Home » Blog » Dissertation » Topics » Finance » Personal Finance » 80 Personal Finance Research Topics

80 Personal Finance Research Topics

FacebookXEmailWhatsAppRedditPinterestLinkedInWelcome to the realm of academic exploration and financial insight! Finding captivating and pertinent topics is the pivotal first step for students embarking on the exhilarating research journey. As you stand at the crossroads of academia and personal finance, unearthing compelling research topics to shape your undergraduate, master’s, or doctoral thesis/dissertation might seem a formidable […]

Welcome to the realm of academic exploration and financial insight! Finding captivating and pertinent topics is the pivotal first step for students embarking on the exhilarating research journey. As you stand at the crossroads of academia and personal finance, unearthing compelling research topics to shape your undergraduate, master’s, or doctoral thesis/dissertation might seem a formidable challenge. Fret not, for this guide is tailored to be your compass in navigating through the labyrinth of possibilities that the world of personal finance offers.

In this blog post, we will explore a treasure trove of potential research topics that pique academic interest and promise to contribute to the ever-evolving landscape of financial wisdom.

A List Of Potential Research Topics In Personal Finance:

- A systematic review of behavioural biases in personal investment decision-making.

- Behavioural biases and their impact on individual investment decisions.

- Impact of Brexit on UK household investment behaviours and attitudes.

- Resilience and adaptability in personal financial management after the pandemic.

- Examining the evolving landscape of personal finance research post-COVID-19.

- Exploring the connection between mental health and financial management.

- Health crisis preparedness and its influence on personal financial planning.

- Role of fintech innovations in shaping the UK personal finance landscape.

- Comparative analysis of active vs. passive investment strategies.

- Social and cultural influences on personal financial behaviours.

- The role of social media in shaping financial attitudes and behaviours.

- Evaluating the impact of financial education programs in schools.

- Effects of economic uncertainty on individual saving and spending behaviours.

- Financial planning for the gig economy workforce.

- Real estate vs. stock market: A comparative study of investment preferences.

- Impact of financial stress on relationships and family dynamics.

- Behavioural insights into credit card usage and debt accumulation.

- Effects of remote work on spending habits and housing preferences.

- Literature synthesis on the impact of financial literacy interventions on youth.

- Pension reforms and retirement planning strategies in the UK.

- The role of financial literacy in retirement planning.

- Analysis of factors influencing successful retirement transitions.

- Ethical considerations in personal investment and portfolio management.

- Cultural perspectives on inheritance and intergenerational wealth transfer.

- Impact of celebrity endorsements on personal finance decisions.

- Implications of behavioural economics for designing effective savings schemes.

- Psychological motivations behind cryptocurrency investment.

- Role of social support networks in coping with financial challenges.

- The psychology of luxury goods consumption and its financial aftermath.

- Behavioural biases in the assessment of insurance needs and coverage.

- Investor reactions to financial market bubbles and crashes.

- Exploring the role of cultural norms in UK millennials’ financial decision-making.

- Gender differences in financial decision-making and their consequences.

- Impact of government stimulus programs on household financial decisions.

- Reviewing the effectiveness of robo-advisors in long-term investment strategies.

- Impact of cognitive ageing on financial decision-making abilities.

- Exploring the link between health and long-term financial planning.

- Digital payment trends and their implications for personal finance management.

- Psychological drivers of charitable giving and philanthropic behaviours.

- Navigating cultural norms and financial practices among immigrants.

- Investor behaviour during times of geopolitical uncertainty.

- Financial implications of the sharing economy and collaborative consumption.

- Role of nostalgia in consumer spending and investment choices.

- Impact of financial infidelity on relationships and trust.

- Evaluating the effectiveness of robo-advisors in ESG investing.

- A critical analysis of gender disparities in financial literacy and empowerment.

- Analysis of the UK’s response to financial challenges during the pandemic.

- Changes in risk perception and investment strategies post COVID-19.

- Effects of income inequality on personal financial well-being.

- Cross-generational perspectives on retirement and legacy planning.

- Neuroscientific insights into impulsive buying behaviour.

- Exploring the link between happiness and financial well-being.

- Financial challenges and opportunities for single-parent households.

- Impact of media portrayal on personal finance perceptions.

- The psychology of debt repayment strategies and decision-making.

- Financial considerations in blended families and step-parenting.

- Risk perception and decision-making in alternative investments.

- Exploring the role of cultural background in shaping financial attitudes.

- Effects of peer comparison on consumer spending choices.

- Analysis of the effectiveness of robo-advisors in investment management.

- Behavioural economics perspectives on retirement planning and pension reforms.

- Behavioural insights into British consumers’ credit card usage and debt management.

- Digitalization of financial services and its influence on consumer behaviour.

- Behavioural biases in mortgage decisions and homeownership outcomes.

- Financial aspirations and their influence on investment behaviour.

- The role of automated savings apps in fostering financial discipline.

- Behavioural insights into the use of budgeting and expense tracking tools.

- Factors influencing early financial education in children.

- Impact of personality traits on investment portfolio diversification.

- The psychology of debt aversion and its implications.

- Behavioural patterns in retirement withdrawal strategies.

- Financial implications of delayed gratification and self-control.

- Exploring the link between personal values and financial choices.

- Literature review on the psychological factors driving cryptocurrency adoption.

- Psychological factors shaping post-pandemic travel and leisure spending.

- Sustainability and ethical considerations in UK investment practices.

- The impact of student loan debt on young adults’ financial futures.

- Investor reactions to corporate social responsibility initiatives.

- Evaluating the role of social media influencers in shaping personal finance attitudes.

- Factors influencing household budgeting and expenditure patterns.

- Implications of the UK housing market dynamics on personal wealth accumulation.

- Long-term financial implications of emergency fund utilization during the crisis.

- Investor reactions to market volatility and uncertainty during the pandemic.

- Navigating the complexities of UK tax regulations in personal financial planning.

- Relationship between personality traits and risk tolerance in investment.

- Synthesizing research on the implications of income inequality for household finance.

- A comprehensive review of strategies for coping with financial stress and anxiety.

- Evaluating the effectiveness of online financial education in the new normal.

- Investor reactions to the Bank of England’s monetary policy shifts.

- Psychological factors affecting impulse buying and their financial implications.

In conclusion, the diverse range of Personal Finance research topics available across various degree levels presents a rich field for in-depth exploration. These topics offer valuable insights into individual financial decision-making and contribute to the broader understanding of economic systems and their impacts. From behavioural aspects to investment strategies and policy implications, students and scholars have a multitude of avenues to delve into, ultimately enhancing our grasp of effective financial management in both personal and societal contexts.

Order Personal Finance Dissertation Now!

External Links:

- Download Personal Finance Dissertation Sample For Your Perusal

Research Topic Help Service

Get unique research topics exactly as per your requirements. We will send you a mini proposal on the chosen topic which includes;

- Research Statement

- Research Questions

- Key Literature Highlights

- Proposed Methodology

- View a Sample of Service

Ensure Your Good Grades With Our Writing Help

- Talk to the assigned writer before payment

- Get topic if you don't have one

- Multiple draft submissions to have supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Installments plan

- Special discounts

Other Posts

- 80 Banking and Finance Research Topics August 30, 2023 -->

- 80 Behavioral Finance Research Topics August 26, 2023 -->

- 80 Corporate Finance Research Topics August 25, 2023 -->

- 80 Finance Research Topics July 28, 2023 -->

- 80 Financial Derivatives Research Topics August 28, 2023 -->

- 80 Financial Econometrics Research Topics August 29, 2023 -->

- 80 Financial Economics Research Topics August 29, 2023 -->

- 80 Financial Management Research Topics August 29, 2023 -->

- 80 Financial Markets Research Topics August 25, 2023 -->

- 80 Financial Risk Management Research Topics August 28, 2023 -->

- 80 Fintech and Digital Finance Research Topics August 26, 2023 -->

- 80 International Finance Research Topics August 26, 2023 -->

- 80 Investment Banking Research Topics August 25, 2023 -->

- 80 Islamic Finance Research Topics August 28, 2023 -->

- 80 Microfinance Research Topics August 30, 2023 -->

- 80 Public Finance Research Topics August 26, 2023 -->

- 80 Quantitative Finance Research Topics August 26, 2023 -->

- 80 Real Estate Finance Research Topics August 26, 2023 -->

- 80 Sustainable Finance Research Topics August 28, 2023 -->

WhatsApp us

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Read our research on: TikTok | Podcasts | Election 2024

Regions & Countries

Personal finances, black americans’ views on success in the u.s..

While Black adults define personal and financial success in different ways, most see these measures of success as major sources of pressure in their lives.

Parents, Young Adult Children and the Transition to Adulthood

Most U.S. young adults are at least mostly financially independent and happy with their parents' involvement in their lives. Parent-child relationships are mostly strong.

U.S. centenarian population is projected to quadruple over the next 30 years

The number of Americans ages 100 and older is projected to more than quadruple over the next three decades.

Older Workers Are Growing in Number and Earning Higher Wages

Roughly one-in-five Americans ages 65 and older were employed in 2023 – nearly double the share of those who were working 35 years ago.

Key facts about the wealth of immigrant households during the COVID-19 pandemic

The median wealth of immigrant households increased by 42% from December 2019 to December 2021.

Tipping Culture in America: Public Sees a Changed Landscape

72% of U.S. adults say tipping is expected in more places today than it was five years ago. But even as Americans say they’re being asked to tip more often, only about a third say it’s extremely or very easy to know whether (34%) or how much (33%) to tip for various services.

What the data says about food stamps in the U.S.

The food stamp program is one of the larger federal social welfare initiatives, and in its current form has been around for nearly six decades.

Most Black adults in the U.S. are optimistic about their financial future

68% of Black adults in the U.S. say they do not have enough income to lead the kind of life they want, but a majority are optimistic that they will one day.

Dating at 50 and up: Older Americans’ experiences with online dating

One-in-six Americans ages 50 and older (17%) say they have ever used a dating site or app.

A record-high share of 40-year-olds in the U.S. have never been married

As of 2021, 25% of 40-year-olds in the United States had never been married, a significant increase from 20% in 2010.

Refine Your Results

About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Theories of Personal Finance

- Personal Financial Planning

Research output : Chapter in Book/Report/Conference proceeding › Chapter › peer-review

This chapter provides an overview of the theories used in personal finance research, practice, and education. Personal finance encompasses financial planning, financial counseling, financial psychology, and financial therapy resulting in a diverse set of theoretical perspectives underpinning personal finance. This chapter highlights the theories unique to financial planning, financial counseling, financial psychology, and financial therapy, in addition to the theories that span across these areas. Lastly, this chapter addresses opportunities, challenges, and future directions for theoretical development within personal finance.

- Financial Counseling

- Financial Planning

- Financial Psychology

- Financial Therapy

- Personal Finance Theory

Access to Document

- 10.1515/9783110727692-005

Other files and links

- Link to publication in Scopus

Fingerprint

- Personal Finance Business & Economics 100%

- Financial Planning Business & Economics 42%

- Counseling Business & Economics 36%

- Psychology Business & Economics 32%

- Therapy Business & Economics 28%

- Future Directions Business & Economics 17%

- Education Business & Economics 10%

T1 - Theories of Personal Finance

AU - Asebedo, Sarah D.

N1 - Publisher Copyright: © 2022 Walter de Gruyter GmbH, Berlin/Boston.

PY - 2022/1/1

Y1 - 2022/1/1

N2 - This chapter provides an overview of the theories used in personal finance research, practice, and education. Personal finance encompasses financial planning, financial counseling, financial psychology, and financial therapy resulting in a diverse set of theoretical perspectives underpinning personal finance. This chapter highlights the theories unique to financial planning, financial counseling, financial psychology, and financial therapy, in addition to the theories that span across these areas. Lastly, this chapter addresses opportunities, challenges, and future directions for theoretical development within personal finance.

AB - This chapter provides an overview of the theories used in personal finance research, practice, and education. Personal finance encompasses financial planning, financial counseling, financial psychology, and financial therapy resulting in a diverse set of theoretical perspectives underpinning personal finance. This chapter highlights the theories unique to financial planning, financial counseling, financial psychology, and financial therapy, in addition to the theories that span across these areas. Lastly, this chapter addresses opportunities, challenges, and future directions for theoretical development within personal finance.

KW - Financial Counseling

KW - Financial Planning

KW - Financial Psychology

KW - Financial Therapy

KW - Personal Finance Theory

UR - http://www.scopus.com/inward/record.url?scp=85134907968&partnerID=8YFLogxK

U2 - 10.1515/9783110727692-005

DO - 10.1515/9783110727692-005

M3 - Chapter

AN - SCOPUS:85134907968

SN - 9783110727494

BT - De Gruyter Handbook of Personal Finance

PB - de Gruyter

Articles on Personal finance

Displaying 1 - 20 of 59 articles.

Financial abuse from an intimate partner? Three ways you can protect yourself

Bomikazi Zeka , University of Canberra

Robo-advisers are here – the pros and cons of using AI in investing

Laurence Jones , Bangor University and Heather He , Bangor University

If you get your financial advice on social media, watch out for misinformation

Lindsey Appleyard , Coventry University

Will Britons work until they’re 71? Expert examines proposed pension age rise

Chris Parry , Cardiff Metropolitan University

Curious Kids: why do you get interest payments when you have a bank account?

Shampa Roy-Mukherjee , University of East London

What are ‘good’ and ‘bad’ debts, and which should I pay off first?

Angel Zhong , RMIT University

The cost-of -living crisis is hitting hard. Here are 3 ways to soften the blow

Ama Samarasinghe , RMIT University

Could you cope with a shock to your bank balance? 5 ways to check you are financially resilient

Needing to borrow money? Four tips on what’s okay and what’s not

Autumn statement: what national insurance cuts and other changes mean for young people

Alexander Tziamalis , Sheffield Hallam University and Yuan Wang , Sheffield Hallam University

Matching state pension to the national living wage would help pensioners maintain their dignity

Six ways the upcoming autumn statement could affect your personal finances

Jonquil Lowe , The Open University

The hidden risks of buy now, pay later: What shoppers need to know

Vivek Astvansh , McGill University and Chandan Kumar Behera , Indian Institute of Management Lucknow

‘Girl math’ may not be smart financial advice, but it could help women feel more empowered with money

Ylva Baeckstrom , King's College London

To fight financial illiteracy, we mapped our money system as waterworks

Martijn Jeroen van der Linden , Hague University of Applied Sciences

How new ‘consumer duty’ rules for financial products could reduce debt-related stress

Hayley Louise James , Aston University

Know thyself, know thy finances: which of the 5 money personalities are you?

Ayesha Scott , Auckland University of Technology and Aaron Gilbert , Auckland University of Technology

Why saving for a pension has become more risky

Jonathan Cribb , Institute for Fiscal Studies

How do credit scores work? 2 finance professors explain how lenders choose who gets loans and at what interest rate

D. Brian Blank , Mississippi State University and Tom Miller Jr. , Mississippi State University

Buy now pay later: Klarna is courting young shoppers with Paris Hilton and TikTok-style algorithms – here’s why it’s a problem

Jehana Copilah-Ali , Newcastle University and Jane Brown , Newcastle University

Related Topics

- Financial literacy

- Quarter Life

Top contributors

Senior Lecturer in Economics and Personal Finance, The Open University

Assistant Professor in Finance and Financial Planning, University of Canberra

Lecturer in Finance, University of Canberra

Principal Lecturer in Finance, Cardiff Metropolitan University

Senior lecturer, Curtin University

Associate Professor, Curtin University

Senior Lecturer in Economics | Freelance Consultant, Sheffield Hallam University

Head of School at the School of Accounting, Curtin University

Senior Lecturer in Economics and Finance, University of Portsmouth

Professor of Marketing, University of Chicago

Associate Professor of Markets, Public Policy and Law, Boston University

Senior Lecturer in Statistics, University of Glasgow

Professor of Social Development Studies, University of Johannesburg

Professeur de Finance, ESSCA School of Management

Lecturer in Data Science/Analytics, Bangor University

- X (Twitter)

- Unfollow topic Follow topic

Advertisement

The Effect of Personal Finance Education on The Financial Knowledge, Attitudes and Behaviour of University Students in Indonesia

- Original Paper

- Open access

- Published: 18 November 2020

- Volume 42 , pages 351–367, ( 2021 )

Cite this article

You have full access to this open access article

- Irni Johan 1 ,

- Karen Rowlingson ORCID: orcid.org/0000-0002-3541-6466 2 &

- Lindsey Appleyard 3

51k Accesses

29 Citations

4 Altmetric

Explore all metrics

There is much debate about the impact of personal finance education on financial knowledge, attitudes and behaviour, particularly based on studies in the United Kingdom (UK) and United States of America (US). This paper makes a contribution to this debate, drawing on analysis of a survey of 521 undergraduate students at Bogor Agricultural University (IPB) in Indonesia in 2015. As part of that study, we measured the impact of a 14-week personal finance education course on financial knowledge, attitudes and behaviour. Our findings show that, when controlling for other factors, the personal finance course did, indeed, have a positive and statistically significant impact on financial knowledge. However, there was no statistically significant impact of the course on financial attitudes or behaviour. Our analysis also shows that family financial socialisation was an important driver of financial knowledge, attitudes and behaviour while other drivers of financial behaviour included income, work experience, year/field of study and discussing money with friends. We do not argue here that formal financial education is unimportant but that its role in changing attitudes and behaviour should be considered carefully if this is, indeed, its aim.

Similar content being viewed by others

Financial Education for University Students: A Personal Leadership Tool

Financial Knowledge and Financial Education of College Students

Does enrolling in finance-related majors improve financial habits? A case study of China’s college students

Wei Huang, Xiaowei Liao, … Panpan Yao

Avoid common mistakes on your manuscript.

Introduction

Financial capability and education in an increasingly financialised world.

Financialisation and the rapid advances in information technology throughout the world have created a more complex and dynamic financial sector, in terms of both products and systems (Marcolin and Abraham 2006 ). Individuals in low, middle, and high income countries are increasingly engaging with this financialised world and this has made money management more complex generally while also opening people up to new vulnerabilities such as risky financial transactions, misleading information, fraud and so on.

Younger generations today are in a particularly challenging situation. Jiang and Dunn ( 2013 ) revealed that young people had higher levels of debt, spent more money on credit cards, and tended to pay off bills relatively slowly compared to the previous generation at the same stage of life due to stagnating wages, low incomes, and paying off education fees. Furthermore, Jiang and Dunn ( 2013 ) point to easier access to credit and more permissive attitudes to debt as potentially contributing to young people’s financial problems.

University or college students are a particularly interesting group to study in relation to financial capability issues. Starting to live independently, college students face new responsibilities to manage their finances, including budgeting, managing income and expenses, and paying bills. Moreover, in some countries, such as the United States (US), students also have access to student loans to cover their tuition fees (Dwyer et al. 2013 ). Elliot ( 1997 ), Holub ( 2002 ), and Boushey ( 2005 ) showed that the inability to plan-ahead may overwhelm students upon graduation, who may be overwhelmed by a debt burden, caused by their inability to manage student loans and credit cards. A study by Boushey ( 2005 ) revealed that high debt is accumulated when students enter college life, and at a higher rate for those on lower incomes.

Given the challenges facing young people in particular, there is clearly a growing need for support to help them understand and navigate our increasingly complex financial world. College students, in particular, might benefit from support to manage money while at college but also be more prepared for post-college life in terms of understanding financial products and services, and raising awareness of financial risks (Beal and Delpachitra 2003 ). Several studies suggest that support to increase financial knowledge, skills, attitudes, and behaviour (collectively referred to as ‘financial capability’–see Kempson and Collard 2006 ; Atkinson et al. 2006 ) can be provided through education (for example, Shim et al. 2009 ; Sekita 2011 ; Klapper et al. 2013 ; Xiao and O’Neill 2016 ). In addition, a major review carried out on behalf of the U.S. Department of the Treasury ( 2015 ) on behalf of the U.S. Financial Literacy and Education Commission concluded that financial education programmes are effective in bringing about positive change on financial knowledge and expected financial behaviour. However, it was advised that more observations are needed in order to support a deeper understanding about suitable programmes (U.S. Department of the Treasury 2015 ). A study by Peng et al. ( 2007 ) showed that financial education delivered during college contributes positively and significantly to financial knowledge about investment patterns. However, contrary results were recorded by Mandell and Klein ( 2009 ) who did not find any difference in term of financial literacy and behaviour between those who took personal finance classes and those who had not. An experimental study by Cole et al. ( 2009 ) also found that financial education had no significant impact in increasing the use of bank/savings account. The study recorded that financial training only had a modest impact among those with low level of education, while it had no effect among the other groups/general population.

Financial capability can also be increased through non-formal financial socialisation agents, for example parents and peer groups (Gerrans and Heaney 2016 ; Fan and Chatterjee 2018 ). For example, Shim et al. ( 2010 ) argued that schools, workplaces and parents have a role in developing not only financial knowledge but also attitudes, and behaviour. The importance of financial socialisation by parents was reinforced by Johnson and Sherraden ( 2006 ) who encouraged parents to set aside time to discuss money and teach their children how to manage it wisely. As shown by Jorgensen ( 2007 ), those who were subject to financial influence from their parents were more likely to achieve a better score of financial knowledge, attitudes, and behaviour.

It is clear that a number of studies have investigated the impact of financial education on various aspects of financial knowledge, attitudes and behaviour and some of these studies focus on U.S. college students. To our knowledge, there have been limited systematic studies of university students in other countries, including Indonesia.

Financial Capability in Indonesia

With a population of 261 million, Indonesia is the fourth most populous country in the world, after China, India and the US (The Office for National Statistics, Indonesia [Badan Pusat Statistik] [BPS] 2018 ). The demographic profile is young (average 28.6 years in 2016), with about 45 million aged 15–24 (BPS 2016 ). Moreover, Indonesia’s economic performance shows impressive levels of growth (over 5% per year) and the country is ranked as the world’s tenth largest economy based on purchasing power parity and is thus also a G20 member (Setiawan 2015 ; The World Bank 2018 ). However, in terms of the financial sector, there appears to be a gap in the level of financial understanding and skills people have. The 2016 National Survey of Financial Literacy identified that only a third of respondents are classified as financially literate (OJK 2016 ).

Given the growth in GDP per capita for Indonesia, potential demand for financial products and services is projected to increase, meaning that the financial markets will develop further and become more complex e.g., with a growth in peer to peer lending (Financial Services Authority Indonesia (OJK) 2017 ). A student loan programme is also planned to be introduced by the government of Indonesia. Footnote 1 Private financial institutions are also planning to expand in Indonesia e.g., in terms of consumer loans. Therefore, the need for appropriate knowledge and skills is increasingly important (Beal and Delpachitra 2003 ).

Our research aimed to measure the financial capability of Indonesian undergraduates at IPB University (Bogor Agricultural University/IPB). Footnote 2 Financial capability is defined here as a combination of financial knowledge, attitudes, and behaviour as in Kempson et al. ( 2005 ), Atkinson et al. ( 2006 ), Johnson and Sherraden ( 2007 ). This paper focuses on the role of financial education in relation to financial capability.

Theoretical Framework

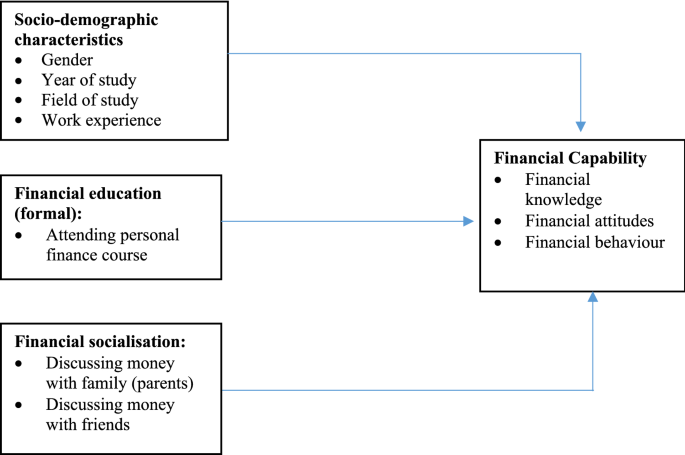

The theoretical framework used in this study drew on previous studies which have shown that financial education is one of a possible range of drivers of financial capability. In this framework, in addition to the personal finance course, the student’s field of study was included as one of the observed variables. Several studies, such as Beal and Delpachitra ( 2003 ) and Fatoki and Oni ( 2014 ) revealed that business studies students have better financial knowledge, planning, and decision making, than those from non-business backgrounds, since they were exposed to the relevant topics more frequently.

Other possible drivers include level of income, financial socialisation, socio-economic status and work experience. For example, according to consumer socialisation theory, “individuals learn through their interactions with their environment, especially where they spend the most time and where they spent time in the early years of life” (Jorgensen 2007 p.47; see also Moschis and Churchill 1978 ; Gudmunson and Danes 2011 ; Fan and Chatterjee 2018 ).

Thus, financial habits can also be developed by watching how parents handle their financial matters, and how parents discussed money with their children. For example, those whose parents talked with them regularly about financial matters are considered to have higher levels of financial knowledge, positive financial attitudes, and in turn, behave in more financially responsible ways (Van Campen et al. 2010 ). Fan and Chatterjee ( 2018 ), also revealed that financial experience and socialisation, such as by family members, improved financial knowledge and skills. In addition, financial learning can also be gained from work experience. Working enables a person to obtain knowledge about managing money; by learning from experience, they can develop a sense of responsibility and increase their money-management expertise (e.g., Shim et al. 2009 ; Hilgert et al. 2003 ; Lowenstein et al. 2001 ; Sohn et al. 2012 ). Ajzen ( 1991 ) explains that, in general, individuals will have a positive attitude toward a certain behaviour when they believe that it will be associated with something positive, and vice versa.

Studies of financial capability have also noted that financial capability is linked to income and socioeconomic status (Worthington 2006 ; Mandell 2008 ; Loke 2017 ). For example, people who are less financially capable are more likely to have lower levels of education, to be young, female, single, unemployed, or on a lower income. In terms of income, several studies revealed (e.g., Cole et al. 2009 ; Xu and Zia 2012 ; Kempson et al. 2013 ) that those with a higher income are, unsurprisingly, more likely to be able to make ends meet which is one component of financial capability. This group also has more flexibility in allocating their resources and will therefore seek related information in order to achieve the optimum result. Thus, they are both aware and more familiar with financial issues. A noticeable variation could also be seen in terms of gender. It is reported that men tend to score higher than women in terms of financial capability (Chen and Volpe 1998 ; Manton et al. 2006 ; Danes and Haberman 2007 ; Peng et al. 2007 ; Hung et al. 2012 ). Danes and Hira ( 1987 ) showed that male students tended to have more knowledge about insurance and loans, while females were more knowledgeable about financial management in general. A study by Kempson et al. ( 2013 ) explained that women were better at managing money in the short term, but in other areas, such as choosing products and wealth accumulation, men showed higher performance. Meanwhile, contrasting results have been presented in several studies, such as Ramasawmy et al. ( 2013 ) and Ibrahim et al. ( 2009 ) and Shaari et al. ( 2013 ), did not find any difference between men and women in terms of the level of financial literacy.

In addition, year of study is also predicted to affect levels of financial capability due to greater financial experience. Danes and Hira ( 1987 ), Chen and Volpe ( 1998 ), and Shaari et al. ( 2013 ) showed that older students tended to have better scores when it came to knowledge about insurance and loans. The literature discussed shows varied results on the relationship between socio-demographic factors and levels of financial capability. This suggests that further research needs to be conducted. Therefore, in addition to examining the effects of formal financial education and financial capability, this study also examined the impact of (non-formal) financial socialisation and several socio-demographic variables, that is gender, year of study, field of study, and income. The framework of this study is illustrated in Fig. 1 below and our null hypotheses are as follows:

H0 1 : There is no statistically significant difference on financial capability (financial knowledge, attitudes, and behaviour) between those who attended the personal finance course and those who had not attended the course.

H0 2 : Socio-demographic characteristics (gender, income, year/field of study, and work experience) have no impact on financial capability (financial knowledge, attitudes, and behaviour).

H0 3 : Bogor Agricultural University (IPB)’s personal finance course has no impact on financial capability (financial knowledge, attitudes, and behaviour).

H0 4 : Financial socialisation (from family and friends) has no impact on financial capability (financial knowledge, attitudes, and behaviour).

Drivers of Financial Capability

Design of Study, Location, and Time

This study adopted a cross-sectional design and was conducted in IPB (Bogor Agricultural University), Indonesia. Ranked as the third top university in Indonesia, Footnote 3 the typical undergraduate programme at IPB takes four years to complete. In 2006, IPB began offering Personal Finance as both a compulsory module in the Department of Family and Consumer Sciences (IKK) and as an elective course for students from other departments. The course runs over 14 weeks with three hours of contact time each week, covering several topics ranging from the concept of financial management, time value of money, savings, credit/loan, tax, choosing products, risk management, insurance, investment, and retirement planning (see Table 1 ). There are very few universities in Indonesia that provide this type of course which is one of the main reasons why IPB was selected as the location of study. Fieldwork took place between May and September 2015.

Population, Sampling and Response Rate

The population of this study were all IPB undergraduate students, comprising 13,825 students. This study used stratified random sampling, with nine faculty and gender as the strata. Faculty refer to the main administrative groupings for the university, e.g., Faculty of Agriculture, Veterinary Medicine, Mathematics and Natural Science, Economics and Management and so on. According to the Slovin formula (Rivera and Rivera 2007 ), the minimum number of respondents needed was 510 students. In order to sample our respondents, a formal letter was sent to the Rector of IPB in order to obtain permission to conduct the survey and access a list of current students. From that list roughly 1000 participation invitations were sent by email and/or text message. Once someone agreed to participate an interview was then arranged. In cases where someone did not respond to the invitation, a weekly reminder email and/or text was sent. This was done three times. If there was still no response after three attempts, the student was replaced by another student who had also been selected randomly.

A total of 244 students declined to take part in the study, 98 did not respond to any contact, and 29 started the survey but did not complete it and so were not included in the final sample for analysis. The final sample size for analysis was 521 respondents. This is a response rate of 58% (521 out of 892 contacts). We also compared our achieved sample with the population for any particular biases and confirmed that there was no particular response bias (see Johan 2018 ) and hence no need for any sample weighting to correct for response bias.

The detailed characteristics of respondents are displayed in Table 2 . First-year students were included in the survey but are not assigned to particular faculty, as they are completing a general foundation year.

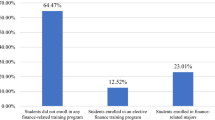

For the data analysis purposes, faculty were then grouped into two categories, that is (1) Economic and Business Major students (from the Faculty of Economics and Management); and (2) Non-Economic Business Majors (other faculty). So, based on the field of study, we have 13% of the sample from Business-economics majors, and the rest were taking non-business economic majors.

Fieldwork Methods

The survey was administered, face-to-face between May until September 2015. Given the large sample size for the face-to-face method, four paid-interviewers were involved in the data collection process. The interviewers were final year undergraduate students who had already had some training in research methods and they all had previous experience as an interviewer in other surveys. One of them was also chosen as the team leader in the field. All of the interviewers were trained for a minimum of 8 h before the data gathering process.

Before the main survey started, a pilot was carried out on other students who shared similar characteristics to the target sample. Besides testing for data quality control, such as question consistency and variation in respondents’ answers, piloting was also done to find out the length of time needed for an interview. Based on the results of the pilot, the average interview duration was recorded as between 30 and 40 min. Some minor changes were made to some questions, including instructions for the interviewer to skip and to filter questions, and the wording of some questions to improve the meaning following translation from English versions.

Interviews were held in the location agreed by the potential respondents, such as a campus cafeteria or canteen, campus hall, in the class after lectures, campus outside space, respondent’s dormitory/home, and so on.

Ethical Considerations

The study received full ethical approval from the Humanities and Social Sciences Ethical Review Committee at the University of Birmingham prior to data collection. Informed consent was obtained from all individual participants included in the study. Data obtained in this study was maintained in accordance to the University’s Code of Practice for Research. The data has been made openly available through the University of Essex (UK) Data Archive. Footnote 4 .

The questionnaire used in this study was based on the UK’s Money Advice Service [MAS] ( 2013 ) questionnaire which, in turn, was based closely on the pioneering study by Kempson et al. (Kempson et al. 2005 ; Kempson and Collard 2006 ). This robust and well-tested questionnaire has been used in many other studies, such as McKay ( 2011 ). In addition, however, we also used two questions from Lusardi and Mitchell’s ( 2005 ) seminal study about compound interest (Q2) and risk diversification (Q4). The full questionnaire from the study (in English) is provided in the supplemental online material. We clearly had to translate the questionnaire into Indonesian and we also very slightly modified a few of the questions to make them more suitable for Indonesian undergraduate students given that these original questionnaires were developed for a general UK/US public survey. For example we used Indonesian currency rather than UK currency, we used an Indonesian version of a bank statement, added ‘Eid’ as an example of big event/national religious holiday, as the majority of Indonesian are Muslim. In this study, to ensure the validity, data in the questionnaire had also been tested using factor analysis (see the supplemental online material). To ensure the internal consistency, Cronbach’s Alpha coefficient was applied to the scale questions relating to attitudes and behaviour (Pallant 2013 ), and the result was broadly acceptable (0.736, 0.610 respectively). The detailed output of the reliability tests can be found in (Johan 2018 , Appendix 17).

As a follow-up to Money Advice Service ( 2013 ), we conceptualised our key dependent variable, financial capability, as having three main dimensions: financial knowledge, attitudes, and behaviour.

In our study, we used financial knowledge to refer to what and how much is known about financial concepts. This was measured using questions focused on knowledge about managing money, inflation, interest rates, diversification, investment, credit cards, choosing financial products and pensions. There was also one question measuring whether respondents knew how to read a bank statement accurately (by asking them to do so and scoring them accordingly).

Moving on to financial attitudes, which refer to what a person feels and believes, and preferences in relation to personal finance matters, we included five sub-dimensions that focused on managing money, managing risk, planning-ahead, choosing products, and staying informed. In this study, 20 statements covering the five sub-dimesions of attitudes were measured using a Likert scale, ranging from 1 (strongly agree) to 5 (strongly disagree).

The third main dimension of financial capability was financial behaviour. This was defined as how people behave in relation to personal finance matters. To measure levels of behaviour, respondents were asked how frequently, if ever, they behaved in particular ways. A Likert scale was employed, on a five-point scale ranging from 1 (always) to 5 (never).

We also based our independent variables on the Money Advice Service ( 2013 ) study where appropriate (e.g., financial socialisation). Where some independent variables had not been used in previous studies (e.g., field of study) we developed these ourselves and then piloted them as mentioned above.

A copy of the full questionnaire, in English, can be found in the supplemental online material. The results presented here do not draw on every question, nevertheless the full questionnaire is shown for information.

Data Analysis Approach

The data obtained was processed using Microsoft Excel and SPSS. Data was inputted manually and then cleaned to check for any errors in data input. Initial descriptive analysis and inferential tests were conducted. The statistical inferential test examined the differences between groups and to determine the factors that influence financial capability.

Summary scores and indexes were then calculated separately for financial knowledge, attitude, and behaviour. For the knowledge questions, each of the correct answers was scored as “1” and the incorrect/others as “0”. As there were only two possibilities for the answer, that is ‘correct’ and ‘incorrect’, therefore in obtaining the score of financial knowledge, this was relatively straightforward as we added up the number of correct answers and transformed this into a scale from 0 to 100.

For the attitude and behaviour questions, we first checked the direction of the agree/disagree scale for each item to ensure unidirectionality. Furthermore, in calculating the scores of attitudes and behaviour, a factor analysis was applied. Factor analysis gives a different weight to each question depending on how well it correlates with the factor. Factor analysis looks at the consistency of questions, or how much different questions seem to be measuring the same thing. A factor analysis of those questions is shown in the supplementary material file. The factor score is a linear combination (a weighted sum) of the observed variables, e.g.:

*Fi = factor, Li = loadings, and Xi = the N variables.

*The “weights” (Li) for the variables (Xi) are based on how much they “load” on the factor.

We then calculated the scores together from all items that made up the subscale or scale. The scores for the knowledge, attitude, and behaviour variables were then transformed so that they had the same range, i.e., 0–100. The overall scores of financial knowledge, attitudes, and behaviour were calculated as the arithmetic mean of the index. The general formula for the transformation index that was used in this study was as follows:

Three models were then constructed to explore the impact of different factors on financial capability (financial knowledge, attitudes, and behaviour) with a multiple linear regression analysis carried out based on this model. The first model was designed to identify the driver for financial knowledge. The dependent variable is the composite score (index) of financial knowledge, while the independent variables are: gender (female and male), year enrolled (first year, and second year and above), whether they attended the personal finance course (yes or no), field of study (economics-business and non-economics-business), work experience (yes or no), discussing money with family (yes or no), discussing money with a friend (yes or no), and income (ratio).

With the same independent variables as applied in the previous model, the second and third model was then constructed, to examine the drivers for financial attitudes and behaviour with the composite score (index) of financial attitudes and behaviour as the dependent variable in each model, respectively. The multiple linear regression model can be defined in the following equation:

Y 1 = Financial knowledge (index).

Y 2 = Financial attitudes (index).

Y 3 = Financial behaviour (index).

X 1 = Gender (1 = male, 0 = female).

X 2 =Year enrolled (1 = year 2 and above; 0 = year 1).

X 3 = Field of study category (1 = Economics-Business major; 0 = non-Economics-Business major).

X 4 = Personal finance category (1 = had taken the course; 0 = had not taken the course).

X 5 = Work experience (1 = had work experience; 0 = no work experience).

X 6 = Discussion of money with family (1 = yes; 0 = never).

X 7 = Discussion of money with friends (1 = yes; 0 = never).

X 8 = Income.

β 1-8 = Regression Coefficient.

α = Constant.

ε = Error.

The analyses conducted in this study were as follows:

Descriptive analysis, to examine the general statistics of the data.

Mann–Whitney U Test, to examine the differences between two groups: that is between attendance of the personal finance class and each question on financial capability (financial knowledge, attitudes, and behaviour).

Independent sample T-test analysis, to examine the differences between two groups, that is between attendance of personal finance class and financial capability score (financial knowledge, attitudes, and behaviour/ the index score).

Factor score, to obtain the loading factor of financial attitudes and behaviour for the purpose of developing an index score of financial attitudes and behaviour (the scale type answer).

Multiple linear regression analysis, to determine the factors that influence financial capability (financial knowledge, attitudes, and behaviour). Before starting the multiple regression test, various tests were employed, including tests of normality; autocorrelation, multicollinearity; and homescedasticity (Pallant 2013 , p.156–157), and the Open University (n.d)). All tests performed well.

The analysis began by comparing the financial knowledge, attitudes, and behaviour (financial capability) of those who took part in the financial education course with those who did not. We then present the results of a multiple linear regression analysis to consider the impact of the course on the different components of financial capability when taking into account other potential factors.

Financial Knowledge

Table 3 shows the percentage of people correctly answering a number of financial knowledge questions, comparing those who had attended the personal finance course and those who had not. The most difficult question for respondents was a complex question about pension savings (Question 5). Only one in five students (19%) who had not attended the financial education course answered this question correctly. Students who had attended the course were more than twice as likely to answer correctly (42%) but this was still less than half the group. The difference between the two groups was statistically significant. Furthermore, all questions were multiple choice so some people may have guessed the answers correctly without really knowing the answer. There was a similar level of difficulty in relation to a question about single company stocks and stock mutual funds (Question 4). It is likely that undergraduate students have had much less direct engagement with pensions and stock funds, hence the lack of understanding of these issues (though with a statistically significantly higher level of knowledge among those who had taken the course–54% versus 21%). Knowledge of credit card ID theft was also much higher among those who had attended the course than those who had not (66% versus 45% on Questions 8), again statistically significantly so.

If we look at knowledge of issues that perhaps fall more within the experience of the students, we saw statistically significantly higher levels of knowledge about discounted sales (Question 3) but in this case the higher level of knowledge was among students who had not attended the course—though the difference was relatively small (89% versus 80% for those who attended the course).

A summary score for financial knowledge was then calculated as explained above. We also employed the Independent samples t -test to examine the difference between the group based on the general score of financial knowledge (index score). As we can see in Table 4 , the result of independent samples t -test showed significant differences in financial knowledge amongst those who had attended the personal finance course and those who had not, where the p -value was found to be less than 0.05.

This study therefore revealed that respondents who had attended the personal finance course had a statistically significantly higher score on financial knowledge overall than those who did not.

Financial Attitudes

As discussed earlier, financial attitudes were broken down into five sub-dimensions: managing money, managing risk, planning ahead, choosing products, and staying up-to-date (Table 5 ). Within each sub-dimension, respondents were asked the extent to which they agreed or disagreed with various statements. Unlike the questions on financial knowledge, there is not necessarily a “right” answer in terms of attitudes although there are some cultural norms which favour saving over spending and borrowing for example. We make no normative judgement here about which attitudes are “right” or “wrong” but merely report on any differences between those who took the personal finance course and those who did not. Regarding managing money, over 80% of all students agreed that they were very organised when it comes to managing money and there was no statistically significant difference between the two groups on this question. The same was true of the question about whether people saw themselves as savers or spenders. There were no statistically significant differences on these questions. However, there was a slight difference between those who attended the course and those who did not when it came to preferring to buy things on credit rather than wait and save up. Here we saw a statistically significantly higher proportion of those who attended the course disagreeing with this statement. Overall, there were very few differences between the two groups, although perhaps more of an aversion to credit use among those who had attended the course.

In relation to risk management, those who had attended the course showed a higher level of trust in the financial services industry, though levels of trust were generally low across both groups. A statistically significant difference between groups was found on Q5, Q6, and Q8 (Table 5 ). But even so, students were more likely to say that life insurance was not necessary and were also more likely to say that they chose not to take out home insurance.

Both groups exhibited highly positive views around planning ahead with no statistically significant group difference on this aspect of financial attitudes. Meanwhile, on the final two sub-dimensions of financial attitudes (choosing products and staying up-to-date), there was relatively little difference between our two groups in terms of overall levels of agreement. Those who attended the course were more likely to strongly agree with the statements on choosing products than those who had not but there was no statistically significant difference, overall, between our two groups on any of these questions.

There were clearly a large number of questions on attitudes and so to summarise our findings we calculated a mean score (Table 6 ). The highest mean score–that is, highest level of agreement was in choosing products, while the attitudes toward risk and insurance was the lowest (with a statistically significant difference between our two groups on this sub-dimension of attitudes). Familiarity with the issue is a plausible explanation here. We also found that those who had taken the personal finance course were more likely to record higher scores in all domains, as shown by the mean scores. However, the independent t -test analysis showed that there was no statistically significant difference in overall attitudes between those who had attended the personal finance course and those who had not (at the 95% level of confidence).

Financial Behaviour

As discussed earlier, financial behaviour was measured here by asking respondents how often they behaved in certain ways. Table 7 shows that students who had attended the personal finance course were statistically significantly more likely than those who had not to say they had a weekly or monthly budget that they follow (Q8). They were also more likely to say they begin saving well before a big event (Q6) and regularly set money aside for savings (Q9).

At the same time, however, they were statistically significantly less likely to have run out of money by the end of the month (Q4). While they said they kept track of their money and tried to save, they seemed to struggle to manage on their income more than other students.

These findings confirmed the complex nature of financial capability. People may be stronger on some dimensions of financial capability than others. In addition, there does seem to be a possible contradiction between regularly setting money aside for savings while at the same time spending more money than they had. The findings may demonstrate the existence of social desirability bias on reported behaviour as some participants may have felt that they should be saving and so reported that they were saving even if they saved very little, if at all.

Once again, given the large number of questions measuring behaviour, we summarised the data in Table 8 using the same mean score method as for financial attitudes. Table 8 shows the differences between those who had taken the personal finance course and those who had not, to reveal that those who had attended the course showed statistically different scores with respect to their financial behaviour, with a higher score recorded by those who had taken the course.

Financial Knowledge, Attitudes, and Behaviour: The Effect of Financial Education

The analysis so far suggests that financial education may have some impact on financial capability but there is a chance that those who took the personal finance course were systematically different from those who did not, and these differences may explain the variation in financial capability. The next step for our analysis was therefore to carry out a multiple linear regression analysis, building on our theoretical framework (see Fig. 1 ). This revealed that the key determinants of financial knowledge were: field of study; attendance in the personal finance course; work experience and financial socialisation from family. Indeed, the results showed that field of study and attendance in the personal finance course were the strongest factors that influenced financial knowledge (Table 9 ).

The following model explains the determinants of financial knowledge:

Meanwhile, gender, field of study, work experience, and financial socialisation from family, had an impact on financial attitudes. Female students, Economics and Business majors, those who had work experience, and those who discussed money with family, had higher chances to have more desirable financial attitudes. In line with the analysis shown in Table 6 , analysis with regression showed that there was no statistically significant effect in financial attitudes between those who had and had not attended the course, once other factors were controlled for (Table 9 ). The model for financial attitudes can be summarised by the following equation:

Moreover, in terms of financial behaviour, the regression analysis showed that the drivers of financial behaviour were financial socialisation from family and friends, work experience, field of study, income, and year of study ( p < 0.05). Furthermore, attendance of the personal finance course was only significant at the level of confidence 90% ( p < 0.1) (Table 9 ). The regression model of financial behaviour can be expressed by the following equation:

Summary and Discussion of Findings

Main findings.

Our findings suggest that, if we do not control for other factors, those who attend the personal finance course have statistically significantly higher levels of financial knowledge overall than those who do not. They also report different types of financial behaviour. But the attitudes of these two groups, on a range of financial issues, do not differ from each other.