Assignment of Limited Liability Company Interest to Revocable Trust | Practical Law

Assignment of Limited Liability Company Interest to Revocable Trust

Practical law standard document w-005-7338 (approx. 11 pages).

How to Transfer Your LLC into a Trust

Are you an executor or trustee?

Want to get organized, want to offer estate planning, need a will or trust.

Limited Liability Companies (LLCs) are flexible business structures that offer personal liability protection to their members. Transferring LLC membership interests into a trust can be a smart move for various reasons, such as protecting the LLC membership interests from creditors, ensuring a smooth transition of business ownership, or incorporating estate planning strategies . This post will guide you through the process of transferring LLC membership interests into a trust.

Understanding LLCs and Trusts

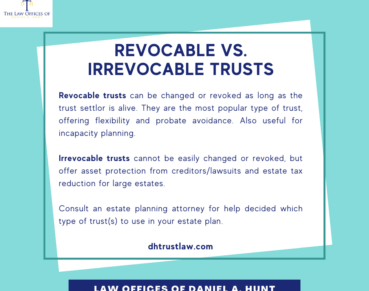

An LLC is a business structure in the United States that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. Trusts, on the other hand, are legal arrangements that allow a third party, or trustee , to hold assets on behalf of beneficiaries. Trusts can be either revocable or irrevocable, offering different levels of control and tax benefits.

Transferring an LLC to a Trust: Benefits and Drawbacks

Transferring ownership of a Limited Liability Company (LLC) into a trust can be a strategic estate planning move, offering several benefits while also presenting certain drawbacks. This section examines the implications of such a transfer, focusing on its impact on estate planning, asset protection, and business continuity.

Benefits of Transferring an LLC to a Trust

- Estate Planning and Probate Avoidance : One of the primary benefits of transferring an LLC into a trust is the facilitation of estate planning and avoidance of probate. When an LLC is owned by a trust, the business can be passed to beneficiaries without the need for probate, which can be time-consuming and costly. This ensures a smoother transition of control and can maintain the confidentiality of the estate's assets.

- Continuity of Business Operations : By placing an LLC in a trust, the grantor can outline specific instructions for the business's operation and succession, ensuring continuity. This is particularly important for family-owned businesses or sole proprietorships where the sudden loss of the owner could disrupt operations.

- Asset Protection : Trusts, especially irrevocable ones, can offer enhanced asset protection from creditors and legal judgments. When an LLC is held within such a trust, its assets can be shielded, providing an extra layer of security against personal liabilities.

- Tax Planning Advantages : Transferring an LLC into a trust can also facilitate certain tax planning strategies. For instance, an irrevocable trust may help in minimizing estate taxes, as the assets transferred into the trust are removed from the grantor's taxable estate.

- Flexibility in Management and Distribution : Trusts allow for detailed instructions regarding the distribution and management of the LLC among the beneficiaries. This can include specifying who manages the business after the grantor's death and how profits are to be distributed, allowing for tailored estate planning.

Drawbacks of Transferring an LLC to a Trust

- Complexity and Cost : The process of transferring an LLC into a trust involves legal complexities and costs. Setting up the trust, drafting the transfer documents, and potentially restructuring the LLC's operating agreement to comply with trust ownership can require significant legal expertise and expense.

- Limited Control : For revocable trusts, while the grantor retains some level of control, transferring an LLC into an irrevocable trust means relinquishing direct control over the business. This might not be desirable for business owners who wish to maintain hands-on management.

- Potential Tax Consequences : Depending on how the trust is structured, there could be immediate or future tax implications, including changes in how the LLC's income is taxed. If not carefully planned, this could lead to unfavorable tax treatment or unexpected tax liabilities.

- Impact on Financing and Business Relationships : Changing the ownership structure of an LLC to a trust can affect the business's ability to secure financing, as lenders may have reservations about lending to a business owned by a trust. Additionally, it may impact relationships with vendors, clients, and partners who may require reassurance regarding the continuity and management of the business.

- Regulatory and Compliance Requirements : Trust ownership of an LLC may trigger additional regulatory and compliance obligations, depending on the jurisdiction and the nature of the business. This can include changes in reporting requirements, business licenses, and registrations.

Steps to Transfer LLC Membership Interests into a Trust

- Choose the type of trust: Depending on your needs and objectives, you can choose between a revocable trust (which can be altered or cancelled by the grantor) or an irrevocable trust (which cannot be modified without the permission of the trustee).

- Select a trustee: The trustee will be responsible for managing the trust's assets, so choose someone trustworthy and competent.

- Create a trust agreement: This is a legal document that outlines the terms and conditions of the trust, identifies the trustee and beneficiaries, and provides instructions for managing the trust assets.

- Assign the LLC membership interests to the trust: This process typically involves completing an assignment form and may also require an amendment to the LLC's operating agreement.

Process of Transferring LLC Membership Interests into a Trust

- Review the LLC's operating agreement: This document may contain specific rules about transferring membership interests that must be complied with.

- Prepare an assignment of membership interests: This is a legal document that transfers the LLC membership interests from the member to the trust.

- Amend the LLC's operating agreement: This step may be necessary to officially recognize the trust as a member of the LLC.

- Record the transfer: This involves updating the LLC's membership ledger to reflect the transfer.

Costs Involved in Transferring an LLC to a Trust

Transferring ownership of a Limited Liability Company (LLC) into a trust is a decision that comes with various costs. These costs are multifaceted, encompassing legal, administrative, and potentially tax-related expenses. Understanding these costs is essential for anyone considering this estate planning strategy to ensure it aligns with their financial and operational goals.

Here's a breakdown of the potential costs involved:

1. Legal Fees

The most significant expense in transferring an LLC to a trust is likely to be legal fees. This process requires the expertise of an attorney who specializes in estate planning and business law to ensure the transfer complies with state laws and serves the intended estate planning purposes. Legal fees can vary widely based on:

- The complexity of the trust structure and the LLC's operating agreement.

- The jurisdiction in which the LLC and trust are established.

- The attorney's experience and billing rates.

Typically, legal fees for setting up a trust and transferring an LLC into it can range from $2,000 to $5,000 or more.

2. Trust Setup Costs

Setting up a trust itself involves costs, separate from transferring the LLC. These costs include drafting the trust document, which outlines the terms, beneficiaries, and trustees, among other critical details. If a revocable living trust is chosen, the cost might be on the lower end of the spectrum, while more complex trusts, such as irrevocable trusts designed for specific tax advantages or asset protection, can be more expensive to establish.

3. Document Preparation and Filing Fees

Transferring an LLC to a trust requires preparing and filing various documents, including:

- Amendments to the LLC's operating agreement to reflect the trust as the new owner.

- Assignments of membership interest, transferring the owner's interest in the LLC to the trust.

- Possible state filings to update the LLC's records regarding the new ownership structure.

These document preparations can incur fees, both from the professionals drafting them and from any filing fees required by state agencies or registries. While these fees may be relatively minor compared to legal fees, they can add up, especially if the LLC operates in multiple states.

4. Appraisal and Valuation Costs

In some cases, especially with irrevocable trusts, it may be necessary to obtain a formal valuation of the LLC to properly document the transfer for tax purposes. The cost of a business valuation can vary significantly based on the size and complexity of the LLC, ranging from a few thousand dollars to tens of thousands for larger enterprises.

5. Tax Advisory Fees

Given the potential tax implications of transferring an LLC into a trust, consulting with a tax advisor is advisable. This consultation can help identify any immediate tax liabilities triggered by the transfer, such as gift taxes, and plan for efficient tax treatment of the LLC's income going forward. Tax advisory fees will vary based on the advisor's expertise and the complexity of the tax planning required.

6. Ongoing Trust Administration Costs

Once the LLC is transferred to the trust, there may be ongoing costs related to administering the trust. These can include annual trustee fees (if a professional trustee is appointed), tax preparation fees for trust tax returns, and any other expenses associated with managing the trust's assets. These costs will depend on the size of the trust, the complexity of its assets, and the terms outlined in the trust agreement.

Transferring Your LLC to a Trust: the Differences Between States

LLC trust transfers vary a lot between states. There are differences in documentation, tax implications, approval requirements, and registration/public records adjustments. Here are a few examples.

- Documentation Requirements : California generally requires a formal amendment to the LLC's operating agreement to reflect the change in membership to a trust. Additionally, an Assignment of Membership Interest form should be executed and kept with the LLC's records.

- Tax Implications : Transferring an LLC into a trust in California may have implications for property taxes if the LLC owns real property, due to Proposition 13. The transfer could potentially be seen as a change in ownership that triggers a reassessment of property value unless a specific exclusion applies.

- Approval Requirements : No state-level approval is typically required for transferring membership interest to a trust, but the LLC's operating agreement may require the consent of other members.

- Registration and Public Records : California does not require the trust to be registered or the change in LLC ownership to be made public beyond the internal records of the LLC and potentially county records for property tax purposes.

- Documentation Requirements : Similar to California, New York requires an assignment document to transfer the LLC membership interest to the trust. The operating agreement should also be reviewed and possibly amended.

- Tax Implications : New York State might impose income tax considerations on the transfer, especially if the LLC is profitable. Consultation with a tax advisor is advisable to navigate these complexities.

- Approval Requirements : New York LLCs generally require the consent of all members for a transfer of membership interest unless the operating agreement specifies otherwise.

- Registration and Public Records : New York does not mandate that this transfer be registered with the state, but the operating agreement and any amendments should be updated and kept with the LLC's records.

- Documentation Requirements : Florida requires the execution of an assignment document to transfer LLC membership interest to a trust. This document should be notarized and kept with the LLC's official records.

- Tax Implications : Florida does not have a state income tax, which simplifies the tax implications of such a transfer. However, documentary stamp taxes may apply if the LLC holds real property and a mortgage.

- Approval Requirements : The transfer of membership interest usually requires adherence to the LLC's operating agreement, which might necessitate approval from other members.

- Registration and Public Records : While Florida does not require the trust itself to be registered, any changes affecting the LLC's management or the information on file with the Florida Department of State must be updated through annual reports or amendments.

- Documentation Requirements : Texas also requires an assignment of membership interest to transfer ownership into a trust, along with potential amendments to the LLC's operating agreement.

- Tax Implications : Texas does not impose a personal income tax, but the franchise tax implications for the LLC should be considered, especially if the transfer changes the management structure.

- Approval Requirements : Depending on the LLC's operating agreement, member consent may be required for the transfer.

- Registration and Public Records : Texas requires the LLC's public records to be updated if there is a change in the management structure. This is done through filings with the Texas Secretary of State.

Consider Seeking Professional Assistance

The process of transferring LLC membership interests into a trust can be complex, involving legal considerations, tax implications, and potential changes to the operation of the LLC. Therefore, it is highly recommended to seek advice from a qualified attorney or tax advisor who is familiar with these matters. They can provide guidance tailored to your specific situation and help ensure the transfer is carried out correctly and in line with your objectives.

Get a plan, get Snug.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

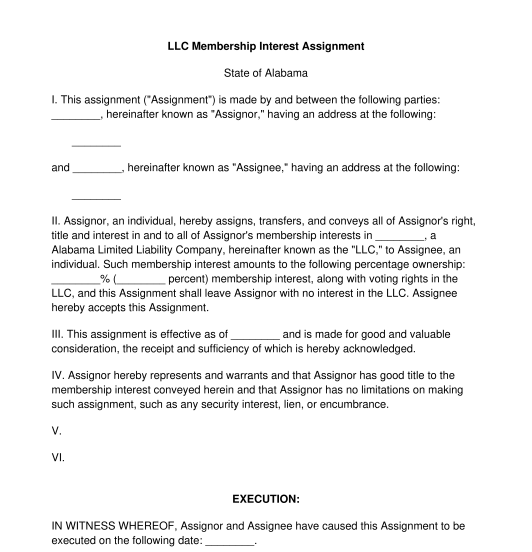

LLC Membership Interest Assignment

Rating: 4.8 - 951 votes

An LLC Membership Interest Assignment is a document used when one member of an LLC, also known as a limited liability company, wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise wants to relinquish the entirety of their interest in the company.

An LLC Membership Interest Assignment normally happens well after the LLC has already been operating . To form a limited liability company in most states, any party must begin with Articles of Organization (sometimes called Certificates of Formation or other varying names). These documents will get the LLC formed and in compliance with state laws.

A limited liability company can operate and be formed for any reason (except illegal ones). For example, even if it is a small business, like dog-walking, the owners might want to have an LLC to protect themselves. If so, and if any owner decided to one day relinquish their interest in the LLC , that owner could use this LLC Membership Interest Assignment to assign it to another person.

LLC Membership Interest Assignments are short, relatively easy documents which contain all the information needed to transfer an interest in an LLC.They contain a place for both the person transferring the interest (called the Assignor) and the person receiving the interest (called the Assignee) to execute the document.

How to use this document

This document can be used when any party would like to transfer the ownership of an interest in an LLC or when any party would like a membership interest in an LLC transferred to them, as long as the current owner of the membership interest agrees. It should be used it when both parties understand that the membership interest will be completely assigned and wish to create a record of their agreement, as well as a document that the LLC will likely keep on file.

This document will allow the form-filler to input details of the identities of both parties, as well as the details of the membership interest, such as percentage and whether or not it comes with voting rights . It also has an optional addendum at the end, in case full consent is needed from all the rest of the members of the LLC .

Please keep in mind that this form requires both signatures , from the party assigning the interest and the party receiving it.

Applicable law

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents, because each individual state governs the businesses formed within that state.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

Other names for the document:

Assignment of Interest for LLC Member, Interest Assignment for LLC Membership, LLC Interest Assignment Agreement, Member Interest Transfer for LLC, Membership Assignment for LLC

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

Assignment Of Membership Interest

Jump to Section

What is an assignment of membership interest.

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes.

Typically seen when a member wishes to exit a business, the assignment of membership interest agreement is used when transferring membership interest to another person. It is possible to transfer membership of an LLC to something like a revocable trust but requires those terms and conditions to be set in the assignment agreement.

Assignment Of Membership Interest Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.1.1.2 3 dex10112.htm ASSIGNMENT OF MEMBERSHIP INTEREST , Viewed October 13, 2021, View Source on SEC .

Who Helps With Assignments Of Membership Interest?

Lawyers with backgrounds working on assignments of membership interest work with clients to help. Do you need help with an assignment of membership interest?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of membership interest. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Meet some of our Assignment Of Membership Interest Lawyers

I am a corporate attorney with offices in Rock Hill, SC, and Lavonia, GA. My practice is focused on contracts, tax, and asset protection planning. I act as a fractional outside general counsel to over 20 businesses in 6 countries. When not practicing law, I can usually be found training my bird dogs.

Oklahoma attorney focused on real estate transactions, quiet title lawsuits, estate planning, probates, business formations, and all contract matters.

International-savvy technology lawyer with 35years+ in Silicon Valley, Tokyo, Research Triangle, Silicon Forest. Outside & inside general counsel, legal infrastructure development, product exports, and domestic & international contracts for clients across North America, Europe, and Asia. Work with Founders to establish startup and continuous revenue, sourcing and partnering with investors to attract funding, define success strategy and direct high-performing teams, advising stakeholders and Boards of Directors to steer company growth.

Licensed to practice law in the states of Missouri and Kansas. Have been licensed to practice law for 44 years. Have been AV rated by Martindale Hubbel for almost 30 years.

Real estate and corporate attorney with over 30 years of experience in large and small firms and in house.

David Alexander advises clients on complex real estate transactions, including the acquisition, disposition, construction, financing and leasing of shopping centers, office buildings and industrial buildings throughout the U.S. An experienced real estate attorney, David reviews, drafts and negotiates all manner of retail, office and industrial real estate agreements, including purchase and sale agreements, construction contracts, leases and financing documentation.

Managing partner at Patel & Almeida and has over 22 years of experience assisting clients in the areas of intellectual property. business, employment, and nonprofit law.

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Corporate lawyers by top cities

- Austin Corporate Lawyers

- Boston Corporate Lawyers

- Chicago Corporate Lawyers

- Dallas Corporate Lawyers

- Denver Corporate Lawyers

- Houston Corporate Lawyers

- Los Angeles Corporate Lawyers

- New York Corporate Lawyers

- Phoenix Corporate Lawyers

- San Diego Corporate Lawyers

- Tampa Corporate Lawyers

Assignment Of Membership Interest lawyers by city

- Austin Assignment Of Membership Interest Lawyers

- Boston Assignment Of Membership Interest Lawyers

- Chicago Assignment Of Membership Interest Lawyers

- Dallas Assignment Of Membership Interest Lawyers

- Denver Assignment Of Membership Interest Lawyers

- Houston Assignment Of Membership Interest Lawyers

- Los Angeles Assignment Of Membership Interest Lawyers

- New York Assignment Of Membership Interest Lawyers

- Phoenix Assignment Of Membership Interest Lawyers

- San Diego Assignment Of Membership Interest Lawyers

- Tampa Assignment Of Membership Interest Lawyers

related contracts

- Asset Acquisition Agreement

- Asset Acquisition Contract

- Asset Purchase

- Asset Purchase Agreement

- Asset Purchase Due Diligence Checklist

- Business Acquisition Agreement

- Business Acquisition Contract

- Business Acquisition Due Diligence Checklist

- Business Purchase Agreement

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Sign up for an account

Sign up for partner account, sign in to your account, reset password.

Assignment of LLC Interest

An Assignment of LLC Interest is a document through which an LLC member can transfer their ownership rights.

- About document

Related documents

How it works.

If an LLC member wishes to transfer their ownership rights to a different entity for any reason, they'll need to submit an Assignment of LLC Interest. This document will be a way for the member to communicate this intention to other LLC members.

What Is an Assignment of LLC Interest?

You can use an Assignment of LLC Interest in situations where an LLC member wishes to secure a loan, settle a debt, or leave their LLC.

In such cases, this document will serve to transfer the member's interest – which can be done wholly or partially – according to state laws and the governing documents of the LLC in question.

Other Names for Assignment of LLC Interest

Since the document's content takes precedence over the title, an Assignment of LLC Interest doesn't necessarily have to bear that name. It's also called:

- Assignment Agreement

- Transfer Agreement

- Interest Transfer Agreement

Who Needs an Assignment of LLC Interest?

LLC members may decide to assign their interest for several reasons. One of the more common reasons for assignment is providing collateral for a loan.

Another reason might be if the member needs to settle a debt, in which case the assignment remains effective while the debt is present.

Finally, a member can assign interest to their legal heirs. In this case, the assignment becomes valid upon the member's death.

Why Use 360 Legal Forms for Your Assignment of LLC Interest?

Customized for you, by you.

Create your own documents by simply answering our easy-to-understand questionnaire to get exactly what you need out of your Assignment of LLC Interest.

Specific to your jurisdiction

Laws vary by location. Each document on 360 Legal Forms is customized for your state.

Fast and easy

All you need to do is fill out a simple questionnaire, print it, and sign. No printer? No worries. You and other parties can even sign online.

How to Create an Assignment of LLC Interest With 360 Legal Forms

An Assignment of LLC Interest should clearly outline the rights and limitations as they apply both to the assignor, i.e., the LLC member transferring interest, and the assignee, i.e., the party receiving interest. For this reason, the document should be detailed and carefully crafted. State laws can potentially restrict assignments, and documents contrary to those laws can be subject to invalidation.

Let 360 Legal Forms help with our extensive library of attorney-vetted legal forms. The process is fast and easy. All you need to do is fill out our easy-to-understand questionnaire. Once complete, simply download your form as a PDF or Word document from your secure online account.

What Information Will I Need to Create My Assignment of LLC Interest?

To create your document, please provide:

- Assignor Information: Details on the LLC member transferring interest

- Assignee Information: Details on the entity receiving interest

- Assignment Type: Description of whether the assignment is partial or full

- Type of Partial Assignment (If Applicable): Determining whether the assignor will transfer a portion of ownership or specific rights and responsibilities

- Signatures : All involved parties need to sign the document to make it legally binding

Assignment of LLC Interest Terms

- Assignor : The LLC member assigning their rights, responsibilities, and interest

- Assignee: The individual or other entity receiving the rights, obligations, and interest from the Assignor

- Authority : A confirmation that the agreement is following regulations affecting all parties (Assignor and Assignee)

- Severability : If you can't execute any individual part of the agreement, the rest of the agreement will remain valid

Assignment of LLC Interest Signing Requirements

An Assignment of LLC Interest is a legally binding document, which means all parties should ensure they understand and agree to all terms within it before signing.

Once the Assignor and Assignee confirm that all information in the document is correct, both parties will need to sign the document to make it valid.

What to Do With Your Assignment of LLC Interest?

An Assignment of LLC Interest defines the scope of interest an LLC member will transfer to another party for other members of the LLC.

After signing the document, you will execute the interest transfer. Both parties should keep their copies of this document for the record.

Frequently Asked Questions

LLC members often have two roles within the LLC: as interest owners and managers. When a member decides to assign interest to another party, the transfer won't affect that member's management role.

Should an LLC member wish to leave the LLC management, they'll need to resign from that role in an action separate from the interest transfer. At that point, they’ll determine their replacement in the management following the LLC operating agreement and the state laws.

An LLC member can transfer their interest fully or partially. Full transfer means that the Assignee receives interest identical to that previously held by the Assignor.

In the case of a partial transfer, an LLC member will assign either a portion of their interest or only certain rights to the Assignee.

In most states, the Assignee won't have the right to participate in the operations of the LLC in question. The Assignee is also protected from the Assignor's liabilities, but this may vary according to the state. For example, the Assignee receives the liability in Florida and California.

If the Assignee is introduced into the LLC as a member following the transfer, the Assignee's limitations and rights will be the same as the Assignor's.

Most states will not prohibit any LLC members from assigning interest. Likewise, in most states, interest transfer won't mean that the Assignor relinquishes their right to vote or continue their involvement in LLC management.

Texas is an exception since that state's law mandates that the Assignor must forfeit their LLC membership upon transfer.

Notifying all LLC members of an assignment is mandatory, and in some states, you can only enforce the document upon approval by all LLC members.

LLC members can decide whether the Assignee will become a member if the Assignor wishes to resign their position. The interest transfer doesn't guarantee that the Assignee will automatically become an LLC member.

Why choose 360 Legal Forms?

Our exhaustive library of documents covers your personal, business, and real estate needs with all of your DIY legal forms.

Easy legal documents at your fingertips

Create professional documents for thousands of purposes.

Easily customized

Make unlimited documents and revisions. Sign online in seconds.

Applicable to all 50 states

Our documents are vetted by lawyers and are applicable to all 50 states.

Know someone who needs this document?

Users that make a Assignment of LLC Interest sometimes need additional documents.

- LLC Consent in Lieu of a Meeting

- LLC Membership Admission Agreement

- LLC Operating Agreement

Guide: How to Transfer Ownership of an LLC to a Trust

As a business owner, it’s natural to want to secure the future of your company. One way to do this is by transferring ownership of your LLC to a trust. However, the process of transferring LLC ownership to a trust can be complex and confusing, with legal implications that can have far-reaching consequences.

In this guide, I will provide a step-by-step overview of the process of transferring ownership of an LLC to a trust. I will also discuss the importance of such a transfer , as well as the best practices to follow to ensure a successful transfer. Whether you’re considering transferring ownership to a revocable living trust or an irrevocable trust, this guide will provide you with the information you need to make an informed decision.

Table of Contents

Key Takeaways:

- Transferring ownership of an LLC to a trust involves legal complexities that require careful consideration.

- By transferring ownership to a trust, you can secure the future of your LLC, protect your assets, and minimize tax liabilities.

- The process of transferring ownership involves several steps, including legal requirements, documentation, and filings.

- Following best practices, such as seeking professional advice and maintaining compliance, can help ensure a successful transfer.

- Common challenges in transferring ownership of an LLC to a trust can be overcome with careful planning and attention to detail.

Understanding the Importance of Transferring LLC Ownership to a Trust

When it comes to protecting your business, transferring LLC ownership to a trust can provide numerous benefits. A revocable living trust allows you to maintain control over the LLC while providing asset protection and flexibility. In this section, I’ll cover the process of transferring LLC ownership to a revocable living trust, including the legal requirements and implications.

The Process of Transferring LLC Ownership to a Trust

The process of transferring LLC ownership to a trust involves legally changing the ownership of the LLC from the current owner to the trust. This requires drafting and executing a trust agreement and transferring the LLC ownership documentation to the trust. It’s important to ensure that all legal requirements are met and that all necessary filings are made. Working with a legal professional can help ensure that the transfer is completed correctly.

Transferring LLC Ownership to a Revocable Living Trust

A revocable living trust is a popular option for transferring LLC ownership. This type of trust allows the owner to make changes and revoke the trust if necessary. By transferring ownership to a revocable living trust, you can maintain control over the LLC while enjoying the benefits of asset protection. This type of trust also avoids the probate process, which can save time and money.

Legal Implications of Transferring LLC Ownership to a Trust

Transferring LLC ownership to a trust can have certain legal implications. It’s important to consider factors such as tax implications, compliance with LLC to trust ownership transfer laws , and maintaining legal compliance. Consulting with a legal professional can help ensure that you understand these implications and navigate the transfer process.

Overall Benefits of Transferring LLC Ownership to a Trust

Transferring LLC ownership to a trust provides numerous benefits, including asset protection, flexibility, and avoiding the probate process. It also allows you to maintain control over the LLC while providing a clear plan for the future. By understanding the process and legal implications involved in transferring ownership to a trust, you can secure the future of your LLC and protect your assets.

Steps to Transfer Ownership of an LLC to a Trust

Transferring ownership of an LLC to a trust involves specific steps and legal requirements. To ensure a smooth transfer and maintain compliance with LLC to trust ownership transfer laws , follow the steps outlined below:

- Evaluate the LLC Operating Agreement: Review the LLC’s Operating Agreement to ensure it permits the transfer of ownership to a trust. If there are any restrictions or approval requirements, comply with them.

- Establish a Trust: Create the trust and ensure it complies with state laws and regulations. You may wish to seek the assistance of an attorney during this process to ensure all legal requirements are met.

- Obtain Consent: Obtain consent from all LLC members to transfer ownership to the trust. This may involve drafting and presenting a resolution to the members for approval.

- Transfer Ownership Interest: Draft and execute the necessary documents to transfer the LLC ownership interest to the trust. This may involve filing relevant documents with the state and updating membership records.

- Notify Third Parties: Notify third parties, such as banks and clients, of the transfer of ownership to the trust.

It’s important to note that the steps involved in transferring LLC ownership to a trust may vary depending on state laws and the specific circumstances of your LLC. Consulting with an attorney or legal professional can provide valuable guidance to ensure a seamless transfer.

Best Practices for Transferring LLC Ownership to a Trust

Transferring ownership of an LLC to a trust can be a complex process, requiring careful consideration and planning. To ensure a seamless transfer, it’s essential to follow best practices.

Understand the Legal Implications

Before initiating the transfer process, it’s important to understand the legal requirements and implications. Seek the advice of a qualified attorney who can guide you through the process and ensure compliance with all applicable laws and regulations.

Choose the Right Type of Trust

One important decision to make is the type of trust to which you will transfer ownership. While a revocable living trust is often the preferred choice, an irrevocable trust can offer additional benefits, such as greater asset protection and tax advantages. Consider seeking advice from a financial planner or tax professional to determine the best option for your specific situation.

Update Your LLC Operating Agreement

As part of the transfer process, it’s important to update your LLC’s operating agreement to reflect the new ownership structure. This will help ensure the LLC continues to operate smoothly and according to the terms of the trust.

Obtain Valuations of LLC Assets

To ensure a fair and accurate transfer of ownership, it’s important to obtain valuations of the LLC’s assets. This will help to determine the value of the transferred ownership interest and ensure the trust is appropriately funded.

Consider Tax Implications

Transferring ownership of an LLC to a trust can have significant tax implications. Consult with a tax professional to understand the tax consequences and ensure proper reporting and compliance.

Maintain Legal Compliance

Throughout the transfer process, it’s essential to maintain legal compliance. Ensure all necessary filings and documentation are completed accurately and on time.

By following these best practices, you can ensure a smooth transfer of ownership from your LLC to a trust, providing a secure and stable future for your business.

Overcoming Common Challenges in LLC to Trust Ownership Transfer

Transferring ownership of an LLC to a trust can present certain challenges that require careful consideration. Here are some of the most common obstacles and strategies for overcoming them:

Challenge: Transferable ownership of an LLC to a trust

LLCs often have unique ownership structures and transferable ownership rules that can make transferring ownership particularly challenging. To overcome this challenge, it’s important to carefully review your LLC’s operating agreement and consult with legal professionals to determine the best course of action.

Challenge: Maintaining legal compliance

Transferring ownership of an LLC to a trust requires adherence to state and federal laws. To avoid any legal complications, it’s important to stay informed of legal requirements and regulations. Working with attorneys and tax professionals can ensure that your ownership transfer is compliant with legal standards.

Challenge: Tax implications

Transferring ownership of an LLC to a trust can have significant tax implications. Careful planning and consulting with tax professionals can help mitigate these risks and help you take advantage of potential tax benefits.

Challenge: Asset protection

Transferring ownership to a trust is often done to protect assets from potential legal actions. However, it’s important to properly structure your trust to ensure that assets are protected. Working with legal professionals can help ensure that your trust is set up in a way that provides the necessary asset protection.

By addressing these challenges, you can successfully navigate the ownership transfer process and secure the future of your LLC through a trust ownership structure.

In conclusion, transferring ownership of an LLC to a trust can provide significant benefits for securing the future of your business. By following the step-by-step process outlined in this guide and adhering to best practices, you can ensure a smooth transfer and maintain legal compliance. It’s important to seek professional advice and overcome any common challenges that may arise during the transfer process.

Remember to consider the advantages of transferring ownership to a revocable living trust, as well as the option of an irrevocable trust. Also, keep in mind the potential tax implications and benefits of asset protection.

Overall, transferring ownership of your LLC to a trust is a complex process, but one that can ultimately provide peace of mind and security for your business’s future. As always, seeking professional advice and taking the time to plan and execute the transfer properly is crucial. Thank you for reading this guide on “How to Transfer Ownership of an LLC to a Trust”.

What is the process of transferring ownership of an LLC to a trust?

The process of transferring ownership of an LLC to a trust involves several steps. First, you need to establish a revocable living trust and ensure it complies with state laws. Then, you will need to prepare a transfer document, usually called an assignment of membership interest, which transfers ownership from the LLC to the trust. Finally, you will need to update the LLC’s operating agreement and notify relevant parties of the ownership transfer.

Why is it beneficial to transfer LLC ownership to a trust?

Transferring LLC ownership to a trust offers several benefits. It allows for seamless estate planning, as the trust can outline how the LLC’s assets are distributed after the owner’s death. Additionally, it provides protection against personal liability, as the trust becomes the owner of the LLC. Furthermore, transferring ownership to a trust can help maintain business continuity and ease the process of transferring ownership to future generations.

What are the steps to transfer ownership of an LLC to a trust?

The steps involved in transferring ownership of an LLC to a trust include: 1. Reviewing the LLC’s operating agreement 2. Creating a revocable living trust 3. Preparing an assignment of membership interest document 4. Updating the LLC’s operating agreement 5. Notifying relevant parties of the ownership transfer 6. Ensuring legal compliance with state laws and regulations

What are the best practices for transferring LLC ownership to a trust?

To ensure a smooth transfer of ownership, it is recommended to: 1. Seek professional advice from an attorney or tax expert specializing in trusts and LLCs 2. Clearly define the ownership transfer terms in the trust document 3. Update the LLC’s operating agreement to reflect the ownership change 4. Comply with all legal requirements and filings related to the transfer 5. Consider the tax implications and consult with a tax professional 6. Regularly review and update the trust and LLC documents to align with any changes in ownership or business structure.

What challenges may arise when transferring LLC ownership to a trust?

Some common challenges in transferring LLC ownership to a trust include: 1. Compliance with state-specific laws and regulations 2. Ensuring the transfer does not violate any contractual agreements with third parties 3. Addressing potential tax implications and consequences 4. Resolving conflicts or disputes among LLC members regarding the transfer 5. Navigating complex legal documentation and requirements 6. Managing ongoing administrative tasks related to the trust and LLC after the ownership transfer.

Comments are closed.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

CDM Law Firm

Estate Planning And Business Law

Funding Your Revocable Trust – Business Interests

You’ve heard the term “ funding your trust ” and we’ve discussed transferring your bank and investment accounts, as well as your real property . If you are a business owner, then this article is for you. Here, we take a look at business interests and the importance of having those interests placed in trust.

Limited Liability Companies (“LLCs”)

Like other assets, the failure to transfer your ownership interest in a LLC to your trust can leave your estate open to probate at your passing. While there are various ways for ownership interests to transfer automatically on the death of a member, the best way to avoid probate is to transfer that ownership interest into your revocable living trust.

The simplest way to achieve this is to add the revocable trust as a member of a LLC. The transfer of an LLC interest to a trust may require the approval of other members or managers within the LLC, but such consent is typically granted by the LLC after it has reviewed the Certificate of Trust and the appropriate assignment documents have been executed.

Just as with bank accounts and real property , as you acquire new LLC interest(s), simply provide a copy of your Certificate of Trust and instruct the LLC that you wish to hold title (as a member of the LLC) in the name of your trust. It is good practice to leave LLC managers in the name of individuals not revocable trusts.

Other Business Interests

Any other business interest or sole proprietorship can generally be transferred to trust by an “Assignment of Business Interest”. This document assigns all property/assets owned in the name of the business, for the purpose of determining title, into your trust so that these interests will avoid probate. However, there may be specific issues with the transfer of interests in businesses (such as permits and licenses) and thus it is necessary that they be reviewed in detail before making the transfer. Accordingly, it is recommended that you obtain legal and tax advice prior to transferring any business interest into your trust.

If you have a business interest in a franchise, any transfer of such interest to your trust will probably require the consent of the franchisor. Typically, such consent will be granted by the franchisor after it has reviewed the Certificate of Trust and the appropriate assignment documents have been executed.

Do you have additional questions about funding your revocable trust? Schedule a free 30-minute estate planning consultation today and let us provide you with the tools you need to reach your estate planning goals.

This article is provided as a public service by the Law Offices of C. David Martinez, PLLC. While the information on this site is about legal issues, it is not legal advice or legal representation. Because of the rapidly changing nature of the law and our reliance upon outside sources, we make no warranty or guarantee of the accuracy or reliability of information contained herein.

The Law Offices of C. David Martinez, PLLC maintains this website to provide general information about its services and various legal topics. The law, however, changes quickly and varies from jurisdiction to jurisdiction. None of this information should be used or relied on as legal advice or opinion about specific matters, facts, situations or issues. You should consult a lawyer about your particular circumstances before you act on any of the information contained in these pages because the information may not apply to you or your problem.

Your reviewing or using this information does not establish an attorney-client relationship between you and our firm or any of our individual lawyers. In addition, you should not send us any information you intend to keep confidential because information you send to us will not be confidential or subject to an attorney-client privilege unless we have previously agreed to represent you on the matters related to the information you send. Hiring a lawyer is an important decision that should not be based solely on advertisements. Before you decide, schedule your free 30-minute consultation so you can decide if our firm meets your legal needs. The firm does not necessarily endorse, and is not responsible for, any third-party content that may be accessed through this website.

This website and Law Offices of C. David Martinez, PLLC are regulated by the Arizona State Bar and the Arizona Rules of Professional Conduct.

Contact C. David Martinez with any questions about our firm.

Privacy Policy

- •

- SLO: (805) 546-8785 | Paso Robles: (805) 226-4148

Transfer Your Interest in an LLC to Your Trust

- By Victor Herrera

- September 13, 2021

- Estate Planning

Protecting family assets

As previously discussed, placing your real property assets into an LLC may be an effective means of asset protection . Now that your real property is titled in an LLC and is protected, a question to consider is: how can you make sure the asset(s) in your LLC are transferred to your children or other beneficiaries with as little difficulty and cost as possible upon your death?

If lacking an estate plan

Traditionally, if you had no estate plan at the time of your death, then any interest you have in an LLC (and its assets) will pass through the laws of intestacy. This means that before the interest can be transferred, a probate proceeding will be initiated. Upon completing the probate proceeding, any interest in the LLC is transferred to the decedent’s heirs. A probate proceeding can be (and often is) an expensive and lengthy public process, often spanning a year or more, that requires court supervision.

A simpler solution

However, if your interest in an LLC is titled to your trust, then any interest in the LLC can be transferred and distributed by the trust’s trustee upon your death as directed by the terms of the trust. This informal process to complete any transfer does not need court supervision, so it is faster, easier, and far less costly.

Conceptualizing this process

A hypothetical can help explain the various outcomes. Mr. Smith passes away, leaving three children. His main asset is an LLC worth $1,000,000.00 at the date of death. He had expressed that he wanted his son, John Smith, to manage his interest in the LLC for five years. During those five years, any income created by the LLC is to be divided equally between his three children. At the end of the five years, the interest in the LLC is to go to John Smith.

Scenario 1: Lacking proper estate planning

At John Smith’s death, he either left no will or had a will, but never created a trust. As he passed away with no further estate planning, a probate proceeding would be initiated to transfer the LLC. After the appointment of a personal representative and payment of any outstanding debts owed by Mr. Smith at his date of death, the court would order that the asset(s) of his estate, including the LLC, be divided equally between Mr. Smith’s three children.

In this scenario, Mr. Smith would be unable to manage the interest in the LLC. The attorney’s fees would equal at least $23,000.00 (the statutory percentage based on the LLC’s value). The personal representative could receive the same compensation as counsel. Mr. Smith’s wishes about the LLC would not (and could not) be fulfilled.

Scenario 2: A properly prepared trust

Before his death, Mr. Smith prepared a trust naming John Smith as the trust’s successor trustee. The trust instructs the successor trustee to manage the LLC for five years. During those five years, any income created by the trust, including the LLC, is divided equally between his three children. Thereafter, the interest in the LLC is to go to John Smith.

After Mr. Smith passes away, John Smith would step in as successor trustee of the trust. For the next five years, he would manage the trust, including the LLC, and distribute any income between Mr. Smith’s three children. Then, after five years, John Smith, as trustee of the trust, would transfer the interest in the LLC to John Smith as a beneficiary of the trust. In this scenario, because Mr. Smith created a trust and titled his assets in the name of that trust, there is neither confusion about what Mr. Smith wants nor any court intervention or supervision. Thus, Mr. Smith’s wishes would be fulfilled.

Contact Legal Professional

The information provided herein does not, and is not intended to, constitute legal advice; instead all information, content, and materials are for general informational purposes only.

If you have any questions, please contact Carmel & Naccasha , and for more details, read our full disclaimer.

It is never too early to start an estate plan or discuss how an estate plan can help fulfill your wishes, so don’t wait. Please contact attorney, Victor Herrera , and his team at Carmel & Naccasha today!

Share this Article

RECENT ARTICLES

Celebrating Earth Day 2024

Carmel & Naccasha Supports Empty Bowls

Carmel & Naccasha Partner Ann Wilson Lends Her Expertise to Local Real Estate Group

Carmel & Naccasha Supports the Women Lawyers Association

Are Wills Needed in a Community Property State?

Contact Us for a Case Evaluation Today

- SAN LUIS OBISPO OFFICE 694 Santa Rosa Street San Luis Obispo, CA 93401

- (805) 546-8785

- (805) 546-8015

- PASO ROBLES OFFICE 1908 Spring Street Paso Robles, CA 93446

- (805) 226-4148

- (805) 226-4147

Recent Posts

Celebrate the Month of the Child 2024

- Domestic Asset Protection Trust

- Asset Protection Planning

How to Transfer Ownership of an LLC into a Trust

Asset Protection Strategies

Under Colorado/Wyoming law, an LLC interest is treated as personal property. Any personal property that you own, as opposed to your trust, at the time of your death will have to go through probate. Therefore, if you own an LLC or an interest in an LLC personally, e.g., it has not been transferred into your trust, it will have to go through probate which can cost a great amount of money, take time, and can delay the transfer of your LLC interests. However, you can transfer your LLC interest(s) to your trust just like you would transfer other personal property.

Before attempting to transfer any interest in the LLC, make sure you or your attorney thoroughly review the LLC’s Operating Agreement to ensure that you are permitted to transfer (or assign) your LLC interest. Violating any transfer provisions can cause your trust beneficiaries to have unrealistic expectations as the intended transfer will more than likely have been ineffective and your trust will not actually own your LLC interest. As you can imagine, this can cause your beneficiaries great frustration and lead to litigation. If your Operating Agreement does allow for transfer, but it places limitations or requires explicit procedures be followed to do so, make sure you follow these provisions to ensure the LLC interest transfer is effective.

Assuming your Operating Agreement allows you to transfer your interest, you will prepare and sign an assignment of your LLC interest to your trust. You will also sign this same document accepting the interest of the LLC as you will be the Trustee of your Trust.

Next, you will need to draft and file an Amendment to your Articles of Organization with the Wyoming/Colorado Secretary of State. If the LLC is member managed, then you will also need to file an amendment to the Articles to update the member of the LLC as prior to the transfer you as an individual would have been named, but after the transfer, the trust, not you as an individual, will be listed as the member. If the LLC is manager managed, you will need to file an amendment with the Colorado/Wyoming Secretary of State if your trust owns 20% or more of the LLC.

It would be ideal to amend the Operating Agreement to reflect the transfer of ownership from you to your trust, although it is not required. Of course, the practicability of doing so depends on the number of members of the LLC and the terms of the then existing Operating Agreement. Additionally, while it’s not required, it would also be a good idea to have the LLC members sign a resolution acknowledging and accepting the transfer of your LLC interest to your trust in order to avoid any future conflict, confusion, and possible litigation. By doing so, any issues within the Operating Agreement that may affect the validity of making this transfer can be dealt with now proactively rather than waiting for a problem to arise after you’ve passed.

RELATED TOPICS

- E-Newsletter

- Scholarship

- Giving Back

- Incapacity Planning

- Powers of Attorney

- Prenuptial Agreements

- Legal Representation for Trustees

- Legal Representation for Beneficiaries

- Trust Administration

- Conservatorships

- Business Planning

- Attorneys & Staff

- Resources + Events

- No-Cost Consultation

- California Satellite Offices

How to Transfer Business Interests into a Trust

After you create a trust, your next step is to transfer your assets into your trust. But what if you own a business interest? Should you transfer that into your trust too? Transferring business interests into a trust can be complicated, but here’s an overview of the basics.

Why Transfer Business Interests into a Trust?

Some people who create a trust choose to transfer their business interests into it for the following reasons:

- Avoiding Probate: Just like any other asset, business interests that exceed the California probate threshold can trigger a lengthy, expensive, and public probate proceeding. Assets that are placed in a trust do not need to be probated.

- Incapacity Planning: A trust ensures that your business can continue operating not only upon your death, but also if you become incapacitated due to an accident or illness. If your business interests are placed in a trust and you become incapacitated, your successor trustee can immediately take over your duties to keep your business operating during your absence.

What to Know Before Transferring Assets

Before transferring your business interests into a trust, you should always consult an experienced estate planning attorney . Depending on what kind of business interest you own, they can help ensure that this transfer won’t violate a corporation’s bylaws, an LLC operating agreement, or a shareholders’ buy-sell agreement.

Your attorney can also draft a trust that specifically grants the trustee powers to manage your business. Each type of business interest has its own requirements so working with an attorney is key to avoiding any potential missteps.

How to Transfer a Business Interest into a Trust

The process for transferring your business interest into a trust varies depending on what kind of business interest you own and how it was set up. Here are a few of the most common types.

Sole Proprietorship

In a sole proprietorship, you are the only business owner. Because of this, you do not need the agreement or permission of anyone else to transfer your business interest into your trust. You would simply assign your business assets and interests into the trust. This is accomplished with an Assignment of Interest agreement. Just like it sounds, this agreement assigns your interests into your trust so that it becomes a trust asset.

Corporations

If you own stock or shares in a corporation, you should contact the corporation and fill out any necessary documents to transfer your stock or shares to a trust. Often this document is called an “Assignment of Stock”. Submit this document to the corporation and have them file it.

Next, the corporation will re-issue you new stock documents listing the trust as the owner. Check with your corporation on any additional terms or conditions when making trust transfers.

LLC or General or Limited Partnership

When it comes to a Limited Liability Company (LLC) or a general or limited partnership, you may own a complete or only a partial interest in the business. You’ll want to first review the terms and conditions of your LLC or partnership agreement to review the requirements for transferring your portion into a trust. If there are other partners, they may need to vote on and approve the change.

Next, seek counsel from your attorney on the best way to transfer your portion of the business into your trust. This will vary, depending on how your business was set up. For an LLC, you may need to execute an “Assignment of Interest”, notify your partners, and sign a document agreeing to the change. For a partnership, you may need to change your partnership ownership certificate to you as the owner of the share.

When transferring business interests into a trust, an experienced estate planning attorney can provide legal advice on how to best achieve your goals. If you have any questions about transferring business interests into a trust, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.

Download our Free “Estate Planning Essentials” eBook

Taking the time to create a comprehensive estate plan is critical for everyone. We have helped many clients develop personalized estate plans. Whether you already have an estate plan that you would like to update or you would like to create your first estate plan, we can help. Download our free "Estate Planning Essentials" eBook to get started.

Related posts

More from daniel hunt law.

- Estate Planning

Disposition of Remains in California

How to Get Power of Attorney in California

Revocable vs. Irrevocable Trusts

- 979 Beachland Blvd. Vero Beach, FL 32963

- Local: (772) 231-1100

- Toll Free: (800) 990-3050

- (772) 231-1100

- (800) 990-3050

The Gould Cooksey Fennell Blog

- All Blog Posts

Operating Agreement Controls Over Revocable Trust in Estate Battle Over Ownership Interest in Limited Liability Company

- January 30, 2015

Jason L. Odom

If you specify a transfer of llc membership interest upon death but promise the same property to someone else in your revocable trust, who wins.

In the case of Blechman v. Estate of Blechman , Bertram Blechman and his sister formed Laura Investments, LLC, a limited liability company. Upon forming the company, Bertram and his sister executed an operating agreement which outlines the business’s basic structure and gave each of them—as an owner—a 50% “Membership Interest” in the company. As defined by the agreement, this “interest” consisted of the “rights to distributions, allocations and information, and the right to vote on matters coming before the Members.”

In addition to providing a managerial framework, the agreement imposed restrictions upon each Member’s ability to convey his interest in the company. In the case of death of a Member, the agreement provided that, unless (i) a Member shall transfer all or a portion of his LLC Membership Interest to a member of his immediate family, (ii) a Member bequeaths the Membership Interest in the Member’s last will and testament to members of the immediate family of the Member, or (iii) all such Membership Interest of a deceased Member are inherited by members of the Member’s immediate family, the LLC Membership Interest shall pass to and immediately vest in the deceased Member’s then living children.

The Bertram Blechman Revocable Living Trust

On December 12, 2000, Bertram executed his last will and testament and The Bertram Blechman Revocable Living Trust. Neither the will, nor the trust, contained any provision relating to Bertram’s 50% ownership interest in the LLC. However, on August 20, 2010, Bertram amended his trust to provide a “specific gift” of his residence and one half of the distributions from the LLC, to a trustee for the benefit of Arlene Roogow—Bertram’s girlfriend since 2003. The trust also required the Estate to pay the expenses associated with maintenance of the home.

Bertram’s Revocable Trust Provision is Nullified

On February 25, 2011, Bertram died. Predictably, Ms. Roogow asked the probate court to award her the residence and to transfer the LLC’s distributions from the Estate account to her own account to pay her expenses associated with the residence, pursuant to the 2010 trust amendment. Bertram’s children, however, took the position that the LLC membership and its distributions were not an estate asset, because upon Bertram’s death his 50% interest in the LLC immediately vested in them, as his children. Ms. Roogow countered that the specific devise in the 2010 trust amendment controlled, and she was therefore entitled to the distributions. The probate court sided with Ms. Roogow and held that the LLC was an estate asset, and as a result, Ms. Roogow was entitled to receive one-half of the distributions from the LLC. The children appealed.

The Florida Fourth District Court of Appeal disagreed with the probate court and reversed. The appellate court held that under Florida law the express language in contracts addressing the disposition of property trumps contrary language in a testamentary instrument, such as a will or trust. In other words, Bertram’s revocable trust provision is nullified to the extent it is contradicted by the LLC’s contractual provisions. The appellate court noted that the express language of the operating agreement provided that, unless the Member’s Interest was transferred or bequeathed to a member of his or her immediate family, the Interest would immediately vest in the Member’s children upon death of the Member. In this case, because Ms. Roogow was not a member of Bertram’s immediate family, Bertram’s 50% interest in the LLC immediately vested in his children upon his death. Furthermore, because Bertram’s 50% interest in the LLC immediately vested in his children, the LLC and distributions from the LLC membership were not a probate asset, which meant the distributions could not be used to pay Estate expenses, such as for the upkeep on the residence that was provided to Ms. Roogow.

The Importance of Proper and Thorough Estate Planning

This case highlights the importance of good, and thorough, estate planning in order to effectuate the client’s intent and avoid litigation. The operating agreement spelled out precisely how a Member could transfer their interest at death; however, for unknown reasons it was obviously not taken into consideration when Bertram amended his trust in 2010. While it seems pretty clear that Bertram intended to provide for Ms. Roogow on his death, he chose the wrong way to go about doing that, which unfortunately resulted in his intent not being carried out.

If you have questions about your revocable trust, or anything to do with Estate Planning, give our experienced attorneys a call to schedule a private consultation .

About The Author

Subscribe To Our Newsletter

- Practice Areas

- Estate, Trust and Tax

- Real Estate

- Personal Injury

- Medical Malpractice

Recent Posts

What Estate Planners Need To Know About 501(c)(4)s

GCF’s Medical Malpractice Team Earns $31.9 Million Jury Verdict for Daughter of Wrongful Death Victim

How to Choose a Real Estate Attorney

What is Property Portability in Florida?

Blog categories.

- Personal Injury Articles

- Estate, Trust and Tax Law Articles

- Real Estate Law Articles

SPEAK WITH A LEGAL PROFESSIONAL

Providing legal services for Trusts, Estates & Tax Law, & Real Estate Law, Personal Injury & Medical Malpractice in Vero Beach & The Treasure Coast.

QUICK LINKS

- Privacy Policy

OFFICE INFO

- [email protected]

SUBSCRIBE TO OUR NEWSLETTER

This site is not intended as legal advice. The legal information provided is for general information and educational purposes and does not establish an attorney-client relationship. Every situation is different and you should seek legal advice to discuss your particular situation.

Copyright 2024 | Gould Cooksey Fennell Law Firm | All Rights Reserved.

site designed by

* Our attorneys and staff value your privacy and will not share your personal information with any third-party entities.

Assignment of Limited Liability Company Interest to Revocable Trust

Create doc / use template

Chat to our AI Legal Assistant

Edit, collaborate & share

AI review , and Export to .docx

Templates properties

assignment-of-limited-liability-company-interest-to-revocable-trust.docx

Free to use

Property Assignment

Business Contract

Business Contracts

Easy-fill with questionnaire

Tweak with our online editor

Export to .docx format

Save, clone, print & share

Use the world's most advanced AI legal assistant, today

IMAGES

VIDEO

COMMENTS

The LLC hereby approves the transfer of the Membership Interest from Assignor to Assignee. The LLC and Assignor hereby release each other from all claims arising under the LLC. 5. EFFECTIVE DATE. The Assignment is effective on ____________________, 2015 . IN WITNESS WHEREOF, Assignor has executed this Assignment as of the Effective Date.

by Practical Law Trusts & Estates. Maintained • USA (National/Federal) A Standard Document used for transferring an interest in a limited liability company (LLC) to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

Additionally, an Assignment of Membership Interest form should be executed and kept with the LLC's records. Tax Implications: Transferring an LLC into a trust in California may have implications for property taxes if the LLC owns real property, due to Proposition 13. The transfer could potentially be seen as a change in ownership that triggers ...

However, you can transfer your portion of the business interest to a Trust as long as you secure a document of transfer, sometimes called an Assignment of Interest. This document will state that you are choosing to transfer your portion of the interests over to a Trust. It will be important to also give a copy of this document to your partners ...

1. Assignment of LLC Interest to Revocable Trust: The Assignment of LLC Interest to Revocable Trust form is designed to transfer the ownership rights and interests of an LLC into a revocable trust. By assigning the LLC interest to the trust, the individual can effectively protect their assets, streamline the management of their business, and ...

Size 2 to 3 pages. 4.8 - 951 votes. Fill out the template. An LLC Membership Interest Assignment is a document used when one member of an LLC, also known as a limited liability company, wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise ...

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes. Typically seen when a member wishes to exit a ...

Make use of the most complete legal library of forms. US Legal Forms is the best platform for finding updated Assignment of LLC Company Interest to Living Trust templates. Our service provides a large number of legal forms drafted by certified lawyers and grouped by state.

An Assignment of LLC Interest is a legally binding document, which means all parties should ensure they understand and agree to all terms within it before signing. Once the Assignor and Assignee confirm that all information in the document is correct, both parties will need to sign the document to make it valid.

The Assignment of LLC Interest to Revocable Trust Form is a legal document that allows an individual to transfer their interest in a limited liability company (LLC) to a revocable trust. This form format provides a detailed outline of the necessary information required for the successful transfer of ownership.

The process of transferring LLC ownership to a trust involves legally changing the ownership of the LLC from the current owner to the trust. This requires drafting and executing a trust agreement and transferring the LLC ownership documentation to the trust. It's important to ensure that all legal requirements are met and that all necessary ...

The general partner or managing member of the LLC may already have a form to assign your interest to your trust. If not, we can prepare one. The Assignment should identify your interest that is being transferred, how the interest should be titled, and that the trustee accepts any liabilities as well as benefits.

The simplest way to achieve this is to add the revocable trust as a member of a LLC. The transfer of an LLC interest to a trust may require the approval of other members or managers within the LLC, but such consent is typically granted by the LLC after it has reviewed the Certificate of Trust and the appropriate assignment documents have been ...

A simpler solution. However, if your interest in an LLC is titled to your trust, then any interest in the LLC can be transferred and distributed by the trust's trustee upon your death as directed by the terms of the trust. This informal process to complete any transfer does not need court supervision, so it is faster, easier, and far less costly.

Single-Member LLC Assignment: This form variation is used when the assignor is the sole LLC member. It enables the transfer of the entire ownership interest of the LLC to the revocable trust. 2. Multiple-Member LLC Assignment: In cases where there are multiple LLC members, this form variation allows a specific member to assign their interest to ...

Assuming your Operating Agreement allows you to transfer your interest, you will prepare and sign an assignment of your LLC interest to your trust. You will also sign this same document accepting the interest of the LLC as you will be the Trustee of your Trust. Next, you will need to draft and file an Amendment to your Articles of Organization ...

Corporations. If you own stock or shares in a corporation, you should contact the corporation and fill out any necessary documents to transfer your stock or shares to a trust. Often this document is called an "Assignment of Stock". Submit this document to the corporation and have them file it. Next, the corporation will re-issue you new ...

Here are two key points to consider: 1. Purpose and Benefits: The primary purpose of an Assignment of LLC Interest to Revocable Trust Form is to facilitate the transfer of ownership of an LLC interest to a revocable trust. This form is commonly used for estate planning purposes, providing numerous benefits to the LLC owner and their beneficiaries.

In addition to providing a managerial framework, the agreement imposed restrictions upon each Member's ability to convey his interest in the company. In the case of death of a Member, the agreement provided that, unless (i) a Member shall transfer all or a portion of his LLC Membership Interest to a member of his immediate family, (ii) a ...

A Revocable Trust is a legal arrangement where assets are transferred into a trust during the lifetime of the trust creator, with the flexibility to modify or revoke the trust at any time. The template outlines the necessary details and provisions to effectuate the assignment, ensuring compliance with applicable state and federal laws regarding ...

Revocable Assignment of LLC Company Interest to Living Trust: Unlike the irrevocable assignment, a revocable assignment allows the owner to modify or revoke the assignment at any time during their lifetime. This flexibility provides the owner with more control over their LLC interest and the ability to adapt the estate plan as needed ...

The grantor transfers and conveys possession, ownership, and all right, title, and interest in the following property to the Living Trust: The grantor warrants that he or she owns this property and that he or she has the full authority to transfer and convey the property to the Living Trust. Grantor also warrants that the property is ...

Conclusion: The Assignment of LLC Interest to Revocable Trust Form for Income Tax is a vital tool in effective estate planning, asset protection, and income tax management. By utilizing this form, individuals can avoid probate, maintain privacy, plan for incapacity, and potentially optimize their income tax situation.