DataSnipper Reaches $1B Valuation with $100M Funding

15 essential questions to ask during an audit walkthrough.

Getting ready for an audit walkthrough and wondering about the questions to throw in? Well, the audit walkthrough is a big deal in the whole auditing process. It's the step where you really dig into the company's financial management and internal control systems.

In this article, we're diving into why audit walkthroughs are so important and giving you the l15 must-ask questions for this part of the process.

The 15 Essential Questions

Now, let's dive into the core of this article – the 15 essential questions to ask during an audit walkthrough. These questions cover various aspects of the company's internal control systems, financial reporting procedures, and compliance with regulatory standards.

Internal Control Systems

- What are the key control activities in place to prevent and detect fraud?

- How are access controls implemented to safeguard sensitive financial information?

- Are there any segregation of duties conflicts that need to be addressed?

- How is the company's risk assessment process conducted?

- Has management identified and documented any significant control deficiencies? How are these deficiencies addressed?

Financial Reporting Procedures

- Can you describe the process of preparing and reviewing financial statements?

- What are the key accounts and significant accounting estimates?

- How are significant transactions recorded, classified, and summarized?

- Are the financial statements prepared in accordance with generally accepted accounting principles?

- What procedures are in place to ensure the accuracy and completeness of financial disclosures?

Compliance with Regulatory Standards

- Are you aware of any potential violations of laws or regulations that could impact the company's financial statements?

- What measures have been implemented to comply with relevant regulatory requirements?

- How does the company monitor changes in accounting standards and regulatory guidelines?

- Is there a process in place to address any non-compliance issues promptly?

- Has the company received any regulatory inquiries or undergone any external audits in the past year?

Interpreting Responses to Audit Questions

As an auditor, it is crucial to interpret the responses to the questions asked during the walkthrough. This involves evaluating the adequacy of control systems and assessing the accuracy of financial reports.

Evaluating the Adequacy of Control Systems

Based on the responses received, auditors should assess the effectiveness of the company's internal control systems. Look for any control weaknesses or gaps that may expose the company to potential risks. Make specific note of any areas that require improvement or corrective actions.

Assessing the Accuracy of Financial Reports

During the walkthrough, auditors should evaluate the accuracy and completeness of the company's financial reporting procedures. Verify if the reported financial information aligns with the documented processes and controls. Identify any discrepancies or inconsistencies that may impact the overall reliability of the financial statements.

- Check out every step of the audit process from planning to reporting.

Post-Audit Walkthrough Actions

Once the audit walkthrough is complete, auditors should take certain actions to ensure that the findings and recommendations are appropriately communicated and implemented.

Communicating Audit Findings

After the walkthrough, auditors should prepare a detailed report outlining their findings and recommendations. This report should clearly communicate any identified deficiencies or weaknesses in the control environment and provide suggestions for improvement. Present the report to management and discuss the key findings and proposed actions.

Implementing Recommended Changes

It's crucial that the management team doesn't delay – they need to act fast on what's highlighted in the audit report. If the report points out areas that need fixing, it's essential to make those changes quickly. This action will strengthen the company's control system and improve their financial practices.

When it comes to an effective audit walkthrough, the key is asking the right questions at every step. By delving into how the company handles things internally, reports their finances, and follows the rules, auditors can uncover valuable insights and suggestions to make financial management even better. As you ask these questions, pay close attention to the answers. That's how you find areas for improvement.

All in all, a solid audit walkthrough brings a big boost of effectiveness and trustworthiness to the entire audit process. So, it's not just about asking questions – it's about making the audit rock-solid and dependable by understanding the company's inner workings, financial reporting practices, and how well they adhere to the rules.

Walkthroughs with DataSnipper

Learn how to efficiently document your walkthrough audit procedure with DataSnipper's Snips and Smart Search.

How do you prepare for a walkthrough audit?

- Review Documentation : Familiarize yourself with relevant policies, procedures, and previous audits to understand the process.

- Define Objectives : Clearly identify what you want to achieve, such as verifying controls or understanding transaction flows.

- Prepare Questions : Develop questions to ask during the walkthrough to probe process execution and control effectiveness.

- Schedule and Identify Personnel : Arrange a suitable time and identify key personnel involved in the process.

- Create a Checklist : List the steps, controls, and compliance points you need to observe.

- Understand Tools and Systems : Get to know any systems or tools used in the process for better assessment.

- Document : Prepare to take detailed notes or recordings during the walkthrough.

- Review Compliance Requirements : Ensure you know any legal or regulatory standards affecting the process.

- Stay Observant : Be ready to notice and note any unexpected issues or insights.

Become a DataSnipper Expert

The Auditor

An exemplar global publication.

- Look in the Mirror: Are you already an Auditor?

- Crucial Update to Management System Standards

- The Greenhouse Effect: Counting Gases and Why It Matters

- Artificial Intelligence: What It Is, How It Works and Why It Matters

- The Two-Step Secret for Control Assessment

- NIST Releases Version 2.0 of Landmark Cybersecurity Framework

- Cyber Expert to Highlight Risks, Opportunities, and How to Build Resilience in the Age of AI

- WTO TBT Committee Adopts New Guidelines to Support Conformity Assessment and International Trade

- Quality Is Not Just a Word We Use, Part Three: The New Gold Standard

- Excellence in Auditing Expo Coming Soon

The Seven Most Important ISO 9001:2015 Audit Questions

By Craig Cochran

If you’re preparing to start auditing to ISO 9001:2015, you’ve probably already asked yourself the timeless question: “What in the heck am I going to ask these people?” There’s no worse feeling in the world than being in the middle of an audit and realizing that you’ve run out of questions. Preparation and planning can remedy this, of course, but the fact remains that ISO 9001:2015 includes a lot of new requirements that have never been part of most audits. To help prepare you for auditing to ISO 9001:2015, I’ve prepared a list of what I consider to be the seven most important audit questions for ISO 9001:2015:

1. What can you tell me about the context of your organization?

This question is the starting point of ISO 9001:2015, appearing in clause 4.1. The standard uses the clunky term “context,” but this could easily be substituted by asking about the organization’s internal and external success factors. Questions about context are usually directed at top management or the person leading the quality management system (QMS)–formerly known as the management representative. As an auditor, you’re looking for a clear examination of forces at work within and around the organization. Does this sound broad and a little vague? It is. Thankfully, the standard provides some guidance, saying that context must include internal and external issues that are relevant to your organization’s purpose, strategy, and QMS goals. Many organizations will probably use a SWOT (strengths, weaknesses, opportunities, and threats) analysis to help get their arms around context, but it’s not a requirement. What the organization learns with this will be a key input to risk analysis. (Note: Not everybody will understand the term “context.” Be prepared to discuss the concept and describe what ISO 9001:2015 is asking for.)

2. Who are your interested parties and what are their requirements?

The natural follow-up to context is interested parties, found in clause 4.2. Just like context, interested parties are a key input to risk. The term “interested parties” has a bizarre, stalker-like ring to it, so smart auditors might want to replace it with “stakeholders.” Remember, effective auditors try to translate the arcane language of ISO 9001:2015 into understandable terms that auditees can grasp. Typical interested parties include employees, customers, suppliers, business owners, debt holders, neighbors, and regulators.

As an auditor, you’re making sure that a reasonable range of interested parties has been identified, along with their corresponding requirements. The best way to audit this is an exploratory discussion. Ask questions about the interested parties, and probe what they’re interested in. If you’ve done some preparation in advance of the audit, you’ll know whether their examination of interested parties is adequate.

This brings up an important planning issue: You’ll have to do a bit more preparation before an ISO 9001:2015 audit. Why? So you’ll have a grasp of context and interested parties. How can you evaluate their responses if you don’t know what the responses should be?

3. What risks and opportunities have been identified, and what are you doing about them?

Risks and opportunities could accurately be called the foundation of ISO 9001:2015. No fewer than 13 other clauses refer directly to risks and opportunities, making them the most “connected” section of the standard. If an organization does a poor job of identifying risks and opportunities, then the QMS cannot be effective, period.

Auditors should verify that risks and opportunities include issues that focus on desired outcomes, prevent problems, and drive improvement. Once risks and opportunities are identified, actions must be planned to address them. ISO 9001:2015 doesn’t specifically mention prioritizing risks and opportunities, though it would be wise for organizations to do this. Risks and opportunities are limitless, but resources are not.

4. What plans have been put in place to achieve quality objectives?

Measurable quality objectives have long been a part of ISO 9001. What’s new is the requirement to plan actions to make them happen. The plans are intended to be specific and actionable, addressing actions, resources, responsibilities, timeframes, and evaluation of results. Auditors should closely examine how the plans have been implemented throughout the organization and who has knowledge of them. Just as employees should be aware of how they contribute to objectives, they should be familiar with the action plans.

5. How has the QMS been integrated into the organization’s business processes?

In other words, how are you using ISO 9001:2015 to help you run the company? This is asked directly of top management (see subclause 5.1.1c) and is a very revealing question. The point is that ISO 9001 is moving away from being a quality management system standard and becoming a strategic management system. It’s not just about making sure products or services meet requirements anymore. The standard is about managing every aspect of the business. Remember clauses 4.1 and 4.2 of ISO 9001:2015? They examine the key topics of context and interested parties. These concepts touch every corner of the organization, and this is exactly how ISO 9001:2015 is intended to be used. Top management should be able to describe how the QMS is used to run the company, not just pass an audit.

6. How do you manage change?

This topic comes up multiple times in ISO 9001:2015. The first and biggest clause on the topic is clause 6.3, Planning of changes. Here we identify changes that we know are coming and develop plans for their implementation. What kind of changes? Nearly anything, but the following changes come to mind as candidates: new or modified products, processes, equipment, tools, employees, regulations. The list is endless. An auditor should review changes that took place and seek evidence that the changes were identified and planned proactively.

Change that happens in a less planned manner is addressed in subclause 8.5.6. Here the auditor will seek records that the changes met requirements, the results of reviewing changes, who authorized them, and subsequent actions that were necessary.

7. How do you capture and use knowledge?

ISO 9001:2015 wants organizations to learn from their experiences, both good and bad. This could be handled by a variety of means: project debriefs, job close-outs, staff meetings, customer reviews, examination of data, and customer feedback. How the organization captures knowledge is up to it, but the process should be clear and functional. The knowledge should also be maintained and accessible. This almost sounds like it will be “documented” in some way, doesn’t it? That’s exactly right. One way to audit this would be to inquire about recent failures or successes. How did the organization learn from these events in a way that will help make it more successful? It’s the conversion of raw information to true knowledge, and it just happens to be one of the most difficult things an organization can achieve.

These are by no means the only questions you’ll want to ask. They’re just the starting point. I didn’t even mention management review, corrective action, or improvement—all of which are crucial to an effective QMS. The seven topics discussed here are the biggest new requirements that auditors need to probe. I would be very interested in hearing from you on this subject. What audit questions do you see as critical in ISO 9001:2015? Please leave your comments below.

About the author

Craig Cochran is the North Metro Regional Manager with Georgia Tech’s Economic Development Institute. He has assisted more than 5,000 companies since 1999 in QMS implementation, problem solving, auditing, and performance improvement. Cochran is a Certified Quality Manager, Certified Quality Engineer, and Certified Quality Auditor through the American Society for Quality. He is certified as a QMS Lead Auditor through Exemplar Global.

He is the author of numerous books, including the newly released ISO 9001:2015 in Plain English , published by Paton Professional .

45 Responses

Hi Craig I would appreciate the ISO 9001 and 14001-2015 check lists. Kindly advise the costs if any have a great day Best Regards Mike Bird

Excellent article. One comment though, to me context is the external and internal “pressures” on the organization and what they do to counter act or respond to these. For example, customers put certain pressures on an organization. What does the organization do because of their customers?

Great ideas for thought

Good listicle, enjoying the book. Kudos Craig!

Craig – thanks for an informative post. As always, appreciate your insights!

Excellent article. Is there a checklist that can be used for internal audits on ISO 9001 : 2015 and ISO 14001 : 2015 ?

This is a great article, interesting reading If possible, where can we obtain checklists for the new standards?

Excellent article adding a new dimension to some of the basic questions used to ascertain where an organisation is at.

Same request is there a checklist and if so may I obtain one? I am concerned about acceptable evidence for the new 9001:2015.

How are these executive level discussions handled in terms of audit nonconformances? If the auditor determines in his/her view that the performance is ineffective, how is that documented as “major” or “minor” nonconformances, and is it not open to debate? How are the auditors trained to have these executive level conversations and make these judgments?

Very apt and insightful questions. Will no doubt ensure value added audit process.

1.to answer Q7 about capturing and maintaining knowledge in the organisation one can refer to Cl 7.1.6-organisation knowledge. 2. For other Questions too author can put the relevant sections of ISO 9001:2015 overall excellent coverage for beginners.

Excellent article. It would be appropriate to also include a question about how the organization has internalized the new term of 7.5 documented information. Best Regards. Víctor Quispe. Lima-Perú.

Very good article. Is there a checklist? May I receive one?

Dear Craig I trust you are well? I requested some information on January 27th 2016-kindly refer to the first [1st] of eleven responses above. Any luck/information or Joy related to this request. Have a great day and Best Regards Mike Bird Fellow and Foundation Member of QSA + 61 408 566 037

Please provide knowledge on: OFI (Opportunities For Improvement) Standard Reference: ISO 9001: 2015 (Clause wise)

Thanks & Regards, Rajeswar Bomma

Hi Craig I would appreciate the ISO 9001 and 14001-2015 check lists. Kindly advise. Have a great day Best Regards David.Thia

Great article where can one find a free 9001:2015 Audit Checklist?

Great info! Same request is there a 9001:2015 Audit Checklist and if so may I obtain one?

hi thanks for describe the requirements of 9001. may i have example for the organizational knowledge and audit check list?

I need one sample good iso 9001 2015 audit report

good and well checklist of iso 9001 2015

Thank you so much, its so much helpful

Thank you Craig. I have your book, ” ISO 9001: 2015 in Plain English” . Well explained. I want to get in touch with you. Can you please share your mail id ?

Can you please share some examples for Audit exercises? (These can be used for training)

That exercise should contain the observation by Auditor and from there we need to identify the Non-Conformities mentioning ISO 9001:2015 clauses.

Thank you once again.

Sorry….these are not the most important questions!

These will get you less than half the picture of whether a QMS is healthy, robust and functioning as intended!

Very informative write up, indeed. Some of the new requirements, such as knowledge base is very deep and value meaning for the organizations. Even a century ago a few organizations avoided trap of “not reinventing the wheel” (inefficiency) by keeping well structured documents (design, amendments, corrections, improvement etc.) so now a days having information technology, data bases, server etc. retaining and protecting information is not a big issue it used to be. However, the structure of the information is key and it is an art form known to a few not many.

Well Done Craig! Definitely using this article as a fantastic reference – thanks!

It is most asked question. Thank for sharing very informative and fantastic article.

hi admin , Nice article where can one find a free 9001:2015 standard Audit- Checklist?

Thank you for your writting! It is easy to understand and detailed. I feel it is interesting, I hope you continue to have such good posts.

Very nice questions for auditing top management!

Subjective Assignment

1.Read and understand the following scenario given below; Based on the scenario, state the Non conformity (NC) and mention the NC clause. State whether it is a major or minor Non conformity. Write the Objective evidence for Non conformity. The supplier development process, “Materials approval on the incoming inspection,” is out of control. Further investigation showed that the major problems were with new suppliers that were selected without any manufacturing site audit, as stated in the supplier development procedure in P7.1, Revision C. According to the purchasing manager, this problem happened because they did not have time to evaluate suppliers in the latest product development.

Enter your answer

Thanks for Sharing Information about ISO 9001 Certification!

Appreciate the time you spend in sharing your knowledge and understanding of these standards. There is always something new for us to learn.

Hi craig this article superb . Is there a checklist that can be used for internal audits on ISO 9001 : 2015 and there relevant clause in all the department ? At least for fresher

Excellent articles

Good Informative. Thanks for sharing it.

FOR ALLCLAUSES

Thanks for ” theauditoronline ” team. shre for this valuable article. all information is very usefull.

its really helpful

https://qsafe.com.qa/iso-certification-training/

As an ISO 9001 Lead Auditor, i can relate to it, thank you.

Leave a Reply Cancel Reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Corporate Finance Assignment Help

- Stock Valuation Assignment Help

- Insurance Assignment Help

- Financial Planning Assignment Help

- Managerial Finance Assignment Help

- Econometrics Assignment Help

- Financial Engineering Assignment Help

- Quantitative Finance Assignment Help

- Financial Market Analysis Assignment Help

- Auditing and Assurance Assignment Help

- Capital Markets Assignment Help

- Bond Valuation Assignment Help

- Mergers and Acquisitions Assignment Help

- Financial Forecasting Assignment Help

- Financial Markets Assignment Help

- Investment Banking Assignment Help

- Portfolio Management Assignment Help

- Financial Modeling Assignment Help

- Financial Reporting Assignment Help

- Banking Assignment Help

- Financial Mathematics Assignment Help

- Public Finance Assignment Help

- Valuation Methods Assignment Help

- Applied Finance Assignment Help

- Corporate Taxation Assignment Help

- Capital Asset Pricing Model (CAPM) Assignment Help

- Financial Counselling Assignment Help

- Financial Technology Assignment Help

- Personal Investment Planning Assignment Help

- Financial Services Assignment Help

- Business Finance Assignment Help

A Step-by-Step Guide to Crafting an Assignment on Auditing and Assurance

In the world of accounting and finance, auditing and assurance are essential elements that guarantee the veracity and accuracy of financial information. You might encounter various assignments as a finance student that require you to delve into the intricacies of assurance and auditing. These assignments help you develop your analytical and critical thinking abilities while also testing how well you understand the material. To help you submit a well-organized and insightful piece of work, we will walk you through the process of writing a thorough assignment to do auditing and assurance homework in this blog. You will learn how to review assignment guidelines, gather pertinent materials, take organized notes, and effectively structure your assignment by following the procedures described in this guide. We'll look at the theoretical underpinnings of auditing and assurance, talk about the various kinds of auditing and assurance homework, and give some insights into the auditing procedure. We'll also talk about the difficulties and moral dilemmas that auditing and assurance professionals face, emphasizing the value of professional ethics and the most recent developments in the industry. You will have the information and resources required to produce and complete your assignment on auditing and assurance by the blog's conclusion.

Understanding Auditing and Assurance

Let's establish a firm understanding of the concepts of assurance and auditing before we begin the assignment writing process. An organization's financial records, transactions, and internal controls are systematically examined and evaluated during an audit to make sure they are accurate, fair, and in compliance with all applicable laws. External auditors are frequently impartial experts who have been hired to conduct this assessment and offer a dispassionate opinion on the company's financial statements. On the other hand, assurance is a more comprehensive idea that goes beyond auditing and encompasses it. It includes a range of services, including attestation, reviews, and agreed-upon procedures, where an impartial expert assesses and offers assurance on various elements of financial data or operational procedures. As you begin writing your assignment, you must comprehend the differences between auditing and assurance. It enables you to comprehend the breadth and importance of each concept and successfully meet the requirements of the assignment. Having established this foundation, let's move on to the assignment writing process and investigate the essential steps to produce a properly organized and insightful piece of work.

Definition of Auditing

The goal of auditing is to verify the accuracy, fairness, and compliance with applicable laws of an organization's financial records, transactions, and internal controls. To evaluate the accuracy and integrity of financial information, a thorough analysis of financial statements, supporting materials, and accounting practices is required. Usually, external auditors, who are independent and impartial experts, are hired to conduct this assessment and offer an unbiased opinion on the company's financial statements. Organizations can be certain that their financial statements accurately reflect their financial position, performance, and cash flows by having them audited.

Definition of Assurance

Auditing is a subset of the larger concept of assurance, which goes beyond it. It includes a range of services like attestation, reviews, and established protocols. Independent experts evaluate and offer assurance on various facets of financial information or operational processes as part of assurance engagements. Assurance services go beyond the review of financial records, while auditing focuses on the verification of financial statements. They also consist of non-financial elements like risk assessment, process evaluation, performance measurement, and others. Engagements in assurance assure stakeholders that information beyond financial statements is trustworthy, credible, and transparent.

Key Differences Between Auditing and Assurance

Although auditing and assurance are similar, their scopes and objectives are different. Through an unbiased assessment of an organization's financial records, auditing primarily focuses on confirming the veracity of financial statements. It guarantees adherence to accounting rules, laws, and regulations. Contrarily, assurance covers a wider range of services beyond the simple verification of financial statements. It entails assessing risks, giving assurance regarding operational procedures, and judging the accuracy of non-financial data. Internal controls, sustainability reporting, regulatory compliance, and performance measurement are some examples of topics that can be covered by assurance engagements. Although assurance includes auditing as a subset, assurance services go beyond financial reporting to give confidence in a variety of organizational operations.

Preparing for the Assignment

Thorough planning is essential for a successful assignment on auditing and assurance. You can prepare for your assignment effectively by following the steps below. First and foremost, carefully read the instructions for the assignment that your teacher has provided. It's essential to comprehend the precise issues or subjects you must deal with as well as any format or citation requirements. Then, compile pertinent information by conducting in-depth research with the aid of scholarly journals, books, and reliable online sources. You will gain a thorough understanding of the subject matter as a result. Take detailed notes as you conduct your research to remember key ideas, quotations, and sources. The writing process will be streamlined as a result, and your assignment's structure will be simpler. Consider outlining as well to structure your ideas and guarantee a logical flow of ideas in your assignment. You will lay a strong foundation for writing an informed and coherent assignment on auditing and assurance by adhering to these pre-writing steps.

Review the Assignment Guidelines

It is crucial to carefully read the instructions provided by your instructor before beginning your assignment on auditing and assurance. Spend some time carefully reading and comprehending the directions, noting any particular questions or subjects you need to cover. Be mindful of the formatting specifications, including the need for margins, font size, and citation style. You can make sure that your assignment satisfies the requirements and addresses the particular areas of focus specified by your instructor by being aware of the rules upfront.

Gather Relevant Materials

Conducting thorough research is essential to producing a well-informed assignment. Make use of a range of resources, including scholarly journals, books, reliable websites, and trade publications. assemble trustworthy and pertinent resources that offer in-depth insights into the field of assurance and auditing. To ensure the accuracy of the information you use in your assignment, keep in mind to critically evaluate the credibility and dependability of each source.

Take Notes and Organize the Information

Organizing your notes will help you remember important ideas, quotations, and sources as you conduct your research. Whether you choose to use digital note-taking tools or conventional pen and paper, come up with a system that works for you. Make sure to meticulously note important details from your sources, such as author names, publication dates, and page numbers. By keeping your notes organized, you can structure your assignment more easily and avoid confusion or plagiarism concerns when citing sources.

Structuring Your Assignment

To present your ideas coherently and logically, it is essential to structure your assignment on auditing and assurance. You can create an assignment that is well-organized by using the following framework. Start by giving a brief overview of auditing and assurance, their importance, and the goal of your assignment in an interesting introduction. Discuss the theoretical underpinnings of auditing and assurance after the introduction, paying particular attention to important terms like materiality, independence, audit risk, and professional skepticism. Continue by describing the various auditing and assurance services, using appropriate examples, such as financial statement audits, operational audits, compliance audits, and review engagements. The auditing procedure should then be described in detail, including each step from planning and risk assessment to assembling evidence and arriving at a conclusion. Consider including a section on the difficulties and moral issues that arise in auditing and assurance, such as professional ethics, ongoing problems, and new trends. Finish your assignment by reiterating the most important ideas. By following this format, you will produce a well-organized assignment that thoroughly explores the subject of auditing and assurance.

Professional Ethics and Code of Conduct

Professional ethics are crucial for maintaining integrity, trust, and public confidence in the fields of auditing and assurance. Describe the role that professional ethics play in maintaining the veracity and accuracy of financial information. The International Ethics Standards Board for Accountants (IESBA) and the American Institute of Certified Public Accountants (AICPA) are two well-known professional organizations that have established high ethical standards. Investigate issues like impartiality, discretion, and professional competence. Emphasize the moral dilemmas that auditors might face and the ethical frameworks for making decisions. In the practice of auditing and assurance, emphasize the importance of adhering to a strict code of conduct and upholding high ethical standards.

Current Issues and Emerging Trends

Practises for auditing and assurance are constantly changing to address new issues and keep up with emerging trends. Highlight the most important current problems and new developments in the industry. Talk about how technology, including data analytics and artificial intelligence, has affected auditing procedures. Learn how technology is being used by auditors to improve efficiency, accuracy, and risk assessment. What role do auditors play in assessing and ensuring the accuracy of environmental, social, and governance (ESG) disclosures? Discuss the rising importance of sustainability reporting. Discuss how auditors are evolving in their ability to spot and stop fraud, financial irregularities, and cybersecurity risks. Your assignment will demonstrate a modern understanding of the dynamic auditing and assurance landscape by addressing these current issues and emerging trends.

Challenges and Ethical Considerations in Auditing and Assurance

Professionals in auditing and assurance face a variety of obstacles and moral quandaries in their work. These issues must be covered in your assignment. Talk about typical difficulties like auditing complicated financial instruments, handling client privacy issues, and preserving independence and objectivity. Describe any challenges auditors might encounter when determining the risk involved in complex financial transactions or juggling confidentiality issues when handling private client information. In addition, stress the value of maintaining ethical standards in assurance and auditing. Investigate subjects like business ethics, regulatory organizations' codes of conduct, and the value of professional skepticism. By addressing these issues and ethical concerns in your assignment, you will show that you have a thorough understanding of the complexities that exist in the auditing and assurance industry as well as your capacity for critical analysis and issue evaluation.

In conclusion, writing an assignment on auditing and assurance necessitates having a firm grasp of the material, meticulous planning, and adherence to ethical standards. You can create a well-organized and insightful assignment that demonstrates your knowledge and critical thinking abilities by following the instructions provided in this guide. Before beginning the writing process, don't forget to read the assignment instructions, gather pertinent materials, and organize your thoughts. Take into account the value of professional ethics as well as the changing auditing and assurance industry, including present problems and future trends. Your assignment will show that you are knowledgeable in the subject by addressing these important factors and will advance both your academic and professional careers. Therefore, approach this assignment with confidence and produce an outstanding piece of work on auditing and assurance.

Post a comment...

Step-by-Step Internal Audit Checklist

Vice Vicente

March 21, 2023

What can internal auditors do to prepare a more comprehensive scope for their internal audit projects? And where can internal auditors find the subject matter expertise needed to create an audit program “from scratch”? AuditBoard’s “ Planning an Audit: A How-To Guide ” details how to build an effective internal audit plan from the ground up through best practices, resources, and insights rather than relying on templated audit programs.

One of the guide’s highlights is a comprehensive checklist of audit steps and considerations to keep in mind as you plan any audit project. Use the checklist below to start planning an audit, and download our full “ Planning an Audit: A How-To Guide ” for tips to help you create a flexible, risk-based audit program.

What is an Internal Audit?

An internal audit is a fundamentally independent function that evaluates an organization’s operations, internal controls, and risk management processes to improve the organization’s effectiveness and efficiency. Internal auditors will conduct interviews, inspect evidence, test controls, and read policies to understand the environment and validate that controls and processes are working — and working well.

The Difference Between Internal and External Audits

The essential difference between internal audits and compliance audits , sometimes called external audits, is who performs the audit. Internal audits, as the name indicates, are performed by internal auditors who are employed by the business. Compliance audits are conducted by independent, third-party, or external auditors, often certified in the audit that is being performed.

The Benefits of an Effective Internal Audit

Internal audits provide many benefits to an organization, giving management and leadership another lens to look at the organization. A Quality Management System (QMS) is a structured framework of policies, processes, and procedures used to plan and implement an organization’s key business areas. The internal audit’s role in the context of a Quality Management System focuses on evaluating the effectiveness of the organization’s QMS, ensuring adherence with requirement standards like ISO 9001, and identifying areas for improvement to enhance overall quality and efficiency.

While external regulatory compliance audits are essential, they often have a specific scope and aim— PCI DSS , for example, zooms in on credit cardholder data. Internal audits have the benefit of a looser scope, allowing an organization to focus on priority areas or areas that may not be examined in a formal compliance audit.

Internal audits give advantages to organizations pursuing external audits and preparing stakeholders and process owners for future audits. Findings from internal audits can be addressed quickly; observations can give management greater insight into the business, people, technology, and processes. Impetus from internal audit reports can encourage optimization, saving the organization in costs and ultimately improving customer satisfaction.

So, how can an organization plan for a successful internal audit ? Read on for our checklist!

Internal Audit Checklist

The steps to preparing for an internal audit are 1) initial audit planning, 2) involve risk and process subject matter experts, 3) frameworks for internal audit processes, 4) initial document request list, 5) preparing for a planning meeting with business stakeholders, 6) preparing the audit program, and 7) audit program and planning review.

1. Initial Audit Planning

All internal audit projects should begin with the team clearly understanding why a given project is part of the internal audit program. The following questions should be answered and approved before fieldwork begins:

- Why was the audit project approved to be on the internal audit plan?

- How does the process support the organization in achieving its goals and objectives?

- What enterprise risk(s) does the audit address?

- What is the overall audit schedule, and how does this project fit into the plan?

- Was this process audited in the past, and if so, what were the results of the previous audit(s)?

- Were audit findings or nonconformities investigated and remediated according to the action plan?

- Have significant changes occurred in the process recently or since the previous audit?

- What is the project’s scope, and what specific requirements need to be met for a successful outcome?

Additionally, participants in the project should review the audit report and audit results to refresh their understanding of the environment, scope, and project parameters. The team may also want to review any standards, frameworks, and regulatory requirements relevant to the project or program. Reporting on internal audit objectives should be delivered to top management periodically — quarterly or biannually is common depending on the size and complexity of the business.

2. Involve Risk and Process Subject Matter Experts

Performing an audit based on internal company information is helpful for assessing the operating effectiveness of the process’s controls. However, for internal audits to keep pace with the business’s changing landscape, and to ensure key processes and controls are also designed correctly, seeking out external expertise is increasingly becoming a best practice, even when a formal external audit is not required.

Organizations can employ Subject Matter Experts (SMEs) from the Big 4 (Deloitte, EY, PwC, and KPMG) and other consulting providers to supplement risk management and internal audit programs. These consultants can provide additional guidance, insight, and clarity on specific regulatory requirements, information security, and business processes. When contracting with consultants, be sure to disclose any other consulting relationships you may have with that firm or company, as there may be independence considerations that the consulting firm has to take into account.

In terms of fostering talent, skills, and development, internal audit professionals should stay abreast of current trends, topics, and themes in their industry. The following resources can help audit professionals understand the present landscape and augment their knowledge:

- Recent articles from WSJ.com , HBR.org , or other leading business periodicals

- Newsletters and updates from the AICPA , ISACA , ISO , NIST , and other similar organizations

- Relevant blog posts from Deloitte Insights , EY Insights , The Protiviti View , RSM’s Blog , or The IIA’s blogs

Image: The Institute of Internal Audit (IIA) Competency Framework for Internal Audit Professionals

Source: The IIA Competency Framework for Internal Audit Professionals

These resources can be leveraged to identify relevant risks, inform internal audit procedures, and encourage continuous improvement in your internal audit program. Having the right people and talent in place to perform the necessary audit activities is critical to your program’s success, and pulling in additional resources during an audit can be challenging. By lining up your SMEs ahead of time, you can smooth out your audit workflow and reduce friction.

3. Frameworks for Internal Audit: The International Professional Practices Framework (IPPF)

Collating guidance from the Institute of Internal Auditors (IIA), the International Professional Practices Framework (IPPF) contains both mandatory and best practice recommendations. The IPPF aims to support the overall mission, “To enhance and protect organizational value by providing risk-based and objective assurance, advice, and insight.” The core elements of the IPPF are the: Core Principles for the Professional Practice of Internal Auditing , Definition of Internal Auditing , Code of Ethics, and International Standards for the Professional Practice of Internal Auditing .

In addition to the IIA, organizations like ISACA can also provide guidance around internal audit processes.

4. Frameworks for Internal Audit Processes: COSO ICIF

Although a risk-based approach to internal auditing can and should result in a bespoke internal audit program for each organization, taking advantage of existing frameworks like the Committee of Sponsoring Organizations of the Treadway Commission’s ( COSO ) 2013 Internal Control — Integrated Framework to inform your program can be a win for your internal audit team and avoid reinventing the wheel. Before applying a specific framework, the internal audit team and leadership should evaluate itssuitability as they map to the business.

While used extensively for Sarbanes-Oxley (SOX) statutory compliance purposes, internal auditors can also leverage COSO’s 2013 Internal Control — Integrated Framework (ICIF) to create a more comprehensive audit program. COSO’s ICIF focuses on fraud, internal controls, and financial reportin g , while covering subjects like the overall Control Environment of the organization, Information, and Communication, and Risk Management. Since COSO’s ICIF was designed to address SOX, which is a U.S. statute, publicly traded companies based in the US may benefit the most from employing this framework as part of their internal audit program.

- Review COSO’s 2013 Internal Control components, principles, and points of focus here .

5. Initial Document Request List

The Document Request List or Evidence Request List, often abbreviated to “Request List” or “RL” is one of the central documents of any audit. The Request List is an evolving list of requests which may cover everything from interview scheduling, evidence requests, policy and procedures, reports, supporting documentation, diagrams, and more with the purpose of providing auditors with the information and documents they need to complete the audit program for the designated projects or processes.

Requesting and obtaining documentation on how processes work is an obvious next step in preparing for an audit. These requests should be delivered to stakeholders as soon as possible in the audit planning process to give stakeholders (with day jobs!) time to provide the right evidence. As requests come in, the internal audit team should review documented information for any follow-ups, and periodically update the request list as items get closed out. The following requests should be made to gain an understanding of processes, relevant applications, and key reports:

- All policies, procedure documents, workflow diagrams, and organization charts

- Key reports used to manage the effectiveness, efficiency, and process success

- Access to critical applications used in the process; read-only if possible

- Description and listing of master data for the processes being audited, including all data fields and attributes

From the listings received of master data, auditors can then make detailed sampling selections to test that processes and controls are being performed effectively, as designed, every time.

6. Preparing for a Planning Meeting With Business Stakeholders

Before meeting with business stakeholders, the internal audit committee should hold a meeting to confirm a high-level understanding of the objectives of the audit plan and program(s), key processes and departments, and the fundamental roadmap for the audit.

Then, after aligning some ducks internally, the audit team should also schedule and conduct a planning meeting with business stakeholders for the scoped processes. This keeps everyone on the same page, and gives business personnel the time and opportunity to coordinate audit efforts with their business units. The following steps should be performed to prepare for a planning meeting with business stakeholders:

- Outline key process steps by narrative, flowchart, or both, highlighting information inflows, outflows, and internal control components.

- Validate draft narratives and flowcharts with subject matter experts and stakeholders (if possible).

- Develop an agenda or questionnaire for all meetings internally or with business stakeholders.

Preparing the questionnaire after the initial research sets a positive tone for the audit , demonstrating that the internal audit is informed and prepared. Planning, preparedness, and cooperation are critical to achieving audit objectives and gaining deeper insights.

7. Preparing the Audit Program

Once the internal audit team has completed initial planning, consulted with SMEs, and researched the applicable frameworks, they will be prepared to create an audit program . Audit teams can leverage past audit programs to better design present and future procedures. An audit program should detail the following information:

Summary and Purpose of the Audit Program

Since internal audit reports are usually designed for the consumption of leadership and management, providing an executive summary of the audit program and outcomes gives the audience a snapshot of the audit and results.

Process Objectives and Owners

Documenting the process objectives and tying each process to owners when completing the audit program designates accountability.

Process Risks

Along with the process objectives and owners, the risks associated with the process should also be noted.

Controls Mitigating Process Risks

Once details about the process, including risks, are documented, the audit team should identify and map the mitigating controls to the risks they address. Compensating controls can also be noted here.

Control Attributes

Control attributes are the components and characteristics of the control activity that are critical to the effective execution of that control. Asking the following questions and documenting the results are a good starting point — though some controls may have unique or uncommon attributes as well.

- Is the control preventive or detective? If the control is detective, are there corrective actions required as part of completing the control?

- How frequently does the control occur (e.g. many times a day, daily, weekly, monthly, quarterly, annually, etc.)?

- What type of risk does the control mitigate (fraud, operational, security, etc.)?

- Is the control manually performed, performed by an application, or a combination?

- How likely will the risk be realized (e.g. Highly Likely, Likely, Unlikely)?

- How impactful would the risk be if it were realized (e.g. High Impact, Medium Impact, Low Impact)?

- What evidence does the audit team need to complete audit testing procedures?

Testing Procedures and Methods for Controls to be Tested During the Audit

There are four ways to test controls as part of an audit. These methods must often be combined to fully and completely test a control. These four methods are as follows:

- Inquiry, or asking how the control is performed

- Observation, or viewing the control be performed, typically in real-time

- Inspection, or reviewing documentation evidencing the control was performed

- Re-performance, or independently performing the control to validate outcomes

A comprehensive audit program contains sensitive information about the business. Access to the full audit program(s) should be restricted to appropriate personnel and shared only when approved.

8. Audit Program and Planning Review

Audit programs, especially those for processes that have never been audited before, should have multiple levels of review and buy-in before being finalized and allowing fieldwork to begin. The following individuals should review and approve the initial audit program and internal audit planning procedures before the start of fieldwork:

- Internal Audit Manager or Senior Manager

- Chief Audit Executive

- Subject Matter Expert(s)

- Management’s Main Point of Contact for the Audit (i.e. Audit Customer)

Internal auditors who take a risk-based approach, create and document audit programs from scratch — and do not rely on template audit programs — will be more capable and equipped to perform audits over areas not routinely audited. When internal audit teams can spend more of their time and resources aligned to their organization’s key objectives, internal auditor job satisfaction increases as they take on more interesting projects and have an effect on the organization. The Audit Committee and C-suite may become more engaged with internal audit ‘s work in strategic areas. Perhaps most importantly, recommendations made by internal audit will have a more dramatic impact to enable positive change in their organizations.

Complete the form to get your free copy of Planning an Audit From Scratch: A How-To Guide .

Vice Vicente started their career at EY and has spent the past 10 years in the IT compliance, risk management, and cybersecurity space. Vice has served, audited, or consulted for over 120 clients, implementing security and compliance programs and technologies, performing engagements around SOX 404, SOC 1, SOC 2, PCI DSS, and HIPAA, and guiding companies through security and compliance readiness. Connect with Vice on LinkedIn .

Related Articles

Auditor Interview Questions

The most important interview questions for Auditors, and how to answer them

Getting Started as a Auditor

- What is a Auditor

- How to Become

- Certifications

- Tools & Software

- LinkedIn Guide

- Interview Questions

- Work-Life Balance

- Professional Goals

- Resume Examples

- Cover Letter Examples

Interviewing as a Auditor

Types of questions to expect in a auditor interview, technical proficiency questions, behavioral questions, scenario-based and case study questions, communication and interpersonal skills questions, questions on adaptability and continuous learning, preparing for a auditor interview, how to do interview prep as an auditor.

- Review Auditing Standards and Regulations: Refresh your knowledge of the Generally Accepted Auditing Standards (GAAS), International Standards on Auditing (ISA), or any other relevant frameworks. Be prepared to discuss how you apply these standards in your work.

- Understand the Company's Industry and Specific Risks: Research the company's industry, regulatory environment, and any financial reporting requirements. This will help you to speak knowledgeably about potential audit risks and industry-specific challenges.

- Brush Up on Accounting Principles: Ensure your accounting knowledge is current, especially regarding the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), as applicable.

- Prepare for Behavioral Questions: Reflect on your past experiences to provide examples of how you've handled ethical dilemmas, maintained independence, or managed a challenging audit assignment.

- Practice Case Studies and Technical Questions: Be ready to walk through a hypothetical audit process or to answer technical questions that demonstrate your critical thinking and problem-solving abilities in an audit context.

- Develop Insightful Questions: Prepare thoughtful questions about the company's audit methodologies, culture, or any recent audits that have been made public. This shows your proactive approach and interest in their specific practices.

- Mock Interviews: Practice with a mentor or colleague to refine your ability to articulate your auditing approach and experiences. Feedback can help you improve your delivery and address any areas of weakness.

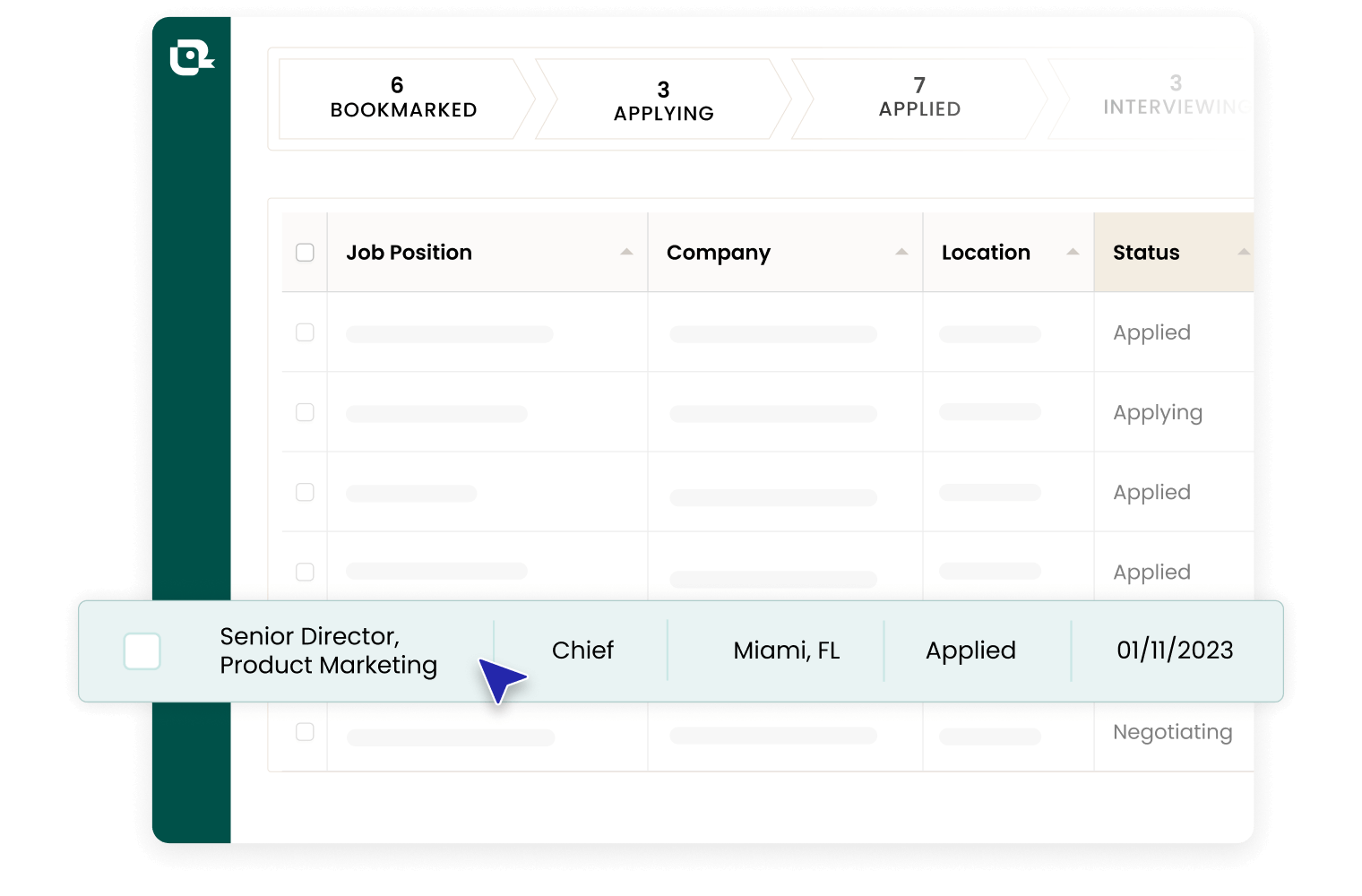

Stay Organized with Interview Tracking

Auditor Interview Questions and Answers

"how do you ensure objectivity and independence in your audits", how to answer it, example answer, "can you describe a particularly challenging audit you conducted and how you handled it", "how do you stay current with changes in accounting standards and regulations", "what is your approach to identifying and assessing audit risks", "how do you handle disagreements with a client regarding a finding in an audit report", "can you explain the concept of materiality and how it applies to auditing", "describe a time when you identified fraud during an audit. how did you proceed", "how do you ensure the quality and reliability of the data used in your audits", which questions should you ask in a auditor interview, good questions to ask the interviewer, "can you describe the audit department's role within the company and how it interacts with other departments", "what are the most significant risks that the company is currently facing, and how does the audit plan address these risks", "how does the company ensure the continuous professional development of its auditors", "can you share an example of a past audit that led to significant change or improvement within the company", what does a good auditor candidate look like, technical expertise, attention to detail, integrity and ethics, analytical and critical thinking, communication skills, adaptability and continuous learning, interview faqs for auditors, what is the most common interview question for auditors, what's the best way to discuss past failures or challenges in a auditor interview, how can i effectively showcase problem-solving skills in a auditor interview.

Auditor Job Title Guide

Related Interview Guides

Navigating financial landscapes, ensuring accuracy and compliance in fiscal management

Driving financial success by overseeing accurate, efficient accounting operations

Steering financial success with strategic oversight, ensuring fiscal integrity and growth

Driving financial strategies, analyzing market trends for business profitability

Navigating business uncertainties, safeguarding assets through strategic risk mitigation

Navigating complex tax landscapes, ensuring compliance while maximizing savings

Start Your Auditor Career with Teal

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Internal audit

- Learn about internal audit

- Back to Learn about internal audit

- A brief guide to internal auditing

- A brief guide to assignment planning

- A brief guide to assessing risks and controls

- A brief guide to assignment quality

A brief guide to assignment reporting

- A brief guide to follow up

- A brief guide to relationship management

- A brief guide to audit governance

- A brief guide to standards and responsibility

- A brief guide to strategic audit planning and resourcing

- A brief guide to working with other providers

- A brief guide to audit committees

- Guidance for Heads of Internal Audit

- Guidance for Audit Committee Chairs on working with the Head of Internal Audit

- Introduction

- Standard 1100 Independence and objectivity

- Standard 2200 Engagement planning

- Standard 2300 Performing the engagement

- Standard 2400 Communicating results

- Standard 2050 Coordination and reliance

- Financial Reporting Council (FRC) International Standards on Auditing (UK)

- Benefits of coordination

- Facilitating coordination

- Guidance on auditing planning for Internal Audit

You’ll report to stakeholders with your opinion on the effectiveness of the controls in place to manage risk, a balanced overview of key effective controls and to agree on actions that will address the key issues.

A ‘no surprises’ approach to continuous communication should be adopted throughout assignments. This open communication will build professional relationships and assist the internal auditor in assuring themselves as to the validity of their findings.

At the end of the audit a formal feedback meeting should also be held with the agreed stakeholders from the assignment planning stage. At this time, a balanced overview should be communicated to provide a complete picture of the audit work undertaken, results of the audit and discuss any issues openly to ensure:

- there are no surprises

- clarify the facts

- avoid misunderstandings

- influence management in respect of what action is required to address risk exposure

- discuss and possibly agree corrective actions at this time

Assignment reporting

Internal audit report to a range of stakeholders with their opinion on the effectiveness of the controls in place to manage risk, a balanced overview of key effective controls and the agreed upon actions to address any areas of improvement identified from the audit.

The reporting format should balance the differing needs of stakeholders. A departmental template for written reports, guidance and training should be in place.

In-house guidance and training should cover both verbal and written reporting, influencing skills, dealing with conflict and how to write effective audit reports. The department should continually improve reporting and seek to meet the needs of all stakeholders, from local to senior management and the audit committee.

Reports generally include an executive summary (to meet the needs of audit committee and senior management) and a detailed findings section (to meet the needs of local management) including the issue detail, evidence, the associated risk and agreed actions with dates and responsibility.

The executive summary should provide a balanced overview enabling senior management and the audit committee to quickly understand why you’ve reached your opinion. It should be in context and include the key risks, key effective controls and key weaknesses identified.

Internal audit needs to provide sufficient context within written reports and importantly remember to write to its audience. The audit committee members may not be fully aware of technical jargon or sector specific terms. Where it is not possible to avoid such language then a glossary may prove beneficial.

It is important to make clear any limitations to the scope of the work as agreed during the assignment planning stage and which may have subsequently arisen during performance of the assignment.

Issues aren’t always black and white and additional information will provide the reader with a full picture as to why controls / processes require strengthening. Aspects to consider include:

- the economic, regulatory and political environment

- competitor behaviour and risk issues

- the market environment

- material organisational changes

- trends highlighted by audit intelligence, eg improving or deteriorating controls or clearance of issues

- all reports should be based on fact and evidence

However, you must balance the above with brevity and focus as otherwise important messages can be lost. The auditor should also balance narrative and statistical / graphical reporting to communicate their message in the most effective manner.

Within the detailed findings section the most material issues should be reported first.

It may be appropriate to group findings together to reduce the overall number of actions for reporting purposes. If doing so, you should consider if findings have the same root cause, the same impact or the same source. For example, do they relate to not evidencing control, imply that data is insecure or all relate to the same team or manager?

There are a variety of views on arriving at the agreed actions presented within reports. In general these are:

- The internal auditor makes recommendations, based upon their understanding, which management then consider and respond to, either accepting or proposing an alternative.

- The internal auditor does not make any recommendation, instead they just present the finding and risk, which management then state how they will address it.

- The two parties discuss the findings and risks identified, exchanging professional views and documenting this within the report, which management then confirm acceptance of.

The key is to agree a protocol that works for your organisation. Whatever approach is adopted, it is important that everyone understands that the agreed actions must be owned by management. It is not internal audit’s responsibility to implement the identified improvements.

Internal audit should agree with the organisation what level of management can agree actions. Relevant factors will include the seriousness of the issue and the length of time the action will remain open, and also who can approve the acceptance of risk and how this should be documented for clear communication to audit committee.

The focus for audit committee should be upon acceptance of issues within the report and what management are going to do to put it right. Avoid excuses.

Audit opinions and issue ratings (if used) should be defined and communicated as an appendix to the audit report. Changes to the grading methodology should be discussed with audit committee and senior management to ensure that they reflect the views of the business and align with wider risk management processes wherever possible.

Performance reporting

Audit progress reports should also include quantitative and qualitative information surrounding the performance of the audit function, particular reporting against any protocol, and key performance indicators within the approved IA charter.

Frequency of reporting

Frequency of reporting at an individual assignment level will be driven by the completion of audits. It is important to issue reports in a timely manner to ensure the results of the audit are communicated whilst the feedback meeting is still fresh in participants' minds and to ensure timely resolution of issues identified.

The CAE should agree the frequency of other reporting and the format of that reporting with audit committee and senior management.

Audit committee should receive a CAE annual internal audit report and opinion. However, most as a minimum will also desire regular progress reporting against the annual plan and sight of any reports which have resulted in a negative opinion and therefore have early sight of issues that impact upon the annual assurance provided.

Depending upon the size of the audit plan, the audit committee may receive copies of all reports in the same manner as management, or a summarised progress report from which they can then choose to dive into the detail of individual reports should they so wish.

Frequency of reporting is likely to reflect the number of audit committees per annum. Typically these occur quarterly.

Some organisations will report upon critical issues every month.

Annual internal audit report and opinion

The annual report should reflect upon the work performed over the year and provide overall opinion in respect of risk management, corporate governance and internal control.

This should be based upon the internal audit work performed during the year, knowledge and consideration of other assurance work, and management’s progress, commitment and ability to implement recommendations and complete required actions on a timely basis.

This report should also highlight significant risk exposures and control issues, including fraud risks, governance issues, and other matters requested by senior management and audit committee.

IIA IPPF Standard 2060 – reporting to senior management and the board

IIA IPPF Standard 2400 – communicating results

IIA IPPF Standard 2600 – acceptance of risk

Related Links

- IIA website

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

- Your Future

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

ASSIGNMENT COURSE: AUDITING AND INVESTIGATIONS (ACC 412) QUESTION

Related Papers

osman preston

Saswot Raj Sharma

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

25 Audit Manager Interview Questions and Answers

Learn what skills and qualities interviewers are looking for from an audit manager, what questions you can expect, and how you should go about answering them.

Audit managers are responsible for planning, directing, and coordinating all aspects of an organization’s audit process. They also develop audit programs, direct staff auditors, and review and analyze audit results.

In order to be successful in this role, you need to be able to effectively communicate with all levels of management, as well as be able to lead and motivate a team. You also need to be able to think critically and have a strong understanding of financial accounting and auditing standards.

Do you have what it takes to be an audit manager? Take a look at the most common interview questions and answers for this position and see how you measure up.

- Are you familiar with the types of audits that we conduct here?

- What are some of the most important qualities for an audit manager to have?

- How would you manage a team that is behind on their audit assignments?

- What is your process for evaluating the risk level of an audit?

- Provide an example of a time when you had to use your negotiation skills to resolve a conflict.

- If we were to perform your job evaluation right now, what grade would you give yourself?

- What would you do if you noticed a pattern of mistakes in the work of one of your auditors?

- How well do you work under pressure?

- Do you have any experience training new employees on how to perform audits?

- When performing an internal audit, what is the first thing you check?

- We want to improve our auditing process. What suggestions do you have?

- Describe your experience with using auditing software.

- What makes you stand out from other candidates for this position?

- Which industries do you have the most experience working in?

- What do you think is the most important aspect of an audit?

- How often do you perform audits on your own?

- There is a conflict between two of your team members. What do you do?

- Could you explain the difference between a financial and operational audit?

- Describe an experience in which you had to adjust your auditing process due to changing circumstances.

- How do you ensure accuracy when conducting an audit?

- What strategies do you use to stay organized when working with multiple projects?

- Do you have any experience creating reports or presentations related to audit findings?

- Are there any areas of auditing that you feel are particularly challenging?

- How would you handle a situation where a client is not cooperating with an audit?

- How do you make sure that all relevant information has been collected during an audit?

1. Are you familiar with the types of audits that we conduct here?

The interviewer may ask this question to see if you have experience with the type of audits that their company performs. If you are not familiar with the types of audits they perform, try to answer honestly and explain why you would be interested in learning more about them.

Example: “Yes, I am familiar with the types of audits that you conduct here. In my current role as an Audit Manager, I have been responsible for overseeing a variety of audit engagements including financial statement audits, internal control reviews, and operational audits. I have also managed projects related to fraud investigations, compliance testing, and risk assessment.

I understand the importance of staying up-to-date on changes in regulations, standards, and best practices. To ensure that I remain knowledgeable about the latest developments in the field, I actively participate in continuing education courses and attend industry conferences.”

2. What are some of the most important qualities for an audit manager to have?

This question can help the interviewer determine if you possess the qualities they’re looking for in an audit manager. Use your answer to highlight your leadership skills, communication abilities and attention to detail.

Example: “As an audit manager, I believe that the most important qualities are strong communication skills, attention to detail, and a commitment to accuracy.

Strong communication skills are essential for any audit manager because they need to be able to effectively communicate with both internal and external stakeholders. This includes being able to explain complex financial information in a way that is easy to understand. It also involves having the ability to build relationships with clients and colleagues.

Attention to detail is another key quality for an audit manager as it ensures that all aspects of the audit process are completed accurately and efficiently. This means double-checking calculations, reviewing documents thoroughly, and ensuring that deadlines are met.

Lastly, a commitment to accuracy is vital for any audit manager. Audits involve making sure that financial statements are free from errors and omissions, so it’s important to have a keen eye for details and to take the time to ensure that everything is correct.”

3. How would you manage a team that is behind on their audit assignments?

This question can help interviewers understand how you manage your team and their productivity. Your answer should show that you are a strong leader who is able to motivate your team members to complete their work on time.

Example: “I understand the importance of staying on top of audit assignments and I have a proven track record of successfully managing teams to ensure that deadlines are met. When faced with a team that is behind on their audit assignments, my first step would be to assess the situation and identify any potential issues or challenges that may be preventing them from meeting their goals. Once identified, I would work with the team to develop an action plan to address these issues and get back on track. This could include providing additional resources, training, or guidance as needed.

At the same time, I would also look for opportunities to improve processes and procedures in order to prevent similar situations from occurring in the future. Finally, I would monitor progress closely and provide regular feedback and encouragement to ensure that the team stays motivated and focused on achieving their goals. With my experience in leading successful audits and motivating teams, I am confident that I can manage a team that is behind on their audit assignments and help them reach their objectives.”

4. What is your process for evaluating the risk level of an audit?

The interviewer may ask you this question to understand how you prioritize your work and determine which projects need the most attention. Use examples from previous experiences to explain how you assess risk levels and decide what tasks require immediate action versus those that can wait until later.

Example: “My process for evaluating the risk level of an audit is comprehensive and methodical. First, I review the financial statements and identify any potential areas of concern. Next, I analyze the internal control environment to determine if there are any weaknesses that could lead to a higher risk assessment. Finally, I assess the external factors such as industry trends, economic conditions, and regulatory requirements to ensure that all risks have been identified and addressed. Throughout this process, I remain mindful of the company’s goals and objectives so that I can provide meaningful insights and recommendations. With my experience in auditing, I am confident that I can accurately evaluate the risk level of any audit.”

5. Provide an example of a time when you had to use your negotiation skills to resolve a conflict.