Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

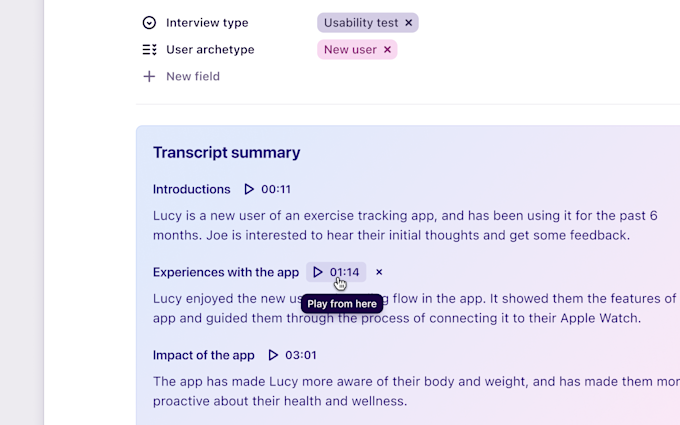

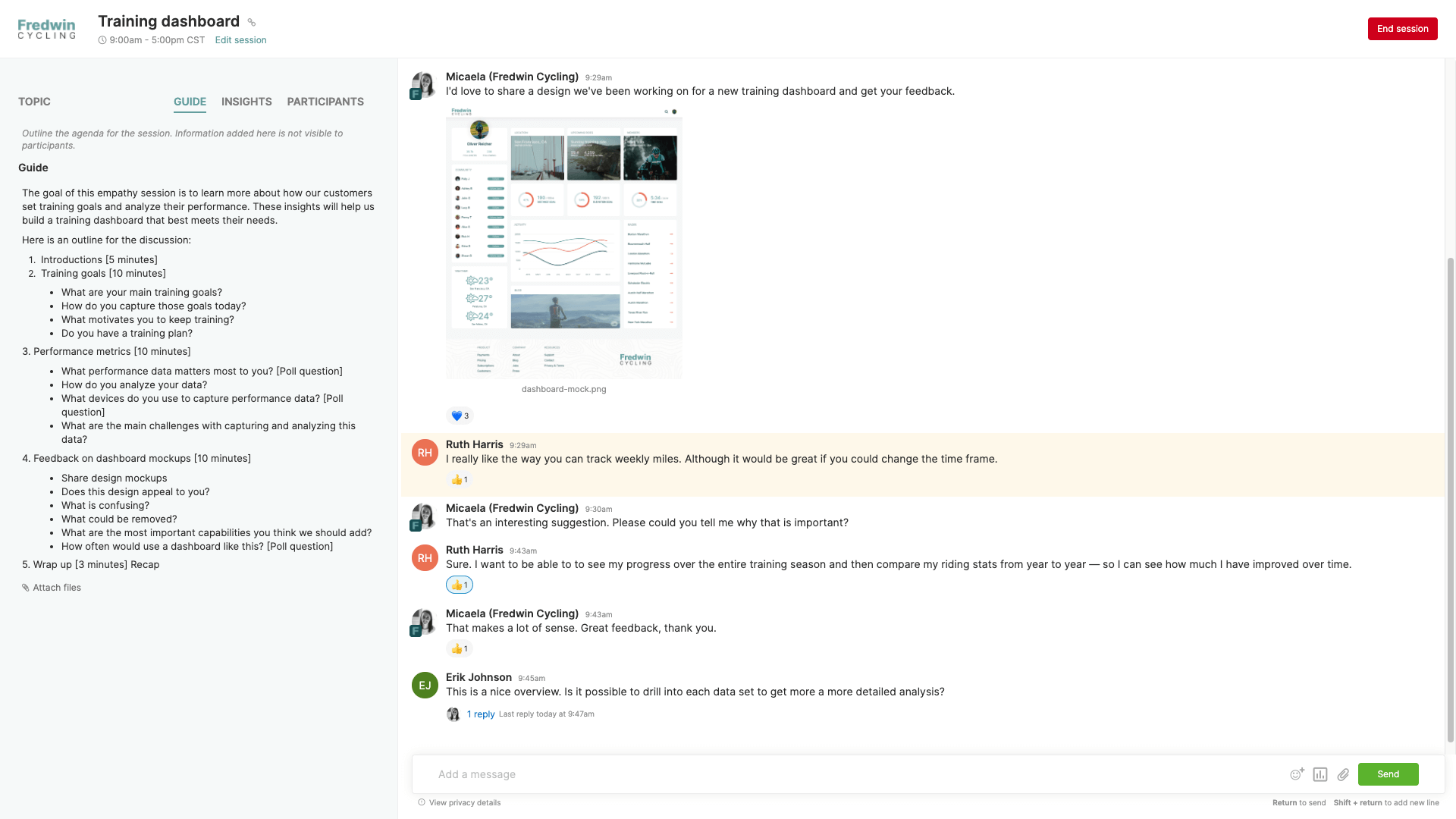

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

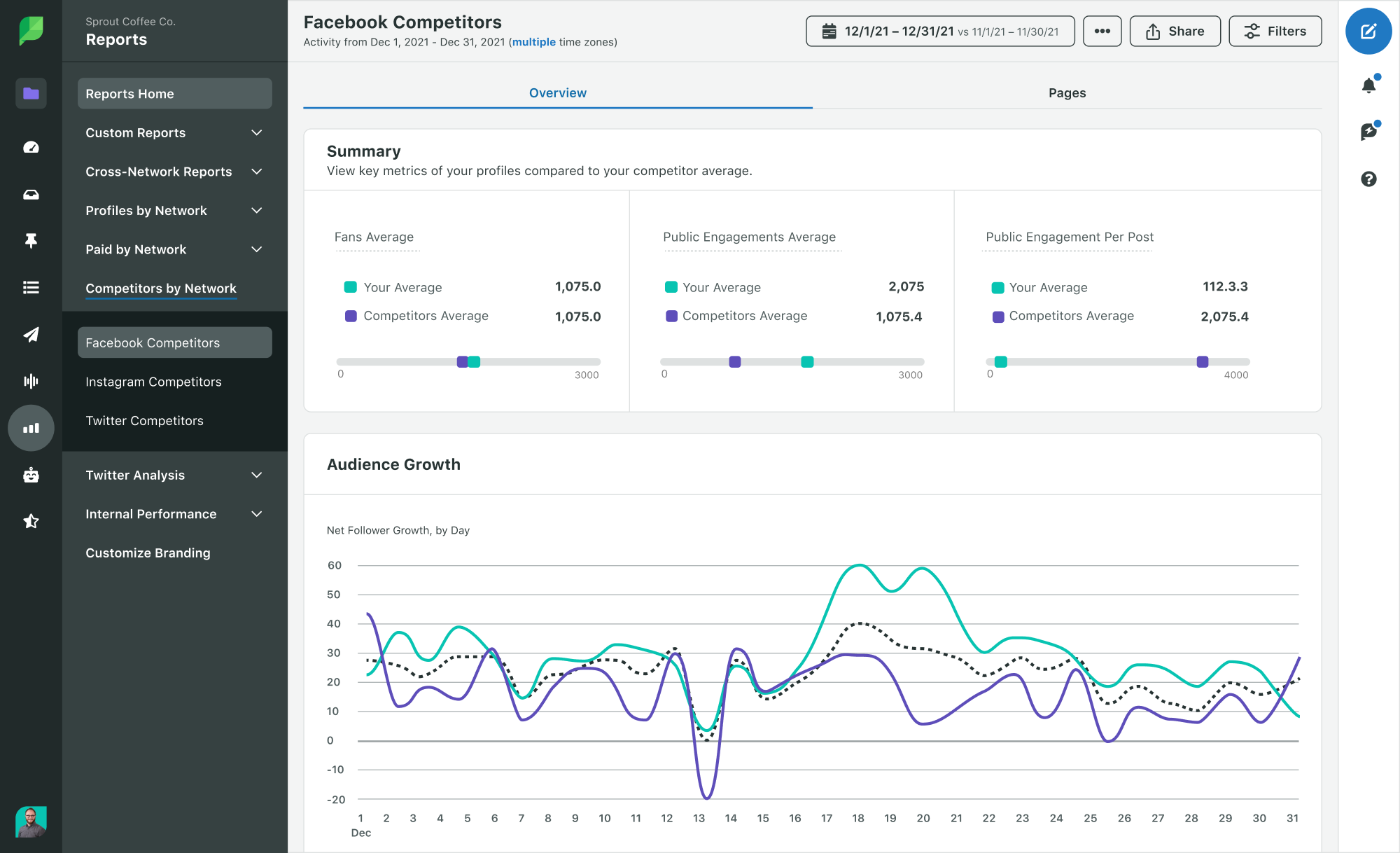

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

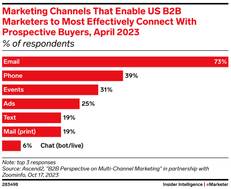

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

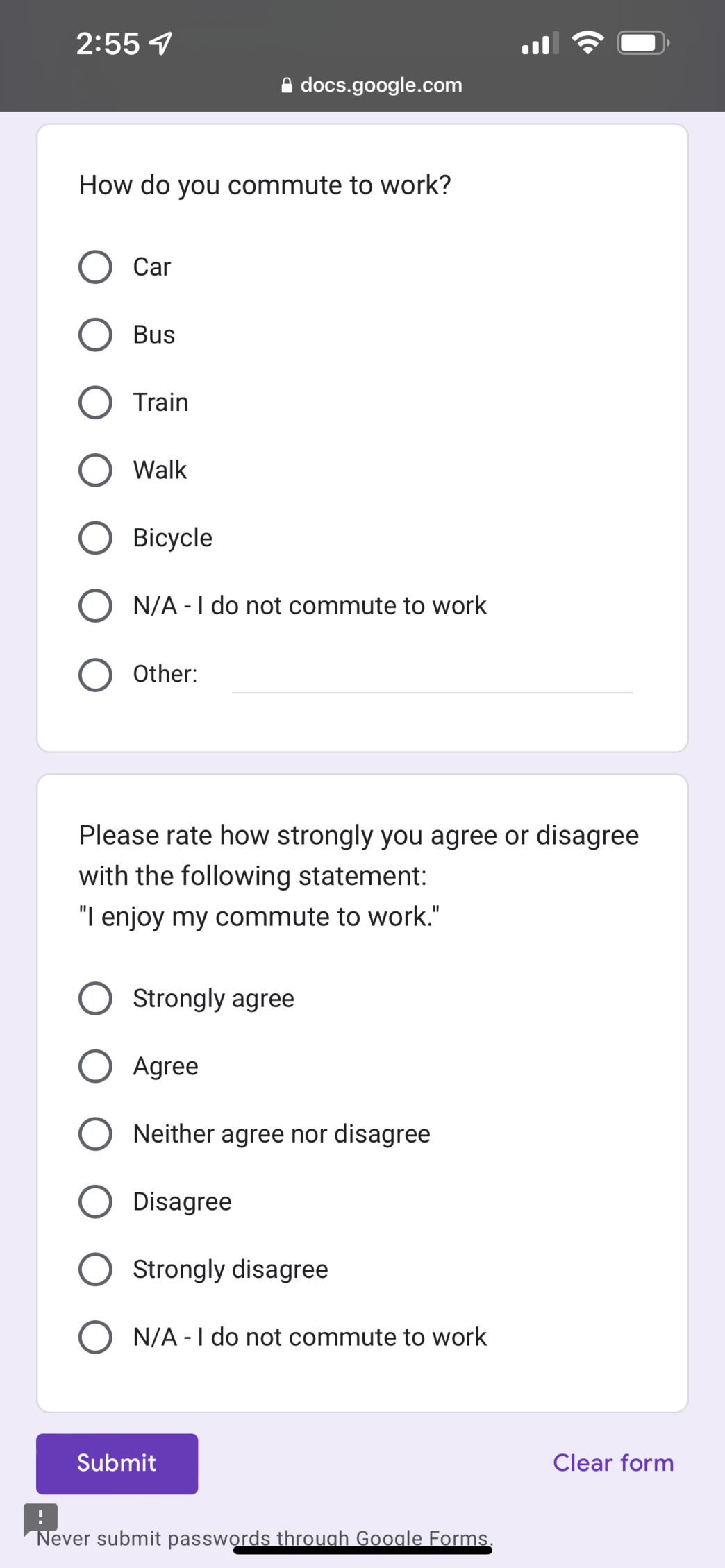

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

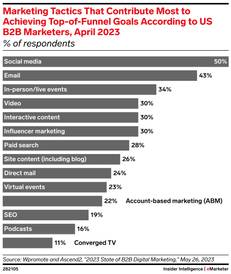

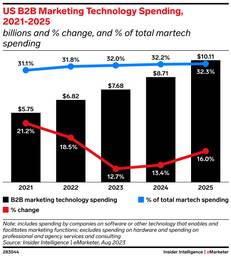

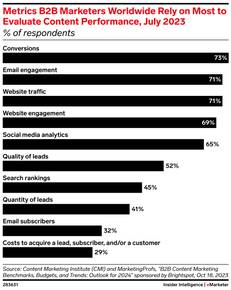

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

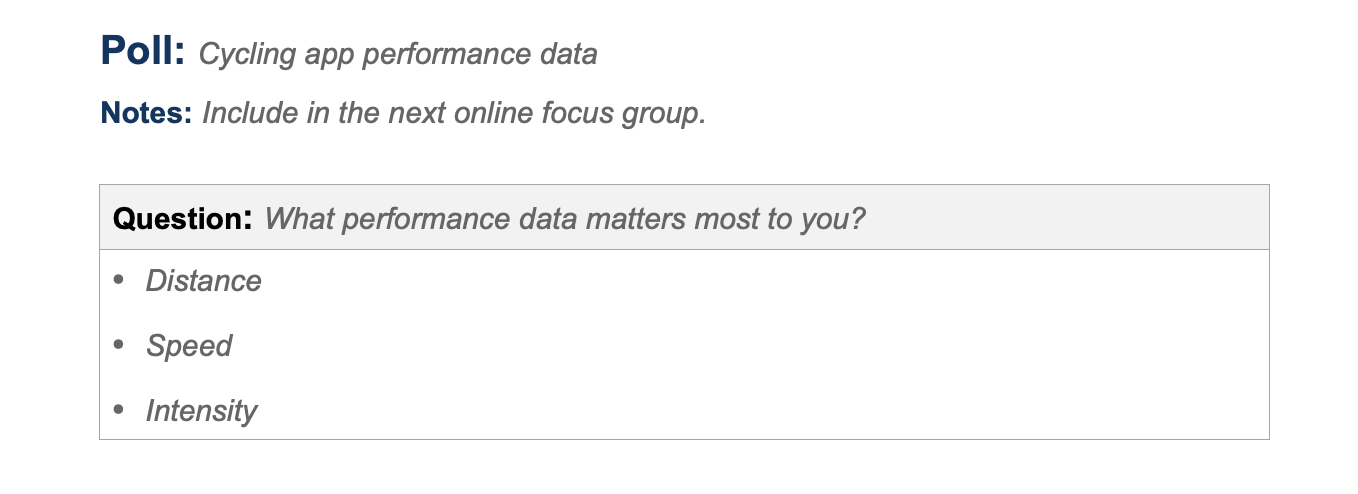

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

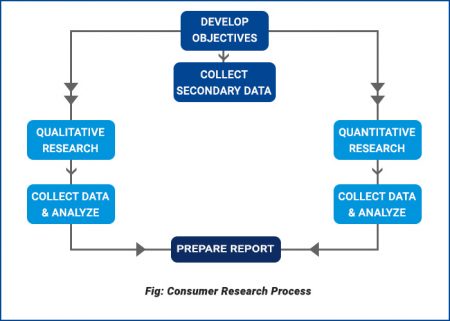

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

- Marketing Disciplines

The 43 best marketing resources we recommend in 2024

Executing a successful demand generation strategy [with examples]

How customer relationship marketing on social media drives revenue

- Other Platforms

SMS marketing 101: What is SMS Marketing (+ examples)

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

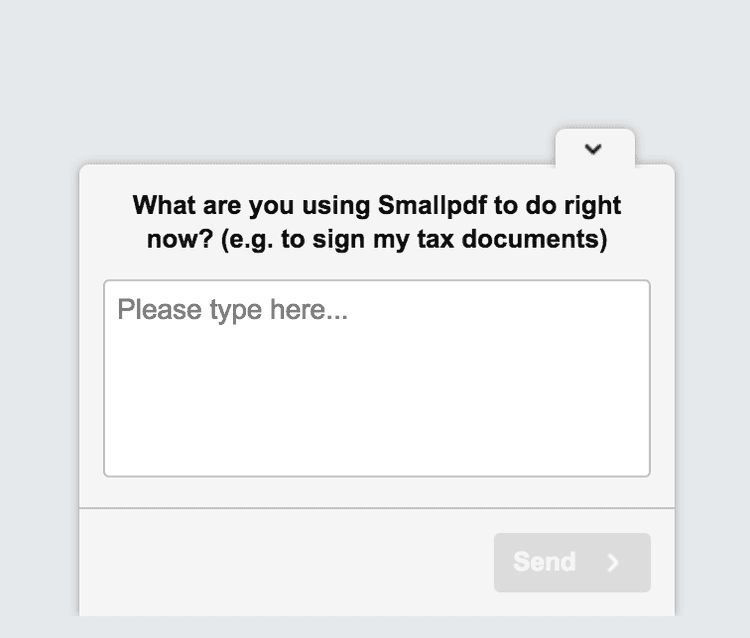

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

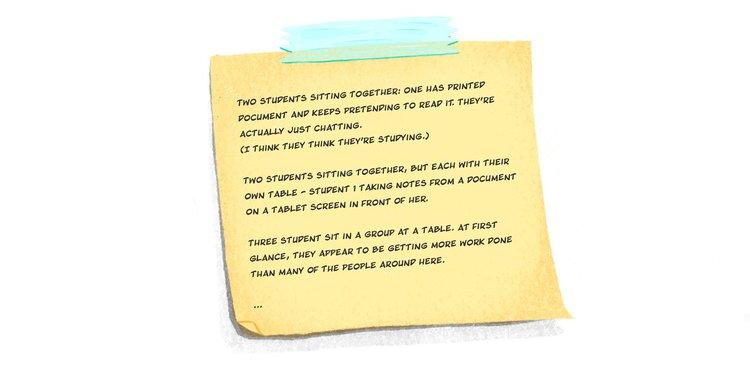

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

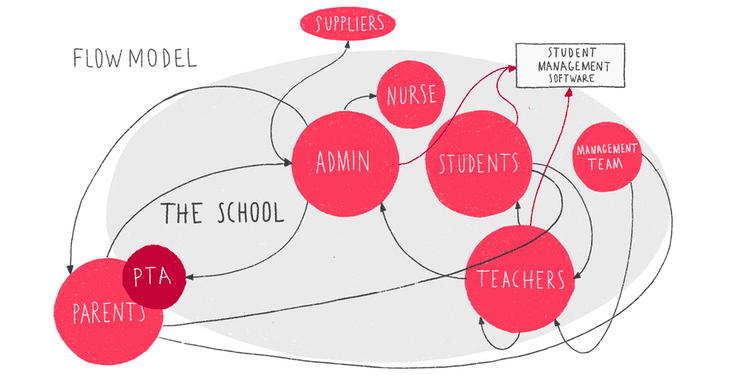

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

Affinity diagram

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.

We wrote a guide about how to analyze open-ended questions to help you sort through and categorize large volumes of response data. You can also do this by hand by clipping up survey responses or interview notes and grouping them (which is what Kristina does).

“For an interview, you will have somewhere between 30 and 60 notes, and those notes are usually direct phrases. And when you literally cut them up into separate pieces of paper and group them, they should make sense by themselves.”

Pro tip: if you’re conducting an online survey with Hotjar, keep your team in the loop by sharing survey responses automatically via our Slack and Microsoft Team integrations. Reading answers as they come in lets you digest the data in pieces and can help prepare you for identifying common themes when it comes time for analysis.

Hotjar lets you easily share survey responses with your team

Customer journey map

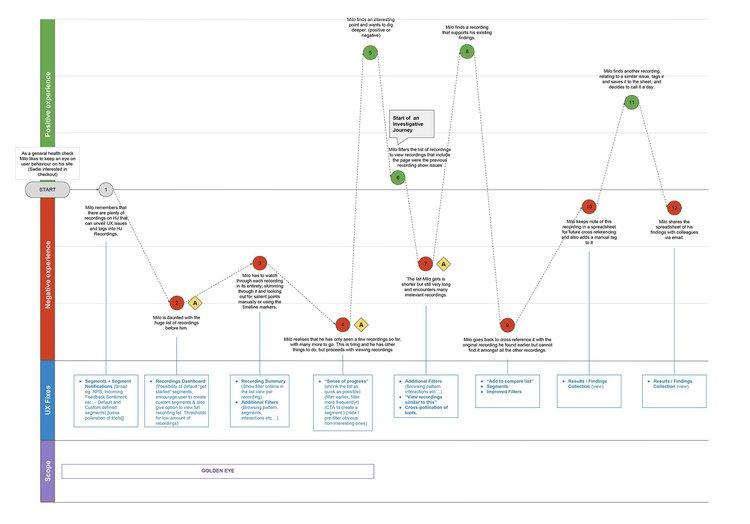

A customer journey map is a diagram that shows the way a typical prospect becomes a paying customer. It outlines their first interaction with your brand and every step in the sales cycle, from awareness to repurchase (and hopefully advocacy).

The above customer journey map , created by our team at Hotjar, shows many ways a customer might engage with our tool. Your map will be based on your own data and business model.

📚 Read more: if you’re new to customer journey maps, we wrote this step-by-step guide to creating your first customer journey map in 2 and 1/2 days with free templates you can download and start using immediately.

Next steps: from research to results

So, how do you turn market research insights into tangible business results? Let’s look at the actions Smallpdf took after conducting their lean market research: first they implemented changes, then measured the impact.

Implement changes

Based on what Smallpdf learned about the challenges that one key user segment (admins) face when trying to convert PDFs into Word files, they improved their ‘PDF to Word’ conversion tool.

We won’t go into the details here because it involves a lot of technical jargon, but they made the entire process simpler and more straightforward for users. Plus, they made it so that their system recognized when you drop a PDF file into their ‘Word to PDF’ converter instead of the ‘PDF to Word’ converter, so users wouldn’t have to redo the task when they made that mistake.

In other words: simple market segmentation for admins showed a business need that had to be accounted for, and customers are happier overall after Smallpdf implemented an informed change to their product.

Measure results

According to the Lean UX model, product and UX changes aren’t retained unless they achieve results.

Smallpdf’s changes produced:

A 75% reduction in error rate for the ‘PDF to Word’ converter

A 1% increase in NPS

Greater confidence in the team’s marketing efforts

"With all the changes said and done, we've cut our original error rate in four, which is huge. We increased our NPS by +1%, which isn't huge, but it means that of the users who received a file, they were still slightly happier than before, even if they didn't notice that anything special happened at all.”

Subscribe to fresh and free monthly insights.

Over 50,000 people interested in UX, product, digital empathy, and beyond, receive our newsletter every month. No spam, just thoughtful perspectives from a range of experts, new approaches to remote work, and loads more valuable insights. If that floats your boat, why not become a subscriber?

I have read and accepted the message outlined here: Hotjar uses the information you provide to us to send you relevant content, updates and offers from time to time. You can unsubscribe at any time by clicking the link at the bottom of any email.

Market research (or marketing research) is any set of techniques used to gather information and better understand a company’s target market. This might include primary research on brand awareness and customer satisfaction or secondary market research on market size and competitive analysis. Businesses use this information to design better products, improve user experience, and craft a marketing strategy that attracts quality leads and improves conversion rates.

David Darmanin, one of Hotjar’s founders, launched two startups before Hotjar took off—but both companies crashed and burned. Each time, he and his team spent months trying to design an amazing new product and user experience, but they failed because they didn’t have a clear understanding of what the market demanded.

With Hotjar, they did things differently . Long story short, they conducted market research in the early stages to figure out what consumers really wanted, and the team made (and continues to make) constant improvements based on market and user research.

Without market research, it’s impossible to understand your users. Sure, you might have a general idea of who they are and what they need, but you have to dig deep if you want to win their loyalty.

Here’s why research matters:

Obsessing over your users is the only way to win. If you don’t care deeply about them, you’ll lose potential customers to someone who does.

Analytics gives you the ‘what’, while research gives you the ‘why’. Big data, user analytics , and dashboards can tell you what people do at scale, but only research can tell you what they’re thinking and why they do what they do. For example, analytics can tell you that customers leave when they reach your pricing page, but only research can explain why.

Research beats assumptions, trends, and so-called best practices. Have you ever watched your colleagues rally behind a terrible decision? Bad ideas are often the result of guesswork, emotional reasoning, death by best practices , and defaulting to the Highest Paid Person’s Opinion (HiPPO). By listening to your users and focusing on their customer experience , you’re less likely to get pulled in the wrong direction.

Research keeps you from planning in a vacuum. Your team might be amazing, but you and your colleagues simply can’t experience your product the way your customers do. Customers might use your product in a way that surprises you, and product features that seem obvious to you might confuse them. Over-planning and refusing to test your assumptions is a waste of time, money, and effort because you’ll likely need to make changes once your untested business plan gets put into practice.

Lean User Experience (UX) design is a model for continuous improvement that relies on quick, efficient research to understand customer needs and test new product features.

Lean market research can help you become more...

Efficient: it gets you closer to your customers, faster.

Cost-effective: no need to hire an expensive marketing firm to get things started.

Competitive: quick, powerful insights can place your products on the cutting edge.

As a small business or sole proprietor, conducting lean market research is an attractive option when investing in a full-blown research project might seem out of scope or budget.

There are lots of different ways you could conduct market research and collect customer data, but you don’t have to limit yourself to just one research method. Four common types of market research techniques include surveys, interviews, focus groups, and customer observation.

Which method you use may vary based on your business type: ecommerce business owners have different goals from SaaS businesses, so it’s typically prudent to mix and match these methods based on your particular goals and what you need to know.

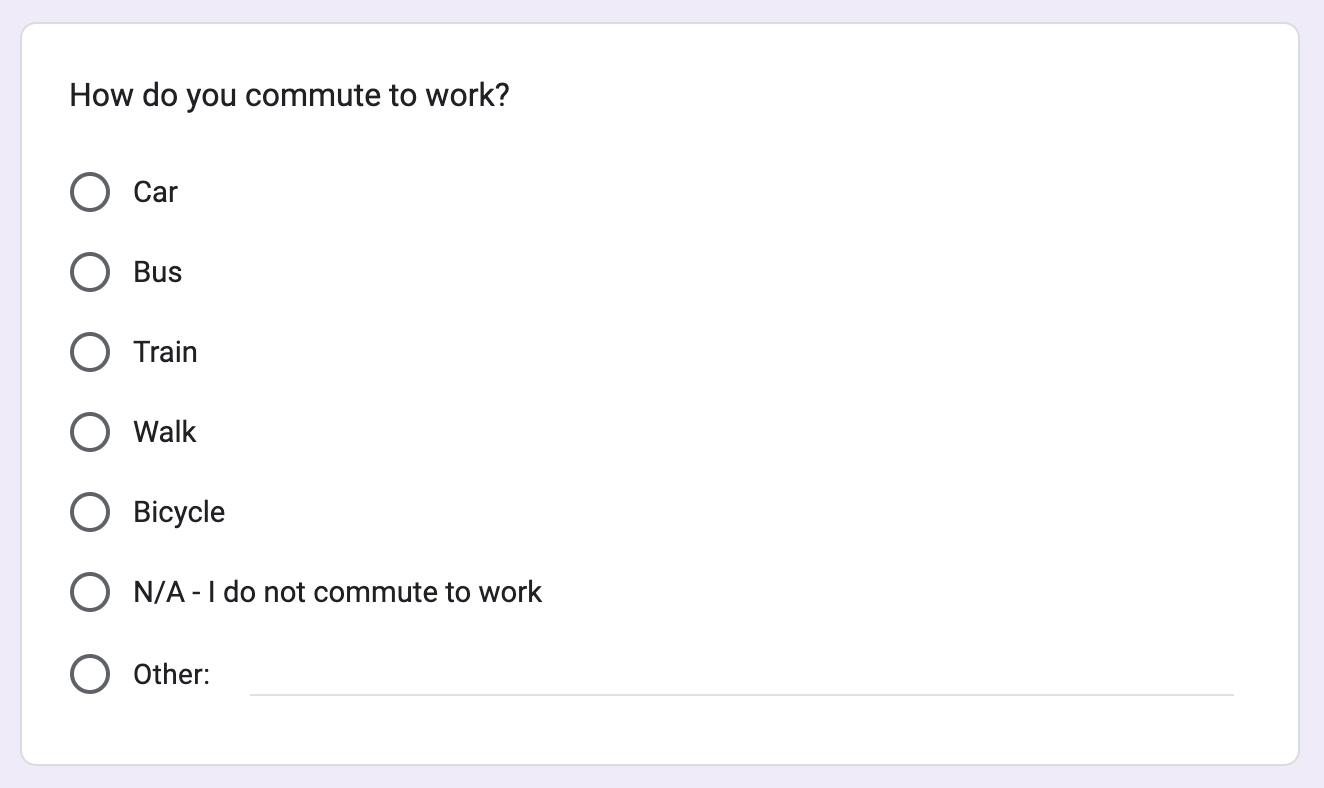

1. Surveys: the most commonly used

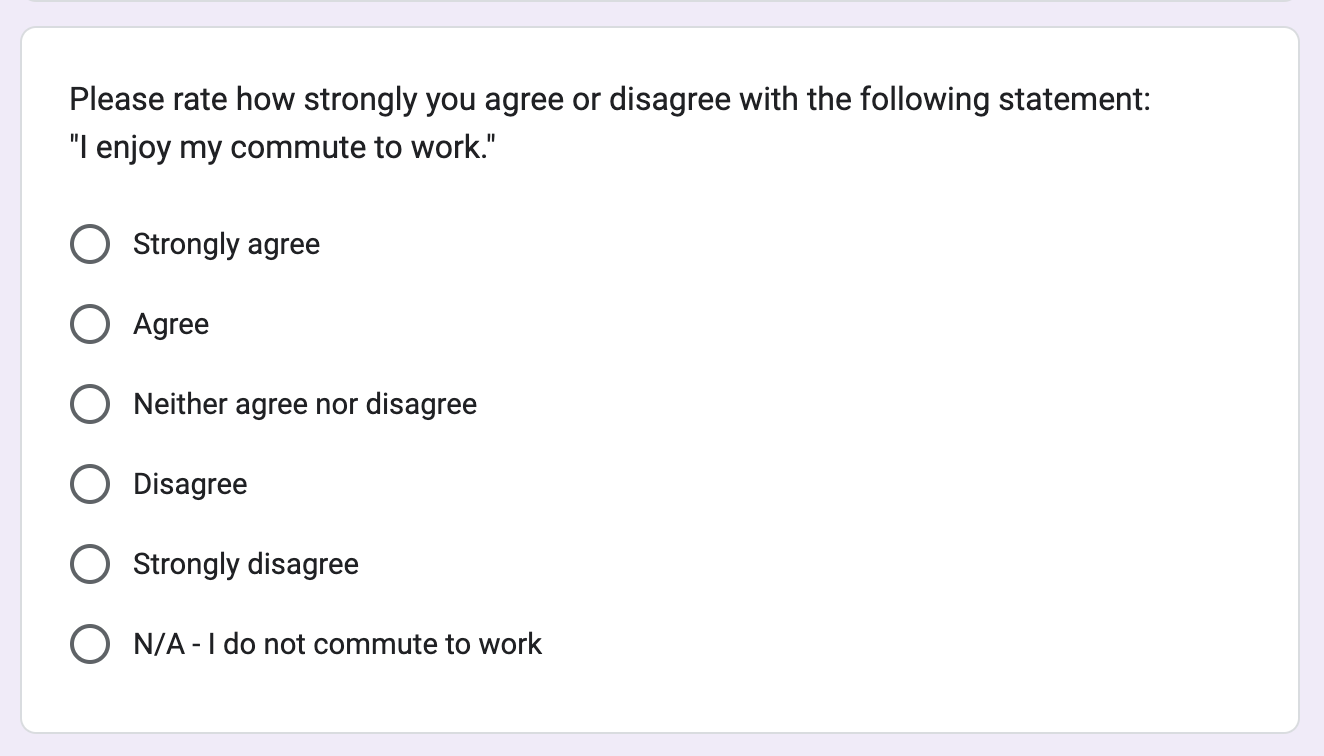

Surveys are a form of qualitative research that ask respondents a short series of open- or closed-ended questions, which can be delivered as an on-screen questionnaire or via email. When we asked 2,000 Customer Experience (CX) professionals about their company’s approach to research , surveys proved to be the most commonly used market research technique.

What makes online surveys so popular?

They’re easy and inexpensive to conduct, and you can do a lot of data collection quickly. Plus, the data is pretty straightforward to analyze, even when you have to analyze open-ended questions whose answers might initially appear difficult to categorize.

We've built a number of survey templates ready and waiting for you. Grab a template and share with your customers in just a few clicks.

💡 Pro tip: you can also get started with Hotjar AI for Surveys to create a survey in mere seconds . Just enter your market research goal and watch as the AI generates a survey and populates it with relevant questions.

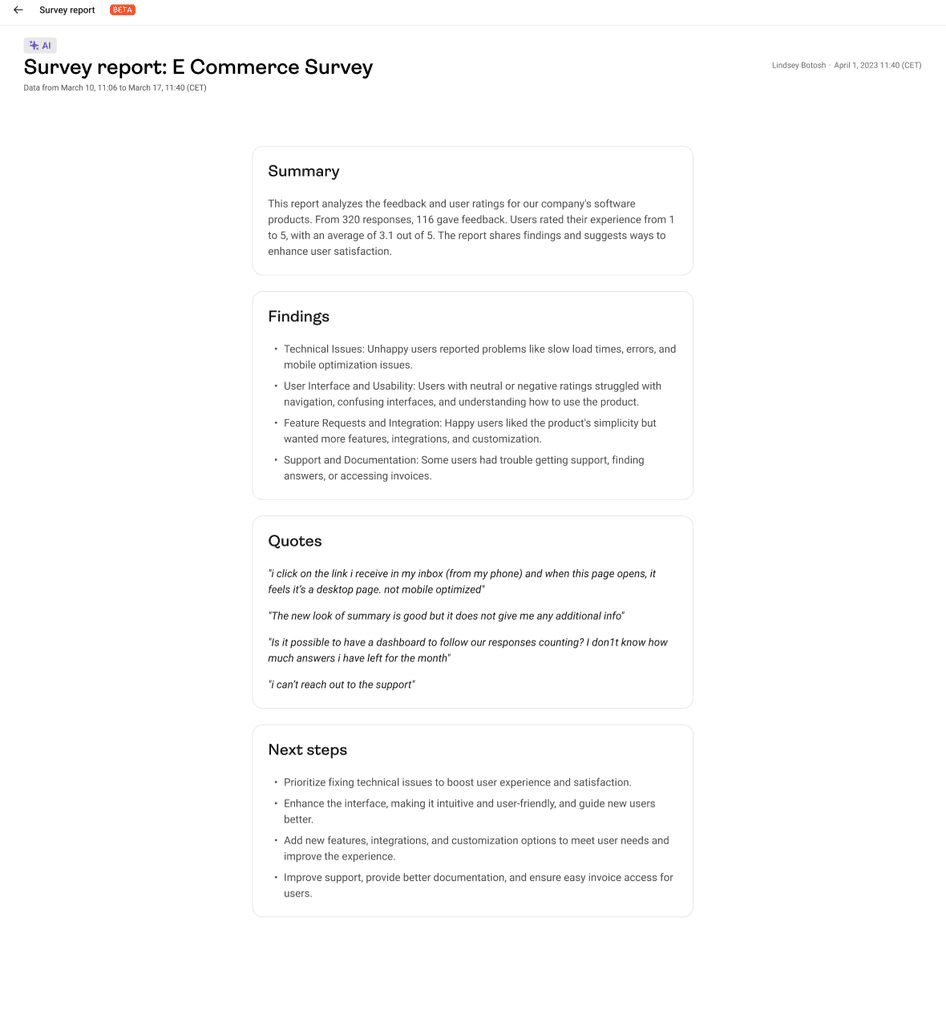

Once you’re ready for data analysis, the AI will prepare an automated research report that succinctly summarizes key findings, quotes, and suggested next steps.

An example research report generated by Hotjar AI for Surveys

2. Interviews: the most insightful

Interviews are one-on-one conversations with members of your target market. Nothing beats a face-to-face interview for diving deep (and reading non-verbal cues), but if an in-person meeting isn’t possible, video conferencing is a solid second choice.

Regardless of how you conduct it, any type of in-depth interview will produce big benefits in understanding your target customers.

What makes interviews so insightful?

By speaking directly with an ideal customer, you’ll gain greater empathy for their experience , and you can follow insightful threads that can produce plenty of 'Aha!' moments.

3. Focus groups: the most unreliable

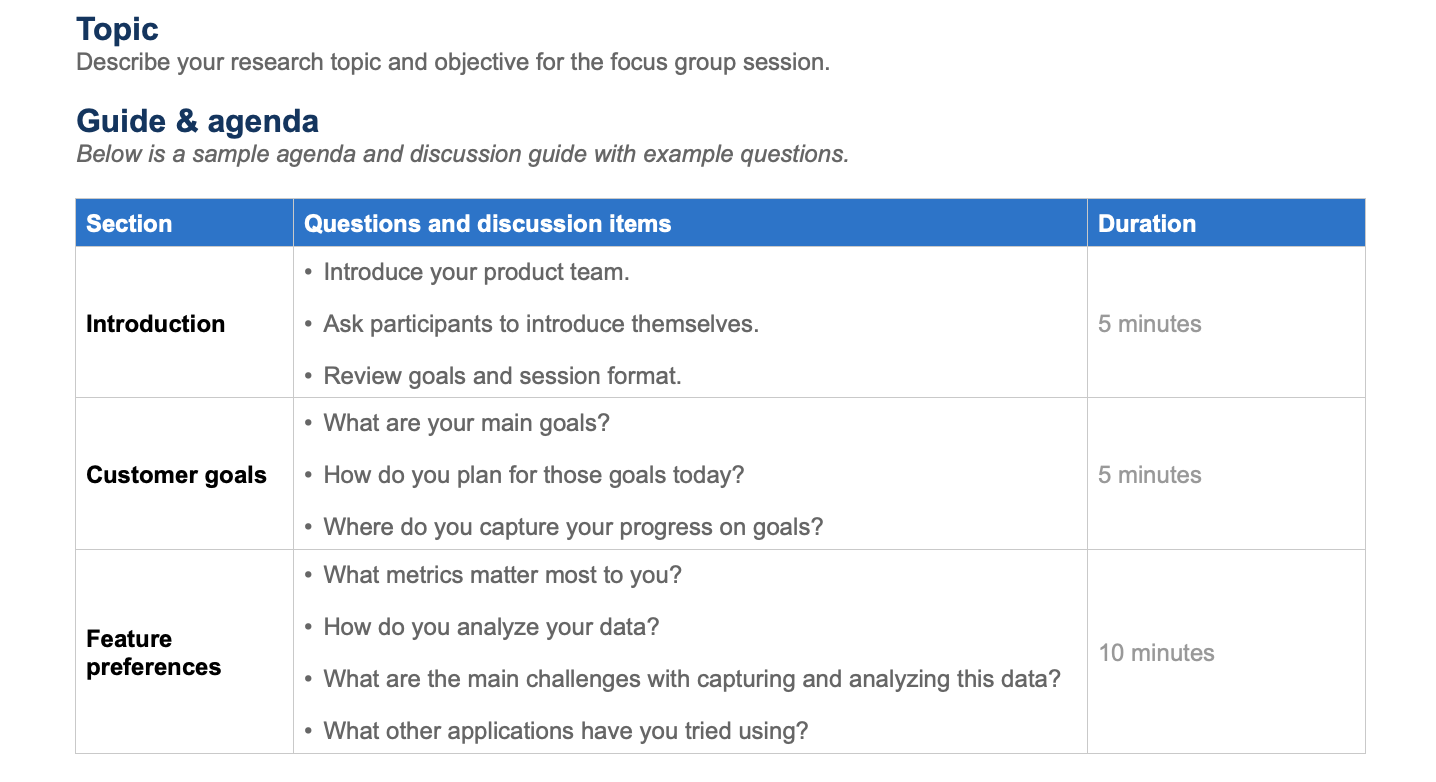

Focus groups bring together a carefully selected group of people who fit a company’s target market. A trained moderator leads a conversation surrounding the product, user experience, or marketing message to gain deeper insights.

What makes focus groups so unreliable?

If you’re new to market research, we wouldn’t recommend starting with focus groups. Doing it right is expensive , and if you cut corners, your research could fall victim to all kinds of errors. Dominance bias (when a forceful participant influences the group) and moderator style bias (when different moderator personalities bring about different results in the same study) are two of the many ways your focus group data could get skewed.

4. Observation: the most powerful

During a customer observation session, someone from the company takes notes while they watch an ideal user engage with their product (or a similar product from a competitor).

What makes observation so clever and powerful?

‘Fly-on-the-wall’ observation is a great alternative to focus groups. It’s not only less expensive, but you’ll see people interact with your product in a natural setting without influencing each other. The only downside is that you can’t get inside their heads, so observation still isn't a recommended replacement for customer surveys and interviews.

The following questions will help you get to know your users on a deeper level when you interview them. They’re general questions, of course, so don’t be afraid to make them your own.

1. Who are you and what do you do?

How you ask this question, and what you want to know, will vary depending on your business model (e.g. business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing).

It’s a great question to start with, and it’ll help you understand what’s relevant about your user demographics (age, race, gender, profession, education, etc.), but it’s not the be-all-end-all of market research. The more specific questions come later.

2. What does your day look like?

This question helps you understand your users’ day-to-day life and the challenges they face. It will help you gain empathy for them, and you may stumble across something relevant to their buying habits.

3. Do you ever purchase [product/service type]?

This is a ‘yes or no’ question. A ‘yes’ will lead you to the next question.

4. What problem were you trying to solve or what goal were you trying to achieve?

This question strikes to the core of what someone’s trying to accomplish and why they might be willing to pay for your solution.

5. Take me back to the day when you first decided you needed to solve this kind of problem or achieve this goal.

This is the golden question, and it comes from Adele Revella, Founder and CEO of Buyer Persona Institute . It helps you get in the heads of your users and figure out what they were thinking the day they decided to spend money to solve a problem.

If you take your time with this question, digging deeper where it makes sense, you should be able to answer all the relevant information you need to understand their perspective.

“The only scripted question I want you to ask them is this one: take me back to the day when you first decided that you needed to solve this kind of problem or achieve this kind of a goal. Not to buy my product, that’s not the day. We want to go back to the day that when you thought it was urgent and compelling to go spend money to solve a particular problem or achieve a goal. Just tell me what happened.”

— Adele Revella , Founder/CEO at Buyer Persona Institute

Bonus question: is there anything else you’d like to tell me?

This question isn’t just a nice way to wrap it up—it might just give participants the opportunity they need to tell you something you really need to know.

That’s why Sarah Doody, author of UX Notebook , adds it to the end of her written surveys.

“I always have a last question, which is just open-ended: “Is there anything else you would like to tell me?” And sometimes, that’s where you get four paragraphs of amazing content that you would never have gotten if it was just a Net Promoter Score [survey] or something like that.”

What is the difference between qualitative and quantitative research?

Qualitative research asks questions that can’t be reduced to a number, such as, “What is your job title?” or “What did you like most about your customer service experience?”

Quantitative research asks questions that can be answered with a numeric value, such as, “What is your annual salary?” or “How was your customer service experience on a scale of 1-5?”

→ Read more about the differences between qualitative and quantitative user research .

How do I do my own market research?

You can do your own quick and effective market research by

Surveying your customers

Building user personas

Studying your users through interviews and observation

Wrapping your head around your data with tools like flow models, affinity diagrams, and customer journey maps

What is the difference between market research and user research?

Market research takes a broad look at potential customers—what problems they’re trying to solve, their buying experience, and overall demand. User research, on the other hand, is more narrowly focused on the use (and usability ) of specific products.

What are the main criticisms of market research?

Many marketing professionals are critical of market research because it can be expensive and time-consuming. It’s often easier to convince your CEO or CMO to let you do lean market research rather than something more extensive because you can do it yourself. It also gives you quick answers so you can stay ahead of the competition.

Do I need a market research firm to get reliable data?

Absolutely not! In fact, we recommend that you start small and do it yourself in the beginning. By following a lean market research strategy, you can uncover some solid insights about your clients. Then you can make changes, test them out, and see whether the results are positive. This is an excellent strategy for making quick changes and remaining competitive.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Related articles

6 traits of top marketing leaders (and how to cultivate them in yourself)

Stepping into a marketing leadership role can stir up a mix of emotions: excitement, optimism, and, often, a gnawing doubt. "Do I have the right skills to truly lead and inspire?" If you've ever wrestled with these uncertainties, you're not alone.

Hotjar team

The 7 best BI tools for marketers in 2024 (and how to use them)

Whether you're sifting through campaign attribution data or reviewing performance reports from different sources, extracting meaningful business insights from vast amounts of data is an often daunting—yet critical—task many marketers face. So how do you efficiently evaluate your results and communicate key learnings?

This is where business intelligence (BI) tools come in, transforming raw data into actionable insights that drive informed, customer-centric decisions.

6 marketing trends that will shape the future of ecommerce in 2023

Today, marketing trends evolve at the speed of technology. Ecommerce businesses that fail to update their marketing strategies to meet consumers where they are in 2023 will be left out of the conversations that drive brand success.

Geoff Whiting

Hey there! Free trials are available for Standard and Essentials plans. Start for free today.

Customer Research: The Key to Meeting Customer Needs

Learn how to conduct market research that provides insights into your customers' behaviors, preferences, and pain points.

Digital marketing isn’t just ads and social media posts. Your digital marketing efforts will require you to deeply understand the wants, needs, and preferences of your customers. If you don’t understand your target audience, then your marketing and sales activities will probably suffer exponentially.

Every stage of marketing has something to do with customer research and meeting customer needs. For these and many other reasons, customer research should hold key importance in any marketing or sales effort you intend to embark on now and in the future.

While it’s important to know your customer inside and out, you may have to start from the beginning to figure things out.

For example, it’s a good idea to start with an ideal customer or customer persona that fits the goals of your business, but you might find through your marketing efforts and data collection that the people who gravitate to your brand are nothing like what you assumed.

For these and many, many other reasons, customer research is of the utmost importance. But what does customer research mean for a business? It’s far more than just the sum of the words. Here is a deeper look at customer research and how it forms the key to meeting customer needs.

What is customer research?

The term itself tells you what customer research entails. However, to formalize it, you can consider target market research as gathering and analyzing data about your target market or audience with the goal of learning:

- The needs of your potential customers

- What your customers prefer

- Behavior patterns of your customers

- Common customer problems and pain points

Armed with this information, your business can create effective marketing and sales strategies that target the right people, have a higher level of conversions, and generate far more sales.

No matter the goals of your brand, customer research will help you obtain them faster, more efficiently, and with less required trial and error to do so.

Customer or market research

Customer research and marketing research both help businesses understand their target audience and create effective marketing strategies. You may come across the terms customer research and market research used interchangeably. These are, in fact, two different things.

Customer research (also called target market research) focuses on gathering data about customers' needs, preferences, behavior, and pain points. Marketing research covers a broader area of research and includes customer research under its umbrella.

When researching a market, you will gather data about trends, competition, and various other factors, along with your customer research. That information will also factor into your marketing, sales, and growth strategies.

Benefits of customer research in marketing

Customer research comes along with several benefits, many of them absolutely crucial to your digital marketing or any other type of marketing effort. This is especially true for a new business, product, or service.

- Identifying target audience. You will come to know precisely who your brand should target as customer research will help you learn the demographics, interests, pain points, and behaviors of those people who your brand can benefit most.

- Understanding customer behavior. You will learn the habits and patterns of your ideal customer. What they do, where they hang out online, and what kind of activity they engage in.

- Creating relevant content. Knowing more about your customer will allow you to create marketing materials and content that speaks directly to them.

- Improving customer experience. Customer research allows for greater personalization, which increases the customer experience.

- Increasing conversion rates. Of course, all the benefits of target market research create more qualified leads and better conversions.

Every benefit of customer research creates and builds another benefit of customer research. You may not even know who your customers might be at the start, which is what makes this type of research an excellent place to start.

No matter the size of the business, initiative, or group, there are always benefits associated with customer research and continuing target market research.

Why is quantitative research key to building a business strategy?

Customer research forms a cornerstone of all business, marketing, and sales strategies. If you don’t know who to target, then your campaigns won’t work as intended, or won’t work at all.

Each of the previously mentioned benefits of customer research point to exactly why you should look at this research as key to building a business strategy.

Helps businesses understand customer needs

What does your ideal customer need? And, can your brand provide them with that need? These important questions can help you form the blueprint of your entire business or brand strategy . Understanding the needs of your ideal customer will help you deliver to them precisely what they’re looking for.

Knowing customer needs will also help you craft highly effective campaigns that do far more for your brand or business in both the short and long term.

Delivers insights for improving products and services

As you form your business strategy around the insights gained through your own market research, you can improve your products and services to cater to your ideal customer. This also applies to new products or services as well.

For example, you may find you have an underperforming content marketing strategy. Your customer research insights might inform you that the reason the strategy underperforms is that you’re using generic content, or it’s not speaking to anyone specifically.

Now that you know who your customers are, what they want, and how they consume content, you transform that underperforming content into content that actively engages and converts the potential leads your business needs the most.

Assists businesses to make informed decisions

Business strategy forms based on a series of decisions. If your decisions aren’t backed by data and analysis, then it might not work quite as well as you would like. Primary research insights can help to inform business decisions at every level.

Yes, you can use customer research data to create excellent marketing funnels, but you can also use that data to create full business plans, goals, and growth strategies for the entirety of your organization. This is the type of thing that large corporations do routinely.

A small business or even a single person with a marketable skill can use primary market research data to figure out in which direction they should point the overall efforts of their business.

Increases customer satisfaction and loyalty

People love to feel catered to. Consumer research helps you to facilitate that feeling in people by providing them with solutions to problems and giving them content that speaks directly to them. This process will give your brand satisfied and loyal customers.

Keep in mind that customer satisfaction and loyalty also lead to:

- Repeat business and increased lifetime value

- Cheerleading and positive word of mouth

- Increased reputation

Loyal customers become repeat customers , as they tend to return to brands they trust when it’s time to purchase again. They may stick around for a long time, which can lead to more customers with higher customer lifetime values ( CLV ).

That satisfaction and loyalty will also prompt customers, especially modern-day customers, to write reviews, cheerlead, and spread the good word about your brand or its offerings. Word-of-mouth is actually a viable form of marketing, a powerful one, and one you can passively receive benefits from.

Provides a competitive advantage

Customer research that informs business decisions will help you stay ahead of your competition. You can use consumer research to find more potential leads, but you can also use it to find new opportunities.

For example, your data may point to gaps in the market or underserved segments of people. While your competitors focus on what’s right in front of them, you can start making efforts to capture segments that can often go overlooked. Compare your potential results from these ventures against your competitors and you might see how you can outdistance them in one or more ways.

Enables businesses to establish long-term relationships with customers

As a brand or business, you want customers who will stay with you for the long term. Customer retention starts with a brand understanding their customer. Under most circumstances, people will not stick with a brand they feel doesn’t get them. Identifying needs and offering solutions to problems isn’t something that stays static.

Customer research will help you stay in step with your audience and they, in turn, will stay loyal to your brand. You can only achieve that kind of synergistic relationship through ongoing consumer research.

How to conduct target market research

You can perform customer market research in many ways. At a basic level, practically any effort you take that leads to greater customer insight counts as quantitative research. However, you’ll want to use methods that offer you more quantifiable data that you can use to make actionable decisions.

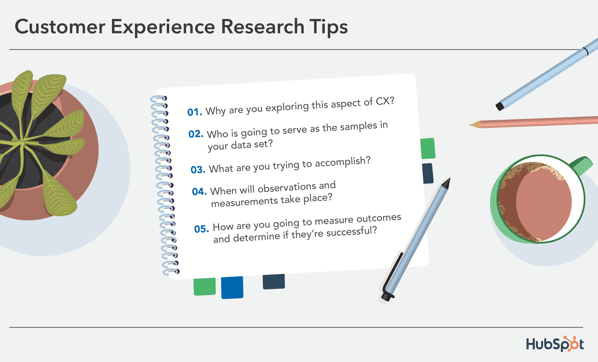

1. Define the research objectives and target audience

Start with a clear objective and define a target audience. Make a statement that defines why you’re conducting this customer research. What do you hope to accomplish with your research?

As indicated, if you don’t have data of your own to figure out who to target while conducting customer research, you can look to various sources to learn more about the people who may have pain points your brand can soothe.

2. Choose the research method and develop the research questions

With an objective and target audience defined, you can then look at the methods available to you for gathering customer insights.

You can break customer research methods down into several types. Primary research basically means research you conduct directly with your targets. Having a target audience also allows you to choose the type of research method that will serve you and them best. Interviews, surveys, and focus groups represent some types of primary research.

Secondary research comes from third parties. When you dig through the data compiled by and offered by others, you’re conducting secondary research. You should strive to conduct customer research in as many ways as you comfortably can. In this way, you can gain both quantitative and qualitative research data with which to conduct further research and create business strategies.

You may notice that most customer research methods have to do with answering questions. It's important to make your research questions specific and to the point. You want answers you can compare directly between research methods. Craft questions that directly tell you something about the customer.

Some examples include:

- What solutions did you try before you tried our service?

- How can we improve our product?

- What information do you feel our website is missing?

- What kind of promotion featuring our service would you have the most interest in?

Keep your questions focused and use your stated goal or objective to help you figure out which questions to ask and what information to seek from customers.

3. Collect, analyze, and interpret data

Once you have data, you need to analyze and interpret it to see exactly what it all means for your business marketing or sales strategies. Continue to collect and analyze data so that you can build one or more potential solutions for your brand. Look for patterns and common themes in the data and dig out the key insights you can leverage the most.

4. Use the research findings

You have the data; you have the insights, you’ve crunched numbers, identified trends, and know everything you need to know about your target audience. It’s time for implementation.

How that implementation looks will vary from business to business, but, at this point, you’ll want to look at marketing techniques and sales strategies that will work best with what you now know about your target audience.

Also, use your insights for your brand or business as well. Customer research data doesn’t just reveal things about your customers or potential customers, it can also reveal a lot about your business. If you find areas where you can and should improve, then use your data to work on those areas.

What are some customer research best practices?

Customer research will work differently between businesses, but there are a few things every brand or business can do to make the most of customer research.

Use more than one method to conduct target market research

Gain as much information as you can by running different customer research methods. Not all methods work best for all businesses, so it’s a good idea to try more than one method, regardless.

As you’ll want both quantitative and qualitative research data, it’s always more beneficial to conduct research geared toward one or the other. Then, you can combine the data. In addition, you may not know which methods actually work best for you, so you’ll want to test these methods until you find the ones that offer you the most benefit.

Always define your research goals and objectives

Before beginning your research, have a goal or objective. Defining what you want to achieve will always help you choose the research methods and research questions that will best serve your goal. Keep your customer research focused. Without a goal or objective, you can garner poor data, waste time, and waste valuable resources for very little gain.

Use professional tools and resources whenever possible

Many tools, services, and professionals exist specifically for helping brands to conduct customer research and other types of market research. When possible, you should always use those professional and polished assets.

For example, you’ll find a tremendous number of survey and quiz providers you can use for research, but you’ll quickly discover they’re not all built to scale. Some services will certainly have the tools you absolutely need, and some may even already have insight into the types of questions your business should ask the survey participants.

Look for knowledge and expertise when you’re looking for customer research solutions.

Follow up and repeat

Your customers will grow and change. Your customer research efforts will also need to grow in change. Your target market may age out of your product or service, while the new generation that fits that demographic may have no interest. Consider ongoing customer research as an absolute necessity for your brand.

Choose a service with customer research tools that can scale along with your brand while also staying with the times. When looking into how to do market research, you’ll probably notice just how many services you might need to involve.

Mailchimp offers a wide variety of professional audience management and marketing tools, including customer journey roadmaps and professional surveys. If you want to start or elevate a customer research strategy, then MailChimp can give you the tools and resources to give you the results you need.

What is customer and market research?

Customer and market research is fundamental in helping product marketers gain an invaluable understanding of the sphere in which they’re operating, the people they’re targeting, whilst also gaining essential feedback to improve their product or service.

This phase is critical in gauging an understanding of:

- What you need to provide for your customer,

- How well a product or service has performed, and

- Where changes can be made in the future.

But where do you get such insights? How do you get customer and prospects to speak to you? What do you ask them when you do chat to them? How do you consolidate all that information? What actions do you need to put in place.

Lots of questions. All the answers.

In this guide, we'll be unpacking:

- Customer & market research essentials

- Why communication is important

- When customer and market research is needed

Alternative access to buyer insights

- Getting started with research

Market and customer research unpacked

Trying to bring a product to life with no understanding of your customers and market is like boarding a plane with no wings – you won’t get anywhere, anytime soon.

Customer and market research is fundamental in helping product marketers gain an invaluable understanding of the sphere in which they’re operating, and the people they’re targeting, whilst also gaining essential feedback to improve their product or service.

Market and customer research are crucial components of developing a successful business strategy. By understanding target markets, customer needs, behaviors, and preferences, companies can create products, services, and marketing campaigns that attract and retain happy customers.

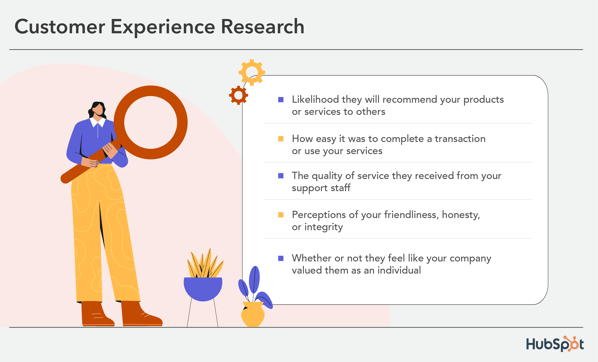

Customer and market research involves gathering insights into customer perspectives and market dynamics in to order inform and improve strategic decision-making. This process often involves quantitative surveys as well as qualitative research like focus groups and interviews. Key areas of focus typically include understanding customer demographics, psychographics, attitudes, behaviors, pain points, and needs.

Customer and market research is a fundamental component of product marketing . It serves as the perfect opportunity for PMMs to see the world from the perspective of the consumer, and the responses gleaned from this process are critical in gauging an understanding of:

- How well a product or service performed, and

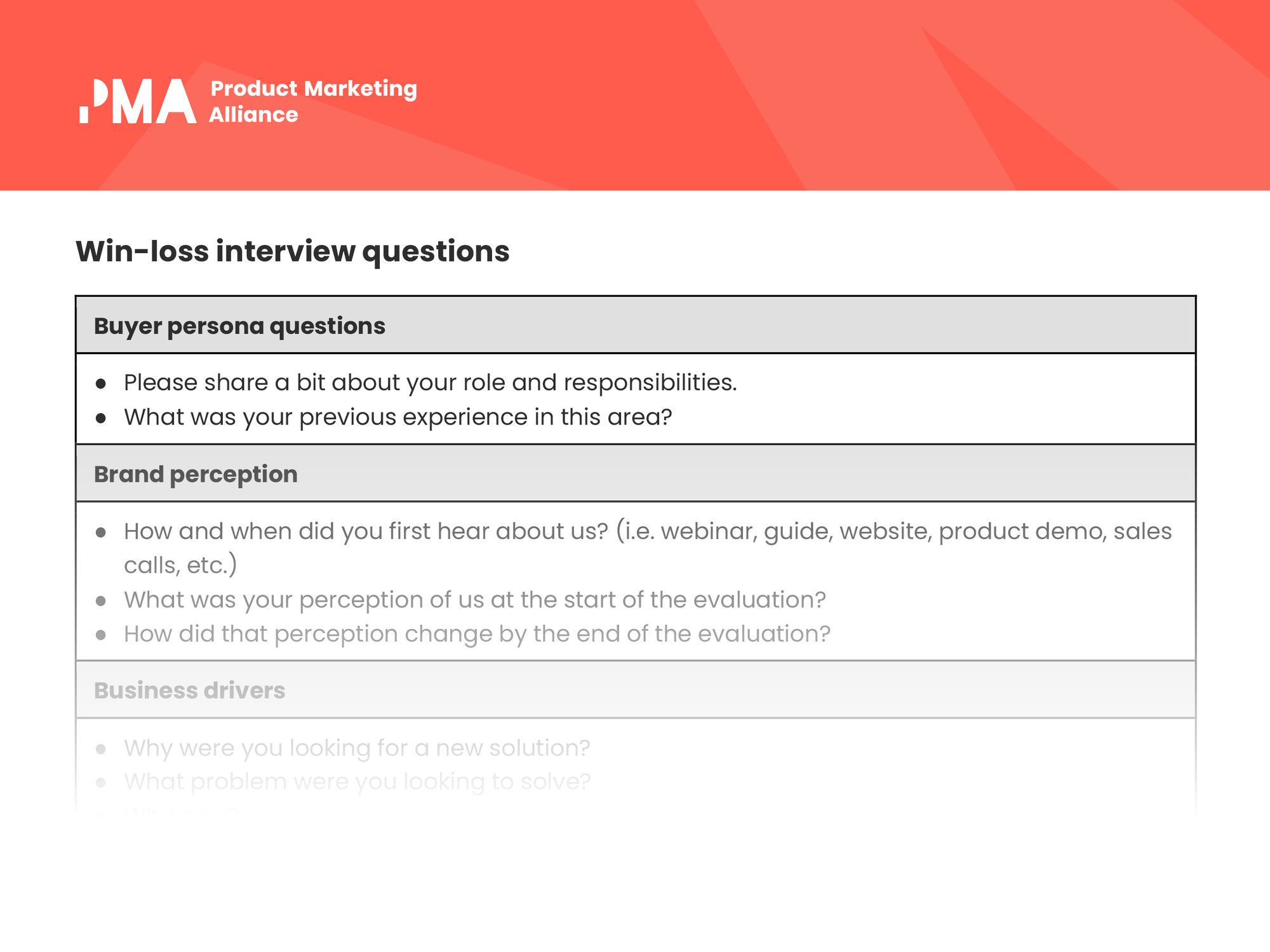

There can be a degree of confusion surrounding the topic of market research, and it’s common for some to cross their wires, and confuse it with win/loss interviews .

You may fall into the same boat. If so, don’t sweat it. You’re not on your own, and we’re here to help.

Customer and market research allows companies to refine their product pre-launch, by addressing the pain points of their prospective customers and also confronting any flaws in the product that may need to be ironed out, after it’s gone to market.

Things worth having don’t land in your lap; you’ve got to work for it. Product marketers need to plan meticulously, and customer and market research is very much a part of the recipe for success, as we’ve highlighted in our essential checklist .

What's the difference between market research and customer research?

What is market research.

Market research is the systematic process of gathering data on target markets or industries as a whole. Its goal is to identify market trends, sizes, growth potential, pricing models, competition levels, and customer demographics.

It typically involves quantitative research methods like surveys, polls, and data analysis. It serves to answer questions like:

- Who makes up the target market?

- How big is the total market size?

- What macro-level trends are shaping the market?

- How are competitors positioned?

- What are average prices and price sensitivity?

This high-level information allows companies to:

- Validate market opportunities

- Develop new products or features

- Set competitive pricing

- Position brands effectively

- Allocate resources to the most lucrative segments

- Maximize marketing ROI

Market research refers to understanding the competitive environment and overall market that your company operates within. This allows you to position your product more effectively in the market.

Why is market research important?

Market research provides the critical big-picture view of trends, opportunities, and competition that successful businesses need. Consider these key benefits:

Validating business ideas

Every new product, service, or business model is just a speculative idea until validated by market research. Surveys, focus groups, and interviews can determine if target customers both want and need what you plan to offer.

This insight de-risks major investments in development and launch plans. It also steers strategic decisions toward the most promising opportunities.

Sizing up opportunities

How big could your market be? Are there adjacent segments ripe for expansion? Market research surfaces crucial data on market size, growth rates, and demographic factors that make new ventures viable.

It also maps out expansion opportunities beyond early adopters by revealing underserved consumer needs in a category.

Benchmarking against competitors

Monitoring competitors goes hand-in-hand with understanding customers. Market research tracks factors like competitor market share, brand awareness, consumer sentiment, pricing, promotional strategies, and product perceived strengths/weaknesses.

These benchmarks help position your business competitively. They also illuminate tactical advantages to better meet customer needs in an evolving marketplace.

Informing business strategy

Market analysis illuminates trends that shape corporate strategy and planning. It provides actionable data to guide decisions around market selection, product/service development, marketing, sales, distribution models, and competitive differentiation.

Optimizing marketing spend

No marketing budget is infinite. Market research identifies high-potential customer segments so you can allocate marketing spend for maximum ROI.

It also surfaces media consumption habits and influencers to refine messaging and choose cost-efficient channels. The end goal is better conversion rates and lower customer acquisition costs.

What is customer research?

While market research explores the wider marketplace, customer research focuses directly on understanding and interacting with customers. It's all about understanding your customers' needs and behaviors in order to appeal to them and create messaging that is relevant to them, in order to sell your product in a meaningful way.

It typically involves more qualitative research approaches like in-depth interviews, ethnographies, usability testing, social listening, and feedback surveys. The goal is to gain specific insights into the end-user experience with a company's brand, products, services, and communications.

Key questions it can answer include:

- Who are the customers and ideal buyer personas ?

- What are their daily challenges, needs, and desires?

- How do they feel about the company and its competitors?

- What excites them or frustrates them?

- How can the customer experience be improved?

Armed with this granular feedback, PMMs can:

- Build detailed buyer personas

- Create tailored marketing campaigns

- Develop customer-focused products

- Improve usability and service

- Increase satisfaction and loyalty

The power of customer research

While market research works top-down to size up opportunities, customer research works bottom-up to optimize the customer experience. Its strategic power comes from providing a detailed view of real people that data alone often misses.

Building buyer personas

Buyer personas represent different consumer groups that make up your broader target audience. They include descriptive details on demographics, attitudes, behaviors, pain points, and brand perceptions.

This data comes straight from talking to living, breathing customers through interviews, focus groups, and surveys. Vivid personas guide product design and all marketing decisions.

Crafting tailored messaging

Communicating effectively starts with understanding motivations. Customer interviews and focus groups provide context on why people buy certain products and what messaging best resonates with their needs or desires.

These perspectives enable you to craft relevant, compelling messaging and campaigns that get results. It also reveals how customers describe your products in their own words, which you can integrate into selling points.

Driving referrals and loyalty

Loyal customers spend more and refer others. But you can’t engender true loyalty without delighting people with outstanding products, services, and support.

In-depth customer feedback exposes pain points and unmet needs you can address to boost satisfaction. It also uncovers potential new offerings or upgrades to make customers rave fans.

Improving products and services

Usability testing and customer co-creation sessions help optimize every aspect of your offerings. Seeing real people interact with products provides insights that lead engineers, designers, and product marketers would never uncover on their own.

Identifying new opportunities

Customer research also illuminates latent needs and new product ideas you may never have considered. These seeds often sprout into disruptive innovations or entirely new lines of business.

Guiding business decisions

Customer perspectives provide tangible guidance on where to invest resources versus where to cut losses. Their feedback steers everything from new market entry to repositioning brands.

8 ways market research supports customer research

Market and customer studies ultimately seek the same goal: To make the right strategic decisions by deeply understanding consumers.

Here are 8 ways market research complements customer research:

1. Validating market segments

Market data indicates segments with distinct needs. Customer research explores those needs with real people.

2. Sizing target markets

Macro-level market research gauges potential sales volume for new products or services. Customer research assesses actual interest and buying criteria.

3. Identifying customer archetypes

Market data reveals demographic clusters. In-depth interviews turn those statistics into living buyer personas.

4. Comparing against competitors

Market share metrics show key rivals. Customer studies reveal why people prefer them over you.

5. Selecting new markets

High-level market scans uncover blue ocean opportunities. Customer studies determine product-market fit.

6. Forecasting industry trends

Market forecasts predict future shifts. Customer input guides strategies to leverage them.

7. Choosing marketing channels

Market research identifies major media outlets and influencers. Customer interviews reveal which touchpoints matter most.

8. Pricing products or services

Industry benchmarking provides pricing ranges. Conjoint analysis finds optimal price points.

Why is communication important?

Product marketers need to communicate with their customers. Period.

Don’t just take our word for it; 80% of respondents we surveyed in the State of Product Marketing Report 2023 identified strong communication as the leading skill PMMs need to succeed.

Which brings us to our next question: When was the last time you spoke to your customer?

After all, they’re the people who use your product, sing its praises, but most importantly, let people know when you’re not ticking the boxes.

Word of mouth spreads like wildfire, so you need to pick up the phone, schedule a Zoom call, and make sure your understanding of your customers is tip-top.

There are a whole bunch of key questions you should be asking yourself:

- Why market to current customers?

- How can qualitative interviews be used to gain essential information?

- Why does the customer trust you, buy from you, and recommend your product?

- Plus, who are your customers, and have they changed over time?

Are these questions enough to set your pulse racing? If so, relax.

When is customer and market research needed?

Put simply, communication needs to be at the heart of a product marketers’ practice; a silent PMM will orchestrate their downfall.

The more a product marketer speaks with their customers, the more feedback they’ll get , and the more they’ll be able to refine their practice. On the other hand, if you don’t reach out to the people who matter the most, i.e. your customer, you’ll be stabbing in the dark and relying on your assumptions.

No number’s been set aside from the PMM gods as far as frequency is concerned, but as we’d alluded to previously, the more you speak, the more you’ll gain.

Do Hershey’s launch a new candy bar without taste tests? Do ad campaigns get signed off without test screenings? Or do fast-food chains launch new burgers without checking out what the punters’ tastebuds are craving?

Answer: A resounding no. Rather than acting on a whim, the company completes meticulous market research beforehand, to improve their chances of a hit, and reduce the likelihood of an expensive pink elephant.

In a nutshell, market research spills the beans on what prompts customers to put their hand in their pocket, buy products and services, and part with their cash.

The process is critical to ensure that the best decisions are made by a company. But how does it help, and why should every company sit up and take notice? All shall be revealed...

The benefits of conducting market research

It helps you identify your customer base.

It’s impossible to build a successful product unless you communicate with prospective customers . Market research provides a set of definitive answers to key questions, including:

- Who is your product aimed at?

- Who are your customer personas?

- What features do they want from your product?

- How much are they willing to spend?

The market research process allows you to clearly paint an image of:

a) your ideal customer – gender, age, location, income, etc.

b) the product you’re going to create, as dictated by the needs of the customer.

When you’ve identified who and what you’re creating, you’re able to successfully tailor your marketing strategy and pricing plans , accordingly.

It can prevent sloppy mistakes

Before launching a product , it’s important to conduct rigorous research and testing , to avoid silly (and expensive) errors.

Let prospective buyers test it out beforehand, so you can iron out any imperfections by conducting market research.

While your hunch may tell you your product will resonate with consumers, it’s not recommended to make a decision based on gut instinct; if things go wrong, you’ll be left rueing your choice not to conduct simple testing.

Focus groups are a great source of customer and market feedback . If things go swimmingly, you’ve got the peace of mind you need and you can push on with the launch. If there are areas for improvement, just go back to the drawing board and make your service even better.

You can protect your business

Market research not only indicates what the market is like now, it allows you to forecast how your industry could shape up in the future.

Proactivity helps you exploit potential gaps in the market other companies may not have spotted, so always stay on your toes and keep your eyes peeled for market opportunities .

Take HMV, for example. While they continued to channel their efforts into the sales of CDs and DVDs, Spotify and Netflix researched the market and developed mobile platforms offering music and film on demand, in line with emerging trends. In 2019, Netflix’s assets were $34.9bn, Spotify was being heralded as ‘the savior of the music industry’, while HMV called in administrators for the second time in six years.

Winner: Market research, by knockout.

Surpass rivals with competitive intelligence

Competitive intelligence can help you and your product marketing team understand the methods being used by your competitors, how their products work, key features and USPs, and pricing strategies , to name a few.

Business is cut-throat, and when a rival poaches customers, it’s often because they’re better prepared and have completed more in-depth research.

Preparation is key for any company, and this remains the same as far as market research is concerned. Don’t get caught in the shadow of your rivals – make them chase you. Seek valuable insights and use your findings to create an innovative strategy that’ll not only generate new leads but also improve customer retention and reduce customer churn .

How to share competitive intelligence findings

To make the most of competitive intelligence, you need to communicate your findings so your teams can use the information to develop and evolve your product.

Results are useless if you keep them to yourself – you need to share the knowledge. Our Competitive Intelligence Trends Report 2022 revealed 87% of product marketers share their findings with Sales teams, closely followed by Product (83%).

Previously, it’s been suggested there’s room for improvement in relations between product marketers and leadership teams. However, it was encouraging to see a significant proportion of people taking part (77%) saying they discuss their findings with executives and leaders.

When we dug a little deeper and explored the preferred methods for sharing competitor intel findings, we found knowledge was shared in-person on a team-by-team basis, and by segmented emails to each relevant team.

Both of these areas accounted for 34% of responses, while a further quarter indicated they send blanket emails to relevant teams within the organization.

Of the 25% of people who fell into the ‘Other’ category, the likes of battle cards, Slack channels, and tools such as Klue were identified as the chosen method of communication. With so many different ways of sharing information, we spoke with Matt Powell, Product Marketing Manager at Docebo , to get an insight into how competitor intel findings are shared at his company: