Search This Blog

Search letters formats here, sample letter to insurance company for loan against policy.

submit your comments here

Post a comment.

Leave your comments and queries here. We will try to get back to you.

- RBI Assistant

- RBI Grade B

- Current Affairs

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- Current Affairs Today

- Current Affairs 2019

Current Affairs Quiz

- Weekly Current Affairs Test

- Current Affairs Quiz PDF

- Current Affairs PDF

- Railway Jobs

- Defence Jobs

- Police Jobs

- Sarkari Result

- General Knowledge

- GK Questions

- General Knowledge PDF

- General Awareness

- General Studies

- Quantitative Aptitude

- Reasoning Questions

- English Questions

- Banking Awareness Quiz

- Computer Awareness Quiz

- Insurance Awareness Quiz

- Marketing Awareness Quiz

- IT Officer Quiz

- Banking Awareness

- Insurance Awareness

- Computer Awareness

- Aptitude Notes

- Reasoning Notes

- English Notes

- Quants Shortcuts Tricks & Tips

- Reasoning Shortcut Tricks & Tips

- English Tips & Tricks

- Interview Tips

- Interview Capsules

- Interview Experiences

- Success Stories

- IBPS Clerk Exam

- IBPS PO Exam

- SBI PO Exam

- IBPS RRB Exam

Letter for Applying Loan Against Insurance Policy

AffairsCloud YouTube Channel - Click Here

AffairsCloud APP Click Here

Write a letter to a Divisional Manager of LIC and apply for loan against the Life Insurance Policy

Cross cut road,

Mani Nagar,

December 1, 2014.

The Divisional Manager,

Life Insurance Corporation of India,

IT Complex Road,

Sub : Loan against Life Insurance Policy No 99945 for Rs 10,00,000/-

I got myself insured for life for a sum of Rs 10,00,000/- (Rs Ten Lakh only), vide the said insurance policy in the year 2004.

Now I very badly need an amount of Rs 2,00,000 (Rs Two Lakh only) in connection with the marriage of my younger brother to be solemnized towards the end of the next month. Despite my best efforts, I could not arrange the required amount from any source.

In the view of the above, I want to take a loan against my Life Insurance Policy which I mentioned above. Please let me know the maximum amount of loan permissible to be under relevant rules. The various formalities to be completed in this regard may also be intimated to me. I shall be grateful if you kindly take necessary action in the matter at your earliest convenience.

Yours faithfully,

Deepika Manoharan

- IBPS RRB Officer - Free Mock Test

- IBPS RRB Assistant - Free Mock Test

- SBI Clerk - Free Mock Test

- SBI PO - Free Mock Test

- IBPS Clerk - Free Mock Test

- RBI Grade B - Free Mock Test

- Download Current Affairs APP

- We are Hiring: Subject Matter Expert (English/Reasoning/Aptitude) – Freelancer/Full Time

- SBI Clerk Mains Admit Card Released - Download Now

- SBI Clerk Mains Admit Card 2023 Released: Download Hall Ticket Now

- Central Bank of India Faculty, Office Assistant, Attender Recruitment 2024 - 10 Posts | Apply Now

- IDBI Junior Assistant Manager Exam Result 2024 Declared - Check Result

- IPPB Executive 2024 Online Registration Last Date | 54 Vacancies

AffairsCloud Today

Current affairs 1 june 2024, current affairs 31 may 2024, current affairs 30 may 2024, current affairs quiz:30 may 2024, current affairs quiz:29 may 2024, current affairs quiz:28 may 2024.

- Current Affairs 2024

- Refund Policy

- Privacy Policy

- Terms & Condition

- 7982774960/ 9693730114

- infobankwhizz@gmail.com

- Descriptive

- Buy Courses

- Essay Topics

- Model Essays

- Login/Signup

Descriptive English मतलब Bank Whizz

How to Write a letter to the BM, LIC for a loan against your policy

Dear Sir/Madam,

I am writing this letter to request a loan against my LIC policy. My policy number is _____________ and I have been a policyholder with LIC for _____________ years.

I am currently in need of financial assistance due to some unexpected expenses that have come up. I believe that availing a loan against my LIC policy will be the best option for me as the interest rates are comparatively lower and the repayment options are flexible.

I would like to request you to kindly provide me with the necessary details regarding the loan process, eligibility criteria, and the amount that can be sanctioned against my policy. I would also like to know about the interest rates and the repayment options that are available.

I assure you that I will repay the loan amount in a timely manner as per the agreed terms and conditions. I have attached all the necessary documents required for processing the loan application.

I request you to kindly consider my request and provide me with the loan against my LIC policy at the earliest possible. I am looking forward to your positive response.

Thank you for your time and consideration.

Yours sincerely,

[Your Name]

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan New

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.75% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹3 crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

- Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

- Fixed Deposit

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

- Loan against Property

Loan Against securities

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

Cancer Care Insurance

Offers & Updates

Download the moneyfy app.

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.75%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers.

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

- Two wheeler Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

EMI Calculators

Compound Interest Calculator

Home Insurance & Travel Insurance

Menu

- Loan for Home

- Loan for Business

- Loan for Education

- Loan for Vehicle

- Personal Use Loan

- Loan for Travel

- Loan for Wedding

- Capital Goods Loan

- Home Repair Loan

- Medical Loan

- Loan on Property

- Loan on Securities

- Wealth Services

- What’s Trending

- RBI Regulations

- Equipment Lease

- Circulating Capital Loan

- Construction Loan

- Leadership Talks

- Dealer Finance

- Shubh Chintak

- Coronavirus

- Government Updates

- Lockdown News

- Finance Solutions

Tata Capital > Blog > Loan on Securities > Loan Against LIC Policy: Interest Rate, Eligibility and How to Apply

Loan against lic policy: interest rate, eligibility and how to apply.

Life Insurance Corporation (LIC) policies safeguard you and your loved ones financially during unforeseeable circumstances. But, did you know that LIC policies can also help you get access to loans when required?

A loan against LIC policy is a type of secured loan that facilitates the option to avail of a loan by pledging the policy to the lender. This provision ensures that you do not need to liquidate your hard-earned assets such as property or automobiles to the lender, so you can retain their ownership. However, before you apply for a loan against your LIC policy, understanding how it works is essential.

To help you make an informed financial decision, this article details the nuances and workings of a loan against LIC policy and how it can help you get the finances you need in times of emergencies.

What is a loan against LIC policies?

LIC policyholders can avail of loans against LIC policy after the policy acquires a surrender value. The loan can be taken against this surrender value of the policy. The surrender value is the amount of money policyholders will receive if they decide to discontinue the policy before maturity.

The key features of loans against LIC policy are:

1 The interest rate on a loan on LIC policy depends on the prevailing rates linked to government bond yields and the applicant's credit profile.

2. Loans against LIC policy are only available to LIC endowment policyholders.

3. The loan amount sanctioned is an advance against the future surrender value of the LIC endowment policy.

4. The maximum loan amount is usually up to 90% of the surrender value for policies in force. For paid-up policies, the maximum is 85% of the surrender value.

5. The LIC insurance policy is held as collateral by LIC against the loan. LIC can withhold or terminate the policy if the applicant defaults on loan repayments.

6. Not all LIC policies have a loan facility. Policyholders must choose plans that specifically offer the loan feature.

7. If an outstanding loan with interest exceeds the surrender value, LIC has the right to terminate the insurance policy.

8. If the policy matures before full loan repayment, LIC can deduct the outstanding loan amount from the policy proceeds before disbursing the balance to the policyholder.

Eligibility criteria for LIC India loan against the policy

Here are the eligibility criteria for availing a loan against LIC policy:

1. The applicant must be a citizen of India.

2. The applicant should be at least 18 years old.

3. The policy must have a guaranteed surrender value.

4. The applicant must have a valid LIC policy.

5. The applicant should have paid at least 3 years' premium in full for the LIC policy to avail the loan facility.

Here are some of the eligible LIC policy plans that can be used as collateral for securing a loan against LIC policy:

1. Jeevan Pragati

2. Jeevan Labh

3. Single-Premium Endowment Plan

4. New Endowment Plan

5. New Jeevan Anand

6. Jeevan Rakshak

7. Limited Premium Endowment Plan

8. Jeevan Lakshya

The application process for availing of a loan against LIC policies

The process is subject to changes by LIC. Here are the key steps to avail a loan against an LIC policy:

1. Offline method

To avail of a loan against LIC policy, offline, follow these steps:

Step 1: Visit the nearest LIC branch office and obtain the loan application form.

Step 2: Fill in the application with your policy details and required information. Attach KYC documents like identity proof and address proof.

Step 3: Submit the duly filled application at the branch along with the original policy bond.

Step 4: The LIC office will verify your policy details, premium payment status and surrender value to determine your loan eligibility.

If approved, LIC will sanction the loan and disburse the amount as per the product terms. The original policy will be retained by LIC until full loan repayment.

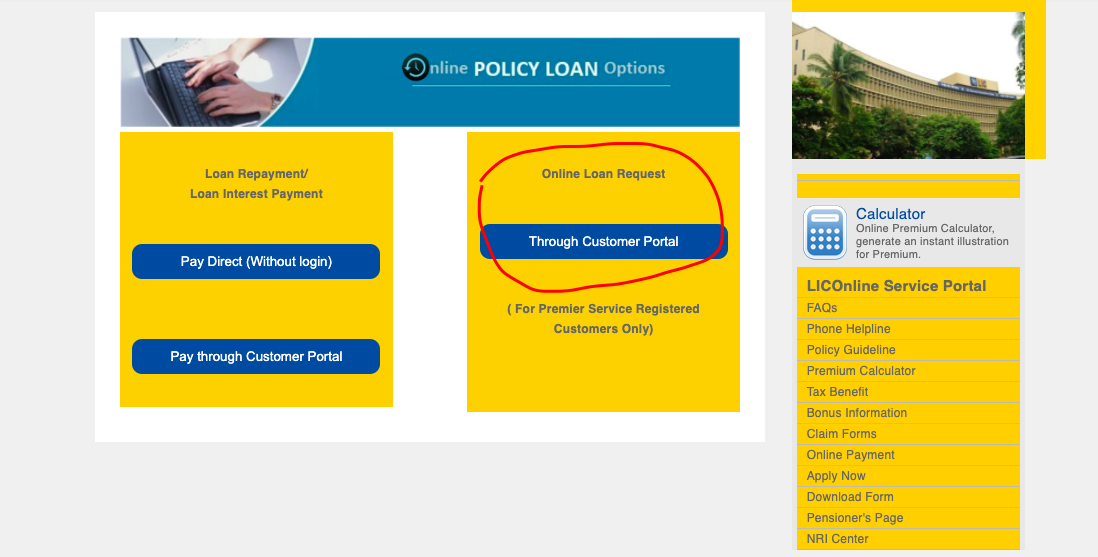

2. Online method

To avail of a loan on LIC policy online, follow these steps:

Step 1: Register for LIC's e-services and login to your account.

Step 2: Check your policy eligibility for a loan and view applicable terms and conditions online.

Step 3: Fill out the application form online and submit it along with scanned copies of KYC documents.

Step 4: You may need to send original physical documents to the nearest LIC branch for verification.

Once verified and approved, the amount is disbursed into your account. Policy documents may be required to be deposited in physical form at the branch.

Terms and conditions to avail of a loan against LIC policies

The terms and conditions are subject to change by LIC. Below are some terms and conditions applicable for loans against LIC policies:

1. The minimum tenure of the loan is 6 months. Shorter tenures are not permitted.

2. Prepayment of the loan is allowed only after paying at least 6 EMIs.

3. In case of the unfortunate demise of the policyholder before loan maturity, interest will be charged only until the date of the demise.

4. If the policy matures during the loan tenure, the maturity claim proceeds can be utilised by LIC to first recover the outstanding loan with interest.

5. Only LIC policyholders with eligible endowment, moneyback and whole-life plans can avail of loans after acquiring the stipulated surrender value.

6. The policyholder needs to pay interest regularly as per the schedule to avoid loan foreclosure.

7. LIC reserves the right to terminate the policy if the loan with interest exceeds the surrender value.

Discover Tata Capital’s loans against securities

Loans against LIC policies allow policyholders to meet liquidity needs seamlessly. However, one must repay interest and principal on time to avoid policy termination or loan ballooning beyond surrender value.

At the same time, it is essential to look for the right lender to avail of a loan against securities . At Tata Capital, we offer competitive loans against securities interest rates , along with a high loan amount and minimal documents required for a loan against securities . To get an estimate of your potential EMIs, head over to our loan against securities EMI calculator. Apply for a loan against securities with Tata Capital today!

Visit the Tata Capital website or download the Tata Capital App for more information!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Most Viewed Blogs

Loans Against Mutual Funds: All You Need To Know

What Are the RBI Guidelines to Avail Loan Against Securities?

Pros & Cons Of Taking Loan Against Shares

What Are Financial Securities?

How Loan Against Shares Work?

Is it possible to opt for loan against securities on a lower interest rate?

7 Common Mistakes to Avoid When Taking a Loan Against Securities

Top Documents Required for a Loan Against Security

5 Things to Know About Loan Against Equity Shares

How To Get Instant Loan Against Securities?

Trending Blogs

- Business Loan EMI Calculator

Used Car Loan EMI Calculator

Two Wheeler Loan EMI Calculator

Loan Against Property Calculator

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Education Loan

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

InsuranceLiya.com

Looking to Get Insured?

+91 965-367-9024

How to take a loan against your LIC policy (Simple Guide)

Are you looking to take a loan against your LIC policy? This article will guide you on how you can do that in simple steps. There are a lot of times where you wish you could take a loan against your existing LIC policy, be it to pay for education expenses, unforeseen medical expenses, or anything else.

Some LIC policies offer their policyholders the flexibility to take a loan against their LIC policy, this could be a massive boon during challenging times for policyholders.

Further, it is also important to know if your LIC policy does offer you this benefit, in case the need arises.

This article will be touching base on the following important topics:

- LIC policies that offer loans

The process to apply for a loan against LIC policy

Required documents, eligibility for availing of a loan, benefits of availing a loan against your lic policy, lic policies that offer loans against a policy.

LIC offers quite a few policies that provide a loan facility. If you have one of the below-mentioned policies, you can avail for a loan by keeping your policy value as collateral. Let us find out which policies are eligible for this benefit:

You can avail of a loan against your policy if you have any of the above policies. That being said, loans are available after the policyholder has completed 1-3 premium paying years.

You can apply for a loan in 2 ways, offline and online. Let us lay down both loan application processes for you.

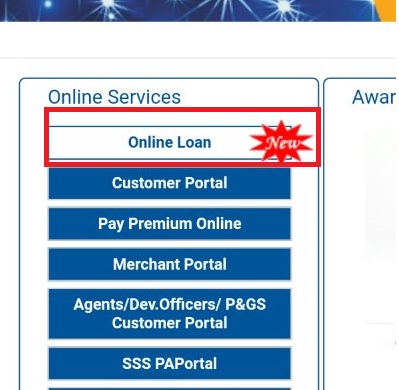

Online loan application

Step 1: register or log in through lic e-services portal.

If you have not registered on LIC e-services , you can view our LIC registration and LIC login guide. They will show you how you can easily register and log in to your LIC e-services account.

Step 2: Check if your policy is eligible to receive a loan

Step 3: check the interest rate of the loan, step 4: check the available loan amount, step 5: apply for the loan, offline loan application.

You can also visit your nearest LIC branch and apply for a loan. Upon visiting, you can request the office to hand over a loan application form. Kindly fill in the form and attach your KYC details. Once done, hand over the form to the officer. He will get back to you at your registered phone number.

The following documents are required on your part if you wish to apply for a loan:

- Original policy bond

- Aadhar card

- Bank account statement

- Driver’s license

- Duly filled loan application form

The following are the eligibility criteria for availing of a loan with LIC

- The policyholder must be an Indian.

- The policyholder must be over 18 years of age.

- The policyholder must have a running LIC policy.

- The policyholder must have paid policy premium for 1-3 years (certain policies provide a loan if the policyholder has paid the first year’s premium, certain policies require that the policyholder has paid at least 3 years premium)

No credit score: You will not require a credit score to avail a LIC loan. The loan value will simply depend on your policy surrender value. The higher the surrender value, the higher the loan you can avail of.

Comparatively low-interest rates: As LIC is a government organization and majorly exists for the welfare of Indians, the interest rates charged by LIC are comparatively lower compared to private and public sector banks. LIC usually charges a 9%-11% interest rate on their loans.

Fast and easy processing: The loan processing is generally done very quickly as LIC already has all the details that they need with them. Online and offline loan processing will be done swiftly.

Flexible loan repayment: You can repay your loans via flexible bite-sized EMIs.

Loan on 90% of surrender value: You can apply for a loan up to 90% of your policy’s surrender value.

Related articles

LIC Jeevan Akshay 7 (An Annuity Policy that Secures Your Future)

LIC vs Mutual Funds- Understanding the Difference

Features and Benefits of LIC Varishtha Pension Bima Yojana

LIC Jeevan Umang Plan- The Dual Benefit Policy

Experience the power of Artificial Intelligence (A.I)

Chat with our super-intelligent A.I model and ask it anything about insurance and related products.

- Business arrow

- Corporate General Insurance

- Group Health Insurance

- Group Life Insurance

- Mutual Funds

- Stock and Securities

- Portfolio Management Services

- Pension Funds

- Corporate Finance

- Mortgage Finance

- Loans Against Securities

- DCM & Loan Syndication

- ABC of Money

- Life Insurance Advisors

- Health Insurance Advisors

- Mutual Funds Advisors

- Stocks & Securities Advisors

- Home Finance Advisors

- Personal Finance Advisors

- Select Advisor

- Careers arrow

- Life Insurance

- Health Insurance

- Multiply Wellness

- Motor Insurance

- Travel Insurance

- Real Estate Investments

- Home Finance

- Personal Finance

- SME Finance

- Loan Against Securities

- ABC Of Calculators

- Footer Navigation

- Customer Services

- Our Solutions

- Advisor Lead

- Our Business

- Our Achievements

- CSR & Sustainability

- Investor Relations

- Press and Media

- Privacy Policy

- Terms and Conditions

Everything about getting a Loan Against a Life Insurance Policy

Posted on 02 June 2020 Updated on 22 June 2023

Some of the Important Features of a Loan Against Life Insurance Policy

- The interest rate applied on a loan against a life insurance policy depends on the applicant's profile.

- The interest rate for a loan against a life insurance policy is relatively low. Any loan taken from a bank has an interest rate of 12 to 14%. While the interest rate of personal loans availed through a life insurance policy is 10.5% to 12.5%.

- To avail of the loan, the life insurance policy has to be surrendered to the bank, the lender or an insurance company. The loan amount is given as an advance on the policy's surrender value.

- This loan is given only to the person having a life insurance policy. It is not given to a person holding any other term insurance plans.

- The interest rate for a loan against a life insurance policy is relatively low. The interest rate of personal loans taken from banks is between 12 to 14%. While the interest rate of personal loans availed through a life insurance policy is 10.5% to 12.5%.

- The loan amount depends on the surrender value of the life insurance policy. Usually, the loan amount is 90% of the policy value.

- Defaulters will not get the maturity amount since this policy is held as collateral and will be terminated. It happens when the loan debt exceeds the policy's surrender value.

- If the policy matures before the completion of the loan, then the insurance company deducts the difference amount from the maturity amount and the loan that is still pending. After these deductions, the maturity amount is handed to the policyholder.

- A loan taken against a life insurance policy is helpful for those with a low credit score (it reflects the creditworthiness of a person). However, having a good credit score will be an added advantage. It can help in reducing the rate of interest charged on this loan.

- Since the applicant already has a life insurance policy which will be kept as collateral, there is no further need for any additional documentation to prove if the person is eligible for the loan or not. Essential documents for KYC(Know Your Customer), like identity cards, residence proof, etc., are sufficient. Mobile numbers and email IDs are also required to provide updates for the loan application.

- However, the original life insurance policy has to be submitted to the lender along with a letter agreeing to the terms and conditions of the lender, bank or insurance company.

Eligibility Criteria for Availing a Loan Against Life Insurance Policy

- The applicant for this loan should not be less than 21 years of age.

- The applicant should be an Indian citizen.

- The applicant can either be a salaried person or a self-employed person.

- The person must have a life insurance policy in their name.

- This policyholder, who is also an applicant for a loan, must have a regular source of income.

- Some banks are particular about the minimum amount of insurance policy that has to be taken by the applicant. Most lenders and insurance companies do not have any issue with the minimum amount of the life insurance policy.

Benefits of Taking a Loan Against Life Insurance Policy

- A loan taken against a life insurance policy is a hassle-free process. It requires minimal documentation and is usually approved instantly. The chances of the loan getting rejected are next to none.

- A loan against a life insurance policy is helpful for those with a low credit score. The credit score is usually checked for people who apply for a loan, which reflects a person's creditworthiness.

- Since the applicant already has a life insurance policy that will be kept as collateral, there is no further need for any documentation to prove whether the person is eligible for the loan.

- In case of the policyholder's demise during the loan tenure, the policy amount is given to the nominee after deducting the loan amount.

Documents Required for Loan Against Life Insurance Policy

- A loan application form : All the relevant information must be provided here. This information is personal and residential details. The applicant should also submit bank details and contact details.

- The original life insurance policy document has to be submitted. The original life insurance policy is kept as collateral by the lender.

- A signed agreement states that the policyholder assigns the life insurance policy to the lender against a loan. It can be kept as collateral for the loan disbursed by the lender or the bank.

The Rate of Interest Against a Life Insurance Policy

The loan amount that a person can get on a life insurance policy, loan application against a life insurance policy, for the direct method:, for online loan application:, repayment of the loan taken against life insurance policy, disadvantages of taking a loan against a life insurance policy, type of policy:, smaller loan amount in the initial years:, the waiting period:, default in repayment will result in policy lapse:, conclusion:, faqs – frequently asked questions, is it compulsory to have a life insurance policy to avail of a loan insurance policy , how much loan amount is given to the person having a life insurance policy , what does one mean by surrender value concerning the insurance policy , what are the disadvantages of taking a loan against a life insurance policy , is it a good idea to take a loan against a life insurance policy .

The information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product. Aditya Birla Capital Group is not liable for any decision arising out of the use of this information.

For Expert Advice on the Right Money Solutions, leave your details below...

I agree to the Terms & Conditions

*All fields are mandatory.

About Aditya Birla Capital

Aditya Birla Capital (‘ the Brand ’) is the single brand for financial services business of Aditya Birla Group. The trade logo “Aditya Birla Capital” and the URL www.adityabirlacapital.com is owned by Aditya Birla Management Corporation Private Limited (trade mark owner) and the same is used herein under the License by Aditya Birla Capital Limited (ABCL) and its subsidiary companies (collectively hereinafter referred to as “ ABC Companies ”). Aditya Birla Capital Limited is the holding company of all financial services businesses.

www.adityabirlacapital.com (“the Website ”) is maintained and run by Aditya Birla Financial Shared Services Limited (having its registered office at 18 th Floor, One India bulls Centre, Tower 1, Jupiter Mills Compound, Senapati Bapat Marg, Elphinstone Road, Mumbai- 400013). The information available on www.adityabirlacapital.com relates either to ABCL and/ or ABC Companies under all associated web pages/ sites which are linked to www.adityabirlacapital.com (“hereinafter referred as the Website ”).

All of the ABC Companies have their own separate legal identities and webpages (details about which are embedded in their respective web pages/sites) but in this Website they may sometimes use "Group", "we" or "us" when we refer to ABC Companies in general or where no useful purpose is served by identifying any particular ABCL Affiliate.

Terms and Conditions and Acceptance

Please read these Terms and Conditions (“ Terms of Use ”) carefully. Your Acceptance of the Terms of Use contained herein constitutes the Agreement for the Purpose as defined hereunder. The Acceptance of Terms of Use will be between You and Aditya Birla Financial Shared Services Limited (hereinafter referred as “ Facilities Provider ”) which is facilitating provision of the services, other than those which are otherwise specifically provided by each of the ABC Companies on their respective web pages / sites to you.

By accessing and using this Website you have confirmed that you have read, understood and bound yourself by these Terms of Use. These Terms of Use shall apply to the access and use of the Website and all associated web pages/ sites which are linked with www.adityabirlacapital.com (“ Website ”). You will be subject to the rules, guidelines, policies, terms, and conditions applicable to any facilities that are provided by this Website and all associated web pages/ sites and they shall be deemed to be incorporated into these Terms of Use and shall be considered as part and parcel of these Terms of Use.

In terms of the information Technology Act, 2000 (as amended from time to time), this document is an electronic record. By accessing the Website and availing for facilities on the Website, the users (hereinafter referred to as " you ", or " your ") agree to be bound by these Terms of Use, the legal disclaimer (‘ Legal Disclaimer ’) and the Privacy Policy (“ Privacy Policy ”), as posted on the Website.

This Agreement describes the terms governing the usage of the facilities provided to you on the Website. Clicking "I Agree" to "Terms & Conditions", shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000. Your continued usage of the facilities from time to time would also constitute acceptance of the Terms of Use including any updation or modification thereof and you would be bound by this Agreement until this Agreement is terminated as per provisions defined herein.

Your electronic consent, accepting these Terms of Use, represents that you have the capacity to be bound by it, or if you are acting on behalf of any person, that you have the authority to bind such person.

You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. All of the ABC Companies may have their own individual web pages/sites which are owned by the respective ABC Companies and the facilities offered by the respective ABC Companies will be governed in accordance with the terms and conditions posted of those web pages/websites which you would be bound while availing the facilities/services of the said respective ABC Companies through their respective web pages / sites or otherwise in any other mode as the case may be.

Changes to the Terms of Use

You agree that these Terms of Use may be subject to change/modification for such reason as it may deem fit and proper, including but not limited to comply with changes in law or regulation, correct inaccuracies, omissions, errors or ambiguities, reflect changes in the process flow, scope and nature of the services, company reorganisation, market practice or customer requirements. Upon any change, the updated Terms of Use will be updated on the Website or any other means. Your continued use of the facilities on this Website constitutes acceptance of the changes and an Agreement to be bound by Terms of Use, as amended. You can review the most current version of the Terms of Use at any time, by clicking the Terms & Conditions link on the Website. No fee of whatsoever nature is to be charged for the use of this Website.

If you do not agree with any of these Terms of Use, you may not use this Website.

Authorisation to Facilities Provider

Whenever consent has been obtained/provided by you in any mode under these Terms and Conditions, for availing information/services related to ABC Companies, You agree and authorize the Facilities Provider to share/transfer/transmit your personal information with its ABC Companies and other third parties, in so far as required for offering of facilities through this Website and for analytical / marketing purposes /report generations and/or to offer connected facilities on the Website and may also include transfer/sharing/transmitting of sensitive personal data or information only if it is deemed necessary for the performance of facilities and to provide you with various value added and ancillary facilities/services and information, to aid you in managing your money needs in the manner agreed under these Terms and Conditions and the privacy policy. You agree to receive e-mails/SMS/phone calls and such other mode as permitted under law from the Facilities Provider or ABC Companies or its third-party service providers regarding the facilities updates, information/promotional offer and/or new product announcements and such other related information.

You also agree and authorize ABC Companies / its third-party service providers to contact you at the contact information provided for service related communication relating to your product or facilities offered even if your number is in National Do Not Call Registry.

You have the option to withdraw the said consent in the manner specified under these Terms of Use. Please also read the Privacy Policy for more information and details as provided on the Website. The Privacy Policy may be updated from time to time. Changes will be effective upon posting of the revised Privacy Policy on the Website.

One ID at Aditya Birla Capital

You can create a unique ID on the Website for managing and transacting all financial and non financial transactions with ABC Companies. One ID enables you to have a single login ID for viewing and transacting all your product and service needs across ABC Companies. One ABC ID can be created by you on the Website or any of the webpage of ABC Companies (Account.ABC.com sign up page.) by using your e-mail Id and login credentials as registered with the respective ABC Companies while availing the products / services and completing the authentication procedure in the manner specified at the time of creation of One ID.

Once you have created ONE ID you can link and view all your financial products held with ABC Companies on single web page through verification / authentication procedure as applicable to your account/financial products held with the respective ABC Companies.

You may choose not to create One ID in which case you will not be able to display all your products across ABC Companies on one page. In circumstances like duplicate email id/phone number you may not be able to create the One ID. In such circumstances you must contact the ABCL Affiliate with whom you have held the product/availed the services to enable update the email id/phone number.

In case you forget the username or password, you can reset the same using the forgot username and password link available on the Website and completing the authentication procedure specified on the Website.

MoneyForLife Planner

To help you for your money needs you can avail the facility of MoneyForLife Planner ( ‘MoneyForLife Planner/ Planner ’). MoneyForLife Planner facility is powered by Aditya Birla Money Limited, a subsidiary of ABCL. MoneyForLife Planner provides an indicative assessment of your money needs based on the factors like income, age, family members and their future, your future money requirements and current lifestyle status as per details filled in by you on the online questionnaire. The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you. The results provided by the Planner are generic in nature and do not necessarily reflect the actual investment profile that you may hold and it is not necessary for you to act on it. The Planner provides a generic indication of your money needs to enable you to prioritize your investment needs which are rule based. Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive.

No fee or consideration or economic benefit either directly or indirectly is associated for availing the assessment through MoneyForLife Planner and therefore it is not to be considered as an investment advice or financial planning and / or investment advisory services.

You agree and understand that use of MoneyForLife Planner does not assure attainment of your investment objectives and there is no assurance that the money objectives will be achieved, as the same is subject to performance of the securities, the forces affecting the securities market and your risk profile. You are advised to consult an investment advisor in case you would like to undertake financial planning and / or investment advice for meeting your investment requirements.

You also agree that risks associated with any investment would be entirely yours and you would not hold ABCL and/or ABC Companies or any of its employees liable for any losses that may arise on account of any investments under taken basis the use of MoneyForLife Planner.

All investment decisions shall be taken by you in your sole discretion. You are advised to read the respective offer documents carefully for more details on risk factors, terms and conditions before making any investment decision in any scheme or products or securities or loan product. All investments in any product / fund / securities etc. will be on the basis, subject to and as per the terms and conditions of the specific product’s / fund’s / security’s offer document, key information memorandum, risk disclosure document, product or sales brochure or any other related documents which are offered by the respective issuer of such product/securities. You can use execution platform/services with any third party as deem fit and proper, and there is no compulsion to use the execution services through this Website.

Not an Investment Advisor, Planner, Broker or Tax Advisor

The facilities on the Website are not intended to provide any legal, tax or financial or securities related advice. You agree and understand that the Website is not and shall never be construed as a financial planner, financial intermediary, investment advisor, broker or tax advisor. The facilities are intended only to assist you in your money needs and decision-making and is broad and general in scope. Your personal financial situation is unique, and any information and advice obtained through the facilities may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your advisor or other financial advisers who are fully aware of your individual circumstances. For more details, please also refer to the Legal Disclaimers provided on the Website.

Financial Solutions

We may provide you with various money solutions and options which are generally available basis your investment profile or those which are generally held by persons of similar investment profile. You authorize us to use/disseminate the information to provide the Financial Solutions however it is not necessarily for you to act on it. It only serves an indicative use of information which you may execute in the manner agreed by you.

Password Protection

You shall not be entitled to avail the facilities without the use of a user name and password. You are responsible for maintaining the confidentiality of your password and Account, and you shall not allow anyone else to use your password at any time. You are fully responsible for all activities that occur using your password or Account. You are requested to please notify www.adityabirlacapital.com immediately of any unauthorized use or access of your password or Account, or any other breach of security. The Website will not be liable for any loss that you may incur as a result of someone else using your password or account, either with or without your knowledge.

Intellectual Property Rights

This Website contains information, materials, including text, images, graphics, videos and sound (“ Materials ”), which is protected by copyright and/or other intellectual property rights. All copyright and other intellectual property rights in these Materials are either owned by ABCL or have been licensed to Facilities Provider, ABCL / ABC Companies by the owner(s) of those rights so that it can use these Materials as part of this Website. Other than those Materials which belong to Third Parties, ABC Companies retains copyright on all Information, including text, graphics and sound and all trademarks displayed on this Website which are either owned by or licensed to by ABCL and/or used under license by ABC Companies.

You shall not (a) copy (whether by printing off onto paper, storing on disk, downloading or in any other way), distribute (including distributing copies), download, display, perform, reproduce, distribute, modify, edit, alter, enhance, broadcast or tamper with in any way or otherwise use any Materials contained in the Website. These restrictions apply in relation to all or part of the Materials on the Website; (b) copy and distribute this information on any other server or modify or re-use text or graphics on this system or another system. No reproduction of any part of the Website may be sold or distributed for commercial gain nor shall it be modified or incorporated in any other work, publication or web site, whether in hard copy or electronic format, including postings to any other web site; (c) remove any copyright, trade mark or other intellectual property notices contained in the original material from any material copied or printed off from the web site; link to this Website; without our express written consent.

No Warranty

Although all efforts are made to ensure that information and content provided as part of this Website is correct at the time of inclusion on the Website, however there is no guarantee to the accuracy of the Information. This Website makes no representations or warranties as to the fairness, completeness or accuracy of Information. There is no commitment to update or correct any information that appears on the Internet or on this Website. Information is supplied upon the condition that the persons receiving the same will make their own determination as to its suitability for their purposes prior to use or in connection with the making of any decision. Any use of this Website or the information is at your own risk. Neither ABCL and ABC Companies, nor their officers, employees or agents shall be liable for any loss, damage or expense arising out of any access to, use of, or reliance upon, this Website or the information, or any website linked to this Website.

No Liability

This Website is provided to you on an "as is" and "where-is" basis, without any warranty. ABCL, for itself and any ABC Companies and third party providing information, Materials (defined later), facilities, or content to this Website, makes no representations or warranties, either express, implied, statutory or otherwise of merchantability, fitness for a particular purpose, or non-infringement of third party rights, with respect to the website, the information or any products or facilities to which the information refers. ABCL will not be liable to you or any third party for any damages of any kind, including but not limited to, direct, indirect, incidental, consequential or punitive damages, arising from or connected with the site, including but not limited to, your use of this site or your inability to use the site, even if ABCL has previously been advised of the possibility of such damages. Any access to information hosted on third party websites of billers/banks/merchants/ABC Companies etc. is not intended and shall not be treated as an offer to sell or the solicitation of an offer to buy any product/offering of these ABC Companies or third parties.

The Facilities Provider or ABCL or ABC Companies shall have absolutely no liability in connection with the information and Material posted on this Website including any liability for damage to your computer hardware, data, information, materials, or business resulting from the information and/or Material or the lack of information and/or Material available on the Website. In no event shall ABCL or ABC Companies shall be liable for any for any special, incidental, consequential, exemplary or punitive damages for any loss, arising out of or in connection with (a) the use, misuse or the inability to use this Website; (b) unauthorized access to or alteration of your transmissions or data; (c) statements or conduct of any third party on the site; or (d) any other matter whatever nature relating to this Website.

Further, the Facilities Provider cannot always foresee or anticipate technical or other difficulties. The facilities may contain errors, bugs, or other problems. These difficulties may result in loss of data, personalization settings or other facilities interruptions. The Website does not assume responsibility for the timeliness, deletion, mis-delivery, or failure to store any user data, communications, or personalization settings.

The Facilities Provider, ABCL, ABC Companies and the providers of information shall not be liable, at any time, for any failure of performance, error, omission, interruption, deletion, defect, delay in operation or transmission, computer virus, communications line failure, theft or destruction or unauthorized access to, alteration of, or use of information contained at this Website.

Manner of Use of Personal Information

All Personal Information including Sensitive Personal Information provided/related to you, shall be stored/used/processed/transmitted expressly for the Purpose or facilities indicated thereon at the time of collection and in accordance with the Privacy Policy. Other than those otherwise indicated and agreed by You, this Website do not collect or store or share your Personal Information. Aditya Birla Capital is the brand and accordingly all products and facilities are provided by respective ABC Companies as applicable. Therefore, for any of these Purposes, the Website will use ABC Companies their authorized third party vendors, agents, contractors, consultants or facilities providers (individually a ‘ Third Party Service Provider ’ and collectively, the “ Third Party Service Providers ”) and to that extent you understand and authorize the Facilities Provider to share/transmit such information to Third Party Service Providers. Such sharing of information will be solely for the purpose to fulfill / complete / authenticate your specific requests/transaction execution and for providing information about any ABC Companies product or facilities or services or for data analytics or to deliver to you any administrative notices, alerts or communications relevant to your Purpose (and which may include sending promotional emails or SMS or calls or any other mode permitted under law) or to analyze the usage and improve the facilities/solutions offered or for any research or troubleshooting problems, detecting and protecting against errors or to improve features, tailor the facilities on the Website to your interests, and to get in touch with you whenever necessary.

Except in the manner as stated in the Privacy Policy, the Website will not disclose your Personal Information with any affiliated or unaffiliated third parties,

You may receive e-mails /communications/notifications from the Third Party Services Providers regarding facilities updates, information/promotional e-mails/SMS and/or update on new product announcements/services in such mode as permitted under law.

Use of Website in India

This Website is controlled and operated from India and there is no representation that the Materials/information are appropriate or will be available for use in other locations. If you use this Website from outside the India, you are entirely responsible for compliance with all applicable local laws. There is no warranty or representation that a user in one region may obtain the facilities of this website in another region.

Information published on the Website may contain references or cross references to products, programs and facilities offered by ABC Companies/third parties that are not announced or available in your country. Such references do not imply that it is intended to announce such products, programs or facilities in your country. You may consult your local advisors for information regarding the products, programs and services that may be available to you.

In your use of the Website, you may enter correspondence with, purchase goods and/or facilities from, or participate in promotions of advertisers or members or sponsors of the web site, including those of ABC Companies. Unless otherwise stated, any such correspondence, advertisement, purchase or promotion, including the delivery of and the payment for goods and/or facilities, and any other term, condition, warranty or representation associated with such correspondence, purchase or promotion, is solely between you and the applicable ABC Companies and/or third parties.

You agree that Facilities Provider / ABC Companies has no liability, obligation or responsibility for any such correspondence, purchase or promotion between you and any other ABC Companies and/or third parties.

Third party websites

This Website may be linked to other websites (including those of ABC Companies) on the World Wide Web that are not under the control of or maintained by ABCL. Such links do not indicate any responsibility or endorsement on our part for the external website concerned, its contents or the links displayed on it. These links are provided only as a convenience, in order to help you find relevant websites, facilities and/or products that may be of interest to you, quickly and easily. It is your responsibility to decide whether any facilities and/or products available through any of these websites are suitable for your purposes. The Facilities Provider or ABCL is not responsible for the owners or operators of these websites or for any goods or facilities they supply or for the content of their websites and does not give or enter into any conditions, warranties or other terms or representations in relation to any of these or accept any liability in relation to any of these (including any liability arising out of any claim that the content of any external web site to which this web site includes a link infringes the intellectual property rights of any third party).

In case any facilities/services, access/dissemination of information or execution of transaction is done through use of any APP related to ABC Companies, the additional terms and conditions governing the Use of APP shall be applicable and to be read along these Terms of Use.

Postings and monitoring

The Facilities Provider or ABCL or ABC Companies does not routinely monitor your postings to the Website but reserves the right to do so if deemed necessary if it is related to the facilities offered on the web site and to comply with law. However, in our efforts to promote good citizenship within the internet community, if the Facilities Provider or ABCL or ABC Companies becomes aware of inappropriate use of the Website or any of its facilities, any information, opinions, advice or offers posted by any person or entity logged in to the Website or any of its associated sites is to be construed as public conversation only, and the Facilities Provider or ABC Companies shall not be liable or responsible for such public conversation. You agree that in such cases, we will respond in any way that, in our sole discretion, as deemed appropriate. You acknowledge that Facilities Provider or ABC Companies will have the right to report to law enforcement authorities any actions that may be considered illegal, as well as any information it receives of such illegal conduct. When requested, ABC Companies/Facilities Provider will co-operate fully with law enforcement agencies in any investigation of alleged illegal activity on the internet.

Submissions and unauthorized use of any Materials contained on this Website may violate copyright laws, trademark laws, the laws of privacy and publicity, certain communications statutes and regulations and other applicable laws and regulations. You alone are responsible for your actions or the actions of any person using your user name and/or password. As such, you shall indemnify and hold Facilities Provider, ABCL / ABC Companies and its officers, directors, employees, affiliates, agents, licensors, and business partners harmless from and against any and all loss, costs, damages, liabilities, and expenses (including attorneys' fees) incurred in relation to, arising from, or for the purpose of avoiding, any claim or demand from a third party that your use of the Website or the use of the Website by any person using your user name and/or password (including without limitation your participation in the posting areas or your submissions) violates any applicable law or regulation, or the rights of any third party.

We reserve the right to terminate access to this Website at any time and without notice. Further this limited license terminates automatically, without notice to you, if you breach any of these Terms of Use. Upon termination, you must immediately destroy any downloaded and printed Materials.

If you come across any breaches/violation or offensive material you must report to us at [email protected]

Use of Cookies

You agree and understand that the Website will automatically receive and collect certain anonymous information in standard usage logs through the Web server, including computer/computer resource-identification information obtained from "cookies" sent to your browser from a web server or other means as explained in the Privacy Policy.

Facilities Changes and Discontinuation

The Website reserves the right to discontinue or suspend, temporarily or permanently, the facilities. You agree that the Facilities Provider/ ABC Companies will not be liable to you in any manner whatsoever for any modification or discontinuance of the facilities. The format and content of this Website may change at any time. We may suspend the operation of this Website for support or maintenance work, in order to update the content or for any other reason.

ABCL, ABC Companies, and its directors, employees, associates, or other representatives shall not be liable for any damages or injury, arising out of or in connection with the use, or non-use including non-availability of the Website and also for any consequential loss or any damages caused because of non-performance of the system due to a computer virus, system failure, corruption of data, delay in operation or transmission, communication line failure, or any other reason whatsoever. The Website will not be responsible for any liability arising out of delay in providing any information on the Website.

Compliance with the Law

You agree that you will not:

- Use any robot, spider, scraper, deep link or other similar automated data gathering or extraction tools, programme, algorithm or methodology to access, acquire, copy or monitor the Website, or any portion of the Website.

- Use or attempt to use any engine, software, tool, agent, or other device or mechanism (including without limitation, browsers, spiders, robots, avatars or intelligent agents) to navigate or search the Website, other than the search engines generally available by third party web browsers

- Post or transmit any file which contains viruses, worms, Trojan horses or any other contaminating or destructive features, or that otherwise interferes with the proper working of the Website or the facilities.

- Attempt to decipher, decompile, disassemble, or reverse engineer any of the software, comprising or in any way making up a part of the Website or the facilities.

- You agree not to use the facilities for illegal purposes or for the transmission of material that is unlawful, harassing, libelous (untrue and damaging to others), invasive of another's privacy, abusive, threatening, or obscene, or that infringes the rights of others.

Restrictions on Commercial Use or Resale

Your right to use the facilities is personal to you; therefore, you agree not to resell or make any commercial use of the facilities. In addition, the Website welcomes your feedback as a user of the facilities. Any feedback you provide will become the confidential and proprietary information of the Website, and you agree that the Website may use in any manner and without limitation, all comments, suggestions, complaints, and other feedback you provide relating to the Website. The Website shall have a worldwide, royalty-free, non-exclusive, perpetual, and irrevocable right to use feedback for any purpose, including but not limited to incorporation of such feedback into the Website or other Website software or facilities.

No Endorsements

All product and facilities marks contained on or associated with the facilities that are not the Website marks are the trademarks of their respective owners. The Website would require you to respect the same. References to any such names, marks, products or facilities of third parties or hypertext links to third party sites or information does not imply the Website’s endorsement, sponsorship or recommendation of the third party, information, product or facilities.

Promotional Offers

You may receive from time to time, announcement about offers with intent to promote this Website and/or facilities/products of ABC Companies (“ Promotional Offers ”). The Promotional Offer(s) would always be governed by these Terms of Use plus certain additional terms and conditions, if any prescribed. The said additional terms and conditions, if prescribed, would be specific to the corresponding Promotional Offer only and shall prevail over these Terms of Use, to the extent they may be in conflict with these Terms of Use. The Website reserves the right to withdraw, discontinue, modify, extend and suspend the Promotional Offer(s) and the terms governing it, at its sole discretion.

Charges for use of Website

There are no charges or fees to be paid by you for use of this Website. However, you are responsible for all telephone access fees and/or internet service fees that may be assessed by your telephone and/or internet service provider. You further agree to pay additional charges, if any levied by Third Party Service Provider(s), for the facilities provided by them through the Website (Additional Charges).

No Endorsement

You are advised to be cautious when browsing on the internet and to use good judgment and discretion when obtaining information or transmitting information. From this Website, users may visit or be directed to third party web sites. The Website makes no effort to review the content of these web sites, nor is the Website or its licensors responsible for the validity, legality, copyright compliance, or decency of the content contained in these sites.

In addition, the Website does not endorse or control the content of any other user and is not responsible or liable for any content, even though it could be unlawful, harassing, libelous, privacy invading, abusive, threatening, harmful, vulgar, obscene or otherwise objectionable, or that it infringes or may infringe upon the intellectual property or other rights of another. You acknowledge that the Website does not pre-screen content, but that the Website will have the right (but not the obligation) in their sole discretion to refuse, edit, move or remove any content that is available via the facilities.

Electronic Communications

These Terms of Use and any notices or other communications regarding the Facilities may be provided to you electronically, and you agree to receive communications from the Website in electronic form. Electronic communications may be posted on the Website and/or delivered to your registered email address, mobile phones etc either by Facilities Provider or ABC Companies with whom the services are availed. All communications in electronic format will be considered to be in "writing". Your consent to receive communications electronically is valid until you revoke your consent by notifying of your decision to do so. If you revoke your consent to receive communications electronically, the Facilities Provider shall have the right to terminate the facilities.

You shall not assign your rights and obligations under this Agreement to any other party. The Website may assign or delegate its rights and/or obligations under this Agreement to any other party in future, directly or indirectly, or to an affiliated or group company.

Legal Disclaimers

The information provided on or through the Website is for general guidance and information purposes only and they do not in any manner indicate any assurance or opinion of any manner whatsoever. Any information may be prone to shortcomings, defects or inaccuracies due to technical reasons. Certain information on Website may be on the basis of our own appraisal of the applicable facts, law and regulations in force at the date hereof.

The information (and opinions, if any) contained on the Website may have been obtained from public sources believed to be reliable and numerous factors may affect the information provided, which may or may not have been taken into account. The information provided may therefore vary (significantly) from information obtained from other sources or other market participants. Any reference to past performance in the information should not be taken as an indication of future performance. The information is dependent on various assumptions, individual preferences and other factors and thus, results or analyses cannot be construed to be entirely accurate and may not be suitable for all categories of users. Hence, they should not be solely relied on when making investment decisions. Your investment or financial decision shall always be at your own discretion and based on your independent research; and nothing contained on the Website or in any information would construe ABCL/ABC Companies or any of its employees/authorized representative as having been in any way involved in your decision making process. Any information and commentaries provided on the Website are not meant to be an endorsement or offering of any stock or investment advice.

Nothing contained herein is to be construed as a recommendation to use any product, process, equipment or formulation, in conflict with any patent, or otherwise and Facilities Provider / ABCL/ABC Companies makes no representation or warranty, express or implied that, the use thereof will not infringe any patent, or otherwise. Information on this Website sourced from experts or third party service providers, which may also include reference to any ABCL Affiliate. However, any such information shall not be construed to represent that they belong or represent or are endorsed by the views of the Facilities Provider or ABC Companies. Any information provided or sourced from ABCL Affiliate belongs to them. ABCL is an independent entity and such information from any ABCL Affiliate are not in any manner intended or to be construed as being endorsed by ABCL or Facilities Provider. The information does not constitute investment or financial advice or advice to buy or sell, or to endorse or solicitation to buy or sell any securities or other financial instrument for any reason whatsoever. Nothing on the Website or information is intended to constitute legal, tax or investment advice, or an opinion regarding the appropriateness of any investment or a solicitation of any type. Investment in the securities market and any financial instruments are inherently risky and you shall always assume complete and full responsibility for the outcomes of all the financial or investment decisions that you make, including but not limited to loss of capital. You are therefore advised to obtain your own applicable legal, accounting, tax or other professional advice or facilities before taking or considering an investment or financial decision.

No Solicitation

No Information at this Website shall constitute an invitation to invest in ABCL or any ABC Companies. These are meant for general information only or to meet statutory requirements or disclosures. ABCL or any of its employees are in no way liable for the use of the information by you, when making any decision or investing or trading through any investment vehicles or ABC Companies, or any other third party which may be engaged in offering of these services.

The information contained on this Website does not represent and should not be used to construe (i) the terms on which a new transaction would be entered into by ABCL or ABC Companies, (ii) the terms on which any existing transactions could be unwound by ABCL or ABC Companies, (iii) the calculation or estimate of an amount that would be payable following an early termination of any past/existing transactions or (iv) the valuations given to any transactions by ABCL or ABC Companies in their books of account for financial reporting, credit or risk management purposes.

Statutory Disclosure

ABCL and ABC Companies are engaged in a broad spectrum of activities in the financial services sectors. You understand and acknowledge that Aditya Birla Money Limited (‘ ABML ’), Aditya Birla Finance Limited (‘ ABFL ’) and Aditya Birla Sun Life Asset Management Company Limited and trustees and sponsor of Aditya Birla Sun Life Mutual Fund (‘ ABSLMF ’) are group companies and ABML / ABFL also acts as a distributor of ABSLMF. Any recommendation or reference of schemes of ABSLMF if any made or referred on the Website, the same is based on the standard evaluation and selection process, which would apply uniformly for all mutual fund schemes. You are free to choose the execution facilities in the manner deemed fit and proper and no commission will be paid by ABSLMF to ABML / ABFL if you choose to execute a transaction with ABSLMF on the Website, unless otherwise agreed by you and ABML/ABFL separately. Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website.