Sample Size Calculator

Find out the sample size.

This calculator computes the minimum number of necessary samples to meet the desired statistical constraints.

Find Out the Margin of Error

This calculator gives out the margin of error or confidence interval of observation or survey.

Related Standard Deviation Calculator | Probability Calculator

In statistics, information is often inferred about a population by studying a finite number of individuals from that population, i.e. the population is sampled, and it is assumed that characteristics of the sample are representative of the overall population. For the following, it is assumed that there is a population of individuals where some proportion, p , of the population is distinguishable from the other 1-p in some way; e.g., p may be the proportion of individuals who have brown hair, while the remaining 1-p have black, blond, red, etc. Thus, to estimate p in the population, a sample of n individuals could be taken from the population, and the sample proportion, p̂ , calculated for sampled individuals who have brown hair. Unfortunately, unless the full population is sampled, the estimate p̂ most likely won't equal the true value p , since p̂ suffers from sampling noise, i.e. it depends on the particular individuals that were sampled. However, sampling statistics can be used to calculate what are called confidence intervals, which are an indication of how close the estimate p̂ is to the true value p .

Statistics of a Random Sample

The uncertainty in a given random sample (namely that is expected that the proportion estimate, p̂ , is a good, but not perfect, approximation for the true proportion p ) can be summarized by saying that the estimate p̂ is normally distributed with mean p and variance p(1-p)/n . For an explanation of why the sample estimate is normally distributed, study the Central Limit Theorem . As defined below, confidence level, confidence intervals, and sample sizes are all calculated with respect to this sampling distribution. In short, the confidence interval gives an interval around p in which an estimate p̂ is "likely" to be. The confidence level gives just how "likely" this is – e.g., a 95% confidence level indicates that it is expected that an estimate p̂ lies in the confidence interval for 95% of the random samples that could be taken. The confidence interval depends on the sample size, n (the variance of the sample distribution is inversely proportional to n , meaning that the estimate gets closer to the true proportion as n increases); thus, an acceptable error rate in the estimate can also be set, called the margin of error, ε , and solved for the sample size required for the chosen confidence interval to be smaller than e ; a calculation known as "sample size calculation."

Confidence Level

The confidence level is a measure of certainty regarding how accurately a sample reflects the population being studied within a chosen confidence interval. The most commonly used confidence levels are 90%, 95%, and 99%, which each have their own corresponding z-scores (which can be found using an equation or widely available tables like the one provided below) based on the chosen confidence level. Note that using z-scores assumes that the sampling distribution is normally distributed, as described above in "Statistics of a Random Sample." Given that an experiment or survey is repeated many times, the confidence level essentially indicates the percentage of the time that the resulting interval found from repeated tests will contain the true result.

Confidence Interval

In statistics, a confidence interval is an estimated range of likely values for a population parameter, for example, 40 ± 2 or 40 ± 5%. Taking the commonly used 95% confidence level as an example, if the same population were sampled multiple times, and interval estimates made on each occasion, in approximately 95% of the cases, the true population parameter would be contained within the interval. Note that the 95% probability refers to the reliability of the estimation procedure and not to a specific interval. Once an interval is calculated, it either contains or does not contain the population parameter of interest. Some factors that affect the width of a confidence interval include: size of the sample, confidence level, and variability within the sample.

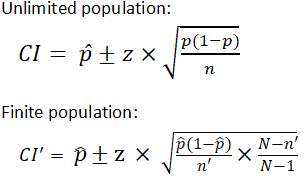

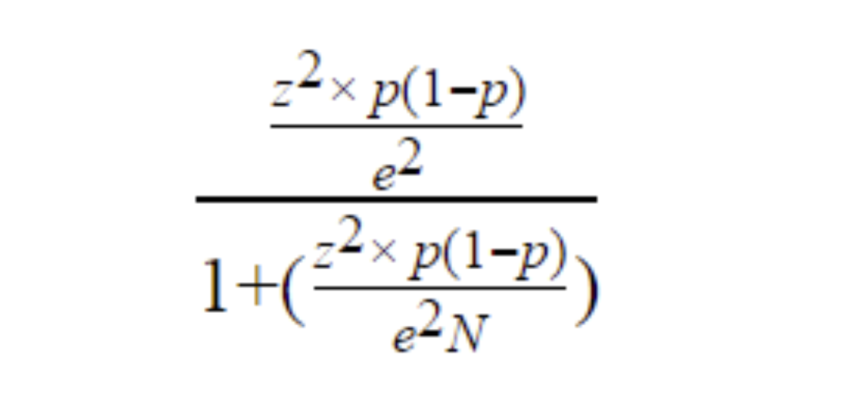

There are different equations that can be used to calculate confidence intervals depending on factors such as whether the standard deviation is known or smaller samples (n<30) are involved, among others. The calculator provided on this page calculates the confidence interval for a proportion and uses the following equations:

Within statistics, a population is a set of events or elements that have some relevance regarding a given question or experiment. It can refer to an existing group of objects, systems, or even a hypothetical group of objects. Most commonly, however, population is used to refer to a group of people, whether they are the number of employees in a company, number of people within a certain age group of some geographic area, or number of students in a university's library at any given time.

It is important to note that the equation needs to be adjusted when considering a finite population, as shown above. The (N-n)/(N-1) term in the finite population equation is referred to as the finite population correction factor, and is necessary because it cannot be assumed that all individuals in a sample are independent. For example, if the study population involves 10 people in a room with ages ranging from 1 to 100, and one of those chosen has an age of 100, the next person chosen is more likely to have a lower age. The finite population correction factor accounts for factors such as these. Refer below for an example of calculating a confidence interval with an unlimited population.

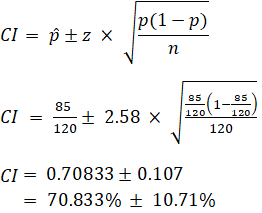

EX: Given that 120 people work at Company Q, 85 of which drink coffee daily, find the 99% confidence interval of the true proportion of people who drink coffee at Company Q on a daily basis.

Sample Size Calculation

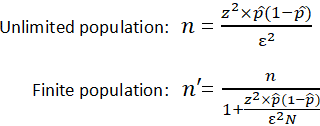

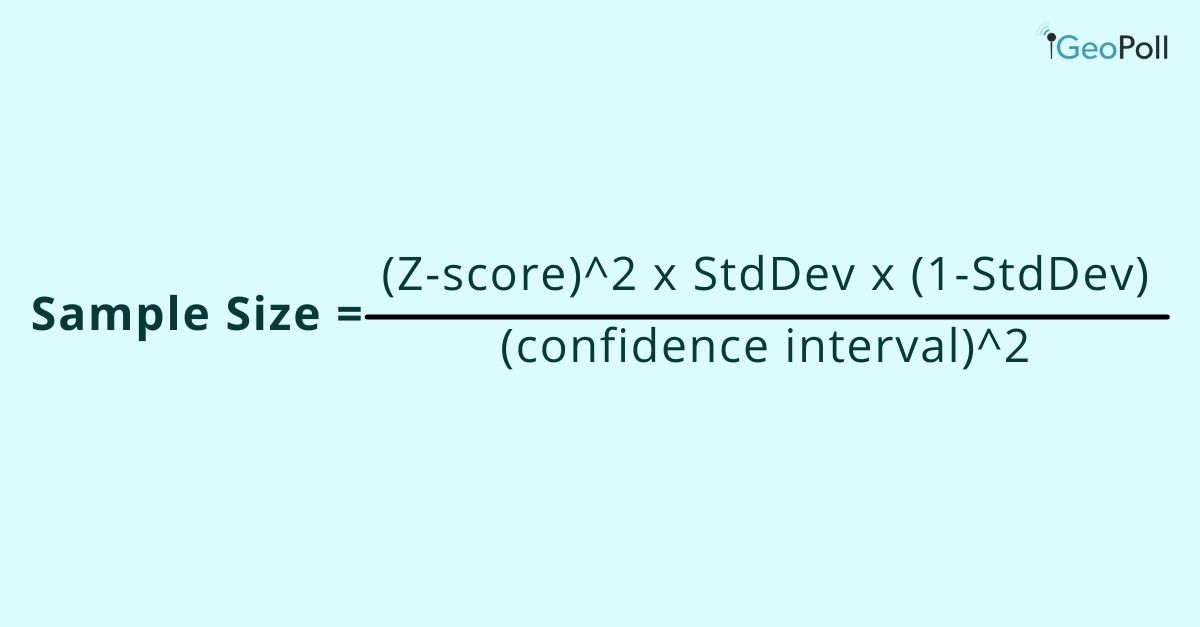

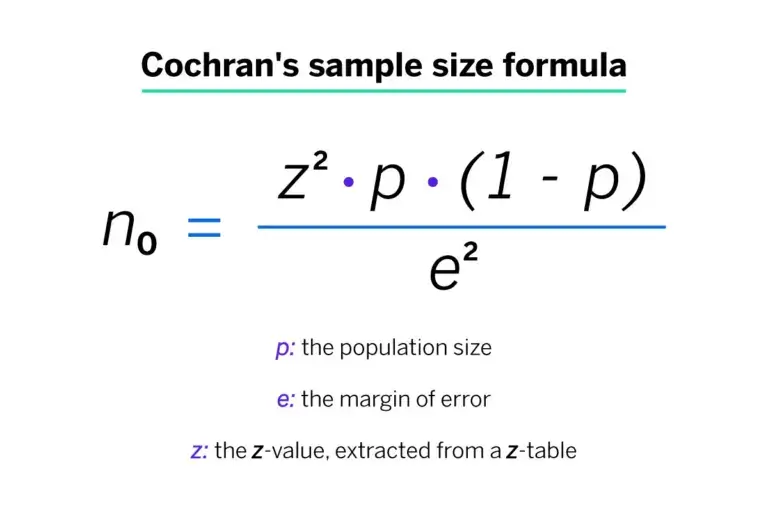

Sample size is a statistical concept that involves determining the number of observations or replicates (the repetition of an experimental condition used to estimate the variability of a phenomenon) that should be included in a statistical sample. It is an important aspect of any empirical study requiring that inferences be made about a population based on a sample. Essentially, sample sizes are used to represent parts of a population chosen for any given survey or experiment. To carry out this calculation, set the margin of error, ε , or the maximum distance desired for the sample estimate to deviate from the true value. To do this, use the confidence interval equation above, but set the term to the right of the ± sign equal to the margin of error, and solve for the resulting equation for sample size, n . The equation for calculating sample size is shown below.

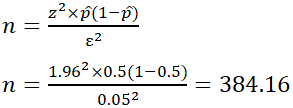

EX: Determine the sample size necessary to estimate the proportion of people shopping at a supermarket in the U.S. that identify as vegan with 95% confidence, and a margin of error of 5%. Assume a population proportion of 0.5, and unlimited population size. Remember that z for a 95% confidence level is 1.96. Refer to the table provided in the confidence level section for z scores of a range of confidence levels.

Thus, for the case above, a sample size of at least 385 people would be necessary. In the above example, some studies estimate that approximately 6% of the U.S. population identify as vegan, so rather than assuming 0.5 for p̂ , 0.06 would be used. If it was known that 40 out of 500 people that entered a particular supermarket on a given day were vegan, p̂ would then be 0.08.

- Previous Article

- Next Article

Six Approaches to Justify Sample Sizes

Six ways to evaluate which effect sizes are interesting, the value of information, what is your inferential goal, additional considerations when designing an informative study, competing interests, data availability, sample size justification.

- Split-Screen

- Article contents

- Figures & tables

- Supplementary Data

- Peer Review

- Open the PDF for in another window

- Guest Access

- Get Permissions

- Cite Icon Cite

- Search Site

Daniël Lakens; Sample Size Justification. Collabra: Psychology 5 January 2022; 8 (1): 33267. doi: https://doi.org/10.1525/collabra.33267

Download citation file:

- Ris (Zotero)

- Reference Manager

An important step when designing an empirical study is to justify the sample size that will be collected. The key aim of a sample size justification for such studies is to explain how the collected data is expected to provide valuable information given the inferential goals of the researcher. In this overview article six approaches are discussed to justify the sample size in a quantitative empirical study: 1) collecting data from (almost) the entire population, 2) choosing a sample size based on resource constraints, 3) performing an a-priori power analysis, 4) planning for a desired accuracy, 5) using heuristics, or 6) explicitly acknowledging the absence of a justification. An important question to consider when justifying sample sizes is which effect sizes are deemed interesting, and the extent to which the data that is collected informs inferences about these effect sizes. Depending on the sample size justification chosen, researchers could consider 1) what the smallest effect size of interest is, 2) which minimal effect size will be statistically significant, 3) which effect sizes they expect (and what they base these expectations on), 4) which effect sizes would be rejected based on a confidence interval around the effect size, 5) which ranges of effects a study has sufficient power to detect based on a sensitivity power analysis, and 6) which effect sizes are expected in a specific research area. Researchers can use the guidelines presented in this article, for example by using the interactive form in the accompanying online Shiny app, to improve their sample size justification, and hopefully, align the informational value of a study with their inferential goals.

Scientists perform empirical studies to collect data that helps to answer a research question. The more data that is collected, the more informative the study will be with respect to its inferential goals. A sample size justification should consider how informative the data will be given an inferential goal, such as estimating an effect size, or testing a hypothesis. Even though a sample size justification is sometimes requested in manuscript submission guidelines, when submitting a grant to a funder, or submitting a proposal to an ethical review board, the number of observations is often simply stated , but not justified . This makes it difficult to evaluate how informative a study will be. To prevent such concerns from emerging when it is too late (e.g., after a non-significant hypothesis test has been observed), researchers should carefully justify their sample size before data is collected.

Researchers often find it difficult to justify their sample size (i.e., a number of participants, observations, or any combination thereof). In this review article six possible approaches are discussed that can be used to justify the sample size in a quantitative study (see Table 1 ). This is not an exhaustive overview, but it includes the most common and applicable approaches for single studies. 1 The first justification is that data from (almost) the entire population has been collected. The second justification centers on resource constraints, which are almost always present, but rarely explicitly evaluated. The third and fourth justifications are based on a desired statistical power or a desired accuracy. The fifth justification relies on heuristics, and finally, researchers can choose a sample size without any justification. Each of these justifications can be stronger or weaker depending on which conclusions researchers want to draw from the data they plan to collect.

All of these approaches to the justification of sample sizes, even the ‘no justification’ approach, give others insight into the reasons that led to the decision for a sample size in a study. It should not be surprising that the ‘heuristics’ and ‘no justification’ approaches are often unlikely to impress peers. However, it is important to note that the value of the information that is collected depends on the extent to which the final sample size allows a researcher to achieve their inferential goals, and not on the sample size justification that is chosen.

The extent to which these approaches make other researchers judge the data that is collected as informative depends on the details of the question a researcher aimed to answer and the parameters they chose when determining the sample size for their study. For example, a badly performed a-priori power analysis can quickly lead to a study with very low informational value. These six justifications are not mutually exclusive, and multiple approaches can be considered when designing a study.

The informativeness of the data that is collected depends on the inferential goals a researcher has, or in some cases, the inferential goals scientific peers will have. A shared feature of the different inferential goals considered in this review article is the question which effect sizes a researcher considers meaningful to distinguish. This implies that researchers need to evaluate which effect sizes they consider interesting. These evaluations rely on a combination of statistical properties and domain knowledge. In Table 2 six possibly useful considerations are provided. This is not intended to be an exhaustive overview, but it presents common and useful approaches that can be applied in practice. Not all evaluations are equally relevant for all types of sample size justifications. The online Shiny app accompanying this manuscript provides researchers with an interactive form that guides researchers through the considerations for a sample size justification. These considerations often rely on the same information (e.g., effect sizes, the number of observations, the standard deviation, etc.) so these six considerations should be seen as a set of complementary approaches that can be used to evaluate which effect sizes are of interest.

To start, researchers should consider what their smallest effect size of interest is. Second, although only relevant when performing a hypothesis test, researchers should consider which effect sizes could be statistically significant given a choice of an alpha level and sample size. Third, it is important to consider the (range of) effect sizes that are expected. This requires a careful consideration of the source of this expectation and the presence of possible biases in these expectations. Fourth, it is useful to consider the width of the confidence interval around possible values of the effect size in the population, and whether we can expect this confidence interval to reject effects we considered a-priori plausible. Fifth, it is worth evaluating the power of the test across a wide range of possible effect sizes in a sensitivity power analysis. Sixth, a researcher can consider the effect size distribution of related studies in the literature.

Since all scientists are faced with resource limitations, they need to balance the cost of collecting each additional datapoint against the increase in information that datapoint provides. This is referred to as the value of information (Eckermann et al., 2010) . Calculating the value of information is notoriously difficult (Detsky, 1990) . Researchers need to specify the cost of collecting data, and weigh the costs of data collection against the increase in utility that having access to the data provides. From a value of information perspective not every data point that can be collected is equally valuable (J. Halpern et al., 2001; Wilson, 2015) . Whenever additional observations do not change inferences in a meaningful way, the costs of data collection can outweigh the benefits.

The value of additional information will in most cases be a non-monotonic function, especially when it depends on multiple inferential goals. A researcher might be interested in comparing an effect against a previously observed large effect in the literature, a theoretically predicted medium effect, and the smallest effect that would be practically relevant. In such a situation the expected value of sampling information will lead to different optimal sample sizes for each inferential goal. It could be valuable to collect informative data about a large effect, with additional data having less (or even a negative) marginal utility, up to a point where the data becomes increasingly informative about a medium effect size, with the value of sampling additional information decreasing once more until the study becomes increasingly informative about the presence or absence of a smallest effect of interest.

Because of the difficulty of quantifying the value of information, scientists typically use less formal approaches to justify the amount of data they set out to collect in a study. Even though the cost-benefit analysis is not always made explicit in reported sample size justifications, the value of information perspective is almost always implicitly the underlying framework that sample size justifications are based on. Throughout the subsequent discussion of sample size justifications, the importance of considering the value of information given inferential goals will repeatedly be highlighted.

Measuring (Almost) the Entire Population

In some instances it might be possible to collect data from (almost) the entire population under investigation. For example, researchers might use census data, are able to collect data from all employees at a firm or study a small population of top athletes. Whenever it is possible to measure the entire population, the sample size justification becomes straightforward: the researcher used all the data that is available.

Resource Constraints

A common reason for the number of observations in a study is that resource constraints limit the amount of data that can be collected at a reasonable cost (Lenth, 2001) . In practice, sample sizes are always limited by the resources that are available. Researchers practically always have resource limitations, and therefore even when resource constraints are not the primary justification for the sample size in a study, it is always a secondary justification.

Despite the omnipresence of resource limitations, the topic often receives little attention in texts on experimental design (for an example of an exception, see Bulus and Dong (2021) ). This might make it feel like acknowledging resource constraints is not appropriate, but the opposite is true: Because resource limitations always play a role, a responsible scientist carefully evaluates resource constraints when designing a study. Resource constraint justifications are based on a trade-off between the costs of data collection, and the value of having access to the information the data provides. Even if researchers do not explicitly quantify this trade-off, it is revealed in their actions. For example, researchers rarely spend all the resources they have on a single study. Given resource constraints, researchers are confronted with an optimization problem of how to spend resources across multiple research questions.

Time and money are two resource limitations all scientists face. A PhD student has a certain time to complete a PhD thesis, and is typically expected to complete multiple research lines in this time. In addition to time limitations, researchers have limited financial resources that often directly influence how much data can be collected. A third limitation in some research lines is that there might simply be a very small number of individuals from whom data can be collected, such as when studying patients with a rare disease. A resource constraint justification puts limited resources at the center of the justification for the sample size that will be collected, and starts with the resources a scientist has available. These resources are translated into an expected number of observations ( N ) that a researcher expects they will be able to collect with an amount of money in a given time. The challenge is to evaluate whether collecting N observations is worthwhile. How do we decide if a study will be informative, and when should we conclude that data collection is not worthwhile?

When evaluating whether resource constraints make data collection uninformative, researchers need to explicitly consider which inferential goals they have when collecting data (Parker & Berman, 2003) . Having data always provides more knowledge about the research question than not having data, so in an absolute sense, all data that is collected has value. However, it is possible that the benefits of collecting the data are outweighed by the costs of data collection.

It is most straightforward to evaluate whether data collection has value when we know for certain that someone will make a decision, with or without data. In such situations any additional data will reduce the error rates of a well-calibrated decision process, even if only ever so slightly. For example, without data we will not perform better than a coin flip if we guess which of two conditions has a higher true mean score on a measure. With some data, we can perform better than a coin flip by picking the condition that has the highest mean. With a small amount of data we would still very likely make a mistake, but the error rate is smaller than without any data. In these cases, the value of information might be positive, as long as the reduction in error rates is more beneficial than the cost of data collection.

Another way in which a small dataset can be valuable is if its existence eventually makes it possible to perform a meta-analysis (Maxwell & Kelley, 2011) . This argument in favor of collecting a small dataset requires 1) that researchers share the data in a way that a future meta-analyst can find it, and 2) that there is a decent probability that someone will perform a high-quality meta-analysis that will include this data in the future (S. D. Halpern et al., 2002) . The uncertainty about whether there will ever be such a meta-analysis should be weighed against the costs of data collection.

One way to increase the probability of a future meta-analysis is if researchers commit to performing this meta-analysis themselves, by combining several studies they have performed into a small-scale meta-analysis (Cumming, 2014) . For example, a researcher might plan to repeat a study for the next 12 years in a class they teach, with the expectation that after 12 years a meta-analysis of 12 studies would be sufficient to draw informative inferences (but see ter Schure and Grünwald (2019) ). If it is not plausible that a researcher will collect all the required data by themselves, they can attempt to set up a collaboration where fellow researchers in their field commit to collecting similar data with identical measures. If it is not likely that sufficient data will emerge over time to reach the inferential goals, there might be no value in collecting the data.

Even if a researcher believes it is worth collecting data because a future meta-analysis will be performed, they will most likely perform a statistical test on the data. To make sure their expectations about the results of such a test are well-calibrated, it is important to consider which effect sizes are of interest, and to perform a sensitivity power analysis to evaluate the probability of a Type II error for effects of interest. From the six ways to evaluate which effect sizes are interesting that will be discussed in the second part of this review, it is useful to consider the smallest effect size that can be statistically significant, the expected width of the confidence interval around the effect size, and effects that can be expected in a specific research area, and to evaluate the power for these effect sizes in a sensitivity power analysis. If a decision or claim is made, a compromise power analysis is worthwhile to consider when deciding upon the error rates while planning the study. When reporting a resource constraints sample size justification it is recommended to address the five considerations in Table 3 . Addressing these points explicitly facilitates evaluating if the data is worthwhile to collect. To make it easier to address all relevant points explicitly, an interactive form to implement the recommendations in this manuscript can be found at https://shiny.ieis.tue.nl/sample_size_justification/ .

A-priori Power Analysis

When designing a study where the goal is to test whether a statistically significant effect is present, researchers often want to make sure their sample size is large enough to prevent erroneous conclusions for a range of effect sizes they care about. In this approach to justifying a sample size, the value of information is to collect observations up to the point that the probability of an erroneous inference is, in the long run, not larger than a desired value. If a researcher performs a hypothesis test, there are four possible outcomes:

A false positive (or Type I error), determined by the α level. A test yields a significant result, even though the null hypothesis is true.

A false negative (or Type II error), determined by β , or 1 - power. A test yields a non-significant result, even though the alternative hypothesis is true.

A true negative, determined by 1- α . A test yields a non-significant result when the null hypothesis is true.

A true positive, determined by 1- β . A test yields a significant result when the alternative hypothesis is true.

Given a specified effect size, alpha level, and power, an a-priori power analysis can be used to calculate the number of observations required to achieve the desired error rates, given the effect size. 3 Figure 1 illustrates how the statistical power increases as the number of observations (per group) increases in an independent t test with a two-sided alpha level of 0.05. If we are interested in detecting an effect of d = 0.5, a sample size of 90 per condition would give us more than 90% power. Statistical power can be computed to determine the number of participants, or the number of items (Westfall et al., 2014) but can also be performed for single case studies (Ferron & Onghena, 1996; McIntosh & Rittmo, 2020)

Although it is common to set the Type I error rate to 5% and aim for 80% power, error rates should be justified (Lakens, Adolfi, et al., 2018) . As explained in the section on compromise power analysis, the default recommendation to aim for 80% power lacks a solid justification. In general, the lower the error rates (and thus the higher the power), the more informative a study will be, but the more resources are required. Researchers should carefully weigh the costs of increasing the sample size against the benefits of lower error rates, which would probably make studies designed to achieve a power of 90% or 95% more common for articles reporting a single study. An additional consideration is whether the researcher plans to publish an article consisting of a set of replication and extension studies, in which case the probability of observing multiple Type I errors will be very low, but the probability of observing mixed results even when there is a true effect increases (Lakens & Etz, 2017) , which would also be a reason to aim for studies with low Type II error rates, perhaps even by slightly increasing the alpha level for each individual study.

Figure 2 visualizes two distributions. The left distribution (dashed line) is centered at 0. This is a model for the null hypothesis. If the null hypothesis is true a statistically significant result will be observed if the effect size is extreme enough (in a two-sided test either in the positive or negative direction), but any significant result would be a Type I error (the dark grey areas under the curve). If there is no true effect, formally statistical power for a null hypothesis significance test is undefined. Any significant effects observed if the null hypothesis is true are Type I errors, or false positives, which occur at the chosen alpha level. The right distribution (solid line) is centered on an effect of d = 0.5. This is the specified model for the alternative hypothesis in this study, illustrating the expectation of an effect of d = 0.5 if the alternative hypothesis is true. Even though there is a true effect, studies will not always find a statistically significant result. This happens when, due to random variation, the observed effect size is too close to 0 to be statistically significant. Such results are false negatives (the light grey area under the curve on the right). To increase power, we can collect a larger sample size. As the sample size increases, the distributions become more narrow, reducing the probability of a Type II error. 4

It is important to highlight that the goal of an a-priori power analysis is not to achieve sufficient power for the true effect size. The true effect size is unknown. The goal of an a-priori power analysis is to achieve sufficient power, given a specific assumption of the effect size a researcher wants to detect. Just like a Type I error rate is the maximum probability of making a Type I error conditional on the assumption that the null hypothesis is true, an a-priori power analysis is computed under the assumption of a specific effect size. It is unknown if this assumption is correct. All a researcher can do is to make sure their assumptions are well justified. Statistical inferences based on a test where the Type II error rate is controlled are conditional on the assumption of a specific effect size. They allow the inference that, assuming the true effect size is at least as large as that used in the a-priori power analysis, the maximum Type II error rate in a study is not larger than a desired value.

This point is perhaps best illustrated if we consider a study where an a-priori power analysis is performed both for a test of the presence of an effect, as for a test of the absence of an effect. When designing a study, it essential to consider the possibility that there is no effect (e.g., a mean difference of zero). An a-priori power analysis can be performed both for a null hypothesis significance test, as for a test of the absence of a meaningful effect, such as an equivalence test that can statistically provide support for the null hypothesis by rejecting the presence of effects that are large enough to matter (Lakens, 2017; Meyners, 2012; Rogers et al., 1993) . When multiple primary tests will be performed based on the same sample, each analysis requires a dedicated sample size justification. If possible, a sample size is collected that guarantees that all tests are informative, which means that the collected sample size is based on the largest sample size returned by any of the a-priori power analyses.

For example, if the goal of a study is to detect or reject an effect size of d = 0.4 with 90% power, and the alpha level is set to 0.05 for a two-sided independent t test, a researcher would need to collect 133 participants in each condition for an informative null hypothesis test, and 136 participants in each condition for an informative equivalence test. Therefore, the researcher should aim to collect 272 participants in total for an informative result for both tests that are planned. This does not guarantee a study has sufficient power for the true effect size (which can never be known), but it guarantees the study has sufficient power given an assumption of the effect a researcher is interested in detecting or rejecting. Therefore, an a-priori power analysis is useful, as long as a researcher can justify the effect sizes they are interested in.

If researchers correct the alpha level when testing multiple hypotheses, the a-priori power analysis should be based on this corrected alpha level. For example, if four tests are performed, an overall Type I error rate of 5% is desired, and a Bonferroni correction is used, the a-priori power analysis should be based on a corrected alpha level of .0125.

An a-priori power analysis can be performed analytically, or by performing computer simulations. Analytic solutions are faster but less flexible. A common challenge researchers face when attempting to perform power analyses for more complex or uncommon tests is that available software does not offer analytic solutions. In these cases simulations can provide a flexible solution to perform power analyses for any test (Morris et al., 2019) . The following code is an example of a power analysis in R based on 10000 simulations for a one-sample t test against zero for a sample size of 20, assuming a true effect of d = 0.5. All simulations consist of first randomly generating data based on assumptions of the data generating mechanism (e.g., a normal distribution with a mean of 0.5 and a standard deviation of 1), followed by a test performed on the data. By computing the percentage of significant results, power can be computed for any design.

p <- numeric(10000) # to store p-values for (i in 1:10000) { #simulate 10k tests x <- rnorm(n = 20, mean = 0.5, sd = 1) p[i] <- t.test(x)$p.value # store p-value } sum(p < 0.05) / 10000 # Compute power

There is a wide range of tools available to perform power analyses. Whichever tool a researcher decides to use, it will take time to learn how to use the software correctly to perform a meaningful a-priori power analysis. Resources to educate psychologists about power analysis consist of book-length treatments (Aberson, 2019; Cohen, 1988; Julious, 2004; Murphy et al., 2014) , general introductions (Baguley, 2004; Brysbaert, 2019; Faul et al., 2007; Maxwell et al., 2008; Perugini et al., 2018) , and an increasing number of applied tutorials for specific tests (Brysbaert & Stevens, 2018; DeBruine & Barr, 2019; P. Green & MacLeod, 2016; Kruschke, 2013; Lakens & Caldwell, 2021; Schoemann et al., 2017; Westfall et al., 2014) . It is important to be trained in the basics of power analysis, and it can be extremely beneficial to learn how to perform simulation-based power analyses. At the same time, it is often recommended to enlist the help of an expert, especially when a researcher lacks experience with a power analysis for a specific test.

When reporting an a-priori power analysis, make sure that the power analysis is completely reproducible. If power analyses are performed in R it is possible to share the analysis script and information about the version of the package. In many software packages it is possible to export the power analysis that is performed as a PDF file. For example, in G*Power analyses can be exported under the ‘protocol of power analysis’ tab. If the software package provides no way to export the analysis, add a screenshot of the power analysis to the supplementary files.

The reproducible report needs to be accompanied by justifications for the choices that were made with respect to the values used in the power analysis. If the effect size used in the power analysis is based on previous research the factors presented in Table 5 (if the effect size is based on a meta-analysis) or Table 6 (if the effect size is based on a single study) should be discussed. If an effect size estimate is based on the existing literature, provide a full citation, and preferably a direct quote from the article where the effect size estimate is reported. If the effect size is based on a smallest effect size of interest, this value should not just be stated, but justified (e.g., based on theoretical predictions or practical implications, see Lakens, Scheel, and Isager (2018) ). For an overview of all aspects that should be reported when describing an a-priori power analysis, see Table 4 .

Planning for Precision

Some researchers have suggested to justify sample sizes based on a desired level of precision of the estimate (Cumming & Calin-Jageman, 2016; Kruschke, 2018; Maxwell et al., 2008) . The goal when justifying a sample size based on precision is to collect data to achieve a desired width of the confidence interval around a parameter estimate. The width of the confidence interval around the parameter estimate depends on the standard deviation and the number of observations. The only aspect a researcher needs to justify for a sample size justification based on accuracy is the desired width of the confidence interval with respect to their inferential goal, and their assumption about the population standard deviation of the measure.

If a researcher has determined the desired accuracy, and has a good estimate of the true standard deviation of the measure, it is straightforward to calculate the sample size needed for a desired level of accuracy. For example, when measuring the IQ of a group of individuals a researcher might desire to estimate the IQ score within an error range of 2 IQ points for 95% of the observed means, in the long run. The required sample size to achieve this desired level of accuracy (assuming normally distributed data) can be computed by:

where N is the number of observations, z is the critical value related to the desired confidence interval, sd is the standard deviation of IQ scores in the population, and error is the width of the confidence interval within which the mean should fall, with the desired error rate. In this example, (1.96 × 15 / 2)^2 = 216.1 observations. If a researcher desires 95% of the means to fall within a 2 IQ point range around the true population mean, 217 observations should be collected. If a desired accuracy for a non-zero mean difference is computed, accuracy is based on a non-central t -distribution. For these calculations an expected effect size estimate needs to be provided, but it has relatively little influence on the required sample size (Maxwell et al., 2008) . It is also possible to incorporate uncertainty about the observed effect size in the sample size calculation, known as assurance (Kelley & Rausch, 2006) . The MBESS package in R provides functions to compute sample sizes for a wide range of tests (Kelley, 2007) .

What is less straightforward is to justify how a desired level of accuracy is related to inferential goals. There is no literature that helps researchers to choose a desired width of the confidence interval. Morey (2020) convincingly argues that most practical use-cases of planning for precision involve an inferential goal of distinguishing an observed effect from other effect sizes (for a Bayesian perspective, see Kruschke (2018) ). For example, a researcher might expect an effect size of r = 0.4 and would treat observed correlations that differ more than 0.2 (i.e., 0.2 < r < 0.6) differently, in that effects of r = 0.6 or larger are considered too large to be caused by the assumed underlying mechanism (Hilgard, 2021) , while effects smaller than r = 0.2 are considered too small to support the theoretical prediction. If the goal is indeed to get an effect size estimate that is precise enough so that two effects can be differentiated with high probability, the inferential goal is actually a hypothesis test, which requires designing a study with sufficient power to reject effects (e.g., testing a range prediction of correlations between 0.2 and 0.6).

If researchers do not want to test a hypothesis, for example because they prefer an estimation approach over a testing approach, then in the absence of clear guidelines that help researchers to justify a desired level of precision, one solution might be to rely on a generally accepted norm of precision to aim for. This norm could be based on ideas about a certain resolution below which measurements in a research area no longer lead to noticeably different inferences. Just as researchers normatively use an alpha level of 0.05, they could plan studies to achieve a desired confidence interval width around the observed effect that is determined by a norm. Future work is needed to help researchers choose a confidence interval width when planning for accuracy.

When a researcher uses a heuristic, they are not able to justify their sample size themselves, but they trust in a sample size recommended by some authority. When I started as a PhD student in 2005 it was common to collect 15 participants in each between subject condition. When asked why this was a common practice, no one was really sure, but people trusted there was a justification somewhere in the literature. Now, I realize there was no justification for the heuristics we used. As Berkeley (1735) already observed: “Men learn the elements of science from others: And every learner hath a deference more or less to authority, especially the young learners, few of that kind caring to dwell long upon principles, but inclining rather to take them upon trust: And things early admitted by repetition become familiar: And this familiarity at length passeth for evidence.”

Some papers provide researchers with simple rules of thumb about the sample size that should be collected. Such papers clearly fill a need, and are cited a lot, even when the advice in these articles is flawed. For example, Wilson VanVoorhis and Morgan (2007) translate an absolute minimum of 50+8 observations for regression analyses suggested by a rule of thumb examined in S. B. Green (1991) into the recommendation to collect ~50 observations. Green actually concludes in his article that “In summary, no specific minimum number of subjects or minimum ratio of subjects-to-predictors was supported”. He does discuss how a general rule of thumb of N = 50 + 8 provided an accurate minimum number of observations for the ‘typical’ study in the social sciences because these have a ‘medium’ effect size, as Green claims by citing Cohen (1988) . Cohen actually didn’t claim that the typical study in the social sciences has a ‘medium’ effect size, and instead said (1988, p. 13) : “Many effects sought in personality, social, and clinical-psychological research are likely to be small effects as here defined”. We see how a string of mis-citations eventually leads to a misleading rule of thumb.

Rules of thumb seem to primarily emerge due to mis-citations and/or overly simplistic recommendations. Simonsohn, Nelson, and Simmons (2011) recommended that “Authors must collect at least 20 observations per cell”. A later recommendation by the same authors presented at a conference suggested to use n > 50, unless you study large effects (Simmons et al., 2013) . Regrettably, this advice is now often mis-cited as a justification to collect no more than 50 observations per condition without considering the expected effect size. If authors justify a specific sample size (e.g., n = 50) based on a general recommendation in another paper, either they are mis-citing the paper, or the paper they are citing is flawed.

Another common heuristic is to collect the same number of observations as were collected in a previous study. This strategy is not recommended in scientific disciplines with widespread publication bias, and/or where novel and surprising findings from largely exploratory single studies are published. Using the same sample size as a previous study is only a valid approach if the sample size justification in the previous study also applies to the current study. Instead of stating that you intend to collect the same sample size as an earlier study, repeat the sample size justification, and update it in light of any new information (such as the effect size in the earlier study, see Table 6 ).

Peer reviewers and editors should carefully scrutinize rules of thumb sample size justifications, because they can make it seem like a study has high informational value for an inferential goal even when the study will yield uninformative results. Whenever one encounters a sample size justification based on a heuristic, ask yourself: ‘Why is this heuristic used?’ It is important to know what the logic behind a heuristic is to determine whether the heuristic is valid for a specific situation. In most cases, heuristics are based on weak logic, and not widely applicable. It might be possible that fields develop valid heuristics for sample size justifications. For example, it is possible that a research area reaches widespread agreement that effects smaller than d = 0.3 are too small to be of interest, and all studies in a field use sequential designs (see below) that have 90% power to detect a d = 0.3. Alternatively, it is possible that a field agrees that data should be collected with a desired level of accuracy, irrespective of the true effect size. In these cases, valid heuristics would exist based on generally agreed goals of data collection. For example, Simonsohn (2015) suggests to design replication studies that have 2.5 times as large sample sizes as the original study, as this provides 80% power for an equivalence test against an equivalence bound set to the effect the original study had 33% power to detect, assuming the true effect size is 0. As original authors typically do not specify which effect size would falsify their hypothesis, the heuristic underlying this ‘small telescopes’ approach is a good starting point for a replication study with the inferential goal to reject the presence of an effect as large as was described in an earlier publication. It is the responsibility of researchers to gain the knowledge to distinguish valid heuristics from mindless heuristics, and to be able to evaluate whether a heuristic will yield an informative result given the inferential goal of the researchers in a specific study, or not.

No Justification

It might sound like a contradictio in terminis , but it is useful to distinguish a final category where researchers explicitly state they do not have a justification for their sample size. Perhaps the resources were available to collect more data, but they were not used. A researcher could have performed a power analysis, or planned for precision, but they did not. In those cases, instead of pretending there was a justification for the sample size, honesty requires you to state there is no sample size justification. This is not necessarily bad. It is still possible to discuss the smallest effect size of interest, the minimal statistically detectable effect, the width of the confidence interval around the effect size, and to plot a sensitivity power analysis, in relation to the sample size that was collected. If a researcher truly had no specific inferential goals when collecting the data, such an evaluation can perhaps be performed based on reasonable inferential goals peers would have when they learn about the existence of the collected data.

Do not try to spin a story where it looks like a study was highly informative when it was not. Instead, transparently evaluate how informative the study was given effect sizes that were of interest, and make sure that the conclusions follow from the data. The lack of a sample size justification might not be problematic, but it might mean that a study was not informative for most effect sizes of interest, which makes it especially difficult to interpret non-significant effects, or estimates with large uncertainty.

The inferential goal of data collection is often in some way related to the size of an effect. Therefore, to design an informative study, researchers will want to think about which effect sizes are interesting. First, it is useful to consider three effect sizes when determining the sample size. The first is the smallest effect size a researcher is interested in, the second is the smallest effect size that can be statistically significant (only in studies where a significance test will be performed), and the third is the effect size that is expected. Beyond considering these three effect sizes, it can be useful to evaluate ranges of effect sizes. This can be done by computing the width of the expected confidence interval around an effect size of interest (for example, an effect size of zero), and examine which effects could be rejected. Similarly, it can be useful to plot a sensitivity curve and evaluate the range of effect sizes the design has decent power to detect, as well as to consider the range of effects for which the design has low power. Finally, there are situations where it is useful to consider a range of effect that is likely to be observed in a specific research area.

What is the Smallest Effect Size of Interest?

The strongest possible sample size justification is based on an explicit statement of the smallest effect size that is considered interesting. A smallest effect size of interest can be based on theoretical predictions or practical considerations. For a review of approaches that can be used to determine a smallest effect size of interest in randomized controlled trials, see Cook et al. (2014) and Keefe et al. (2013) , for reviews of different methods to determine a smallest effect size of interest, see King (2011) and Copay, Subach, Glassman, Polly, and Schuler (2007) , and for a discussion focused on psychological research, see Lakens, Scheel, et al. (2018) .

It can be challenging to determine the smallest effect size of interest whenever theories are not very developed, or when the research question is far removed from practical applications, but it is still worth thinking about which effects would be too small to matter. A first step forward is to discuss which effect sizes are considered meaningful in a specific research line with your peers. Researchers will differ in the effect sizes they consider large enough to be worthwhile (Murphy et al., 2014) . Just as not every scientist will find every research question interesting enough to study, not every scientist will consider the same effect sizes interesting enough to study, and different stakeholders will differ in which effect sizes are considered meaningful (Kelley & Preacher, 2012) .

Even though it might be challenging, there are important benefits of being able to specify a smallest effect size of interest. The population effect size is always uncertain (indeed, estimating this is typically one of the goals of the study), and therefore whenever a study is powered for an expected effect size, there is considerable uncertainty about whether the statistical power is high enough to detect the true effect in the population. However, if the smallest effect size of interest can be specified and agreed upon after careful deliberation, it becomes possible to design a study that has sufficient power (given the inferential goal to detect or reject the smallest effect size of interest with a certain error rate). A smallest effect of interest may be subjective (one researcher might find effect sizes smaller than d = 0.3 meaningless, while another researcher might still be interested in effects larger than d = 0.1), and there might be uncertainty about the parameters required to specify the smallest effect size of interest (e.g., when performing a cost-benefit analysis), but after a smallest effect size of interest has been determined, a study can be designed with a known Type II error rate to detect or reject this value. For this reason an a-priori power based on a smallest effect size of interest is generally preferred, whenever researchers are able to specify one (Aberson, 2019; Albers & Lakens, 2018; Brown, 1983; Cascio & Zedeck, 1983; Dienes, 2014; Lenth, 2001) .

The Minimal Statistically Detectable Effect

The minimal statistically detectable effect, or the critical effect size, provides information about the smallest effect size that, if observed, would be statistically significant given a specified alpha level and sample size (Cook et al., 2014) . For any critical t value (e.g., t = 1.96 for α = 0.05, for large sample sizes) we can compute a critical mean difference (Phillips et al., 2001) , or a critical standardized effect size. For a two-sided independent t test the critical mean difference is:

and the critical standardized mean difference is:

In Figure 4 the distribution of Cohen’s d is plotted for 15 participants per group when the true effect size is either d = 0 or d = 0.5. This figure is similar to Figure 2 , with the addition that the critical d is indicated. We see that with such a small number of observations in each group only observed effects larger than d = 0.75 will be statistically significant. Whether such effect sizes are interesting, and can realistically be expected, should be carefully considered and justified.

G*Power provides the critical test statistic (such as the critical t value) when performing a power analysis. For example, Figure 5 shows that for a correlation based on a two-sided test, with α = 0.05, and N = 30, only effects larger than r = 0.361 or smaller than r = -0.361 can be statistically significant. This reveals that when the sample size is relatively small, the observed effect needs to be quite substantial to be statistically significant.

It is important to realize that due to random variation each study has a probability to yield effects larger than the critical effect size, even if the true effect size is small (or even when the true effect size is 0, in which case each significant effect is a Type I error). Computing a minimal statistically detectable effect is useful for a study where no a-priori power analysis is performed, both for studies in the published literature that do not report a sample size justification (Lakens, Scheel, et al., 2018) , as for researchers who rely on heuristics for their sample size justification.

It can be informative to ask yourself whether the critical effect size for a study design is within the range of effect sizes that can realistically be expected. If not, then whenever a significant effect is observed in a published study, either the effect size is surprisingly larger than expected, or more likely, it is an upwardly biased effect size estimate. In the latter case, given publication bias, published studies will lead to biased effect size estimates. If it is still possible to increase the sample size, for example by ignoring rules of thumb and instead performing an a-priori power analysis, then do so. If it is not possible to increase the sample size, for example due to resource constraints, then reflecting on the minimal statistically detectable effect should make it clear that an analysis of the data should not focus on p values, but on the effect size and the confidence interval (see Table 3 ).

It is also useful to compute the minimal statistically detectable effect if an ‘optimistic’ power analysis is performed. For example, if you believe a best case scenario for the true effect size is d = 0.57 and use this optimistic expectation in an a-priori power analysis, effects smaller than d = 0.4 will not be statistically significant when you collect 50 observations in a two independent group design. If your worst case scenario for the alternative hypothesis is a true effect size of d = 0.35 your design would not allow you to declare a significant effect if effect size estimates close to the worst case scenario are observed. Taking into account the minimal statistically detectable effect size should make you reflect on whether a hypothesis test will yield an informative answer, and whether your current approach to sample size justification (e.g., the use of rules of thumb, or letting resource constraints determine the sample size) leads to an informative study, or not.

What is the Expected Effect Size?

Although the true population effect size is always unknown, there are situations where researchers have a reasonable expectation of the effect size in a study, and want to use this expected effect size in an a-priori power analysis. Even if expectations for the observed effect size are largely a guess, it is always useful to explicitly consider which effect sizes are expected. A researcher can justify a sample size based on the effect size they expect, even if such a study would not be very informative with respect to the smallest effect size of interest. In such cases a study is informative for one inferential goal (testing whether the expected effect size is present or absent), but not highly informative for the second goal (testing whether the smallest effect size of interest is present or absent).

There are typically three sources for expectations about the population effect size: a meta-analysis, a previous study, or a theoretical model. It is tempting for researchers to be overly optimistic about the expected effect size in an a-priori power analysis, as higher effect size estimates yield lower sample sizes, but being too optimistic increases the probability of observing a false negative result. When reviewing a sample size justification based on an a-priori power analysis, it is important to critically evaluate the justification for the expected effect size used in power analyses.

Using an Estimate from a Meta-Analysis

In a perfect world effect size estimates from a meta-analysis would provide researchers with the most accurate information about which effect size they could expect. Due to widespread publication bias in science, effect size estimates from meta-analyses are regrettably not always accurate. They can be biased, sometimes substantially so. Furthermore, meta-analyses typically have considerable heterogeneity, which means that the meta-analytic effect size estimate differs for subsets of studies that make up the meta-analysis. So, although it might seem useful to use a meta-analytic effect size estimate of the effect you are studying in your power analysis, you need to take great care before doing so.

If a researcher wants to enter a meta-analytic effect size estimate in an a-priori power analysis, they need to consider three things (see Table 5 ). First, the studies included in the meta-analysis should be similar enough to the study they are performing that it is reasonable to expect a similar effect size. In essence, this requires evaluating the generalizability of the effect size estimate to the new study. It is important to carefully consider differences between the meta-analyzed studies and the planned study, with respect to the manipulation, the measure, the population, and any other relevant variables.

Second, researchers should check whether the effect sizes reported in the meta-analysis are homogeneous. If not, and there is considerable heterogeneity in the meta-analysis, it means not all included studies can be expected to have the same true effect size estimate. A meta-analytic estimate should be used based on the subset of studies that most closely represent the planned study. Note that heterogeneity remains a possibility (even direct replication studies can show heterogeneity when unmeasured variables moderate the effect size in each sample (Kenny & Judd, 2019; Olsson-Collentine et al., 2020) ), so the main goal of selecting similar studies is to use existing data to increase the probability that your expectation is accurate, without guaranteeing it will be.

Third, the meta-analytic effect size estimate should not be biased. Check if the bias detection tests that are reported in the meta-analysis are state-of-the-art, or perform multiple bias detection tests yourself (Carter et al., 2019) , and consider bias corrected effect size estimates (even though these estimates might still be biased, and do not necessarily reflect the true population effect size).

Using an Estimate from a Previous Study

If a meta-analysis is not available, researchers often rely on an effect size from a previous study in an a-priori power analysis. The first issue that requires careful attention is whether the two studies are sufficiently similar. Just as when using an effect size estimate from a meta-analysis, researchers should consider if there are differences between the studies in terms of the population, the design, the manipulations, the measures, or other factors that should lead one to expect a different effect size. For example, intra-individual reaction time variability increases with age, and therefore a study performed on older participants should expect a smaller standardized effect size than a study performed on younger participants. If an earlier study used a very strong manipulation, and you plan to use a more subtle manipulation, a smaller effect size should be expected. Finally, effect sizes do not generalize to studies with different designs. For example, the effect size for a comparison between two groups is most often not similar to the effect size for an interaction in a follow-up study where a second factor is added to the original design (Lakens & Caldwell, 2021) .

Even if a study is sufficiently similar, statisticians have warned against using effect size estimates from small pilot studies in power analyses. Leon, Davis, and Kraemer (2011) write:

Contrary to tradition, a pilot study does not provide a meaningful effect size estimate for planning subsequent studies due to the imprecision inherent in data from small samples.

The two main reasons researchers should be careful when using effect sizes from studies in the published literature in power analyses is that effect size estimates from studies can differ from the true population effect size due to random variation, and that publication bias inflates effect sizes. Figure 6 shows the distribution for η p 2 for a study with three conditions with 25 participants in each condition when the null hypothesis is true and when there is a ‘medium’ true effect of η p 2 = 0.0588 (Richardson, 2011) . As in Figure 4 the critical effect size is indicated, which shows observed effects smaller than η p 2 = 0.08 will not be significant with the given sample size. If the null hypothesis is true effects larger than η p 2 = 0.08 will be a Type I error (the dark grey area), and when the alternative hypothesis is true effects smaller than η p 2 = 0.08 will be a Type II error (light grey area). It is clear all significant effects are larger than the true effect size ( η p 2 = 0.0588), so power analyses based on a significant finding (e.g., because only significant results are published in the literature) will be based on an overestimate of the true effect size, introducing bias.

But even if we had access to all effect sizes (e.g., from pilot studies you have performed yourself) due to random variation the observed effect size will sometimes be quite small. Figure 6 shows it is quite likely to observe an effect of η p 2 = 0.01 in a small pilot study, even when the true effect size is 0.0588. Entering an effect size estimate of η p 2 = 0.01 in an a-priori power analysis would suggest a total sample size of 957 observations to achieve 80% power in a follow-up study. If researchers only follow up on pilot studies when they observe an effect size in the pilot study that, when entered into a power analysis, yields a sample size that is feasible to collect for the follow-up study, these effect size estimates will be upwardly biased, and power in the follow-up study will be systematically lower than desired (Albers & Lakens, 2018) .

In essence, the problem with using small studies to estimate the effect size that will be entered into an a-priori power analysis is that due to publication bias or follow-up bias the effect sizes researchers end up using for their power analysis do not come from a full F distribution, but from what is known as a truncated F distribution (Taylor & Muller, 1996) . For example, imagine if there is extreme publication bias in the situation illustrated in Figure 6 . The only studies that would be accessible to researchers would come from the part of the distribution where η p 2 > 0.08, and the test result would be statistically significant. It is possible to compute an effect size estimate that, based on certain assumptions, corrects for bias. For example, imagine we observe a result in the literature for a One-Way ANOVA with 3 conditions, reported as F (2, 42) = 0.017, η p 2 = 0.176. If we would take this effect size at face value and enter it as our effect size estimate in an a-priori power analysis, the suggested sample size to achieve 80% power would suggest we need to collect 17 observations in each condition.

However, if we assume bias is present, we can use the BUCSS R package (S. F. Anderson et al., 2017) to perform a power analysis that attempts to correct for bias. A power analysis that takes bias into account (under a specific model of publication bias, based on a truncated F distribution where only significant results are published) suggests collecting 73 participants in each condition. It is possible that the bias corrected estimate of the non-centrality parameter used to compute power is zero, in which case it is not possible to correct for bias using this method. As an alternative to formally modeling a correction for publication bias whenever researchers assume an effect size estimate is biased, researchers can simply use a more conservative effect size estimate, for example by computing power based on the lower limit of a 60% two-sided confidence interval around the effect size estimate, which Perugini, Gallucci, and Costantini (2014) refer to as safeguard power . Both these approaches lead to a more conservative power analysis, but not necessarily a more accurate power analysis. It is simply not possible to perform an accurate power analysis on the basis of an effect size estimate from a study that might be biased and/or had a small sample size (Teare et al., 2014) . If it is not possible to specify a smallest effect size of interest, and there is great uncertainty about which effect size to expect, it might be more efficient to perform a study with a sequential design (discussed below).

To summarize, an effect size from a previous study in an a-priori power analysis can be used if three conditions are met (see Table 6 ). First, the previous study is sufficiently similar to the planned study. Second, there was a low risk of bias (e.g., the effect size estimate comes from a Registered Report, or from an analysis for which results would not have impacted the likelihood of publication). Third, the sample size is large enough to yield a relatively accurate effect size estimate, based on the width of a 95% CI around the observed effect size estimate. There is always uncertainty around the effect size estimate, and entering the upper and lower limit of the 95% CI around the effect size estimate might be informative about the consequences of the uncertainty in the effect size estimate for an a-priori power analysis.

Using an Estimate from a Theoretical Model

When your theoretical model is sufficiently specific such that you can build a computational model, and you have knowledge about key parameters in your model that are relevant for the data you plan to collect, it is possible to estimate an effect size based on the effect size estimate derived from a computational model. For example, if one had strong ideas about the weights for each feature stimuli share and differ on, it could be possible to compute predicted similarity judgments for pairs of stimuli based on Tversky’s contrast model (Tversky, 1977) , and estimate the predicted effect size for differences between experimental conditions. Although computational models that make point predictions are relatively rare, whenever they are available, they provide a strong justification of the effect size a researcher expects.

Compute the Width of the Confidence Interval around the Effect Size

If a researcher can estimate the standard deviation of the observations that will be collected, it is possible to compute an a-priori estimate of the width of the 95% confidence interval around an effect size (Kelley, 2007) . Confidence intervals represent a range around an estimate that is wide enough so that in the long run the true population parameter will fall inside the confidence intervals 100 - α percent of the time. In any single study the true population effect either falls in the confidence interval, or it doesn’t, but in the long run one can act as if the confidence interval includes the true population effect size (while keeping the error rate in mind). Cumming (2013) calls the difference between the observed effect size and the upper bound of the 95% confidence interval (or the lower bound of the 95% confidence interval) the margin of error.

If we compute the 95% CI for an effect size of d = 0 based on the t statistic and sample size (Smithson, 2003) , we see that with 15 observations in each condition of an independent t test the 95% CI ranges from d = -0.72 to d = 0.72 5 . The margin of error is half the width of the 95% CI, 0.72. A Bayesian estimator who uses an uninformative prior would compute a credible interval with the same (or a very similar) upper and lower bound (Albers et al., 2018; Kruschke, 2011) , and might conclude that after collecting the data they would be left with a range of plausible values for the population effect that is too large to be informative. Regardless of the statistical philosophy you plan to rely on when analyzing the data, the evaluation of what we can conclude based on the width of our interval tells us that with 15 observation per group we will not learn a lot.

One useful way of interpreting the width of the confidence interval is based on the effects you would be able to reject if the true effect size is 0. In other words, if there is no effect, which effects would you have been able to reject given the collected data, and which effect sizes would not be rejected, if there was no effect? Effect sizes in the range of d = 0.7 are findings such as “People become aggressive when they are provoked”, “People prefer their own group to other groups”, and “Romantic partners resemble one another in physical attractiveness” (Richard et al., 2003) . The width of the confidence interval tells you that you can only reject the presence of effects that are so large, if they existed, you would probably already have noticed them. If it is true that most effects that you study are realistically much smaller than d = 0.7, there is a good possibility that we do not learn anything we didn’t already know by performing a study with n = 15. Even without data, in most research lines we would not consider certain large effects plausible (although the effect sizes that are plausible differ between fields, as discussed below). On the other hand, in large samples where researchers can for example reject the presence of effects larger than d = 0.2, if the null hypothesis was true, this analysis of the width of the confidence interval would suggest that peers in many research lines would likely consider the study to be informative.

We see that the margin of error is almost, but not exactly, the same as the minimal statistically detectable effect ( d = 0.75). The small variation is due to the fact that the 95% confidence interval is calculated based on the t distribution. If the true effect size is not zero, the confidence interval is calculated based on the non-central t distribution, and the 95% CI is asymmetric. Figure 7 visualizes three t distributions, one symmetric at 0, and two asymmetric distributions with a noncentrality parameter (the normalized difference between the means) of 2 and 3. The asymmetry is most clearly visible in very small samples (the distributions in the plot have 5 degrees of freedom) but remains noticeable in larger samples when calculating confidence intervals and statistical power. For example, for a true effect size of d = 0.5 observed with 15 observations per group would yield d s = 0.50, 95% CI [-0.23, 1.22]. If we compute the 95% CI around the critical effect size, we would get d s = 0.75, 95% CI [0.00, 1.48]. We see the 95% CI ranges from exactly 0.00 to 1.48, in line with the relation between a confidence interval and a p value, where the 95% CI excludes zero if the test is statistically significant. As noted before, the different approaches recommended here to evaluate how informative a study is are often based on the same information.

Plot a Sensitivity Power Analysis

A sensitivity power analysis fixes the sample size, desired power, and alpha level, and answers the question which effect size a study could detect with a desired power. A sensitivity power analysis is therefore performed when the sample size is already known. Sometimes data has already been collected to answer a different research question, or the data is retrieved from an existing database, and you want to perform a sensitivity power analysis for a new statistical analysis. Other times, you might not have carefully considered the sample size when you initially collected the data, and want to reflect on the statistical power of the study for (ranges of) effect sizes of interest when analyzing the results. Finally, it is possible that the sample size will be collected in the future, but you know that due to resource constraints the maximum sample size you can collect is limited, and you want to reflect on whether the study has sufficient power for effects that you consider plausible and interesting (such as the smallest effect size of interest, or the effect size that is expected).

Assume a researcher plans to perform a study where 30 observations will be collected in total, 15 in each between participant condition. Figure 8 shows how to perform a sensitivity power analysis in G*Power for a study where we have decided to use an alpha level of 5%, and desire 90% power. The sensitivity power analysis reveals the designed study has 90% power to detect effects of at least d = 1.23. Perhaps a researcher believes that a desired power of 90% is quite high, and is of the opinion that it would still be interesting to perform a study if the statistical power was lower. It can then be useful to plot a sensitivity curve across a range of smaller effect sizes.

The two dimensions of interest in a sensitivity power analysis are the effect sizes, and the power to observe a significant effect assuming a specific effect size. These two dimensions can be plotted against each other to create a sensitivity curve. For example, a sensitivity curve can be plotted in G*Power by clicking the ‘X-Y plot for a range of values’ button, as illustrated in Figure 9 . Researchers can examine which power they would have for an a-priori plausible range of effect sizes, or they can examine which effect sizes would provide reasonable levels of power. In simulation-based approaches to power analysis, sensitivity curves can be created by performing the power analysis for a range of possible effect sizes. Even if 50% power is deemed acceptable (in which case deciding to act as if the null hypothesis is true after a non-significant result is a relatively noisy decision procedure), Figure 9 shows a study design where power is extremely low for a large range of effect sizes that are reasonable to expect in most fields. Thus, a sensitivity power analysis provides an additional approach to evaluate how informative the planned study is, and can inform researchers that a specific design is unlikely to yield a significant effect for a range of effects that one might realistically expect.

If the number of observations per group had been larger, the evaluation might have been more positive. We might not have had any specific effect size in mind, but if we had collected 150 observations per group, a sensitivity analysis could have shown that power was sufficient for a range of effects we believe is most interesting to examine, and we would still have approximately 50% power for quite small effects. For a sensitivity analysis to be meaningful, the sensitivity curve should be compared against a smallest effect size of interest, or a range of effect sizes that are expected. A sensitivity power analysis has no clear cut-offs to examine (Bacchetti, 2010) . Instead, the idea is to make a holistic trade-off between different effect sizes one might observe or care about, and their associated statistical power.

The Distribution of Effect Sizes in a Research Area

In my personal experience the most commonly entered effect size estimate in an a-priori power analysis for an independent t test is Cohen’s benchmark for a ‘medium’ effect size, because of what is known as the default effect . When you open G*Power, a ‘medium’ effect is the default option for an a-priori power analysis. Cohen’s benchmarks for small, medium, and large effects should not be used in an a-priori power analysis (Cook et al., 2014; Correll et al., 2020) , and Cohen regretted having proposed these benchmarks (Funder & Ozer, 2019) . The large variety in research topics means that any ‘default’ or ‘heuristic’ that is used to compute statistical power is not just unlikely to correspond to your actual situation, but it is also likely to lead to a sample size that is substantially misaligned with the question you are trying to answer with the collected data.

Some researchers have wondered what a better default would be, if researchers have no other basis to decide upon an effect size for an a-priori power analysis. Brysbaert (2019) recommends d = 0.4 as a default in psychology, which is the average observed in replication projects and several meta-analyses. It is impossible to know if this average effect size is realistic, but it is clear there is huge heterogeneity across fields and research questions. Any average effect size will often deviate substantially from the effect size that should be expected in a planned study. Some researchers have suggested to change Cohen’s benchmarks based on the distribution of effect sizes in a specific field (Bosco et al., 2015; Funder & Ozer, 2019; Hill et al., 2008; Kraft, 2020; Lovakov & Agadullina, 2017) . As always, when effect size estimates are based on the published literature, one needs to evaluate the possibility that the effect size estimates are inflated due to publication bias. Due to the large variation in effect sizes within a specific research area, there is little use in choosing a large, medium, or small effect size benchmark based on the empirical distribution of effect sizes in a field to perform a power analysis.

Having some knowledge about the distribution of effect sizes in the literature can be useful when interpreting the confidence interval around an effect size. If in a specific research area almost no effects are larger than the value you could reject in an equivalence test (e.g., if the observed effect size is 0, the design would only reject effects larger than for example d = 0.7), then it is a-priori unlikely that collecting the data would tell you something you didn’t already know.