Letter Templates & Example

Cover Letter for Life Insurance Application: Tips and Samples

When it comes to applying for life insurance, one document that can make a big difference in boosting your chances of approval is a cover letter. While many people may dismiss the importance of a cover letter, it can actually be a helpful tool in providing additional information about yourself and your situation that may not be fully captured in the application itself.

If you’re unsure of where to start or what to include in your cover letter for a life insurance application, don’t worry. There are plenty of examples available online that you can use as a starting point and edit to fit your specific needs. With a well-crafted cover letter, you can help your application stand out and increase the likelihood of approval from insurance underwriters. So take the time to craft a strong cover letter and give yourself the best chance of securing the life insurance coverage you need.

Structuring Your Cover Letter for a Life Insurance Application

When it comes to applying for life insurance, it’s important to put your best foot forward. One way to do this is to create a well-structured cover letter that showcases your strengths and explains why you’re a good fit for the policy you’re applying for. Here’s how you can organize your cover letter:

Introduction: In the first few sentences of your cover letter, you should introduce yourself and explain why you’re applying for life insurance. Be sure to mention the type of policy you’re interested in and why you think it’s a good match for your needs. This is also a good opportunity to express enthusiasm for the company you’re applying to and show that you’ve done your homework on their offerings.

Body: The body of your cover letter is where you can really shine. This is where you can highlight your skills, experience, and qualifications that make you a good candidate for life insurance. You should use specific examples and metrics to demonstrate your expertise, and explain how your past successes can translate into future benefits for the insurance company. If you have any special certifications or training that are relevant to the policy you’re applying for, make sure to mention those as well.

Closing: In your closing paragraph, you should thank the company for considering your application and reiterate your interest in working with them. This is also a good opportunity to provide any additional information that you think might be helpful, such as references or a link to your online portfolio. Finally, be sure to include your contact information so that the company can get in touch with you if they have any questions.

Overall, the key to a successful cover letter for a life insurance application is to be clear, concise, and focused on the benefits that you can bring to the company. By organizing your letter around these core ideas, you can showcase your strengths and make a compelling case for why you’re the right fit for the policy you’re applying for.

Life Insurance Cover Letter Templates

Cover letter for life insurance for newlywed couple.

Dear [Insurance Agent’s Name],

With great pleasure, I am writing to request life insurance coverage for myself and my beloved spouse. As newlyweds, we are beginning our joint journey together with high hopes for the future. However, we understand the importance of planning ahead for all eventualities, including unexpected tragedies.

We would like to secure comprehensive life coverage so that we can protect each other financially if one of us should pass. We believe your company offers the best possible policies and we have confidence in your expertise in helping us decide on the right plan for us. Thank you for your time and attention, and we look forward to speaking with you soon.

Sincerely, [Your Names]

Cover Letter for Life Insurance for Parents with Children

I am writing to request life insurance coverage for myself and my partner, as we recently welcomed our first child. As new parents, we understand the importance of securing our family’s future in case of any unfortunate event. We are looking for a reliable and comprehensive policy to ensure that our child is protected.

We believe your company offers extensive coverage and excellent customer service that can help us towards making the right decision. We have gone through your policies and are interested in discussing them further with you. Thank you for your time and attention, and we look forward to hearing from you soon.

Cover Letter for Life Insurance for Retirees

I am writing to request information regarding life insurance coverage options available to me during my retirement. As I approach my golden years, I understand the importance of preparing for the future and am interested in ensuring that my loved ones are adequately protected in case of any unfortunate event.

Having done some research, I believe that your company offers comprehensive and affordable policies that suit my needs. I’m interested in discussing the available options with you. I appreciate your time and look forward to hearing from you soon.

Sincerely, [Your Name]

Cover Letter for Life Insurance in Case of Critical Illness

I am writing to request more information on the life insurance policies that cover critical illness. As someone who has a family history of critical disease, I have become increasingly aware of the importance of preparing against unforeseeable events.

I believe that your offerings accommodate the needs that I have for specialized coverage. I am interested in scheduling a meeting with you to discuss the specifics of your critical illness policy. Thank you for your attention, and I am looking forward to hearing from you soon.

Cover Letter for Life Insurance for Business Owners

I am writing to request more information on life insurance policies for business owners like myself. As an entrepreneur, I understand the importance of planning for the future, especially during unforeseeable times.

I have gone through your offerings and believe that your company provides comprehensive coverage that provides security, flexibility and peace of mind. I am interested in scheduling an appointment with you to discuss your products further and learn more about how to customize them to fit my business’s specific needs. Thank you for your attention, and I am looking forward to hearing from you soon.

Cover Letter for Life Insurance for Young Professionals

I am writing to request more information about life insurance plans for young professionals. Even though this is the beginning of my career, I already understand the importance of planning for the future, building a nest egg, and securing my financial resources.

I believe that your company’s offerings meet my needs and offer options for future exploration in different dimensions. I am looking forward to scheduling an appointment with you to discuss these policies further and understand their requirements. Thank you for your attention, and I am looking forward to hearing from you soon.

Cover Letter for Life Insurance for Freelancers

I am writing to request more information about life insurance policies for freelancers. As someone who is going through the ups and downs of working as a freelancer, I know how challenging it can be to balance the need to build a career on my own and secure my financial future.

I have researched the policies your company offers and believe they are best suited to my current situation. I am interested in learning more about the available options, their premiums, and how they can benefit my situation. Thank you for providing me with valuable insights into this and looking forward to hearing back from you soon.

Best regards, [Your Name]

Cover Letter Tips for Life Insurance Application

When applying for life insurance, submitting a well-written cover letter can make a significant difference in your chances of getting approved. Here are some tips to help you craft a compelling cover letter:

- Address the letter: Begin the letter with “To Whom It May Concern” or “Dear Life Insurance Underwriter” to personalize your correspondence.

- Introduce yourself: Write a brief introduction that includes your name and a summary of your health history.

- Explain the reason for buying life insurance: State the reasons why you are applying for life insurance and explain what is driving your decision to get coverage.

- Provide additional information: Include any additional information that may help your case, such as your occupation, hobbies, or travel plans.

- Highlight your strengths: Emphasize your good habits, such as exercising regularly and maintaining a healthy lifestyle.

- Show honesty: Be honest about your health history and any pre-existing conditions, as hiding information can cause problems later on.

- End the letter strongly: Conclude the letter by thanking the underwriter for their time and consideration, expressing your eagerness to get coverage, and providing your contact information.

By following these tips, you will be able to create a strong cover letter that showcases your strengths and increases the chances of your application being approved.

FAQs About Cover Letter for Life Insurance Application

What is a cover letter for a life insurance application?

A cover letter for a life insurance application is a document that accompanies your application. It provides an introduction and additional context about your life insurance needs, health, and other important factors necessary for the insurer to make an informed decision about your application.

Is a cover letter necessary for a life insurance application?

No, a cover letter is not mandatory, but it is recommended. It can help you highlight your needs and demonstrate why you are a good candidate for life insurance. It can also provide additional information that may not be covered in the application form.

What should I include in a cover letter for a life insurance application?

You should provide basic information about yourself, including your name, address, and contact details. You should also explain why you need life insurance, how much coverage you require, and any other relevant details about your health and lifestyle that may affect the insurer’s decision.

How long should my cover letter for a life insurance application be?

Your cover letter should be concise and to the point. Aim for one page or less, and focus on providing the key information that the insurer needs to know to assess your application. Avoid unnecessary details or information that is not relevant to your application.

Can a cover letter help me get a better rate for my life insurance?

While a cover letter is not a guarantee of a lower rate, it can help you make a better case for why you should be approved for coverage. It can also help you explain any factors that might affect your premium, such as past medical history or lifestyle habits.

Can I submit a cover letter after I’ve already submitted my life insurance application?

Yes, you can submit a cover letter after you have submitted your application. However, it is better to include a cover letter with your initial application to ensure that all relevant details are considered.

Should I hire a professional to write my cover letter for a life insurance application?

While a professional writer can help you craft a better cover letter, it is not necessary. You can write a strong cover letter on your own by focusing on the most important details and keeping your writing clear and concise.

Wrapping It Up

So there you have it, folks. Cover letters might seem tedious, but they’re an essential part of the life insurance application process. Always remember to personalize your letter for each company, highlight your relevant experience, and keep it concise. Thanks for reading and best of luck with your life insurance application. Don’t forget to come back and visit us again soon for more helpful tips on navigating the world of insurance. Stay safe!

Top Sample Letter of Interest for Insurance Provider Templates to Land Your Ideal Coverage Crafting the Perfect Cover Letter for Insurance Advisor Positions How to Write a Compelling Hardship Letter to Your Insurance Company The Importance of a Pre-Determination Letter for Insurance Coverage The Benefits of Setting Up a Crummey Letter Irrevocable Life Insurance Trust Sample Letter to Insurance Company for Weight Loss Surgery: How to Write a Compelling Request

How to Write a Good Life Insurance Cover Letter

Updated: September 5, 2023, at 4:11 PM

I’m sure underwriters ask you for cover letters…and cover letters…and more cover letters.

I was once at an underwriting conference with 20 or so carriers, and the individual carrier underwriters kept talking about cover letters. But all that talk doesn’t necessarily tell you how to write a life insurance cover letter.

When I was a home office underwriter, I learned that well-written cover letters are essential. How else could I understand the context of the application? Where else was I going to get necessary information that didn’t fit on the forms? At the same time, I didn’t appreciate cover letters that were poorly written or full of extraneous information.

Now that I’m in a position to write cover letters myself, here are the three main underwriting factors I think about to make sure I give the underwriter what he or she needs.

1. Is it Needed?

As important as cover letters are, not all cases need them. Say a young individual making $50,000 a year at an office job, with no medical history, comes in for a $100,000 term for the purpose of income replacement. In that scenario, no extra information is necessary.

Underwriters already read a lot so they don’t appreciate being given unnecessary material. Look at the information you’re sending. If it tells a complete story by itself, you don’t need a cover letter. If it doesn’t, or if there’s some facet of the applicant’s situation you want to stress, then it’s best to write a letter.

2. Purpose of Coverage

Your life insurance cover letter should focus on explaining the need and justifying the face amount, especially in cases where the need may be outside normal underwriting guidelines.

For example, say the case involves business key person insurance at 15 to 20 times the applicant’s compensation. Since key person insurance is generally only five to ten times compensation, you have to make a strong case of why your client’s employer would suffer a loss of the applied-for amount.

If your client has a difficult medical situation, you could have a hard time securing the rate you want. You’ll have to use your cover letter to address all potential roadblocks and pull out every favorable factor about the client’s medical history to lobby for the best rates.

That’s a lot easier if you have the complete medical records in front of you. If you don’t, do the best you can based on the application itself. And use the information obtained during your fact-finding.

3. Writing the Cover Letter

Now that you know whether to write a cover letter and what to put in it, be sure to write it well; meaning keep it short, clear, and to the point—with no unnecessary information.

No cover letter should ever be over one page in length, and most should be shorter. Also, be realistic. If your client had three heart attacks before the age of 40, don’t recommend him or her for Super Preferred. You’re not going to get it, and pretending you are is a good way to quickly lose credibility with an underwriter.

Again: write a clear, succinct, and realistic letter that makes both the need and amount clear to the underwriter and highlights the favorable factors of your client’s medical history. That letter is your best bet to secure the best possible rates for your client.

Keep Reading: How Life Insurance Loans Work

You May Also Like

Maximizing your conference experience: a guide for financial..., closing the divide: insight from 3 female leaders..., 7 tips to help you master the art..., lead generation strategies for financial advisors: 9 appointment-setting..., 2024 new year’s resolutions for financial planners [7..., a gratuitous recipe: tips for financial decision-making and..., ai and cybersecurity: what financial professionals need to..., mastering the monster hunt for top talent: stay..., do you need a business coach or business..., 5 facts & 5 thoughts on market volatility....

Redbird Agents

How to Write a Life Insurance Cover Letter Like a Million Dollar Producer

August 13, 2015 By Drew Gurley

A commonly overlooked element of insurance sales training is learning how to write a life insurance cover letter to an underwriter.

This is something I learned from a mentor of mine who was a top 1% advisor in the country.

Using a life insurance cover letter when submitting life insurance applications is one of the easiest and quickest ways to increase your placement. And, earn more commissions.

Yes, this is something top insurance agents have learned to do because they know it increases their productivity!

You have a strategy for your life insurance sale pitch right? Why not have one for your underwriters?

Why Write a Life Insurance Cover Letter

The purpose of the life insurance cover letter is simple: provide case-specific details that help get your client the most competitive offer from the life insurance company and likely expedite the approval process.

Here’s the scenario.

You just submitted a life insurance application and after a few days the emails begin pouring in about outstanding requirements holding the case from moving forward. A life insurance cover letter submitted with the original application will help avoid these interruptions.

The more information you provide an underwriter on the front end, the better off you’ll be. Plus, you’ll begin to build great relationships with the underwriting team. Tip…life insurance underwriters love cover letters because it makes their job easier!

Save yourself the time and headache and include a life insurance cover letter with every application you submit. One of the easiest ways to get a request for letter of explanation is by not including the information ahead of time in your cover letter.

The most recent example of a cover letter working to our advantage was an impaired risk case we ended up placing for a target premium of $43,000. The underwriter loved our detail and it avoided a bunch of wasted time communicating back and forth.

General Life Insurance Cover Letter Information:

Each life insurance cover letter should include the basic information that an underwriter will want to review. Below are the items you should include in your life insurance cover letter at a minimum.

- Employment and community involvement

- Your relationship with the client (Example, new, longstanding, center of influence, etc.)

- The offer you are looking for and the timeline you are trying to work within

- Any other pending applications or life insurance offers

- Explanation why any requirement is not available or attainable

Purpose of Insurance, Sales Strategy, and Financial Information:

- Is the applicant married, divorced, widowed?

- Do they have children or other dependents?

- Is there a formal buy-sell agreement or business appraisal in place ?

- How was the value of the business determined?

- Are all partners applying?

- What are the proposed insured’s job duties?

- How experienced is this person in the industry?

- How was the loss to the company determined?

- How long has this business been in operation?

- How many employees?

- Is this the only key person?

- What is the purpose of the loan?

- Is this an SBA loan?

- What is the duration and value of the loan?

- Estate planning

- Was an estate planning attorney or CPA involved?

- How was the face amount determined?

- Will the policy be owned by a trust?

- What is the exit strategy to repay the loan?

- What is the client’s net worth?

- What is the client’s current income?

- Has a lender already been identified?

Health and life style summary:

- Health factors in the client’s history that might make placing the case tough

- Any extensive travel plans

- Citizenship details

- Details not provided in application regarding avocations or driving history

- Reasons for any substandard ratings or declinations in the past

Underwriters are information junkies… the more you provide, the easier it is on the underwriter to approve the life application or consider a more competitive offer.

Conclusion:

Consistently implementing the use of an underwriting cover letter will result in three things.

- You will quickly become a better fact finder with your clients and instantly raise consumer confidence during your sales cycle.

- You will build stronger relationships with the insurance companies and underwriting departments which means your quality of business will improve.

- You will increase your referrals because your clients will recognize you actually care about the process. People do business with those they like and trust, and they will see you as a reliable, knowledgeable problem solver.

So, go make underwriters a priority in your sales cycle and start reaping the rewards! 🙂

Other Trending Articles

- Understanding how business owners use life insurance.

- Building a six-figure income in the Medicare space.

- Guide to understanding how ancillary insurance products work.

FREE DOWNLOAD: Redbird Insurance Income Estimator

Ever wonder what your true income potential is in the insurance business?

Use our Redbird Insurance Income Estimator and accurately forecast your income.

Sign up to get instant access to our FREE Estimator.

" * " indicates required fields

About Drew Gurley

As a co-founder of Redbird Advisors, one of my primary missions in growing our business is connecting bright minds that together can accomplish great things. Leading our team down a path with clearly defined goals and objectives while adapting to change along the way.

Popular Articles

Seo for insurance agencies: services, tips and tricks, selling your medicare book of business and maximizing your valuation, agent’s guide to selling medicare [2024 edition], top medicare fmos for 2024 [contact info included], insurance strategy consulting and when it is necessary for your agency, how to become a medicare insurance agent, 16 of the best insurance sales books for 2024, ultimate guide to selling final expense insurance [2024], why the ebitda multiple is useful…but has seven caveats, 10 rules for creating a kick ass insurance blog, the immense value of “long tail keywords” for insurance seo, top vendors for medicare supplement and medicare advantage leads in 2023, how to sell indexed universal life insurance: agent’s ultimate guide, insurance agent’s guide to how business owners use life insurance.

- Leadership Team

- The Opportunity

- Insurance Copywriting Team

- Insurance Websites

- Insurance Leads

- Insurance License Prep

- Continuing Education Courses

- E&O Insurance

- The Burial Insurance Manifesto

Stay up to date with REdbird

- Customer Experience Services

- Content & Copywriting

- Keynotes and Sales Workshops

- Mergers & Acquisitions

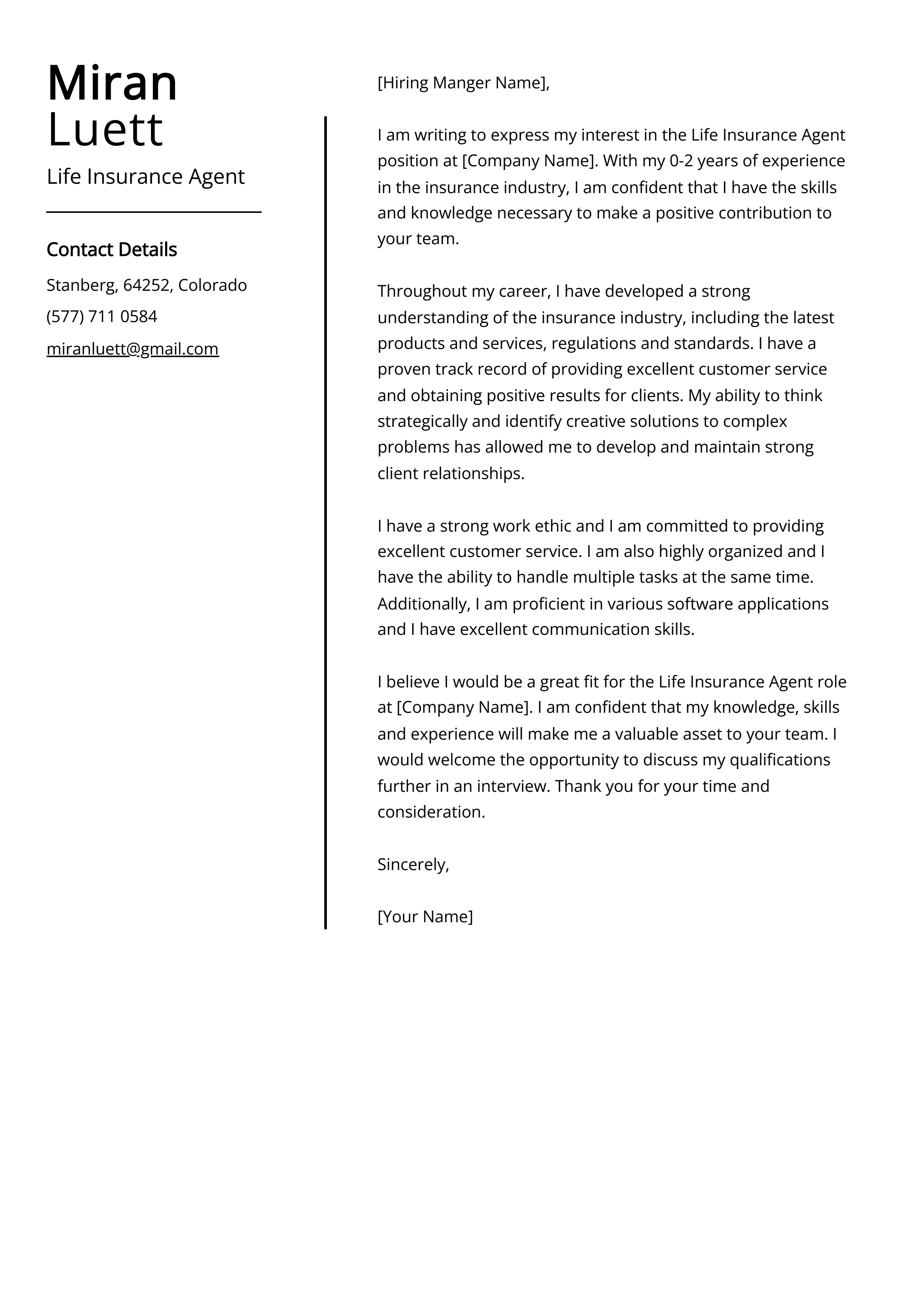

Life Insurance Agent Cover Letter: Job Description, Sample & Guide

Create a standout life insurance agent cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

As a life insurance agent, it is crucial to have a compelling cover letter to showcase your skills and experience to potential employers. A well-crafted cover letter can make a big difference in getting noticed and landing an interview. In this guide, we will provide you with tips and examples to help you create a strong cover letter that sets you apart in the competitive field of life insurance sales.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- Why you should use a cover letter template

Related Cover Letter Examples

- Blood Bank Technologist Cover Letter Sample

- Ct Technologist Cover Letter Sample

- Health Unit Coordinator Cover Letter Sample

- Clinical Trial Manager Cover Letter Sample

- Hospice Nurse Cover Letter Sample

- Certified Pharmacy Technician Cover Letter Sample

- Geriatric Nursing Assistant Cover Letter Sample

- Direct Care Worker Cover Letter Sample

- Behavioral Health Technician Cover Letter Sample

- Patient Access Manager Cover Letter Sample

- Ekg Technician Cover Letter Sample

- Patient Care Technician Cover Letter Sample

- Patient Sitter Cover Letter Sample

- Mds Coordinator Cover Letter Sample

- Biostatistician Cover Letter Sample

- Medical Engineer Cover Letter Sample

- Certified Home Health Aide Cover Letter Sample

- Nurse Aide Cover Letter Sample

- Clinical Social Worker Cover Letter Sample

- Outpatient Therapist Cover Letter Sample

Life Insurance Agent Cover Letter Sample

Dear Hiring Manager,

I am writing to express my interest in the Life Insurance Agent position at your esteemed company. With over 5 years of experience in the insurance industry, I am confident in my ability to contribute to your team and help clients secure the best coverage for their needs.

In my previous role as a Life Insurance Agent, I was responsible for prospecting new clients, conducting thorough needs assessments, and presenting comprehensive insurance solutions tailored to each client's unique situation. I consistently exceeded sales targets and received positive feedback from satisfied clients. I am passionate about helping people protect their families and assets and strive to provide exceptional customer service in every interaction.

I am skilled in building and maintaining strong client relationships, educating clients on available coverage options, and simplifying complex insurance jargon into easily understandable terms. I am proficient in leveraging various communication channels, including phone, email, and in-person meetings, to effectively connect with clients and address their insurance needs.

Additionally, I am well-versed in underwriting guidelines, policy analysis, and industry regulations, allowing me to confidently navigate the insurance landscape and guide clients toward the most suitable life insurance options. I am also proficient in utilizing CRM systems and other technology tools to streamline processes and enhance productivity.

I am attracted to the opportunity to join your company due to your strong reputation for providing top-notch insurance solutions and dedication to client satisfaction. I am confident that my proven track record and dedication to excellence make me an ideal candidate for this role.

I am enthusiastic about the possibility of bringing my unique blend of skills and experience to your team and contributing to your continued success. Thank you for considering my application. I am looking forward to the opportunity to further discuss how I can contribute to your company.

Sincerely, [Your Name]

Why Do you Need a Life Insurance Agent Cover Letter?

- Stand out from the competition: A well-written cover letter can help you stand out from other candidates by showcasing your unique skills and experiences.

- Highlight your passion for the industry: A cover letter allows you to express your passion for the life insurance industry and your desire to help clients protect their loved ones.

- Showcase your communication skills: A cover letter gives you the opportunity to demonstrate your written communication skills, which are essential in the insurance industry.

- Personalize your application: Including a cover letter allows you to tailor your application to the specific company and position, showing that you've done your research and are genuinely interested in the opportunity.

- Explain any career gaps or transitions: If you have any gaps in your work history or are transitioning from a different industry, a cover letter gives you the chance to explain these circumstances and emphasize how they have prepared you for the role of a life insurance agent.

A Few Important Rules To Keep In Mind

- Include a professional greeting and address the hiring manager by name if possible. For example, "Dear Mr. Smith,"

- Start by stating your interest in the Life Insurance Agent position and where you came across the job opening, whether it was through a job posting, referral, or networking.

- Highlight your relevant experience and qualifications, including your insurance certifications, sales experience, and knowledge of different insurance products.

- Showcase your excellent communication skills and ability to build rapport with clients, as well as your track record of meeting or exceeding sales targets.

- Express your enthusiasm for the opportunity to work for the company and your commitment to helping clients protect their financial futures through life insurance.

- Thank the hiring manager for considering your application and express your eagerness to discuss how you can contribute to the team in more detail during an interview.

- Close the cover letter with a professional sign-off, such as "Sincerely" or "Best regards," followed by your full name and contact information.

What's The Best Structure For Life Insurance Agent Cover Letters?

After creating an impressive Life Insurance Agent resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Life Insurance Agent cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Life Insurance Agent Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

I am writing to express my strong interest in the Life Insurance Agent position at your company. With a background in sales and a passion for helping individuals and families protect their financial future, I believe that I would be a valuable addition to your team.

- Introduction: Begin by introducing yourself and stating the purpose of your letter. Express your interest in the Life Insurance Agent position and mention where you found the job posting.

- Sales Experience: Highlight any relevant sales experience or expertise you have, emphasizing your ability to effectively communicate the benefits of life insurance to potential clients. Provide specific examples or achievements that demonstrate your success in sales.

- Customer Service Skills: Discuss your ability to build and maintain strong relationships with clients, providing exceptional customer service and support throughout the insurance purchasing process.

- Knowledge of Insurance Products: Explain your familiarity with life insurance products and your ability to educate clients on their options, helping them make informed decisions that align with their individual needs and financial goals.

- Licensing and Certifications: If applicable, mention any relevant licenses or certifications you hold, demonstrating your commitment to professional development and compliance with industry regulations.

- Closing: Express your enthusiasm for the opportunity to contribute to the success of the company and request the opportunity to discuss how your skills and experience align with the needs of the Life Insurance Agent role in more detail during an interview.

Thank you for considering my application. I am eager to bring my passion for sales and dedication to helping others to your team. I look forward to the possibility of contributing to your company's continued success as a Life Insurance Agent.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Life Insurance Agent Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Avoid using generic and vague language that doesn't highlight your specific qualifications and experiences.

- Avoid making the cover letter too long or too short. Aim for a balance that effectively communicates your skills and passion for the role.

- Avoid including irrelevant information or unnecessary details that do not directly relate to the position.

- Avoid using a one-size-fits-all approach. Tailor your cover letter to each specific job and company you are applying to.

- Avoid making spelling and grammatical errors. Proofread your cover letter multiple times before submitting it.

- Avoid focusing solely on what the company can do for you. Instead, emphasize what you can bring to the company and how you can contribute to its success.

Key Takeaways For a Life Insurance Agent Cover Letter

- Strong sales and communication skills

- Proven track record of meeting and exceeding sales targets

- Extensive knowledge of various life insurance products

- Ability to build and maintain strong client relationships

- Excellent organizational and time management skills

- Detail-oriented and able to analyze and understand complex insurance policies

- Flexibility and adaptability in a fast-paced, changing environment

- Proficient in utilizing technology and CRM systems to manage client information

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Life Insurance Cover Letter

15 life insurance cover letter templates.

How to Write the Life Insurance Cover Letter

Please consider me for the life insurance opportunity. I am including my resume that lists my qualifications and experience.

Previously, I was responsible for case and policy level servicing, focusing on low complexity level plans for universal life products within Corporate Insurance.

Please consider my experience and qualifications for this position:

- Willing to travel as the job requires, occasionally overnight

- B Com Honours or equivalent NQF level 7 qualification

- Broker Dealer experience preferred, ACS designation preferred with continued coursework toward FLMI

- Multi-carrier Case Manager experience preferred

- Strong understanding of Underwriting, New Business and Producer Services Department workflows

- Experience providing the highest quality service to the field force, insureds and Underwriting staff

- Provides oversight and manages the changing regulatory environment

- Proactively identifies strategic and tactical regulatory solutions by providing compliance subject matter expertise for CoSA project/process/product initiatives

Thank you in advance for taking the time to read my cover letter and to review my resume.

Sawyer Anderson

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Life Insurance Cover Letter

Life insurance responsible for insights on new and emerging life insurance best practices and contribute to the development of service offerings.

Life Insurance Examples

Example of life insurance cover letter.

I submit this application to express my sincere interest in the life insurance position.

In the previous role, I was responsible for field management and agents with a high level of life insurance technical expertise, knowledge of emerging trends and sales support via in-person presentations, e-mail, and phone contact.

My experience is an excellent fit for the list of requirements in this job:

- Directs the implementation of appropriate strategic/tactical solutions for compliance business requirements

- Directs the monitoring and managing of regulatory requirements and reporting

- Apply biostatistics methodology

- Understand the financial impact of mortality decisions and enhancements

- Strong Internet skills to research complex medical issues

- Interact courteously and professionally

- Thorough knowledge of Telephony systems and applications (IVR, Call recordings, Workforce Management, Predictive Dialer)

- Computer programming and structured program design

Thank you for your time and consideration.

Cameron Daugherty

Previously, I was responsible for expertise to bank clients in all lines of life insurance.

- Detailed knowledge of individual life insurance products is strongly preferred and/or Product development experience

- Administration of Learning Management System preferred

- Experience documenting requirements for large and complex data processing and analysis projects

- Experience with issue tracking/project planning applications (JIRA)

- Build the relationships with expatriate distribution partners and maintain the age of New Business in-force pipeline

- Proactively contact the consultants and customers by mean of phone or visit the brokers to explain the follow up the NB cycle time and improve complete ratio

- Embed or visit brokers to go through NB pipeline and pre-vet applications flagging urgent/sensitive cases for priority

- Monitor and identify the breaches of performance in meeting SLAs/TAT and carry out appropriate escalation

Thank you for considering me to become a member of your team.

Story Gleichner

I would like to submit my application for the life insurance opening. Please accept this letter and the attached resume.

Previously, I was responsible for support to the EMEA Head of Life Insurance in the governance of the Life Insurance business in Courtage.

Please consider my qualifications and experience:

- Drive, energy and self-managed

- Advanced computer and keyboarding skills, including experience with internet and database research

- Applied experience with establishing, managing and delivering large scale, complex IT projects

- Experience in project management, SDLC, SAFe, RUP, Scrum, ITIL, Dev Ops, and application solution development and deployment

- Experience in working on large initiatives with variable staffing including onsite/offshore execution model

- Experience with Life Insurance (Term, Whole life, Variable and Universal) products and business systems strongly preferred

- Support delivery of ORSA and SST reporting, related controls, documentation and process enhancement

- Support maintenance, development and efficiency improvements for related capital management processes

Thank you in advance for reviewing my candidacy for this position.

Dakota Crona

In the previous role, I was responsible for life insurance subject matter expertise to key constituents and stakeholders.

- Prepare inputs, run models and aggregate outputs, analyse results

- Strong background in financial economics, statistics and/or actuarial science

- Expertise in MS Excel, VBA and/or other programming languages (C, R, Matlab, ...)

- ASA, FSA, MAAA designations preferred

- Strong understanding of regulatory requirements for reserving and rating

- Strong interpersonal, presentation, analytical and statistical skills

- Strong Life, Health and/or Annuity Insurance Industry experience and knowledge

- Programming in VBA, SAS (other programming languages are advantage)

Lennon West

In the previous role, I was responsible for technical and functional expertise regarding Life Insurance related matters.

- Conduct pre-sales and NB end-to-end process, system and process training to our distributors with the target of improving the complete ratio of applications and enhance their knowledge of our requirements and digital tools

- Closely collaborate with Underwriting and other internal teams to speed up the process of cases if in need and identify and resolve any issues

- Interact with and response to distributor and customer inquiries and take the voices from brokers and return feedback to enhance service quality and customer experience

- Completed IIQE Paper 1, 3 and 5 with license

- Familiar with life insurance products and operations

- Knowledge in channel sales and distribution management

- Prior experience with LTC or acceleration riders preferred

- Depth of experience in at least one core service area including Enterprise Risk Management, ALM and investment, financial and regulatory reporting, Solvency II, M&A and corporate restructuring, product and distribution strategy and financial modelling

Charlie Treutel

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

Life Insurance Agent Cover Letter Examples

A great life insurance agent cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following life insurance agent cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Nahima Hemmerling

(420) 995-4730

Dear Kalayla Tope,

I am writing to express my interest in the Life Insurance Agent position with New York Life Insurance Company, as advertised. With a solid five-year track record at Prudential Financial, Inc., I have honed my skills in client service, policy management, and sales strategies, making me a strong candidate for your team.

During my tenure at Prudential Financial, Inc., I have excelled in building and maintaining client relationships, consistently surpassing my sales targets through personalized and ethical service. My dedication to understanding the unique needs of each client has enabled me to tailor life insurance solutions that provide peace of mind and financial security. This client-centric approach has resulted in a significant increase in customer satisfaction and retention rates.

I have always admired New York Life Insurance Company for its commitment to excellence and the comprehensive support it offers to its policyholders. Your company’s reputation for innovative products and services align with my professional values and skills. I am eager to bring my expertise in life insurance to your esteemed company, contributing to your mission of protecting families and helping them to secure their financial future.

Moreover, my continuous drive for professional development has led me to obtain relevant certifications and stay updated with industry trends and regulations. This proactive learning mindset ensures that I provide the most current and effective solutions to my clients.

I am excited about the opportunity to further discuss how my experience, skills, and passion for life insurance can be a valuable addition to New York Life Insurance Company. Thank you for considering my application. I look forward to the possibility of contributing to your team and playing a key role in expanding your client base.

Warm regards,

Related Cover Letter Examples

- Insurance Sales Agent

- Insurance Agent

- Health Insurance Agent

- Child Life Specialist

Elite Marketing Group is now EMG Insurance Brokerage. Learn more.

- Register / Create Account

- Universal Life

- Life Settlements

- Premium Finance

- Disability Insurance

- Ancillary Products

- EMG Collective 401K Plan

- Group Health

- Group Disability

- Group Dental

- Group Vision

- Individual Dental

- Critical Illness

- Medicare Supplement Plans

- Travel Health

- Long-Term Care

- Sales Tools and Concepts

- Annuity Request Form

- Webinars / Events

- Pre-Qualifying Questionnaires

- Underwriting

- Insurance Glossary

- Case Studies

- Independent Professionals

- Meet Our Team

- Company History

- Elite Marketing Group

Life Insurance , Life Insurance Classifications , Uncategorized

The 8 components of a life insurance application cover letter..

The Importance of Cover Letters to Expedite Underwriting for Life Insurance Agents:

No one likes to do paperwork. The thought of writing a cover letter on a case is a lot to concur with. However, when collecting the relevant information and composing the client’s story to share with the carrier, an agent can save time and the case!

The purpose of the cover letter is to tell the story of the intended insured. If the situation is not explained, the underwriter will make certain assumptions about the individual, and the agent will inevitably end up trying to appeal an adverse decision. A cover letter helps the underwriter justify making an offer when they can see the whole picture. It gives them a picture of the entire puzzle; so, they know where the pieces go.

A well-written cover letter is essential for the underwriter to understand the context of the case. Often seasoned advisors fail to understand that when writing insurance, two sales always must be made:

- The first sale is the client buying the recommendation, where time and energy are spent.

- The second sale is selling the underwriter on the case, where many advisors fall short and lose the case.

The templet of the 8 components for writing a good letter:

- Who is the agent and why are they writing the letter?

- The agent’s relationship with the client (when one exists) Alternatively, the relationship with the advisor. Explain how the information shared with the underwriter was obtained.

- Identify and personalize the client. For example, Jim runs a successful company and provides widgets for all of Texas. He has 100 employees. He is the 100% stock owner of the Widget company; from Widget, Inc., he earns an annual salary of $250,000 with the usual end-of-year bonus of $50,000.

- Justify the insurance. For example, Jim has $500,000 of term, and the coverage is eight years old. Widget Inc. needs another $1.5 million on Jim. Further, elaborate that $750,000 will go to the business for debt and contract obligations in the event of death, and $750,000 would go to the family for income replacement.

- In-force insurance. Address this topic, especially on large cases as underwriters look at the entire line of coverage. This could cause the case to be underwritten facultatively instead of by the carrier itself. This is where an informal may be the best choice.

- Medical History and family history. This is where the story needs to be told. Example: Both parents are still living and in their mid 80’s. He exercises regularly and does not smoke or drink. Note that he has regular annual physicals and has regularly scheduled exams, not intermittent ones. If exams are intermittent, this could be a potential red flag. Explain vitamin use, etc. the client may take. This is the best opportunity to tell the story and obtain the desired offer.

- Medications. This is also a critical area, and most companies search the RX database, and medication usage will arise. So, if the client started using an anti-anxiety drug, tell the story. The client was bidding on a large Widget project and had geared up significantly, adding both staff and office space in anticipation. Now they have the contract there have been performance issues.

- Owner and beneficiaries. If there is anything different, then an explanation is appropriate. Example: The business owns the policy, but the beneficiaries are the business and the family. Tell them why it was designed that way, at the recommendation of the family attorney, Mr. Family Lawyer, Esquire, and supported by his CPA, Mr. Certified Public Accounted.

Cover these eight points every single time. Missing a step means additional weeks in underwriting and perhaps an offer that the advisor cannot place.

Help paint the picture for the underwriter reviewing the important cases. Do not have them put the puzzle together upside-down. Help the underwriter connect with the agent, and the insured, so they are not just another case number on their desk!

Durr Sexton, CLU

1 Insurance Agent Cover Letter Example

Insurance Agents excel at assessing risk, tailoring policies to individual needs, and providing peace of mind in uncertain situations. Similarly, your cover letter is your opportunity to assess and present your own professional 'risks' and 'policies' - your skills, experiences, and unique value - in a way that provides recruiters with confidence in your potential. In this guide, we'll navigate through top-notch Insurance Agent cover letter examples, ensuring your application stands out in the competitive insurance industry.

Cover Letter Examples

Cover letter guidelines, insurance agent cover letter example, how to format a insurance agent cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for insurance agent, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for insurance agent, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for insurance agent, cover letter body, what to focus on with your cover letter body:, cover letter body examples for insurance agent, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for insurance agent, pair your cover letter with a foundational resume, cover letter writing tips for insurance agents, highlight your expertise in the insurance industry, showcase your sales skills, demonstrate your customer service abilities, emphasize your attention to detail, express your adaptability, cover letter mistakes to avoid as a insurance agent, failing to highlight relevant skills, using generic language, not proofreading, being too lengthy, not showing enthusiasm, cover letter faqs for insurance agents.

The best way to start an Insurance Agent cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and state the position you're applying for. Make sure to include a compelling hook in your opening paragraph that highlights your relevant experience, skills, or achievements. For instance, you could mention how your expertise in risk management strategies led to a significant decrease in claims at your previous company. This not only grabs the reader's attention but also shows that you understand the role and its requirements.

Insurance Agents should end a cover letter by summarizing their key skills and experiences that make them a suitable candidate for the role. They should express enthusiasm for the opportunity and show interest in the company's mission or values. It's also crucial to include a call to action, such as a request for an interview or a meeting. For example: "I am excited about the opportunity to bring my unique blend of skills and experience to your team and am confident that I can contribute to your company's success. I look forward to the possibility of discussing my application with you further. Thank you for considering my application." Remember to end the letter professionally with a closing like "Sincerely" or "Best regards," followed by your full name and contact information.

An Insurance Agent's cover letter should ideally be about one page long. This length is sufficient to introduce yourself, explain why you're interested in the insurance field, highlight your relevant skills and experiences, and express your interest in the specific agency you're applying to. It's important to keep it concise and to the point, as hiring managers often have many applications to review and may not spend a lot of time on each one. A well-written, one-page cover letter can effectively convey your qualifications and enthusiasm for the job without overwhelming the reader with too much information.

Writing a cover letter with no experience as an Insurance Agent can seem challenging, but it's all about showcasing your transferable skills, eagerness to learn, and passion for the industry. Here's a step-by-step guide on how to do it: 1. Start with a Professional Greeting: Address the hiring manager by name if possible. If you can't find the name, use a professional greeting such as "Dear Hiring Manager". 2. Opening Paragraph: Begin by stating the position you're applying for. Express your enthusiasm for the role and the company. If someone referred you, mention their name and connection to the company here. 3. Highlight Transferable Skills: Even if you don't have direct experience as an Insurance Agent, you likely have skills that can be applied to the role. These could include customer service, sales, problem-solving, or analytical skills. Use specific examples from your past work, education, or volunteer experience to demonstrate these skills. For example, if you've worked in retail, you might discuss how you upsold products or handled customer complaints. 4. Show Industry Knowledge: Show that you understand the insurance industry and the role of an Insurance Agent. You could mention relevant coursework, certifications, or self-study. Discuss why you're interested in insurance and how you plan to contribute to the company. 5. Show Enthusiasm and Willingness to Learn: Employers value candidates who are eager to learn and grow. Express your willingness to undergo training and learn the ins and outs of the industry. 6. Closing Paragraph: Reiterate your interest in the role and the company. Thank the hiring manager for considering your application and express your hope for further discussion. 7. Professional Sign-off: Close the letter with a professional sign-off such as "Sincerely" or "Best regards", followed by your full name. Remember to keep your cover letter concise and to the point, and always proofread before sending it. Tailor each cover letter to the specific job and company, showing that you've done your research and are genuinely interested in the role.

Related Cover Letters for Insurance Agents

Insurance agent cover letter, call center cover letter.

Customer Service Manager Cover Letter

Customer Success Manager Cover Letter

Flight Attendant Cover Letter

Personal Trainer Cover Letter

Related Resumes for Insurance Agents

Insurance agent resume example.

Try our AI-Powered Resume Builder

Resume Worded | Career Strategy

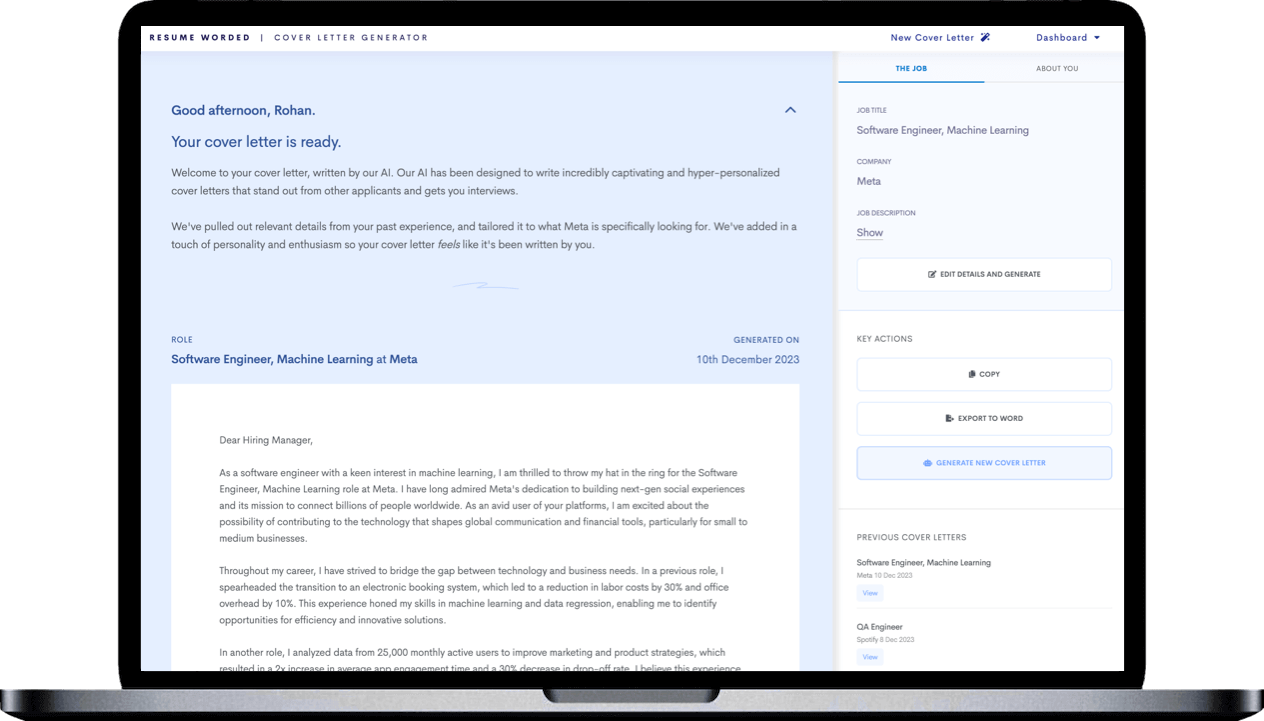

5 insurance agent cover letters.

Approved by real hiring managers, these Insurance Agent cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Insurance Agent

- Senior Insurance Agent

- Senior Insurance Advisor

- Alternative introductions for your cover letter

- Insurance Agent resume examples

Insurance Agent Cover Letter Example

Why this cover letter works in 2024, increase in policy sales.

Highlighting specific achievements, such as increasing policy sales by a significant percentage, shows your ability to deliver results and make a positive impact on the company.

Client Retention Rate

Mentioning a high client retention rate demonstrates your ability to build strong relationships and provide excellent customer service, which is essential in the insurance industry.

Excitement About Company Values

Expressing your enthusiasm for the company's values, such as community involvement, shows you care about more than just the job and are genuinely interested in being a part of the company culture.

Highlight Relevant and Impressive Metrics

Here's the thing, numbers tell a story. When you showcase your success with numbers like a 95% client satisfaction rate, it provides a tangible measure of your abilities. It tells me, that not only are you good with people and handling clients, but you're exceptionally good at it.

Showcase Your Sales Acumen

You managed to increase policy upgrades by 20%? That's impressive. It demonstrates that you have a knack for sales and can effectively persuade customers to invest more in their insurance, which is a key skill for an Insurance Agent. It's this kind of information that makes me want to speak with you more.

Highlight Relevant Experience and Skills

Pointing out your relevant experience and skills in the insurance sector sends the message that you're not a newbie. It shows you've honed your skills in the industry and understand the complexities of dealing with clients on a personal level. Not to mention how this gives a sneak peek into how you've handled responsibilities in similar roles before.

Demonstrate Problem-Solving Skills

Showing that you've used data analytics to enhance client satisfaction is a practical way of saying, "Hey, I can solve problems using modern tools." It's a strong indicator that you're technologically adept and can use data to make informed decisions, which is crucial in today's data-driven business world.

Show Alignment With Company Culture

Saying that you're excited about the company's culture tells me that you've done your homework. You know what the company stands for and that you resonate with it. This not only shows that you'd fit in but also that you're likely to stick around longer because you share the same values.

Indicate Eagerness to Contribute

Explicitly stating that you're looking forward to contributing to the company's excellence shows confidence and commitment. It suggests that you're not just looking for any job, but specifically want this one and are ready to bring your A-game.

Close With Warmth

The sign-off is your final impression. "Warm regards" feels personal and leaves a positive, friendly last impression. It's a small detail that subtly reinforces your interpersonal skills.

Senior Insurance Agent Cover Letter Example

Lead with leadership success.

Leading a team and exceeding sales targets by 30%? That's the kind of leadership success we need in a Senior Insurance Agent role. It tells me that you not only understand the insurance industry but how to inspire a team towards a common goal. This is a big tick in my book.

Retention is Crucial

Having the highest client retention rate is a clear indicator of excellent customer service. In the insurance industry, keeping a client can be even more valuable than acquiring a new one. This little nugget of information tells me you understand the value of keeping clients happy and your team is doing an incredible job at it.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Senior Insurance Advisor Cover Letter Example

Share your motivation and achievements.

Explaining your dedication to enhancing client understanding and engagement combined with sharing a quantifiable achievement is a powerful one-two punch. It gives me a sense of your drive, your work ethic, and the tangible results you've delivered.

Illustrate Your Ability to Innovate

By mentioning how you've integrated technology into client engagement processes, you're showing that you're not just comfortable with change - you drive it. It's a clear signal that you're resourceful and proactive at addressing inefficiencies, which any company would appreciate.

Offer Your Expertise

Telling me that you're eager to bring your expertise in team leadership, process improvement, and tech-savvy client solutions to the company, reassures that you're not just applying randomly. You've considered what the company needs and you're confident that you can provide it.

Express Professional Alignment

Stating your enthusiasm about contributing to a company that cares for its clients and employees alike shows that you value a balanced work environment. It suggests that you'll fit in well with a team that shares these priorities.

Propose a Follow-Up

Mentioning that you're looking forward to discussing your potential contribution signals that you're serious about the role and are ready to move forward. Plus, it's a polite way of nudging the hiring manager to invite you for an interview.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Insurance Agent Roles

- Health Insurance Agent Cover Letter Guide

- Insurance Agent Cover Letter Guide

- Insurance Case Manager Cover Letter Guide

- Insurance Claims Manager Cover Letter Guide

- Insurance Investigator Cover Letter Guide

- Insurance Sales Agent Cover Letter Guide

- Insurance Underwriter Cover Letter Guide

- Life Insurance Agent Cover Letter Guide

Other Other Cover Letters

- Business Owner Cover Letter Guide

- Consultant Cover Letter Guide

- Correctional Officer Cover Letter Guide

- Demand Planning Manager Cover Letter Guide

- Executive Assistant Cover Letter Guide

- Operations Manager Cover Letter Guide

- Orientation Leader Cover Letter Guide

- Plant Manager Cover Letter Guide

- Production Planner Cover Letter Guide

- Recruiter Cover Letter Guide

- Recruiting Coordinator Cover Letter Guide

- Site Manager Cover Letter Guide

- Supply Chain Planner Cover Letter Guide

- Teacher Cover Letter Guide

- Vice President of Operations Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Sample Letter To Life Insurance Company For Claim: Free & Effective

Drawing from extensive experience, I offer insights into the complexities of life insurance claims, emphasizing clear communication, policy understanding, and persuasion, alongside a practical guide and template for effective claim navigation.

Key Takeaways

- Understand the essential components of a claim letter to a life insurance company.

- Learn step-by-step how to write an effective claim letter.

- Discover tips and tricks from real-life experiences to enhance your claim process.

- Free Template: Use the provided template to simplify and streamline your claim letter writing.

Understanding the Basics

Before delving into the complexities of claim letters, it’s essential to grasp the basics.

Life insurance is a contract between an individual and an insurance company where the company pays a designated beneficiary a sum of money upon the death of the insured person.

In my experience, understanding the terms of your policy is crucial. It determines how you should approach the claim process.

Real-Life Example

In one instance, I had to write a letter for a client whose policy had specific clauses about accidental death. By highlighting these clauses, I was able to strengthen the claim.

Step-by-Step Guide to Writing a Claim Letter

- Gather Necessary Documents : Before writing, collect all necessary documents such as the death certificate, policy documents, and any other required forms.

- Start with Personal Details : Begin your letter by introducing yourself, the policyholder, and the insured individual.

- State the Purpose : Clearly mention that the letter is to file a claim on the life insurance policy.

- Include Policy Details : Provide the policy number and other relevant details. This helps in quicker processing.

- Detail the Circumstances : If necessary, explain the circumstances of the death, especially if it relates to policy clauses.

- Attach Supporting Documents : Mention that you have attached all necessary documents.

- Request Further Instructions : Ask for any additional steps or information required from your end.

- Provide Contact Information : Conclude by offering your contact details for further communication.

- Professional Closing : End the letter with a professional closing like “Sincerely” or “Respectfully”.

Tips for Effective Communication

- Be Concise and Clear : Insurance companies deal with numerous claims. A clear and concise letter is more likely to be processed efficiently.

- Be Polite but Firm : Maintain a polite tone but be assertive about your request.

- Follow-up : If you don’t receive a response, don’t hesitate to follow up.

Table: Dos and Don’ts of Writing a Claim Letter

A particularly challenging case involved a disputed claim due to a minor policy violation. By carefully presenting the facts and maintaining a respectful tone, I was able to negotiate a favorable outcome for the client.

Writing a claim letter to a life insurance company can seem daunting, but with the right approach and understanding, it can be a straightforward process. Remember, it’s about clear communication, understanding your policy, and being persistent yet respectful.

Template for a Claim Letter to a Life Insurance Company

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Insurance Company Name] [Claims Department] [Company Address] [City, State, Zip Code]

Subject: Life Insurance Claim for [Policyholder’s Full Name], Policy No. [Policy Number]

Dear [Insurance Company’s Claims Department/Specific Contact Person if known],

I am writing to file a claim on the life insurance policy of [Policyholder’s Full Name], who passed away on [Date of Death]. I am [your relationship to the deceased], and I am the [beneficiary/executor of the estate] as designated in the policy.

The policy number for reference is [Policy Number]. I have enclosed all necessary documents to support this claim, including:

- Certified copy of the Death Certificate.

- Copy of the Life Insurance Policy.

- [Any other required document, e.g., Proof of Identity, Claimant’s Statement, etc.]

[If applicable, include any specific details about the death that relate to the policy’s terms, especially if there are special clauses about accidental death, travel, or specific medical conditions.]

Please inform me if there are any additional forms or procedures I need to complete as part of this claim process. I am keen to settle this matter efficiently and would appreciate prompt processing and communication regarding any further requirements.

For any queries or additional information, please contact me at [Your Phone Number] or via email at [Your Email Address]. I look forward to your prompt response and resolution of this claim.

Thank you for your attention to this matter.

[Your Signature (if sending a hard copy)] [Your Printed Name]

I hope this article helps you navigate the often-complex world of life insurance claims. If you have any specific questions or need more detailed guidance, please leave a comment below, and I’ll be happy to share more insights from my experiences.

Related Posts

- 3 Letter To Life Insurance Company For Claim Templates: Get Paid Faster

- Sample Email to Insurance Company for Claim: Free & Effective

- Sample Letter of Reconsideration for Insurance Claims: Free & Effective

Frequently Asked Questions (FAQs)

Q: How Do I Start the Process of Claiming Death Benefits?

Answer: I began by contacting the insurance company directly. I requested the necessary claim forms and gathered the required documents, such as the death certificate and policy information.

Q: What Documents are Needed to Claim Death Benefits?

Answer: In my experience, I needed the original death certificate, the policyholder’s insurance policy, and any additional documentation requested by the insurance company, like proof of identity.

Q: How Long Does It Take to Receive Death Benefits?

Answer: It took me several weeks to a few months to receive the death benefits. The timeline depends on the insurance company’s process and how quickly you submit all required documents.

Q: Can I Claim Death Benefits if I’m Not the Named Beneficiary?

Answer: Generally, only named beneficiaries can claim death benefits. However, if there are no living beneficiaries, I found that legal heirs may have a claim, but it involves a more complex legal process.

Q: Are Death Benefits Taxable?

Answer: From my understanding, death benefits are generally not subject to income tax. However, if the policy earns interest, that portion might be taxable.

Q: What If the Insurance Company Denies My Claim for Death Benefits?

Answer: If my claim was denied, I learned it’s important to ask for the specific reason in writing. I could then provide additional information or appeal the decision. Consulting a legal expert in such cases can also be helpful.

Related Articles

Car insurance claim appeal letter sample: free & effective, sample cancellation letter for health insurance: free & effective, gap insurance cancellation letter sample: free & effective, pet insurance cancellation letters [free samples], flood insurance claim letter for damaged goods (free sample), auto insurance cancellation letter sample: free & helpful, 2 thoughts on “sample letter to life insurance company for claim: free & effective”.

how to write a letter to insurance company for death claim?

Writing a letter to an insurance company about a death claim can be pretty straightforward. Start by clearly stating the purpose of your letter, like “I’m writing to file a death claim for [Name of Deceased].”

Include key details like the policy number, the date of the policyholder’s death, and any required documentation, such as a death certificate. Be clear and concise, and don’t forget to provide your contact information.