Life Insurance: Theory and Practice

Life insurance can be defined as the contract between the insurer and the person who owns the policy. Some countries include some events like bills and death expenses are included in the premium policy. The insurer is bound to pay some money in case an event happens to occur.

If the insurer enters the contract, he pays an annual or monthly amount known as premium. If an event occurs, the benefit is paid to the beneficiaries. The insurance only considers the people who are included in the life policy. If any kind of event happens, the people who are insured are the only ones who are considered since it’s a contract between two parties, i.e., the policy owner and the insurer.

The only person allowed to pay for the policy is only the policy owner, and he also acts as the guarantee. They don’t consider the insurer as being a party to the contract since he acts as a participant. In life insurance, the insurer plays different roles compared to the roles of the policy owner. They sometimes seem to be the same, but they are totally different.

The owner appoints the beneficiary, although he is not entitled to the policy. If the beneficially happens to revoke the insurance contract, any changes that come along must be agreed upon by the beneficiary. This means that the owner has the right to change the beneficiary unless the beneficiary chooses to change or withdraw the policy. The changes might include cash value borrowing or policy assignments.

In life insurance, there are special requirements which are found in it. If the person commits suicide within a given period of time, this type of section is highly considered. If the application is misrepresented by the insured is considered as part of nullification. In most of the states in the US feel that the period of contestability cannot be more than two years.

The insurer will be considered to have a legal right to follow the claim relating to misrepresentation and ask additional information before denying the claim or accepting to pay only if the insured passes on within the mentioned period. In life insurance, the face amount on the policy is the one that the insurer is paid if he dies, and it’s still the original sum paid by the policy when the policy happens to mature.

In most cases, life insurance and life assurance always go together. In life, any of the events is most likely bound to happen. In life insurance, they are only events that are bound to happen e.g., floods, theft, the fire they come unexpectedly, causing a lot of damage. The events that are covered life assurance are events that one is sure they are going to happen in future e.g., death.

Types of insurance

Life assurance is basically divided into two categories, permanent and temporary.

(a) Temporary insurance is also known as term insurance; this type of life insurance does not accumulate cash value since it covers for a specified term of years and for a specified premium. The premium is termed as pure as it covers and buys protection in the events of death only. The only major areas which are considered in this term insurance are only the length of coverage, face amount which caters to protection or death benefits, and the premium which is going to be paid.

(b) Permanent; this type of insurance remains contact until the policy matures. If the owner is not in a position to pay the premiums on time, the policy becomes outdated or the policy lapses. The law defines that any type of policy cannot be canceled by the insurer for any reason, not unless signs of fraud are detected in the application. If there is any cancellation, there is a specific time given, which is normally two years. There are three types of permanent insurance;

(1) Whole life insurance; in this type of insurance, the cash value is included in the policy guaranteed by the company since they provide a level premium. The advantages of this insurance are that the whole life is guaranteed cash value, fixed and known annual premiums, and death benefits. We can also see that the disadvantages of whole life insurance are that the internal rate of return in the policy is usually not competitive with other savings. They also don’t have flexibility in their premiums.

(2) Endowments; endowments are considered to more expensive in terms of annual premiums compared with the rest of the insurance policies. Comparing with whole life or universal life, the period of the endowment is shortened, and it has earlier dates. In this policy, the cash value is built up inside the policy. The face amount has death benefits at a specific age. The age in which it starts is known as the endowment age. The endowment insurance is usually paid at a specific period e.g., 15 years or if the insured is living or dead.

(3) Universal life coverage; this is a new insurance cover which plans to offer a permanent insurance cover which has flexible premiums payments affordable for everyone with a quality higher internal rate of return. This insurance has a cash account, which is increased by the premium. The interest is paid within the policy, and it also recorded and credited at the rates decided by the company.

(4) Accidental death; this is limited insurance, and it only covers the insured when they pass away because of an accident. These accidents might be in the form of injury; they don’t cover any death that might occur due to health problems or any type of suicide. The policies are less expensive because they only cover death compared to other life insurances. The benefits are much better because they not only cover accidental death, but they also benefit those who have lost their limbs and also their bodily functions e.g., hearing and sight.

(5) Limited-pay; in this type of permanent insurance, all its premiums are paid over a specified duration of time. There are no extra premiums that are due to keep the policy in force.

When you come to look at life insurance, there are actually two main functions that make it operate fully. They include cash function and mortality function. In mortality function, the premium of everybody else covers the death benefits of anybody who die within a given period of time. In cash, function age varies, meaning that the policy matures and endows the face value of the policy depending on sate and company.

Time value of money

This concept refers to any type of interest that one happens to receive from any kind of payment. This is a present formula, which is the core formula for the time value of money. All the formulae are derived from the formula below;

The present value (PV) formula has four variables

PV value at time=0

FV value at time=n

I rate of compounding

N number of periods

Summing the contributions of FV the value of the cash flow, you will get the cumulative value.

The present value of growing perpetuity, if it grows at different fixed rates, you easily determine the value at looking at the following formula. There are various qualifications and modifications to this valuation application. It’s not easy to find a growing perpetual annuity with true perpetual cash flow or fixed rates.

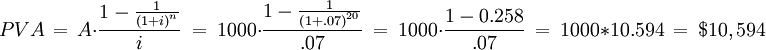

When you want to calculate the value of the regular savings deposit in the future, you first calculate the present value of a stream of deposits of $1,000 every year for 20 years, earning an interest of 7%. (Steven A. Finkler, 1992)

Calculating the value at a duration of 20 years

This formula can be put together into a single formula.

Lester William Zartman, Life Insurance, 1914

Joseph Brotherton maclean, Life Insurance, 1962

Robert Irwin Mehr: Life Insurance: Theory and Practice, 1977

Solomon Stephen Huebner, George Lawrence Amrhein, Chester Alexander Kline, Life Insurance, 1935

Steven A. Finkler, Christina M. Graf, Budgeting Concepts for Nurse Managers, 1992

Jae K. Shim, Accounting and Finance for the Nonfinancial Executive: An Integrated, 2000

Cite this paper

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2020, January 6). Life Insurance: Theory and Practice. https://studycorgi.com/life-insurance-theory-and-practice/

"Life Insurance: Theory and Practice." StudyCorgi , 6 Jan. 2020, studycorgi.com/life-insurance-theory-and-practice/.

StudyCorgi . (2020) 'Life Insurance: Theory and Practice'. 6 January.

1. StudyCorgi . "Life Insurance: Theory and Practice." January 6, 2020. https://studycorgi.com/life-insurance-theory-and-practice/.

Bibliography

StudyCorgi . "Life Insurance: Theory and Practice." January 6, 2020. https://studycorgi.com/life-insurance-theory-and-practice/.

StudyCorgi . 2020. "Life Insurance: Theory and Practice." January 6, 2020. https://studycorgi.com/life-insurance-theory-and-practice/.

This paper, “Life Insurance: Theory and Practice”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: January 6, 2020 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

- Search Search Please fill out this field.

What Is Life Insurance?

- Compare Top Companies

Term vs. Permanent Life Insurance

- What Affects Life Insurance Costs?

Life Insurance Buying Guide

Benefits of life insurance, who needs life insurance.

- What to Do Before Buying

How Life Insurance Works

- Riders and Policy Changes

Qualifying for Life Insurance

- Life Insurance

Life Insurance: What It Is, How It Works, and How To Buy a Policy

Amy Fontinelle has more than 15 years of experience covering personal finance, corporate finance and investing.

:max_bytes(150000):strip_icc():format(webp)/fontinelle-5bfc262a46e0fb0083bf8446.jpg)

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies in exchange for premiums the policyholder pays during their lifetime. The best life insurance companies have good financial strength, a low number of customer complaints, high customer satisfaction, several policy types, available and included riders, and easy applications.

Key Takeaways

- Life insurance is a legally binding contract that promises a death benefit to the policy owner when the insured person dies.

- For a life insurance policy to remain in force, the policyholder must pay a single premium upfront or pay regular premiums over time.

- When the insured person dies, the policy’s named beneficiaries will receive the policy’s face value, or death benefit.

- Term life insurance policies expire after a certain number of years. Permanent life insurance policies remain active until the insured person dies, stops paying premiums, or surrenders the policy.

- A life insurance policy is only as good as the financial strength of the life insurance company that issues it. State guaranty funds may pay claims if the issuer can’t.

Investopedia / Theresa Chiechi

Types of Life Insurance

Many different types of life insurance are available to meet all sorts of needs and preferences. Depending on the short- or long-term needs of the person to be insured, the major choice of whether to select temporary or permanent life insurance is important to consider.

Term life insurance

Term life insurance is designed to last a certain number of years, then end. You choose the term when you take out the policy. Common terms are 10, 20, or 30 years. The best term life insurance policies balance affordability with long-term financial strength.

- Decreasing term life insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

- Convertible term life insurance allows policyholders to convert a term policy to permanent insurance.

- Renewable term life insurance provides a quote for the year the policy is purchased. Premiums increase annually and are usually the least expensive term insurance in the beginning.

Many term life insurance policies allow you to renew the contract on an annual basis once the term is up. This is one way to extend your life insurance coverage, but since the renewal premiums are based on your current age, they can rise steeply each year. A better solution for permanent coverage is to convert your term life insurance policy into a permanent policy. This is not an option on all term life policies; look for a convertible term policy if this is important to you.

Permanent Life Insurance

Permanent life insurance is more expensive than term, but it stays in force for the insured’s entire life unless the policyholder stops paying the premiums or surrenders the policy. Some policies allow for automatic premium loans when a premium payment is overdue.

- Whole life insurance is a type of permanent life insurance, which means it lasts your whole lifespan. It includes a cash value component, which is similar to a savings account. Cash-value life insurance allows the policyholder to use the cash value for many purposes, such as for loans or to pay policy premiums.

- Universal life (UL) insurance is another type of permanent life insurance with a cash value component that earns interest. Universal life features flexible premiums. Unlike term and whole life, the premiums can be adjusted over time and designed with a level death benefit or an increasing death benefit.

- Indexed universal life (IUL) is a type of universal life insurance that lets the policyholder earn a fixed or equity-indexed rate of return on the cash value component.

- Variable universal life (VUL) insurance allows the policyholder to invest the policy’s cash value in an available separate account. It also has flexible premiums and can be designed with a level death benefit or an increasing death benefit.

Top-Rated Companies to Compare

When shopping for insurance, you might want to start with our list of the best life insurance companies, some of which are listed below.

Term life insurance differs from permanent life insurance in several ways but tends to best meet the needs of most people looking for affordable life insurance coverage. Term life insurance only lasts for a set period of time and pays a death benefit should the policyholder die before the term has expired. That's in contrast to permanent life insurance, which stays in effect as long as the policyholder pays the premium. Another critical difference involves premiums—term life is generally much less expensive than permanent life because it does not involve building a cash value.

Before you apply for life insurance, you should analyze your financial situation and determine how much money would be required to maintain your beneficiaries’ standard of living or meet the need for which you’re purchasing a policy. Also, consider how long you'll need coverage for.

For example, if you are the primary caretaker and have children 2 and 4 years old, you would want enough insurance to cover your custodial responsibilities until your children are grown up and able to support themselves.

You might research the cost of hiring a nanny and a housekeeper or using commercial child care and cleaning services, then perhaps add money for education. Include any outstanding mortgage and retirement needs for your spouse in your life insurance calculation—especially if the spouse earns significantly less or is a stay-at-home parent. Add up what these costs would be over the next 16 or so years, add more for inflation, and that’s the death benefit you might want to buy—if you can afford it.

Burial or final expense insurance is a type of permanent life insurance that has a small death benefit. Despite the names, beneficiaries can use the death benefit as they wish.

What Affects Your Life Insurance Premiums and Costs?

Many factors can affect the cost of life insurance premiums . Certain things may be beyond your control, but other criteria can be managed to potentially bring down the cost before (and even after) applying. Your health and age are the most important factors that determine cost, so buying life insurance as soon as you need it is often the best course of action.

After being approved for an insurance policy, if your health has improved and you’ve made positive lifestyle changes, you can request to be considered for a change in risk class. Even if it is found that you’re in poorer health than at the initial underwriting , your premiums will not go up. If you’re found to be in better health, then you your premiums may decrease. You may also be able to buy additional coverage at a lower rate than you initially did.

Investopedia / Lara Antal

Step 1: Determine How Much You Need

Think about what expenses would need to be covered in the event of your death. Consider things like mortgage, college tuition, and other debts, not to mention funeral expenses. Plus, income replacement is a major factor if your spouse or loved ones need cash flow and are not able to provide it on their own.

There are helpful tools online to calculate the lump sum that can satisfy any potential expenses that would need to be covered.

Step 2: Prepare Your Application

Life insurance applications generally require personal and family medical history and beneficiary information. You may need to take a medical exam and will need to disclose any preexisting medical conditions, history of moving violations, DUIs, and any dangerous hobbies, such as auto racing or skydiving. The following are crucial elements of most life insurance applications:

- Age: This is the most important factor because life expectancy is the biggest determinant of risk for the insurance company.

- Gender: Because women statistically live longer, they generally pay lower rates than males of the same age.

- Smoking: A person who smokes is at risk for many health issues that could shorten life and increase risk-based premiums.

- Health: Medical exams for most policies include screening for health conditions like heart disease, diabetes, and cancer and related medical metrics that can indicate risk.

- Lifestyle : Dangerous lifestyles can make premiums much more expensive.

- Family medical history: If you have evidence of major disease in your immediate family, your risk of developing certain conditions is much higher.

- Driving record: A history of moving violations or drunk driving can dramatically increase the cost of insurance premiums.

Standard forms of identification will also be needed before a policy can be written, such as your Social Security card, driver's license, or U.S. passport.

Step 3: Compare Policy Quotes

When you've assembled all of your necessary information, you can gather multiple life insurance quotes from different providers based on your research. Prices can differ markedly from company to company, so it's important to make the effort to find the best combination of policy, company rating, and premium cost. Because life insurance premiums are something you will likely pay monthly for decades, finding the best policy to fit your needs can save an enormous amount of money.

Our lineup of the best life insurance companies can give you a jump start on your research. It lists the companies we've found to be the best for different types of needs, based on our research of nearly 100 carriers.

There are many benefits to having life insurance . Below are some of the most important features and protections offered by life insurance policies.

Most people use life insurance to provide money to beneficiaries who would suffer a financial hardship upon the insured’s death. However, for wealthy individuals, the tax advantages of life insurance, including the tax-deferred growth of cash value, tax-free dividends, and tax-free death benefits, can provide additional strategic opportunities.

Avoiding Taxes

The death benefit of a life insurance policy is usually tax-free. It may be subject to estate taxes , but that's why wealthy individuals sometimes buy permanent life insurance within a trust. The trust helps them avoid estate taxes and preserve the value of the estate for their heirs.

Tax avoidance is a law-abiding strategy for minimizing one’s tax liability and should not be confused with tax evasion , which is illegal.

Life insurance provides financial support to surviving dependents or other beneficiaries after the death of an insured policyholder. Here are some examples of people who may need life insurance:

- Parents with minor children. If a parent dies, the loss of their income or caregiving skills could create a financial hardship. Life insurance can make sure the kids will have the financial resources they need until they can support themselves.

- Parents with special-needs adult children. For children who require lifelong care and who will never be self-sufficient, life insurance can make sure their needs will be met after their parents pass away. The death benefit can be used to fund a special needs trust that a fiduciary will manage for the adult child’s benefit.

- Adults who own property together. Married or not, if the death of one adult would mean that the other could no longer afford loan payments, upkeep, and taxes on the property, life insurance may be a good idea. One example would be an engaged couple who take out a joint mortgage to buy their first house.

- Seniors who want to leave money to adult children who provide their care. Many adult children sacrifice time at work to care for an elderly parent who needs help. This help may also include direct financial support. Life insurance can help reimburse the adult child’s costs when the parent passes away.

- Young adults whose parents incurred private student loan debt or cosigned a loan for them. Young adults without dependents rarely need life insurance, but if a parent will be on the hook for a child’s debt after their death, the child may want to carry enough life insurance to pay off that debt.

- Children or young adults who want to lock in low rates. The younger and healthier you are , the lower your insurance premiums. A 20-something adult might buy a policy even without having dependents if there is an expectation to have them in the future.

- Stay-at-home spouses. Stay-at-home spouses should have life insurance as they have significant economic value based on the work they do in the home. According to Salary.com, the economic value of a stay-at-home parent would have been equivalent to an annual salary of $162,581 in 2018.

- Wealthy families who expect to owe estate taxes. Life insurance can provide funds to cover the taxes and keep the full value of the estate intact.

- Families who can ’ t afford burial and funeral expenses. A small life insurance policy can provide funds to honor a loved one’s passing.

- Businesses with key employees. If the death of a key employee, such as a CEO, would create a severe financial hardship for a firm, that firm may have an insurable interest that will allow it to purchase a life insurance policy on that employee .

- Married pensioners. Instead of choosing between a pension payout that offers a spousal benefit and one that doesn’t, pensioners can choose to accept their full pension and use some of the money to buy life insurance to benefit their spouse. This strategy is called pension maximization .

- Those with preexisting conditions. Such as cancer, diabetes, or smoking. Note, however, that some insurers may deny coverage for such individuals, or else charge very high rates.

Each policy is unique to the insured and insurer. It’s important to review your policy document to understand what risks your policy covers, how much it will pay your beneficiaries, and under what circumstances.

What to Do Before Buying Life Insurance

Research policy options and company reviews.

Because life insurance policies are a major expense and commitment, it's critical to do proper due diligence to make sure the company you choose has a solid track record and financial strength, given that your heirs may not receive any death benefit for many decades into the future. Investopedia has evaluated scores of companies that offer all different types of insurance and rated the best in numerous categories.

Consider How Much Death Benefit You Need

Life insurance can be a prudent financial tool to hedge your bets and provide protection for your loved ones in case of death should you die while the policy is in force. However, there are situations in which it makes less sense —such if you buy too much or insure people whose income doesn't need to be replaced. So it's important to consider the following.

What expenses couldn't be met if you died? If your spouse has a high income and you don't have any children, maybe it's not warranted. It is still essential to consider the impact of your potential death on a spouse and consider how much financial support they would need to grieve without worrying about returning to work before they’re ready. However, if both spouses' income is necessary to maintain a desired lifestyle or meet financial commitments, then both spouses may need separate life insurance coverage.

Know Why You're Buying Life Insurance

If you're buying a policy on another family member's life, it's important to ask—what are you trying to insure? Children and seniors really don't have any meaningful income to replace, but burial expenses may need to be covered in the event of their death. Beyond burial expenses, a parent may also want to protect their child’s future insurability by purchasing a moderate-sized policy when they are young. Doing so allows that parent to ensure that their child can financially protect their future family. Parents are only allowed to purchase life insurance for their children up to 25% of the in-force policy on their own lives.

Could investing the money that would be paid in premiums for permanent insurance throughout a policy earn a better return over time? As a hedge against uncertainty, consistent saving and investing—for example, self-insuring—might make more sense in some cases if a significant income doesn't need to be replaced or if policy investment returns on cash value are overly conservative.

A life insurance policy has two main components—a death benefit and a premium. Term life insurance has these two components, but permanent or whole life insurance policies also have a cash value component.

1. Death benefit. The death benefit or face value is the amount of money the insurance company guarantees to the beneficiaries identified in the policy when the insured dies. The insured might be a parent, and the beneficiaries might be their children, for example. The insured will choose the desired death benefit amount based on the beneficiaries’ estimated future needs. The insurance company will determine whether there is an insurable interest and if the proposed insured qualifies for the coverage based on the company’s underwriting requirements related to age, health, and any hazardous activities in which the proposed insured participates.

2. Premium. Premiums are the money the policyholder pays for insurance. The insurer must pay the death benefit when the insured dies if the policyholder pays the premiums as required, and premiums are determined in part by how likely it is that the insurer will have to pay the policy’s death benefit based on the insured’s life expectancy. Factors that influence life expectancy include the insured’s age, gender, medical history, occupational hazards, and high-risk hobbies. Part of the premium also goes toward the insurance company’s operating expenses. Premiums are higher on policies with larger death benefits, individuals who are at higher risk, and permanent policies that accumulate cash value.

3. Cash value. The cash value of permanent life insurance serves two purposes. It is a savings account that the policyholder can use during the life of the insured; the cash accumulates on a tax-deferred basis. Some policies have restrictions on withdrawals depending on how the money is to be used. For example, the policyholder might take out a loan against the policy’s cash value and have to pay interest on the loan principal. The policyholder can also use the cash value to pay premiums or purchase additional insurance. The cash value is a living benefit that remains with the insurance company when the insured dies. Any outstanding loans against the cash value will reduce the policy’s death benefit.

Good to Know

The policy owner and the insured are usually the same person, but sometimes they may be different. For example, a business might buy key person insurance on a crucial employee such as a CEO, or an insured might sell their own policy to a third party for cash in a life settlement .

Life Insurance Riders and Policy Changes

Many insurance companies offer policyholders the option to customize their policies to accommodate their needs. Riders are the most common way policyholders may modify or change their plans. There are many riders, but availability depends on the provider. The policyholder will typically pay an additional premium for each rider or a fee to exercise the rider, though some policies include certain riders in their base premium.

- The accidental death benefit rider provides additional life insurance coverage in the event the insured’s death is accidental.

- The waiver of premium rider relieves the policyholder of making premium payments if the insured becomes disabled and unable to work.

- The disability income rider pays a monthly income in the event the policyholder becomes unable to work for several months or longer due to a serious illness or injury.

- Upon diagnosis of terminal illness, the accelerated death benefit rider allows the insured to collect a portion or all of the death benefit.

- The long-term care rider is a type of accelerated death benefit that can be used to pay for nursing-home, assisted-living, or in-home care when the insured requires help with activities of daily living, such as bathing, eating, and using the toilet.

- A guaranteed insurability rider lets the policyholder buy additional insurance at a later date without a medical review.

Borrowing Money. Most permanent life insurance accumulates cash value that the policyholder can borrow against. Technically, you are borrowing money from the insurance company and using your cash value as collateral. Unlike with other types of loans, the policyholder’s credit score is not a factor. Repayment terms can be flexible, and the loan interest goes back into the policyholder’s cash value account. Policy loans can reduce the policy’s death benefit, however, if you don't pay them back.

Funding Retirement. Policies with a cash value or investment component can provide a source of retirement income. This opportunity can come with high fees and a lower death benefit, so it may only be a good option for individuals who have maxed out other tax-advantaged savings and investment accounts. The pension maximization strategy described earlier is another way life insurance can fund retirement.

It’s prudent to reevaluate your life insurance needs annually or after significant life events, such as divorce , marriage, the birth or adoption of a child, or major purchases, such as a house. You may need to update the policy’s beneficiaries, increase your coverage, or even reduce your coverage.

Insurers evaluate each life insurance applicant on a case-by-case basis, and with hundreds of insurers to choose from, almost anyone can find an affordable policy that at least partially meets their needs. In 2018 there were 841 life insurance and annuity companies in the United States, according to the Insurance Information Institute.

On top of that, many life insurance companies sell multiple types and sizes of policies, and some specialize in meeting specific needs, such as policies for people with chronic health conditions. There are also brokers who specialize in life insurance and know what different companies offer. Applicants can work with a broker free of charge to find the insurance they need. This means that almost anyone can get some type of life insurance policy if they look hard enough and are willing to pay a high enough price or accept a perhaps less-than-ideal death benefit.

Insurance is not just for the healthy and wealthy, and because the insurance industry is much broader than many consumers realize, getting life insurance may be possible and affordable even if previous applications have been denied or quotes have been unaffordable.

In general, the younger and healthier you are, the easier it will be to qualify for life insurance, and the older and less healthy you are, the harder it will be. Certain lifestyle choices, such as using tobacco or engaging in risky hobbies such as skydiving, also make it harder to qualify or lead to higher rates.

You need life insurance if you need to provide security for a spouse, children, or other family members in the event of your death. Life insurance death benefits, depending on the policy amount, can help beneficiaries pay off a mortgage, cover college tuition, or help fund retirement. Permanent life insurance also features a cash value component that builds over time.

What Affects Your Life Insurance Premiums?

- Age (life insurance is less expensive)

- Gender (female tends to be less expensive)

- Smoking (smoking increases premiums)

- Health (poor health can raise premiums)

- Lifestyle (risky activities can increase premiums)

- Family medical history (chronic illness in relatives can raise premiums)

- Driving record (good drivers save on premiums)

What Are the Benefits of Life Insurance?

- Payouts are tax-free. Life insurance death benefits are paid as a lump sum and are not subject to federal income tax because they are not considered income for beneficiaries.

- Dependents don't have to worry about living expenses. Most policy calculators recommend a multiple of your gross income equal to seven to 10 years that can cover major expenses like mortgages and college tuition without the surviving spouse or children having to take out loans.

- Final expenses can be covered. Funeral expenses can be significant and can be avoided with a burial policy or with standard term or permanent life policies.

- Policies can supplement retirement savings. Permanent life policies such as whole, universal, and variable life insurance can offer cash value in addition to death benefits, which can augment other savings in retirement.

How Do You Qualify for Life Insurance?

To qualify for life insurance, you need to submit an application. But life insurance is available to almost anyone. However, the cost or premium level can vary greatly based on your age, health, and lifestyle. Some types of life insurance don't require medical information but generally have much higher premiums and involve an initial waiting period before the death benefit is available.

How Does Life Insurance Work?

Life insurance works by providing a death benefit in exchange for paying premiums. One popular type of life insurance—term life insurance—only lasts for a set amount of time, such as 10 or 20 years. Permanent life insurance also features a death benefit but lasts for the life of the policyholder as long as premiums are paid.

Insurance Information Institute. " What are the Different Types of Term Life Insurance Policies? "

Allstate. " What Is Variable Universal Life Insurance? "

Insurance Information Institute. " What are the Different Types of Permanent Life Insurance Policies? "

Internal Revenue Service. " Life Insurance & Disability Insurance Proceeds ."

Social Security Administration. " Liens, Adjustments and Recoveries, and Transfers of Assets ."

NAIC. " Life Insurance ."

Insurance Information Institute. " Facts + Statistics: Industry Overview ."

- How to Get Life Insurance 1 of 41

- Life Insurance: What It Is, How It Works, and How To Buy a Policy 2 of 41

- When Should You Get Life Insurance? 3 of 41

- How Age Affects Life Insurance Rates 4 of 41

- Is Life Insurance Worth It? 5 of 41

- What to Expect When Applying for Life Insurance 6 of 41

- Universal Life Insurance vs. Whole Life 7 of 41

- 11 Best Term, Whole, and No-Exam Life Insurance Companies for April 2024 8 of 41

- Term Life Insurance: What It Is, Different Types, Pros and Cons 9 of 41

- What Is Term Insurance? How Does It Work, and What Are the Types? 10 of 41

- Group Term Life Insurance: What It Is, How It Works, Pros & Cons 11 of 41

- Best Term Life Insurance Companies of April 2024 12 of 41

- Permanent Life Insurance: Definition, Types, and Difference from Term Life 13 of 41

- What Is Cash Value in Life Insurance? Explanation With Example 14 of 41

- Whole Life Insurance Definition: How It Works, With Examples 15 of 41

- Best Whole Life Insurance Companies of April 2024 16 of 41

- What Is Universal Life (UL) Insurance? 17 of 41

- Variable Universal Life (VUL) Insurance: What It Is, How It Works 18 of 41

- What Is Indexed Universal Life Insurance (IUL)? 19 of 41

- Paid-Up Additional Insurance: Definition and the Role of Dividends 20 of 41

- Adjustable Life Insurance: Definition, Pros & Cons, vs. Universal 21 of 41

- Guaranteed Issue Life Insurance: What it is, How it Works, 22 of 41

- Final Expense Insurance: What it is, Who Needs it, Pros and Cons 23 of 41

- Burial Insurance: What It is, How It Works 24 of 41

- 8 Common Life Insurance Riders 25 of 41

- Accelerated Benefit Riders: How They Work 26 of 41

- Dread Disease Rider: What it is, How it Works 27 of 41

- Family Income Rider: What It Is, How It Works 28 of 41

- Are Return of Premium Riders Worth It? 29 of 41

- Waiver of Premium Rider: Definition, Purpose, Benefits, and Cost 30 of 41

- Long-Term Care Rider: What it is, How it Works 31 of 41

- How Can I Borrow Money From My Life Insurance Policy? 32 of 41

- Cashing in Your Life Insurance Policy 33 of 41

- What Is Cash Surrender Value? How It Compares to Cash Value 34 of 41

- Cash Value vs. Surrender Value: What's the Difference? 35 of 41

- IRA vs. Life Insurance for Retirement Saving: What's the Difference? 36 of 41

- How Does Life Insurance Work? 37 of 41

- Understanding Taxes on Life Insurance Premiums 38 of 41

- What Are the Tax Implications of a Life Insurance Policy Loan? 39 of 41

- What Is a 1035 Exchange? Definition and How the Rules Work 40 of 41

- Do Beneficiaries Pay Taxes on Life Insurance? 41 of 41

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1465621717-5f131bf876c043898c13e6c471acf50f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

235 Insurance Essay Topic Ideas & Examples

🏆 best insurance topic ideas & essay examples, 👍 good essay topics on insurance, 📌 most interesting insurance topics to write about, ⭐ simple & easy insurance essay titles, 💡 interesting topics to write about insurance, ❓ research questions about insurance.

- Social Insurance Programs and Their Influence on Society Socioeconomic and political forces can also affect social insurance programs as political and economic determine the longevity of social security programs.

- The Importance of HRM Within the Insurance Industry First, the company undertakes a rigorous procedure to ensure that the jobs that have been designed specifically meet the needs and requirements of the firm and its clientele and most importantly, the job description attracts […] We will write a custom essay specifically for you by our professional experts 808 writers online Learn More

- Role of Insurance in Economic Development The importance of the insurance sector in the economic development of the country is being increasingly felt, due to the continued increase in the contribution of the insurance sector to the overall financial sector.

- Company Analysis: Aviva Life Insurance Company Directors and management of a company are interested in its efficiency to generate profits, the company’s viability from the investor’s point of view, the company’s ability to generate sufficient returns to investors and gearing ratio […]

- Insurance Agency’s Organizational Behavior To achieve the objective of determining effective usage of human skills in management, the top manager, Miss Kally, was interviewed about of the company.

- Risk Management: Types of Insurance Even though insurance cannot avoid the occurrence of bad things, it has the capability of transferring the financial consequences of the events to an insurance carrier, thus limiting the financial commitments of the insured firms.

- Insurance Barriers in Mental Health Population With the help of the Affordable Care Act, access to mental health care among people with low income and from ethnic and racial minorities was improved significantly.

- Corporate Demand for Insurance on Risks In addition, empirical studies indicate that the capability of firms to self-insure decreases the demand for corporate insurance coverage for other policies apart from the property exposure.

- Risk Management and Commercial Property Insurance In the quest to understand risk management and commercial property insurance, one should understand the risks in society, the relationship between risk and insurance, risk management tools, and the legal principles of risk and insurance […]

- Insurance Frauds and How They Can Be Managed Insurance refers to the services offered by companies that are willing and able to undertake risk prevention and compensation services to individuals and property.

- Emotional Appeal in the Insurance Advertising The centrality of the word, as well as the uniformity of the blue background, forces the viewer to notice it and probably remember it for a long time, given the jolt of transition.

- Organizational Behavior in Insurance Marketing Group The paper assesses how the organization’s behavior has been influenced by different components, which include the organization’s culture, internal communication, motivational techniques, nature of authority, areas of emotional quotient embraced by the organization, and the […]

- The Tort Law and Liability Insurance System The changes in the insurance system made it more accessible and enabled poorer people to buy insurances and get costs in case of insured accident.

- Operational Risk Within Lloyd’s Insurance Market The article entitled, Operational Risk within an Insurance Market reflected the ideas of Manning and Gurney when it comes to the development and implementation of risk management within Lloyd’s insurance market. The article’s objective is […]

- Insurance Companies Using Artificial Intelligence In these situations, the decisions AI would make would not contribute to improving the situation for these people and would not better the society as a whole.

- Progressive Insurance’s Diversity, Equity and Inclusion It can be used to assess the effectiveness of diversity recruiting and retention efforts, measure the value of diversity training, and survey workers about the success of diversity initiatives, such as supplier programs, employee resource […]

- The Replacement for the ACA Healthcare Insurance Policy For example, the AHCA policy allows a waiver of the ACA’s healthcare provision for societal rating and enables the federal government to charge patients more capital regarding the payment of premiums.

- The Health Insurance Portability Policy Analysis These changes demonstrate that policymakers draw sufficient attention to ensure that the HIPAA policy addresses current issues and keeps abreast of changing technologies that are actively applied in the medical sphere.

- Aspects of Insurance Financial Planning The basic principle of investment is that an increase in the risk of an investment increases the potential for high returns.

- How the Insurance and Drug Industries Affected the Universal Healthcare Universal healthcare in the United States guarantees that all citizens have access to the medical care they need, regardless of their capacity to pay.

- Macro-Environmental Analysis: Health Insurance for Children Additional sub-questions to be evaluated will be: Will the free-standing children’s hospitals go the way of rural hospitals and become obsolete?

- Australia Comprehensive Car Insurance Industry Thus, the sector is characterized by the dominance of the four biggest insurers cooperating with the highest number of customers and possessing the biggest market shares. Altogether, it is possible to conclude that the car […]

- Comparing Insurance in the UK and Germany Insurance within the framework of the first category is aimed at maintaining the well-being of citizens and, in the second – reducing financial losses in the event of risks to property.

- Art and Music Therapy Coverage by Health Insurance However, I do believe that creative sessions should be available for all patients, and I am going to prove to you that music and art are highly beneficial for human health.

- Privacy Issues of the Health Insurance Act The rule requires health entities to notify their patients when their health data is impermissibly used or disclosed in a manner that compromises the security and privacy of the PHI.

- Insurance in Europe Profitability and the Macroeconomic Environment The assignment analyses the cost structure of the industry, the economic landscape in Europe, and how it relates to the insurance sector, changing consumer preference, and the impact of Covid-19 on the industry.

- Struggles of Democracy: Social Insurance Programs There are always segments of people in the society who struggle more than the general population, and by taking measures, the government increases the economic growth and general well-being.

- The Future of Retirement and Health Insurance There are many risks related to them due to a number of factors: stock market instability, possible changes to the funding of those programs and the threat of the abolishment of Medicare.

- Should Health Insurance Be Mandatory for All American Citizens? With state-initiated changes, there is a chance for healthcare insurance to become obligatory for every resident inhabiting the United States improving their well-being, treatment outcomes, and quality of life.

- Healthcare Insurance and Job Search The company choices rangers from the people covered by the insurance, hospitals that the insurance is accepted, the amount the insurance can raise the amount deducted from the salary for the cover.

- Health Insurance Portability and Accountability Act Marketing Process: Advertising Advertising is regarded as a vital type of information for medical service competitiveness due to the competitive nature of medicine and the firm establishment of practically all business sectors in the United States, presently deemed […]

- The Life Insurance Industry: Key Aspects Nevertheless, there is a problem of understanding the need and functions of life insurance among the population, which becomes an obstacle to the registration of such services.

- Content Analysis of Cyber Insurance Policies Overall, the information that the course has provided has allowed me to understand and embrace the framework for addressing the cases of personal data breach.

- Consideration of Insurance From an Ethical Point of View The payment by the insurer of the insurance indemnity to the policyholder is the responsibility of the insurer. Setting a payment limit is a solution to the problem of losses for an insurance company in […]

- Outback Insurance Company vs. Dexter’s Facility In case of violations of the rules of operation, use of the vehicle, and its management, the detention of the vehicle is applied.

- Features of the Entry of a Foreign Insurance Company to the UAE Market The modern United Arab Emirates is striving to diversify the economy and minimize the influence of an obscure sector on the development of the country. CCL regulates the activities of agents for foreign companies in […]

- Insurance Inequality in New Zealand This applies both to the employer’s territory and outside it, either during the journey to the place of work or returning from the place of work.

- UHC: Managing HACs and HAIs in the Context of Insurance Programs On the one hand, if the number of HACs continues to trend upward, this will lead to the establishment of larger sizes and impose more stringent requirements on the operation of clinical organizations.

- TriTerm Health Insurance Program in West Virginia In addition, one of the last steps is the need for feedback to adjust the plan and make timely changes. Thus, this is what creates some disconnect between the framework and the TriTerm health plan […]

- Health Insurance Portability and Accountability Act: Privacy and Security Rules Violation Most cases present with the use of malicious malware to access protected data without the consent of the insurers and inappropriate use of that information.

- Medicaid, American Governmental Health Insurance Program The Federal government covers the main part of the insurance, and the other part is paid from the state’s budget. The other factors that influence the individual’s permission to use it are the cost of […]

- Case Study: Happy Acres and Insurance Being on the second floor of the facility, she fell down the stairs and broke her hip, and got a concussion. The nursing home had failed to implement the relevant measures to maximize the safety […]

- Usage-Based Insurance Company Project In order to explain the opportunity, I would like to share with you the state of the market, potential competitors, and the description of the target customer base.

- Cost Sharing Under State Children’s Health Insurance Program Because of the implementation of cost sharing, the yearly allowances for the families eligible for SCHIP have been significantly reduced, leading to the impossibility of dental care for the children.

- Corporate Finance Law in Saudi Arabian Insurance Institutions This study will stand on available research to examine the fundamental growth drivers and estimate the prospects that Insurance institutions in Saudi Arabia have under the corporate finance law in terms of the situation of […]

- The Health Insurance Portability and Accountability Act and the Medical Billing Process As of now, the disclosure and use of health information is safeguarded by a collage of state legislations that leave gaps in the protection of patients’ health records that are private and confidential.

- Malpractice Lawsuits: Professional Liability Insurance The interests of the healthcare professional are secondary to those of the employer in case of a lawsuit. One disadvantage of having professional liability insurance is that its premiums might be expensive to some healthcare […]

- Whole Life Insurances Case Study The type of health policy they use is named the Whole Life Insurance, which presupposes insured person’s coverage for the duration of their lives as long as they pay the premium on time.

- Professional Liability Insurance As a result of the discussion, nurses received new information about the professional liability policy; one of the nurses decided to obtain the individual plan.

- Health & Safety & Insurance: Risk Management There are chances that the regular or single insurance program or policy will not be able to cover all the possible exposures.

- Risk vs. Cost in Natural Disaster Insurance Floods are more predictable, and it is possible to create a map for each flood-prone area that would allow insurance companies to calculate the exact cost of premiums.

- Nursing: Malpractice Insurance First of all, it is hard to estimate the exact amount of insurance that I may require since the amounts of money paid to different patients may vary widely. Therefore, I should clarify whether I […]

- Children’s Health Insurance Program This presentation discusses the role of the Children’s Health Insurance Program, a component of U.S. health policy regulating different mechanisms of medical services for children.

- Economics: Insurance Industry in 2005 The first is trade in risk and the second is diversification. When an insurance company is able to take advantage of the predictability that comes from aggregating a large number of independent events, it is […]

- Landlord and Tenant, Insurance and Estates It is an owner of the property who yields the right to use the property for a particular point in time in exchange for the reception of the rental fee.

- National Disability Insurance Scheme Implementation This paper explores the economic, political, sociological, epidemiological public health factors affecting the implementation of the NDIS, and their effect on the health policy in response to the growing needs of the community.

- J.C. Durick Insurance v. Peter Andrus Law Case The dispute was a result of changes made to the insurance cover policy, by the plaintiff without the consent of the defendant.

- Australian Business Law: Insurance Contracts Act Insurance basics state that the insurer covers the insured and in the event of any circumstances unknown to the insured, the insurer is supposed to pay relief to the insured.

- Manifestations of Gender Discrimination in Insurance In the past, insurance companies have engaged in gender discrimination in the classification, acceptance and rating of risks. This paper provides an in-depth analysis of the concept of gender discrimination and insurance in the world.

- The Selection Process for the Type of Health Insurance for Staff in a Medium-Sized Company The cost of health insurance would also be a useful piece of information for determining the right health insurance policy to take.

- Bank (HSBC) and Life Insurance Company (Protective) The report also investigates the profitability of the two companies, the metrics used to measure profitability, variation in the last five years and the reasons for these variations.

- Employment Law in Australian Insurance Sector As a matter of fact, there was no evidence to prove that the inclusion of the implied term in the contract was a professional custom in the insurance sector.

- A Change in the Medical Insurance Plan It is not a secret that health insurance is one of the most sensitive topics in the workplace, as employees are insured with the help of employer-sponsored medical insurance every year.

- Measles and Health Insurance in Illinois It is also shown that Illinois had the 23rd position among the states of the U.S.according to the percentage of the population not covered by health insurance in 2014, beginning with the states that had […]

- The United Health Care Insurance Program In most cases, the insurer is the insurance company that provides different insurance packages to individuals in an exchange for payment of a small fee that is referred to as a premium.

- Health Insurance and the Affordable Care Act As soon as the specifics of the staff’s role in the organization and the threats that they are exposed to are taken into account, the implementation of the PPO strategy should help improve the quality […]

- Zurich Insurance Company’s Risk Management Principles A look at the structure of the insurance industry of Bahrain reveals that it is made up of two types of firms, the Takaful institutions and the conventional insurance companies. There is a couple of […]

- Healthcare Insurance and Quality Improvement The current paper discusses the impact of technological innovation, pay-for-performance, and evidence-based medicine to improve care quality and reduce costs. Pay-for-performance initiatives such as Medicaid and Medicare encourage the identification of programs that are most […]

- Health Insurance and the Labor Market To understand the implications of the adverse selection, it is important to focus on the aspects of the issue. While changing the distribution of the number of labor hours among employees and the size of […]

- Financing Healthcare and Public Health Insurance The alternative sources of funding are critical for the sustainable functioning of the healthcare system. These regulations can be critical for minimizing the cost of healthcare.

- Hospitality Law: Dram Shop Insurance It should be mentioned that the employees of restaurants and hotels can also sustain their injuries in the workplace, even if this risk is lower in comparison with other industries.

- Insurance Companies’ Profitability in Saudi Arabia The insurance companies are required to raise a minimum capital of SAR100 million in order to be licensed to operate in the industry.

- Car Insurance in Saudi Arabia vs. USA The main objective of car insurance is to protect the car owner and the family from financial losses in the event of an accident or any other eventuality.

- The Principles of Insurance Before agreeing with the insurer, the insurance company often evaluates the risk factors of the insurer and the probability of occurrence of such risks.

- Insurance Sector in Arabic Gulf Region The growth in the insurance sector in the Gulf region matches with the growth of the economy, population growth, improved regulatory framework and increased responsiveness of the products offered by the industry in these regions.

- Commercial Law: Insurance Contracts Act ‘An insured’s duty of disclosure under the Common Law and the Insurance Contracts Act 1984’ Under section twenty one of the 1984 Insurance Contacts Act, all customers are required to make a disclosure to the […]

- Takaful Insurance Company of South Africa It points out the aims of and objective of conventional and takaful insurance. This therefore transits the ownership of the insurance resources or money and processes to the policy owner.

- Saudi Arabia Insurance Companies and Stocks The insurance sector is one of the highest-ranking areas of investment in the Saudi Arabia Stock Exchange. However, compared to other emerging markets, this does not much most well-performing markets probably because of the policies […]

- Health Insurance in the USA: A Basic Necessity for the Population In my view, a good plan to start the solution chain for this problem would be the proper reallocation of federal funds in favor of healthcare research and insurance coverage.

- Insurance Policies and Covers in the Construction Industry This dissertation is aimed at exploring the insurance responses shown by construction firms in the industry in their attempt to reduce their exposure to inherent risks in the industry Insurance is a term that refers […]

- Implementing the Health Insurance Portability and Accountability Act of 1996 However, efficient recording and transmittal of essentially private information over the Internet and even proprietary networks posed a threat to the individual right to privacy of health and treatment information.

- Long-Term Care Insurance Sources The reason is the credibility of the brand; it is one of my most well-known service providers and its customers have generally been happy with them.

- Long-Term Care Insurance for Different Age Categories A look at the escalation in premium suggests that purchase of LTC while a person is younger and can afford continuity in premium payments is prudent.

- “China Life Plots Overseas Insurance Buys” by Dyer & Waldmeir With the current economic down surge, most companies are not able to make investment decisions for fear of uncertainties that are likely to befall them. This is to take advantage of the untapped opportunities and […]

- Process of Professional Integration in Hospitals and Expansion of Managed Care Health Insurance However, in the case of MaineHealth a Clinical Integration and Community Health Improvement organization a perfect integration has resulted in profound success in extending services to the community. The hospital followed the process of integrating […]

- The Single-Payer Healthcare System and Improve Health Insurance Availability The single-payer framework will boost healthcare management through centralization, thus, raising the accessibility of quality clinical services among all individuals who need them.

- The National Disability Insurance Scheme: The Issue of Financing Professionals working within the sphere of Aged Care and Disability Services have to collaborate with many organizations in order to ensure that their clients and patients receive the most benefits from the system.

- National Disability Insurance Scheme The development of NDIS is conditional upon the existence of specific issues related to the provision of healthcare services to disabled people.

- A Company Having Healthcare Insurance for Workers: Pros and Cons In terms disadvantages, the constant increase in the cost of health insurance is also a factor to consider. In such situations, employees are required to provide a medical certificate, and paid sick leave is only […]

- The Significant Mistakes That Go Against Insurance Policies Crastination has not gone to the office for the annual examinations, and the procedures done by Dr. Since the visit was entirely considered a medical treatment, it does not meet the requirements of an insurance […]

- Multiple Insurance Contracts and Customer Behavior Research Goal: This study will help to understand the dominant pattern in the insurance companies and comprehend why some of the companies have established multiple insurance services.

- Risk Management Throughout History: The Origins and Development of Private Insurance In particular, Chapter 4 The Return of Risk tracks the origins and development of private insurance and welfare state and examines the limitations of different risk management practices.

- The Future of Automobile Insurance Thus, progressive insurance politics can become a backbone of the safety of Canadian vehicles, while the consequences of the abolishment of insurances through the usage of new technologies are unpredictable.

- A Flood Insurance Program in Canada: The Way to Protect Lives and Homes Floods are the major source of property loss: according to the analysis made by Munich, insurance companies do not want to take all the bills they get and ignore the majority of them.

- Quality Management at Empire Blue Cross Shield Insurance Company Boasting of over 75 years experience in the insurance industry, the company has expanded its activities to cover all market segments.

- The Allianz SF Insurance Company and Its Activities in Saudi Arabia It should be observed that most of the firms coming from the other half of the world, commit the blunder of imposing the same marketing ploys and campaigns to the Saudi Arabia market; Allianz group […]

- AllSafe Insurance Company’s Ethics and Competition In this case, the customers of D & M Insurance Company are expected to buy more policies for the company as the prices of their policies would be expected to be lower.

- Portfolio Insurance: Types of Risk in Fund Investing Their main investment area is the stock exchange that is subjected to external forces that affect the prices of the shares. This is because the factors that lead to it are national and a wise […]

- Life Insurance: The Key Points The ultimate aim of Insurance is without a doubt to minimize the risks involved in various aspects of life and in addition to this, to cover and compensate the owner if any loss is suffered […]

- Employment Insurance Training Benefits in Canada In this regard, those workers that have been laid-off are in a dire need of sufficient benefits for their sustenance and that of their families, as they seek to look for other forms of employment.

- Insurance Against Weather Conditions In Florida, the standard wind insurance payment increased from $723 to $1465 from 2002 to 2007, and in Florida’s coastal regions payments have tripled or even quadrupled. In addition, insurance companies have increased deductibles which […]

- Historical Development of Insurance This is the paper that will be briefly discussing the history of insurance along with the needs of insurance that has been realized in the past.

- Reiki Therapy: Why It Should Be Covered by Insurance It is success that counts most in this world and it is the system of Reiki holistic healing that is the success story of the day and under such conditions it should be covered by […]

- Programs of Social Insurance The category that is highly represented in this group of the uninsured is the working population basically due to lack of coverage for health insurance by their employers and also due to the amount of […]

- Price Discrimination in Healthcare and Family Health Care Insurance The benefit of the global pricing is that payer of the price and the service provider share equal risk. The main objective of price discrimination is to maximise revenue and increase the profit of the […]

- Ethical Issue Facing Health Care: Healthcare Insurance Issues These problems can range from whether or not the person has healthcare insurance to the doubt that whether or not the insurance providers are going to pay for the medical treatments.

- Introduction to Insurance The main aim of Insurance is to minimize the risks involved in various aspects of life and to cover and compensate the owner for any loss is suffered by the owner.

- Healthcare Trends and Implications. Insurance Affordable health care insurance needs to become a top priority and this article talks about the attempts of various states to increase health care coverage by providing greater access to healthcare and public coverage to […]

- The Captive Insurance Services: Different Types Captive insurers are insurers who are owned in part or in full by companies in the business of insurance. Captive insurance in Bahrain is well defined and in this country they have a number of […]

- Technological Development: Oman Insurance Company According to the requirements of combining information technology and information system relating to the internal and external environmental elaboration and development purpose, critical analysis of technological background and overall judgment of competency regarding the selected […]

- Personal Injury Insurance Adjuster in North Carolina But it is not always that the first person to arrive to your case will be a lawyer but most of the time it is an insurance adjuster who arrives first in a bid to […]

- Sompo Japan Insurance Incorporation in the US The insurance rate though is vital for the determination of the amount which is called as the premium which has to be changed for a particular amount of an insurance coverage.

- Critical Illness Insurance Critical Illness insurance is a pretty new form of insurance in Canada and pays you a benefit if you are stricken by a critical illness such as cancer or heart attack.

- The Concept of Taxation and National Insurance In general, it can be said that taxable income is the portion of an individual’s income that is the subject of taxation according to the laws that determine what is income and the taxation rate […]

- Health Insurance Portability and Accountability Issues The survey consisted of 20 questions and wherein they assessed the procedures in place for HIPPA compliance, the involvement of the Health Information Managers with regards to setting HIPPA policy, the incidents of confidentiality breaches […]

- Home Insurance Increase in Florida Home insurance increases in Florida, and more and more people have to sell their homes because of high insurance rates and fraudulent actions of insurers.

- Insurance in Developing Social Responsibility Though insurance is all about covering and managing risks, the contribution of the collective and obligatory social insurance systems towards developing social responsibility on every individual of a society is not only built up to […]

- Disability Insurance Plans in Canada Disability insurance is the type of insurance that provides you with financial security when you are unable to work and earn an income due to an accident or illness.

- Healthcare Insurance for Domestic Partners Healthcare benefits are just part of the benefits offered to domestic partners of employees in US companies. According to some findings, more than 13 percent of the employers in the country were offering benefits to […]

- State Farm Mutual Automobile Insurance Company’s Finance Based on the income and expense statement, net income, the loss ratio, the expense ratio, and the combined ratio have been calculated.

- Business Insurance: Best Ways to Protect Companies This category of business insurance is tricky because there is a lack of coverage when it comes to losing information and not all insurance companies agree to take the risk. The list of possible business […]

- Car Insurance Charges and Gender and Age Factors In this regard, the majority of insurance companies prefer that drivers wait until they attain 25 years of age for them to start paying normal adult insurance rates. It is sensible for insurance companies to […]

- UniFirst and Progressive Insurance Corporation’s Technologies The use of PDA and IRV systems by both UniFirst and Progressive Insurance have enabled the businesses to expand, increase their output and customer base.

- Islamic Finance and Takaful Insurance Takaful is the Islamic version of conventional insurance. The Islamic form of insurance or Takaful discourages the levying of interest and gambling.

- Green Health Company: Dropping Insurance Products Paul, the vice president of Small Group Products, understands the risks of dropping the most popular programs in the state and notes that the losses for the business may be more significant than estimated.

- Health Insurance Provision in the USA In the first drafts of this major document, a health care reform was proposed as a way to change the insurance policies and provide people with more opportunities to get access to healthcare.

- Employer-Sponsored Health Insurance and Its Influence Employer-sponsored health insurance has a long history in the United States and remains the main form of individuals’ access to medical services in the country.

- Malpractice Insurance for Nurse Practitioners The author goes further to indicate that NPs should be willing to analyze the role of license insurance coverage. Studies should also be undertaken to analyze the nature of different malpractices and liabilities associated with […]

- Mandatory Health Insurance in Abu Dhabi and Dubai As a way of providing effective mandatory health insurance policies in Abu Dhabi and Dubai, the administrations should focus on the overall cost, localities of coverage by the insurance policies on the insured and the […]

- Pearl and Mutual Benefit Insurance Company’s Turnover The result is the recruitment of individuals that may not fit in the organization, leading to a high rate of turnover. It is important to analyze the strengths and weaknesses of the recruitment process.

- Health Insurance Portability and Accountability Act There is also a Security Rule that is also created to guarantee the protection of crucial information and provide specific safeguards that are needed to prevent the appearance of different complications.

- Healthcare Availability and Insurance Regarding the ACA health insurance, it is defined as the lack of information available to insurers to make an appropriate decision.

- The UAE’s Healthcare System and Insurance The UAE has made incredible progress in its healthcare sector, owing to the government’s plan to establish comprehensible health initiatives and programs that target both private and public health sectors. The World Health Organization now […]

- Prospective Insurance Company: History and Information Its vision and mission is to be the best insurance organization in the world and to positively impact on the community through the provision of effective financial security planning.

- Insurance Company’s Advantage and Competencies Regarding the source of differential advantage for the new insurance company, such a source as the targeted segment may be applied to the current case.

- Driver Insurance, Its Gender and Age Factors To prove the importance of high rates of insurance for young male drivers, it is necessary to think about its benefits.

- Insurance Premiums in Relation to the Driver’s Age Drivers who are 16-19 years old are more likely to be involved in a car accident; at the same time, drivers who are 60 years old or older also pay more for their insurance compared […]

- Personal Financial Planning: Insurance Case Given the fact that the rent for the house is comparatively low, as well as the fact that there are valuable personal possessions, it will be reasonable to spend a significant number of the financial […]

- UAE vs. Saudi and Qatari Insurance Market The UAE is one of the dominant states in GCC, and its insurance conditions remain to be the most successful. The peculiar feature of insurance brokers in the GCC is their decision to capitalize on […]

- Risk, Insurance, and Third-Party Administrators The purpose of this paper is to discuss the term ‘risk’ and associated insurances, focus on the concepts of the ‘third party administrator’ and areinsurance,’ and report on the financial results of the major insurance […]

- Preventive Healthcare or Insurance Access Policy? It is possible to pay attention to some features of the current policy to find a way to effectively solve the problem of access to health insurance.

- Insurance: Purchasing Trends on Consumer Behavior These aspects have been seen to create dynamics for marketers in the insurance sector because they have continuously influenced the psychology and expectations of insurance consumers across the world.

- Unemployment Insurance Extension in the US In this way, extended UI lets them realize that they are not forgotten by the rest of society, and there is still an opportunity to find an appropriate job.

- Blafax Insurance Group’s SWOT Analysis Therefore, the customers of the company range from the US citizens to those across the globe, particularly in Europe and Asia.

- Pediatric Health Care and Insurance in the USA Despite the efforts of the U.S.government to ensure a thorough health care coverage for all children who are residents of the country, there remains a number of children who are uninsured and have no access […]

- Economics of Cyber Insurance This led to the need of protecting the Internet users standing through other means, the foremost among them being the cyber insurance policies.

- Unemployment Insurance Policy in the United States Despite some of the efforts embraced by different communities, the issue of unemployment has continued to affect the welfare of many citizens in the country.

- The Children’s Health Insurance Program in the US The Children’s Health Insurance Program is one of the current and robust healthcare policies targeting children in the United States. The main goal of the Children’s Health Insurance Program is to offer medical insurance coverage […]

- Kaiser Permanente’s Healthcare Insurance Program One possible solution to this would be to create a similar system as seen in the case of Kaiser Permanente wherein through its network of 36 medical centers and 14,000 medical professionals it does allow […]

- BP Company’s Insurance Strategy and Risk Management BP was the largest company in the UK in the 1980s and 1990s. To the extent of such potential losses, BP has to buy insurance in exchange for loss settlements should the risks occur.

- Council of Cooperative Health Insurance: Performance Management The PMS underscores the need to measure these outcomes as a vital component of evaluating the value of employees and management activities in assisting the agency to assume a proactive and client-focused approach in regulating […]

- Ethics and Issuing a Health Insurance Surcharge The primary reason for companies to refuse to issue a health insurance surcharge to employees who smoke or drink against medical advice is the fallacious argument that such employees in the work environment are conscientious […]

- Oil Drilling and Oil Services Insurance It is important to analyze the role of insurance in the development of the Oil Drilling and Oil Services industry in the United Arab Emirates and examine its basic principles in the local and international […]

- Life Insurance Policy Choice Whole life insurance is a fixed premium insurance policy which covers the lifetime of the insured, as long as the premiums are paid.

- Health Insurance in the UAE In Dubai and Abu Dhabi, the policy started in 2014 and it is expected that the majority of people living in the UAE will have obtained the health insurance by 2016.

- The World Insurance Partnership: Ethics Program The Ethics Program for the World Insurance Partnership is designed to declare the company’s core values, to promote the ethical principles and standards among the stakeholders with the focus on principles of transparency, integrity, and […]

- Constructit & E-editor Companies’ Health Insurance Changes to the Castor health insurance strategy result in the development of the Castor Enhanced Minor, which is most appropriate for the E-editor employees.

- Health Insurance Cooperatives In the United States, nonprofit health insurance cooperatives have been recommended as the third option to the tradition private health insurance and the newly suggested public health insurance.

- Takaful Insurance Company in the UAE The Malaysian Takaful operator, Syrikat Takaful Malaysia, illustrated the swift growth of the first Takaful portfolio in the country, all based on a model which served as a platform for expansion to the other countries […]