Tracking Studies

What are tracking studies.

In the broadest sense, tracking studies are longitudinal studies used in marketing research that survey a target population or audience at a specific time interval to measure changes in attitudes and behaviors. The questionnaire is rarely changed, and the time interval is kept consistent (i.e., weekly, monthly, etc.) so that results can be measured wave-to-wave.

Why Are Tracking Studies Important?

Objectives of tracking studies.

Tracking studies can have different objectives depending on the organization. Overall, their main goal is to measure changes in attitudes and behaviors and how they impact their brand. Here are just a few different things that tracking studies can be used to measure:

- Advertising Impact / Effectiveness

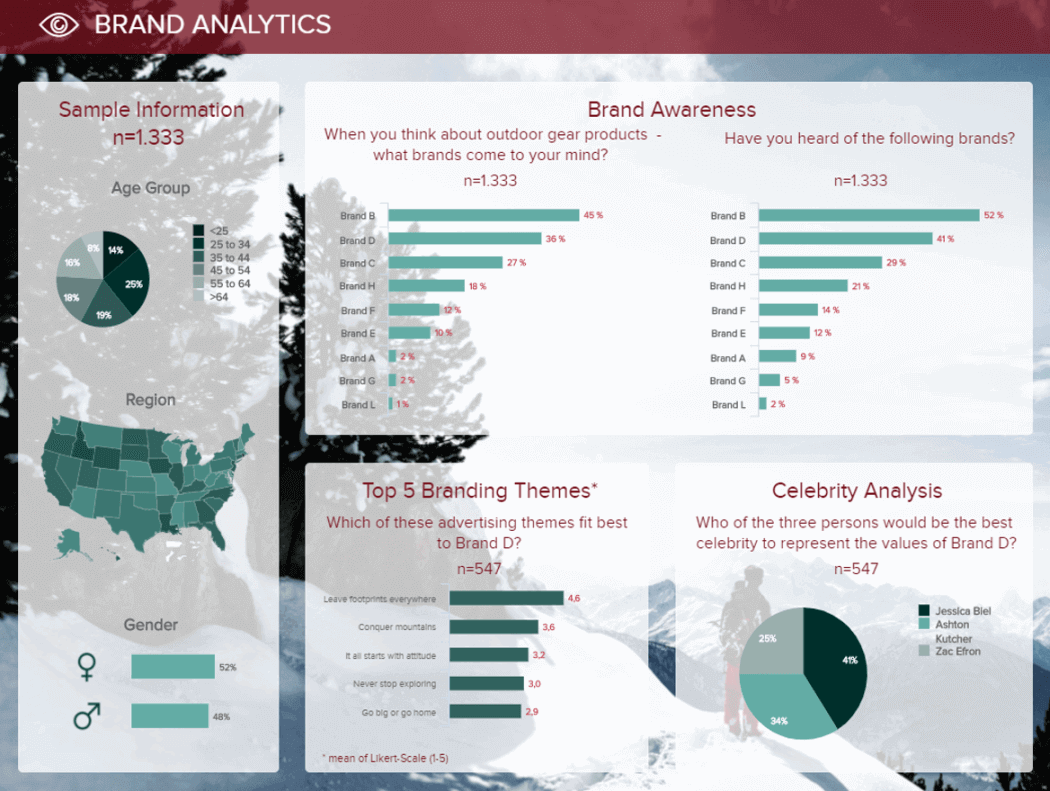

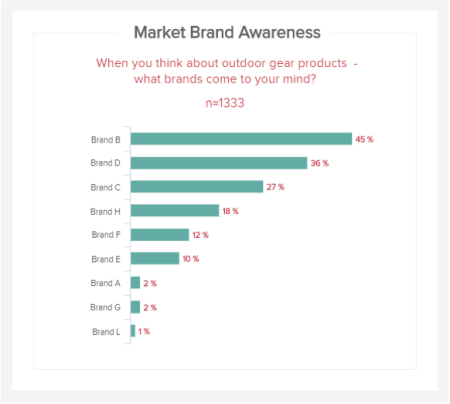

- Brand Awareness

- Brand Equity

- Brand Rating

- Brand Health

- Competitive Advantage

- Customer Perception

- Key Event Impact / Effectiveness

- Changes in attitudes or perceptions

- Brand, Social Issues, etc.

- Marketing Impact / Effectiveness

- New Product Launch

- Impact / Effectiveness

- Promotions Impact / Effectiveness

Types of Tracking Studies

There are many different types of tracking studies an organization might employ. The type of tracking study a brand or other organization may utilize depends on the type of information they are looking to gather and the goal of the research.

The diverse types of tracking studies include:

Online Customer Surveys

Brands and other organizations commonly use tracking studies that focus on their customers to understand how they change and evolve over time by continuously measuring buying patterns, habits, behaviors, attitudes, and demographics to identify shifts.

With each wave, you can collect feedback from customers on their habits, attitudes, perceptions, product awareness, emotions, and other key performance indicators, and compare them to previous waves to identify and understand changes in the brand’s consumersentiment

Insights gathered through these studies can help organizations make multi-million-dollar business decisions that can impact not only the brand, but the overall organization and its performance.

Receipt Tracking Surveys

Receipt tracking surveys take customer surveys to the next level. With customer surveys, brands, retailers, and other service providers are dependent on the respondents to self-identify if they are a customer. That is not the case with receipt tracking.

With receipt tracking, customers are required to upload their receipts to prove that they shopped at a specific store or bought a specific product. This allows brands to be more precise in their targeting of customers.

Non-Customer Surveys

This type of tracker study is like the customer survey, but the target audience is non-customers, neither current nor lapsed. Surveying non-customers, or even the general population on a consistent basis, can help an organization gather insights that can help measure and define items like:

Likelihood that potential buyers would switch brands/Customer loyalty

This study tracks the importance of price and/or other factors that buyers look at when comparing competing brands or products.

Awareness level of the product, brand, or organization among the general population

By conducting this type of survey, organizations can better evaluate their marketing plans or sales strategies, and adjust based on data-driven decisions, and overall win more business.

Employee Tracking Studies

While most tracking studies are focused on customers or potential customers, there are some that focus on employees. Employee tracking studies can be used to measure employee satisfaction, productivity, and engagement.

Employee tracking studies can help the human resources and executive teams understand what employees are feeling, while also helping identify any potential organizational issues so they can put plans in place to fix them.

Not only will it help identify organizational issues, but as you compare the tracking data wave-to-wave, you will be able to compare the results to benchmarks and identify areas of improvement.

Ad Effectiveness Studies

One of the more common tracker studies is an ad effectiveness tracker. In an advertising tracking study, marketers are looking to understand the effectiveness of their marketing efforts. For many marketers, campaign metrics only give one aspect of the story. It can be difficult to ascertain which components were impactful with consumers, and which may not have been. Ad effectiveness studies can help marketers and brands understand things like:

- Has brand awareness increased or declined?

- How do potential customers feel about our brand? (Both before and after a campaign, and if there was a change in brand perception.)

- Were consumers persuaded to purchase the product or service?

- Comparing data gathered from ad effectiveness studies from both customers and non-customers can be a great way to show how influential a marketing campaign was, and how much it has impacted consumer behaviors.

Best Practices for Tracking Studies

Given that tracker studies are some of the most important studies fielded in market research – with brands, consumer goods companies, and other organizations using them to base million-dollar decisions on – it is imperative that trackers provide the most accurate data possible.

To ensure that you get the best data out of your tracker, we have put together some best practices.

1. Know Your Sample Sources

Not every sample source is the same, and neither is the data they provide. It is critical to know your sample providers, how they recruit and manage their panel, their incentive structure, which devices respondents tend to take surveys on, and how suppliers invite their respondents. You should also be aware of their quality measures.

2. Use a Strategic Blend of Sources

Using a single source in your tracker study can cause a lot of problems, ranging from data bias, running out of sample, and over-representation of a single group, to data inconsistencies over time.

To avoid these problems, you should use a strategic blend of sample sources for your tracker studies. This means you take a systematic and deliberate approach in selecting and blending your sample suppliers. Doing so will allow you to avoid all the problems that a single source can cause, as well as ensure long-term success of your tracking study.

3. Adjust Over Time

While you want to keep as many variables as consistent as possible wave-to-wave, sample panels change over time. This is due to changes in their recruitment methods, incentive structure, panelist turnover, and more. As panel companies change, the data their respondents provide can also change. Every year you should evaluate your sample providers and look to see if you need to replace any to ensure that your overall sample plan remains stable, and your data remains reliable.

4. Overlay the Results with Current Market

Tracking studies can provide a wealth of data about your product or brand, as well as insights into purchasing behaviors. However, you should always look at what is going on in the marketplace and overlay the results. This will allow you to see if specific market events or conditions impact your data. Depending on the event, it could also explain any data anomalies or outliers when compared to previous waves.

5. Employ a Mobile-First Design Strategy

As with any type of online study, an ever-increasing number of respondents are taking surveys from their mobile devices, whether it’s from a phone or a tablet. This needs to be considered not only when you are designing your survey, but you should also look to make improvements wave-to-wave to ensure that the respondent experience is as good as it can be.

6. Shorter Questionnaires

Another aspect of respondent engagement that ensures you get the best results from your tracking studies is to ensure your questionnaires are not too long. You want to design your survey to ask the questions you want to gather your insights on but exclude any extraneous questions that might cause it to be longer than it needs to be. A tracking study is not the time to get “nice-to-have” insights.

History of Tracking Studies and Online Sample

In the old days of sampling, the best practice was leveraging a single sample source. The philosophy being that by using the same single source, you ensured data consistency wave-to-wave. Sample companies maintained similar panel management, ensuring that their panel was similar over time.

However, over the last few years, the perception of using a single sample source as a best practice diminished. There are a variety of factors that drove this change – mergers, technological advancements such as programmatic sampling, mobile apps, the interwovenness of providers because of API integrations, higher levels of fraud, providers plain running out of target respondents. All of this has led to a shift in market researchers using multiple sample sources for studies.

Researchers started using multiple sample sources out of necessity, not because they thought it was the best way to do it. Panel sources they had engaged for a study were falling short and they had to bring on additional sources to “top-up” the study. Demand certainly outpaced supply.

There are even times when a client or a researcher may have thought they were using a single source, but the supplier brought in other providers to fill needed completes or quotas their panel couldn’t achieve. This method of aggregating sample is known as “stacking” suppliers. Multiple suppliers are used because a single sample source cannot provide all the completes needed on a particular study.

Other sample sources are added at the end of the study to gather the rest of the needed completes. There is no magic number of sample sources added with this method; sources are simply added until the study has all the completes needed. Using this method can make closing studies feel like fire drills. It almost takes the control of your project away from you.

Blended Sample

Sample blending is the process of using multiple suppliers, but with a more planned and intentional method. It usually means using three or more different panels and setting limits on the number of completes each panel can get, so no one panel gets more than 50%.

EMI’s Approach to Tracking Studies

Consistency. It is one of the most key factors for any market researcher, especially ones conducting tracking studies. That is why EMI’s approach to tracking studies focuses on providing you accurate insights, long-term feasibility, and data consistency wave-to-wave. We do this by creating a strategic sample blend customized to your tracking studies, your needs, and your research goals. By creating a custom, strategic sample blend, EMI can ensure consistency and quality in your study.

Strategic Sample Blending

EMI is unique in that we don’t just blend sample for the sake of blending. We do it with quality and consistency in mind, understanding that not all techniques for combining multiple panel providers are created equal. In other methods of combining sample like stacking or aggregating, no care is given to panel makeup, respondents’ attitudes and behaviors, or panel bias, and is often done in a last-ditch effort to reach feasibility goals. EMI is different. We know that customizing a strategic blend based on clients’ unique needs will ensure the best results possible. So, what does strategic sample blending entail?

Strategic sample blending takes sample blending a step further. Not only do you use three or more sample providers, but the selection and blending of the selected providers is done in an intentional and controlled manner. Sample sources are selected to complement one another, while reducing the overall sample bias and any potential behavioral or attitudinal impacts a panel can have. This ensures not only the accuracy of your tracker’s data, but that it is truly representational of demographics, behavior, and attitudes of your target audience.

Additionally, by strategically selecting your providers and managing their allocation, you can increase your overall feasibility for the life of your tracker, avoiding the dreaded “top-up” situation that can skew your data. By strategically blending sample, you can ensure the consistency and reliability of your tracker and the data it provides, allowing you and your organization to make the best business decisions possible.

So, how do we do this? We start with a typical blend formula, then customize it based on a variety of criteria so that the strategic blend ensures you will meet the goals of your study. After taking all the factors into account, we develop your strategic blend by plotting out all the partners on the factors we discussed and by identifying panel partners that fit into the sweet spot to meet all the criteria, while providing consistency and feasibility for the life of the tracker. We also balance the partners on attitudes and behaviors to eliminate bias.

Strategic sample blending has several advantages:

- Improved Feasibility

- Improved Consistency

- Reduced Risk

- Reduced Field Time

Collaborating with clients, EMI serves as an extension of your market research team.

EMI’s network of 150 global partners can connect you with your target audience – Business, Consumer, or other specialty population – by connecting you with the right panel blends to measure and track attitudes, behaviors, and other opinions across the globe.

IntelliBlend®

IntelliBlend® is EMI’s unique methodology of strategically blending sample sources in an intentional and controlled approach in order to deliver the most representative and accurate demographic, behavioral, and attitudinal data. This approach includes double opt-in research panels but may also include non-traditional sources such as social media, which is utilized in a limited and controlled manner.

IntelliBlend® can vary from project-to-project based on the needs of the research. The unique blend is developed by leveraging proprietary research-on-research data as well as over 20 years of sample experience. For ongoing work, the custom sample plan is replicated from wave-to-wave utilizing EMI’s sample management platform, SWIFT, which enforces sample source quotas, thus ensuring data consistency.

Our Recommendations for Adjusting Your Tracking Study Over Time

There are numerous factors that may cause you to adjust the sample allocation of your providers, or your decision to work with specific sample providers, including:

- Changes in base size

- Changes in length of interview (LOI)

- Changes to the incidence rate (IR)

- Changes to the sample quotas

- Feasibility of one or more of your sample providers

- Poor or declining data quality

- Mergers/Acquisitions in the sample industry

Similarly, there is a variety of criteria that we can control when creating your blend, including:

- Attitudes and Behaviors by panel

- Client KPIs

- Feasibility

- Targeting Criteria

- Fielding Time & Fielding Criteria

- And much more

When you are looking to adjust your tracking studies, we have five key recommendations you should follow:

Monitor all KPIs by sample provider over time.

Have at least one or more sample provider that provides a small amount of completes per wave but can increase their allotment of completes if necessary.

Make slight adjustments to sample partner blends to start. Immediate major changes may have adverse impacts on KPIs.

Maintain full transparency between the research team, client team, and sample team and ensure everyone understands the advantages and disadvantages of adjusting the blend.

Work with a sample expert to help identify like panels to ensure minimal impact to KPIs.

Transitioning a Tracking Study to EMI

EMI’s strategic sample blending methodology ensures we can help you transition your brand tracking study, no matter the scenario you currently face, and build a strategic blend that is controlled and intentional to help you meet your study’s goals, while also reducing bias and ensuring consistency over time.

When you are looking to transition your tracking study, you should collaborate with an expert on the sample industry, not just one specific panel. We work with clients to transition their tracking studies all the time and have established a process that leads clients to have higher quality data and viability of their tracker long-term.

First, we conduct research-on-research on the sample industry to determine similarities and differences in attitudes and behaviors between sample providers. This allows us to examine the specific sample provider you are looking to replace, identify providers that have similar characteristics, and make recommendations on the replacement.

We also conduct a side-by-side comparison of your existing partner mix and our recommended panel blend to measure for consistency. No matter the scenario you face, EMI has a migration method that can help. To learn more about which method might be right for you, check out the video below.

Ready to take that next step?

Privacy overview.

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

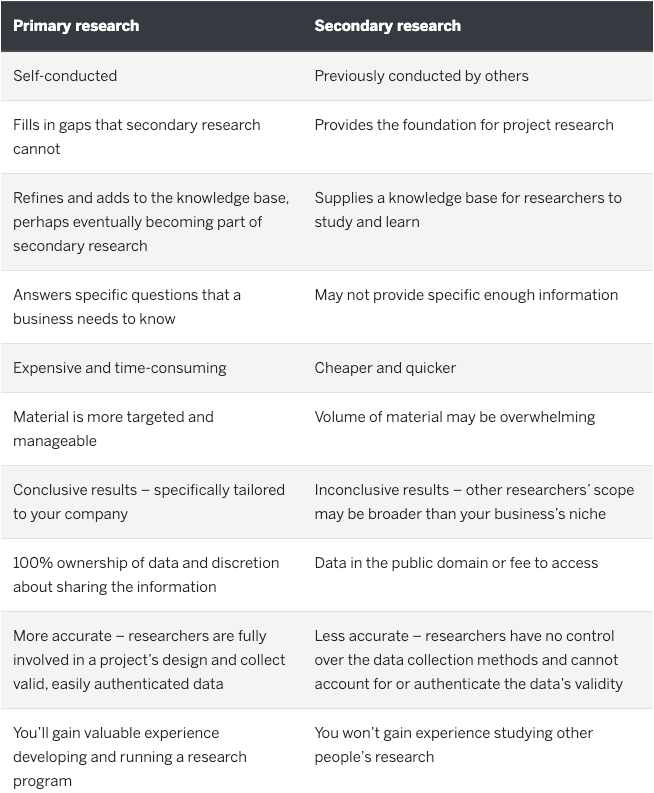

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

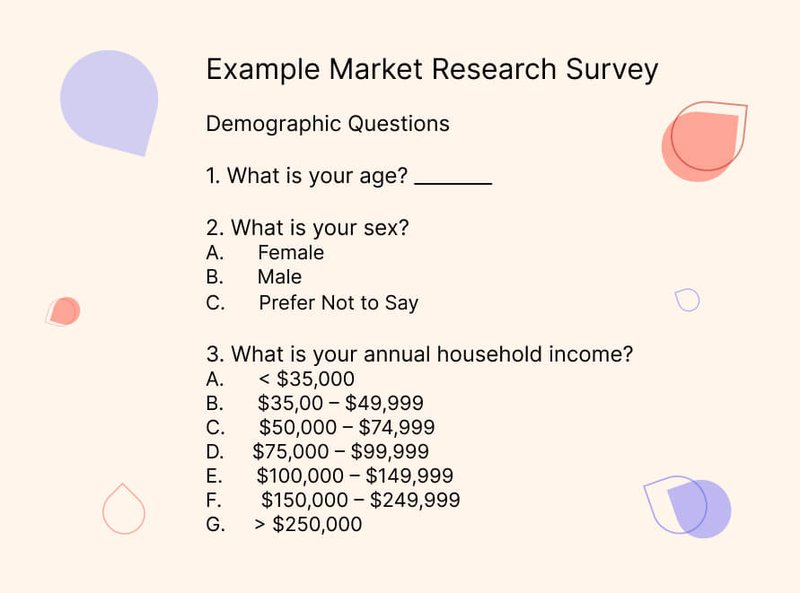

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

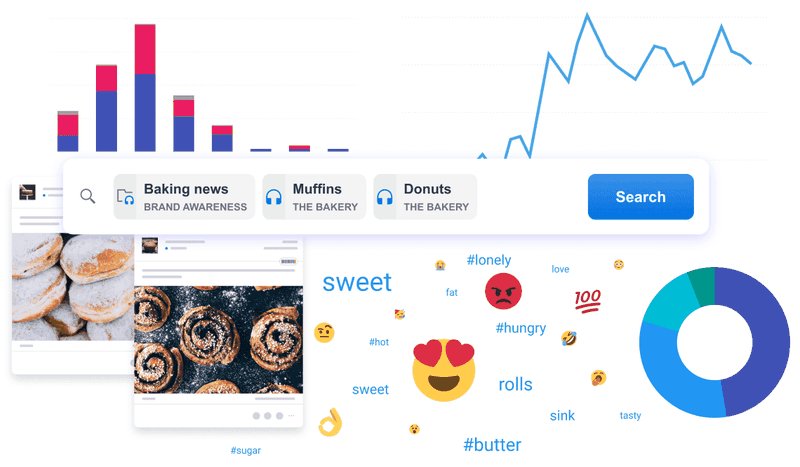

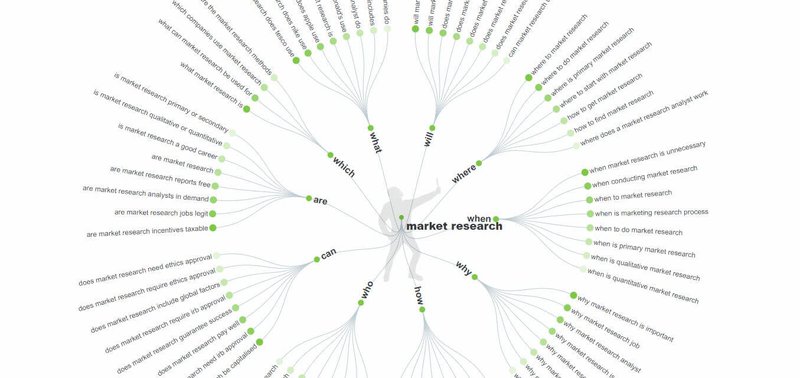

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

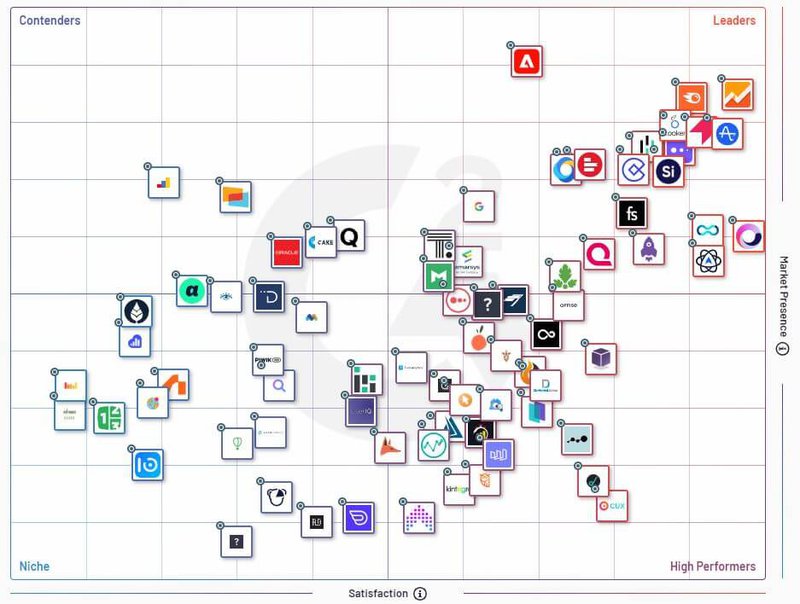

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

- Company History

- Executive Team

- Banking, Finance, and Insurance

- Business-to-Business

- Consumer Packaged Goods (FMCG)

- Governmental Agencies

- Home Improvement & Trade Research

- Pharma, Medical, Health, and Wellness

- Restaurants

- Social Responsibility/Social Causes

- Technology Sector

- Client List

- Quality Assurance

- Data Security

- Advertising Testing Systems

- Advertising Tracking Research

- Awareness Trial Usage (ATUs)

- Brand Equity Monitoring

- Category Management

- Education Survey Research

- Economic Development Research

- Concept Testing

- Customer Loyalty Simulator

- Mail Surveys

- Data Entry Services

- Multilingual Coding

- Cross-Tabulation Services

- Employee Satisfaction Research

- Employee Retention

- Global Research

- American Home Comfort Study

- Economic Index

- Marketing Strategy

- Brand Name Research

- DecisionSystems

- Technology Forecasting

- Global Internet Panels

- Online Communities

- Panel Management

- Private Online Research Panels

- ESOMAR 28 Questions

- Simulated Shopping with Shelf Sets

- Custom/Ad Hoc Packaging Research

- Optima Product Testing

- Custom Product Testing

- Product Quality Monitoring

- Sensory Research Systems

- Promotion Testing

- Shopping Research

- Strategy Research

Tracking Research

- Win-Loss Research

- Meet Our Moderators

- Digital Ethnography

- In the Moment Research

- Large-Scale Qualitative

- Online Qualitative

- Qualitative Research (Focus Groups)

- Unconventional Qualitative Methods

- Qualitative Research Library

- Analytical Consulting

- Choice Modeling Techniques

- Conceptor Volumetric Forecasting

- Demand Forecasting

- Economic Feasibility Analysis

- Economic Impact Analysis

- Econometric Modeling

- Marketing Science

- Marketing Mix Modeling

- Market Segmentation Methods

- Operations Research

- Predictive Analytics & Marketing Research

- Text Mining

- Pricing Research

- Sales Forecasting and Sales Modeling

- Acquisition Reviews

- Asset Optimization

- GIS mapping

- Location Analysis

- Shopping Center Repositioning

- The Imaginators®

- Relevant Innovation

- Brand Explorations

- Jerry W. Thomas Blogs

- Audrey Guinn Blogs

- Bonnie Janzen Blogs

- Clay Dethloff Blogs

- Elizabeth Horn Blogs

- Felicia Rogers Blogs

- Heather Kluter Blogs

- Jennifer Murphy Blogs

- John Colias Blogs

- Julie Trujillo Blogs

- Lesley Johnson Blogs

- Tom Allen Blogs

- Blog Archives 2017-2021

- Case Histories

- Download Our Complimentary Report

- Economic Index Background

- Email Newsletter

- Free Software

- Videos - General Marketing Research

- Videos - Leadership Strategy Interviews

- Videos - Market Segmentation

- Videos - Media Mix Minute

- Videos - Strategy Series

- Webinars - Insider Series

White Papers

- Research Advice

New and established products give rise to the need for tracking awareness, trial, usage, and image (either continuously or periodically).

- Advertising Tracking (CopyTrack®)

Attitudinal/Image Tracking

Attitudes and images within, and relative to, a product category change over time. Every two to three years (depending upon this rate of change), a comprehensive attitudinal/image assessment is desirable to serve as a platform for marketing planning, new product development, and competitive intelligence.

New Product/Test Market Tracking

Systematically monitoring awareness, trial, and repeat purchase rates for new products is a valuable application of telephone tracking or Internet-based tracking. Usually this tracking data is combined with other data (shipments, store audits, scanner data, and distribution checks) for a full evaluation of the test market.

- Customer Experience Optimization & Loyalty Tracking

This can be an important component in the overall marketing research plan, as long as it is carefully planned and limited in its demands upon customers (lest we offend them with customer satisfaction surveys). Sometimes, the very best customer satisfaction tracking does not involve any formal surveys. We strive to help our clients design and implement efficient and unobtrusive satisfaction measurement systems.

Brand Equity Monitor™

Decision Analyst’s Brand Equity Monitor™ is a comprehensive metric that measures relative brand preference, based on all aspects of the brand including both rational and emotional perceptions of the products/services, customer service, images, and supply or availability in the marketplace.

Tracking Research Services

For more information on Tracking Research, please contact Jerry W. Thomas , President/CEO, by emailing him at [email protected] , or by calling 1-800-ANALYSIS (262-5974) or 1-817-640-6166 .

Watch Our Tracking Research Video

- View More Videos

- Dark Energy in the Digital Age

- Small Business Survival

- Survival Of The Fittest

How to conduct a brand tracking study

What is a brand tracking study, why are brand tracking studies so vital, what brand health metrics should you be tracking, different types of brand tracking studies, how to conduct a brand tracking study in 7 steps, brand tracking made easy with attest.

Are all those creative juices from your team flowing in the right direction? Is your brand getting more well-known, more popular, or more loved—or is it a combination of the three?

Where your brand stands today is crucial knowledge to inform tomorrow’s strategy. Yet, a lot of businesses tend to not take stock, launching campaigns left and right without creating a benchmark.

If you want to do things differently—i.e. better—you’ve come to the right place. Here we’ll walk you through the essentials of running brand tracking studies .

A brand tracking study is a research method used to track the perception of a particular brand over time. This type of study can be used to assess how well a brand is performing, identify any changes in perception that need to be addressed, and determine what factors might be influencing the public’s perception of the brand.

How to track your brand with Attest

Learn what people REALLY think about your brand—and how this affects their likelihood to buy—with a brand tracking study

Would you want to know what people are thinking of you at all times? Personally, probably not.

But for businesses, things are a little different. You can and should ask consumers how they feel about them, because ultimately, you create a brand, product, or service for them—your target audience.

That’s why it’s incredibly important to measure things like brand awareness, brand perception and other brand health metrics. Not just once, but over time, regularly, to figure out if you’re on the right path to charming your consumers.

Brand tracking will shine a light on which actions and campaigns have contributed in a positive way to your brand health , and which ones were not such great ideas. This will serve as incredible fuel for your future decisions.

Brand tracking metrics are super important to measure because they can provide insights into how customers view a company and its products, over time.

Measuring brand health can help businesses track the effectiveness of their marketing campaigns and identify any areas where they may need to improve their brand strategy.

Additionally, tracking brand health can help you spot any potential problems early and take corrective action. Here’s which key metrics from brand tracking studies we encourage you to track to make sure you’re on top of your overall brand health.

Brand reputation

A brand’s reputation is an important aspect to track in your market research, as it can have a big impact on whether people trust your brand enough to spend their money with you.

There are a number of factors that can influence a brand’s reputation, including the quality of the product or service, customer service, marketing and advertising efforts, and the company’s overall ethical and social responsibility.

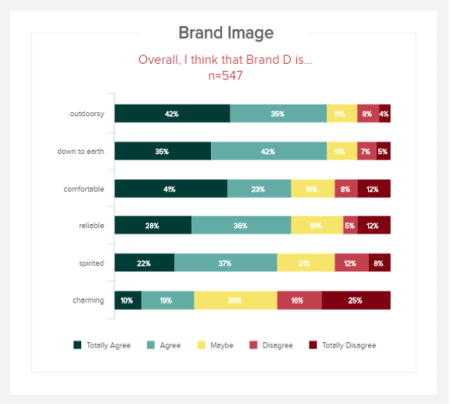

Brand perception

Brand perception refers to the way your brand makes people think and feel. Much like reputation, it can be affected by a variety of factors, such as the quality of the product or service, the company’s reputation, marketing and advertising efforts, and customer service.

When tracking brand perception, it’s important to measure ALL perceptions—positive, negative and everything in between.

- Brand awareness

Brand awareness is one of the most important metrics to measure in your brand tracking research. It measures how well the public is aware of a particular brand and can be used to gauge the success of marketing campaigns and other promotional activities.

Measuring brand awareness over time can help you identify any changes in perception and determine what factors might be influencing the level of awareness people have of your brand.

Brand recall

Recall is a metric used in market research to measure how often a customer remembers a brand. This can be done through surveys, where customers are asked if they remember a certain brand. This is often used to measure the effect of a marketing campaign. Bear in mind: recall is not the same as brand recognition. Learn more about the difference between recall and recognition.

Brand equity

Brand equity measures the value of a brand, in the context of your market and competitors.

There are four main elements that make up brand equity:

- Loyalty to your brand

- Perceived quality

- Brand association

When you bring together all of these elements, you’ll begin to understand how much of your market belongs to you and how much your brand is worth.

Brand loyalty

Loyalty to your brand is a key measure of brand health, as it indicates how likely customers are to stick with a particular brand, which is especially important if you’re trying to increase your customer lifetime value (CLV).

There are a number of factors that can influence loyalty, including the quality of your product or service, your brand’s reputation, marketing and advertising efforts, and customer service.

Branding linkage

Would you be able to tell which advertisement is from our business? What about if we remove any logos or slogans in order for the audience?

Branding linkage = Brand association after a ‘non-branded’ content effort

If a viewer can associate an unbranded marketing effort from your business as being connected to your business, you’re on the right track. If not, you need to reconsider some creative decisions.

Branded searches

Branded searches are when a person searches for a specific product or company on the internet. They are usually looking for information about the company, such as the address or phone number, or they are looking to buy a product from the company. Branded searches can also be used to track how well a company is doing online. For instance, people googling ‘Nike running shoes’ shows their branding success: they’re not simply looking for ‘running shoes’.

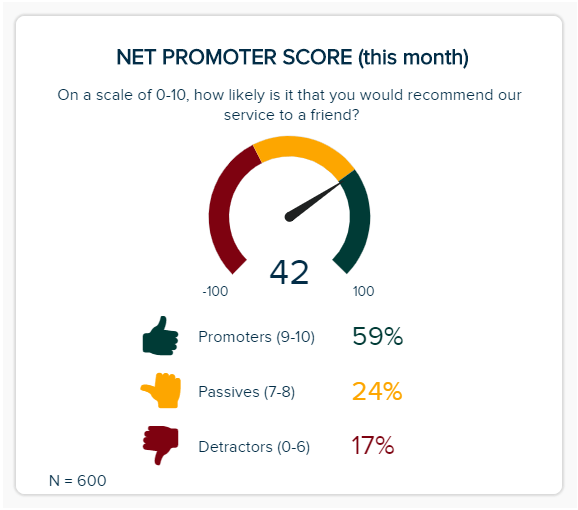

NPS (Net Promoter Score)

The net promoter score (NPS) is a metric used to measure customer loyalty and is calculated by asking customers how likely they are to recommend a brand to others. Your NPS number is based on the answer to the question “how likely are you to recommend our company/product/service to a friend or colleague?” Respondents then give their answer on a range from 1 to 10. It’s a classic when it comes to brand tracking.

Brand favorability

A brand’s favorability is a measure of whether people favor your brand over another or not. Bear in mind: this doesn’t necessarily show whether they love you. They might favor your brand over your arch enemy—but it’s still possible they don’t like either of you. Combine it with purchase intent and market share to learn more.

Want to know more about brand health metrics before starting your brand tracking survey? Here are the 14 most important brand health metrics!

Why are these brand health metrics so important?

Businesses traditionally look at metrics such as customer retention, sales, profit and market share. But combining these numbers over time with the knowledge you gather from your brand tracking study, will show you what has affected those retention, sales and profit numbers.

We have some bad news—you can’t just throw a few metrics in the blender and call it a brand tracking survey. Your brand tracking studies should inform the long-term brand strategy you’ve laid out for your business. Here are some examples of brand tracking studies.

Tracking marketing efforts and campaign effectiveness

The metrics you’ll be using: brand awareness/perception/reputation (depending on the goal of the campaign), brand linking, branded searches.

Next time you launch a big advertising campaign, set up a brand tracking study alongside it. You’ll be measuring right before the campaign, right after and an X amount of months after the campaign to see its long-term impact on your brand. Depending on the goal of the campaign, you can focus on awareness, perception, or reputation.

Tracking customer satisfaction/feedback

The metrics you’ll be using: brand’s loyalty, brand favorability, brand reputation.

How is the relationship with your current customers evolving over time? How can you increase customer loyalty, and turn existing customers into advocates for organic brand growth? This is what you’ll be measuring if you focus on this type of brand tracking study. You can track changes in the relationship, and see what effect price changes, new products, new competing brands and other events in your product category have.

Tracking your brand’s health among non-customers

The metrics you’ll be using: brand awareness, branded searches, brand perception.

It’s crucial to also keep an eye on people who aren’t your customers—yet… Are they becoming at least more aware of your brand? What misconceptions do they have about you? What’s your general reputation? But make sure you balance your target audiences right: there’s no use in collecting data from people who will never be your customers; however don’t forget about the influence non-customers might have over the purchasing decisions your actual customers might make.

Tracking your brand amongst (possible) employees

The metrics you’ll be using: brand awareness, brand perception and brand reputation

It’s not just potential customers you want to impress—it’s future employees, too. A great way to keep your hiring process sharp is by infusing it with a brand tracking study that revolves around your reputation amongst jobseekers.

Tracking your brand alongside other brands

The metrics you’ll be using: brand awareness, NPS, branding linkage

Market research is incredibly versatile, so find something that fits your goals! If you want to get more insights in how you’re performing in your target market, track brand health against competition. You can check what new competitors, consumer behavior and other unexpected events do to performance metrics such as business growth, market penetration and brand usage.

Now you’ve seen that there are different types of brand tracking studies, you understand that there is not just one road that leads there. But in general, there are some steps you simply can’t miss if you want to make your brand tracking study the success it deserves to be.

Step 1: Set a goal and corresponding metrics

Choosing the right metrics for your brand tracking study can be tricky. You want to make sure you’re measuring the things that are important to your business, but you also need to make sure they’re relevant to your customers.

Follow your strategy: what are you focusing on in the next 5 years? Is it building stronger relationships with current customers? Gathering more customers? Let this lead the way to choosing the right metrics.

Step 2: Select an audience

When selecting your target audience for a brand tracking study, it’s important to be as specific as possible. Trying to measure the awareness and perception of a brand among the general public is a daunting task, and you’ll likely get more useful information by narrowing down your focus.

Will you be focusing on current customers who’ve been with you for a while? New customers? Or do you want to learn the purchase intent for the ones whose heart you have yet to conquer? Make sure it makes sense with the metrics you choose.

Step 3: Ask the right questions

You’re in luck! We’ve written several guides about which survey questions you can ask for certain metrics. We’ll just leave them here:

- 100 Great Survey Questions and Examples

- Brand Perception Survey: Questions, Examples and Template

- 16 Brand positioning survey questions that work

- 24 brand image survey questions for real insights

- And we have a whole learning hub, with loads of guides on brand tracking —head over to our Consumer Research Academy !

Step 4: Collect that data!

When it comes to data collection for your brand tracking study, there are a few different ways to go about it. The most common way is through surveys, but you can also look at other numbers such as customer retention rates, profit and loss statements, and social media analytics. No matter how you collect the data, make sure they match periods and audiences.

Track your brand with Attest

Set up a regular brand tracker to see how your awareness and perception are changing over time—and spot trends before they become an issue!

Step 5: Analyze, analyze, analyze

Once you’ve gathered all your data, it’s time to start analyzing it. This is where you’ll see what trends are emerging with your brand—the good, the bad and the neutral.

Are people becoming more aware of your brand? What do they think of your products? How does customer satisfaction change over time?

There are a million questions you can get answered in the data you get, but make sure to stay focused on the goal of your research.

Step 6: And then… Action!

Once you’ve gathered all your data, it’s time to start acting on it. Which campaigns do more harm than good? What is attracting customers to your competitors? How can you become more proactive to keep them on board?

Step 7: Repeat regularly

This is where the tracking part comes in. Brand tracking isn’t something you should do once and forget thereafter. How often you will conduct these studies depends on the length of them. You can also choose to run smaller surveys more often that focus on specific parts of your larger brand tracking study.

Bonus step: Create context with competitors

With this step you’re going the extra mile in your brand tracking study. Let’s say your NPS is a big part of your brand tracking study, because your long-term goal is to grow your brand from the inside out, gathering more customers organically.

A handy trick to give more context in your study, is to not only measure your own metrics, but compare yourself to a competitor. So, if you ask respondents for your own NPS, also ask about another brand. This will put the number in perspective and will guide your decisions a whole lot better.

Alright, what else do you need for your first brand tracking study? Is it templates? Help from an expert researcher? More resources for the true DIYers?

We’ve got it all! Attest is here for all levels of brand trackers. We’ve created some handy templates that will have your online survey up and running in no time. Have a look and play around with it to make it yours!

If you are keen to get started but want to ask an expert for their opinion, let’s chat. All our users get access to brand tracking researchers who have done this rodeo over and over, and are eager to put their latest insights to use in your survey.

The Experts’ Guide to Brand Tracking

How to look at the impact of things like audience reach, panel diversity, and survey design to help you decide whether your current brand tracker is up to scratch.

VP Customer Success

Sam joined Attest in 2019 and leads the Customer Research Team. Sam and her team support brands through their market research journey, helping them carry out effective research and uncover insights to unlock new areas for growth.

Related articles

7 brand intelligence software to collect insights, brand tracking, will travelers be more risk-averse in q4, open-ended survey questions: definition, examples and tips, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

The Ultimate Guide to Market Research [+Free Templates]

A comprehensive guide on Market Research with tools, examples of brands winning with research, and templates for surveys, focus groups + presentation template.

Rakefet is the CMO at Mayple. She manages all things marketing and leads our community of experts through live events, workshops, and expert interviews. MBA, 1 dog + 2 cats, and has an extensive collection of Chinese teas.

Learn about our

Natalie is a content writer and manager who is passionate about using her craft to empower others. She thrives on team dynamic, great coffee, and excellent content. One of these days, she might even get to her own content ideas.

Updated February 26, 2024.

![market research studies tracking The Ultimate Guide to Market Research [+Free Templates] main image](https://entail.mayple.com/en-assets/mayple/62b4087370d3b5eab8bfb6b6_marketingresearch1_e2786f4e8b966e44f1401562fa23c07b_2000-1699776197229.jpg)

Before you do anything in business you have to have a good grasp of the market. What’s the market like? Who are your competitors? And what are the pain points and challenges of your ideal customer? And how can you solve them? Once you have the answers to those questions then you are ready to move forward with a marketing plan and/or hire a digital marketing agency to execute it.

In this guide we break down what market research is, the different types of market research, and provide you with some of the best templates, tools, and examples, to help you execute it on your own.

Excited to learn?

Let’s dive in.

What is market research?

Market research is the process of gathering information about your target market and customers to determine the success of your product or service, make changes to your existing product, or understand the perception of your brand in the market.

“Research is formalized curiosity, it is poking and prying with a purpose.” - Zora Neale Hurston

We hear the phrase "product-market fit" all the time and that just means that a product solves a customer's need in the market. And it's very hard to get there without proper market research. Now, I know what you're going to say. Why not get actionable insights from your existing customers? Why not do some customer research?

The problem with customer research is two-fold:

- You have a very limited amount of data as your current customers don't represent the entire market.

- Customer research can introduce a lot of bias into the process.

So the real way to solve these issues is by going broader and conducting some market research.

Why do market research?

There are many benefits of doing market research for your company. Here are a few of them:

- Understand how much demand exists in the market, the market size

- Discover who your competitors are and where they are falling short.

- Better understand the needs of your target customers and the problems and pain points your product solves.

- Learn what your potential customers feel about your brand.

- Identify potential partners and new markets and opportunities.

- Determine which product features you should develop next.

- Find out what your ideal customer is thinking and feeling.

- Use these findings to improve your brand strategy and marketing campaigns.

“The goal is to transform data into information, and information into insight.” - Carly Fiorina

Market research allows you to make better business decisions at every stage of your business and helps you launch better products and services for your customers.

Primary vs secondary research

There are two main types of market research - primary and secondary research.

Primary research

Primary market research is when researchers collect information directly, instead of relying on outside sources of information. It could be done through interviews, online surveys, or focus groups and the advantage here is that the company owns that information. The disadvantage of using primary sources of information is that it's usually more expensive and time-consuming than secondary market research.

Secondary research

Secondary market research involves using existing data that is summarized and collected by third parties. Secondary sources could be commercial sources or public sources like libraries, other websites, blogs , government agencies, and existing surveys. It's data that's more readily available and it's usually much cheaper than conducting primary research.

Qualitative vs quantitative research

Qualitative research is about gathering qualitative data like the market sentiment about the products currently available on the market (read: words and meanings). Quantitative research deals with numbers and statistics. It's data that is numbers-based, countable, and measurable.

Types of market research

1. competitive analysis.

Every business needs to know its own strengths and weaknesses and how they compare with its largest competitors in the market. It helps brands identify gaps in the market, develop new products and services, uncover market trends, improve brand positioning , and increase their market share. A SWOT analysis is a good framework to use for this type of research.

2. Consumer insights

It's also equally important to know what consumers are thinking, what the most common problems are and what products they are purchasing. Consumer research can be done through social listening which involves tracking consumer conversations on social media. It could also include analyzing audiences of brands , online communities, and influencers, and analyzing trends in the market.

3. Brand awareness research

Brand awareness is a super important metric for understanding how well your target audience knows your brand. It's used to assess brand performance and the marketing effectiveness of a brand. It tells you about the associations consumers make when they think of your brand and what they believe you're all about.

4. Customer satisfaction research

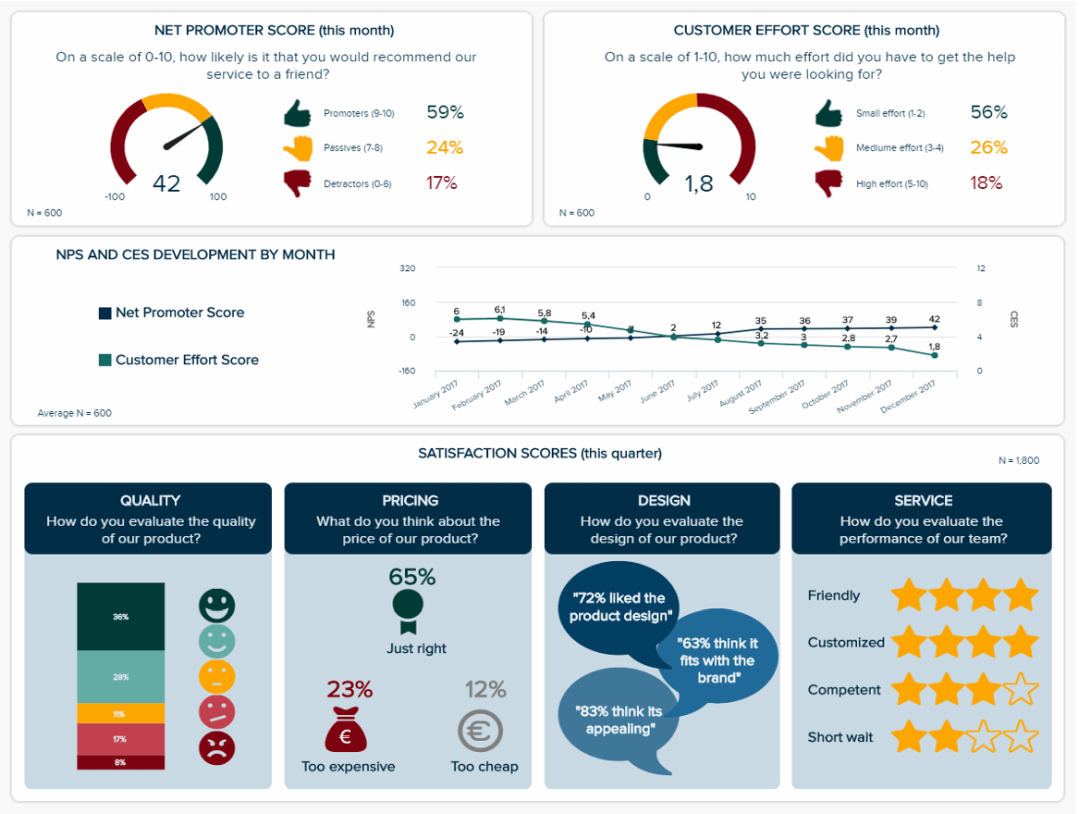

Customer satisfaction and loyalty are two really important levers for any business and you don't have to conduct in-depth interviews to get that information. There is a wide range of automated methods to get that kind of data including customer surveys such as NPS surveys, customer effort score (CES) surveys, and regularly asking your customers about their experience with your brand.

5. Customer segmentation research

Customer segmentation research involves figuring out what buckets consumers fall into based on common characteristics such as - demographics, interests, purchasing behavior, and more. Market segmentation is super helpful for advertising campaigns, product launches, and customer journey mapping.

6. Interviews

Customer interviews are one of the most effective market research methods out there. It's a great way for business owners to get first-party data from their customers and get insights into how they are doing in real time.

7. Focus groups

Focus groups are a great way to get data on a specific demographic. It's one of the most well-known data collection methods and it involves taking a sample size of people and asking them some open-ended questions. It's a great way to get actionable insights from your target market.

8. Pricing research

Pricing strategy has a huge influence on business growth and it's critical for any business to know how they compare with the leading brands in their niche. It can help you understand what your target customer is willing to pay for your product and at what price you should be selling it.

To start, get automated software to track your competitors' pricing . Then, summarize your research into a report and group the results based on product attributes and other factors. You can use quadrants to make it easier to read visually.

9. Campaign research

It's also important for a brand to research its past marketing campaigns to determine the results and analyze their success. It takes a lot of experimentation to nail the various aspects of a campaign and it's crucial for business leaders to continuously analyze and iterate.

10. Product/service use research

Product or user research gives you an idea of why and how an audience uses a product and gives you data about specific features. Studies show that usability testing is ranked among the most useful ways to discover user insights (8.7 out of 10), above digital analytics and user surveys. So it's a very effective way to measure the usability of a product.

Now that you know the different types of market research let's go through a step-by-step process of setting up your study.

How to conduct a market research study

Looking for your next business idea? Want to check which niche markets are going to be best for it? if it's going to Here's a pretty simple process for conducting

1. Define your buyer persona

The first step in market research is to understand who your buyers are. For that, you need a buyer persona (sometimes called a marketing persona) which is a fictional generalized description of your target customer. You could (and should) have several buyer personas to work with.

Key characteristics to include in your buyer personas are:

- Job title(s)

- Family size

- Major challenges

Now that you've got your customer personas it's time to decide who to work with for your research.

2. Identify the right people to engage with

It's critical that you pick the right group of people to research. This could make or break your market research study. It's important to pick a representative sample that most closely resembles your target customer. That way you'll be able to identify their actual characteristics, challenges, pain points, and buying behavior.

Here are a few strategies that will help you pick the right people:

- Select people who have recently interacted with you

- Pull a list of participants who made a recent purchase

- Call for participants on social media

- Leverage your own network

- Gather a mix of participants