- International

- Today’s Paper

- Premium Stories

- Express Shorts

- Health & Wellness

- Board Exam Results

Explained: The cause and effect of rising inflation

Inflation in april is at its highest in the last 8 years, and almost twice the rbi's target. a look at the factors that have kept inflation high since october 2019, and how it impacts consumers and the economy..

On Thursday, official data revealed that retail inflation had grown by 7.8% in April . In other words, the general price level Indian consumers faced was almost 8% higher than it was in April last year.

This is not only the highest rate in the last eight years but also almost twice the inflation rate targeted by the Reserve Bank of India. According to law, since October 2016, the RBI is required to maintain retail inflation at a level of 4%; it is, however, given a leeway of two percentage points on either side — that is, in a particular month, inflation can either fall as low as 2% or rise as much as 6%.

Is the April spike because of Ukraine?

While the war in Ukraine and the associated inflation via higher prices of crude oil are a significant contributor, April’s high inflation data is neither unexpected nor a one-off spike.

Retail inflation has been high since October 2019 and has, in fact, touched the 4% mark just once since then. In all other months, it has been not only been higher than 4% but regularly breached the 6% mark.

April’s inflation is the seventh straight month when inflation rate has gone up. Further, inflation in India has been above 6% since the start of 2022 (before Russia’s invasion of Ukraine happened in February) and the eventual pass-through of the higher crude oil prices to domestic consumers (which started happening in late March after elections to five Assemblies were completed).

What is worse is that most analysts expect retail inflation to remain outside that comfort zone (6%) for the rest of the year as well.

So, what is driving inflation?

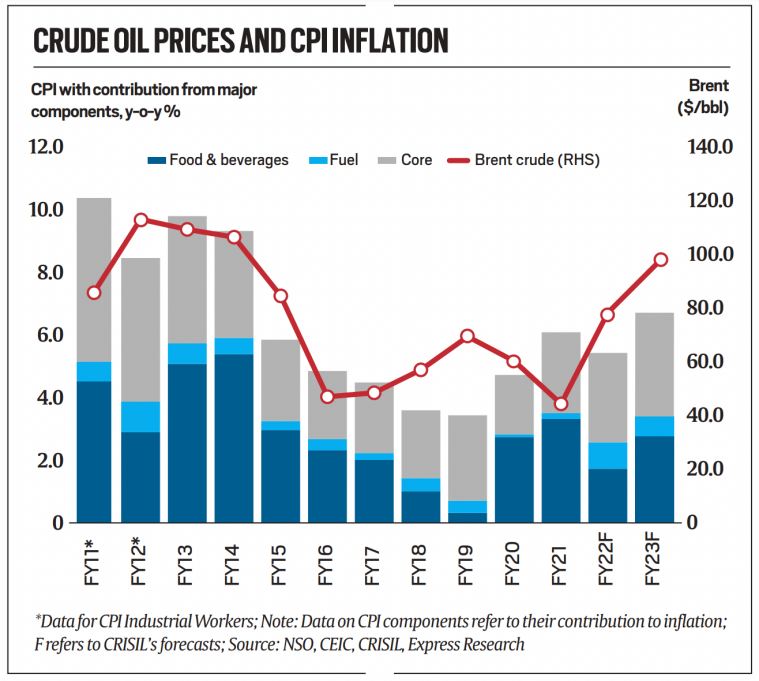

Headline inflation has been above the 4% mark since 2019-20 — the year when the current Narendra Modi government won its second term. Headline inflation is calculated using the Consumer Price Index. This index had different categories with varying weights. There are three main categories:

FOOD ITEMS , which account for 46% of the index;

FUEL & LIGHT , with a weight of 7%;

CORE , all other items, which make up the remaining 47%.

Given the different weights, it is important to understand that a 10% increase in food items will obviously raise the overall inflation far more than a 10% increase in fuel prices.

As the years have rolled by, overall inflation has been driven by more and more factors. In 2019-20, when overall inflation was 4.8%, the main reason was a 6% spike in food prices.

And in 2020-21, when the pandemic hit the economy, food prices rose by an even larger factor (7.3%) and even core inflation rose by 5.5%.

But until then, fuel price inflation was still low — 1.3% in 2019-20 and 2.7% in 2020-21. In 2021-22, the year when the global economy started recovering sharply, even though food price inflation moderated to 4%, fuel prices rose by 11.3% and core inflation went up to 6%.

In the current financial year, it is estimated that all three components will experience an inflation rate of 6% or more.

What are the effects of high inflation?

In the short term, inflation creates winners and losers, but in the eventual analysis, everyone suffers if it stays persistently high.

- Why fentanyl figured in the discussions during Antony Blinken’s China visit

- Expert Explains: What Election Commission can do in case normal polling process is disrupted

- What is a Bambi Bucket, being used by an IAF helicopter to fight Nainital forest fires?

Some of the likely impacts of inflation:

* It reduces people’s purchasing power. Given the actual observed inflation as well as the expected inflation in the current year, the general price level at the end of 2022 would be around 25% higher than it was at the start of 2019. Even in normal times, this would have restricted people’s ability to purchase things, but coupled with reduced incomes and job losses, households would struggle even more. The poor are the worst affected because they have little buffer to sustain through long periods of high inflation.

* It reduces overall demand. The eventual fallout of reduced purchasing power is that consumers demand fewer goods and services. Typically, non-essential demands such as a vacation get curtailed while households focus on the essentials.

* It harms savers and helps borrowers. High inflation eats away the real interest earned from keeping one’s money in the bank or similar savings instruments. Earning a 6% nominal interest from a savings deposit effectively means earning no interest if inflation is at 6%. By the reverse logic, borrowers are better off when inflation rises because they end up paying a lower “real” interest rate.

* It helps the government meet debt obligations. In the short term, the government, which is the single largest borrower in the economy, benefits from high inflation. Inflation also allows the government to meet its fiscal deficit targets. Fiscal deficit limits are is expressed as a percentage of the nominal GDP. As the nominal GDP rises because of inflation (without necessarily implying an increase in overall production), the same amount of fiscal deficit (borrowing) become a smaller percentage of the GDP.

* Mixed results for corporate profitability. In the short term, corporates, especially the large and dominant ones, could enjoy higher profitability because they might be in a position to pass on the prices to consumers. But for many companies, especially smaller ones, persistently higher inflation will reduce sales and profitability because of lower demand.

* It worsens the exchange rate. High inflation means the rupee is losing its power and, if the RBI doesn’t raise interest rates fast enough, investors will increasingly stay away because of reduced returns. For instance, as of Thursday, the return on a 10-year Government of India bond, which is essentially a risk-free investment, was 7.2%. But with inflation at 7.8%, this implies a negative rate of return.

* It leads to expectations of higher inflation. Persistently high inflation changes the psychology of people. People expect future prices to be higher and demand higher wages. But this, in turn, creates its own spiral of inflation as companies try to price goods and services even higher.

The way out is for the RBI to raise interest rates in a credible fashion. The difficulty is that raising interest rates at the current juncture, when growth is iffy, could lead to concerns of stagflation.

Newsletter | Click to get the day’s best explainers in your inbox

Campervan travellers are discovering off-the-grid vacays Subscriber Only

Ruslaan movie review

Heeramandi actors on playing women with different shades Subscriber Only

Vijay Rana's Kashi: The Abode of Shiva Subscriber Only

A bird's beak: Tool for life (and love)

Mohanlal Gandhi’s The Making of a Metropolis Subscriber Only

Challengers movie review

Breaking the Mould revisits Indian economy’s inequalities Subscriber Only

Knife: Salman Rushdie’s triumph over fate Subscriber Only

Udit Misra is Deputy Associate Editor. Follow him on Twitter @ieuditmisra ... Read More

- Explained Economics

- Express Explained

- Express Premium

In a crucial IPL match, Gujarat Titans (GT) will take on Royal Challengers Bengaluru (RCB) with all eyes on Virat Kohli and Shubman Gill. GT, currently seventh on the table, needs their pacers to step up as their bowling unit has been underwhelming. Meanwhile, RCB's middle-order, led by Patidar, has shown potential. Follow the live score and updates from Ahmedabad.

More Explained

Best of Express

EXPRESS OPINION

Apr 28: Latest News

- 01 6.1 magnitude earthquake shakes Indonesia’s Java Island, tremors felt in Jakarta

- 02 Two Israeli hostages seen in latest video issued by Hamas

- 03 Ships from Turkey planning to deliver aid to Gaza denied right to sail

- 04 ‘Dozens’ of cell phones, SIM cards recovered from Kolhapur Central prison; Two officers, nine guards dismissed

- 05 Pakistan PM Sharif removes 25 senior tax officers for corruption: Report

- Elections 2024

- Political Pulse

- Entertainment

- Movie Review

- Newsletters

- Gold Rate Today

- Silver Rate Today

- Petrol Rate Today

- Diesel Rate Today

- Web Stories

Explained: Why inflation risk is growing in India

You can’t live with it, you can’t live without it

Inflation is called a necessary evil--no one likes it but it is needed for economic growth. Too much inflation can create major problems for policy makers. Both wholesale and retail inflation continued to increase month-on-month in April 2021, though the rise in the former has been much sharper. What’s more, there are chances it may rise further. So, what’s causing this rise in inflation? How will it impact the Indian economy and stock markets and what can be done to control it? Let’s hear what Crisil Research has to say.

What is the current status of inflation in India?

Official data tells us that wholesale price index (WPI)-linked inflation went double-digit at 10.5% year-on-year in April 2021 (from 7.4 per cent in March), for the first time since 2010. The CPI inflation, moderated to 4.3 per cent (from 5.5 per cent in March) – led by a high base of the previous year (it had spiked to 7.2 per cent in April 2020). But last year’s base may not reflect accurate trends, as data collection was disrupted in April and May 2020. A month-on-month analysis may put the picture in better perspective.

What is causing inflation in India?

The sharp rise in commodity prices across the world is a major reason behind the inflation spike in India. This is increasing the import cost for some of the crucial consumables, pushing inflation higher. Brent crude prices crossed $65 per barrel in May 2021, more than double of what it was a year ago. Price of vegetable oils, a major import item, shot up 57% to reach a decadal high in April 2021. Metals prices are near the highest in 10 years and international freight costs are escalating. “The trend of WPI rising for inputs is showing up in manufacturing costs including in chemicals, paper, and textile sectors,” said Dharmakirti Joshi, Chief Economist at Crisil.

What about food inflation?

Food inflation, though currently in check, thanks to falling vegetable prices, can rise. Globally, there has been a secular rise in food prices. Mandi arrivals have been disrupted due to local lockdowns. According to Crisil, inflation has gained momentum in consumer durables, where metals are key production inputs. But, in the case of FMCG, which accounts for 9% of the CPI basket, the sequential inflation has slowed since the start of CY2021. These are in line with expectations but things may change. “Producers are bearing a higher burden of rising input costs than consumers. However, as demand revives, these costs can get increasingly passed on to consumers” said Joshi.

How much can the inflation rise?

As per Crisil estimates, CPI inflation was likely to moderate to 5% this fiscal from 6.2% last fiscal. This was based on lower food inflation benefitting from the high base of last year and assuming a normal monsoon. However, upside inflation risks are growing. On top of rising input prices, supply disruptions brought on by the second Covid wave in rural India are adding to inflationary pressure. These are the major reasons behind such change in projections.

What does this mean for the economy and stock markets?

Controlling inflation is one of the most vital mandates of the Reserve Bank of India, and any unchecked rise can force the central bank to increase interest rates, which have been at historic low levels. It may also have to reconsider its accommodative stance. An increase in interest rates means sucking liquidity out of the system, the availability of which has been the chief driver of stock markets in the last one year. Rise in inflation will also lead to rise in bond yields, making government borrowing costlier.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

- Website Inauguration Function.

- Vocational Placement Cell Inauguration

- Media Coverage.

- Certificate & Recommendations

- Privacy Policy

- Science Project Metric

- Social Studies 8 Class

- Computer Fundamentals

- Introduction to C++

- Programming Methodology

- Programming in C++

- Data structures

- Boolean Algebra

- Object Oriented Concepts

- Database Management Systems

- Open Source Software

- Operating System

- PHP Tutorials

- Earth Science

- Physical Science

- Sets & Functions

- Coordinate Geometry

- Mathematical Reasoning

- Statics and Probability

- Accountancy

- Business Studies

- Political Science

- English (Sr. Secondary)

Hindi (Sr. Secondary)

- Punjab (Sr. Secondary)

- Accountancy and Auditing

- Air Conditioning and Refrigeration Technology

- Automobile Technology

- Electrical Technology

- Electronics Technology

- Hotel Management and Catering Technology

- IT Application

- Marketing and Salesmanship

- Office Secretaryship

- Stenography

- Hindi Essays

- English Essays

Letter Writing

- Shorthand Dictation

English Essay on “Inflation in India” Complete Essay, Paragraph, Speech for Class 10, 12 Students.

Inflation in India

Inflation as an economic phenomenon may be described as the continuous upward spiral of prices in all parts of the economy. This can be described as a boost to the economy, but, if it is not properly handled we may be burdened with rising prices which may prove detrimental to economic growth. The economic situation in a country can be analyzed under the following heads of production and distribution.

When we talk of production we are considering the fields of agriculture and industry. In the agricultural arena, the production process involves all farmer’s activities in the fields together with the working of co-operatives for providing of facilities like better seeds, fertilizers, etc, and last but not the least the facility of proper marketing by the cooperatives to enable the farmer to get the return for his labor which should be reasonable enough an amount for him to be able to look after his domestic needs and responsibilities.

This is desirable to enable the Indian farmer to progress. This seems to be quite logical and simple, but does it really benefit the farmer, how does it aggravate or remedy the process of inflation. In its effort to help the farmer, the Government buys the grain from him, and we have huge warehouses stacked with grain which is expected to feed the Public Distribution System. For this, experience has shown that the lengthy distribution system has often resulted in a lot of wastage of food grains, whiles the Government on its part, is trying to fix a high price for the farmer’s grain and send food for the common man. Here again, prices are fixed by the Government and steadily keep increasing resulting in aggravation of the inflationary process. If the farmers are provided facilities of better seeds, implements, and marketing facilities, production would improve and the market forces of supply and demand would automatically fix appropriate prices.

In the same way, in the industrial sector, also, the Government can help to finance Projects which are found to be socially and economically beneficial, and there are fewer loans not paid back to banks. Thus even in the industrial sector, it is important to have the national interest uppermost in the minds of the authorities. It is not uncommon to see large Projects worth crores of rupees going halfway and then being abandoned. If it was not a useful Project for the Nation, why was it ever started, and colossal sums of money were wasted on it? The same trend has aggravated the upward spiral of the ogre of inflation, ever since the advent of industrialization in free India. —

In politically independent India, we have seen great industrialists like the Tatas and the Birlas who have without fail combined industrial progress with rational utilization of their profits for the benefits of the people. We can be sure that, if their examples were followed for our guidance all the help in the form of Capital goods and money loans from the IMF and the World Bank would, in the span of half a century see India at a much better economic position than we are in, today. As the number of rules and regulations increase there is less participation of market forces and prices continue to be fixed at higher and higher levels, with each passing year. Unless we learn to spread out our gains over a large number of people the inflationary trend will continue to be fuelled.

Every time we have the national budget raising any petrol or diesel prices, we see gradually all prices receive an impetus to rise, and inflationary trend just continues unabated. Hence, in the industrial sphere also see how artificial fixation of prices leads to further inflation.

In India, the importance of small-scale industries cannot be ignored. In this area also we see that though, co-operatives are prominent and do a lot of good to the village artisan, but, once again, the marketing which is done by the co-operative, it is of great benefit but, once again the worker still does not get a proper ‘share of the gains. The artificial fixation of prices in no manner ensures the gain for the workers because of the inflationary trend fuelled by the fixation of prices rather than the sharing of profits by a larger number of people.

In essence, we have seen that, though India has progressed with the passage of time, this progress made does not compare favorably with other countries like Japan who managed to bounce back on the International Economic scene. Inflationary trends are essential when we have just started to invest in capital goods from foreign markets, and are just building up the infrastructure of roads, railways, and dams, etc. but that phase soon after a few decades should get over when the industry starts using their machines to the optimum capacity, and the transport system facilitates trading activity even to the remotest part of the country, and the poverty line includes lesser people with each passing day.

It would be very unfair to say that, nothing has been done but, it definitely needs correction as far as large resources of the country stand blocked in the form of ‘Black Money. The gap of this unaccounted money is becoming tighter and tighter on the economy. The result of all this being that, we have innumerable houses lying vacant, and myriads of people without houses, we have plenty of students needing admission to schools and plenty of trained teachers, but there is a paucity of schools why? This all happens when we have unaccounted money and we cannot do much with it except pay high prices and this class of money further fuels inflation. This is the fertile soil for all corruption, which erodes the economy still further.

At the individual level also as citizens of India we can help in curbing this process for example when we buy anything do we insist on taking a receipt for it? I daresay most of us do not because, not taking a receipt helps the shopkeeper to save his income tax, and the customer saves the sales tax. Hence the system is today flourishing because each one of us, yes, each one of us is contributing to the very existence of ‘Black Money’ and this, in turn, restricts the spread of benefits of progress to the poorer classes, hence a major part of the Indian population continues to live in abject poverty, with a total lack of facilities, education, and have, hardly any chances of progress. Prices must come down by the play of market forces and not in the form of depression leading to an increase in unemployment and poverty.

About evirtualguru_ajaygour

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Quick Links

Popular Tags

Visitors question & answer.

- slide on 10 Comprehension Passages Practice examples with Question and Answers for Class 9, 10, 12 and Bachelors Classes

- अभिषेक राय on Hindi Essay on “Yadi mein Shikshak Hota” , ”यदि मैं शिक्षक होता” Complete Hindi Essay for Class 10, Class 12 and Graduation and other classes.

- Gangadhar Singh on Essay on “A Journey in a Crowded Train” Complete Essay for Class 10, Class 12 and Graduation and other classes.

- Hemashree on Hindi Essay on “Charitra Bal”, “चरित्र बल” Complete Hindi Essay, Paragraph, Speech for Class 7, 8, 9, 10, 12 Students.

- S.J Roy on Letter to the editor of a daily newspaper, about the misuse and poor maintenance of a public park in your area.

Download Our Educational Android Apps

Latest Desk

- Role of the Indian Youth | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Students and Politics | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Menace of Drug Addiction | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- How to Contain Terrorism | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Sanskrit Diwas “संस्कृत दिवस” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Nagrik Suraksha Diwas – 6 December “नागरिक सुरक्षा दिवस – 6 दिसम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Jhanda Diwas – 25 November “झण्डा दिवस – 25 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- NCC Diwas – 28 November “एन.सी.सी. दिवस – 28 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Example Letter regarding election victory.

- Example Letter regarding the award of a Ph.D.

- Example Letter regarding the birth of a child.

- Example Letter regarding going abroad.

- Letter regarding the publishing of a Novel.

Vocational Edu.

- English Shorthand Dictation “East and Dwellings” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines.

- English Shorthand Dictation “Haryana General Sales Tax Act” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Deal with Export of Goods” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Interpreting a State Law” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

Essay on Inflation in India

Students are often asked to write an essay on Inflation in India in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Inflation in India

Understanding inflation.

Inflation is the rate at which the general level of prices for goods and services is rising. It erodes purchasing power, each unit of currency buys fewer goods and services.

Inflation in India

India has battled inflation for decades. It’s primarily caused by demand-pull or cost-push factors. Demand-pull happens when demand exceeds supply. Cost-push inflation is when costs of production increase.

Impact on Economy

High inflation impacts the economy negatively. It reduces the value of money, creates uncertainty, and can lead to less economic growth.

Controlling Inflation

The Reserve Bank of India uses monetary policy to control inflation. It adjusts interest rates and reserves to manage money supply.

250 Words Essay on Inflation in India

Introduction.

Inflation, a crucial economic indicator, refers to the sustained rise in the general level of prices for goods and services. It erodes purchasing power, causing distress among the population, particularly those with fixed incomes. In India, inflation has been a persistent issue, influencing both the economic and social fabric of the country.

Causes of Inflation

India’s inflation is primarily driven by supply-side factors. These include agricultural output fluctuations due to unpredictable monsoons, global commodity price changes, and supply chain disruptions. On the demand side, rapid economic growth, rising incomes, and increased government spending can also contribute to inflationary pressure.

Impacts of Inflation

Inflation impacts India in several ways. It reduces the real income of people, especially the poor and those on fixed incomes. High inflation can also deter investment, as it creates uncertainty about future prices, thereby hindering economic growth.

Managing Inflation in India

The Reserve Bank of India (RBI) plays a pivotal role in managing inflation through monetary policy. The RBI uses tools like the repo rate, reverse repo rate, and cash reserve ratio to control money supply and thus, inflation.

While inflation is a complex issue with multiple causes and effects, prudent economic policies and efficient supply chain management can help mitigate its impacts. It is crucial for India to strike a balance between growth and inflation control to ensure sustainable economic development.

500 Words Essay on Inflation in India

Inflation, a sustained rise in the general level of prices for goods and services, is a fundamental economic concept impacting nations worldwide. In India, it has been a persistent issue, influencing the economic stability and growth trajectory of the nation.

Causes of Inflation in India

The causes of inflation in India are multifaceted. The primary cause is the demand-supply imbalance. When demand for goods and services exceeds their supply, prices tend to rise, leading to inflation. This phenomenon is often driven by increased spending by the government or the private sector.

Another significant cause is the cost-push inflation, where the rising cost of production, including wages, raw materials, and overheads, pushes up the prices of final goods and services. Additionally, India’s dependence on oil imports often leads to inflation due to fluctuations in global oil prices.

Impact of Inflation

Inflation impacts the Indian economy and its citizens in numerous ways. It erodes the purchasing power of money, meaning people have to spend more to buy the same quantity of goods and services. This situation is particularly harsh for those with fixed incomes, such as pensioners.

Inflation also creates uncertainty in the economy, discouraging investment and savings, and potentially leading to lower economic growth. Moreover, it can lead to income redistribution, benefiting those who can hedge against inflation and disadvantaging those who cannot.

Measures to Control Inflation

The Reserve Bank of India (RBI) has several tools at its disposal to control inflation. The most commonly used is the manipulation of interest rates. When the RBI increases interest rates, borrowing becomes more expensive, leading to reduced spending and lower inflation.

Another measure is the regulation of money supply through open market operations. By selling government securities, the RBI can absorb excess liquidity from the market, thereby reducing the money supply and controlling inflation.

Inflation, while a natural part of a growing economy, can become problematic if it is too high or volatile. Thus, understanding and managing inflation is crucial for India’s economic stability and growth. While the RBI plays a key role in controlling inflation, structural reforms to improve supply chains, enhance productivity, and reduce dependency on oil imports are also essential. Through a combination of these measures, India can hope to achieve a stable and low inflation rate conducive to sustained economic growth.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on India Today

- Essay on History of India

- Essay on Agriculture – The Backbone of the India

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Effects of Inflation on Indian Economy

India’s annual GDP saw a growth rate of approx 6.6% last year. This is actually lower than in the previous few years. Now there are a lot of factors for the slow down in growth. One of them is increasing inflation rates. But did you know that inflation can also have a positive impact on the economy? Let us learn more about the effects and results of inflation on the Indian Economy.

Suggested Videos

What is inflation.

Inflation is an economic phenomenon that describes the general increase in the prices of goods and services in the economy. So inflation is the rate at which the average prices of certain selected goods increase in a given time period.

So inflation also indicates the loss of purchasing power of the consumer. The same unit of currency will buy fewer goods and services as their prices increase. This is the loss of purchasing power of the currency of a country.

Effects/ Results of Inflation on Indian Economy

Persistent inflation in an economy can have some very adverse effects. Many problems currently plaguing our economy are results of inflation in our economy. Rapid inflation can disrupt our entire economy can cause a financial crisis in the country. Let us take a look at some of the adverse effects that are results of inflation in the Indian Economy.

Browse more Topics under Money And Money Market

- Introduction to Money

- Measures of Money Supply in India

- Monetary Standards

- Money Market

- Security Related to Money Market

- Classification of Inflation

- Measures to Check Inflation

Balance of Payments

India’s current account deficit is around 17 billion dollars for the last quarter of 2018. This is roughly 2.5% of our GDP. This is because for years now India’s imports are mismatched with their exports. With increasing prices of goods in India, exports have seen a further decline. And the imports have actually become cheaper. So the current account deficit will continue to be a problem for our economy.

Industrial Sector

India has seen a stagnation in the industrial growth in the last few years. The industrial growth for the month of February 2019 year-on-year was merely 0.1%. This is because inflation has adversely affected the industrial sector as well.

The rising prices mean that the factors of production like labor and raw materials have also become expensive. The profit margins of the companies are decreasing. And after an extent, the companies pass on the burden of these additional expenses to the final consumer. And the entire economy suffers.

Final Consumer

The person most affected by rising inflation is the final consumer of goods. The prices of goods and services are constantly rising. But the salaries and income of consumer do not rise proportionately, there is a lag. So the goods and services become less affordable to these final consumers. And the population in the lowest income group are the most affected. They cannot even afford basic necessities.

Investments

One of the major results of inflation in an economy is the general slowdown of the economy. When this happens unemployment rates rise, the purchasing power of the consumer decreases, credit becomes expensive. All these cause a strain on the entire financial system of the country. It discourages heavy investment in the economy by both domestic and international players.

Solved Question on Results of Inflation

Q: Can inflation have a positive impact on the economy?

Ans: Yes, in fact, inflation can have a positive impact on the economy. If it is creeping inflation of about 2%, then it promotes economic growth and has an overall positive impact on a nation’s economy. Anything above 3% inflation is generally considered bad.

Customize your course in 30 seconds

Which class are you in.

Money and Money Market

- Securities Related to Money Market

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Inflation in India: Causes, Effects and Curve

Inflation in India: Causes, Effects and Curve!

Meaning of Inflation:

By inflation we mean a general rise in prices. To be more correct, inflation is a persistent rise in the general price level rather than a once-for-all rise in it.

On the other hand, deflation represents persistently falling prices. Inflation or persistently rising prices is a major problem in India today. When price level rises due to inflation the value of money falls. When there is a persistent rise in price level, the people need more and more money to buy goods and services.

To enable the people to meet their daily needs of consumption of goods and services when their prices are rising, their incomes must rise if they have to maintain their standard of living. For government employees, their dearness allowance is increased. Wages and salaries employed in the organised private sector are also raised, though after some time- lag.

ADVERTISEMENTS:

But people with fixed incomes and those who are self-employed are unable to raise their prices and suffer a lot due to inflation. The poor suffer the most from persistent rise in prices, especially of food-grains and other essential items.

Rate of inflation during the seventies and eighties was very high as compared to the rates of inflation experienced earlier during previous periods. In India, in recent years, 2010-11, 2011-12 and 2012-13, rate of inflation as measured by consumer price index (CPI) has been in double digit figures. Prior to Jan. 2013, even WPI inflation was quite high which compelled Reserve Bank of India to adopt tight monetary policy.

Causes of Inflation:

Let us understand how the inflation originates or what causes it.

Depending upon the specific causes, three types of inflation have been distinguished:

(1) Demand-pull inflation,

(2) Cost-push inflation, and

(3) Structuralist inflation.

An important cause of demand-pull inflation is the excessive growth of money supply in the economy. We will explain this cause of inflation in the Monetarist Theory of Inflation. We will explain and discuss below these three types of inflation.

Demand-Pull Inflation :

This represents a situation where the basic factor at work is the increase in aggregate demand for output either from the households or the entrepreneurs or government organised. The result is that the pressure of demand is such that it cannot be met by the currently available supply of output.

If, for example, in a situation of full employment, the government expenditure or private investment goes up, this is bound to generate an inflationary pressure in the economy. Keynes explained that inflation arises when there occurs an inflationary gap in the economy which comes to exist when aggregate demand for goods and services exceeds aggregate supply at full-employment level of output.

Basically, inflation is caused by a situation whereby the pressure of aggregate demand for goods and services exceeds the available supply of output (both being counted at the prices ruling at the beginning of a period). In such a situation, the rise in price level is the natural consequence.

Now, this imbalance between aggregate demand and supply may be the result of more than one force at work. As we know, aggregate demand is the sum of consumers’ spending on consumer goods and services, government spending on goods and services and net investment being contemplated by the entrepreneurs.

When aggregate demand for all purposes—consumption, investment and government, expenditure—exceeds the supply of goods at current prices, there is arise in price level. Since inflation is a continuous increase in the price level, not a one time rise in it, sustained inflation requires continuous increase in aggregate demand.

In the modem macroeconomics, inflation is explained with AD-AS model. Inflation can be explained by increase in aggregate demand (called “demand shock”) or decrease in aggregate supply or rise in cost of production generally called “supply shock”. Demand-pull inflation occurs when there is upward shift in aggregate demand when supply shocks are absent.

As stated above , demand-pull inflation occurs when there is increase in any component of aggregate demand, namely, consumption demand by households, investment by business firms, increase in government expenditure unmatched by increase in taxes (that is, deficit spending by the government financed by either creation of new money by the central bank or borrowing by the government from the market).

To illustrate the cause of demand-pull inflation, let us assume the government adopts expansionary fiscal policy under which it increases its expenditure without levying extra taxes to finance its increased expenditure by borrowing from the Reserve Bank of India.

To illustrate the above point, let us assume that the government adopts expansionary fiscal policy under which it increases its expenditure on education, health, defence and finances this extra expenditure by borrowing from Reserve Bank of India which prints new notes for this purpose. This will lead to increase in aggregate demand (C + I + G).

If aggregate supply of output does not increase or increases by a relatively less amount in the short run, this will cause demand-supply imbalances which will lead to demand-pull inflation in the economy, that is, general rise in price level.

Similarly, an inflationary process will be initiated if business firms anticipating the opportunities of making profits decide to invest more and to finance the new investment projects by borrowing from the banks being unable to get sufficient funds through savings out of profits and savings invested by the public in them.

This new investment by the firms leads to the increase in aggregate demand for goods and services. However, inflation will occur by this new investment if aggregate supply of output does not increase adequately in the short run to match the increase in aggregate demand.

Therefore, demand-pull inflation generally occurs when the economy is already working at full-employment level of resources or what is now generally called when there is natural rate of unemployment. This is because if aggregate demand increases beyond the full-employment level of output, output of goods cannot be increased adequately without much increase in cost.

Note that in developing countries such as India, there are difficulties of measuring employment, unemployment and full employment. Therefore in the Indian context, instead of full-employment level of output, we use full capacity output of the economy beyond which supply of output cannot be increased.

It is important to note that Keynes in his booklet How to Pay for the War published during the Second World War explained inflation in terms of excess demand for goods relative to the aggregate supply of their output. His notion of the inflationary gap which he put forward in his booklet represented excess of aggregate demand over full-employment output.

This inflationary gap, according to him, leads to the rise in prices. Thus, Keynes explained inflation in terms of demand-pull forces. Therefore, the theory of demand-pull inflation is associated with the name of Keynes.

Since beyond full-employment level of aggregate supply output cannot increase in response to increase in demand, this results in rise in prices under the pressure of excess demand. Aggregate supply curve, according to him, is vertical at full-employment level.

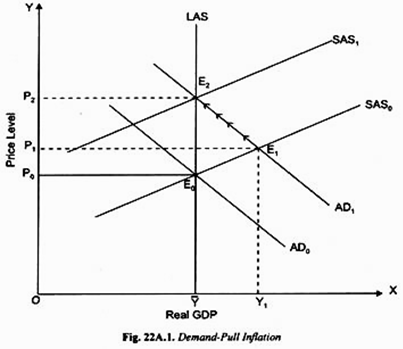

Demand-pull inflation is shown in Figure 22A.1. In the modern macroeconomics distinction is drawn between long-run aggregate supply curve (LAS) and short-run aggregate supply curve (SAS). The long-run aggregate supply curve (LAS) is a vertical line drawn at the full-employment level (i.e. at natural rate of unemployment) or in the Indian context full-capacity output level.

This full-employment level or full-capacity output is also called potential output. The short-run aggregate supply curve SAS 0 slopes upward to the right which shows more supply of output is forthcoming at a higher price and is drawn with a constant wage rate. This short-run aggregate supply curve (SAS) slopes upward because with the increase in employment of labour, diminishing returns to labour occur which raises marginal cost of production.

This short-run aggregate supply curve slopes upward to the right even beyond full-employment or potential level of output. This is because, as explained earlier , even at full-employment level, some unemployment occurs due to frictional and structural factors and therefore beyond full-employment level, employment of labour can increase with reduction in natural unemployment under the pressure of aggregate demand.

It will be seen from Figure 22A. 1 that short-run aggregate supply curve SAS 0 cuts long-run aggregate supply curve LAS at point E 0 . To begin with, aggregate demand curve AD 0 intersects both short-run aggregate supply curve SAS 0 and long-run aggregate supply curve (LAS) at point E 0 and this shows that at point E 0 there is long-run equilibrium at potential or full-employment GDP level Y and at price level P 0 .

Now suppose without increasing taxes government increases its expenditure on goods and services and finances it by borrowing from the Reserve Bank which in turn prints money for this purpose. As a result of increase in government expenditure, aggregate demand curve shifts to the right to AD 1 which intersects the short-run aggregate supply curve SAS 0 at point E 1 and as a result price level rises to P 1 and real GDP to Y 1 .

It needs to be emphasized that price level has risen as a result of rightward shift in aggregate demand curve to AD 1 because aggregate supply has not increased to the extent of increase in aggregate demand and thereby creating demand-supply imbalances.

If short-run aggregate curve had been horizontal line through point E 0 , the aggregate supply would have increased by an equal amount to the increase in aggregate demand when aggregate demand curve shifts to right to AD 1 . Thus, the price level has risen because aggregate demand has increased relatively more than the aggregate supply, that is, due to demand-supply imbalances.

However, the response to the initial increase in aggregate demand to AD 1 does not stop at point E 1 . It may be recalled that in drawing short-run aggregate supply curve wage rate of labour is kept constant. Now, the rightward shift in aggregate demand curve to AD 1 has caused the price level to rise from P 0 to P 1 and real gross domestic output (GDP) has risen to Y 1 .

This rise in price level, the wage rate remaining constant, would cause decline in workers’ real wage rate, W/P 1 < W/P 0 where P 1 > P 0 . When workers realize that their real wage has fallen as a result of increase in aggregate demand causing rise in price level, they will demand higher wages in their negotiations with their employers which are likely to be conceded to.

Further, as pointed out above, equilibrium to the right of potential GDP level Y implies that unemployment has fallen below the natural rate of unemployment and will cause shortage of labour which implies wage rate will rise. When wages are raised by the firms short-run aggregate supply curve will shift upward and this process of shifting short-run aggregate supply curve upward will continue until it reaches SAS 1 which cuts the new aggregate demand curve AD 1 at point E 2 that lies at the long-run supply curve LAS and as a result price level further rises to P 2 .

Equilibrium between aggregate demand and aggregate supply with price as P 2 and at point E 2 on the long-run average supply curve LAC the wage rate has risen by E 0 E 2 equal to the rise in price level by P 0 P 2 . Thus, real wage has been restored at the level prior to increase in aggregate demand from AD 0 to AD 1 .

Note that equilibrium and wage rate at point E 1 on the short-run average supply curve will move to point E 2 at the long-run average supply curve not with a single jump but through various steps of wage adjustment and upward shifting of short-run aggregate supply curve. That is why we depicted this movement from point E 1 to point E 2 on the LAS through various arrows.

Note that not only there is shifting upward of short-run average supply curve to restore previous level of real wage rate but also real GDP has returned to potential or full-employment GDP level Y.

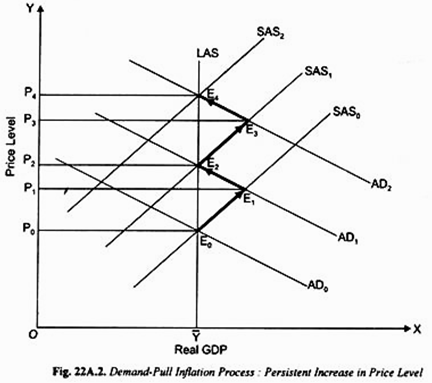

Demand-Pull Inflation Process to Cause Continuous Rise in Price Level:

We have explained above the process of demand-pull inflation when for a given increase in aggregate demand, price level has eventually gone up to price level P 2 and wages have risen enough to restore the real wage to its previous full-employment level.

But, as noted above , inflation is a continuous increase in the price level and not a one-time jump in the price level in response to a given increase in aggregate demand. For sustained or persistent inflation to take place the continuous increase in aggregate demand must occur. In our example aggregate demand can persistently increase if a government has a large persistent budget deficit that it finances by borrowing from the Central Bank or alternatively borrowing from the market year after year.

Besides, continuous increase in aggregate demand can occur if quantity of money is persistently increased by the Central Bank of the country. In these two cases aggregate demand increases year after year causing price level to rise persistently.

This continuous rise in price level is shown in Fig. 22A.2 in which we have assumed that government runs the budget deficit year after year and finances it by borrowing from the Central Bank (that is, government sells its bonds to the Central Bank which prints new money to pay for these bonds).

As a result, aggregate demand increases year after year bringing about continuous rise in price level. Initially, the equilibrium is at point E 0 at which an aggregate demand curve AD 0 intersects long- run aggregate supply curve (LAS) as well as short-run aggregate supply curve SAS 0 .

Now suppose that increase in government expenditure financed by borrowing from the Central Bank shifts aggregate demand curve to AD 1 which intersects the short-run aggregate supply curve SAS 0 at point E 1 raising the price level to P 1 . As explained above , with rise in price level to P 1 real wages of labour will fall and they will demand higher wages.

As a result of rise in wage rate over a number of stages or steps short-run aggregate supply curve (SAS) shifts to the left till it intersects the new aggregate demand curve AD 1 at point E 2 that lies at the long-run aggregate supply curve (LAS). With this equal rise in price level and wage rate, real wage rate of workers is restored.

Now suppose next year the government again incurs a budget deficit and finances its further increase in expenditure by borrowing more from the Central Bank. With this aggregate demand curve shifts to the right to AD 2 and cuts the short-run aggregate supply curve SAS 1 at E 3 and causes price level to rise further to P 3 as shown in Fig. 22A.2.

The rise in price level will cause the fall in real wage rate of workers who will demand increase in their money wage rate further. When higher money wage rate is conceded to, short-run aggregate supply curve will start shifting to the left and the process will eventually end when short-run aggregate supply curve has shifted to the position SAS 2 which intersects aggregate demand curve AD 2 at point E 4 at which price level has risen to P 4 and with that real wage rate of workers is restored at full-employment level with potential GDP equal to Y.

If government further increases its expenditure next year and finances it by borrowing from the Central Bank, price level will further rise. In this way there is continuous inflation triggered by increase in government expenditure and the operation of wage price spiral under the pressure of increase in aggregate demand.

In Fig. 22A.2 we have traced the rise in price level through arrows as aggregate demand increases and short-run aggregate supply curve shifts to the right as a result of increase in money wage rate.

Inflationary Expectations:

Inflationary expectations are an important cause of inflation. The expectations of future prices play a significant role in decision-making by firms regarding price and output. If a firm expects that its rival firms will raise their prices, it may also raise its own price in anticipation.

Suppose inflation has been occurring at a rate of 8 per cent per annum in the past, a firm will expect this inflation rate to continue in future too and therefore it will raise its price by 8 per cent. If every firm expects that other firms will raise their prices by 8 per cent, every one will raise its prices by 8 per cent.

As a result, inflation rate of about 8 per cent will occur. This is how inflationary expectations cause inflation. Elaborating on this, Case and Fair write, “Expectations can lead to an inertia that makes it difficult to stop an inflationary spiral. If prices have been rising and if people’s expectations are adaptive, that is, if they form their expectations on the basis of past pricing behaviour – that firms may continue raising prices even if demand is slowing.” Therefore, to check inflation, steps should be taken to break the inflationary expectations.

Cost-Push Inflation :

We can visualize situations where even though there is no increase in aggregate demand, prices may still rise. This may happen if there is initial increase in costs independent of any increase in aggregate demand.

The four main autonomous increases in costs which generate cost-push inflation have been suggested:

1. Oil Price Shock

2. Farm Price Shock

3. Import Price Shock

4. Wage-Push Inflation

Cost-Push inflation is also called supply-side inflation:

1. Oil Price Shock:

In the seventies the supply shocks causing increase in marginal cost of production became more prominent in bringing about cost-push inflation. During the seventies, rise in prices of energy inputs (hike in crude oil price made by OPEC resulting in rise in prices of petroleum products). The sharp rise in world oil prices during 1973-75 and again in 1979-80 produced significant supply shocks resulting in cost-push inflation.

The sharp rise in the price of oil leads to inflation in all oil-importing countries. The rise in oil price also occurred in 1990, 1999-2000 and again in 2003-08 which resulted in rise in rate of inflation in oil-importing countries such as India.

In recent years, there have been a good deal of fluctuations in oil prices; in some periods they go up and in some others they go down. It may be noted that rise in oil prices not only gives rise to the increase in inflation, but also adversely affects the balance of payments raising current account deficit of the oil-importing countries such as India.

2. Farm Price Shock:

Cost-push inflation can also come about from increase in prices of other raw materials, especially farm products, in economies such as that of India where they are of greater importance. In India when monsoon is not adequate or come very late or when weather conditions are quite unfavourable, they reduce the supply of agricultural products and raise their prices.

These farm products are raw materials for various industries such as sugar industry, other agro-processing industries, cotton textile industry, jute industry and as a result when prices of farm products rise they lead to rise in prices of goods which use the farm products as raw materials. This is farm price shock causing cost-push inflation.

Even rise in food prices or what is called food inflation is caused by supply-side factors such as inadequate rainfall or untimely monsoon and other adverse weather conditions and inadequate availability of fertilizers which lead to reduction in output of food grains is the example of cost-push or supply-side inflation.

3. Import Price Shock:

These days currencies of most countries of the world are flexible, that is, determined by demand for and supply of a currency and they can appreciate or depreciate every month in terms of the US dollar. For example, when the Indian rupee depreciates, more rupees are required to buy one US dollar and therefore in terms of rupees, imports become costlier.

The Indians who import raw materials for industries such as petroleum products, coal, machines and other equipment, oilseeds, fertilizers, Indian consumers who imports gold, cars and other final products have to pay higher prices in terms of rupees when Indian rupee depreciates against US dollar.

This raises the cost of production of the producers who in turn raise the prices of final products produced by them. This inflation is the result of import price shock. Thus depreciation of rupee causes cost-push inflation. For example, in the month of June 2013, there was sharp depreciation of the Indian rupee. The value of rupee fell by about 9.5 per cent in this single month from about Rs. 56 to a US dollar in the first week of June 2013 to around Rs. 61 to a dollar in the last week of June 2013.

4. Wage Push Inflation:

It has been suggested that the growth of powerful trade unions is responsible for the spread of inflation, especially in the industrialized countries. When trade unions push for higher wages which are not justifiable either on grounds of a prior rise in productivity or of cost of living they produce a cost-push effect.

The employers in a situation of high demand and employment are more agreeable to concede to these wage claims because they hope to pass on these rises in costs to the consumers in the form of hike in prices. If this happens we have cost-push inflation.

It may be noted that as a result of cost-push effect of higher wages, short-run aggregate supply curve of output shifts to the left and, given the aggregate demand curve, results in higher price of output.

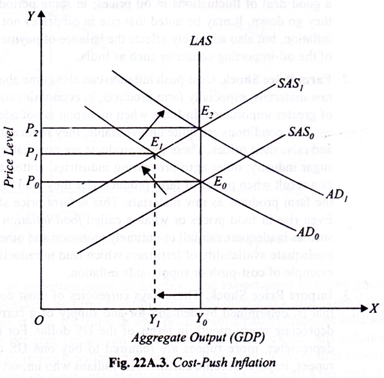

Cost-Push Inflation Spiral :

Let us consider Figure 22A.3 where to begin with aggregate demand curve AD 0 and short-run aggregate supply curve SAS 0 intersect at point E 0 and determine price level P Q and output level Y 0 . Further suppose that Y 0 is the full-capacity (i.e., full-employment) level of output and therefore long-run aggregate supply curve LAS is vertical at Y 0 level of output.

Suppose there is increase in oil prices which causes shifts in short-run aggregate supply curve to the left from SAS 0 to SAS 1 . As a result, price level rises to P 1 but output falls from Y 0 to Y 1 . With decline in output unemployment will also increase.

Thus cost-push inflation not only causes rise in price level (or inflation) but also brings about fall in GDP level. The rise in price level or inflation and simultaneously fall in GDP level is called stagflation. Thus cost-push inflation results in stagflation.

When the real GDP decreases as a result of cost- push inflation in the first stage, the unemployment will also rise. When unemployment emerges there is a huge hue and cry by the workers who are rendered unemployed.

In such a situation either the Central Bank will respond by increasing the money supply to raise aggregate demand or the government will increase its expenditure to provide fiscal stimulus to aggregate demand. As a result of either of these responses, aggregate demand curve shifts to the right from AD 0 to AD 1 .

With this, the economy moves from equilibrium position E 1 to the equilibrium position E 2 . As will be seen from Fig. 22A.3, as a result of this increase in aggregate demand while real GDP has returned to the potential GDP level Y 0 , price level has further risen to P 2 (that is, more inflation will occur).

But the inflationary process of cost-push inflation will not stop at equilibrium point E 2 . If there is further rise in any of the cost-push factors such as rise in oil price, increase in price of farm output, import price shock or wage rate increase takes place short-run aggregate supply curve SAS will shift further to the left of SAS 1 and intersects the aggregate demand curve AD 1 to the left of the long-run aggregate supply curve LAS causing further rise in price level or inflation above P 2 and fall in GDP from the potential level Y 0 resulting again in unemployment of workers.

To restore full employment and raise GDP to the potential level Y 0 , the Central Bank will further increase the money supply or the government will further increase its expenditure. As a result, aggregate demand curve will again shift to the right of AD 1 .

With this, GDP level will be back at the potential level Y 0 and full employment of workers will be restored but price level or inflation will further rise. In this way cost-push inflation spiral will work to cause sustained or persistent inflation.

Many economists think inflation in the economy is generally caused by the interaction of the demand pull-and cost-push factors. The inflation may be started in the first instance either by cost-push factors or by demand-pull factors, both work and interact to cause sustained inflation over time.

Thus, according to Matchup, “There cannot be a thing as cost-push inflation because without an increase in purchasing power and demand, cost increases will lead to unemployment and depression, not to inflation”. Likewise, Cairn-cross writes, “There is no need to pretend that demand and cost inflation do not interact or that excess demand does not aggregate wage inflation, of course it does.”

Monetarist Theory of Inflation :

We have explained above the Keynesian theory of demand-pull inflation. It is important to note that both the original quantity theorists and the modern monetarists, prominent among whom is Milton Friedman, also explain inflation in terms of excess demand for goods and services.

But there is an important difference between the monetarist view of demand-pull inflation and the Keynesian view of it. Keynes explained inflation as arising out of real sector forces. In his model of inflation excess demand comes into being as a result of autonomous increase in expenditure on investment or consumption, or increase in government expenditure on goods and services, that is, the increase in aggregate expenditure or demand occurs independent of any increase in the supply of money.

On the other hand, monetarists explain the emergence of excess demand and the resultant rise in prices on account of the increase in money supply in the economy. To quote Friedman, “Inflation is always and everywhere a monetary phenomenon….. and can be produced only by a more rapid increase in the quantity of money than in output.”

Friedman holds that when money supply is increased in the economy, then there emerges an excess supply of real money balances with the public over the demand for money. This disturbs the equilibrium. In order to restore the equilibrium, the public will reduce the money balances by increasing expenditure on goods and services.

Thus, according to Friedman and other modern quantity theorists, the excess supply of real monetary balances results in the increase in aggregate demand for goods and services. If there is no proportionate increase in output, then extra money supply leads to excess demand for goods and services. This causes inflation or rise in prices.

The whole argument can be presented in the following scheme:

M s > kPY →AD ↑ → P↑ …(1)

where M s stands for quantity of money and P for the price level, Therefore, M s /P represents real cash balances. Y stands for national income and k for the ratio of income which people want to keep in cash balances. Hence kPY represents demand for cash balances (i.e., demand for money), AD represents aggregate demand for or aggregate expenditure on goods and services which is composed of consumption demand (C) and investment demand (I).

In the above scheme it will be seen that when the supply of money (M s ) is increased, it creates excess supply of real cash balances. This is expressed by M s > kPY. This excess supply of real money balances leads to (→) the rise (↑) in aggregate demand (AD). Then increase (↑) in aggregate demand (AD) leads to (→) the rise (↑) in prices (P).

Friedman’s monetarist theory of inflation can be better explained with quantity equation (P = MV/Y = M/Y . 1/k) written in percentage form which is written as below taking For k as constant

where ∆P/P is the rate of inflation, ∆M s /M s

is the rate of growth of money supply and ∆Y/Y is the rate of growth of output. Thus, according to equation (2), rate of inflation (∆P/P) of money supply (∆M s /M) and rate of growth of output (∆Y/Y), with velocity of circulation (V) or k remaining constant. Friedman and other monetarists claim that inflation is predominantly a monetary phenomenon which implies that changes in velocity and output are small.

It thus follows that when money supply increases, it causes disturbance in the equilibrium, that is, M s > kPY. According to Friedman and other monetarists, the reaction of the people would be to spend the excess money supply on goods and services so as to bring money supply in equilibrium with the demand for money.

This leads to the increase in aggregate demand or expenditure on goods and services which, k remaining constant, will lead to the increase in nominal national income (PY). They further argue that the real national income or aggregate output (i.e., Y in the demand for money function stated above) remains stable at full-employment level in the long run due to the flexibility of wages.

Therefore, according to Friedman and his followers (modern monetarists), in the long run, the increase in nominal national income (PY) brought about by the expansion in money supply and resultant increase in aggregate demand will cause a proportional increase in the price level.

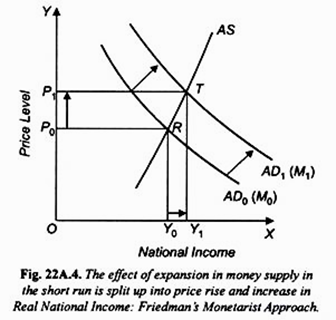

However, in the short run, like Keynesians, they believe that the economy may be working at less than full employment, that is, in the short run there may prevail excess capacity and unemployment of labour so that expansion in money supply and consequent increase in nominal income partly induces expansion in real income (Y) and partly results in rise in the price level as shown in Fig. 22A.4.

To what extent price level increases depends upon the elasticity of supply or aggregate output in the short run. It will be seen from Fig. 22A.4 that effect of increase in money supply from M 0 to M 1 and resultant increase in aggregate demand curve for goods and services from AD 0 to AD 1 is split up into the rise in price level (from P 0 to P 1 ) and the increase in real income or aggregate output (from Y 0 to Y 1 ).

It should be noted that Friedman and other modem quantity theorists believe that in the short run full employment of labour and other resources may not prevail due to recessionary conditions and, therefore, they admit the possibilities of increase in output. But they emphasize that in the short run when the growth in money supply is greater than the growth in output, the result is excess demand for goods and services which causes rise in prices or demand-pull inflation.

It follows from above that both Friedman and Keynesians explain inflation in terms of excess demand for goods and services. Whereas Keynesians explain the emergence of excess demand due to the increase in autonomous expenditure, independent of any increase in money supply. Friedman explains that inflation is caused by proportionately greater increase in money supply than the increase in aggregate output. In both views inflation is of demand-pull variety.

Money and Sustained Inflation :

Many economists believe in the monetarist view of inflation. Increase in money shifts the aggregate demand curve to the right and if the economy is operating at full capacity (i.e., along the vertical part of the aggregate supply curve), the upward shift in aggregate demand curve will cause price level to rise. A big drawback of this approach is that it assumes that supply of output does not increase sufficiently to counter this effect of expansion in money supply on aggregate demand.

In this context there is a need to distinguish between a one-time increase in the price level and sustained inflation which occurs when the general price level continues to rise over a long period of time. It is generally believed by most of the economists that whatever be the initial cause of inflation (demand- pull, cost-push or inflationary expectations), for the price level to continue rising, period after period, it must be accommodated by expansion in money supply.

Sustained inflation is therefore considered as a purely monetary phenomenon. It is not possible for the price level to continue rising if the money supply remains constant. The increase in money supply continues shifting the aggregate demand curve to the right; if aggregate supply does not increase sufficiently to match the increase in aggregate demand, price level will continue rising.

Sustained inflation can be better understood when Government increases its expenditure without raising taxes. This leads to the increase in aggregate demand which, aggregate supply remaining constant, will cause a rise in price level. It is important to know what happens when the price level rises. The higher price level raises the demand for money to rise for transaction purposes.

With supply of money remaining constant, the greater demand for money causes interest rate to rise. The rise in interest rate crowds out private investment. If the Central Bank of a country wants to prevent the fall in the private investment, it will expand the money supply to keep the interest constant. But this expansion in money supply through its effect on aggregate demand will cause the price level to rise further if increase in more supply of output is not possible.

This further rise in price level will again cause greater demand for money leading to higher interest rate. And the Central Bank, if it is committed to keep the interest rate constant so that private investment does not decline, will further expand the money supply which will cause further inflation. This process could lead to hyperinflation which represents a rapid and continuous rise in price level, period after period.

The historical experience shows this hyperinflation in some countries when the Central Bank or Government of these countries kept pumping in more and more money either to finance its persistent budget deficit of the government year after year of to prevent the interest rate to rise. However, as mentioned above , hyperinflation disrupts the payment system and people’s loss of credibility of the currency. This leads to a deep crisis in the economy. If hyperinflation is to be avoided, then the process of rapid expansion in money supply must be halted.

Structuralist Theory of Inflation :

Structuralist theory, another important theory of inflation, is also known as structural theory of inflation and explains inflation in the developing countries in a slightly different way. The Structuralist argue that increase in investment expenditure and the expansion of money supply to finance it are the only proximate and not the ultimate factors responsible for inflation in the developing countries.

According to them, one should go deeper into the question as to why aggregate output, especially of food grains, has not been increasing sufficiently in the developing countries to match the increase in demand brought about by the increase in investment expenditure and money supply. Further, they argue why investment expenditure has not been fully financed by voluntary savings and as a result excessive deficit financing has been done.

Structuralist theory of inflation has been put forward as an explanation of inflation in the developing countries especially of Latin America. The well-known economists, Myrdal and Streeten, who have proposed this theory have analyzed inflation in these developing countries in terms of structural features of their economies. Recently Kirkpatrick and Nixon have generalized this structural theory of inflation as an explanation of inflation prevailing in all developing countries.

Myrdal and Streeten have argued that it is not correct to apply the highly aggregative demand- supply model for explaining inflation in the developing countries. According to them, there is a lack of balanced integrated structure in them where substitution possibilities between consumption and production and inter-sectoral flows of resources between different sectors of the economy are not quite smooth and quick so that inflation in them cannot be reasonably explained in terms of aggregate demand and aggregate supply.

In this connection it is noteworthy that Prof. V.N. Pandit of Delhi School of Economics has also felt the need for distinguishing price behaviour in the Indian agricultural sector from that in the manufacturing sector.

Thus, it has been argued by the exponents of structuralism theory of inflation that economies of the developing countries of Latin America and India are structurally underdeveloped as well as highly fragmented due to the existence of market imperfections and structural rigidities of various types.

The result of these structural imbalances and rigidities is that whereas in some sectors of these developing countries we find shortages of supply relative to demand, in others under utilisation of resources and excess capacity exist due to lack of demand. According to structuralists, these structural features of the developing countries make the aggregate demand-supply model of inflation inapplicable to them.

They therefore argue for analysing dis-aggregative and sectoral demand-supply imbalances to explain inflation in the developing countries. They mention various sectoral constraints or bottlenecks which generate the sectoral imbalances and lead to rise in prices.

Therefore, to explain the origin and propagation of inflation in the developing countries, the forces which generate these bottlenecks or imbalances of various types in the process of economic development need to be analyzed. A study of these bottlenecks is therefore essential for explaining inflation in the developing countries.

These bottlenecks are of three types:

(1) Agricultural bottlenecks which make supply of agricultural products inelastic,

(2) Resources constraint or Government budget constraint, and

(3) Foreign exchange bottleneck. Let us explain briefly how these structural bottlenecks cause inflation in the developing countries.

Agricultural Bottlenecks:

The first and foremost bottlenecks faced by the developing countries relate to agriculture and they prevent supply of food grains to increase adequately. Of special mention of the structural factors are disparities in land ownership, defective land tenure system which act as disincentives for raising agricultural production in response to increasing demand for them arising from increase in people’s incomes, growth in population and urbanization.

Besides, use of backward agricultural technology also hampers agricultural growth. Thus, in order to control inflation, these bottlenecks have to be removed so that agricultural output grows rapidly to meet the increasing demand for it in the process of economic development.

Resources Gap or Government’s Budget Constraint:

Another important bottleneck mentioned by structuralist relates to the lack of resources for financing economic development. In the developing countries planned efforts are being made by the Government to industrialise their economies. This requires large resources to finance public sector investment in various industries. For example, in India, huge amount of resources were used for investment in basic heavy industries started in the public sector.

But socio-economic and political structure of these countries is such that it is not possible for the Government to raise enough resources through taxation, borrowing from the public, surplus generation in the public sector enterprises for investment in the projects of economic development. Revenue raising from taxation has been relatively very small due to low tax base, large scale tax evasion, inefficient and corrupt tax administration.

Consequently, the government has been forced to resort to excessive deficit financing (that is, creation of new currency) which has caused excessive growth in money supply relative to increase in output year after year and has therefore resulted in inflation in the developing countries. Though rapid growth of money supply is the proximate cause of inflation, it is not the proper and adequate explanation of inflation in these economies.

For proper explanation of inflation one should go deeper and enquire into the operation of structural forces which have caused excessive growth in money supply in these developing economies. Besides, resources gap in the private sector due to inadequate voluntary savings and underdevelopment of the capital market have led to their larger borrowings from the banking system which has created excessive bank credit for it.

This has greatly contributed to the growth of money supply in the developing countries and has caused rise in prices. Thus, Kirkpatrick and Nixon write, “The increase in the supply of money was a permissive factor which allowed the inflationary spiral to manifest itself and become cumulative—it was a system of the structural rigidities which give rise to the inflationary pressures rather than the cause of inflation itself.”

Foreign Exchange Bottleneck:

The other important bottleneck which the developing countries have to encounter is the shortage of foreign exchange for financing needed imports for development. In the developing countries ambitious programme of industrialisation is being undertaken. Industrialisation requires heavy imports of capital goods, essential raw materials and in some cases, as in India, even food grains have been imported. Besides, imports of oil on a large scale are being made.

On account of all these imports, import expenditure of the developing countries has been rapidly increasing. On the other hand, due to lack of export surplus, restrictions imposed by the developing countries, relatively low competitiveness of exports, the growth of exports of the developed countries has been sluggish.

As a result of sluggish exports and mounting imports, the developing countries have been facing balance of payment difficulties and shortage of foreign exchange which at times has assumed crisis proportions. This has affected the price level in two ways.

First, due to foreign exchange shortage domestic availability of goods in short supply could not be increased which led to the rise in their prices. Secondly, in Latin American countries as well as in India and Pakistan, to solve the problem of foreign exchange shortage through encouraging exports and reducing imports devaluation in the national currencies had to be made. But this devaluation caused rise in prices of imported goods and materials which further raised the prices of other goods as well due to cascading effect. This brought about cost-push inflation in their economies.

Physical Infrastructural Bottlenecks:

Further, the structuralists point out various bottlenecks such as lack of infrastructural facilities, i.e., lack of power, transport and fuel which stands in the way of adequate growth in output. At present in India, there is acute shortage of these infrastructural inputs which are hampering growth of output.

Sluggish growth of output on the one hand, and excessive growth of money supply on the other have caused what is now called stagflation, that is inflation which exists along with stagnation or slow economic growth.

According to the structuralist school of thought, the above bottlenecks and constraints are rooted in the social, political and economic structure of these countries. Therefore, in its view a broad-based strategy of development which aims to bring about social, institutional and structural changes in these economies is needed to bring about economic growth without inflation.

Further, many structuralists argue for giving higher priority to agriculture in the strategy of development if price stability is to be ensured. Thus, we see that structuralist view is greatly relevant for explaining inflation in the developing countries and for the adoption of measures to control it. Let us further elaborate the causes of inflation in the developing countries.

The Social Costs and Effects of Inflation :

Having discussed the so called inflation fallacy we proceed to explain in detail the social cost and effects of inflation. Apart from reducing the purchasing power of people’s incomes, inflation inflicts some other costs on the society. To explain such costs of inflation it is necessary to distinguish between anticipated inflation and unanticipated (i.e., unexpected) inflation. As noted above, in case of anticipated inflation, the expected rise in price level is taken into account while making economic transactions, for example, in negotiating wage rate of labour etc.

Costs of Anticipated Inflation :