Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

Your ultimate guide to questionnaires and how to design a good one

The written questionnaire is the heart and soul of any survey research project. Whether you conduct your survey using an online questionnaire, in person, by email or over the phone, the way you design your questionnaire plays a critical role in shaping the quality of the data and insights that you’ll get from your target audience. Keep reading to get actionable tips.

What is a questionnaire?

A questionnaire is a research tool consisting of a set of questions or other ‘prompts’ to collect data from a set of respondents.

When used in most research, a questionnaire will consist of a number of types of questions (primarily open-ended and closed) in order to gain both quantitative data that can be analyzed to draw conclusions, and qualitative data to provide longer, more specific explanations.

A research questionnaire is often mistaken for a survey - and many people use the term questionnaire and survey, interchangeably.

But that’s incorrect.

Which is what we talk about next.

Get started with our free survey maker with 50+ templates

Survey vs. questionnaire – what’s the difference?

Before we go too much further, let’s consider the differences between surveys and questionnaires.

These two terms are often used interchangeably, but there is an important difference between them.

Survey definition

A survey is the process of collecting data from a set of respondents and using it to gather insights.

Survey research can be conducted using a questionnaire, but won’t always involve one.

Questionnaire definition

A questionnaire is the list of questions you circulate to your target audience.

In other words, the survey is the task you’re carrying out, and the questionnaire is the instrument you’re using to do it.

By itself, a questionnaire doesn’t achieve much.

It’s when you put it into action as part of a survey that you start to get results.

Advantages vs disadvantages of using a questionnaire

While a questionnaire is a popular method to gather data for market research or other studies, there are a few disadvantages to using this method (although there are plenty of advantages to using a questionnaire too).

Let’s have a look at some of the advantages and disadvantages of using a questionnaire for collecting data.

Advantages of using a questionnaire

1. questionnaires are relatively cheap.

Depending on the complexity of your study, using a questionnaire can be cost effective compared to other methods.

You simply need to write your survey questionnaire, and send it out and then process the responses.

You can set up an online questionnaire relatively easily, or simply carry out market research on the street if that’s the best method.

2. You can get and analyze results quickly

Again depending on the size of your survey you can get results back from a questionnaire quickly, often within 24 hours of putting the questionnaire live.

It also means you can start to analyze responses quickly too.

3. They’re easily scalable

You can easily send an online questionnaire to anyone in the world and with the right software you can quickly identify your target audience and your questionnaire to them.

4. Questionnaires are easy to analyze

If your questionnaire design has been done properly, it’s quick and easy to analyze results from questionnaires once responses start to come back.

This is particularly useful with large scale market research projects.

Because all respondents are answering the same questions, it’s simple to identify trends.

5. You can use the results to make accurate decisions

As a research instrument, a questionnaire is ideal for commercial research because the data you get back is from your target audience (or ideal customers) and the information you get back on their thoughts, preferences or behaviors allows you to make business decisions.

6. A questionnaire can cover any topic

One of the biggest advantages of using questionnaires when conducting research is (because you can adapt them using different types and styles of open ended questions and closed ended questions) they can be used to gather data on almost any topic.

There are many types of questionnaires you can design to gather both quantitative data and qualitative data - so they’re a useful tool for all kinds of data analysis.

Disadvantages of using a questionnaire

1. respondents could lie.

This is by far the biggest risk with a questionnaire, especially when dealing with sensitive topics.

Rather than give their actual opinion, a respondent might feel pressured to give the answer they deem more socially acceptable, which doesn’t give you accurate results.

2. Respondents might not answer every question

There are all kinds of reasons respondents might not answer every question, from questionnaire length, they might not understand what’s being asked, or they simply might not want to answer it.

If you get questionnaires back without complete responses it could negatively affect your research data and provide an inaccurate picture.

3. They might interpret what’s being asked incorrectly

This is a particular problem when running a survey across geographical boundaries and often comes down to the design of the survey questionnaire.

If your questions aren’t written in a very clear way, the respondent might misunderstand what’s being asked and provide an answer that doesn’t reflect what they actually think.

Again this can negatively affect your research data.

4. You could introduce bias

The whole point of producing a questionnaire is to gather accurate data from which decisions can be made or conclusions drawn.

But the data collected can be heavily impacted if the researchers accidentally introduce bias into the questions.

This can be easily done if the researcher is trying to prove a certain hypothesis with their questionnaire, and unwittingly write questions that push people towards giving a certain answer.

In these cases respondents’ answers won’t accurately reflect what is really happening and stop you gathering more accurate data.

5. Respondents could get survey fatigue

One issue you can run into when sending out a questionnaire, particularly if you send them out regularly to the same survey sample, is that your respondents could start to suffer from survey fatigue.

In these circumstances, rather than thinking about the response options in the questionnaire and providing accurate answers, respondents could start to just tick boxes to get through the questionnaire quickly.

Again, this won’t give you an accurate data set.

Questionnaire design: How to do it

It’s essential to carefully craft a questionnaire to reduce survey error and optimize your data . The best way to think about the questionnaire is with the end result in mind.

How do you do that?

Start with questions, like:

- What is my research purpose ?

- What data do I need?

- How am I going to analyze that data?

- What questions are needed to best suit these variables?

Once you have a clear idea of the purpose of your survey, you’ll be in a better position to create an effective questionnaire.

Here are a few steps to help you get into the right mindset.

1. Keep the respondent front and center

A survey is the process of collecting information from people, so it needs to be designed around human beings first and foremost.

In his post about survey design theory, David Vannette, PhD, from the Qualtrics Methodology Lab explains the correlation between the way a survey is designed and the quality of data that is extracted.

“To begin designing an effective survey, take a step back and try to understand what goes on in your respondents’ heads when they are taking your survey.

This step is critical to making sure that your questionnaire makes it as likely as possible that the response process follows that expected path.”

From writing the questions to designing the survey flow, the respondent’s point of view should always be front and center in your mind during a questionnaire design.

2. How to write survey questions

Your questionnaire should only be as long as it needs to be, and every question needs to deliver value.

That means your questions must each have an individual purpose and produce the best possible data for that purpose, all while supporting the overall goal of the survey.

A question must also must be phrased in a way that is easy for all your respondents to understand, and does not produce false results.

To do this, remember the following principles:

Get into the respondent's head

The process for a respondent answering a survey question looks like this:

- The respondent reads the question and determines what information they need to answer it.

- They search their memory for that information.

- They make judgments about that information.

- They translate that judgment into one of the answer options you’ve provided. This is the process of taking the data they have and matching that information with the question that’s asked.

When wording questions, make sure the question means the same thing to all respondents. Words should have one meaning, few syllables, and the sentences should have few words.

Only use the words needed to ask your question and not a word more .

Note that it’s important that the respondent understands the intent behind your question.

If they don’t, they may answer a different question and the data can be skewed.

Some contextual help text, either in the introduction to the questionnaire or before the question itself, can help make sure the respondent understands your goals and the scope of your research.

Use mutually exclusive responses

Be sure to make your response categories mutually exclusive.

Consider the question:

What is your age?

Respondents that are 31 years old have two options, as do respondents that are 40 and 55. As a result, it is impossible to predict which category they will choose.

This can distort results and frustrate respondents. It can be easily avoided by making responses mutually exclusive.

The following question is much better:

This question is clear and will give us better results.

Ask specific questions

Nonspecific questions can confuse respondents and influence results.

Do you like orange juice?

- Like very much

- Neither like nor dislike

- Dislike very much

This question is very unclear. Is it asking about taste, texture, price, or the nutritional content? Different respondents will read this question differently.

A specific question will get more specific answers that are actionable.

How much do you like the current price of orange juice?

This question is more specific and will get better results.

If you need to collect responses about more than one aspect of a subject, you can include multiple questions on it. (Do you like the taste of orange juice? Do you like the nutritional content of orange juice? etc.)

Use a variety of question types

If all of your questionnaire, survey or poll questions are structured the same way (e.g. yes/no or multiple choice) the respondents are likely to become bored and tune out. That could mean they pay less attention to how they’re answering or even give up altogether.

Instead, mix up the question types to keep the experience interesting and varied. It’s a good idea to include questions that yield both qualitative and quantitative data.

For example, an open-ended questionnaire item such as “describe your attitude to life” will provide qualitative data – a form of information that’s rich, unstructured and unpredictable. The respondent will tell you in their own words what they think and feel.

A quantitative / close-ended questionnaire item, such as “Which word describes your attitude to life? a) practical b) philosophical” gives you a much more structured answer, but the answers will be less rich and detailed.

Open-ended questions take more thought and effort to answer, so use them sparingly. They also require a different kind of treatment once your survey is in the analysis stage.

3. Pre-test your questionnaire

Always pre-test a questionnaire before sending it out to respondents. This will help catch any errors you might have missed. You could ask a colleague, friend, or an expert to take the survey and give feedback. If possible, ask a few cognitive questions like, “how did you get to that response?” and “what were you thinking about when you answered that question?” Figure out what was easy for the responder and where there is potential for confusion. You can then re-word where necessary to make the experience as frictionless as possible.

If your resources allow, you could also consider using a focus group to test out your survey. Having multiple respondents road-test the questionnaire will give you a better understanding of its strengths and weaknesses. Match the focus group to your target respondents as closely as possible, for example in terms of age, background, gender, and level of education.

Note: Don't forget to make your survey as accessible as possible for increased response rates.

Questionnaire examples and templates

There are free questionnaire templates and example questions available for all kinds of surveys and market research, many of them online. But they’re not all created equal and you should use critical judgement when selecting one. After all, the questionnaire examples may be free but the time and energy you’ll spend carrying out a survey are not.

If you’re using online questionnaire templates as the basis for your own, make sure it has been developed by professionals and is specific to the type of research you’re doing to ensure higher completion rates. As we’ve explored here, using the wrong kinds of questions can result in skewed or messy data, and could even prompt respondents to abandon the questionnaire without finishing or give thoughtless answers.

You’ll find a full library of downloadable survey templates in the Qualtrics Marketplace , covering many different types of research from employee engagement to post-event feedback . All are fully customizable and have been developed by Qualtrics experts.

Qualtrics // Experience Management

Qualtrics, the leader and creator of the experience management category, is a cloud-native software platform that empowers organizations to deliver exceptional experiences and build deep relationships with their customers and employees.

With insights from Qualtrics, organizations can identify and resolve the greatest friction points in their business, retain and engage top talent, and bring the right products and services to market. Nearly 20,000 organizations around the world use Qualtrics’ advanced AI to listen, understand, and take action. Qualtrics uses its vast universe of experience data to form the largest database of human sentiment in the world. Qualtrics is co-headquartered in Provo, Utah and Seattle.

Related Articles

December 20, 2023

Top market research analyst skills for 2024

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

September 14, 2023

How BMG and Loop use data to make critical decisions

August 21, 2023

Designing for safety: Making user consent and trust an organizational asset

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

June 16, 2023

How Qualtrics Helps Three Local Governments Drive Better Outcomes Through Data Insights

April 1, 2023

Academic Experience

How to write great survey questions (with examples)

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

How to Design Effective Research Questionnaires for Robust Findings

As a staple in data collection, questionnaires help uncover robust and reliable findings that can transform industries, shape policies, and revolutionize understanding. Whether you are exploring societal trends or delving into scientific phenomena, the effectiveness of your research questionnaire can make or break your findings.

In this article, we aim to understand the core purpose of questionnaires, exploring how they serve as essential tools for gathering systematic data, both qualitative and quantitative, from diverse respondents. Read on as we explore the key elements that make up a winning questionnaire, the art of framing questions which are both compelling and rigorous, and the careful balance between simplicity and depth.

Table of Contents

The Role of Questionnaires in Research

So, what is a questionnaire? A questionnaire is a structured set of questions designed to collect information, opinions, attitudes, or behaviors from respondents. It is one of the most commonly used data collection methods in research. Moreover, questionnaires can be used in various research fields, including social sciences, market research, healthcare, education, and psychology. Their adaptability makes them suitable for investigating diverse research questions.

Questionnaire and survey are two terms often used interchangeably, but they have distinct meanings in the context of research. A survey refers to the broader process of data collection that may involve various methods. A survey can encompass different data collection techniques, such as interviews , focus groups, observations, and yes, questionnaires.

Pros and Cons of Using Questionnaires in Research:

While questionnaires offer numerous advantages in research, they also come with some disadvantages that researchers must be aware of and address appropriately. Careful questionnaire design, validation, and consideration of potential biases can help mitigate these disadvantages and enhance the effectiveness of using questionnaires as a data collection method.

Structured vs Unstructured Questionnaires

Structured questionnaire:.

A structured questionnaire consists of questions with predefined response options. Respondents are presented with a fixed set of choices and are required to select from those options. The questions in a structured questionnaire are designed to elicit specific and quantifiable responses. Structured questionnaires are particularly useful for collecting quantitative data and are often employed in surveys and studies where standardized and comparable data are necessary.

Advantages of Structured Questionnaires:

- Easy to analyze and interpret: The fixed response options facilitate straightforward data analysis and comparison across respondents.

- Efficient for large-scale data collection: Structured questionnaires are time-efficient, allowing researchers to collect data from a large number of respondents.

- Reduces response bias: The predefined response options minimize potential response bias and maintain consistency in data collection.

Limitations of Structured Questionnaires:

- Lack of depth: Structured questionnaires may not capture in-depth insights or nuances as respondents are limited to pre-defined response choices. Hence, they may not reveal the reasons behind respondents’ choices, limiting the understanding of their perspectives.

- Limited flexibility: The fixed response options may not cover all potential responses, therefore, potentially restricting respondents’ answers.

Unstructured Questionnaire:

An unstructured questionnaire consists of questions that allow respondents to provide detailed and unrestricted responses. Unlike structured questionnaires, there are no predefined response options, giving respondents the freedom to express their thoughts in their own words. Furthermore, unstructured questionnaires are valuable for collecting qualitative data and obtaining in-depth insights into respondents’ experiences, opinions, or feelings.

Advantages of Unstructured Questionnaires:

- Rich qualitative data: Unstructured questionnaires yield detailed and comprehensive qualitative data, providing valuable and novel insights into respondents’ perspectives.

- Flexibility in responses: Respondents have the freedom to express themselves in their own words. Hence, allowing for a wide range of responses.

Limitations of Unstructured Questionnaires:

- Time-consuming analysis: Analyzing open-ended responses can be time-consuming, since, each response requires careful reading and interpretation.

- Subjectivity in interpretation: The analysis of open-ended responses may be subjective, as researchers interpret and categorize responses based on their judgment.

- May require smaller sample size: Due to the depth of responses, researchers may need a smaller sample size for comprehensive analysis, making generalizations more challenging.

Types of Questions in a Questionnaire

In a questionnaire, researchers typically use the following most common types of questions to gather a variety of information from respondents:

1. Open-Ended Questions:

These questions allow respondents to provide detailed and unrestricted responses in their own words. Open-ended questions are valuable for gathering qualitative data and in-depth insights.

Example: What suggestions do you have for improving our product?

2. Multiple-Choice Questions

Respondents choose one answer from a list of provided options. This type of question is suitable for gathering categorical data or preferences.

Example: Which of the following social media/academic networking platforms do you use to promote your research?

- ResearchGate

- Academia.edu

3. Dichotomous Questions

Respondents choose between two options, typically “yes” or “no”, “true” or “false”, or “agree” or “disagree”.

Example: Have you ever published in open access journals before?

4. Scaling Questions

These questions, also known as rating scale questions, use a predefined scale that allows respondents to rate or rank their level of agreement, satisfaction, importance, or other subjective assessments. These scales help researchers quantify subjective data and make comparisons across respondents.

There are several types of scaling techniques used in scaling questions:

i. Likert Scale:

The Likert scale is one of the most common scaling techniques. It presents respondents with a series of statements and asks them to rate their level of agreement or disagreement using a range of options, typically from “strongly agree” to “strongly disagree”.For example: Please indicate your level of agreement with the statement: “The content presented in the webinar was relevant and aligned with the advertised topic.”

- Strongly Agree

- Strongly Disagree

ii. Semantic Differential Scale:

The semantic differential scale measures respondents’ perceptions or attitudes towards an item using opposite adjectives or bipolar words. Respondents rate the item on a scale between the two opposites. For example:

- Easy —— Difficult

- Satisfied —— Unsatisfied

- Very likely —— Very unlikely

iii. Numerical Rating Scale:

This scale requires respondents to provide a numerical rating on a predefined scale. It can be a simple 1 to 5 or 1 to 10 scale, where higher numbers indicate higher agreement, satisfaction, or importance.

iv. Ranking Questions:

Respondents rank items in order of preference or importance. Ranking questions help identify preferences or priorities.

Example: Please rank the following features of our app in order of importance (1 = Most Important, 5 = Least Important):

- User Interface

- Functionality

- Customer Support

By using a mix of question types, researchers can gather both quantitative and qualitative data, providing a comprehensive understanding of the research topic and enabling meaningful analysis and interpretation of the results. The choice of question types depends on the research objectives , the desired depth of information, and the data analysis requirements.

Methods of Administering Questionnaires

There are several methods for administering questionnaires, and the choice of method depends on factors such as the target population, research objectives , convenience, and resources available. Here are some common methods of administering questionnaires:

Each method has its advantages and limitations. Online surveys offer convenience and a large reach, but they may be limited to individuals with internet access. Face-to-face interviews allow for in-depth responses but can be time-consuming and costly. Telephone surveys have broad reach but may be limited by declining response rates. Researchers should choose the method that best suits their research objectives, target population, and available resources to ensure successful data collection.

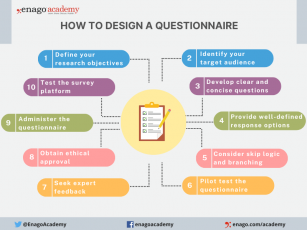

How to Design a Questionnaire

Designing a good questionnaire is crucial for gathering accurate and meaningful data that aligns with your research objectives. Here are essential steps and tips to create a well-designed questionnaire:

1. Define Your Research Objectives : Clearly outline the purpose and specific information you aim to gather through the questionnaire.

2. Identify Your Target Audience : Understand respondents’ characteristics and tailor the questionnaire accordingly.

3. Develop the Questions :

- Write Clear and Concise Questions

- Avoid Leading or Biasing Questions

- Sequence Questions Logically

- Group Related Questions

- Include Demographic Questions

4. Provide Well-defined Response Options : Offer exhaustive response choices for closed-ended questions.

5. Consider Skip Logic and Branching : Customize the questionnaire based on previous answers.

6. Pilot Test the Questionnaire : Identify and address issues through a pilot study .

7. Seek Expert Feedback : Validate the questionnaire with subject matter experts.

8. Obtain Ethical Approval : Comply with ethical guidelines , obtain consent, and ensure confidentiality before administering the questionnaire.

9. Administer the Questionnaire : Choose the right mode and provide clear instructions.

10. Test the Survey Platform : Ensure compatibility and usability for online surveys.

By following these steps and paying attention to questionnaire design principles, you can create a well-structured and effective questionnaire that gathers reliable data and helps you achieve your research objectives.

Characteristics of a Good Questionnaire

A good questionnaire possesses several essential elements that contribute to its effectiveness. Furthermore, these characteristics ensure that the questionnaire is well-designed, easy to understand, and capable of providing valuable insights. Here are some key characteristics of a good questionnaire:

1. Clarity and Simplicity : Questions should be clear, concise, and unambiguous. Avoid using complex language or technical terms that may confuse respondents. Simple and straightforward questions ensure that respondents interpret them consistently.

2. Relevance and Focus : Each question should directly relate to the research objectives and contribute to answering the research questions. Consequently, avoid including extraneous or irrelevant questions that could lead to data clutter.

3. Mix of Question Types : Utilize a mix of question types, including open-ended, Likert scale, and multiple-choice questions. This variety allows for both qualitative and quantitative data collections .

4. Validity and Reliability : Ensure the questionnaire measures what it intends to measure (validity) and produces consistent results upon repeated administration (reliability). Validation should be conducted through expert review and previous research.

5. Appropriate Length : Keep the questionnaire’s length appropriate and manageable to avoid respondent fatigue or dropouts. Long questionnaires may result in incomplete or rushed responses.

6. Clear Instructions : Include clear instructions at the beginning of the questionnaire to guide respondents on how to complete it. Explain any technical terms, formats, or concepts if necessary.

7. User-Friendly Format : Design the questionnaire to be visually appealing and user-friendly. Use consistent formatting, adequate spacing, and a logical page layout.

8. Data Validation and Cleaning : Incorporate validation checks to ensure data accuracy and reliability. Consider mechanisms to detect and correct inconsistent or missing responses during data cleaning.

By incorporating these characteristics, researchers can create a questionnaire that maximizes data quality, minimizes response bias, and provides valuable insights for their research.

In the pursuit of advancing research and gaining meaningful insights, investing time and effort into designing effective questionnaires is a crucial step. A well-designed questionnaire is more than a mere set of questions; it is a masterpiece of precision and ingenuity. Each question plays a vital role in shaping the narrative of our research, guiding us through the labyrinth of data to meaningful conclusions. Indeed, a well-designed questionnaire serves as a powerful tool for unlocking valuable insights and generating robust findings that impact society positively.

Have you ever designed a research questionnaire? Reflect on your experience and share your insights with researchers globally through Enago Academy’s Open Blogging Platform . Join our diverse community of 1000K+ researchers and authors to exchange ideas, strategies, and best practices, and together, let’s shape the future of data collection and maximize the impact of questionnaires in the ever-evolving landscape of research.

Frequently Asked Questions

A research questionnaire is a structured tool used to gather data from participants in a systematic manner. It consists of a series of carefully crafted questions designed to collect specific information related to a research study.

Questionnaires play a pivotal role in both quantitative and qualitative research, enabling researchers to collect insights, opinions, attitudes, or behaviors from respondents. This aids in hypothesis testing, understanding, and informed decision-making, ensuring consistency, efficiency, and facilitating comparisons.

Questionnaires are a versatile tool employed in various research designs to gather data efficiently and comprehensively. They find extensive use in both quantitative and qualitative research methodologies, making them a fundamental component of research across disciplines. Some research designs that commonly utilize questionnaires include: a) Cross-Sectional Studies b) Longitudinal Studies c) Descriptive Research d) Correlational Studies e) Causal-Comparative Studies f) Experimental Research g) Survey Research h) Case Studies i) Exploratory Research

A survey is a comprehensive data collection method that can include various techniques like interviews and observations. A questionnaire is a specific set of structured questions within a survey designed to gather standardized responses. While a survey is a broader approach, a questionnaire is a focused tool for collecting specific data.

The choice of questionnaire type depends on the research objectives, the type of data required, and the preferences of respondents. Some common types include: • Structured Questionnaires: These questionnaires consist of predefined, closed-ended questions with fixed response options. They are easy to analyze and suitable for quantitative research. • Semi-Structured Questionnaires: These questionnaires combine closed-ended questions with open-ended ones. They offer more flexibility for respondents to provide detailed explanations. • Unstructured Questionnaires: These questionnaires contain open-ended questions only, allowing respondents to express their thoughts and opinions freely. They are commonly used in qualitative research.

Following these steps ensures effective questionnaire administration for reliable data collection: • Choose a Method: Decide on online, face-to-face, mail, or phone administration. • Online Surveys: Use platforms like SurveyMonkey • Pilot Test: Test on a small group before full deployment • Clear Instructions: Provide concise guidelines • Follow-Up: Send reminders if needed

Thank you, Riya. This is quite helpful. As discussed, response bias is one of the disadvantages in the use of questionnaires. One way to help limit this can be to use scenario based questions. These type of questions may help the respondents to be more reflective and active in the process.

Thank you, Dear Riya. This is quite helpful.

Rate this article Cancel Reply

Your email address will not be published.

Enago Academy's Most Popular Articles

- Publishing Research

- Reporting Research

How to Optimize Your Research Process: A step-by-step guide

For researchers across disciplines, the path to uncovering novel findings and insights is often filled…

- Industry News

- Trending Now

Breaking Barriers: Sony and Nature unveil “Women in Technology Award”

Sony Group Corporation and the prestigious scientific journal Nature have collaborated to launch the inaugural…

Achieving Research Excellence: Checklist for good research practices

Academia is built on the foundation of trustworthy and high-quality research, supported by the pillars…

- Promoting Research

Plain Language Summary — Communicating your research to bridge the academic-lay gap

Science can be complex, but does that mean it should not be accessible to the…

Science under Surveillance: Journals adopt advanced AI to uncover image manipulation

Journals are increasingly turning to cutting-edge AI tools to uncover deceitful images published in manuscripts.…

Choosing the Right Analytical Approach: Thematic analysis vs. content analysis for…

Comparing Cross Sectional and Longitudinal Studies: 5 steps for choosing the right…

Research Recommendations – Guiding policy-makers for evidence-based decision making

Sign-up to read more

Subscribe for free to get unrestricted access to all our resources on research writing and academic publishing including:

- 2000+ blog articles

- 50+ Webinars

- 10+ Expert podcasts

- 50+ Infographics

- 10+ Checklists

- Research Guides

We hate spam too. We promise to protect your privacy and never spam you.

I am looking for Editing/ Proofreading services for my manuscript Tentative date of next journal submission:

What should universities' stance be on AI tools in research and academic writing?

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Questionnaire: The ultimate guide, advantages & examples

What is a Questionnaire?

A questionnaire is a research instrument that consists of a set of questions or other types of prompts that aims to collect information from a respondent. A research questionnaire is typically a mix of close-ended questions and open-ended questions .

Open-ended, long-form questions offer the respondent the ability to elaborate on their thoughts. Research questionnaires were developed in 1838 by the Statistical Society of London.

LEARN ABOUT: Candidate Experience Survey

The data collected from a data collection questionnaire can be both qualitative as well as quantitative in nature. A questionnaire may or may not be delivered in the form of a survey , but a survey always consists of a questionnaire.

LEARN ABOUT: Testimonial Questions

Advantages of a good questionnaire design

- With a survey questionnaire, you can gather a lot of data in less time.

- There is less chance of any bias(like selection bias ) creeping if you have a standard set of questions to be used for your target audience. You can apply logic to questions based on the respondents’ answers, but the questionnaire will remain standard for a group of respondents that fall in the same segment.

- Surveying online survey software is quick and cost-effective. It offers you a rich set of features to design, distribute, and analyze the response data.

- It can be customized to reflect your brand voice. Thus, it can be used to reinforce your brand image.

- The responses can be compared with the historical data and understand the shift in respondents’ choices and experiences.

- Respondents can answer the questionnaire without revealing their identity. Also, many survey software complies with significant data security and privacy regulations.

LEARN ABOUT: Structured Questionnaire

Characteristics of a good questionnaire

Your survey design depends on the type of information you need to collect from respondents. Qualitative questionnaires are used when there is a need to collect exploratory information to help prove or disprove a hypothesis. Quantitative questionnaires are used to validate or test a previously generated hypothesis. However, most questionnaires follow some essential characteristics:

- Uniformity: Questionnaires are very useful to collect demographic information, personal opinions, facts, or attitudes from respondents. One of the most significant attributes of a research form is uniform design and standardization. Every respondent sees the same questions. This helps in data collection and statistical analysis of this data. For example, the retail store evaluation questionnaire template contains questions for evaluating retail store experiences. Questions relate to purchase value, range of options for product selections, and quality of merchandise. These questions are uniform for all customers.

LEARN ABOUT: Research Process Steps

- Exploratory: It should be exploratory to collect qualitative data. There is no restriction on questions that can be in your questionnaire. For example, you use a data collection questionnaire and send it to the female of the household to understand her spending and saving habits relative to the household income. Open-ended questions give you more insight and allow the respondents to explain their practices. A very structured question list could limit the data collection.

LEARN ABOUT: Best Data Collection Tools

- Question Sequence: It typically follows a structured flow of questions to increase the number of responses. This sequence of questions is screening questions , warm-up questions, transition questions, skip questions, challenging questions, and classification questions. For example, our motivation and buying experience questionnaire template covers initial demographic questions and then asks for time spent in sections of the store and the rationale behind purchases.

Types & Definitions

As we explored before, questionnaires can be either structured or free-flowing. Let’s take a closer look at what that entails for your surveys.

- Structured Questionnaires: Structured questionnaires collect quantitative data . The questionnaire is planned and designed to gather precise information. It also initiates a formal inquiry, supplements data, checks previously accumulated data, and helps validate any prior hypothesis.

- Unstructured Questionnaires: Unstructured questionnaires collect qualitative data . They use a basic structure and some branching questions but nothing that limits the responses of a respondent. The questions are more open-ended to collect specific data from participants.

Types of questions in a questionnaire

You can use multiple question types in a questionnaire. Using various question types can help increase responses to your research questionnaire as they tend to keep participants more engaged. The best customer satisfaction survey templates are the most commonly used for better insights and decision-making.

Some of the widely used types of questions are:

- Open-Ended Questions: Open-ended questions help collect qualitative data in a questionnaire where the respondent can answer in a free form with little to no restrictions.

- Dichotomous Questions: The dichotomous question is generally a “yes/no” close-ended question . This question is usually used in case of the need for necessary validation. It is the most natural form of a questionnaire.

- Multiple-Choice Questions: Multiple-choice questions are a close-ended question type in which a respondent has to select one (single-select multiple-choice question) or many (multi-select multiple choice question) responses from a given list of options. The multiple-choice question consists of an incomplete stem (question), right answer or answers, incorrect answers, close alternatives, and distractors. Of course, not all multiple-choice questions have all of the answer types. For example, you probably won’t have the wrong or right answers if you’re looking for customer opinion.

- Scaling Questions: These questions are based on the principles of the four measurement scales – nominal, ordinal, interval, and ratio . A few of the question types that utilize these scales’ fundamental properties are rank order questions , Likert scale questions , semantic differential scale questions , and Stapel scale questions .

LEARN ABOUT: System Usability Scale

- Pictorial Questions: This question type is easy to use and encourages respondents to answer. It works similarly to a multiple-choice question. Respondents are asked a question, and the answer choices are images. This helps respondents choose an answer quickly without over-thinking their answers, giving you more accurate data.

Types of Questionnaires

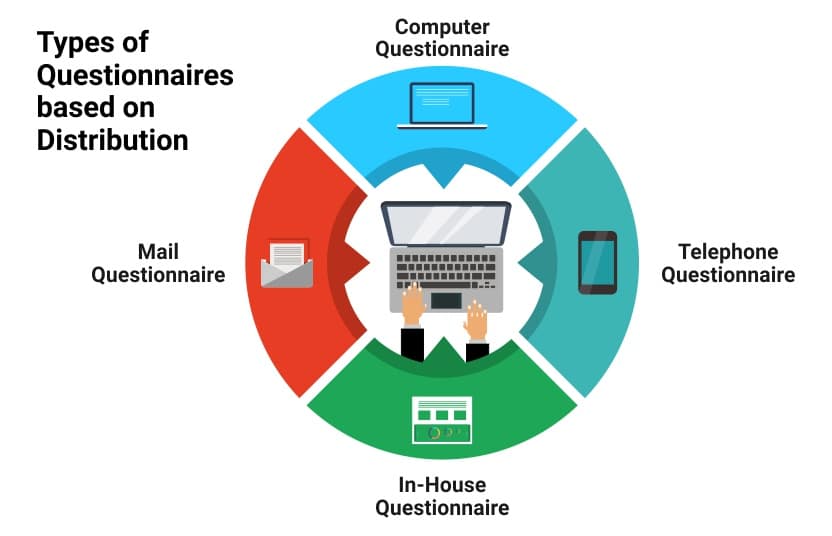

Questionnaires can be administered or distributed in the following forms:

- Online Questionnaire : In this type, respondents are sent the questionnaire via email or other online mediums. This method is generally cost-effective and time-efficient. Respondents can also answer at leisure. Without the pressure to respond immediately, responses may be more accurate. The disadvantage, however, is that respondents can easily ignore these questionnaires. Read more about online surveys .

- Telephone Questionnaire: A researcher makes a phone call to a respondent to collect responses directly. Responses are quick once you have a respondent on the phone. However, a lot of times, the respondents hesitate to give out much information over the phone. It is also an expensive way of conducting research. You’re usually not able to collect as many responses as other types of questionnaires, so your sample may not represent the broader population.

- In-House Questionnaire: This type is used by a researcher who visits the respondent’s home or workplace. The advantage of this method is that the respondent is in a comfortable and natural environment, and in-depth data can be collected. The disadvantage, though, is that it is expensive and slow to conduct.

LEARN ABOUT: Survey Sample Sizes

- Mail Questionnaire: These are starting to be obsolete but are still being used in some market research studies. This method involves a researcher sending a physical data collection questionnaire request to a respondent that can be filled in and sent back. The advantage of this method is that respondents can complete this on their own time to answer truthfully and entirely. The disadvantage is that this method is expensive and time-consuming. There is also a high risk of not collecting enough responses to make actionable insights from the data.

How to design a Questionnaire

Questionnaire design is a multistep process that requires attention to detail at every step.

Researchers are always hoping that the responses received for a survey questionnaire yield useable data. If the questionnaire is too complicated, there is a fair chance that the respondent might get confused and will drop out or answer inaccurately.

LEARN ABOUT: Easy Test Maker

As a survey creator , you may want to pre-test the survey by administering it to a focus group during development. You can try out a few different questionnaire designs to determine which resonates best with your target audience. Pre-testing is a good practice as the survey creator can comprehend the initial stages if there are any changes required in the survey .

Steps Involved in Questionnaire Design

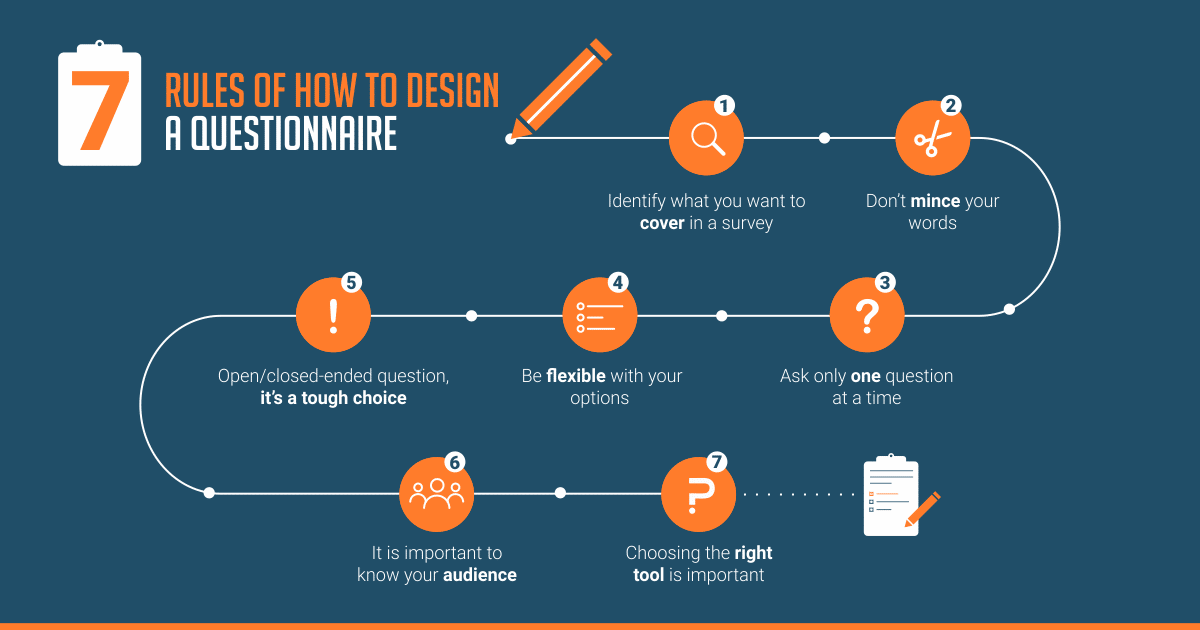

1. identify the scope of your research:.

Think about what your questionnaire is going to include before you start designing the look of it. The clarity of the topic is of utmost importance as this is the primary step in creating the questionnaire. Once you are clear on the purpose of the questionnaire, you can begin the design process.

LEARN ABOUT: Social Communication Questionnaire

2. Keep it simple:

The words or phrases you use while writing the questionnaire must be easy to understand. If the questions are unclear, the respondents may simply choose any answer and skew the data you collect.

3. Ask only one question at a time:

At times, a researcher may be tempted to add two similar questions. This might seem like an excellent way to consolidate answers to related issues, but it can confuse your respondents or lead to inaccurate data. If any of your questions contain the word “and,” take another look. This question likely has two parts, which can affect the quality of your data.

4. Be flexible with your options:

While designing, the survey creator needs to be flexible in terms of “option choice” for the respondents. Sometimes the respondents may not necessarily want to choose from the answer options provided by the survey creator. An “other” option often helps keep respondents engaged in the survey.

5. The open-ended or closed-ended question is a tough choice:

The survey creator might end up in a situation where they need to make distinct choices between open or close-ended questions. The question type should be carefully chosen as it defines the tone and importance of asking the question in the first place.

If the questionnaire requires the respondents to elaborate on their thoughts, an open-ended q u estion is the best choice. If the surveyor wants a specific response, then close-ended questions should be their primary choice. The key to asking closed-ended questions is to generate data that is easy to analyze and spot trends.

6. It is essential to know your audience:

A researcher should know their target audience. For example, if the target audience speaks mostly Spanish, sending the questionnaire in any other language would lower the response rate and accuracy of data. Something that may seem clear to you may be confusing to your respondents. Use simple language and terminology that your respondents will understand, and avoid technical jargon and industry-specific language that might confuse your respondents.

For efficient market research, researchers need a representative sample collected using one of the many sampling techniques , such as a sample questionnaire. It is imperative to plan and define these target respondents based on the demographics required.

7. Choosing the right tool is essential:

QuestionPro is a simple yet advanced survey software platform that the surveyors can use to create a questionnaire or choose from the already existing 300+ questionnaire templates.

Always save personal questions for last. Sensitive questions may cause respondents to drop off before completing. If these questions are at the end, the respondent has had time to become more comfortable with the interview and are more likely to answer personal or demographic questions.

Differences between a Questionnaire and a Survey

Read more: Difference between a survey and a questionnaire

Questionnaire Examples

The best way to understand how questionnaires work is to see the types of questionnaires available. Some examples of a questionnaire are:

USE THIS FREE TEMPLATE

The above survey questions are typically easy to use, understand, and execute. Additionally, the standardized answers of a survey questionnaire instead of a person-to-person conversation make it easier to compile useable data.

The most significant limitation of a data collection questionnaire is that respondents need to read all of the questions and respond to them. For example, you send an invitation through email asking respondents to complete the questions on social media. If a target respondent doesn’t have the right social media profiles, they can’t answer your questions.

Learn More: 350+ Free Survey Examples and Templates

MORE LIKE THIS

Healthcare Staff Burnout: What it Is + How To Manage It

Apr 4, 2024

Top 15 Employee Retention Software in 2024

Top 10 Employee Development Software for Talent Growth

Apr 3, 2024

Top 5 Insight Community Platforms to Elevate Your Research

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Privacy Policy

Buy Me a Coffee

Home » Questionnaire – Definition, Types, and Examples

Questionnaire – Definition, Types, and Examples

Table of Contents

Questionnaire

Definition:

A Questionnaire is a research tool or survey instrument that consists of a set of questions or prompts designed to gather information from individuals or groups of people.

It is a standardized way of collecting data from a large number of people by asking them a series of questions related to a specific topic or research objective. The questions may be open-ended or closed-ended, and the responses can be quantitative or qualitative. Questionnaires are widely used in research, marketing, social sciences, healthcare, and many other fields to collect data and insights from a target population.

History of Questionnaire

The history of questionnaires can be traced back to the ancient Greeks, who used questionnaires as a means of assessing public opinion. However, the modern history of questionnaires began in the late 19th century with the rise of social surveys.

The first social survey was conducted in the United States in 1874 by Francis A. Walker, who used a questionnaire to collect data on labor conditions. In the early 20th century, questionnaires became a popular tool for conducting social research, particularly in the fields of sociology and psychology.

One of the most influential figures in the development of the questionnaire was the psychologist Raymond Cattell, who in the 1940s and 1950s developed the personality questionnaire, a standardized instrument for measuring personality traits. Cattell’s work helped establish the questionnaire as a key tool in personality research.

In the 1960s and 1970s, the use of questionnaires expanded into other fields, including market research, public opinion polling, and health surveys. With the rise of computer technology, questionnaires became easier and more cost-effective to administer, leading to their widespread use in research and business settings.

Today, questionnaires are used in a wide range of settings, including academic research, business, healthcare, and government. They continue to evolve as a research tool, with advances in computer technology and data analysis techniques making it easier to collect and analyze data from large numbers of participants.

Types of Questionnaire

Types of Questionnaires are as follows:

Structured Questionnaire

This type of questionnaire has a fixed format with predetermined questions that the respondent must answer. The questions are usually closed-ended, which means that the respondent must select a response from a list of options.

Unstructured Questionnaire

An unstructured questionnaire does not have a fixed format or predetermined questions. Instead, the interviewer or researcher can ask open-ended questions to the respondent and let them provide their own answers.

Open-ended Questionnaire

An open-ended questionnaire allows the respondent to answer the question in their own words, without any pre-determined response options. The questions usually start with phrases like “how,” “why,” or “what,” and encourage the respondent to provide more detailed and personalized answers.

Close-ended Questionnaire

In a closed-ended questionnaire, the respondent is given a set of predetermined response options to choose from. This type of questionnaire is easier to analyze and summarize, but may not provide as much insight into the respondent’s opinions or attitudes.

Mixed Questionnaire

A mixed questionnaire is a combination of open-ended and closed-ended questions. This type of questionnaire allows for more flexibility in terms of the questions that can be asked, and can provide both quantitative and qualitative data.

Pictorial Questionnaire:

In a pictorial questionnaire, instead of using words to ask questions, the questions are presented in the form of pictures, diagrams or images. This can be particularly useful for respondents who have low literacy skills, or for situations where language barriers exist. Pictorial questionnaires can also be useful in cross-cultural research where respondents may come from different language backgrounds.

Types of Questions in Questionnaire

The types of Questions in Questionnaire are as follows:

Multiple Choice Questions

These questions have several options for participants to choose from. They are useful for getting quantitative data and can be used to collect demographic information.

- a. Red b . Blue c. Green d . Yellow

Rating Scale Questions

These questions ask participants to rate something on a scale (e.g. from 1 to 10). They are useful for measuring attitudes and opinions.

- On a scale of 1 to 10, how likely are you to recommend this product to a friend?

Open-Ended Questions

These questions allow participants to answer in their own words and provide more in-depth and detailed responses. They are useful for getting qualitative data.

- What do you think are the biggest challenges facing your community?

Likert Scale Questions

These questions ask participants to rate how much they agree or disagree with a statement. They are useful for measuring attitudes and opinions.

How strongly do you agree or disagree with the following statement:

“I enjoy exercising regularly.”

- a . Strongly Agree

- c . Neither Agree nor Disagree

- d . Disagree

- e . Strongly Disagree

Demographic Questions

These questions ask about the participant’s personal information such as age, gender, ethnicity, education level, etc. They are useful for segmenting the data and analyzing results by demographic groups.

- What is your age?

Yes/No Questions

These questions only have two options: Yes or No. They are useful for getting simple, straightforward answers to a specific question.

Have you ever traveled outside of your home country?

Ranking Questions

These questions ask participants to rank several items in order of preference or importance. They are useful for measuring priorities or preferences.

Please rank the following factors in order of importance when choosing a restaurant:

- a. Quality of Food

- c. Ambiance

- d. Location

Matrix Questions

These questions present a matrix or grid of options that participants can choose from. They are useful for getting data on multiple variables at once.

Dichotomous Questions

These questions present two options that are opposite or contradictory. They are useful for measuring binary or polarized attitudes.

Do you support the death penalty?

How to Make a Questionnaire

Step-by-Step Guide for Making a Questionnaire:

- Define your research objectives: Before you start creating questions, you need to define the purpose of your questionnaire and what you hope to achieve from the data you collect.

- Choose the appropriate question types: Based on your research objectives, choose the appropriate question types to collect the data you need. Refer to the types of questions mentioned earlier for guidance.

- Develop questions: Develop clear and concise questions that are easy for participants to understand. Avoid leading or biased questions that might influence the responses.

- Organize questions: Organize questions in a logical and coherent order, starting with demographic questions followed by general questions, and ending with specific or sensitive questions.

- Pilot the questionnaire : Test your questionnaire on a small group of participants to identify any flaws or issues with the questions or the format.

- Refine the questionnaire : Based on feedback from the pilot, refine and revise the questionnaire as necessary to ensure that it is valid and reliable.

- Distribute the questionnaire: Distribute the questionnaire to your target audience using a method that is appropriate for your research objectives, such as online surveys, email, or paper surveys.

- Collect and analyze data: Collect the completed questionnaires and analyze the data using appropriate statistical methods. Draw conclusions from the data and use them to inform decision-making or further research.

- Report findings: Present your findings in a clear and concise report, including a summary of the research objectives, methodology, key findings, and recommendations.

Questionnaire Administration Modes

There are several modes of questionnaire administration. The choice of mode depends on the research objectives, sample size, and available resources. Some common modes of administration include:

- Self-administered paper questionnaires: Participants complete the questionnaire on paper, either in person or by mail. This mode is relatively low cost and easy to administer, but it may result in lower response rates and greater potential for errors in data entry.

- Online questionnaires: Participants complete the questionnaire on a website or through email. This mode is convenient for both researchers and participants, as it allows for fast and easy data collection. However, it may be subject to issues such as low response rates, lack of internet access, and potential for fraudulent responses.

- Telephone surveys: Trained interviewers administer the questionnaire over the phone. This mode allows for a large sample size and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Face-to-face interviews : Trained interviewers administer the questionnaire in person. This mode allows for a high degree of control over the survey environment and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Mixed-mode surveys: Researchers use a combination of two or more modes to administer the questionnaire, such as using online questionnaires for initial screening and following up with telephone interviews for more detailed information. This mode can help overcome some of the limitations of individual modes, but it requires careful planning and coordination.

Example of Questionnaire

Title of the Survey: Customer Satisfaction Survey

Introduction:

We appreciate your business and would like to ensure that we are meeting your needs. Please take a few minutes to complete this survey so that we can better understand your experience with our products and services. Your feedback is important to us and will help us improve our offerings.

Instructions:

Please read each question carefully and select the response that best reflects your experience. If you have any additional comments or suggestions, please feel free to include them in the space provided at the end of the survey.

1. How satisfied are you with our product quality?

- Very satisfied

- Somewhat satisfied

- Somewhat dissatisfied

- Very dissatisfied

2. How satisfied are you with our customer service?

3. How satisfied are you with the price of our products?

4. How likely are you to recommend our products to others?

- Very likely

- Somewhat likely

- Somewhat unlikely

- Very unlikely

5. How easy was it to find the information you were looking for on our website?

- Somewhat easy

- Somewhat difficult

- Very difficult

6. How satisfied are you with the overall experience of using our products and services?

7. Is there anything that you would like to see us improve upon or change in the future?

…………………………………………………………………………………………………………………………..

Conclusion:

Thank you for taking the time to complete this survey. Your feedback is valuable to us and will help us improve our products and services. If you have any further comments or concerns, please do not hesitate to contact us.

Applications of Questionnaire

Some common applications of questionnaires include:

- Research : Questionnaires are commonly used in research to gather information from participants about their attitudes, opinions, behaviors, and experiences. This information can then be analyzed and used to draw conclusions and make inferences.

- Healthcare : In healthcare, questionnaires can be used to gather information about patients’ medical history, symptoms, and lifestyle habits. This information can help healthcare professionals diagnose and treat medical conditions more effectively.

- Marketing : Questionnaires are commonly used in marketing to gather information about consumers’ preferences, buying habits, and opinions on products and services. This information can help businesses develop and market products more effectively.

- Human Resources: Questionnaires are used in human resources to gather information from job applicants, employees, and managers about job satisfaction, performance, and workplace culture. This information can help organizations improve their hiring practices, employee retention, and organizational culture.

- Education : Questionnaires are used in education to gather information from students, teachers, and parents about their perceptions of the educational experience. This information can help educators identify areas for improvement and develop more effective teaching strategies.

Purpose of Questionnaire

Some common purposes of questionnaires include:

- To collect information on attitudes, opinions, and beliefs: Questionnaires can be used to gather information on people’s attitudes, opinions, and beliefs on a particular topic. For example, a questionnaire can be used to gather information on people’s opinions about a particular political issue.

- To collect demographic information: Questionnaires can be used to collect demographic information such as age, gender, income, education level, and occupation. This information can be used to analyze trends and patterns in the data.

- To measure behaviors or experiences: Questionnaires can be used to gather information on behaviors or experiences such as health-related behaviors or experiences, job satisfaction, or customer satisfaction.

- To evaluate programs or interventions: Questionnaires can be used to evaluate the effectiveness of programs or interventions by gathering information on participants’ experiences, opinions, and behaviors.

- To gather information for research: Questionnaires can be used to gather data for research purposes on a variety of topics.

When to use Questionnaire

Here are some situations when questionnaires might be used:

- When you want to collect data from a large number of people: Questionnaires are useful when you want to collect data from a large number of people. They can be distributed to a wide audience and can be completed at the respondent’s convenience.

- When you want to collect data on specific topics: Questionnaires are useful when you want to collect data on specific topics or research questions. They can be designed to ask specific questions and can be used to gather quantitative data that can be analyzed statistically.

- When you want to compare responses across groups: Questionnaires are useful when you want to compare responses across different groups of people. For example, you might want to compare responses from men and women, or from people of different ages or educational backgrounds.

- When you want to collect data anonymously: Questionnaires can be useful when you want to collect data anonymously. Respondents can complete the questionnaire without fear of judgment or repercussions, which can lead to more honest and accurate responses.

- When you want to save time and resources: Questionnaires can be more efficient and cost-effective than other methods of data collection such as interviews or focus groups. They can be completed quickly and easily, and can be analyzed using software to save time and resources.

Characteristics of Questionnaire

Here are some of the characteristics of questionnaires:

- Standardization : Questionnaires are standardized tools that ask the same questions in the same order to all respondents. This ensures that all respondents are answering the same questions and that the responses can be compared and analyzed.

- Objectivity : Questionnaires are designed to be objective, meaning that they do not contain leading questions or bias that could influence the respondent’s answers.

- Predefined responses: Questionnaires typically provide predefined response options for the respondents to choose from, which helps to standardize the responses and make them easier to analyze.

- Quantitative data: Questionnaires are designed to collect quantitative data, meaning that they provide numerical or categorical data that can be analyzed using statistical methods.

- Convenience : Questionnaires are convenient for both the researcher and the respondents. They can be distributed and completed at the respondent’s convenience and can be easily administered to a large number of people.

- Anonymity : Questionnaires can be anonymous, which can encourage respondents to answer more honestly and provide more accurate data.

- Reliability : Questionnaires are designed to be reliable, meaning that they produce consistent results when administered multiple times to the same group of people.

- Validity : Questionnaires are designed to be valid, meaning that they measure what they are intended to measure and are not influenced by other factors.

Advantage of Questionnaire

Some Advantage of Questionnaire are as follows:

- Standardization: Questionnaires allow researchers to ask the same questions to all participants in a standardized manner. This helps ensure consistency in the data collected and eliminates potential bias that might arise if questions were asked differently to different participants.

- Efficiency: Questionnaires can be administered to a large number of people at once, making them an efficient way to collect data from a large sample.

- Anonymity: Participants can remain anonymous when completing a questionnaire, which may make them more likely to answer honestly and openly.

- Cost-effective: Questionnaires can be relatively inexpensive to administer compared to other research methods, such as interviews or focus groups.

- Objectivity: Because questionnaires are typically designed to collect quantitative data, they can be analyzed objectively without the influence of the researcher’s subjective interpretation.

- Flexibility: Questionnaires can be adapted to a wide range of research questions and can be used in various settings, including online surveys, mail surveys, or in-person interviews.

Limitations of Questionnaire

Limitations of Questionnaire are as follows:

- Limited depth: Questionnaires are typically designed to collect quantitative data, which may not provide a complete understanding of the topic being studied. Questionnaires may miss important details and nuances that could be captured through other research methods, such as interviews or observations.

- R esponse bias: Participants may not always answer questions truthfully or accurately, either because they do not remember or because they want to present themselves in a particular way. This can lead to response bias, which can affect the validity and reliability of the data collected.

- Limited flexibility: While questionnaires can be adapted to a wide range of research questions, they may not be suitable for all types of research. For example, they may not be appropriate for studying complex phenomena or for exploring participants’ experiences and perceptions in-depth.

- Limited context: Questionnaires typically do not provide a rich contextual understanding of the topic being studied. They may not capture the broader social, cultural, or historical factors that may influence participants’ responses.

- Limited control : Researchers may not have control over how participants complete the questionnaire, which can lead to variations in response quality or consistency.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Survey Research – Types, Methods, Examples

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game New

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Education and Communications

How to Develop a Questionnaire for Research

Last Updated: December 4, 2022 Fact Checked

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 24 people, some anonymous, worked to edit and improve it over time. There are 13 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 586,735 times. Learn more...

A questionnaire is a technique for collecting data in which a respondent provides answers to a series of questions. [1] X Research source To develop a questionnaire that will collect the data you want takes effort and time. However, by taking a step-by-step approach to questionnaire development, you can come up with an effective means to collect data that will answer your unique research question.

Designing Your Questionnaire

- Come up with a research question. It can be one question or several, but this should be the focal point of your questionnaire.

- Develop one or several hypotheses that you want to test. The questions that you include on your questionnaire should be aimed at systematically testing these hypotheses.

- Dichotomous question: this is a question that will generally be a “yes/no” question, but may also be an “agree/disagree” question. It is the quickest and simplest question to analyze, but is not a highly sensitive measure.

- Open-ended questions: these questions allow the respondent to respond in their own words. They can be useful for gaining insight into the feelings of the respondent, but can be a challenge when it comes to analysis of data. It is recommended to use open-ended questions to address the issue of “why.” [2] X Research source

- Multiple choice questions: these questions consist of three or more mutually-exclusive categories and ask for a single answer or several answers. [3] X Research source Multiple choice questions allow for easy analysis of results, but may not give the respondent the answer they want.

- Rank-order (or ordinal) scale questions: this type of question asks your respondent to rank items or choose items in a particular order from a set. For example, it might ask your respondents to order five things from least to most important. These types of questions forces discrimination among alternatives, but does not address the issue of why the respondent made these discriminations. [4] X Research source

- Rating scale questions: these questions allow the respondent to assess a particular issue based on a given dimension. You can provide a scale that gives an equal number of positive and negative choices, for example, ranging from “strongly agree” to “strongly disagree.” [5] X Research source These questions are very flexible, but also do not answer the question “why.”

- Write questions that are succinct and simple. You should not be writing complex statements or using technical jargon, as it will only confuse your respondents and lead to incorrect responses.

- Ask only one question at a time. This will help avoid confusion

- Asking questions such as these usually require you to anonymize or encrypt the demographic data you collect.

- Determine if you will include an answer such as “I don’t know” or “Not applicable to me.” While these can give your respondents a way of not answering certain questions, providing these options can also lead to missing data, which can be problematic during data analysis.

- Put the most important questions at the beginning of your questionnaire. [7] X Research source This can help you gather important data even if you sense that your respondents may be becoming distracted by the end of the questionnaire.

- Only include questions that are directly useful to your research question. [9] X Trustworthy Source Food and Agricultural Organization of the United Nations Specialized agency of the United Nations responsible for leading international efforts to end world hunger and improve nutrition Go to source A questionnaire is not an opportunity to collect all kinds of information about your respondents.

- Avoid asking redundant questions. This will frustrate those who are taking your questionnaire.