Discover the insights of 300+ marketing professionals on the essential tools, resources, and skills for success.

- · Brandwatch Academy

- Forrester Wave

Brandwatch Consumer Research

Formerly the Falcon suite

Formerly Paladin

Published October 17 th 2023

10 Essential Methods for Effective Consumer and Market Research

When it comes to understanding the world around you, market research is an essential step.

We live in a world that’s overflowing with information. Sifting through all the noise to extract the most relevant insights on a certain market or audience can be tough.

That’s where market research comes in – it’s a way for brands and researchers to collect information from target markets and audiences.

Once reliant on traditional methods like focus groups or surveys, market research is now at a crossroads. Newer tools for extracting insights, like social listening tools, have joined the array of market research techniques available.

Here, we break down what market research is and the different methods you can choose from to make the most of it.

What is market research, and why is it critical for you as a marketer?

Market research involves collecting and analyzing data about a specific industry, market, or audience to inform strategic decision-making. It offers marketers valuable insights into the industry, market trends, consumer preferences, competition, and opportunities, enabling businesses to refine their strategies effectively.

By conducting market research, organizations can identify unmet needs, assess product demands, enhance value propositions, and create marketing campaigns that resonate with their target audience.

This practice serves as a compass, guiding businesses in making data-driven decisions for successful product launches, improved customer relationships, and a stronger positioning in the business landscape.

For marketers and insights professionals, market research is an indispensable tool. It helps them make smarter decisions and achieve growth and success in the market.

These 10 market research methods form the backbone of effective market research strategies.

Continue reading or jump directly to each method by tapping the link below.

- Focus groups

- Consumer research with social media listening

- Experiments and field trials

- Observation

- Competitive analysis

- Public domain data

- Buy research

- Analyze sales data

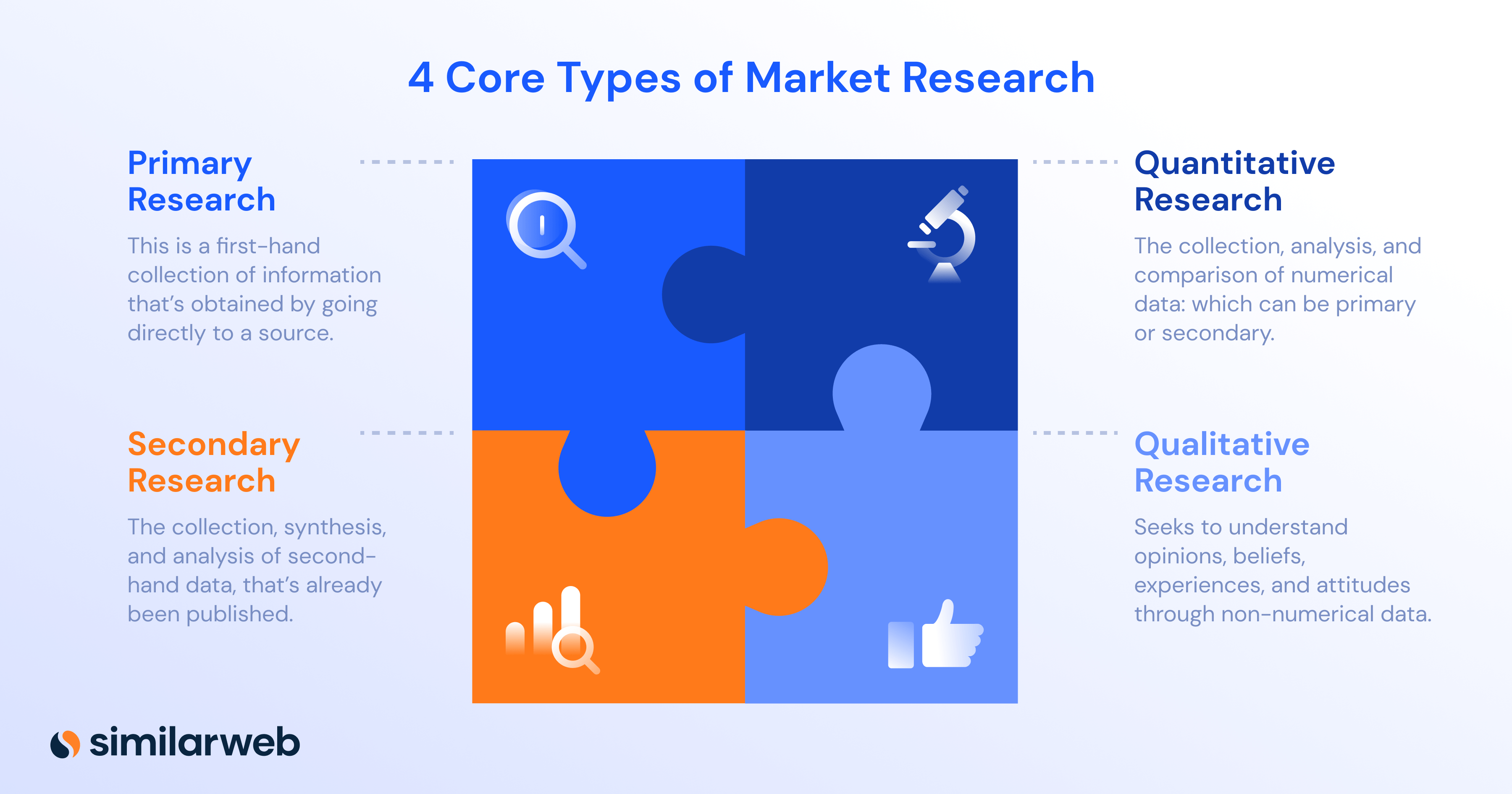

Use of primary vs secondary market research

Market research can be split into two distinct sections: primary and secondary. These are the two main types of market research.

They can also be known as field and desk, respectively (although this terminology feels out of date, as plenty of primary research can be carried out from your desk).

Primary (field) research

Primary market research is research you carry out yourself. Examples of primary market research methods include running your own focus groups or conducting surveys. These are some of the key methods of consumer research. The ‘field’ part refers to going out into the field to get data.

Secondary (desk) research

Secondary market research is research carried out by other people that you want to use. Examples of secondary market research methods include studies carried out by researchers or financial data released by companies.

10 effective methods to do market research

The methods in this list cover both areas. Which ones you want to use will depend on your goals. Have a browse through and see what fits.

1. Focus groups

It’s a simple concept but one that can be hard to put into practice.

You bring together a group of individuals into a room, record their discussions, and ask them questions about various topics you are researching. For some, it’ll be new product ideas. For others, it might be views on a political candidate.

From these discussions, the organizer will try to pull out some insights or use them to judge the wider society’s view on something. The participants will generally be chosen based on certain criteria, such as demographics, interests, or occupations.

A focus group’s strength is in the natural conversation and discussion that can take place between participants (if they’re done right).

Compared to a questionnaire or survey with a rigid set of questions, a focus group can go off on tangents the organizer could not have predicted (and therefore not planned questions for). This can be good in that unexpected topics can arise; or bad if the aims of the research are to answer a very particular set of questions.

The nature of the discussion is important to recognize as a potential factor that skews the resulting data. Focus groups can encourage participants to talk about things they might not have otherwise, and others might impact the group. This can also affect unstructured one-on-one interviews.

In survey research, survey questions are given to respondents (in person, over the phone, by email, or via an online form). Questions can be close-ended or open-ended. As far as close-ended questions go, there are many different types:

- Dichotomous (two choices, such as ‘yes’ or ‘no’)

- Multiple choice

- Rating scale

- Likert scale (common version is five options between ‘strongly agree’ and ‘strongly disagree’)

- Matrix (options presented on a grid)

- Demographic (asking for information such as gender, age, or occupation)

Surveys are massively versatile because of the range of question formats. Knowing how to mix and match them to get what you need takes consideration and thought. Different questions need the right setup.

It’s also about how you ask. Good questions lead to good analysis. Writing clear, concise questions that abstain from vague expressions and don’t lead respondents down a certain path can help your results reflect the true colors of respondents.

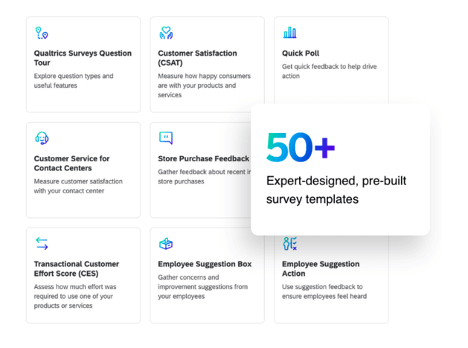

There are a ton of different ways to conduct surveys as well, from creating your own from scratch or using tools that do lots of the heavy lifting for you.

3. Consumer research with social media listening

Social media has reached a point where it is seamlessly integrated into our lives. And because it is a digital extension of ourselves, people freely express their opinions, thoughts, and hot takes on social media.

Because people share so much content on social media and the sharing is so instant, social media is a treasure trove for market research. There is plenty of data to monitor , tap into, and dissect.

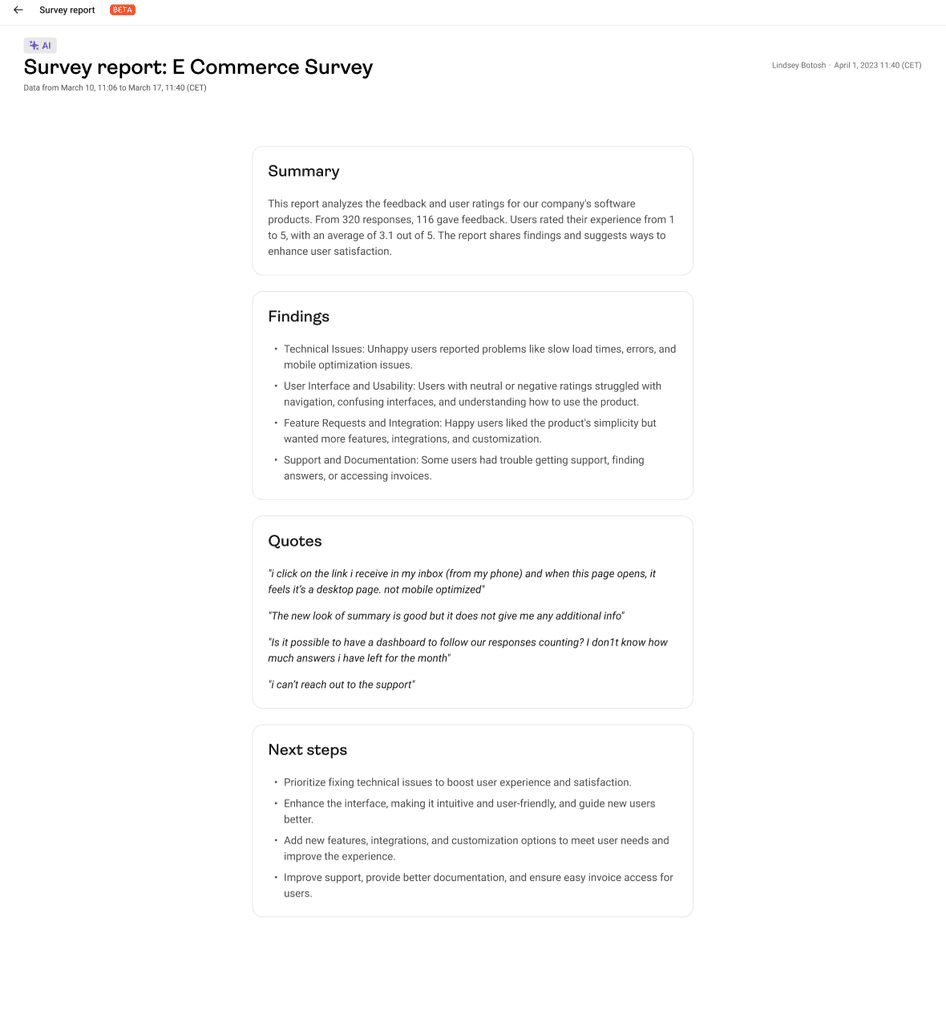

By using a social listening tool, like Consumer Research , researchers can identify topics of interest and then analyze relevant social posts. For example, they can track brand mentions and what consumers are saying about the products owned by that brand. These are real-world consumer research examples.

View this post on Instagram A post shared by Brandwatch (@brandwatch)

Social media listening democratizes insights, and is especially useful for market research because of the vast amount of unfiltered information available. Because it’s unprompted, you can be fairly sure that what’s shared is an accurate account of what the person really cares about and thinks (as opposed to them being given a subject to dwell on in the presence of a researcher).

You might like

Your complete social listening guide.

Learn how to get started with social listening

4. Interviews

In interviews, the interviewer speaks directly with the respondent. This type of market research method is more personal, allowing for communication and clarification, making it good for open-ended questions. Furthermore, interviews enable the interviewer to go beyond surface-level responses and investigate deeper.

However, the drawback is that interviews can be time-intensive and costly. Those who opt for this method will need to figure out how to allocate their resources effectively. You also need to be careful with leading or poor questions that lead to useless results. Here’s a good introduction to leading questions .

5. Experiments and field trials

Field experiments are conducted in the participants’ environment. They rely on the independent variable and the dependent variable – the researcher controls the independent variable in order to test its impact on the dependent variable. The key here is to establish whether there’s causality.

For example, take Hofling’s experiment that tested obedience, conducted in a hospital setting. The point was to test if nurses followed authority figures (doctors) and if the authority figures’ rules violated standards (The dependent variable being the nurses, the independent variable being a fake doctor calling up and ordering the nurses to administer treatment.)

According to Simply Psychology , there are key strengths and limitations to this method.

The assessment reads:

- Strength: Behavior in a field experiment is more likely to reflect real life because of its natural setting, i.e., higher ecological validity than a lab experiment.

- Strength: There is less likelihood of demand characteristics affecting the results, as participants may not know they are being studied. This occurs when the study is covert.

- Limitation: There is less control over extraneous variables that might bias the results. This makes it difficult for another researcher to replicate the study in exactly the same way.

There are also massive ethical implications for these kinds of experiments and experiments in general (especially if people are unaware of their involvement). Don’t take this lightly, and be sure to read up on all the guidelines that apply to the region where you’re based.

6. Observation

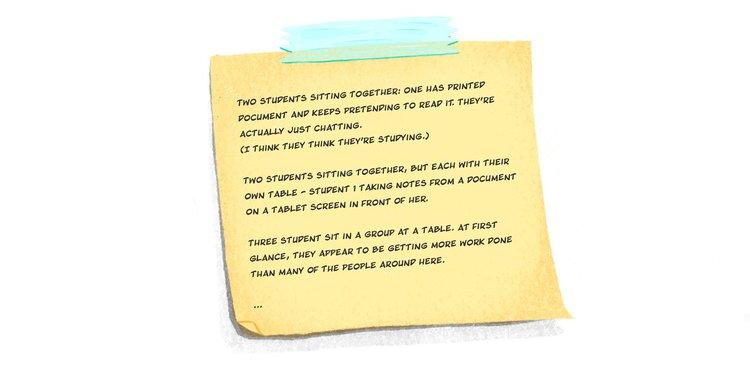

Observational market research is a qualitative research method where the researcher observes their subjects in a natural or controlled environment. This method is much like being a fly on the wall, but the fly takes notes and analyzes them later. In observational market research, subjects are likely to behave naturally, which reveals their true selves.

They are not under much pressure. However, if they’re aware of the observation, they can act differently.

This type of research applies well to retail, where the researcher can observe shoppers’ behavior by day of the week, by season, when discounts are offered, and more. However, observational research can be time-consuming, and researchers have no control over the environments they research.

7. Competitive analysis

Competitive analysis is a highly strategic and specific form of market research in which the researchers analyze their company’s competitors. It is critical to see how your brand stacks up to rivals.

Competitive analysis starts by defining the product, service, brand, and market segment. There are different topics to compare your firm with your competitors. It could be from a marketing perspective: content produced, SEO structure, PR coverage, and social media presence and engagement. It can also be from a product perspective: types of offerings, pricing structure. SWOT analysis is key in assessing strengths, weaknesses, opportunities, and threats.

We’ve written a whole blog post on this tactic, which you can read here .

8. Public domain data

The internet is a wondrous place. Public data exists for those strapped for resources or simply seeking to support their research with more data. With more and more data produced every year, the question about access and curation becomes increasingly prominent – that’s why researchers and librarians are keen on open data.

Plenty of different types of open data are useful for market research: government databases, polling data, “fact tanks” like Pew Research Center, and more.

Furthermore, APIs grant developers programmatic access to applications. A lot of this data is free, which is a real bonus.

9. Buy research

Money can’t buy everything, but it can buy research. Subscriptions exist for those who want to buy relevant industry and research reports. Sites like Euromonitor, Statista, Mintel, and BCC Research host a litany of reports for purchase, oftentimes with the option of a single-user license or a subscription.

This can be a massive time saver, and you’ll have a better idea of what you’re getting from the very beginning. You’ll also get all your data in a format that makes sense, saving you effort in cleaning and organizing.

10. Analyze sales data

Sales data is like a puzzle piece that can help reveal the full picture of market research insights. Essentially, it indicates the results. Paired with other market research data, sales data helps researchers better understand actions and consequences. Understanding your customers, their buying habits, and how they change over time is important.

This research will be limited to customers, and it’s important to keep that in mind. Nevertheless, the value of this data should not be underestimated. If you’re not already tracking customer data, there’s no time like the present.

Choosing the right market research method for your strategy

Not all methods will be right for your situation or your business. Once you’ve looked through the list and seen some that take your fancy, spend more time researching each option.You’ll want to consider what you want to achieve, what data you’ll need, the pros and cons of each method, the costs of conducting the research, and the cost of analyzing the results.

Get it right, and it’ll be worth all the effort.

Former Brandwatch Employee

Share this post

Brandwatch bulletin.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

New: Consumer Research

Make the world your focus group.

With Brandwatch Consumer Research, you can turn billions of voices into valuable insights.

More in marketing

How to market your sustainability as a brand in 2024.

By Emily Smith Mar 18

The Swift Effect: What Brands Can Learn from Taylor Swift

By Emily Smith Feb 29

How B2B Brands Can Benefit from Social Listening

By Ksenia Newton Feb 23

7-Step Guide: Choosing the Right Social Media Monitoring Tool for You

By Emily Smith Feb 20

We value your privacy

We use cookies to improve your experience and give you personalized content. Do you agree to our cookie policy?

By using our site you agree to our use of cookies — I Agree

Falcon.io is now part of Brandwatch. You're in the right place!

Existing customer? Log in to access your existing Falcon products and data via the login menu on the top right of the page. New customer? You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Paladin is now Influence. You're in the right place!

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution. Want to access your Paladin account? Use the login menu at the top right corner.

- Solutions Corporate Market Analysis Customer Experience Product Lifecycle Brand Strategy Research & Insights Higher Education Enrollment Management Academic Program Development Student Success Operations & Finance Advancement Marketing Grants Research & Insights K-12 Education Curriculum and Instruction Diversity, Equity, and Inclusion Academic Program Planning and Impact Strategic Planning Teacher Recruitment and Retention Operational Planning School Climate Research & Insights

- Data Analysis

- Qualitative Research

- Strategic Advising

- Benchmarking & Best Practices

- Market Modeling

- Research & Insights By Industry Corporate Higher Education K–12 Education By Type Insights Blog Reports & Briefs Case Studies Webinars All Research & Insights

- Client Testimonials

- Current Openings

- Recruitment Process

- Social Impact

- Careers in Research

- Careers in Sales and Account Management

- Diversity, Equity, and Inclusion

- Client Login

What are the Market Research Methods?

- August 15, 2023

- Topic: Brand Strategy , Corporate , Corporate Trends , Customer Experience , Market Analysis , Product Lifecycle

- Resource type: Insights Blog

So, you have a question, but you are unsure of how to get your answer. Maybe you are wondering who your target audience is or why you lost out on a deal to your competition. Maybe you are looking to expand into a new market and want to know more about the customers and competitors in the industry. While these examples are similar in the way they help you understand your business better, they all require different market research methodologies to arrive at the answer.

What are Market Research Methodologies?

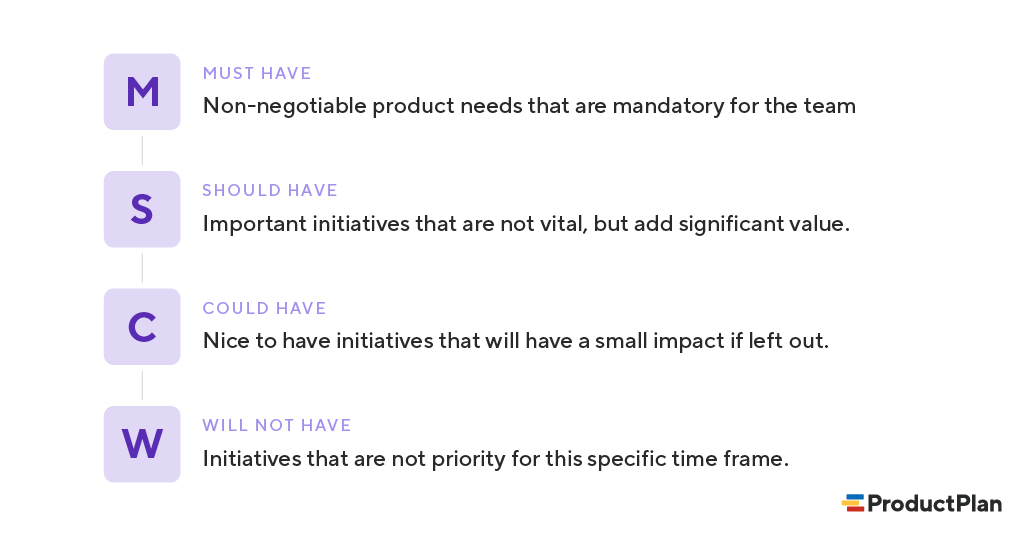

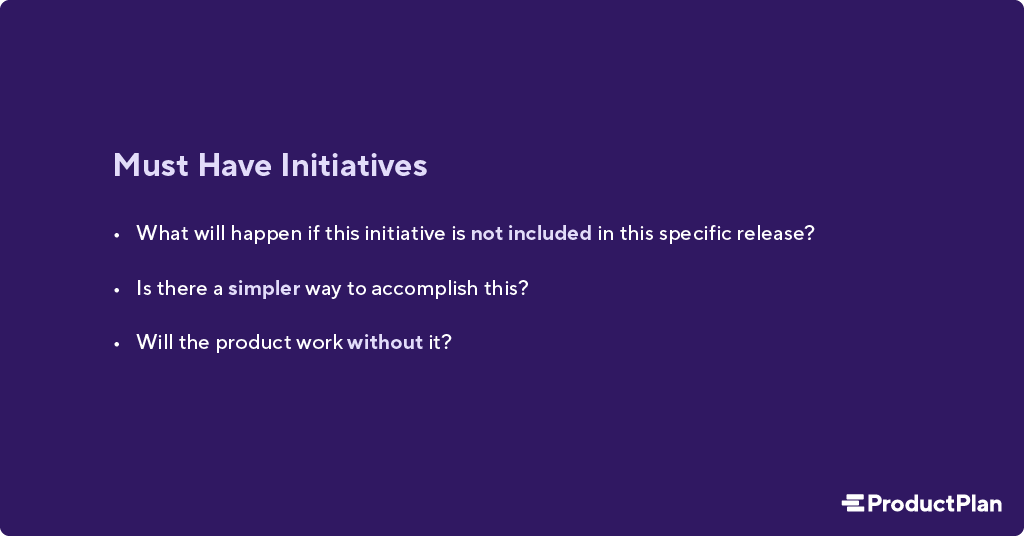

Research methodologies are various ways to perform research to understand your problem. The correct type to employ depends on the answers you are seeking, the information you have, and the information you need to gather. There are many different methods, but most fall into four categories: data analytics, survey, qualitative, and secondary.

In this post, we will provide an overview of the four main research methodologies along with benefits and challenges of each.

Custom or Syndicated Research

In addition to the types of methodologies, there are two types of funded research: custom and syndicated.

Custom research is funded by a single company and is focused on answering the key questions the business seeks to understand. Though more costly, the research design, implementation, and results are unique and targeted toward addressing the funding company’s needs.

On the other hand, syndicated research is not curated or funded by a specific client; a market research company conducts it to offer data such as industry statistics, current best practices, or recent trends. Though not directly tied to a single company’s situation, businesses often buy syndicated research to gather perspective on their performance and identify areas where custom research can help provide more insight.

The Four Types Of Market Research

Data analytics .

Data analytics research involves collecting and analyzing large sets of data to derive answers, uncover patterns, and predict future outcomes. This method helps you identify and understand things you are aware of but don’t yet understand.

Data can come from a variety of sources including CRM data, historical transactional data, survey data, a third-party publisher, and more to build a holistic map of the situation, identify gaps and discern trends. Data analytics is the most common research method with almost 70% of companies using it in at least one market research project in the past year.

For example, you might have large sets of historical data and know there is a data-backed answer for how to segment your customers, but you have yet to compile all your information together to identify the answer.

Benefits and Challenges

Benefits: Analyzing historical data provides a holistic view of a situation by combining different sets of data and modeling potential scenarios and outcomes. You can confirm hypotheses, break biases, and help build cases internally.

Challenges: This method requires a lot of data, and some of that data may be hard to access, hard to generate, or not easily analyzed. This method also requires a lot of time, money, and resources to acquire and parse the correct data.

Survey research involves gathering opinions, preferences, and experiences by asking a set of questions to a targeted group of people. The focus of survey research is to test theories, assumptions, and hypotheses. The answers are collected from a representative sample of a targeted audience, allowing the researchers to quantify data and generalize the results to the wider population with a reasonable margin of error and strong confidence level.

Survey data can be collected from consumers, other business decision-makers, or your customer lists. Surveys are a very popular market research methodology with over 60% of companies performing at least one survey in the last year.

For example, you may be wondering how satisfied your customers are, what factors drive satisfaction, and how you compare to key competitors in the market. By surveying your customers and those of key competitors you can understand the drivers of satisfaction and your relative strengths and opportunity areas in the market.

Benefits and Challenges

Benefits : Surveys provide an aggregate but statistically significant picture that companies can leverage to make decisions that align with their audiences’ preferences. Surveys also offer the ability to segment answers based on segments of the audience to analyze how different groups respond to the same questions.

Challenges: Surveys are a fixed set of questions and cannot be adjusted once the survey has been deployed. Responses are limited to the questions posed by the researcher and don’t allow for open-ended qualitative responses. Surveys require many respondents, and depending on the target audience, it can be challenging to find a large enough sample size to provide statistically significant results. Lastly, surveys need to incentivize respondents, which could lead to a high price tag.

Qualitative Methodologies

Qualitative research focuses on targeted insights around concepts, opinions, and preferences. Unlike quantitative methods, these market research methodologies leverage a smaller set of data and respondents but allow for more in-depth answers. It also allows for companies to gather follow-up data that delves deeper into the reasoning behind responses

This method is exploratory in nature to help you formulate hypothesis and establish directional themes or trends. Qualitative research also helps you understand the underlying motivations, attitudes, and perceptions of respondents.

The two most common qualitative research methodologies are in-depth interviews and focus groups.

In-depth interviews

This market research methodology involves one-on-one conversations between interviewers and those from the target audience. The interview follows a pre-determined set of questions to reveal sentiment, decision-making processes, and unmet needs. With only 40% of companies conducting them, interviews are the least used methodology, likely a result of the challenges mentioned below.

Benefits : Interviews provide the ability to gather more in-depth answers on customer preferences by allowing researchers to ask follow-up questions to probe deeper and further clarify responses. It also allows respondents to answer in their own words rather than be bound by the available responses offered by a survey.

Challenges: Interviews are responses from a small group of people and the results cannot be generalized to a wider audience. They are also very challenging to implement. Often, it is a struggle to identify and incentivize enough participants, and the price per respondent can be costly depending on their rarity and level of expertise. It is also critical to enlist an experienced interviewer to ensure that both the initial and follow-up questions are tailored to gather accurate information that fully addresses your target questions.

Focus groups

These facilitator-led group discussions reveal perceptions of or reception to a concept or idea. While the facilitator guides the meeting, the direction of the conversation is determined by the participants creating organic responses that stem from participant perception. Just over half of companies have conducted a focus group in the last year.

Benefits: F ocus groups allow for exploration of concepts and physical products beyond set responses like those available in through a survey. The social aspect of the focus group can also gather multiple points of view on a topic in one setting. This can add additional insight for both participants in their ongoing feedback and facilitators for their final analysis.

Challenges: Focus groups are kept small to gather meaningful insights from a group of people, something that would be difficult if the group was too large. As such, the sample size is very small, and the responses can‘t be extrapolated to a larger audience. It is also challenging to find a group of qualified participants that are all available at the same time.

Traditionally, focus groups were conducted in person and there was a higher cost to host the group live. Now depending on the product or concept being reviewed, focus groups can be conducted over video calls, lessening the burden of cost and logistics, however the cost to incentivize members to take part remains. Similar to interviews, you will need to enlist an experienced moderator that can facilitate the conversation and help direct it as needed to ensure the target questions are addressed

Secondary Research Methodologies

Secondary research, a lso known as desk research, is leveraging data that already exists to answer your questions. This market research method is helpful for answering questions or deepening your understanding of things you are not directly familiar with but understand. It can be used to understand what others in your market are doing, identify potential markets for growth or expansion, or allow you to compare your organization to others on key performance indicators.

For example, you might understand that customer preferences have affected your market, but you don’t know the exact changes. However, others have already done related research that can provide context or direct answers to your question. Secondary research is a very popular method with over half ( 55% ) of companies conducting secondary research to get insights they need for their strategies.

Benefits: Secondary research is one of the quicker methodologies as it leverages existing data. The bulk of the time is spent identifying the problem, accessing existing data, and consolidating it for analysis and insights.

Challenges: Some of the data you need might require payment, which would increase the cost of the overall project. There is also the risk that a data point needed for your analysis does not exist, requiring you to either speak to an expert or conduct your own research to fill in the gap.

Picking the Right Research Methodology

Though there are many options to choose from, the correct market research methodology to implement will be guided by the information you already have and the questions you are trying to answer.

Before you start your research, begin by listing what you know and what you are looking to learn. Some choices are very clear cut. For example, are you looking to learn more about your company’s operations in the hopes of identifying a better strategy? Since you have access to your own data and are looking to learn more, data analytics would be your best path forward.

Sometimes choosing the right market research methodology might require more thought. For example, are you looking to launch a new product and want to learn more about customer preferences? You could interview customers or launch a focus group, but do you know what questions to ask? And as the sample pool is so small, the results from qualitative methods should not be used to make assumptions about a larger customer base.

The best place to start would be to conduct a survey to the target audience to get a basic understanding of the market and potential customer preferences. If it is a well-known customer base, you may be able to through secondary research by leveraging existing data to analyze the market.

Discover how leading companies leverage market research for success

Related Content

- Insights Blog

Four Stages of Product Development Where Qualitative Research Counts

- Corporate , Product Lifecycle

- Reports & Briefs

Product Concept Testing: The Secret to Meeting Customer Needs

- Corporate , Customer Experience , Product Lifecycle

Related Research & Insights

Critical Questions for New Product Development

Research & Insights

Receive industry-leading insights directly in your inbox.

If you have difficulty accessing any part of this website or the products or services offered by Hanover Research, please contact us at [email protected] for support.

Become a client

Access the best custom research to help hit your organization’s goals . Request your custom consult below and a member of our team will be in touch.

Have questions? Please visit our contact page .

Let us come to you!

Receive industry insights directly in your inbox.

Our newsletters are packed with helpful tips, industry guides, best practices, case studies, and more. Enter your email address below to opt in:

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

Create Viral Infographics That Boost Your Organic Traffic

How to Create a Video Sales Letter (Tips and Tricks from a 7-Figure Copywriter)

How to Write a Sales Email That Converts in 2024

What Is a Media Kit: How to Make One in 2024 (With Examples)

Namestorming: How to Choose a Brand Name in 20 Minutes or Less

10 Ways to Increase Brand Awareness without Increasing Your Budget

What Is a Content Creator? A Deep Dive Into This Evolving Industry

Content Creator vs Influencer: What’s the Difference?

How Much Do YouTube Ads Cost? A Beginner’s Pricing Breakdown

How to Get Podcast Sponsors Before Airing an Episode

How Founders Can Overcome Their Sales Fears with AJ Cassata

How to Grow Your YouTube Channel & Gain Subscribers Quickly

How to Write Good Instagram Captions That Hook Your Audience

Discovering the Best CRM for Consultants

10 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

4 Types of Market Research + 6 New Ways to Do It Smarter

In June this year, 500 business leaders shared their favorite types of market research with me via a direct external survey.

Astonishingly, 83% of people said the same thing: favoring qualitative research ( specifically market research surveys ) over anything else.

Having a favorite is all good and well, but as we know, variety is the spice of life. By avoiding dependency on any single type of market research, you get a relevant, unbiased view of your market and opportunities at all times.

Spoiler alert 🚨 The types of market research I outline in this post will speed up your time to insight significantly. Instead of a process that spans days and weeks, certain tasks can be done and dusted in a few hours at most.

To help you stay on top of your game, I’m outlining the different types of market research, their benefits, and how to use them. As a bonus, I’m sharing six modern ways to do market research using digital research intelligence tools (like Similarweb).

The 4 types of market research

1. Primary research

Primary research is the first-hand collection of data. You go directly to a source instead of relying on existing information. It’s also known as field research.

Who is it for? Doing primary research involves collecting information relevant to a specific research context. For instance, if data is required about the shifting needs of a target market , primary research methods are a great way to explore this.

How to collect the data? Usually, an individual will go into the marketplace (field) to find the information they need.

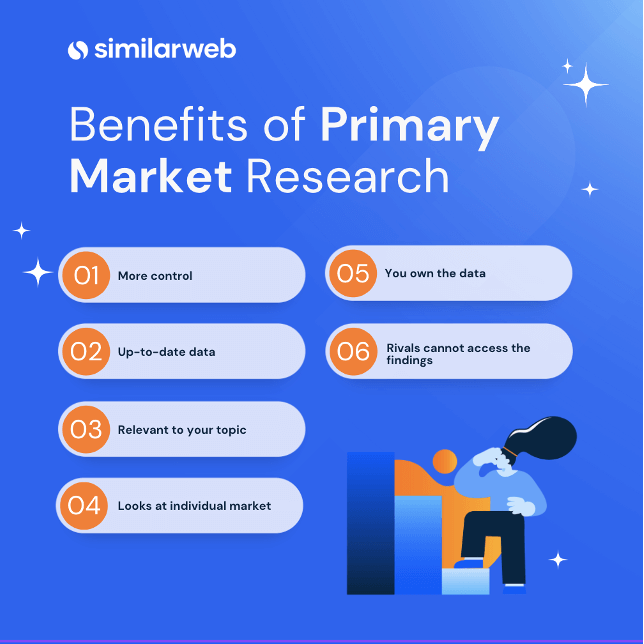

Benefits of primary research

- You get more control over the research methodologies.

- The information is up-to-date.

- Because data is relevant, it reveals current trends, not outdated ones.

- Most primary research addresses the individual market instead of the mass market.

- The data collector retains ownership of the data.

Types of primary research

The right research method depends on the goal of the research and the resources available. Here are five of the best ways to do primary research.

- Ethnographic or observational research

- Trials or experiments

- Focus groups

2. Secondary research

Secondary research collates existing information or research for analysis. Essentially, it’s a type of market research that uses second-hand data.

Who is it for? Secondary research is ideal for start-ups and small businesses, needing a type of market research that’s low-cost and quick to undertake.

How to collect the data? Secondary data is collected from various places but always comes from existing third-party information.

Benefits of secondary research

- A low-cost type of research

- It’s quick to conduct

- Data is easy to access

- Initial findings can help shape any longer-term investment in primary research

- Anybody can do it; there’s no professional training required

- Gives you a broad understanding of a topic quickly

Types of secondary research

Most secondary market research methods can be done for free. It’s also called desk research . Here are some of the most popular places to obtain that data.

- Internet search engines

- Trade associations

- Research companies

- Media outlets

- Industry experts

- Government and non-government agencies

- Digital intelligence platforms (like Similarweb)

- Educational institutions

- Company reports

- Academic journals

- Public libraries

- Competitor websites

If you’d like to learn more, read our complete guide to desk research .

3. Qualitative research

Qualitative research aims to understand opinions, beliefs, experiences, attitudes, and interactions by collecting and analyzing non-numerical data. It helps researchers understand why things are so, through observation or unstructured questioning.

Compared to quantitative methods, this is more of a touchy-feely type of market research. It’s more about emotions and opinions than crunching numbers.