- Search Search Please fill out this field.

What Is Hypothesis Testing?

Step 1: define the hypothesis, step 2: set the criteria, step 3: calculate the statistic, step 4: reach a conclusion, types of errors, the bottom line.

- Trading Skills

- Trading Basic Education

Hypothesis Testing in Finance: Concept and Examples

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Your investment advisor proposes you a monthly income investment plan that promises a variable return each month. You will invest in it only if you are assured of an average $180 monthly income. Your advisor also tells you that for the past 300 months, the scheme had investment returns with an average value of $190 and a standard deviation of $75. Should you invest in this scheme? Hypothesis testing comes to the aid for such decision-making.

Key Takeaways

- Hypothesis testing is a mathematical tool for confirming a financial or business claim or idea.

- Hypothesis testing is useful for investors trying to decide what to invest in and whether the instrument is likely to provide a satisfactory return.

- Despite the existence of different methodologies of hypothesis testing, the same four steps are used: define the hypothesis, set the criteria, calculate the statistic, and reach a conclusion.

- This mathematical model, like most statistical tools and models, has limitations and is prone to certain errors, necessitating investors also considering other models in conjunction with this one

Hypothesis or significance testing is a mathematical model for testing a claim, idea or hypothesis about a parameter of interest in a given population set, using data measured in a sample set. Calculations are performed on selected samples to gather more decisive information about the characteristics of the entire population, which enables a systematic way to test claims or ideas about the entire dataset.

Here is a simple example: A school principal reports that students in their school score an average of 7 out of 10 in exams. To test this “hypothesis,” we record marks of say 30 students (sample) from the entire student population of the school (say 300) and calculate the mean of that sample. We can then compare the (calculated) sample mean to the (reported) population mean and attempt to confirm the hypothesis.

To take another example, the annual return of a particular mutual fund is 8%. Assume that mutual fund has been in existence for 20 years. We take a random sample of annual returns of the mutual fund for, say, five years (sample) and calculate its mean. We then compare the (calculated) sample mean to the (claimed) population mean to verify the hypothesis.

This article assumes readers' familiarity with concepts of a normal distribution table, formula, p-value and related basics of statistics.

Different methodologies exist for hypothesis testing, but the same four basic steps are involved:

Usually, the reported value (or the claim statistics) is stated as the hypothesis and presumed to be true. For the above examples, the hypothesis will be:

- Example A: Students in the school score an average of 7 out of 10 in exams.

- Example B: The annual return of the mutual fund is 8% per annum.

This stated description constitutes the “ Null Hypothesis (H 0 ) ” and is assumed to be true – the way a defendant in a jury trial is presumed innocent until proven guilty by the evidence presented in court. Similarly, hypothesis testing starts by stating and assuming a “ null hypothesis ,” and then the process determines whether the assumption is likely to be true or false.

The important point to note is that we are testing the null hypothesis because there is an element of doubt about its validity. Whatever information that is against the stated null hypothesis is captured in the Alternative Hypothesis (H 1 ). For the above examples, the alternative hypothesis will be:

- Students score an average that is not equal to 7.

- The annual return of the mutual fund is not equal to 8% per annum.

In other words, the alternative hypothesis is a direct contradiction of the null hypothesis.

As in a trial, the jury assumes the defendant's innocence (null hypothesis). The prosecutor has to prove otherwise (alternative hypothesis). Similarly, the researcher has to prove that the null hypothesis is either true or false. If the prosecutor fails to prove the alternative hypothesis, the jury has to let the defendant go (basing the decision on the null hypothesis). Similarly, if the researcher fails to prove an alternative hypothesis (or simply does nothing), then the null hypothesis is assumed to be true.

The decision-making criteria have to be based on certain parameters of datasets.

The decision-making criteria have to be based on certain parameters of datasets and this is where the connection to normal distribution comes into the picture.

As per the standard statistics postulate about sampling distribution , “For any sample size n, the sampling distribution of X̅ is normal if the population X from which the sample is drawn is normally distributed.” Hence, the probabilities of all other possible sample mean that one could select are normally distributed.

For e.g., determine if the average daily return, of any stock listed on XYZ stock market , around New Year's Day is greater than 2%.

H 0 : Null Hypothesis: mean = 2%

H 1 : Alternative Hypothesis: mean > 2% (this is what we want to prove)

Take the sample (say of 50 stocks out of total 500) and compute the mean of the sample.

For a normal distribution, 95% of the values lie within two standard deviations of the population mean. Hence, this normal distribution and central limit assumption for the sample dataset allows us to establish 5% as a significance level. It makes sense as, under this assumption, there is less than a 5% probability (100-95) of getting outliers that are beyond two standard deviations from the population mean. Depending upon the nature of datasets, other significance levels can be taken at 1%, 5% or 10%. For financial calculations (including behavioral finance), 5% is the generally accepted limit. If we find any calculations that go beyond the usual two standard deviations, then we have a strong case of outliers to reject the null hypothesis.

Graphically, it is represented as follows:

In the above example, if the mean of the sample is much larger than 2% (say 3.5%), then we reject the null hypothesis. The alternative hypothesis (mean >2%) is accepted, which confirms that the average daily return of the stocks is indeed above 2%.

However, if the mean of the sample is not likely to be significantly greater than 2% (and remains at, say, around 2.2%), then we CANNOT reject the null hypothesis. The challenge comes on how to decide on such close range cases. To make a conclusion from selected samples and results, a level of significance is to be determined, which enables a conclusion to be made about the null hypothesis. The alternative hypothesis enables establishing the level of significance or the "critical value” concept for deciding on such close range cases.

According to the textbook standard definition , “A critical value is a cutoff value that defines the boundaries beyond which less than 5% of sample means can be obtained if the null hypothesis is true. Sample means obtained beyond a critical value will result in a decision to reject the null hypothesis." In the above example, if we have defined the critical value as 2.1%, and the calculated mean comes to 2.2%, then we reject the null hypothesis. A critical value establishes a clear demarcation about acceptance or rejection.

This step involves calculating the required figure(s), known as test statistics (like mean, z-score , p-value , etc.), for the selected sample. (We'll get to these in a later section.)

With the computed value(s), decide on the null hypothesis. If the probability of getting a sample mean is less than 5%, then the conclusion is to reject the null hypothesis. Otherwise, accept and retain the null hypothesis.

There can be four possible outcomes in sample-based decision-making, with regard to the correct applicability to the entire population:

The “Correct” cases are the ones where the decisions taken on the samples are truly applicable to the entire population. The cases of errors arise when one decides to retain (or reject) the null hypothesis based on the sample calculations, but that decision does not really apply for the entire population. These cases constitute Type 1 ( alpha ) and Type 2 ( beta ) errors, as indicated in the table above.

Selecting the correct critical value allows eliminating the type-1 alpha errors or limiting them to an acceptable range.

Alpha denotes the error on the level of significance and is determined by the researcher. To maintain the standard 5% significance or confidence level for probability calculations, this is retained at 5%.

According to the applicable decision-making benchmarks and definitions:

- “This (alpha) criterion is usually set at 0.05 (a = 0.05), and we compare the alpha level to the p-value. When the probability of a Type I error is less than 5% (p < 0.05), we decide to reject the null hypothesis; otherwise, we retain the null hypothesis.”

- The technical term used for this probability is the p-value . It is defined as “the probability of obtaining a sample outcome, given that the value stated in the null hypothesis is true. The p-value for obtaining a sample outcome is compared to the level of significance."

- A Type II error, or beta error, is defined as the probability of incorrectly retaining the null hypothesis, when in fact it is not applicable to the entire population.

A few more examples will demonstrate this and other calculations.

A monthly income investment scheme exists that promises variable monthly returns. An investor will invest in it only if they are assured of an average $180 monthly income. The investor has a sample of 300 months’ returns which has a mean of $190 and a standard deviation of $75. Should they invest in this scheme?

Let’s set up the problem. The investor will invest in the scheme if they are assured of the investor's desired $180 average return.

H 0 : Null Hypothesis: mean = 180

H 1 : Alternative Hypothesis: mean > 180

Method 1: Critical Value Approach

Identify a critical value X L for the sample mean, which is large enough to reject the null hypothesis – i.e. reject the null hypothesis if the sample mean >= critical value X L

P (identify a Type I alpha error) = P(reject H 0 given that H 0 is true),

This would be achieved when the sample mean exceeds the critical limits.

= P (given that H 0 is true) = alpha

Graphically, it appears as follows:

Taking alpha = 0.05 (i.e. 5% significance level), Z 0.05 = 1.645 (from the Z-table or normal distribution table)

= > X L = 180 +1.645*(75/sqrt(300)) = 187.12

Since the sample mean (190) is greater than the critical value (187.12), the null hypothesis is rejected, and the conclusion is that the average monthly return is indeed greater than $180, so the investor can consider investing in this scheme.

Method 2: Using Standardized Test Statistics

One can also use standardized value z.

Test Statistic, Z = (sample mean – population mean) / (std-dev / sqrt (no. of samples).

Then, the rejection region becomes the following:

Z= (190 – 180) / (75 / sqrt (300)) = 2.309

Our rejection region at 5% significance level is Z> Z 0.05 = 1.645.

Since Z= 2.309 is greater than 1.645, the null hypothesis can be rejected with a similar conclusion mentioned above.

Method 3: P-value Calculation

We aim to identify P (sample mean >= 190, when mean = 180).

= P (Z >= (190- 180) / (75 / sqrt (300))

= P (Z >= 2.309) = 0.0084 = 0.84%

The following table to infer p-value calculations concludes that there is confirmed evidence of average monthly returns being higher than 180:

A new stockbroker (XYZ) claims that their brokerage fees are lower than that of your current stock broker's (ABC). Data available from an independent research firm indicates that the mean and std-dev of all ABC broker clients are $18 and $6, respectively.

A sample of 100 clients of ABC is taken and brokerage charges are calculated with the new rates of XYZ broker. If the mean of the sample is $18.75 and std-dev is the same ($6), can any inference be made about the difference in the average brokerage bill between ABC and XYZ broker?

H 0 : Null Hypothesis: mean = 18

H 1 : Alternative Hypothesis: mean <> 18 (This is what we want to prove.)

Rejection region: Z <= - Z 2.5 and Z>=Z 2.5 (assuming 5% significance level, split 2.5 each on either side).

Z = (sample mean – mean) / (std-dev / sqrt (no. of samples))

= (18.75 – 18) / (6/(sqrt(100)) = 1.25

This calculated Z value falls between the two limits defined by:

- Z 2.5 = -1.96 and Z 2.5 = 1.96.

This concludes that there is insufficient evidence to infer that there is any difference between the rates of your existing broker and the new broker.

Alternatively, The p-value = P(Z< -1.25)+P(Z >1.25)

= 2 * 0.1056 = 0.2112 = 21.12% which is greater than 0.05 or 5%, leading to the same conclusion.

Graphically, it is represented by the following:

Criticism Points for the Hypothetical Testing Method:

- A statistical method based on assumptions

- Error-prone as detailed in terms of alpha and beta errors

- Interpretation of p-value can be ambiguous, leading to confusing results

Hypothesis testing allows a mathematical model to validate a claim or idea with a certain confidence level. However, like the majority of statistical tools and models, it is bound by a few limitations. The use of this model for making financial decisions should be considered with a critical eye, keeping all dependencies in mind. Alternate methods like Bayesian Inference are also worth exploring for similar analysis.

Sage Publications. " Introduction to Hypothesis Testing ," Page 13.

Sage Publications. " Introduction to Hypothesis Testing ," Page 11.

Sage Publications. " Introduction to Hypothesis Testing ," Page 7.

Sage Publications. " Introduction to Hypothesis Testing ," Pages 10-11.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-175599141-50515a113a524f5585dedf7846ccce8b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial Statement Analysis

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

What is financial statement analysis.

Financial statement analysis is one of the most fundamental practices in financial research and analysis.

In layman’s terms, it is the process of analyzing financial statements so that decision-makers have access to the right data.

Financial statement analysis is also used to take the pulse of a business. Since statements center on a company’s key financial details, they are useful for evaluating activities.

This is essential to understanding the firm’s overall performance.

What Are Financial Statements?

According to the American Institute of Public Accounts, financial statements are prepared for the following purposes:

- Presenting a periodical review or report on the progress made by the management

- Dealing with the status of investments in the business and the results achieved during the period under review

Financial statements reflect a combination of recorded facts, accounting conventions, and personal judgments.

The judgments and conventions that are applied are dependent on the competence and integrity of those who make them and on their adherence to generally accepted accounting principles (GAAP) and conventions.

Public companies are forced to keep track of their financial statements in very specific ways through a balance sheet, income statement, and cash flow statement.

However, private companies often underestimate the importance of these statements because they are not required to keep track of them. It’s not that they don’t create them, but they typically don’t use them to their full benefit.

Let’s consider the following important financial documents:

- Balance Sheet: Details a company’s value based on its assets , liabilities , and shareholder equity . We can learn a lot about the efficiency of a business’s operations from its short-term cash flow and accounts receivable.

- Income Statement: An income statement breaks down a company’s earnings by comparing expenses and revenue . It is broken down into separate categories that businesses can use to help them identify profitable areas.

- Cash Flow Statement : This report shows a company’s cash flow in terms of operational activities, financial ventures, and investments .

Tools and Techniques Used For Financial Statement Analysis

Financial statement analysis is centered on the balance sheet, income statement, and cash flow statement. It is the best way to gauge the overall health of a business.

There are several tools and techniques with which this is done, including:

- Fundamental Analysis: This analytical practice is used on a company’s most basic financial levels. It shows the health of the business on a financial level and helps provide insight into the overall value.

- DuPont Analysis: This tool is used to help companies prevent conclusions that are misleading. Sometimes, looking at sheer profitability doesn’t tell the whole story, so DuPont Analysis is used to create a detailed assessment.

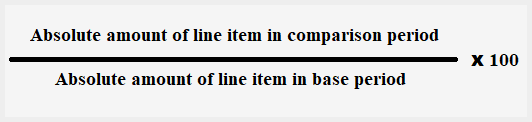

- Horizontal Analysis: Here, we compare financial ratios, a specified benchmark, and a specified line item over a specific period. This allows firms to examine changes that have been made and compare them with other behaviors.

- Vertical Analysis: This financial analytical practice shows items within the financial statement as a percentage of the base figure. It’s simple, so it’s the method that most businesses prefer.

Value of Financial Statement Analysis When Analyzing and Reporting Financial Statements

Now that we’ve gone over some of the basics, let’s dive deeper into financial research and analysis. Here’s what makes financial statement analysis such a powerful tool.

Identifying the Industry’s Economic Characteristics

Financial statement analysis can identify several important factors in a business’s marketplace, sometimes finding smaller niches that are other methods miss.

We can use financial statement analysis to determine market size, compare competitors , and investigate the growth rate of a market as it relates to a variable such as spending.

It’s also possible to look beyond your own company and find out how others are faring in new markets before you decide to invest in them.

Another powerful tool that a lot of brands are using is product differentiation analysis. This method crunches financial numbers to see how well a brand’s products and prices are holding up against others in the same market.

There are several factors at play here, including distribution, purchasing, and advertising costs .

Identifying Company Strategies

All entrepreneurs understand the importance of finding the right strategy to meet the needs of their business. They spend a lot of time searching for the perfect one.

When you break it all down, the blueprint is usually the same, whether it’s developing a business plan or developing advanced strategies. That blueprint is defined by data.

The only difference between the two is that a business strategy is focused more on the future and the development of the business.

Once a strategy is established, then it has to be measured. The only true way to get accurate results is to compare financials.

Most strategies evolve, and financial analysis helps steer us in the right direction. For example, a detailed financial statement analysis will reveal the direction your company is moving. It will be the first indicator if growth is not where you want it to be.

Assessing the Quality of a Company’s Financial Statements

All businesses must have a method of efficiently analyzing their financial statements. This process requires three key points of understanding that must always be accounted for.

These can all be found through a sound financial statement analysis.

- Businesses must identify the economic characteristics of their industry and compare their finances to the average.

- Companies must be able to identify which strategies are profitable and which are not.

- Businesses must be able to gauge the quality of their financial statements.

Inaccurate financial statements are common in small businesses. If left unchecked, this will lead down a path of ruin.

Financial research and analysis are the best way to ensure that these valuable reports are steering your growth in the right direction.

Analyzing Profitability and Identifying Potential Business Risks

Every business strategy has risks, and the majority of those risks are felt on a financial level. Therefore, it’s important for businesses to devise ways to identify and mitigate these risks.

While it’s not possible to avoid every risk, we can identify them before they cause too much damage. This is done by keeping a close eye on profitability.

Noteworthily, then, financial statement analysis helps you to keep track of profitability ratios, enabling you to truly measure the overall value of a strategy moving forward.

Preparing Financial Statement Forecasts

Forecasts are how companies predict the direction in which their business is heading. These forecasts need to be aligned with the company’s overall goals.

Income , cash flow, and balance sheets must all be closely monitored to ensure that they are aligned with the organization’s overall growth objectives.

Financial statement analysis is the practice that the world’s leading businesses engage in to stay ahead of their competitors.

Financial Statement Analysis FAQs

What is financial statement analysis.

Financial Statement Analysis is the process of analyzing a company’s financial statements and using this information to gauge its performance over time, assess its current condition, and make predictions about future performance.

Why is Financial Statement Analysis important?

Financial Statement Analysis is an essential tool for investors and financial professionals as it can help them better understand a company’s financial health and improve their decision-making processes when making investments or loan decisions.

What types of Financial Statements are analyzed?

The three main financial statements used in Financial Statement Analysis are the Balance Sheet, Income Statement, and Cash Flow statement.

What analysis techniques are used to review Financial Statements?

Common analysis techniques used in Financial Statement Analysis include trend analysis, vertical and horizontal analyses, ratio analysis, and cash flow statement analysis.

What information can be gathered through Financial Statement Analysis?

Financial Statement Analysis can provide insights into a company’s financial position, performance over time, liquidity and solvency, profitability, the efficiency of operations, and more. It can also be used to assess the quality of accounting practices and risk levels.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Are Bonds Current Assets?

- Are Buildings Noncurrent Assets?

- Are Construction Works-In-Progress a Current Asset?

- Are Debt Investments Current Assets?

- Are Fixed Assets Current Assets?

- Are Intangible Assets Current Assets?

- Are Investments Current Assets?

- Are Marketable Securities Current Assets?

- Are Office Supplies a Current Asset?

- Are Supplies a Current Asset?

- Carrying Value or Book Value

- Chart of Accounts

- Combined Leverage

- Components of the Balance Sheet

- Creative Accounting

- Current Liabilities on the Balance Sheet

- Difference Between Trial Balance and Balance Sheet

- Effects of Transactions on a Balance Sheet

- Enterprise Value Formula & Calculation

- Financial Leverage

- Functions and Limitations of Balance Sheet

- Funds From Operations (FFO)

- Horizontal Analysis of Financial Statements

- Income Statement Analysis

- Indifference Analysis

- Is a Loan a Current Asset?

- Is a Patent a Noncurrent Asset?

- Is Accounts Payable a Current Asset?

- Is Accounts Receivable a Current Asset?

- Is Accounts Receivable a Material Component of a Company’s Total Current Assets?

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Introduction to Financial Analysis

(0 reviews)

Kenneth S. Bigel, New York City, New York

Copyright Year: 2022

Publisher: Open Touro

Language: English

Formats Available

Conditions of use.

Table of Contents

- About the Author

- Author's Acknowledgements

- Open Touro Acknowledgements

- Chapter 1: Introduction

- Chapter 2: Financial Statement Analysis: The Balance Sheet

- Chapter 3: Financial Statements Analysis: The Income Statement

- Chapter 4: Financial Statements and Finance

- Chapter 5: Financial Ratios and Forecasting; Liquidity and Solvency Ratios

- Chapter 6: Profitability and Return Ratios, and Turnover

- Chapter 7: Market Ratios

- Chapter 8: Cash Flow, Depreciation, and Financial Projections

- Chapter 9: Corporate Forecasting Models

- Chapter 10: The Time Value of Money: Simple Present- and Future-Values

- Chapter 11: The Time Value of Money: Annuities, Perpetuities, and Mortgages

- Chapter 12: Fixed Income Valuation

- Chapter 13: Interest Rates

- Chapter 14: Equity Valuation and Return Measurement

Ancillary Material

About the book.

This Open Textbook is a dynamic guide incorporating the essential skills needed to build a foundation in Financial Analysis . Students and readers will learn how to insightfully read a Financial Statement, utilize key financial ratios in order to derive forward-looking investment-related inferences from the accounting data, engage in elementary forecasting and modeling, master the theory of the Time Value of Money , and learn to price stocks and bonds in an environment in which interest rates constantly change. Ample problems and solutions, and review questions are provided to the student so that s/he can gauge his/her progress. This text will be continually updated in order to provide novel information and enhance students’ experiences.

About the Contributors

Dr. Bigel was formerly a fixed income analyst in the International Banking Department of the Bankers Trust Company (now DeutscheBank), analyzing international wholesale loans and debt instruments, and a graduate of its Institutional Credit Training Program. He later was affiliated with the Ford Motor Company, conducting investment analysis and planned car profits analysis, annual budgeting, and strategic planning. Subsequently, he worked as a senior portfolio manager attached to the wealth management division of Prudential Securities. He was formerly registered under Series 3, 7, 15, 24, 63, and 65.

As an independent consultant, he was involved in numerous high-profile cases including Enron. Dr. Bigel has conducted executive education programs for Morgan Stanley Capital Markets, Merrill Lynch Capital Markets, UBS, Lehman Brothers, CIBC, G.X. Clarke & Co. (now part of Goldman Sachs), and China CITIC Bank. He currently serves on the Financial Industry Regulatory Association’s Board of Arbitrators.

His extensive published research relates to Financial Ethics and Moral Development, Behavioral Finance, and Political Economy. He has been teaching college and graduate level finance courses since 1989.

Dr. Bigel has been interviewed on American radio, was a visiting scholar at Sichuan University and at Xi’an Jiaotong University in China, and appeared on Chinese television. At Touro University, he is a member of the Faculty Senate, The Touro Academy of Leadership and Management, The Assessments Committee, and The Promotions Committee. He chairs the Integrity Committee at LCM.

His wife and their three children reside in New York City. He enjoys reading, playing 60’s guitar, seeing his students succeed professionally, and watching his kids grow.

Educational Background:

- Ph.D., (high honors) New York University, Steinhardt School of Culture, Education, and Human Development (Business Education and Financial Ethics)

- M.B.A., New York University, Stern School of Business (Finance)

- B.A. (honors), Brooklyn College of the City University of New York (Philosophy and Mathematics)

- CFP™, International Board of Standards and Practices for Certified Financial Planners

- Hebrew University of Jerusalem (one-year program)

Dr. Bigel welcomes questions and constructive suggestions. He can be reached at <[email protected]>.

Contribute to this Page

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

1.4: Financial Statement Analysis

- Last updated

- Save as PDF

- Page ID 9064

Financial Statement Analysis: “How Are We Doing?”

Financial statement analysis informs a wide variety of strategic management questions, including:

- What is this organization’s overall financial position? Is it liquid? Profitable? Solvent?

- How does this organization’s financial position compare to its peer organizations?

- How can this organization adjust its operations and policies to strengthen its financial position?

- How much debt or other long-term liabilities can this organization afford?

On March 22, 2014 the side of a hill near the town of Oso, Washington gave out after three days of relentless rainfall. A massive landslide followed, with mud and debris covering more than a square mile. Forty-three people were killed when their homes were engulfed by the slide.

In the days that followed more than 600 personnel participated in search and recovery operations. They rescued eight people from the mud and evacuated more than 100 others to safety. Most of the rescue personnel came from the four rural Snohomish County fire districts that surround Oso.

Minutes after hearing of the slide, staff at the Washington State Office of Financial Management (OFM) – the governor’s budget office – made two critical phone calls. Earlier that week they had reviewed some data on the financial health of local special districts across the state. They observed that rural fire districts in the counties north of greater Seattle were showing signs of acute fiscal stress. Those districts had seen huge growth in property tax collections during the real estate boom of the 2000’s. But since the real estate crisis of 2007-2009, those revenues had fallen precipitously. Many of those districts had laid off staff, cut back on specialized training, and back-filled shifts with volunteer firefighters.

So moments after hearing of the slide, OFM staff called the fire chiefs at two of the most financially-stressed Snohomish County fire districts. Their message to those chiefs was simple: send your people. OFM agreed to reimburse the districts from state or federal emergency management funds if needed. In turn, personnel from two of those districts were among the first on the scene, and were responsible for three of the eight life-saving rescues.

A few weeks later the chiefs of both those districts acknowledged that had OFM not called, they would not have sent their personnel. Both districts were so financially stressed that they could not have afforded the overtime wages and other expenses they’d have incurred to participate in the rescue operations.

Financial condition matters. It shapes how a public organization thinks about its mission and its capabilities. In the case of the Oso mudslide, it was the focal point for some life-saving decisions. That’s why all aspiring public servants need to know how to evaluate financial statements, and to measure, manage, and improve their organization’s financial position.

Learning Objectives

After reading this chapter, you should be able to:

- Compute and interpret ratios that describe liquidity, profitability, and solvency.

- Contrast how those ratios mean slightly different things across the government, non-profit, and for-profit sectors.

- Compute the “Ten Point Test” for governments.

- Understand the typical strategies organizations employ to improve their liquidity, profitability, and solvency.

- Contrast short-term solvency with long-term solvency, particularly for governments.

What is Financial Position?

Financial position is a public organization’s ability to accomplish its mission now and in the future. When stakeholders ask “how are we doing, financially?” the answer should reflect that organization’s financial position.

An organization’s financial position has three main components:

- Liquidity. Does the organization have liquid resources – especially cash – to cover its near-term liabilities? Can it convert its less liquid assets to cash to cover those liabilities?

- Profitability. Do the organization’s revenues cover its operating expenses?

- Solvency. Can the organization generate enough resources to cover its near-term and long-term liabilities?

Till Debt Do Us Part Some say there are two types of non-profits: “Those that have debt, and those that don’t.” This is a powerful sentiment. It suggests that once a non-profit has taken on debt, none of its other stakeholders matter. If that organization encounters significant financial stress and cannot repay its creditor(s), then those creditors have a legal claim to its assets. In that circumstance, that organization’s board, clients, funders, and others will have little recourse, and the mission will suffer.

In the previous chapter you learned how to extract information about an organization’s financial position from its balance sheet. For example are most of its assets liquid (e.g., cash and marketable securities), or does it have assets that are more difficult to convert to cash (e.g., receivables, inventory, or prepaid expenses)?

The balance sheet also tells us a lot about solvency, namely if the organization has a lot of long-term liabilities (e.g., long-term debt or pension obligations). Long-term liabilities mean the organization will have to divert some of its resources to meet those liabilities, and that can mean fewer resources to invest in its mission. To be clear, there are times when an organization can and should take on long-term liabilities in pursuit of its mission. Sometimes it makes sense to borrow and invest in a new facility that allows the organization to effectively serve its clients. Pensions and retiree health care benefits are an important employee recruitment and retention tool, even though they result in a long-term liability.

To learn about profitability we typically look to the income statement. Recall that if an organization’s revenues exceed its expenses, then its net assets will grow. The income statement makes clear the organization’s major sources of revenues, which revenues are growing, and whether those revenues cover program and administrative expenses. On the income statement, we can also see depreciation, bad debt expenses, and other expenses that reduce net assets but don’t necessarily impact cash. These are all profitability concerns.

While financial ratios can provide us with useful metrics, always start off with a quick review of the financial statements. Ideally, the financial statements you are working with should report on the organization’s operating and financial position for at least two financial periods. Keep in mind that funding agencies and financial analysts often would need access to at least four if not five years of financial data.

What do the financial statements tell you about the organization’s financial position? Operating results? Cash flows? Review the financial statements and take note of the changes in assets, liabilities, revenues and expenses. Carefully review the notes to the financial statements as they will provide you with more detailed information regarding the organization’s financial position. For example, a note related to fixed assets will report fixed assets at historical cost, assets subject to depreciation, any additions or retired assets, annual depreciation expense as well as accumulated depreciation, and ending balance as reported in the balance sheet. A note for pledges receivable will report amounts due in one year (or current portion), amounts due more than one year but less than five years, and amounts due more than five years. The note will also detail bad debt expense and the discount factor used to find the present value of non-current pledges receivable. A review of the trends should inform your interpretation of the ratios.

A review of the Statement of Financial Position (or Balance Sheet) can be guided by the following questions:

- Assets : How have the assets changed? What proportion is current? How much is reported under cash and cash equivalents? How much is reported under property plant and equipment, net of depreciation? Were there any new investments in property plant and equipment (review notes related to fixed assets)? How much is reported under investments? What proportion of investments is restricted? Have investments changed significantly and was this the result of market gains and investment income, a capital campaign, or transfers from cash (review note on investments)? How much more or less is the organization reporting in receivables/prepaid expenses? Have changes in current assets had a negative or positive impact on cash flows (also review Cash Flow Statement)?

- Liabilities : How have the liabilities changed? What proportion of liabilities is the result of borrowing or financing activities? To assess long-term solvency, what proportion of liabilities are reported as long-term debt obligations? Are there any covenants or restrictions associated with these obligations? To assess short-term solvency, what proportion of liabilities are current? Of that, how much is in the form of a short-term loan or a line of credit? Are there any contingent liabilities reported in the notes to the financial statements?

- Net Assets : What proportion is reported as unrestricted? Of restricted net assets, what proportion is reported as permanently restricted?

Your review of the Income Statement can be guided by similar questions:

- Revenues : What are the major sources of revenues? Have there been significant changes in revenues? Of total revenues, what percent is unrestricted, restricted (i.e., temporarily versus permanently)? How much of the organization’s revenue is driven by earned income activities? Is the organization susceptible to changes in policy or funding priorities of a governmental agency?

- Expenses : How much did the organization spend on programs? How much did the organization spend on administration? Fundraising? Have there been significant changes in the level of spending? Have personnel costs changed? Are there other fixed costs that limit budget flexibility? How much did the organization report in depreciation and amortization?

Financial Statement Ratios

The purpose of accounting is to help organizations make better financial decisions. Financial statement analysis is the process of analyzing an organization’s financial statements to produce new information to inform those decisions. Public organizations make dozens of crucial decisions everyday: Should we expand a program? Should we lease or buy a new building? Should we move cash into longer-term investments? Should we take a new grant from a local government?

All of these decisions must be informed by financial statement analysis. An organization should not expand if its existing programs are not profitable. It should buy a new building only if it knows how its current rent and other operating expenses contribute or detract from its profitability. It should move cash into less liquid investments only if it knows how much liquid resources it needs to cover its operating expenses? And so on. To answer these questions with precision, we need good metrics that illustrate an organization’s liquidity, profitability, and solvency.

For those metrics, we turn to financial ratios (sometimes called financial statement ratios ). Financial ratios are calculations derived from the financial statements. Each ratio illustrates one dimension of an organization’s overall financial health.

Analysts who evaluate public organizations’ financial statements employ dozens of different financial ratios. The first table lists a set of liquidity ratios. Liquidity ratios speak to the composition of an organization’s assets, and how quickly those assets can be deployed to cover the organization’s day-to-day expenses. The numerator in these ratios is a measure of liquid resources — either current assets or a specific type of current asset (cash and cash equivalents, receivables etc). The denominator in these ratios is either current liabilities or a measure of average daily cash expenses. For the latter, we take total expenses and remove expenses like depreciation, amortization, and bad debt expense that do not require an outflow of liquid resources. This adjusted for spending number is divided by 365 to produce a rough measure of average daily spending.

Profitability ratios are derived from changes in net assets. Recall that net assets increase when revenues exceed expenditures. This is an intuitive measure of profitability. The operating margin speaks to profitability in the organization’s basic (i.e., unrestricted) operations. Net asset growth is a more inclusive measure of profitability across the entire organization. Net asset growth will include changes in temporarily restricted and permanently restricted net assets that are not included in the operating margin.

Margin (sometimes called the profit margin) is the price at which a good or service is sold, minus the unit cost. Industries like retail clothing have extraordinarily tight margins, meaning the price exceeds unit cost by just a percent or two. Low margin businesses must be “high volume,” meaning they must sell a lot of product to be profitable. Professional services like accounting, tax consulting, and equipment leasing are “high margin,” meaning the price charged exceeds the unit cost by a lot, sometimes by orders of magnitude. High margin industries tend to have barriers to entry. They require highly-trained professionals, expensive equipment, and other significant up-front investments.

Profitability measures are less salient for governments because governments need not be profitable to continue operating. Unlike a non-profit or for-profit, a government can bolster its financial position by raising taxes or fees. Most governments don’t have wide latitude to that effect, but they have more than other organizations. That’s why profitability measures for government are focused both on growth in net assets, but also on the share of total revenue that’s derived from revenue sources the government can control on its own, like general revenues and capital grants.

The solvency measures speak to where the organization gets its resources. If it depends too much on unpredictable or volatile revenues from donors, that’s a potential solvency concern. The same is true of revenues from governments. Government revenues can disappear quickly if the government changes its own fiscal policies and priorities. Debt, although sometimes necessary, indicates a drain on future resources. All these factors can inhibit an organization’s ability to continue to serve its mission.

The Internal Revenue Service (IRS) monitors the contributions ratio as part of its public support test for charitable organizations. According to this test, a non-profit must receive at least 10% of its support from contributions from the general public and/or from gross receipts from activities related to its tax-exempt purposes. Less than that suggests the public is not invested in that organization’s mission. By contrast, non-profit analysts also emphasize the tipping point where a non-profit depends too much on individual donors. Different analysts define the tipping point threshold differently, but most agree that 80% of total revenues from individual contributions is dangerously high. At that point, a non-profit’s ability to serve its mission is far too dependent on unpredictable individual donors, and not dependent enough on corporate, foundation, and government support.

For governments, the solvency ratios are focused entirely on debt and other long-term obligations. Governments can borrow money that won’t be paid back for decades. If careless, a government can take on too much leverage. That’s why these solvency ratios focus on how much money a government has borrowed in both its governmental and enterprise funds, and its ability to pay back that debt. The later is known as coverage . Bond investors, particularly for public utilities, often stipulate how much coverage a government must maintain at all times. Coverage ratios are usually expressed as operating revenues as a percentage of interest expenses.

In addition to financial health, financial statements can illuminate how efficiently a non-profit raises money and how much of its resources it devotes to its core mission. These effectiveness measures are related to, but separate from financial position. Fundraising efficiency shows the financial return a non-profit realizes for its investments in fundraising capacity.

The program expense ratio is one of the most closely-watched and controversial ratios in non-profit financial management. It tells us how much of a non-profit’s total expenses are invested in its programs and services, rather than administration, fundraising, and other overhead spending. Many analysts and non-profit monitors recommend a program service ratio of at least 80%.

Ratios and Rules of Thumb

These rules of thumb are derived from the rich academic literature and industry analysis of public organizations. To be clear, there is no legal or GAAP-based definition of “financially healthy,” or “strong financial position.” Every foundation, donor, or grantor defines these metrics differently. They’ll also vary across different type and size of organizations. The rules listed in this table are some of the common figures cited by across many analysts in the public and private sector.

Before going further let’s consider a few key points about financial statement ratios:

- Ratios are only part of the story. Ratios are useful because they help us quickly and efficiently focus our attention on the most critical parts of an organization’s financial position. In that sense they’re are a bit like watching on ESPN the thirty-second highlight recap of a football game (or whatever sporting event, if any, you find interesting). If we want to know which team won, and who made some big plays, we’ll watch the highlight reel. If we want to know the full story – the coaches’ overall game plan, which players played well throughout the game, when a key mistake changed the course of the game, etc. – we need to watch a lot more than just the highlights. Ratios are the same way. They’re fast, interesting, and important. If we want a quick overview and not much more, they’re useful. If we don’t have the time to dig deeper into an organization’s operations, or if it’s not appropriate for us to dig deeper, then they’re the best tool we have. But they’re never the whole story. Always keep this limitation in mind.

- Always interpret ratios in context. Ratios are useful because they help identify trends in an organization’s financial behavior. Is its profitability improving? How has its overall liquidity changed over time? Are its revenues growing? And so on. But on their own, ratios don’t tell us anything about trends. To reveal a trend, we must put a ratio in context. We need to compare it to that same ratio for that same organization over time. For that reason we often need multiple years of financial data. It’s also essential to put ratios in an industry context. Sometimes, a broader financial trend will affect many organizations in similar ways. A decline in corporate giving will mean lower donor revenues for many non-profits. Increases in overall health care costs will impact all organizations’ income statements. Reductions in certain federal and state grants will affect particular types of non-profits in similar ways. To understand these trends we need to compare an organizations’ financial ratios to the ratios of organizations in similar industries. It’s useful, for instance, to compare human services-focused non-profits with less than $2 million in assets to other small, human-service focused non-profits in the same region with less than $2 million in assets. We should compare fee-for-service revenue-based non-profits to other fee-for-service revenue-based non-profits to other fee-for-service revenue-based non-profits. Large non-profits with a national or international mission should be compared to each other. There are clear rules about defining comparable organizations. The only rule is that without context, an analysis doesn’t tell us much.

- Financial statement analysis raises questions. A good financial statement analysis will almost always reveal some contradictory trends. Why does this organization’s profitability look strong but the current ratio is well below the rule of thumb? Why is this organization less liquid than its peers? Why does this organization not have debt, and is far more liquid, than similar organizations? A good financial statement analysis raises many of these types granular questions about the organization’s financial assumptions, program operations, and overall effectiveness. Sometimes these follow-up questions can be answered from other publicly-available information, such as the notes to the financial statements or the annual report. Sometimes they can’t. If your analysis concludes with many unanswered questions, that does not mean your analysis is bad. It simply means there are limits to what we can learn from financial statements alone.

- Ratios are retrospective. Most organizations release their financial statements three to six months after the close of their fiscal year. Analysis based on those statements is relying on information that is at least 12 to 18 months old. A lot can happen in 18 months. Always keep this in mind when doing financial statement analysis.

What’s Your Industry?

Financial analysts in the for-profit sector focus on financial trends within the industry sectors defined by the North American Industry Classification System or NAICS. These codes identify businesses by key aspects of their operations. For instance, according to recent estimates, there are just over 72,000 businesses in the US within NAICS code 152101 – “Single-family home remodeling, additions, and repairs.” The National Center for Charitable Statistics has developed an analog classification scheme for non-profits known as the National Taxonomy of Exempt Entities (NTEE). NTEE is not as precise or specific as the NAICS, but it is a useful way to think about sub-sectors within the non-profit sector.

Non-Profit Financial Ratios – An Illustration

To see these ratios in action let’s return to Treehouse. The table below shows its computations for the key financial ratios from its FY15 financial statements. All the information for these computations is taken from Treehouse’s basic financial statements included in the previous chapter.

We can summarize Treehouse’s financial position as strong. Each of its ratios are at or better than their benchmarks. It’s profitable, it has a robust and effective fundraising operation that produces 70% of its total revenues, it does not have debt, and it depends minimally on government revenues. [1] These are all markers of a strong financial position. Its contributions ratio suggests that going forward it should seek to diversify some of its revenues away from donations. Perhaps not surprisingly, its program service ratio is .79, almost exactly the .8 rule of thumb.

Treehouse is also quite liquid. Its current ratio suggests its current assets could cover its current liabilities almost 15 times over, and its quick ratio suggests its most liquid resources alone could cover those liabilities more than 11 times over. It also has just above the recommended days of liquid net assets and days of cash on hand. So in other words, it does not keep a startling amount of cash, but it is highly liquid. Nonprofits that depend on pledges often see precisely this dynamic. If an organization depends on pledges then it will in turn book a lot of pledges receivable that will roll in throughout the year. Those receivables are liquid resources, but they’re not necessarily cash, that’s available to spend. And since most of Treehouse’s expenses are for salaries and other near-term spending, it carries few if any current liabilities. That combination of high receivables and low current liabilities can make Treehouse look more liquid than it is, especially given its modest cash holdings.

The “Ten Point Test” – An Illustration

Throughout the past few decades, analysts have developed a popular framework to evaluate local governments’ financial condition. It’s known as the “ Ten Point Test .” It’s comprised of ten key ratios that, when taken together, summarize a government’s liquidity, profitability, and solvency. In the Ten Point Test framework a government earns “points” based on how its ratios compare to its peer governments. If its ratios are consistently better than its peers it earns a higher score. If its ratios are consistently worse than its peers, it’s scores are lower and in some instance negative.

To see the Test at work let’s return to Overland Park, KS. The table below shows the Ten Point Test ratios and their computations based on its FY2015 financial statements. To compute these ratios yourself refer back to OP’s basic financial statements included in the previous chapter. [2]

OP ratios look good overall. It has plenty of liquidity. Its short-run financial position (i.e. it’s “fund balance ratio”) is 29%, well above the rule of thumb. It also has more than enough cash to cover its general fund current liabilities. Its net assets are growing, only six percent of its operating revenues are from sources it does not control, it has few near-term liabilities [3] , and its “operating margin” (i.e. the extent to which it relies on taxes, rather than user charges to cover its operating expenses) of 0.61 is positive. For these reasons it’s no surprise that Overland Park maintains the highest possible “AAA” rating from two major credit rating agencies – Moody’s and Standard & Poor’s.

Fortunately, the Ten Point Test framework allows us to go a step further. Instead of asking how OP compares to generic benchmarks, we have the tools to compare OP to its peer local governments. This allows us to make much more precise statements about OP’s current and future financial position.

Analysts typically do these peer comparisons by computing the Ten Point Test ratios for a variety of local governments, and then assigning point values based on relative rankings. For example, to compute OP’s Ten Point test score for FY 2015, refer to the table below. This table shows national trends for these same ratios. These trends are based on data from the financial statements of 3,721 city governments and 1,282 county governments from FY2005-2015. [4] The ratios are presented in quartiles. Recall that a quartile is a group of percentiles, and a percentile identifies a point in the distribution of that ratio. The table is organized by population groups. So for instance, for cities with populations between 100,000 and 250,000 (OP’s peer group) the 25th percentile for short-run financial position was 8%. That means one-quarter of OP’s peer cities had short-run financial position less than 8%, and three-quarters had short-run financial position equal to or greater 8%. For all the ratios shown here the first quartile starts at the lowest ratio and ends at the 25th percentile, the second quartile covers the 25th percentile through the 50th percentile, and the third quartile covers the 50th percentile through the 75th percentile. The fourth quartile includes all observations above the 75th percentile.

These quartiles are the basis for the Ten Point Test scoring. If a local government is in the second quartile for a ratio, its score for that ratio is zero. It is not qualitatively better or worse than its peers, so that ratio does not help or hurt its relative score. If a ratio is in the third quartile it earns one point. The logic here is that a ratio above the median (i.e. the 50th percentile) is a financial positive for that government. If a ratio is in the fourth quartile it earns two points. To land in the fourth quartile, a government is better than most of its peers on that particular ratio, and that indicates a source of financial strength. By contrast, a ratio in the first quartile means that government is comparatively weak on that dimension of financial health. To reflect that weakness, we subtract one point.

A local government’s overall Ten Point Test score is easy to interpret. Analysts generally use the following categories:

- A score of 10 or greater suggests a government’s financial position is “among the best.” It can easily meet its immediate spending needs, it has more-than-adequate reserves to mitigate the immediate effects of recessions, natural disasters, or other unexpected events, and it has the capacity to generate adequate resources to cover its long-term spending needs. To earn that score most of its ten ratios must be as good as or better than its peer governments.

- A score between 5 and 9 means the government is “better than most.” Most of its ratios are better than its peer governments, and a few ratios are equal to its peers.

- A score between 1 to 4 means the government is “average.” Most of its ratios are equal to, or weaker than its peer governments.

- A score between 0 and -4 means the government is “worse than most.” Most of its ratios are weaker than its peer governments.

- A score less than -5 means the government is “among the worst.” It has major financial problems and may be insolvent. Scores this low are quite rare.

Let’s return to OP, to compute its Ten Point Test Score. Recall that OP’s population in FY2015 was 187,730, so we’ll use the “Population 100,000 to 250,000” quartiles.

As we saw above, OP’s liquidity is strong. It scores in the top quartile for both short-run financial position and liquidity. It’s profitability ratios are also acceptable, but not nearly as strong as its liquidity. It was in the first quartile for net asset growth, and the third quartile for own-source revenues. These two ratios reflect the same underlying fact: OP depends mostly on general taxes like sales taxes and property taxes, and depends little on user charges and fees or on outside grants or other support. That’s why its own-source revenue is comparatively high, but its operating margin is comparatively low.

OP’s solvency profile is mixed. It has virtually no current liabilities in its governmental funds, and virtually no long-term debt in its proprietary funds. That’s why its near-term solvency and coverage 2 ratios, respectively, are both in the top quartile. At the same time, it is quite leveraged. That fact is reflected in its comparatively high debt burden and its comparatively low coverage 1 ratio. It also appears that in 2015 OP’s investment in capital assets was comparatively low, despite its comparatively high leverage.

Taken together, OP’s ratios add up to an overall Ten Point Test score of seven. Its main financial strengths are its liquidity and its near-term solvency. At the same time, its higher than average debt load and dependence on general revenue sources, lowered that score. Recall that a score of seven suggests OP is “better than most” similarly-sized local governments.

With this overall framework you can compute and interpret a Ten Point Test score for virtually any local government.

Financial Position and Financial Strategy

Financial statement analysis can tell us a lot about an organization’s financial position. The question, then, is what to do about it? As mentioned, sometimes financial statement analysis implies some clear follow-up questions about an organization’s financial operations and overall performance. Ideally, it also suggests some steps that management can take to improve that financial position and performance.

The table below identifies some of those potential steps. It is organized around liquidity, profitability, and solvency. Plus signs identify that part of the organization’s financial position that is strong. Minus signs suggests a potential weakness. There is no “textbook” definition of a financial strength or weakness. However, most public sector analysts define ratios above the benchmark rule of thumb or above the median within a peer group as strong, and ratios below the benchmark rule of thumb or below the median within a peer group as weak. This is not a comprehensive list, but it does illustrate some basic management strategies that tend to follow from different patterns of financial position.

For example, the top right box lists strategies appropriate for a non-profit with good liquidity and good profitability, but concerns about solvency. An organization with these characteristics has enough resources on hand and is currently able to generate enough resources to cover its expenses. What’s less clear is whether it can continue that trend into the future. Perhaps it is too dependent on donor revenues or government grants. Maybe it delivers a service that no one will want in the future. Maybe it has had to borrow a lot of money to build out its service delivery capacity. Regardless of what’s driving the solvency concerns, it’s clear this organization has a good, profitable business. The challenge is ensuring it has enough demand for its services to support its ongoing operations.

To that end, an organization with these characteristics could consider investing in additional capital equipment or facilities that might help it expand its client or customer base. It might also expand or extend its programs to include new lines of business that will allow it to tap into new clients/customers. If long-term liabilities are part of the solvency concern it could consider restructuring or re-negotiating those liabilities.

“Scrubbing” Your Expenses

To “scrub” expenses is to carefully review all current major spending items for potential cost savings. Some contemporary examples include:

- Transition bills to online payments and save on transaction costs and timing delays associated with processing paper bills.

- Move employee reimbursements from checks to direct payroll deposits.

- Renegotiate premiums with your health insurance provider. Bundle different insurance policies with one carrier to improve economies of scale.

- Hire a human resources consultant to identify appropriate salary ranges for future salary negotiations and collective bargaining.

- Shift from traditional phone service to a “voice over internet” (VOI) system. VOI generally offers more lines and better reliability at a lower cost.

- Move to a “multi-platform” plan with your wireless/cellular communications provider. Save money by running phones, iPads, and other wireless devices on one plan.

- Negotiate with credit card providers for lower annual percentage rates and transaction fees.

- Consider opening a line of credit with your existing financial institution. Some institutions offer discounts for bundling banking with credit services.

- Negotiate better terms with your credit card payment processing company. Consider investing in an online processing system that does not require you to lease or purchase credit card terminals

- Move from local servers to a cloud-based, server-less computing environment.

- Explore “software as a service” for typical business applications.

Each of these tactics should happen only after careful attention to costs associated with disrupting the organization.

Contrast this with an organization that has concerns about liquidity, but is otherwise profitable and solvent. This is a good example of a “profitable but cash poor” organization. Here the challenge is to convert some of that profitability into a stronger base of liquid resources. To that end, an organization under these circumstances could consider some short-term borrowing to better manage its cash flow. This might weaken its solvency a bit, but that might be a necessary trade-off relative to weak liquidity. It might also make a specific ask to donors for a reserve fund or other financial contingency fund to bolster its liquidity.

Of course, organizations with concerns about all three aspects of financial position might consider more drastic measures like a merger with another non-profit.

In short, these strategies are some of the most typical for organizations with different financial position profiles.

CASE: JONAS COMMUNITY CENTER

THE JONAS COMMUNITY CENTER, INC.

AUDITED FINANCIAL STATEMENTS

JUNE 30, 2015 AND 2014

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization The Jonas Community Center, Inc. (the “Center”) is a Washington not-for-profit corporation. The Center provides comprehensive services, including emotional and substance abuse counseling, HIV/AIDS education and prevention, residential treatment and neighborhood center services to residents of central Washington.

The Center’s wholly owned subsidiary, Jonas Social Enterprises, Inc., is a taxable entity created in 2005. It is engaged in construction remodeling, repair, and maintenance, employing individuals who have been served by the Center’s programs.

Note 2. Summary of Significant Accounting Policies The accompanying consolidated financial statements include the accounts and activities of the Center and its wholly-owned subsidiary. All intercompany balances and transactions have been eliminated in consolidation.

Net assets and revenues, gains and losses are classified based on the existence or absence of donor-imposed restrictions. Accordingly, net assets and changes therein are classified as follows:

Temporarily restricted net assets – Net assets subject to donor-imposed stipulations that may or may not be met by actions of the Center and/or the passage of time Unrestricted net assets – Net assets not subject to donor-imposed stipulations

Grants and other contributions are reported as temporarily restricted support if they are received with donor stipulations that limit the use of the donated assets. When a donor restriction expires, that is, when a stipulated time restriction ends or purpose restriction is accomplished, temporarily restricted net assets are reclassified to unrestricted net assets and reported in the consolidated statement of activities as net assets released from restrictions. Temporarily restricted support is reported as unrestricted if the donor restrictions are met in the same reporting period. At June 30, 2015, temporarily restricted net assets are subject to time restrictions.

Management uses estimates and assumptions in preparing financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were used.

Property, plant, and equipment are stated at cost or, if donated, at the estimated market value at the date of donation, and are depreciated on a straight-line basis over their estimated useful lives.

Intangible assets are recorded at costs and amortized on the straight-line method over periods ranging from three to seven years.

The Center is exempt from income taxes under Section 501(c)(3) of the Internal Revenue Code. Accordingly, no provision for income taxes is required. Donors may deduct contributions made to the Center within the Internal Revenue Code regulations. There are no unrecognized tax benefits and income tax returns remain subject to examination by major tax jurisdictions for the standard three-year statute of limitations.

The costs of providing the various programs and other activities have been summarized on a functional basis in the statement of activities. Accordingly, certain costs have been allocated among the programs and supporting services benefitted.

A number of unpaid volunteers have made contributions of their time to develop and operate the Center’s programs. The value of this contributed time is not reflected in the financial statements since the Center does not have a clearly measurable basis for the amount to be recorded.

Certain reclassifications have been made to the 2014 financial statements in order to conform them to the 2015 presentation.

Note 3. Accounts Receivable

Accounts Receivable are stated net of an allowance for doubtful accounts of $7,500 at both June 30, 2015, and 2014.

Note 4. Property, Plant, and Equipment

Property, Plant, and Equipment consist of:

Intangible Assets consist of:

Note 6. Notes Payable

Note 7. Long-Term Debt

Note 7. Long-Term Debt (cont.) Following are maturities of long-term debt for each of the next five years and in the aggregate:

Interest expense incurred on all corporate obligations totaled $210,183 in 2015 and $204,664 in 2014. Interest paid totaled $208,822 in 2015 and $198,450 in 2014.

The mortgage note payable above includes provisions requiring the Center to maintain certain restrictive financial covenants. At June 30, 2015, all covenants were met by the Center.

Note 8. Operating Leases

The Center leases real estate, motor vehicles, and office equipment under operating leases expiring at various intervals through 2018. The following is a summary of future minimum rental payments required under these leases as of June 30, 2015 for each of the next three years:

Rental payments made under leases with remaining terms in excess of one year totaled $158,111 in 2015 and $147,042 in 2014.

Note 9. Concentration

The Center received a substantial amount of its support and revenue from the State of Washington. If a significant reduction in the level of this support and revenue were to occur, it may have an effect on the Center’s programs and activities.