Ph.D. Admissions Open

Doctorate of Philosophy

In Association With

Admission Enquiry

Online phd in taxation admission 2024 - dates, eligibility, fees, entrance exams, application process.

- Name: Online Phd In Taxation

- Full Name: ONLINE DOCTOR OF PHILOSOPHY IN TAXATION

- Duration: 3 Years

- Eligibility: PG With 55% ( Equivalent Field)

- Type: Degree

Online PhD in Taxation,Highlights, Entrance Exam, admission, Eligibility, Duration, Selection Criteria, How to Apply, Application Form, Application Process, fee, Syllabus,Salary and Jobs,career opportunities

Sure, I can provide you with information on an online PhD in Taxation program.

Online PhD in Taxation Highlights:

A PhD in Taxation is a terminal degree program that focuses on advanced research and scholarship in the field of taxation.

The program aims to equip students with the skills and knowledge needed to conduct original research and contribute to the advancement of the field.

The curriculum includes courses in taxation theory, research methods, and advanced topics in taxation.

Students are expected to complete a dissertation on a topic related to taxation.

Online PhD in Taxation Entrance Exam and Admission:

Most universities require applicants to have a master's degree in taxation or a related field, and to submit transcripts, letters of recommendation, and a statement of purpose.

Some universities may also require GRE or GMAT scores.

Admission is highly competitive and is based on academic achievements, research experience, and potential for research.

Online PhD in Taxation Eligibility:

Applicants must have a master's degree in taxation or a related field from an accredited institution.

They must have a minimum GPA of 3.0 on a 4.0 scale, and may be required to have relevant work experience.

International students may need to demonstrate proficiency in English through TOEFL or IELTS scores.

Online PhD in Taxation Duration:

The duration of an online PhD in Taxation program varies depending on the university and the student's pace of study.

Typically, the program takes 3-5 years to complete.

Online PhD in Taxation Selection Criteria:

The selection criteria for a PhD in Taxation program vary by university.

Generally, universities consider academic achievements, research experience, and potential for research.

They may also consider factors such as work experience, extracurricular activities, and leadership qualities.

Online PhD in Taxation How to Apply:

Applicants can apply to online PhD in Taxation programs through the university's website or online application portal.

They must submit transcripts, letters of recommendation, a statement of purpose, and any required test scores.

Some universities may also require a writing sample or a research proposal.

Online PhD in Taxation Application Form and Process:

The application form for an online PhD in Taxation program is available on the university's website or online application portal.

Applicants must fill out the form with their personal and academic information, and pay the application fee.

They must also upload supporting documents such as transcripts, letters of recommendation, and test scores.

Online PhD in Taxation Fee:

The fee for an online PhD in Taxation program varies depending on the university.

Generally, the fee ranges from $500 to $1,500 per credit hour.

Online PhD in Taxation Syllabus:

The syllabus for an online PhD in Taxation program varies depending on the university.

Typically, the curriculum includes courses in taxation theory, research methods, and advanced topics in taxation.

Some universities may also offer elective courses in related fields such as accounting, economics, or finance.

Online PhD in Taxation Salary and Jobs:

The salary and job prospects for graduates of an online PhD in Taxation program vary depending on their experience and the industry they work in.

Graduates may find employment as tax consultants, academics, or researchers.

According to the U.S. Bureau of Labor Statistics, the median annual salary for accountants and auditors, which includes tax consultants, was $73,560 in May 2020.

Online PhD in Taxation Career Opportunities:

Graduates of an online PhD in Taxation program may find career opportunities in a variety of fields such as academia, government, or the private sector.

They may work as tax consultants, researchers, or educators.

They may also work in fields such as accounting, finance, or economics.

ONLINE PHD. IN TAXATION

Taxation refers to the practice of collecting money from citizens and trading companies by the government institutions, in order to finance public institutions, goods and services. Taxation studies prepare professionals who can help organizations take important business decisions, by providing financial counseling and guidance. Their area of expertise includes accounting administrations, calculating tax liabilities, performing legal analysis, and more.

PhD in Taxation often involves a combination of coursework and research. PhD in Taxation students will take such courses as financial reporting, empirical methodology, and accounting research. Examples of subjects of research are the effects of the tax-induced incentives on corporations, and the economic impact of the federal regulations on accounting information. Graduates with a PhD in the Taxation often go on to careers in academia, or other careers such as the government researcher, corporate accounting consultant, or financial analyst.

If you are interested in economics, finance, and accounting, then a PhD in Taxation may be the degree you are looking for. Take a look through the options below and find the university with the program for you!

Rules of Access

A student who is in possession of a taxation-orientated master’s qualification on NQF LEVEL 9 may apply for admission to this qualification. Alternatively any other related qualification with the program-specific minimum level of competency on NQF LEVEL 9, and related experience which is considered relevant and sufficient by the Department of Accountancy. Finalization of registrations for the program (and/or continued registration) is subject to students complying with departmental-specific requirements. Such requirements usually include preparatory work leading up to a research proposal that is approved by the department. Possible examples of the preparatory work are pre-reading, literature reviews, concept developments, and successful completion of short courses aimed at skills and or knowledge development. Students may also be required to successfully defend their research proposals at the special discussion sessions.

First Semester

- Thesis: Taxation * TTA10X1 – 360 credits

Second Semester

- Thesis: Taxation * TTA10X2 – 360 credits

· A requirement for awarding this qualification includes that the students will, with the submission of their traditional thesis, submit two articles for the possible publication.

Please note: A student will only pass and get the 360 credits for either TTA10X1 or TTA10X2.

What are the tasks of a PhD in Taxation

Doctor of Philosophy in the Taxation tasks includes analyzing trends and issues in the taxation and analyzing all the legal and regulatory aspects of the business, monitoring the receipt of the tax and other payments, as well as researching and developing tax positions for clients with regard to the tax controversy cases, as well as tax consulting engagements. Masters’ duties in this field include creating monetary documents, ledgers, and reports.

TOP UNIVERSITIES:

- STANFORD UNIVERSITY

- HARVARD UNIVERSITY

- DUKE UNIVERSITY

- UNIVERSITY OF NOTRE DAME

- UNIVERSITY OF FLORIDA

Online Phd In Taxation: Subjects of Study (Syllabus)

Call for Applications: Four fully-funded PhD scholarships in tax and development

The International Centre for Tax and Development (ICTD) is a research centre aiming to improve tax policy and administration in lower-income countries through collaborative research and engagement. The ICTD’s primary base is the Institute of Development Studies (IDS), at the University of Sussex in Brighton (UK). The ICTD is funded by the British and Norwegian governments and by the Bill & Melinda Gates Foundation.

The ICTD will fund up to four PhD students from countries in Africa and South Asia to start in September 2023. Students will receive full scholarships including university fees, a stipend in line with UK research council funding ( currently 17,668 GBP per year ), and other benefits such as funds to attend conferences, to cover visa costs and part of relocation expenses.

In addition to financial support, successful applicants will benefit from being fully embedded in the ICTD team and networks. As such, they are expected to play an active role in the life of the Centre, for example by participating in team and research meetings, external events, and by contributing to blogs or papers for ICTD publications series. Successful candidates will be based at IDS or a department of the University of Sussex. At least one of their supervisors will be an ICTD Fellow. They will be expected to spend at least the first and third year at IDS/Sussex in person, to facilitate connections with the ICTD team and participation in training opportunities.

To be eligible for funding, PhD projects should focus on taxation in African and/or south Asian countries. Within the broad area, candidates can focus on any issue of their own interest. While projects do not need to fall within one of our existing research programmes, candidates may find it helpful to review the research portfolio of the ICTD and its individual Fellows on the ICTD website . The ICTD is a multidisciplinary centre: as such, suitable proposals can take any disciplinary or interdisciplinary approach, including those coming from economics, political science, anthropology, amongst others. We expect this scholarship to be very competitive.

Applications will be evaluated on the basis of:

- Academic quality of the research proposal . Some of the elements that the reviewers will consider, amongst others, are: is the topic relevant to policy and research? Is it sufficiently linked to existing knowledge? Are the methods appropriate and robust? Is the proposed study feasible?

- Candidates’ profiles, including skills and experience. Preference will be given to candidates with relevant work experience. A good result in a Master’s degree is also essential for admission to the PhD programme at Sussex/IDS.

- Fit with supervisors’ and ICTD’s research interests. Availability of supervisors with relevant research interests and knowledge of relevant methods. We will also consider how projects complement ICTD’s research portfolio.

To be considered, both the applicant’s nationality and the main focus of the project should be countries in Africa or south Asia, though it is not necessary for projects to have a single-country focus.

IDS is committed to eliminating discrimination, and to embedding and supporting equality, diversity and inclusion among our workforce, in our work and in all our activities. We welcome applications from all sections of the community, irrespective of background, belief or identity and particularly encourage applications from groups which are underrepresented at IDS.

How to apply

Applications for the ICTD scholarship should be submitted using the dedicated form by 15 March 2023 (deadline 23.59 BST). Applicants are not required to have submitted an application for a PhD place at the University of Sussex before applying for the ICTD scholarship, nor to have identified a potential supervisor. Shortlisted candidates will be encouraged to do so between 31 March and 8 May 2023.

To facilitate candidates’ planning and the preparation of supporting documents, here below is a tentative timeline for the selection process.

- Initial deadline to fill in the ICTD form: 15 March

- Shortlist decisions and comments on proposals: 31 March

- Revised applications through Sussex: 8 May

- Final decisions: 31 May

Full list of documents required:

Now (deadline 15 March)

- Research proposal (1500 words)

- Personal statement

If shortlisted (deadline 8 May)

- Research proposal (2000-3500 words)

- Two academic references

- Degree certificates and transcripts

- English language qualification (where applicable)

*If English isn’t your first language, you will need to meet the University of Sussex English Language requirements (‘Advanced’ level score).

Please apply by 15 March 2023, using the online form .

Frequently asked questions:

What is the expected duration of the PhD?

A typical full-time PhD course runs for 3-4 years, and we expect the scholarships to run for 3.5 years. For more information on the typical structure of a PhD have a look at the guide to PhD study by the University of Sussex .

Is it possible to do the PhD as a part-time student?

Scholarships are meant to be full time, but we will do everything we can to accommodate requirements linked to care responsibilities, where possible.

Is it possible for candidates from Francophone African countries to apply for the scholarships?

Yes, candidates from Francophone African countries can apply, however, the course is run in English, the PhD thesis will need to be written in English and candidates will need to meet the University of Sussex’ English language requirements.

Can you help me to refine my proposal before I submit my application?

Because of the large interest in these positions, we are not able to offer comments on application documents at this stage. If you are shortlisted, we will provide you with comments which it will be important that you take into account before submitting the second stage application.

What subjects can the PhD be in as I don’t seem to see a PhD in taxation at the University of Sussex website?

Taxation isn’t a stand-alone subject, therefore the PhD would have to be in one of the related subjects , such as Development Studies or Economics. Your qualification should be in a relevant social sciences subject.

Does the 1,500 word count for the research proposal include references, a bibliography or footnotes?

No, the 1,500 word count does not include references / a bibliography or footnotes.

Is there a specific format for the CV or the personal statement?

No, there is no specific format, however, please ensure that the documents you provide include relevant information and are succinct.

In case of further questions, please contact Susanne Schirmer on [email protected]

Negotiations for new UN Framework Convention on Tax – what next?

The UN ad hoc committee concluded yesterday the first round of negotiations for the final parameters – or the “terms of reference” – for a UN framework convention on tax, which some have said “could deliver the biggest shake-up in history of the global tax system.”…

Wilson Prichard Leads Session on Revenue Systems at Harvard Ministerial Leadership Forum

Harvard University hosted its annual Harvard Ministerial Leadership Forum last month welcoming finance and economic planning…

ICTD rounds up Gender and Tax month

Here’s a quick recap of a diverse range of ICTD content exploring showcasing research on gender and tax – from poetry, to reading lists, to thought-provoking publications both old and new….

- JEE Main 2024

- MHT CET 2024

- JEE Advanced 2024

- BITSAT 2024

- View All Engineering Exams

- Colleges Accepting B.Tech Applications

- Top Engineering Colleges in India

- Engineering Colleges in India

- Engineering Colleges in Tamil Nadu

- Engineering Colleges Accepting JEE Main

- Top IITs in India

- Top NITs in India

- Top IIITs in India

- JEE Main College Predictor

- JEE Main Rank Predictor

- MHT CET College Predictor

- AP EAMCET College Predictor

- GATE College Predictor

- KCET College Predictor

- JEE Advanced College Predictor

- View All College Predictors

- JEE Main Question Paper

- JEE Main Cutoff

- JEE Main Advanced Admit Card

- JEE Advanced Admit Card 2024

- Download E-Books and Sample Papers

- Compare Colleges

- B.Tech College Applications

- KCET Result

- MAH MBA CET Exam

- View All Management Exams

Colleges & Courses

- MBA College Admissions

- MBA Colleges in India

- Top IIMs Colleges in India

- Top Online MBA Colleges in India

- MBA Colleges Accepting XAT Score

- BBA Colleges in India

- XAT College Predictor 2024

- SNAP College Predictor

- NMAT College Predictor

- MAT College Predictor 2024

- CMAT College Predictor 2024

- CAT Percentile Predictor 2023

- CAT 2023 College Predictor

- CMAT 2024 Answer Key

- TS ICET 2024 Hall Ticket

- CMAT Result 2024

- MAH MBA CET Cutoff 2024

- Download Helpful Ebooks

- List of Popular Branches

- QnA - Get answers to your doubts

- IIM Fees Structure

- AIIMS Nursing

- Top Medical Colleges in India

- Top Medical Colleges in India accepting NEET Score

- Medical Colleges accepting NEET

- List of Medical Colleges in India

- List of AIIMS Colleges In India

- Medical Colleges in Maharashtra

- Medical Colleges in India Accepting NEET PG

- NEET College Predictor

- NEET PG College Predictor

- NEET MDS College Predictor

- NEET Rank Predictor

- DNB PDCET College Predictor

- NEET Result 2024

- NEET Asnwer Key 2024

- NEET Cut off

- NEET Online Preparation

- Download Helpful E-books

- Colleges Accepting Admissions

- Top Law Colleges in India

- Law College Accepting CLAT Score

- List of Law Colleges in India

- Top Law Colleges in Delhi

- Top NLUs Colleges in India

- Top Law Colleges in Chandigarh

- Top Law Collages in Lucknow

Predictors & E-Books

- CLAT College Predictor

- MHCET Law ( 5 Year L.L.B) College Predictor

- AILET College Predictor

- Sample Papers

- Compare Law Collages

- Careers360 Youtube Channel

- CLAT Syllabus 2025

- CLAT Previous Year Question Paper

- NID DAT Exam

- Pearl Academy Exam

Predictors & Articles

- NIFT College Predictor

- UCEED College Predictor

- NID DAT College Predictor

- NID DAT Syllabus 2025

- NID DAT 2025

- Design Colleges in India

- Top NIFT Colleges in India

- Fashion Design Colleges in India

- Top Interior Design Colleges in India

- Top Graphic Designing Colleges in India

- Fashion Design Colleges in Delhi

- Fashion Design Colleges in Mumbai

- Top Interior Design Colleges in Bangalore

- NIFT Result 2024

- NIFT Fees Structure

- NIFT Syllabus 2025

- Free Sample Papers

- Free Design E-books

- List of Branches

- Careers360 Youtube channel

- IPU CET BJMC

- JMI Mass Communication Entrance Exam

- IIMC Entrance Exam

- Media & Journalism colleges in Delhi

- Media & Journalism colleges in Bangalore

- Media & Journalism colleges in Mumbai

- List of Media & Journalism Colleges in India

- Free Ebooks

- CA Intermediate

- CA Foundation

- CS Executive

- CS Professional

- Difference between CA and CS

- Difference between CA and CMA

- CA Full form

- CMA Full form

- CS Full form

- CA Salary In India

Top Courses & Careers

- Bachelor of Commerce (B.Com)

- Master of Commerce (M.Com)

- Company Secretary

- Cost Accountant

- Charted Accountant

- Credit Manager

- Financial Advisor

- Top Commerce Colleges in India

- Top Government Commerce Colleges in India

- Top Private Commerce Colleges in India

- Top M.Com Colleges in Mumbai

- Top B.Com Colleges in India

- IT Colleges in Tamil Nadu

- IT Colleges in Uttar Pradesh

- MCA Colleges in India

- BCA Colleges in India

Quick Links

- Information Technology Courses

- Programming Courses

- Web Development Courses

- Data Analytics Courses

- Big Data Analytics Courses

- RUHS Pharmacy Admission Test

- Top Pharmacy Colleges in India

- Pharmacy Colleges in Pune

- Pharmacy Colleges in Mumbai

- Colleges Accepting GPAT Score

- Pharmacy Colleges in Lucknow

- List of Pharmacy Colleges in Nagpur

- GPAT Result

- GPAT 2024 Admit Card

- GPAT Question Papers

- NCHMCT JEE 2024

- Mah BHMCT CET

- Top Hotel Management Colleges in Delhi

- Top Hotel Management Colleges in Hyderabad

- Top Hotel Management Colleges in Mumbai

- Top Hotel Management Colleges in Tamil Nadu

- Top Hotel Management Colleges in Maharashtra

- B.Sc Hotel Management

- Hotel Management

- Diploma in Hotel Management and Catering Technology

Diploma Colleges

- Top Diploma Colleges in Maharashtra

- UPSC IAS 2024

- SSC CGL 2024

- IBPS RRB 2024

- Previous Year Sample Papers

- Free Competition E-books

- Sarkari Result

- QnA- Get your doubts answered

- UPSC Previous Year Sample Papers

- CTET Previous Year Sample Papers

- SBI Clerk Previous Year Sample Papers

- NDA Previous Year Sample Papers

Upcoming Events

- NDA Application Form 2024

- UPSC IAS Application Form 2024

- CDS Application Form 2024

- CTET Admit card 2024

- HP TET Result 2023

- SSC GD Constable Admit Card 2024

- UPTET Notification 2024

- SBI Clerk Result 2024

Other Exams

- SSC CHSL 2024

- UP PCS 2024

- UGC NET 2024

- RRB NTPC 2024

- IBPS PO 2024

- IBPS Clerk 2024

- IBPS SO 2024

- CBSE Class 10th

- CBSE Class 12th

- UP Board 10th

- UP Board 12th

- Bihar Board 10th

- Bihar Board 12th

- Top Schools in India

- Top Schools in Delhi

- Top Schools in Mumbai

- Top Schools in Chennai

- Top Schools in Hyderabad

- Top Schools in Kolkata

- Top Schools in Pune

- Top Schools in Bangalore

Products & Resources

- JEE Main Knockout April

- NCERT Notes

- NCERT Syllabus

- NCERT Books

- RD Sharma Solutions

- Navodaya Vidyalaya Admission 2024-25

- NCERT Solutions

- NCERT Solutions for Class 12

- NCERT Solutions for Class 11

- NCERT solutions for Class 10

- NCERT solutions for Class 9

- NCERT solutions for Class 8

- NCERT Solutions for Class 7

- Top University in USA

- Top University in Canada

- Top University in Ireland

- Top Universities in UK

- Top Universities in Australia

- Best MBA Colleges in Abroad

- Business Management Studies Colleges

Top Countries

- Study in USA

- Study in UK

- Study in Canada

- Study in Australia

- Study in Ireland

- Study in Germany

- Study in China

- Study in Europe

Student Visas

- Student Visa Canada

- Student Visa UK

- Student Visa USA

- Student Visa Australia

- Student Visa Germany

- Student Visa New Zealand

- Student Visa Ireland

- CUET PG 2024

- IGNOU B.Ed Admission 2024

- DU Admission 2024

- UP B.Ed JEE 2024

- LPU NEST 2024

- IIT JAM 2024

- IGNOU Online Admission 2024

- Universities in India

- Top Universities in India 2024

- Top Colleges in India

- Top Universities in Uttar Pradesh 2024

- Top Universities in Bihar

- Top Universities in Madhya Pradesh 2024

- Top Universities in Tamil Nadu 2024

- Central Universities in India

- CUET DU Cut off 2024

- IGNOU Date Sheet

- CUET Mock Test 2024

- CUET Admit card 2024

- CUET Result 2024

- CUET Participating Universities 2024

- CUET Previous Year Question Paper

- CUET Syllabus 2024 for Science Students

- E-Books and Sample Papers

- CUET Exam Pattern 2024

- CUET Exam Date 2024

- CUET Cut Off 2024

- CUET Exam Analysis 2024

- IGNOU Exam Form 2024

- CUET PG Counselling 2024

- CUET Answer Key 2024

Engineering Preparation

- Knockout JEE Main 2024

- Test Series JEE Main 2024

- JEE Main 2024 Rank Booster

Medical Preparation

- Knockout NEET 2024

- Test Series NEET 2024

- Rank Booster NEET 2024

Online Courses

- JEE Main One Month Course

- NEET One Month Course

- IBSAT Free Mock Tests

- IIT JEE Foundation Course

- Knockout BITSAT 2024

- Career Guidance Tool

Top Streams

- IT & Software Certification Courses

- Engineering and Architecture Certification Courses

- Programming And Development Certification Courses

- Business and Management Certification Courses

- Marketing Certification Courses

- Health and Fitness Certification Courses

- Design Certification Courses

Specializations

- Digital Marketing Certification Courses

- Cyber Security Certification Courses

- Artificial Intelligence Certification Courses

- Business Analytics Certification Courses

- Data Science Certification Courses

- Cloud Computing Certification Courses

- Machine Learning Certification Courses

- View All Certification Courses

- UG Degree Courses

- PG Degree Courses

- Short Term Courses

- Free Courses

- Online Degrees and Diplomas

- Compare Courses

Top Providers

- Coursera Courses

- Udemy Courses

- Edx Courses

- Swayam Courses

- upGrad Courses

- Simplilearn Courses

- Great Learning Courses

Top P.G.D Taxation Law Colleges in India

Gender diversity, popular private law colleges.

DSU- Dayanand Sagar University LAW 2024

60+ Years of Education Legacy | UGC & AICTE Approved | Prestigious Scholarship Worth 6 Crores | DSAT exam date: May 25 & 26

Centurion University Integrated Law Admissions 2024

Moot court Available | Legal Aid Cell | Moot Court Available

Birla Global University BBA-LLB Admissions 2024

Almost 100% Placements

NIRMA UNIVERSITY Law Admissions 2024

Scholarship Worth 1.25 Crore | Approved by BCI

Lovely Professional University | Law Admissions 2024

BCI approved | Meritorious Scholarships up to 5 lacs / Student | Application closing soon

- Taxation Law

Arihant College of Arts Commerce and Science, Pune

Bharati vidyapeeth's new law college, sangli, dr dy patil arts commerce and science college, akurdi, top institutes accepting applications.

Merit Scholarships worth 1 Crore on offer | Accredited by NAAC | Approved by BCI

Admissions open for B.A. LL.B (Hons) , B.A. LL.B , BBA LL.B.(Hons) , B.Com.LL.B. (Hons.)

Ranked #21 amongst Institutions in India by NIRF | Ranked #9 in India by QS University Rankings 2023 | Last Date to Apply: 31st May

Admissions open for B.A. LL.B. (Hons.), B.B.A. LL.B. (Hons.) and LL.B Program (3 Years)

Ranked #1 Law School in India & South Asia by QS- World University Rankings | Merit cum means scholarships

6000+ Opportunities Created | 600+ Recruitment Partners

Global College of Law, Ghaziabad

- P.G.D ( 5 Courses )

Filter by State

- Maharashtra

- Madhya Pradesh

- Uttar Pradesh

Gondwana University, Gadchiroli

- P.G.D ( 11 Courses )

JNVU Jodhpur - Jai Narain Vyas University, Jodhpur

- P.G.D ( 1 Course )

Karmveer Abasaheb Alias NM Sonawane Arts Commerce and Science College, Satana

Khalsa university, amritsar, filter by city, lamrin tech skills university, sbs nagar, msu baroda - maharaja sayajirao university of baroda, vadodara, narayanrao chavan law college, nanded.

- P.G.D ( 3 Courses )

RTMNU Nagpur - Rashtrasant Tukadoji Maharaj Nagpur University, Nagpur

- P.G.D ( 12 Courses )

Sabarmati University, Ahmedabad

Spcl chandrapur - shantaram potdukhe college of law, chandrapur.

- P.G.D ( 7 Courses )

Shikshan Prasarak Sanstha's Sangamner Nagarpalika Arts DJ Malpani Commerce and BN Sarada Science College, Sangamner

Shree pm patel post graduate institute of law and human rights, anand, filter by ownership, university college of law, osmania university, hyderabad.

- Fees : ₹ 12 K

- P.G.D ( 2 Courses )

VP Law College - Vidya Partishtan's Vasantrao Pawar Law College, Pune

Vikram university, ujjain.

- Fees : ₹ 11.68 K

Yeshwant Mahavidyalaya, Wardha

- P.G.D ( 6 Courses )

Upcoming Law Exams

( ailet ) all india law entrance test.

- Eligibility Criteria

- Application Process

- Exam Pattern

- Counselling Process

( CLAT ) Common Law Admission Test

Counselling Date - Publication of fifth and final allotment list

Online Mode

- Preparation Tips

( LSAT-India ) Law School Admission Test for India

( mhcet law ) maharashtra common entrance test law.

Exam Date - MH CET LLB 5 years

( AP LAWCET ) Andhra Pradesh Law Common Entrance Test

Late Fee Application Date - With late fee of Rs.3000/-

( TS LAWCET ) Telangana State Law Common Entrance Test

( ulsat ) university of petroleum and energy studies law studies aptitude test.

Application Date - Phase-2 - last date to apply (LL.B - 5 years)

( AIBE ) All India Bar Examination

Explore on careers360.

- Top Law Exams

- Explore Law Colleges

- Colleges By Location

- College By Courses

- Study Abroad

- CLAT Important Dates

- CLAT Application Form

- CLAT Eligibility Criteria

- CLAT Admit Card

- CLAT Exam Pattern

- CLAT Exam Centres

- CLAT Syllabus

- CLAT Sample Paper

- CLAT Mock Test

- CLAT Answer Key

- AILET Important Dates

- AILET Application Form

- AILET Eligibility Criteria

- AILET Admit Card

- AILET Exam Pattern

- AILET Exam Centres

- AILET Syllabus

- AILET Answer Key

- AILET Result

- AILET Merit List

- AP LAWCET Important Dates

- AP LAWCET Application Form

- AP LAWCET Eligibility Criteria

- AP LAWCET Admit Card

- AP LAWCET Syllabus

- AP LAWCET Exam Pattern

- AP LAWCET Question Papers

- AP LAWCET Answer Key

- AP LAWCET Result

- AP LAWCET Counselling

- TS LAWCET Important Dates

- TS LAWCET Application Form

- TS LAWCET Eligibility Criteria

- TS LAWCET Hall Ticket

- TS LAWCET Syllabus

- TS LAWCET Exam Pattern

- TS LAWCET Question Papers

- TS LAWCET Answer Key

- TS LAWCET Result

- TS LAWCET Cut off

- PU LLB Important Dates

- PU LLB Application Form

- PU LLB Eligibility Criteria

- PU LLB Admit Card

- PU LLB Exam Pattern

- PU LLB Syllabus

- PU LLB Sample Papers

- PU LLB Answer Key

- PU LLB Result

- PU LLB Cut off

- MH CET Law Important Dates

- MH CET Law Application Form

- MH CET Law Eligibility Criteria

- MH CET Law Admit Card

- MH CET Law Exam Pattern

- MH CET Law Syllabus

- MH CET Law Sample Paper

- MH CET Law Result

- MH CET Law Cut off

- MH CET Law Counselling

- LSAT India Important Dates

- LSAT India Application Form

- LSAT India Eligibility Criteria

- LSAT India Admit Card

- LSAT India Exam Pattern

- LSAT India Syllabus

- LSAT India Sample Paper

- LSAT India Result

- LSAT India Cut off

- PU BA LLB Important Dates

- PU BA LLB Application Form

- PU BA LLB Eligibility Criteria

- PU BA LLB Admit Card

- PU BA LLB Exam Pattern

- PU BA LLB Syllabus

- PU BA LLB Sample Paper

- PU BA LLB Answer Key

- PU BA LLB Merit List

- PU BA LLB Result

- DU LLB Important Dates

- DU LLB Application Form

- DU LLB Eligibility Criteria

- DU LLB Admit Card

- DU LLB Exam Pattern

- DU LLB Syllabus

- DU LLB Sample Paper

- DU LLB Answer Key

- DU LLB Result

Colleges By Degree

- B.A. L.L.B Colleges in India

- B.B.A. L.L.B Colleges in India

- B.Com L.L.B Colleges in INdia

- LLM Colleges in India

- M.Phil. Law Colleges in India

- B.Sc. LLB Colleges in India

Colleges By Branches

- Criminology And Forensic Law

- Corporate Law

- IP and Technology Law

Colleges By Exam

- Law Colleges in India Accepting CLAT

- Law Colleges in India Accepting LSAT India

- Law Colleges in India Accepting AP LAWCET

- Law Colleges in India Accepting TS LAWCET

- Law Colleges in India Accepting LPU NEST

- Law Colleges in India Accepting KLEE

- Private Law Colleges Accepting CLAT

- Govt. Law Colleges Acceting CLAT

- Law Colleges in Delhi

- Law Colleges in Mumbai

- Law Colleges in Pune

- Law Colleges in Chennai

- Law Colleges in Kolkata

- Law Colleges in Hyderabad

- Law Colleges in Bangalore

- Law Colleges in Tamil Nadu

- Law Colleges in Maharashtra

- Law Colleges in Kerala

- Law Colleges in West Bengal

- Law Colleges in Uttar Pradesh

- Law Colleges in Madhya Pradesh

- Law Colleges in Rajasthan

- Law Colleges in Punjab

- Law Colleges in Gujarat

- LLM in Corporate Law Colleges in India

- LLM in Forensic Law Colleges in India

- LLM in Cyber Law Colleges in India

- LLM in IP and Technology Colleges in India

- Diploma Colleges in India

- Diploma in Labour Law Colleges in India

- Diploma in Criminology and Forensic Colleges in India

- Diploma in Taxation Law Colleges in India

- Diploma in Commercial Law Colleges in India

Popular Study Abroad Exams

- PTE Academic

Abroad Law Colleges By Degree

- B.A. in Law Colleges/Universities Abroad

- LLB in Law Colleges/Universities Abroad

- LLM in Law Colleges/Universities Abroad

- M.Sc. in Law Colleges/Universities Abroad

- M.A. in Law Colleges/Universities Abroad

- Ph.D in Law Colleges/Universities Abroad

- B.Sc.(Hons) in Law Colleges/Universities Abroad

- B.A.(Hons) in Law Colleges/Universities Abroad

Abroad Law Colleges By Country

- Law Colleges/Universities in United Kingdom

- Law Colleges/Universities in Australia

- Law Colleges/Universities in Ireland

Top Law Colleges Abroad

- University of Cambridge, Cambridge

- University of Oxford

- University College London

- The University of Edinburgh

- The University of Sydney

- The University of Queensland

- Trinity College Dublin

- Queens University, Belfast

Download Careers360 App's

Regular exam updates, QnA, Predictors, College Applications & E-books now on your Mobile

Certifications

We Appeared in

Your direct access to university admissions

India – PhD programs in Taxation

We found 1 university offering 1 PhD program.

Study the PhD programs in Taxation in India

Universities

Years of study

~ RUB 22,401

Tuition fees

Who is PhD in Taxation?

Doctor of Philosophy in Taxation is postgraduate who holds knowledge in national, state and local codes of taxation, financial management, corporation law and the legal environment, budgetary arrangement, accounting, superannuation, as well forecasting and planning in taxation.

What are the tasks of a PhD in Taxation?

Doctor of Philosophy in Taxation tasks includes analyzing trends and issues in the taxation and analyzing all the legal and regulatory aspects of the business, monitoring the receipt of tax and other payments, as well researching and developing tax positions for clients with regards to tax controversy cases, as well as tax consulting engagements. Masters’ duties in this field include creating monetary documents, ledgers, and reports.

India – PhD programs in Taxation statistics

Free-Apply.com provides information about 1 PhD program in Taxation at 1 university in India. Furthermore, you can choose one of 45 Bachelor programs in Taxation at 45 universities, 17 Master programs in Taxation at 17 universities, and 1 PhD program in Taxation at 1 university.

Reasons to study in India

No 104 in the world education ranking.

- 102. Algeria

- 103. Tunisia

- 106. Guatemala

No 61 in the world ease of doing business ranking

- 59. Indonesia

- 60. Morocco

- 63. Kazakhstan

No 58 in the world economy ranking

- 56. Lithuania

- 57. Philippines

- 59. Sri Lanka

- 60. Romania

No 104 in the world safety ranking

- 102. Senegal

- 103. Guatemala

- 105. Russia

- 106. Sierra Leone

The largest cities offering PhD programs in Taxation in India

Higher education statistics of the largest cities in India.

India – Average monthly personal finance statistics

~ rub 9,173, ~ rub 8,504, ~ rub 11,290, ~ rub 40,401, india – where to study.

The most popular student cities in India.

100% discount for the 1st year

Apply now and get a 100% tuition fee discount for the first year of studies

Universities offering the most popular PhD programs in Taxation in India

Davangere University

India, Davangere

Endeavour is to bring our University within the 10th place in the overall ranking of Universities in the country, besides placing it in the world map in advanced Science and Techno...

CMS College Kottayam

India, Kottayam

Two hundred years is but a tiny drop in the unceasing flow of cosmic time. On the human scale, however, it amounts to the life span of about ten generations. That is, if the first-...

Kongu Arts and Science College

India, Erode

The Kongu Vellalar Institute of Technology Trust was founded on 5th October 1983 by forty one philanthropists of Kongu Vellalar Community. The institutions established by the Trust...

Sree Saraswathi Thyagaraja College

India, Pollachi

Saraswathi Thyagaraja College is an Autonomous and Self financing Institution under the aegis of V.S.V. Vidhyaa Mandir, a charitable trust committed to provide quality education at...

International Management Institute New Delhi

India, Delhi

International Management Institute, New Delhi, known as IMI, New Delhi is a private business school located in New Delhi, India. Established in the year 1981, it was India's first...

We use cookies to personalise content and adverts, to provide social media and to analyse traffic.

- Top Colleges

- Top Courses

- Entrance Exams

- Admission 2024

- Study Abroad

- Study in Canada

- Study in UK

- Study in USA

- Study in Australia

- Study in Germany

- IELTS Material

- Scholarships

- Sarkari Exam

- Visual Stories

- College Compare

- Write a review

- Login/ Register

- Login / Register

Top PhD Taxation Colleges in India 2024

Found 1 Colleges Clear All

Selected Filters

- Rajasthan (1)

Program Mode

- Offline (1)

Exams Accepted

Course Type

- Doctorate (1)

Central University of Rajasthan

Ajmer, Rajasthan

Average Fees

No. of Courses Offered

Median Salary

Get Free Scholarship worth 25000 INR

Browser does not support script.

- Working paper series

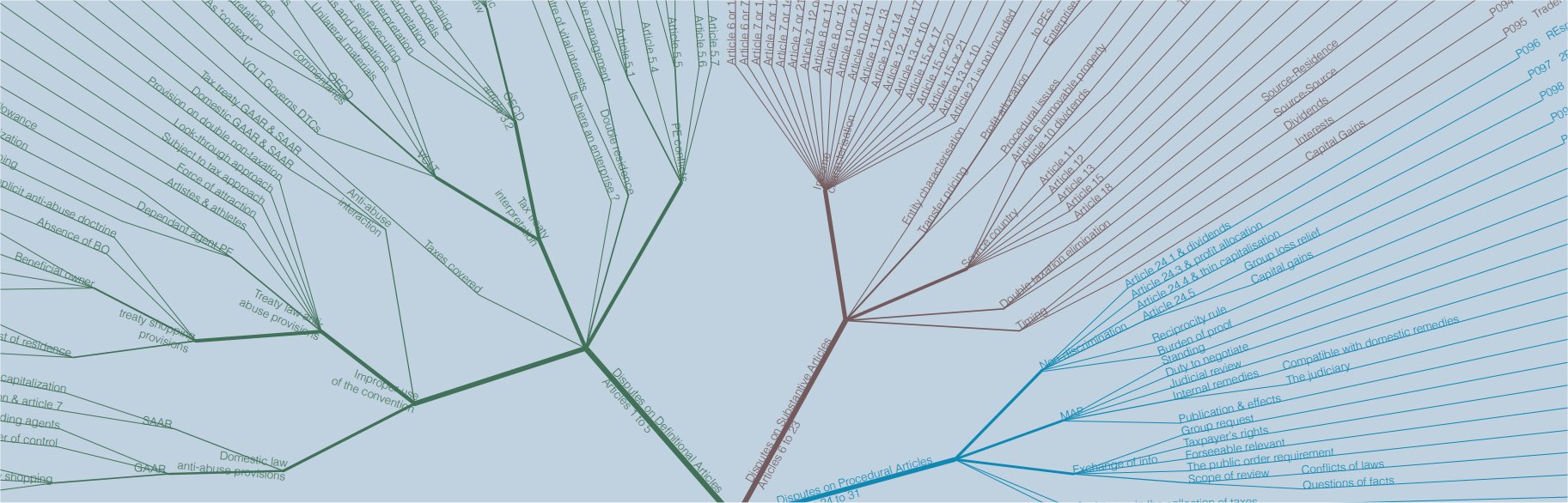

PhD Global Tax Symposia

The mission of the PhD Global Tax Symposia (GTS) is to become the first interdisciplinary mobile research platform on fundamental issues of international taxation. It is grounded on the belief that crossing African, American, Asian, Asian-Pacific and European perspectives is beneficial to all participants, especially in the current political and economic global context.

The Ph.D. Global Tax Symposia (Ph.D. GTS) provides a platform for young researchers to share and discuss their papers annually in various cities across the world. A panel consisting of renowned tax academics, tax administrators, policymakers, and practitioners from different regions and disciplines will examine each paper.

The founding institutions are the following:

Africa: University of Pretoria (South Africa); Americas : Universidad Torcuato Di Tella (Argentina), University of São Paulo (Brazil), McGill University (Canada), New York University (United States of America); Asia: Wuhan University (People's Republic of China), Meiji University (Japan), National Institute of Public Finance and Policy (India), Moscow State University (Russian Federation), King Saud University (Kingdom of Saudi Arabia), University of Seoul (South Korea); Asia-Pacific : the University of Melbourne and UNSW Sydney (Australia), University of New South Wales, University of Auckland (New Zealand); Europe: University of Louvain (Belgium), Sorbonne Law School (France), University of Münster (Germany), Leiden University and ERC funded project GLOBTAXGOV (The Netherlands), Stockholm University (Sweden), Koç University (Turkey) and London School of Economics (United Kingdom).

Programme details and video recordings of recent symposia:

- 2023 PhD Global Tax Symposium - Programme

- 2022 PhD Global Tax Symposium - Programme

- 2022 PhD Global Tax Symposium - Abstracts

- 2021 PhD Global Tax Symposium

Global Tax Symposia

LSE Law Taxation home page

- Interesting

- Scholarships

- UGC-CARE Journals

PhD in India 2024 – Cost, Duration, and Eligibility for Admission

Complete guide to phd in india: duration, costs, eligibility, and recent updates 2024.

Embarking on a PhD journey in India is a significant academic and professional pursuit. Aspiring research scholars often have questions regarding the duration of a PhD, the associated costs, eligibility criteria, and recent developments in the field. In this comprehensive guide, ilovephd aims to address these queries and shed light on the essentials of pursuing a PhD in India.

How many years is a PhD in India?

A PhD program in India typically takes around 3 to 5 years to complete, depending on various factors such as the discipline, research area, individual progress, and university regulations.

The duration may vary, but it is important to be prepared for a substantial commitment of time and effort.

How much does a PhD cost in India?

The cost of pursuing a PhD in India varies across institutions. Generally, public universities offer PhD programs with minimal or subsidized tuition fees. Private universities may have higher fees.

It’s advisable to explore funding options such as scholarships, fellowships, or research grants provided by government bodies, funding agencies , or individual institutions to support your PhD journey.

What qualifications are required for a PhD in India?

To pursue a PhD in India, a candidate typically needs a postgraduate degree (Master’s or equivalent) in a relevant field. It is important to note that specific eligibility criteria may vary between universities and disciplines.

Additionally, universities often require candidates to clear entrance exams or interviews and meet minimum academic standards to be considered for admission.

What is the age limit for a PhD in India? Is 25 too old to start a PhD?

In most cases, there is no strict age limit for pursuing a PhD in India. As long as you meet the eligibility criteria and demonstrate the necessary academic qualifications, you can pursue a PhD at any age.

Therefore, 25 is certainly not too old to start a PhD Many scholars begin their doctoral studies later in life, bringing valuable experiences and perspectives to their research.

Can I do a Ph.D. without the National Eligibility Test (NET)?

While the National Eligibility Test (NET) is a common requirement for lectureships and research fellowships in India , it is not mandatory for all PhD programs. Some universities may have their own entrance exams or selection processes.

It is important to check the specific requirements of the university or institution where you plan to pursue your PhD

Who is eligible for direct PhD admission?

Direct Ph.D. admission is a pathway for exceptional candidates who have completed their undergraduate studies and wish to pursue a PhD without a Master’s degree.

However, this option is typically available to a limited number of candidates, and universities may have specific criteria and guidelines for direct PhD admissions. It is advisable to consult with individual institutions to understand their policies regarding direct Ph.D. admissions.

Is it okay to do a PhD without a Master’s degree?

While a Master’s degree is generally the standard qualification for pursuing a PhD, some universities in India offer integrated PhD programs that allow students to directly enter the Ph.D. track after completing their undergraduate studies.

However, this option may be limited to certain disciplines or institutions. It’s important to research and identify institutions that offer such programs if you wish to pursue a PhD without a Master’s degree.

What are the recent rules for PhD admissions in India?

The rules and regulations for Ph.D. admissions in India are subject to change and can vary between universities and disciplines.

It is advisable to stay updated with the guidelines provided by individual universities and regulatory bodies such as the University Grants Commission (UGC) or the All India Council for Technical Education (AICTE) to ensure compliance with the latest requirements.

25 Tips to Join PhD in India

25 tips to help you join a PhD program in India:

- Research your field of interest thoroughly to identify potential research areas and topics.

- Explore various universities and research institutes in India that offer PhD programs in your chosen field.

- Check the eligibility criteria and admission requirements of each institution you are interested in.

- Take note of application deadlines and ensure you submit your application well in advance.

- Prepare a strong statement of purpose (SOP) that highlights your research interests, goals, and why you are interested in pursuing a Ph.D.

- Contact potential supervisors or faculty members whose research aligns with your interests to discuss your research proposal.

- Prepare for entrance exams that may be required for admission, such as the UGC-NET, GATE, or university-specific entrance exams.

- Enhance your academic profile by participating in research projects, publishing papers, or presenting at conferences.

- Build a strong recommendation letter portfolio by reaching out to professors or mentors who can attest to your academic abilities and research potential.

- Seek out scholarships, fellowships, or research grants offered by government bodies, universities, or funding agencies to fund your Ph.D.

- Familiarize yourself with the research facilities, laboratories, and resources available at the institutions you are considering.

- Attend research seminars, workshops, and conferences related to your field to stay updated with the latest developments and network with researchers.

- Develop good communication and writing skills, as they are essential for presenting research findings and publishing papers.

- Create a well-structured and feasible research proposal that clearly outlines your research objectives, methodology, and expected outcomes.

- Be prepared for interviews or presentations as part of the selection process, where you may need to defend your research proposal or discuss your academic background.

- Gain teaching experience by assisting professors or taking up teaching assignments to enhance your profile for future academic positions.

- Connect with current Ph.D. students or alumni of the institutions you are interested in to gain insights into the program and research environment.

- Stay updated with any changes in the rules, regulations, or policies related to Ph.D. admissions in India.

- Develop a strong work ethic and time management skills, as PhD programs require dedication, self-discipline, and long hours of research.

- Consider the location and infrastructure of the institution, ensuring it suits your research needs and provides a conducive environment for learning.

- Explore interdisciplinary opportunities and collaborations to broaden your research scope and gain different perspectives.

- Discuss funding options and financial support with the institutions you are applying to, and be prepared to seek external funding if necessary.

- Keep track of your research progress and maintain regular communication with your supervisor or mentor.

- Attend preparatory courses or workshops on research methodology or academic writing to enhance your research skills.

- Finally, be passionate, persistent, and proactive in pursuing your PhD dream. Embrace the challenges, stay motivated, and enjoy the journey of knowledge creation.

Remember, each institution may have its specific requirements and procedures, so it’s crucial to carefully review their official websites or contact the admissions offices for accurate and up-to-date information.

10 Steps to Join PhD in India

Here are 10 steps to join a PhD program in India:

- Research your field: Explore different research areas and identify your specific field of interest for pursuing a PhD in India.

- Shortlist institutions: Identify universities or research institutes in India that offer PhD programs in your chosen field.

- Review eligibility criteria : Check the eligibility requirements of the institutions you are interested in, including minimum educational qualifications and entrance exam scores.

- Prepare application documents: Gather the necessary documents, such as academic transcripts, recommendation letters, statement of purpose (SOP), and research proposal.

- Prepare for entrance exams: If required, prepare for entrance exams like UGC-NET, GATE, or university-specific exams. Familiarize yourself with the syllabus and exam pattern.

- Apply to institutions: Submit your applications to the shortlisted institutions within the specified deadlines. Pay attention to the required application fees and submission procedures.

- Attend interviews (if applicable): Some institutions may conduct interviews or presentations to assess your research aptitude and fit for the program. Prepare well for these interactions.

- Secure funding: Explore funding opportunities such as scholarships, fellowships, or research grants. Check if the institutions offer any financial support or external funding options.

- Accept an offer : After receiving acceptance letters from the institutions you applied to, carefully evaluate and select the most suitable offer based on research facilities, faculty expertise, funding, and overall fit.

- Complete admission formalities: After accepting an offer, complete the necessary admission formalities as specified by the institution. This may include submitting additional documents, paying fees, and fulfilling any other requirements.

It’s important to note that the specific steps and procedures may vary between institutions. Therefore, always refer to the official websites and admission guidelines of the institutions you are applying to for accurate and up-to-date information.

Pursuing a PhD in India is a rewarding and intellectually stimulating endeavor. Understanding the duration, costs, eligibility criteria, and recent developments is crucial to navigating the process effectively.

By considering these factors and conducting thorough research, aspiring Ph.D. scholars can embark on their academic journey confidently and clearly.

Remember to contact universities or institutions directly for specific information and seek guidance from mentors or faculty members who can provide valuable insights into the PhD application process in your chosen field. Good luck with your Ph.D. pursuit!

Also Read: Best 100 Institutions to Study PhD in India – 2024

- doctoral studies

- Ph.D. admission

- Ph.D. costs

- Ph.D. duration

- Ph.D. eligibility

- Ph.D. in India

- Ph.D. programs

- Ph.D. updates

- PhD Admission

- PhD Admissions in India

- PhD in India

- pursuing Ph.D.

- research scholars in India

How to Write a Research Paper in a Month?

Example of abstract for research paper – tips and dos and donts, list of phd and postdoc fellowships in india 2024, most popular, india science and research fellowship (isrf) 2024-25, photopea tutorial – online free photo editor for thesis images, eight effective tips to overcome writer’s block in phd thesis writing, google ai for phd research – tools and techniques, 100 connective words for research paper writing, phd supervisors – unsung heroes of doctoral students, india-canada collaborative industrial r&d grant, best for you, 24 best free plagiarism checkers in 2024, what is phd, popular posts, how to check scopus indexed journals 2024, how to write a research paper a complete guide, popular category.

- POSTDOC 317

- Interesting 258

- Journals 234

- Fellowship 129

- Research Methodology 102

- All Scopus Indexed Journals 92

iLovePhD is a research education website to know updated research-related information. It helps researchers to find top journals for publishing research articles and get an easy manual for research tools. The main aim of this website is to help Ph.D. scholars who are working in various domains to get more valuable ideas to carry out their research. Learn the current groundbreaking research activities around the world, love the process of getting a Ph.D.

Contact us: [email protected]

Google News

Copyright © 2024 iLovePhD. All rights reserved

- Artificial intelligence

Quick Links

- Official Directory

- Copyright 2024 ICAI.

- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- Savitribai Phule Pune University

- B.M. College of Commerce

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Business psychology improves job satisfaction and motivates employees to perform better. In simple terms, it is the study of how people and groups interact to maximize their productivity.

Nurses provide daily clinical care based on evidence-based practice. They improve patient health outcomes by using evidence-based practice nursing. Take a look at why you should consider a career as an EBP nurse to contribute to the healthcare industry.

Feminist dissertation topics focus on the people who believe that women should have equal chances and rights as men. Feminism is a historical, social, and political movement founded by women to achieve gender equality and remove injustice.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

- Vision & Mission

- University Logo

- University Song

- General Council

- Executive Council

- Academic Council

- Statutory Bodies as on March 2022

- Vice Chancellor

- Chief Account Officer

- Director, Center of Education

- Director, Center of Training

- Director, Centre of Extension

- Director, Center of Special Education

- Director , Center of Research

- WRITE OFF COMMITTEE

- BUILDING AND WORKS COMMITTEE

- ALUMNI-RELATION WING COMMITTEE

- CENTRE OF EXTENSION SERVICES COUNCIL

- CENTRE OF RESEARCH COUNCIL

- IPR SCRUTINY COMMITTEE

- MUSEUM COMMITTEE

- SSIP COMMITTEE

- ANTI-RAGGING MONITORING CELL

- EQUAL OPPORTUNITY CELL

- DIGITAL INNOVATION COMMITTEE

- GRIEVANCE REDRESSAL COMMITTEE

- INTERNAL COMPLAINTS COMMITTEE

- STANDING COMMITTEE

- UNIVERSITY LIBRARY COMMITTEE

- SPORTS COMMITTEE

- SEARCH COMMITTEE

- WOMEN DEVELOPMENT CELL

- STUDENT SUPPORT,CULTURAL AND WELFARE COMMITTEE

- EXECUTIVE COUNCIL MINUTES

- ACADEMIC COUNCIL MINUTES

- GENERAL COUNCIL MINUTES

- B.A. - B.Ed. (04 Years Integrated)

- M.A. / M.Sc. M.Ed. (03 Years) (Innovative & Integrated)

- Ph.D. (Education)

- Departments of "Center of Education"

- Faculty Development Courses and Short Term Courses

- Departments of Extension

- MINUTES OF COUNCIL MEETING: CENTRE OF RESEARCH

- Examination

- Photo Gallery

- Video Gallery

- NACC Certification

- Minutes of Meeting and Action Taken Reports

- IQAC Notifications and Committees

- IIQA Undertaking

- Self Study Report (SSR)

- Best Practice

- Year 2016 - 2017

- Year 2017- 2018

- Year 2018 - 2019

- Year 2019 - 2020

- Year 2020 - 2021

- Year 2022-23

- PDF Documents

- Disabled Friendly Software

- NEP Committee Letter

- NCTE AFFIDAVITE

- Social Media Policy

- Academic Calendar

- Marksheet Verification form

- Degree Certificate Verification Form

- CURRICULUM FRAMEWORK New

- CURRICULUM FRAMEWORK Old

- Student Login Link

- Form for Change in Marksheet

- Instructions related to Grading System and Percentage Conversion

- Transcript Form

- APPLICATION FOR DUPLICATE GRADE CARD

- Circular for Change in Student Record

- Circular for step by step filling registration form for student batch 2021

- M.A Education

- B.A B.Ed Education

- M.Sc Education

- M.Sc M.Ed Education

- M.A M.Ed Education

- B.Sc B.Ed Education

- Roll of Registered Graduates - 2021

- Research Program

Being a university dedicated to generation of knowledge, IITE offers research programmes like Ph.D. and encourage research in the field of Education. The IITE has to comply with UGC Regulations 2018 and, in addition with IITE Ordinance for PhD 2019 of the university. The students has to appear for entrance test following with GDPA and presentation of their research proposals which is to be evaluate by subject experts and RDC members for concern research work.

Download Brochure

Mode of Admission :

Eligible candidates shall have to appear in i3T – Integrated Test for Teacher Trainee conducted by the Indian Institute of Teacher Education (IITE) as per schedule mentioned in the brochure. Admission will be given as per merit list prepared based on marks of i3T

Junior Research Fellowship

Indian Institute of Teacher Education, Gandhinagar (IITE) hereby invites proposal for Junior Research Fellowship (JRF) leading to Senior Research Fellowship (SRF) under its Ph.D. Programmes being offered; the objective of this fellowship is to provide opportunity to NET-GSLET-GSET-JRF qualified candidates to undertake advance studies and research in the fields of Education leading to Ph.D. Degree in Education

Fellowship : Rs. 31000/- per month.

The Fellowship assistance will be normally for a period of three years and extendable up to four years. It shall be Junior Research Fellowship for the first 18 months for Ph.D. Scholars and Senior Research Fellowship for the next 18 months for Ph.D. Scholars

Prerequisites:

The Fellowship shall be open for all Ph.D. Scholars of the University subject to the following eligibility criteria.The candidate must be admitted in full time (Regular) Ph.D. Programmes at the UniversityThe candidate should not be receiving any grant or research assistance by whatever name called from any other source including UGC.The candidate should not be engaged in any part-time or full time employment of any nature during the entire tenure of Fellowship.The candidate must be present full time at the University during the period of the fellowship.Candidates who are UGC-NET and/or GSLET/GSET qualified can apply for JRF/SRF.

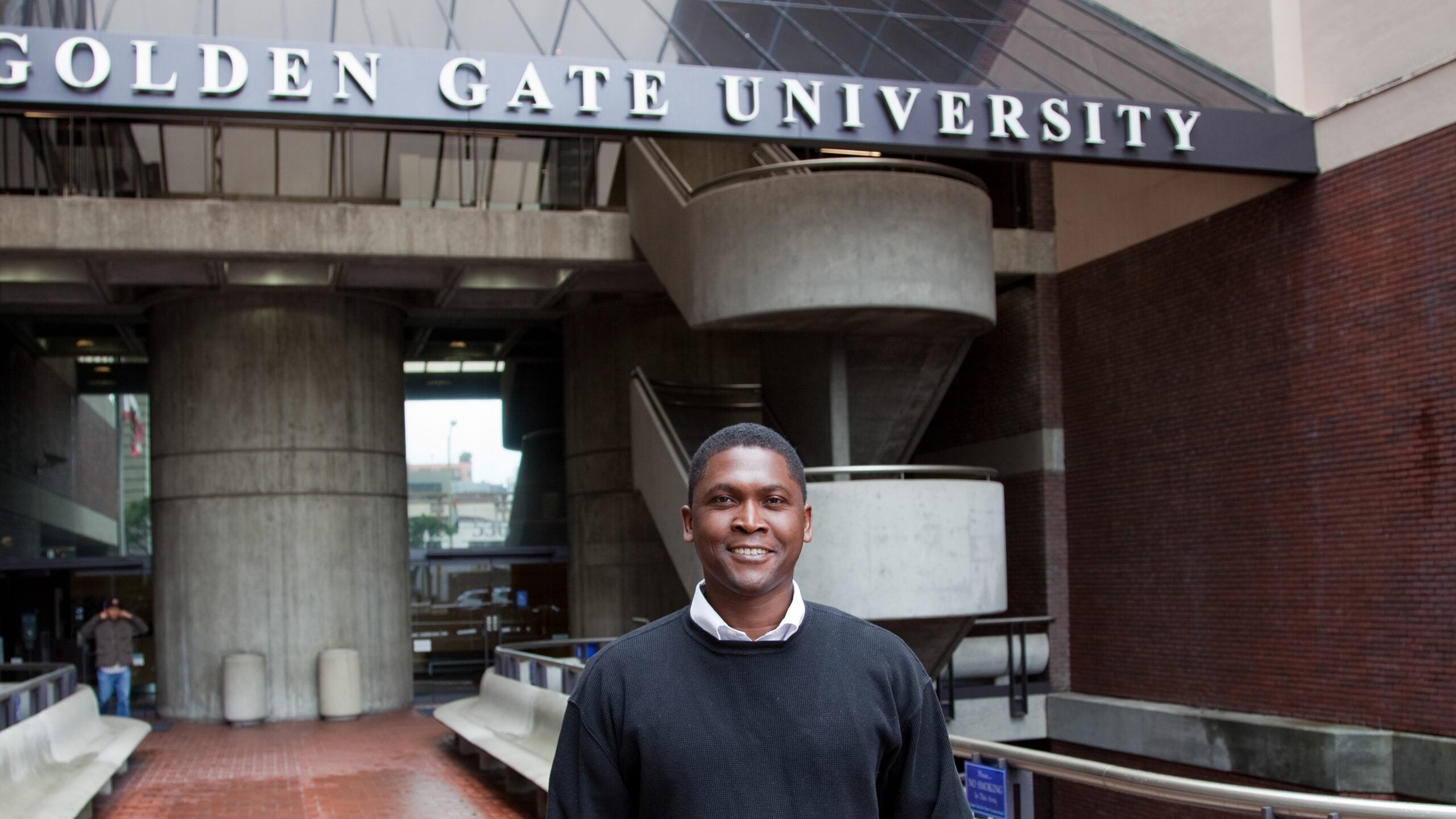

Bruce F. Braden School of Taxation

A comprehensive tax education.

The Bruce F. Braden School of Taxation at Golden Gate University is the largest and one of the most respected graduate tax programs in the United States. Our tax program has earned a reputation for providing the most comprehensive and applicable tax education available today. That’s why the Big Four and Global Six firms hire GGU graduates and most regularly send their employees to GGU to update their tax education.

Our offerings are highly focused and prepare students to be knowledgeable tax professionals by providing a thorough and current knowledge of tax law concepts and practices, as well as trends in the discipline in an environment that promotes the development of analytical and communication skills.

Since many of our students are already tax practitioners, our programs are designed to meet the needs of working professionals seeking to advance their careers. Our tax courses bring contemporary issues into the classroom, allowing for spirited investigation with their peers. A relevant and practical curriculum combined with hands-on skills training gives students the necessary tools to be an effective leader in this very specialized field.

Join the largest tax program in the United States

Learn from leading tax accountants & attorneys

Tackle real-world problems through case studies

Take career-focused courses designed for working adults

Explore Braden School of Taxation Programs

- Degree Level Toggle Degree Level dropdown

- All Degree Levels

- Bachelor’s

Master’s

- Undergraduate Certificate

Graduate Certificate

- Area of Interest Toggle Area of Interest dropdown

- All Areas of Interest

- Public Administration

- Format Toggle Format dropdown

- All Formats

- Online/Hybrid in English

Select your program from the list below or use the filters above to explore your options.

Showing program programs No results for . Reset Filters

Degree Level

Area of Interest

Advanced Studies in Taxation

Online, Hybrid

Estate Planning

International Taxation

State & Local Taxation

Taxation, MS

Taxation Internship

Learn how to apply for a taxation internship and the requirements.

Why Choose the Braden School of Taxation?

As the nation’s leading tax school, we offer more tax classes more frequently than any other university, and our large adjunct faculty and student body allow us to offer a greater variety of classes within areas of specialization. As a private university, we have the flexibility to quickly make changes to the curriculum in response to new developments in the industry.

The Braden School of Taxation provides one of the most cost-effective sources of high-quality continuing professional education for Certified Public Accountants (CPAs) and Enrolled Agents (EAs). Each academic unit equals 15 CPE hours, or 45 hours for the typical three-unit course. For lawyers, MCLE credit may also be earned. The MS in Taxation also fulfills the California State Bar’s educational requirement for Certified Specialists in Taxation Law.

The professionalism and expertise the GGU faculty bring is amazing. I learned so much that has benefited my clients and employees.

Francis Custodio — MS Taxation ’19

Find out more about admission requirements for your program, tuition and financial aid, scholarships, and how to get started.

Student Experience

Discover what it’s like to be a Golden Gate University student and explore all of the resources available to our GGU community.

Explore our university’s rich history and beautiful San Francisco campus as you discover what makes GGU different.

Dean’s List

Take a look at the current Dean’s List for the Ageno School of Business, the Braden School of Taxation, and the School of Accounting.

- MyGGU Portal

- Student Resources

- Registrar’s Office

- Accreditation

- Give to GGU

- Consumer Info

- Campus Safety

- Careers at GGU

536 Mission St. San Francisco, CA 94105 1-415-442-7800 | [email protected]

Privacy Policy | © 2024 Golden Gate University

Request Information

Fill out the form below to learn more about tuition, admission requirements, curriculum, and more.

By submitting this form, I agree to be contacted via phone, email, or text message by Golden Gate University using automated technology. Privacy Policy

COMMENTS

Alphabetical Order Z to A. Find the list of all universities for PHD in Tax in India with our interactive university search tool. Use the filter to list universities by subject, location, program type or study level.

PhD in Accountancy is a full- time course, IGNOU offers a distance learning course for PhD in Commerce. The average fee ranges from INR 15,000 to INR 50,000 whereas the average annual starting salary can be around INR 7-14 LPA in India based on the candidates' capacity and their previous experiences. Table of Content.

Know all about Online Phd In Taxation Admissions in India 2024. Get details on Online Phd In Taxation admission process 2024, Online Phd In Taxation entrance exams, Online Phd In Taxation eligibility criteria .

Direct Taxation in India A Comprehensive Study: Udemy: 25 hours: Offline Certificate Taxation Courses. Few popular offline Taxation Certificate Courses have been mentioned below: ... Upon completion of the PhD Taxation course, the candidates will earn around INR 5,00,000 to 10,00,000.

The ICTD will fund up to four PhD students from countries in Africa and South Asia to start in September 2023. Students will receive full scholarships including university fees, a stipend in line with UK research council funding ( currently 17,668 GBP per year ), and other benefits such as funds to attend conferences, to cover visa costs and ...

Find exclusive scholarships for international PhD students pursuing Taxation studies in India. Search and apply online today.

Taxation studies prepare professionals who can help organisations take important business decisions, by providing financial counselling and guidance. Their area of expertise includes accounting administration, calculating tax liabilities, performing legal analysis, and more. You will learn how governments set their taxes, what gets taxed, and ...

Research CommitteeThe Institute of Chartered Accountants of India30th March, 2021. ICAI Doctoral Scholarship Scheme 2021 - An Initiative by the Research Committee (Last Date extended till December 31, 2021) Announcement. Application Form. Last updated on 23rd August, 2021.

University College of Law, Osmania University, Hyderabad. Hyderabad, Telangana Public/Govt 4.0/5 2 Reviews. Post Graduate Diploma in Taxation and Insurance Law. Fees : ₹ 12 K. P.G.D (2 Courses) Compare.

Established in the year 1981, it was India's first... Free-Apply.com provides information about 1 PhD program in Taxation at 1 university in India. Furthermore, you can choose one of 45 Bachelor programs in Taxation at 45 universities, 17 Master programs in Taxation at 17 universities, and 1 PhD program in Taxation at 1 university.

Find Top PhD Taxation Colleges in India based on ranking with details on courses, fees, placements, admission, reviews, cut off, and latest news. Top Colleges; Top Courses; Entrance Exams; ... PhD Taxation Arts . State. Rajasthan (1) Streams. Arts (1) Courses. PhD (1) Program Mode. Offline (1) Exams Accepted. CUET (1) Course Type.

The mission of the PhD Global Tax Symposia (GTS) is to become the first interdisciplinary mobile research platform on fundamental issues of international taxation.It is grounded on the belief that crossing African, American, Asian, Asian-Pacific and European perspectives is beneficial to all participants, especially in the current political and economic global context.

ing for graduates in the field of international taxation, including and combining the disciplines of economics, law, and management. DIBT focuses on high-quality academic education and ... a PhD degree to graduates. During the first year, partici - pants acquire the basic knowledge necessary for conduct - ing interdisciplinary work. Building on ...

To pursue a PhD in India, a candidate typically needs a postgraduate degree (Master's or equivalent) in a relevant field. It is important to note that specific eligibility criteria may vary between universities and disciplines. Additionally, universities often require candidates to clear entrance exams or interviews and meet minimum academic ...