Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

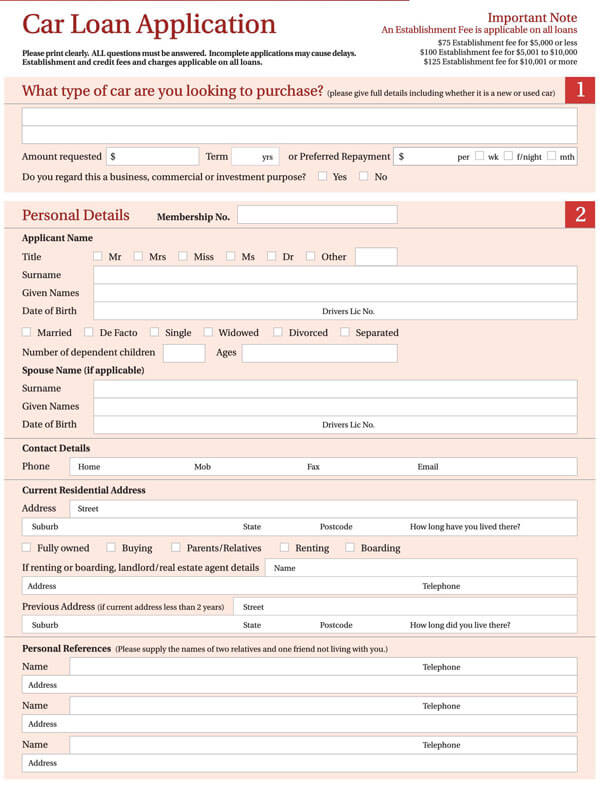

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

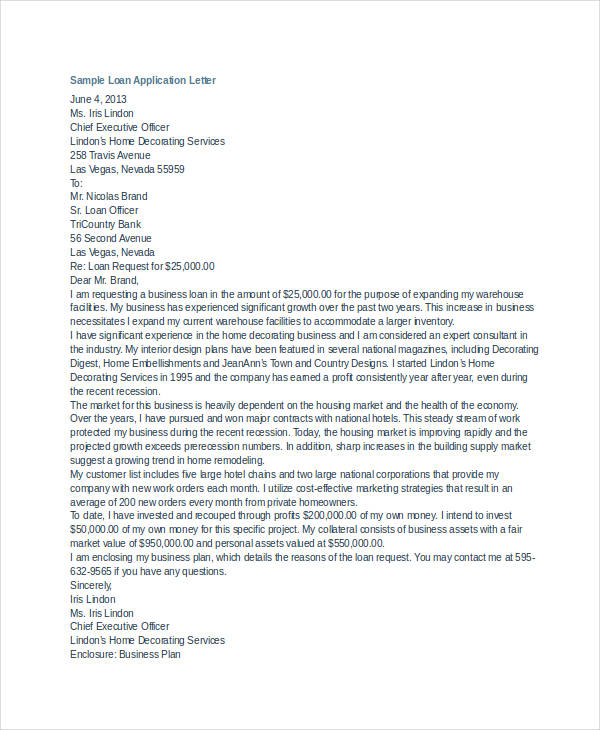

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

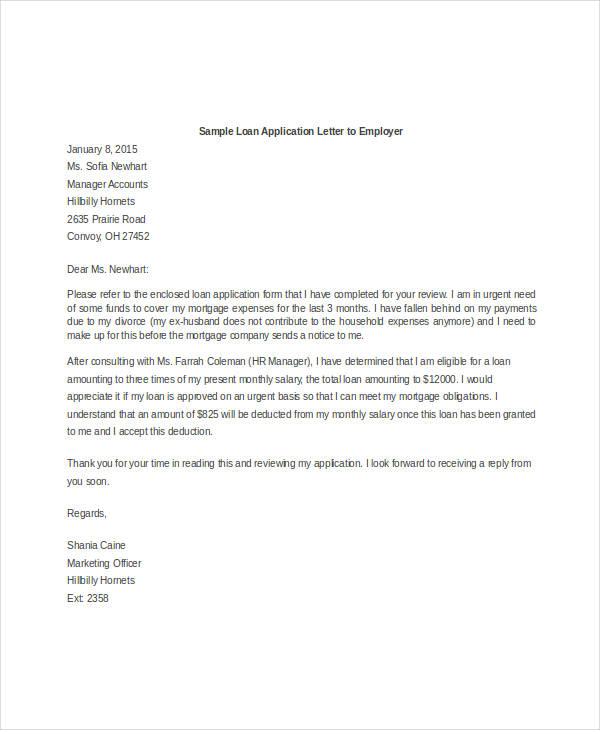

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

Letters.org

The Number 1 Letter Writing Website in the world

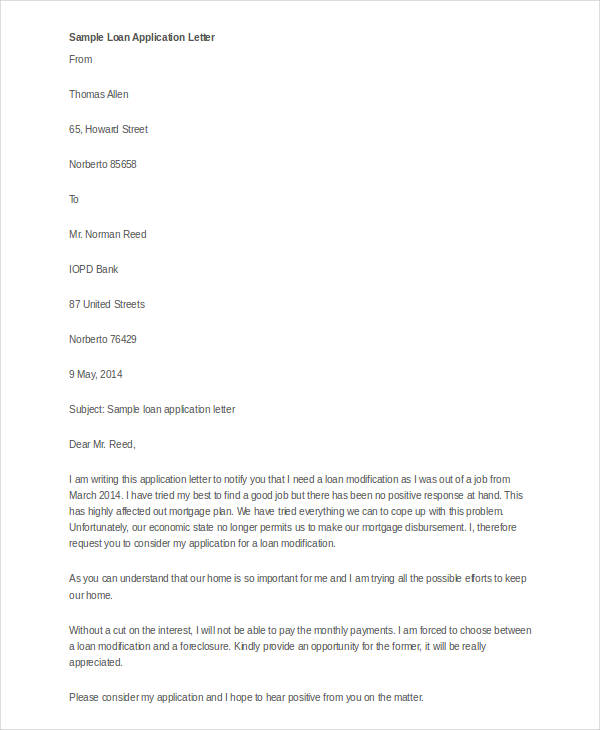

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Get a Loan from the Bank in 5 Steps

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

1. Check whether you qualify for a bank loan

2. compare rates on bank loans, 3. submit your application for a bank loan, 4. review the loan agreement, 5. receive your funds.

Banks offer personal loans typically ranging from $1,000 to $100,000. These loans have low interest rates and can come with perks for existing customers. Though not all banks offer personal loans, those that do are a smart first stop for borrowers.

Getting a loan from a bank can seem overwhelming if you’ve never done it before. These five steps will guide you through the process.

on NerdWallet

» COMPARE: Best bank loans

Before applying for a bank loan, you’ll want to know whether you qualify. Most banks require applicants to have good to excellent credit (a 690 credit score or higher), though some banks may accept applicants with fair credit (a 630 to 689 credit score).

» MORE: See your credit score for free on NerdWallet

Banks may also evaluate your debt-to-income ratio and whether you have enough cash flow to take on new debt. Though most banks don’t disclose a maximum requirement, 36% or lower is generally considered a good DTI.

One of the best ways to check your eligibility is to pre-qualify with the bank. Pre-qualifying takes a few minutes and involves filling out a preliminary application to see what rate, loan amount and repayment term you may be eligible for. Pre-qualifying won’t hurt your credit score.

Not all banks offer this option, though. If your bank doesn’t, call customer service and ask about eligibility criteria. Try to get as much detail as you can, including any minimum credit score and income requirements.

Some banks only lend to current customers, by invitation only or require you to have an open checking account for a certain amount of time before you can apply for a personal loan.

Even if you have a bank in mind, it’s still important to compare loans from different lenders to ensure the one you choose best fits your needs.

The annual percentage rate , which includes interest and any fees, is the best way to compare a loan’s cost. Finding the lowest APR can mean significant savings.

For example, if one bank offers a $20,000, four-year loan at 12% APR, you’ll make monthly payments of $527 and pay $5,280 in interest. But if another lender offers the same loan at 10% APR, you’ll make monthly payments of $507 and pay $4,348 in interest.

Many banks list their APR ranges on their websites.

You may also want to pre-qualify with a few online lenders . Almost all online lenders will show you personalized rates and terms with a soft credit check, so you’ll have more options to consider with no risk to your credit score.

As you compare rates, determine also what repayment term and monthly payment best fit your budget. The longer your repayment term, the smaller your monthly payment, but the more you’ll pay on interest.

Use NerdWallet’s personal loan calculator to estimate your monthly payment by plugging in different loan amounts and terms.

Once you’ve checked eligibility, compared rates and selected the best option, it’s time to apply.

Some banks may require you to apply at a local branch if you’re a new customer, but most applications are online.

The application itself will vary by bank, but you’ll likely need to submit:

Personal details, including name, address, phone number, date of birth and Social Security number.

Loan details, including desired loan amount, loan purpose and repayment term.

Proof of employment and income.

Information about current debts.

Information about monthly expenses, including housing costs.

Once you submit the application, you’ll undergo a hard credit check, which temporarily lowers your credit score by a few points. Depending on the bank, you could hear whether you’re approved or denied within minutes, while some banks may take a few days.

Once approved for the loan, you’ll receive the loan agreement. Some banks may require you to sign the agreement at your local branch, but most will let you sign electronically.

Make sure to read the loan agreement carefully to confirm that the loan amount, repayment term, APR and monthly payment amount are correct.

Also pay close attention to any fees, including late payment fees.

Once you’ve signed the loan agreement, you should receive the funds in a lump sum within a week, though some banks promise same or next-day funding after you’re approved. You can have the funds directly deposited in your personal checking account or a check may be mailed to you.

Once you receive the money, make a plan to repay your loan . Most banks offer an automatic payment option, which could help you avoid late fees, and some banks will even discount your rate for opting in to autopay.

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Cold and Cough Leave Message to Boss

- Secret Santa Messages to Coworkers

- Warning Letter for Insufficient Adherence to Instructions

- Undertaking Letter for Company

- Query Letter for Misconduct

- Search Search Please fill out this field.

How to Write a Loan Letter to Your Bank

How a Letter to the Bank Might Get Your Loan Approved

Why Write a Letter to Your Bank?

- Letter for a Mortgage Application

Parts of a Loan Letter to a Bank

Sample outline for a loan letter.

Maskot / Getty Images

Sometimes getting a loan is as easy as filling out an application. But as dollar amounts increase or the situation gets more complicated, lenders may want reassurance. They could even ask you to explain why your loan is a good idea.

If your bank wants more than the basic information that goes on an application, a letter to the bank could be in order. Some banks specifically request letters, while others might appreciate any extra steps you take to try and win the loan.

Learn how a loan letter can improve your application and what you should include in one.

When you write a loan letter to accompany your application, you have the chance to explain exactly why the lender should approve your request. It gives you an opportunity to:

- Add commentary on topics that do not appear in a standard application

- Explain your financial situation thoroughly

- Lay out your plan for using and repaying the loan

- Address any weak spots in your application or finances

Loan letters can be particularly beneficial for small businesses, which often need capital to grow but may not meet the strict requirements laid out by bank loan applications.

Like a cover letter for a job application, a loan letter is your chance to make your case on your terms.

Loan Letter for a Mortgage Application

If you are applying for a mortgage and your application has some weak spots or unexplained elements, writing a loan letter can increase your chances of approval or of receiving a lower interest rate.

You may need to write a letter to accompany your mortgage application if you have:

- Multiple names on your credit report

- Negative entries in your credit report

- Gaps in employment

- Atypical sources of incomes, such as a small business or freelance work

- A recent change in jobs

- Unusual activity in your bank account

- Former delinquencies or bankruptcies

A loan letter gives you a chance to explain these things and address any concerns they may create for the bank.

When writing a letter to accompany your loan application, you need to both keep things brief and provide sufficient detail to make a convincing argument.

Even while keeping things concise, however, there is still specific information you will want to include.

Who and What

Tell the bank a little bit about yourself. If you're applying for a business loan , be sure to include information about the whole team, including the number of employees and how long you've been in business.

Highlight any strengths, designations, or credentials you've earned, as well as successes in your past. Don't go overboard: just pick just a few of the most impressive and relevant things that come to mind.

Lay out the specific amount that you are requesting for your loan. But sure to include the timeframe, such as $100,000 to be repaid over five years.

Explain exactly how you will use the funds. Your lender needs to know that the money will be put to good use.

For example, if you have been turning away business because you didn't previously have capacity, let your lender know about this unmet demand and your ability to satisfy it.

Demonstrate that you have done some market research and know how the loan will impact your business or personal finances .

Your lender needs to know how you’ll fund the repayment. Will you repay a personal loan from your salary or a business loan from increased revenues?

Be specific about how and why your earnings will increase as a result of the loan.

Your lender will notice if you have bad credit or insufficient income to repay the loan. When you address those issues directly, you signal that you're a serious borrower who understands what's at stake.

Be polite and formal in your language, addressing your letter to the loan officer or specialist that you are working with and ending with "Sincerely" or "Regards." Be sure to include your full legal name, address, and contact information.

Like a cover letter for a resumé, aim to keep your loan letter no longer than one page.

Sample for a Small Business Loan Letter

- Overview : “ACME Enterprises specializes in… and has been in business since 2007...”

- Reason : “I’m writing to request a loan for $100,000…”

- Professional information : “ACME Enterprises was founded by Jane Doe, who has over 10 years of industry experience. The marketing team is led by John Jones, who previously helped grow XYZ Corporation…”

- How funds will be used : “Our goal is to increase the number of daily service visits by purchasing an additional vehicle and related equipment. The total cost of these investments is…”

- Benefit : “Currently we are unable to respond to 30% of requests for service, which results in customers calling our competitors or switching products. We will be able to profitably respond to all of those calls with the additional equipment…”

- Basic financial information : “ACME Enterprises currently operates at a profit. Revenue from the previous year was $X, and net income was $Y…”

- Concerns : Anything else that shows you’ve done your homework and deserve the loan.

- Closing : “Please see the enclosed business plan, and feel free to contact me with any questions you have at…”

You will also need to submit a business plan with your loan application. Think of your introductory letter as an abbreviated version of the business plan.

Sample for a Mortgage Loan Letter

- Personal information : “My spouse and I have recently submitted a mortgage application at XYZ Bank, our full names and contact information are...”

- Basic financial information : “You will see in our application that our joint income for the last ten years has ranged from $X to $Y..."

- Concerns : “I’m writing to explain my irregular income and why this will not impact my ability to repay the mortgage I have applied for…”

- Explanation : "Since 2011, I have been self-employed. My business is ABC Enterprises, which provides freelance ABC services for clients such as... My business has made an annual income of no less than $XX for the last ten years, out of which my personal salary has increased from $X to $Y. In the enclosed business plan, you will see that due to These Market Factors I expect demand to continue increasing as I expand my services..."

- Closing : “Thank you for your time and attention, and feel free to contact me with any questions you have at…”

The lending decision ultimately depends on the financials, such as your credit scores , income, collateral , and ability to repay the amount you borrow. But a loan letter can improve your chances by explaining your situation and the impact the loan will have on those factors.

Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

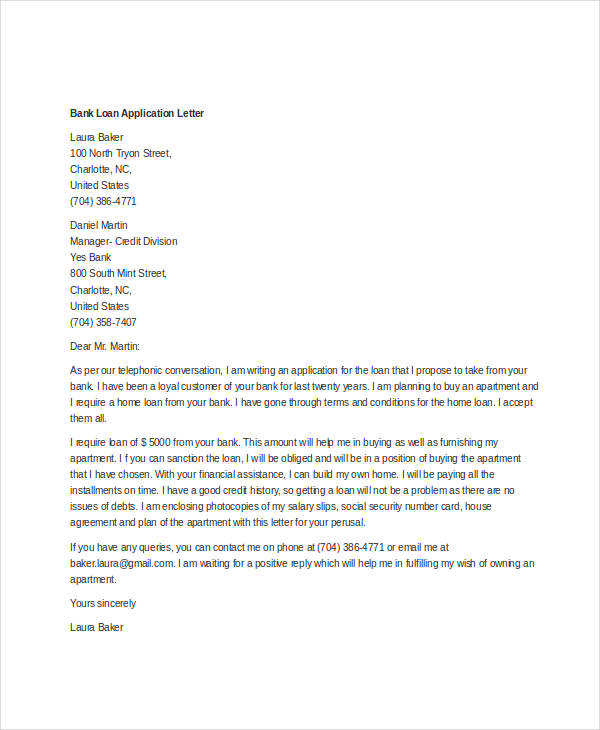

Bank Loan Application Letter Sample 8+ With Format

One format and 8 sample on bank loan letter.

Table of Contents

Bank Loan Application Letter Sample: Naturally, we take a loan from a bank when we fall into a money crisis. We talk to the branch manager about it. After that, he discussed everything and instructs us on all terms and conditions. Some bank managers tell to submit a request letter with the required documents. And then many people can not write a proper request letter. So I have written the post with a format and six samples that will clear your confusion and create a good idea about any type of bank loan application letter sample. Then you can write a new application in your own way. A well-written request letter for the loan can help you to be approved your application at the time of applying for a loan.

There are different types of loans in the bank. For example

- Business loan

- Personal loan

- Educational loan

- Two-wheeler loan

- Loan against property

When you will apply for a personal loan, eligibility is a must for you.

Personal loan eligibilit:

- You should be salaried person.

- You should have a job under government, public company.

- Your age should be between 25-50 years.

- You need to be an Indian citizen.

- The minimum salary should be 25000 but it depends on the city.

Application Format

Bank loan application letter.

The Bank Manager

[Name of the bank]

[Name of the branch]

[Address of the branch]

Date: …../ …../ ……

Sub: [Application for home loan]

Respected Sir/Madam,

I am ___________ [Your name]. I am a [savings/current] account holder with your branch for _____ years. I am a ______ service man. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for _____________ [Purpose of the loan].

I am requesting you for an amount Rs. __________ as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and condition of the bank.

I am waiting for positive response from you.

Thanking you

Yours sincerely

[Name of the applicant]

Contact details

Bank Loan Application Letter Sample

Bank of India

[Branch Name]

[Branch Address]

Date: 00/00/00

Sub: [Request for business loan]

Dear Sir/Madam,

With due respect, I beg to state that I have a current account with your branch. I am a businessman and run three restaurants. I need an amount of Rs. 100000/- as a loan for my business purpose.

I will be thankful to you if you will consider my request as early as possible.

Write A Letter To Bank Manager For Educational Loan

Gabgachi Branch

Delhi-700 071

Date: 12/11/2021

Sub: Application for educational loan

I, Ashutosh Kumar Saha, a permanent resident of Sukanta More, Gabgachi, would like to apply for an education loan for further studies. I have just appeared for my higher secondary board exams and would like to complete a course in B.TEC from a reputed institution in Delhi.

I can come to the branch at your convenience to discuss it required to get a loan in my favor. I will always be grateful to you if you look into the matter and approve my loan.

Ashutosh Kumar Saha

Application For Home Loan

Name of the bank

Name of the branch

Address of the branch

I am prakash saha. I am a savings account holder with your branch for ten years. I am a government serviceman. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for building my house.

I am requesting you for an amount of Rs. 200000/- [Two Lakh] as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and conditions of the bank.

I am waiting for a positive response from you.

Application For Personal Loan

It is stated that I would like to request you for a personal loan of Rs. 200000/-. I have a savings account for 15 years with your branch and save a good balance in the first week of the month. I have been working in an I.T company for 20 years and my salary is 25,000/-. I will pay the loan by deduction money by a savings account. I have read the term and conditions and got it. I have enclosed the necessary document as the instruction.

I am waiting for your positive response of hearing.

Yours faithfully

Sample of Bank Loan Application Letter

Sub: [Application for __________________ ]

With a lot of respect, I beg to state that I am an old account holder in your branch. My account number is XXXXXXXXX. Now I am a serviceman. I am doing my job in Malda Sonoscan Nursing Home. My salary is 12000/-. I need a loan amounting to Rs. 80000/- for buying a car. The deduction should be from my salary account.

Therefore I request you to grant me the loan and then I will be obliged to you.

Business Proposal For Bank Loan Sample

Sub: [Application of proposal of the business loan]

I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch. I am an account holder for ten years and maintain a good balance in this account.

My company name is [XYZ]. It is a growing business that serves furniture to customers. You can follow our success online at [website name]. 25 workers work here daily.

I have attached all the required documents along with this application as you instructed earlier. So I earnestly request you for a small loan.

I am looking forward to hearing at your convenience.

FAQ’s On Requesting Loan

How do I write a letter requesting a loan?

Answer: It is not a hard matter. Just follow the structure and fill up the place with your right information.

Sub: [Application for_______ ]

Write first paragraph following the format.

Second paragraph

Third paragraph

That is enough for a letter of requesting loan.

What is the difference between application and letter?

Answer: There is a difference between application and letter. A letter is written for communication or giving information to anyone. On the other hand, an application is written to request for something.

How do you end an application letter?

Answer: You end an application letter with “Yours faithfully or your sincerely”. Besides it nowadays to write contact details at the end is very important.

Should I write thank you in advance?

Answer: Yes. You should write “Thank you” in advance for close connotation. It will express your politeness.

- Closing your bank account

- A new pass book

- New check-book

- Transfer bank account

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen bank loan application letter sample . If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Stop Payment Cheque Letter With Format And Sample

- Closing Bank Account Letter With 20+ Sample

You May Also Like

Application For Opening Account In Bank With 10 Samples

Application For New Passbook With 6+ Sample

Application For Change Mobile Number In Bank With Sample

All Formats

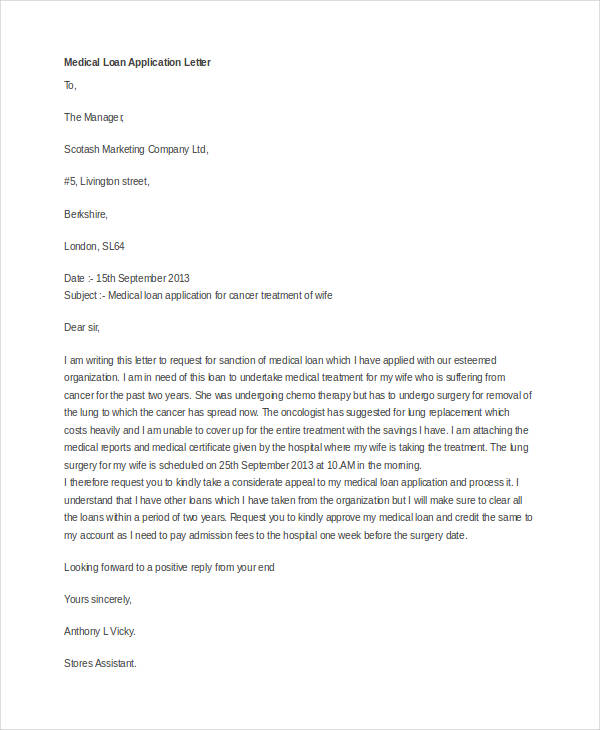

13+ Loan Application Letter Templates

Thinking of asking for a loan? Opening up a business and need the extra money to kick your idea into existence? Loan applications form are a standard piece of document that is significant when asking for a sample loan , and in this website, we provide you with ample of application letter templates for loan to choose from and use.

Business Loan Application Letter Template

Car Loan Application Letter Template

Personal Loan Application Letter Template

Loan Forgiveness Application Letter Template

Calamity Loan Application Letter Template

Sample Loan Application Letter Template

Loan Application Letter Templates

What Is a Loan?

How to fill out a loan application, employee loan application letter template.

Medical Loan Application Letter Template

Basic Loan Application Letter Template

Bank Loan Application Letter Template

Tips before Filling for a Loan

- Why do I need the loan for?

- How will it help my business?

- How will I spend it?

- Who will manage the loan?

- Start by filling up the basics, such as the type of business, the name, contact numbers, and the legal structures.

- Typically after the application, there will an agreement concerning fees associated with the loan. These should be discussed personally with the lender.

- Be sure to double-check that every question is filled. If anything is amiss, the application might end up with the underwriter and may be delayed.

- Be sure to bring plenty of back up documents when meeting personally the lender. These documents include a resume, a credit report templates, past tax returns, the business plan templates, and balance sheets .

- Do not be afraid to include too much information so that there would be an assurance of confidence from you lender that it is strictly business and is legitimate.

More in Letters

Loan requisition letter, loan application letter template, simple loan application letter template, loan application letter to employer template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Request Letter to Bank Manager for Loan (6+ Samples)

Do you have any bank account that has been active for a long time and your financial position is also not correct at your present time? If yes, and you need a lot of money for some reason, the reason could be anything like education, business, health, wedding expenses, debt consolidation, etc. So there is one solution that the majority of people adopt to apply for a loan.

Are you also applying for a loan? If yes, and you are looking for the format to write a letter to the bank manager for a loan then you should take a sigh of relief because in this post I will provide samples of letters for requesting a bank loan from the bank manager.

Below you can read the given samples and you can use the one you like for your letter. Just pay attention that whatever important details are in the sample letter, you should replace them according to your information so that there is no inaccuracy in your letter.

To submit your letter, you need to visit your respective bank branch with all the documents required for verification and approval of your loan. Without a single visit to your bank branch, there is no chance that you will get a loan approved according to your money amount. So, you have to visit your bank branch.

1. Personal Loan Request Letter to Bank Manager

2. letter to bank manager for loan, 3. application for bank loan for business, 4. loan application letter to bank manager, 5. application for applying loan in bank, 6. requesting letter to bank manager for personal loan, 7. application letter for loan from bank.

From, ABC Near ______, Sector 11, New Delhi.

To, The Branch Manager, Union Bank of India, E Block XYZ Road, New Delhi.

Date:- Date/Month/Year

Subject:- Request to bank manager for a personal loan.

Respected Sir/Madam, My self Prabhas Sahu and I live in “your address”. I have been a savings account holder in your branch for the last 6 years and my account number is ************. I want a personal loan of _____ amount from your bank because I borrowed money from a person and now I want to repay it as soon as possible because he is asking me for money.

I have done some huge amounts of transactions in my bank account over the years. Therefore, I hope you will consider my request and try your best to approve my loan at the earliest.

Thank you in Advance, Yours Obediently Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 12, Jaipur.

To, The Branch Manager, UCO Bank, F Block XYZ Road, Jaipur.

Subject:- Letter for the loan request to a bank manager.

Dear Sir/Madam, I am a government employee in the Department of Directorate of Information and Public Relations, Jaipur and I am also a current account holder in your branch. I need a loan of an amount ______. You can see in my account how much the average balance is maintained in my account and my salary is also _____ which is credited to this account. My account number is ************.

Therefore, I request you to please understand my problem and try to approve my loan request as soon as possible.

Thanking You, Yours Faithfully Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 13, Mumbai.

To, The Branch Manager, State Bank of India, G Block XYZ Road, Mumbai.

Subject:- Request letter to bank manager for a loan.

Respected Sir/Madam, I am maintaining a current account in your branch which account holder’s name is _______ and the account number is ************. I am doing a good amount of transactions every month in my account and I also maintain an average balance above Rs. _____. The reason for telling you all this is that I need a business loan of amount _______ from your bank.

Therefore I request you to please accept my concern and try your best to approve my loan. If you do this for me I will be forever grateful to you.

Thanking You, Yours Truly Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 14, Kolkata.

To, The Branch Manager, Punjab National Bank, H Block XYZ Road, Kolkata.

Subject:- Loan application letter to bank manager for a loan.

Dear Sir/Madam, With all due respect, I want to inform you that my name is “mention your name” and I need a personal loan of amount _____ from your bank. I need this loan because my son’s health is not good and my current financial condition is also not good. You can see that my account has a good number of transactions taking care of it every month. My account number is ************.

So, I urge you to please understand my situation and try to approve my loan request as soon as possible. My blessings are always with you.

Thank you in Advance, Your Trusty Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 15, Bengaluru.

To, The Branch Manager, Punjab and Sind Bank, J Block XYZ Road, Bengaluru.

Subject:- Application letter for a bank loan to the bank manager.

Respected Sir/Madam, Due to the Coronavirus and also due to the lockdown, my business savings have been completely exhausted. Now I need money to bounce back business. So, I need a business loan from your bank of Rs. ______. My account number is ************. If you need a guarantor then one of my brothers is ready to be my guarantor he is a government employee in the central government.

I hope you will approve my loan request as soon as possible.

Thanking You, Yours Sincerely Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 16, Chennai.

To, The Branch Manager, Indian Overseas Bank, K Block XYZ Road, Chennai.

Subject:- Requesting to bank manager for a personal loan.

Hello Sir/Madam, I am a Village Development Officer of the district _______ and I belong to “address”. Currently, I live at “your current address”. My bank account has been open in your branch for the last 5 years and I am also doing a good amount of transactions in this account. My account number is ***********. My purpose for writing this letter is that I want a small personal loan of the amount _____. I also provide all the documents that you need to release a personal loan for me.

Therefore, I hope you will approve my request as soon as possible.

Thanking You, Regards Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 17, Hyderabad.

To, The Branch Manager, Bank of India, L Block XYZ Road, Hyderabad.

Subject:- Application letter for a loan of amount ______.

Respected Sir/Madam, My name is “mention your name” and I am a worker having a monthly salary _____. I need a Rs _____ loan from your bank. My savings bank account number is ************. I have enclosed all the documents that you need for my loan approval.

Therefore, kindly approve my loan because I need urgent money.

Frequently Asked Questions (FAQs)

How do i write a letter to my bank manager for a loan.

First, write the sender’s name and address and after that write the date and subject. By giving respect write the body of the letter describing all the details. Lastly, close the letter by saying thank you.

How do I write a bank loan request?

During the loan request process, you have to write a letter to your bank manager to get a loan and also describe the reason behind getting the loan.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to print (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Related Post

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Search This Blog

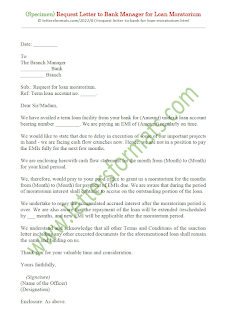

Search letters formats here, request letter format to bank manager for loan moratorium.

submit your comments here

Post a comment.

Leave your comments and queries here. We will try to get back to you.

Board Resolution For Obtaining Loan From Bank

As per section 179(3) of the Companies Act, 2013 , A Board resolution Would be required to be passed by the Board of Directors of the company in order to borrow funds from the bank by executing such agreements as required. The following format of Board resolution can be used for obtaining loan from Bank.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified or contained in the sanction letter or Loan agreement dated (letter or agreement date) which is placed on the table before the board for approval.

RESOLVED FURTHER THAT the consent and approval of the Board be and is hereby accorded to the company to borrow the aforesaid funds on such terms and conditions as mentioned in the sanction letter or loan agreement dated (letter or agreement date).

RESOLVED FURTHER THAT the board of directors of the company be and are hereby authorised to hypothecate the items which are purchased out of the loan funds and if required deposit the title deeds of the property of the company situated at (address of the property) admeasuring an area of (area of property) to create an equitable mortgage thereon as collateral security in favour of the bank for the loan amount so borrowed.

RESOLVED FURTHER THAT the board of directors of the company be and are hereby borrowed the Loan funds on such terms that the funds so advanced from the bank shall be repaid within a period of (Loan repayment period) and which shall carry interest at the rate of (interest rate)per annum on the outstanding balance.

RESOLVED FURTHER THAT Mr/Ms. (Name of the Person),(DIN:XXXX), Director of the company be and is hereby severally authorized in relation to the said facility to act on behalf of the company to sign and execute the requisite documents, agreements, deeds, undertakings, indemnities etc.., under the common seal of the company, wherever required in terms of the Articles of Association of the company.

FOR AND BEHALF OF BOARD OF DIRECTORS OF (COMPANY NAME)

(DIN: XXXXXXX)

Note: In the case of a public company, where

The amount already borrowed + the amount to be borrowed

The aggregate of its Paid-up Share Capital and Free Reserves (Other than the temporary loan taken from the company’s banker in the normal course of business),

Then, such a company would also require to pass a Special Resolution for taking the loan.

Although, the said provision shall not be applicable for the banking company accepting the deposits from the public which is repayable on demand or otherwise, in the normal course of business.

1 thought on “Board Resolution For Obtaining Loan From Bank”

This was quite helpful. Thank you but can you please upload a resolution format/example for a one person company(opc) for a single member.

Leave a Comment Cancel reply

Save my name, email, and mobile in this browser for the next time I comment.

Home » Letters » Bank Letters » Request Letter to Bank for Closing Loan Account

Request Letter to Bank for Closing Loan Account

To, The Branch Manager, ____________ (Loan Department) ____________ (Name of the Bank) ____________ (Branch Address)

Date: __/__/____ (Date),

Subject- Closure of the loan account (Loan Account number)

Respected sir,

I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.). The reason for closure is due to ___________ (reason for account closure – loan tenure complete/EMI Complete/ Full Amount Paid/Any other reason).

Details of the account are mentioned below: Loan Account holder/s name: ____________ Account number: ____________

As per bank requirement, I am enclosing ___________ (Loan account closure form, KYC, other documents if applicable) with the application. I have already _________ (completed the tenure/All EMI Paid /Full Amount Paid). I am authorizing to debit charges from the account for the closure of the loan account (if any).

Thanking you,

Kind regards, ____________ (Name) ____________ (Address), ____________ (Contact Number)

Incoming Search Terms:

- loan account close application format

- application for closing bank loan account letter format

- letter for closing bank loan account

By lettersdadmin

Related post, internship request letter – how to write an application for internship | sample letter, salary increment request letter – sample request letter for salary increment, loan application letter | sample application letter to bank manager for loan, leave a reply cancel reply.

You must be logged in to post a comment.

Application for Half Day Leave – Sample Leave Application to Principal for Half Day Leave

Simple leave application in office – sample request letter for leave of absence, privacy overview.

IMAGES

VIDEO

COMMENTS

Name of Loan Officer. Name of Financial Institution or Bank. Address of Financial Institution or Bank. City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial ...

It should include: Your name and contact information: Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached. The date: Include the month, day, and year of the letter.

Use a formal business letter format. Include your contact information and the date. 3. Introduce Yourself and Your Business. Briefly describe who you are and what your business does. Highlight your experience and achievements. 4. State the Purpose of the Loan. Clearly define why you need the loan.

Business telephone and cell phone numbers. Lender's contact details. Lender's or Loan Agent's Name and Title. A subject line stating the loan amount you are requesting for. Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Your name. Company name. Company phone number. Company address. Loan agent or lender's name and title. Loan agent or lender's contact details. A subject line stating the desired loan amount. Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone. 2.

Follow the steps to write a letter for loan approval: 1. Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. An effective header includes some lines, providing the basics of your business loan request.

Subject: Loan application letter. Dear Sir/Madam, I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank. I am a salaried employee, and I work for a central government organisation as a research scientist.

3. Submit your application for a bank loan. 4. Review the loan agreement. 5. Receive your funds. MORE LIKE THIS Personal Loan Reviews Personal Loans Loans. Banks offer personal loans typically ...

I assure you that I am capable of repaying the loan amount in a timely manner, as per the agreed terms and conditions. I am open to discussing the details of the loan application and providing any additional information if required. Thank you for considering my loan application. I look forward to a favorable response from your end.

There are many financing options for small businesses, and depending on which one you pursue, you'll spend more or less time and effort on your business loan application.In most cases, a business loan request letter is required for only two types of loans—conventional bank term loans and SBA loans. Each of these lenders need similar information, and we'll get to that in a bit.

Re: Bank loan request for $50,000. Dear Lender's Name, The aim of this letter is to request a small business loan of $50,000 to improve and upgrade my restaurant. My business is registered and approved by the health department. I have been in business for the past five years and have shown a profit each year.

1-. I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father.

Letter for a Mortgage Application. Parts of a Loan Letter to a Bank. Sample Outline for a Loan Letter. Photo: Maskot / Getty Images. Writing a letter can improve your chances of loan approval. Learn why and see what should go in a loan letter.

Sub: [Application of proposal of the business loan] Respected Sir/Madam, I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch.

Loan applications form are a standard piece of document that is significant when asking for a sample loan, and in this website, we provide you with ample of application letter templates for loan to choose from and use. Our simple templates are free of charge, reusable, easily accessible for your own convenience, and simple to use.

E Block XYZ Road, New Delhi. Date:- Date/Month/Year. Subject:- Request to bank manager for a personal loan. Respected Sir/Madam, My self Prabhas Sahu and I live in "your address". I have been a savings account holder in your branch for the last 6 years and my account number is ************.

Prerequisites for Writing Loan Request Letters. While a loan request letter may be needed for bank and SBA loans, it won't be enough for approval unless it's supported by a sound credit situation and solid financial planning.For your request to be persuasive to lenders, you should do 2 things before preparing your business request letter and loan application package:

A loan account holder of a bank can also make a formal application to the bank for loan moratorium. You have to come out with genuine reasons to convince the bank to give you a loan moratorium. Here is a sample of such an application letter from a company term-loan-account-holder for getting loan moratorium.

October 12, 2019. As per section 179 (3) of the Companies Act, 2013, A Board resolution Would be required to be passed by the Board of Directors of the company in order to borrow funds from the bank by executing such agreements as required. The following format of Board resolution can be used for obtaining loan from Bank.