The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Internal audit

- Learn about internal audit

- Back to Learn about internal audit

- A brief guide to internal auditing

A brief guide to assignment planning

- A brief guide to assessing risks and controls

- A brief guide to assignment quality

- A brief guide to assignment reporting

- A brief guide to follow up

- A brief guide to relationship management

- A brief guide to audit governance

- A brief guide to standards and responsibility

- A brief guide to strategic audit planning and resourcing

- A brief guide to working with other providers

- A brief guide to audit committees

- Guidance for Heads of Internal Audit

- Guidance for Audit Committee Chairs on working with the Head of Internal Audit

- Introduction

- Standard 1100 Independence and objectivity

- Standard 2200 Engagement planning

- Standard 2300 Performing the engagement

- Standard 2400 Communicating results

- Standard 2050 Coordination and reliance

- Financial Reporting Council (FRC) International Standards on Auditing (UK)

- Benefits of coordination

- Facilitating coordination

- Guidance on auditing planning for Internal Audit

It takes careful planning to ensure all the key controls are in place and operating effectively for an audit to provide reasonable assurance.

Key controls reviewed as part of an internal audit must be operating effectively to provide reasonable assurance over the management of risk. It takes careful planning to ensure a thorough enough understanding of the risk environment to identify those key controls that need to be in place.

Effective assignment planning considers everything from the assessment of risk, work required, resources available and deadlines, to effective team and stakeholder engagement.

The key output of the planning stage is a terms of reference document clearly stating the scope, audit objectives/risks, resources, timing and ideally any prior information needs which will assist in the smooth delivery of the audit.

The advance warning of information needs also assists in reducing the pressure upon management when handling the impact of an internal audit while continuing with their day-to-day job, and alleviates some of the concerns occasionally raised by management when notified of an audit.

Your assessment of risk may include a review of:

- organisation / department / system objectives

- policy and procedural documentation

- risks, related risk appetite, exposure, acceptance and key controls as reported on risk registers / board assurance framework

- key risk indicators and key performance indicators

- organisation information from the intranet, material incidents reported, and self-assessment reports

- reports from risk oversight functions, external auditors, and regulators, etc

- previous audit reports, known weaknesses and progress on resulting actions

- management concerns and those of the audit team with their knowledge of that risk / area / process / system / legislation and regulation

- recent and planned changes such as key staff / systems / process / legislation and regulation / risk, etc

Your assessment of work required may include consideration of:

- volumes and values of transactions / budgets to determine sample size

- work locations and the number of business areas / senior managers involved

- the time it will take to create or update existing audit process / risk documentation

- whether reliance can be placed upon assurance provided and planned by other assurance providers

- testing methodology to be used - for example, whether it will be highly manual or employ computer-assisted audit techniques (CAATs)

- timing to achieve optimal assurance and internal reporting deadlines

Your assessment of resources may include:

- availability, experience, skills, specialist technical knowledge required and base location

- need for co-sourcing, availability, cost and budget available

- selection of a suitable person to lead the audit

Effective stakeholder engagement may include:

- an assessment of all likely stakeholders, including regulators

- face-to-face meetings with key stakeholders to understand their roles, recent and planned changes, their key drivers, their views and key concerns and for you to explain how the audit will be undertaken, by whom, when and to ‘sell’ the value of the assurance that’s being provided

- agreement over who in the business will ‘own’ the audit report

- agreement over how they wish to be updated on the progress and findings

Your assessment of limitations may include:

- limitation of any sampling methodology vs testing entire populations

- any limitations which may be placed upon your ability to fulfil your role, for example the absence of right to audit clauses in third party provider contracts

- exclusion of specific areas of scope, for example the technical IT security surrounding systems may be subject to another specialist IT audit

- statement re the limitations of audit and the provision of reasonable assurance

- statement re the approved budget for the assignment, especially if this is less than the internal audit team originally proposed to management and audit committee

- extent to which the validity of supporting documentation may be verified back to source

- statement re the responsibility for the operation of the system of internal control residing with management

The resulting terms of reference document should be circulated to key stakeholders, discussed and approach agreed with the auditee and ideally the senior management team member responsible for the area under review.

A clear terms of reference should provide guidance to the audit team in respect delivery, help ensure stakeholders have a common understanding of the assignment and assist manage any expectation gaps.

IIA IPPF Standard 2200 – engagement planning

IIA IPPF Standard 2300 – performing the engagement

Related links

- IIA global website

- IIA UK website

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

- Your Future

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

Audit Officer Salary

How much does an Audit Officer make? The average Audit Officer salary is $65,445 as of March 26, 2024, but the salary range typically falls between $60,102 and $71,926 . Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

Search Audit Officer Jobs

- View Hourly Wages

- Adjust Audit Officer Salary:

- Select State

- Select City

- Choose Similar Job

- Pick Related Category

- View Cost of Living in Major Cities

Analyze the market and your qualifications to negotiate your salary with confidence.

Search thousands of open positions to find your next opportunity.

Individualize employee pay based on unique job requirements and personal qualifications.

Get the latest market price for benchmark jobs and jobs in your industry.

Search Audit Officer Job Openings

What does an audit officer do.

View Job Skills and Competency Data for more than 15,000 Job Titles, 18 Industries, and 26 Job Families.

Our job description management tool- JobArchitect streamlines your job description process. Say goodbye to the hassle of crafting job descriptions.

Audit Officer Salary in Major Cities

Audit officer salary by state.

- Connecticut

- District of Columbia

- Massachusetts

- Mississippi

- North Carolina

- North Dakota

- New Hampshire

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Audit Officer Salary by City

Average salary range for audit officer, average base salary.

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View Average Salary for Audit Officer as table

Estimate salary for audit officer online for free.

- Select Relevant job experience

- Select person you report to

- Senior Management

- CEO / Board of Directors

- Select Level of education

- I have not earned a degree

- High School Diploma or Tech Certificate

- Associate's Degree

- Bachelor's Degree

- Master's Degree or MBA

- JD, MD, PhD or Equivalent

- Select number of people you manager

Similar Jobs to Audit Officer

Comments about audit officer, audit officer frequently asked questions.

Recently searched related titles: Hospital Education Specialist , Sewage Treatment Engineer , Internal Audit

Learn more about: Compensation Packages , Employee Flight Risk , Gender Pay Gap , Job Openings for This Role

Jobs with a similar salary range to Audit Officer : Retirement Community Director , Audit Principal , Mall Santa

Last Update: March 26, 2024

SSC CGL Assistant Audit Officer (AAO), Job Profile, Salary

SSC CGL Assistant Audit Officer profile is offered through the CGL Exam. SSC CGL AAO is highly sought-after and an attractive salary post. Explore the SSC CGL AAO Salary, Job Profile in this article.

January 12, 2024

Table of Contents

SSC CGL Assistant Audit Officer (AAO): The Assistant Audit Officer (AAO) stands as the most esteemed and lucratively compensated position introduced by SSC in 2016. Aligned with the India Audit & Accounts Department under CAG’s supervision, it represents the sole gazetted post by SSC with the highest salary. Aspiring candidates aim to secure this prestigious role, necessitating exceptional performance in both Paper 1 and Paper 2 of the SSC CGL exam to meet cut-off marks.

This article furnishes a comprehensive overview of the SSC CGL Assistant Audit Officer Salary and job profile, comprising work responsibilities, training, promotion avenues, work hours, and transfer details. Explore further for an in-depth understanding of the SSC CGL AAO post.

SSC CGL Assistant Audit Officer (AAO)

The SSC CGL Assistant Audit Officer is a Group B position within the Indian Audit & Accounts Department under C&AG, and uniquely, it’s the sole gazetted post filled through SSC CGL. The salary for this role falls within the range of INR 47,600 to 1,51,100. As an Assistant Audit Officer, responsibilities include supporting senior Audit officers in conducting audits and inspections, making sectional decisions, and contributing to report preparation.

SSC CGL ASO Full Form

The Staff Selection Commission administers the SSC CGL Exam , facilitating the recruitment of candidates for a range of Gazetted and Non-Gazetted Posts, including the role of Assistant Audit Officer (AAO). Introduced in 2016, AAO stands for Assistant Audit Officer.

SSC AAO Job Profile and Training

Despite being an entry-level Officer post, the Assistant Audit Officer holds immense popularity, primarily due to its status as the highest-paying position among all SSC CGL posts.

Upon recruitment, individuals undergo a 2-3 month training period before being assigned postings nationwide. AAOs play a crucial role by assisting Audit or Senior Audit Officers in conducting various departmental audits for Government organizations and Public Sector Companies. Responsibilities include making sectional decisions, preparing inspection reports, and reviewing department employees’ bills for allowances.

The job is a mix of desk and fieldwork, requiring travel for inspections and auditing. AAOs actively contribute to departmental efficiency improvements and, in case of transfers, may move to Tier 1 and Tier 2 cities.

SSC CGL Assistant Audit Officer Promotion and Career Growth

Candidates appointed as AAO through SSC CGL can attain promotions based on dedicated service over time. It’s crucial to note that the trajectory of promotions and career growth hinges on their diligence, hard work, and acquired skills.

SSC CGL AAO Salary

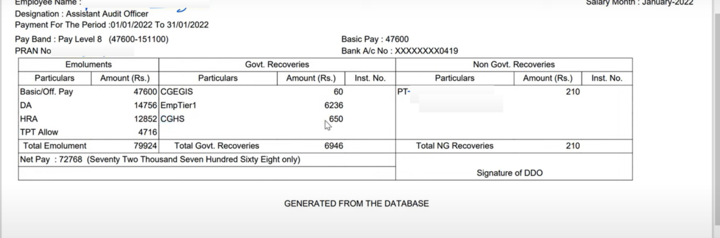

The Assistant Audit Officer’s salary corresponds to Pay Level 8, ranging from INR 47,600 to INR 1,51,100. At the minimum basic pay of INR 47,600, the total in-hand salary falls between 63,000-70,000. Detailed information about allowances and the salary structure is provided below.

SSC CGL AAO Salary Structure

SSC CGL AAO Salary Structure is as follows:

SSC CGL AAO Salary Slip

SSC CGL Assistant Audit Officer Allowances

Assistant Audit Officers enjoy a range of allowances and perks, some of which include:

1. Dearness Allowance 2. House Rent Allowance 3. Leave Travel Allowance 4. Children Education Allowance 5. Newspaper Allowance, etc.

SSC CGL Assistant Audit Officer (AAO) Work Timings

SSC AAO job profiles typically have fixed working hours, inducing a work-life balance. The role doesn’t exert excessive work pressure, and regular timings contribute to a comfortable work environment. Moreover, frequent travel is not a part of the routine, occurring only when inspections are necessary.

SSC CGL Job Location & Transfer

AAOs enjoy postings predominantly in Tier-1 and Tier-2 cities, sparing them from rural assignments. Transfers are typically within Tier-1 and Tier-2 cities, minimizing inconvenience for the employees.

SSC CGL AAO Eligibility Criteria

The SSC CGL AAO Eligibility Criteria comprises essential factors such as age limit, educational qualifications, and nationality. These criteria are tailored to each specific post. For the Assistant Audit Officer (AAO) position, the following eligibility requirements apply:

SSC CGL AAO Educational Qualification

Candidates aspiring for AAO in CSS should hold a Bachelor’s degree from any recognized university or its equivalent. Additional qualifications may be desirable for this post.

SSC CGL AAO Age Limit

The age limit for AAO in CSS ranges from 18 to 30 years. Certain categories receive upper age relaxations: OBC: 3 years SC/ST: 5 years PwD + Gen: 10 years PwD + OBC: 13 years PwD + SC/ST: 15 years Ex-Servicemen: 3 years (after deducting military service) Defence Personnel disabled in operations: 3 years Defence Personnel disabled in operations (SC/ST): 8 years

Meeting these criteria is crucial for candidates to ensure their eligibility and progression in the SSC CGL AAO recruitment process.

SSC CGL Assistant Audit Officer FAQs

Yes, AAO is the only gazetted post under SSC CGL which has the highest salary.

Yes, Is AAO a gazetted officer.

Vacancies for AAO for 2024 cycle are not released yet.

SSC CPO Tier 2 Answer Key 2023 Out, Download Answer Key PDF

HSSC CET Group D Result 2023 Out, Check Expected Cut Off, Marks

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

.st1{display:none} Related Articles

- List of Chief Ministers of Karnataka from 1947 to 2024, Check Now

- SSC CGL 3 Months Study Plan, Check Complete Plan for CGL

- List of Chief Ministers of Kerala From 1957-2024, Important Facts

- Chief Ministers of Maharashtra, Check List from 1960 To 2024

- One Word Substitution Examples, 200+ One Word Substitution

- Idioms and Phrases

- List of Chief Ministers of Bihar From 1946-2024, Important Facts

- List of Chief Ministers of Gujarat from 1960 to 2024, CM List

- List of Chief Ministers of Uttar Pradesh from 1950 to 2024

- SSC CGL Books, Check Complete Book List for All Subjects

FAC Number: 2024-03 Effective Date: 02/23/2024

42.102 Assignment of contract audit services.

(a) As provided in agency procedures or interagency agreements, contracting officers may request audit services directly from the responsible audit agency cited in the Directory of Federal Contract Audit Offices. The audit request should include a suspense date and should identify any information needed by the contracting officer .

(b) The responsible audit agency may decline requests for services on a case-by-case basis, if resources of the audit agency are inadequate to accomplish the tasks. Declinations shall be in writing .

Definitions

FAC Changes

Style Formatter

- Data Initiatives

- Regulations

- Smart Matrix

- Regulations Search

- Acquisition Regulation Comparator (ARC)

- Large Agencies

- Small Agencies

- CAOC History

- CAOC Charter

- Civilian Agency Acquisition Council (CAAC)

- Federal Acquisition Regulatory Council

- Interagency Suspension and Debarment Committee (ISDC)

ACQUISITION.GOV

An official website of the General Services Administration

SSC CGL Assistant Audit Officer (AAO): Salary Structure, Allowances, Job Profile And Career Prospects

The Staff Selection Commission Combined Graduate Level (SSC CGL) examination is a prestigious gateway for individuals seeking lucrative and fulfilling job opportunities in the government sector. Among the vast array of positions offered through SSC CGL, the role of Assistant Audit Officer (AAO) holds significant importance. It is under the control of the CAG’s India Audit & Accounts Department. As the SSC’s only gazetted position with the highest pay, this post attracts a lot of applicants.

For detailed information on SSC CGL Notification , click on the given link and go through the notification.

The SSC CGL Assistant Audit Officer position’s outstanding compensation package is just one of its alluring features. According to the 7th Pay Commission, AAOs earn a competitive compensation package that includes a range of benefits and allowances. In this comprehensive article, we will explore the salary, job profile, career progression, and job roles of an SSC CGL Assistant Audit Officer.

Aspirants must note that Assistant Audit Officer is the most reputed and highest-paid job profile introduced by SSC in 2016. The position of an AAO demands a keen eye for detail, strong analytical skills and a comprehensive understanding of financial management practices. As an AAO, one gets the opportunity to contribute to financial transparency, accountability and the efficient management of funds in government organisations.

The Staff Selection Commission through its official SSC exam calendar has announced the date for SSC CGL 2023 recruitment. Check the details in the linked article.

SSC CGL AAO Salary Structure

The salary structure of an SSC CGL Assistant Audit Officer (AAO) is highly attractive. AAOs fall under Level 8 (Rs. 47,600 – 1,51,100) of the 7th Pay Commission . Along with the basic pay, AAOs are entitled to various allowances, such as Dearness Allowance (DA), House Rent Allowance (HRA), Transport Allowance (TA), and other benefits as per government rules. These allowances further enhance the overall salary package, making it lucrative for aspirants.

The SSC CGL AAO post is classified as a Group B (Gazetted Post) and has a grade pay of Rs. 4800 . The basic pay for an AAO is Rs. 47,600, resulting in a salary range of Rs. 47,600 to Rs. 1,51,100. The AAO’s salary falls within the pay band 2, which ranges from Rs. 9300 to Rs. 34800.

The House Rent Allowance (HRA) provided to AAOs varies based on the category of the city they are posted in. The HRA rates are typically higher in metro cities compared to other locations. The exact rates for HRA can be referred to in the official SSC notifications and government guidelines.

For more information on the In-Hand salary of SSC CGL , check the linked article.

It’s important to note that the salary structure and allowances may be subject to revisions based on government policies and recommendations of future pay commissions. Candidates are advised to refer to the official SSC notifications for the most accurate and up-to-date information regarding the SSC CGL AAO salary structure.

The in-hand salary of an SSC CGL AAO ranges between Rs. 70,000 and Rs. 80,000 per month .

Candidates willing to appear for different exams and posts under the staff selection commission can check other details for the SSC exams in the linked article.

SSC CGL AAO: Allowances And Benefits

The SSC CGL AAO (Assistant Audit Officer) position offers various allowances and benefits in addition to the basic salary. These allowances and benefits aim to provide financial support and perks to the AAOs. Here are some of the allowances and benefits provided to SSC CGL AAOs:

- Dearness Allowance (DA): AAOs receive Dearness Allowance, which is a cost of living adjustment allowance calculated as a percentage of the basic pay. DA is revised periodically to compensate for inflation and changes in the cost of living. According to the 7th Pay Commission, the Dearness Allowance for candidates would be 38% of Basic Pay . In September 2022, the union cabinet increased the DA to 38%.

- House Rent Allowance (HRA) : AAOs are eligible for House Rent Allowance, which depends on the city/category of the city they are posted in. For X category cities, the minimum HRA is Rs. 5400/- per month, for Y category cities it is Rs. 3600/- per month, and for Z category cities, it is Rs. 1800/- per month. The HRA rates for X, Y, and Z category cities are as follows:

- X Category Cities : AAOs posted in X category cities will receive HRA equivalent to 27% of their Basic Pay.

- Y Category Cities: AAOs posted in Y category cities will receive HRA equivalent to 18% of their Basic Pay.

- Z Category Cities: AAOs posted in Z category cities will receive HRA equivalent to 9% of their Basic Pay.

- Transport Allowance (TA): A fixed monthly amount is provided as Transport Allowance to AAOs to cover their commuting expenses between their residence and workplace. Employees posted in cities receive a travel allowance of Rs. 3600. For employees posted in places other than cities, the travel allowance is Rs. 1800.

- Leave Travel Concession (LTC): AAOs are entitled to Leave Travel Concession, which allows them to travel with their family members to their hometown or any selected destination during their leave period. The expenses for travel and accommodation are reimbursed as per government rules.

- Medical Benefits : AAOs are provided with medical benefits, including coverage for medical expenses for themselves and their dependents. This coverage can include reimbursement of medical bills, hospitalisation expenses and access to government medical facilities.

- Pension and Retirement Benefits : AAOs are entitled to pension benefits after completing their service as per the government rules. They can also contribute to the National Pension System (NPS) for additional retirement benefits.

- Other Allowances: Depending on government rules and regulations, AAOs may also receive additional allowances such as Children Education Allowance, Leave Encashment, and other benefits as per the prevailing norms.

It’s important to note that the exact details and rates of allowances and benefits may vary based on government policies and revisions. Candidates are advised to refer to the official SSC notifications and government guidelines for the most accurate and up-to-date information regarding the allowances and benefits associated with the SSC CGL AAO exam.

Candidates can check SSC CGL Previous Year Question Paper for a thorough understanding of the level and scope of the SSC CGL exam and for revision of their learnings.

SSC CGL AAO: Job Profile And Responsibilities

The job profile of SSC CGL Assistant Audit Officer (AAO) is highly prestigious and comes with significant responsibilities. AAOs play a crucial role in ensuring financial accountability and transparency within government departments. Let’s delve into the key job roles and responsibilities of an AAO in detail:

- Field Audit: AAOs are required to conduct field audits, which involve visiting government departments and organizations to assess their financial operations. They scrutinise financial records, verify expenditures and ensure compliance with financial regulations and policies.

- Audit Tours: AAOs are expected to undertake audit tours, typically up to four times a year. During these tours, they visit various locations and establishments to conduct audits and gather relevant information for their assessments.

- Scrutiny and Presentation : AAOs have the responsibility of scrutinising audit findings and preparing reports. They assist in analysing the collected data, identify financial irregularities or discrepancies, and present their work to the Director and other relevant stakeholders.

- Audit Planning: AAOs handle the crucial task of planning audits for different fields and tours. This involves assisting in strategising the audit approach, determining the scope and objectives of the audit, and allocating resources effectively.

- Financial Audit: AAOs perform financial audits to ensure financial transactions’ accuracy, completeness and compliance within central and state government departments. They examine financial statements, records and transactions to identify any irregularities and ensure financial accountability.

- Compliance Audit: AAOs are responsible for conducting compliance audits to assess whether government departments are adhering to financial regulations, policies and guidelines. They ensure that financial transactions are conducted in accordance with established norms and procedures.

- Performance Audit: AAOs also undertake performance audits, which involve evaluating the efficiency and effectiveness of government programs and initiatives. They assess whether the allocated funds are utilised optimally and whether the desired outcomes are achieved.

Understanding the SSC CGL Selection Process 2023 is crucial for aspiring candidates to prepare effectively and increase their chances of success. Visit the linked article for more information.

SSC CGL AAO: Career Progression

The career progression of SSC CGL Assistant Audit Officers (AAOs) is a result of their hard work, dedication, and the acquisition of relevant experience and skills. Based on their performance and years of service, AAOs have the opportunity to advance to higher positions within the government sector. Here is an outline of the potential career progression for SSC CGL AAOs:

- Promotion to Audit Officer (AO): After serving for a minimum of 6-10 years, AAOs can be promoted to the position of Audit Officer. This promotion is based on their experience, performance, and the fulfilment of eligibility criteria set by the government.

- Promotion to Senior Audit Officer (Sr. AO): After serving as an Audit Officer for 2-4 years, AAOs who demonstrate exceptional skills and capabilities can be promoted to the position of Senior Audit Officer. This promotion recognises their expertise and increased responsibilities in overseeing audit activities.

- Promotion to Deputy Accountant General: Further progression in the career of an AAO depends on their experience, seniority and other factors determined by the government. After serving for a certain period of time and based on their performance, AAOs can be promoted to the position of Deputy Accountant General.

- Promotion to Senior Deputy Accountant General : AAOs with extensive experience and demonstrated leadership qualities may have the opportunity to progress to the position of Senior Deputy Accountant General. This promotion signifies their enhanced responsibilities, seniority and contribution to the field of auditing.

It’s important to note that the exact timeframes and promotion criteria may vary and are subject to government policies, rules and regulations. The career progression mentioned above is an outline of the potential advancement for SSC CGL AAOs based on common trends observed in the government sector.

Aspirants willing to appear for the next recruitment of the Combined graduate level exam can check SSC CGL Apply Online page linked here for convenience.

Aspirants of other examinations conducted by the Staff Selection Commission can check the following links for assistance-

Connect with us for Free Preparation

Get access to free crash courses & video lectures for all government exams..

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

- 4.23.21.1.1 Background

- 4.23.21.1.2 Authority

- 4.23.21.1.3 Responsibilities

- 4.23.21.1.4.1 Program Reports

- 4.23.21.1.5 Acronyms

- 4.23.21.1.6 Related Resources

- 4.23.21.2 Overview – General

- 4.23.21.3.1 Reference Material

- 4.23.21.4.1 Establishing Case Files

- 4.23.21.5.1 Contacting the Taxpayer

- 4.23.21.5.2 Conducting the Interview

- 4.23.21.5.3 Developing the Issue(s)

- 4.23.21.5.4 Managerial Involvement in ET TCO Cases

- 4.23.21.6.1 Workpapers

- 4.23.21.6.2 Report Writing Procedures for Cases with Taxpayer Contact

- 4.23.21.6.3 Report Writing Procedures for No-Response Cases (No Show) or Unlocatable Taxpayers

- 4.23.21.6.4 Case File Assembly

- 4.23.21.7 Case Closing

- 4.23.21.8 Statute Control Quality

- Exhibit 4.23.21-1 Action Codes and Purge Dates

Part 4. Examining Process

Chapter 23. employment tax, section 21. tax compliance officer employment tax procedures, 4.23.21 tax compliance officer employment tax procedures, manual transmittal.

November 17, 2021

(1) This transmits a revision to IRM 4.23.21, Employment Tax - Tax Compliance Officer Employment Tax Procedures.

Material Changes

(1) IRM 4.23.21.1.6. Added information on Taxpayer Advocate Service and Disclosure.

(2) IRM 4.23.21.3.1. Added links to Employment Tax TCO Desk Guide and TCO Job Aid for Embedded Quality.

(3) IRM 4.23.21.5.2.4. Added (4) If the taxpayer responds that they have already filed Forms W-2, see IRM 4.19.4.3.28, Reply States Taxpayer Already Filed Forms W-2, to submit a Form 9337, Social Security Administration (SSA) Reconciliation Referrals, to SSA.

(4) IRM 4.23.21.6.1. Added "140 – Mandatory Issues Check Sheet in ET Examinations" to the list of exempt leadsheets, per IGM SBSE-04-1219-0047.

(5) IRM 4.23.21.6.2. Additional expansion notification explained. The ET TCO must notify the taxpayer of the examination of all periods and returns in which adjustments are being proposed prior to the issuance of the 30-day letter and report and document the action in the case file.

(6) Editorial and technical changes have been made throughout this section.

Effect on Other Documents

Effective date.

Kellie L. McCann Acting Director, Specialty Examination Policy Small Business/Self-Employed Division

Program Scope

Purpose : This IRM provides guidance to the Tax Compliance Officer (TCO) Program in SB/SE Specialty Examination, Employment Tax (ET).

Audience : This section contains instructions and guidelines for Small Business/Self-Employed (SB/SE) examiners and managers.

Policy Owner : Director, Specialty Examination Policy of the Small Business/ Self-Employed Division.

Program Owner : Program Manager - Employment Tax Policy. The mission of Employment Tax Policy is to establish effective policies and procedures to support compliance with employment tax laws.

Primary Stakeholders :

Employment Tax – Workload Selection and Delivery (ET-WSD)(SE:S:DCE:E:HQ:ECS:S:ETEGCS:EWSD)

Specialty Examination - Employment Tax (SE:S:DCE:E:SE:ET)

Specialty Examination Policy, Employment Tax Policy (SE:S:DCE:E:HQ:SP:ETP)

Program Scope: The mission of Employment Tax Policy is to establish effective policies and procedures and to support compliance with employment tax laws.

The purpose of this section is to provide instructions unique to the Tax Compliance Officer (TCO) Program in SB/SE Specialty Examination, Employment Tax (ET). IRM 4.23.21 serves as a starting point for consistent administration of employment taxes by ET TCOs. It is intended that ET TCOs rely on the direction contained in this section for unique procedures that pertain to the assignment, audit, and closure of ET TCO cases. Any instructions or procedures not addressed in this section indicate there is no difference between the ET TCO process and other current employment tax and/or field procedures, and the ET TCO should rely on IRM 4.23, Employment Tax, or IRM 4.10, Examination of Returns.

Employment tax provisions are found at Internal Revenue Code Subtitle C:

Chapter 21, Federal Insurance Contributions Act (FICA),

Chapter 22, Railroad Retirement Tax Act (RRTA),

Chapter 23, Federal Unemployment Tax Act (FUTA),

Chapter 24, Federal Income Tax Withholding (FITW), and

Chapter 25, General Provisions relating to employment taxes and collection of income taxes at source.

The Employment Tax Program is governed by Policy Statements and other internal guidance that apply to all Service personnel regardless of operating division. The Policy Statements found in IRM 1.2.1, Servicewide Policies and Authorities - Servicewide Policy Statements, apply to all employment tax issues and examinations. Examiners should review these Policy Statements to properly perform their examination duties.

A website, Delegation Orders and Policy Statements by Process, located at https://www.irs.gov/privacy-disclosure/delegation-orders-and-policy-statements-by-process, summarizes data contained in the applicable IRM sections under IRM 1.2.1 and IRM 1.2.2, Servicewide Policies and Authorities, Servicewide Delegations of Authority, in a single electronic source.

IRM 4.23 provides Servicewide instructions for all operating divisions with employees involved with the correct filing, reporting, and payment of employment taxes. IRM 4.23 serves as the foundation for consistent administration of employment taxes by various IRS operating divisions. By providing one source of authority for all operating divisions, the Service greatly reduces philosophical and procedural inconsistencies.

Responsibilities

Director, Specialty Examination Policy is responsible for the procedures and updates addressed in this IRM.

Director, Examination Specialty Tax, is the executive responsible for Specialty examination operational compliance.

Program Objectives and Review

Program Goals: The processes and procedures provided in this IRM are consistent with the objectives or goals for Employment Tax - Examination that are addressed in IRM 1.1.16.3.3.3, Employment Tax Examination and for Employment Tax Policy, found in IRM 1.1.16.3.5.2.2, Employment Tax Policy.

Program Effectiveness: Program goals are measured with Employment Tax Embedded Quality Performance Reports that monitor whether quality attributes are applied uniformly and consistently.

Annual Review: Employment Tax Policy - Program Manager, is responsible for reviewing the information in this IRM annually to ensure accuracy and promote consistent tax administration.

Program Reports

Program Reports: Information regarding the reporting of program objectives are included on, but not limited to, the following reports:

Headquarters Examination Monthly Briefing,

Program Manager Monthly Briefing,

Examination Operational Review, and

Business Performance Reviews.

The following table lists commonly used acronyms and their definitions:

Related Resources

The following table lists the primary sources of guidance:

Other helpful information sources include:

The SB/SE Knowledge Management home page for Employment Taxes https://portal.ds.irsnet.gov/sites/vl014/pages/default.aspx.

The Specialist Referral System home page: https://srs.web.irs.gov/.

A list of SB/SE Employment Tax Policy Analysts, their contact information and program assignments, are found at: Policy Analysts.

The web site "Examining an Employment Tax Case" at: https://portal.ds.irsnet.gov/sites/vl014/pages/home.aspx?bookshelf=examining an employment tax case.

The Taxpayer Bill of Rights (TBOR) lists rights that already existed in the tax code, putting them in simple language and grouping them into 10 fundamental rights. Employees are responsible for being familiar with and acting in accord with taxpayer rights. See IRC 7803(a)(3), Execution of Duties in Accord with Taxpayer Rights. For additional information about the TBOR. See IRC 7803(a)(3). For additional information about TBOR, see https://www.irs.gov/taxpayer-bill-of-rights.

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS whose employees assist taxpayers experiencing economic harm, who are seeking help in resolving tax problems that have not been resolved through normal procedures, or who believe that an IRS system or procedure is not working as it should. Pub 1546, Taxpayer Advocate Service - We Are Here to Help You, provides contact and additional information. The program is designed to alleviate taxpayer hardships that arise from systemic problems or the application of the Internal Revenue Code. In addition, see IRM 13.1.7, Taxpayer Advocate Service (TAS) Case Criteria, and IRM 13.1.19, TAS Operations Assistance Request (OAR) Process, for additional information.

Employment tax examiners should consider the disclosure provisions when preparing agreed and unagreed case reports. See the Privacy, Governmental Liaison and Disclosure web site at: https://irssource.web.irs.gov/PGLD/Pages/Home.aspx for additional information.

Overview – General

ET TCO groups increase compliance through the use of remote audit techniques and limited scope employment tax examinations. Initial assignment of cases to ET TCOs will be based on limited identified issues (e.g., ET non-filer, officer compensation, or unique focused issues such as COBRA) that require less extensive audit development than more complex employment tax issues. The utilization of a limited scope approach increases the amount of employment tax compliance coverage directly impacting filing, payment, and reporting compliance.

ET TCO Cases - General

ET TCO case assignments are generally post of duty (POD) neutral, recognizing that the audit is conducive to being worked using the remote audit process. The remote audit criteria were developed specifically for use by ET TCO examiners.

Remote audit features include:

Interviews conducted by telephone to discuss the audit process and develop the identified issues with the appropriate party.

The request of limited source documents, including books and records to be supplied via mail or fax, for the examiner's review.

Expansion of the pre-identified scope of audit to include multiple years, related pick-ups, or expansion to additional issues when approved by the group manager.

ET TCOs may conduct face-to-face examinations when the taxpayers are within their geographic location. These face-to-face examinations may be conducted in the IRS office or, in rare circumstances, at the taxpayer’s place of business.

ET TCOs are not generally required to conduct a tour of the business, since the majority of the examinations are worked using the remote audit process. However, in examinations where ET TCOs conduct the examination at the taxpayer’s place of business, the ET TCO will request and conduct a tour.

If the development of the pre-identified or subsequently identified issues indicates a more in-depth on-site examination is warranted, the ET TCO will consider transferring the case to an employment tax field group. The ET TCO will discuss such cases with their manager to determine the best course of action. The factors considered and decisions made must be documented in the case file.

Reference Material

An Employment Tax TCO Desk Guide and a TCO Job Aid for Embedded Quality (EQ) are both available for use by ET TCOs when working their cases. These documents provide a more in-depth discussion of the ET TCO procedures and provide examples of best practices.

Case Assignment

Appropriate case selection for ET TCO examinations is critical to the success of the program. Cases must:

Be conducive to the remote audit process, and

Involve limited scope of not more than one or two issues identified during classification.

Cases conducive to remote audit include, but are not limited to, Combined Annual Wage Reporting (CAWR) and officer compensation cases.

CAWR cases involve employers that failed to file Employment Tax returns or has a discrepancy between the reported amounts and forms filed.

Officer compensation cases involve Form 1120S returns where little or no officer compensation is noted on the face of the S Corporation income tax return; distributions may or may not be indicated on the 1120S return or attachments.

Establishing Case Files

When a case is assigned to the ET TCO, initial set-up in Inventory Management System (IMS) must take place to organize the case file and allow the examiner time to perform pre-contact analysis. See "Issue Management System (IMS) –New User Introduction," ITM Course 40486a or Training Publication 56523-102, for additional assistance.

ET TCOs will complete their daily time report contemporaneously to account for all hours of the day. Examiners must use action codes and purge dates for the completion of the daily time report. See Exhibit 4.23.21-1 , Action Codes and Purge Dates, for the specific action codes, definitions, and purge dates.

Examiners must utilize the ETLS - Employment Tax Lead Sheets for all examinations. See IRM 4.23.21.6.1 , Workpapers, for more information on the use of these lead sheets in ET TCO examinations.

The scope of an ET TCO case is initially limited to issues shown on the classification sheet. Examiners must review the case file and other relevant information prior to contacting the taxpayer. If this pre-contact analysis leads to a change in the scope of the examination, either removing issues identified during classification or adding issues found during the pre-contact analysis, the examiner will discuss these changes with the manager. This discussion and conclusions reached will be documented on Form 9984, Examining Officer’s Activity Record.

Conducting the Examination – General

ET TCO audits are based on the premise of a limited scope approach utilizing a remote audit process; pre-planning activities are critical in every examination. Before making contact with the taxpayers, ET TCOs will research internal sources to determine:

The taxpayer’s filing history,

Prior audit results,

The identified issues, and

Documents needed.

External sources should also be researched.

Use the action codes and purge dates in Exhibit 4.23.21-1 , to maintain the Microsoft Outlook planning calendar throughout the examination; this ensures cases are timely worked and meet all established time-frames.

The "Employment Tax TCO Desk Guide" provides a more detailed discussion of pre-planning actions.

Contacting the Taxpayer

Letter 3850-T, Employment Tax TCO Appointment, will be issued to schedule a date and time for a telephone interview; this letter was specifically developed for use in a remote audit.

When a taxpayer is located in the same area as the ET TCO, face-to-face appointments may be conducted. If a face-to-face appointment is scheduled, use the normal appointment letter, Letter 3850, Employment Tax Appointment Letter.

Both Letter 3850-T and Letter 3850 will include Pub 1, Your Rights as a Taxpayer, Pub 5146, Employment Tax Returns: Examinations and Appeal Rights, and Notice 609, Privacy Act Notice. During the initial conversation with the taxpayer, ET TCOs must ensure the taxpayer received these documents and have no questions concerning them. This discussion must be documented in the case file.

The ET TCO must attach a Form 4564, Information Document Request (IDR), to the Letter 3850-T or Letter 3850. The IDR will be tailored to each taxpayer, requesting specific information and documents to assist in developing the issues identified through both classification and pre-planning. IDRs should:

Be specific to the classified issues and any additional issues that were approved by the group manager,

State the tax periods covered by the examination,

Include a date and method of submission for the information requested (e.g., via mail/fax or bring to initial appointment), and

Include a request for copies of appropriate income tax returns when electronic copies are not available for review (e.g., returns available in the Employee User Portal (EUP)). The ET TCO will be able to review these documents for other employment tax issues or potential referral to income tax, when warranted.

In a remote audit, the requested information will be due to the ET TCO prior to the initial telephone interview. If a face-to-face appointment is scheduled, the taxpayer will be asked to provide the information at the initial appointment.

Conducting the Interview

Interviews are required in ET TCO examinations. The interview will help determine:

If there are other employment tax issues,

If there are any related entities with potential employment tax issues,

The reasons for non-compliance with employment tax filing or reporting requirements, and

If the non-compliance is intentional, i.e., the identification of the badges of fraud.

During the initial interview, the ET TCO will gain an understanding of the taxpayer's business and the taxpayer's understanding of employment tax laws by asking questions specific to the taxpayer and the classified issues.

Interviews are used to probe for other employment tax non-compliance and to help determine the applicability of penalties, including fraud. Therefore, some type of interview will be conducted in all ET TCO cases except when the taxpayer cannot be located, is unresponsive to the request for an appointment, or refuses to participate in an interview. See IRM 4.23.21.5.3 (2) for additional information.

If the taxpayer responds that they have already filed Forms W-2, see IRM 4.19.4.3.28, Reply States Taxpayer Already Filed Forms W-2, to submit a Form 9337, Social Security Administration (SSA) Reconciliation Referrals, to SSA.

Developing the Issue(s)

When conducting a remote audit, ET TCOs should have the requested books, records, and supporting documentation prior to the initial interview. If documents were not received prior to the initial interview, the reasons for the delayed receipt must be fully documented. If after the receipt of the non-filed return(s) or interview, the ET TCO decides not to pursue obtaining the books and records previously requested, the rationale to discontinue the examination must be fully documented.

When taxpayers are unresponsive or uncooperative, ET TCOs must consider all options, (e.g., whether to issue a "no-show report" based on the information available or use appropriate enforcement actions such as issuance of a summons). These decisions will be based on the facts and circumstances and be documented in the case file.

In all non-filer cases, the ET TCO must determine the reasons for non-filing during the interview. If facts and circumstances warrant, the ET TCO will discuss the case with their manager to determine the following:

Are additional books and records required to fully develop the issue?

Can the ET TCO obtain the additional books and records or should the case be transferred to a field specialist to complete the audit?

Follow-up IDRs may be required. The IDR will include a request for specific information needed to continue the development of the issues and include a specific due date and delivery method. Prior to issuance of this IDR, ET TCOs will attempt to discuss this request to ensure the taxpayer fully understands why additional records are being requested. This discussion will also allow the examiner to clarify the information that is needed. If attempts to discuss the request are unsuccessful, ET TCOs should document the case file and issue the IDR.

Appropriate research should be conducted to assist the examiner in developing the issue. This can include making third party contacts when warranted. See IRM 4.11.57, Examining Officers Guide (EOG) - Third Party Contacts, for information on making third party contacts.

Managerial Involvement in ET TCO Cases

ET TCOs are required to obtain managerial approval when:

Based on facts learned during the pre-contact analysis, review of the requested documentation, or interview of the taxpayer, the scope of the exam is being changed from the classified issues,

There are indications that a worker reclassification issue needs to be developed,

The taxpayer cannot be located and a decision must be made whether the audit will continue, (See IRM 4.10.2.8.6, Case Closing Procedures if the Taxpayer Cannot be Located, and IRM 4.23.21.6.3 .)

The examiner cannot determine a substantially correct wage adjustment based on information available,

Transfer to a field group may be warranted, or

Penalties are being proposed that require managerial approval, (e.g., negligence).

If badges of fraud are present, the TCO will discuss the case with their manager and jointly decide when/if to contact the Fraud Enforcement Advisor (FEA).

All discussions with the manager must be documented in the case file either on the case activity record or appropriate lead sheet.

ET TCOs are not required to hold Group Manager Concurrence Meetings covered in (8) of IRM 4.23.4.3, Guide for Examiners Using ETLS – Employment Tax Lead Sheets.

ET TCO managers are encouraged to contact the taxpayer on unagreed cases being closed for assessment or issuance of Letter 3523, Notice of Employment Tax Determination Under IRC Section 7436; contact is not required on no-response cases. Managers are required to make contact on any case in which the taxpayer requests a formal appeal, unless the taxpayer specifically waived the right to a managerial conference offered by the examiner. See IRM 4.23.21.6.2 (3) . The refusal must be documented in the case file.

In addition to the specific items noted here, other sections of IRM 4.23 may also apply when managerial involvement is required.

Workpapers, Report Writing and Case File Assembly

Except as noted in this section, ET TCOs will follow the same procedures, guidelines, and time-frames that employment tax specialists use when preparing:

Workpapers,

Employment Tax Examination Report (ETER), and

The case for closure.

ET TCOs are required to use the ETLS - Employment Tax Lead Sheets.

ET TCOs are exempt from using the following lead sheets that are mandatory in other ET cases:

115 – GM Concurrence Meeting Check Sheet

140 – Mandatory Issues Check Sheet in ET Examinations

150 – Risk Analysis Workpaper

Refer to IRM 4.23.4, Employment Tax - General Procedures and Workpapers, for additional information on workpapers.

Report Writing Procedures for Cases with Taxpayer Contact

The ET TCO must notify the taxpayer of the examination of all periods and returns in which adjustments are being proposed prior to the issuance of the 30-day letter and report. This notification must be documented in the case file.

The ET TCO must attempt to discuss the issues with the taxpayer to ensure the taxpayer has a full understanding of the proposed adjustments; this can be done either before or after the issuance of the 30-day letter and report.

ET TCOs must offer a managerial conference or Fast Track Settlement (FTS) to all taxpayers when a request for an appeal is received. If the taxpayer declines one or both offers, that declination must be documented in the case file.

See IRM 4.10.7.5.5, SB/SE Fast Track Settlement, for additional information.

Report Writing Procedures for No-Response Cases (No Show) or Unlocatable Taxpayers

A no-response case occurs when a "deliverable" address exists, but the taxpayer does not respond to correspondence or does not "show" for a scheduled appointment. A follow-up attempt must be made to contact the taxpayer and secure their cooperation. The examiner will make a telephone call to the taxpayer or use Letter 3850-F, Employment Tax Second Contact, in an attempt to obtain their cooperation. If the ET TCO has a valid telephone number and makes telephone contact with the taxpayer, use this opportunity to discuss as much about the case as possible, as it may be the only contact. The ET TCO will not leave a message for the taxpayer to return the call. If the ET TCO does not have a valid telephone number or the taxpayer does not answer, the ET TCO will issue the Letter 3850-F to schedule the follow-up appointment within sixteen calendar days, and the IDR response within eleven calendar days. Document all attempts to contact the taxpayer, by phone or letter, on the Form 9984, Examining Officer’s Activity Record.

If the ET TCO can determine a substantially correct wage adjustment from the information available, a 30-day letter and report will be issued, even if the taxpayer fails to keep the appointment scheduled in Letter 3850-F or makes no attempt to reschedule.

If the examiner cannot determine a substantially correct wage adjustment based on the information available, the examiner will discuss the case with their manager to determine the best course of action to resolve the classified issues, as well as any additional issues identified through the pre-contact analysis. The final decision may include:

Transfer of case to a field group,

Use of appropriate summons procedures to gain taxpayer cooperation, or

Closure of the case using survey procedures.

If a no-response occurs because the address is not valid (mail returned as undeliverable), appropriate steps must be taken to locate a valid address and make contact with the taxpayer before issuing a report. See IRM 4.10.2.8.4, Undeliverable Initial Contact Letters, for procedures to follow when a taxpayer is unlocatable. If the taxpayer cannot be located, the ET TCO must discuss whether the audit will continue with the manager.

If taxpayer does not file a small case request or formal written protest within the time allowed but indicates their intent to do so, follow the procedures in IRM 4.23.22.8.3, Follow-Up to 30-Day Letters, and issue Letter 923-P, Letter Extending Time to File Protest – Employment Tax, within seven calendar days after the expiration of the original 30-day letter.

Refer to IRM 4.23.10, Employment Tax - Report Writing Guide for Employment Tax Examinations, for more information on report writing.

ET Tax Compliance Officers should not use Status Code 13 as outlined in IRM 4.23.22.6 (13), 30-Day Letters: Unagreed Case Procedures. Managers will use action codes and purge dates, or other case monitoring systems, to ensure timely actions are taken after the issuance of the 30-day letter.

Case File Assembly

Refer to IRM 4.23.10.19.2, Assembly of Employment Tax Case File Folder - SB/SE, for information on case file assembly.

Case Closing

ET TCO cases will be closed following the same procedures and time-frames used by all employment tax specialists:

Agreed, No-Change, Surveyed, or Unagreed cases not requiring the issuance of Letter 3523, Notice of Employment Tax Determination under IRC Section 7436, will be closed to the appropriate Centralized Case Processing Unit.

Form 3198, Special Handling Notice for Examination Case Processing, needs to be annotated if the taxpayer is entitled to an interest-free period per IRC 6205. Also, the closing document, Form 5344, Examination Closing Record, needs to show TC 308 with the interest start date if the taxpayer is entitled to an interest-free period. See IRM 20.2.10.5, Employment Taxes.

Unagreed cases requiring the issuance of Letter 3523, Notice of Employment Tax Determination under IRC Section 7436, "Offer In Compromise – Doubt as to Liability" cases, or a case where the taxpayer has requested a formal appeal, will be closed to the appropriate Technical Services Unit.

Statute Control Quality

In determining whether Attribute 100, "Protection of Statute of Limitations," is met, ET TCOs will be measured on whether the employee took appropriate actions to protect the Statute of Limitations and whether the statute expired. See IRM 4.23.14, Statute Control and Extension, for more information.

Action Codes and Purge Dates

More Internal Revenue Manual

Zumwalt: “I will not be resigning” after scathing audit released

Editor’s Note: This story has been clarified to accurately reflect Shelly Zumwalt’s roles within the Oklahoma Office of Management and Enterprise Services (OMES). During her time there, she was a budget analyst for OMES. She spearheaded communications for the OMES Employees Group Insurance Division. She was the Director of the Public Affairs Division at OMES and she was the Chief of Innovation at OMES.

OKLAHOMA CITY (KFOR) — Oklahoma Secretary of Tourism, Shelley Zumwalt, refused to step down Tuesday after Oklahoma Attorney General Gentner Drummond called for her to resign following the release of a state audit.

The audit revealed two state agencies Zumwalt previously worked for awarded a company, of which her husband is the vice president, no-bid contracts totaling millions of dollars.

“Transparency has always been a top priority of mine and I will not be resigning,” Zumwalt said to reporters late Tuesday evening. “It was not an issue and it’s not a conflict of interest.”

While Zumwalt currently serves as Oklahoma’s Secretary of Tourism, she previously held several different roles at multiple state agencies.

Zumwalt became the Chief Innovation Officer at the Oklahoma Office of Management and Enterprise Services (OMES) in February 2020.

Two months later, OMES awarded Oklahoma City-based IT firm ‘Phase 2’ a nearly $1 million dollar contract to upgrade computer systems for the Oklahoma Employment Security Commission (OESC).

The Vice President of Phase 2 is John Zumwalt—Shelley Zumwalt’s husband.

In May 2020, Shelley Zumwalt was appointed as the director of OESC.

The audit revealed over the following two years with Zumwalt in charge of OESC, she personally signed off on an additional $8.6 million in extensions of the original no-bid contract with Phase 2.

To date, the auditor’s office says the state has paid Phase 2 more than $21 million.

State auditor Cindy Byrd told News 4 there a few red flags with Zumwalt’s situation that caught her attention.

First, Byrd said those high-dollar contracts awarded to Phase 2 were never put out for competitive bidding—despite an executive order from Gov. Stitt requiring all state contracts for more than $250,000 be put through the competitive bidding process.

“There was still that requirement for anything over $250,000 to be competitively bid to make sure that OMES was getting the best price, the best product for the taxpayer,” Byrd said.

Secondly, Byrd said if the initial contract were to have been properly put out for competitive bidding, OMES should have been able to find there was a “related-party” conflict-of-interest between Zumwalt and her husband.

“If they had put out a competitive bid process, they could have asked that question and they could have made sure that any high dollar award for a contract did not have a related-party transactions,” Byrd said.

On Tuesday, Zumwalt claimed she made her connection to Phase 2’s VP known at the time she accepted her role with OESC, and lawyers from OMES and OESC told her she was in the clear.

“I have disclosed this information for probably going on three years now,” Zumwalt said. “There was not a moment where that was not disclosed.”

But the state auditor’s office released a sworn-affidavit Zumwalt signed at the end of 2020, in which she declared she had not been “involved in any related-party transactions with the OESC” that year, and that and her “spouse or dependents were not involved” in any OESC transactions either.

Despite that sworn affidavit Zumwalt signed, the state auditor’s office revealed Zumwalt signed and approved a no-bid contract extension between OESC and Phase 2 for $40,000 in November 2020.

Zumwalt approved four additional extensions of the no-bid contract between November 2020 and April 2022, totaling more than $8.6 million.

“It was a true arm’s length transaction for the state of Oklahoma,” Byrd said.

On Tuesday, Zumwalt denied Phase 2’s initial no-bid contract, as well as the subsequent extensions of which she signed off on, could have benefitted her husband financially.

“I want to be crystal clear John Zumwalt has not and has never been part of the Phase 2 ownership group,” Zumwalt said.

However, at the top of Phase 2’s website, the company proclaims it is “employee owned” beneath its main logo.

On Tuesday, Oklahoma Attorney General Gentner Drummond c alled on Zumwalt to resign her position as Secretary of Tourism and cooperate with an investigation being performed by his office.

While Zumwalt told reporters she would not be resigning, she said she would cooperate with any investigation by Drummond’s office.

Video below is of the interview with Zumwalt after the audit was released.

Byrd’s office released an 80+ page document of what they described as “receipts” proving the audit’s findings about Zumwalt. It includes all the contracts she signed and the dates she signed them.

You can view the document below.

For the latest news, weather, sports, and streaming video, head to KFOR.com Oklahoma City.

- Share full article

Advertisement

Supported by

Agent Removed From Harris’s Detail After ‘Distressing’ Behavior

The Secret Service agent was removed during an incident on Monday morning shortly before Vice President Kamala Harris left for a campaign event in Wisconsin.

By Hamed Aleaziz and Jazmine Ulloa

A U.S. Secret Service agent was removed from Vice President Kamala Harris’s security detail this week after the officer “began displaying behavior their colleagues found distressing,” an agency spokesman said on Thursday.

The incident happened Monday morning at Joint Base Andrews outside of Washington, shortly before Ms. Harris left for a campaign event in Wisconsin. A New York Times reporter who was among the media members traveling with Ms. Harris heard medical personnel trying to calm a person down at the scene. The incident was earlier reported by The Washington Examiner .

“At approximately 9 a.m. April 22, a U.S. Secret Service special agent supporting the vice president’s departure from Joint Base Andrews began displaying behavior their colleagues found distressing,” the Secret Service spokesman, Anthony Guglielmi, said in a statement.

“The agent was removed from their assignment while medical personnel were summoned,” Mr. Guglielmi said. He added that Ms. Harris was at the Naval Observatory in Washington, where the vice president lives, during the incident and that “there was no impact on her departure from Joint Base Andrews.”

Secret Service officials did not provide any further information on the incident, saying only that it was a “medical matter.”

Hamed Aleaziz covers the Department of Homeland Security and immigration policy. More about Hamed Aleaziz

Jazmine Ulloa is a national politics reporter for The Times, covering the 2024 presidential campaign. She is based in Washington. More about Jazmine Ulloa

Passed: Leon County Schools finances in good shape, state audit report shows

The Leon County school district is boasting a clean financial audit report from the state's Auditor General, according to a Wednesday news release.

“One of the greatest responsibilities I have, as superintendent, is to properly manage and account for our annual budget of over $600 million to ensure that every single taxpayer dollar is going exactly where it is intended to go,” Leon Schools Superintendent Rocky Hanna said in the release.

The Florida Auditor General routinely audits government entities. The last financial audit of the district was 2020.

The team from the Auditor General's office determined its review didn't generate any red flags or notable findings.

The report revealed most of the district's net position is its investments in capital assets, which includes land construction projects, furniture, equipment, vehicles and other holdings. The district's investments for the 2023 fiscal year up to the end of June amounted to $416 million.

The school district is committed to financial transparency, according to Naomi Coughlin, the district's chief financial officer.

“Over my 34-year career I have been proud of our commitment to transparency and track record of positive evaluations by the auditor general. This is a direct result of Superintendent Hanna’s leadership and his commitment to ensure our district resources and taxpayer dollars are accounted for at the highest standard possible,“ Coughlin said of the superintendent, who is currently campaigning for reelection .

Schools spokesperson Chris Petley said the state Auditor General visits the school district every three years to complete an audit. In the meantime, the district hires an independent auditing firm to conduct an annual financial review in the years between.

Alaijah Brown covers children & families for the Tallahassee Democrat. She can be reached at [email protected] .

Secret Service officer protecting Kamala Harris came to blows with other agents at Joint Base Andrews

- View Author Archive

- Get author RSS feed

Thanks for contacting us. We've received your submission.

A Secret Service agent tasked with protecting Vice President Kamala Harris brawled with several other agents on Monday morning, the agency confirmed.

The altercation took place around 9 a.m. near Joint Base Andrews on the outskirts of Washington, DC, prior to Harris’ arrival.

The agent in question, whose identity has not been revealed, was immediately “removed from their assignment,” the Secret Service told The Post.

“A US Secret Service special agent supporting the Vice President’s departure from Joint Base Andrews began displaying behavior their colleagues found distressing,” Anthony Guglielmi, chief of communications for the US Secret Service, said to The Post.

“The US Secret Service takes the safety and health of our employees very seriously.”

Medical personnel were called to the scene, per Guglielmi. The agent had been at Joint Base Andrews to support Harris’ planned departure, but ultimately the scuffle did not delay her travel.

Guglielmi added that because it was a “medical matter,” the department would not “disclose any further details.”

Harris traveled to New York City, where she was scheduled to tape an interview on “The Drew Barrymore Show.”

The agent who instigated the fight was armed and grew aggressive with others, the Washington Examiner reported . A detail shift supervisor and special agent in charge attempted to cool them off, but then a fight broke out, according to the report.

That agent began acting erratically when she arrived at Joint Base Andrews, eventually getting on top of the special agent in charge of the vice president before punching him, RealClearPolitics reported .

Afterward, the unnamed agent was reportedly handcuffed and received medical attention.

BREAKING: Sources within the Secret Service community tell me the agent assigned to VP Kamala Harris was armed during the fight – that the gun was secured in the agent's holster until other agents physically restrained the agent and took the gun from the agent's possession. I'm… https://t.co/kxLLOlFy4b — Susan Crabtree (@susancrabtree) April 24, 2024

Following the blow-up, some questioned the hiring process behind that agent, including any assessment of that individual’s background, according to RealClearPolitics.

There had also apparently been longstanding concerns about the agent in question prior to Monday’s incident, per the report.

Harris was notified about the situation, according to Guglielmi.

Editor’s note: A previous version of this story wrongly identified the Secret Service agent as a male. Sources have since informed The Post the agent was female.

Share this article:

Secret Service removes agent from Kamala Harris' detail after 'distressing' behavior

WASHINGTON — A Secret Service special agent was removed from Vice President Kamala Harris' detail after having exhibited "distressing" behavior this week, a spokesperson confirmed Thursday.

The agent, whose identity has not been disclosed, had been involved with the Harris' departure from Joint Base Andrews, Maryland, on Monday morning, when Harris was headed to Wisconsin.

The agent "began displaying behavior their colleagues found distressing," Anthony Guglielmi, chief of communications for the Secret Service, said in a statement Thursday. "The agent was removed from their assignment while medical personnel were summoned."

Harris was not present when the incident took place. She was at the Naval Observatory, the vice president's residence, and Guglielmi said her departure was not affected.

“The U.S. Secret Service takes the safety and health of our employees very seriously,” Guglielmi said. “As this was a medical matter, we will not disclose any further details.”

Additional information about the incident, which was first reported by the Washington Examiner , was not released. The vice president's office did not comment Thursday.

Megan Lebowitz is a politics reporter for NBC News.

IMAGES

VIDEO

COMMENTS

9,142 Audit Assignment jobs available on Indeed.com. Apply to Auditor, Senior Compliance Officer, Payroll Specialist and more!

What does an Audit Officer do? Office administrators perform various clerical tasks to help an organization's operations run efficiently. They may primarily provide administrative support to staff, organize files, arrange travel for executives, and perform bookkeeping and process payroll. They also oversee administrative functions and supervise ...

Risk Managers. Responsibilities of Audit Professionals. Planning and Conducting Audits. Evaluating Internal Controls. Reporting Audit Findings. Recommending Corrective Actions. Monitoring Progress and Follow-Up. In today's business landscape, audits are critical to ensuring compliance and accountability. Auditing is the process of examining and ...

An auditing career requires many competencies, including keen analytical skills, strong communication skills and technical proficiency with the subject matter under audit. Auditors play a key role ...

Assignment reporting. Internal audit report to a range of stakeholders with their opinion on the effectiveness of the controls in place to manage risk, a balanced overview of key effective controls and the agreed upon actions to address any areas of improvement identified from the audit. The reporting format should balance the differing needs ...

As an Internal Auditor you will provide systematic and disciplined approach to effectiveness of risk management control and governance processes. You will possess a thorough knowledge of accounting procedures and a sound judgement. You will be accountable for the examination and evaluation of organization processes, reporting findings back to ...

Effective assignment planning considers everything from the assessment of risk, work required, resources available and deadlines, to effective team and stakeholder engagement. The key output of the planning stage is a terms of reference document clearly stating the scope, audit objectives/risks, resources, timing and ideally any prior ...

Auditor salary expectations. An Auditor makes an average salary of $66,447 per year without factoring bonuses, commissions and overtime. The salary of an Auditor is subject to changes in market value and the urgency of the role. The average tenure for a person in this position is one to three years.

The average Audit Officer salary is $65,445 as of March 26, 2024, but the salary range typically falls between $60,102 and $71,926. Salary ranges can vary widely depending on many important factors, ... and target deadline of each assignment. January 26, 2023. Reviews the design and tests the operating effectiveness of internal controls over ...

Entrance Conference. An entrance conference with contractor's designated representative(s) are held at the start of each separate audit assignment (or each group of assignments to be covered in a single field visit) Requestors / Contracting officers are invited to attend. Explains the purpose of the audit, the overall plan for its performance ...

This section discusses the audit assignment; factors influencing the audit scope; preparation of the audit program, the types, sources, and relative quality of audit evidence; and the use of quantitative methods and IT in contract audits. 3-202 Audit Assignment ** a. An audit assignment is an authorization to perform a particular phase or aspect of

Given the important role of individual auditors in the audit process, appropriate staffing is an essential issue in audit firms. Using unique audit data for both listed and private companies in China, we define the downward mismatch between auditors and clients as an inappropriate assignment of the engagement auditors who are supposed to serve only private companies, but sign the audit reports ...

Assignment: Audit Readiness. By Chief Warrant Officer 3 Heath M. Stone March 16, 2017. 1 / 3 Show Caption + Contractor-acquired property and material to be acquired, received, stored, maintained ...

Together, they are responsible for auditing compliance and the financial transactions of the union and state governments, union territories and public sector organisations. An Assistant Audit Officer (AAO) is an entry level officer job in the IAAD. They work under senior audit officers of the department. The AAO's job is to assist the senior ...