- Project Managment

How to Use Math to Create a Winning Business Plan

Introduction.

Welcome to Business Plan Math Math Quiz! This quiz is designed to help you understand the basics of business planning and the math involved in the process. It will cover topics such as financial statements, budgeting, forecasting, and more. With this quiz, you will gain a better understanding of the math behind business planning and be able to make more informed decisions when it comes to your business. So let’s get started!

Creating a winning business plan requires a combination of both creative and analytical thinking. A successful business plan should include a clear vision of the company’s goals, a detailed strategy for achieving those goals, and a financial plan that outlines the resources needed to make the plan a reality. Math is an essential tool for developing a successful business plan, as it can help to quantify the potential success of the venture and provide a roadmap for achieving the desired results.

The first step in using math to create a winning business plan is to develop a clear understanding of the company’s goals. This includes defining the target market, the products or services to be offered, and the desired financial outcomes. Once these goals are established, it is important to use math to create a realistic timeline for achieving them. This timeline should include milestones and deadlines for each step of the plan, as well as a budget for each stage of the project.

The next step is to use math to develop a strategy for achieving the desired goals. This includes analyzing the competition, researching the target market, and creating a marketing plan. Math can also be used to calculate the potential return on investment (ROI) of the venture, as well as the cost of goods sold (COGS) and other expenses associated with the business.

Finally , math can be used to create a financial plan for the business. This includes creating a budget for the venture, estimating the cost of capital, and forecasting the expected cash flow. It is important to use realistic assumptions when creating the financial plan, as this will help to ensure that the business is able to meet its financial goals.

By using math to create a winning business plan , entrepreneurs can ensure that their venture is well-positioned for success. Math can provide a roadmap for achieving the desired goals, as well as a way to quantify the potential success of the venture. With a clear understanding of the company’s goals and a detailed strategy for achieving them, entrepreneurs can use math to create a winning business plan that will help them reach their desired outcomes.

The Benefits of Incorporating Math Quizzes into Business Planning

Math quizzes can be a valuable tool for businesses when it comes to planning and decision-making. Incorporating math quizzes into business planning can help to ensure that decisions are based on accurate data and that the best possible outcome is achieved. Here are some of the benefits of incorporating math quizzes into business planning:

1. Improved Decision-Making: Math quizzes can help to ensure that decisions are based on accurate data and that the best possible outcome is achieved. By incorporating math quizzes into business planning, businesses can ensure that decisions are based on sound mathematical principles and that the results are reliable.

2. Increased Efficiency: Math quizzes can help to streamline the decision-making process by providing a quick and easy way to assess the data. This can help to reduce the amount of time spent on decision-making and can help to ensure that decisions are made quickly and efficiently.

3. Improved Problem-Solving Skills: Math quizzes can help to improve problem-solving skills by providing a platform for employees to practice their math skills. This can help to ensure that employees are better equipped to solve complex problems and can help to improve overall productivity.

4. Improved Understanding of Business Concepts: Math quizzes can help to improve understanding of business concepts by providing a platform for employees to practice their math skills. This can help to ensure that employees are better equipped to understand and apply business concepts and can help to improve overall productivity.

Incorporating math quizzes into business planning can be a valuable tool for businesses. By incorporating math quizzes into business planning, businesses can ensure that decisions are based on accurate data and that the best possible outcome is achieved. This can help to improve decision-making, increase efficiency, improve problem-solving skills, and improve understanding of business concepts.

How to Use Math to Analyze Market Trends and Make Strategic Decisions

Making strategic decisions in the stock market requires a thorough understanding of the market and the ability to analyze trends. Using math to analyze market trends can help investors make informed decisions and maximize their returns.

The first step in using math to analyze market trends is to identify the key indicators that will be used to measure the performance of the market. These indicators can include the price of a stock, the volume of trading, the number of shares outstanding, and the market capitalization. Once these indicators have been identified, investors can use mathematical formulas to calculate the average price of a stock, the average volume of trading, and the market capitalization.

Once the key indicators have been identified , investors can use mathematical formulas to calculate the rate of return on their investments. This rate of return is calculated by subtracting the cost of the investment from the current market value of the stock. This calculation will provide investors with an indication of how their investments are performing.

Investors can also use mathematical formulas to calculate the volatility of the market. Volatility is a measure of how much the market is fluctuating. By calculating the volatility of the market, investors can determine whether the market is trending up or down.

Finally , investors can use mathematical formulas to calculate the correlation between different stocks. Correlation is a measure of how closely two stocks are related. By calculating the correlation between different stocks, investors can determine which stocks are likely to move in the same direction.

By using math to analyze market trends , investors can make informed decisions and maximize their returns. By understanding the key indicators of the market, calculating the rate of return on their investments, calculating the volatility of the market, and calculating the correlation between different stocks, investors can make strategic decisions that will help them maximize their returns.

The Role of Math in Financial Planning and Budgeting

Math plays an essential role in financial planning and budgeting. It is the foundation of any successful financial plan and budget. Without a thorough understanding of mathematics, it is impossible to accurately assess the financial situation of an individual or business.

Math is used to calculate the present value of future cash flows , which is essential for making sound financial decisions. It is also used to calculate the rate of return on investments, which helps to determine the best investment options. Math is also used to calculate the cost of borrowing money, which helps to determine the best financing options.

Math is also used to calculate the cost of goods and services , which helps to determine the best pricing strategies. Math is also used to calculate the cost of taxes, which helps to determine the best tax strategies. Math is also used to calculate the cost of insurance, which helps to determine the best insurance policies.

Math is also used to calculate the cost of living , which helps to determine the best budgeting strategies. Math is also used to calculate the cost of retirement, which helps to determine the best retirement plans.

In conclusion , math is an essential tool for financial planning and budgeting. It is used to calculate the present value of future cash flows, the rate of return on investments, the cost of borrowing money, the cost of goods and services, the cost of taxes, the cost of insurance, the cost of living, and the cost of retirement. Without a thorough understanding of mathematics, it is impossible to accurately assess the financial situation of an individual or business.

How to Use Math to Calculate Risk and Maximize Profits

Calculating risk and maximizing profits are two of the most important tasks for any business. By using mathematical formulas and calculations, businesses can make informed decisions that will help them to reduce risk and maximize profits.

The first step in using math to calculate risk and maximize profits is to identify the variables that will affect the outcome. These variables can include the cost of goods, the cost of labor, the cost of materials, the cost of marketing, and the cost of overhead. Once these variables have been identified, businesses can use mathematical formulas to calculate the expected return on investment (ROI) for each variable.

The next step is to use mathematical formulas to calculate the probability of success for each variable. This can be done by using probability theory, which is a branch of mathematics that deals with the likelihood of certain outcomes. By calculating the probability of success for each variable, businesses can determine which variables are most likely to yield a positive return on investment.

Once the probability of success has been calculated, businesses can use mathematical formulas to calculate the expected return on investment for each variable. This can be done by multiplying the probability of success by the expected return on investment for each variable. By doing this, businesses can determine which variables are most likely to yield a positive return on investment.

Finally , businesses can use mathematical formulas to calculate the expected return on investment for each variable. This can be done by subtracting the cost of goods, labor, materials, marketing, and overhead from the expected return on investment for each variable. By doing this, businesses can determine which variables are most likely to yield a positive return on investment.

By using mathematical formulas and calculations , businesses can make informed decisions that will help them to reduce risk and maximize profits. By calculating the probability of success for each variable and subtracting the cost of goods, labor, materials, marketing, and overhead from the expected return on investment for each variable, businesses can determine which variables are most likely to yield a positive return on investment. By doing this, businesses can make informed decisions that will help them to reduce risk and maximize profits.

The Benefits of Using Math to Develop a Comprehensive Business Plan

Creating a comprehensive business plan is essential for any business to succeed. Utilizing math in the development of a business plan can provide a number of benefits. Math can be used to analyze data, create projections, and develop strategies.

Analyzing data is an important part of developing a business plan. Math can be used to identify trends in the market, analyze customer behavior, and measure the success of marketing campaigns. This data can be used to make informed decisions about the direction of the business.

Projections are also an important part of a business plan. Math can be used to create financial projections, such as sales forecasts, budget projections, and cash flow projections. This information can be used to create a realistic plan for the future of the business.

Strategies are also an important part of a business plan. Math can be used to develop strategies for pricing, marketing, and product development. This information can be used to create a plan for the future of the business.

Using math to develop a comprehensive business plan can provide a number of benefits. It can be used to analyze data, create projections, and develop strategies. This information can be used to create a realistic plan for the future of the business. Utilizing math in the development of a business plan can help ensure the success of the business.

- Business Plan Math – Math Quiz questions & answers for quizzes …

- Virtual Business Retailing – Financing & Business Planning – Math …

- Business Math Quiz 1B (with answers)

- Previous How to Create a Business Plan for a Youth Group Home

- Next How to Create a Comprehensive Business Plan Module

Best Strategies to Ace the CAPM Exam

Outfitter Business Plan

Interview Questions And Answers For Project Manager In Software Company

Your email address will not be published. Required fields are marked *

- Sample Page

Have an account?

Suggestions for you See more

Exploring Entrepreneurship

9th - 12th , stock market game rules, 10th - 12th , stock market terms study guide.

Business Plan Math - Reading Quiz

11th - 12th grade.

10 questions

Introducing new Paper mode

No student devices needed. Know more

What is the term used for a 3-5 year forecast of your income and expenses?

Financial model

Profits and losses

Spreadsheet

What is an example of a monthly, recurring expense?

Lease down payment

What is the type of pricing determined largely by what other companies in your industry are charging?

Competitors' pricing

Value-based pricing

Simple pricing

Cost-plus pricing

What is the rate at which the business grows or increases revenue from sales?

Profit margin

Monthly profit

Growth percentage

Examples of direct costs are:

Utilities and rent

Labor and material costs

Pricing your product based how a customer perceives the product is called:

Sales revenue is calculated by:

Number of sales multiplied by average customer sale dollar amount

Sales price multiplied by cost of goods sold

Number of sales multiplied by cost of goods sold

True or False: Net profit is greater than gross profit.

Starting a company in which you only spend money that is absolutely necessary at each point in time is called a:

Lean startup

Sole proprietor

Growth startup

What is the description of each axis on a breakeven chart?

Profit and volume

Sales and expenses

Direct costs and indirect costs

Explore all questions with a free account

Continue with email

Continue with phone

Knowledge and Science Bulletin Board System

Exploring the World of Knowledge and Understanding

Maximizing Your Business Potential through Smart Financing and Planning: A Math Quiz

By knbbs-sharer.

Running a successful business is no small feat. It requires both smart financing and effective planning to achieve long-term success. As a business owner, it’s important to have a good understanding of your financial situation and to make wise decisions when it comes to investments, expenditures, and cash flow management.

This is where the math comes in. By using simple and effective financial calculations, you can gain insights into your business that will help you make better decisions for the future. In this article, we’ll explore some of the key math formulas that can help you maximize your business potential.

The Break-Even Point Formula

One of the most important calculations that every business owner should know is the break-even point formula. This formula helps you determine the minimum amount of sales that your business needs to generate in order to cover all of its expenses.

Here’s the formula:

Break-Even Point = Total Fixed Costs / (Price per Unit – Variable Costs per Unit)

For example, let’s say you own a small bakery, and you know that your total fixed costs each month are $2,000. You sell cupcakes for $2 each, and your variable costs (ingredients, labor, etc.) are $0.50 per cupcake. Using the formula, you can calculate your break-even point:

Break-Even Point = $2,000 / ($2 – $0.50) = 1,333 cupcakes

This means that you need to sell at least 1,333 cupcakes every month just to break even. Any sales above that amount will result in a profit for your business.

Return on Investment (ROI) Formula

Another important calculation for business owners is the return on investment (ROI) formula. This formula helps you determine the profitability of a particular investment, such as a new piece of equipment or a marketing campaign.

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment

For example, let’s say you decide to invest $10,000 in a new social media marketing campaign, and as a result, you generate an additional $15,000 in sales. Using the formula, you can calculate your ROI:

ROI = ($15,000 – $10,000) / $10,000 = 0.5 or 50%

This means that for every dollar you invested in the marketing campaign, you earned $1.50 in return. A positive ROI is a good sign that your investment was worthwhile.

Debt to Equity Ratio Formula

One more formula that can help you understand your business’s financial situation is the debt to equity ratio formula. This formula helps you determine how much debt your business has compared to its equity (how much it’s worth).

Debt to Equity Ratio = Total Liabilities / Total Equity

For example, let’s say your business has $50,000 in liabilities (debt) and $100,000 in equity (value). Using the formula, you can calculate your debt to equity ratio:

Debt to Equity Ratio = $50,000 / $100,000 = 0.5 or 50%

This means that your business has $0.50 in debt for every $1 of equity. A low debt to equity ratio is generally a good sign, as it means your business is not overburdened with debt.

By using these simple math formulas, you can gain valuable insights into your business’s financial situation and make smart decisions for the future. Remember to calculate your break-even point, ROI, and debt to equity ratio regularly to stay on top of your finances. With careful planning and a little bit of math, you can maximize your business potential and achieve long-term success.

(Note: Do you have knowledge or insights to share? Unlock new opportunities and expand your reach by joining our authors team. Click Registration to join us and share your expertise with our readers.)

Share this:

Discovery new post:.

- Understanding the Categories of Business Finance: A Comprehensive Guide

- Understanding the 1.3.4 Sources of Business Finance: Choose the One That Fits Your Needs

- A Beginner’s Guide to How Business Financing Works

- Exploring the Role of Business Development in Private Equity: Techniques and Challenges

Hi, I'm Happy Sharer and I love sharing interesting and useful knowledge with others. I have a passion for learning and enjoy explaining complex concepts in a simple way.

Related Post

2023 food business trends: from sustainability to automation, future of the fashion business: top 5 trends to watch out for in 2023, the top food business trends that are taking the industry by storm, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Explore the Colors and Traditions of Global Cultural Festivals

5 simple strategies for learning english faster and more effectively, 5 common great dane health issues you need to know about.

Financial Math test: Pre-employment screening assessment to hire the best candidates

Summary of the financial math test.

This Financial Math test assesses a candidate’s ability to perform mathematical computations essential for identifying and evaluating financial outcomes. The test helps you identify candidates who can perform these computations efficiently and accurately.

Covered skills

Linear programming and mathematical progression

Time value of money

Application of time value of money in business

Use the Financial Math test to hire

Financial analysts, financial researchers, financial officers, executives, members of in-house finance and accounts departments, and anyone else responsible for performing mathematical analysis and computations for financial decision-making.

About the Financial Math test

Sustainable growth for many businesses depends on accurate financial information. At the core of this financial information is financial math: functions, computations, and arithmetic related to financial information. Proper business decision-making is supported by various mathematical analyses and computations.

High-quality financial mathematics is a hallmark of high-quality financial positions. To find suitable candidates for your organization, this screening test uses practical, scenario-based questions that ask candidates to solve financial math problems that regularly come up when handling finance-related matters, such as computation of present and future value, net present value, internal rate of return, real and nominal rate of return, and products leading to profit maximization.

Candidates performing well on this Financial Math test will possess a good understanding of financial math and help your organization solve complicated finance-related problems and computations. Successful candidates will provide valuable input for your company’s financial decisions.

All Financial Math test questions can be solved without using a calculator, but given the time constraints, access to a calculator is highly recommended for all candidates taking this test.

The test is made by a subject-matter expert

Abdul is a chartered accountant and certified ISO 31000 risk manager with over 15 years of experience managing other accountants and staff in many businesses, large and small. Abdul also has an MBA with significant consulting experience across business sectors, including oil and gas, pharmaceuticals, food, and education. He has worked as a university lecturer in accounting, finance, and tax-related subjects for more than five years and currently works on complex risk management policies as a senior risk management officer.

Crafted with expert knowledge

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation. Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject. Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

What our customers are saying

TestGorilla helps me to assess engineers rapidly. Creating assessments for different positions is easy due to pre-existing templates. You can create an assessment in less than 2 minutes. The interface is intuitive and it’s easy to visualize results per assessment.

VP of engineering, mid-market (51-1000 FTE)

Any tool can have functions—bells and whistles. Not every tool comes armed with staff passionate about making the user experience positive.

The TestGorilla team only offers useful insights to user challenges, they engage in conversation.

For instance, I recently asked a question about a Python test I intended to implement. Instead of receiving “oh, that test would work perfectly for your solution,” or, “at this time we’re thinking about implementing a solution that may or may not…” I received a direct and straightforward answer with additional thoughts to help shape the solution.

I hope that TestGorilla realizes the value proposition in their work is not only the platform but the type of support that’s provided.

For a bit of context—I am a diversity recruiter trying to create a platform that removes bias from the hiring process and encourages the discovery of new and unseen talent.

Chief Talent Connector, small business (50 or fewer FTE)

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Learn how each candidate performs on the job using our library of 400+ scientifically validated tests.

Test candidates for job-specific skills like coding or digital marketing, as well as general skills like critical thinking. Our unique personality and culture tests allow you to get to know your applicants as real people – not just pieces of paper.

Give all applicants an equal, unbiased opportunity to showcase their skills with our data-driven and performance-based ranking system.

With TestGorilla, you’ll get the best talent from all walks of life, allowing for a stronger, more diverse workplace.

Our short, customizable assessments and easy-to-use interface can be accessed from any device, with no login required.

Add your company logo, color theme, and more to leave a lasting impression that candidates will appreciate.

Watch what TestGorilla can do for you

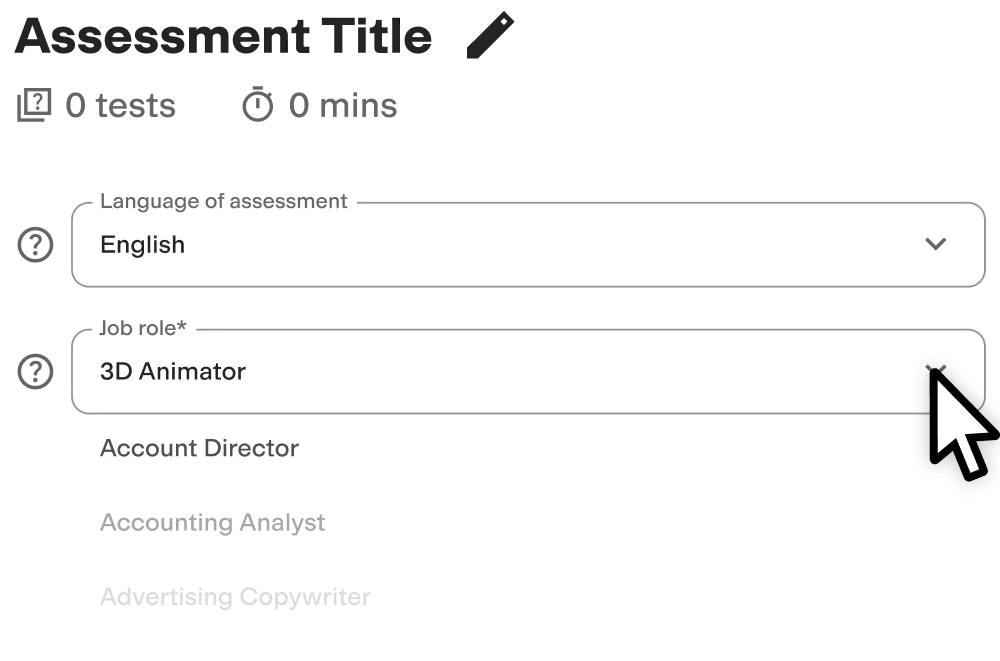

Create high-quality assessments, fast.

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

Building assessments is quick and easy with TestGorilla. Just pick a name, select the tests you need, then add your own custom questions.

You can customize your assessments further by adding your company logo, color theme, and more. Build the assessment that works for you.

Send email invites directly from TestGorilla, straight from your ATS, or connect with candidates by sharing a direct link.

Have a long list of candidates? Easily send multiple invites with a single click. You can also customize your email invites.

Discover your strongest candidates with TestGorilla’s easy-to-read output reports, rankings, and analytics.

Easily switch from a comprehensive overview to a detailed analysis of your candidates. Then, go beyond the data by watching personalized candidate videos.

View a sample report

The Financial Math test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.

An assessment is the total package of tests and custom questions that you put together to evaluate your candidates. Each individual test within an assessment is designed to test something specific, such as a job skill or language. An assessment can consist of up to 5 tests and 20 custom questions. You can have candidates respond to your custom questions in several ways, such as with a personalized video.

Yes! Custom questions are great for testing candidates in your own unique way. We support the following question types: video, multiple-choice, coding, file upload, and essay. Besides adding your own custom questions, you can also create your own tests.

A video question is a specific type of custom question you can add to your assessment. Video questions let you create a question and have your candidates use their webcam to record a video response. This is an excellent way to see how a candidate would conduct themselves in a live interview, and is especially useful for sales and hospitality roles. Some good examples of things to ask for video questions would be "Why do you want to work for our company?" or "Try to sell me an item you have on your desk right now."

Besides video questions, you can also add the following types of custom questions: multiple-choice, coding, file upload, and essay. Multiple-choice lets your candidates choose from a list of answers that you provide, coding lets you create a coding problem for them to solve, file upload allows your candidates to upload a file that you request (such as a resume or portfolio), and essay allows an open-ended text response to your question. You can learn more about different custom question types here .

Yes! You can add your own logo and company color theme to your assessments. This is a great way to leave a positive and lasting brand impression on your candidates.

Our team is always here to help. After you sign up, we’ll reach out to guide you through the first steps of setting up your TestGorilla account. If you have any further questions, you can contact our support team via email, chat or call. We also offer detailed guides in our extensive help center .

It depends! We offer five free tests, or unlimited access to our library of 400+ tests with the price based on your company size. Find more information on our pricing plans here , or speak to one of our sales team for your personalised demo and learn how we can help you revolutionize hiring today.

Yes. You can add up to five tests to each assessment.

We recommend using our assessment software as a pre-screening tool at the beginning of your recruitment process. You can add a link to the assessment in your job post or directly invite candidates by email.

TestGorilla replaces traditional resume screening with a much more reliable and efficient process, designed to find the most skilled candidates earlier and faster.

Related tests

Performance management, human-computer interaction design, instagram marketing, risk management, network engineering, store first-line management, ai product manager, computer networking fundamentals, linkedin advertising, data storytelling.

Total Instructional Time

The instructional time for RETAILING ranges from 24 hours (simulation exercises only) to 35 hours (simulation exercises, reading assignments , reading quizzes, and math quizzes) . You can configure your course to include or exclude reading assignments (3.7 hours) , reading quizzes (1.8 hours) and math quizzes (5.5 hours) . For instructions on how to configure your course, click here to access a series of videos to help you get your classroom up and running with Virtual Business.

Prior to beginning work with RETAILING , students should sign in to their account at vb.KnowledgeMatters.com and go through the Tutorial.

Lesson: Market Research

Description.

In this lesson, students learn that market research is critical to the success of a retail business. They begin by taking a survey of prospective customers to learn both product preferences and time of day preferences. Students then try to save some money by taking a similar survey but with reduced sample size. They are introduced to the mathematical concept of decreasing reliability of a survey as the sample size decreases. Students then explore the more sophisticated technique of analyzing survey data through segmentation. Finally, students use market research information to book radio advertising on a radio station that matches the demographic of their target customers. They run the simulation to try to achieve a specific profit goal.

LEARNING OBJECTIVES

- Define market research

- Explain the difference between primary and secondary research

- Determine an adequate sample size for a survey

- Use segmentation to analyze survey results

- Use market research to make smart advertising decisions for a business

Lesson: Product

In this lesson, students begin as managers of a grocery store that is performing poorly. They look at their location and surrounding customers. Next, students use surveys to discover what products these customers want. Unfortunately, those aren’t the products their store is currently stocking. They replace a non-popular product with a popular one and see sales rise. Students then add a display to carry another popular product and and see an additional increase in sales. Finally, students take over an electronics store with similar problems and work to change the product offerings in pursuit of a specific weekly profit goal.

- Explain the importance of product choices in retailing

- Use surveys to determine most popular products

- Be able to change product mix and interpret sales results

- Manage product selection to achieve profit goals

Lesson: Place

In this lesson, students learn about location...location, location. Students begin by looking around their city. They identify the available square footage of buildings and the cost per square foot for the space. They compare costs per square foot for downtown versus suburban locations. Students next study what types of customers are near each location. Students also scout competitor locations within the city. Finally, students are asked to choose a location for their store. They run the simulation to try to reach a specific profit goal. If they are not successful, they try relocating their store.

- Understand the concept of cost per square foot

- Be able to compare amount and cost of space at different locations

- Assess the types of customers around a given location

- Assess potential locations given competitor locations

- Choose a store location that will yield a profit

Lesson: Price

In this lesson, students see how prices interact with the law of supply and demand to determine sales levels. They begin by reviewing the concepts of price, cost and margin. They then intentionally set prices quite high and observe that volume and profits drop. Next, they try setting prices very low. The observe greatly increased volume, but profits remain low due to slim margins. They try a price in between the initial price points and see how profit can be maximized. They see how profit can be plotted as a curve against price levels. Students then learn about the use of “loss leaders” to drive customers into stores with very low prices on attractive items. Finally, students are challenged to set prices for their store to meet a specific weekly profit goal.

- Explain the relationship between price, cost, and margin

- Explain how prices and sales volume is related

- Find a price that maximizes profit by generated reasonable volume and reasonable margins

- Define a “loss leader”

- Set prices across all products to achieve a profit goal

Lesson: Promotion - Traditional Media

In this lesson, students study the role of promotion in the marketing mix. They begin by finding their current weekly revenue on their Income Statement. Students then examine where their current customers are coming from -- a relatively small area of the city. To grow their customer base, they lease a billboard across town then compare their increase in revenue with the expense of the billboard. As an alternative to billboard promotion, they try running a one page ad in a newspaper circular. Students compare the revenue and expenses of the two different forms of promotion. Finally, students use promotions of their choosing to achieve a weekly revenue goal while keeping their promotional spending below a specified level.

- Understand promotion as a key element of the marketing mix

- Identify different types of promotion

- Track revenue and expenses associated with promotional activities

- Be able to compare efficiency of promotional campaigns

- Choose promotional means to achieve business goals

Lesson: Promotion - Email

In this lesson, students explore the use of Email as part of the marketing mix. Email is a relatively new, but extremely important, component of retail promotion. Students begin by looking atways to assemble target lists, including customer loyalty programs and purchased lists of Email addresses. They purchase a list and then make a strong offer to attract customers to sign up to receive more Emails. Students discover some perils of Email promotion by trying to send to the same list too frequently. This results in high spam reports that could shut down their Email capability. Finally, students use what they have learned about Email to promote their business successfully and reach a specific profit goal.

- Identify different sources of Email address lists

- Understand the importance of subject lines and offers in Email marketing

- Track and analyze Email response metrics

- Avoid spam reports by properly spacing Emails

- Use Email promotion to achieve profit goals

Lesson: Staffing, Selling & Customer Service

In this lesson, students take responsibility for staffing several types of retail stores. They begin in a grocery store and set conservative staffing levels for cashiers and stockers. They observe customers complaining about long lines and unstocked shelves. Students correct the staffing problem and observe increased profit on their Income Statement. Next students switch to an electronics store with high-ticket items that may require consultative selling. They use sales reports to find an item that is selling poorly. They then add salespeople and use the sales report to examine the subsequent increase in sales. Finally, students take on a sporting goods store with poor overall staffing and are challenged to staff the store to make a specific profit goal.

- Explain several different job functions within a retail store

- List the problems that can result from understaffing at each position

- Discuss why some retail establishments staff salespeople while others don’t

- Understand the expense/revenue tradeoff of staffing decisions

- Adequately staff a retail store to achieve a profit goal

Lesson: Purchasing & Inventory Control

In this lesson, students take over the role of purchasing manager in a retail business. They begin by intentionally purchasing a very low, conservative amount. They observe employees and customers complaining that they can’t find products they need. Next, they try purchasing very large amounts. This eliminates stock-outs, but now they observe certain products expiring. Students identify a specific product with a short shelf-life and set a custom purchasing level to eliminate expiration. Then students see how they can re-allocate space in their backroom to insure adequate stockpiles of products. Finally, students take control of all purchasing to try to run a full week with no products expiring and no complaints of customers being unable to find goods.

- Explain why purchasing is essential to a retail business

- Understand target inventory levels

- Explain the tradeoffs between purchasing too much and too little

- Set custom purchasing policies for rapidly expiring items

- Manage purchasing for efficiency and customer satisfaction

Lesson: Merchandising

In this lesson, students take over control of the layout of their store. Students begin by finding their weekly revenue on their Income Statement. Their revenue is good, but not great. They then identify whether certain items in the store are more likely “needs” or “impulse” items. Students are next introduced to the merchandising concept of putting needs in the back of the store to draw customers past impulse items. They rearrange a need item and watch as revenue increases. Students then place a “complementary” good next to the item it complements. Again, they experience rising sales. Finally, students are asked to apply these principles by rearranging their store layout to achieve a specific weekly revenue goal.

- Define merchandising in a retail store

- Identify items that are likely needs

- Identify items that are likely impulse purchases

- Identify items that are likely complementers

- Describe strategies for placing needs, impulse items, and complementers

- Use merchandising principles to improve the revenue of a business

Lesson: Security & Risk Management

In this lesson, students take on the role of security consultant for three different types of retail stores. They begin by looking at shrinkage (unexplained product shortages) at a grocery store. They identify which items are likely being shoplifted and reduce shoplifting by moving those items to more visible areas. Next, they look at an electronics store with high value items. They install an expensive scanner system and compare its cost with the shoplifting losses prevented. Finally, they head to a sporting goods store with medium value items and try to find an appropriate security system that will reduce losses within a certain budget.

- Explain the importance of security in a retail business

- Given different options for increasing security

- Analyze the cost-effectiveness of a security system

- Plan store security to achieve profit goals

Lesson: Financing & Business Planning

In this lesson, students will discover how to estimate their financing needs when starting a new business. They begin by figuring out how much they will need to spend on their building lease, equipment leases, and initial inventory. They then add in staffing costs to estimate their total start-up expenses. They take out a loan for the appropriate amount and start the business. After several weeks, they look at their Balance Sheet to see what their lowest cash position was. Using this information, they take on the challenge of starting an even larger retail store. Their goal is to borrow enough money to get the business off the ground while minimizing financing costs.

- Understand that most business require substantial financing (capital) to get started

- Be able to estimate start-up costs for a business

- Monitor cash levels to determine adequacy of financing

- Extrapolate from a small business to a larger business when estimating financing needs

- Acquire adequate financing to start a business while minimizing financing costs

Lesson: Retailing Mogul - Unique City Per Class

In this capstone project, students put to use the knowledge and skills they have learned in the lessons. They are challenged to build a retail grocery business from the ground up. They must choose a location, design their store layout, staff the business, choose products to carry, set prices, and more. All students start in the same city and pursue a specific profit goal. By default, the class scoreboard is turned on so students can compare their profitability to others. The instructor can turn the scoreboard off.

- Understand the options for financing a start up

- Choose a suitable location for a business

- Design an effective retail floor plan

- Understands how to staff a retail business efficiently

- Plan merchandise selection and purchasing

- Use common financial statements to pursue a profit goal

- Understand the challenges and rewards of entrepreneurship

Lesson: Extra Credit: Retailing Mega Mogul - Unique City Per Class

In this extra credit project, students are free to explore all that the simulation has to offer. They can start grocery, sporting goods, and electronics stores. They can also start multiple stores of each type. This project is open-ended; students do not have a specific profit goal and can continue on as long as they desire. By default, the class scoreboard is turned on so instructors can use this project as a competition.

- Understand how to start a grocery business

- Understand how to start a sporting goods business

- Understand how to start an electronics business

- Compare and contrast running different types of retail businesses

- Manage the complexity of running multiple businesses

- Understand the importance of long-term planning and effort in growing a large business or businesses

Lesson: Extra Credit: Turnaround

In this extra credit project, students take over a struggling sporting goods retailer. The business has poor staffing, inappropriate product selection, and a terrible layout. Students are challenged to find and diagnose the problems. They then set about correcting them. Students learn that a single correction may not produce profits if other factors are not aligned. Eventually, students work through all the issues to achieve a profit. By default, the class scoreboard is turned on so students can compete against each other for the title of “Turnaround King.”

- Identify problems within an existing business

- Formulate corrective actions

- Use financial statements and other reports to assess effectiveness of corrections

- Understand how corrections in one area of a business affect and depend on other areas of the business

- Restore an unprofitable business to profitability

- High School

- News & Events

- Support Home

- Privacy Policy

- Share full article

For more audio journalism and storytelling, download New York Times Audio , a new iOS app available for news subscribers.

Ronna McDaniel, TV News and the Trump Problem

The former republican national committee chairwoman was hired by nbc and then let go after an outcry..

This transcript was created using speech recognition software. While it has been reviewed by human transcribers, it may contain errors. Please review the episode audio before quoting from this transcript and email [email protected] with any questions.

From “The New York Times,” I’m Michael Barbaro. This is “The Daily.”

[MUSIC PLAYING]

Today, the saga of Ronna McDaniel and NBC and what it reveals about the state of television news headed into the 2024 presidential race. Jim Rutenberg, a “Times” writer at large, is our guest.

It’s Monday, April 1.

Jim, NBC News just went through a very public, a very searing drama over the past week, that we wanted you to make sense of in your unique capacity as a longtime media and political reporter at “The Times.” This is your sweet spot. You were, I believe, born to dissect this story for us.

Oh, brother.

Well, on the one hand, this is a very small moment for a major network like NBC. They hire, as a contributor, not an anchor, not a correspondent, as a contributor, Ronna McDaniel, the former RNC chairwoman. It blows up in a mini scandal at the network.

But to me, it represents a much larger issue that’s been there since that moment Donald J. Trump took his shiny gold escalator down to announce his presidential run in 2015. This struggle by the news media to figure out, especially on television, how do we capture him, cover him for all of his lies, all the challenges he poses to Democratic norms, yet not alienate some 74, 75 million American voters who still follow him, still believe in him, and still want to hear his reality reflected in the news that they’re listening to?

Right. Which is about as gnarly a conundrum as anyone has ever dealt with in the news media.

Well, it’s proven so far unsolvable.

Well, let’s use the story of what actually happened with Ronna McDaniel and NBC to illustrate your point. And I think that means describing precisely what happened in this situation.

The story starts out so simply. It’s such a basic thing that television networks do. As elections get underway, they want people who will reflect the two parties.

They want talking heads. They want insiders. They want them on their payroll so they can rely on them whenever they need them. And they want them to be high level so they can speak with great knowledge about the two major candidates.

Right. And rather than needing to beg these people to come on their show at 6 o’clock, when they might be busy and it’s not their full-time job, they go off and they basically put them on retainer for a bunch of money.

Yeah. And in this case, here’s this perfect scenario because quite recently, Ronna McDaniel, the chairwoman of the Republican National Committee through the Trump era, most of it, is now out on the market. She’s actually recently been forced out of the party. And all the networks are interested because here’s the consummate insider from Trump world ready to get snatched up under contract for the next election and can really represent this movement that they’ve been trying to capture.

So NBC’S key news executives move pretty aggressively, pretty swiftly, and they sign her up for a $300,000 a year contributor’s contract.

Nice money if you can get it.

Not at millions of dollars that they pay their anchors, but a very nice contract. I’ll take it. You’ll take it. In the eyes of NBC execs she was perfect because she can be on “Meet the Press” as a panelist. She can help as they figure out some of their coverage. They have 24 hours a day to fill and here’s an official from the RNC. You can almost imagine the question that would be asked to her. It’s 10:00 PM on election night. Ronna, what are the Trump people thinking right now? They’re looking at the same numbers you are.

That was good, but that’s exactly it. And we all know it, right? This is television in our current era.

So last Friday, NBC makes what should be a routine announcement, but one they’re very proud of, that they’ve hired Ronna McDaniel. And in a statement, they say it couldn’t be a more important moment to have a voice like Ronna’s on the team. So all’s good, right? Except for there’s a fly in the ointment.

Because it turns out that Ronna McDaniel has been slated to appear on “Meet the Press,” not as a paid NBC contributor, but as a former recently ousted RNC chair with the “Meet The Press” host, Kristen Welker, who’s preparing to have a real tough interview with Ronna McDaniel. Because of course, Ronna McDaniel was chair of the party and at Trump’s side as he tried to refuse his election loss. So this was supposed to be a showdown interview.

From NBC News in Washington, the longest-running show in television history. This is “Meet The Press” with Kristen Welker.

And here, all of a sudden, Kristin Welker is thrown for a loop.

In full disclosure to our viewers, this interview was scheduled weeks before it was announced that McDaniel would become a paid NBC News contributor.

Because now, she’s actually interviewing a member of the family who’s on the same payroll.

Right. Suddenly, she’s interviewing a colleague.

This will be a news interview, and I was not involved in her hiring.

So what happens during the interview?

So Welker is prepared for a tough interview, and that’s exactly what she does.

Can you say, as you sit here today, did Joe Biden win the election fair and square?

He won. He’s the legitimate president.

Did he win fair and square?

Fair and square, he won. It’s certified. It’s done.

She presses her on the key question that a lot of Republicans get asked these days — do you accept Joe Biden was the winner of the election?

But, I do think, Kristen —

Ronna, why has it taken you until now to say that? Why has it taken you until now to be able to say that?

I’m going to push back a little.

McDaniel gets defensive at times.

Because I do think it’s fair to say there were problems in 2020. And to say that does not mean he’s not the legitimate president.

But, Ronna, when you say that, it suggests that there was something wrong with the election. And you know that the election was the most heavily scrutinized. Chris Krebs —

It’s a really combative interview.

I want to turn now to your actions in the aftermath of the 2020 election.

And Welker actually really does go deeply into McDaniel’s record in those weeks before January 6.

On November 17, you and Donald Trump were recorded pushing two Republican Michigan election officials not to certify the results of the election. And on the call —

For instance, she presses McDaniel on McDaniel’s role in an attempt to convince a couple county commissioner level canvassers in Michigan to not certify Biden’s victory.

Our call that night was to say, are you OK? Vote your conscience. Not pushing them to do anything.

McDaniel says, look, I was just telling them to vote their conscience. They should do whatever they think is right.

But you said, do not sign it. If you can go home tonight, do not sign it. How can people read that as anything other than a pressure campaign?

And Welker’s not going to just let her off the hook. Welker presses her on Trump’s own comments about January 6 and Trump’s efforts recently to gloss over some of the violence, and to say that those who have been arrested, he’ll free them.

Do you support that?

I want to be very clear. The violence that happened on January 6 is unacceptable.

And this is a frankly fascinating moment because you can hear McDaniel starting to, if not quite reverse some of her positions, though in some cases she does that, at least really soften her language. It’s almost as if she’s switching uniforms from the RNC one to an NBC one or almost like breaking from a role she was playing.

Ronna, why not speak out earlier? Why just speak out about that now?

When you’re the RNC chair, you kind of take one for the whole team, right? Now, I get to be a little bit more myself.

She says, hey, you know what? Sometimes as RNC chair, you just have to take it for the team sometimes.

Right. What she’s really saying is I did things as chairwoman of the Republican National committee that now that I no longer have that job, I can candidly say, I wished I hadn’t done, which is very honest. But it’s also another way of saying I’m two faced, or I was playing a part.

Ronna McDaniel, thank you very much for being here this morning.

Then something extraordinary happens. And I have to say, I’ve never seen a moment like this in decades of watching television news and covering television news.

Welcome back. The panel is here. Chuck Todd, NBC News chief political analyst.

Welker brings her regular panel on, including Chuck Todd, now the senior NBC political analyst.

Chuck, let’s dive right in. What were your takeaways?

And he launches right into what he calls —

Look, let me deal with the elephant in the room.

The elephant being this hiring of McDaniel.

I think our bosses owe you an apology for putting you in this situation.

And he proceeds, on NBC’S air, to lace into management for, as he describes it, putting Welker in this crazy awkward position.

Because I don’t know what to believe. She is now a paid contributor by NBC News. I have no idea whether any answer she gave to you was because she didn’t want to mess up her contract.

And Todd is very hung up on this idea that when she was speaking for the party, she would say one thing. And now that she’s on the payroll at NBC, she’s saying another thing.

She has credibility issues that she still has to deal with. Is she speaking for herself, or is she speaking on behalf of who’s paying her?

Todd is basically saying, how are we supposed to know which one to believe.

What can we believe?

It is important for this network and for always to have a wide aperture. Having ideological diversity on this panel is something I prided myself on.

And what he’s effectively saying is that his bosses should have never hired her in this capacity.

I understand the motivation, but this execution, I think, was poor.

Someone said to me last night we live in complicated times. Thank you guys for being here. I really appreciate it.

Now, let’s just note here, this isn’t just any player at NBC. Chuck Todd is obviously a major news name at the network. And him doing this appears to just open the floodgates across the entire NBC News brand, especially on its sister cable network, MSNBC.

And where I said I’d never seen anything like what I saw on “Meet the Press” that morning, I’d never seen anything like this either. Because now, the entire MSNBC lineup is in open rebellion. I mean, from the minute that the sun comes up. There is Joe Scarborough and Mika Brzezinski.

We weren’t asked our opinion of the hiring. But if we were, we would have strongly objected to it.

They’re on fire over this.

believe NBC News should seek out conservative Republican voices, but it should be conservative Republicans, not a person who used her position of power to be an anti-democracy election denier.

But it rolls out across the entire schedule.

Because Ronna McDaniel has been a major peddler of the big lie.

The fact that Ms. McDaniel is on the payroll at NBC News, to me that is inexplicable. I mean, you wouldn’t hire a mobster to work at a DA’s office.

Rachel Maddow devotes an entire half hour.

It’s not about just being associated with Donald Trump and his time in the Republican Party. It’s not even about lying or not lying. It’s about our system of government.

Thumbing their noses at our bosses and basically accusing them of abetting a traitorous figure in American history. I mean, just extraordinary stuff. It’s television history.

And let’s face it, we journalists, our bosses, we can be seen as crybabies, and we’re paid complaining. Yeah, that’s what we’re paid to do. But in this case, the NBC executives cannot ignore this, because in the outcry, there’s a very clear point that they’re all making. Ronna McDaniel is not just a voice from the other side. She was a fundamental part of Trump’s efforts to deny his election loss.

This is not inviting the other side. This is someone who’s on the wrong side —

Of history.

Of history, of these moments that we’ve covered and are still covering.

And I think it’s fair to say that at this point, everyone understands that Ronna McDaniel’s time at NBC News is going to be very short lived. Yeah, basically, after all this, the executives at NBC have to face facts it’s over. And on Tuesday night, they release a statement to the staff saying as much.

They don’t cite the questions about red lines or what Ronna McDaniel represented or didn’t represent. They just say we need to have a unified newsroom. We want cohesion. This isn’t working.

I think in the end, she was a paid contributor for four days.

Yeah, one of the shortest tenures in television news history. And look, in one respect, by their standards, this is kind of a pretty small contract, a few hundred thousand dollars they may have to pay out. But it was way more costly because they hired her. They brought her on board because they wanted to appeal to these tens of millions of Americans who still love Donald J. Trump.

And what happens now is that this entire thing is blown up in their face, and those very same people now see a network that, in their view, in the view of Republicans across the country, this network will not accept any Republicans. So it becomes more about that. And Fox News, NBC’S longtime rival, goes wall to wall with this.

Now, NBC News just caved to the breathless demands from their far left, frankly, emotionally unhinged host.

I mean, I had it on my desk all day. And every minute I looked at that screen, it was pounding on these liberals at NBC News driving this Republican out.

It’s the shortest tenure in TV history, I think. But why? Well, because she supports Donald Trump, period.

So in a way, this leaves NBC worse off with that Trump Republican audience they had wanted to court than maybe even they were before. It’s like a boomerang with a grenade on it.

Yeah, it completely explodes in their face. And that’s why to me, the whole episode is so representative of this eight-year conundrum for the news media, especially on television. They still haven’t been able to crack the code for how to handle the Trump movement, the Trump candidacy, and what it has wrought on the American political system and American journalism.

We’ll be right back.

Jim, put into context this painful episode of NBC into that larger conundrum you just diagnosed that the media has faced when it comes to Trump.

Well, Michael, it’s been there from the very beginning, from the very beginning of his political rise. The media was on this kind of seesaw. They go back and forth over how to cover him. Sometimes they want to cover him quite aggressively because he’s such a challenging candidate. He was bursting so many norms.

But at other times, there was this instinct to understand his appeal, for the same reason. He’s such an unusual candidate. So there was a great desire to really understand his voters. And frankly, to speak to his voters, because they’re part of the audience. And we all lived it, right?

But just let me take you back anyway because everything’s fresh again with perspective. And so if you go back, let’s look at when he first ran. The networks, if you recall, saw him as almost like a novelty candidate.

He was going to spice up what was expected to be a boring campaign between the usual suspects. And he was a ratings magnet. And the networks, they just couldn’t get enough of it. And they allowed him, at times, to really shatter their own norms.

Welcome back to “Meet the Press,” sir.

Good morning, Chuck.

Good morning. Let me start —

He was able to just call into the studio and riff with the likes of George Stephanopoulos and Chuck Todd.

What does it have to do with Hillary?

She can’t talk about me because nobody respects women more than Donald Trump.

And CNN gave him a lot of unmitigated airtime, if you recall during the campaign. They would run the press conferences.

It’s the largest winery on the East Coast. I own it 100 percent.

And let him promote his Trump steaks and his Trump wine.

Trump steaks. Where are the steaks? Do we have steaks?

I mean, it got that crazy. But again, the ratings were huge. And then he wins. And because they had previously given him all that airtime, they’ve, in retrospect, sort of given him a political gift, and more than that now have a journalistic imperative to really address him in a different way, to cover him as they would have covered any other candidate, which, let’s face it, they weren’t doing initially. So there’s this extra motivation to make up for lost ground and maybe for some journalistic omissions.

Right. Kind of correct for the lack of a rigorous journalistic filter in the campaign.

Exactly. And the big thing that this will be remembered for is we’re going to call a lie a lie.

I don’t want to sugarcoat this because facts matter, and the fact is President Trump lies.

Trump lies. We’re going to say it’s a lie.

And I think we can’t just mince around it because they are lies. And so we need to call them what they are.

We’re no longer going to use euphemisms or looser language we’re. Going to call it for what it is.

Trump lies in tweets. He spreads false information at rallies. He lies when he doesn’t need to. He lies when the truth is more than enough for him.

CNN was running chyrons. They would fact check Trump and call lies lies on the screen while Trump is talking. They were challenging Trump to his face —

One of the statements that you made in the tail end of the campaign in the midterms that —

Here we go.

That — well, if you don’t mind, Mr. President, that this caravan was an invasion.

— in these crazy press conferences —

They’re are hundreds of miles away, though. They’re hundreds and hundreds of miles away. That’s not an invasion.

Honestly, I think you should let me run the country. You run CNN. And if you did it well, your ratings —

Well, let me ask — if I may ask one other question. Mr. President, if I may ask another question. Are you worried —

That’s enough. That’s enough.

And Trump is giving it right back.

I tell you what, CNN should be ashamed of itself having you working for them. You are a rude, terrible person. You shouldn’t be working for CNN.

Very combative.

So this was this incredibly fraught moment for the American press. You’ve got tens of millions of Trump supporters seeing what’s really basic fact checking. These look like attacks to Trump supporters. Trump, in turn, is calling the press, the reporters are enemies of the people. So it’s a terrible dynamic.

And when January 6 happens, it’s so obviously out of control. And what the traditional press that follows, traditional journalistic rules has to do is make it clear that the claims that Trump is making about a stolen election are just so abjectly false that they don’t warrant a single minute of real consideration once the reporting has been done to show how false they are. And I think that American journalism really emerged from that feeling strongly about its own values and its own place in society.

But then there’s still tens of millions of Trump voters, and they don’t feel so good about the coverage. And they don’t agree that January 6 was an insurrection. And so we enter yet another period, where the press is going to have to now maybe rethink some things.

In what way?

Well, there’s a kind of quiet period after January 6. Trump is off of social media. The smoke is literally dissipating from the air in Washington. And news executives are kind of standing there on the proverbial battlefield, taking a new look at their situation.

And they’re seeing that in this clearer light, they’ve got some new problems, perhaps none more important for their entire business models than that their ratings are quickly crashing. And part of that diminishment is that a huge part of the country, that Trump-loving part of the audience, is really now severed from him from their coverage.

They see the press as actually, in some cases, being complicit in stealing an election. And so these news executives, again, especially on television, which is so ratings dependent, they’ve got a problem. So after presumably learning all these lessons about journalism and how to confront power, there’s a first subtle and then much less subtle rethinking.

Maybe we need to pull back from that approach. And maybe we need to take some new lessons and switch it up a little bit and reverse some of what we did. And one of the best examples of this is none other than CNN.

It had come under new management, was being led by a guy named Chris Licht, a veteran of cable news, but also Stephen Colbert’s late night show in his last job. And his new job under this new management is we’re going to recalibrate a little bit. So Chris Licht proceeds to try to bring the network back to the center.

And how does he do that?

Well, we see some key personalities who represented the Trump combat era start losing air time and some of them lose their jobs. There’s talk of, we want more Republicans on the air. There was a famous magazine article about Chris Licht’s balancing act here.

And Chris Licht says to a reporter, Tim Alberta of the “Atlantic” magazine, look, a lot in the media, including at his own network, quote unquote, “put on a jersey, took a side.” They took a side. And he says, I think we understand that jersey cannot go back on him. Because he says in the end of the day, by the way, it didn’t even work. We didn’t change anyone’s mind.

He’s saying that confrontational approach that defined the four years Trump was in office, that was a reaction to the feeling that TV news had failed to properly treat Trump with sufficient skepticism, that that actually was a failure both of journalism and of the TV news business. Is that what he’s saying?

Yeah. On the business side, it’s easier call, right? You want a bigger audience, and you’re not getting the bigger audience. But he’s making a journalistic argument as well that if the job is to convey the truth and take it to the people, and they take that into account as they make their own voting decisions and formulate their own opinions about American politics, if tens of millions of people who do believe that election was stolen are completely tuning you out because now they see you as a political combatant, you’re not achieving your ultimate goal as a journalist.

And what does Licht’s “don’t put a jersey back on” approach look like on CNN for its viewers?

Well, It didn’t look good. People might remember this, but the most glaring example —

Please welcome, the front runner for the Republican nomination for president, Donald Trump.

— was when he held a town hall meeting featuring Donald J. Trump, now candidate Trump, before an audience packed with Trump’s fans.

You look at what happened during that election. Unless you’re a very stupid person, you see what happens. A lot of the people —

Trump let loose a string of falsehoods.

Most people understand what happened. It was a rigged election.

The audience is pro-Trump audience, was cheering him on.

Are you ready? Are you ready? Can I talk?

Yeah, what’s your answer?

Can I? Do you mind?

I would like for you to answer the question.

OK. It’s very simple to answer.

That’s why I asked it.

It’s very simple. You’re a nasty person, I’ll tell you that.

And during, the CNN anchor hosting this, Kaitlan Collins, on CNN’s own air, it was a disaster.

It felt like a callback to the unlearned lessons of 2016.

Yeah. And in this case, CNN’s staff was up in arms.

Big shakeup in the cable news industry as CNN makes another change at the top.

Chris Licht is officially out at CNN after a chaotic run as chairman and CEO.

And Chris Licht didn’t survive it.

The chief executive’s departure comes as he faced criticism in recent weeks after the network hosted a town hall with Donald Trump and the network’s ratings started to drop.

But I want to say that the CNN leadership still, even after that, as they brought new leadership in, said, this is still the path we’re going to go on. Maybe that didn’t work out, but we’re still here. This is still what we have to do.

Right. And this idea is very much in the water of TV news, that this is the right overall direction.

Yeah. This is, by no means, isolated to CNN. This is throughout the traditional news business. These conversations are happening everywhere. But CNN was living it at that point.

And this, of course, is how we get to NBC deciding to hire Ronna McDaniel.

Right. Because they’re picking up — right where that conversation leaves off, they’re having the same conversation. But for NBC, you could argue this tension between journalistic values and audience. It’s even more pressing. Because even though MSNBC is a niche cable network, NBC News is part of an old-fashioned broadcast network. It’s on television stations throughout the country.

And in fact, those networks, they still have 6:30 newscasts. And believe it or not, millions of people still watch those every night. Maybe not as many as they used to, but there’s still some six or seven million people tuning in to nightly news. That’s important.

Right. We should say that kind of number is sometimes double or triple that of the cable news prime time shows that get all the attention.

On their best nights. So this is big business still. And that business is based on broad — it’s called broadcast for a reason. That’s based on broad audiences. So NBC had a business imperative, and they argue they had a journalistic imperative.

So given all of that, Jim, I think the big messy question here is, when it comes to NBC, did they make a tactical error around hiring the wrong Republican which blew up? Or did they make an even larger error in thinking that the way you handle Trump and his supporters is to work this hard to reach them, when they might not even be reachable?

The best way to answer that question is to tell you what they’re saying right now, NBC management. What the management saying is, yes, this was a tactical error. This was clearly the wrong Republican. We get it.

But they’re saying, we are going to — and they said this in their statement, announcing that they were severing ties with McDaniel. They said, we’re going to redouble our efforts to represent a broad spectrum of the American votership. And that’s what they meant was that we’re going to still try to reach these Trump voters with people who can relate to them and they can relate to.

But the question is, how do you even do that when so many of his supporters believe a lie? How is NBC, how is CNN, how are any of these TV networks, if they have decided that this is their mission, how are they supposed to speak to people who believe something fundamentally untrue as a core part of their political identity?

That’s the catch-22. How do you get that Trump movement person who’s also an insider, when the litmus test to be an insider in the Trump movement is to believe in the denialism or at least say you do? So that’s a real journalistic problem. And the thing that we haven’t really touched here is, what are these networks doing day in and day out?

They’re not producing reported pieces, which I think it’s a little easier. You just report the news. You go out into the world. You talk to people, and then you present it to the world as a nuanced portrait of the country. This thing is true. This thing is false. Again, in many cases, pretty straightforward. But their bread and butter is talking heads. It’s live. It’s not edited. It’s not that much reported.

So their whole business model especially, again, on cable, which has 24 hours to fill, is talking heads. And if you want the perspective from the Trump movement, journalistically, especially when it comes to denialism, but when it comes to some other major subjects in American life, you’re walking into a place where they’re going to say things that aren’t true, that don’t pass your journalistic standards, the most basic standards of journalism.

Right. So you’re saying if TV sticks with this model, the kind of low cost, lots of talk approach to news, then they are going to have to solve the riddle of who to bring on, who represents Trump’s America if they want that audience. And now they’ve got this red line that they’ve established, that that person can’t be someone who denies the 2020 election reality. But like you just said, that’s the litmus test for being in Trump’s orbit.

So this doesn’t really look like a conundrum. This looks like a bit of a crisis for TV news because it may end up meaning that they can’t hire that person that they need for this model, which means that perhaps a network like NBC does need to wave goodbye to a big segment of these viewers and these eyeballs who support Trump.

I mean, on the one hand, they are not ready to do that, and they would never concede that that’s something they’re ready to do. The problem is barring some kind of change in their news model, there’s no solution to this.

But why bar changes to their news model, I guess, is the question. Because over the years, it’s gotten more and more expensive to produce news, the news that I’m talking about, like recorded packages and what we refer to as reporting. Just go out and report the news.

Don’t gab about it. Just what’s going on, what’s true, what’s false. That’s actually very expensive in television. And they don’t have the kind of money they used to have. So the talking heads is their way to do programming at a level where they can afford it.

They do some packages. “60 Minutes” still does incredible work. NBC does packages, but the lion’s share of what they do is what we’re talking about. And that’s not going to change because the economics aren’t there.

So then a final option, of course, to borrow something Chris Licht said, is that a network like NBC perhaps doesn’t put a jersey on, but accepts the reality that a lot of the world sees them wearing a jersey.

Yeah. I mean, nobody wants to be seen as wearing a jersey in our business. No one wants to be wearing a jersey on our business. But maybe what they really have to accept is that we’re just sticking to the true facts, and that may look like we’re wearing a jersey, but we’re not. And that may, at times, look like it’s lining up more with the Democrats, but we’re not.

If Trump is lying about a stolen election, that’s not siding against him. That’s siding for the truth, and that’s what we’re doing. Easier said than done. And I don’t think any of these concepts are new.

I think there have been attempts to do that, but it’s the world they’re in. And it’s the only option they really have. We’re going to tell you the truth, even if it means that we’re going to lose a big part of the country.

Well, Jim, thank you very much.

Thank you, Michael.

Here’s what else you need to know today.

[PROTESTERS CHANTING]

Over the weekend, thousands of protesters took to the streets of Tel Aviv and Jerusalem in some of the largest domestic demonstrations against the government of Prime Minister Benjamin Netanyahu since Israel invaded Gaza in the fall.

[NON-ENGLISH SPEECH]

Some of the protesters called on Netanyahu to reach a cease fire deal that would free the hostages taken by Hamas on October 7. Others called for early elections that would remove Netanyahu from office.

During a news conference on Sunday, Netanyahu rejected calls for early elections, saying they would paralyze his government at a crucial moment in the war.

Today’s episode was produced by Rob Szypko, Rikki Novetsky, and Alex Stern, with help from Stella Tan.

It was edited by Brendan Klinkenberg with help from Rachel Quester and Paige Cowett. Contains original music by Marion Lozano, Dan Powell, and Rowan Niemisto and was engineered by Chris Wood. Our theme music is by Jim Brunberg and Ben Landsverk of Wonderly.

That’s it for “The Daily.” I’m Michael Barbaro. See you tomorrow.

- April 2, 2024 • 29:32 Kids Are Missing School at an Alarming Rate

- April 1, 2024 • 36:14 Ronna McDaniel, TV News and the Trump Problem

- March 29, 2024 • 48:42 Hamas Took Her, and Still Has Her Husband

- March 28, 2024 • 33:40 The Newest Tech Start-Up Billionaire? Donald Trump.

- March 27, 2024 • 28:06 Democrats’ Plan to Save the Republican House Speaker

- March 26, 2024 • 29:13 The United States vs. the iPhone

- March 25, 2024 • 25:59 A Terrorist Attack in Russia

- March 24, 2024 • 21:39 The Sunday Read: ‘My Goldendoodle Spent a Week at Some Luxury Dog ‘Hotels.’ I Tagged Along.’

- March 22, 2024 • 35:30 Chuck Schumer on His Campaign to Oust Israel’s Leader

- March 21, 2024 • 27:18 The Caitlin Clark Phenomenon

- March 20, 2024 • 25:58 The Bombshell Case That Will Transform the Housing Market

- March 19, 2024 • 27:29 Trump’s Plan to Take Away Biden’s Biggest Advantage

Hosted by Michael Barbaro

Featuring Jim Rutenberg

Produced by Rob Szypko , Rikki Novetsky and Alex Stern

With Stella Tan