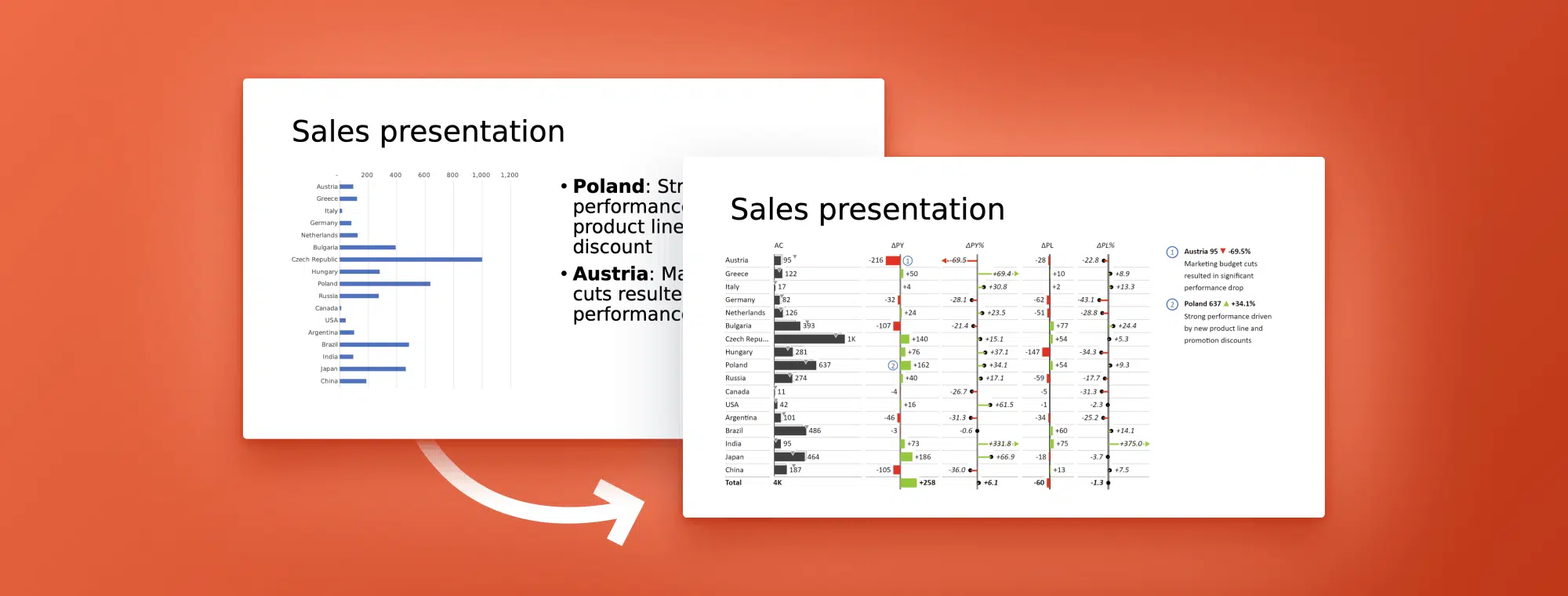

- Choose the Right Visuals: Select visuals that accurately represent the information you want to convey. Use charts and graphs for presenting data , diagrams for illustrating processes or relationships, and images or icons for emphasizing key concepts.

- Maintain consistency: Use a consistent visual style throughout your presentation to create a cohesive look and feel. This includes using similar colors, fonts, and graphical elements that align with your company's branding.

- Simplify Data Visualization: When presenting data, opt for clear and straightforward charts or graphs that are easy to read and understand. Avoid overly complicated visuals that confuse your audience or obscure the main message.

- Balance Text and Visuals: Strive for a balance between text and visuals on each slide. Too much text can be overwhelming and difficult to read, while too many visuals can be distracting. Aim to create a harmonious blend of both elements that effectively convey your message.

- Use High-Quality Images: Ensure that all images, icons, and graphics used in your investor PowerPoint presentations are of high quality and resolution. Blurry or pixelated visuals can appear unprofessional and detract from your message.

- Opt for Readable Fonts and Colors: Choose fonts and colors that are easy to read and provide sufficient contrast between text and background. Avoid using excessively small font sizes or color combinations that strain the eyes.

- Animate with a Purpose: If you use animations or transitions, use them sparingly and for a clear purpose. Excessive or overly flashy animations can distract and detract from your presentation's overall message.

By utilizing visuals effectively in your investor PowerPoint presentations, you can create a more engaging and memorable experience for your audience, ultimately increasing your chances of securing investment and driving your business forward.

Highlighting Key Metrics and Data

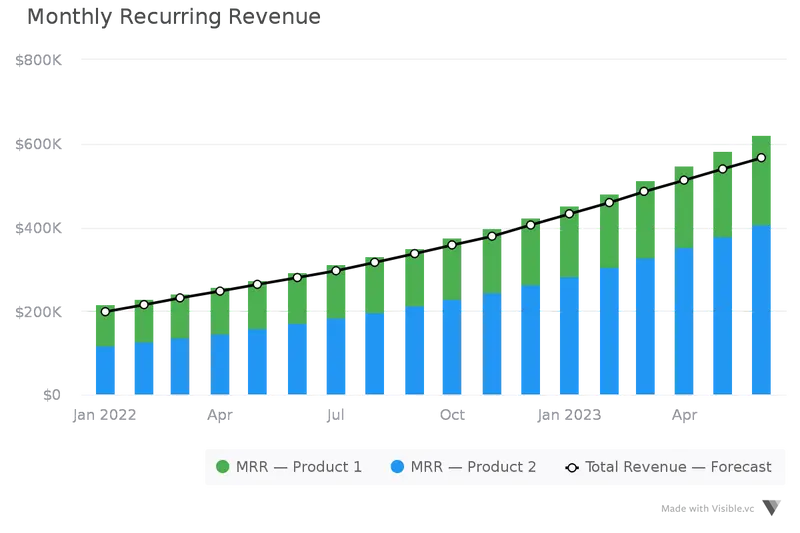

Presenting key metrics and data in your investor PowerPoint presentations helps demonstrate your company's financial performance , growth potential, and overall viability. By effectively showcasing this information, you can provide investors with a clear understanding of your business's strengths and the potential return on their investment. Here are some tips for highlighting key metrics and data in your investor PowerPoint presentations:

- Identify the Most Important Metrics: Determine the most relevant and impactful metrics for your business and industry. These may include financial figures such as revenue growth, profit margins, and cash flow. In addition, they may include industry-specific metrics like customer acquisition cost, lifetime value of a customer, and churn rate.

- Use appropriate data visualization: Present your metrics and data using clear, easy-to-understand charts and graphs. Choose the most suitable visualization method for each data set. This includes line charts for displaying trends over time, bar charts for comparing values across categories, or pie charts for showing proportions.

- Emphasize Key Data Points: Draw attention to the most relevant data points or metrics by using bold colors, larger font sizes, or other visual elements. This helps ensure that investors can quickly identify and understand crucial information in your presentation.

- Provide Context for Your Metrics: When presenting metrics and data, provide context to help investors understand their significance. This may include comparing your figures to industry benchmarks, discussing historical trends, or explaining the impact of specific events on your numbers.

- Include Projections and Forecasts: Investors are interested in your company's future growth potential, so include projections and forecasts in your investor PowerPoint presentations. Clearly outline your assumptions and methodologies, and demonstrate how your plans align with these projections.

- Be transparent and honest: Present your data and metrics accurately and transparently. Be prepared to explain any discrepancies or anomalies, and avoid manipulating figures to create misleading impressions. Transparency and honesty help build trust with investors and support your presentation's credibility.

By effectively highlighting key metrics and data in your investor PowerPoint presentations, you can give investors the information they need to evaluate your business' potential. Enabling them to make informed investment decisions, in turn, increase your chances of securing the funding necessary to grow and succeed.

Polishing and Practicing Your Presentation

A polished and well-rehearsed investor PowerPoint presentation demonstrates professionalism but also helps you deliver your message confidently and effectively. Taking the time to refine and practice your presentation can significantly impact investors' impressions. Here are some tips for polishing and practicing your investor PowerPoint presentation:

- Review and Edit Your Content: Carefully read through your presentation, checking for errors in grammar, spelling, and punctuation. Ensure that your content is clear, concise, and easy to understand. Consider asking a colleague or advisor to review your presentation and provide feedback.

- Ensure Consistent Design and Branding: Check that your presentation's design elements, such as colors, fonts, and graphics, are consistent throughout and align with your company's branding. Consistency creates a cohesive and professional look, reinforcing your company's identity.

- Optimize Slide Transitions and Animations: Make sure that any slide transitions or animations you include are smooth and serve a purpose, such as emphasizing a point or guiding the audience's attention. Avoid excessive or overly flashy transitions that can distract or detract from your message.

- Test on Different Devices: To ensure that your investor PowerPoint presentation displays correctly on various screens and devices, test it on different monitors, projectors, or laptops. This helps identify and resolve any formatting or compatibility issues before presenting to investors.

- Practice Your Delivery: Rehearse your presentation multiple times, focusing on your pacing, tone, and body language. Practicing helps you become more comfortable with the material and enables you to speak confidently and clearly.

- Anticipate Questions and Prepare Answers: Think about potential questions investors might ask and prepare thoughtful, data-backed responses. This demonstrates your expertise and preparedness, building trust and credibility with your audience.

- Adjust Based on Audience Feedback: After practicing your presentation, consider any feedback or reactions from your test audience. Be open to adjustments to improve your presentation's clarity, engagement, and effectiveness.

By polishing and practicing your investor PowerPoint presentation, you can ensure a professional, engaging, and impactful presentation that effectively communicates your business's potential and increases your chances of securing investment.

Creating an effective investor PowerPoint presentation is crucial for capturing potential investors' attention and securing the funding needed to grow your business. By focusing on the key elements discussed in this guide, you can craft a compelling and engaging presentation that showcases your company's potential:

- Craft a compelling story that highlights your business model, market opportunities, and investment benefits.

- Keep your presentation focused and simple, prioritizing key points and using clear, concise language.

- Utilize visuals effectively to enhance your message and engage your audience.

- Highlight key metrics and data that demonstrate your company's financial performance and growth potential.

- Polish and practice your presentation to ensure professional and confident delivery.

By following these tips and putting in the necessary effort to create a well-structured, engaging, and data-driven investor PowerPoint presentation, you can significantly increase your chances of securing the investment needed to propel your business forward.

Ready to supercharge your PowerPoint presentations?

Try Zebra BI for Office for free. Don't miss the chance to create engaging presentations that drive results for free!

Related Resources

7 Tips for Creating Effective Financial PowerPoint Presentation: Best Practices and Techniques

Best practices for creating PowerPoint template for business presentations

5 Essential Steps to Mastering Your PowerPoint Consulting Presentation

How to use PowerPoint to create compelling sales presentations

Leave a comment cancel reply.

Want to join the discussion? Feel free to contribute!

Save my name, email, and website in this browser for the next time I comment.

Commentary Revolution: Transforming Power BI Dashboards with Dynamic Comments

Privacy Policy

Legal documentation

Try it in your Excel. For free.

Dos and don’ts: Mastering the investor presentation

While presentation meetings with potential investors are a key IR task, mastering an effective delivery can be challenging. It all depends on crystal-clear communications, proactive use of digital tools, transparency and added value.

‘Messaging is getting better and delivery is getting richer,’ said Harry Shah, founder and CEO at OUTKREATE, during a recent IR Magazine webinar now available to watch on demand, in which we asked IROs and investors to define what makes a good presentation and point out some of the regular gaffes they see.

For a company, the focus must be on answering the needs of the analysts and investors and the key to that is to keep things simple, think two steps ahead and be mindful of who you are talking to, say experts.

For Gervais Williams, head of equities at Premier Miton Investors, presentations are about understanding the long-term investment thesis and the role of the management team within a company.

‘It’s about the scale of the opportunity, the true cash in and cash out, which we’re very interested in,’ he said at the webinar. ‘And metrics along the way as to how progress is going. Companies often say it’s going quite well, or it’s going really well. But what we’re looking for is something a bit more demanding that actually gives us real insight: perhaps they have won a large number of customers, maybe they have got verification from some large brand names around the world.

‘We use proxies like that to get a real understanding on the detail of the business and the scale of the upside. Most particularly, cash generation and the duration before you get into that cash generation are the risks we’re willing to tolerate on behalf of our customers.

‘You need to inject a lot of thought into making sure you keep your investors entrenched because if they feel [your presentation] is really helpful and they learn things, they will see you again. If they keep seeing the same old thing, they won’t see you again.’

Keeping your message alive

Balancing time constraints with the amount of information companies need to provide to investors and analysts is also a juggling act. Focusing on actionable tips, catchy visuals and highlighting corporate next steps in the wider market ecosystem are considered best practice.

‘It’s called ‘so what?’ structure,’ Shah explained. ‘When you look at what’s going on around you and the macro trends, think about the headwinds and the tailwinds. So what? How is your company and your strategy affected by that? If those are the trends, what does it mean for you and what are your next steps?’

Showing investors that the company financial model is based on the wider market opportunities and factoring that into the presentation structure could gain IROs an edge, experts said. Steering away from past practices would also be beneficial, changing and adapting visuals to investors’ needs and avoiding cluttering or overloading slides with too much information.

Mark Zindler, vice president of IR at Verra Mobility, said it’s important ‘not to fall into the trap’ of sticking to what’s usually been done.

‘Develop key objectives,’ he advised. ‘Do not repeat what you have done before or rely too much on a template. Really assess what it is you want to convey in this presentation to that specific audience, and then you can figure it out. Use pictures because one picture is worth a thousand words.’

Watch the ‘IR Magazine Webinar – Creating impactful investor presentations that help differentiate your story’ on demand here.

Noemi Distefano

Stay informed and ahead on the latest trends and activities in the fast-moving world of investor relations by signing up for our popular newsletters today. Our weekly and monthly updates give you topical updates, expert analysis and comprehensive coverage of market changes, regulatory updates, IR trends and best practices, careers and much more.

Topic-related

Global Roadshow Report 2023

Best practice report: investor day best practices and measurements for success.

Planning your investor day

Best Practice Report: How to demonstrate the value of your IR program

Global Roadshow Report 2022

Best Practice Report: Conducting an ESG Roadshow

5 approaches to implement your investor day and earnings calls Q&A

Best Practice Report – How to hold an ESG investor day

Corporate Access II Report

What To Include In Your Investor Presentation

Like Bill Murray in Groundhog Day , IROs find themselves incessantly repeating one particular task. It does not involve a rodent or a maniacal drive over a cliff, but it does provoke, at times, frustration and uncertainty. The task is creating and recreating the investor presentation to address the various informational needs of current and potential shareholders.

In this issue of IR focus , we answer commonly asked questions about best practices in investor presentation content. (For tips on how to deliver a presentation and ideas about designing PowerPoint slides, the first two IR focus issues from 2012 provide guidance. Refer to 'Where To Get More Information' at the bottom of this article for links.)

Is it acceptable to have more than one deck?

The answer is that it is more than acceptable, it is obligatory – for the simple reason that your executive team will speak to audiences that have different informational needs. A deck used to update a long-term shareholder on quarterly performance will have content that is narrower and more focused than a ‘core’ presentation deck used to explain business basics to a potential stock owner.

That said, it is best not to allow too many variations of the presentation to exist. In an ideal world, there should be just two: one used to update existing investors on recent (quarterly) performance (‘the update deck’) and one telling the full investment story for newcomers (‘the core deck’). This is not always possible since the need for special presentations arises from time-to-time for purposes such as marketing an acquisition, satisfying the specific requirements of a broker conference invitation, or making a presentation at the annual shareholders’ meeting. But finding common ground in each presentation variant by reusing slides whenever possible is good practice (as is posting your current decks on the investor page of your website).

Creating (and maintaining) even two decks presents challenges. One is achieving consistency between decks in the presentation of financial information. The other is the workload associated with keeping both decks current. A suggestion that helps to address both problems is to ensure that the deck used for quarterly reporting purposes is developed to double as the update deck and is designed to be ported over for inclusion in the core deck as the financial section. Elements of both decks should then be used, wherever possible, to satisfy special presentation needs associated with an AGM or broker conference.

Based on a review of the presentations of 50 public companies, conducted by IR focus , it is apparent that in many cases, quarterly webcast slides have not been created with this degree of portability in mind; they lack high-level messaging about quarterly performance as it relates to broader corporate strategy. These quarterly decks address only the narrow ‘data’ needs of an analyst audience, making them somewhat unsuitable to be used for both update decks and core decks.

An exception is Ford Motor Company. Its quarterly webcast decks (see link below) are hybrids (no pun intended) that appear to have been developed jointly by finance and investor relations. They contain a wealth of data, as well as helpful messaging to update the viewer on Ford’s progress against its stated strategies. It would be relatively easy to use Ford’s webcast slides as an update deck and to insert them into a core presentation. This prompts another recommendation: when creating investor presentations, it is valuable to review decks created by other companies.

How many slides should be in a core presentation deck?

In general, presentations err on the side of providing more information than less, based on two assumptions: first, investors need/want detail; and second, investors will not take the time to search through disclosure documents to find what they need and will therefore expect an investor deck to be the sole source of insight.

Institutional investors we spoke to refuted the concept that they need an investor deck to contain an encyclopedia’s worth of information on a company they are interested in or already own. Many investors told us they prefer when management teams cut to the chase by prioritizing information to a few simple key messages and key slides.

It is interesting to note that at one of its upcoming fall conferences, one Canadian bank-owned broker asked corporate participations to provide just one slide! As this broker states in its invitation, the single slide should be used to “best illustrate any key items you would like investors to know.” While this is an extreme example, it is worth remembering how investor decks are used (or not) by corporate presenters and their audiences. In most cases, executives prefer to have focused conversations with investors. Decks that are too long are simply provided as collateral ‘leave behinds’ never to be actually presented.

Many IROs we spoke to segment their decks so that presentation-worthy material is confined to the first 10 slides (ideally with one message per slide). Beyond the first 10, other slides are included as ‘supplements’ within an appendix to be used by the audience following the management meeting. Working with your CEO to determine his/her top priority messages will improve the likelihood that the deck will be used as a speaking aid during focused chats rather than just as something to leave behind.

What’s the most important content to include in a core deck?

Opinions vary on this topic, but there are some common content elements (beyond forward-looking statements).

The first is what is referred to colloquially as ‘the money slide’. A money slide (often entitled ‘investment summary’) answers the question, why invest? In IPO decks, this slide appears at the front and again at the end of every deck based on the principle that repetition equals retention.

For companies that are not actively selling stock, the money slide should still be present (once is enough) and it should be carefully crafted – without platitudes – to create interest and frame the value proposition.

Since investment stories vary widely between companies and industries, it is difficult to provide one-size-fits-all advice on content beyond the money slide. However, investors and IROs suggest including messaging for core investor decks that communicates:

- your company’s vision, objectives and (available) market opportunity;

- the strategies you use to achieve your vision and generate growth/value;

- your company’s current market position versus your competitors and the positioning you hope to achieve;

- the key assets (capabilities) of the business and competitive points of distinction;

- recent strategic, operating and financial progress (with content borrowed from the quarterly webcast/update deck); and

- outlook and key risks/assumptions associated with that outlook (again borrowed from the quarterly webcast/update deck).

In preparing this information, remember that investors appreciate balance and will quickly tire of boastful, always rosy presentations. An admission of risks/weaknesses and content that discusses countermeasures adds credibility.

Other content that is popular with investors includes case studies to illustrate strategies in action and slides that include logos of your customers. There are risks associated with providing this information, as inevitably investors will call a company’s customers to learn about the status of the relationship. Many customers also do not react kindly to finding their logos in a supplier’s presentation, so it is best to ask permission.

Finding a way to adequately explain (the advantages of) the business model is also an important task. As one institutional investor put it: “If I’m looking at investing in an entertainment company, I want to know if it makes money screening movies or selling popcorn. If management isn’t clear about their sources of cash, how can I determine what’s important in looking at the business and its capabilities?”

Keeping a core deck to approximately 10 main slides allows for more attention to be paid within the IR department to carefully crafting each slide’s message. It also means it is relatively easy to keep the information current.

Overall, there is no getting around the fact that creating purpose-built investor presentations demands time and attention. By taking inspiration from other companies’ decks, applying creative thinking, keeping presented information to key investor-relevant topics and ensuring that quarterly webcast slides are designed to be ported over to other decks, your task becomes easier and the results will be better.

Where To Get More Information

- Investor Presentation

- March/April 2012

Fund Marketing

Investor presentation: the guide for fund managers.

Raising capital is no easy feat. It takes more than a promising thesis – pitching potential LPs calls for a carefully planned out process that identifies, pitches and engages the right targets. One of the most powerful tools within this strategic process is your investor presentation. The truth is, the quality of your investor presentation will absolutely make or break your successful capital raise.

That’s why we’ve compiled our most valuable insights into crafting a winning investor presentation. Read on to find out the key elements of a strong capital raising presentation and best practices for an effective presentation that wins investors.

Raising Capital For Your Fund – A Quick Overview

The very first step of raising capital from investors is communicating the right investment thesis. Your investment thesis should fully align with your interests and expertise, whether that is:

- Distressed Companies

- Sustainable Energy

- Infrastructure

- Alternative Lending

- Consumer Goods

- Emerging Markets

Once you’ve identified your thesis, you’ll need to spend sufficient time researching suitable investors or limited partners (LPs) to approach. It's crucial to target investors who share your investment philosophy and have past investments in your area of focus.

Securing an anchor investor early on can be a game-changer for your fund, providing you with the necessary credibility to attract additional suitable investors. A strong first closing will significantly help you build momentum and keep going with your fundraising efforts. Use the first closing accordingly, to remind investors you already had contact with or reach out to new potential LPs.

The next step is making your first capital allocations, i.e. by identifying and acquiring attractive target companies, thereby demonstrating proof of your investment thesis to help build investor confidence. We recommend that you continue to promote your fund until the final closing, and use each closing and investment to generate further attention and momentum.

Why You Need A Solid Investor Presentation

A solid fund presentation is a critical component of any fundraising strategy, for startups and funds alike. It serves as an important marketing tool to help you effectively communicate your investment opportunity to potential investors.

In today's world, it's easier than ever to get a first introduction to potential investors thanks to remote communication tools like Zoom, or Google Meet for example. Hopping on a call is much less of a commitment, than having long sessions in the office. The downside, however, is that investors are hearing fund pitches more than ever before .

To stand out in this increasingly crowded market, your investor presentation needs to be well-crafted, informative, and engaging. It needs to strongly communicate your investment thesis, show the comprehensive experiences of your team, financial projections, and define a clear exit strategy in a concise and focused manner.

But how exactly do you do that? Let’s find out! ⬇️

The Key Structure of a Strong Investor Presentation

1. introducing the fund and the investment opportunity.

Firstly, you have to introduce your fund . The main purpose here with this is to provide investors with a clear and concise overview of your fund. Your introduction should emphasize the unique selling points of your investment opportunity, like a potential for high returns, low risk, or access to a specific industry or market.

2. Explaining the investment thesis

Subsequently, you will need to provide further details of your investment thesis. Your investment thesis must clearly articulate your investment philosophy, including the specific types of companies and/or industries in which you plan to invest, the types of returns you seek to achieve, and any other factors that influence your investment decision-making process in detail.

It's also important to highlight how your investment thesis aligns with current market trends . Including in-depth market knowledge will help investors understand the relevance and potential of your investment approach and confirm your profound understanding of respective the market environment.

3. Market analysis and market opportunity

Providing a comprehensive market analysis helps investors in understanding the broader market landscape and any potential opportunities and challenges accordingly.

Your market analysis should therefore include a detailed overview of the market size, growth potential, and competitive landscape, as well as any regulatory or policy changes that could have an effect on your fund in the future.

Your clear objective is to ensure that your investors are confident and convinced that you have a profound understanding of the respective market dynamics .

4. ESG Ratings and KPIs

ESG ratings (Environmental, Social and Governance risks) and KPIs have gained significant importance in the private equity industry, with investors placing more emphasis on sustainable investing.

Therefore, you need to include information on your fund's commitment to ESG principles and how to measure and report on your ESG performance accordingly. Providing transparent and reliable ESG ratings and KPIs will demonstrate your fund's dedication to responsible investing and build confidence in potential investors to support sustainable investments.

Thereby, it is recommendable to focus on a limited selection of ESG themes that fit well with your thesis and respective market. This helps investors to trust in your focused ESG strategy.

5. Team overview and track record

Investors look for private equity and venture capital funds with experienced and successful teams who can deliver outstanding returns . It is therefore of great importance to include an in-depth team overview and track record to underpin the team's experience, expertise, and successes in managing investments. Be prepared to provide one-on-one interviews with potential investors and selected team members to confirm the strong composition of your investment team.

6. Financial analysis and projections

Financial analysis and projections are crucial in any investor presentation, to demonstrate how you will generate strong returns for investors. Make sure you provide a detailed analysis of your fund's financials, including expense management, and a clear and transparent fee structure. This will demonstrate your commitment to fairness and transparency, and build trust among potential investors.

7. Exit strategy

A valid and profound exit strategy demonstrates when and how investors can expect respective returns on their investments. Therefore, a detailed overview of the exit options available, such as IPOs or strategic sales, as well as the timeline for these exits is inevitable to support your thesis accordingly.

5 Best Practices for Your Fund Presentation

You’ll need more than just an idea of the key elements to include in order to create a strong investor presentation. While the Fund Presentation has a unique Structure, the fundamentals that make your pitch successful are like in any other presentation. Let’s go over 5 best practices for a successful presentation.

1. Tailoring the presentation to your audience

First, it’s essential that you tailor your presentation to your specific audience. This means understanding their priorities, concerns, and areas of interest, and customizing your presentation to address these factors directly.

2. Keep the presentation concise and focused

It’s a good idea to keep your presentation concise and focused. Avoid unnecessary information or tangents and focus on the key elements that will help make your case to potential investors.

3. Use visual aids effectively

Using visual aids effectively, such as infographics or charts, can help make your presentation more engaging and easier to understand, which can increase the likelihood of securing investment. Use graphics sparingly though, so your presentation doesn’t become crowded.

4. Share additional resources

Use a data room to share additional resources for later review. They can review the information at their own pace and get a more detailed understanding of your investment approach and financial projections.

5. Review and Optimize

Seek feedback from trusted advisors, and refine your fund presentation after each pitch. Make it more persuasive and effective in securing investment - one investor at a time.

Creating a strong investor presentation is crucial to raising your private equity or venture capital fund. A winning presentation should:

- Introduce your fund and investment opportunity

- Explain and underpin your investment thesis

- Provide comprehensive market insights

- Highlight potential opportunities and challenges

- Present your ESG ratings and KPIs

- Highlight your team's track record

- Provide profound financial analysis and projections

- Present your defined exit strategy

Ready to take your investor presentation to the next level and optimize your chances of securing your investment? Vestlane's Data Room maximizes your chances of success by obtaining full transparency on which documents investors are focusing on, supporting your efforts to tailor your presentation accordingly. Check it out now and start your journey to powerful investor presentations!

FAQ – Frequently Asked Questions

What should be included in a presentation to an investor.

Include elements such as an introduction to your fund, investment thesis, market analysis, ESG ratings, team overview, financial projections, and exit strategy.

What is the rule for making an investor presentation?

While there are no hard rules for making an investor presentation, best practices include tailoring the presentation to your audience, using visual aids effectively, and seeking feedback from trusted advisors.

How to do a good investor pitch?

Focus on telling a compelling story about your fund, emphasizing your team's track record and expertise, and demonstrating a clear path to generating returns for your LPs.

Similar posts

Limited Partners

Who can invest in venture capital.

Fund Administration

Use vestlane to manage your management equity plan.

Venture Capital vs. Private Equity: a Comparison

Start your 14-day free trial.

Investor Presentation Best Practices

We have created a myriad of investor presentations and slides, sat through countless investor meetings and attended numerous conference presentations. As we think about preparing for the annual J.P. Morgan conference in January – having a good investor deck is on the priority list.

We have captured some of the most frequently asked questions, and how to address them, with our take on best practices.

1 | Content – what should be included in a public company investor presentation?

We don’t believe that all investor decks need to follow the same template. In fact, effective decks communicate, not only the key messages of the company, but they also convey corporate culture and style. For example – there is quite a bit of variability between how transparent and granular the information is versus staying at a high level. Similarly, not all companies choose to start their presentation with the traditional “Investment Highlights” slide, in fact, many are opting to begin with a mission statement, patient story or comment on culture.

Despite the many choices and variability, a public company investor presentation does typically contain between 15 to 25 content-slides, which collectively present a simple and compelling message about your company to potential investors. Importantly, we believe the deck should both stand on its own and be a reference for more in-depth discussions. Similarly, we believe it should be tailored so that a generalist investor can understand your value proposition but also open the door for more granular conversations with sector specialists.

A strong investor presentation should …

- Identify the problem that needs to be addressed

- Outline the addressable market opportunity

- Explain what is differentiated about your technology

- Map out a commercial strategy

- Delineate upcoming milestones and opportunities for growth

- Summarize financial highlights

2 | Timing – how often/when should it be updated? How often/when should you overhaul?

Throughout the year, slides are often updated to reflect new product launches, reimbursement decisions, FDA approvals, quarterly financials, etc. At least once every 12-18 months, we find it helpful for companies to reflect on their comprehensive progress and strategic objectives moving forward and ensure those core messages are incorporated into their investor presentation.

Often, companies will want to create a new look and feel of their deck, update the strategic message and overhaul the presentation in preparation for a large analyst meeting. From a calendar perspective, one of the best times to review a corporate deck is in the later summer while things may be quiet, or in the fall when the calendar year is coming to a close. The fall can be particularly appropriate since much of the strategic planning for the following year is well underway and companies are preparing for a week of meetings at the annual J.P. Morgan Healthcare Conference at the start of the new year. But don’t leave it until the last minute – it can take several iterations to create a good investor presentation, and as a non-critical path item, it’s usually not on the top of management team’s priority list. (Luckily, it’s on the top of ours!)

3 | Ownership – who should update it?

Investor presentations are most typically updated by a member of the investor relations team, working collaboratively with the management team. In addition to basic updates with new information, your IR team will suggest the introduction of new slides or formats to convey major milestones, shifts in strategy, etc. For major overhauls – we usually will have investor relations project manage, but rely on heavy input from the management team, bringing in folks from several divisions within the company to share ideas and content.

Once a deck is final, it is important to have it reviewed by members of the company’s senior leadership teams across R&D, Commercial, Marketing and Legal to confirm information is correct and up to date across the board.

4 | Appendix – should you have one, and if so, what should be included?

When thinking through the content on your investor presentation, as we mentioned earlier, we believe the deck should both stand on its own and be a reference for more in-depth discussions, while also serving as an effective tool for both generalist investors and sector specialists. While not necessary, an appendix can help guide discussions in 1×1 meetings, but generally will not be used as part of the podium presentation. Examples of slides in the appendix, which can provide helpful back-up information, could be further delineation of the market opportunity, disease state, clinical trial design and data, the reimbursement landscape, or any area where a familiar investor may want to delve further into the weeds. As a point of reference, about 40% of investor decks on which we work contain Appendix slides.

5 | Accessibility – should your investor deck be accessible on the IR website?

An investor deck needs a form 8-K filed if it discloses any new material information, but it does not need to appear on a company’s website. That said, posting presentations is a great way to make information accessible to interested investors and is a practice adopted by many large-cap companies. Similarly, it’s considered best practice to webcast conference participation. Our strong recommendation is to include both the audio and the slides as part of the webcast, as well as a PDF version of the slides so investors can download them. Finally, from a convenience standpoint, it’s simply easier to provide a download link to anyone who requests your investor deck.

In our experience, one of the first steps analysts and investors will take when learning about a new company is to review the investor deck. This means that we want it to be accessible with a clear message on your value proposition. We have worked with hundreds of healthcare companies as they work on iterating their investor deck, overhauling it with a new strategy or content, or just wanting a fresh new look and feel. With our Street backgrounds, coupled with our immersion in the sector, we are uniquely positioned to share what makes decks effective and why. We will roll up our sleeves to help both strategically and logistically to ensure the message is as clean as possible. Our ultimate goal is to maintain and build credibility to create shareholder value. For more ideas and help on your investor deck, contact us .

Carrie Mendivil, Principal

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Careers & Culture

- Investor Relations

- IPO & Capital Markets

- Strategy & Consulting

- KOL/Analyst Education

- Shareholder Engagement

- Presentation Creation

- Perception Audit

- Events Calendar

- Gilmartin Guides

- ESG Newsletters

- Representative Clients

- Case Studies

Building a Solid Investor Pitch Deck: Key Elements and Best Practices

Need help crafting a great pitch deck for potential startup investors? Whether you need a startup pitch deck or a slide deck to grow a new business, you need to know how to craft and deliver a successful pitch presentation.

And that’s where we come in.

In this guide, we’re walking you through what to do before building your deck, along with four simple steps you can take to build your very own pitch deck.

Ready to learn more?

Grab a pen and a notepad, and let’s get started!

3 things to do before building your investor pitch deck

Techcrunch did research on 320 pitch decks. This study showed that investors decide in the first two minutes and 13 seconds whether to end the presentation or allow it to continue. That means you’ve got under two and a half minutes to make your case.

You’d better make it count.

Here’s how to lay the groundwork for your investor pitch deck:

1. Outline your ideal target investors

Start by assessing your ideal investors.

Keep everything organized by creating a buyer persona :

- Who are they?

- What’s their risk comfort level?

- What kind of businesses do they typically invest in? Are they in the same industry and niche as your startup?

- What are their pain points and how can you solve them?

Then, conduct research and create a list of solid potential investors. Be sure to uncover how their investments typically turn out and if they’ve had any issues investing in the past.

To find potential investors, take advantage of networking tips for small business owners . These include using virtual or “smart” business cards and strategizing follow-up plans.

Consider attending industry events, joining directories, and building your brand on LinkedIn.

Networking is vital to establishing meaningful connections and finding aligned investors. Feel free to check out the following fundraising solutions for additional support.

*Pro-Tip: Get clear on each investor’s preferred messaging style before reaching out! Speaking to them in their ideal “language” is key to getting on the same page.

2. Get clear on your funding goals and mutual benefits

Outline your investment needs and how an investor could benefit by supplying you with funding.

Create specific goals that lay out how you’ll use the money and how investing in these objectives can help both of you.

3. Collect trust elements

Gather examples of previous successful startups you’ve created in the past and how much money investors have earned by helping you. Grab past financial projection charts and compare them against your real results.

How to build your investor pitch deck in four simple steps

Now it’s time to choose a pitch deck template. Choose one with professional slide layouts you can easily customize in your brand colors, fonts, and graphics.

To take your pitch deck presentation up a notch, consider using a video presentation maker. It can help you incorporate personalized recordings into your pitch deck so investors can rewatch it. This humanizes your pitch and gives you the opportunity to explain parts of your proposal in depth.

If you don’t have time to record yourself speaking, consider using professional voice-over actors . This allows you to create voice-overs to your presentation. Simply choose a voice that aligns with your natural sound and your potential investor’s ideal messaging style.

Another way to make your presentation stand out is to add an audio option for the text portion. This not only allows your audience to hear your entire pitch, but also demonstrates your dedication to inclusivity. Anyone with vision difficulties may appreciate text-to-speech services without having to ask.

Without further ado, here’s how to build a winning pitch deck:

1. Use storytelling to introduce your vision and investment needs

Share your vision and investment needs by using storytelling techniques.

Here’s how:

1.1 Start with an official elevator pitch

Introduce yourself with a brief summary of who you are and what you need in 30 seconds or less.

For instance:

“Hi, we’re Jacob and Janna from PSoft, and we invented a new productivity software tool for business owners with ADHD called FocusEasy. We need YOUR help to launch our new app to market.”

Then go more in-depth …

Introduce the story and outline your investment offer as the “hero” of the story

Dig deeper into your brand story.

How’d you get to where you are today? What inspired you? And how can an investment take your company further?

Position the investor’s capital as the “solution” to your long-term vision and communicate in their ideal messaging style.

1.2 Lay out your business model, target market, and investment vision

Offer target investors a glimpse into your future plans and how you intend to use their funds.

For instance, let’s say you’re looking to streamline the home-buying process with an app that compares mortgage rates in real time. Your go-to-market strategy could involve partnering with mortgage lenders. They’d benefit from your app’s increased visibility and customer reach.

Your pitch to investors could include how this partnership accelerates market penetration. You’d also mention how it provides a steady revenue stream through fees and commissions.

By including mortgage lenders as key partners in your business model, you prove a clear understanding of your industry. You also showcase a strategy leveraging existing infrastructure and networks for business growth. To an investor, this shows promise, potential, and profit.

Then, share where their money will go, specifically , and why it’s an essential part of your growth plan. For instance, that might include capital to build the app, hire outreach specialists , and fund robust campaigns.

1.3 Explain your audience’s pain points and what you offer as the solution

While your vision and ideas may sound promising, investors need assurance. They need to know your target customer has a need for what you’re offering and that there’s a solid market opportunity there.

Consider using the pain-point-agitate-solution (PAS) framework to drive this home.

Here’s an example:

“Hers, a leading telehealth brand, is on a mission to provide accessible healthcare solutions to women worldwide.

( Image Source )

The problem? Many women face challenges accessing affordable solutions to sensitive issues. These issues include hair loss, acne, and mental health concerns. This became an even bigger challenge after the pandemic wreaked havoc on people’s physical, emotional, and mental health.

Our solution? Partnering with pharmaceutical brands that offer generic products like Spironolactone for hair loss. And Escitalopram for depression and anxiety.

Our digital platform focuses on providing users with seamless access and exceptional experiences. We supply patients with online consultations, prescription deliveries, and personalized treatment plans. Our innovative technology allows us to meet their needs where they are.

When it comes to our patients, we’ll do whatever it takes to keep them happy and healthy. As we tackle the problem of limited access to essential medications, we need your help. Your support will allow us to provide affordable solutions to our target market.”

1.4 Include a competition slide that outlines a competitive analysis

What does the competitive landscape look like in your industry? Who are you up against, and why does your company have the advantage? What’s your competitive edge or “secret sauce”?

Share a competitive analysis to break it all down.

To keep this succinct, consider providing two assets:

- An “alternatives” list

- A comparison guide with your solution as the top choice on the list

For instance, here’s an example that breaks down five Citrix alternatives :

And here’s a comparison guide that lists Connecteam as the top choice for online time clocks:

1.5 Include important startup details

What stage is your startup in? Have you launched it yet, or are you proposing a new business idea? (If so, make sure you provide your business plan.)

Win investors by showing transparency and integrity. Provide all necessary details about the current stage of your business.

1.6 Recap your investment needs and what you’ll use the money for

Finish your story by recapping how many dollars in funding you need and where the money will go. I.e., “We need x million in funding to revamp our x, buy more y, and open z more locations.”

Go the extra mile by breaking down how your business will use the investment to achieve specific growth milestones.

Here’s a quick template you can use:

Growth Milestones Investment Plan

- Milestone 1: We’ll apply $_________ toward _________ to _________.

- Milestone 2: We’ll apply $_________ toward _________ to _________.

- Milestone 3: We’ll apply $_________ toward _________ to _________.

- Milestone 4: We’ll apply $_________ toward _________ to _________.

- Milestone 5: We’ll apply $_________ toward _________ to _________.

2. Provide trust elements that alleviate concerns about execution

Provide peace of mind to potential investors by going over the trust elements you collected before building your deck.

Here’s what to do:

Provide trust elements that back you up as an entrepreneur

Provide records of success, stats, research, and other examples that show your efficacy as an entrepreneur. Share examples of previous successful startups you’ve created and how much money investors have earned by helping you.

Be honest about the state of your business and consider asking a consultant to provide an official recap and sign off on it.

Consider including positive brand mentions and customer testimonials (if you have any). These help demonstrate to investors that your customers advocate for your business, too.

Include trust elements that alleviate concerns about your business

Highlight aspects of your business that inspire confidence in potential investors. These might include a robust infrastructure, secure data management, or records management strategy .

For instance, if you’re starting a technology company, you might explain why hosting equipment in a colocation data center is the best option. It offers robust security measures, enterprise-grade infrastructure, and advanced cooling systems.

You might also share that this model improves network security and reliability while keeping costs low.

Making the following points a priority can go a long way toward building trust with investors.

- Show your commitment to safeguarding sensitive information

- Ensuring uninterrupted operations

3. Walk the prospect through a realistic projected profit simulation timeline

While not guaranteed, you can give potential investors a glimpse into how much profit they could earn by betting on you.

Be realistic about the potential return they could earn and identify any potential risks. To do so, create a projected profit simulation timeline with data backing up your projections.

4. Ask for the investment and list the exact steps your investor will need to take to support you

Now that investors have all of the information they need about your proposal, explain what they’d need to do next to support your goals, step by step.

Keep this part short and sweet.

Here’s a quick example:

“Ready to invest in our venture?

Follow these steps:

- Book a meeting with us (book here).

- Join us on a group call with our law firm to smooth out the details.

- Wait to receive wire transfer details and all necessary paperwork.

- Complete your paperwork and wire your investment.”

Once you’ve filled out your pitch deck, go through it with a fine-tooth comb.

Be sure to edit it for spelling, grammar, and punctuation errors. Add captivating visuals, and ensure the formatting looks clean and professional. Add your company logo to each slide so your brand name stays top of mind, and get feedback on your deck before officially publishing it.

Finally, make sure to have a follow-up plan in place, whether the prospect chooses to invest or not. To create long-term, meaningful relationships, continue nurturing and networking with leads and investors.

A solid investor pitch deck lays out the mutual benefits of investing in your offer.

By following the steps in today’s guide, you can bring prospects on board and show them why investing in your venture is a win-win proposal.

Remember, it’s never too late to ask for support. Get clear on your needs, conduct research, and take steps to reach out to relevant investors.

And speaking of support …

Want startup tools delivered to your inbox? Sign up for a weekly curated email of startup tools and articles — absolutely free.

That’s it for now.

Here’s to your success!

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.

More from the blog...

Must-have tools for bootstrapped startups: a handpicked list for new ventures.

Bootstrapped startups have to be more mindful of cash flow than startups with external funding. With a business model solely…

11 Best SEO Software for Agencies In 2024 (Free and Paid Tools)

Solid SEO software is the bedrock of any agency that prioritizes exceptional results. There are so many agency tools available on the…

The Power of Startup Testimonials: Inspiring Examples That Make an Impact on Startups

Fostering trust with your ideal clients should be a top priority when launching an early-stage startup. The startup ecosystem always…

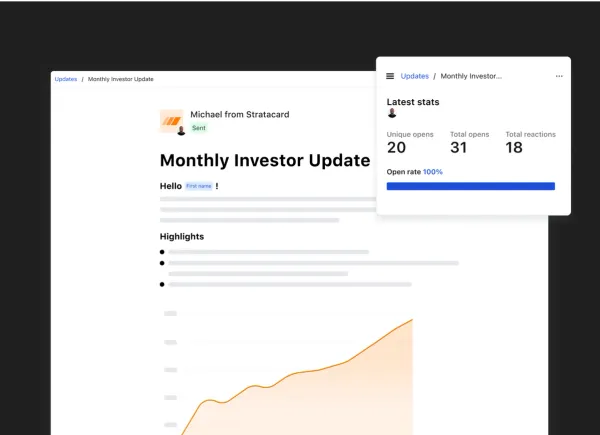

How To Write the Perfect Investor Update (Tips and Templates)

What is an Investor Update?

An investor update is a document that includes recent wins and losses, financials, team updates, customer wins, and core metrics. They are typically shared via email but can also be shared via PDF, deck, or link.

For many startup founders, investor updates are shared every month but can also be shared on a quarterly (or more frequent) basis. Learn more about why and how to create investor updates for your business below:

Why Send Investor Updates?

Step into the shoes of your investors and it will help understand the importance of investor updates. Put simply, an investor’s (venture capitalist) job is to deploy limited partners’ capital by investing in startups, generate excess returns, and pay back their limited partners with the hopes of doing it again. This means that an investor’s success hinges on the success of their portfolio company. Put simply, your investors need you to succeed.

Your investors likely have other investments and can’t be expected to know exactly where to help each company. In a crowded space building, strong relationships centered on trust and transparency is an easy way to stand out amongst other startups. By sending regular investor updates you can stay top of mind for your investors and tap into their knowledge, resources, and capital to continue to grow your business.

Below you will find our guide to help you write the perfect investor update by understanding what metrics and data to share, properly asking for help, sharing big wins and losses, and raising additional capital. We’ve also included 7 of our favorite investor update templates.

Essential Communication

We believe that regular communication with investors and important stakeholders is key to a startup’s success. If your investors don’t know what’s going on in your business, they don’t know how to help. Building a reporting cadence with your investors is a great way to promote transparency and build a relationship focused on trust.

Related Reading: Should You Send Investor Updates?

Follow-On Funding

One of the biggest reasons to report to your investors is the increased likelihood of follow-on funding. In our own research, we have found that companies that regularly communicate with their investors are twice as likely to raise follow-up funding.

Try Visible to find investors, track your raise, share your deck, and update investors. Give it a free try for 14 days here .

Networking Opportunity

Generally speaking, investors' networks often have had experience as an operator and investors. Tapping into their network can be an easy way to find introductions to investors, partners, potential hires, and mentors. Getting an investor to go to bat for you will likely carry a bit more weight. As Tomasz Tunguz, VC at Redpoint Ventures, states;

“Investors network frequently, work together, and have long-term relationships with each other so a referral should go a long way.”

Finding Talent

In hand with tapping into their network, investors are a great resource when it comes to hiring top talent. Between their other portfolio companies and previous experience most investors likely know a number of solid candidates to fill a role. If they don’t have someone in mind for the job, they can at least help talk you through the different candidates you are weighing for an open position.

Knowledge and Experience

Between their own experience and other portfolio companies, investors have seen just about anything. If you have an operational or tactical question investors are a great resource and can lend experience and knowledge.

Related Resources:

- Our 15 Favorite Newsletters for Startup Founders

- How to Write the Perfect Investment Memo

- 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

Accountability & Reflection

One of the often overlooked benefits of sending monthly investor updates is the reflection and accountability it offers founders. Investor updates can be a great forcing function for founders to look back at the previous month or quarter and better understand what is and is not working for their business.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Tips For Writing Investor Updates

Investor updates can be a tricky balance between informing investors and keeping things succinct and digestible. Most things boil down to keeping your updates consistent and regular.

Keep the Cadence Consistent

If you commit to sending a monthly update, you'll want to make sure you stick to sending an investor update every month. Skipping an update when times are tough can be a negative signal to investors.

Keep Metrics the Same

Make sure to keep the metrics you are tracking stay the same from month to month. For example, if you are calculating net new MRR using a certain formula, keep that consistent from month to month.

Stick to a Format

When creating an update, sticking to a regular format or template is a great way to help get the ball rolling every month. If you're not sure where to get started, we studied our data to understand the most popular components included in Visible Updates, check it out below:

- 81% of Updates include “Highlights”

- 47% of Updates include a “Team” section

- 42% of Updates include “Product Launches”

- 42% of Updates include a “KPIs” section

- 39% of Updates include a “Fundraising” section

Investor Update Templates: Examples For Your Next Update

Sending your first investor update can be a daunting task. We believe that the best place to learn is from someone who has been there before. Luckily, countless founders and investors have shared their templates and best practices for sending investor updates.

We suggest starting with a template you like and tweaking it to your needs (more on this later). Once you’ve found your format, it is all about making sure you keep tabs on the data and context so you are not scrambling when it is time to send. A couple of small steps when sending your first Update:

- Gather your data — As you should be sharing other a few metrics with investors, it is important to keep tabs here. These should be vital to your business and something that you have on hand at all times.

- Review the month — A perk of sending an investor update is the ability to look back at the previous month. Think about any major highlights, lowlights, areas you need help, so you can start to craft your Update.

- Add context — Sharing your data without context can be dangerous. Do your best to explain any metric movements.

- Send it — Getting your update sent out a consistent basis is a win. If you’re looking to get an idea of when founders using Visible send their Updates, check out our post, “ Most Popular Times to Send Your Investor Update .”

1. Techstars Minimum Viable Update

In the “Minimum Viable Investor Update”, Jens Lapinski, Former Managing Director of Techstars METRO, lays out 3 items that he finds most useful in his portfolio early-stage company monthly updates.

2. Founder Collective “Fill-in-the-Blank” Investor Update Email Template

An investor Update template for busy founders put together by the team at Founder Collective. Simply fill out the bolded sections and have your investor Updates out the door in no time.

3. Kima Ventures Investor Update Template

An Update template put together by Jean and the team at Kima. Quickly fill in the quantitative and qualitative data Kima finds most useful.

4. GitLab Investor Investor Update Email Template

A 6 part template put together by the team at GitLab. Built for investors to quickly read and locate the information that is most relevant to them.

5. Y Combinator Investor Update Template

An investor update template from Aaron Harris of Y Combinator. Aaron recommends highlighting repeatable key performance indicators (KPIs) and major asks for your investors.

6. Shoelace: Investor Update Email Template

A template based off of Reza Khadjavi’s, Founder & CEO of Shoelace, investor update email used to wow investors.

7. The Visible “Standard” Investor Update Email Template

Our Standard Monthly Investor Update template put together from best practices and tips from Visible users.

For more ideas, check out our investor update template library here .

Related Reading: 4 Items to Include in Your Next Investor Update (If You Want to Drive Engagement)

8. Bread & Butter Ventures Update Template

Bread & Butter Ventures is an early-stage VC firm based in Minnesota investing globally while leveraging their state and region’s unparalleled access to strong corporate connections, commercial opportunities, and industry expertise for the benefit of our teams. Learn more about what Brett Brohl of Bread & Butter Ventures likes to see in an Update below:

Sharing Metrics and Data

Determining what metrics and key performance indicators (KPIs) to share with your investors can be tricky. There are a slew of different key metrics and different investors may have their eyes on different things. Changing metric names or what you are reporting can be an easy way to break trust with investors. At the end of the day, it is most important that you share the same metrics from month to month. And as we’ve discussed before, it is okay to share bad months!

We suggest sharing a handful of key performance indicators (KPIs) with your investors. Depending on your relationship, some may only want to see 3 metrics while others may want to see 10. Talk with your investors and discuss what types of key metrics they’d like to see. A couple of examples are churn rate, number of active users, monthly recurring revenue (MRR), burn rate, and more.

Related reading: Startup Metrics You Need to Monitor

Every company has missed the mark and any investor is aware that this happens. Building a company is hard! With that being said, we do have a few areas where investors would expect some data:

Being able to generate revenue is essential to a business. However, you determine to measure revenue should be kept consistent from month to month. For example, don’t share bookings one month and revenue the next. For SaaS companies, including your monthly recurring revenue (MRR) and the movements are always good to include as well.

Cash is king. Cash is the lifeblood of your business and investors expect some insight into how their capital is being managed and used. This is also a great way for you as a founder to stay accountable and on top of your spending as you continue to grow your business.

As we mentioned above, cash is king. By tracking and reporting your burn rate, you will be able to avoid surprises with investors. A common mistake we see founders make is surprising their investors when their cash balance is low and months to 0 is nearing. Sharing your burn rate is an easy way to build trust with your investors and give them a better idea of when you’ll need to raise a new round.

Generating solid margins is a must for any successful business. Except the “gig economy,” Frank Mastronuzzi of Greenough Consulting Group suggest that every business should have at least a 55% margin. While likely more important during a fundraise, sharing your margins will help investors evaluate your COGS and acquisition costs.

Number of Active Users

Depending on your company goals and KPIs, the number of active users could be valuable to understanding growth.

Being able to keep your burn rate under control is an easy way to grow your business. In the early days, some investors may want to keep close tabs on burn rates to understand what part of your funnel may be lacking.

Customer Acquisition Costs

Being able to efficiently acquire and expand customers is a surefire way to grow. Without a sustainable way to acquire new customers, a business will struggle to grow or even exist.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Sharing Wins and Losses

One of the most exciting aspects of being a founder is sharing and celebrating your victories. As we all know, with every victory comes plenty of losses. Investors are keyed in on your success so it is important to stress both wins and losses equally.

Sharing Wins/Highlights With Investors

Sharing your company’s accomplishments is generally pretty straightforward. Share why and how you accomplished your goal and carry on. Investors generally won’t be able to move the needle for your wins but is best to keep them informed so they can signal to their network of your successes.

Most important is to call out individual contributors when it comes to sharing major accomplishments. All employees like to be recognized for their contributions and there is no greater place to do so than in front of your outside stakeholders.

Along the lines of sharing individual kudos, it is also a great time to highlight new hires. A shout-out to new hires will make offer them a warm welcome and the chance to open up to investors.

Sharing Losses/Lowlights With Investors

The most dreaded and arguably the most important aspect of an investor update; sharing losses. Startups are hard and everyone involved with the process knows this. It is vital that you key your investors into any troubles you are facing and why you are facing them. We find it best to layout the lowlight and offer a solution to improve this moving forward (If you do not have a solution read on to the “Asking for Help” section below).

Generally speaking, nothing is ever as good or as bad as it seems. Sharing bad news is an easy way to strengthen your relationship with investors and they know you’ll be open and honest with them moving forward. Most importantly, this gives your investors an opportunity to step in and help to keep you moving in the right direction.

Related Reading: How to Deliver Bad News to Investors

Asking Investors for Help

Last but certainly not least is asking your investors for help. While every section mentioned above lends itself to asking questions, it is most important to lay out actionable questions where you believe your investors can help.

By laying out a pointed list of areas you could use help, you can easily tap into your investors’ network, resources, experiences, and capital. A couple of key areas we see founders have the most success:

Related Resource: Navigating Investor Feedback: A Guide to Constructive Responses

Closing Deals

From our article, “ You Should be Asking Your Investors for Help. Here’s How. ”

“At its core, building a VC-backed business is about generating revenue. The biggest value add for a business? Closing more deals. Your investors are in the “deal-making” business and likely have a knack for closing deals.

Use your investor’s professional networks to make an intro, set a meeting, or bring in the necessary backup to close a large deal. If you see your investor has a specific connection you’re looking for, don’t beat around the bush. Ask the investor for the exact intro you’re looking for and tell them how they can be of most value.”

Help With Hiring

Talent is the resource every company is in competition for on a daily basis. Any tool or resource you can use to find top talent for your business is worth leveraging. Investors generally happen to help fill an open role and often have an extensive network to do so. Be specific as possible about the role, as well as items like the experience level required, and target compensation to make it low-maintenance for your investors.

Pro tip: Include a direct link to a LinkedIn search that fits the criteria of the person you’d like to hire to make it easy as possible for investors.

Fundraising