No internet connection.

All search filters on the page have been cleared., your search has been saved..

- All content

- Dictionaries

- Encyclopedias

- Sign in to my profile My Profile

- Sign in Signed in

- My profile My Profile

- Business Ethics & Corporate Social Responsibility

- Diversity, Equality & Inclusion

- Entrepreneurship

- General Business & Management

- Human Resource Management

- Information & Knowledge Management

- International Business & Management

- Operations Management

- Organization Studies

- Other Management Specialties

- Research Methods for Business & Management

- Strategic Management

- Australasia

- Cases with Enhanced Learning Tools

- Content Partners

- Information for authors

- Information for instructors

- Information for librarians

- Information for students and researchers

- Submit Case

Capital Budgeting Decision Analysis

- By: Varun Dawar

- Publisher: SAGE Publications: SAGE Business Cases Originals

- Publication year: 2018

- Online pub date: January 02, 2018

- Discipline: Capital Budgeting , Corporate Finance

- DOI: https:// doi. org/10.4135/9781526446718

- Keywords: budgeting , capital budgeting , cash flow , depreciation , internal rate of return , operating cash flow , rate of return Show all Show less

- Contains: Teaching Notes Length: 1,405 words Region: Southern Asia Country: India Industry: Manufacture of textiles Type: Experience case info Organization: fictional/disguised Organization Size: Small info Online ISBN: 9781526446718 Copyright: © Varun Dawar 2018 More information Less information

Teaching Notes

On September 20, 2016, Saurabh Sharma, Senior Vice President of Bhatia Textiles Company, sat in his office pondering the new capital budgeting proposal for setting up a product line of branded shirts. As per standard company practice, he was required to evaluate the capital budgeting project using the traditional Net Present Value (NPV) approach and the Internal Rate of Return (IRR) criterion and present his findings to the management committee meeting scheduled for the next week. Saurabh wondered whether this new proposal would turn out to be a good investment for his company, which was looking to deploy funds in NPV positive projects. The case puts students in a financial analyst role wherein they conduct capital budgeting analysis using the popular techniques of NPV and IRR.

Learning Outcomes

By the end of this case study, students should be able to:

- Understand the concept and importance of capital budgeting and investment decision-making.

- Discuss and identify the various information required for financial evaluation of investment proposals.

- Understand and calculate after-tax operating cash flows for capital budgeting analysis, taking into account the revenues, costs, depreciation, and working capital.

- Determine terminal year cash flows after considering salvage value and working capital.

- Understand the computation of cost of capital for determination of discounting rate.

- Determine the Net Present Value (NPV) and Internal Rate of Return (IRR) for accepting or rejecting a capital budgeting proposal.

Introduction

On September 20, 2016, Saurabh Sharma, Senior Vice President of Bhatia Textiles Company, was preparing for a meeting with the management committee scheduled the next week. On his desk was a capital budgeting and investment proposal – a new product line of branded shirts that the committee was considering for launch. As the head of the finance department, Saurabh was required to work along with his team on a detailed capital budgeting analysis and present the findings to the management committee for their approval. As per standard company practice, each capital budgeting and investment project was evaluated using the traditional Net Present Value (NPV) approach and the Internal Rate of Return (IRR) criterion for determining whether the company would undertake the project or not.

Saurabh had a lot to think about as he considered the analysis of the capital budgeting project using the traditional Net Present Value (NPV) approach and the Internal Rate of Return (IRR) criterion. What would be the basis for calculating the after-tax operating cash flows for the capital project? How would he arrive at the depreciation and working capital requirements for computing the NPV? What would be the basis for calculating the terminal year cash flows? With all these questions in mind, Saurabh decided to focus on the proposed capital budgeting project for the next few days.

Indian Retail Market

The Indian retail market is at the cusp of a sweet spot driven by strong GDP (Gross Domestic Product) growth, benign inflation, and rising per capita income and purchasing power of consumers. Currently, the retail industry accounts for more than ten percent of the Indian Gross Domestic Product and approximately eight percent of employment. The industry is expected to nearly double, from US$ 600 billion in 2015 to US$ 1 trillion, by 2020 driven by income growth, urbanization, and attitudinal shifts (Indian Terrain Annual Report, 2015–16). It has been estimated that, by 2030, the Indian apparel market, in particular, is expected to grow at a CAGR (compounded annual growth rate) of approximately 10–12%, backed by increasing affordability on account of an increase in disposable incomes, increase in aspirations, and a shift from unbranded to branded products by the burgeoning middle class. This trend is likely to be further accentuated by the rise of e-commerce companies that enable shopping from anywhere, thereby leading to increased penetration in small cities and towns (Indian Terrain Annual Report, 2015–16).

Company Background

Bhatia Textiles is a small, privately owned clothing company based in New Delhi, India. It was founded in 1995 by Harish Bhatia, a retired executive. Since then, the company had grown steadily by catering to middle to low income consumers in the Delhi-National Capital Region (NCR). The company recorded a stellar growth of 50% in its sales during the last financial year of 2015–16. With a healthy operating margin ratio and low leverage levels, the company had been able to grow its profits at a CAGR of 25% during the last 10 years. With a good brand name and healthy financial metrics, the company was now looking to expand its footprint to new product lines catering to middle to high income customers.

Project Investment Proposal Details

The project is estimated to be of 10 years duration. It involves setting up new machinery with an estimated cost of as much as INR 500 million, including installation. This amount could be depreciated using the straight line method (SLM) over a period of 10 years with a resale value of INR 15 million. The project would require an initial working capital of INR 20 million with cumulative investment in net working capital to be maintained at 10% of each year’s projected revenue. With the planned new capacity, the company would be able to produce 240,000 pieces of shirts each year for the next 10 years. In terms of pricing, each shirt can initially be sold at INR 1,300 apiece, which takes into account the target segment and competitor pricing. The project proposal incorporates an annual increase of 3% in the price of the shirt to compensate for inflationary impact. With regards to the raw material costs and other expenses, the project estimated the following details:

- Raw material cost for manufacturing shirts at INR 400 per shirt, slated to rise by 5% per annum on account of inflation.

- Other direct manufacturing costs at INR 125 per shirt with an annual increase of 5% per annum on account of inflation.

- Selling, general, and administrative expenses (including employee expenses) at INR 35 million per annum, expected to increase by 10% each year.

- Depreciation expense on the basis of SLM.

- Tax rate was assumed to be 25%.

For funding of the expansion project, the promoters agreed to infuse 50% in the form of equity with the rest (50%) being financed from issue of new debt. Based on the current credit position and market scenario, new debt can be raised by the company at 12% per annum. Cost of equity was assumed to be 15% by Saurabh. The requisite discounting rate or weighted average cost of capital (WACC) for NPV and IRR calculations can now be calculated with the help of the above assumptions.

Demand Scenario

Although the project proposal estimates maximum annual production of 240,000 shirts, Saurabh decided to do capital budgeting analysis under two demand scenarios: Optimistic and Expected. The likely annual demand estimated under each scenario is as follows:

Discussion Questions

- 1. Why are capital budgeting decisions important for a business firm? Discuss their concept and significance.

- 2. List the types of information generally required for evaluating the capital budgeting decisions of a firm from a financial standpoint.

- 3. What is meant by the Net Present Value (NPV) technique? Discuss its key assumptions and calculation methodology (including an estimation of the discount rate).

- 4. Explain the concept of the Internal Rate of Return (IRR). What is the criterion generally used by firms while accepting or rejecting a capital budgeting project on the basis of the IRR technique?

- 5. On the basis of the financial information given in the case, calculate the after-tax operating cash flows, NPV, and IRR under the Optimistic and Expected scenarios. Clearly specify the calculations required for the same.

- 6. Based on your analysis, as Saurabh Sharma, what recommendation would you make on whether the company should undertake the project or not? Clearly specify the decision based on both the NPV technique as well as the IRR criterion.

Further Reading

This case was prepared for inclusion in Sage Business Cases primarily as a basis for classroom discussion or self-study, and is not meant to illustrate either effective or ineffective management styles. Nothing herein shall be deemed to be an endorsement of any kind. This case is for scholarly, educational, or personal use only within your university, and cannot be forwarded outside the university or used for other commercial purposes.

2024 Sage Publications, Inc. All Rights Reserved

Sign in to access this content

Get a 30 day free trial, more like this, sage recommends.

We found other relevant content for you on other Sage platforms.

Have you created a personal profile? Login or create a profile so that you can save clips, playlists and searches

- Sign in/register

Navigating away from this page will delete your results

Please save your results to "My Self-Assessments" in your profile before navigating away from this page.

Sign in to my profile

Sign up for a free trial and experience all Sage Learning Resources have to offer.

You must have a valid academic email address to sign up.

Get off-campus access

- View or download all content my institution has access to.

Sign up for a free trial and experience all Sage Knowledge has to offer.

- view my profile

- view my lists

A study on capital budgeting practices of some selected companies in Bangladesh

PSU Research Review

ISSN : 2399-1747

Article publication date: 5 April 2021

Issue publication date: 12 September 2023

The purpose of this paper is to investigate the current capital budgeting practices in Bangladeshi listed companies and provide a normative framework (guidelines) for practitioners.

Design/methodology/approach

Data were collected with a structured questionnaire survey taking from the chief financial officers (CFOs) of companies listed in the Dhaka Stock Exchange in Bangladesh. Garnered data were then analyzed using descriptive and inferential statistical techniques.

The results found that net present value was the most prevalent capital budgeting method, followed closely by internal rate of return and payback period. Similarly, the weighted average cost of capital was found to be the widely used method for calculating cost of capital. Further, results also revealed that CFOs adjust their risk factor using discount rate.

Originality/value

The findings of this study might help the firms, policymakers and practitioners to take a wise decision while evaluating investment projects. Additionally, this study’s findings enrich the existing body of knowledge in the field of capital budgeting practices by providing more reliable and comprehensive analysis taking samples from a developing economy.

- Financial management

- Capital budgeting

Mollah, M.A.S. , Rouf, M.A. and Rana, S.M.S. (2023), "A study on capital budgeting practices of some selected companies in Bangladesh", PSU Research Review , Vol. 7 No. 2, pp. 137-151. https://doi.org/10.1108/PRR-10-2020-0035

Emerald Publishing Limited

Copyright © 2021, Md. Anhar Sharif Mollah, Md. Abdur Rouf and S.M. Sohel Rana.

Published in PSU Research Review . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence maybe seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

The basic objective of financial management is the maximization of the shareholders’ wealth by focusing on three decisions which are capital budgeting decisions, capital structure decision and dividend decision. Most of the scholar and practitioner opine that although three decisions are important, firm success and survival ultimately depend on a right investment decision because a good investment decision remains good business even though bad finance taken; on the contrary, a bad investment decision will be a wrong decision even with best finance policy ( Brealey et al. , 2015 ). A sound capital budgeting decision is very critical for a firm because it is aligned with the firm’s primary objective (wealth maximization), and it requires a substantial amount of resource and long-term commitment. Once the decision has been made, the process cannot be manipulated without incurring losses ( Hall and Millard, 2010 ). Capital budgeting is a major terrain of the sphere of financial management. Capital budgeting is related activities, it is not a standalone single activity; rather it is defined as a process called “capital budgeting process.” Capital budgeting is extremely important for capital investment decisions owing to its nature of capital budgeting process. Gitman et al. (2015) define capital budgeting as “the process of evaluating and selecting long term investment consistent with the firm owners’ goal of wealth maximization” (p. 344). Universally accepted definition yet to exist, because it is involved with multifaceted activities and influenced by many changing factors in the organizational environment.

Capital budgeting practices are the most vital component of financial management ( Bunch, 1996 ) and one of the most widely investigated topic in corporate finance literature. Majority of the studies investigating the capital budgeting practices among surveyed firms are from developed economies followed by emerging economies [e.g. the USA ( Graham and Harvey, 2001 ), Canada ( Jog and Srivastava, 1995 ; Bennouna et al. , 2010 ), Japan ( Shinoda, 2010 ), the UK ( Arnold and Hatzopoulos, 2000 ), India ( Singh et al. , 2012 ; Verma et al. , 2009 ) and Sri Lanka ( Nurullah and Kengatharan , 2015a, 2015b )]. However, in contrast to the developed world, this area is less investigated in emerging economies. Bangladesh is a rapidly growing emerging economy. Till date and as per best of our knowledge, there is no comprehensive study exploring the key aspects of capital budgeting practices by listed firms in Bangladesh. This presents an opportunity to investigate the topic under discussion for an emerging economy like Bangladesh. Therefore, the aim of this study is to fill this gap in the empirical literature by providing first-time comprehensive empirical evidence from Bangladesh.

Currently, research on capital budgeting practice has attracted scholars because of its importance and insight gained. However, in comparison with developed countries, this area is less studied in emerging economies like Bangladesh. Till date and as per the best of authors’ knowledge, no major studies except Shakila (2015) has been conducted on capital budgeting practices in Bangladesh. Therefore, the purpose of this study is to investigate the current scenario of capital budgeting practices in Bangladesh and to identify the pitfalls of capital budgeting practices of listed companies in Bangladesh.

2. Literature review

2.1 defining and understanding capital budgeting.

Capital budgeting is not a stand-alone single activity related decision; rather it is a process called the “capital budgeting process.” The nature of the capital budgeting process makes it extremely important in arriving at a capital investment decision. The capital budgeting process is a multifaceted activity designed to help in the selection of investment projects that are viable and worthy of pursuing. It is dynamic, not static. No all-around acknowledged agreement exists, and it is affected by many changing factors in the organizational environment. Mainly, capital budgeting process deals with planning, reviewing, analyzing, selecting, implementing and following up activities. Leon et al. (2008) pointed out that capital budgeting is a process of evaluating and decision-making on investment projects. The authors also stated that evaluation must involve the cash flows from the proposed project considering the risk and uncertainty. Thus, care must be taken in project selection to ensure a greater probability that positive results will be made in the long run to the firm.

Capital budgeting is considered an important element in the firm managerial decisions ( Garrison et al. , 2018 ) and long-term financial performance ( Emmanuel et al. , 2010 ).

Ross et al. (2016) defined capital budgeting as the ways of planning and managing the firm investment in the long-term assets. Capital budgeting also plays a vital role in the firm’s strategic decisions like firm expansion, asset replacement and new asset selection, cost minimization and choosing between leases or buy.

2.2 Capital budgeting techniques

Capital budgeting method can be categorized into two groups: discounted cash flow (DCF) method and non-discounted cash flow (non-DCF) methods. Non-DCFs include payback method (PBM) and accounting rate of return (ARR). DCFs include net present value (NPV), internal rate of return (IRR), discounted payback method and profitability index (PI). While DCFs take into account the time value of money, the non-discounted methods are not considered time value of money ( Alleyne et al. , 2018 ; Hermes et al. , 2007 ).

Haka et al. (1985) divided capital budgeting methods into two categories: sophisticated and naïve selection techniques. Sophisticated techniques consider risk adjusted net cash flows, time value of money and inflation. Sophisticated techniques are NPV, IRR and PI; on the other hand, naïve method does not consider risk adjusted factor and time value of money. Major categories of naïve methods are PBP and ARR.

According to Baker and Powell (2009) , the capital budgeting process involves six stages: identifying project proposals, estimating project cash flows, evaluating projects, selecting projects, implementing projects and performing a post-completion audit. A clear explanation of capital budgeting was set forth by Segelod (1998) , who said:

[…] capital budgeting is the procedures, routines, methods and techniques used to select investment opportunities, develop initial ideas into specific investment proposals, evaluate and select a project, and control the investment project to assess forecast accuracy.

2.3 Factors influencing the selection of capital budgeting method

According to Alles et al. (2020) , selection of capital budgeting techniques can be influenced by both the financial and nonfinancial factors. The nonfinancial factors include demographic variables of the decision-maker. But Katabi and Dimoso (2016) conducted a study in Tanzania and found that business-related factors like industry of the business, sales growth, business establishment, number of employees and form of business play a vital role for selecting capital budgeting methods.

Leon et al. (2008) found eight factors that motivate them to choose a capital budgeting method in Indonesian’s firm. Factors are chief financial officers’ (CFOs) education, size of the firm, total annual investment, industry type, ownership structure, multinational culture and financial leverage. In addition, Brunzell et al. (2013) found one more factor which is political risk for selecting methods. Daunfeldt and Hartwig (2008) conducted a study on Swedish listed companies and found few new factors such as dividend payout ratio, potentiality of firm growth and foreign sales amount.

Nonetheless, a transformation was witnessed by the end of the 1980s wherein surveys stated that popularity of DCF methods of IRR and NPV was increasing day by day and decreasing the usage of payback period (PBP) as a primary method, while it was highly popular method as secondary criteria ( Blazouske et al. , 1988 ; Brigham, 1975 ; Gitman and Forrester, 1977 ; Farragher et al. , 2001 ; Farragher et al. , 2001 ).

2.4 Prior studies on capital budgeting practices: a brief overview

A review of the past research, of the 1960s and beginning of 1970s, stated the dominance of non-discounted techniques like PBP (Graham and Harvey), after that by ARR. During this time most of the researchers found that the DCF model was the least popular method for capital investment decision ( Baker and Beardsley, 1972 ). But, by the end of 1980s, research found a changing trend regarding more use of DCF methods of NPV, IRR and started decline in the usage of non-DCF methods of PBP and IRR as primary methods but remain highly popular as secondary methods. Pike and Neale (2006) and Arnold (2008) now provide diagrams that illustrate the multistage nature of investment decision-making in firms.

Kester and Robbins (2011) conducted a survey of CFOs of listed companies on Irish Stock Exchange on capital budgeting techniques used by Irish listed companies. The results found that they use DCF methods, and NPV was the most popular measure for capital budgeting decision, followed closely by PB, and IRR was ranked third, also mentioned that ARR was the least important technique according to the respondents. Scenario analysis and sensitivity analyses were perceived to be the most prevalent tools for incorporating risk. The respondent executives also indicated that they use a single discount rate based on weighted average cost of capital (WACC) that was the most widely accepted method used for calculating discount rate. On the other hand, Lazaridis (2004) studied capital budgeting practices in Cyprus, and PB was found to be the most prevalent method, but not NPV.

Shinoda (2010) conducted a survey focusing on capital budgeting practices in Japan taking sample data from 225 companies listed on the Tokyo Stock Exchange. The results found that Japanese firms manage their capital budgeting decisions by a combination of PB and NPV methods. The capital budgeting techniques used depend on the subject and situation. Effective decision-making with regard to capital budgeting requires a more multifaceted approach to the issue of capital budgeting methods rather than rigorous academic theory.

Over the past two decades, very few studies have been conducted on the capital budgeting practices in the developing countries. Compared to developed countries, the results of most studies show inconsistencies. In most developing countries, the PB method was the most popular method in evaluating investment projects. Kester et al. (1999) conducted a survey on 226 companies considering six countries: Australia, Hong Kong, Indonesia, Malaysia, the Philippines and Singapore. Their results indicated that PBP is the most used method and that DCF methods have become increasingly popular. In five Asian countries, 95% of firms used the PB method and 88% used the NPV in evaluating projects. However, PBP and NPV methods were equally popular. The rate of capital asset pricing model (CAPM) is more used in Australia compared with other countries considered for the adjustment of risk.

Hermes et al. (2007) conducted a comparative study of Dutch and Chinese firms taking data from a survey among 250 Dutch and 300 Chinese firms with regard to their capital budgeting practices. In total 89% of the Dutch CFOs reported that NPV method is the most popular method followed by PBP, but ARR method is the clearly least popular in Dutch. In total 66.7% of the Dutch CFOs stated that they used WACC and only 9.5% of them used PDCC. Small firms used cost of debt (CD) most often (22.7%) in comparison with larger firms (5.0%). In contrast, 53.3% of the Chinese firms indicated that they used WACC, and just 15.7% of the CFOs of Chinese firms used PDCC. However, 28.90% of the CFOs reported that they used CD, which was more than their Dutch counterparts. The Chinese CFOs stated that they were more likely to use NPV and PB methods (89% and 84%, respectively) in evaluating capital budgeting projects. Hence, Dutch CFOs usually use more sophisticated capital budgeting techniques compared to Chinese CFOs. de Andrés et al. (2015) conducted a survey with a sample of 140 nonfinancial Spanish firms to shed further light on the capital budgeting techniques used by Spanish companies. Primarily payback was the most widely used tool, while real options were used relatively little. Furthermore, their results confirmed that a firm’s size and industry were related to the frequency of use of certain capital budgeting techniques. Finally, they found that the relevance of growth opportunities and flexibility was an important factor in explaining the use of real options.

Mubashar and Tariq (2019) carried out a study on 200 nonfinancial firms listed on Pakistan Stock Exchange, with a response rate of 35%. It was found that Pakistani listed firms frequently used NPV, IRR and PI for capital budgeting. Out of these DCF methods, NPV is the most used method (61.4% of respondent firms always use NPV) of capital budgeting. Again, 27% firms always used IRR, but interestingly all the respondents firms use IRR with NPV as a secondary method. Similarly, WACC is estimated using target value weights, and capital asset pricing model (with extra risk factors) is used to determine the cost of equity capital. For risk assessment, sensitivity analysis and scenario analysis are the dominant approaches; however, despite the theoretical superiority, the use of real options is very low. Overall, investment decision responses significantly differ across firms’ demographics and executive characteristics.

Baker et al. (2017) based on the survey on 75 listed companies of Morocco revealed that 64% firms used IRR, 63% ARR and 53% PBM but NPV is least popular method in Morocco. Few of the responding firms use real options when making capital budgeting decisions. They tend to use less sophisticated techniques to evaluate investment opportunities and calculate the cost of capital than their counterparts in developed countries. The most frequently used techniques by Chittagong Stock Exchange-listed companies to estimate the cost of equity capital are the CD plus equity risk premium and the accounting return on equity. Alleyne et al. (2018) conducted a study on 41 firms in Barbados. The study suggested that firms in Barbados are not likely to use capital budgeting practices in project selection. Majority of respondents list the PBM as the preferred capital budgeting method to be used owing to simplicity, ease of calculation, possibility of less effort and agility of the methods. Results also showed that most organizations use “crude methods” and nontraditional methods of capital budgeting to aid decision-making. While there are no statistically significant differences in the capital budgeting practices used in different sectors, professional accountants are more likely to use NPV and sensitivity analysis than nonprofessional accountants.

Nurullah and Kengatharan (2015a ) conducted a comprehensive primary survey of 32 out of 46 CFOs of manufacturing and trading companies listed on the Colombo Stock Exchange in Sri Lanka. The results revealed that NPV was the most used capital budgeting method, followed closely by PBP and IRR. Similarly, for incorporating risk, sensitivity analysis was considered as the dominant capital budgeting tool, and the most preferred method for calculating cost of capital was the WACC. Moreover, results stated that the use of the capital budgeting methods (NPV, IRR and PB) and incorporating risk tool were (sensitivity analysis and simulation) influenced by size of the capital budget.

Andor et al. (2015) conducted a comprehensive phone survey of 400 CEOs of small, medium and large firms in ten countries of Central and Eastern Europe (CEE). They concluded that capital budgeting practices of CEE are mostly affected by firm size, culture and country’s code of ethics and firm objectives, while targeted leverage, management ownership and number of projects to be analyzed also play a moderate role. The same is true for calculating the cost of capital and the use of CAPM. Large firms used 56% DCF method which is more than small and medium enterprises (45%). Surprisingly, study revealed that even though advanced capital budgeting practices including DCF, sensitivity analysis and real options are available, still top management can reject a handsome project that was once chosen based on DCF methods owing to several other factors such as ethical and moral considerations, financial resources scarcity, strategic fit, trust in the analysts or reliable sources of data.

Bennouna et al. (2010) stated that the Canadian firms preferred to use NPV but still show a gap between theory and practice. Moreover, 17% of large firms did not use DCF. Of those, the majority of the Canadian firms used NPV and IRR, and only 8% preferred real options. The result shows a theory-practice gap remains in the detailed elements of DCF capital budgeting decision techniques and in real options.

Khamees et al. (2010) conducted a study on the Jordan Industrial Corporation and found that firms used equal percentages of DCF and non-DCF methods in evaluating capital investment projects. Results also reported that the most popular method is the PI followed by the PBP. The results revealed that respondents do not depend on a single technique. However, the results did not state that DCF or non-DCF cash flow methods are preferred over the other methods. On other hand, the PI technique was the most used technique followed closely by the PBP.

De Souza and Lunkes (2016) investigated the use of capital budgeting practices by large Brazilian publicly traded companies. Their findings reveal that managers of Brazilian companies mostly used the PB (71%) followed closely by NPV (65%) and (IRR) (61%). The study also reports that the most frequent practice used in setting the minimum rate of return is WACC (63%). For assessing risk, the results show that the most widely used techniques are scenario analysis (68%) and sensitivity analysis (55%).

Batra and Verma (2017) examined responses from 77 Indian companies listed on the Bombay Stock Exchange. Their evidence reveals that corporate managers largely follow the capital budgeting practices proposed by academic theory. DCF techniques of NPV and IRR and risk-adjusted sensitivity analysis are the most popular. Managers also favor WACC as the cost of capital. Yet, the theory-practice gap exists in adopting specialized techniques of real options, modified internal rate of return (MIRR) and Nurullah and Kengatharan (2015b ) simulation. Managers also consider nonfinancial criteria in selecting projects.

3. Methodology

The nature of this study allowed for the use of an explanatory sequential mixed method design, by collecting quantitative data and to further explain it using qualitative research. This allowed for the researchers and end users of the final report to be provided with general data and also enabled them to develop a greater understanding of the reasons for the decisions (Creswell, 2014). For this reason, open-ended questions were also included within the survey instrument. This allowed the respondents to write down their opinions, and at the same time, the researchers were able to obtain answers to “why, what and how” ( Saunders et al. , 2007 ). The reliability of the responses from the survey phase was tested with follow-up interviews. These interviews were scheduled and used to clarify issues and gather additional information regarding the reasons why the techniques (practices) documented within the questionnaire are (not) used and determine what techniques are being used.

This is an exploratory study using survey methodology to collect data regarding current practices of capital budgeting in Bangladesh. The population included 285 firms listed in Dhaka Stock Exchange (DSE). The questionnaire used to collect data was adopted from previous seminal studies ( Nurullah and Kengatharan, 2015b ). The questionnaires were sent to the top DSE 100 companies in terms of market capitalization. The DSE100 indexed firms were chosen because they are representatives of DSE. The questionnaires were sent to the company’s CFO and director finance through email. The email addresses were fetched from the official website of DSE and company’s respective website. The initial response rate was very poor; only seven firms responded. Subsequently, reminders were sent to the remaining companies through email and by the help of Chartered accountant Association. Out of 100 companies 46 firms responded, the response rate is 46%.

Collected data were presented and analyzed using descriptive and inferential statistics. Data were presented in terms of firm background, CFO/finance director background, purpose of using capital budgeting and cause of using different techniques in investment decisions.

4. Results and analysis

4.1 educational qualification of the chief financial officers/finance directors.

Classification of the educational qualification of the CFOs was grouped into: bachelor degree, MBA, non-MBA Master’s, above Master’s degree and professional qualification (e.g. CA, CIMA and ACCA). Professional degree was held by 51.28% of CFOs, followed by MBA qualification (33.33% non-MBA Master’s 10.26%). Above Master’s degree respondents are 5.13%, as per Table 1 .

4.2 Experience of the chief financial officers

CFOs’ experience is categorized into three groups based on the number of years they worked in a particular profession. In this study, 30.77% (12) of CFOs have working experience of more than 20 years. In total 48.72% (19) of CFOs have working experience between 11 and 20 years, and finally 20.51% (9) CFOs have working experience of below ten years. Results are depicted in Table 2 .

4.3 Firms’ size of the capital

Size of the capital budget has been categorized into five groups which are presented in Table 3 . The size generally takes a minimum of ten million and a maximum of more than one billion. In total 20.51% of companies’ size of the capital budget is less than ten million, while only 5.13% represented for more than one billion; 25.64% of companies’ capital budget is between 10 and 100 million. A total of 14 companies (35.89%) mentioned their size of the capital budget is 100–200 billion, and rest of the companies (15.22%) falls between 200 and 300 million.

4.4 Firms’ planning horizon

As per Table 4 , among the 39 firms, 35.89% (14) firms take capital budget plan before three years ahead followed by 23.08% (nine firms take decision one year ahead). Also seen 17.95% (7) took their capital budgeting decision two years before. Meanwhile, five firms taking capital budgeting decision four four years ahead and four firms taking capital budgeting decision more than five years ago.

4.5 Purpose of capital budgeting methods

To analyze the purpose of capital budgeting ( Table 5 ), 46.15% of CFOs ( N = 18) describe that the dominant motivation for making investment is for expansion into existing business only. In all 17.95% of CFOs reported that their main purpose for capital budget is for expansion of new business only, 15.38% of CFOs indicated for expansion of new facilities, 12.82% of CFOs reported for equipment replacement, but 7.69% considered capital budgeting for merger and acquisition purpose. The results are almost similar to those of Verma et al. (2009) .

4.6 Capital budgeting methods in practice

The respondents were also asked to indicate whether capital budgeting methods are used as primary methods, secondary methods or neither. Results are shown in Table 6 . In total 71.79% of the CFOs indicated that NPV is used as the primary method for capital budgeting decisions. Whereas 53.85% and 48.71% of CFOs reported that PBP and IRR are used as primary methods, respectively. Surprisingly, it is also shown that 41.03% of CFOs considered personal judgment as primary capital budgeting decisions. The most prevalent secondary method is the PBP (46.15%) followed by PI, IRR, MIRR, personal judgment, discount payback period and ARR.

The results in Table 6 indicate that NPV, IRR and PBP are the most frequently used methods of capital budgeting by Bangladeshi listed companies. Out of these methods, NPV is the most popular method of capital budgeting where 74.36% of CFOs “always” prefer NPV whose yielding mean is 4.67 ( N = 29). On the other hand, IRR is “always” used method by 48.71% CFOs whose mean is 4.33 ( N = 19), followed by PBP (46.15%) and personal judgment (41.07%) used “always” by CFOs, respectively. The results also reported that IRR is an “often” preferred method considered by the 38.46% CFOs among all the methods followed by PBP (35.89%). The rest of the methods are not popular with the CFOs in Bangladesh. The results are consistent with Mubashar and Tariq (2019) ; Nurullah and Kengatharan (2015a ); and Verma et al. (2009) .

4.7 Factors determining capital budgeting methods

The finance theory describes that NPV is technically superior to IRR ( Mubashar and Tariq, 2019 ). This research result also reported that theory and practice gap is very minimum among the listed companies in Bangladesh where the most popular method is NPV. This result is also relevant with Arnold and Hatzopoulos (2000) but not consistent with that of De Souza and Lunkes (2016) .

4.8 Cost of capital calculating methods

The minimum required rate of return, i.e. cost of capital or discount rate is considered very important for calculating DCF methods (NPV, IRR, PI, MIRR) which involve time value of money. The CFOs were asked about the methods of calculating cost of capital on a Likert scale from “never” (1) to “always” (5). Results are presented in Table 7 . The majority of CFOs (53.85%) reported that WACC is the most prevalent method to evaluate their investment project which is yielding mean value of 4.18 ( N = 21) followed by the CD which is the next “always” widely used method to calculate cost of capital, the value is 15.38% ( M = 3.15). The results also indicated that CD is an “often” preferred method considered by 33.33% CFOs among all other methods. The remaining methods (CAPM cost of equity, arbitrary rate and average historical return) are least preferred methods by the CFOs of listed companies in Bangladesh. The previous studies by Mubashar and Tariq (2019) ; Nurullah and Kengatharan (2015a ); Arnold and Hatzopoulos (2000) ; and Khamees et al. (2010) also found the same results ( Table 9 ).

4.9 Factors determining capital budgeting methods

Table 8 summarized the results of determining factors of capital budgeting method. In all 48.72% CFOs reported that, “importance of the project” is the most prevalent factor for determining capital budgeting method whose mean value is M = 4.08. This was followed by “experience and competency” (43.5 and “finance theory” 38.46%). However, 38.46% CFOs considered top management familiarity as “important factors,” but remaining two factors, i.e. rule of thumb and easy understandability, are not important for deciding capital budgeting decisions whose mean value is less than 3.00.

4.10 Problems or difficulties in capital budgeting practices

In response to questions on the problems of capital budgeting practice used by CFOs, the survey found that 51.28% of companies are “highly influenced” by high fixed cost to practice capital budgeting method among the sample companies followed by “variation of cash flow pattern.” It is revealing to note that 35.90% CFOs reported that political instability is an “influential” factor for practicing capital budgeting methods ( Figure 1 ).

4.11 Risk factors and adjustments

Researchers asked the CFOs whether they adjust cash flows or discount rate for the different types of risk. The survey results Figure 2 reported that for the majority of the respondents (53.85%), risk of unexpected inflation is adjusted by discount rate followed by interest rate risk adjusted by discount rate (4.72%). However, commodity price risk is significantly (43.03%) adjusted by the cash flows. The survey results are consistent with those of Batra and Verma (2017) , Graham and Harvey (2001) ; and Nurullah and Kengatharan (2015a ).

5. Conclusion and recommendations

The main purpose of this study is to investigate the current practices of capital budgeting methods based on 39 sample listed firms in DSE, Bangladesh. The result revealed that almost two-third of the CFOs use NPV method for evaluating investment projects and closely followed by IRR and PBP methods, respectively. Survey results also found that “importance of the project” is the most influential factor for choosing a capital budgeting method.

For calculating cost of capital or minimum required rate of return, WACC is the most preferred method among the samples listed firms. The results also found that the majority of the respondents face the main pitfall for capital budgeting practice because of the high fixed cost component in Bangladesh. Generally, risk factors including the risk of unexpected inflation, interest rate risk, term structure risk, GDP or business cycle risk, commodity price risk and foreign exchange risk were adjusted by either increasing the discount rate or reducing cash flows or both. Bangladeshi firms mainly use discount rate for adjusting the risk of unexpected inflation, interest rate risk and foreign exchange.

Majority of the respondents relied more on NPV and IRR, but firms can use real option because it is more valuable in an uncertain environment and also gives flexibility in changing the course of the project.

Consider qualitative factors for capital budgeting practices.

Bangladesh is now a digitized country so it is better to use more information technology and its application in the capital budgeting process.

Problems of capital budgeting practice

Adjustment of either the discount rate or cash flows for the risk factor

Classification of educational qualification of CFO/finance director

Classification of CFOs experience

Classification of firms’ size of capital

Company’s planning horizon for capital expenditure budget

Purpose of the firms’ capital budgeting

Purpose of the firms’ capital budgeting, primary vs. secondary

Use/preference of capital budgeting techniques for the project appraisal

Calculating methods of cost of capital

Factors influencing the choice of capital budgeting methods

Alles , L. , Jayathilaka , R. , Kumari , N. , Malalathunga , T. , Obeyesekera , H. and Sharmila , S. ( 2020 ), “ An investigation of the usage of capital budgeting techniques by small and medium enterprises ”, Quality and Quantity , pp. 1 - 14

Alleyne , P. , Armstrong , S. and Chandler , M. ( 2018 ), “ A survey of capital budgeting practices used by firms in Barbados ”, Journal of Financial Reporting and Accounting , Vol. 16 No. 4 , pp. 564 - 584 .

Andor , G. , Mohanty , S.K. and Toth , T. ( 2015 ), “ Capital budgeting practices: a survey of Central and Eastern European firms ”, Emerging Markets Review , Vol. 23 , pp. 148 - 172 .

Arnold , G. ( 2008 ), Corporate Financial Management , Pearson Education .

Arnold , G.C. and Hatzopoulos , P.D. ( 2000 ), “ The theory-practice gap in capital budgeting: evidence from the United Kingdom ”, Journal of Business Finance & Accounting , Vol. 27 Nos 5/6 , pp. 603 - 626 .

Baker , J.C. and Beardsley , L. ( 1972 ), “ Capital budgeting by US multinational companies ”, The Financial Review , Vol. 7 No. 1 , pp. 115 - 121 .

Baker , H.K. and Powell , G. ( 2009 ), Understanding Financial Management: A Practical Guide , John Wiley and Sons .

Baker , H.K. , Jabbouri , I. and Dyaz , C. ( 2017 ), “ Corporate finance practices in Morocco ”, Managerial Finance , Vol. 43 No. 8 , pp. 865 - 880 .

Batra , R. and Verma , S. ( 2017 ), “ Capital budgeting practices in Indian companies ”, IIMB Management Review , Vol. 29 No. 1 , pp. 29 - 44 .

Bennouna , K. , Meredith , G.G. and Marchant , T. ( 2010 ), “ Improved capital budgeting decision making: evidence from Canada ”, Management Decision , Vol. 48 No. 2 , pp. 225 - 247 .

Blazouske , J. , Carlin , I. and Kim , S.H. ( 1988 ), “ Current capital budgeting practices in Canada ”, CMA Magazine , Vol. 62 , pp. 51 - 54 .

Brealey , R.A. , Myers , S.C. , Allen , F. , Soria , L.N. and Izquierdo , M.Á.F. ( 2015 ), Principios de Finanzas Corporativas , McGraw-Hill Interamericana .

Brigham , E.F. ( 1975 ), “ Hurdle rates for screening capital expenditure proposals ”, Financial Management , Vol. 4 No. 3 , pp. 17 - 26 .

Brunzell , T. , Liljeblom , E. and Vaihekoski , M. ( 2013 ), “ Determinants of capital budgeting methods and hurdle rates in Nordic firms ”, Accounting and Finance , Vol. 53 No. 1 , pp. 85 - 110 .

Bunch , B.S. ( 1996 ), “ Current practices and issues in capital budgeting and reporting ”, Public Budgeting & Finance , Vol. 16 No. 2 , pp. 7 - 22 .

Daunfeldt , S.-O. and Hartwig , F. ( 2015 ), “ Capital budgeting practices in Spain ”, BRQ Business Research Quarterly , Vol. 18 No. 1 , pp. 37 - 56 .

De Andrés , P. , De Fuente , G. and San Martín , P. ( 2015 ), “ Capital budgeting practices in Spain ”, BRQ Business Research Quarterly , Vol. 18 No. 1 , pp. 37 - 56 .

De Souza , P. and Lunkes , R.J. ( 2016 ), “ Capital budgeting practices by large Brazilian companies ”, Contaduría y Administración , Vol. 61 No. 3 , pp. 514 - 534 .

Emmanuel , C. , Harris , E. and Komakech , S. ( 2010 ), “ Towards a better understanding of capital investment decisions ”, Journal of Accounting and Organizational Change , Vol. 6 No. 4 , pp. 477 - 504 .

Farragher , E.J. , Kleiman , R.T. and Sahu , A.P. ( 2001 ), “ The association between the use of sophisticated capital budgeting practices and corporate performance ”, The Engineering Economist , Vol. 46 No. 4 , pp. 300 - 311 .

Garrison , R. , Webb , A. and Libby , T. ( 2018 ), Managerial Accounting , McGraw-Hill Ryerson .

Gitman , L.J. and Forrester , J.R. Jr , ( 1977 ), “ A survey of capital budgeting techniques used by major US firms ”, Financial Management , Vol. 6 No. 3 , pp. 66 - 71 .

Gitman , L.J. , Juchau , R. and Flanagan , J. ( 2015 ), Principles of Managerial Finance , Pearson Higher Education AU .

Graham , J.R. and Harvey , C.R. ( 2001 ), “ The theory and practice of corporate finance: evidence from the field ”, Journal of Financial Economics , Vol. 60 Nos 2/3 , pp. 187 - 243 .

Haka , S.F. , Gordon , L.A. and Pinches , G.E. ( 1985 ), “ Sophisticated capital budgeting selection technique and firms’ performance ”, The Accounting Review , Vol. 60 No. 4 , pp. 651 - 669 .

Hall , J. and Millard , S. ( 2010 ), “ Capital budgeting practices used by selected listed South African firms ”, South African Journal of Economic and Management Sciences , Vol. 13 No. 1 , pp. 85 - 97 .

Hermes , N. , Smid , P. and Yao , L. ( 2007 ), “ Capital budgeting practices: a comparative study of The Netherlands and China ”, International Business Review , Vol. 16 No. 5 , pp. 630 - 654 .

Jog , M. and Srivastava , A. ( 1995 ), “ Capital budgeting practices in corporate Canada ”, Financial Practice and Education , Vol. 5 No. 2 , pp. 37 - 43 .

Katabi , R. and Dimoso , R. ( 2016 ), “ The effect of small business characteristics on the choice of investment evaluation techniques for small and medium enterprises in Tanzania ”, Journal of Business Management , Vol. 18 No. 4 , pp. 11 - 18 .

Kester , G. and Robbins , G. ( 2011 ), “ The capital budgeting practices of listed Irish companies: insights from CFOs on their investment appraisal techniques ”, Accountancy Ireland , Vol. 43 , pp. 28 - 30 .

Kester , G.W. , Chang , R.P. , Echanis , E.S. , Haikal , S. , Isa , M.M. , Skully , M.T. , Tsui , K.-C. and Wang , C.-J. ( 1999 ), “ Capital budgeting practices in the Asia-Pacific region: Australia, Hong Kong, Indonesia, Malaysia, Philippines, and Singapore ”, Financial Practice and Education , pp. 25 - 33 .

Khamees , B.A. , Al-Fayoumi , N. and Al-Thuneibat , A.A. ( 2010 ), “ Capital budgeting practices in the Jordanian industrial corporations ”, International Journal of Commerce and Management , Vol. 20 No. 1 , pp. 49 - 63 .

Lazaridis , I.T. ( 2004 ), “ Capital budgeting practices: a survey in the firms in Cyprus ”, Journal of Small Business Management , Vol. 42 No. 4 , pp. 427 - 433 .

Leon , F.M. , Isa , M. and Kester , G.W. ( 2008 ), “ Capital budgeting practice of listed Indonesian companies ”, Asian Journal of Business and Accounting , Vol. 2 No. 1 , pp. 175 - 192 . PP. ISSN 1985-4064 .

Mubashar , A. and Tariq , Y.B. ( 2019 ), “ Capital budgeting decision-making practices: evidence from Pakistan ”, Journal of Advances in Management Research , Vol. 16 No. 2 , pp. 142 - 167 .

Nurullah , M. and Kengatharan , L. ( 2015a ), “ Capital budgeting practices: evidence from Sri Lanka ”, Journal of Advances in Management Research , Vol. 12 No. 1 , pp. 55 - 82 .

Nurullah , M. and Kengatharan , L. ( 2015b ), “ Capital budgeting practices: evidence from Sri Lanka ”, Journal of Advances in Management Research ., Vol. 12 No. 1 ,

Pike , R. and Neale , B. ( 2006 ), Corporate Finance and Investment: Decisions and Strategies , Pearson Education .

Ross , S.A. , Westerfield , R.W. , Jordan , B. and Roberts , G. ( 2016 ), Corporate Finance , McGraw-Hill Ryerson .

Saunders , M. , Lewis , P. and Thornhill , A. ( 2007 ), Research Methods for Business Students , 4th edition , Pearson Education Limited , Essex .

Segelod , E. ( 1998 ), “ Capital budgeting in a fast-changing world ”, Long Range Planning , Vol. 31 No. 4 , pp. 529 - 525 .

Shakila , Y. ( 2015 ), “ Capital budgeting in practice: an explorative study on Bangladeshi companies ”, Int J Eng Bus Enterp Appl , Vol. 11 , pp. 158 - 163 .

Shinoda , T. ( 2010 ), “ Capital budgeting management practices in Japan: a focus on the use of capital budgeting methods ”, Economic Journal of Hokkaido University , Vol. 39 , pp. 39 - 50 .

Singh , S. , Jain , P.K. and Yadav , S.S. ( 2012 ), “ Capital budgeting decisions: evidence from India ”, Journal of Advances in Management Research , Vol. 9 No. 1 , pp. 96 - 112 .

Verma , S. , Gupta , S. and Batra , R. ( 2009 ), “ A survey of capital budgeting practices in corporate India ”, Vision: The Journal of Business Perspective , Vol. 13 No. 3 , pp. 1 - 17 .

Corresponding author

Related articles, we’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Justifying Investments With the Capital Budgeting Process

For a business manager, choosing what to invest in should not be an exercise of instinct. With capital budgeting methods, managers can appraise various projects simultaneously, with the end result indicating which one will have the highest impact on company value.

By David Bradshaw

David is an expert in planning asset acquisitions, managing projects of up to $100m across the financial, real estate and consumer space.

Executive Summary

- The funds that businesses have to invest are finite by nature, yet there are always ample opportunities for how to invest them. The capital budgeting formula allows managers to allocate scarce capital to such investments in the most value accretive manner.

- Money also has a time value component to it. $1.00 now is worth more than $1.00 received in five years' time. Why? Because the money received now can be invested and grown within that five-year time scale.

- Ascertain exactly how much is needed for investment in the project

- Calculate the annual cash flows received from the project

- At the end of the project's life (if there is one), what will be the residual value of the asset?

- Using the weighted average cost of capital, cash flows are discounted to determine their value in today's terms

- If an NPV for a project is positive, it means that the project generates value, because it returns more than it costs. Yet this value should be stress tested, by applying sensitivity analysis to the project's inputs

- When purchasing a portfolio of assets, an NPV analysis provides an aggregate view of its total value. With relevant stress tests made on the cash flow and discount rate assumptions, a valuable tool is then gained for pricing negotiations with the seller.

- For new business units that are being launched inside a company, the first financial step is often accountancy-based budgeting. Augmenting this with capital budgeting will help to demonstrate whether the new venture will actually generate value for the parent.

- Be sure to account for all sources of cash flow from a project. Aside from revenues and expenses, large projects may impact cash flows from changes in working capital, such as accounts receivable, accounts payable, and inventory. Calculating a meaningful and accurate residual or terminal value is also critical.

- Don't blindly assume that a seller's projections are gospel.

- Net income is not a cash flow.

- Be careful not to overestimate a residual or terminal value. Using an ambitious, but unrealistic, IPO target as a residual value could be the game changer between a positive and negative NPV.

The funds available to be invested in a business either as equity or debt, also known as capital, are a limited resource. Accordingly, managers must make careful choices about when and where to invest capital to ensure that it is used wisely to create value for the firm. The process of making these decisions is called capital budgeting . This is a very powerful financial tool with which the investment in a capital asset, a new project, a new company, or even the acquisition of a company, can be analyzed and the basis (or cost justification) for the investment defined and illustrated to relevant stakeholders.

Essentially, capital budgeting allows the comparison of the cost/investment in a project versus the cash flows generated by the same venture. If the value of the future cash flows exceeds the cost/investment, then there is potential for value creation and the project should be investigated further with an eye toward extracting this value.

Far too often, business managers use intuition or “gut feel” to make capital investment decisions. I have heard managers say, “It just feels like the best move is to expand operations by building a new and better factory.” Or perhaps they jot down a few thoughts and prepare a “back of an envelope” financial analysis. I have seen investors decide to invest capital based on the Payback Period or how long they think it will take to recover the investment (with everything after being profit). All of these methods alone are a recipe for disaster. Investing capital should not be taken lightly and should not be made until a full and thorough analysis of the costs (financial and opportunity) and outcomes has been prepared and evaluated.

In this article, I will describe the objectives of capital budgeting, delineate the steps used to prepare a capital budget, and provide examples of where this process can be applied in the day to day operations of a business.

The Capital Budgeting Process and the Time Value of Money

The capital budgeting process is rooted in the concept of time value of money , (sometimes referred to as future value/present value) and uses a present value or discounted cash flow analysis to evaluate the investment opportunity.

Essentially, money is said to have time value because if invested—over time—it can earn interest. For example, $1.00 today is worth $1.05 in one year, if invested at 5.00%. Subsequently, the present value is $1.00, and the future value is $1.05.

Conversely, $1.05 to be received in one year’s time is a Future Value cash flow. Yet, its value today would be its Present Value, which again assuming an interest rate of 5.00%, would be $1.00.

The problem with comparing money today with money in the future is that it’s an apples to oranges comparison. We need to compare both at the same point in time. Likewise, the difficulty when investing capital is to determine which is worth more: the capital to be invested now, or the value of future cash flows that an investment will produce. If we look at both in terms of their present value we can compare values.

Net Present Value

The specific time value of money calculation used in Capital Budgeting is called net present value (NPV) . NPV is the sum of the present value (PV) of each projected cash flow, including the investment, discounted at the weighted average cost of the capital being invested (WACC) .

If upon calculating a project’s NPV, the value is positive, then the PV of the future cash flows exceeds the PV of the investment. In this case, value is being created and the project is worthy of further investigation. If on the other hand the NPV is negative, the investment is projected to lose value and should not be pursued, based on rational investment grounds.

Preparing a Capital Budgeting Analysis

To illustrate the steps in capital budgeting analysis, we will use a hypothetical example of the purchase of a truck to be used by AAA Trucking for making local, short haul deliveries. AAA plans to acquire the truck, use it for 4 years and the sell it for fair value on the resale market. It plans to use the sales proceeds as a down payment on a more modern replacement truck. It estimates the WACC at 14.00%.

Step 1: Determine the total amount of the investment.

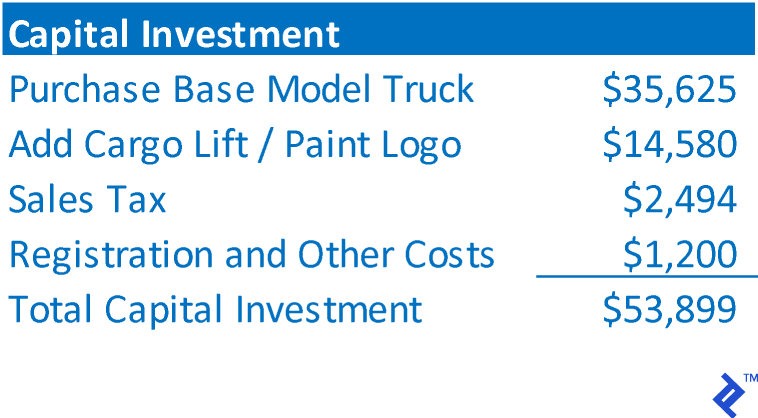

The total investment represents the total cost of the asset being acquired, or the total investment necessary to fund the project. In the case of AAA, that would consist of:

Step 2: Determine the cash flows the investment will return.

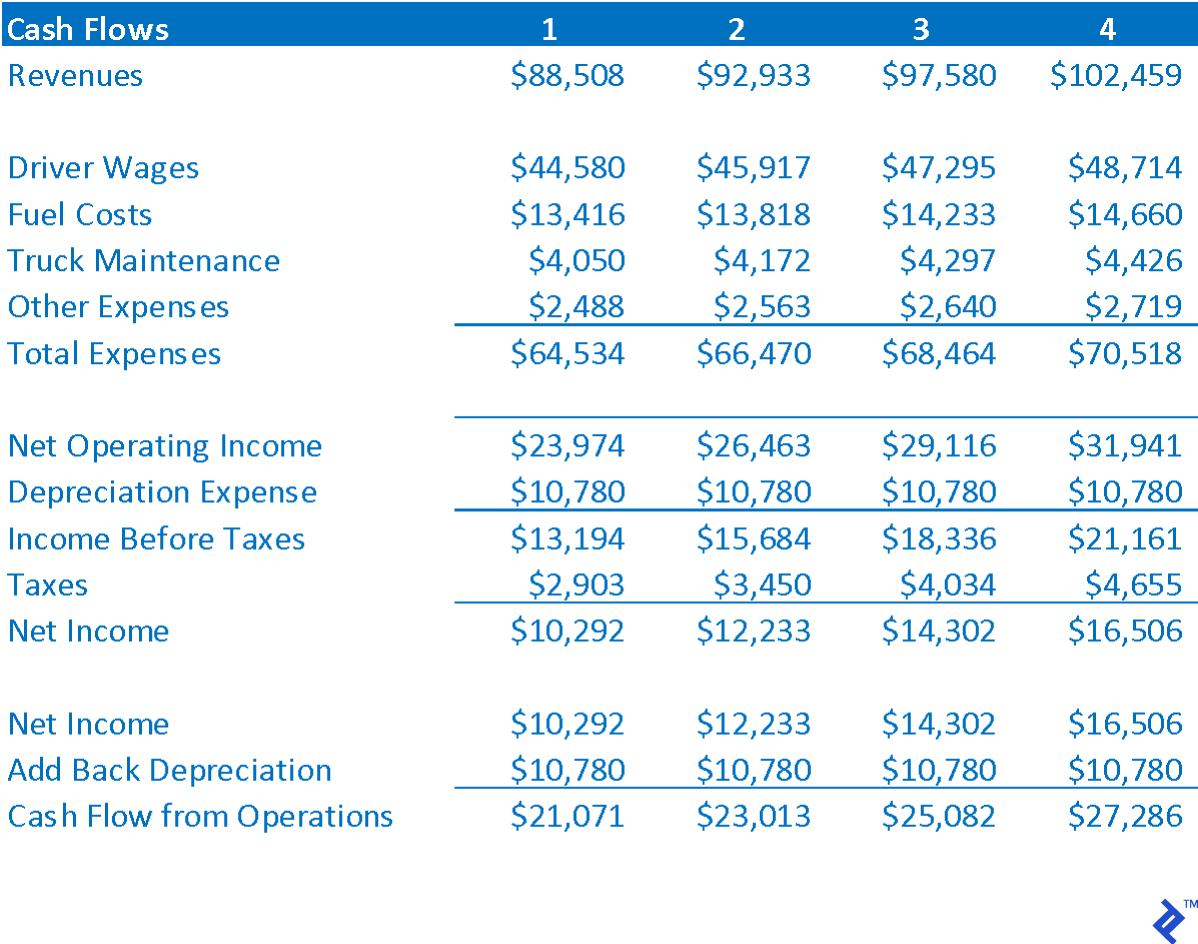

This step consists of determining the net cash flows that the investment will return, NOT the accounting earnings. Typically, investment cash flows will consist of projecting an income statement for the project. For AAA’s new truck, it has projected the following:

Step 3: Determine the residual/terminal value

Capital Budgeting requires there to be a finite number of future cash flows. In the case of AAA, it plans to sell the truck in four years time, thus the future cash flows are inherently finite in nature anyway. In such cases, the residual value is equal to the net sales proceeds to be received from disposition of the asset. (If the asset will be scrapped, this value can be 0)

Some investments do not have a projected ending. For example, if the investment is the initiation of a new business unit, it is likely that the business is assumed to continue indefinitely into the future. So in order to truncate the future cash flows and have a finite timeline to evaluate the cash flows and calculate the NPV, it is often assumed that such a venture is sold and the final cash flow is a residual value. This would be in a similar manner to how a financial investor would appraise deals it is investing in

However, another way to allow for continuing operations is to calculate a terminal value . A terminal value assumes that the cash flow in the final year of the projection will continue at that level indefinitely into the future. To calculate the terminal value, the last cash flow is divided by the discount rate. Using AAA cash flows and discount rate, a terminal value would be $27,286 ÷ 14.00% = $194,900. This terminal value is a proxy for all cash flows that will occur beyond the scope of the projection. Again, a terminal value is used only when the true operations of the investment are expected to continue indefinitely into the future.

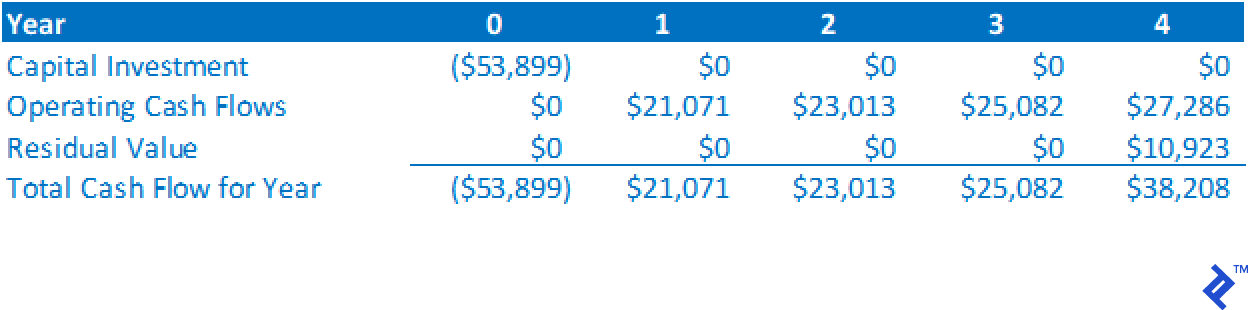

Step 4: Calculate the annual cash flows of the investment

Calculating the annual cash flows is completed by incorporating the values from Steps 1 to 3 into a timeline. Cash outflows are shown as negative values, and cash inflows are shown as positive values. By aligning cash flows with the periods in which they occur and adding each periods’ cash flows together, the annual cash flow amounts can be determined.

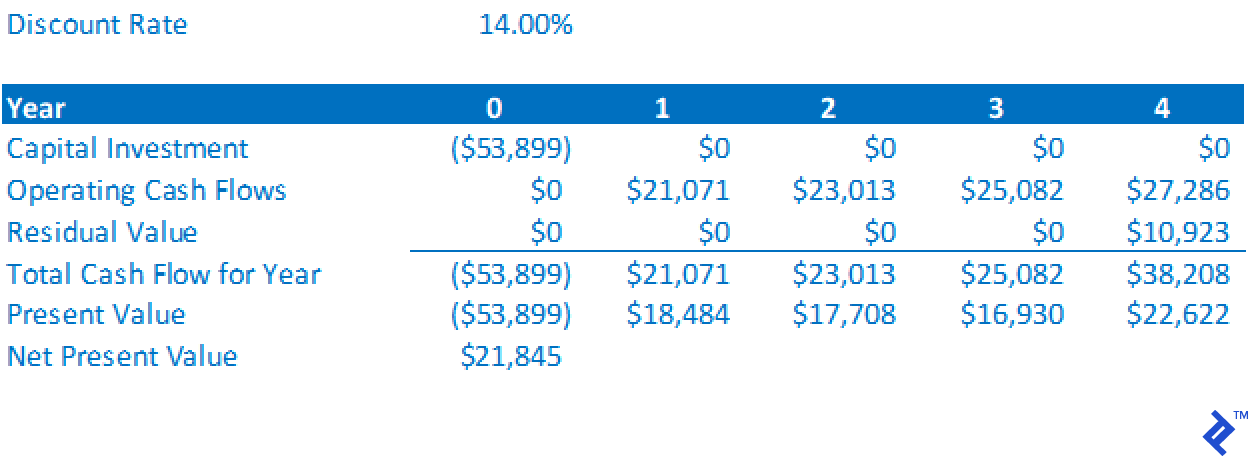

Step 5: Calculate the NPV of the cash flows

The NPV is the sum of the PV of each year’s cash flow. To calculate the PV of each year’s cash flow, the following formula is used:

PV of Cash Flow = Cash Flow ÷ (1 + Discount Rate) Year

Below is the NPV for AAA’s new truck investment.

The NPV is positive, therefore AAA has determined that the project will return value in excess of the investment amount and is worth further investigation. To put it bluntly, it is spending money to make more money, which is a fundamental catalyst for business growth.

Step 6: Run a sensitivity analysis

While a positive NPV on a base case projection is an indication that the project is worth further consideration, it should not be the sole basis for proceeding with an investment. Recall that all of the values in the analysis are based on projections, a process that itself is a complicated art. Therefore if a positive NPV is returned, don’t pop open champagne just yet; instead, start stress testing your work. Various “what if” analyses should be run. For instance, in our capital budgeting example involving AAA:

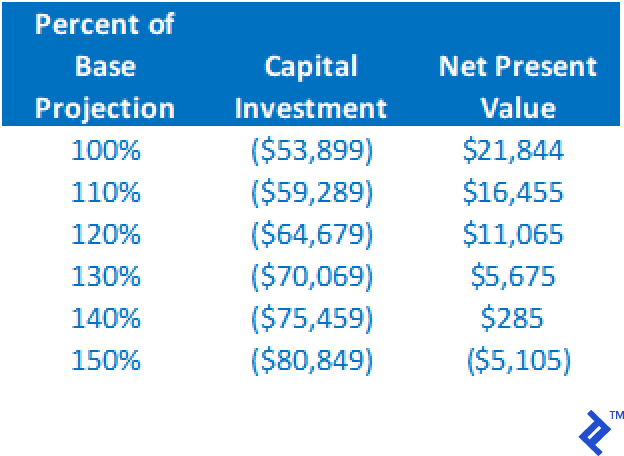

- What if the actual cost of the truck is greater than $53,899?

- What if the operating cash flows are less than anticipated?

- What if the residual value is overstated?

- What if the WACC is higher than estimated?

Below is a summary table of the impact to the NPV through altering the capital investment cost and holding all other assumptions the same. Note that an increase to 140% of the baseline estimate still results in a positive NPV.

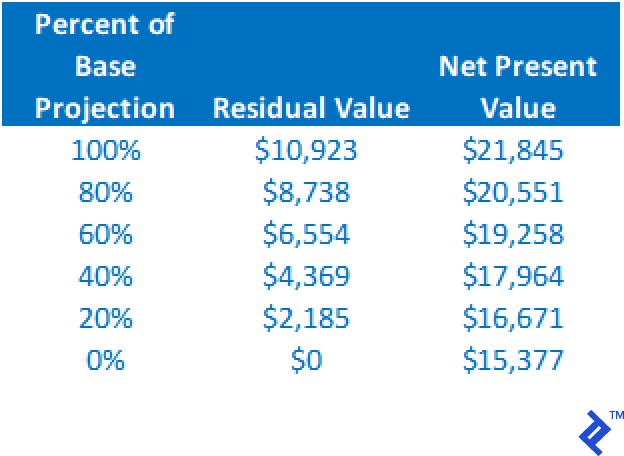

NPV will reduce as the residual value decreases, but we can see from this analysis that even if the residual value drops to $0, holding all other assumptions constant, the NPV is still positive.

From just these two analyses, we can see the project is quite stable and robust. Even with errors in the base projections of these two variables, the project still warrants further consideration via a positive NPV.

By running various scenarios to determine the impact on NPV, the risk of the project is better defined. If the alternate outcomes continue to provide a positive NPV, the greater the confidence level one will have in making the investment.

NPV vs. IRR

As I have discussed previously , NPV as used in capital budgeting does not provide a return on investment value. NPV is simply describing whether or not the project provides sufficient returns to repay the cost of the capital used in the project. If a project’s return on investment is desired, then internal rate of return (IRR) is the calculation required. Essentially, IRR is the discount rate that will make the NPV equal exactly $0. It is the rate of return that is directly indicated by the project’s cash flows.

Capital Budgeting Applications

A capital budget can be used to analyze almost any type of investment from the purchase of a piece of capital equipment, to investing in expanded operations, to starting a new business, to purchasing existing business operations.

When Acquiring a Portfolio of Assets

When I worked at GE Commercial Finance, I held a role in business development (BD). My focus was on acquiring portfolios of existing commercial real estate and equipment loans from other lenders in our market space. Using the asking price for the portfolio, the cash flows from the loans and the return rate required (as a discount rate), the NPV could be determined. Further, by running sensitivity on the asking price (investment size), we could determine the price range within which the purchase could be justified. The key to this valuation was allowing the BD director to know what the ROI would be on the purchase at alternative prices, and the absolute maximum price that could be paid and still return an acceptable ROI. When I implemented this process, it improved purchase negotiations as the director could negotiate price in real time without the need to pause negotiations to rerun the numbers.

When Projecting Operations for New Ventures

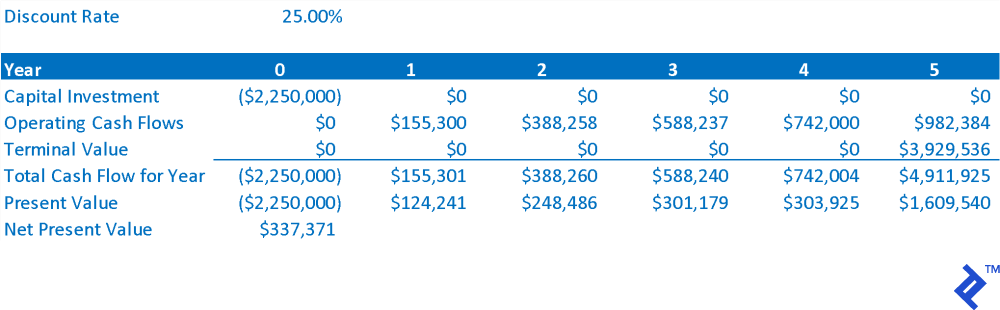

Several consulting clients have asked me to project operational performance for new business ventures. Using capital budgeting techniques, the financial feasibility of the new venture can be determined. One client had developed a proprietary fitness equipment product, the capital budgeting analysis for that company is shown below. As operations were expected to continue beyond the 5-year projection, a terminal value was used in the analysis.

The sensitivity analysis showed that the NPV remained positive, so long as the capital investment was less than $2.6 million, and cash flow could drop to 87% of projected levels (with all other factors held constant).

Successful Capital Budgeting Rules to Follow

The key to capital budgeting is the accuracy of the projected cash flows. The total investment is often easy. However, making sure to account for all sources of cash flow can be all-encompassing. In addition to revenues and expenses, large projects may impact cash flows from changes in working capital, such as accounts receivable, accounts payable and inventory. Calculating a meaningful and accurate residual or terminal value is also important.

In my experience, failed attempts at using capital budgeting came from not using detailed projections of project cash flows. I worked with one company who attempted to evaluate the purchase of another company by using the target’s projected income statement as the sole basis of operating cash flows. It used net income, which is NOT cash flow. Further, it completely ignored the impact to cash flow from changes in working capital. Lastly it did not accurately allow for a residual value. This all seriously understated cash flow, leading to an apparent value (investment amount) less than the seller would accept, and which ultimately was less than the fair market value of the company.

One should also be careful not to overestimate a residual or terminal value. I have seen projections for starting a new venture where the residual value was the anticipated value to be received upon taking the company public. The IPO value was far above a reasonable amount, and without the high residual value the NPV would be negative. Placing too much of the NPV value in the residual can be a mistake.

The greater the amount of an investment, the greater the risk of error. Key to preparing a successful capital budgeting analysis is finding someone with the expertise and experience to calculate accurate and reasonable cash flows. If a business does not have a person like this on hand, it does become more of a passion play and less an exercise in critical business judgement.

Understanding the basics

What do you mean by capital budgeting.

Capital budgeting is the process of determining how to allocate (invest) the finite sources of capital (money) within an organization. There is usually a multitude of potential projects from which to choose, hence the need to budget appropriately

What is the process of capital budgeting?

It involves assessing the potential projects at hand and budgeting their projected cash flows. Once in place, the present value of these cash flows is ascertained and compared between each project. Typically, the project that offers the highest total net present value is selected, or prioritized, for investment.

How do you calculate net present value?

Net present value (NPV) requires the projected cash flows from a project to be calculated and then discounted back to present day using the weighted average cost of capital. When added back to the negative cost of investment, this will provide the overall NPV

What does the IRR tell you?

Internal rate of return (IRR) is the discount rate created by a set of cash flows that will goal seek to an NPV of 0. Hence, it is the isolate return on investment of a project

David Bradshaw

Lake Saint Louis, MO, United States

Member since April 27, 2018

About the author

World-class articles, delivered weekly.

Subscription implies consent to our privacy policy

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Managers

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal ® community.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

CAPITAL BUDGETING: A Case Study

Related Papers

Nursing Research

Graham J McDougall Jr

Alexandre M Sebbenn

Journal of the International Society of Sports Nutrition

Andrew Jagim

Habib M R Karim

Abstract: Background and objectives: The shortage of medical teachers and quality teaching is felt greatly in the current medical education system. The Medical Council of India (MCI) has initiated faculty development programs to reduce this deficiency. However, this program doesn't include residents, who are actually involved in teaching to a great extent. The present study was aimed to evaluate the efficacy of adapted Medical Education Technology (MET) workshop for resident doctors in changing their perception as teachers of medicine. Methods: After obtaining the informed consent regarding this study and data collection, the resident doctors participating in the MET workshop were given a set of question papers designed to quantify their own perception (a 0 to 10 scale) about themselves as a medical teacher both for pre-workshop and post-workshop time. Data thus collected were analyzed by paired t-test using INSTAT software and a p-value of <0.05 was taken as statistically si...

Akrópolis - Revista de Ciências Humanas da UNIPAR

Marcia Ronqui

O presente artigo utilizou-se de revisão bibliográfica com objetivo de conhecer a Reorientação Profissional (REO) enquanto estratégia de promoção da saúde numa perspectiva psicossocial. Buscou-se estudar os princípios de atuação do psicólogo nos processos de Orientação Profissional (OP) e de Reorientação Profissional (REO), as possibilidades da Reorientação Profissional (REO) a públicos com restrições físicas e sociais, o atual conceito de saúde mental e a inter relação da Reorientação Profissional (REO) como promotora de saúde mental. O estudo levou em consideração as mudanças socioeconômicas que a sociedade sofre constantemente e as experiências vividas por estes públicos frente à construção de sua singularidade. A Reorientação Profissional (REO), aqui compreendida enquanto um processo que visa a facilitar a estas pessoas a compreensão de todos os aspectos que estão envolvidos no momento da reescolha , devido ao seu contexto e as suas necessidades. Conclui-se que a Reorientação Pr...

JPMA. The Journal of the Pakistan Medical Association

Tahir Jameel

Leukocyte adhesion defect (LAD) is a rare, autosomal recessive primary immunodeficiency disorder of phagocytes, in which there is defective aggregation at the site of infection due to the absence of surface integrins. Diagnosis is based primarily on flowcytometric analysis of neutrophils for the surface expression of CD11, CD18 and CD15s. We describe here a case of a 7-months-old boy who presented with a characteristic history of recurrent infections, marked leukocytosis and delayed separation of umbilical cord. The diagnosis was established by demonstration of the absence of integrins on the surface of patient's neutrophils by flowcytometric analysis.

- Mathematics

Vassilis C Gerogiannis

Production of electricity from the burning of fossil fuels has caused an increase in the emission of greenhouse gases. In the long run, greenhouse gases cause harm to the environment. To reduce these gases, it is important to accurately forecast electricity production, supply and consumption. Forecasting of electricity consumption is, in particular, useful for minimizing problems of overproduction and oversupply of electricity. This research study focuses on forecasting electricity consumption based on time series data using different artificial intelligence and metaheuristic methods. The aim of the study is to determine which model among the artificial neural network (ANN), adaptive neuro-fuzzy inference system (ANFIS), least squares support vector machines (LSSVMs) and fuzzy time series (FTS) produces the highest level of accuracy in forecasting electricity consumption. The variables considered in this research include the monthly electricity consumption over the years for differe...

Arifin Nurul

Persamaan Laplace merupakan suatu persamaan diferensial parsial yang diberikan oleh uxx + uyy = 0; a b . Metode dekomposisi Adomian merupakan suatu metode yang mendekomposisikan fungsi yang tidak diketahui u(x,y) ke dalam P sejumlah tak hingga komponen yang dide�nisikan oleh deret u(x; y) = 1 n=0 un(x; y), dimana himpunan un(x; y); n � 0 adalah fungsi yang akan diten- tukan. Penyelesaian persamaan Laplace dapat ditentukan dengan metode dekom- posisi Adomian, yaitu dengan menggunakan operator diferensial dan invers, sub- stitusikan kondisi batas, dan uraikan fungsi tersebut ke dalam dekomposisi Ado- mian. Hasil yang diperoleh adalah solusi dalam bentuk fungsi eksplisit. Kata kunci: Persamaan Laplace, Metode Dekomposisi Adomian.

Data Assimilation for Atmospheric, Oceanic and Hydrologic Applications (Vol. II)

Tadashi Tsuyuki

RELATED PAPERS

Psychiatry Research

Nahoko Harada

Psychologie du Travail et des Organisations

Florinda Sauli

Shruti Rathi

Shafiq-ur Rehman

BMC Psychology

Eefje Rondeel

Julia Briskin

Schedare il patrimonio dei musei locali. Formazione, educazione al patrimonio e tutela

Gaia Solimeno , Pietro Di Lorenzo

Trends in Ecology & Evolution

Abdul Mouazen

Neurochirurgie

Haydar Yasa

SOCA: Jurnal Sosial, Ekonomi Pertanian

Eva Dolorosa

Revista de la Facultad de Odontología

Angela Herrera

Taikomoji kalbotyra

Alina Yevchuk

Abant sosyal bilimler dergisi

Erhan Bıyık

Osteoarthritis and Cartilage

Shawn Grogan

Advances in Finance, Accounting, and Economics

Kutay Aytuğ

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Computer Science

- Academia ©2024

Capital budgeting -case study

- By Research Team

- on August 13, 2020

- in Sample Papers

Instructions :-

Capital Budgeting Case – From the given case information, calculate the firm’s WACC then use the WACC to calculate NPV and evaluate IRR for proposed capital budgeting projects with a capital rationing constraint. After you choose the project(s), recalculate the capital structure based on the assumption that the project(s) are implemented and determine if the new capital structure will signal the investors either positively, negatively, or not at all. Write a business report on your findings. Include an executive summary and appendices if applicable. See rubric for specific graded criteria. Click on the attached document for additional information.