Simple Business Plan Templates

By Joe Weller | April 2, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve compiled a variety of simple business plan templates, all of which are free to download in PDF, Word, and Excel formats.

On this page, you’ll find a one-page business plan template , a simple business plan for startups , a small-business plan template , a business plan outline , and more. We also include a business plan sample and the main components of a business plan to help get you started.

Simple Business Plan Template

Download Simple Business Plan Template

This simple business plan template lays out each element of a traditional business plan to assist you as you build your own, and it provides space to add financing information for startups seeking funding. You can use and customize this simple business plan template to fit the needs for organizations of any size.

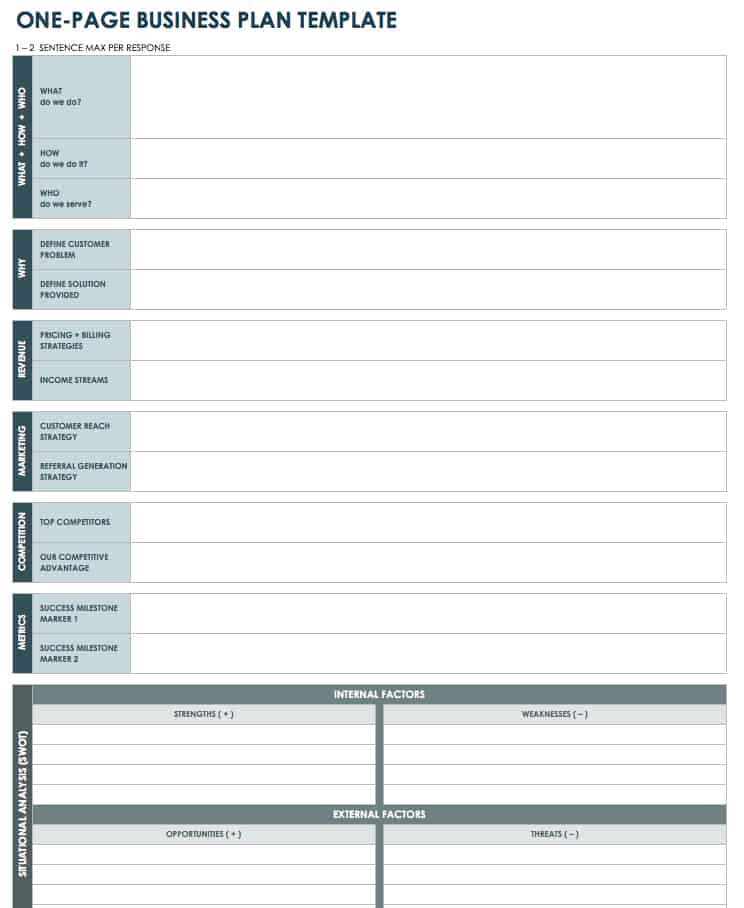

One-Page Business Plan Template

Download One-Page Business Plan Template

Excel | Word | PDF | Smartsheet

Use this one-page business plan to document your key ideas in an organized manner. The template can help you create a high-level view of your business plan, and it provides easy scannability for stakeholders. You can use this one-page plan as a reference to build a more detailed blueprint for your business.

For additional single page plans, take a look at " One-Page Business Plan Templates with a Quick How-To Guide ."

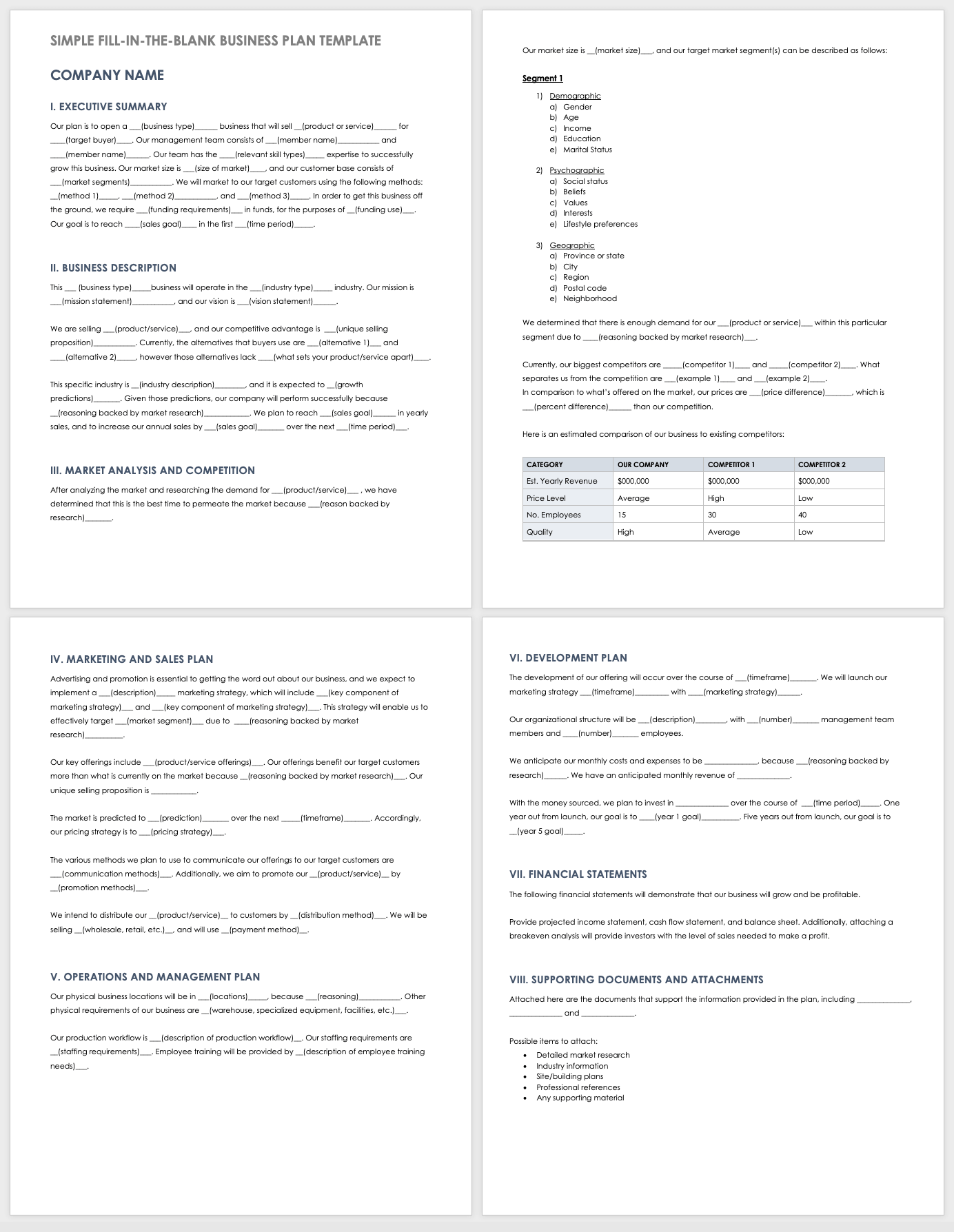

Simple Fill-in-the-Blank Business Plan Template

Download Simple Fill-in-the-Blank Business Plan Template

Use this fill-in-the-blank business plan template to guide you as you build your business plan. Each section comes pre-filled with sample content, with space to add customized verbiage relevant to your product or service.

For additional free, downloadable resources, visit " Free Fill-In-the-Blank Business Plan Templates ."

Simple Business Plan for Startup

Download Startup Business Plan Template — Word

This business plan template is designed with a startup business in mind and contains the essential elements needed to convey key product or service details to investors and stakeholders. Keep all your information organized with this template, which provides space to include an executive summary, a company overview, competitive analysis, a marketing strategy, financial data, and more. For additional resources, visit " Free Startup Business Plan Templates and Examples ."

Simple Small-Business Plan Template

Download Simple Small-Business Plan Template

This template walks you through each component of a small-business plan, including the company background, the introduction of the management team, market analysis, product or service offerings, a financial plan, and more. This template also comes with a built-in table of contents to keep your plan in order, and it can be customized to fit your requirements.

Lean Business Plan Template

Download Lean Business Plan Template

This lean business plan template is a stripped-down version of a traditional business plan that provides only the most essential aspects. Briefly outline your company and industry overview, along with the problem you are solving, as well as your unique value proposition, target market, and key performance metrics. There is also room to list out a timeline of key activities.

Simple Business Plan Outline Template

Download Simple Business Plan Outline Template

Word | PDF

Use this simple business plan outline as a basis to create your own business plan. This template contains 11 sections, including a title page and a table of contents, which details what each section should cover in a traditional business plan. Simplify or expand this outline to create the foundation for a business plan that fits your business needs.

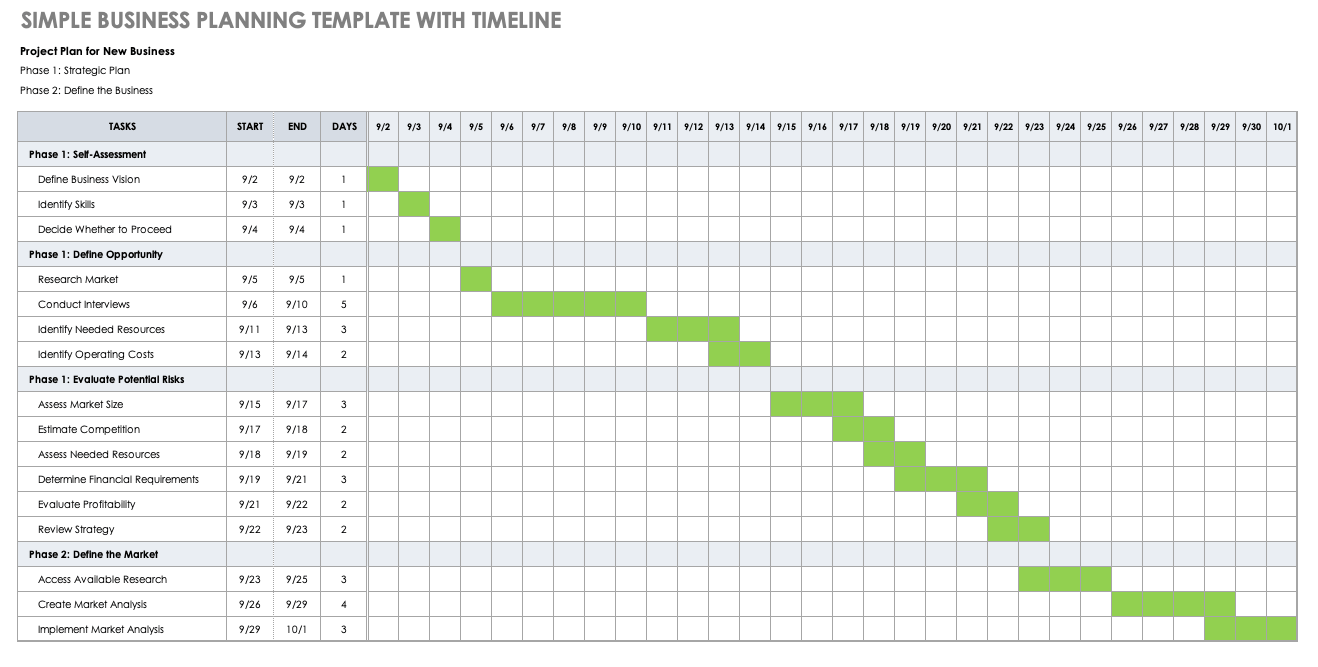

Simple Business Planning Template with Timeline

Download Simple Business Planning Template with Timeline

Excel | Smartsheet

This template doubles as a project plan and timeline to track progress as you develop your business plan. This business planning template enables you to break down your work into phases and provides room to add key tasks and dates for each activity. Easily fill in the cells according to the start and end dates to create a visual timeline, as well as to ensure your plan stays on track.

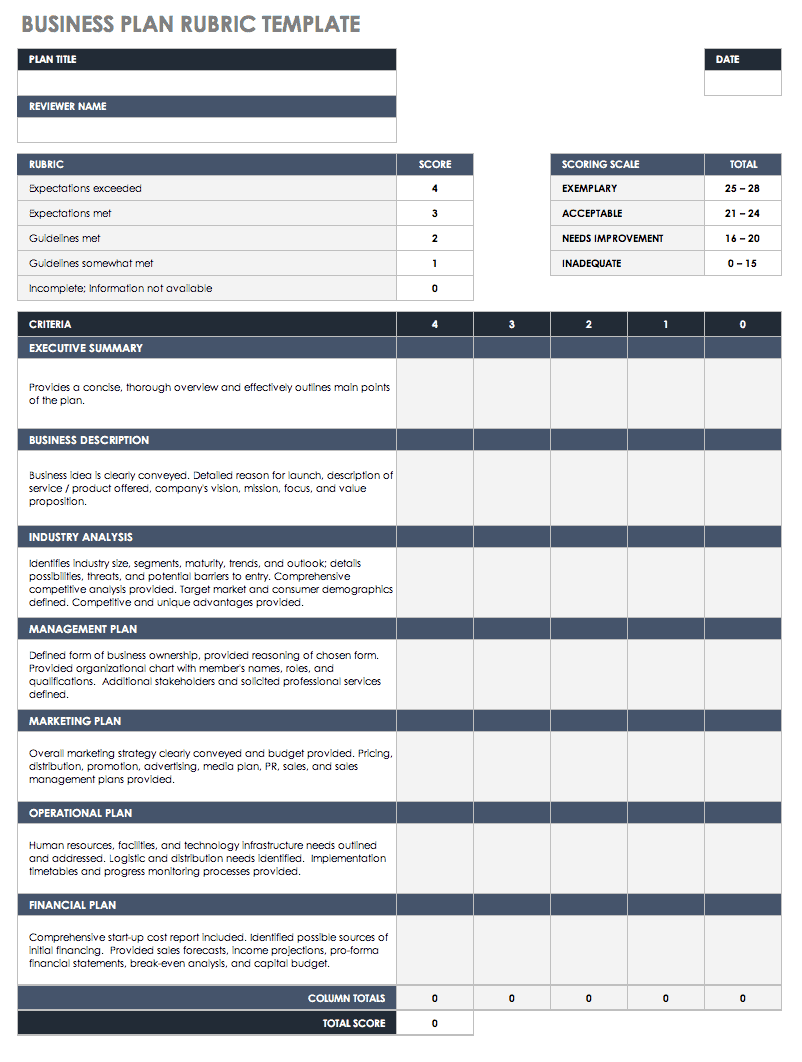

Simple Business Plan Rubric Template

Download Simple Business Plan Rubric

Excel | Word | PDF | Smartsheet

Once you complete your business plan, use this business plan rubric template to assess and score each component of your plan. This rubric helps you identify elements of your plan that meet or exceed requirements and pinpoint areas where you need to improve or further elaborate. This template is an invaluable tool to ensure your business plan clearly defines your goals, objectives, and plan of action in order to gain buy-in from potential investors, stakeholders, and partners.

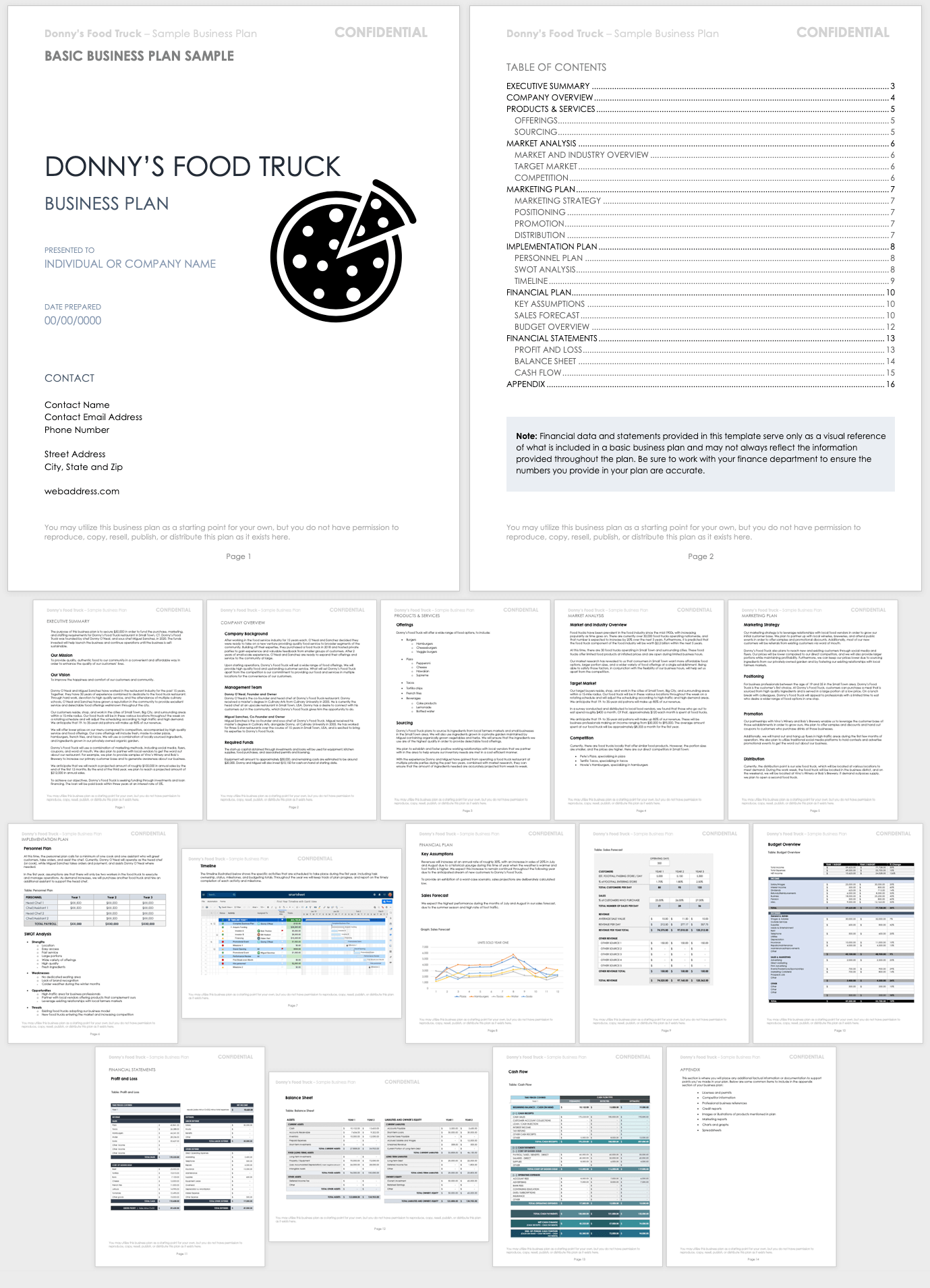

Basic Business Plan Sample

Download Basic Business Plan Sample

This business plan sample serves as an example of a basic business plan that contains all the traditional components. The sample provides a model of what a business plan might look like for a fictional food truck business. Reference this sample as you develop your own business plan.

For additional resources to help support your business planning efforts, check out “ Free Strategic Planning Templates .”

Main Components of a Business Plan

The elements you include in your business plan will depend on your product or service offerings, as well as the size and needs of your business.

Below are the components of a standard business plan and details you should include in each section:

- Company name and contact information

- Website address

- The name of the company or individual viewing the presentation

- Table of Contents

- Company background and purpose

- Mission and vision statement

- Management team introduction

- Core product and service offerings

- Target customers and segments

- Marketing plan

- Competitive analysis

- Unique value proposition

- Financial plan (and requirements, if applicable)

- Business and industry overview

- Historical timeline of your business

- Offerings and the problem they solve

- Current alternatives

- Competitive advantage

- Market size

- Target market segment(s)

- Projected volume and value of sales compared to competitors

- Differentiation from competitors

- Pricing strategy

- Marketing channels

- Promotional plan

- Distribution methods

- Legal structure of your business

- Names of founders, owners, advisors, etc.

- Management team’s roles, relevant experience, and compensation plan

- Staffing requirements and training plans

- Physical location(s) of your business

- Additional physical requirements (e.g., warehouse, specialized equipment, facilities, etc.)

- Production workflow

- Raw materials and sourcing methods

- Projected income statement

- Projected cash flow statement

- Projected balance sheet

- Break-even analysis

- Charts and graphs

- Market research and competitive analysis

- Information about your industry

- Information about your offerings

- Samples of marketing materials

- Other supporting materials

Tips for Creating a Business Plan

It’s easy to feel overwhelmed at the thought of putting together a business plan. Below, you’ll find top tips to help simplify the process as you develop your own plan.

- Use a business plan template (you can choose from the variety above), or refer to the previous section to create a standard outline for your plan.

- Modify your outline to reflect the requirements of your specific business. If you use a standard business plan outline, remove sections that aren’t relevant to you or aren’t necessary to run your business.

- Gather all the information you currently have about your business first, and then use that information to fill out each section in your plan outline.

- Use your resources and conduct additional research to fill in the remaining gaps. (Note: It isn’t necessary to fill out your plan in order, but the executive summary needs to be completed last, as it summarizes the key points in your plan.)

- Ensure your plan clearly communicates the relationship between your marketing, sales, and financial objectives.

- Provide details in your plan that illustrate your strategic plan of action, looking forward three to five years.

- Revisit your plan regularly as strategies and objectives evolve.

- What product or service are we offering?

- Who is the product or service for?

- What problem does our product or service offering solve?

- How will we get the product or service to our target customers?

- Why is our product or service better than the alternatives?

- How can we outperform our competitors?

- What is our unique value proposition?

- When will things get done, and who is responsible for doing them?

- If you need to obtain funding, how will you use the funding?

- When are payments due, and when do payments come in?

- What is the ultimate purpose of your business?

- When do you expect to be profitable?

To identify which type of business plan you should write, and for more helpful tips, take a look at our guide to writing a simple business plan .

Benefits of Using a Business Plan Template

Creating a business plan can be very time-consuming, especially if you aren’t sure where to begin. Finding the right template for your business needs can be beneficial for a variety of reasons.

Using a business plan template — instead of creating your plan from scratch — can benefit you in the following ways:

- Enables you to immediately write down your thoughts and ideas in an organized manner

- Provides structure to help outline your plan

- Saves time and valuable resources

- Helps ensure you don’t miss essential details

Limitations of a Business Plan Template

A business plan template can be convenient, but it has its drawbacks — especially if you use a template that doesn’t fit the specific needs of your business.

Below are some limitations of using a business plan template:

- Each business is unique and needs a business plan that reflects that. A template may not fit your needs.

- A template may restrict collaboration with other team members on different aspects of the plan’s development (sales, marketing, and accounting teams).

- Multiple files containing different versions of the plan may be stored in more than one place.

- You still have to manually create charts and graphs to add to the plan to support your strategy.

- Updates to the plan, spreadsheets, and supporting documents have to be made in multiple places (all documents may not update in real time as changes are made).

Improve Your Business Plan with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Business Plan Templates

Free Download

.png)

2 Essential Templates For Starting Your Business. Available as an interactive PDF or a Google Docs template.

With this business plan template, you'll be able to:

- Write a company description that sells your story

- Plan for the future: lay out goals and metrics for success

- Describe your product line in detail and plan for how to stand out from competitors

- Consider any legal formalities that require attention when starting your business

- Put together necessary financial projections to make a strong start

- Create your buyer persona and determine your product/marketing fit

Build A Business Plan That Works

Available as a one-page interactive PDF and a full template on both Google Docs and Microsoft Word!

Whether you’re starting a business or drafting a formalized document with your current business goals, it’s important to clearly defi ne the scope of all aspects of the venture — from mission, to target customers, to fi nances, and beyond.

When just starting out, it can be tempting to think of a business plan as simply your company’s name and a description of your product or service. But in reality, planning a business involves thinking through a lot more details.

In this business plan template we’ll guide you through the steps of writing company and product descriptions, setting sales and marketing goals and plans, and thinking through legal and fi nancial logistics. We've included a plain text, designed , and completed example version of this template.

Frequently Asked Questions (FAQs)

How do you write a business plan.

A business plan is a formal written document that you can use to identify the purpose of your company, make important decisions about your future and help grow your company. HubSpot's free business plan templates provides guidance to establishing your company mission, customer research, competition, and a business strategy to profitability.

Why do I need to fill out the information requested?

We will always keep your personal information safe..

We ask for your information in exchange for a valuable resource in order to (a) improve your browsing experience by personalizing the HubSpot site to your needs; (b) send information to you that we think may be of interest to you by email or other means; (c) send you marketing communications that we think may be of value to you. You can read more about our privacy policy here .

Where can I get a free business plan template?

HubSpot's Free Business Plan Templates are the best way to create a professional, thorough business plan. The templates include instructions and everything you need to know about starting your company.

Is this really free?

Absolutely.

Just sharing some free knowledge that we hope you’ll find useful. Keep us in mind next time you have marketing questions!

What are the basic format of a business plan?

A business plan is a written document that outlines the company's goals, strategy and implementation. The format of the plan varies depending on the type of organization (e.g., for-profit or nonprofit) and size, but most plans share some common features such as an overview, executive summary, and financial information.

What is the best business plan template?

A great business plan template clearly defines the scope of the venture -- from mission, to target customers, to finances, and beyond. HubSpot's business plan template will guide you through the steps of writing company and product descriptions, setting sales and marketing goals and plans, and thinking through legal and financial logistics.

What is needed to start a business?

If you're thinking about starting a business, you'll need to do some research first. You can't just start a business without doing any market research. Market research will tell you if there's an opportunity to turn your idea into a successful business. After that, write your business plan so that you know how much money and time it will take for the project to succeed. Use HubSpot's free business plan template today!

Set yourself up for success with this business plan template

Download the free business plan template.

All fields are required.

Easily create great, effective landing pages for free

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Business and self-employed

- Business finance and support

Write a business plan

Download free business plan templates and find help and advice on how to write your business plan.

Business plan templates

Download a free business plan template on The Prince’s Trust website.

You can also download a free cash flow forecast template or a business plan template on the Start Up Loans website to help you manage your finances.

Business plan examples

Read example business plans on the Bplans website.

How to write a business plan

Get detailed information about how to write a business plan on the Start Up Donut website.

Why you need a business plan

A business plan is a written document that describes your business. It covers objectives, strategies, sales, marketing and financial forecasts.

A business plan helps you to:

- clarify your business idea

- spot potential problems

- set out your goals

- measure your progress

You’ll need a business plan if you want to secure investment or a loan from a bank. Read about the finance options available for businesses on the Business Finance Guide website.

It can also help to convince customers, suppliers and potential employees to support you.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

SELF-EMPLOYED BUSINESS PLAN: How do I Write One?

- by Kenechukwu Muoghalu

- August 13, 2023

- No comments

- 7 minute read

Table of Contents Hide

What is a self-employed business plan, what is the importance of a business plan, is it difficult to write a self-employed business plan, #1. executive summary, #2. company overview, #3. market analysis, #4. management and organisational team, #5. competitive analysis, #6. sales and marketing strategy, #7. financial plan, #8. appendix, can you write a self-employed business plan in a day, how long should a self-employed business plan be for a small business, when should i start a self-employed business plan, still confused about how you can write a self-employed business plan, conclusion , why do business plans fail , what makes an excellent business plan, what are the common errors in the preparation of a business plan.

Whichever profession or career you determine to settle for, taking the decision to work on your terms and become self-employed is a big step. Hence, for you to run a smooth business while being self-employed, you need to have a business plan. Owning a business plan as a self-employed individual can help outline your goals and aid you achieve those goals. To get more insights on how you can run a successful business on your own, this article will cover the basic information you need to know about a self-owned business. With our self-employed business plan template, you will also learn how to write a plan for your business.

Just before we dive in, you can choose to ignore these procedures and just stick to our ready-made self-employed business plan .

A self-employed business plan is a living document that analyses your business ideas, its goals, your products or services, your mission, how you intend to make revenue, its leadership and many other details essential to its success. You can also define a business plan as a road map that will help you attain the growth of your business.

Read Also: SELF EMPLOYED MORTGAGE: How to Get One

Not every potential or successful corporation started with a business plan, but many wise founders take out time to research their ideas, market, and audience to understand the basics of how to scale in their new field. This is strictly why you need to sit down and learn how to write a self-employed business plan for you to be able to handle your business on your own. To fail to plan is to plan to fail.

Working side by side with a business plan comes with multiple advantages. As a self-employed individual, you might need some form of funding at some point, and you can only pull that through by having a business plan. Investors and banks rely solely on a business plan to evaluate the credibility of a business before agreeing to sponsor it.

Aside from needing a business plan in terms of funding, it can also help you focus on more important goals with the highest chance of success. A business plan also has the ability to help you manage your resources wisely and know when best to take in opportunities. Working for yourself can be rewarding because you get to choose what you are passionate about, work long hours and control your income, but it can only become better with a plan.

Writing a business plan can be a fun activity because all you have to do is to write down those growth strategies. But other times, the process can be daunting, especially when it is your first time. But to make it easier, we have provided a unique template that can help you create a self-employed business plan with ease. In any case, if it gets too tough along the way, you can use our ready-made business plan. Having known this, let’s analyse how to write a self-employed business plan using the template below.

How is a Self-employed Business Plan Written?

To write a business plan, you will need a structured outline that will serve as a guide on the best steps to take. These outlines will also help you construct a compelling plan that any reader will access with ease. They include:

Your executive summary is a brief of the other sections. It is more of a summary of what your business is all about. Most of the time, your readers might not have all the time in the world to go through your business plan. To curb this, they will refer directly to your executive summary. This being the case, this section should serve as a hook that will attract them to read more. Make sure to also leave it clear and concise during this course. This section should cover your financial plan, team, marketing strategy, market analysis and goals among others.

The company overview section of your self-employed business plan is where you get to explain who you are and the unique plans you have for your business. You can give a brief history of your business, yourself, industry, vision, and objectives, among others. Ensure not to leave out your short and long-term goals in this section.

Before you settle down to conclude your target market and market analysis , you will have to perform some research on your market. The essence of this research is to understand your industry and predict who your target client is. As a self-employed individual, you may require some assistance during this section. Discovering this information will also convince your readers of your ability to reach your ideal audience.

Your team should not be left out of your business plan. You should be able to tell your readers about the personnel involved in the smooth running of your business. While doing this, you can also utilise this opportunity to highlight their different roles and skills in the firm. You can also educate your readers on how each person will contribute to the growth of your company.

Your competitors are clearly not left out of this plan. In this section of your competitive analysis , you will need to research who your competitors are and also tell your readers how you plan on being different from the crowd. You also need to note their weaknesses and strengths and decipher how to approach your client better.

Your sales and marketing strategy should cover the different marketing techniques you will be applying to your business to identify prospects, sell your products, and land new clients. You can decide to create an online presence or use manual advertisements.

Your financial plan is also an essential section of your self-employed business plan. You will need to explain your current funding, a clear estimation of how much revenue your business will yield per month, a list of expenditures, a balance sheet, a cash flow statement, and an income statement.

The appendix of your business plan covers any other important supplemental documents that didn’t make their way into the plan. This document can come in the form of insurance, resumes, legal forms, credit histories, licences and permits, among others. They will also convince your readers of how credible your corporation is.

The time span solely depends on the amount of data you have at your disposal. If your business plan is a complex one that will cover a lot of information about your business, then you should be able to pull it through within 2-7 days. Whereas, when creating a basic plan, it should last for 3 hours or a day to finish.

A business plan for self-employment should be basically from two to four pages. You should focus more on making it clear, brief and concise. It does not need to be too complex and wordy. Let it serve as a clear guide that would easily define what your business is all about.

According to the current statistics, an average successful entrepreneur writes their business plan between six and twelve months after planning on how to start up a business. Constructing a plan within this time frame tends to yield more results.

If there are something entrepreneurs still find hard to manoeuvre whilst starting a business, then it is mostly getting stuck on how to write a self-employed business plan for themselves. It is normal to face difficulties considering the fact that you are new to this field.

This is exactly why we have created a professional, ready-to-use self-employed business plan for your convenience. Over the years, Businessyield consulting has helped thousands of entrepreneurs like you start up on the right foot by taking the time to construct a unique plan for your business. What else do you seek? Get a copy here and unleash those ideas.

Making provisions for a business plan before starting off any type of business is always a great way to start and validate your business idea. That is why you need to give it a good steer to be able to produce a clear, concise and realistic self-employed business plan using our template , in order to enjoy all of its benefits. You should also remember to review the plan once in a while to keep your data updated.

Owning a business plan does not fully guarantee the success of your business. Most of the time, you can face a certain failure, and this is mainly because you lack quality operational force. You end up planning the whole day and then put in zero effort to actualize your plans. Your action elements are not applied, monitored, functional, or refined. Once you do not put in the work, then your business plan will not reach its full potential.

A professional business plan should contain some necessary elements, including a marketing strategy, an executive summary, a financial plan, an operational structure, and a clear market analysis.

There are common errors that you should take note of when writing a self-employed business plan for your firm. They include using a bad business idea, neglecting the essence of an exit strategy, using an incapable team, having spelling and grammatical errors and writing half-baked financial projections among others. These are crucial errors you should take note of while writing.

Related Articles

- HOW TO PAY LESS TAX UK: 15+ Ways to Pay Less and Save More on Tax(Updated)

- CLEANING BUSINESS PLAN: Template & All You Need to Know

- All Clear Travel Insurance Best Reviews 2023

- BUSINESS PLAN WRITING SERVICE COST: Best UK Practice In 2023

Kenechukwu Muoghalu

Kenny, an accomplished business writer with a decade of experience, excels in translating intricate industry insights into engaging articles. Her passion revolves around distilling the latest trends, offering actionable advice, and nurturing a comprehensive understanding of the business landscape. With a proven track record of delivering insightful content, Kenny is dedicated to empowering her readers with the knowledge needed to thrive in the dynamic and ever-evolving world of business.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Rolling Contract: Definitions & Guidelines

<strong>online coaching business plan: how to start a coaching business now</strong>.

Home > Business > Business Startup

From Employee to Entrepreneur: 8 Steps for Transitioning to Self-Employment

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Syndicated from The Penny Hoarder

Freelancing, consulting or starting your own business could be the perfect way to launch the career of your dreams.

But making the jump to self-employment is never easy. Leaving behind the comfort and security of your day job in exchange for the massive responsibility of running your own business is exciting — but totally nerve-wrecking.

By signing up I agree to the Terms of Use and Privacy Policy .

8 steps for transitioning to self-employment

If you’ve been an employee for years, it’s tough to know where to start. Here are some important tips to keep in mind during your self-employment journey.

1. Develop a business plan

One of the first steps in transitioning to self-employment is writing a business plan .

Your business plan should outline your goals, the services or products you’ll offer, your target audience and your financial projections.

Ask yourself these questions when creating a business plan:

- What services will you offer?

- Who is your target audience and how will you reach them?

- How will you land your first contract or project? How will you find future clients and leads?

- How will you price your products or services?

- How much revenue do you need to cover expenses?

- When and where do you want to work?

- How will you grow your skills and network?

You can also check out this free 30-minute course on how to create a business plan from the Small Business Administration.

When developing your plan, be realistic about your financial projections and set achievable goals. Don't underestimate the time and resources required to get your business up and running .

This is also a good time to determine what makes your skills or service unique. How will you differentiate yourself from competitors and position yourself as an expert in your field?

2. Create wiggle room in your current job

You can work toward your new freelancing career even before you leave your old job — in fact, this is advised by most career experts.

You’re likely spending more time than necessary doing work you don’t like in your current position. Start your transition by trimming the fat.

Figure out what tasks should be completed by subordinates or other departments, and get them off your plate.

Cutting out the mundane aspects of your job, like team-wide meetings and performance reviews, can free up more time to focus on your own business.

Start to grow your side hustle , working with a few clients and gigs in the time you’ve freed up so you can replace your income and transition your work and lifestyle slowly.

Your side hustle will probably take over your free time and other hobbies for a while. But it will pay off when you’re able to leave your day job behind, start a new career and do what you love.

Need some start-up money? Here’s how to get a small business loan .

3. Get your finances ready

Aim to save three to six months' worth of living expenses in an emergency fund, plus whatever capital you need for the business.

This financial cushion will give you some breathing room if you hit unexpected expenses or a slow month.

Start saving by looking for ways to cut expenses and identify ways to save money fast, like canceling subscriptions and shopping for cheaper car insurance quotes.

Use an expense tracking app so you can identify areas where you can cut back and save more money.

By preparing yourself for life at a lower income, you can remove the financial fear that comes with quitting your day job.

Now is also a good time to take care of big expenses. Upgrade your computer, pay off credit card debt and eliminate as much other debt as possible while you can still rely on your current income.

You also need to figure out how much money you need to start your business and how you will finance it: Personal savings, small business loans or private investors .

Calculate how many hours per day and per week that you need to work in order to meet your financial goals and replace your current income.

Don't expect to make a full-time income right away and be prepared to work hard and stay committed.

Finally, create separate accounts for your business and personal finances. This makes it easier to track your business income and expenses for tax purposes. Keeping things separate also helps avoid a mix up between your personal savings and your business cash reserves .

Compare the Top Small-Business Banks

Data effective 4/20/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

4. Figure out your health care and taxes

Launching your own business means you’ll be responsible for many expenses currently covered by your employer, including taxes and health insurance.

Unlike traditional jobs, self-employed individuals are responsible for paying their own taxes. A good rule of thumb is to set aside about 20% to 35% of every paycheck you make to cover your self-employment taxes .

You’ll need to pay estimated taxes each quarter in addition to filing an annual tax return. This will include both federal income tax and self-employment tax , an additional tax levied on independent contractors currently totalling 15.3%.

Before you transition to self-employment, sit down with a certified public accountant . This professional can help set-up your accounting processes and tax reporting. A CPA can also assist in helping you create realistic billable rates.

Taxes are complicated. Check out our guide on how to file small business taxes to learn more.

Next, you’ll need to figure out your health insurance. Buying your own coverage can be costly, but luckily, there are a few ways to get health insurance if you’re self-employed.

You can purchase a plan through the Affordable Care Act (ACA) Health Insurance Marketplace . Here, you can compare health insurance from a variety of providers — and you may be eligible for subsidies based on your income.

Additionally, you can look into getting health insurance from your spouse’s employer. Or maybe you can continue working part-time for your current employer to keep your benefits in place.

5. Network and learn

Use this time before leaving your full-time job to educate yourself about freelancing and your new industry.

Continuing education and professional development are key to staying competitive in today’s job market.

Attend workshops and conferences, take online courses and read industry publications to stay up-to-date with business trends and best practices.

Networking is also key. It’s crucial to start building relationships before you make the transition to self-employment.

Learn how to utilize your resources, and find new ones. Join your local chamber of commerce , reach out to the Small Business Administration and connect with colleagues on social media.

Work to add more people to your support network over time, whether that's a mentor, a business coach or a meet-up of fellow entrepreneurs.

You don’t need to be a social butterfly to thrive at networking events. These networking tips for introverts can help.

6. Embrace time management

As a self-employed individual, you’re responsible for managing your own schedule, finances and client relationships.

It’s important to stay organized in your business and keep track of your to-do list and deadlines.

Learning how to track your time will make it easier to calculate your billable hours, create reports and conduct a proper cost/benefit analysis. It’ll also help you get time back from your business .

Consider using tools like project management software , accounting software and time-tracking apps to stay on top of your workload.

Using a timesheet calculator or a similar app for a few weeks can provide insight into your biggest time wasters, as well as your most productive hours.

7. Make the jump … gracefully

When the time comes to part ways with your job, give proper notice and maintain a positive relationship with your employer.

After all, you never know when you might need a reference or want to work with the company again on a part-time or contract basis.

Before calling it quits, review your employment contract to identify any non-compete or non-disclosure agreements you may have signed.

Don’t let these documents stop you, though.

Be proactive and let your employer know that you won’t solicit their clients. If you’re honest and objective, your employer is less likely to enforce a NDA or non-compete.

8. Know what’s holding you back — and let go of those fears

Sometimes fear is the biggest thing holding people back from transitioning to self-employment.

You have the passion and the ability to acquire all the skills and knowledge you need to do what you want. Hurdles in your life may make the transition difficult — a family who needs your time and attention, a day job that leaves you exhausted, a mortgage that insists on being paid each month.

But none of these challenges make your dream impossible.

Be prepared for the ups and downs of entrepreneurship and have a plan in place for dealing with setbacks and challenges.

Then take a deep breath and jump.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer at The Penny Hoarder. She focuses on retirement, investing, taxes, and life insurance.

Related reading

- The 5 Best Bank Accounts for Entrepreneurs

- Small-Business Grants for Women 2023: 5 Programs with Free Money for Women

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

Want affordable banking with great perks? With Bluevine, you can get a fee-free business checking account―and you can even earn up to $5,000 in interest.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Free Small-Business Budget Templates

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget template is one of the most important tools you can use to run your small business. However, many small-business owners skip this vital business management step.

The misconceptions surrounding budgeting are plenty. It seems complicated and time-consuming. But with a good business budget template, the process can be much less daunting.

An effective small-business budget template is a living document. Creating a budget and then forgetting about it is wasted effort. You must compare your actual numbers against your budgeted numbers regularly.

Therefore, your budget should be easy to access and adjust on an ongoing basis. But you don’t have to spend a lot of money on business budgeting software , if you don't want to. There are several free small-business budget templates available online.

QuickBooks Online

Why you need a business budget template

A business budget template is an essential tool for business owners who want to take care of their bottom line. Why should you invest in a smart template from the start?

Here's how a business budget template can set you up for success:

Track cash flow, expenses and revenue.

Prepare for regular business slowdowns.

Allocate your budget to the portions of your business that need capital most.

Plan for business investments and purchases.

Project all costs to starting and running your business.

Generally speaking, your business budget template can act as a business health scorecard if you invest in setting one up properly. Here's our list of the best budget templates available so you can do just that.

Capterra’s Free Small-Business Budget Template

The Capterra small-business budget template has been a fan favorite since it was published in 2015. In this one simple Excel workbook, you can create your monthly budget, your annual budget and then compare your actual numbers to your budgeted numbers. It also has a convenient overview sheet, which gives users access to their performance at a glance.

To help you through the process, Capterra has included a detailed Instructions tab, which walks you through how to use the template step by step. Start here to save yourself hours of time and frustration. As a bonus, there are several resources linked on the Instructions tab to help you create the perfect budget for your small business.

PDFConverter.com 15 Best Budgets

Rather than one bloated Excel workbook that tries to do everything, PDFConverter.com has compiled a library of 15 small-business budget templates.

These templates cover a wide range of budgeting needs, from a basic overview of your business income and expenses to marketing budget templates. The startup budget template is ideal for newbie entrepreneurs still in the planning stage of their businesses. And the cash flow template is perfect for identifying and plugging cash flow leaks.

Annual Business Budget in Google Sheets

Do you love all things Google? You can create a comprehensive budget for your small business right from Google Sheets. Simply navigate to your Sheets and then click on Template Gallery . Our friends at Intuit QuickBooks have created an annual business budget you can use for free.

To fully appreciate the power of the template, review the Summary tab after you have entered your budget figures. The tables and graphs on this tab offer a visual representation of your income and expenses, making it easy to see where you stand at a glance.

Microsoft Office Template

This beautiful template from Microsoft Office focuses exclusively on expenses, but it does that job exceptionally well. There are tabs for planned and actual expenses, a tab for automatically calculated variances between the two and an expense analysis tab complete with pie charts.

Your accounting software

While not a free template per se, you likely have a powerful budgeting tool available right inside your business accounting software . Though not as flexible as a separate template, there are many advantages to using the budgeting feature of your accounting software.

The budgeting feature in your accounting software will coincide with your chart of accounts. Depending on the software you use, you can create a budget to actual comparison reports with the click of a button, making analysis a cinch.

Some software programs even let you set multiple budget scenarios and have “cloning” features, which simplify the budgeting process after the first year.

Designing your budget

Now that you’ve chosen your business budget template, it’s time to start designing your budget. This is where many small-business owners procrastinate because people typically see budgeting as restrictive or punishing.

It's time to shift your perspective on budgeting. Most people start with income and tinker with their expense amounts until they arrive at a balanced or surplus budget. This method usually leads to unrealistic projections and ends in frustration.

Instead of a top-down approach, consider “reverse engineering” your budget by following these four simple steps:

Form your income projections and write those down outside of your budget template. Put this paper or spreadsheet away until after you have completed the next step.

Enter your expenses into your budget template. Be very honest in your entries and include everything. Going through several months’ or even a year’s worth of accounting data or bank and credit card statements will ensure you capture all your spending. This is not the step where you want to try to eliminate expenses. Record everything, only excluding expenses you have already eliminated from your monthly or annual spending.

Enter your income from the projections you formed in step 1.

Review your budget. If your budget shows a projected loss, analyze your expenses and identify areas where you can reduce spending.

This approach makes sure you avoid the temptation of forcing your budget to balance. While you do want your budget to balance — or better, to show a cash surplus — having unrealistic income or expense numbers will lead to frustration and resistance during the budgeting process.

Monthly or quarterly, compare your actual income and expense numbers to your budgeted numbers. Regular tracking helps identify financial pitfalls before they become unmanageable.

Frequently asked questions

How do i make a budget template.

You can create a small-business budget template from scratch by using free software like Microsoft Excel or Google Sheets. However, it’s often more efficient to download a template (see our list above). A template with built-in tables and formulas makes plugging in your revenue and expenses and calculating your profit or loss quick and straightforward.

What is included in a small-business budget?

Your small-business budget will include your revenue, expenses and your profit or loss. Each section will be broken into subcategories. For example, under revenue, you might have sales and income from sponsorships. Expenses might be broken down into rent, employee salaries and marketing. After you tally your revenue and expenses, you can then calculate your profit and loss statement.

How much should a small-business budget be?

A budget will vary by your business and industry. For example, you can potentially start a social media consulting business for less than $5,000. But a food truck business may necessitate a budget of at least $50,000. You must tailor your small-business budget to your unique needs.

On a similar note...

Self-Employment 101: A Guide to Starting the Process

A re you considering taking the path of entrepreneurship but feeling unsure where to begin? Well, you’re in the right place! Our guide below will go over some tips for starting the process of your self-employment journey and joining the 16 million Americans who identify as self-employed.

Keep reading to learn more about being self-employed.

Identify Your Passions and Interests

When you start a business, you have the chance to turn what you’re passionate about into a profitable venture. First, you will need to take some time to do some self-reflection. Think about what activities you enjoy and what you’re truly passionate about.

Also, think about the problems you enjoy solving, either for yourself or others. Most businesses emerge from addressing certain challenges. So, if there’s a problem you’re passionate about solving, this could be your starting point for your business venture.

Once you have some things in mind, it’s time to conduct some market research. You want to explore niches and industries that already exist. The goal is to find any gaps where your idea can fit in and help others.

Create a Business Plan

Creating a business plan is a critical step in starting any business. Briefly describe your business idea, its unique value proposition, and the problem it solves. Outline your short and long-term objectives and what you aim to achieve with the business.

You also want to define the purpose and mission of your business. Think about the legal structure of your business. The most common choices are sole proprietorship, LLC, and partnership.

It’s also important to analyze the industry your business will operate in and its current trends. Define your target audience and their specific needs in your business plan. You will also have to do a competitor analysis, where you evaluate who your competitors are along with their strengths and weaknesses.

Your business plan will need a section where you write all the details about your product or service. Highlight what makes your business product unique and different from anything else out there.

There should also be a section for your implementation plan. Create a timeline for launching your business where you include key milestones. Write down the tasks and responsibilities for you to implement the plan.

Keep in mind that the business plan you create will continue to evolve as you get started. You want to revisit this and adjust the plan as needed. Think of this plan as your roadmap that will help with day-to-day operations and even securing funding.

Legal and Practical Considerations

Once you have a business name and have decided on which legal structure is best, you will need to register your business. Depending on where you live, there are certain local, state, and federal authorities you will need to follow to stay legit. This is also where you have to see if your industry or location requires certain licenses or permits to operate legally.

For example, if your business deals with food, public health, or hazardous materials, you might need specific health and safety permits. If your business impacts the environment, then you will more than likely need environmental permits.

You can’t forget about Uncle Sam because self-employment taxes are a must to avoid any fines or legal issues in the future. You will have to keep track of all your income and expenses. It’s also a smart idea to estimate quarterly taxes because it will help you not fall behind when tax season comes around.

We recommend setting up an accounting system to help you manage all the money that comes in and out for business purposes. If you don’t have the time or are not good with finances, then you might want to consider hiring an accountant. There’s also the option to use accounting software that is linked to your bank account that does most of the sorting for you.

If you have a brand name, logo, or product that you feel people can easily use as their own, you might want to consider protecting it through copyrights and trademarks. Also, if you deal with sensitive information, then you want to use confidentiality agreements to help safeguard your data.

Marketing and Branding

The foundation of your business image is your brand identity. Part of your brand identity is your business logo, name, typography, and color scheme. The more consistent you are with these elements, the more you will create a strong and memorable presence where people start to associate your colors with your business.

For example, most people think of Target when they see red circles or Starbucks when they see a certain shade of green. The reason is that these brands have been very consistent with their color scheme throughout the years.

When you are working on your marketing, you want to identify what your unique selling proposition (USP) is. These are the things that set your business apart from the competition. When you highlight your own USP, it will help customers understand why they choose your products or services instead of your competitors.

You have to understand your target audience so that you can speak to them through your marketing. During your research, you have to identify where your target audience likes to spend their time. The goal is to show up where they are hanging out so that you can reach them.

This includes speaking to your target audience through social media platforms. This is a great place to meet and speak to your target audience.

Now You’re Familiar With Starting the Process

Taking on the task of becoming your own boss can be both exciting and challenging at the same time. Sometimes you will find yourself working a lot more than a 40-hour work week, but it’s satisfying because you are doing it for your own company instead of growing someone else’s company. As you can see, starting the process doesn’t have to be complicated.

Did our article help you out? We have more helpful guides, so make sure you check out the rest of our business section.

This article is published by NYTech in collaboration with Syndication Cloud.

- Skip to navigation

- Skip to main content

How to write a business plan

The business plan is a strategic document that summarises the plans you have for your business. It allows you to examine whether your plans are viable and whether a market exists for your product or service.

On this page

What is a business plan, business plan preparation, using a business plan template, business plan checklist, tips for writing a business plan.

What is a business plan and why write one? A business plan is not mandatory, but is often essential if you are thinking about seeking finance for your company. It also forces you to make certain choices and helps you avoid overlooking any important issues. Banks and funders often ask for your business plan before they grant you a loan or invest in your business.

Your idea is the basis for your future business. Perhaps you have been thinking about this for quite some time now, but have not yet put it into writing. Try to write your idea down in no more than a few sentences. Refine your idea as far as you can. In effect, this is the start of your business plan. Once you have succeeded in explaining your idea in just a few sentences, you will notice that writing a business plan becomes a lot easier, as it provides sharper focus. You can also give it to others to read to get tips and feedback.

A business plan template can prove useful if you are thinking about drafting a business plan yourself. Sample business plan templates are available online for download, for instance from the Qredits website . Alternatively, you could hire a consultant to write your business plan for you.

A business plan should address the following issues:

- Your idea – described in concrete terms.

- Your financial plan – how much money will you need and where will this come from?

- Your organisational plan – how will you set up your administrative system and arrange your insurance cover?

- Your marketing plan – who are your customers and your competitors?

- Business details – describe in concrete terms how you intend to put your idea into practice.

- Personal details – information about your entrepreneurial skills and/or business acumen.

- Use a template; you can find various business plan templates online.

- Start with a short summary or introduction.

- Set aside plenty of time to write your plan.

- Be realistic and honest.

- Ask others for feedback.

Related articles

- Watch the video: Registering and Starting up your business

- Registering with the Netherlands Chamber of Commerce

- A mission, vision, and strategy

Questions relating to this article?

Please contact the Startup Information Desk, KVK

Go to homepage business.govt.nz business.govt.nz

Business.govt.nz, in association with, introduction to business planning.

If you are self-employed, own or run a business, planning helps you step out of day-to-day tasks to set work goals and decide how you’re going to reach them.

Business planning is about setting a clear plan for where you and your business are going and how to achieve goals. It also involves regular monitoring to make sure you’re on track.

Why it’s important

Every business benefits from a business plan, whether you’re a one-person, part-time operation or a large corporation. Regular business planning helps you:

- have a clear plan of where you’re going and the path ahead

- build a business that best suits you and your lifestyle

- understand your current business skills and identify any gaps

- spot opportunities that can help you reach your end goal

- use your resources wisely — without a plan you can end up spreading your time, money and energy too thinly

- know whether to say yes or no to opportunities that come up — if they don’t support your vision, move on.

Countdown to launch

Before launching Common Ledger, Carlos Chambers and his team had an idea for software to streamline the information accountants received from their clients’ different programs. They spent six months speaking to accountants in New Zealand and Australia to understand their potential market and refine their product.

“We learned there was this really deep problem that accountants around the world were facing. That’s what we were looking for — huge problem and huge opportunity and a huge way to really help this industry move forward.”

The next step was to develop an 18-month plan and a three-to-five-year strategy to turn their start-up into a fully fledged company. They’ve since raised more than $1m and launched in both countries.

“We’re close to our targets on our initial forecasts. We’ve brought on the right board. We’ve hired the right team members. All these things are probably the result of thorough planning. We would never have been able to usefully create our strategy if we hadn’t done that first six months of research.”

Read Common Ledger’s full story — and those of other small businesses — on our case studies page:

See what others are doing

Common elements in business planning

What goes into a business plan can vary, but often includes:

- an overview of your business — name, products or services you offer, revenue, key partners, goals

- an overview of your market — your customers, your industry, how many people will buy your product or service, whether you’ll sell overseas

- your marketing strategy — how you’ll get customers, the cost of attracting customers

- competitor analysis — your rivals, how your strengths and weaknesses compare, your competitive edge

- financials — your costs, revenues, growth rates, measures of success

- team — employees’ skills, skills you need, your mentors and advisors

- operations information — IT, systems, compliance.

Introduction to business finance

What you need to know about exporting

Business planning tips

- Put time in your diary for business planning — monitoring progress regularly is good to do.

- Set short-term, mid-term, and long-term goals to help you understand the milestones you’re trying to reach.

- Do your planning offsite — getting out of your normal workplace can put you in a different mindset and help you see things you wouldn’t normally.

Involving your team in business planning can be a good thing. Don’t delegate the planning though. Having the owner or manager involved in setting the direction of the business is important.

Common mistakes

Avoid these common mistakes:

- Getting caught up in the day-to-day running of the business without taking the time to look forward.

- Reacting to things as they pop up as opposed to setting clear goals.

- Investing time and money into things outside your value proposition. Make sure you have a clear statement that sets out how your product or service solves customers’ problems, and refer to it when you plan.

- Creating a business plan that sits on the shelf and doesn’t get used.

- Failing to regularly check in on how you’re tracking to your plan.

- Failing to think through what happens if your business grows. For example, if you might export your goods or services in future, you’ll need to prepare well in advance.

How helpful was this information?

"Rate this" is required

You must enable JavaScript to submit this form

Related content

Business planning advice.

Whether you’re growing fast or new to business, expert advice can kick-start your planning.

Start-up business plan

Use this template to help write a great plan for your new business.

10-step business plan

Quick-focus planning to make sure you work on the right things for your growing business — every day.

Test if you’re ready to grow

Are you and your business ripe to expand? Take our self-assessment test and find out.

Who to talk to and when

Electrical Contractor Business Plan Template

Written by Dave Lavinsky

Electrical Contractor Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their electrical contracting businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an electrical contractor business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your electrical contractor business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start an electrical contractor business, or grow your existing electrical contractor business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your electrical contractor business in order to improve your chances of success. Your electrical contracting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Electrical Contractor Businesses

With regards to funding, the main sources of funding for an electrical contractor business are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the electrical contractor will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for electrical contractor businesses.

Finish Your Business Plan Today!

How to write a business plan for an electrical contracting business.

If you want to start an electrical contracting business or expand your current one, you need a business plan. Below are the details for each section of your electrical contractor business plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of electrical contractor business you are operating and its status. For example, are you a start-up, do you have an electrical contractor business that you would like to grow, or are you operating a chain of electrical contractor businesses?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the electrical contractor industry. Discuss the type of electrical contractor business you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of electrical contractor business you are operating.

For example, you might operate one of the following types of electrical contractor businesses:

- Commercial Electrical Contractor : this type of electrical contractor business will focus on developing outdoor spaces such as college campuses, parks, gardens and more.

- Residential Electrical Contractor: this type of electrical contractor business collaborates with homeowners to design and/or install electrical and electronic systems.

- Industrial Electrical Contractor: this type of electrical contractor business works on large projects for manufacturers or warehouse facilities.

In addition to explaining the type of electrical contractor business you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, number of positive reviews etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the electrical contractor industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the electrical contractor industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your electrical contractor business plan:

- How big is the electrical contractor industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your electrical contractor business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your electrical contractor business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: homeowners, businesses, general contractors, developers, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of electrical contractor business you operate. Clearly, a homeowner would respond to different marketing promotions than a local government, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most electrical contractor businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target audience. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Dog Kennel Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other electrical contractor businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes in-house electricians and homeowners who do minor electrical work themselves. You need to mention such competition as well.

With regards to direct competition, you want to describe the other electrical contractor businesses with which you compete. Most likely, your direct competitors will be electrical contractors located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of projects do they specialize in?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide a wider array of services?

- Will you provide special discounts or perks for returning customers?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an electrical contractor business plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of electrical contracting business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to installing traditional electrical systems, will you also install smart home control systems or fire and security systems?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your electrical contractor company. Document your location and mention how the location will impact your success. For example, is your electrical contractor business located in a growing community with a booming construction sector, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your electrical contractor marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your business operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your electrical contractor business, including marketing your business, working on current projects, prepare for upcoming projects, and overseeing the entire project.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to install your 500 th electrical system, or when you hope to reach $X in revenue. It could also be when you expect to expand your electrical contractor business to a new city.

Management Team

To demonstrate your electrical contractor business’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing electrical contractor businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in overseeing construction projects or successfully running their own electrical contractor businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you work on 1 project at a time or will you oversee multiple projects at any given time? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your electrical contractor business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.