Paper Gold: What It Is, How You Buy It, and More

Many people choose to invest in gold as a stable asset that has preserved its value since the dawn of civilization. However, the cost and logistics of storing a pile of gold bullion might deter some investors.

If that’s true for you, you might consider investing in paper gold. Of course, it doesn’t have to be an either-or choice. You can buy both physical gold and gold-backed securities for a robust, diverse investment portfolio.

Learn about paper gold, its benefits and potential risks, and how to decide whether it’s the right investment choice for you.

Table of Contents

What Is Paper Gold?

Paper gold is any type of gold-backed asset that’s tied to the spot price of gold but doesn’t involve holding physical metal. Gold paper investments let you tap into the advantages of owning gold without the added markup of delivery, storage, and insurance prices.

Types of Paper Gold Investment

If you look into the paper gold market, you’ll see it includes different types of investments: ETFs, digital gold assets, certificates, and gold futures.

Gold Exchange-Traded Funds (ETFs)

Gold-backed ETFs work much like traditional stocks. The value of these assets is tied to the price of physical gold, rising or falling accordingly. ETF shares are easy to buy and trade through brokers.

Investing in gold ETFs means you purchase shares in the gold assets that the fund owns. If you choose to cash out your investment, you still won’t hold physical metal. Instead, you’ll get the money equivalent of your shares.

Physical Gold Certificates

Gold investment certificates let you own physical gold without holding it. Your asset is tangible metal stored in a physical vault, and the authority issuing gold certificates takes care of the storage and security.

Traditionally, banks and other financial companies issue such certificates. A more modern form of this investment is electronic gold trading. You can purchase gold bullion online from reputable companies and let the seller continue handling the storage. You can also trade your gold on digital platforms.

Gold Futures Contracts

When you buy gold futures, you agree to purchase a certain amount of physical gold at a specific time for a predetermined price. You don’t take hold of the metal right away, but rather at some future date.

Gold futures can be a short-term or a long-term investment. You can sell these contracts to someone else before you receive the physical metal or wait until the date you agreed to purchase the gold and take possession of the physical gold bullion.

Commodity Pools Accounts

Some paper gold investors choose the option of commodity pools, i.e., funds that gather, administer, and invest capital from a group of people or entities. A professional management team is responsible for running these pooled gold-backed securities.

Commodity pools offer higher liquidity and streamlined management. Investors can add up their resources to purchase different gold assets. Fund managers handle all investment decisions, which is convenient for those who want a low-maintenance setup.

What Is the Benefit of Using Paper Gold in Place of Physical Gold?

When you consider buying gold shares or certificates vs. bullion, it’s easy to see that paper gold offers some important perks, namely:

- Flexibility. You can invest however much or little money you’re willing to put into paper gold. With physical metal, you may need to buy in bulk to make delivery and storage costs practical.

- Liquidity. You can easily convert your ETF shares or futures contracts into cash when market conditions are favorable. Simply trade via a reputable stock exchange or online platform for a quick, convenient transaction.

- Fewer associated costs. When you buy paper gold, you don’t need to pay for shipping, a secure storage vault, or insurance. Your only markup would be the broker’s commission. In contrast, the costs of storing and insuring physical gold can add up over time.

- No storage concerns. You don’t need to worry about losing your precious metals or someone stealing your paper gold.

What Are the Risks of Paper Gold Investment?

On the other hand, if gold appeals to you as a stable asset with a steady intrinsic value, investing in paper gold may also come with some drawbacks:

- Dependence on other parties, such as the financial institution or fund that issued your gold-backed securities. If the organization runs into a crisis because of bad management or for other reasons, this may jeopardize your investment.

- Valuation gaps between the spot price of physical gold and your gold-backed assets. Tracking errors, management fees, and other factors could create a price discrepancy.

- Market volatility. Some gold-backed assets, like gold futures, are speculative in nature and may be more vulnerable to market ups and downs compared to physical gold.

- No physical metal ownership. When you buy paper gold, you don’t get the satisfaction and security of holding physical bullion.

Should You Still Invest in Physical Gold Today?

With the ease and flexibility of investing in paper gold, does it still make sense to buy physical precious metals? Despite the cost and logistics of shipping, storing, and insuring gold bullion, it still holds its ground as a safe hedge investment.

Pros of Physical Gold

When you purchase physical gold, you get:

- Ironclad intrinsic value. Although ETF shares and other paper gold assets are generally stable investments, their value may still suffer because of market trends or poor investment decisions. When you own physical gold, your asset’s value depends less on third parties.

- Stability. Gold prices may move up and down , but physical gold will always be a valuable commodity. Gold has held its value for millennia and will keep its worth even if modern currencies fall.

- Security. Unlike digital assets, physical gold isn’t vulnerable to hacking or cyber threats.

- Tradability. You can physically hold your gold bullion and exchange it practically anytime and anywhere. Thus, your gold coins or bars remain an accessible, tradable commodity even in a scenario of total economic collapse.

Cons of Physical Gold

On the other hand, owning physical gold involves some concerns, such as:

- Markup prices. Whether you choose to buy gold bars or coins, you’ll pay some markup on top of the metal’s spot price. Larger gold bars usually come with a lower markup but may also be more difficult to sell.

- Storage and insurance costs. When you buy a substantial amount of physical gold, secure storage is a must. You’ll likely need to pay annual fees to a gold depository and possibly purchase insurance to safeguard your precious metal.

- Risks like theft and natural disasters. If a burglar breaks into your vault and steals your bullion, you may lose your wealth unless it’s properly insured. The same is true if you lose your gold in a flood or another natural disaster.

- Slower liquidity. You can always find a buyer for physical gold, but it could take longer than trading ETF shares or digital gold assets. Additionally, you’ll likely have to pay a dealer’s fee when you sell gold bullion.

Factors To Consider When Choosing Between Physical Gold and Paper Gold

You don’t necessarily have to choose between paper gold and gold bullion. In fact, putting all your eggs in one basket could be a bad idea. With a diversified investment portfolio, you may enjoy profits when gold-backed securities rise in value but still preserve wealth when the market crashes. During an economic crisis, you can usually expect physical gold to appreciate in value while paper assets depreciate.

If you’re a seasoned investor with a sum of money you’re ready to direct into the gold market and you’re prepared to absorb a loss if your investment fails, gold ETF shares or futures could be a solid option for you. Of course, you should always consult an investment advisor before you put a significant amount into any gold venture.

On the other hand, if you like the idea of gold as the ultimate hedge investment that’s immune to market shifts, you may lean more toward purchasing physical gold. Gold bullion is a safe haven asset that can give you financial security when stocks and fiat currencies crash. It can help you save for retirement and provide for your heirs after you pass.

Choose Wisely When Investing in Paper Gold

If you buy gold ETF shares or another type of paper gold asset, it’s usually better to choose a fund that gets full backing from physical gold. This way, you’ll reduce any risks that come with improper management or bad investment decisions. Also, look into different investment options’ past returns and associated management costs.

Consider a Gold IRA

A gold IRA can combine the security of physical bullion with the convenience of paper gold. Since 1997, certain self-directed IRAs can hold physical precious metals like gold, silver, and platinum, not only precious metal shares and securities. Gold IRAs gained popularity following the 2008 financial crisis, which showed many people how unstable stocks and other paper assets can be.

Both physical gold and paper gold are attractive options, provided you choose an IRA partner that suits your needs. Complete our short questionnaire , and let us match you with some of the best IRA companies on the market.

Subscribe To Our Newsletter!

Want to be matched with an accredited partner.

Should I Buy Paper Gold?

10 minutes read

Sep 21, 2021

You've decided to add gold to your investment portfolio, but you’re not sure what to buy — physical gold or paper gold? Take a look at the key factors that can help you make the choice.

If you’ve been looking at how to invest in gold, chances are you might have come across the notion of paper gold. To some it might look like an easier way to buy gold, while others see it as a riskier asset that isn’t actually always backed by the physical precious metal.

So what is paper gold, exactly? How does it work? And, most importantly, how is it different from physical gold?

Let’s unpack.

What is paper gold?

Paper gold is essentially a catch-all term for different types of gold-related assets that reflect the spot price of gold, but are not gold themselves. In other words, with paper gold, you don’t own the actual physical metal .

Now, let’s see what are the key types of paper gold.

How does paper gold work?

Basically, there are three main types of paper gold — exchange-traded funds (ETFs), gold futures and gold certificates.

Exchange-Traded Funds (ETFs)

What are ETFs: gold ETFs are commodity funds that act and trade like individual stocks. Gold-backed ETFs give investors exposure to the gold price without having to buy the physical metal.

How do ETFs work: in principle, ETFs are shares of gold owned by the fund, and few of them actually hold physical gold. This basically means that even if you redeem a gold ETF, you won’t get the actual physical product. Instead, you will receive the cash equivalent . ETFs usually trade through online brokers and broker-dealers.

Gold futures

What are gold futures: to put it simply, gold futures are a financial contract between an investor and a seller where an investor agrees to buy a specific amount of gold at a preset price and date.

How do gold futures work: buying a gold futures contract doesn't mean you actually take immediate possession of the physical asset. Rather, a futures contract gives a buyer the right to get a precious metal at a future date . Gold futures usually trade on Comex — a futures and options market to trade commodities like silver, gold, aluminum, and copper.

Gold certificates

What are gold certificates: as a type of paper gold, gold certificates are less popular today than gold futures or ETFs. While they are still being issued by some banks and companies, in the U.S., gold certificates now only have a collectible value.

How do gold certificates work: in essence, gold certificates allow you to own physical gold without actually taking possession of it . A certificate is basically a proof that you own a certain amount of gold, which is usually stored in a secure vault by the authority that issues gold certificates.

Is it good to invest in paper gold?

Indeed, paper gold has several advantages that might make it look attractive for some investors. Here they are:

Liquidity: generally, gold ETF shares can be converted for cash quite easily through a broker. They are usually traded on stock exchanges, and you can make a transaction any time during market hours.

Affordability: with gold ETFs, one can invest practically any amount of money . The minimum investment limit is 1 unit, which is equivalent to 1g of gold.

No shipping, delivery, and storage fees: with paper gold, you don’t pay shipping or delivery fees, only the commission a broker charges you for the transaction. The same goes for storage — ETFs don’t have extra storage costs because, like shares, they’re purchased on a stock exchange.

Safety: unlike physical gold that has to be stored in a vault for safety, gold ETFs only exist in digital form. However, this digital form could possibly make them vulnerable to server issues or hacking .

And yet, like any other asset, paper gold comes with a number of risks that are important to keep in mind, especially for beginning investors, before making a decision to invest in paper gold assets.

What are the risks of paper gold?

Counterparty risk: this is one of the most common risks usually associated with paper gold. A company or broker in charge of your ETFs could go bankrupt or fail to live up to their obligations, misrepresenting the true state of their portfolio.

You don’t really own gold: in reality, the institution that sold you an ETF share might only hold a fraction of your asset’s value in physical metal. So, for example, if too many investors wanted to cash in their paper gold, the fund that sold it to them might not have enough of the physical metal to repay everyone.

Tracking error: tracking errors arise mainly due to transaction costs, cash amount held by an ETF as well as the expenses charged for managing the fund. A slight degree of a tracking error is somewhat natural in any ETF product, however, it may also lead to an unexpected profit or loss.

Volatility: the gold futures market can be quite volatile, partly due to the speculative nature of gold futures assets. This basically means that if there is a chance to make 2,000 U.S. dollars, there is also a possibility to lose 2,000 U.S. dollars.

Is physical gold a better investment than paper gold?

For an inexperienced investor, paper gold and physical gold might look like similar portfolio options but, they’re in fact very different.

Advocates of paper gold tend to highlight several risks of investing in physical gold :

- The costs and risks associated with storing and insuring your gold;

- The complexity and costs at resale;

But in reality, you can easily avoid those risks by choosing the right physical gold reseller .

And there’s a number of factors that actually make physical metal a much safer investment than paper gold:

No counterparty risk: with physical gold you don’t rely on any third-party individual or company to hold and own your wealth for you. Whether you decide to store it at home at your own expense, or with free and insured storage with GOLD AVENUE, with physical gold, it’s you who hold it .

Value: unlike paper gold, paper currencies, stocks, bonds, or mutual funds, physical gold is a tangible asset with an intrinsic value that cannot go to zero . Also, when you own a gold coin or bar, it means you own a physical product that holds value as an investment as well as a form of currency.

Reliable hedge against economic downturns: physical precious metals have always been considered a hedge against economic and societal downturns such as a breakdown of the monetary system, for example. It’s not that we’re saying it will happen any time soon, but it will always be easier to pay for your groceries with a silver coin than an ETF. 🙃

So what’s the bottom line?

Fundamentally, a decision of whether to buy paper gold or not largely depends on one’s investment goals and strategy.

If you are an experienced investor looking for a short-term exposure to the gold market and are ready to accept the risks coming from a possible higher volatility and counterparties, paper gold could be a choice. However, if you want to make sure your investment is protected, fully allocated (owned entirely by you), and will retain its value in the long-term, then physical gold could be a better choice .

Or, if you’re looking to diversify your portfolio, investing in both physical and paper gold might an option . As we’ve explained, while it can help you get short-term exposure to the gold price, potential risks attached to paper gold could result in large gains just as well as severe losses. So, one way to protect oneself from such risk could be by hedging this riskier investment with a more stable and safe asset like physical gold .

The Spotlight

The free newsletter helping you understand how to build your wealth.

You may also be interested in

5 minutes read

4 Things to Remember When Buying Gold for Your Children

If your children are the lucky ones to get a hoard of gold as an inheritance, there are 4 things you should do before passing it on to them.

15 minutes read

How to Start Investing in 2023? Here's What You Need to Know

You want to start investing but you don't know where to start? Here is a beginner’s guide to investing.

2 minutes read

What an Investor Should Do When Paper Money Loses Value

U.S. veteran investor Mark Mobius says there’s this one investment you should make to protect yourself from a possible currency crisis.

Get the Spotlight

What is Paper Gold?

- 24 Jul 2023

Get to know the A-Z of stock markets under 5 mins!

- 6 min read

Wondering What’s The Ideal Age To Start Investing In Mutual Funds?

- 4min read

- 29 Feb 2024

What Percent Of Your Income Can Go For Mutual Funds?

What is the Timing of Intraday Trading and Its Importance?

- 4 min read

- 05 Mar 2024

What is Gap Up and Gap Down in Stock Market Trading?

Why Are Mutual Funds Subject To Market Risks?

- 01 Mar 2024

Similar Articles

Trending articles.

- Learning Centre

What is paper gold?

Paper gold refers to gold investments that do not involve physically owning the precious metal. Understand its implications for investors.

Paper gold refers to a financial derivative that is a financial instrument based on gold as its underlying asset. Unlike physical gold, paper gold is a virtual asset traded through financial markets. Its existence is for the convenience of investors in gold trading , providing a more flexible and convenient trading method.

The operation of paper gold involves investors purchasing gold contracts through trading platforms or brokers, and the value and price of these contracts are closely related to the actual gold price. Investors can buy or sell gold contracts based on market conditions and personal expectations in order to profit from the price difference between the rise and fall of gold prices.

The investment risk of paper gold comes from the volatility of gold prices. The price of gold is influenced by many factors, such as the global economic situation, geopolitical risks, and inflation expectations. Therefore, the price of paper gold will continue to fluctuate, and investors should always pay attention to the dynamics of the gold market and make correct judgments and decisions.

What types of paper gold do they include?

The concept of "paper gold" is a reserve asset and accounting unit established by the International Monetary Fund to solve the balance of payments deficit among member countries.

Paper gold is a virtual type of gold whose price positioning is based on a certain variety of gold and converted into the price of RMB. Participating in paper gold trading is essentially a virtual transaction, which can be seen as a derivative transaction in the gold market. The trading records of investors are only reflected in the "gold passbook account", rather than the withdrawal of physical gold. The profit model is to obtain profits by buying low and selling high. Paper gold actually profits from speculative transactions rather than physical Gold as an investment.

The domestic paper gold market mainly includes paper gold from China Construction Bank, the Industrial and Commercial Bank of China, and the Bank of China. The handling fee for paper gold from ICBC is relatively low, with a unilateral spread of 0.8 yuan/gram. In addition to the more common types of paper gold, such as gold settlement orders, gold deposit receipts, gold bills of exchange, and large denomination gold certificates of deposit, paper gold also includes gold bonds, gold account passbooks, gold warehouse receipts, gold bills of lading, and special drawing rights of the International Monetary Fund.

What are the characteristics of paper gold?

1. Paper gold is usually bookkeeping gold, which not only saves storage costs for investors but also provides convenience for their monetization. Usually, after purchasing real gold, investors need to worry about how to store it. When it comes to implementation, identifying whether it is genuine gold also requires a certain cost. And paper gold adopts accounting methods, using international gold prices and converting them into RMB prices, saving the inconvenience of investing in real gold.

2. Paper gold is linked to the international gold price and adopts a 24-hour trading model. The domestic nights correspond to the daytime in Europe and the United States, which is usually a time when gold prices are likely to fluctuate significantly, providing ample time for office workers who have no time for financial management during the day.

3. Paper gold provides two trading modes: USD gold and RMB gold, providing corresponding opportunities for foreign currency and RMB financial management. At the same time, paper gold was delivered using the T+0 delivery method, which was purchased at that time and traded at that time. Intraday trading was very convenient, providing more intraday opportunities than domestic stocks.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

- Related Articles

SZSE Index Investment and Market Analysis

The SZSE Index includes composite and constituent indices. Use a diversified, long-term strategy and track policy changes for stable returns.

A Practical Guide to DMI Indicators

DMI indicators include +DI, -DI, and ADX; traders use them to assess market trends, create effective strategies, and increase success rates.

Investment Value and Long-Term Strategy of CSI 300

The CSI 300 index includes 300 high-market-cap stocks with strong investment value. Investing diversifies risk and increases returns.

EBC site region / language

- ئۇيغۇر تىلى

Products & Trading

- Trading Products

- Trading Accounts

- Trading Conditions – Deposit & Withdrawals

- Trading Conditions – Leverage & Margin

- Trading Platforms – MT4

- Trading Platforms – Dividend

EBC Institute

- Research Report

- Global Focus

- EBC Official

Institutional

- Liquidity Solutions

- Institutional Services

- Forex Tools

- Legal Documents

- Sustainability & Impact

- Gold IRA Guide

- Client Reviews

- Call for expert advice (877) 646-5347

- Open An Account

Physical Gold vs. Paper Gold — Which Is the Better Investment?

Published: October 6, 2022

You’ve worked hard to save money throughout your life and want to invest it wisely. Gold has been a highly sought-after investment option for decades. However, the type of gold you invest in can impact your risks, returns, fees, storage options, and more.

Understanding the distinctions between physical gold and paper gold can help you make an informed decision about your savings.

At Noble Gold Investments, we aim to help you secure your financial future by investing in precious metals like gold and silver. Continue reading to learn more about how physical gold differs from paper gold as an investment option.

What Is Paper Gold?

When most people think of gold, they imagine traditional gold bars or gold coins . Paper gold is an investment asset that represents a certain amount of gold. Exchange-traded funds (ETFs) are a common example of a gold-backed investment that rises and falls with the price of gold.

The idea of paper gold dates back to 1870 , when the United States and other nations adopted the gold standard policy. The monetary system aligned paper money with the fixed quantity of gold. The United States ultimately terminated the gold standard in 1971 to curb inflation.

Types of Paper Gold Investments

There are a few options when investing in paper gold. A gold-backed investment opportunity must be selected since paper gold isn’t a tangible asset.

Gold ETFs are commodity funds that allow you to own gold without managing the physical asset. Essentially, the investment works similarly to stocks, allowing you to purchase, trade, or sell shares that match the current value of gold.

Investors select gold ETFs to track gold value fluctuations, understand price trends, and learn more about the precious metals industry without storing and securing the physical item.

Gold Mining Stocks

Gold mining stocks are stock market investments in gold mining companies. Investing in a mining stock includes more value fluctuation and risk factors related to the company’s debt, foreign location, infrastructure, and age.

Major mining stocks refer to strong, established organizations with reliable performance history. Junior mining stocks are typically newer start-ups with riskier track records that fluctuate more frequently due to the company’s lack of experience.

Note that mining stock investments follow market trends instead of actual gold values.

Gold Certificates

Gold certificates are tickets you can purchase and redeem for physical gold. Unfortunately, more gold certificates exist than actual gold, so the tickets bought, sold, and traded may not have registered inventories. The theory behind gold certificates is sound, though it does come with complications and risks.

During the height of the gold standard, the United States used gold certificates as a convenient form of money. Today, they’re sold as collector’s items.

Advantages of Investing in Paper Gold

Paper gold investments have many advantages, depending on your financial goals. We recommend considering the pros and cons of physical gold versus paper gold before making any decisions.

No Insurance Necessary

Physical gold requires insurance, like other tangible assets such as cars, properties, and jewelry. Insurance is necessary to protect gold from theft and transportation damage.

Paper gold doesn’t require insurance because it only represents ownership. ETF theft would require highly complex fraud and theft is impossible.

Paper Gold Is More Liquid

Liquidity refers to how readily available an asset is. Purchasing physical gold requires seller research, shipping fees, delivery complications, and more.

Paper gold, like ETFs, is easy to acquire. With access to a bank or the market, you can easily purchase and trade ETFs without excessive wait periods or complications.

Affordability

Purchasing physical gold requires a significant upfront investment. Aside from the initial cost, insurance, storage, delivery fees, and more need to be paid upfront. Often, the smallest quantities you can purchase are coins.

Paper gold allows you to invest in precious metals in smaller and cheaper quantities. There are no shipping and storage costs, so you only pay for the actual asset. Note that you may have to pay trading fees.

Flexibility

When you purchase gold bullion, you often stay locked into the investment. After you’ve paid for shipping and storage, you won’t want to repeat the process just to trade for another precious metal or gold type.

With gold ETFs and other paper money options, you can easily buy, sell, and trade at any point without high costs or scheduling conflicts. Paper gold offers better flexibility than physical gold, especially if you don’t have a specific long-term plan.

Disadvantages of Investing in Paper Gold

While paper gold may have a few advantages, it also has disadvantages. Paper gold generally offers more convenience but increased risks. Depending on your financial goals, you may want a more stable option.

Stock Market Effects

When you invest in physical gold, your finances depend on the actual asset’s value. Paper gold’s value depends on many other factors, including stock market health. In economic downturns, when the stock market drops, you may suffer value losses, even though physical gold may maintain its status.

While the stock market frequently fluctuates, you shouldn’t encounter many issues if you plan to invest long-term. Investors who want quick wins within a year or two may suffer losses from economic downturns, though if you hold your investment for decades, you can often avoid this.

Expense Ratio and Associated Fees

When considering physical gold versus paper gold, you must factor in the added fees. The expense ratio is an annual fee you must pay your ETF funds for management costs. You may also have to pay commission fees when selling or buying ETFs.

If you plan to purchase and carry your investment for decades, you can avoid excessive trading fees, though you’ll still have to pay the expense ratio each year. Consider these added expenses when weighing your investment choices.

Higher Risks

Paper gold represents gold, which means you must rely on intermediaries rather than carrying and storing the physical asset. For example, if you invest in a mining company, your funds depend on the business’s success, not the value of gold itself. Such indirect investments increase risks because they include additional factors that could affect your outcome, like companies filing for bankruptcy.

Non-Tangible Nature

You can’t take possession of paper gold like you can with physical gold. If the market crashes or your investment fails, your only option is to settle for cash, which may not be as valuable as your initial investment. Regardless of market factors, you can maintain your physical gold asset as its value matures.

What Is Physical Gold?

Physical gold refers to the traditional precious metal that is shaped into bars, coins, jewelry, and other forms. People first discovered gold in rivers and streams across the world, appearing as shiny, golden nuggets.

In 4000 B.C. , ancient cultures in today’s Southeastern Europe used it for decorative objects and fashion. Historians estimate that people first mined for gold at this time in either Thrace (modern-day Greece, Turkey, and Bulgaria) or the Transylvanian alps.

Types of Physical Gold Investments

Investing in physical gold rather than paper gold means purchasing and storing the asset. Each type of physical gold comes with its own purchase prices, pros, cons, and investment returns.

Understanding the differences between the various physical gold options will help you make a better decision.

Gold Bullion

Gold bullion is the purest and most basic version of the physical asset. Unlike jewelry and coins, which offer other usages, the sole purpose of bullion is to carry the value of gold as an investment. Usually, bullion comes in 99%, 99.5%, or 99.99% purities.

You can purchase bullion as ingots, nuggets, or gold bars depending on your desired weight quantity. Each item will come printed with the manufacturer’s name, gold content, fineness, and weight. The investment offers low additional expenditures and high liquidity when converting to cash, making it a safe choice.

Gold Jewelry

Gold has remained the most timeless and popular metal choice for jewelry. You can purchase nearly any jewelry in gold, though you will pay increased acquisition costs due to the styling efforts. Most gold jewelry is not pure but is an alloy (mixed with another metal to harden the material).

Gold jewelry cannot be sold for the same price it was purchased at. Like other used items, it loses value after it enters your possession. It may remain fairly valuable, though gold jewelry isn’t the best investment choice for those wishing to capitalize on their returns.

Like jewelry, gold coins are typically an alloy. Gold on its own would be too soft in coin form, leaving gold coins to be approximately 91% pure gold. You can purchase a variety of gold coins from different predominant countries, like:

- U.S. Gold Buffaloes or Gold Eagles

- South African Krugerrands

- Canadian Gold Maple Leaf Coins

Collectors often purchase gold coins to add to their collection, while investors use the coins as an opportunity to invest in smaller quantities.

Vaulted Gold

Vaulted gold is bullion that is stored in a professional bank vaulting facility. You still own the bullion, and the carrier has zero ownership over your investment. Annual fees must be paid to keep items secure in the vault, though this price is worth the security for larger investments.

Usually, you won’t ever touch your physical vaulted gold asset. You can only control any actions you wish to take with the gold, like buying more, selling, or trading. Vaulted gold offers all the benefits of bullion, with better security and reduced transportation costs.

Advantages of Investing in Physical Gold

Just like paper gold, physical gold comes with advantages and disadvantages. We recommend weighing all of these considerations before deciding how you want to invest. Continue reading to learn about the pros of investing in physical gold.

Reliability

Reliability is enormous when considering any investment opportunity, including physical gold and paper gold. Physical gold offers better reliability than paper because it doesn’t directly relate to the government or large organizations. You can rely on physical gold’s steady appreciation rates better when you don’t have to worry about the actions or fluctuations of other parties.

Physical gold also stays safe from hacking events or cyber-attacks. Many paper gold assets only offer digital trails, which are less reliable than physical assets.

Tangibility

Because physical gold is a tangible asset, there’s a finite and limited amount of it. The precious metal’s complex mining process increases its rarity and ensures that the product will remain valuable for the foreseeable future.

Paper gold’s worth relies on many other factors, while physical gold directly relates to quantity. The more scarce gold becomes, the more physical gold investments gain value.

Globally Accepted

Global cultures have used gold for centuries for trading purposes. Physical gold is a universally accepted asset that all nations recognize as valuable. Paper gold investments only offer rewards in certain places, while physical gold is beneficial regardless of where you go.

While other universal investments often have stability issues between global government policies and political events, gold remains stable because of its tangible and reliable features.

Gold Has Zero Counterparty Risk

When you purchase paper gold, you’re relying on other organizations. For example, when you buy gold certificates, you trust that the seller has the associated physical gold to go along with the purchase. Digital scammers exist, and when counterparties are involved, your risks of unfulfilled obligations increases.

The organizations that orchestrate paper money deals may not intentionally steal your money, but if they fail, so does your investment. There are no counterparty risks when it comes to physical gold. You are the sole owner of your investment and directly control everything that happens with your funds.

Gold Is A Great Hedge Against Inflation

Inflation refers to the concept of money losing value over time. When inflation occurs, the money you earn becomes less valuable because the price of goods increases. The United States and all other nations experience inflation at different economic times.

Gold maintains and increases its value during inflation , unlike cash (fiat money). Imagine that you earned $50,000 in cash pay the year you were 25, which was enough to cover rent, food, bills, and $10,000 in savings. When you retire decades later, those savings may not last you more than a few months because of the increased cost of living.

However, if you invested that $10,000 in gold, its value would increase, just as the cost of living does. When you pull those savings out to retire, you’ll have an equivalent or increased value to what you initially put in. You work hard to earn money throughout your life, and physical gold helps prevent your savings from going to waste.

Disadvantages of Investing in Physical Gold

While physical gold’s security and reliability may offer appealing advantages as you begin your precious metals investments, it isn’t without disadvantages. Physical gold isn’t as convenient as its digital counterpart, which can cause issues, especially when dealing with large and heavy quantities.

While the tangibility of gold reduces some risks, it also creates some. When you own physical gold, it must be properly stored, secured, and managed to keep it safe. Storing large quantities of physical gold at home can pose challenges because of the need for a large enough safe or vault.

You may not have as much trouble buying an at-home safe if you only own a few coins. On the other hand, purchasing bullion in bulk will likely require a vaulting service. You don’t want to risk losing hundreds of thousands or more from theft or property damage.

Because gold is a physical asset, you also must insure it in case of an accident. You can purchase insurance for your investment through dealers or the vaulting company where you store your assets.

Insurance protects your purchase, though you must pay additional fees for this security. Some investors may find the need for insurance a nuisance after having to buy the gold itself. This extra cost may be a turnoff for those weighing their gold investment options.

Hidden Upfront and Backend Fees

Many investments involve excessive fees, and gold is no exception to this rule. Often, dealers charge percentages upon sales, and some vaults may charge a withdrawal fee. We recommend reading the fine print to understand all associated costs before investing funds.

It’s important to remember that gold isn’t immune to taxes. Like other investments, associated purchase taxes must be paid, which can add up quite a bit when spending large quantities. With gold IRAs , you can reduce tax requirements since you can’t access the funds until you retire.

Buying Physical Gold At Noble Gold Investments

At Noble Gold Investments , we’re experts when it comes to gold and other precious metals. We believe that physical gold is one of the best investments you can make considering it offers reduced risks, reliable appreciation rates, and improved security when weighing physical gold versus paper gold investments.

If you’re interested in investing in physical gold coins, gold bars, or even buying precious metals in a gold or silver IRA we can help you select and purchase the products that make the most sense for your portfolio.

Feel free to give us a call at (877) 646-5347 to speak to one of our experts. We’re ready to help you open an online account with Noble Gold Investments today and begin saving for the rest of your life.

Dive deeper into precious metals

The Impact Central Bank Policies Have On Gold And Silver Price Fluctuations

Structural Challenges Facing the Global Banking System

Identifying Countries At Risk For Sovereign Debt

Economic Sanctions And The Impact On Global Trade Dynamics

- 877-646-5347

- Email us: [email protected]

- Press inquiries: [email protected]

© Noble Gold 2024. All rights reserved.

Download Our Guide To Learn How Investing In Precious Metals Will Help You...

- ✔ Guard Against Inflation

- ✔ Hedge Against The Dollar

- ✔ Outperform Stocks & Bonds

- ✔ And So Much More!

" * " indicates required fields

No thanks, I’m not interested!

The industry source for precious metals investing

What Is Paper Gold Investment?

Thursday, May 2nd 2024

Gold has long been valued as an investment due to its perceived value and stability; historically serving as an effective bulwark against inflation ( 1 ), currency fluctuations, and geopolitical risks. More recently, paper gold investment has offered investors another way to take advantage of gold without physically owning it themselves – this post attempts to demystify and explain this new form of asset ownership without getting bogged down in technicalities or confusion.

Understanding Paper Gold

Paper gold investment refers to an investment strategy in which an investor gains exposure to gold’s price movements without owning physical gold in their possession. Instead, investors buy financial instruments which track gold prices such as exchange-traded funds (ETFs), futures contracts or options which track it – these instruments are sometimes known as digital or paper gold investments due to being tied directly with price of the metal and existing only in paper form (rather than physical form).

Types of Paper Gold Investments

Paper gold investments come in various forms, each offering distinct advantages and considerations:

- Gold ETFs and mutual funds ( 2 ) : Gold-focused investment funds track the price of gold by buying and storing it on behalf of investors; shares can then be traded like stocks on exchanges.

- Gold mining stocks : An indirect way of investing in gold, purchasing shares of companies that mine it provides exposure to both their profits and losses which depend on gold’s price fluctuations.

- Gold futures and options : Gold futures and options provide investors with contracts granting them access to purchase gold at set prices in the future, often at greater complexity than more straightforward investments such as stocks. Due to these risks, this form of investing should typically only be undertaken by experienced traders and investors.

Advantages of Paper Gold Investment

Paper gold investment offers several attractive attributes that may make it attractive to many investors:

- Liquidity : Paper gold investments such as ETFs or futures contracts tend to be more liquid than physical gold, meaning investors can buy or sell quickly and conveniently, which makes investing simpler overall.

- Storage and security : With paper gold, no need is necessary for you to worry about storing or insuring physical gold – this decreases costs and risks associated with holding physical gold.

- Affordable : Paper gold investments typically carry lower initial costs compared to buying physical gold, making them more accessible and available for investors of various backgrounds.

Disadvantages and Risks of Paper Gold Investment

Paper gold investment brings with it many advantages; however, its associated risks and drawbacks should also not be overlooked:

- Lack of physical ownership : Paper gold investments might not provide as much security during times of crises because they’re simply paper or digital assets compared with tangible gold holdings.

- Counterparty risks : Investments such as ETFs or futures contracts pose counterparty risks that could lead to losses for investors if their issuer doesn’t fulfill its contractual obligations, leading them to default and incur losses themselves.

- Volatility : Paper gold investments such as futures and options may be subject to high levels of price volatility that could lead to substantial financial loss if improperly managed.

Comparing Paper Gold and Physical Gold

Physical gold has its own important place in any well-rounded portfolio, while paper gold offers something different altogether. Physical gold can provide tangible security against economic or geopolitical crises or turmoil while remaining subject to no counterparty risk – often used as insurance against this form of risk.

Paper gold, in contrast, is an asset-backed financial product which mirrors its prices and can easily be traded. Therefore, it makes an ideal option for anyone wishing to speculate on gold prices or use it as short-term protection against price volatility.

Considerations before Investing in Paper Gold

Before investing in paper gold, it is vitally important to carefully consider several considerations:

- Investment goals and risk tolerance : Paper gold investments may provide liquidity, ease of trading, lower upfront costs and are suitable for investors seeking liquidity; however, they come with increased risks which may not provide as much security in times of crises as owning physical gold would do.

- Market awareness : The gold market can be affected by various influences, including geopolitical events, inflation rates, demand and supply shifts and global events such as geo-ethics crises. A thorough understanding of all these elements will assist investors in making wiser investment decisions.

- Professional advice : Due to the complexity of some forms of paper gold investments such as futures and options trading, it might be prudent to consult an advisor prior to diving headfirst into this realm of investing.

Navigating the World of Paper Gold Investment

Below are key steps and strategies for getting started:

- Educate yourself : Before making any gold investment decisions, it’s advisable to familiarize yourself with the fundamentals of gold investing, its various forms, and how it all works. There are various educational resources online which will assist with getting you underway.

- Establish your investment goals : Your investment goals should play a pivotal role when considering paper gold investments. If your focus is quick profits, futures or options might be appropriate; but for long-term stability a gold ETF or mutual fund might offer better solutions.

- Consider your risk tolerance : Various paper gold investments come with differing risks and it is crucial that you fully comprehend these before investing. In doing so, assess and identify what risks suit your tolerance level best before diving in.

- Start small : For beginners just starting out in paper gold investment, it may be prudent to begin small at first until you understand how everything works. As your experience builds up, gradually increasing your investments can become possible.

- Professional advice : If you are unsure about gold investment get advice from an advisor who specializes in the field. They can provide you with advice for your specific financial needs and desired investment goals.

Paper gold investment provides investors with an accessible and simple means of accessing the gold market without physically possessing it. While its various benefits such as liquidity and ease of trading may entice some, before diving in it’s essential to first understand and evaluate all risks as well as your own investment objectives and risk tolerance to ensure success with any paper gold investments you consider making. As with all investments, due diligence and understanding are the keys to successfully navigating paper gold investing successfully.

Every person wants peace of mind regardless of retirement goals. If you’re looking to add silver and gold in your retirement investment portfolio and want to make it happen, you can do so by establishing a self-directed IRA. These types of accounts permit you to build a retirement portfolio that increases in value on a tax-advantaged basis. As with all investment instruments take care to conduct your due diligence. For more information, take a look at our gold IRA bureaus reviews for the “top firms in the US below. Learn more about: American Hartford Gold IRA

Learn more about: Augusta Precious Metals trust pilot

Learn more about: Goldco Direct precious metals IRA

Learn more about: Advantage Gold reviews

Learn more about: Birch Gold Group problems

Learn more about: Noble Gold bbb rating

Learn more about: Rosland Capital complaints

Learn more about: Lear Capital fees

Learn more about: Patriot Gold trustlink

Learn more about: Oxford Gold Group precious metals

Learn more about: Regal Assets

- Author Details

Related posts:

- What Can A Traditional IRA Be Rolled Into? Individual Retirement Account (IRA), an investment tool to promote long-term...

- Can I Open A Gold IRA? An Individual Retirement Account (IRA) allows investors to diversify their...

- How Do IRA Custodians Make Money? Individual Retirement Accounts, more commonly referred to as IRAs, have...

- What Are The Tax Benefits Of A Gold IRA? Investment can be an intimidating maze of choices and market...

I’ll never invest in such a joke!

This is up to you however, please consider diversification and consulting a professional in order to get proper guidance.

Happy investing!

Online orders available 24/7 throughout Festive Period. Despatch and Customer Support will resume on 3rd Jan

020 7060 9992 | Email us

Live prices

£ __ oz

£ __ g

Looking for advice? Call 020 7060 9992 or send us an email

Shop Gold Coins

- Gold Sovereign Coins

- Gold Britannia Coins

- One Ounce Gold Coins

Shop Gold bars

- 1oz Gold Bars

- 100g Gold Bars

- 1kg Gold Bars

Monthly Saver

Accumulate gold coins on a regular basis for home delivery or storage.

Director's Pick

Let our experts hand-pick a gold investment portfolio for you.

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Shop Silver Coins

- Silver Britannia Coins

- One Ounce Silver Coins

- Silver Tudor Beasts Coins

Shop Silver Bars

- 1kg Silver Bar

- 100g Silver Bar

- Best Value Silver Bars

Accumulate silver coins on a regular basis for home delivery or storage.

Let our experts hand-pick a silver investment portfolio for you.

Sell Gold Bars

We buy gold bars from 5g up to 1KG

Sell Gold Coins

We pay market leading rates for gold coins

Sell Silver Bars

Sell your silver bullion to us

Sell Silver Coins

Find a price for your silver coins

- Delivery & Storage

What is Paper Gold Investment?

16/05/2021 Daniel Fisher

Investors looking for portfolio diversification often turn to paper gold investments. Investors view gold as a safe haven and hedge their risks by investing in all types of gold . In 2020, during the height of the global pandemic, the price of gold rose steadily to reach its highest point ever . This was made possible by increased investor demand due to the safety and security that gold provides. Usually, physical gold investments can be categorised into gold bars, gold coins and gold jewellery. Investors usually park their money by buying bars and coins. However, paper gold investments can be another viable option.

What is paper gold?

Paper gold investment refers to the purchase of an asset that isn’t tangible but instead represented on paper. This can take the form of gold mutual funds such as the Blackrock Gold & General Fund, individual mining shares, spread betting on the gold market, gold futures and gold ETFs. Those seeking tangible investment need to buy gold bars or coins.

Physical gold bars do not carry counterparty risks

The abbreviation ETF stands for Exchange Traded Funds . In other words, it is a fund that invests the money collected from investors into various types of gold investments . These investment choices are spread across all types of gold-related investments in the market.

Physical gold could be one of them, but the fund usually diversifies its gold portfolio by investing in many other categories, like gold mining stocks, refiners that produce gold, companies that manufacture gold products and government bonds. It is important to note that individual investors who subscribe to the fund have no say in these investment decisions. The decisions are made by professional investment managers, who are responsible for running the fund.

Gold futures

Another type of paper gold investment is gold futures . Since gold is a commodity, it is actively traded every day on the gold markets. Therefore, speculation can be made on the price of the commodity for a future date. Gold futures are contracts entered into by investors, who agree to take delivery of the gold on an agreed date at a price point. The contract can be finalised by making an initial payment. It is a speculative risk-based transaction. The price of gold can fluctuate, and the investor may lose money on the transaction if there is a significant price drop between signing the agreement and the delivery date.

Paper gold funds also invest in gold mining stocks

Counterparty risk

The biggest downside to paper gold investments is counterparty risk . This is the risk of a third-party dishonouring a contract due to poor performance in the market. In a worst-case scenario, the company may even become bankrupt. All paper gold investments carry this risk since the investor is entering into a contract with a third party. However, physical gold investments are tangible and the investor is in possession of the asset at all times. Therefore, the question of counterparty risks does not arise as there is no third party involved in the trade.

Prefer the idea of investing in real gold coins and bars? Download our investment cheat sheet FREE

Tax efficiency

Investment-grade gold is VAT free in the UK. Additionally, investments in gold coins that are legal tender in the country, like the Gold Britannia or the Gold Sovereign can also make your investments Capital Gains Tax (CGT) free. However, paper gold investments do not qualify for these tax exemptions. Most paper gold investments attract long-term capital gains tax.

Speak to our gold experts for all your gold investments

Physical Gold is one of the U.K.’s most reputed gold dealers and our investment advisors are always happy to hear from you and offer free advice on any gold investments, you might want to make. Call us on (020) 7060 9992 or contact us online to speak to a member of our investment team.

Image credits: Mark Herpel and TheDigitalArtist

Share this post on:

Latest Posts:

How are Gold Coins Made?

How to Remove Tarnish from Silver Bars and Silver Coins

Sell Scrap Silver

Gold Information

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Silver Information

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.

- Learning Center

- Share Market

What is Paper Gold: Meaning, How to Buy & Invest in India

It is sometimes suggested that the best way to invest money is by investing in gold. Apart from buying physical gold, there are other ways to invest in gold, like paper gold. If you want to know more about paper gold investment, read on.

What Is Paper Gold?

Paper gold can be described as an asset that reflects the price of gold but is not gold. It's not backed with real metal, so it's just on paper. Owning paper gold allows you to participate in the market value of gold without owning physical gold. It is considered more profitable for trading than as a long-term investment opportunity.

Why Opt for Paper Gold Instead of Physical Gold?

Invest right, invest now.

Open a FREE* Demat + Trading account and enjoy

Zero commission* on Mutual Funds and IPO

₹20* per order on Equity, F&O, Commodity and Currency

Enter your mobile number to continue

*By signing up you agree to our Terms and Conditions

Of course, storage services are not free, so these costs must be considered, reducing your return on gold. When you buy paper gold, you get a piece of paper that roughly reflects the gold's market value, saving you the cost and hassle of storing it.

If you don't have enough money to buy an ounce of gold, ETFs can be a good option. ETF stocks or comparable alternative investments enable you to invest in less than an ounce of gold. Additionally, paper gold allows you to invest in gold without having the money to buy an ounce. The low cost of ETFs is another reason retail investors prefer paper gold over physical gold.

Is Paper Gold Safe?

When you do not get tangible gold after investing, thoughts like whether investing your money in paper gold is reliable might arise. This is an important consideration because buying paper gold exposes the investor to counterparty risk (the risk that the transaction partner will not be able to fulfil their end of the bargain).

For instance, when you buy a gold ETF share, you get a paper document that trades similarly to gold. In such a case, an ETF (along with its collaborators) issues additional shares to help ease price pressure, with the new shares supported by real gold or a gold derivative (like futures contracts). As a result, increased demand for ETF shares will lead to a rise in the number of shares available instead of a price increase. If insufficient demand for these shares and the price declines, the ETF (and its business partners) will sell a portion of its real assets and use the money raised to redeem existing shares.

However, if it does not own physical gold and runs out of money (for example, due to a futures market collapse), it might not be able to pay you for your gold share, culminating in an ETF default. However, if the gold derivatives fail, the gold price falls, and/or demand for these shares falls significantly, such ETFs may be unable to redeem all their shares. As a result, the less real gold the fund has, the more likely you will be caught off guard in an emergency.

How to Buy Paper Gold

Now that you know how paper gold works, here are some ways to invest in paper gold:

Gold Exchange-traded Funds (ETFs)

Gold Exchange Traded Funds (ETFs) are open-ended mutual funds based on shifting gold prices. Investing in them provides two advantages: investing in gold and having the flexibility to trade stocks. The money invested is at low risk, making it ideal for those who want to diversify their investments. You can buy gold ETFs online because they are flexible and easy to enter and exit. The initial investment is minimal. You can begin with as little as one gram of gold.

Digital Gold

With the advent of digital gold, this metal has become more available, approachable, and operational. Individuals can now purchase coins, bars, and jewellery online. Purchasing digital gold is comparable to purchasing physical gold, except the entire transaction occurs online. It would be like 24-karat gold stored in a vault that a purchaser can obtain at any time via digital platforms. The gold purchased by a person online will be stored in vaults by the seller. It can be purchased or sold via digital platforms.

Sovereign Gold Bonds

Government securities broken down in grams of gold are known as SGBs. The bonds are considered a better alternative to gold in physical form because they reduce the theft risk. To put it simply, they are alternatives for physical gold. The advantage of investing in SGBs is that the amount of gold paid for is protected because the investor receives the current market price at the time of redemption.

Gold Mutual Funds

Gold mutual funds invest in gold ETFs or foreign gold funds. Investors can choose a SIP with these mutual funds to invest in gold regularly and thus reap the benefits of RCA (Rupee Cost Averaging). A Demat account is not required for investors to invest in these funds.

Although there are advantages to investing in paper gold, one must exercise caution before making a final decision. Furthermore, before making a decision, one must also consider the taxation on gains levied on these investment options.

The investment options and stocks mentioned here are not recommendations. Please go through your own due diligence and conduct thorough research before investing. Investment in the securities market is subject to market risks. Please read the Risk Disclosure documents carefully before investing. Past performance of instruments/securities does not indicate their future performance. Due to the price fluctuation risk and the market risk, there is no guarantee that your personal investment objectives will be achieved.

Explore More Fundamentals

What is Paper Gold?

TOP TRENDING

Trending stories.

- IPL Today Match DC vs KKR: Dream11 prediction, head to head stats, fantasy value, key players, pitch report and ground history of IPL 2024

- IPL 2024 Orange Cap Update: RCB's Virat Kohli 1st, CSK's Ruturaj Gaikwad 2nd and GT's Sai Sudharsan 3rd after match 46

- Best 5 Star Refrigerator Picks: Advanced Cooling Technology for Optimal Cooling with Energy Efficiency

- HP Board Class 12 Result likely today at 2:30 PM

- TS EAMCET Hall Ticket 2024 to be out today at eapcet.tsche.ac.in, here's how to check your admit card

- IPL 2024 Purple Cap Update: MI's Jasprit Bumrah 1st, CSK's Mustafizur Rahman 2nd and PBKS' Harshal Patel 3rd after match 41

- Union minister Smriti Irani rides through Amethi on scooty, video goes viral

- ‘Not polarising to show Congress brought religion-based quota’: PM

- Delhi Police registers FIR over Amit Shah's viral doctored video

- UPA govt faltered on free ration, ours giving succour to 80 crore: BJP

- Pune sales executive quits 'toxic job', plays 'dhol' in front of his manager

- Congress's Indore candidate withdraws nomination, joins BJP

- Why BJP has preferred to forget Pramod Mahajan

- '90% population SCs, STs, OBCs, but no representation in corporate sector'

- Prajwal obscene video case: 'Will BJP continue alliance with JD(S)?'

- Railways on track to establish 100 Gati Shakti Cargo Terminals

- 42 years of Bachchan 'darshan': A hero worship like no other

- Reliance has a 'Jio plan' for TV, washing machine & other market

- Sunita and Delhi minister Atishi meets Delhi CM inside Tihar jail

- Three masked men murder Muslim cleric in Ajmer Masjid

BullionStar

In this blog, BullionStar shares what's happening inside BullionStar as well as news and research from the local and global precious metals markets.

What Sets the Gold Price – the Paper or Physical Market?

The following article is arranged in Question and Answer (Q & A) format. Through the Q & A approach, this article raises some important issues about price discovery in the gold markets and aims to explain the view that the gold price is being set by the paper gold markets.

BullionStar’s CEO Torgny Persson and precious metals analyst Ronan Manly are of the opinion that due to the structure of contemporary gold markets, it is primarily trading activity in the paper gold markets which sets the international price of gold.

Question: The international gold price is constantly quoted in the financial media alongside other major financial indicators. What is this international gold price, and how is it defined?

The international gold price usually refers to the price of gold quoted in US Dollars per troy ounce as traded on the 24-hour global wholesale gold market (XAU/USD). Gold is traded non-stop globally during the entire business week, creating a continuum of international gold price quotes from Sunday evening New York time all the way through to Friday evening New York time. Depending on the context, this international gold price sometimes refers to a spot gold market quote, such as spot gold traded in London, and at other times may refer to the front month of a gold futures contract price as traded on the US Commodity Exchange (COMEX) . The front month contract is a nearby month which will usually exhibit the highest trading volume and activity.

The international gold price can also at times be referring to the LBMA Gold Price benchmark price as derived during the London daily gold price auctions (morning and afternoon auctions). LBMA is an abbreviation for London Bullion Market Association .

Therefore, this ‘international price’ could be referencing a spot gold price, a futures gold price, or a benchmark gold price, but all three would, at a comparable time, be roughly similar in magnitude.

Question: Where does this international gold price come from, where is it derived? Recent empirical research has determined that gold price discovery is jointly driven by London Over-the-Counter (OTC) spot gold market trading and COMEX gold futures trading, and that the “international gold price" is derived from a combination of London OTC gold prices and COMEX gold futures prices. See “ Who sets the price of gold? London or New York (2015)” by Hauptfleisch, Putniņš, and Lucey.

In general, the higher the trading volume and liquidity in a specific asset market, the more that market contributes to discovering prices for that asset. This is also true of the global gold market. Between them, the London OTC and New York trading venues account for the vast majority of global gold trading volume, and in 2015, the London OTC spot market represented approximately 78% of global gold market turnover while COMEX accounted for a further 8% (See Hauptfleisch, Putniņš, and Lucey (2015)).

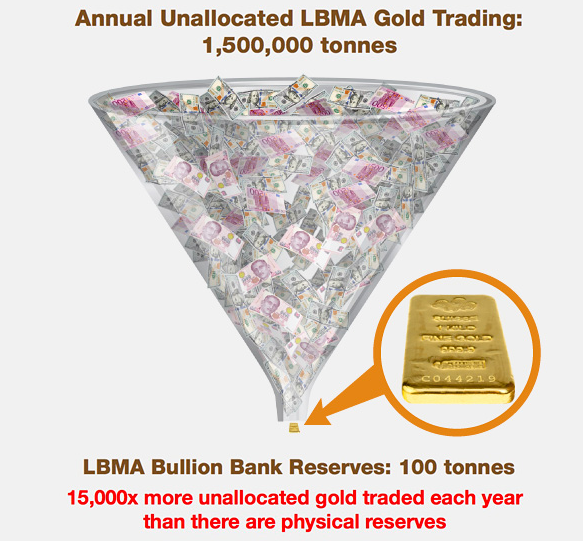

Based on London gold clearing statistics for 2016, a quick calculation shows that total trading volume in the London OTC gold market is estimated to have been at least the equivalent of 1.5 million tonnes of gold in 2016, while trading volume of the 100 oz COMEX gold futures contract reached 57.5 million contracts during 2016, equivalent to 179,000 tonnes of gold. Gold trading volume on the London OTC gold market in 2016 was therefore about 8.4 times higher than trading volume in the COMEX 100 oz gold futures contract.

However, COMEX has been found, by the above academic research, to have a larger influence on price discovery than London OTC, despite the lower trading volumes of COMEX. This is most likely due to a combination of factors such as COMEX’ accessibility and extended trading hours via use of the GLOBEX platform, the higher transparency of futures trading compared to OTC trading, and the lower transaction costs and ease of leverage in COMEX trading. In contrast, the London OTC gold market has limited trading hours (during London business hours), barriers to wider participation since it’s an opaque wholesale market without central clearing, and trading spreads which are dictated by a small number of LBMA bullion bank market-makers and a handful of London-based commodity brokerages.

The bottom line though is that both sets of trading statistics, London OTC and COMEX, are gigantic in comparison to the size of the underlying physical gold markets in London and New York.

Question: So, does the physical gold market or the paper gold market set this international price of gold? The international gold price is purely set by paper gold markets, in other words it is set by non-physical gold markets. Based on their respective gold market structures, the London OTC gold market and COMEX are both paper gold markets. Supply of and demand for physical gold plays no role in setting the gold price in these markets. Physical gold transactions in all other gold markets just inherit the gold prices that are discovered in these paper gold markets.

The London OTC gold market predominantly involves the trading of synthetic unallocated gold, where trades are cash-settled and not physically delivered (i.e. no delivery of physical gold). These synthetic gold transactions have little connection to any underlying gold holding, hence they are de-facto gold derivative positions. By definition, unallocated gold positions are just a series of claims on bullion banks where the holder is an unsecured creditor of the bank, and the bank has a liability to that claim holder for an amount of gold. The holder, on its side, takes on credit risk towards the bullion bank. The London OTC gold market is therefore merely a venue for trading gold credits.

The London OTC gold market is also one in which the bullion banking participants employ fractional-reserve gold trading to create large amounts of paper gold out of thin air (analogous to commercial lending), where the trading is also leveraged and opaque, and where this paper gold is only fractionally backed by physical gold. This “gold” is essentially synthetic gold. See BullionStar Gold university article “ Bullion banking Mechanics " for further details on fractional-reserve gold trading.

Since COMEX only trades exchange-based gold futures contracts, it is, by definition, a derivatives market. Cash-settlement is the norm. Only 1 in 2500 gold futures contracts traded on COMEX is delivered with a transfer of warrants representing metal. The rest of the contracts are cash-settled. This means that 99.96% of COMEX gold futures contracts are cash-settled. See BullionStar US Gold Market Infographic for details.

Given COMEX trading gold futures and London trading synthetic unallocated gold, both the London and COMEX gold markets essentially trade gold derivatives, or paper gold instruments, and by extension, the international gold price is being determined in these paper gold markets.

Beyond the London OTC gold market and COMEX, all other gold trading venues are predominantly price takers that take in and use the gold prices established by the paper gold markets in London and New York. These other markets include physical gold markets around the world which look to the international gold price as an input into their domestic gold price setting mechanisms and conventions.

Question: Explain a little more about the market structures of these London OTC and COMEX markets? By definition, futures trading is trading of securities whose value is derived from an underlying asset but whose securities are distinct from those of the underlying asset, i.e. derivatives. COMEX gold futures contracts are derivatives on gold. COMEX registered gold stocks are relatively small, very little physical gold is ever delivered on COMEX, and even less physical gold is withdrawn from COMEX approved gold vaults. COMEX gold trading also employs significant leverage. Hauptfleisch, Putniņš, and Lucey (2015) state that “ such trades [on COMEX] contribute disproportionately to price discovery ”. Note that the COMEX gold futures market is actually a 24-hour market but its liquidity is highest during US trading hours.

Turning to the London OTC gold market, nearly the entire trading volume of the London OTC gold market represents trading in unallocated gold, which to reiterate, merely represents a claim by a position holder on a bullion bank for a certain amount of gold, a claim which is rarely exercised. London OTC gold trades also predominantly cash-settle. Traders, speculators and investors in unallocated gold positions virtually never take delivery of physical gold.

This is a fact confirmed by a UK HMRC / LBMA Memorandum of Understanding published in 2013 which states that in the London gold market “investors acquire an interest in the metals, although in most situations, physical delivery will not occur and in 95% of trades, trading in unallocated metals will be undertaken.” Additionally, in 2011, the then LBMA CEO Stuart Murray also confirmed that there were ‘ very substantial amounts of unallocated gold ’ held in London.

A 2015 legal opinion on unallocated gold drafted by respected global law firm Dentons describes unallocated gold as ‘synthetic’ gold and as a derivatives transaction.

Dentons states that “ the reality of unallocated bullion trading is that buyers and sellers rarely intend for physical delivery to ever take place. Unallocated bullion is used as a means to have “synthetic” holdings of gold and so obtain exposure to the price of gold by reference to the London gold fixing. ”

Although the LBMA does not publish gold trading volumes on a regular basis, it did publish a one-off gold trading survey covering Q1 2011 in which it was revealed that during the first quarter of 2011, 10.9 billion ozs of gold (340,000 tonnes) were traded in the London OTC gold market. During the same period, 1.18 billion ozs of gold (36,700 tonnes) were cleared in the London OTC gold market. This would suggest a trading turnover to clearing turnover ratio of 10:1. In the absence of live trading data from the London OTC gold market, this 10:1 proxy ratio can continue to be applied as a multiplier to the LBMA London Gold Market daily clearing statistics, which are published every month, and which are always phenomenally high.

For example, average daily clearing volumes in the London Gold Market during January 2017 totalled 20.5 million ounces. That’s the equivalent 638 tonnes of gold cleared per day in London. On a 10:1 trading to clearing multiple, that’s the equivalent of 6,380 tonnes of gold traded per day , or 1.6 million tonnes of gold traded per year.

Since there are only about 6,500 tonnes of gold stored in London, most of which represents static holdings of central banks, ETFs and other holders , the London OTC gold trading activities are totally disconnected from the underlying physical gold holdings. Furthermore, only about 190,000 tonnes of gold have ever been mined throughout history, half of which are estimated to be held in the form of jewellery. Therefore, the trading of nearly 6,500 tonnes of gold per day within the London OTC gold market has nothing to do with the physical gold market, yet perversely, this trading activity drives global gold price discovery and the pricing of physical bullion trades and transactions.

Revealingly, according to the LBMA bullion bankers who established the reporting of London gold clearing statistics, who specifically were the then LMPCL chairman, Peter Fava, and JP Morgan’s Peter Smith, these LBMA gold clearing statistics include trading activities such as “ leveraged speculative forward bets on the gold price” and “investment fund spot price exposure via unallocated positions ”, activities which are just side-bets on the gold price. See October 2003 article titled “ Clearing the Air Discussing Trends and Influences on London Clearing Statistics “, from LBMA Alchemist Issue 32.

In essence, trading activity in the London gold market predominantly represents huge synthetic artificial gold supply, where paper gold trading is deriving the price of gold, not physical gold trading. Synthetic gold is just created out of thin air as a book-keeping entry and is executed as a cashflow transaction between the contracting parties. There is no purchase of physical gold in such a transaction, no marginal demand for gold. Synthetic paper gold therefore absorbs demand that would otherwise have flowed into the limited physical gold supply, and the gold price therefore fails to represent this demand because demand has been channelled away from physical gold transactions into synthetic gold.

Likewise, if an entity dumps gold futures contracts on the COMEX platform representing millions of ounces of gold, that entity does not need to have held any physical gold, but that transaction has an immediate effect on the international gold price. This has real world impact, because many physical gold transactions around the world take this international gold price as the basis of their transactions.

Although gold clearing volumes and the LBMA’s market survey provide some useful inputs into calculating London gold trading volumes, there is very little known publicly about how much physical gold actually trades in the London gold market. This is because the LBMA and its member banks choose not to reveal this information . There is no trade reporting in the London OTC gold market, no reporting of physical gold vault positions, no reporting of the unallocated gold liabilities of LBMA member bullion banks, and no reporting of how much physical gold in total these bullion banks retain to back up their fractional-reserve unallocated gold trading system. However, physical gold trading is by definition an extremely minuscule percentage of average daily trading volumes in the London OTC gold market. For details on the workings of the gold market in London, see BullionStar Infographic the “ London Gold Market “.

While one of the three components that comprise the London gold clearing statistics is stated to be “ physical transfers and shipments by LPMCL clearing members ”, the LBMA doesn’t even see fit to publish a breakdown of these 3 components. This compounds the secrecy and is another example of where bullion banks and central banks keep the global gold market in the dark about how much gold is being physically transferred and shipped.