- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.

A Vault Platform study found that dealing with workplace misconduct cost U.S. businesses over $20 billion in 2021. In addition, Soltes says in Strategy Execution that corporate fines for misconduct have risen 40-fold in the U.S. over the last 20 years.

One way to mitigate financial losses related to employee misconduct is by implementing internal controls. According to Strategy Execution , internal controls are the policies and procedures designed to ensure reliable accounting information and safeguard company assets.

“Managers use internal controls to limit the opportunities employees have to expose the business to risk,” Simons says in the course.

One company that could have benefited from implementing internal controls is Volkswagen (VW). In 2015, VW whistle-blowers revealed that the company’s engineers deliberately manipulated diesel vehicles’ emissions data to make them appear more environmentally friendly.

This led to severe consequences, including regulatory penalties, expensive vehicle recalls, and legal settlements—all of which resulted in significant financial losses. By 2018, U.S. authorities had extracted $25 billion in fines, penalties, civil damages, and restitution from the company.

Had VW maintained more rigorous internal controls to ensure transparency, compliance, and proper oversight of its engineering practices, perhaps it could have detected—or even averted—the situation.

Related: What Are Business Ethics & Why Are They Important?

3. Encourages Innovation and Growth

Risk management isn’t just about avoiding negative outcomes. It can also be the catalyst that drives your organization’s innovation and growth.

“Risks may not be pleasant to think about, but they’re inevitable if you want to push your business to innovate and remain competitive,” Simons says in Strategy Execution .

According to PwC , 83 percent of companies’ business strategies focus on growth, despite risks and mixed economic signals. In Strategy Execution , Simons notes that competitive risk is a challenge you must constantly monitor and address.

“Any firm operating in a competitive market must focus its attention on changes in the external environment that could impair its ability to create value for its customers,” Simons says.

This requires incorporating boundary systems —explicit statements that define and communicate risks to avoid—to ensure internal controls don’t extinguish innovation.

“Boundary systems are essential levers in businesses to give people freedom,” Simons says. “In such circumstances, you don’t want to stifle innovation or entrepreneurial behavior by telling people how to do their jobs. And if you want to remain competitive, you’ll need to innovate and adapt.”

Netflix is an example of how risk management can inspire innovation. In the early 2000s, the company was primarily known for its DVD-by-mail rental service. With growing competition from video rental stores, Netflix went against the grain and introduced its streaming service. This changed the market, resulting in a booming industry nearly a decade later.

Netflix’s innovation didn’t stop there. Once the steaming services market became highly competitive, the company shifted once again to gain a competitive edge. It ventured into producing original content, which ultimately helped differentiate its platform and attract additional subscribers.

By offering more freedom within internal controls, you can encourage innovation and constant growth.

4. Enhances Decision-Making

Risk management also provides a structured framework for decision-making. This can be beneficial if your business is inclined toward risks that are difficult to manage.

By pulling data from existing control systems to develop hypothetical scenarios, you can discuss and debate strategies’ efficacy before executing them.

“Interactive control systems are the formal information systems managers use to personally involve themselves in the decision activities of subordinates,” Simons says in Strategy Execution . “Decision activities that relate to and impact strategic uncertainties.”

JPMorgan Chase, one of the most prominent financial institutions in the world, is particularly susceptible to cyber risks because it compiles vast amounts of sensitive customer data . According to PwC , cybersecurity is the number one business risk on managers’ minds, with 78 percent worried about more frequent or broader cyber attacks.

Using data science techniques like machine learning algorithms enables JPMorgan Chase’s leadership not only to detect and prevent cyber attacks but address and mitigate risk.

Start Managing Your Organization's Risk

Risk management is essential to business. While some risk is inevitable, your ability to identify and mitigate it can benefit your organization.

But you can’t plan for everything. According to the Harvard Business Review , some risks are so remote that no one could have imagined them. Some result from a perfect storm of incidents, while others materialize rapidly and on enormous scales.

By taking an online strategy course , you can build the knowledge and skills to identify strategic risks and ensure they don’t undermine your business. For example, through an interactive learning experience, Strategy Execution enables you to draw insights from real-world business examples and better understand how to approach risk management.

Do you want to mitigate your organization’s risks? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to build a successful strategy.

About the Author

- Search Search Please fill out this field.

Identifying Risks

Physical risks, location risks, human risks, technology risks, strategic risks, making a risk assessment, insuring against risks, risk prevention, the bottom line.

- Business Essentials

Identifying and Managing Business Risks

:max_bytes(150000):strip_icc():format(webp)/522293_3816099810338_52357726_n1__marc_davis-5bfc2625c9e77c0058760671.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Running a business comes with many types of risk. Some of these potential hazards can destroy a business, while others can cause serious damage that is costly and time-consuming to repair. Despite the risks implicit in doing business, CEOs and risk management officers can anticipate and prepare, regardless of the size of their business.

Key Takeaways

- Some risks have the potential to destroy a business or at least cause serious damage that can be costly to repair.

- Organizations should identify which risks pose a threat to their operations.

- Potential threats include location hazards such as fires and storm damage, a l cohol and drug abuse among personnel, technology risks such as power outages, and strategic risks such as investment in research and development.

- A risk management consultant can recommend a strategy including staff training, safety checks, equipment and space maintenance, and necessary insurance policies.

If and when a risk becomes a reality, a well-prepared business can minimize the impact on earnings, lost time and productivity, and negative impact on customers. For startups and established businesses, the ability to identify risks is a key part of strategic business planning . Risks are identified through a number of ways. Strategies to identify these risks rely on comprehensively analyzing a company's specific business activities. Most organizations face preventable, strategic and external threats that can be managed through acceptance, transfer, reduction, or elimination.

A risk management consultant can help a business determine which risks should be covered by insurance.

Below are the main types of risks that companies face:

Building risks are the most common type of physical risk. Think fires or explosions. To manage building risk, and the risk to employees, it is important that organizations do the following:

- Make sure all employees know the exact street address of the building to give to a 911 operator in case of emergency.

- Make sure all employees know the location of all exits.

- Install fire alarms and smoke detectors.

- Install a sprinkler system to provide additional protection to the physical plant, equipment, documents and, of course, personnel.

- Inform all employees that in the event of emergency their personal safety takes priority over everything else. Employees should be instructed to leave the building and abandon all work-associated documents, equipment and/or products.

Hazardous material risk is present where spills or accidents are possible. The risk from hazardous materials can include:

- Toxic fumes

- Toxic dust or filings

- Poisonous liquids or waste

Fire department hazardous material units are prepared to handle these types of disasters. People who work with these materials, however, should be properly equipped and trained to handle them safely.

Organizations should create a plan to handle the immediate effects of these risks. Government agencies and local fire departments provide information to prevent these accidents. Such agencies can also provide advice on how to control them and minimize their damage if they occur.

Among the location hazards facing a business are nearby fires, storm damage, floods, hurricanes or tornados, earthquakes, and other natural disasters. Employees should be familiar with the streets leading in and out of the neighborhood on all sides of the place of business. Individuals should keep sufficient fuel in their vehicles to drive out of and away from the area. Liability or property and casualty insurance are often used to transfer the financial burden of location risks to a third-party or a business insurance company.

There are other business risks associated with location that are not directly related to hazards, such as city planning. For example, a gas station exists on a major road, and as a result of its location, it receives plenty of business. City planning can eventually restructure the area around the gas station. The city may close the road the gas station is on, build other infrastructure that would make the gas station inaccessible, or overall just not take the gas station into consideration with any redevelopment. This would leave the gas station with no traffic to serve.

Alcohol and drug abuse are major risks to personnel in the workforce. Employees suffering from alcohol or drug abuse should be urged to seek treatment, counseling, and rehabilitation if necessary. Some insurance policies may provide partial coverage for the cost of treatment.

Protection against embezzlement , theft and fraud may be difficult, but these are common crimes in the workplace. A system of double-signature requirements for checks, invoices, and payables verification can help prevent embezzlement and fraud. Stringent accounting procedures may discover embezzlement or fraud. A thorough background check before hiring personnel can uncover previous offenses in an applicant's past. While this may not be grounds for refusing to hire an applicant, it would help HR to avoid placing a new hire in a critical position where the employee is open to temptation.

Illness or injury among the workforce is a potential problem. To prevent loss of productivity, assign and train backup personnel to handle the work of critical employees when they are absent due to a health-related concern. Other human-related risks under public attention could be associated with their behaviors and values. Misbehavior of management related to bias, racism, sexism, harassment, corruption, discrimination, pollutive actions, and carelessness about the environment are all actions that represent risk for the companies where these managers work.

A power outage is perhaps the most common technology risk. Auxiliary gas-driven power generators are a reliable back-up system to provide electricity for lighting and other functions. Manufacturing plants use several large auxiliary generators to keep a factory operational until utility power is restored.

Computers may be kept up and running with high-performance back-up batteries. Power surges may occur during a lightning storm (or randomly), so organizations should furnish critical business systems with surge-protection devices to avoid the loss of documents and the destruction of equipment.

Cloud storage is another source of risks nowadays. The process involves backing up data with Amazon Web Services, for example, using Azure, IBM, and Oracle, for instance. This is a huge undertaking that should be considered given the reliance on cloud-based data to run most businesses now. It is important to establish both offline and online data backup systems to protect critical documents.

Although telephone and communications failure are relatively uncommon, risk managers may consider providing emergency-use company cell phones to personnel whose use of the phone or internet is critical to their business.

Strategy risks are not altogether undesirable. Financial institutions such as banks or credit unions take on strategy risk when lending to consumers, while pharmaceutical companies are exposed to strategy risk through research and development for a new drug. Each of these strategy-related risks is inherent in an organization's business objectives. When structured efficiently, the acceptance of strategy risks can create highly profitable operations.

Companies exposed to substantial strategy risk can mitigate the potential for negative consequences by creating and maintaining infrastructures that support high-risk projects. A system established to control the financial hardship that occurs when a risky venture fails often includes diversification of current projects, healthy cash flow, or the ability to finance new projects in an affordable way, and a comprehensive process to review and analyze potential ventures based on future return on investment .

After the risks have been identified , they must be prioritized in accordance with an assessment of their probability. The first step is to establish a probability scale for the purposes of risk assessment .

For example, risks may:

- Be very likely to occur

- Have some chance of occurring

- Have a small chance of occurring

- Have very little chance of occurring

Other risks must be prioritized and managed in accordance with their likelihood of occurring. Actuarial tables —statistical analysis of the probability of any risk occurring and the potential financial damage ensuing from the occurrence of those risks—may be accessed online and can provide guidance in prioritizing risk.

Insurance is a principle safeguard in managing risk, and many risks are insurable. Fire insurance is a necessity for any business that occupies a physical space, whether owned outright or rented, and should be a top priority. Product liability insurance, as an obvious example, is not necessary for a service business.

Some risks are an inarguably high priority, for example, the risk of fraud or embezzlement where employees handle money or perform accounting duties in accounts payable and receivable. Specialized insurance companies will underwrite a cash bond to provide financial coverage in the event of embezzlement, theft or fraud.

When insuring against potential risks, never assume a best-case scenario. Even if employees have worked for years with no problems and their service has been exemplary, insurance against employee error may be a necessity. The extent of insurance coverage against injury will depend on the nature of your business. A heavy manufacturing plant will, of course, require more extensive coverage for employees. Product liability insurance is also a necessity in this context.

If a business relies heavily on computerized data—customer lists and accounting data, for example—exterior backup and insurance coverage is necessary. Finally, hiring a risk management consultant may be a prudent step in the prevention and management of risks.

The best risk insurance is prevention. Preventing the many risks from occurring in your business is best achieved through employee training, background checks, safety checks, equipment maintenance and maintenance of the physical premises. A single, accountable staff member with managerial authority should be appointed to handle risk management responsibilities. A risk management committee may also be formed with members assigned specific tasks with a requirement to report to the risk manager.

The risk manager, in conjunction with a committee, should formulate plans for emergency situations such as:

- Hazardous materials accidents or the occurrence of other emergencies

Employees must know what to do and where to exit the building or office space in an emergency. A plan for the safety inspection of the physical premises and equipment should be developed and implemented regularly including the training and education of personnel when necessary. A periodic, stringent review of all potential risks should be conducted. Any problems should be immediately addressed. Insurance coverage should also be periodically reviewed and upgraded or downgraded as needed.

Prevention is the best insurance against risk. Employee training, background checks, safety checks, equipment maintenance, and maintenance of physical premises are all crucial risk management strategies for any business.

While business risks abound and their consequences can be destructive, there are ways and means to ensure against them, to prevent them, and to minimize their damage, if and when they occur. Finally, hiring a risk management consultant may be a worthwhile step in the prevention and management of risks.

:max_bytes(150000):strip_icc():format(webp)/TypesofInvestmentRisk-5684887a5f9b586a9e0bdf97.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organization’s capital and earnings. These threats , or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters.

If an unforeseen event catches your organization unaware, the impact could be minor, such as a small impact on your overhead costs. In a worst-case scenario, though, it could be catastrophic and have serious ramifications, such as a significant financial burden or even the closure of your business.

To reduce risk, an organization needs to apply resources to minimize, monitor and control the impact of negative events while maximizing positive events. A consistent, systemic and integrated approach to risk management can help determine how best to identify, manage and mitigate significant risks.

Get insights to better manage the risk of a data breach with the latest Cost of a Data Breach report.

Register for the X-Force Threat Intelligence Index

At the broadest level, risk management is a system of people, processes and technology that enables an organization to establish objectives in line with values and risks.

A successful risk assessment program must meet legal, contractual, internal, social and ethical goals, as well as monitor new technology-related regulations. By focusing attention on risk and committing the necessary resources to control and mitigate risk, a business protects itself from uncertainty, reduce costs and increase the likelihood of business continuity and success.

Three important steps of the risk management process are risk identification, risk analysis and assessment, and risk mitigation and monitoring.

Risk identification is the process of identifying and assessing threats to an organization, its operations and its workforce. For example, risk identification can include assessing IT security threats such as malware and ransomware, accidents, natural disasters and other potentially harmful events that could disrupt business operations.

Risk analysis involves establishing the probability that a risk event might occur and the potential outcome of each event. Risk evaluation compares the magnitude of each risk and ranks them according to prominence and consequence.

Risk mitigation refers to the process of planning and developing methods and options to reduce threats to project objectives. A project team might implement risk mitigation strategies to identify, monitor and evaluate risks and consequences inherent to completing a specific project, such as new product creation. Risk mitigation also includes the actions put into place to deal with issues and effects of those issues regarding a project.

Risk management is a nonstop process that adapts and changes over time. Repeating and continually monitoring the processes can help assure maximum coverage of known and unknown risks.

There are five commonly accepted strategies for addressing risk. The process begins with an initial consideration of risk avoidance then proceeds to 3 additional avenues of addressing risk (transfer, spreading and reduction). Ideally, these three avenues are employed in concert with one another as part of a comprehensive strategy. Some residual risk may remain.

Avoidance is a method for mitigating risk by not participating in activities that may negatively affect the organization. Not making an investment or starting a product line are examples of such activities as they avoid the risk of loss.

This method of risk management attempts to minimize the loss, rather than completely eliminate it. While accepting the risk, it stays focused on keeping the loss contained and preventing it from spreading. An example of this in health insurance is preventive care.

When risks are shared, the possibility of loss is transferred from the individual to the group. A corporation is a good example of risk sharing—several investors pool their capital and each only bears a portion of the risk that the enterprise may fail.

Contractually transferring a risk to a third-party, such as, insurance to cover possible property damage or injury shifts the risks associated with the property from the owner to the insurance company.

After all risk sharing, risk transfer and risk reduction measures have been implemented, some risk will remain since it is virtually impossible to eliminate all risk (except through risk avoidance). This is called residual risk.

Risk management standards set out a specific set of strategic processes that start with the objectives of an organization and intend to identify risks and promote the mitigation of risks through best practice.

Standards are often designed by agencies who are working together to promote common goals, to help to ensure high-quality risk management processes. For example, the ISO 31 000 standard on risk management is an international standard that provides principles and guidelines for effective risk management.

While adopting a risk management standard has its advantages, it is not without challenges. The new standard might not easily fit into what you are doing already, so you could have to introduce new ways of working. And the standards might need customizing to your industry or business.

Manage risk from changing market conditions, evolving regulations or encumbered operations while increasing effectiveness and efficiency.

Speed insights, cut infrastructure costs and increase efficiency for risk-aware decisions with IBM RegTech.

Simplify how you manage risk and regulatory compliance with a unified GRC platform fueled by AI and all your data.

Better manage your risks, compliance and governance by teaming with our security consultants.

Identify IT security vulnerabilities to help mitigate business risks.

Create a smarter security framework to manage the full threat lifecycle.

Understand your cybersecurity landscape and prioritize initiatives together with senior IBM security architects and consultants in a no-cost, virtual or in-person, 3-hour design thinking session.

Understand your cyberattack risks with a global view of the threat landscape.

Discover how a governance, risk, and compliance (GRC) framework helps an organization align its information technology with business objectives, while managing risk and meeting regulatory compliance requirements.

Find out how threat management is used by cybersecurity professionals to prevent cyber attacks, detect cyber threats and respond to security incidents.

Explore financial impacts and security measures that can help your organization avoid a data breach, or in the event of a breach, mitigate costs.

Keep up to date with the latest strategies from our expert writers.

Protect your business from potential risks and strive towards compliance with regulations as you explore the world of proper governance.

Cybersecurity threats are becoming more advanced and more persistent, and demanding more effort by security analysts to sift through countless alerts and incidents. IBM Security QRadar SIEM helps you remediate threats faster while maintaining your bottom line. QRadar SIEM prioritizes high-fidelity alerts to help you catch threats that others simply miss.

How to Build a Comprehensive Risk Management Plan

Aaron Lancaster

January 29, 2024

Risk management is an essential component of any successful project management plan. A risk management plan outlines strategies to identify, assess, and mitigate potential risks associated with a project. A well-thought-out risk management plan can help to ensure the success of a project by minimizing unexpected risks and ensuring that resources are used effectively. In this blog post, we’ll discuss how to create an effective risk management plan to maximize success and minimize risk.

Understanding the Importance of Risk Management

Risk management is not just a fancy buzzword thrown around in the world of audit, risk, and compliance. It is a crucial element that can make or break the success of an organization. So, let’s dive into the importance of risk management and why it should never be overlooked.

First and foremost, risk management allows organizations to take a proactive approach rather than a reactive one. By identifying potential risks early on, project managers can devise strategies to mitigate or eliminate them. This not only saves time and resources but also helps to maintain project timelines and budgets.

One of the key reasons why risk management is vital is that it helps risk owners effectively communicate with stakeholders. When known risks are assessed, risk management leadership can provide stakeholders with realistic expectations regarding potential issues that may arise during the project’s lifecycle. This transparency fosters trust and credibility, as key stakeholders are informed about the project’s potential risks and how they will be handled.

A risk management plan also aids in decision-making processes. When organizations have a comprehensive understanding of potential risks, they can make informed decisions to address and minimize these risks. For example, if a risk assessment reveals a high potential impact on a specific business process, risk owners can allocate additional resources or adjust project timelines accordingly. This ensures that business process objectives are achieved, even in the face of adversity.

Furthermore, risk management promotes a proactive and collaborative approach with corporate executives and management teams. By involving team members in risk identification and analysis processes, organizations tap into the collective expertise and experience of their teams. This collaborative effort not only results in better risk identification but also fosters a sense of ownership and accountability among team members.

A risk management plan acts as a blueprint for the project team to follow. It provides a structured framework for risk identification, assessment, and response. Without a risk management plan, the organization would be left vulnerable to unexpected risks, leading to project delays, cost overruns, and overall project failure.

Finally, risk management is an iterative process. Throughout the risk management lifecycle, new types of risks may emerge, or the severity of existing risks may change. A robust risk management plan allows project managers to monitor and track risks continually, updating their risk register and response plans as needed. This adaptability ensures that the project remains on track, even when faced with unforeseen challenges.

Identifying Potential Risks

Now that we understand the importance of risk management, let’s dive into the first step of creating an effective risk management plan: identifying potential risks. This step is crucial because it sets the foundation for the entire risk management process.

To identify potential risks, risk owners can employ various techniques and tools. One popular method is brainstorming sessions. Gather your risk management team members, stakeholders, and subject matter experts in a room and encourage them to share any risks they can think of. By tapping into the collective knowledge and expertise of your team, you can identify risks that might have otherwise been overlooked.

Another helpful tool for identifying potential risks is using a risk management plan template . A risk management plan template provides a structured framework for capturing and categorizing potential risks. It prompts the risk management team to consider different aspects of the business process, such as technology, resources, and external factors, which can help uncover potential risks.

During the risk identification process, it’s important to think broadly and consider both internal and external factors that could negatively impact the organization’s security posture. Internal risks may include issues with team dynamics, resource availability, or technical limitations. External risks, on the other hand, may arise from factors beyond your control, such as regulatory changes, market fluctuations, or natural disasters.

Once potential risks have been identified, it’s important to document them in a risk register or a risk analysis tool. This record should include details about each risk, such as its description, likelihood of occurrence, potential impact, and risk owner. Assigning a risk owner is essential, as it ensures that someone takes responsibility for monitoring and managing each identified risk.

As risks are identified, they should also evaluate the severity of each risk. By evaluating risk severity, organizations can prioritize risks and allocate resources accordingly. The severity of risk can be determined by assessing the likelihood of occurrence and the potential impact it could have on the enterprise component. This evaluation allows the focus to be placed on high-severity risks first, ensuring that resources are used effectively.

It’s worth mentioning that the process of identifying potential risks should not be a one-time event. Throughout the project lifecycle, new risks may emerge, or the severity of existing risks may change. Therefore, risk identification should be an ongoing process, with regular risk monitoring and review.

Evaluating Risk Severity

Now that we have identified potential risks, it is crucial to evaluate their severity. Evaluating risk severity allows project managers to prioritize risks and allocate resources effectively. By understanding the potential impact and likelihood of each risk, risk management leadership can make informed decisions about which risks to address first.

To evaluate risk severity, risk owners should consider both the potential impact and the likelihood of occurrence. The potential impact refers to the magnitude of the consequences if a risk were to materialize. For example, financial risk management may reveal a risk that could result in a big financial loss or project failure, which has a greater potential impact than a risk with minor consequences.

Likelihood of occurrence, on the other hand, refers to the probability that a risk will happen. This can be based on historical data, expert judgment, or statistical analysis. Risks that are more likely to occur pose a higher threat to the project and should be given greater attention.

To evaluate risk severity, organizations can use a risk assessment matrix. This matrix typically consists of a grid with severity levels ranging from low to high, and likelihood levels ranging from unlikely to almost certain. Each risk is then assessed and assigned a severity level based on its potential impact and likelihood of occurrence.

Once risks have been assigned severity levels, they can be prioritized, and then a risk response plan can be developed. The risk response plan outlines response strategies for mitigating, transferring, accepting, or avoiding each identified risk. By addressing high-severity risks first, risk owners can minimize their impact and decrease the chances of negative impact on the organization.

In addition to the risk response plan, organizations should also consider developing a contingency plan for high-severity risks. A contingency plan is a backup plan that outlines actions to be taken if a risk materializes. This plan helps companies to be prepared and minimizes the potential disruption caused by unexpected risk events.

It is important to note that risk severity evaluations should be revisited regularly throughout the project lifecycle. As new risks emerge or existing risks change, the severity levels may need to be adjusted. Regular review and evaluation of risk severity ensure that the risk management plan remains effective and up to date.

Developing a Risk Mitigation Plan

Developing a Risk Mitigation Plan is a crucial step in the risk management process. Once potential risks have been identified and their severity evaluated, it’s time to develop a plan to mitigate these risks and minimize their impact on the project. The goal of a risk mitigation plan is to put measures in place to reduce the likelihood of risks occurring and to decrease their potential impact.

To develop a risk mitigation plan, project managers should start by prioritizing the high-severity risks identified during the risk evaluation process. These are the risks that have the highest potential impact and are most likely to occur. By focusing on these risks first, resources can be effectively allocated and address the most critical threats to the company’s success.

Once high-severity risks have been identified, risk management team members can start brainstorming strategies to mitigate them. Several approaches can be taken, depending on the nature of the risk and the specific circumstances. Some common risk mitigation strategies include:

1. Risk Avoidance: In some cases, the best way to mitigate a risk is to avoid it altogether. This may involve making changes to the project plan, such as choosing a different technology or methodology that reduces the risk’s likelihood.

2. Risk Transfer: Sometimes, it’s possible to transfer the risk to another party. This could involve outsourcing certain aspects of the project to a third-party vendor or purchasing insurance to cover potential losses.

3. Risk Reduction: This strategy involves taking steps to reduce the likelihood or impact of a risk. For example, implementing strict quality control measures can reduce the risk of product defects, or conducting regular backup procedures can reduce the risk of data loss.

4. Risk Acceptance: In some cases, the potential impact of a risk may be low enough that it is acceptable to simply monitor the risk and take no further action. This strategy is often used for low-severity risks or risks that are outside of the organization’s control.

Once risk mitigation strategies have been identified, it’s important to document them in the risk response plan. The risk response plan outlines the specific actions that will be taken to mitigate each identified risk. It should include details such as who is responsible for implementing the strategy, the timeline for completion, and any associated costs.

Implementing and monitoring the project risk management plan are the next steps in the risk management process. Once the risk analysis and management plan has been developed, it’s important to put it into action and monitor its effectiveness. This involves tracking the progress of risk mitigation strategies, assessing their impact on the project, and making adjustments as needed.

Implementing and Monitoring the Plan

Once you have developed your risk mitigation plan, it’s time to put it into action and start implementing and monitoring your strategies. This is a crucial step in the risk management process as it allows you to track the progress of your risk mitigation efforts and make adjustments as needed.

To begin, ensure that your risk response plan is communicated clearly to all relevant team members. Each person responsible for implementing a specific risk mitigation strategy should understand their role and the timeline for completion. This promotes accountability and ensures that everyone is on the same page when it comes to managing project risks.

As you implement your risk mitigation strategies, it’s important to monitor their effectiveness. Regularly assess how well your strategies are working and whether they are effectively reducing the likelihood or impact of identified risks. This can be done through regular project meetings, check-ins, and progress reports. Additionally, establish key performance indicators (KPIs) or metrics to track the success of your risk mitigation efforts.

If you find that certain strategies are not achieving the desired results, be prepared to make adjustments. This might involve revisiting your risk response plan and identifying alternative strategies to address the risk. Flexibility and adaptability are key when it comes to managing project risks, so don’t be afraid to make changes if needed.

In addition to monitoring the effectiveness of your risk mitigation strategies, it’s important to regularly review and update your risk register. As new risks emerge or existing risks change, make sure to document them in your risk register and assess their potential impact. This ensures that your risk management plan remains current and reflects the evolving nature of your project.

Remember, risk management is an ongoing process, and monitoring your risk mitigation strategies is crucial to the success of your project. By regularly assessing the effectiveness of your strategies and making necessary adjustments, you can stay one step ahead of potential risks and increase the likelihood of project success.

Adapting and Improving Your Risk Management Strategy

Creating an effective risk management plan is a dynamic process that requires continuous adaptation and improvement. As your project progresses and new information becomes available, it’s essential to reassess your risk management strategies and make necessary adjustments. In this section, we’ll explore the importance of adapting and improving your risk management strategy and provide some tips for doing so effectively.

One of the first steps in adapting your risk management strategy is to regularly review and update your risk response plan. As you implement your risk mitigation strategies and monitor their effectiveness, you may discover that certain strategies are not achieving the desired results or that new risks have emerged. By revisiting your risk response plan and identifying alternative strategies, you can address these challenges head-on and increase the likelihood of project success.

In addition to updating your risk response plan, it’s crucial to regularly communicate with your project team and stakeholders about any changes or adjustments to the risk management strategy. This open and transparent communication ensures that everyone is on the same page and can adjust their plans and expectations accordingly. It also fosters a collaborative environment where team members feel empowered to provide feedback and suggest improvements.

Another important aspect of adapting your risk management strategy is to learn from past experiences. As your project progresses, take the time to reflect on any risks that have occurred and evaluate how well your risk mitigation strategies addressed them. Did the strategies effectively reduce the impact of the risks? Were there any unforeseen challenges or opportunities that arose? By reflecting on these experiences, you can identify areas for improvement and adjust your risk management strategy accordingly.

Continuous improvement is key to effective risk management. This means regularly seeking feedback from your project team and stakeholders, as well as staying updated on industry best practices and emerging risk management trends . Attend relevant conferences or webinars, read industry publications, and engage in discussions with other project managers to stay informed and gain new insights.

Risk management is an ongoing process that requires vigilance and adaptability. By regularly reviewing and updating your risk management strategy, communicating with your team and stakeholders, learning from past experiences, and staying informed, you can ensure that your project is well-positioned to minimize risks and maximize success.

In conclusion, an effective risk management strategy is crucial for project success. By understanding the importance of risk management, identifying potential risks, evaluating their severity, developing a risk mitigation plan, implementing and monitoring the plan, and adapting and improving your risk management strategy, you can minimize risks and increase the likelihood of project success.

Aaron Lancaster is a Manager of Partner Solutions at AuditBoard, where he serves as a product and industry expert to support AuditBoard’s alliance members. Aaron has more than 15 years of experience in internal audit, risk management, organizational controls, compliance, and business process improvement with primary focus on financial services. Connect with Aaron on LinkedIn .

Related Articles

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Managing Risks: A New Framework

- Robert S. Kaplan

- Anette Mikes

Risk management is too often treated as a compliance issue that can be solved by drawing up lots of rules and making sure that all employees follow them. Many such rules, of course, are sensible and do reduce some risks that could severely damage a company. But rules-based risk management will not diminish either the likelihood or the impact of a disaster such as Deepwater Horizon, just as it did not prevent the failure of many financial institutions during the 2007–2008 credit crisis.

In this article, Robert S. Kaplan and Anette Mikes present a categorization of risk that allows executives to understand the qualitative distinctions between the types of risks that organizations face. Preventable risks, arising from within the organization, are controllable and ought to be eliminated or avoided. Examples are the risks from employees’ and managers’ unauthorized, unethical, or inappropriate actions and the risks from breakdowns in routine operational processes. Strategy risks are those a company voluntarily assumes in order to generate superior returns from its strategy. External risks arise from events outside the company and are beyond its influence or control. Sources of these risks include natural and political disasters and major macroeconomic shifts. Risk events from any category can be fatal to a company’s strategy and even to its survival.

Companies should tailor their risk management processes to these different risk categories. A rules-based approach is effective for managing preventable risks, whereas strategy risks require a fundamentally different approach based on open and explicit risk discussions. To anticipate and mitigate the impact of major external risks, companies can call on tools such as war-gaming and scenario analysis.

Smart companies match their approach to the nature of the threats they face.

Editors’ note: Since this issue of HBR went to press, JP Morgan, whose risk management practices are highlighted in this article, revealed significant trading losses at one of its units. The authors provide their commentary on this turn of events in their contribution to HBR’s Insight Center on Managing Risky Behavior.

- Robert S. Kaplan is a senior fellow and the Marvin Bower Professor of Leadership Development emeritus at Harvard Business School. He coauthored the McKinsey Award–winning HBR article “ Accounting for Climate Change ” (November–December 2021).

- Anette Mikes is a fellow at Hertford College, Oxford University, and an associate professor at Oxford’s Saïd Business School.

Partner Center

- Contact sales

Start free trial

How to Make a Risk Management Plan (Template Included)

You identify them, record them, monitor them and plan for them: risks are an inherent part of every project. Some project risks are bound to become problem areas—like executing a project over the holidays and having to plan the project timeline around them. But there are many risks within any given project that, without risk assessment and risk mitigation strategies, can come as unwelcome surprises to you and your project management team.

That’s where a risk management plan comes in—to help mitigate risks before they become problems. But first, what is project risk management ?

What Is Risk Management?

Risk management is an arm of project management that deals with managing potential project risks. Managing your risks is arguably one of the most important aspects of project management.

The risk management process has these main steps:

- Risk Identification: The first step to manage project risks is to identify them. You’ll need to use data sources such as information from past projects or subject matter experts’ opinions to estimate all the potential risks that can impact your project.

- Risk Assessment: Once you have identified your project risks, you’ll need to prioritize them by looking at their likelihood and level of impact.

- Risk Mitigation: Now it’s time to create a contingency plan with risk mitigation actions to manage your project risks. You also need to define which team members will be risk owners, responsible for monitoring and controlling risks.

- Risk Monitoring: Risks must be monitored throughout the project life cycle so that they can be controlled.

If one risk that’s passed your threshold has its conditions met, it can put your entire project plan in jeopardy. There isn’t usually just one risk per project, either; there are many risk categories that require assessment and discussion with your stakeholders.

That’s why risk management needs to be both a proactive and reactive process that is constant throughout the project life cycle. Now let’s define what a risk management plan is.

What Is a Risk Management Plan?

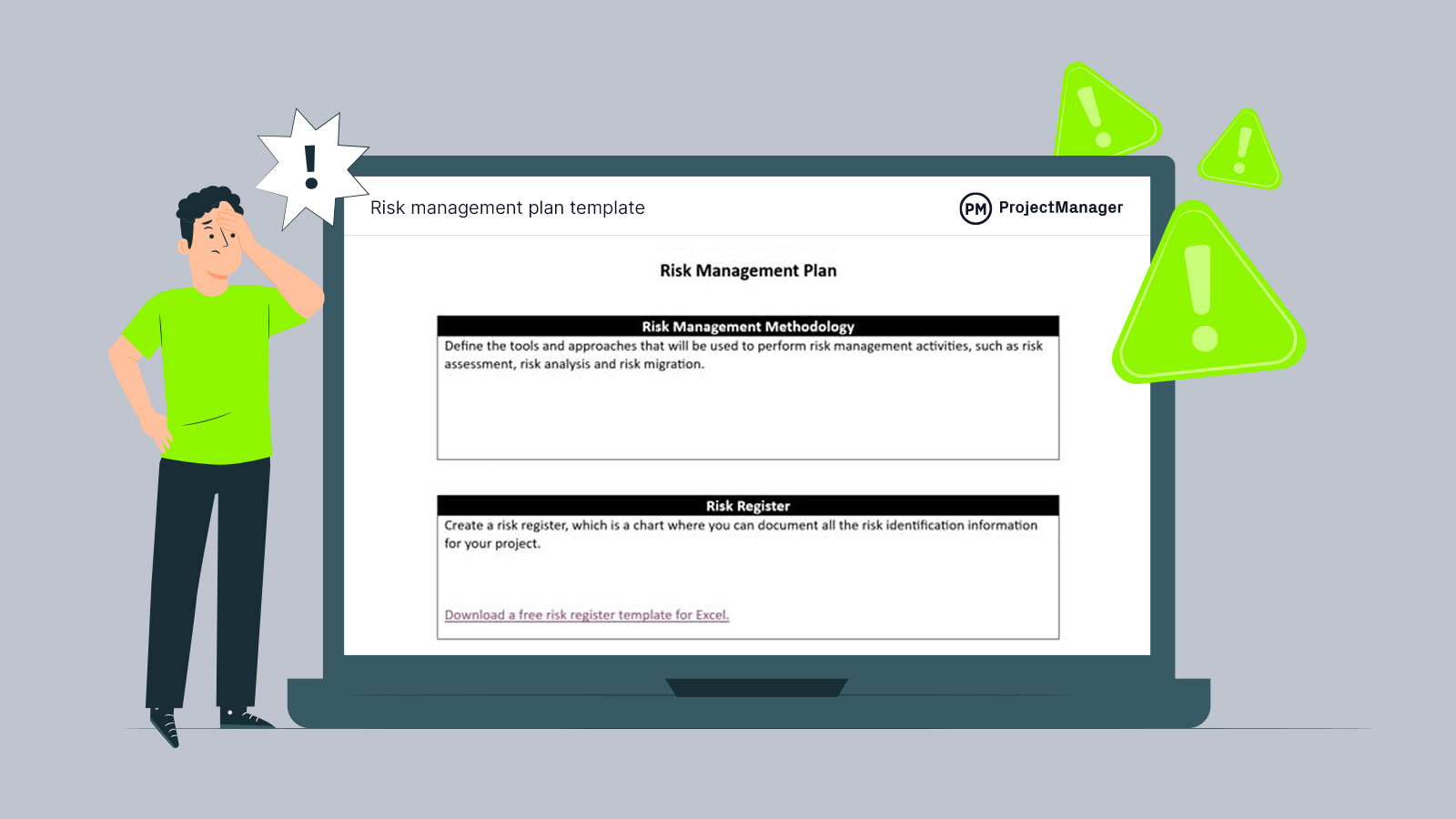

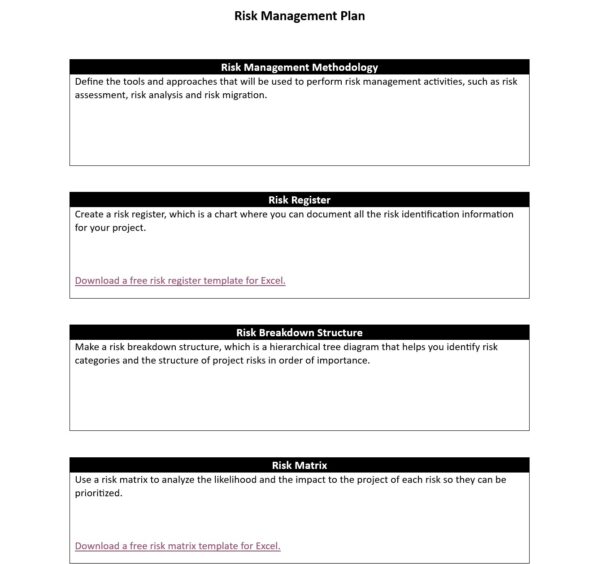

A risk management plan defines how your project’s risk management process will be executed. That includes the budget , tools and approaches that will be used to perform risk identification, assessment, mitigation and monitoring activities.

Get your free

Risk Management Plan Template

Use this free Risk Management Plan Template for Word to manage your projects better.

A risk management plan usually includes:

- Methodology: Define the tools and approaches that will be used to perform risk management activities such as risk assessment, risk analysis and risk mitigation strategies.

- Risk Register: A risk register is a chart where you can document all the risk identification information of your project.

- Risk Breakdown Structure: It’s a chart that allows you to identify risk categories and the hierarchical structure of project risks.

- Risk Assessment Matrix: A risk assessment matrix allows you to analyze the likelihood and the impact of project risks so you can prioritize them.

- Risk Response Plan: A risk response plan is a project management document that explains the risk mitigation strategies that will be employed to manage your project risks.

- Roles and responsibilities: The risk management team members have responsibilities as risk owners. They need to monitor project risks and supervise their risk response actions.

- Budget: Have a section where you identify the funds required to perform your risk management activities.

- Timing: Include a section to define the schedule for the risk management activities.

How to Make a Risk Management Plan

For every web design and development project, construction project or product design, there will be risks. That’s truly just the nature of project management. But that’s also why it’s always best to get ahead of them as much as possible by developing a risk management plan. The steps to make a risk management plan are outlined below.

1. Risk Identification

Risk identification occurs at the beginning of the project planning phase, as well as throughout the project life cycle. While many risks are considered “known risks,” others might require additional research to discover.

You can create a risk breakdown structure to identify all your project risks and classify them into risk categories. You can do this by interviewing all project stakeholders and industry experts. Many project risks can be divided up into risk categories, like technical or organizational, and listed out by specific sub-categories like technology, interfaces, performance, logistics, budget, etc. Additionally, create a risk register that you can share with everyone you interviewed for a centralized location of all known risks revealed during the identification phase.

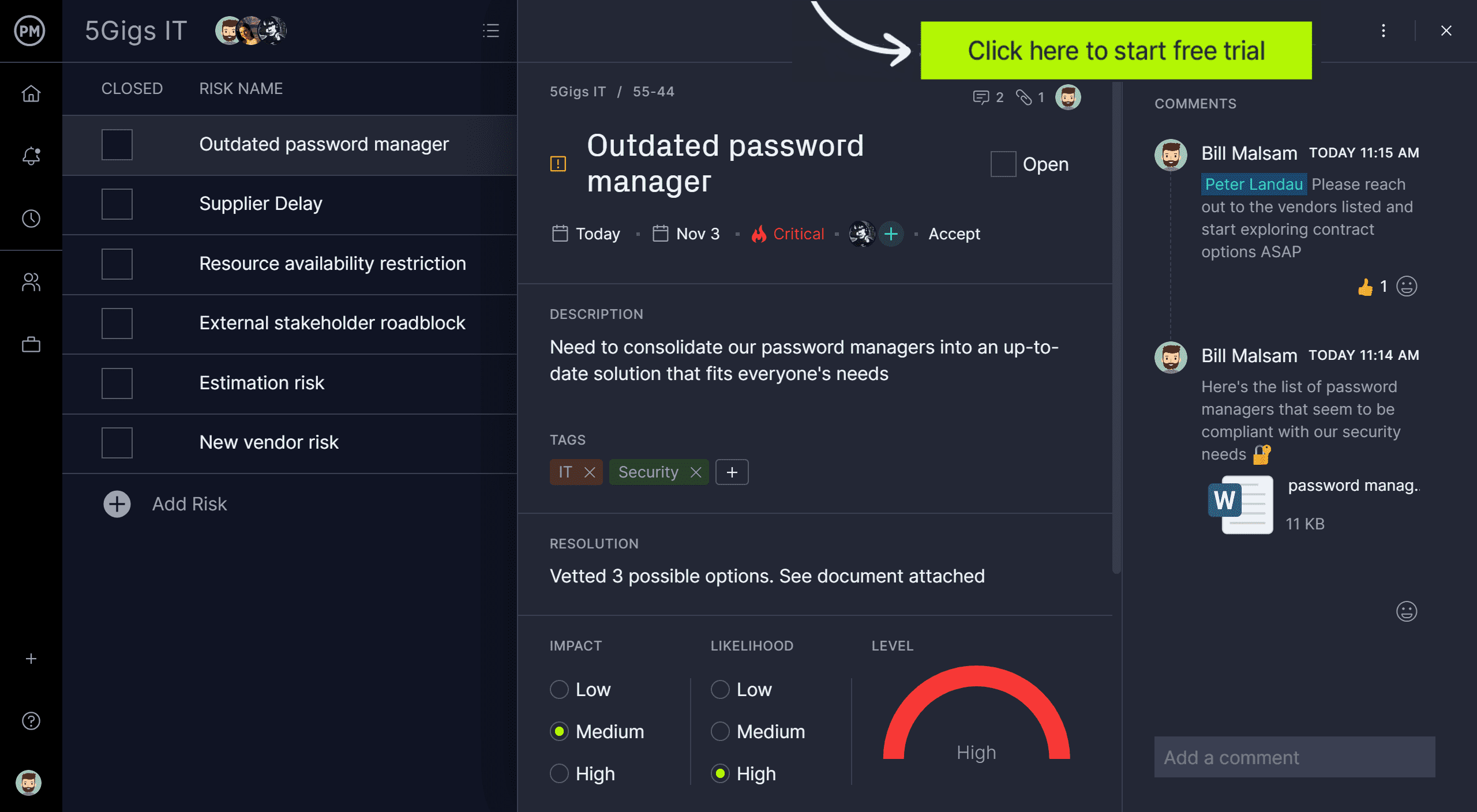

You can conveniently create a risk register for your project using online project management software. For example, use the list view on ProjectManager to capture all project risks, add what level of priority they are and assign a team member to own identify and resolve them. Better than to-do list apps, you can attach files, tags and monitor progress. Track the percentage complete and even view your risks from the project menu. Keep risks from derailing your project by signing up for a free trial of ProjectManager.

2. Risk Assessment

In this next phase, you’ll review the qualitative and quantitative impact of the risk—like the likelihood of the risk occurring versus the impact it would have on your project—and map that out into a risk assessment matrix

First, you’ll do this by assigning the risk likelihood a score from low probability to high probability. Then, you’ll map out your risk impact from low to medium to high and assign each a score. This will give you an idea of how likely the risk is to impact the success of the project, as well as how urgent the response will need to be.

To make it efficient for all risk management team members and project stakeholders to understand the risk assessment matrix, assign an overall risk score by multiplying your impact level score with your risk probability score.

3. Create a Risk Response Plan

A risk response is the action plan that is taken to mitigate project risks when they occur. The risk response plan includes the risk mitigation strategies that you’ll execute to mitigate the impact of risks in your project. Doing this usually comes with a price—at the expense of your time, or your budget. So you’ll want to allocate resources, time and money for your risk management needs prior to creating your risk management plan.

4. Assign Risk Owners

Additionally, you’ll also want to assign a risk owner to each project risk. Those risk owners become accountable for monitoring the risks that are assigned to them and supervising the execution of the risk response if needed.

Related: Risk Tracking Template

When you create your risk register and risk assessment matrix, list out the risk owners, that way no one is confused as to who will need to implement the risk response strategies once the project risks occur, and each risk owner can take immediate action.

Be sure to record what the exact risk response is for each project risk with a risk register and have your risk response plan it approved by all stakeholders before implementation. That way you can have a record of the issue and the resolution to review once the entire project is finalized.

5. Understand Your Triggers

This can happen with or without a risk already having impacted your project—especially during project milestones as a means of reviewing project progress. If they have, consider reclassifying those existing risks.

Even if those triggers haven’t been met, it’s best to come up with a backup plan as the project progresses—maybe the conditions for a certain risk won’t exist after a certain point has been reached in the project.

6. Make a Backup Plan

Consider your risk register and risk assessment matrix a living document. Your project risks can change in classification at any point during your project, and because of that, it’s important you come up with a contingency plan as part of your process.

Contingency planning includes discovering new risks during project milestones and reevaluating existing risks to see if any conditions for those risks have been met. Any reclassification of a risk means adjusting your contingency plan just a little bit.

7. Measure Your Risk Threshold

Measuring your risk threshold is all about discovering which risk is too high and consulting with your project stakeholders to consider whether or not it’s worth it to continue the project—worth it whether in time, money or scope .

Here’s how the risk threshold is typically determined: consider your risks that have a score of “very high”, or more than a few “high” scores, and consult with your leadership team and project stakeholders to determine if the project itself may be at risk of failure. Project risks that require additional consultation are risks that have passed the risk threshold.

To keep a close eye on risk as they raise issues in your project, use project management software. ProjectManager has real-time dashboards that are embedded in our tool, unlike other software where you have to build them yourself. We automatically calculate the health of your project, checking if you’re on time or running behind. Get a high-level view of how much you’re spending, progress and more. The quicker you identify risk, the faster you can resolve it.

Free Risk Management Plan Template

This free risk management plan template will help you prepare your team for any risks inherent in your project. This Word document includes sections for your risk management methodology, risk register, risk breakdown structure and more. It’s so thorough, you’re sure to be ready for whatever comes your way. Download your template today.

Best Practices for Maintaining Your Risk Management Plan

Risk management plans only fail in a few ways: incrementally because of insufficient budget, via modeling errors or by ignoring your risks outright.

Your risk management plan is one that is constantly evolving throughout the course of the project life cycle, from beginning to end. So the best practices are to focus on the monitoring phase of the risk management plan. Continue to evaluate and reevaluate your risks and their scores, and address risks at every project milestone.

Project dashboards and other risk tracking features can be a lifesaver when it comes to maintaining your risk management plan. Watch the video below to see just how important project management dashboards, live data and project reports can be when it comes to keeping your projects on track and on budget.

In addition to your routine risk monitoring, at each milestone, conduct another round of interviews with the same checklist you used at the beginning of the project, and re-interview project stakeholders, risk management team members, customers (if applicable) and industry experts.

Record their answers, adjust your risk register and risk assessment matrix if necessary, and report all relevant updates of your risk management plan to key project stakeholders. This process and level of transparency will help you to identify any new risks to be assessed and will let you know if any previous risks have expired.

How ProjectManager Can Help With Your Risk Management Plan

A risk management plan is only as good as the risk management features you have to implement and track them. ProjectManager is online project management software that lets you view risks directly in the project menu. You can tag risks as open or closed and even make a risk matrix directly in the software. You get visibility into risks and can track them in real time, sharing and viewing the risk history.

Tracking & Monitor Risks in Real Time

Managing risk is only the start. You must also monitor risk and track it from the point that you first identified it. Real-time dashboards give you a high-level view of slippage, workload, cost and more. Customizable reports can be shared with stakeholders and filtered to show only what they need to see. Risk tracking has never been easier.

Risks are bound to happen no matter the project. But if you have the right tools to better navigate the risk management planning process, you can better mitigate errors. ProjectManager is online project management software that updates in real time, giving you all the latest information on your risks, issues and changes. Start a free 30-day trial and start managing your risks better.

Deliver your projects on time and under budget

Start planning your projects.

Octobits Learning Center

Consolidated Dashboard of all your IT services

- IT Strategy

Risk Management Planning: Definition, Process, and Types

Risk Management Planning (Image by Entrepreneur Handbook)

Risk management planning is a proactive strategy essential for anticipating and addressing potential challenges before they escalate.

This method is critical in diminishing uncertainties that could affect the success of projects or business operations.

Let’s say you’re launching a new product, confident in your research and excited about the market.

But what if a competitor swoops in? Or what if an unexpected supply chain disruption throws your schedule off? Such situations underline the importance of risk management planning.

Risk management planning involves identifying potential risks, assessing their likelihood and impact, and then developing strategies to mitigate or manage them.

In the business context, this planning is instrumental for making well-informed decisions.

It allows companies to navigate through uncertainties with greater confidence and stability, turning potential problems into manageable situations.

For IT projects, where adhering to timelines and budgets is crucial, risk management planning takes on additional significance.

Projects can stay on track when unexpected challenges arise by anticipating potential setbacks and having strategies in place.

This article below aims to provide a comprehensive understanding of IT risk management planning.

The goal is to offer valuable insights that can be practically applied in your organization’s risk management strategies.

We hope this knowledge will help you make your projects and business operations more resilient and adaptable to change.

Definition of Risk Management Planning

Risk management planning is a strategic process aimed at identifying, assessing, and mitigating risks in business and IT environments.

Strong risk management planning is a crucial factor in preventing risk management failures . It’s about being proactive rather than reactive, ensuring that risks are managed before they become problematic.

Risk management planning involves three key steps. First, it’s about spotting potential risks – these could be anything from market fluctuations to IT system failures.

The second step is assessing these risks. This means understanding how likely they are to happen and what impact they could have.

Finally, it’s about taking action – developing strategies to either reduce these risks or manage their impact effectively.

Risk management planning helps companies navigate through uncertainties, making sure that they are not caught off guard.

Due to the fast changing nature of technology and the increasing threat of cyber-attacks, IT projects require extra vigilance.

Implementing risk management planning guarantees that projects remain on track, within budget, and, most importantly, secure.

Key Components of Risk Management Planning

Risk management planning is a systematic approach that involves several essential components.

These components work together to ensure an organization can effectively anticipate, understand, and manage risks.

Let’s break down the key tools that keep your project or business running smoothly.

First up is risk identification. This is about being alert and aware, pinpointing potential risks that could impact your organization.

Brainstorm every possible risk, from a tech outage to a competitor’s sneaky launch. No stone (or server) should be left unturned!.

Next is risk assessment. Here, you’re evaluating the identified risks to understand how likely they are to happen and what impact they could have.

Not all risks are created equal. You analyze each one, figuring out how likely it is to happen and how much damage it could do.

Then comes risk mitigation. This step is all about strategy. You’re developing plans to either reduce the likelihood of these risks or minimize their impact if they do happen.

Yes, you must develop strategies to avoid, minimize, or respond to those risks. Think of it as having a Plan B (and maybe even a Plan C) ready to go if things get hairy.

Keep in mind that risks can be difficult to detect, therefore monitoring is crucial. This ongoing process involves keeping an eye on the risk landscape and the effectiveness of your mitigation strategies.

You must track their likelihood and impact, ready to adjust our defenses as needed.

Finally, communication is critical. Effective risk management requires clear and continuous communication within the organization.

Share the plan with all involved stakeholders to keep them informed and prepared.

Importance of Risk Management Planning

Why is Risk management planning so important? Well, in the dynamic world of business and IT, risks are like uncharted waters.

A robust risk management plan helps navigate these waters, ensuring that potential issues are identified and managed before they escalate into major problems.

One of the key benefits is improved decision-making. With a clear understanding of potential risks, business can make more informed choices, balancing opportunities against possible pitfalls.

Identifying and assessing potential risks allows for informed decision-making based on facts rather than intuition.

For IT projects, risk management planning is about anticipating and preparing for obstacles to ensure that projects stay on track, within budget, and complete successfully.

Moreover, risk management planning contributes significantly to organizational resilience. It builds a culture of preparedness, where teams are not just reacting to crises, but are proactively managing potential threats.

This forward-thinking approach fosters an environment of agility and adaptability, enabling organizations to withstand and even thrive amidst challenges.

Types of Risks Covered in Risk Management Planning

There are many different types of risks faced by businesses. These risks can broadly be categorized into strategic, operational, financial, and compliance risks.

Each category has its unique challenges and requires specific strategies to manage. Let’s investigate some of the most common troublemakers to keep an eye out for.

First, we have strategic risks. These are big-picture risks related to the overall direction and goals of the organization.

Strategic risks involve missed opportunities, changing market trends, or even new competitors throwing wrenches in your plans.

A good plan helps you navigate these twists and turns, keeping your city (business) on the path to success.

Operational risks are more about the day-to-day functioning of the business. These include risks from internal processes, people, and systems.

Having a plan ensures you have detours and repair crews ready to keep your city (business) running smoothly.

Financial risks deal with the financial aspects of the organization. They include market fluctuations, credit risks, and liquidity issues.

Therefore, it is important to have a solid financial foundation to manage these risks. A strong plan helps you build financial resilience, weather those storms, and protect your city’s (business) prosperity.

Compliance risks are linked to legal and regulatory requirements. Every industry has its regulations, and failing to comply can lead to legal consequences and damage to reputation.

Staying up-to-date with these regulations and integrating them into business practices is essential.

Please note, each type of risk requires a tailored approach to manage effectively.

Businesses can not only protect themselves, but position themselves for growth and success by understanding and preparing for these risks.

Benefits of Effective Risk Management Planning

Effective risk management planning brings tangible benefits that can transform how an organization operates and is perceived. But what are the tangible benefits this planning brings?

Firstly, enhanced decision-making is a significant benefit. Instead of stumbling in the dark, risk management equips you with a floodlight, illuminating potential dangers.

You can make informed decisions based on facts, not gut feelings, avoiding costly missteps and maximizing opportunities.

Stakeholder confidence is another key advantage. Investors, clients, and team members gain trust when they see a well-managed approach to risk.

You build trust and confidence with investors, employees, and customers, creating a calmer and more productive environment.

They know you’re prepared, and that breeds positive vibes all around.

Project success is closely tied to effective risk management. By getting ahead of potential roadblocks such as budget cuts or software glitches, you’ll be prepared to navigate around them with grace.

No more panic over delays or derailed schedules. Your projects finish smoothly, boosting efficiency and morale.

Risk management planning also encourages innovation and drives your business forward. A well-managed risk environment fosters a culture that encourages calculated risk-taking.

You’re not paralyzed by fear, but empowered to explore new ventures and ideas, knowing there’s a safety net to catch you if you stumble.

The good news is risk management planning is also an investment in your brand image that pays big dividends. How?

Proactively addressing potential compliance or ethical concerns shows the world that you care.

You build a stronger reputation for responsibility and transparency, attracting loyal customers and top talent.

Common Challenges and How to Overcome Them

So you’ve embarked on the noble quest of risk management planning – fantastic! But hold your horses, every adventurer encounters hurdles.

One common challenge is underestimating risks. Sometimes, risks might seem distant or unlikely, leading to inadequate preparation.

To overcome this, it’s important to conduct thorough risk assessments and consider even low-probability events.

Another challenge is the rapidly changing risk landscape, especially in tech-driven industries.

To keep up, your business must regularly update its risk management plans. Staying current ensures that you’re always on the right track.

A lack of clear communication can also hinder effective risk management. It’s essential for everyone in the organization to understand the risks and the strategies in place to manage them.

Clear, consistent communication is like a well-marked map – it helps everyone stay on course and move in the same direction.

Resource constraints often pose a challenge. Not all organizations have the luxury of extensive resources to dedicate to risk management.

The key here is to prioritize. Focus on the risks with the highest impact and likelihood, ensuring the most critical areas are covered.

Finally, ensuring stakeholder buy-in can be tricky. So, it’s important to demonstrate the value of risk management to all stakeholders.

Show them it’s not just about avoiding problems, but about enabling smoother, more successful operations.

With thorough assessment, regular updates, clear communication, strategic resource allocation, and stakeholder engagement, these challenges can be effectively managed.

Best Practices in Risk Management Planning

Best practices in risk management planning include working across the organization, regularly updating risk assessments, fostering a risk-aware culture, maintaining clear communication, and having solid contingency plans in place.

The practices outlined below illustrate how to ensure your business is prepared to face uncertainty, making it more resilient and adaptable.

A key practice is to involve all levels of the organization. Risk management shouldn’t be confined to top executives or a specific department.

Brainstorming with diverse perspectives uncovers hidden threats and boosts ownership.

Regular risk assessments ensure that your strategies are current and effective. Please remember, not all risks are created equal. Focus on the high-impact, high-likelihood ones first.

Another best practice is integrating risk management into the organizational culture. This means making risk awareness part of the daily conversation.

So, be sure that your fancy document isn’t enough. Build a practical response plan for each risk, complete with clear roles and responsibilities. Think of it as an “if-then” playbook for any unexpected storm.

That’s why, never leave your team in the dark. Communicate the plan clearly and regularly, keeping everyone informed and engaged.

Finally, contingency planning is a must. It’s not enough to identify and assess risks; you need actionable plans to address them if they occur.

Technology and Tools in Risk Management Planning

Technology and tools in risk management planning offer a multitude of benefits. They give you insights, ramp up accuracy, keep an eye on things in real time, and make teamwork a breeze.

Take Cisco, for example. It’s a shield against the digital dangers of network breaches, cyber-attacks, and uninvited guests, keeping your network’s integrity rock solid.

Then there’s Microsoft Azure, your security framework in the cloud. It’s got your back with disaster recovery and backup solutions, ensuring your data stays safe and sound, even when things go south.