Insurance Agency Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 3,000 entrepreneurs and business owners create business plans to start and grow their insurance agencies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an insurance agency business plan template step-by-step so you can create your plan today.

Download our Ultimate Insurance Business Plan Template here >

What is an Insurance Agency Business Plan?

A business plan provides a snapshot of your insurance agency as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Insurance Agency

If you’re looking to start an insurance agency or grow your existing insurance agency you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your insurance agency in order to improve your chances of success. Your insurance agency business plan is a living document that should be updated annually as your agency grows and changes.

Source of Funding for Insurance Agencies

With regards to funding, the main sources of funding for an insurance agency are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate the business.

The second most common form of funding for an insurance agency is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund an insurance agency unless it is based on a unique, scalable technology.

Finish Your Business Plan Today!

Your insurance agency business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of insurance agency business you are operating and the status; for example, are you a startup, do you have an insurance agency that you would like to grow, or are you operating multiple insurance agency locations already.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the insurance agency industry. Discuss the type of insurance agency you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of insurance agency you are operating.

For example, you might operate one of the following types:

- Direct Writer / Captive : this type of insurance agency only sells one insurance company’s products – like Allstate or State Farm

- Independent Insurance Agent : this type of insurance agency is privately-owned, and sells policies with may different insurance companies

In addition to explaining the type of insurance agency you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new location openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the insurance business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the insurance industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards weather-related policy purchases, it would be helpful to ensure your plans call for flood insurance options.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your insurance company business plan:

- How big is the insurance agency business (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key insurance carriers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your insurance agency. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

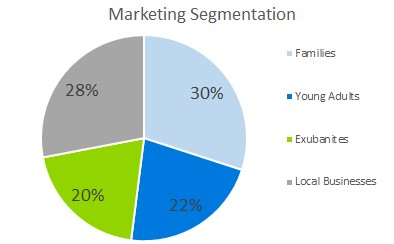

The customer analysis section of your insurance agency business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, households, businesses, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of insurance agency you operate. Clearly baby boomers would want different pricing and product options, and would respond to different marketing promotions than recent college graduates.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most insurance agencies primarily serve customers living in their same geographic region, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Insurance Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Insurance Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other insurance agencies.

Indirect competitors are other options that customers have to purchase from you that aren’t direct competitors. This includes self pay and public (Medicare, Medicaid in the case of health insurance) insurance or directly working with an insurance carrier. You need to mention such competition to show you understand that not everyone who purchases insurance does so through an insurance agency.

With regards to direct competition, you want to detail the other insurance agencies with which you compete. Most likely, your direct competitors will be insurance agencies located in your geographic region.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior insurance agency products/services?

- Will you provide insurance agency products that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your products?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an insurance agency business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of insurance agency that you documented in your Company Analysis. Then, detail the specific products/services you will be offering. For example, in addition to P&C insurance, will you also offer life insurance?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the menu items you offer and their prices.

Place : Place refers to the location of your insurance agency. Document your location and mention how the location will impact your success. For example, is your insurance agency located next to the Department of Motor Vehicles, or a heavily populated office building, etc. Discuss how your location might provide a steady stream of customers.

Promotions : the final part of your insurance agency marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Making your insurance agency’s front store extra appealing to attract passing customers

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Partnerships with local organizations (e.g., auto dealerships or car rental stores)

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your insurance agency such as serving customers, procuring relationships with insurance carriers, negotiating with repair shops, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your 500th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your insurance agency’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in the insurance agency business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in insurance agencies and/or successfully running small businesses.

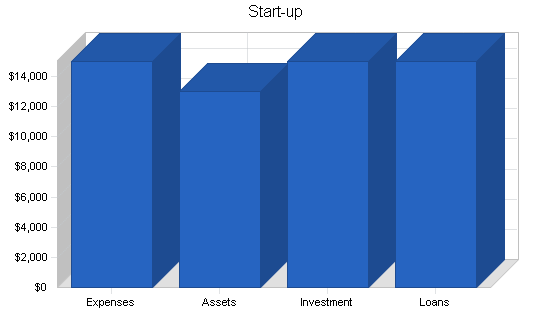

Financial Plan

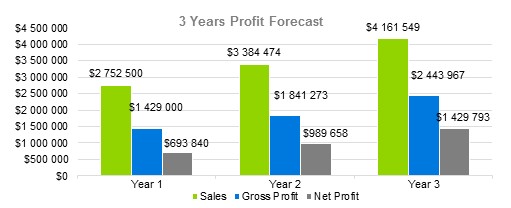

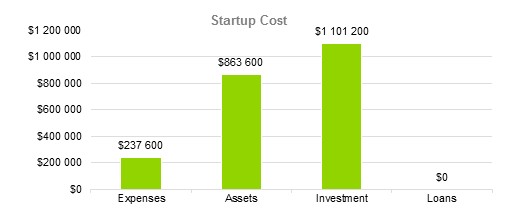

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

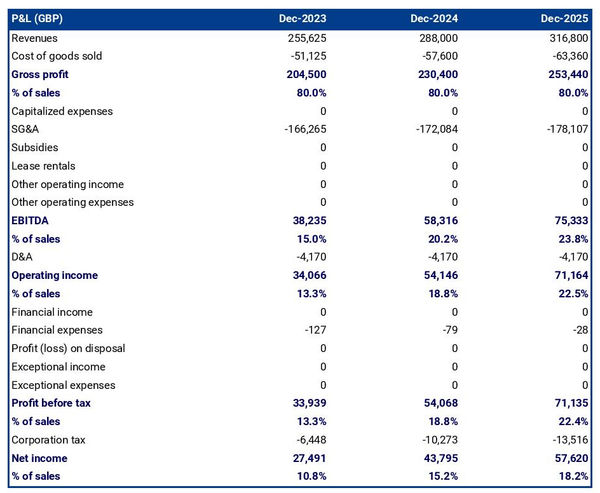

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you acquire 20 new customers per month or 50? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

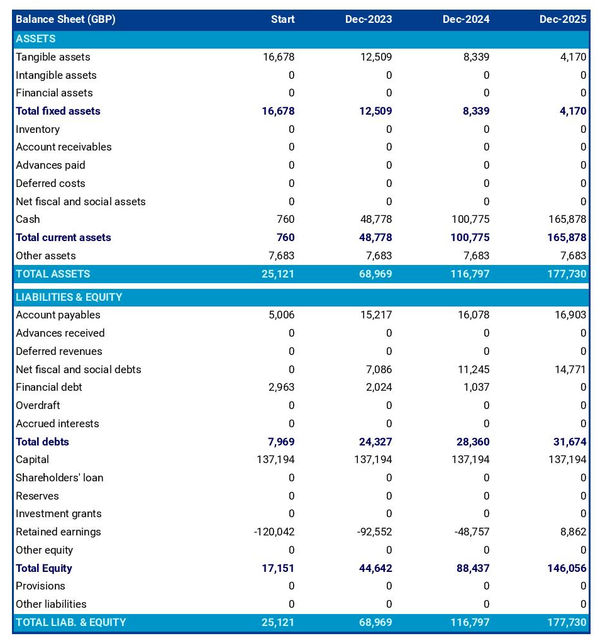

Balance Sheets : While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your insurance agency location and/or website, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an insurance agency:

- Location build-out including design fees, construction, etc.

- Marketing expenses

- Website development

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your store design blueprint or location lease.

Insurance Business Plan Summary

Putting together a business plan for your insurance agency is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the insurance agency business, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful insurance agency.

Download Our Insurance Business Plan PDF

You can download our insurance business plan PDF here . This is a business plan template you can use in PDF format.

Insurance Business Plan FAQs

What is the easiest way to complete my insurance business plan.

Growthink's Ultimate Insurance Business Plan Template allows you to quickly and easily complete your Insurance Business Plan.

Where Can I Download an Insurance Business Plan PDF?

You can download our insurance business plan PDF template here . This is a business plan template you can use in PDF format.

Don’t you wish there was a faster, easier way to finish your Insurance business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to learn about Growthink’s business plan writing services .

Other Helpful Business Plan Articles & Templates

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

* Mandatory fields

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. Consent.

- Agents Blog

- Running & Growing your Agency

- Upcoming Webinars

- IAA Presentations

- Share this Hub

- EverQuote Pro Blog »

Launch Your New Insurance Agency With This Business Plan Template

Whether you're a brand new agent or one with several decades of experience, the idea of opening a new insurance agency probably seems daunting—where do you start?

One of the first things you’ll need to do is come up with a business plan for your insurance agency. After all, you can walk into a bank or a potential investor’s office looking for funding, but you won’t get very far unless you have a robust insurance agency business plan that proves you’re on the right track toward turning a profit in the near future.

Follow the steps below when building out your insurance business plan to maximize your chances of securing funding and getting your new agency off to a strong start.

7 Steps To Build Your Insurance Agency Business Plan

1. develop your executive and business summaries..

In business plan terms, the executive summary is the driving force behind your other decisions. It should explain why you’re starting your agency. The business summary is similar, but it should narrow down your “why” into a list of “hows.”

Ask yourself:

- Why do you want to open an agency?

- What types of insurance do you wish to sell?

- What do you hope to accomplish?

- What return on investment do you expect to receive?

- How are you going to generate demand and ensure supply for your service?

Jot your answers down so you can refer back to them as you move forward.

2. Decide whether you want to be a captive agent or an independent agent.

Many large agencies, such as Allstate and Farmers, work with captive agents who can only sell insurance for that specific provider. Independent agents, on the other hand, can sell insurance for multiple providers, but they get locked out of working with the big-name captive carriers who only work with captive agents. (Read more about captive agents here and get a seasoned agent’s POV on both types of agents here. )

Before you can nail down the details of the rest of your business plan, you’ll have to make a choice between these two options.

3. Do a market analysis.

Though it might seem like a tedious process, conducting a thorough market analysis is crucial to your success. Analyzing your local market—including the backgrounds, shopping behaviors, and preferences of your target customers—gives you the insights you’ll need to attract these folks to your business.

Your market analysis will look a little different depending on whether you prefer to be a captive or an independent agent. The state you live in is another factor that will affect your analysis—in fact, it may even influence your decision to be captive or independent.

Take a close look at the demographics of your region.

- How many homeowners live in your state?

- What’s the average insurance premium per home?

- How many people live in each home, on average?

- How many drivers live in your state?

- How many vehicles does the average household own?

- Do you live in an area with an aging population ?

- How many families live in your region?

- What insurance carriers do locals in your state gravitate toward?

- In your area, what might be some successful strategies for retaining clients (rather than just acquiring them)?

These questions are all important, but pay particular attention to the last one. If you open an agency without a plan for client retention, you’re going to struggle. And, unfortunately, this is one of the most overlooked aspects of an insurance agency business plan.

4. Identify where you’ll find your first clients.

It’s one thing to know there are X number of potential clients living in your state, but it’s quite another to have a plan that will help you reach out to those folks and land your first policy sales.

Some investors will require a list of leads before they’ll even consider funding your agency. Even if it’s not a requirement, it’s always a good idea to have a pipeline ready to go. This is where getting set-up for purchasing warm leads from EverQuote can put you in a great position for success.

Plus, tackling this step before you even open your doors will help you better understand the costs you’ll incur—and therefore how much startup funding you will need.

You might also consider other options, such as placing ads in local newspapers, going to networking events, investing in digital marketing, sponsoring local Little League teams, or asking for referrals.

5. Create a financial plan.

Many new agencies fail because their owners overlooked something critical during startup. Do your best to look at your financial plans from every angle:

- Where will you find leads, and how much will they cost?

- What is your advertising budget?

- Does this budget line up with the going rates of local newspapers, billboards, or online ads?

- Do you plan to have 1099 employees or W2 employees selling insurance for your agency?

- How will you decide on a commission and benefits structure for these employees?

- What retention and loss ratios (for clients and employees) do you expect based on the numbers of other agencies in your area?

- How will you handle the delay between policy renewals and income hitting your bank account?

- If there are X amount of people shopping for insurance in your area, what percentage of those people are in a niche you can serve?

- From that percentage of potential clients, how many do you think you can successfully land?

- If you sell policies to these customers, how much will you earn from their premiums?

- How do your projected profits compare to your expected advertising costs, the cost to buy leads, office rent, and other expenses?

Take detailed notes of your calculations, and try to run the numbers a few different ways to obtain a conservative outcome, a likely outcome, and a “best case scenario.”

6. Draw up a formal business plan using a proven format.

Your notes will be incredibly valuable as you move forward, but you’ll need a way to present them clearly and concisely in a way that looks attractive to investors.

Loan officers and investors don’t want to read long-form essays detailing your business background and your ideas for the future. Keep your format simple and straightforward, with clear sections that answer the questions investors will want to know.

We recommend a format similar to the following:

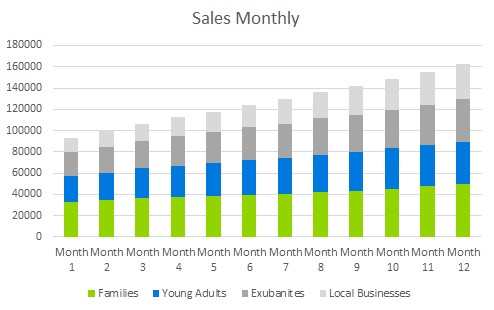

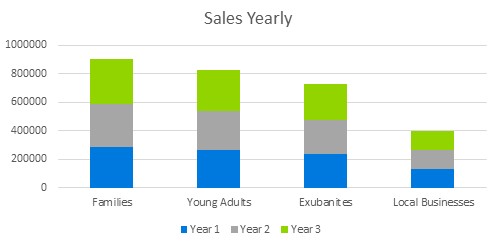

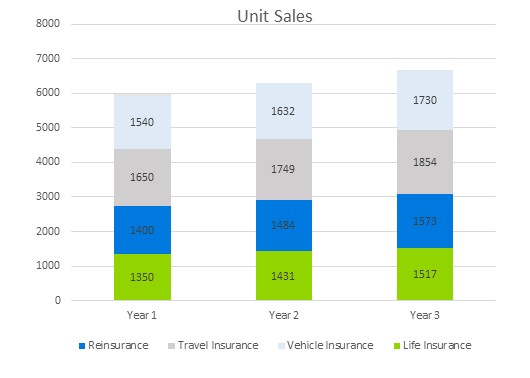

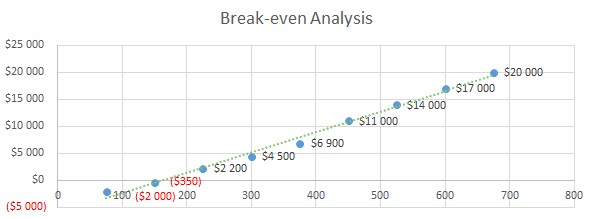

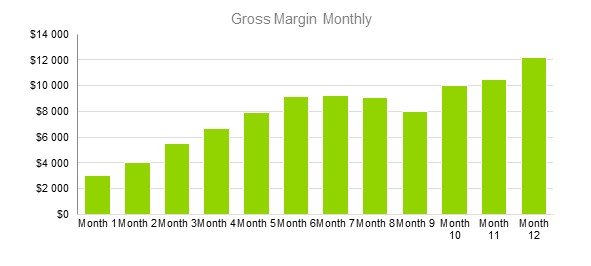

Executive Summary Overall mission Primary objectives Keys to success Financial plans Profit forecast for at least three years Business Summary Business overview Summary of startup costs Funding you’ll require Company executives/ownership Services Services you provide Market Analysis Overall business analysis Details of your competition Buying patterns of your competition Your planned buying patterns Market segmentation and analysis Target market strategies Include details for each market segment Strategy Your competitive edge Marketing strategy Sales strategy Yearly sales projections Key milestones Management Your plan for finding staff Financial Plan Funding you have accepted Funding you will need Detailed startup costs Calculations for your break-even point Projected profit Yearly profit Gross and net yearly profit Anticipated losses, if any Cash flow patterns Plans for balance sheet Calculations of important business ratios

7. Revise and adjust your plan over time.

You may not secure funding for your agency immediately. Even if you do, you’ll likely find that your real world numbers don’t match up exactly with your calculated projections. Plus, carriers frequently change their underwriting policies, and the economy itself is always in a state of flux.

Keep your business plan current by updating the information anytime circumstances change.

Start your journey with a full lead pipeline from EverQuote.

One of the scariest parts about starting a new agency is not being certain where and when you’ll be able to start making sales.

Skip the fear and the unknown and go right to making sales with warm real-time leads from EverQuote. Whether you’re still trying to find startup funding or your doors are already open, you can always boost your business and maximize your chances of a steady income by working with EverQuote.

Connect with us today.

Topics: Featured , Insurance Agency Growth

About the Author Chris Durling, VP of P&C Sales

Chris Durling is a visionary leader in P&C insurance sales and distribution, with over 10 years of experience in the industry.

Most Recent Articles

If the year 2023 had a buzzword, that buzzword was definitely AI. Artificial intelligence took off...

Despite current economic complexities, many industries are still hiring at a dependable pace. Among...

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job,...

Creating a new insurance agency is a complex process, just like building any new business from the...

Is buying warm life insurance leads the right option for your business?

It can be! Keep reading for...

At EverQuote, we work with insurance agencies every single day. We hear so many stories of how the...

How can you, as an insurance agency owner or manager, successfully hire and retain new agents in...

Previous Article

Next Article

Ready to see what partnering with EverQuote can do for you?

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers.

Terms of Use

Privacy Policy

For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers

How To Write an Insurance Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance companies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance company owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Company Business Plan?

An insurance company business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Company Business Plan?

An insurance company business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Company Business Plan

The following are the key components of a successful insurance company business plan:

Executive Summary

The executive summary of an insurance company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance company , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance company firm, mention this.

You will also include information about your chosen insurance company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an insurance company may include individuals, families, small businesses, and large corporations.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance company services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance company may have:

- Specialized industry knowledge

- Proven track record

- Strong customer relationships

- Robust product offerings

- Innovative solutions

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance company business via word of mouth.

Operations Plan

This part of your insurance company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance company include reaching $X in sales. Other examples include expanding to a new geographic market, launching a new product or service line, or signing on new major customers.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

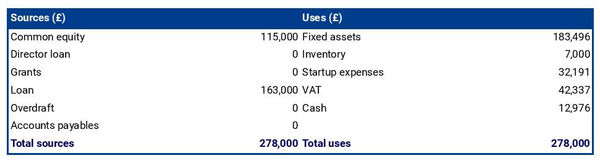

Sample Balance Sheet for a Startup Insurance Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

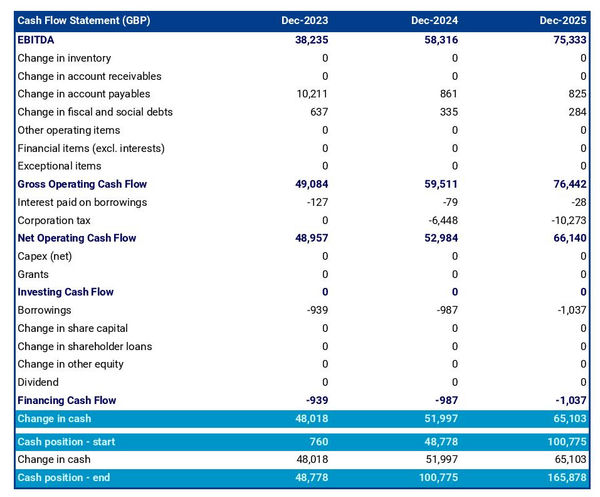

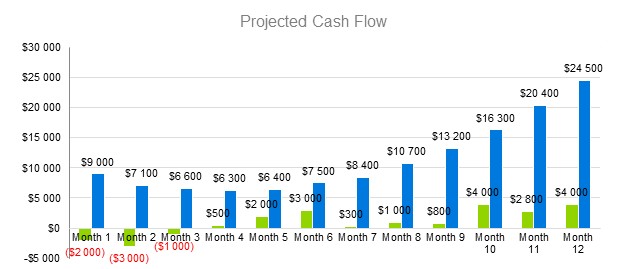

Below is a sample of a projected cash flow statement for a startup insurance company business.

Sample Cash Flow Statement for a Startup Insurance Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your insurance company . It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it. All in all, a business plan is a key to the success of any business.

Finish Your Insurance Business Plan in 1 Day!

Other helpful articles.

How To Write an Insurance Agency Business Plan + Template

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Start an Insurance Company

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

1. Become a licensed insurance agent

2. write a business plan, 3. choose a business structure, 4. register and license your business, 5. get business insurance, 6. form relationships with insurance companies, 7. grow your client base.

Starting an insurance agency is a lot like starting any business . You’ll need to choose a business structure, register and license your business, get insurance and more.

But you’ll also need to become a licensed insurance agent and learn how to navigate a highly regulated field.

Here’s how to get started.

Looking for tools to help grow your business?

Tell us where you're at in your business journey, and we'll direct you to the experience that fits.

on NerdWallet's secure site

You can get an insurance agent license in a matter of weeks or months, depending on the requirements in your state. Here are the steps to follow:

Learn about your state’s licensing process. The National Insurance Producer Registry or your state’s branch of the Independent Insurance Agents and Brokers of America can help you understand those specific requirements.

Decide what type of insurance to sell. You can be licensed to sell several different “lines of authority” or types of insurance. The most extensive lines of authority include:

Accident and health or sickness.

The names of these lines of authority may differ in your state. You can be licensed to sell multiple lines of authority. Life and health are often offered as one package, as are property and casualty.

In general, most types of business insurance are property or casualty policies. With a property and casualty license, you can sell personal and commercial insurance . Most agents choose to specialize in one or the other, though.

Take a pre-licensing class. Your coursework should focus on the type of insurance you choose to specialize in. Courses can be done in person or online in most states.

Schedule your licensing exam. These are usually administered at testing centers run by third-party testing companies, which may immediately inform you of the results.

Apply for your license. Submit your licensing application to your state’s governing body. You’ll need to provide personal information, such as your Social Security number, date of birth and residency information, and pay any applicable fees. If your application is approved, you’ll be able to sell insurance products.

If you’re new to selling insurance, you may want to get some experience working for an insurance company or another brokerage before venturing out on your own.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Your business plan outlines what you want your business to look like and how you plan to get there. The process of writing it should force you to answer complex questions, like what unique value you’ll offer customers and how much money you’ll need to get started.

» MORE: NerdWallet's picks for the best business plan software

Your business structure determines how your business profits are taxed and how your personal and business assets are kept separate, among other things.

There’s also an insurance-specific question you’ll need to answer: Whether you want your insurance agency to work with one specific insurer or with many different providers.

Captive agents (agents who work with a particular insurance company) can benefit from brand recognition and don’t have to convince insurers to work with them. But, on the other hand, they can only sell a limited suite of insurance policies. For example, State Farm works with a network of independent contractor agents who run their agencies but only sell State Farm products.

Many other insurance agency owners are independent agents, selling products from multiple insurance companies. Independent agents might have to work harder to establish and market their brand to customers and insurers, but they can start relationships with many insurance providers.

Before running your business, you’ll need to register with your state, typically with the secretary of state’s office.

Most insurance businesses will probably need to apply for an employer identification number from the IRS. With an EIN, you can open a business checking account .

As part of this process, make sure to obtain a business license, a sales tax permit and any other documents your state or city requires.

Your business entity may also need a license from your state's insurance department. Check your state’s requirements to find out what you need.

» MORE: Everything you need to do to start a business

As an insurance agent, you already know how important it is for your customers to be fully insured. Get business insurance to protect your business assets.

Most insurance companies are likely to need professional liability insurance and general liability insurance . Depending on your agency’s size, location and day-to-day activities, you may also need commercial auto insurance, workers’ compensation insurance and other types of business insurance.

If you’re an independent agent, you’ll need to apply to work with any insurance companies whose products you want to sell. If they approve your application, they’ll grant you an appointment to sell their policies.

It can be challenging to start relationships with insurance companies directly without having several years of experience and a client base.

Joining a professional association, like the Independent Insurance Agents and Brokers of America, or an agent network like Smart Choice, can help you access insurance providers to sell their policies. These groups may also provide marketing materials, discounts on your business insurance policies, and other resources.

If you choose to start an independent agency, you may have to hustle for your first few clients. Start by joining your local Chamber of Commerce, attending networking events and advertising in your local market.

Having an online presence is essential, too. Make sure your website clearly outlines what kinds of insurance you sell and the customers you serve. Information about how to contact you should be easy to find.

If you start an agency affiliated with a particular insurance company, you might get referrals as customers seek out agents near them. However, you’ll probably need to do local marketing too.

On a similar note...

How to Create a Business Plan for an Insurance Agency

If the adage is true that even the greatest enthusiasm is no substitute for planning, independent insurance agents know that both are required in order for an agency to succeed.

An insurance agency business plan is therefore essential, especially for brand-new agencies in addition to established firms. A thoughtfully developed plan provides you direction for your efforts and structure for ongoing business development.

Without a plan, all you have is good intentions – and those won’t get you where you want to go. A map, on the other hand, will.

With this in mind, let’s dive into how to create a business plan for insurance agents and the things you’ll need to do to set your agency on the path to success.

Why is an agency business plan important?

A well-constructed insurance agency business plan helps you to set realistic goals, define your needs for specific resources, and focus your attention on the essential must-dos for accelerating your business.

As the principal, you must continually refine your vision for what you ultimately want to achieve: the type of business you want to run, its operations, its cash flow, its culture, and its workflows. Then, you can list the necessary steps to reverse-engineer the ideal agency that you’ve pictured.

Not only will the business plan for your insurance agency serve as a tool for internal management and decision-making, but it’s also extremely useful in conveying the vision for your business to other parties. Among these are investors, lenders, and potential partners – and new insurance carriers will often want to review your agency’s business plan before they’ll partner with you.

It’s worth noting that over time, the business plan for an insurance agency can and will change, and the agency owner must be flexible in both thought and execution as a new agency is forged. For example, you may envision writing a large portion of your agency’s book of business in a certain line, and later discover that market conditions or intense competition will encourage you to pivot to other lines that may also prove profitable.

What should be included in the business plan for an insurance agency

Agency principals will create a comprehensive summary that mindfully considers everything from the agency’s location and target markets to the products it will offer.

To get started, let’s review the various sections that make up a comprehensive business plan, and how each section contributes to the overall plan’s effectiveness.

Your insurance agency business plan should run about 5,000 words, outlining the following in detail:

- An executive summary detailing your “vision” for your agency

- Description of your company

- List of the insurance products your agency plans to offer

- Business analysis of your market

- Your agency’s marketing strategy

- Organizational structure

- Your agency’s financial plan

- Agency funding needs

If you’re already thinking, “I’m not a writer; I can’t do this,” fear not. You’re summarizing what you’re setting out to achieve and how you plan to get there – not writing a sonnet. Once you start writing, you’ll be surprised how far you’ll get.

The aforementioned word count, while a solid goal, isn’t set in stone. Don’t pad what you’re writing; stick to the facts. In the end, your business plan should be thorough, useful to you, and appealing to investors.

Let’s break down each of these sections one by one.

Executive summary

Think of this section as a concise overview of the overall business plan for your agency – your mission statement. Include highlights of your agency’s mission, goals, and its competitive advantage. Highlight your agency’s projected growth and potential profitability.

Be realistic and truthful in your assessments. It’s good to be optimistic, but not pie-in-the-sky level, especially for new agencies. Remember, you could find yourself answering to an investor sometime in the future.

Company description

Here’s where you explain what makes your agency special. Tell your story powerfully. What’s your vision for your organization? How would you describe your company culture ? How do you recruit new talent ?

What is your target market? What are your customer demographics? Who will be selling, and what are their strengths? How do you manage your relationships with your insurance carrier partners? What types of agency technology do you leverage in your customer service efforts?

Offer details on what you consider your unique selling proposition. Do you offer specialization in certain lines of business? If so, explain the inherent value in the expertise you possess.

Keep this question in mind as you write: What makes your firm exceptional, and why would someone want to invest in it?

List of products

The composition of your agency’s book of business is critical , and here you’ll lay out exactly what products you’re selling (or plan to sell). Provide a detailed breakdown of the insurance products and services offered by your agency, including a brief explanation of each product’s features and benefits.

In addition, include ideas for expanding your product lineup in years to come.

Market analysis

Investors and carriers alike want to know that you possess comprehensive knowledge of both your local insurance market and the forces influencing the wider industry. Offer analysis of your agency’s target market, including the demographics of your potential clients.

Then, provide a thorough analysis of the insurance industry’s current challenges and evolving exposures, with emphasis on how those trends affect the types of clients you serve. (This section doesn’t need to be exhaustive – again, don’t pad it – but it should reflect your macro perspective on the P&C market as well as how market forces will factor into your pricing and risk selection.)

Marketing strategy

How do you market your agency to prospects? Do you utilize digital marketing, social media, or create content that will resonate with potential customers? Community engagement is key in endearing your business to local prospects, as are networking events.

Detail your marketing strategy, and explain which types of outreach you’ve found most effective.

Note: As an agency owner it’s especially important to be flexible with your plans in this area, as certain approaches may prove less effective over time. When they do, you’ll need to pivot.

Organization and management

Effective leadership and a clear organizational chart will contribute greatly to your agency’s success. In this section, lay out your agency’s organizational structure – the hierarchy of your leaders. Include profiles of key team members, highlighting their various expertise.

Financial plan

Here’s where you begin to get more detailed on dollars and cents. Offer your realistic financial projections for your agency, taking into account expenses, revenue, and projected profitability.

Your projections should include a breakdown of any and all financial forecasts and possible variables taken into consideration. Contingency plans to address potential financial challenges should likewise be included.

Agency funding

Your agency’s financial needs are assessed in detail here. Apply your knowledge of what you want your agency to achieve, versus what it will cost. This includes (but is not limited to) rent, payroll, utilities, phone service, and business insurance.

Include the purpose behind each expenditure, and demonstrate how funding for your firm will be used to cultivate growth.

By the time this section is complete, you’ll have an informed understanding of exactly what it will cost to fund your organization – and how much you may need to borrow to manifest your vision. Provide an outline of potential sources of funding, including personal investments, loans, or investors.

What is the Best Business Structure for an Insurance Agency?

There are several business structures you can consider for your agency, each with various benefits. These include:

- Sole proprietorship

- Partnership

- Corporation

There are various legal, financial, and operational factors to consider in selecting the structure that’s best for you, which we’ll explore in greater detail in a future blog.

How your insurance agency business plan will evolve

As your agency evolves over time, so too will your firm’s business plan. It’s best to revisit and refine your overall plan at least every seven to 12 months, in order to chart your progress and adopt new strategies that will help to continuously drive revenue.

The path to agency success is long and at times extremely difficult, but thoughtful planning will aid your firm’s execution and growth for years to come.

About Renaissance

Powered by a differentiated suite of technology products and services, Renaissance drives organic, profitable revenue growth for your insurance agency.

Keep Reading

How insurance agencies can benchmark their success, how independent insurance agents can raise the bar on customer service, 4 strategies for growing your independent insurance agency.

155 N Wacker Dr., Suite 820 Chicago, IL 60606 (800) 514-2667

NON-DISCLOSURE TERMS AND CONDITIONS

These Non-Disclosure Terms and Conditions (“ Agreement ”) govern the provision of information by Renaissance Alliance Insurance Services, LLC (“ Renaissance ”) to a prospective agency member (“ Recipient ”). Renaissance and Recipient Renaissance and Recipient are hereinafter referred to together as the “ Parties ,” and each may be referred to separately as a “ Party .”

The Parties acknowledge that Renaissance may disclose to Recipient certain of Renaissance’s confidential, sensitive and/or proprietary information including, but not limited to, business, financial or technical information, in connection with the potential establishment and/or conduct of a business relationship or transaction between the Parties (the “ Transaction ”). In connection therewith, for good and valuable consideration, the receipt and sufficiency of which consideration are hereby acknowledged by Recipient, and as a condition of the provision of Confidential Information (as defined below) to Recipient, Recipient hereby agrees as follows:

- Confidential Information. “ Confidential Information ” means any and all information provided by Renaissance to Recipient in any form, and at any time (including prior to or following the execution of this Agreement), including but not limited to any such information that (a) is related to Renaissance’s business, finances, financial information, pricing, business plans, profitability, projections, business or financial opportunities, investment strategies, other strategies, data, products, services, concepts, contacts, personnel, customers, vendors, prospects, intentions, formulas, methods, processes, practices, models, tools, computer programs, software, discoveries, inventions, know-how, negative know-how, business relationships, agreements (including this Agreement), intellectual property, trade secrets (whether or not patentable or copyrightable), trade secrets, or other confidential or proprietary information, (b) contains or is related to any communications, negotiations or proposals regarding the Transaction; (c) Recipient has either been informed, or reasonably should know, is confidential in nature; or (d) consists of or contains names, addresses or other information of any description relating to any of Renaissance’ member agencies or any of such member agencies’ customers or clients. Confidential Information shall also include any analyses, compilations, studies or other documents or materials prepared by Recipient or by any of its Representatives, that contain, rely upon, are derivative of or otherwise reflect any Confidential Information as described in the preceding sentence. The foregoing notwithstanding, Confidential Information shall not include any information which, at the time it is provided to Recipient; (i) is already known to Recipient, (ii) is then or later becomes available to the general public without violation of any requirement of confidentiality.

- Providing of Confidential Information. Renaissance may provide to Recipient any Confidential Information, in such manner and at such times as Renaissance may determine, to assist Recipient in evaluating, negotiating and carrying out the Transaction, but shall have no obligation to provide any, or any particular, Confidential Information to Recipient. Renaissance makes no, and disclaims any, representations or warranties regarding any Confidential Information it may provide, except as may be provided in any definitive documentation relating to a Transaction.

- Non-Use and Non-Disclosure; Representatives. Recipient agrees not to use any of Renaissance’s Confidential Information for any purpose other than for or in connection with the evaluation, negotiation, entering into or carrying out of a Transaction. Recipient agrees not to disclose any of Renaissance’s Confidential Information to any third party other than Recipient’s directors, officers, employees, affiliates, counsel, consultants, advisers, representatives and agents (collectively, “ Representatives ”) who have a reasonable need for the same in connection with the uses thereof permitted under this Agreement. Any such Representatives who are provided with any Confidential Information shall be instructed to maintain the same in confidence, and not to make any use or disclosure of the same other than as permitted under this Agreement. Recipient shall be responsible for any breach of this Agreement by any of its Representatives, to the same extent as though Recipient had committed such breach personally. Recipient agrees to use the same level of care in protecting the Confidential Information from unauthorized disclosure as it uses to protect its own confidential or proprietary information, and in any case will use no less than a commercially reasonable level of care in protecting all Confidential Information from unauthorized disclosure. The foregoing notwithstanding, Recipient shall be permitted to disclose so much of the Confidential Information as has been authorized for release by Renaissance in writing, to the persons and upon the conditions so authorized by Renaissance, in connection with the carrying out of the Transaction. Recipient shall not circumvent or seek to circumvent Renaissance’s negotiations with any third party, either by entering into discussions directly with such third party otherwise than on behalf of Renaissance, or otherwise. For purposes of this Section, each Party shall act in good faith and deal fairly with the other Party.

- No License; Return of Confidential Information. Recipient will not acquire any license or other rights whatsoever with respect to any of the Confidential Information by virtue of its disclosure to Recipient pursuant to this Agreement, or by virtue of any use thereof permitted hereunder. Recipient agrees to destroy or to return all Confidential Information to Renaissance, including both originals and all copies thereof (other than copies created as part of the routine backup of Recipient’s servers, or copies retained pursuant to a requirement of a governmental or regulatory authority, all of which retained copies shall be held confidential for so long as such materials are so retained), and to confirm the completion of such return or destruction to Renaissance in writing, promptly upon demand by Renaissance within the term of this Agreement. The term of this Agreement shall be for a period of five (5) years, commencing on the Effective Date set forth above. Either Party may terminate this Agreement at any time, upon written notice to the other Party, provided that the obligations of Recipient hereunder shall nevertheless survive for the period above stated, with respect to all Confidential Information provided prior to such termination.

- Orders Requiring Production. In the event Recipient receives a court subpoena, request for production of documents, court order or other requirement of a governmental agency to disclose any Confidential Information (a “ Disclosure Requirement ”), Recipient shall (unless prohibited by law) give prompt written notice to Renaissance thereof so that Renaissance may seek to challenge or limit the Disclosure Requirement. Recipient agrees to cooperate reasonably in any effort of Renaissance to limit or prevent any required disclosure of Confidential Information, provided that Recipient shall: (i) not be required to incur any expense in connection with such cooperation, and (ii) not be required to disobey any Disclosure Requirement. Recipient shall not be deemed in violation of this Agreement if it complies with any such Disclosure Requirement either after having provided Renaissance with notice thereof and a reasonable opportunity to contest the same, or if such notice is not permitted. Recipient agrees to (a) exercise reasonable efforts to disclose only the minimum amount of Confidential Information that Recipient is compelled to disclose, in the opinion of its legal counsel, and (b) request that confidential treatment (if legally permissible) will be accorded to the Confidential Information being disclosed.

- Injunctive Relief. Recipient acknowledges that the Confidential Information is confidential, and that disclosure or use of said information in violation of the terms of this Agreement would result in substantial and irreparable harm to Renaissance, the actual dollar amount of which damage would be impossible to determine. Accordingly, Recipient agrees that, in addition to any other remedies that may be available, in law, in equity or otherwise, Renaissance shall be entitled to seek injunctive relief against the actual or threatened breach of this Agreement or the continuation of any such breach by Recipient, without the necessity of proving actual damages and without posting bond. This provision shall not limit the right of Renaissance to seek actual damages or any other legal or equitable remedy for any breach hereof.

- Miscellaneous. This Agreement shall be construed in accordance with and governed by the laws of the State of Illinois, without regard to its conflicts of laws principles. Any action or proceeding against either Party relating in any way to this Agreement shall be brought and enforced only in the Federal (to the extent appropriate jurisdiction exists) and State courts located in Cook County in the State of Illinois, and the Parties irrevocably submit to the jurisdiction of such courts in respect of any such action or proceeding, and irrevocably waive any objection to venue in such courts, including but not limited to any objection that such venue is inconvenient. This Agreement embodies the entire agreement of the Parties with respect to the subject matter hereof, and supersedes all prior and contemporaneous agreements and understandings, oral or written. No amendment to this Agreement and no waiver of any provision hereunder shall be effective unless it is in writing and signed by an authorized officer of the Party against whom such amendment or waiver is asserted. No invalidity or unenforceability of any provision of this Agreement shall affect the validity or enforceability of the remaining portions hereof. This Agreement shall be binding upon, and shall inure to the benefit of, each of the Parties and their respective successors and assigns. There are no intended third-party beneficiaries of this Agreement. This Agreement does not in any way bind either Party to enter into or continue any type of business relationship with the other. Nothing in this Agreement shall prevent Renaissance from at any time disclosing any of its Confidential Information to others or negotiating with others for any purpose whatsoever. Nothing contained in this Agreement shall be construed to constitute the Parties as partners, joint venturers, co-owners or otherwise as participants in a joint or common undertaking. Recipient’s indication of assent to this Agreement via electronic means shall be equally binding and effective as an original signature hereon, and shall be deemed duly and effectively delivered if so transmitted or provided.

- We're Hiring!

Crafting an Effective Insurance Agency Business Plan

If you're an independent insurance agent, you know that success doesn't happen by chance. It requires strategic planning and a clear roadmap for the future. That's where an insurance agency business plan comes into play.

In this guide, we'll explore what a business plan is, why it's essential, and how to create one tailored to your home insurance agency.

At a glance:

- Crafting a well-defined insurance agency business plan provides strategic direction and goal-setting for success.

- A comprehensive business plan allows for adaptability in an ever-evolving industry.

- Defining your brand, researching funding options, and staying compliant with regulations, are the ingredients that can transform your business plan into an effective tool for growth.

Benefits of having a business plan

Having a solid roadmap is like holding a compass in a dense forest. It not only guides you on how to become a successful insurance agency, but also ensures you stay on course.

Strategic direction

So let’s continue that analogy: you’re on a road trip without a map, compass, or GPS. You might eventually reach your destination, but it would be a long and uncertain journey. Similarly, running an insurance agency without a business plan is like traveling without a guide. A well-crafted plan provides a clear path and helps you stay focused on your goals.

Goal setting

Setting realistic and achievable goals is vital for any business. Your insurance agency business plan acts as a compass, allowing you to establish clear objectives. Whether you want to increase your client base, revenue, or expand your services, a business plan helps you chart the course.

Investor confidence

If you find yourself in a place to seek external funding, whether from investors or lenders, a comprehensive business plan is a must. It demonstrates that you've thought through your business strategy, increasing your chances of securing financial support.

Adaptability

The insurance industry is never stagnant, and as such adaptability is key. A business plan isn't set in stone; it's a living document that can be adjusted as circumstances change. If done correctly, it allows you to stay flexible and make informed decisions as market trends shift.

Key components of an insurance agency business plan

Your business plan is the document that transforms your vision into a tangible reality, ensuring your journey as an independent insurance agent is not only successful but prosperous too.

Let’s explore the key components of an effective business plan, including the executive summary, company overview and more.

Executive summary

The executive summary serves as the elevator pitch for your entire business plan. It's designed to capture the reader's attention and give them a quick, compelling overview of your insurance agency. You'll want to concisely highlight your agency's mission, vision, and goals. Think of it as distilling your agency's essence into a few powerful sentences. It's an invitation for the reader to learn more about your agency's journey.

Company overview

The company overview is your opportunity to introduce your insurance agency in detail. It's where you set the stage for the rest of your business plan. In this section, you’ll want to dive into the history of your agency, including its founding story, location(s), and size. You should also describe every type of insurance product you offer and provide a snapshot of what makes your agency unique.

Industry analysis

The industry analysis puts your industry knowledge to good use. It's all about understanding the broader insurance market, including its trends, challenges, and opportunities. In this section, you'll research and present data and insights into the insurance industry. Discuss market trends, regulatory changes, and any challenges that could impact your independent agency. Identifying opportunities within the industry allows you to position your agency effectively to take advantage of them.

Customer analysis

Understanding your target market is essential for tailoring your services and marketing efforts effectively. Create detailed buyer personas that encompass their needs, preferences, and pain points. This information is the foundation for developing products and services that resonate with your audience.

Competitive analysis

Knowing your competition is about gaining insights into their strengths and weaknesses. When performing your market analysis, or market research, be sure to look at factors like their market share, marketing strategy, pricing models, and customer service practices. Understanding how you stack up against the competition will help you develop a winning strategy that sets your agency apart.

Marketing plan

Your marketing plan is the strategic playbook for how you'll attract and retain clients. Specify your marketing channels, both online and offline; outline your budget and set measurable goals. Whether it's through digital advertising, content marketing, or print advertising, your marketing plan should maximize your independent insurance agency's reach and impact.

Operations plan

The operations plan is the behind-the-scenes blueprint for how your independent agency runs day-to-day. Detail your team structure, office setup, and technology requirements. It's about ensuring smooth workflow and efficient service delivery. This section gives a clear picture of how your agency operates on a daily basis.

Management team