Real Estate Investing & Rental Management | How To

How to Write a Real Estate Investment Business Plan (+ Free Template)

Published September 22, 2023

Published Sep 22, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Jealie Dacanay

Download our Merchant Account Application Guide

Your Privacy is important to us.

This article is part of a larger series on Investing in Real Estate .

Get the templates and resources you need as a landlord

Download our Landlord Handbook e-book

- 1 Write Your Mission & Vision Statement

- 2 Conduct a SWOT Analysis

- 3 Choose a Real Estate Business Investing Model

- 4 Set Specific & Measurable Goals

- 5 Write a Company Summary

- 6 Determine Your Financial Plan

- 7 Perform a Rental Market Analysis

- 8 Create a Marketing Plan

- 9 Build a Team & Implement Systems

- 10 Have an Exit Strategy

- 11 Bottom Line

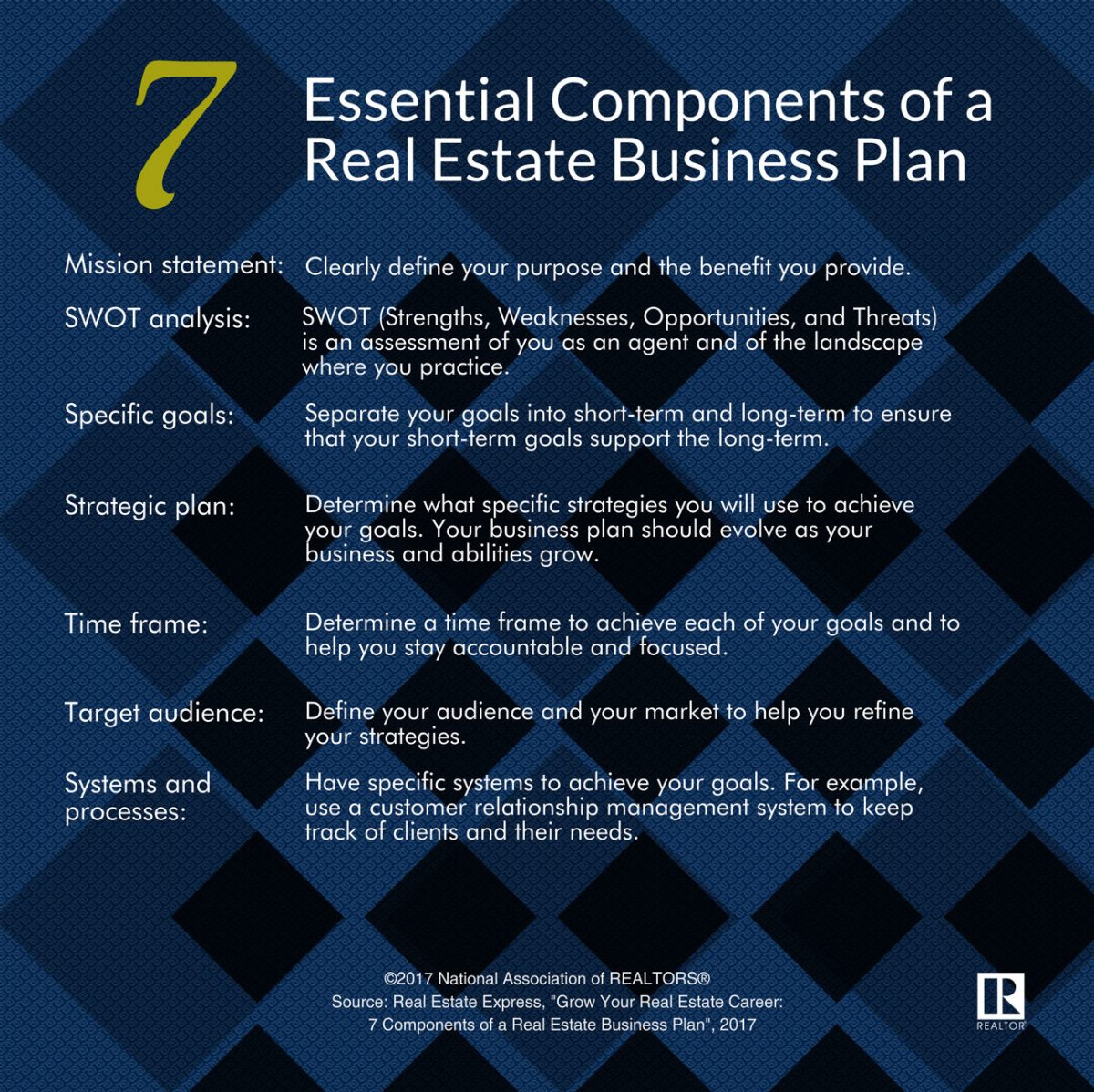

A real estate investment business plan is a guide with actionable steps for determining how you’ll operate your real estate investing business. It also indicates how you’ll measure your business’ success. The plan outlines your mission and vision statement, lets you conduct a strengths, weaknesses, opportunities, and threats (SWOT) analysis, and sets goals in place. It’s similar to a business plan for any business, but the objectives are geared toward how you will manage the business, grow your investment, and secure funding.

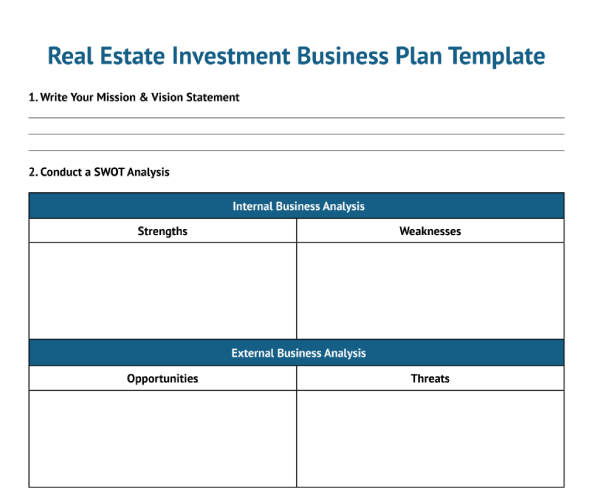

We’ve created a free real estate investment business plan template for you to download and use as a guide as you read through the article and learn how to write a business plan for real estate investment:

FILE TO DOWNLOAD OR INTEGRATE

Free Real Estate Investment Business Plan Template

Thank you for downloading!

1. write your mission & vision statement.

Every real estate investment business plan should begin with a concrete mission statement and vision. A mission statement declares actions and strategies the organization will use—serving as its North Star in achieving its business or investment objectives. A strong mission statement directs a real estate business, keeps teams accountable, inspires customers, and helps you measure success.

Before you compose your mission statement, you need to think about the following questions to do it effectively:

- What exactly is our business? The answer should encompass the essential functions of your real estate organization.

- How are we doing it? The response must explain your real estate goals and methods based on your core principles.

- Who are we doing it for? The response explains who your primary market is.

- What are our guiding principles? The “why” for your real estate company’s existence.

Mission statement example (Source: Oak Tree Capital )

The example above provides the mission statement of Oak Tree Capital. As a real estate investment business, it’s clear what its ultimate business objective is and how it will approach investing with integrity to maximize profit. Essentially, the investment company will drive monetary results—while maintaining its moral principles.

On the other hand, vision statements differ slightly from mission statements. They’re a bit more inspirational and provide some direction for future planning and execution of business investment strategies. Vision statements touch on a company’s desires and purpose beyond day-to-day operational activity. A vision statement outlines what the business desires to be once its mission statement is achieved.

For more mission statement examples, read our 16 Small Business Mission Statement Examples & Why They Inspire article and download our free mission statement template to get started.

If you want to write a vision statement that is truly aspirational and motivating, you should include your significant stakeholders as well as words that describe your products, services, values, initiatives, and goals. It would be best if you also answer the following questions:

- What is the primary goal of your organization?

- What are the key strengths of your business?

- What are the core values of your company?

- How do you aim to change the world as a business?

- What kind of global influence do you want your business to have?

- What needs and wants does your company have?

- How would the world be different if our organization achieved its goals?

In the example below from Aguila Real Estate, it hopes to be the preferred real estate company in its market.

Example of a vision statement (Source: Aguila Real Estate )

To make it easier, download our free template and follow our steps to create a vision statement for your small business. Take a look also at our 12 Inspiring Vision Statement Examples for Small Businesses in 2023 article to better understand how to create an impactful vision statement.

2. Conduct a SWOT Analysis

A SWOT analysis section of your real estate investing business plan template helps identify a business’ strengths, weaknesses, opportunities, and threats. This tool enables real estate investors to identify internal areas of improvement within their business through their strengths and weaknesses.

The opportunities and threats can assist with motivating a team to take actions that keep them ahead of an ever-changing real estate landscape. For a real estate business investor, the SWOT analysis is aimed at helping grow and protect investments over time.

Strengths & Weaknesses

Specifically for real estate investing, strengths and weaknesses correlate with the investment properties’ success and touch on items that will drive investment growth. The strengths can be the property’s location, condition, available amenities, and decreased vacancy. All of these items contribute to the success of a property.

On the contrary, the weaknesses include small unit sizes, excessive expenditures (finances to repair, upgrade, properties to acquire), low rents, and low cap rates. These weaknesses indicate less money is being collected and a lower overall return on investment (ROI). They are all factors that limit cash flow into the business and are internal factors that an investor can change.

See below for an example of strengths and weaknesses that could be included in a SWOT analysis:

Opportunities & Threats

Opportunities and threats are external factors that can affect an investment business. You don’t have control over these items, but you can maneuver your business to take advantage of the opportunities or mitigate any long-term effects of external threats. Opportunities relating to investment properties can be receiving certification with a city as a preferred development or having excess equity.

However, threats to an investment property do not need to be particularly connected to the property itself. They can be factors that affect your overall business. For example, interest rates may be high, which cuts your profits if you obtain a mortgage during that time frame.

An example of possible opportunities and threats for an investment business could be:

After creating your SWOT analysis, an investor can use these factors to develop business goals to support your strengths and opportunities while implementing change to combat the weaknesses and threats you anticipate. It also helps investors prioritize what items need to be addressed to succeed. These factors in a SWOT can change as the business grows, so don’t forget to revisit this portion and continuously reevaluate your SWOT.

3. Choose a Real Estate Business Investing Model

The core of real estate investing is to purchase and sell properties for a profit. How to make that profit is a factor in identifying your investment model. Different investing models are beneficial to an investor at different times.

For example, when interest rates are low, you may consider selling your property altogether. When interest rates are high and it is more difficult for people to obtain a mortgage, you may choose to rent out your properties instead. Sometimes, you must try a few models to see what works best for your business, given your area of expertise.

We’ve identified some investment business models to consider:

- Buy and hold: This strategy mainly involves renting out the property and earning regular rental income. This is also considered the BRRRR method : buy, rehab, rent, refinance, and repeat until you have increased your portfolio.

- Flipping properties : Flipping a property entails purchasing, adding value, and selling it higher than the investment costs. Many investors have a set profitability number they would like to hit but should consider market fluctuations on what they can realistically receive during the sale. Read our article on how to find houses to flip for more information.

- Owner-occupied: Investors can live in the property while renting out extra units to reduce their housing costs and have rental income coming in simultaneously. This model is best if you own multifamily units, especially duplexes, triplexes, or fourplexes . It’s also a great way to understand the complexities of being a landlord. You can transition your unit to another renter when you want to move.

- Turnkey: Buying a turnkey property is the best option for investors who wish to enter the real estate market without having to deal with renovations or tenant management. It’s a practical way for seasoned investors to diversify their portfolios with fewer time commitments.

Investors don’t have to stick to one model, and they can have a few of these investment models within their portfolio, depending on how much effort they would like to put into each property. Before choosing an investment model, consider which will help you meet your investing goals most efficiently.

Read our Investing in Real Estate: The 14-Tip Guide for Beginners article to learn how real estate investment works and other investing business models. Also, if you’re new to real estate investing and are looking for foundational knowledge to get started or seeking information about the best online courses for real estate investing, look at our The 13 Best Real Estate Investing Courses Online 2023 article.

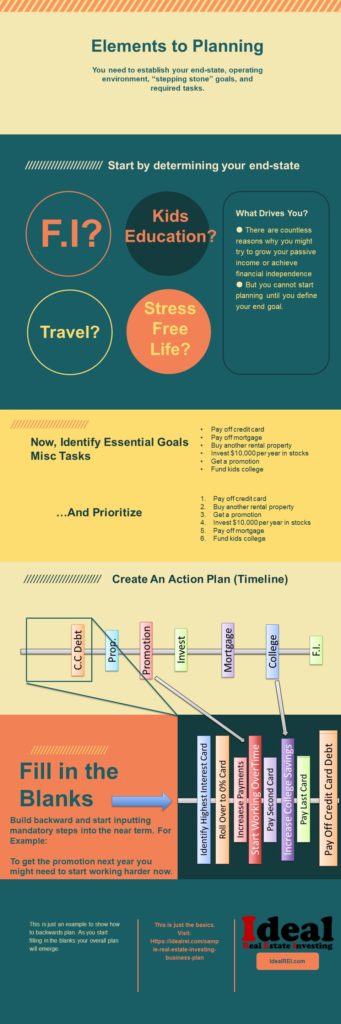

4. Set Specific & Measurable Goals

The next step to completing a real estate investment business plan for real estate investing is to set SMART goals. SMART is an acronym that stands for specific, measurable, achievable, relevant, and time-bound. Creating goals that contain all of the criteria of SMART goals results in extremely specific goals, provides focus, and sets an investor up for achieving the goals. The process of creating these goals takes some experience and continued practice.

An investor’s goals can consist of small short-term goals and more monumental long-term goals. Whether big or small, ideal goals will propel your business forward. For example, your end goal could be having a specific number of properties in your portfolio or setting a particular return on investment (ROI) you want to achieve annually.

Remember that your SMART goals don’t always have to be property-related just because you’re an investor. They can be goals that help you improve your networking or public speaking skills that can also add to a growing business.

Example of improving goals with SMART in mind:

Begin creating SMART goals with an initial goal. Then, take that initial goal and break it down into the different SMART components. SMART goals leave no room for error or confusion. The specific, measurable, and time-bound criteria identify the exact components for success.

However, the relevant and achievable parts of the goal require a little extra work to identify. The relevancy should align with your company’s mission, and extra research must be performed to ensure the goal is attainable.

Initial goal: Receive a 5% return on investment from the property

Smart goal:

- Specific: I want to achieve a 5% return on the 99 Park Place property.

- Measurable: The goal is to sell it for greater than or equal to $499,000.

- Achievable: The current market value for a two-bedroom in Chicago is selling for $500,000 and growing by 1% yearly.

- Relevant: I aim to meet my overall portfolio returns by 20% annually.

- Time-bound: I want to offload this property in the next three years.

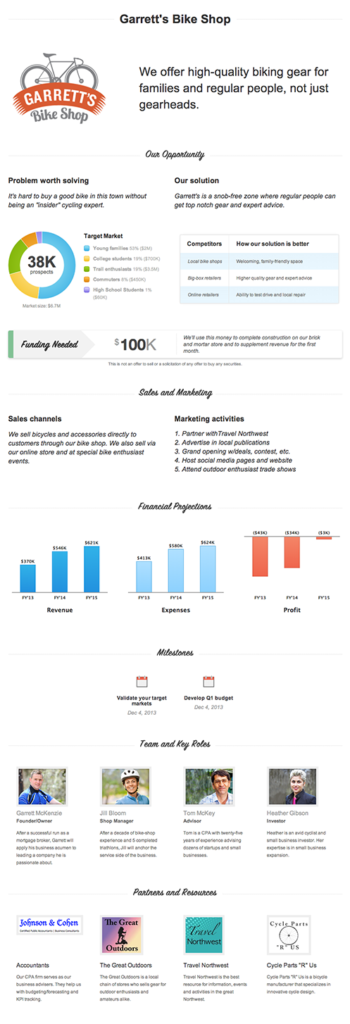

5. Write a Company Summary

The company summary section of a business plan for investors is a high-level overview, giving insight into your business, its services, goals, and mission, and how you differentiate yourself from your competition. Other items that can be included in this overview are business legal structure, business location, and business goals. The company summary is beneficial if you want to involve outside investors or partners in your business.

Example company profile from Choueri Real Estate

A company summary is customizable to your target audience. If you’re using this section to recruit high-level executives to your team, center it around business operations and corporate culture. However, if you’re looking to target funding and develop investor relationships for a new project, then you should include investor-specific topics relating to profitability, investment strategy, and company business structure.

Partners and outside investors will want to consider your company’s specific legal business structure to know what types of liabilities are at hand. Legal business structure determines how taxes are charged and paid and what legal entity owns the assets. This information helps determine how the liabilities are separated from personal assets. For example, if a tenant wants to seek legal damages against the landlord and the property is owned by an LLC, personal assets like your personal home will not be at risk.

6. Determine Your Financial Plan

The most essential part of creating a real estate investing business is the financial aspect since much of the business involves purchasing, managing, and selling real estate. To buy real estate initially, you’ll have to determine where funding will come from. Funding can come from your personal assets, a line of credit, or external investors.

A few options are available to real estate investors when obtaining a loan to purchase properties. The lending options available to most real estate investors include the following:

- Mortgage: This is one of the most common means of obtaining financing. A financial institution will provide money based on a borrower’s credit score and ability to repay the loan.

- Federal Housing Authority (FHA) loans : This loan is secured by the FHA to assist with getting you a low down payment or lower closing costs, and sometimes easily obtain credit. There are some restrictions to qualify for this loan—but it could be suitable for newer investors who want to begin investing starting with their primary home.

- Home equity line of credit (HELOC) : If you currently have property, obtain a HELOC by using your current property to secure the line of credit and borrow against the equity in your property. As you repay the loan, your available balance on the line of credit gets replenished.

- Private lenders : These are lenders who are not financial institutions. These individual lenders typically have fewer restrictions than traditional lenders and will lend money to individuals who can grow their investments.

- Hard-money loans : This loan requires a hard asset to be leveraged for money. For example, you can put up the home you want to purchase as the asset for cash upfront, and the hard-money loan will be paid back once the home is sold or other funding is secured. This is great for short-term deals due to quick approval and little upfront money.

After funding is obtained to purchase property, financial projections help investors understand their financial standing. These projections can tell you potential income, profits, and when you may need additional funding in the future. Similar to lending options, these calculations are specific to your investing model. If you’re not planning to rent out the property, then calculations like gross rent multiplier are not applicable.

For more information on what is needed to obtain financing, read our articles Investment Property Financing & Requirements and 5 Best Crowdfunding Sites for Investors 2023 .

Additional Investment Calculations

In a rental property business plan, it’s important to use a rental property calculator to determine a property’s potential return on investment. The calculator considers various factors, such as purchase price, operating expenses, monthly income, or vacancy rates, to determine whether a property is a good investment.

Click on the tabs below for the other important calculations all investors should be aware of when purchasing and managing rental properties :

- Gross Operating Income

- Gross Rent Multiplier

- Vacancy Rate

The gross operating income (GOI) calculates the amount of rent and income received from a property minus any vacancy. It doesn’t take into account other expenses. It tells an investor how much income they’ll make after some assumed losses with vacancy.

GOI = Total rent + Other income – Vacancy losses

The capitalization (cap) rate calculates the return on investment (ROI) of a property. This equation is used to compare the return of one building to another. The higher the cap rate, the better since the purchase price is low.

Cap Rate = Net operating income / Purchase price

The gross rent multiplier (GRM) is a factor that helps determine a property’s potential profitability. It can be used to compare perspective buildings to determine which one is the better deal.

GRM = Property price / Gross annual income

The vacancy rate calculates the vacancy percentage of all your investment properties during a specific period. Percentage helps an investor determine how their property performs given current market conditions. If you have a high vacancy rate, you must determine the cause. Perhaps your asking rents are too high for the current housing market.

Vacancy Rate Formula = # of Vacant Units x 100 / Total # of Units

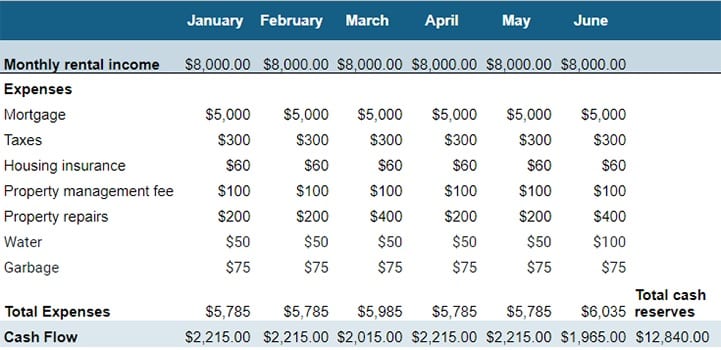

Cash flow is the movement of money in and out of your business, also known as net operating income. In an ideal scenario, investors will bring in more income than expenses, thus showing profit and a positive cash flow. Positive cash flow allows investors to decide how to use that profit. They can invest it in growing their portfolio or increasing their cash reserves for unexpected expenses.

Cash Flow = Gross rental income – Total expenses

Investors can use their current cash flow to forecast future cash flows, which will give you an idea of how much profit you will see over a specific period. Use past cash flow information to determine if there are any trends. For example, during the summer, your water expenses increase, or possibly every few months, you see an increase in property repairs. Consider these trends when estimating future cash flows and compare actual numbers to determine if your forecasting is accurate.

Use the template below to forecast future cash flow for six months and determine how much cash flow reserves you will have:

Cash Flow Template

💡 Quick tip:

In addition to the template, investing in property management software like TenantCloud will set you up for success. The free plan from TenantCloud will help you list apartments, collect rent payments, and screen applicants to maximize profits and minimize vacancies.

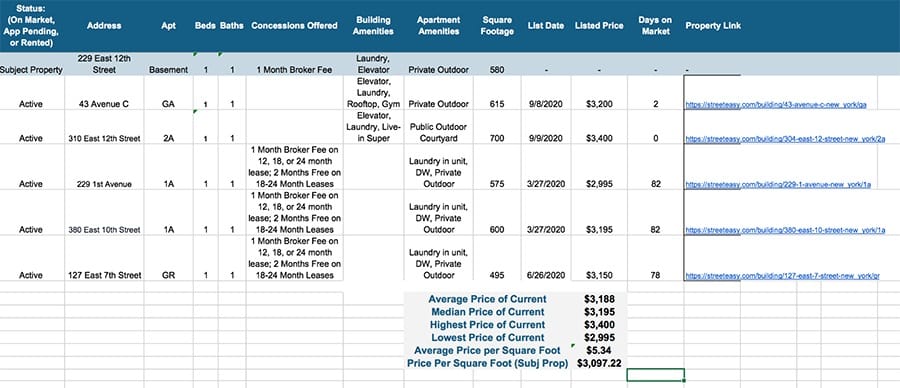

7. Perform a Rental Market Analysis

While determining what properties to purchase, investors should perform a rental market analysis (RMA) to gauge the investment potential of a rental property. The RMA consists of running comparables against current units on the market and collecting data that may affect your rental rate to understand if the rental property in question is a solid long-term investment. The analysis helps determine the average rental rate and future rent if you want to make any property upgrades.

Investors can use resources like Zillow to pull comparable property information and gather information on unit layout, building amenities, rental concessions offered, or listing prices. Once the information is gathered, the spreadsheet itemizes the average, median, highest, and lowest rent. When such information is available, it also provides an average price per square foot compared to the subject property. With this information, investors can decide whether the subject property is worth the investment.

Read our 10 Best States to Invest in Real Estate (& 5 Worst) in 2023 article to better understand which states yield a positive cash flow, build equity, and have long-term profitability.

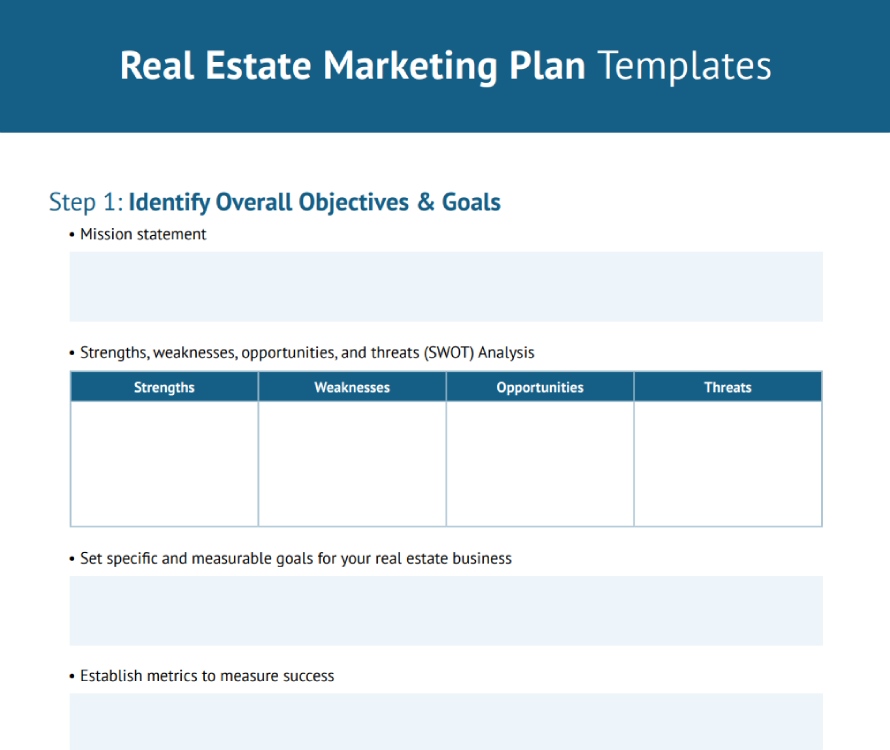

8. Create a Marketing Plan

Once you determine which property to invest in, investors should identify a marketing plan to list the vacant units. Some investors offload the marketing and advertising to real estate agents and brokerages, which will also collect a fee for renting out the property. Refer to some of the best real estate marketing materials to get started, or use our free real estate marketing plan template to lay out your objectives and tactics.

A real estate marketing plan should include your goals, budget, target market, competitors, feasible marketing strategies, and unique selling offers. In addition, it’s crucial to balance your strategy and split your potential marketing plans into categories, like print materials, online ads, email, and social media, so that you can be very specific with your goals and metrics.

Here are some of the real estate marketing mediums to include as you set your marketing goals:

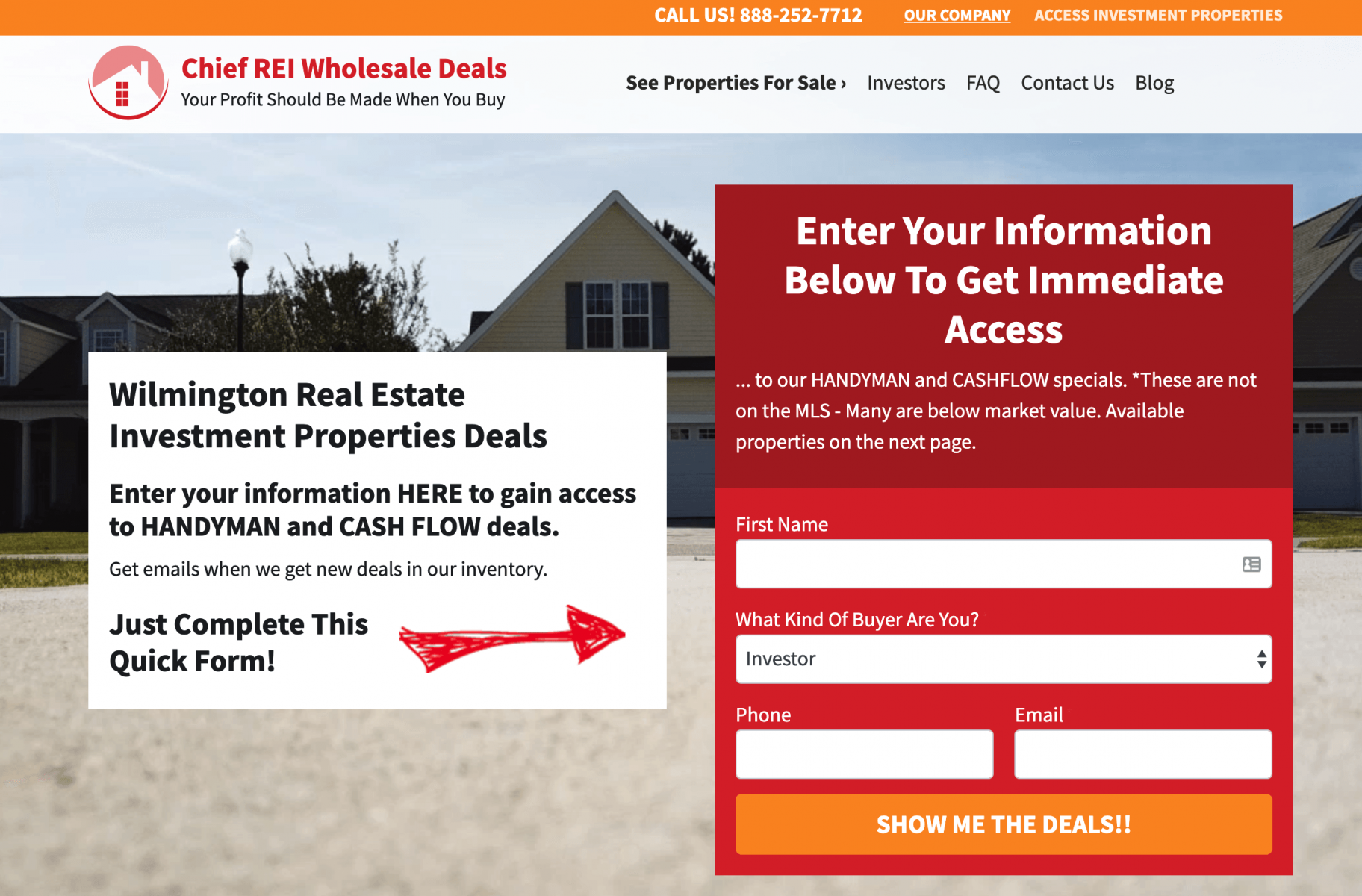

- Real estate website and landing pages

- Email marketing

- SMS and text message marketing

- Real estate ads

- Social media marketing

- Print marketing materials

- Real estate signs

Download our marketing plan template by visiting our article Free Real Estate Marketing Plan Template & Strategy Guide .

9. Build a Team & Implement Systems

As a new investor, you may be unable to hire an entire team of employees to help perform research, run analysis, property management , and accounting duties. It is best to have a list of vendors you can rely on to assist you with purchasing, rehabilitating, and buying or selling your investment properties. Find vendors you trust so you can free yourself from having to micromanage them and know they have your best interest and the interest of your investments in mind.

Here are a few people you want to include on your team:

- Contractors

- Electricians

- Property managers

- Accountants

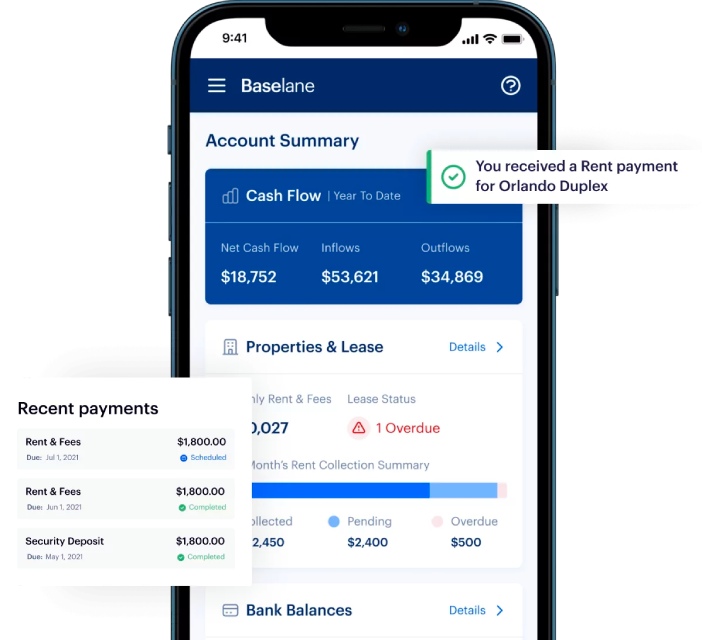

You should also utilize real estate investing apps and property intelligence software like Baselane that relieve you of manually performing daily duties to keep your investments profitable.

Automated rent collection feature (Source: Baselane )

Baselane is an all-in-one solution—from banking to rent collection, bookkeeping, reporting, and analytics. This software will help you efficiently manage your portfolio and eliminate the need for manual tasks. Learn more about how Baselane can make you a better property owner.

Visit Baselane

If you’re looking for more tools to help you get started, improve your portfolio management, and streamline your operations, read our 6 Best Real Estate Software for Investors 2023 article. We listed the six best software tools available for real estate investing based on affordability, customer reviews, features, and support to assist you in finding the best software that suits your needs.

10. Have an Exit Strategy

Since an investor’s money is tied up in the properties they own until they choose to sell, deciding when to sell or liquidate to get access to your money is part of an investor’s overall real estate exit strategy. The exit strategy for a real estate investment business is a plan for when an investor would like to remove themself from a deal or the business altogether. It helps weigh the different scenarios to minimize business risks and maximize the total return on investments.

A few exit strategy examples are:

The factors that an investor should consider when devising an exit strategy are minimizing financial loss, recouping as much of their original investment as possible, and avoiding any unseen fees that will cut into profits like tax consequences. An investor’s plan should always be to grow their original investment, but unforeseen circumstances may occur that will require you to plan on when to cut your losses as well.

Bottom Line

Before launching a successful real estate investment business, you must have an efficient business plan, aligning your strategies with your business objectives. Our real estate investment business plan template can help get you started. These plans act as a roadmap so you can focus on the steps required to grow your business. Business plans evolve, so continuously revisit and improve your strategies. There is no right or wrong way to write a real estate investor business plan as long as it is used to achieve your goals.

About the Author

Find Jealie On LinkedIn

Jealie Dacanay

Jealie is a staff writer expert focusing on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

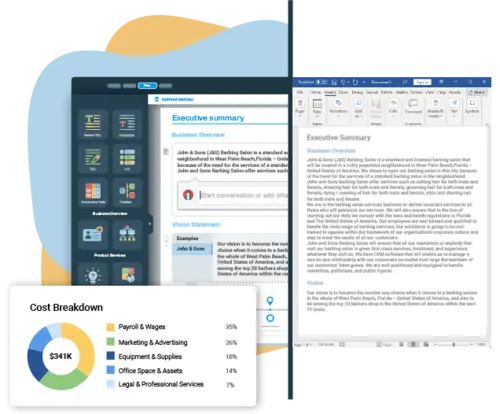

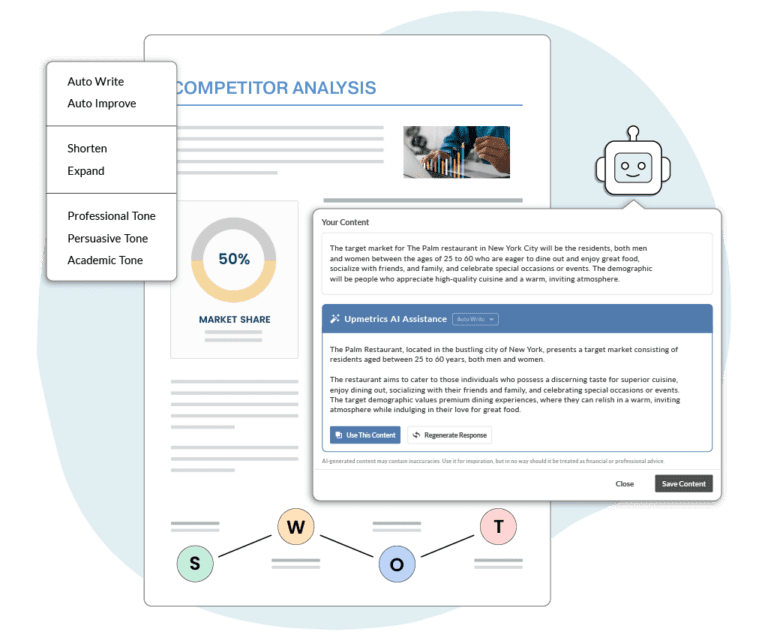

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

- Real Estate & Rentals

Real Estate Investment Business Plan

Real estate has been one of the fastest-growing industries in recent times. So, if considering starting a real estate investment business—this is the right time.

Whether you’re a seasoned investor to get into real estate or a rookie aiming to set your foot in this rapidly growing market, you need a solid business plan to make your real estate investing business a runaway success.

Need assistance writing your business plan? Worry not.

We have prepared a real estate investment business plan template to help you get started.

Let’s cut to the chase: download this template, follow step-by-step instructions, and finish the first draft of your plan.

recognize opportunities and deal with challenges in an effective way. It’ll also help you devise an investment strategy that brings you maximum returns.

Real Estate Industry Overview 2023

Here is an overview of the current state of the real estate industry in 2023:

Market size and growth potential:

Employment scenario:, key players:.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing a Real Estate Investment Business Plan

Select the right property location.

Selecting the right location to invest in is one of the primary requirements for a real estate business’s success. You should select the location based on what is the potential of infrastructural development in the area. Is it a preferable location for commercialization and urbanization or not? You should always keep these things in mind to ensure the maximum possible returns on your investment.

Know the purpose of your investment

Knowing what you want by investing in real estate is the first step toward making a proper plan. After all, a proper purpose gives you a well-defined goal to work towards and makes it easier to decide what steps you’ll need to take. Hence, decide why you want to invest in real estate. Whether it is for primary income, secondary income, planning for the future, etc.

Do your research

Research is essential if you want to thrive in the real estate business. Doing your research helps you understand what you are getting yourself into and how your different decisions can impact your business. It also helps you make a better and more fact-based plan.

Know all of your options

Although a lot of people go for long-term investments, it might not be the right thing depending on various factors. But that doesn’t mean that you have to give up on your idea of real estate investment. You can simply look into the other options like real investment trust, real investment company stocks, and so on and pick the option that works for you.

How Can a Real Estate Investment Business Plan Help You?

You may want to start investing as soon as possible, after all, investments take time to grow, right? But just like a stitch in time saves nine, a real estate investment business plan can help your investment business prosper in the future even if it seems time-consuming at the moment.

It can help you design a proper business model and formulate a great business growth strategy. Moreover, it can also help you track your progress along the way.

All in all, it can make your investments way smoother than going about without a business plan.

Chalking out Your Business Plan

The real estate sector is one of the most profitable sectors to invest in. Many investors swear by it as a bankable source of secondary income.

Not just that, the real estate investment market increased from 9.6 trillion dollars in 2019 to 10.5 trillion dollars in 2020. Although it may take time, investment in the housing market can help your money grow.

And though the above information invests in the real estate sector as a rosy prospect, it can go horribly wrong without a proper business plan and investment strategy.

Read on to find out what a business plan can do for your investment business.

Real estate investment business plan outline

This is the standard real estate investment business plan outline which will cover all important sections that you should include in your business plan.

- Purpose of the Plan

- Introduction

- The Problem

- The Solution

- A fundamental change in the US housing market

- All three legs of the apartment investment stool are in place

- Weak Housing Market

- Competitive Advantage

- Business Model

- Growth Opportunity

- Corporate Structure Overview

- Source and Use of Funds

- Return on Investment

- Mission Statement

- Business Objectives

- Legal Structure

- Company Ownership

- Location and Premises

- Intellectual Property

- CREI Business Model

- Revenue Projections

- The Amount of Investment Funds Requested

- Business Benefits

- Investment Repayments

- Good Investment Trends in Apartment Rentals

- Rent Spikes Coming For a Good Investment in Apartment Buildings

- Apartments Continue as Good Investment Through 2012 and Beyond

- Apartment Buildings Going From Good Investment to Great

- Filling Basic Needs Makes for a Good Investment

- More Americans renting by choice

- The Apartment Building Investment Triple Opportunity Is Right Now

- Internet Growth Allows Renters to Locate Good Apartments

- Industry Participants

- Competitive Advantages

- Strategic Initiatives?

- Brand Strategy

- Provide Individuals, Families, and Businesses with Quality Rental Properties at an Affordable Price.

- Positioning Statement

- Pricing Strategy

- Sales Strategy

- Sales Forecast

- Sales Programs

- Strategic Alliances

- Social networking websites

- Email campaigns

- SEO (Search Engine Optimization) PPC

- Banner advertisements

- Search Engine Optimization

- Organizational Structure

- SWOT Analysis

- Key Assumptions

- Key Financial Indicators

- Explanation of Break-even Analysis

- Business Ratios

- Long-term Plan and Financial Highlights

- Projected Income Statement

- Projected Cash Flow

- Projected Balance Sheet

How to Write a Real Estate Investment Business Plan?

A real estate investment business plan consists of several key areas that must be included in it and add things that would be unique to you and your business.

Also, there are several ways in which you can write a business plan including online business plan software and pre-designed templates. You can choose the method that works best for your individual needs.

What to Include in a Real Estate Investment Business Plan?

Although a business plan should be customized as per the needs of an individual and market situation, there are certain areas that every real estate investment business plan must include. They are as follows:

1. Executive Summary

The executive summary section is the first and foremost section of your business plan. It consists of what your entire business stands for. It focuses on everything ranging from opportunities and threats, competitive advantages your business has, the structure of the current market as well as the financial needs of the business.

Most importantly for a real estate investment business plan, it would also consist of the prospective return of investment one can expect from the business as well as the expected duration of time for that growth to happen.

2. Business Concept and Revenue Model

This section would include the type of investment concept and revenue model you plan on following with your business. So, before writing this section it is a good practice to analyze the current trends in the market as well as your own finances, to find the concept that fits the best for you in the current market situation.

In this section, you can also include methods of tracking the progress of your investments.

3. Market Analysis

Whenever one starts a new business it is mandatory to carry out market analysis to flourish in it. It not only helps you in understanding the market, but it also helps you in choosing the right strategy for your own business.

For example, in the US rent spikes and increasing demand for rental accommodations make the rent department an extremely profitable segment in the real estate market. A thorough analysis of the market can thus help you choose the most favorable market segment as well as the best locality to invest in.

4. Growth Strategy

In this section, you should include the milestones you plan on having for your investment business. It helps you set well-defined tasks to achieve those milestones and keeps you motivated while doing the same. Also, with the help of milestones, you can always pinpoint when and where you are going wrong and need a shift in direction.

5. Web Plan

Having a web presence can be immensely helpful in building your network and reaching out to potential partners and organizations that can help you grow.

For building an online presence you can use various tools like social media, email marketing, optimized web pages, etc.

6. Management Summary

This segment includes information regarding the roles and responsibilities of the people in your business. The people in your business are a major aspect that decides its success or downfall, therefore a thorough detail of their work and progress is an essential part of your business plan.

7. SWOT Analysis

Carrying out a SWOT analysis before writing your business plan can make the process faster, easier, and way more well-defined. Hence, including it in your business plan is always a good idea.

8. Financial analysis

Even though financial analysis is crucial for any business, it is especially important for investment businesses. In this section, you can include the time required to reach the break-even point, the projected growth of your business, long-term finances as well and strategies to deal with potential changes in the market.

Download a sample real estate investment business plan

Need help writing your business plan from scratch? Here you go; download our free real estate investment business plan pdf to start.

It’s a modern business plan template specifically designed for your real estate investment. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Write your business plan with Upmetrics

Using a business planning app like Upmetrics is the best way to draft your business plan. This incredible tool comes with step-by-step instructions and a library of 400+ customizable business plan templates to help you get started.

So what are you waiting for? Download your example and draft a perfect business plan.

Related Posts

Real Estate Investment Financial Plan

Real Estate Development Business Plan

Real Estate Agent Business Plan

Rental Property Business Plan

Business Plan Presentation Making Guide

Small Business Plan Writers

Frequently asked questions, do you need a business plan for real estate investing.

Indeed. Whether you plan to start a real estate investing, development, or mortgage broker business—you need a solid business plan to make your real estate business a runaway success. You can use Upmetrics’ real estate & rental business plan templates to get started writing your plan.

What's the importance of a marketing strategy in a real estate investment business plan?

Marketing strategy is a key component of your real estate investment business plan. Whether it is about achieving certain business goals or helping your investors understand your plan to maximize their return on investment—an impactful marketing strategy is the way to do it!

Here are a few pointers to help you understand the importance of having an impactful marketing strategy:

- It provides your business an edge over your competitors.

- It helps investors better understand your business and growth potential.

- It helps you develop products with the best profit potential.

- It helps you set accurate pricing for your products or services.

What is the easiest way to write your real estate investment business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any real estate investment business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business planning tool .

How do I write a good market analysis in a real estate investment business plan?

Market analysis is one of the key components of your business plan that requires deep research and a thorough understanding of your industry.

We can categorize the process of writing a good market analysis section into the following steps:

- Stating the objective of your market analysis—e.g., investor funding.

- Industry study—market size, growth potential, market trends, etc.

- Identifying target market—based on user behavior and demographics.

- Analyzing direct and indirect competitors.

- Calculating market share—understanding TAM, SAM, and SOM.

- Knowing regulations and restrictions

- Organizing data and writing the first draft.

Writing a marketing analysis section can be overwhelming, but using ChatGPT for market research can make things easier.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Property Management 101

- Property Law

- Join Our Network

How to Create a Real Estate Investment Business Plan for Residential Rental Properties (Free Template)

Ready to unlock the potential of real estate investment and build your financial future? Whether you’re an experienced investor or just starting out , crafting a well-thought-out business plan is critical if you're to succeed in the world of residential rental properties.

This article will guide you through the essential steps, considerations, and components of creating a real estate investment business plan. Plus, we've got a valuable free template to make your journey even more manageable.

Why You Need a Business Plan for Real Estate Investment

Crafting an effective real estate investment business plan is about more than paperwork; it's about turning your aspirations into achievements.

Creating a formalized business plan for your real estate investment venture is tantamount to success. It forces you—the investor—to organize your thoughts, feelings, goals, and ideas moving forward in the business in a single, powerful document.

Remember, this is a living document meant to be flexible as your business grows or changes tactics over the years. It keeps you on target, helps expand your business, and keeps your financial goals on track.

It’s also a helpful document for potential investors, creditors, and partners to peruse before pursuing a business venture with you.

And speaking of collaborators, finding sample real estate investment business plans or a template to download to get you started is a good idea. But before diving into that, let's look at a few general considerations that will shape your plan.

General Considerations for a Real Estate Investment Business Plan

Before you start actually writing your business plan, there are a few general considerations to keep in mind:

- The Why. When you start any new venture, it’s good to know you’ve got the strength to realize your goals, even when things get tricky. Defining why you’re embarking upon this real estate investment journey is necessary if you want to reach your destination. Why do you want to invest in real estate? To create financial independence? To serve the community? To provide for your family? Everyone’s “why” is unique to them. As such, your underlying motivation should be the starting point of creating a business plan. Everything follows from this origin.

- Financial Goals. Next, it’s wise to consider your financial goals. What are you hoping to accomplish financially? This is a business, and having defined financial goals will help keep your real estate investments trending in the right direction.

- Timeline. When do you want to achieve all this? Are you taking this business from now until retirement or looking to flip a few houses before the decade closes? Having a general timeline in mind when planning means you’ll be realistic about what goals you can accomplish.

- Real Estate Investment Strategy. There are countless ways to jumpstart your real estate investments. Doing a bit of research to discover which real estate investment strategies best suit your financial goals and desired timeline will ensure your business plan is realistic moving forward.

These considerations form the foundation of your real estate investment business plan. But how do you piece it together and create a comprehensive, winning document?

Spoiler alert: Property managers can be your secret weapon in crafting an airtight plan and guiding you through your investment journey.

But first, let's explore the essential components of your business plan and how a property manager can make the process smoother.

Essential Components of a Business Plan for Real Estate Investment

A well-thought-out business plan for real estate investment should help you secure the financing and partnerships needed to bring your dream to fruition.

To do this, it must include the following components:

- Executive Summary: a bird’s eye view. The first section of a business plan is like an abstract for a research paper. Here, you’ll introduce the plan and give an overview of what comes later in the document.

- Define your team. Who are you bringing on this journey? What are their qualifications? This section can attract new investors and partners by touting the team's accomplishments.

- Outline marketing strategy. A business plan won’t succeed without a marketing strategy to connect with potential clients, in this case, future tenants. Your real estate business plan must include understanding the need for top-quality marketing and a method to market your business successfully. Will you run social media ads? Rent local billboard space?

- Demonstrate initiative and a willingness to learn. Include a section to show that you know this industry, have researched the competition, and are aware of local real estate market trends and areas for growth. This will communicate to potential investors you’re willing to put in the elbow grease it takes to succeed long-term in this business.

- Describe the “What”. What services will you offer? What type of properties will you invest in? What are the next steps to your plan moving forward?

As you dive deeper into your real estate investment journey, remember that the strength of every property manager relationship reflects the property owner's dedication.

How to Create a Residential Real Estate Business Plan Quickly

If you're looking to create a residential real estate business plan quickly, here are a few must-have tips to get you started:

- Define: Mission. Vision. Values. A business is only as strong as its “big three” pillars: the mission, vision, and values. Begin your business plan by defining what the purpose of your business is (its mission), your plan to bring this mission to life (vision), and the values that will guide your actions when the going gets tough. Careful consideration of these will give you clarity when finding team members to build your business later on. You need people who click with what your business stands for.

- Identify short and long-term goals. A real estate business is only as successful as it prepares to be. Remember the adage: if you fail to plan, you plan to fail. Spending time identifying short (3-12 months out) and long (1-5 years in the future) term goals gives you and your team ways to mark the journey to success with well-defined milestones.

- Figure out the finances. How will you fund your business? There are many ways to find capital to bring your real estate business plan to life, but you may have to get creative. And you’ll need to stay organized and on task to bring your financial goals to fruition.

- Find the perfect property manager. The quickest way to accomplish this magnificent business plan you’re creating? Hire a property manager to help you skip the grunt work. But while finding the right manager for your business isn’t easy—you’ll need to research and interview several property managers before you get a feel for what’s best for you—the road will be much less bumpy with a solid business plan in hand.

How a Property Manager Can Help You Create a Real Estate Investment Business Plan

A property manager can help you create a real estate investment business plan in five important ways.

- Provide you with insights into the local real estate market.

- Help you identify and evaluate potential investment properties.

- Help you develop a marketing strategy to attract tenants.

- Help you manage your finances and keep track of your expenses.

- Provide you with guidance and support throughout the investment process.

When you enter property manager interviews armed with a robust business plan, you demonstrate your commitment and pave the way for a successful partnership.

Ultimately, creating the ideal business plan for real estate investment begins with you. Every property manager relationship is only as strong as the drive of the property owner.

Download APM’s free sample real estate investment business plan template to get started.

Get the latest property management trends delivered right to your inbox.

Find A Property Manager

- Single-Family Property Management

- Multifamily Property Management

- Apartment Property Management

- Condo Property Management

- Homeowners' Association (HOA) Property Management

- Commercial Property Management

For Property Owners

For property managers.

- Resource Center

- My Client Center

- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Write A Real Estate Business Plan

What is a real estate business plan?

8 must-haves in a business plan

How to write a business plan

Real estate business plan tips

Success in the real estate investing industry won’t happen overnight, and it definitely won’t happen without proper planning or implementation. For entrepreneurs, a real estate development business plan can serve as a road map to all of your business operations. Simply put, a real estate business plan will serve an essential role in forming your investing career.

Investors will need to strategize several key elements to create a successful business plan. These include future goals, company values, financing strategies, and more. Once complete, a business plan can create the foundation for smooth operations and outline a future with unlimited potential for your investing career. Keep reading to learn how to create a real estate investment business plan today.

What Is A Real Estate Investing Business Plan?

A real estate business plan is a living document that provides the framework for business operations and goals. A business plan will include future goals for the company and organized steps to get there. While business plans can vary from investor to investor, they will typically include planning for one to five years at a time.

Drafting a business plan for real estate investing purposes is, without a doubt, one of the single most important steps a new investor can take. An REI business plan will help you avoid potential obstacles while simultaneously placing you in a position to succeed. It is a blueprint to follow when things are going according to plan and even when they veer off course. If for nothing else, a real estate company’s business plan will ensure that investors know which steps to follow to achieve their goals. In many ways, nothing is more valuable to today’s investors. It is the plan, after all, to follow the most direct path to success.

8 Must-Haves In A Real Estate Business Plan

As a whole, a real estate business plan should address a company’s short and long-term goals. To accurately portray a company’s vision, the right business plan will require more information than a future vision. A strong real estate investing business plan will provide a detailed look at its ins and outs. This can include the organizational structure, financial information, marketing outline, and more. When done right, it will serve as a comprehensive overview for anyone who interacts with your business, whether internally or externally.

That said, creating an REI business plan will require a persistent attention to detail. For new investors drafting a real estate company business plan may seem like a daunting task, and quite honestly it is. The secret is knowing which ingredients must be added (and when). Below are seven must-haves for a well executed business plan:

Outline the company values and mission statement.

Break down future goals into short and long term.

Strategize the strengths and weaknesses of the company.

Formulate the best investment strategy for each property and your respective goals.

Include potential marketing and branding efforts.

State how the company will be financed (and by whom).

Explain who is working for the business.

Answer any “what ifs” with backup plans and exit strategies.

These components matter the most, and a quality real estate business plan will delve into each category to ensure maximum optimization.

A company vision statement is essentially your mission statement and values. While these may not be the first step in planning your company, a vision will be crucial to the success of your business. Company values will guide you through investment decisions and inspire others to work with your business time and time again. They should align potential employees, lenders, and possible tenants with the motivations behind your company.

Before writing your company vision, think through examples you like both in and out of the real estate industry. Is there a company whose values you identify with? Or, are there mission statements you dislike? Use other companies as a starting point when creating your own set of values. Feel free to reach out to your mentor or other network connections for feedback as you plan. Most importantly, think about the qualities you value and how they can fit into your business plan.

Goals are one of the most important elements in a successful business plan. This is because not only do goals provide an end goal for your company, but they also outline the steps required to get there. It can be helpful to think about goals in two categories: short-term and long-term. Long-term goals will typically outline your plans for the company. These can include ideal investment types, profit numbers, and company size. Short-term goals are the smaller, actionable steps required to get there.

For example, one long-term business goal could be to land four wholesale deals by the end of the year. Short-term goals will make this more achievable by breaking it into smaller steps. A few short-term goals that might help you land those four wholesale deals could be to create a direct mail campaign for your market area, establish a buyers list with 50 contacts, and secure your first property under contract. Breaking down long-term goals is a great way to hold yourself accountable, create deadlines and accomplish what you set out to.

3. SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. A SWOT analysis involves thinking through each of these areas as you evaluate your company and potential competitors. This framework allows business owners to better understand what is working for the company and identify potential areas for improvement. SWOT analyses are used across industries as a way to create more actionable solutions to potential issues.

To think through a SWOT analysis for your real estate business plan, first, identify your company’s potential strengths and weaknesses. Do you have high-quality tenants? Are you struggling to raise capital? Be honest with yourself as you write out each category. Then, take a step back and look at your market area and competitors to identify threats and opportunities. A potential threat could be whether or not your rental prices are in line with comparable properties. On the other hand, a potential opportunity could boost your property’s amenities to be more competitive in the area.

4. Investment Strategy

Any good real estate investment business plan requires the ability to implement a sound investment strategy. If for nothing else, there are several exit strategies a business may execute to secure profits: rehabbing, wholesaling, and renting — to name a few. Investors will want to analyze their market and determine which strategy will best suit their goals. Those with long-term retirement goals may want to consider leaning heavily into rental properties. However, those without the funds to build a rental portfolio may want to consider getting started by wholesaling. Whatever the case may be, now is the time to figure out what you want to do with each property you come across. It is important to note, however, that this strategy will change from property to property. Therefore, investors need to determine their exit strategy based on the asset and their current goals. This section needs to be added to a real estate investment business plan because it will come in handy once a prospective deal is found.

5. Marketing Plan

While marketing may seem like the cherry on top of a sound business plan, marketing efforts will actually play an integral role in your business’s foundation. A marketing plan should include your business logo, website, social media outlets, and advertising efforts. Together these elements can build a solid brand for your business, which will help you build a strong business reputation and ultimately build trust with investors, clients, and more.

First, to plan your marketing, think about how your brand can illustrate the company values and mission statement you have created. Consider the ways you can incorporate your vision into your logo or website. Remember, in addition to attracting new clients, marketing efforts can also help maintain relationships with existing connections. For a step by step guide to drafting a real estate marketing plan , be sure to read this guide.

6. Financing Plan

Writing the financial portion of a business plan can be tricky, especially if you are starting your business. As a general rule, a financial plan will include the income statement, cash flow, and balance sheet for a business. A financial plan should also include short and long-term goals regarding the profits and losses of a company. Together, this information will help make business decisions, raise capital, and report on business performance.

Perhaps the most important factor when creating a financial plan is accuracy. While many investors want to report on high profits or low losses, manipulating data will not boost your business performance in any way. Come up with a system of organization that works for you and always ensure your financial statements are authentic. As a whole, a financial plan should help you identify what is and isn’t working for your business.

7. Teams & Small Business Systems

No successful business plan is complete without an outline of the operations and management. Think: how your business is being run and by whom. This information will include the organizational structure, office management (if any), and an outline of any ongoing projects or properties. Investors can even include future goals for team growth and operational changes when planning this information.

Even if you are just starting or have yet to launch your business, it is still necessary to plan your business structure. Start by planning what tasks you will be responsible for, and look for areas you will need help with. If you have a business partner, think through your strengths and weaknesses and look for areas you can best complement each other. For additional guidance, set up a meeting with your real estate mentor. They can provide valuable insights into their own business structure, which can serve as a jumping-off point for your planning.

8. Exit Strategies & Back Up Plans

Believe it or not, every successful company out there has a backup plan. Businesses fail every day, but investors can position themselves to survive even the worst-case scenario by creating a backup plan. That’s why it’s crucial to strategize alternative exit strategies and backup plans for your investment business. These will help you create a plan of action if something goes wrong and help you address any potential problems before they happen.

This section of a business plan should answer all of the “what if” questions a potential lender, employee, or client might have. What if a property remains on the market for longer than expected? What if a seller backs out before closing? What if a property has a higher than average vacancy rate? These questions (and many more) are worth thinking through as you create your business plan.

How To Write A Real Estate Investment Business Plan: Template

The impact of a truly great real estate investment business plan can last for the duration of your entire career, whereas a poor plan can get in the way of your future goals. The truth is: a real estate business plan is of the utmost importance, and as a new investor it deserves your undivided attention. Again, writing a business plan for real estate investing is no simple task, but it can be done correctly. Follow our real estate investment business plan template to ensure you get it right the first time around:

Write an executive summary that provides a birds eye view of the company.

Include a description of company goals and how you plan to achieve them.

Demonstrate your expertise with a thorough market analysis.

Specify who is working at your company and their qualifications.

Summarize what products and services your business has to offer.

Outline the intended marketing strategy for each aspect of your business.

1. Executive Summary

The first step is to define your mission and vision. In a nutshell, your executive summary is a snapshot of your business as a whole, and it will generally include a mission statement, company description, growth data, products and services, financial strategy, and future aspirations. This is the “why” of your business plan, and it should be clearly defined.

2. Company Description

The next step is to examine your business and provide a high-level review of the various elements, including goals and how you intend to achieve them. Investors should describe the nature of their business, as well as their targeted marketplace. Explain how services or products will meet said needs, address specific customers, organizations, or businesses the company will serve, and explain the competitive advantage the business offers.

3. Market Analysis

This section will identify and illustrate your knowledge of the industry. It will generally consist of information about your target market, including distinguishing characteristics, size, market shares, and pricing and gross margin targets. A thorough market outline will also include your SWOT analysis.

4. Organization & Management

This is where you explain who does what in your business. This section should include your company’s organizational structure, details of the ownership, profiles on the management team, and qualifications. While this may seem unnecessary as a real estate investor, the people reading your business plan may want to know who’s in charge. Make sure you leave no stone unturned.

5. Services Or Products

What are you selling? How will it benefit your customers? This is the part of your real estate business plan where you provide information on your product or service, including its benefits over competitors. In essence, it will offer a description of your product/service, details on its life cycle, information on intellectual property, as well as research and development activities, which could include future R&D activities and efforts. Since real estate investment is more of a service, beginner investors must identify why their service is better than others in the industry. It could include experience.

6. Marketing Strategy

A marketing strategy will generally encompass how a business owner intends to market or sell their product and service. This includes a market penetration strategy, a plan for future growth, distribution channels, and a comprehensive communication strategy. When creating a marketing strategy for a real estate business plan, investors should think about how they plan to identify and contact new leads. They should then think about the various communication options: social media, direct mail, a company website, etc. Your business plan’s marketing portion should essentially cover the practical steps of operating and growing your business.

Additional Real Estate Business Plan Tips

A successful business plan is no impossible to create; however, it will take time to get it right. Here are a few extra tips to keep in mind as you develop a plan for your real estate investing business:

Tailor Your Executive Summary To Different Audiences: An executive summary will open your business plan and introduce the company. Though the bulk of your business plan will remain consistent, the executive summary should be tailored to the specific audience at hand. A business plan is not only for you but potential investors, lenders, and clients. Keep your intended audience in mind when drafting the executive summary and answer any potential questions they may have.

Articulate What You Want: Too often, investors working on their business plan will hide what they are looking for, whether it be funding or a joint venture. Do not bury the lede when trying to get your point across. Be clear about your goals up front in a business plan, and get your point across early.

Prove You Know The Market: When you write the company description, it is crucial to include information about your market area. This could include average sale prices, median income, vacancy rates, and more. If you intend to acquire rental properties, you may even want to go a step further and answer questions about new developments and housing trends. Show that you have your finger on the pulse of a market, and your business plan will be much more compelling for those who read it.

Do Homework On The Competition: Many real estate business plans fail to fully analyze the competition. This may be partly because it can be difficult to see what your competitors are doing, unlike a business with tangible products. While you won’t get a tour of a competitor’s company, you can play prospect and see what they offer. Subscribe to their newsletter, check out their website, or visit their open house. Getting a first-hand look at what others are doing in your market can greatly help create a business plan.

Be Realistic With Your Operations & Management: It can be easy to overestimate your projections when creating a business plan, specifically when it comes to the organization and management section. Some investors will claim they do everything themselves, while others predict hiring a much larger team than they do. It is important to really think through how your business will operate regularly. When writing your business plan, be realistic about what needs to be done and who will be doing it.

Create Example Deals: At this point, investors will want to find a way to illustrate their plans moving forward. Literally or figuratively, illustrate the steps involved in future deals: purchases, cash flow, appreciation, sales, trades, 1031 exchanges, cash-on-cash return, and more. Doing so should give investors a good idea of what their deals will look like in the future. While it’s not guaranteed to happen, envisioning things has a way of making them easier in the future.

Schedule Business Update Sessions: Your real estate business plan is not an ironclad document that you complete and then never look at again. It’s an evolving outline that should continually be reviewed and tweaked. One good technique is to schedule regular review sessions to go over your business plan. Look for ways to improve and streamline your business plan so it’s as clear and persuasive as you want it to be.

Reevauating Your Real Estate Business Plan

A business plan will serve as a guide for every decision you make in your company, which is exactly why it should be reevaluated regularly. It is recommended to reassess your business plan each year to account for growth and changes. This will allow you to update your business goals, accounting books, and organizational structures. While you want to avoid changing things like your logo or branding too frequently, it can be helpful to update department budgets or business procedures each year.

The size of your business is crucial to keep in mind as you reevaluate annually. Not only in terms of employees and management structures but also in terms of marketing plans and business activities. Always incorporate new expenses and income into your business plan to help ensure you make the most of your resources. This will help your business stay on an upward trajectory over time and allow you to stay focused on your end goals.

Above all else, a real estate development business plan will be inspiring and informative. It should reveal why your business is more than just a dream and include actionable steps to make your vision a reality. No matter where you are with your investing career, a detailed business plan can guide your future in more ways than one. After all, a thorough plan will anticipate the best path to success. Follow the template above as you plan your real estate business, and make sure it’s a good one.

Click the banner below to register for a FREE one-day online event and get started learning how to create cash flow from the stock market!

NAR Settlement: What It Means For Buyers And Sellers

What is the assessed value of a property, what is bright mls a guide for agents and investors, how to pass a 4 point home inspection, defeasance clause in real estate explained, what is the federal funds rate a guide for real estate investors.

Your 10 Step Guide to Building a Real Estate Investing Business Plan

Real estate empires grow from a blueprint, not last-minute hunches. This guide outlines how to create a real estate investing business plan to help you navigate market dynamics, seek funding, and add to your team so that you can successfully grow your business.

Let’s be honest, the idea of drafting a formal real estate investing business plan probably doesn’t excite you. After all, you got into real estate investing to scout deals and transform properties, not write novels full of financial projections.

But experienced investors know a solid plan spells the difference between profitability and major headaches. It forces clarity on direction and feasibility before you sink hundreds of thousands into property purchases and rehabs.

Think of your business plan as a blueprint for success tailored to your unique investment goals and market conditions. Whether you currently own a few rentals or are launching a full-fledged development firm, a plan guides decisions, aligns partners, and demonstrates viability to secure financing.

So how do you build one effectively without needless complexity? What key strategy areas require your focus? Let’s explore components that set you up for growth while avoiding common first-timer pitfalls. With realistic planning as your foundation, your investing journey can start smooth and stay the course.

What is a real estate investing business plan?

At its core, a real estate investment business plan is simply a strategic guide outlining your intended real estate approach. It defines target markets, preferred project types based on expertise, capital sources, growth strategy, key operational procedures, and other investment specifics tailored to your situation.

View your plan as an evolving document rather than a rigid static rulebook collecting dust. It should provide goalposts and guardrails as markets shift over time and new opportunities appear. You'll be able to refer back to the plan to confirm that these new opportunities align with proven tactics that yield predictable returns.

Detailed upfront planning provides a sound foundation for confident direction. It protects stakeholders by identifying potential pitfalls and mitigation strategies before costly surprises trip up the stability of your real estate business.

So, it's worth it to take the time and develop a customized plan aligned to your niche, resources, and risk tolerance. While initially tedious, the practice of putting together your strategic real estate business plan ultimately provides clarity and confidence moving forward.

Importance of having a business plan

Now that we’ve defined what a business plan is, let’s explore why having one matters — especially if you want to grow a successful real estate investment company.

Have you considered what originally attracted you to investing in properties? Whether it was rehabbing flips, acquiring rentals, or simply a lucrative hobby, your motivations and ideal path can get lost in the daily distractions of life. That’s where an intentional business plan provides clarity and conviction moving forward.

Reasons every real estate investor should prioritize planning are:

- Goals and vision : You might be wanting to quit your day job and focus on real estate full time, or you might simply want to generate some extra income on the side. Either way, a business plan forces you to define what success looks like for you.

- Due diligence : Creating a plan forces you to research the real estate markets you want to invest in — analyzing sales, rents, permits, zoning, demographics, and growth projections. This helps you objectively identify high-potential neighborhoods and properties rather than relying on hearsay or intuition.

- Funding and financing : Lenders and potential investors will want to review your business plan to evaluate the viability and profitability of your real estate investment business before offering any financing . A complete plan builds credibility and confidence with stakeholders.

- Guide decision-making : It's easy to get distracted by the latest real estate seminar or shiny new construction techniques. But sticking to the parameters and strategies laid out in your plan prevents you from making hasty changes or going down rabbit holes.

- Identify potential risks : There are always things that can unexpectedly go wrong: what if interest rates spike and make your loans unaffordable, or your best tenants move out and unreliable folks move in? Brainstorming these scenarios in advance allows you to minimize risks and have contingency plans.

- Systemize operations : As you grow, how will you scale operations? A business plan helps you identify areas that will require attention as your business evolves, like creating maintenance checklists for rentals, standardizing lease agreements , or automating accounting procedures.

- Build the right team : Your business plan provides guidance on the team you'll need for your business. Know if you require a real estate agent to help you find deals or a property manager to handle tenant complaints at 2 AM.

- Track progress : Your plan helps you compare things like actual rehab costs, rental occupancy rates, cash flow, etc. to your initial projections and determine whether you're on track. You can then make adjustments as needed.

- Maintain strategy : As you scale your operations with new hires or partnerships, you'll want to maintain direction in alignment with your original business plan. For example, if you are considering new verticals like commercial real estate, does evaluation criteria match your proven risk metrics and return hurdles? A real estate business plan keeps everyone focused on the same goals as your business grows.

What to include in a real estate investment business plan

A good real estate investing business plan covers everything from business goals to financing strategy. Here are the ten key elements you should include:

1. Executive summary

The executive summary provides a high-level overview of your real estate investment business plan. It briefly describes your company mission, objectives, competitive advantages, growth strategies, team strengths, and financial outlook.

Think of it as the elevator pitch for your business plan, and write it last after you have completed the full plan. Limit it to 1-2 pages at most.

Make your executive summary compelling and motivate investors or lenders to learn more. Be sure to also summarize your past successes and experiences to build credibility.

2. Company description

The company description section provides background details on your real estate investment company. Keep this section brief, but use it to legitimize your business and team.

- Business model : Explain your core business model and investment strategies. Will you primarily flip properties, buy and hold rentals, conduct wholesale deals, or use another approach?

- Company history and achievements : Provide a brief timeline of your company's history, including its formation, past projects, key milestones, and achievements.

- Legal business structure : Identify your corporate structure, such as LLC , S-Corp , C-Corp, or sole proprietorship.

- Office location : Provide your company's office address, which lends you credibility. If you are initially working from home, consider establishing a local PO Box or virtual address.

- Founders and key team members : Introduce your founders and key team members. Highlight relevant real estate, finance, management expertise, and credentials.

- Past projects : Provide an overview of any successful prior real estate projects your company or founders have executed.

- Competitive advantages : Explain unique resources, systems, or other strengths that give your company an edge over competitors. These could be proprietary analytic models, contractor relationships, deal access, or specialized expertise.

- Technologies and tools : Discuss technologies, software programs, or tools your company uses to streamline processes and optimize operations.

3. Market analysis