- Entrepreneurship

- Starting a Business

- My #1 Online Biz

- Business Planning

- Advertising

- Content Marketing

- Digital Marketing

- Public Relations

- Business Model

- Financial Forecasting

- Market Research

- Risk Management

- Business Plan

- Conferences

- Online Communities

- Professional Associations

- Social Media

- Human Resource

- Productivity

- Legal Requirements

- Business Structure

- Mission Statement

- Financial Plan

- Market Analysis

- Operational Plan

- SWOT Analysis

- Target Market

- Competitor Analysis

- Customer Profiling

- Market Trends

- Pricing Strategies

- Sole Proprietorship

- Partnership

- Cooperative

- Corporation

- Limited Liability

The Importance Of Business Planning: A Beginner’s Guide

by Mike Vestil

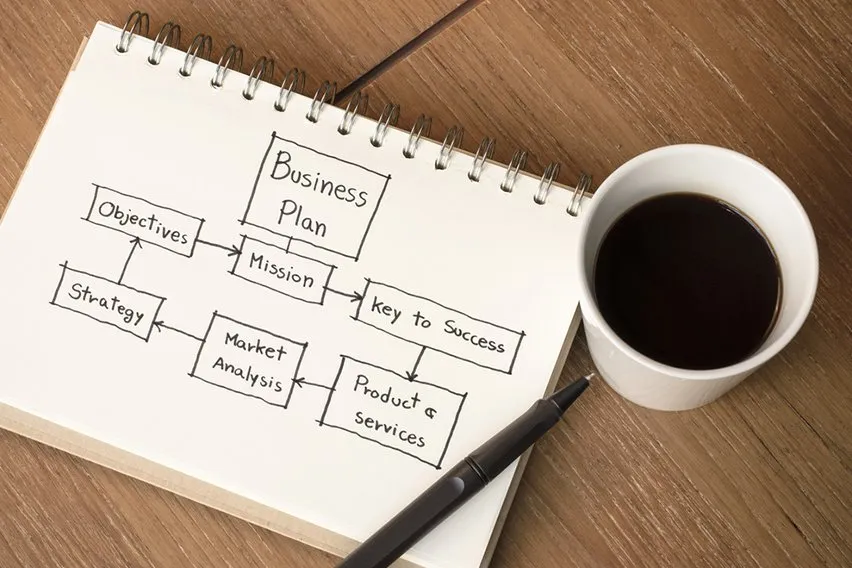

Business planning is the process of determining the goals and objectives of a business and developing a roadmap to achieve them.

It involves the analysis of current and future market conditions, operational capabilities, financial resources, and other factors that impact business success.

Effective business planning helps entrepreneurs and organizations navigate the complexities of the market and make strategic decisions that increase profitability and longevity.

Whether you are starting a new business or looking to expand an existing one, a well-crafted business plan is critical to your success.

In this article, we will explore the key components of business planning and provide insights on how to create a plan that meets your specific needs.

Introduction To Business Planning

What is business planning.

A business plan can be described as a document that outlines and describes the goals of a business and the strategies that will be employed to achieve these goals.

It typically includes detailed information about the company, such as the products, services, and customers that it intends to target, as well as an analysis of the market and the competition.

A business plan also describes the financial projections and resources needed to achieve these goals, such as the amount of money that will be invested, the sales projections, and the operational costs.

The purpose of a business plan is to provide a roadmap for the business owner and all stakeholders, including investors, employees, and management teams.

The importance of a business plan cannot be overstated as it serves as a guide to identify and address potential challenges that a business owner may encounter along the way.

Starting and running a business can be a daunting task, but having a well-crafted business plan can help alleviate some of the stress associated with the unknowns of business ownership.

A business plan helps to define and communicate the vision of the business, which can be invaluable to gaining traction with potential investors or partners who can assist in the growth and development of the company.

It also serves as a tool for measuring success as it provides specific goals and objectives that can be compared to actual results.

In conclusion, a well-written business plan is essential to the overall success of a business.

It provides a clear road map of what the business hopes to achieve and how it intends to do so. It serves as a guide for all stakeholders and helps to communicate the vision of the business to potential investors, employees, and partners.

Ultimately, a business plan helps to mitigate potential risks and set the business up for success.

Importance Of Business Planning

Business planning is an essential activity that every organization must engage in irrespective of its nature or size. It helps organizations in setting goals, staying focused, and measuring progress.

There are several reasons why business planning is of great importance, such as guiding decision-making, allocating resources, and identifying potential risks and opportunities.

First and foremost, business planning helps organizations in setting realistic goals and determining the best strategies to achieve them. It provides a roadmap for the future that enables executives and managers to make informed decisions based on available data and market trends.

Additionally, business planning is a critical tool for allocating resources and ensuring that they are used efficiently.

By analyzing financial data and identifying areas of potential wastage, organizations can reduce costs and increase profitability.

Furthermore, business planning is an effective means of identifying potential risks and opportunities that an organization may face.

By conducting a thorough analysis of internal and external factors that may impact the business, organizations can develop contingency plans to mitigate risks and capitalize on opportunities.

Another essential aspect of business planning is that it enables organizations to monitor and measure their progress.

Through the use of key performance indicators (KPIs), organizations can track their performance against set objectives and make adjustments where necessary.

This helps to ensure that the organization is on track towards achieving its goals and that everyone within the organization is working towards the same objectives.

Moreover, business planning is a critical tool for securing external funding. Investors and lenders are more likely to invest in organizations that have a well-defined strategy and a clear understanding of their market and industry.

In conclusion, business planning is a critical activity for any organization that wants to thrive in a competitive marketplace.

It provides a framework for decision-making, resource allocation, risk management, and measuring progress. Without a solid business plan, organizations are likely to struggle to achieve their goals, make efficient use of their resources, and identify potential risks and opportunities.

Therefore, it is crucial for organizations to invest time and resources into developing a comprehensive and realistic business plan that reflects their unique strengths, weaknesses, and objectives.

Purpose Of Business Planning

Business planning is a critical aspect of establishing a successful business. The purpose of business planning is to outline the objectives, strategies, and steps necessary to achieve those objectives.

This process involves creating a roadmap for the future of the business, identifying potential obstacles and opportunities, and developing tactics to overcome or leverage them.

Business planning is essential for potential investors, as it provides an overview of the company’s goals and how they plan to achieve them. It also allows for more effective decision-making, as it provides a framework for assessing whether or not certain decisions align with the company’s overall goals.

Similarly, business planning is critical for internal stakeholders, as it helps to establish a shared vision and objective for the company, as well as the roadmap for achieving it.

Ultimately, business planning is a vital tool for any business owner or entrepreneur looking to establish a thriving enterprise in today’s complex and competitive market.

Key Elements Of Business Planning

Executive summary.

The executive summary is a critical component of any business plan, providing a concise yet comprehensive summary of the key elements of the plan.

It should provide a clear and compelling overview of the business, highlighting its unique value proposition, target market, competitive advantages, and key strategies for success.

Key financial projections should also be included, providing investors and other stakeholders with a clear understanding of the anticipated risks and rewards associated with the venture.

The executive summary should be written in a clear and concise manner, using language that is both easy to understand and engaging to the reader.

It should be designed to capture the attention of potential investors, lenders, or other stakeholders, providing them with a clear understanding of the business and its potential for success.

Market Analysis Of Business Planning

The Market Analysis section of a business plan is a crucial component that provides a thorough analysis of the target market, industry trends, competition, and customer base.

This subsection should focus on the target market’s size, demographics, and psychographics, including their purchasing habits, preferences, and behaviors.

The assessment of industry trends involves investigating the direction of the market, identifying opportunities, and assessing the impact of external factors such as economic conditions and government regulations.

The section on competition analysis must provide a detailed analysis of direct and indirect competitors, including their strengths, weaknesses, and market share.

This information can be obtained through the use of surveys, online research, and networking. The subsection should also assess the customer base, including market segmentation, potential growth, and loyalty.

Moreover, the subsection should include a SWOT analysis that examines the strengths, weaknesses, opportunities, and threats of the company.

The analysis should focus on the potential challenges faced by the company as well as the opportunities that can be leveraged to achieve success.

This analysis provides an insight into the company’s competitive position and helps identify areas where the company can improve.

Overall, the Market Analysis section is critical for any business plan as it provides a well-rounded understanding of the target market, industry trends, and competitive landscape.

The information provided in this section can be used to develop a sound business strategy and make informed decisions that drive the company’s success.

Company Description Of A Business Plan

The Company Description subsection of a business plan provides an overview of the company and its history, current status, and future prospects.

It should detail what the company does, what sets it apart from competitors, and how it intends to achieve success. A well-crafted company description should also communicate the company’s core values, mission statement, and vision for the future.

It is important to include any relevant company history and milestones as well as any notable achievements, partnerships, or industry awards.

Additionally, a clear explanation of the management team’s experience and qualifications, including their education, certifications, and industry experience, is essential to demonstrate the company’s capacity to succeed.

Furthermore, the products or services offered by the company and how they meet the needs and desires of customers should also be emphasized.

Overall, a concise and compelling company description sets the foundation for the rest of the business plan and conveys a sense of confidence and expertise to potential investors and stakeholders.

Organization And Management

The Organization and Management subsection is crucial in any business plan as it highlights the structure, roles, and responsibilities of the key personnel who will be at the helm of the organization.

The success of any business is largely dependent on the capabilities of the people managing it.

Therefore, it is essential to outline the experience and expertise of each member of the management team. This subsection should also provide clear information on the ownership structure of the organization, including the distribution of shares or ownership percentages.

It is important to highlight any legal or regulatory requirements that the management needs to fulfill to operate the business effectively.

Additionally, the subsection should explain the key operational and administrative functions, as well as any external professional services that will be necessary to ensure the smooth running of the business.

Service Or Product Line

Service or Product Line is a crucial section of a business plan that outlines the products or services a company intends to offer.

This section must describe the key attributes of the product or service, including its unique features, the target market, and what sets it apart from competitors.

Additionally, this section must touch on the production process and costs, as well as the pricing strategy the company will use to ensure that the product or service is profitable.

A successful business plan must ensure that its offerings add value to the target market and adapt accordingly by conducting market research, understanding the competition, and leveraging innovation to create new and improved products.

Marketing And Sales Of A Business Plan

The Marketing and Sales subsection of a business planning document is designed to outline the strategies that will be used to promote and sell a company’s product or service.

This section should include a market analysis and an explanation of how the company plans to differentiate itself from competitors. The marketing plan should identify target customers, their needs, and the benefits that the product or service will provide.

The sales plan should identify the distribution channels that will be used, as well as the pricing model and the sales team structure.

Additionally, this section should identify any marketing and sales metrics that will be used to measure success, such as conversion rates and lead generation.

It is crucial for companies to have a comprehensive marketing and sales plan in place to ensure that they are able to effectively reach their target audience and drive revenue growth.

Funding Request Of A Business Plan

The Funding Request subsection of a business plan is where the entrepreneur explains their financial needs to potential investors or lenders. This section starts with the amount of money required and how it will be utilized, such as for inventory, facilities, or equipment.

The business owner must provide an accurate estimate of the total costs involved, including monthly expenses and projected revenues.

It is also essential to explain how the funding request will affect the company’s financial position and how it will help achieve the specified goals.

Sometimes, entrepreneurs may need to explain their willingness to give up a portion of their company’s ownership to secure financing.

The funding request should be provided with detailed financial statements and projections to support the proposal.

Moreover, entrepreneurs should also specify the repayment schedule and interest rates if they are looking for loans.

The objective is to persuade potential investors or lenders that the proposed investment is feasible, and the revenue from the company is likely to provide a satisfactory return on investment within an acceptable time frame.

A well-written and researched funding request inspires confidence in potential investors or lenders and increases the entrepreneur’s chance of securing the necessary funds.

Importance Of Financial Projections In Business Plan

The subsection Financial Projections is a crucial aspect of any business plan. It entails forecasting the financial outcomes of the proposed business operations.

Financial projections encompass several critical elements, including income statements, cash flow statements, and balance sheets.

Accurately projecting financial outcomes is vital for securing funding from investors and financial institutions.

Furthermore, it is a critical tool for managing resources, making critical financial decisions, and monitoring day-to-day financial activities.

When preparing financial projections, it is essential to consider various factors that might influence the outcomes, such as market trends, competition, industry regulations, and other economic indicators.

One critical element that should not be overlooked is setting realistic goals and timelines for achieving the forecasted outcomes.

Additionally, it is essential to prepare alternative scenarios to gauge the impact of unforeseen events on the business’s financial health.

Overall, the Financial Projection subsection provides insights into the potential financial performance of the business and enables entrepreneurs to develop a well-informed roadmap for success.

Appendix Section In A Business Plan

The Appendix section is an optional section that can be included in a business plan. This section provides space to include any additional information that investors or lenders may find useful in evaluating the business plan.

The Appendix can be used to include resumes of key personnel, product or service brochures, legal documents, and any other relevant information that supports the business plan.

It is important to remember that the Appendix should not be used to include information that should be in other sections, but rather to include supplementary information that adds value to the overall plan.

Steps In Business Planning

Step 1: research and analysis.

A crucial step in creating a successful business plan is conducting thorough research and analysis. This step involves collecting and analyzing relevant data from various sources, such as industry reports, customer surveys, and competitor analysis.

The purpose of this research is to gain a deep understanding of the market, identify potential customers, and evaluate market trends and changes.

Analyzing the data collected enables entrepreneurs to identify opportunities and potential threats that their business may face.

Additionally, this step involves evaluating the resources required to establish and run the business, including understanding the costs associated with acquiring and retaining customers, product development, and distribution.

One of the essential factors to consider during the research and analysis stage is the target market. It is important to identify the audience who would be interested in the product or service offered by the business.

Identifying the target market helps entrepreneurs to evaluate the size of the market, the preferences of their potential customers, and the most effective marketing strategies.

Moreover, research provides entrepreneurs with an understanding of customer spending habits and the overall demand for the product.

This knowledge enables entrepreneurs to tailor their business plan to meet the needs of the target market and increase the likelihood of success.

Another critical aspect of the research and analysis stage is evaluating the competition. An analysis of the existing businesses in the industry helps entrepreneurs identify potential rivals.

It also provides insights into the strengths and weaknesses of competitors, their marketing strategies, and the types of products or services they offer.

This information empowers entrepreneurs to develop unique value propositions and competitive advantages that will differentiate their business from others in the market.In summary, research and analysis are the foundation of a successful business plan.

It provides entrepreneurs with a clear understanding of the market, target audience, and competition.

This information enables entrepreneurs to create a comprehensive plan that outlines the steps required to establish and run a profitable business.

Conducting thorough research and analysis is essential to increase the chances of success and minimize the risks associated with starting a new business.

Step 2: Develop A Strategic Plan

The second step in the business planning process is to develop a strategic plan. This is a critical step that involves identifying goals and objectives for the company, as well as the strategies and tactics that will be used to achieve them.

A strategic plan should include a detailed analysis of the company’s strengths, weaknesses, opportunities, and threats. This information can be obtained through market research, customer surveys, and other methods.

Once this analysis is complete, the company can begin to develop a plan for achieving its goals. This should include a detailed description of the company’s products or services, its target market, and its competitors.

It should also include a plan for marketing and sales, as well as financial projections for the next few years.

An important component of the strategic plan is the identification of key performance indicators (KPIs) that will be used to measure the success of the plan.

These KPIs should be specific and measurable, and should be reviewed regularly to ensure that the plan is on track.

The strategic plan should also consider the company’s resources, including its human capital, financial resources, and technological infrastructure. It should identify any gaps in these resources and make recommendations for how they can be filled.

Ultimately, the strategic plan should be a living document that is reviewed and updated regularly. As the company grows and changes, the plan should be adjusted accordingly to ensure that it remains relevant and effective.

Step 3: Create A Business Plan

Step 4: implement the plan.

The actual implementation of a business plan involves executing each step of the strategy. The effectiveness of the plan heavily relies on the satisfaction of the plan’s objectives, the use of realistic timelines, and the deployment of adequate resources.

The business’ management will need to generate functional plans to ensure that resources are allocated optimally. Timelines must also be established for every step of the process to monitor progress and adjust the plan if necessary.

Good communication with all stakeholders is essential to successful implementation. The plan must be communicated to all employees, contractors, and vendors.

The resources, including personnel and funding, must be aligned with the plan. Efficient coordination is necessary to ensure that everyone is working towards the same end goal.

Performance measurement is crucial, as adjustment to the plan may be necessary to achieve the intended outcomes.

Technology and software may also be necessary in executing specific strategies, which should be included in the plan.

Addressing challenges and roadblocks along the way may also require flexible thinking and adapting the plan accordingly.

Therefore, the process of implementing a business plan involves evaluating the plan’s success and adaption of the plan to current business operations.

By successfully implementing the plan, the business can achieve its desired outcome and ultimately achieve its end goal.

Step 5: Monitor And Review

After implementing a business plan, monitoring and reviewing are crucial steps to ensure success. This stage is vital because it allows a business owner to determine if their strategies are working effectively or if changes need to be made.

It is an opportunity to observe the strengths and weaknesses of a business, discover any financial or operational problems, and measure progress toward established goals.

Monitoring includes tracking financial performance, sales figures, production levels, and customer satisfaction rates.

Reviewing involves analyzing the data gathered from monitoring activities and implementing changes to improve the business.

Monitoring and reviewing also help with business planning, providing entrepreneurs with a basis for decision-making.

Ongoing tracking and analysis can identify potential areas of growth, new opportunities, and potential risks.

Keeping current with industry trends, competitive analysis, and customer feedback can be included in the monitoring and review process.

By identifying and addressing challenges, a business can stay ahead of the competition and improve operations, products, and services.

Regular reviews act as a preventative measure for changes in the market or industry. Real-time optimization can be applied to marketing campaigns, cost structures, sales techniques, and more.

By consistently monitoring and reviewing, a business owner can take immediate corrective action instead of waiting until it’s too late.

Additionally, reviewing allows for continual improvement by providing insight into potential opportunities for growth and increased profitability.

A monitoring and review system should be established as part of the overall plan. This should include setting benchmarks and metrics, as well as scheduling regular reviews of progress toward established goals.

Once the system is in place, the focus should shift towards utilizing data gathered from monitoring and review activities.

This data should be analyzed, identifying areas that require changes and taking action to implement those changes.

In conclusion, monitoring and reviewing are important elements to ensure the continued success of a business.

Through monitoring and reviewing activities, entrepreneurs can gain a better understanding of their business operations and optimize accordingly.

By utilizing data and implementing changes, businesses can ensure long-term profitability and sustainable growth.

Types Of Business Plans

Startup business plan.

A startup business plan is an essential document that outlines the road map for a new business venture.

It is a comprehensive document that typically includes an executive summary, market analysis, company description, product or service offerings, marketing and sales strategies, financials, and a timeline.

The purpose of the business plan is to help entrepreneurs map out their goals and objectives, identify potential roadblocks, and develop strategies to overcome them.

By creating a startup business plan, entrepreneurs can gain a better understanding of their customers, competitors, and market trends.

In addition, they can use the plan to secure funding from investors or financial institutions, to communicate their vision to potential employees, and to develop a clear and concise strategy for scaling the business.

A well-crafted startup business plan is a crucial component of launching a successful new business venture.

Internal Business Plan

The Internal Business Plan is a critical component of the overall business plan. It outlines the internal strategies and tactics that a company will use to achieve its objectives.

This plan is developed by the management team and guides the day-to-day operations of the company. The Internal Business Plan addresses the company’s marketing, operations, financial, and human resources objectives.

A key part of the plan is developing a clear understanding of the company’s competitive advantage and how it will use this advantage to successfully compete within the marketplace.

The Internal Business Plan is also used to assess the company’s progress toward its goals and to make adjustments to the plan as needed.

This plan is different from the Strategic Business Plan which addresses the direction and overall vision of the company, while the Internal Business Plan is focused on the day-to-day operations.

A successful Internal Business Plan is critical to any start-up business as it provides a roadmap for the company to follow and helps create a culture of accountability and focus on achieving the company’s objectives.

Strategic Business Plan

A strategic business plan is a vital component of any successful business. It outlines a company’s overall direction, goals, and objectives over the long term.

A strategic business plan is not just a document, but rather a roadmap that guides a company’s decision-making processes.

It involves conducting a thorough analysis of a company’s market, competition, resources, and capabilities to create a unique value proposition.

The strategic business plan enables a company to position itself in the market and differentiate itself from competitors. The plan should also outline specific actions that need to be taken to achieve the desired objectives.

The strategic business plan typically includes the mission statement, which defines the company’s purpose, values, and culture.

It should also identify the target market and customer segments, as well as the channels and strategies used to reach them.

The plan should also analyze the competitive landscape, identifying strengths, weaknesses, opportunities, and threats (SWOT) to the business.

One of the critical components of a strategic business plan is setting clear and measurable goals and objectives over the long term.

These should be specific, measurable, achievable, relevant, and time-bound (SMART). The goals and objectives should align with the company’s mission statement and vision, and support the overall strategy.

The strategic plan should also outline the tactics and actions that will be taken to achieve these goals, as well as the timeline and resources required.

Another important element of a strategic business plan is the financial plan. This should include a detailed budget, sales forecast, cost of goods sold, cash flow projection, and profit and loss statement.

The financial plan should also consider contingencies and risk management strategies.

A well-executed strategic business plan can significantly benefit a company’s growth and success.

It provides a clear roadmap for decision-making, enabling a company to make informed and strategic choices.

It also helps to align all stakeholders around a common vision and direction, which can improve employee engagement and motivation.

Finally, a strategic business plan enhances a company’s credibility and reputation, which can attract investors, customers, and partners.

Operations Business Plan

The Operations Business Plan is a crucial component of any business plan, as it details the necessary steps to achieve operational efficiency and success.

This subsection focuses on the day-to-day running of the business, outlining the processes and procedures that will be followed, including production, logistics, inventory management, customer service, and more.

A well-crafted Operations Business Plan should provide clear guidance on how the company will meet its goals, reduce costs, and optimize processes.

One of the key elements of an Operations Business Plan is the production plan, which outlines the processes and resources needed to manufacture products or deliver services to customers.

This plan should include production schedules, quality control measures, and contingency plans in case of unexpected delays or problems.

Additionally, inventory management is crucial to ensure that the business has the appropriate amount of goods on hand, minimizing waste and avoiding shortages.

Another important aspect of an Operations Business Plan is logistics, covering the transport of goods and services from the company to the customers.

Logistics might include shipping, delivery, or other transportation-related activities that can affect the efficiency and effectiveness of the business.

Customer service is also a critical component, ensuring that customers feel valued and satisfied with their interactions with the company.

Efficient operation requires effective management, and an Operations Business Plan should outline the organizational structure of the company, including roles and responsibilities of staff members.

Clear communication and collaboration among team members are essential to ensuring that the business runs smoothly and effectively.

Overall, a well-conceived Operations Business Plan is a fundamental component of an effective business plan.

By addressing the day-to-day operations and processes needed for a business to function, this plan helps ensure that the company can operate effectively, minimize waste, and achieve its goals.

Feasibility Business Plan

One of the most critical components of a successful business launch is creating a feasibility business plan.

This type of plan focuses on determining whether a business idea is practical and worth pursuing.

At its core, a feasibility plan looks at the market demand for a product or service, analyzes the competition, examines potential revenue streams, and evaluates the resources required to bring the idea to fruition.

The plan should also outline the risks and challenges associated with the business, as well as any legal and regulatory considerations that may impact its viability.

During the feasibility analysis, entrepreneurs should identify their target audience and understand their behavior and needs.

This analysis is crucial in determining the market demand for the product or service. At the same time, businesses must determine how they will differentiate themselves from the competition.

It’s important to analyze your competition’s strengths and weaknesses, identify opportunities, and determine how to leverage them to create a competitive advantage.

Another critical aspect of the feasibility analysis is identifying potential revenue streams. Businesses need to consider the various ways they can generate income and determine which ones are the most viable.

They should also consider potential expenses, such as marketing and advertising, rent, utilities, and employee salaries.

Once revenue and expenses have been identified, businesses can create financial projections to determine their profitability and whether their business idea is economically sound.

Resource allocation is another essential consideration in a feasibility business plan. Entrepreneurs need to determine what resources they will require to launch and sustain their business.

This includes financial resources, such as startup capital and ongoing funding, as well as human resources, such as employees and contractors.

Businesses must also consider the resources required for production, such as equipment, raw materials, and supplies.

Finally, it’s essential to identify and understand the risks and challenges associated with launching and running a business.

This includes legal and regulatory concerns, such as permits and licenses, as well as other challenges, such as technological advancements or changes in the market.

By identifying and evaluating these risks, businesses can create contingency plans and ensure they have the resources and expertise needed to overcome potential obstacles.

In conclusion, creating a feasibility business plan is an essential first step in launching a successful business.

It provides a comprehensive overview of the business idea, evaluating its potential and risks, and determines whether it is a sound investment.

By conducting a thorough analysis of the market demand, competition, potential revenue streams, resource allocation, and risk and challenges, entrepreneurs can make an informed decision and pursue their business idea with a greater level of confidence and success.

Growth Business Plan

Growth Business Plan is a vital component for businesses that have survived their initial stages and are looking to scale up their operations.

This type of plan focuses on strategies that can be implemented to facilitate growth and increased profitability.

One of the primary concerns of a Growth Business Plan is identifying new areas for expansion, such as new products, markets, or services.

It also involves assessing current operations to determine how they can be optimized and scaled efficiently.

The first step to creating a Growth Business Plan is conducting a market analysis to gain a comprehensive understanding of industry trends, consumer demands, and emerging opportunities.

This involves collecting and analyzing data from various sources such as industry reports, competitor analysis, and consumer feedback.

The goal is to identify untapped markets, potential partnerships, and new revenue streams that can be leveraged to facilitate growth.

The second step is to assess the existing organizational structure to determine if changes need to be made to support growth.

This includes hiring additional staff, expanding the physical infrastructure, or investing in new technology.

A comprehensive growth strategy must also address potential risks and challenges that may arise during the scaling process, such as changes in consumer behavior, supply chain disruptions, or regulatory changes.

Another critical aspect of a Growth Business Plan is financial planning. This involves conducting a financial analysis of the company’s operations to identify areas where cost savings can be realized and new revenue streams can be generated.

The plan must also include a detailed financial forecast that outlines revenue projections, cash flow forecasts, and budgets for capital expenditures.

Ultimately, a successful Growth Business Plan must articulate a clear and comprehensive strategy that establishes a roadmap for scaling up operations while maintaining profitability.

The plan must be flexible enough to adapt to changes in the market, consumer behavior, or the regulatory environment while also being prudent in managing risks associated with growth.

Clear communication of the plan to all the stakeholders of the business is necessary for flawless execution of the expansion efforts.

Exit Business Plan

One important aspect of business planning that is often overlooked is the Exit Business Plan. This subsection of a business plan outlines the steps that the company will take in the event that it needs to close down or be sold.

This can be an important consideration for investors and stakeholders, as it can help them understand the potential risks and rewards associated with their investment.

The Exit Business Plan should include a thorough analysis of the company’s financials, including any outstanding debts or liabilities, as well as projections for future revenue and expenses.

It should also outline the company’s strategy for selling its assets or winding down its operations, including any legal or regulatory considerations that may come into play.

Another important aspect of the Exit Business Plan is succession planning. This involves identifying key personnel who will be responsible for ensuring a smooth transition in the event of an exit, and outlining their roles and responsibilities.

It may also involve identifying potential buyers or partners who could take over the company, and developing a strategy for negotiating a sale or merger.

Ultimately, the purpose of the Exit Business Plan is to minimize risk and maximize value for all stakeholders involved.

By planning for the possibility of an exit from the outset, companies can be better prepared to handle unforeseen circumstances and minimize the potential impact on their investors and employees.

Summary Of Business Planning

Business planning is an essential component of any successful enterprise. It serves as a roadmap for achieving business objectives, providing a framework for decision-making, and establishing accountability.

Through the process of business planning, a company can identify its strengths and weaknesses, capitalize on opportunities, and mitigate risks.

When developing a business plan, it is essential to consider a variety of factors, such as market trends, competitive analysis, financial projections, and growth strategies.

Although it can be challenging to predict the future, a comprehensive business plan can help a company navigate the uncertainties of the marketplace, establish credibility with stakeholders, and secure funding.

The process of creating a business plan can also reveal gaps in knowledge or resources, providing an opportunity for further research or collaboration.

As businesses continue to evolve and adapt to changing market conditions, a robust business plan can serve as a foundation for future growth and success.

Future Outlook Of Business Planning

The future of business planning is promising and exciting. As technology continues to advance, businesses are able to gather more data and better understand their customers, which can inform their strategic planning.

With the increasing use of artificial intelligence and machine learning, businesses can gather insights faster and with greater accuracy. This allows for more precise forecasting and strategic decision-making.

Another relevant trend is the growing popularity of sustainability-focused business planning. Many companies are recognizing the importance of sustainability, given the impact of climate change and the increasing demand for sustainable products and services.

This approach to planning involves looking beyond short-term profits and considering the long-term impact of a business’s actions on the environment and society.

Moreover, the trend toward remote work and decentralized teams is changing how businesses approach planning. Virtual collaboration tools, such as video conferencing and online project management platforms, have made it easier for teams to work effectively from anywhere in the world.

This allows businesses to tap into talent pools globally, which can lead to more diverse and innovative ideas.

Finally, the future of business planning involves adapting to the changing needs of customers, who are increasingly looking for personalized and convenient experiences. Businesses that can offer this are likely to thrive, while those that fail to adapt may fall behind.

This means incorporating customer feedback into planning and investing in technologies, such as chatbots and personalization engines, that can help businesses provide more targeted and relevant experiences to their customers.

Implementing Recommendations

After conducting a thorough examination of Business Planning, it is clear that several recommendations must be made to ensure successful implementation of a business plan.

Firstly, businesses must ensure that every employee is included in the planning process. All departments within the company must have clear communication channels, as collaboration is essential to the success of the plan.

Secondly, businesses should regularly collect and analyze data relevant to their operations. This data can be used to improve and adjust plans as necessary.

Thirdly, businesses must regularly review their business plans and make necessary alterations to keep their plan relevant and up-to-date.

Finally, businesses should always have contingency plans in place. This will help them prepare for unexpected circumstances and better navigate potential risks.

In conclusion, businesses must remain flexible and adaptable in their planning to achieve success, and implementation of the above recommendations will enable them to do so.

Business Planning: FAQs

1. what is business planning.

Business Planning is the process of creating a roadmap for a business’s future. It comprises various steps, including identifying company objectives, conducting a market analysis, determining financial projections, and outlining strategies to achieve goals.

2. Who Needs A Business Plan?

Business planning is essential for any business, irrespective of its size, stage of operations, or industry. Entrepreneurs, startups, and established businesses that want to scale their operations and increase their profitability require a comprehensive and well-structured business plan.

3. Why Is Business Planning Important?

It ensures that a business has a clear direction and vision, helps identify potential opportunities, mitigates challenges, and reduces risks. Furthermore, it plays a crucial role in securing financing, attracting investors, and keeping the organization focused and accountable for its actions.

4. What Should My Business Plan Include?

A comprehensive business plan should include an executive summary, company overview, market analysis, products and services description, marketing and sales strategy, financial projections, organization structure, and operational plan.

5. How Often Should I Update My Business Plan?

Business plans aren’t static documents and should be updated regularly to reflect changes in the market, business evolution, and goals. A business plan should be reviewed annually and updated as needed to ensure that it remains effective and relevant.

6. Can I Write My Own Business Plan?

Yes, although it may be challenging to develop a comprehensive and effective business plan without prior experience. However, there are several resources and tools available, including templates, guides, software, or seeking the services of a business consultant.

Learn how to make passive income online

I've put together a free training on *How We Used The Brand New "Silver Lining Method" To Make $3k-$10k/mo (profit) With Just A Smart Phone In As Little As 8 Weeks …

About the author

Mike Vestil

Mike Vestil is an author, investor, and speaker known for building a business from zero to $1.5 million in 12 months while traveling the world.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Table of Contents

What is a business plan, the advantages of having a business plan, the types of business plans, the key elements of a business plan, best business plan software, common challenges of writing a business plan, become an expert business planner, business planning: it’s importance, types and key elements.

Every year, thousands of new businesses see the light of the day. One look at the World Bank's Entrepreneurship Survey and database shows the mind-boggling rate of new business registrations. However, sadly, only a tiny percentage of them have a chance of survival.

According to the Bureau of Labor Statistics, about 20% of small businesses fail in their first year, about 50% in their fifth year.

Research from the University of Tennessee found that 44% of businesses fail within the first three years. Among those that operate within specific sectors, like information (which includes most tech firms), 63% shut shop within three years.

Several other statistics expose the abysmal rates of business failure. But why are so many businesses bound to fail? Most studies mention "lack of business planning" as one of the reasons.

This isn’t surprising at all.

Running a business without a plan is like riding a motorcycle up a craggy cliff blindfolded. Yet, way too many firms ( a whopping 67%) don't have a formal business plan in place.

It doesn't matter if you're a startup with a great idea or a business with an excellent product. You can only go so far without a roadmap — a business plan. Only, a business plan is so much more than just a roadmap. A solid plan allows a business to weather market challenges and pivot quickly in the face of crisis, like the one global businesses are struggling with right now, in the post-pandemic world.

But before you can go ahead and develop a great business plan, you need to know the basics. In this article, we'll discuss the fundamentals of business planning to help you plan effectively for 2021.

Now before we begin with the details of business planning, let us understand what it is.

No two businesses have an identical business plan, even if they operate within the same industry. So one business plan can look entirely different from another one. Still, for the sake of simplicity, a business plan can be defined as a guide for a company to operate and achieve its goals.

More specifically, it's a document in writing that outlines the goals, objectives, and purpose of a business while laying out the blueprint for its day-to-day operations and key functions such as marketing, finance, and expansion.

A good business plan can be a game-changer for startups that are looking to raise funds to grow and scale. It convinces prospective investors that the venture will be profitable and provides a realistic outlook on how much profit is on the cards and by when it will be attained.

However, it's not only new businesses that greatly benefit from a business plan. Well-established companies and large conglomerates also need to tweak their business plans to adapt to new business environments and unpredictable market changes.

Before getting into learning more about business planning, let us learn the advantages of having one.

Since a detailed business plan offers a birds-eye view of the entire framework of an establishment, it has several benefits that make it an important part of any organization. Here are few ways a business plan can offer significant competitive edge.

- Sets objectives and benchmarks: Proper planning helps a business set realistic objectives and assign stipulated time for those goals to be met. This results in long-term profitability. It also lets a company set benchmarks and Key Performance Indicators (KPIs) necessary to reach its goals.

- Maximizes resource allocation: A good business plan helps to effectively organize and allocate the company’s resources. It provides an understanding of the result of actions, such as, opening new offices, recruiting fresh staff, change in production, and so on. It also helps the business estimate the financial impact of such actions.

- Enhances viability: A plan greatly contributes towards turning concepts into reality. Though business plans vary from company to company, the blueprints of successful companies often serve as an excellent guide for nascent-stage start-ups and new entrepreneurs. It also helps existing firms to market, advertise, and promote new products and services into the market.

- Aids in decision making: Running a business involves a lot of decision making: where to pitch, where to locate, what to sell, what to charge — the list goes on. A well thought-out business plan provides an organization the ability to anticipate the curveballs that the future could throw at them. It allows them to come up with answers and solutions to these issues well in advance.

- Fix past mistakes: When businesses create plans keeping in mind the flaws and failures of the past and what worked for them and what didn’t, it can help them save time, money, and resources. Such plans that reflects the lessons learnt from the past offers businesses an opportunity to avoid future pitfalls.

- Attracts investors: A business plan gives investors an in-depth idea about the objectives, structure, and validity of a firm. It helps to secure their confidence and encourages them to invest.

Now let's look at the various types involved in business planning.

Become a Business and Leadership Professional

- Top 10 skills in demand Business Analysis As A Skill In 2020

- 14% Growth in Jobs Of Business Analysis Profile By 2028

Business Analyst

- Industry-recognized certifications from IBM and Simplilearn

- Masterclasses from IBM experts

Post Graduate Program in Business Analysis

- Certificate from Simplilearn in collaboration with Purdue University

- Become eligible to be part of the Purdue University Alumni Association

Here's what learners are saying regarding our programs:

Assistant Consultant at Tata Consultancy Services , Tata Consultancy Services

My experience with Simplilearn has been great till now. They have good materials to start with, and a wide range of courses. I have signed up for two courses with Simplilearn over the past 6 months, Data Scientist and Agile and Scrum. My experience with both is good. One unique feature I liked about Simplilearn is that they give pre-requisites that you should complete, before a live class, so that you go there fully prepared. Secondly, there support staff is superb. I believe there are two teams, to cater to the Indian and US time zones. Simplilearn gives you the most methodical and easy way to up-skill yourself. Also, when you compare the data analytics courses across the market that offer web-based tutorials, Simplilearn, scores over the rest in my opinion. Great job, Simplilearn!

I was keenly looking for a change in my domain from business consultancy to IT(Business Analytics). This Post Graduate Program in Business Analysis course helped me achieve the same. I am proficient in business analysis now and am looking for job profiles that suit my skill set.

Business plans are formulated according to the needs of a business. It can be a simple one-page document or an elaborate 40-page affair, or anything in between. While there’s no rule set in stone as to what exactly a business plan can or can’t contain, there are a few common types of business plan that nearly all businesses in existence use.

Here’s an overview of a few fundamental types of business plans.

- Start-up plan: As the name suggests, this is a documentation of the plans, structure, and objections of a new business establishments. It describes the products and services that are to be produced by the firm, the staff management, and market analysis of their production. Often, a detailed finance spreadsheet is also attached to this document for investors to determine the viability of the new business set-up.

- Feasibility plan: A feasibility plan evaluates the prospective customers of the products or services that are to be produced by a company. It also estimates the possibility of a profit or a loss of a venture. It helps to forecast how well a product will sell at the market, the duration it will require to yield results, and the profit margin that it will secure on investments.

- Expansion Plan: This kind of plan is primarily framed when a company decided to expand in terms of production or structure. It lays down the fundamental steps and guidelines with regards to internal or external growth. It helps the firm to analyze the activities like resource allocation for increased production, financial investments, employment of extra staff, and much more.

- Operations Plan: An operational plan is also called an annual plan. This details the day-to-day activities and strategies that a business needs to follow in order to materialize its targets. It outlines the roles and responsibilities of the managing body, the various departments, and the company’s employees for the holistic success of the firm.

- Strategic Plan: This document caters to the internal strategies of the company and is a part of the foundational grounds of the establishments. It can be accurately drafted with the help of a SWOT analysis through which the strengths, weaknesses, opportunities, and threats can be categorized and evaluated so that to develop means for optimizing profits.

There is some preliminary work that’s required before you actually sit down to write a plan for your business. Knowing what goes into a business plan is one of them.

Here are the key elements of a good business plan:

- Executive Summary: An executive summary gives a clear picture of the strategies and goals of your business right at the outset. Though its value is often understated, it can be extremely helpful in creating the readers’ first impression of your business. As such, it could define the opinions of customers and investors from the get-go.

- Business Description: A thorough business description removes room for any ambiguity from your processes. An excellent business description will explain the size and structure of the firm as well as its position in the market. It also describes the kind of products and services that the company offers. It even states as to whether the company is old and established or new and aspiring. Most importantly, it highlights the USP of the products or services as compared to your competitors in the market.

- Market Analysis: A systematic market analysis helps to determine the current position of a business and analyzes its scope for future expansions. This can help in evaluating investments, promotions, marketing, and distribution of products. In-depth market understanding also helps a business combat competition and make plans for long-term success.

- Operations and Management: Much like a statement of purpose, this allows an enterprise to explain its uniqueness to its readers and customers. It showcases the ways in which the firm can deliver greater and superior products at cheaper rates and in relatively less time.

- Financial Plan: This is the most important element of a business plan and is primarily addressed to investors and sponsors. It requires a firm to reveal its financial policies and market analysis. At times, a 5-year financial report is also required to be included to show past performances and profits. The financial plan draws out the current business strategies, future projections, and the total estimated worth of the firm.

The importance of business planning is it simplifies the planning of your company's finances to present this information to a bank or investors. Here are the best business plan software providers available right now:

- Business Sorter

The importance of business planning cannot be emphasized enough, but it can be challenging to write a business plan. Here are a few issues to consider before you start your business planning:

- Create a business plan to determine your company's direction, obtain financing, and attract investors.

- Identifying financial, demographic, and achievable goals is a common challenge when writing a business plan.

- Some entrepreneurs struggle to write a business plan that is concise, interesting, and informative enough to demonstrate the viability of their business idea.

- You can streamline your business planning process by conducting research, speaking with experts and peers, and working with a business consultant.

Whether you’re running your own business or in-charge of ensuring strategic performance and growth for your employer or clients, knowing the ins and outs of business planning can set you up for success.

Be it the launch of a new and exciting product or an expansion of operations, business planning is the necessity of all large and small companies. Which is why the need for professionals with superior business planning skills will never die out. In fact, their demand is on the rise with global firms putting emphasis on business analysis and planning to cope with cut-throat competition and market uncertainties.

While some are natural-born planners, most people have to work to develop this important skill. Plus, business planning requires you to understand the fundamentals of business management and be familiar with business analysis techniques . It also requires you to have a working knowledge of data visualization, project management, and monitoring tools commonly used by businesses today.

Simpliearn’s Executive Certificate Program in General Management will help you develop and hone the required skills to become an extraordinary business planner. This comprehensive general management program by IIM Indore can serve as a career catalyst, equipping professionals with a competitive edge in the ever-evolving business environment.

What Is Meant by Business Planning?

Business planning is developing a company's mission or goals and defining the strategies you will use to achieve those goals or tasks. The process can be extensive, encompassing all aspects of the operation, or it can be concrete, focusing on specific functions within the overall corporate structure.

What Are the 4 Types of Business Plans?

The following are the four types of business plans:

Operational Planning

This type of planning typically describes the company's day-to-day operations. Single-use plans are developed for events and activities that occur only once (such as a single marketing campaign). Ongoing plans include problem-solving policies, rules for specific regulations, and procedures for a step-by-step process for achieving particular goals.

Strategic Planning

Strategic plans are all about why things must occur. A high-level overview of the entire business is included in strategic planning. It is the organization's foundation and will dictate long-term decisions.

Tactical Planning

Tactical plans are about what will happen. Strategic planning is aided by tactical planning. It outlines the tactics the organization intends to employ to achieve the goals outlined in the strategic plan.

Contingency Planning

When something unexpected occurs or something needs to be changed, contingency plans are created. In situations where a change is required, contingency planning can be beneficial.

What Are the 7 Steps of a Business Plan?

The following are the seven steps required for a business plan:

Conduct Research

If your company is to run a viable business plan and attract investors, your information must be of the highest quality.

Have a Goal

The goal must be unambiguous. You will waste your time if you don't know why you're writing a business plan. Knowing also implies having a target audience for when the plan is expected to get completed.

Create a Company Profile

Some refer to it as a company profile, while others refer to it as a snapshot. It's designed to be mentally quick and digestible because it needs to stick in the reader's mind quickly since more information is provided later in the plan.

Describe the Company in Detail

Explain the company's current situation, both good and bad. Details should also include patents, licenses, copyrights, and unique strengths that no one else has.

Create a marketing plan ahead of time.

A strategic marketing plan is required because it outlines how your product or service will be communicated, delivered, and sold to customers.

Be Willing to Change Your Plan for the Sake of Your Audience

Another standard error is that people only write one business plan. Startups have several versions, just as candidates have numerous resumes for various potential employers.

Incorporate Your Motivation

Your motivation must be a compelling reason for people to believe your company will succeed in all circumstances. A mission should drive a business, not just selling, to make money. That mission is defined by your motivation as specified in your business plan.

What Are the Basic Steps in Business Planning?

These are the basic steps in business planning:

Summary and Objectives

Briefly describe your company, its objectives, and your plan to keep it running.

Services and Products

Add specifics to your detailed description of the product or service you intend to offer. Where, why, and how much you plan to sell your product or service and any special offers.

Conduct research on your industry and the ideal customers to whom you want to sell. Identify the issues you want to solve for your customers.

Operations are the process of running your business, including the people, skills, and experience required to make it successful.

How are you going to reach your target audience? How you intend to sell to them may include positioning, pricing, promotion, and distribution.

Consider funding costs, operating expenses, and projected income. Include your financial objectives and a breakdown of what it takes to make your company profitable. With proper business planning through the help of support, system, and mentorship, it is easy to start a business.

Our Business And Leadership Courses Duration And Fees

Business And Leadership Courses typically range from a few weeks to several months, with fees varying based on program and institution.

Get Free Certifications with free video courses

Business and Leadership

Business Analysis Basics

Data Science & Business Analytics

Business Intelligence Fundamentals

Learn from Industry Experts with free Masterclasses

From Concept to Market - How to Excel at Product Management in 2024 with SP Jain Program

Ascend the Product Management Career Ladder in 2024 with UC San Diego

Career Information Session: Find Out How to Become a Business Analyst with IIT Roorkee

Recommended Reads

Business Intelligence Career Guide: Your Complete Guide to Becoming a Business Analyst

Corporate Succession Planning: How to Create Leaders According to the Business Need

Top Business Analyst Skills

Business Analytics Basics: A Beginner’s Guide

Financial Planning for Businesses Across the Globe

How to Become a Business Analyst

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model