Qualitative Market Research Methods + Examples

Qualitative market research is one of the most effective ways to understand consumer sentiment . If you really want to know how people feel about a product or business; and the ‘why’ behind it, qualitative research will tell you what you need to know.

This guide covers qualitative market research methods, including the different tools and techniques, their benefits, and examples of qualitative research in action.

What is qualitative market research?

Qualitative market research uncovers key insights into how people feel about a product or brand. It’s more of a touchy-feely type of market research than quantitative research , often performed with a small, handpicked group of respondents.

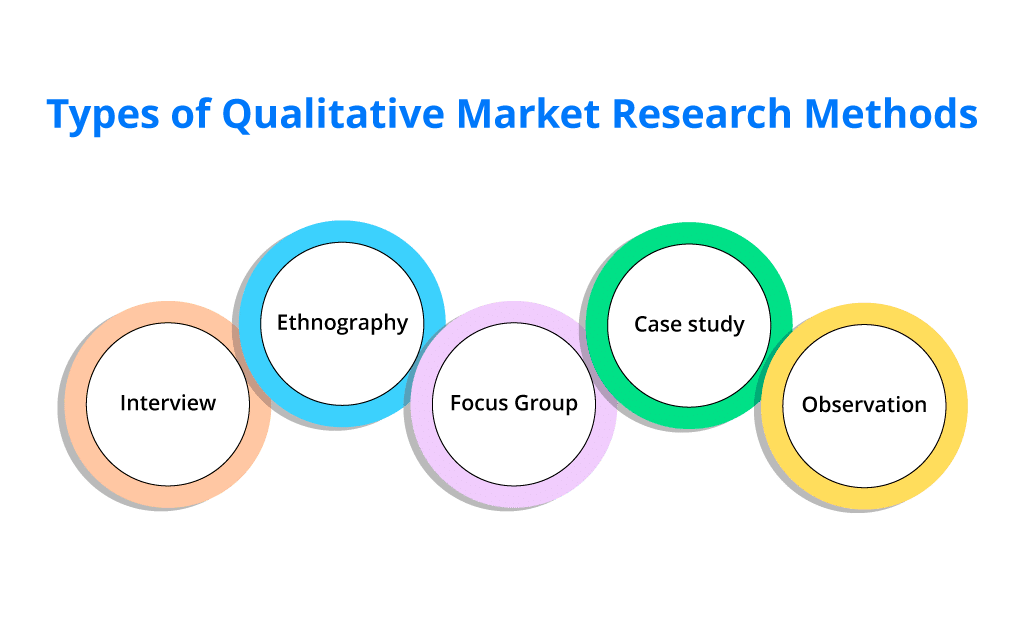

There are many different ways to conduct qualitative research. These include focus groups, interviews, ethnographic, observational research, and even biometrics. Although it takes time to conduct and analyze results, it’s one of the most popular types of market research .

Qualitative market research methods

Market research surveys are the most widely used qualitative market research method. Perhaps that’s down to their ease of use, availability, or the low cost of getting them out, in, and analyzed. But let’s be honest; all types of market research have pros and cons, which is exactly why picking the right technique is key.

Focus groups

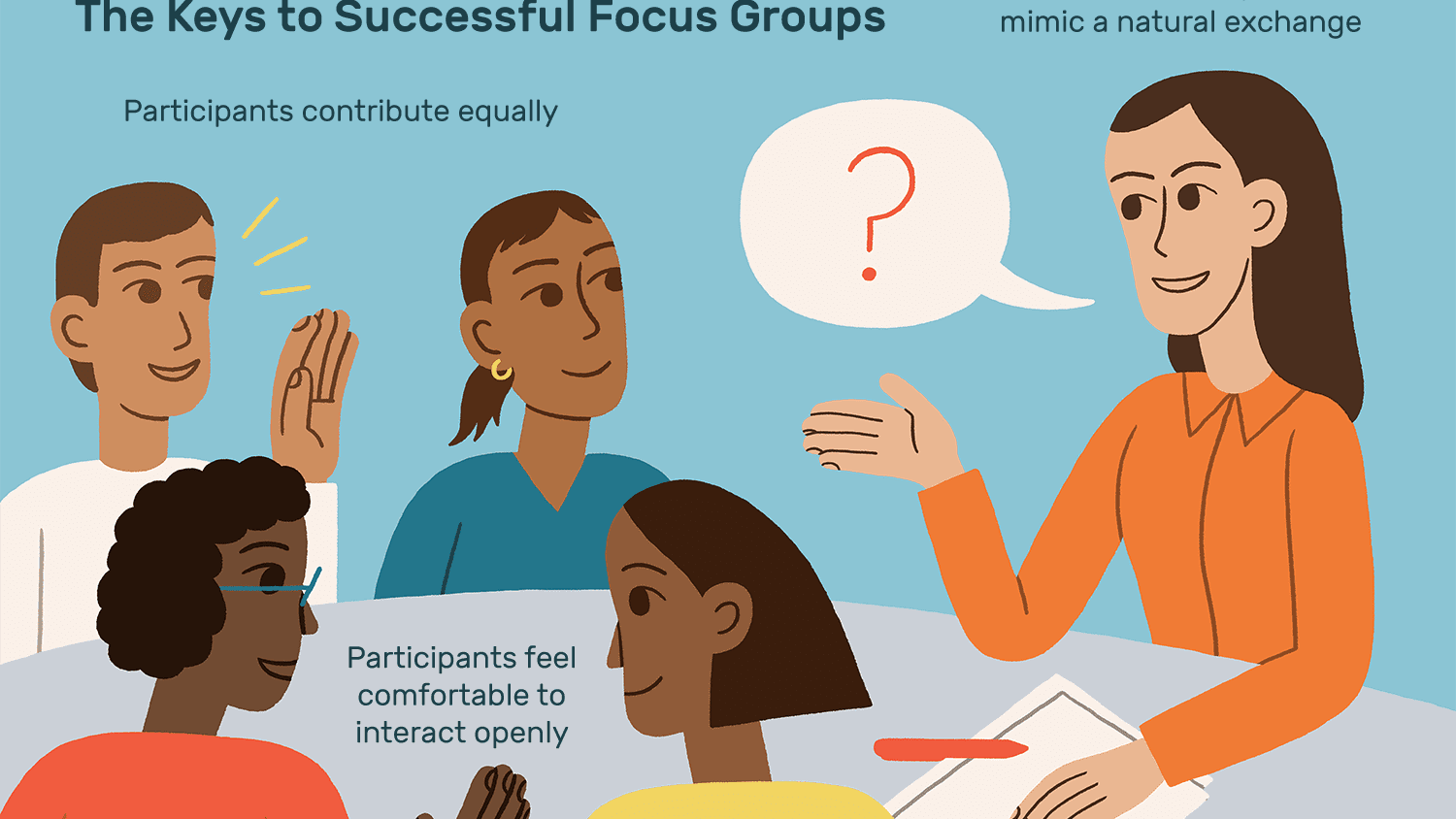

What it is: Focus groups can be done in person or online. Participants are selected from within a target market or audience. Typically, people answer questions about the how, what, and why of a specific topic. While focus group formats vary, participant numbers should always be limited to ensure each person has the chance to contribute.

Best for: This type of qualitative market research is beneficial for testing new concepts or products in a market. It’s also good for getting feedback on existing products and things like usability, functionality, and ease of use.

Good to know: Online focus groups are becoming increasingly popular. As no interaction is required between participants, running them online allows responses to be collected in minutes without impacting data quality. It also reduces costs and means more people can attend due to fewer travel or time constraints.

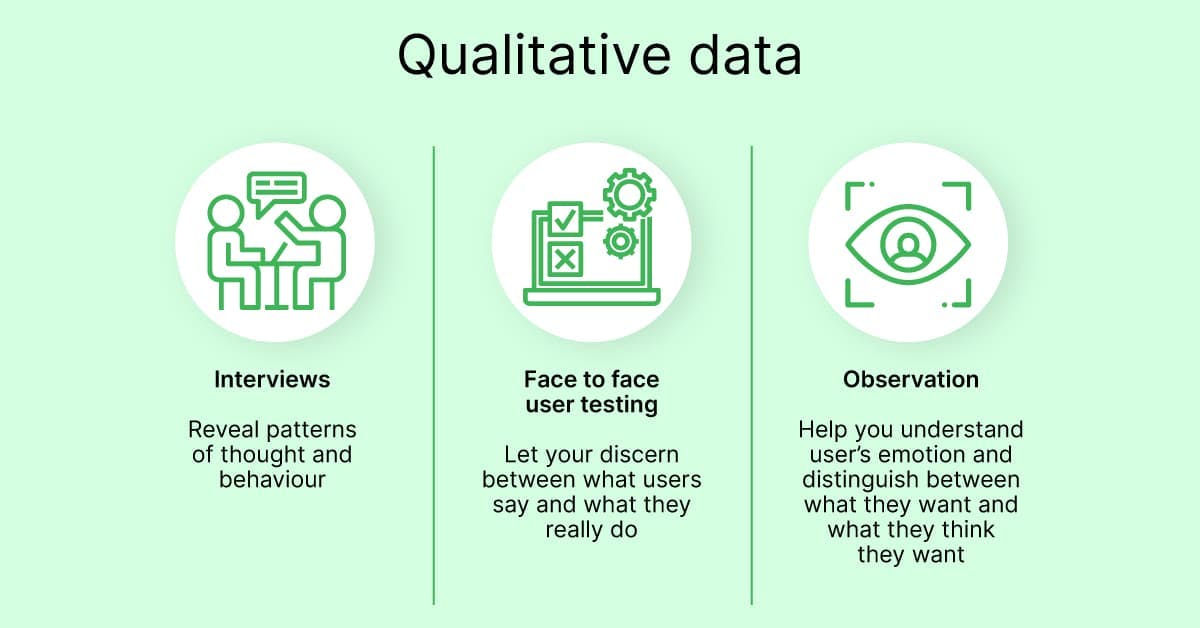

What it is: Interviews are a tried-and-trusted qualitative research method that can be done in person or over the phone. It’s a highly personal approach that takes a conversational format between just two or three people. Researchers ask pre-set questions designed to collect intel and insights for further analysis. Interview formats vary depending on the research questions .

Best for Granular feedback from people within a target market or a target persona. Researchers obtain details about a person’s intentions, beliefs, motivations, and preferences.

Helpful Scroll to the qualitative market research examples section and view a copy of our template for customer interviews at Similarweb.

Read more: 83 Qualitative Research Questions & Examples

What it is: Most people have used or consumed case study content in the past without necessarily realizing it’s a type of qualitative research. It analyzes contextual factors relevant to a specific problem or outcome in detail. Case study research can be carried out by marketing professionals or researchers and typically follows a structured approach, exploring a problem, the solution, and its impact.

Case studies can take anything from one month upwards to a year to develop and often involve using other types of qualitative market research, such as focus groups or interviews, to inform key content.

Best for: They’re more commonly used as a marketing tool to showcase a solution or service’s impact within a target market or use case. But, new product or service developments are two other popular applications.

What it is: One of the lesser-known methods of qualitative market research is biometrics. There’s an article about this on Bloomberg , showcasing how Expedia uses biometrics in its market research stack. The format for their project takes the trusty focus group scenario, adding a modern twist.

In this example, research participants were asked to attach a set of skin response sensors to their hands. But there could also be eye-tracking, emotional analysis, heat mapping, or facial sensors being used to track responses in tandem. Individuals were tasked with surfing the web; a researcher requested they do specific tasks or carry out a search in a self-directing manner. Responses are recorded, analyzed, and translated into meaningful insights.

Depending on the tech being used, the direction, and the goal of the research, this type of qualitative market research can show:

- How people surf the web or use a site

- The way people react in a specific situation

- How they respond to content, CTAs, layouts, promotions, tasks, or experiences

- Insights into what drives people to take action on a site

Best for: Larger digital-first companies with a budget to suit; those who want to perform UX testing to improve the content, customer journey, experience, or layout of a website.

Insightful The adoption of biometric technology in market research was at an all-time high in 2020. With the technology becoming more widely available, the adoption cost will likely fall, making it more accessible to a larger pool of organizations.

Ethnography

What it is: Enthnograprhic market research (EMR) is one of the costliest types of qualitative research. An experienced ethnographic researcher is needed to design and conduct the study. It analyzes people in their own environment, be it at home, an office, or another location of interest.

Research can take place over a few hours, months, or even years. It’s typically used during the early-stage development of a user-centric design project. But it can also be useful in identifying or analyzing issues arising once a product or service has gone to market.

Best for: It’s widely adopted within useability, service design, and user-focused fields. Getting under the skin of a design problem helps develop a deeper understanding of issues a product should solve. Outcomes help to build improvements or new features in products or services.

Grounded theory

What it is: Researchers use various qualitative market research methods, such as surveys or interviews, and combine them with other types of secondary market research to inform outcomes. Typically, participant groups are between 20-60, making it a larger sample size than focus groups. Responses are collated, and a series of specialist coding techniques are used to formulate a theory that explains behavioral patterns.

Best for: Organizations can better understand a target audience by using research to generate a theory. The findings provide explanations that can inform design decisions or spark new innovation through features or improvements to products or services. A typical use case could be when particularly heavy use of a product occurs or frustrations arise with usability – grounded theory is then used to explore the reasoning behind these behaviors.

Observational

What it is: Contrary to belief, this type of qualitative market research can occur remotely or on-site. A researcher will observe people via camera or being physically present in a shopping mall, store, or other location. Systematic data are collated using subjective methods that monitor how people react in a natural setting. Researchers usually remain out of sight to ensure they go undetected by the people they observe.

Best for: Low-budget market research projects. Suited to those with a physical store or who seek to examine consumer behavior in a public setting. Researchers can see how people react to products or how they navigate around a store. It can also provide insights into shopping behavior, and record the purchase experience.

Useful to know: Observational research provides more effective feedback than market research surveys. This is because instinctive reactions are more reflective of real-world behaviors.

Online Forums

What it is: A web message board or online forum is quick and easy to set up. Most people know how they work, and users’ names can be anonymized. This makes it a safe space to conduct group research and gain consensus or garner opinions on things like creative concepts, promotions, new features, or other topics of interest. The researcher moderates it to ensure discussions remain focused and the right questions are asked to thoroughly explore a topic.

Organizations typically invite between 10-30 participants, and forums are open for anything between 1-5 days. The researcher initiates various threads and may later divide people into subgroups once initial responses are given.

Here’s an example.

If a group of male participants indicates they dislike a specific content on the forum. The moderator would create a subgroup on the fly, with the intent of probing into the viewpoints of that group in more detail.

Best for: Discussing sensitive research topics that people may feel uncomfortable sharing in a group or interview. Getting feedback from people from a broad area and diverse backgrounds is easy. And a more cost-effective way to run focus groups with similar aims and outcomes.

What it is: For a survey to be considered a type of qualitative market research, questions should remain open and closed-ended. Surveys are typically sent digitally but can also be done in person or via direct mail. Feedback can be anonymous or with user details exposed. Surveys are a type of primary research and should be tailored to the research goals and the audience. Segmentation is a great way to uncover more about a select group of people that make up a target persona or market.

Best for: A low-cost way to question a large group of people and gain insights into how they feel about a topic or product. It can be used to flesh out usability issues, explore the viability of new features, or better understand a target audience in almost any sector. Surveys can also be used to explore UX or employee experience in greater detail.

Read more: 18 Ways Businesses Can Use Market Research Surveys

Diary or journal logging

What it is: When you think about it, almost all qualitative research methods aim to help you understand the experiences, lives, and motivations of people. What better way is there to connect with how people think and feel than a journal? Yes, it’s pretty much exactly what it claims to be; a simple note-taking exercise that records regular input, insights, feelings, and thoughts over a period of time.

A survey or focus group captures sentiment at a single point in time. Whereas journal logging gives way to more frequent input without any pressures of time to consider. It’s also more reliable data, as there’s no requirement for people to think about and recall data, as input occurs at the moment. Popular formats include digital diaries, paper journals, and voice journals.

Key parameters are set out from the start. And offer prompts so people know what to record, how often they need to make an entry, the time of day (if relevant), how much they should write, and the purpose or goal of the research.

Best for: Measuring change or impact over time. They’re also a great tool to establish things like:

- Usage scenarios

- Motivations

- Changes in perception

- Behavioral shifts

- Customer journeys

Start building your story with Similarweb today

Benefits of qualitative market research.

- Flexible – It can be adjusted according to the situation. For example, if the questions being asked aren’t yielding useful information, the researcher can change direction with open questions and adapt as needed.

- Clear and open communication – Forums like these can help a brand and its customers communicate effectively. The voice of the customer is paramount, and participants are encouraged to express their values and needs freely.

- Provides detailed information – One of the biggest draws of qualitative research is the level of detail given by respondents. Data collected can be vital in helping organizations gain an in-depth understanding of consumer pain points and perspectives.

- Improve retention – Qualitative research gets under the hood, helping an organization know how consumers think or feel about a business or its products. The intel can shape future offerings or improve service elements, thus boosting loyalty.

Qualitative market research examples

Whether you’ve carried out qualitative research in the past or not, it’s never a bad idea to look at what others are doing. Who knows, it could inspire your research project or give you an example of qualitative research in action to use as a base.

Here are three qualitative market research examples in action!

Example 1: This Voice of Customer questionnaire is an example of qualitative research we use here at Similarweb.

Example 2: A market research survey used in retail. It’s sent out with a digital copy of a store receipt and aims to explore how people feel about their in-store experience.

Example 3: A case study report published by Forrester Consulting. It highlights the ROI of Similarweb following a period of use and a forward-looking estimation.

A smarter way to get Similar results in less time

While different in nature, qualitative and quantitative research go hand in hand. In short, qualitative can explain what quantitative research shows. While qualitative research costs vary, it takes time to plan, conduct, and analyze. Not everybody has the luxury of time or the resources to carry out their own qualitative market research. And with how fast markets and consumer behaviors shift, it’s not always the optimal solution.

Feature spotlight: Audience Analysis

Similarweb’s audience behavior research tool shows you where people in your target market spend their time online. Uncovering critical, unbiased insights at pace.

- Audience metrics show you demographics , geographics , audience loyalty , and interests.

- Competitive insights allow you to see any rivals’ reach and unpack their successes.

- Visualize your target market like never before – layered with insights that show where and how they spend time online.

- Segment your audience to see industry-specific consumer interests.

- Discover untapped audiences to acquire and grow your share of market.

As a single source of truth, Similarweb Research Intelligence lets you get the measure of the digital world that matters to you most. At a glance, you can see what’s happening in any market, and drill down into any rival or audience group to spot trends, analyze changes, and inform key decisions; fast. As far as market research tools go, it’s the only platform that brings together feedback from mobile web, desktop, and mobile apps in a single place. Giving you a complete and comprehensive picture of your digital landscape.

Wrapping Up…

Compared to quantitative research, the qualitative approach can take more time and cost more money. But, there are distinct benefits that make it hard to dismiss. While statistical research can show you the ‘what,’ ‘who,’ and ‘when’, qualitative research complements this and helps uncover the ‘why’ and ‘how’ – giving you the complete picture.

From the high-hitting budget owners to the SMBs who need to research a market or audience, qualitative research is a vital tool that’ll help you uncover insights and focus on growth.

Digital intelligence platforms like Similarweb can give you a framework to outline a story that can be filled in with qualitative research later down the line.

What’s the difference between quantitative and qualitative research methods? Qualitative market research is a type of primary research method that explores how people think and feel about a topic. Quantitative research is statistics-based and analyses numerical data.

What are the different types of qualitative market research? The most popular types of qualitative market research include Focus groups, interviews, ethnography, case studies, grounded theory, observational, online forums, open-ended surveys, biometrics, narrative, thematic analysis, diary or journal logging, thematic analysis, and phenomenological study.

How is qualitative research used in marketing? Qualitative market research serves as a tool that helps marketing teams identify consumer needs, refine product messaging, generate ideas for campaigns, discover new channels, and develop targeted campaigns that resonate with target audiences.

What Types of Questions are Asked in Qualitative Market Research? Qualitative market research often focuses on open-ended questions that allow respondents to provide detailed answers about their attitudes, opinions, and experiences. Examples of questions include: What factors influence your decision to purchase a particular product or service? How do you use a product or service? What do you like or dislike about a product or service?

What are the Limitations of Qualitative Market Research? Qualitative market research can be subjective and may be limited by the number of participants and the amount of time available for research. Additionally, qualitative research does not provide quantitative data, which can be useful for measuring and comparing consumer behavior.

Related Posts

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

From AI to Buy: The Role of Artificial Intelligence in Retail

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Industry Research: The Data-Backed Approach

How to Do a Competitive Analysis: A Complete Guide

Wondering what similarweb can do for you.

Here are two ways you can get started with Similarweb today!

A comprehensive guide to qualitative market research

Last updated

3 April 2024

Reviewed by

Grow your business

Understand the needs of your customers

Launch a new product

Expand into new markets

Meet any lofty goals you set for your business

The two research methods you can use to glean these insights are quantitative and qualitative.

Quantitative research provides you with hard data you can use to find the size and scale of customer sentiment, discover causal relationships between variables, and support generalizations about macro-level populations.

Qualitative market research is an open-ended research method that looks at the reasons and motivations behind customer behavior, at the micro level. Qualitative market research gives you actionable insights you can use to improve everything from your customer service strategies to your products and services.

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

- What is qualitative market research?

Qualitative market research is an open-ended research method that studies people's behavior and motivations within a specific market. While quantitative research is about hard numbers and analytics, qualitative market research takes a more generalized approach. It focuses on small sample sizes to encourage in-depth analysis of individual customers’ experiences.

The conversational nature of qualitative research is designed to encourage in-depth discussion. For businesses, qualitative market research is a powerful way to understand customers' points of view, as well as their pain points and desires.

- Why is it important to do qualitative market research?

Whether you are a CEO or a project manager, the thoughts and feelings of your customers should matter deeply to you. Through qualitative market research, you can identify the needs of your customers in a more nuanced, in-depth way than is possible with quantitative research.

Depending on the questions you pose, you can also get a feel for how customers perceive your marketing messages and communications, as well as more broad perceptions of your company as a whole.

If you're planning on launching a new product or service, qualitative market research can help you refine the launch and even make improvements. By using the feedback and insights from your research to make changes leading up to the launch, you are more likely to increase your revenue and receive glowing reviews.

- Advantages of qualitative market research

There are many advantages to qualitative market research. It's flexible, so you can adapt to the quality of information you receive. For example, if the available information isn't providing what you hoped, it's easy to change direction and collect more data using new questions.

Qualitative market research also helps you gather more detailed information than most quantitative data. While quantitative market research gives you metrics, qualitative market research allows you to better understand the subtleties within the data.

Long-term, qualitative market research can reduce customer churn. By conducting regular qualitative market research, businesses can better understand what consumers want (and what they don’t) and learn whether they are fulfilling their needs. This reduces customer churn and helps build a stronger relationship between a business and the people it serves.

- Disadvantages of qualitative market research

The most notable disadvantage of market research is that it’s time-consuming. Depending on the scope of the research and the amount of people dedicated to the project, it can take weeks or even months to complete. If you're working on a tight timeline, or if you have limited resources to dedicate to research, it might not be feasible.

Qualitative market research can also be expensive. While much of the cost will depend on the size and scope of the project, you might also need to hire additional people to help you complete the research.

If you compensate participants for their time (and experts advise some sort of compensation), that's another expense to consider.

Finally, qualitative market research is highly subjective, as the conclusions are drawn by individual researchers and their interpretation and analysis.

- Eight qualitative market research methods

The most common methods for qualitative market research include focus groups, individual interviews, and observations. However, many other methods should be considered as viable options for your market research.

Social media analysis

Social media has become an important part of many people's lives, with millions of people around the world interacting with their favorite platforms on a daily, even hourly, basis. Social media analysis can, therefore, be a powerful way to gather and analyze information.

If your brand is active on social media, take the opportunity to solicit responses from customers who follow you. This can be via a survey feedback form or some sort of direct response from customers.

You can also perform content analysis on social media, scanning comments left by consumers on your posts and checking for frequently used words.

For the most in-depth responses, consider gathering insights directly from the people who follow your pages and regularly interact with you.

Lifestyle immersion

If customer comfort is one of your top priorities as you conduct market research, lifestyle immersion might be the best option.

Lifestyle immersion is a research method that allows the researcher to observe the customer in their natural environment. By observing the participant in a natural setting, you can see their unguarded behavior and learn more about their needs and motives.

Focus groups

Focus groups are a popular method for conducting qualitative market research. Focus groups are typically comprised of 6–10 people, along with a market researcher who functions as a moderator.

During the focus group, participants are encouraged to share their unguarded thoughts and opinions on a product, service, or marketing campaign.

Traditionally, focus groups were held in person, since verbal and non-verbal reactions are an important part of measuring responses. However, web-based focus groups have been gaining popularity in recent years, especially in light of the COVID-19 pandemic. Online focus groups tend to be more cost-effective and convenient for most participants.

Observations

Observations, also known as shop-alongs, involve researchers following participants as they walk through a store. The goal of observations in qualitative market research is to gauge customers’ interactions and reactions to things they encounter, including products, displays, and advertising.

Observations don't require the market researcher to physically accompany participants. Typically, the researcher will observe from a distance or watch a camera feed.

Individual interviews

Individual interviews are a highly personalized method of conducting market research. These interviews are in person, over the phone, or through video-conferencing software.

They tend to be most successful when held as part of a free-flowing conversation that puts the participant at ease and makes them feel comfortable sharing their unfiltered thoughts and opinions. The interviews can be structured or unstructured, depending on the nature of the questions and your overall goals for the project.

Include plenty of open-ended questions in your interview outline to keep the conversation moving. Pay attention throughout the interview to see how the participant responds to the questions and if they seem uncomfortable or ill at ease. If they do, switch gears to make the conversation more relaxed again.

Diary or journal-logging

A diary study, also known as journal-logging, is a research method that aims to collect data about user behaviors, activities, and experiences over a set period.

During the designated reporting period, participants are asked to keep a diary and record specific information about the activities you want to analyze. The data is self-reported by participants when the reporting period is up.

Diary studies can be useful for gathering information about users’ habits and thought patterns. They can also effectively capture attitudes and motivations. However, it can be challenging to recruit dedicated users, since diary studies require greater involvement over a longer period than more traditional market research methods.

Surveys are a popular method of conducting market research. A powerful form of primary research, surveys are endlessly customizable. They can be done:

Over the phone

Via email or other online delivery method

If you opt for an online survey, test the software ahead of time, so you can be sure everything works properly and displays well on mobile devices.

It's also a good idea to run a test survey with a smaller group. This allows you to refine your questions and eliminate any confusing wording.

Ethnographic research

Ethnographic research involves observing participants in their natural environment, primarily how they go about mundane tasks such as cleaning their house or preparing a meal. Unlike observations, ethnography can involve a variety of approaches, including diary studies and video recordings.

The goal of ethnographic research is to understand the social dynamics, beliefs, and behaviors of participants through direct observation and participation in their daily activities. Ethnographic research can take place over an extended period, from a few weeks to a year or more. It's versatile and is best done with the assistance of an experienced ethnographic researcher.

- An example of qualitative market research

One of the main benefits of qualitative market research is its flexibility. No matter what your goal is or what outcome you're hoping for, you can design an effective study.

One example of qualitative market research using a focus group is a cereal company wishing to update the packaging of one of its most popular products. After producing several design concepts, the company opts to commission a series of focus groups to gauge responses to each concept.

During the focus groups, with the help of a moderator, participants discuss each design, evaluating the pros and cons. Based on the feedback received in the focus groups, the cereal company can move forward with the design most appealing to their customers.

- Best practices for qualitative market research

While qualitative research is flexible, there are still best practices to follow. Regardless of which research method you choose, consider these tips when crafting your approach and designing the questions.

Accurately identify research goals

Before embarking on any market research, you should know your end goal. Think about the specific questions you want answered, including the nature of the product or service you wish to refine or develop. Outline your goals and share them with every project stakeholder, including managers and the CEO, if necessary.

Understand your customers

Knowing your customers is vital for accurately targeting survey participants. Your business should have a customer profile that includes basic demographics such as:

Shopping habits

Use this profile to create questions that are useful for your study. When crafted thoughtfully, your questions will identify needs that aren't being met and meet study participants where they are.

Choose the most appropriate research method

There are many ways to conduct qualitative market research, but not all of them might be right for your unique needs. Think about what method will give you the optimal results and work best for the study participants you wish to recruit.

Focus groups are an ever-popular research method, but it isn't always possible to dedicate time and energy to moderating one. A survey or series of observations might be more effective, depending on your available resources and goals.

Use open-ended questions

The goal of qualitative market research is to gain thoughtful responses from participants. Use open-ended questions that require more than a simple yes or no response. The idea is to maintain an open dialogue, even through vehicles such as surveys or focus groups.

Test out questions on yourself and your team members before launching them to participants, so you can be sure they make sense and give people the chance to truly share their thoughts.

- Tips for qualitative data analysis

Qualitative data analysis is rarely a linear process. Since qualitative market research often doesn't result in hard numbers, be flexible in your approach to analysis.

After you finish your research, organize and collate your responses into one location for further analysis. If you have audio or video files, allocate time to transcribe the data, whether that means bringing in a transcriptionist or guiding your team members through the process.

As you go through the responses, become familiar with the data. This will help you better understand your customers and identify any potential gaps in the research. Always involve other stakeholders in the process, not only along the way but also once the final results have been collated. This promotes transparency in the project and improves communication across the board.

Are customer surveys qualitative?

Customer surveys are one method of market research. They can be made qualitative or quantitative, depending on the nature of the questions. They are one of the most popular forms of qualitative market research because they are versatile and highly customizable. Surveys can be done in person or through web software, such as email.

What are qualitative marketing objectives examples?

While quantitative objectives are usually specific and measurable, qualitative marketing objectives are more subjective. They tend to be conceptually broad, such as "we want to learn more about how our customers rank our service compared to our competitors,” "we want to increase brand awareness," and "we want to improve customer satisfaction." It can be helpful to have qualitative and quantitative objectives for your market research, depending on the nature of the project and whether it's related to a specific product or service.

Get started today

Go from raw data to valuable insights with a flexible research platform

Editor’s picks

Last updated: 3 April 2024

Last updated: 26 May 2023

Last updated: 11 April 2023

Last updated: 22 July 2023

Last updated: 1 June 2023

Latest articles

Related topics, log in or sign up.

Get started for free

- Pollfish School

- Market Research

- Survey Guides

- Get started

The Complete Guide to Qualitative Market Research

So what exactly is qualitative research? At a glance, this type of research method seeks to gather in-depth data about a phenomenon without focusing on numerical data or on quantities.

But there is much more to this kind of study method. Learn holistically about qualitative market research with this complete guide.

What Defines & Makes Up Qualitative Research?

Qualitative research is centered around experiences, ideas and opinions. As such, it does not focus on statistical or quantitative outcomes. Instead, it seeks out an in-depth understanding of an issue, occurrence or phenomenon.

Thus, this research method zeroes in on the “what” and more importantly, the “why” of a research subject. (Unlike quantitative research, which focuses on the “how much”).

Here are some of the applications of qualitative research:

Understanding an issue in greater depth

Finding the reason behind an occurrence (whether it’s desirable or undesirable)

Uncovering trends in target market opinions

Forming educated solutions to address customer/studied subject concerns

Discovering the causes of certain actions

Qualitative research generally relies on a smaller sample size in order to get a deep read of happenings, causes and motivations. This kind of research method functions through the usage of open-ended and exploratory questions.

Understanding the “why” behind an issue is then used to make decisions on how to resolve the issue or how to improve on an existing productive situation.

Qualitative data must occur in natural environments. This denotes a kind of environment in which participants discuss their opinions at length and at ease, which researchers use to gain deeper knowledge and form inferences around a topic.

Prior to the internet, this kind of research was conducted in-person, but with the advent of the internet and innovations in market research, qualitative data has been collected online. The digital space can also serve as a natural environment.

The Five Main Types of Qualitative Research

Just as with quantitative research, there is not a single approach to conducting qualitative research. On the contrary, there are five main varieties of performing qualitative research. Aside from their methodology, these sub-categories also seek different types of answers and conclusions.

1. Narrative Research

This research is used to form a cohesive story, or narrative, by way of consolidating several events from a small group of people. It involves running in-depth interviews and reading up on documents featuring similar actions as a means of theme-searching.

The point of this is to discover how one narrative is shaped by larger contextual influences. Interviews should be conducted for weeks to months and sometimes even for years. The narrative that the researcher uncovers does not have to be presented in sequential order.

Instead, it should be projected as one with defined themes that attempt to reconcile inconsistent stories. This method can highlight the research study’s ongoing challenges and hardships, which can be used to make any improvements.

2. Ethnographic Research

The most common qualitative research method, ethnography relies on entrenching oneself in various participant environments to extract challenges, goals, themes and cultures.

As the name suggests, it involves taking an ethnographic approach to research, meaning that researchers would experience an environment themselves to draw research. Using this firsthand observation, the researcher would not need to then rely on interviews or surveys.

This approach may seem to be far-fetched where market research is concerned, but it is doable. For example, you’d like to see the effectiveness or frustration that customers face when using your product. Since you can’t follow them home, you can request videos that show them using it. Many big brands have call-outs on their websites (ex: on product pages) for their customers to send in videos of their interactions with the products.

3. Phenomenological Research

This qualitative method entails researchers having to probe a phenomenon or event by bringing lived experiences to light and then interpreting them. In order to achieve this, researchers use several methods in combination.

These include conducting surveys, interviews and utilizing secondary research such as available documents and videos on the studied phenomenon. Additionally, as in ethnographic research, phenomenological research involves visiting places to collect research.

These will help you understand how your participants view your subject of examination. In turn, you will gain insight into the participants’ motivations.

In this research type, you would conduct between 5 and 25 surveys or interviews, then peruse them for themes. Once again, you would scrutinize experiences and sentiment over numerical data.

4. Grounded Theory Research

In contrast to phenomenological research, which seeks to fully form the core of an issue, grounded theory attempts to find explanations (the why) behind an issue. To achieve this, researchers use interviews, surveys and secondary research to form a theory around the issue/occurrence.

The sample of this study tends to be on the larger side, at 20-60 participants. Data extracted from this type of research is interpreted to determine the reasoning behind, for example, heavy usage of or frustration with a product. These types of studies help a business innovate an existing product by getting into the weeds of how it’s used.

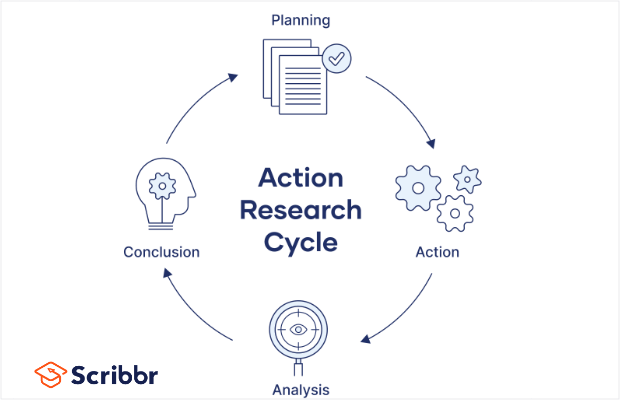

5. Action Research

This type of research involves researchers and participants working collaboratively to bring theory to practice. Also called participatory research, collaborative inquiry, emancipatory research and action learning, this method entails the act of “learning by doing.”

This means a group of researchers come together to find and address a problem, resolve it and then study the success of their endeavors. If they underperformed or their outcomes don’t satisfy their expectations, they would then reattempt the process.

In action research , a researcher spends a considerable amount of time on collecting, analyzing, and presenting data in an ongoing, periodic process. This involves researchers coming up with their own surveys and interviews around a subject matter, then presenting their findings to one another to draw conclusions and solutions.

They would put into practice the means to improve a situation and continue measuring their success throughout the process.

Examples of Questions for Qualitative Research

When working within the capacity of any of the above research types, it’s crucial to ask the right questions. Here you’ll find the questions you can use when conducting each of the five types of qualitative research.

Bear in mind that some of these questions will appear to be similar in nature; some are even interchangeable. That is normal, as researchers may search for the same answers, but apply a different approach in their research method.

In any case, all of the below features questions that fit within the larger qualitative research framework.

Learn more about asking insightful market research questions . Here are a few examples of the questions within the five categories:

1. How do people who witnessed domestic violence understand its effects in their own relationships?

Variable: Views of domestic violence on one’s own relationships

Demographic: People in relationships, who’ve witnessed domestic violence

Qualitative Research Type : Narrative

2. What are the lived experiences of working-class Americans between the ages of 20 and 40?

Variable: Experiences and views of a working-class background

Demographic: Working-class Americans ages 20-40

3. How do Asian Americans experience reaching out to address mental health concerns?

Variable: The experiences in seeking out care for mental health

Demographic: Asian Americans seeking help for mental health

Qualitative Research Type: Ethnographic

4. What do you enjoy about this product or service?

Variable: The positive experiences of using a particular product/service

Demographic: The target market of a product or service

5. How have people who have experienced poverty changed their shopping habits when they entered the middle (or higher) class?

Variable: The changes or stagnation in shopping habits

Demographic: those who experienced poverty, but climbed the social ladder

Qualitative Research Type : Phenomenological

6. What was it like when you had a negative online shopping experience?

Variable: unpleasant shopping experiences

Demographic: a group that is most likely to shop at a particular online store

7. What influences managers in private sectors to seek further professional advancement?

Variable: Motivation for seniority

Demographic: Managers in the private sector

Qualitative Research Type: Grounded Theory

8. How do women in third world countries set up financial independence?

Variable: Efforts at reaching financial independence

Demographic: Women in third-world countries

9. What impact does collaborative working have on the UX optimization efforts of a telecommunications company?

Variable: effects of collaboration on the UX of a telecommunications company

Demographic: workers in the telecommunications space

Qualitative Research Type: Action Research

10. What strategies can marketing managers use to improve the reach of millennial customers?

Variable: Strategies to improve millennial reach and their outcomes

Demographic: Marketing managers

When to Use the Research and How to Analyze It

The qualitative research method has specific use cases. You ought to consider which is best for your particular business, which includes your strategy, your marketing and other facets.

The core of qualitative research is to understand a phenomenon (a problem, an inadequacy, and a slew of other occurrences) including its causes, its motivations, its goals and its solutions. Researchers do this by observing smaller portions of a population.

Researchers should use this form of research whenever you need to get the gist of a particular occurrence or event. It is particularly useful for studying how your target market experiences certain situations and how it feels about them.

There are several more specific ways that elucidate why this research style is valuable if not completely necessary. Here are some of the most crucial ways this method of research is vital:

Helps brands see the emotional connections customers have with them

Allows brands to find gaps in customer experience (CX) and user experience (UX)

Enables brands to create experiences that are more tailored to their target market

Helps businesses understand how they can improve on their product, service or CX

Finds experiences that customers had that highlight sensitive topics/language for them

Shows businesses how customers compare them to their competitors

Identifies possible solutions and innovations based on customer attitudes and experiences

To analyze qualitative research, you should first identify your subject of study and decide on the type of research you need to conduct based on the five types of research that fall under the qualitative category.

Then, brainstorm several questions that you can use to form the base of your studies. During the process make sure to jot down (either digitally or otherwise) your observations. For example, record interviews and store surveys in an organized database.

Make sure you ask open-ended questions in surveys, interviews, focus groups, et al. Aggregate secondary research such as government database documents, articles in your niche, images, videos and more.

Search for patterns or similarities within your findings. When you group them together and organize them by demographics, you can start drawing conclusions and proposing solutions.

The Benefits and Drawbacks of Qualitative Research

Qualitative research can be extraordinarily beneficial. But as with other aspects of research and beyond, it too comes with a set of drawbacks. As a business owner, marketer or market researcher, you should know both the pros and cons. Here are some notable ones:

More intimate understanding of context and causation: besides understanding “what” in a granular way, you also learn the “why” and “how” of a particular situation.

Understanding key experiences: Open-ended questions lead to unique answers, exposing things numerical-based surveys can’t answer.

A foundation of deep insights: The design of the study is made to understand how customers relate to particular occurrences, events, ideas and products.

Context-driven: Finding insights on motivation and past behaviors allows researchers to understand what their target market needs and what it tries to avoid.

No need to find and create the correct measuring units: Open-ended questions don’t require a scale, a number range or any other measuring tools — one less thing to worry about.

Smaller sample size: Smaller sample sizes allow researchers to study responses more thoroughly to form more accurate hypotheses and conclusions.

Inspirational : The responses received can also help researchers form new studies.

Flexible and detail-oriented : Since questions aren’t based on scales and other units, you can ask more creative and in-depth questions. Questions focus on details and subtleties for robust insights.

Relies on researcher experience: It relies on the researchers’ experience; not all are familiar with industry topics.

Not statistically representative: Only collects perspective-based research; does not provide statistical representation. Only comparisons, not measurements can be executed.

Difficult to make copies of data. Individual perspectives make it hard to replicate findings, making it it more difficult to form conclusions.

More likely to have researcher bias: Both conscious or subconscious of the researcher can affect the data. The conclusions they draw can thus be influenced by their bias. (This can be avoided by using controls in data collection.

The Final Word

Market research is a wide-spanning undertaking. It has a wide swath of aspects, practices and applications. As such, researchers should know its main categories and qualitative research is one such category of significance.

As opposed to quantitative research, which has four methods, qualitative research has five — not all of which will be of use to your particular market research needs. In any case, this type of research involves imbuing as much context and particularities around a phenomenon as possible.

As such, researchers should create questions more specific to the aforementioned examples of this article. That is because those are more encompassing, generalized questions that researchers can attempt to answer after conducting all of their research and parsing of the findings.

But prior to that, researchers should ask several related questions around a particular topic and tailor those questions as best as possible to the target audience.

Frequently asked questions

What is qualitative research.

Qualitative research is a type of research that is conducted to gain deep or unexpected insights rather than focusing on numeral or quantitative data.

Why is qualitative research conducted?

Qualitative research is conducted to find the “why” of the research subject, rather than the “what’ of that subject. For example, qualitative research might be conducted to understand an issue more deeply, to understand why something is happening, or to learn how to address a target market’s concerns.

What is narrative research?

Narrative research is a type of research that is used to create an in-depth story about a phenomenon or event. It is conducted by interviewing a small group of people who were directly involved in the event.

How is ethnographic research conducted?

When conducting ethnographic research, the researchers use firsthand observations of an environment to more deeply understand the goals, challenges, or opinions of the target audience.

What is action research?

Action research is a type of qualitative research in which researchers and participants collaborate to better understand a phenomenon. Together the group works to find and solve the problem by gathering information on an ongoing and evolving basis.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

The qualitative market research guide: actionable methods for best results

What is qualitative market research, the ethics of qualitative market research, how to conduct qualitative market research, what are the applications of qualitative market research, overcoming the challenges of qualitative market research.

If you’re thinking about skipping qualitative market research and just going with your gut, this article is a must-read.

While some brands and products in the past have won big based on someone’s intuition, it certainly isn’t a reliable recipe for success — because many more who’ve invested based on an instinct, have failed. Hard.

That’s why we want to highlight the importance and value of qualitative market research. It’s what explains why people pick one product over another that seems just as good.

Qualitative research digs into the nuances, offering insights that can significantly impact your marketing approach and product development. Here we’ll show you exactly how you can turn it into your secret weapon.

Qualitative market research goes straight to the core of your customer’s thoughts and feelings. It’s not just about how many people clicked or bought, but why they did it, or even why they didn’t.

This kind of research lets you in on the stories behind the statistics, giving you a more in-depth understanding of your target audience’s behaviors, perceptions and motivations. And with this rich insights and data, you can tailor your products and marketing strategies to truly resonate with your audience.

Here’s a quick rundown of the types of market research out there:

- Quantitative research: Deals with numbers and measurable forms.

- Qualitative research: Focuses on understanding the quality of consumer interactions and thoughts.

- Mixed methods: Combines both quantitative and qualitative research.

It’s good to know qualitative and quantitative research make a great pair – it helps you give context to numbers, and vice versa. And it’s good to know when you could run qualitative research:

- Before your quantitative research ? If you’re grasping for ideas and inspiration, qualitative market research can be a great source. Your respondents will often flag issues or make suggestions that you and your team might never have thought of. And for extra peace of mind, you can follow-up your qualitative research with quantitative studies to make sure that inspo is truly representative.

- After your quantitative research ? Often teams will have run quantitative studies and spotted threads they’d like to pull at and see whether there’s more to learn. This is where qualitative market research comes in – it can add flavor and context to your quant data. And it can be a great way to personalize your data for internal or client signoff.

Of course, there are different ways of gathering qualitative data. So when we talk qualitative research, these are the main methods you’ll come across:

- Ethnographic research: observing your customers in their natural environment, seeing how they live, work, and play.

- Narrative research: collecting stories from individuals to better understand their experiences.

- Phenomenological research: used to understand common experiences among a group of people, researching shared perceptions.

- Grounded theory: developing a theory based on the data you collect, starting with the data and working towards a theory.

- Action research: a collaborative approach, working with groups to identify solutions to problems and implement changes.

Each of these approaches gives you unique insights into the minds and lives of your customers, helping you make more informed decisions that can drive your brand forward.

If you want to know more about the ins and outs of different research types, check out our blog about the difference between quantitative vs qualitative research , and here’s a quick video summary to get you started…

While it’s not exactly mind reading, qualitative market research does touch more on personal thoughts and opinions than, for instance, quantitative research does. That means it requires trust – and that’s where ethics come into play. Here’s what keeping it ethical looks like:

- Participant confidentiality : Keeping the identities of your participants under wraps is a non-negotiable.

- Informed consent : Participants need to know what they’re getting into, how their insights will be used, and how they can change their involvement.

- Sensitive information : Any data that could be considered sensitive deserves extra protection and consideration.

Data isn’t high quality when it isn’t ethical, and vice versa. If your respondents don’t feel that their answers will be handled with care, they might not answer honestly – if at all.

At Attest, we’re all about making sure your insights are built on a solid foundation of excellent data quality, trust and transparency – for both you and your respondents.

Because what’s the point of qualitative research if you can’t trust the results? Check out how we assure data quality that you can rely on.

The research you do should be the foundation of the actions that follow — don’t just conduct research for the sake of it. Choosing the right qualitative research methods and tools is crucial, but there’s more to it.

By following the steps below, you’ll not only gather rich, qualitative data but also pave the way for meaningful changes in your product development, marketing strategy, and overall brand experience.

1. Create a research plan

When you conduct qualitative research, or any kind really, the steps you take should be based on your research objectives, and related to the actual changes you might be making. This is what makes market research crucial for marketing experts : it shows you which actions to take, instead of just doing creative guesswork.

First, decide on your qualitative research methods—will you go for surveys, focus groups, or a mix? Define clear objectives. What do you want to learn? Keep in mind how to balance your research approach: you can opt for direct exploration for fresh insights, monadic testing for focused feedback, sequential monadic testing for comparative insights, or discrete choice testing to understand preferences. Each method has its place, and combining them strategically can offer a fuller picture of your market.

Next up, consider your sampling methods. Who are your ideal participants? Where can you find them? (Hint: we help you with this!)

Once you know what to ask and who you’ll be speaking to, it’s time to start crafting your survey — and using our templates makes that even easier. Take your pick and start tweaking.

The final step of your research plan, is choosing which qualitative market research tool to choose for. The steps below give you some guidance on what to look for.

2. Recruit the right participants

The power of qualitative research lies not in the most fancy tools, but in the quality of your participants.

You’re looking for individuals who reflect your target audience or represent a new market you’re exploring. The key is to ensure diversity and relevance to get a comprehensive understanding of consumer behavior and opinions. Read more about how we help you get in touch with the right people — picking from an audience of 125 million people in 59 markets spread across the globe.

3. Conduct interviews, surveys or focus group research

Jumping into your audience’s world, interviews, surveys, and focus groups are essential tools in your research kit. But how do these qualitative market research methods add value?

- One-on-one interviews offer a closer look into what your consumers are thinking and feeling, providing valuable insights into their personal experiences and expectations. This intimate format fosters detailed conversations that can uncover deep-seated motivations and stories.

- Surveys allow for a broad reach, enabling you to connect with a wide audience very quickly to collect various data points. This method is great for identifying trends, preferences and behaviors on a larger scale.

- Focus groups, on the other hand, bring a unique dynamic. In these sessions, participants’ interactions can generate new insights and perspectives, offering a diverse view of your product or service. This collaborative environment encourages research participants to build on each other’s ideas, revealing insights that might not emerge in individual settings.

Remember: you don’t have to limit yourself to only one option – but pick a mix that works best for your research goals, and your audience. Their participation is key here.

4. Conduct observational research (optional)

Now this is optional, but if you want an extra layer to your research process, observational research is a great supplement to your qualitative study.

Instead of just hearing what your target audience is thinking, you are going to see how it affects their actions, by tracking how they interact with your products, navigate your stores or use your website.

Watching from a distance, you might discover that consumers use your product in ways you hadn’t imagined. It might also clarify some statements you heard or uncovered during the survey or interview phase – observational research can unearth gems of insights that are invisible in one-on-one conversations or online focus groups.

Of course, this approach requires patience and a non-intrusive stance. You don’t want to influence people, and it’s not easy to do it at a large scale – but in some scenarios adding an extra research method like this certainly gives extra depth to your findings.

5. Analyze your research data

With data in hand, it’s time to sift through the stories and sentiments to find patterns and themes. Qualitative data analysis can be complex, but it’s where you begin to understand the ‘why’ behind the behaviors that drive your customers’ choices.

Don’t just use qualitative insights to confirm your hopes and beliefs. Actively look for commonalities, differences, and surprising insights that can guide your strategy.

6. Report and communicate findings to key stakeholders

This is the springboard to action. If you can package your findings in a way that resonates with your team, management, or clients, you’re one step closer to meaningful and impactful changes.

Clear, compelling reporting translates your research into actionable insights – and our tool helps you get them.

Share stories, highlight key themes, and suggest next steps. Make your qualitative research findings a cornerstone for your decision-making and strategy development.

Get the full picture with qualitative research from Attest

Whether you’re looking for inspo, or backing up your quant research with qual context, you can run your research studies side-by-side with Attest

You can use qualitative market research for practically every aspect of your business. But let’s highlight some of the most popular applications first:

- Product development: Before your product hits the shelves or the digital marketplace, qualitative research helps you tune into what your customers really need and want. Insights gained can directly inform product features, design and enhancements to meet consumer needs effectively.

- Creating data-driven marketing strategies: Armed with qualitative insights, you can craft marketing campaigns that resonate deeply with your audience. Tailored messaging and campaigns can address specific consumer pain points, preferences and values, increasing engagement and conversion rates.

- Understanding customer perceptions: Ever wonder how your brand is viewed through the eyes of your consumers? If you haven’t, you should. It’s not something to be scared of, it’s something to learn from – through, you guessed it, qualitative research. It will uncover the perceptions, misconceptions, and the emotional ties customers have with your brand, and be a trusted guide on how to position yourself in the market.

- Consumer segmentation: Two customers might seem alike, but not shop alike. That’s because there are underlying differences. By identifying distinct consumer segments within your broader audience, qualitative research allows for more targeted and personalized marketing efforts. Understanding the varied needs and motivations of each segment leads to more effective and efficient marketing strategies.

Beyond the usual suspects, qualitative market research has some lesser-known yet incredibly valuable applications.

- Examining the impact of customer service language tweaks on overall customer satisfaction and loyalty.

- Exploring consumer reactions to different packaging materials to align brand perception with sustainability goals.

- Refining the user experience on your website based on nuanced user feedback about navigation and content.

The possible applications of qualitative market research are limitless – and brands who experiment with really specific, seemingly small applications, often find suggestions for meaningful changes that drive big results. Just check out our customers’ stories for some inspiration.

We won’t tell you that qualitative market research is something you can do on autopilot or with your eyes closed – doing it right is challenging in some ways. But not in ways you can overcome.

Let’s walk through some common obstacles and how to vault over them, and how using Attest can turn these challenges into opportunities for richer insights.

- What to do : Use targeted recruitment to ensure your sample closely mirrors your target market. Attest helps you find and engage with the right participants, making even small sample sizes filled with insights.

- What to do : Streamline the process with efficient planning and execution. Attest offers streamlined survey design and distribution tools that cut down on both time and cost, making in-depth qualitative research more accessible. And with your designated research manager to guide you , you know your studies will be well designed and give you reliable results.

- What to do 2 : Bear in mind that good qualitative market research, with a clear purpose and action plan, will lead to better business results. It could affect your bottom line, increase sales or impact your ROI in other ways. It’s not investing in qualitative research that could cost you way more money.

- What to do : It starts with awareness, and implementing protocols that avoid bias. Attest’s platform is designed to ensure unbiased data collection, with features that support anonymity and objectivity in responses. And this is also where you Customer Research Manager can steer you towards honest, unbiased research.

- What to do : Make the most of technology to conduct efficient and effective research within your means. Better yet, choose Attest. You’ll get access to your very own dedicated research expert that will help you get the most value out of your research.

Get the best of quantitative and qualitative research with Attest

To ensure your market research truly hits the mark, blending the depth of qualitative insights with the breadth of quantitative data is key. For the clearest picture of your market landscape and the most informed decisions, a platform that offers both qualitative and quantitative insights is your best bet. Attest provides this comprehensive approach, equipping you with the tools to not just navigate but thrive in your market. Ready to see the full picture?

Discover how Attest can elevate your research game and support your brand’s growth with expert-backed insights.

Customer Research Manager

Related articles

Attest’s enhanced parental leave policy, attest’s fertility treatment and family support policy, quantitative market research questions to ask for actionable insights, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

Qualitative research in marketing: definition, methods and examples

Apr 7th, 2022

What is qualitative research?

Qualitative research methods, how to design qualitative research , qualitative research examples.

- Share this article

Qualitative research allows businesses to determine customers’ needs, generate ideas on improving the product or expanding the product line, clarify the marketing mix and understand how the product would fit into customers’ lifestyles. The research will be useful for businesses of any size and type. For example, entrepreneurs can use qualitative research to gain insight into customers’ feelings, values, and impressions of the product or service. With qualitative research, you can understand the reasons and motives of customers’ reactions and use this information to create marketing and sales strategies .

The research can also help you design products and services that meet the requirements of your target audience. For instance, imagine you are a restaurant owner and want to introduce a new menu; you can conduct qualitative research and invite local residents to give you feedback on the food, service, and pricing. This approach will increase your chances of success.

Qualitative research studies the motives that determine consumer behavior by employing observation methods and unstructured questioning techniques, such as individual in-depth interviews and group discussions. The approach involves the collection and analysis of primary and secondary non-numerical data. The goal of qualitative research is to understand the underlying reasons for making purchasing decisions and learn about customers’ values and beliefs.

Qualitative research asks open-ended questions beginning with the words “what”, “how”, and “why” to get feedback concerning a new product or service before the launch or development phase. This method reveals customers’ perceptions of the brand, buyers’ needs, advantages, and drawbacks of the product or service. Furthermore, it helps evaluate promotional materials and predict how the product or service can influence the lives of your customers.

This research method emerged in the early 1940s when American sociologist Paul Lazarsfeld introduced focus group interviews to study the impact of propaganda during World War II. In the late 1940s, American psychologist and marketing expert Ernest Dichter developed a new type of consumer research called motivational research. Dichter used Freudian psychoanalytic concepts to understand the motives of consumer behavior. He conducted in-depth interviews to learn more about customers’ needs and attitudes towards certain products.

In the 1960s, marketing academic John Howard began studying consumer behavior from the perspective of social sciences, including psychology, anthropology, and economics. At the same time, market researchers focused on the emotions, feelings, and attitudinal elements of consumption. As a result, in-depth interviews, video-recorded focus groups, and computer-assisted telephone interviews became prevalent qualitative research techniques.

With the advent of the Internet and mobile devices, qualitative research has undergone numerous changes. Today the Internet allows researchers to conduct surveys on a much larger scale. The marketers can use hyper-segmentation and hyper-personalization to launch targeted advertising campaigns, utilize market research analysis software and gather customer opinions using social media analysis. Let us take a detailed look at the basic methods of qualitative research.

The most common qualitative research methods include focus groups, individual interviews, observations, in-home videos, lifestyle immersion, ethnographic research, online sentence completion, and word association. We will consider each of them in more detail below.

Focus groups

Focus groups are discussions dedicated to a specific product and its marketing strategies . The groups typically consist of 6-10 people and a moderator who encourages them to express their opinions and feelings about the product. Usually, focus groups are held in-person to study consumers’ verbal and non-verbal reactions to the product or advertising campaign.

This method has several applications, including testing marketing programs, evaluating the overall concept for a product, examining the copy and images of the advertisements, and analyzing the new types of product packaging. Nowadays, in-person focus groups are losing popularity, while online discussions via video conferencing tools are attracting a lot of attention from researchers.

Social media analysis

Social media and mobile devices give brands more opportunities to gather and analyze information. Customers now interact directly with brands on social media platforms where they spend their free time. Content analysis of Facebook posts, comments, tweets, YouTube videos , and Instagram photos allows brands to track consumers’ activities, locations, and commonly used words.

You can ask for users’ feedback , encourage them to fill out a brief survey, or engage with customers to inform them of your marketing plans and the development of new products. Furthermore, the qualitative research participants can provide additional contextual information like photos and videos, which gives a better understanding of their thoughts and attitudes.

Individual interviews

An individual interview is usually conducted in person, over the phone, or via video conferencing platforms. The interviewer asks the existing customer a number of questions to determine his motivation to buy a particular product. One-to-one interviews are held as a free-flowing conversation and include open-ended questions. The interviews can be flexible, semi-structured, and unstructured. You can ask about the customer’s frustrations concerning the product, motivations and reasons for purchase, and the sources of information from which they learned about the product.

Observations

Observations allow researchers to see how the customers react to the products in the store and analyze their shopping behavior and purchase experience. This method is more effective than written surveys as it provides better insight into consumer reactions. For example, the researchers can observe how customers stop outside the store, what attracts them to the shop window and which way they walk once they enter the store. In addition, observations help determine problems related to product placement on store shelves, clutter, or products that are out of stock. You can also collect customer feedback to improve some aspects of the shopping process, like packaging design.

In-home videos

In-home videos allow researchers to watch how customers engage with the product in the comfort of their own homes. Using this method, you can monitor user behavior in a natural and relaxed environment. Thus, you can have a better picture of the ways people use your product. The customers can keep video diaries or film the videos with detailed comments concerning your product. You can store the qualitative content in one place and create an insight hub to analyze and reuse the collected information in the future.

Lifestyle immersion

Lifestyle immersion is another method that allows obtaining customer feedback in a comfortable environment. Immersion refers to the researcher’s profound personal involvement in a customer’s life. For instance, the researcher visits an event, such as a party or family gathering, and observes the user’s reactions and behaviors in a familiar setting. Watching how users speak to their family and friends is an increasingly effective technique that allows learning more about their needs, challenges, and motives.

Ethnographic research

Ethnography is a type of research that originates from 20th-century anthropology and involves observing people in a natural environment rather than a lab. Namely, the researchers watch how respondents cope with their daily tasks, such as grocery shopping or preparing dinner. This helps see what people actually do instead of what they claim to do.

Ethnography applies a variety of approaches, including direct observation, video recordings, diary studies, and photography. Researchers can observe the user’s behavior at home, at the workplace, or with their family or friends. Passive observation as a method of ethnographic research implies following and watching users without interacting with them or interfering with their actions. Active observation, in contrast, entails working or cooperating with consumers, asking them questions about a product or service, and joining their team or group.

Online sentence completion and word association

Sentence completion is a projective technique used in qualitative research to allow customers to express their opinions and feelings. According to this method, the respondents receive the survey with unfinished sentences. They should complete sentences that describe the product or find the words that would be appropriate in the context of the sentence. With this method, the researcher can put qualitative data in a structured form.

Word association is a similar technique that helps researchers gather information about brand awareness , images, and associations related to a specific product or brand. The respondents are given the trigger words and instructed to write the first word, association, or image that comes to mind. In contrast to the interviews and focus groups, sentence completion and word association techniques can reach more people when conducted online. Moreover, it takes less time to analyze the results and understand users’ perceptions.

Once you have learned about the most widely used qualitative research methods, it is time to plan the research process step by step.

The success of your research outcomes greatly depends on adequate planning and appropriate strategy. Here we will list some general guidelines on how to conduct qualitative research.

Determine research objectives

The first step to designing or running qualitative market research is understanding the goals you want to achieve with your study. In particular, the research objectives might include discovering the existing or potential product or brand positioning , understanding perceptions about the company or product, investigating how people react to advertising campaigns, packaging or design, evaluating website usability, and identifying strengths and weaknesses in the product. The absence of clear objectives would create challenges for the researcher as qualitative research involves open-ended questions and in-depth replies that are difficult to interpret and analyze directly.

Choose the methodology to conduct the research

Determine the most suitable method to perform market research taking into account demographics, geographical location of your target audience, lifestyle behaviors, and the product that is being examined. Market researchers usually collaborate with professional recruiters who find and screen the participants. A significant part of the researcher’s work is to develop a list of topics for discussion in small groups. You need to involve moderators who would spend from 90 to 120 minutes with the group asking questions, observing their reactions, and analyzing behavior.

Investigate various data collection methods

Once you have chosen the observation method, you need to involve a moderator to examine the participants’ behavior and take notes. This approach usually requires a video camera or a one-way mirror. You can also combine qualitative and quantitative research to collect numerical data and analyze metrics together with customers’ replies and observation results.

When running focus groups, you can either organize one discussion with eight to ten participants or a series of online meetings which will last three-four days. Respondents will answer the questions from the moderator or react to prerecorded videos.

When you conduct one-on-one interviews, you need to speak with the respondents on the phone or organize a personal meeting. This method will be suitable if you want customers to try the product and share their impressions.

Analyze the collected data