- Free Case Studies

- Business Essays

Write My Case Study

Buy Case Study

Case Study Help

- Case Study For Sale

- Case Study Service

- Hire Writer

Case Study on Bank Management System

Case study on bank management system:.

Bank management system is the complicated software system which is aimed at the professional management of the client’s activities in the bank and high-quality and quick access to the client’s account.

With the rapid development of the banking system, the necessity of the high-quality bank management system has become extremely relevant. Today, there is hardly a person in the world who is not involved into the banking services and naturally, everyone has an account in a bank and saves money there. It is obvious that everyone wants to have the constant access to his finance but it is impossible without the high-quality management system which provides clients with such opportunities 24/7. Naturally, the financial institutions work only in the definite hours of the day, but if the client requires the access to his finance at night or does not have the opportunity to come to the bank, his wish will be failed. In order to enable clients operate their accounts well, the bank management system was created. Today, due to the development of the online banking the opportunities of both the financial institutions and clients have become extremely wide.

We Will Write a Custom Case Study Specifically For You For Only $13.90/page!

With its help clients can operate their finance faster and fulfill more operations at a moment’s notice making the whole banking system more rapid and dynamic. The system stores the information about clients, their withdrawals and deposits and helps them manage and monitor their finance effectively increasing the trust to the banking services.Bank management systems are extremely popular and effective nowadays, because they improve the quality of the banking services and help clients operate their finance better. When a student is asked to analyze the definite case on bank management system, he will have to get to know about the system itself in order to be able to analyze this question deeper later. A successful bank management system case study should explain the purpose of the research of the problem, describe the problem itself and touch upon its core aspects. Furthermore, one should collect data on the problem to learn about its cause and effect in order to be able to brainstorm the effective solutions to the problem and demonstrate his professional and critical thinking skills.

In order to cope with the process of case study writing the student should take advantage of the reliable help of the Internet and follow the expert’s manner of writing and professional way of data analysis reading a free example case study on bank management system. Due to a well-organized free sample case study on bank management system prepared by an expert a student learns about the process of the right formatting and construction of the logical structure ad succeeds in writing.

Related posts:

- ICICI Bank Case Study

- Bank of America’s Management Case Study

- Case Study on Wealth Management

- Analysis of Commercial Bank Operation and Regulation-Case Study on Dhaka Bank Limited

- The Old Bank Case Study

- Case Study on SBI Bank

- Metropolitan Bank Case Study

Quick Links

Privacy Policy

Terms and Conditions

Testimonials

Our Services

Case Study Writing Service

Case Studies For Sale

Our Company

Welcome to the world of case studies that can bring you high grades! Here, at ACaseStudy.com, we deliver professionally written papers, and the best grades for you from your professors are guaranteed!

[email protected] 804-506-0782 350 5th Ave, New York, NY 10118, USA

Acasestudy.com © 2007-2019 All rights reserved.

Hi! I'm Anna

Would you like to get a custom case study? How about receiving a customized one?

Haven't Found The Case Study You Want?

For Only $13.90/page

Username or Email Address

Remember Me Forgot Password?

Get New Password

Case Study: Bank Management System

- September 8, 2023

In this case study, we will explore the development of a Bank Management System using Python. The Bank Management System is a console-based application that allows bank employees to perform various operations, including creating new accounts, depositing and withdrawing funds, checking account balances, listing all account holders, closing accounts, and modifying account details.

Project Overview

The Bank Management System is implemented as a command-line application. It offers the following key features:

- Account Creation : Bank employees can create new accounts by providing essential information such as the account holder’s name, account type (current or savings), and initial deposit.

- Deposit and Withdrawal : The system supports depositing and withdrawing funds for existing accounts. Users need to specify the account number and the desired operation.

- Balance Enquiry : Employees can check the account balance for a specific account by entering the account number.

- Listing All Account Holders : The system can list all existing account holders, providing their account numbers, names, account types, and current balances.

- Account Closure : Accounts can be closed by entering the account number, removing the account from the system.

- Account Modification : Bank employees can modify account details, including the account holder’s name, account type, and account balance.

Implementation Details

The core functionality of the Bank Management System is implemented using Python classes and file handling. Here are the key aspects of the implementation:

- Account Class : The Account class defines the structure and behavior of individual bank accounts. It includes methods for creating, displaying, modifying, depositing, and withdrawing funds from an account.

- File Handling : Account data is stored in a file named “accounts.data” using the pickle module for serialization. Accounts are loaded from and saved to this file when performing operations.

- Main Menu : The main menu presents various options for performing different banking operations. Users can input their choice (1-8) to select an operation.

- User Input and Validation : User inputs are collected through the console, and appropriate validation is applied to ensure data integrity. For example, deposit and withdrawal operations are validated to prevent negative balances.

- Run the Python script to start the Bank Management System.

- The main menu will be displayed, presenting a list of available banking operations.

- Select a specific operation by entering the corresponding number (1-8) and follow the on-screen prompts to complete the operation.

- You can create new accounts, deposit and withdraw funds, check balances, list account holders, close accounts, and modify account details.

- To exit the system, select option 8 from the main menu.

The Bank Management System is a practical example of a console-based banking application. It allows bank employees to efficiently manage accounts, perform transactions, and maintain account records. While this is a simple text-based system, it can serve as a foundation for building more advanced banking applications with additional features and a graphical user interface.

Leave a Reply Cancel Reply

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment *

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Trending now

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Case Study: Will a Bank’s New Technology Help or Hurt Morale?

- Leonard A. Schlesinger

A CEO weighs the growth benefits of AI against the downsides of impersonal decision making.

Beth Daniels, the CEO of Michigan’s Vanir Bancorp, sat silent as her chief human resources officer and chief financial officer traded jabs. The trio had founded their community bank three years earlier with the mission of serving small-business owners, particularly those on the lower end of the credit spectrum. After getting a start-up off the ground in a mature, heavily regulated industry, they were a tight-knit, battle-tested team. But the current meeting was turning into a civil war.

- Leonard A. Schlesinger is the Baker Foundation Professor at Harvard Business School, where he serves as chair of its practice-based faculty.

Partner Center

Search anything:

System Design of Bank Management System

System design software engineering.

Get this book -> Problems on Array: For Interviews and Competitive Programming

In this article, we will take a look at the key features a bank management system needs to offer, its high-level, low-level design, database design, and some of the already existing bank management systems.

Table of Contents:

Bank Management System

Functional requirements, non-functional requirements, software requirements, monolithic architecture, event-driven architecture, low-level design, database design, leading bank management systems.

The bank management system is a set of essential tools and processes that allow banks and their credit institutions to carry out their functions. The components of the bank management system may differ depending on the bank, but generally, the system includes core banking to manage basic transactions, loans, mortgages, and payments accessible via ATM, mobile banking, and branches. Other components that may be included are CRM systems, Risk Management Systems, Human Resource Management Systems, and Business Intelligence systems.

System Requirements

The requirements for a bank management system provide a complete description of the system behavior and are based on the business expectations. The functioning of the system must comply with the laws and regulatory acts of the country. In the United States, for example, Consumer Financial Protection Bureau, Federal Reserve Board, Federal Deposit Insurance Corporation, and Financial Crimes Enforcement Network are the institutions that govern banking activities.

The key requirements that need to be offered by the Bank Management System can be classified into functional and non-functional requirements.

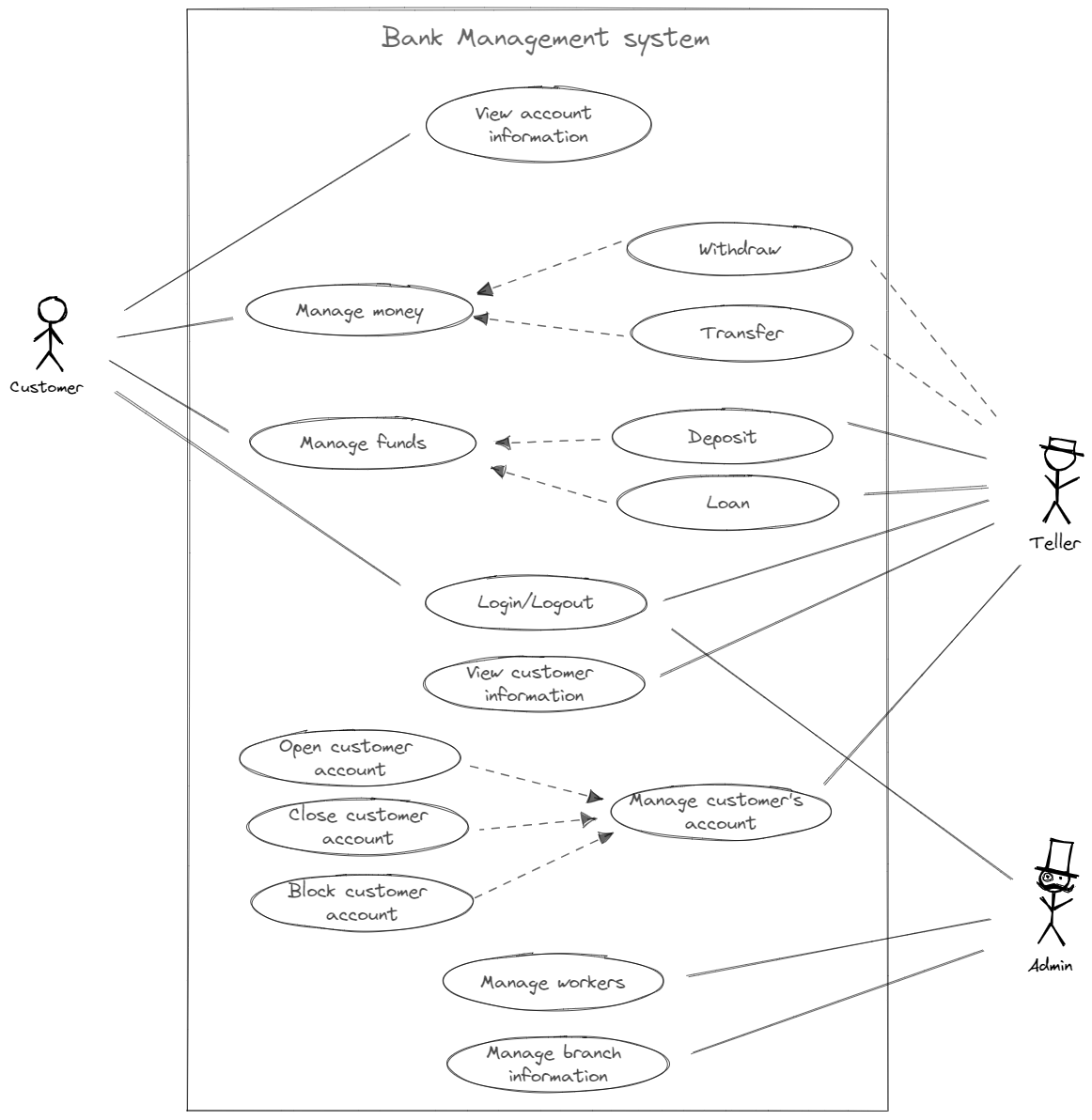

Functional Requirements describe the service that the banking management system must offer, they are subdivided into three access levels: Admin Mode, Teller Mode, and Customer Mode:

- Sign in with login and password.

- Update personal details.

- Change password.

- View balance.

- View personal history of transactions.

- Transfer money.

- Submit Cash.

- Register new bank customers.

- View customer information.

- Manage customer accounts.

- View manager and customer details.

- Add or update bank branch details.

- Add or update manager details.

Non-functional requirements specify criteria that can be used to judge the operation of a system as a whole rather than specific behaviors. They describe emergent properties like security, performance, and availability and, unlike the functional requirements that can be worked around, are essential to fulfill for a usable system. The estimation of whether the product fulfills the non-functional requirement or not usually reduces to a boolean answer: yes or no.

For a bank management system, the most important non-functional requirements include security, performance, usability, and availability.

Security Bank management systems are notorious for being subject to malicious attacks, so security is the major requirement for the system. Unauthorized access to the data is not permissible. The data must be backed up daily and stored in a secured location, at a distance from different facilities of the system.

Online transactions and stored digital files must be encrypted according to 128-bit or 256-bit AES encryption standards. The system also must employ firewall software as a defense against network attacks.

From the client-side, the system must provide an automatic log-out after an inactivity period, accept only secure passwords that have sufficient length and non-alphabetic characters, and block login attempts after several unsuccessful trials.

Performance The bank management system is a multi-client system that must reach response time targets for each of the clients during simultaneous calls and must be able to run a target number of transactions per second without failure. The system must effectively utilize the hardware and energy resources to minimize operational costs.

Usability The system must provide different graphical interfaces for customers, tellers, and admins. All system interfaces must be user-friendly and simple to learn, including helping hints and messages and intuitive workflow, especially in a client interface: the client must be able to fast learn and use the interface without prior knowledge of banking terminology or rules.

The interfaces must automatically adjust to devices with different screen sizes, and allow to change typeface size and color scheme to improve readability.

Availability The system must be available during bank working hours. The mobile banking and ATM must be available round-the-clock with minimal maintenance times, reaching 99.999% availability time per year.

Software requirements specification (SRS) is the description of the software system that is going to be developed, it is made at the latest phase of analysis, after the functional and non-functional requirements. The set of programming tools and technologies that can be applied to the bank management system depends on whether the on-premise, cloud, or hybrid computing model is used.

Most large-scale financial institutes have their core banking system run on-premise, which may be enforced by the legal system requirement to facilitate servers that store personal data on the territory of the country.

The development of the system is based on the following technologies:

- Servers running Windows Server/Linux OS, ATM running Windows 10.

- For the backend part, a scalable programming language supporting multi-threading like Java is required, and Python is required for the data analysis and fraud detection engine.

- Modern front-end frameworks like React/AngularVue/jQuery for user-interface.

- Relational DBMS with an engine that supports ACID transactions like Microsoft SQL Server or Oracle RDBMS.

High-Level Design

After analysis and agreement on the requirements, the next stage is to describe system architecture on a high level.

The traditional way to implement bank management systems is with a monolithic architecture, where different tasks are managed with a single unified unit. As shown in the diagram below, Java handles a variety of jobs that come from the branch office, from electronic card processing and from the requests to API open to other banks and clients.

The load balancer distributes evenly jobs between application servers that run multiple copies of the application, and on the backside, the application manages database requests. The load balancer also plays the role of the inner firewall, in addition to the outer firewall that provides first-level protection from network attacks.

The architecture is simple and thus easy to develop and deploy, scaling is also relatively easy with the load balancers - just add another application/database server when needed.

The monolithic architecture is the easiest to implement, but it is hard to maintain in the long run, and it is very hard to add new features or update the old ones. Moreover, with a monolithic architecture, it is hard to introduce new tools and frameworks to the developing stack, as there are no points inside the monolithic structure to connect new technologies.

Event-driven architecture is one of the alternatives to the traditional Monolithic architecture that centers around "events" rather than entities. For example, events when an office teller submits a new client, when a customer presses an ATM button to withdraw money, or when the account balance is getting lower than the threshold. All incoming events are registered within the API layer and added to the Kafka stream.

The Apache Kafka, an open-source distributed event streaming platform, distributes events between the consumers: Application Jobs, Data storage, Statistics collectors, Notification routines, and the special Fraud Check engine. Fraud Check is written in Python to automatically detect and block suspicious transactions to prevent money laundering and other violations.

With the event-driven architecture, implementing new services is easier, as there is no need to constantly synchronize states between them, for example, to synchronize the current balance state with the upcoming transactions from credit cards and open API. Instead, the program can introduce an even that controls and fixes the balance changes, so the transaction service only needs information about balance changes and does not care about other transactions and processes.

As event-driven architecture requires a careful design in the initial stages and thus needs more time and resources spend on development, this is a good option for large financial institutions that aim for a large client auditory and provide a row of different services.

The Bank Management System application defines all available operations in a Bank interface, according to the Data Access Object Pattern (DAO). The actual implementations of this interface are interchangeable and do not require changes on the front-end:

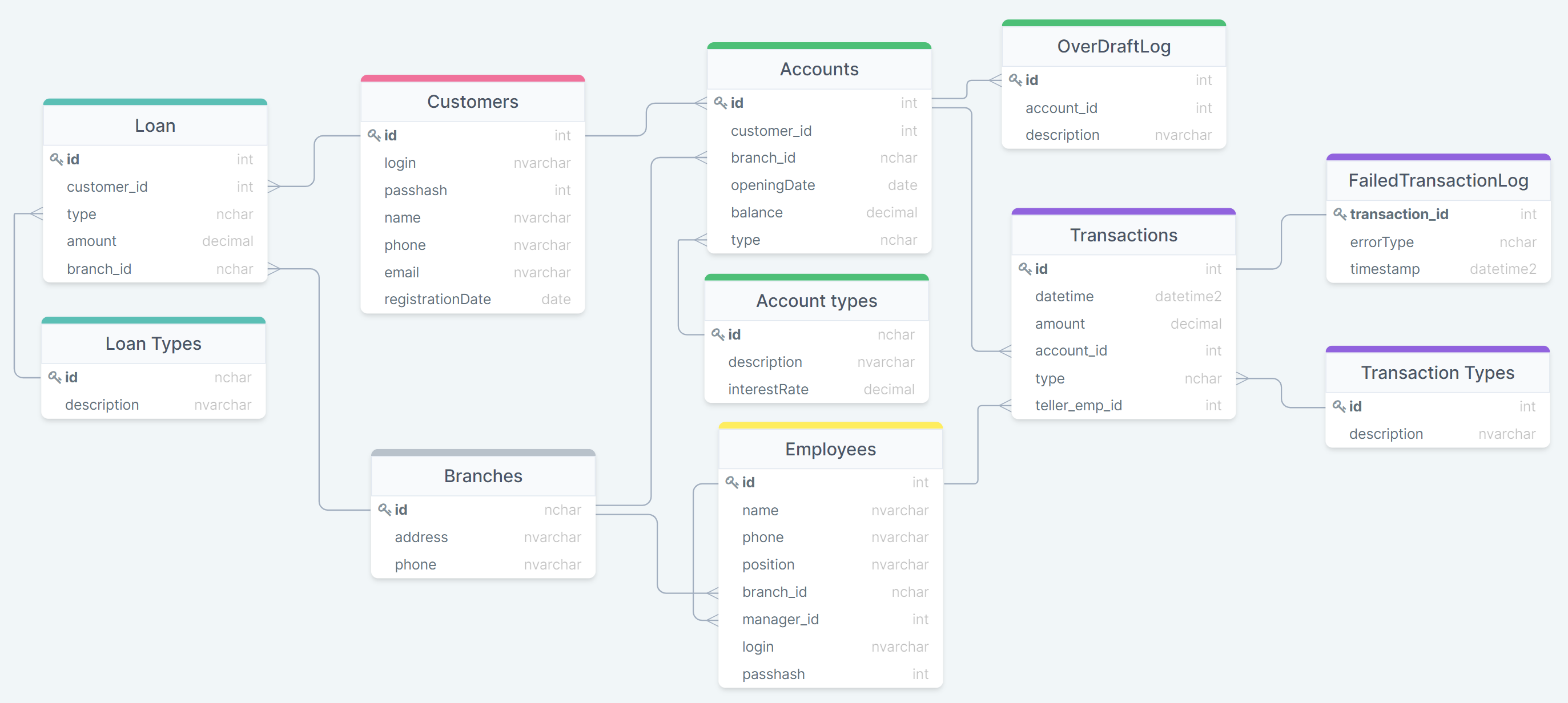

The application has six persistence entities that correspond to the database tables: Account, Branch, Customer, Employee, Loan, and Transaction. Abstract class Person reuses repeating code for Customer and Employee classes and is not present in the database.

The actions over the persistence entities are controlled via controller classes, one controller for each of the persistence entities. These controllers are to be called in the implementation of the Bank interface.

The most important class to pay attention to is the TransactionController with withdraw(), deposit() and transfer() methods, all of which must provide absolute accuracy as neither bank nor client is willing to lose money. Such methods should be managed as a single unit of work (database transaction) with the ability to roll back all changes, and include multiple checks of sending and receiving accounts, checks for fraud, and others before committing the transaction.

Customers relation stores information about bank clients, each of the customers can have multiple balance Accounts and Loans .

Branches relation store information about bank branches, with bank Employees each assigned to one of the bank branches. Client accounts and Loans are also assigned to one of the bank branches for easier management. Each employee can have another employee assigned as the manager.

When a client withdraws, submits, or transfers money either by credit card, mobile banking, or at the bank branch office, the information about the action is stored in the Transactions table. Not all transactions are accepted, as the bank has multiple checks to perform, the history of failed transactions is stored in the FailedTransactionsLog table to collect data and provide the basis for bank security systems improvement.

The database has some tables not reflected in the domain model: Loan Types , Account Types , and Transaction Types , as they represent static information.

Traditionally, large banks prefer their own Bank Management Systems deployed on-premise, the alternative to the traditional approach is the cloud-based banking solutions or adapting of the open-source software projects. The choice of the Bank Management System is not a trivial task, as the market has lots of cloud-based solutions with different features and pricing plans.

Finacle , for example, provides Core banking solutions and a cloud-native Banking Suite as SaaS to "engage customers with a robust foundation". The Finacle can be run on AWS or MS Azure and applies componentized microservices-based architecture, and is agnostic to the technology platform.

Cobis is another cloud-native, real-time, modular system for the origination of financial products that provides a customizable work environment, omnichannel portal (Mobile, Internet, Call Center, Branch, Agent, ATM, API), risk and compliance modules, and analytics. It also supports integration with 3rd parties for cross-selling and information sharing and is available both SaaS and on-premise.

An example of a platform with open code is the Apache Fineract or build on top of it Mifos X Community App that has over 170 contributors and over 3.9M Docker pulls. Fineract is aimed at innovative mobile and cloud-based solutions and enables digital transaction accounts for all. The domain of Fineract includes accounts, held by customers, with transactions made to those accounts. Other functionalities support use cases for teller operations, basic treasury management, accounting, portfolio management, authentication, account opening, and similar topics that are common to a retail banking operation.

The MyBanco is a fully free core banking platform written on PHP licensed under GNU Affero General Public License that allows making any changes in the code to adapt for the business.

With this article at OpenGenus, you must have a strong idea of the System Design of the Bank Management System.

Case Study Hub | Samples, Examples and Writing Tips

Case study on bank management system, case study on bank management system:.

Bank management system is the complicated software system which is aimed at the professional management of the client’s activities in the bank and high-quality and quick access to the client’s account. With the rapid development of the banking system, the necessity of the high-quality bank management system has become extremely relevant. Today, there is hardly a person in the world who is not involved into the banking services and naturally, everyone has an account in a bank and saves money there. It is obvious that everyone wants to have the constant access to his finance but it is impossible without the high-quality management system which provides clients with such opportunities 24/7. Naturally, the financial institutions work only in the definite hours of the day, but if the client requires the access to his finance at night or does not have the opportunity to come to the bank, his wish will be failed. In order to enable clients operate their accounts well, the bank management system was created.

We can write a Custom Case Study about Bank Management for you!

Today, due to the development of the online banking the opportunities of both the financial institutions and clients have become extremely wide. With its help clients can operate their finance faster and fulfill more operations at a moment’s notice making the whole banking system more rapid and dynamic. The system stores the information about clients, their withdrawals and deposits and helps them manage and monitor their finance effectively increasing the trust to the banking services.

Bank management systems are extremely popular and effective nowadays, because they improve the quality of the banking services and help clients operate their finance better. When a student is asked to analyze the definite case on bank management system, he will have to get to know about the system itself in order to be able to analyze this question deeper later. A successful bank management system case study should explain the purpose of the research of the problem, describe the problem itself and touch upon its core aspects. Furthermore, one should collect data on the problem to learn about its cause and effect in order to be able to brainstorm the effective solutions to the problem and demonstrate his professional and critical thinking skills.

In order to cope with the process of case study writing the student should take advantage of the reliable help of the Internet and follow the expert’s manner of writing and professional way of data analysis reading a free example case study on bank management system. Due to a well-organized free sample case study on bank management system prepared by an expert a student learns about the process of the right formatting and construction of the logical structure ad succeeds in writing.

At EssayLib.com writing service you can buy a custom case study on Bank Management System topics. Your case study will be written from scratch. We hire top-rated Ph.D. and Master’s writers only to provide students with professional case study help at affordable rates. Each customer will get a non-plagiarized paper with timely delivery. Just visit our website and fill in the order form with all paper details:

Related Posts:

- Case Study – Zara International: Fashion at…

- Case Study on Zappos – How They Did It

- Case Study – Amazon: One E-Store to Rule Them All

- Health Management: Business Case Study

- Apple Inc Case Study Sample

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Case Study 7: The Digital Transformation of Banking—An Industry Changing Beyond Recognition

- First Online: 06 February 2020

Cite this chapter

- Hubert Tardieu 6 ,

- David Daly 7 ,

- José Esteban-Lauzán 8 ,

- John Hall 9 &

- George Miller 10

Part of the book series: Future of Business and Finance ((FBF))

1896 Accesses

1 Citations

Partly as a result of the rise of FinTechs, banking is a sector that is facing significant disruption. In this case study, we identify some of the innovations that are being made both by young start-ups and long-established banks. We explore emerging opportunities in terms of business models, as well as how new operating models will boost customer-centricity and optimize costs through intelligent automation. The challenges of strategy, leadership, and attracting and retaining digital talent are analyzed. Finally, we conclude with a discussion of how platforms will enable new ecosystems of partners to work together to create and capture customer value.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Accenture. (2018). Beyond north Star gazing . https://www.accenture.com/_acnmedia/pdf-85/accenture-banking-beyond-north-star-gazing.pdf . Accessed October 26, 2019.

Bain. New bank strategies require new operating models . https://www.bain.com/contentassets/a97b9014afc84a76ae9fb723d3e94ead/bain_brief_new_bank_strategies_require_new_operating_models.pdf . Accessed October 26, 2019.

The Financial Brand. Is the banking industry prepared for a world without bankers ? https://thefinancialbrand.com/86253/banking-future-of-work-training-digital-trends/ . Accessed October 26, 2019.

Capgemini. (2017, October). The digital talent gap . https://www.capgemini.com/wp-content/uploads/2017/10/report_the-digital-talent-gap_final.pdf . Accessed October 26, 2019.

Efma. (2018, September). World retail banking report 2018 . https://www.efma.com/study/detail/28603 . Accessed October 26, 2019.

EY. (2018, June). How convergence in banking could be an opportunity for growth . https://consulting.ey.com/convergence-banking-opportunity-growth/ . Accessed October 26, 2019.

EY. (2016). Global consumer banking survey . https://eyfinancialservicesthoughtgallery.ie/wp-content/uploads/2016/10/ey-the-relevance-challenge-2016.pdf . Accessed October 26, 2019.

IDC. (2018, March). The business value of the stripe payments platform . https://stripe.com/files/payments/IDC_Business_Value_of_Stripe_Platform_Full%20Study.pdf

KPMG. (2019, July). The future of digital banking: Banking in 2030. https://home.kpmg/au/en/home/insights/2019/07/future-of-digital-banking-in-2030.html . Accessed October 26, 2019.

McKinsey. (2018, August). The lending revolution: How digital credit is changing banks from the inside . https://www.mckinsey.com/business-functions/risk/our-insights/the-lending-revolution-how-digital-credit-is-changing-banks-from-the-inside . Accessed October 26, 2019.

OnDeck. (2019). https://www.ondeck.com/home5-lendstart . Accessed October 26, 2019.

Quartz. (2019, August). Digital banks are racking up users, but will they ever make money ? https://qz.com/1679197/when-will-digital-banks-like-n26-and-revolut-start-making-money/ . Accessed october 26, 2019.

Download references

Author information

Authors and affiliations.

Paris, France

Hubert Tardieu

Nottingham, Nottinghamshire, UK

Madrid, Spain

José Esteban-Lauzán

Warrington, Cheshire, UK

West Wittering, West Sussex, UK

George Miller

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Hubert Tardieu .

Rights and permissions

Reprints and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Tardieu, H., Daly, D., Esteban-Lauzán, J., Hall, J., Miller, G. (2020). Case Study 7: The Digital Transformation of Banking—An Industry Changing Beyond Recognition. In: Deliberately Digital. Future of Business and Finance. Springer, Cham. https://doi.org/10.1007/978-3-030-37955-1_28

Download citation

DOI : https://doi.org/10.1007/978-3-030-37955-1_28

Published : 06 February 2020

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-37954-4

Online ISBN : 978-3-030-37955-1

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Skip to content

- Accessibility Policy

- Oracle blogs

- Lorem ipsum dolor

Case Study: How a bank turned challenges into opportunities to serve its customers using NoSQL Database

Acknowledgements: Michael Brey, Director of NoSQL Database Development, Oracle

An industry in flux

Financial services industries are at crossroads and are experiencing massive changes in response to shifting customer demands. With the increasing adoption of cloud technologies, digital-only enterprises are offering innovative solutions at the lowest cost.

Customer experience is a strategic imperative for most organizations today, but delivering an engaging experience across the growing number of digital customer touchpoints can be challenging, especially if they have an aging technology stack.

Additionally, organizations have to navigate these transformational changes while managing vast volumes of digital transactions, a variety of data, and velocity without straining their business systems, experiencing data loss, breaches, and/or downtime.

The below graphic shows the IT priorities of financial services institutions, and it is no surprise that 25% of them want to modernize their systems and equally the same % want to ramp up on their digital touchpoints.

This blog will examine how one of India's leading private banks modernized and expedited its digital presence, providing an enhanced experience for their customers using Oracle NoSQL Database .

Some of the bank's challenge:

- Exceeding customer expectations : India has more than 50% of its population below age 25 and more than 65% below age 35 . Banks customers are increasingly comparing banking experiences to other areas of their digital lives. These digital natives aren't looking to check their balances and deposit checks. They are looking for more meaningful online experiences, e.g., they are looking to start and finish applications to open an account without ever walking into a bank, and they want it to happen fast. The bank was looking at a system that can provide an engaging and personalized digital customer experience in real-time under strict SLA (e.g., process a loan under 10 sec).

- Ability to provide comprehensive services : Provide 'Always-on' digital services and delight customers by assisting them through chatbot interactions. Additionally, they want to experiment and deliver new services such as enhanced payment and block-chain technologies valued by their customers.

- Provide customer 360 experience : The bank offers various services, and their customers interact with those services in many different ways. However, customers want a consistent experience, regardless of the business division they are interacting with or the device they use in the process. Delivering an engaging and personalized customer experience with a single customer view and a unified view of all interactions encompassing each touchpoint with the bank is challenging.

- Managing change without disruption : The bank needed agility to launch new services and make their development staff more productive. They want to minimize outages with high availability built into the system.

Choosing the right data management strategy

A comprehensive data management strategy sets the stage for establishing a deeper understanding of customer experience. It can offer a single view by collecting all the customer's structured and unstructured data from across the organization and other relevant external sources into one place. A NoSQL database is an ideal choice. It can store personal and demographic information and customer interactions with the company, including calls, chats, emails, texts, social media responses, product/service activity history, past and present purchases. McKinsey's study suggests that data-driven companies tend to be 19X profitable when they use data as a differentiation, as they tend to acquire 23X more customers and retain 6X more customers.

Source: https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/five-facts-how-customer-analytics-boosts-corporate-performance

Why Oracle NoSQL Database

Oracle NoSQL Database multi-data model makes it easy for developers to store and combine data of any structure within the database without giving up sophisticated validation rules to govern data quality.

- Support for flexible data model:

With the JSON document model, the schema can be dynamically modified without application or database downtime. Bank can localize all data for a given entity – such as a financial asset class or user class – into a single document, rather than spreading it across multiple relational tables. Customers can access entire documents in a single database operation, rather than joining separate tables spread across the database. As a result of this data localization, application performance is often much higher when using Oracle NoSQL Database, which can be the decisive factor in improving customer experience.

- Predictable scalability with always-on availability

As banking use cases evolve, data sources and attributes grow. Onboarding additional applications, various digital channels, and users' demands, processing and storage capacity quickly grow.

Oracle NoSQL database supports scale-out architecture and sharding technology. With sharding, the data is distributed across multiple database instances spread across different machines, thus overcoming limitations of a single server and associated resources such as CPU, RAM, or I/O. An Oracle NoSQL cluster can be expanded horizontally online without incurring any application downtime and one hundred percent transparent to the application. Oracle NoSQL Database maintains multiple copies of data for high availability purposes.

- Scale-out architecture for business continuity

The bank needed the ability to deploy the system across multiple data centers for disaster recovery purposes and also for the ability to perform local writes to the data center. Oracle NoSQL Database supports active-active architecture with multi-region tables. A multi-region architecture is two or more independent, geographically distributed Oracle NoSQL Database clusters bridged by bi-directional replication, ensuring the customers always have fast access to services and the latest data.

- Simplify application development with rich query and APIs

Oracle NoSQL provides a rich query language and extensive secondary indexes giving users fast and flexible access to data with any query pattern. This can range from simple key-value lookups to complex search, traversals, and aggregations across rich data structures, including embedded sub-documents and arrays. It also supports several easy-to-use SDKs in various programming languages – in particular, the customer was looking at NodeJS drivers.

High-level architecture of the proposed solution

Critical components in the architecture include:

- Applications Layer: This layer manages all user input applications, e.g., loan or credit card applications. The applications are based on forms technology, allowing the developers to create adaptive and responsive documents to capture information. The forms have a notion of fragments that allows for pulling out standard segments such as personal details like name and address, family details, income details, etc. The application layer is responsible for doing all the "application plumbing": interacting with the database, enforcing validation at event points, etc. It interacts with the bank's backend system through the API gateway and doesn't store any personal or sensitive information.

- Database Layer: A CRM system is used primarily for lead generation to target customers. Also available in this layer is the ELK stack (Elasticsearch, Logstash, Kibana), which is primarily used to audit the log data stored in the NoSQL Database. Oracle NoSQL Database has an out-of-box integration with Elasticsearch. Oracle NoSQL Database also feeds the user drop-off (incomplete form activity) data to the orchestration framework primarily used for retargeting the users.

- Marketing Layer : This layer hosts various servers that drive the business decision process. It comprises servers and tools used for customer segmentation (identify groups of individuals who are similar in attitudes, demographic profile, etc.) and customer journey analysis (a sum of all customer experiences with the bank). Additionally, it handles personalization (showing the product or service a customer would be interested in buying) and retargeting (persuading the potential customers to reconsider bank's products and services after they left or got dropped off from their app) based on the drop-off campaign's data that's coming out the Oracle NoSQL Database.

Banking experience re-imagined

A typical user's journey, e.g., loan processing, starts with a user interacting with banks loan processing applications via – the web, mobile device, email, or even branch. The application is served off the forms in the application layer. At this stage, the user fills in details and submits the scanned supporting documents. These scanned forms are classified, and information is extracted, and the data is sent to the NoSQL Database store. The data is sent to the processing system that triggers the underwriting process, beginning with the rule engine and credit scoring engine. Depending on the underwriting process results, an application will be approved, denied, or sent back to the user for additional information. If the application is approved, the loan amount is deposited into the user's account. Suppose the user drops off at any point while filling the form. In that case, this drop-off information is stored in the NoSQL Database and feeds into the orchestration system to kick start the retargeting campaign that allows the bank to target the customer who got dropped off. The process is repeated with specific ads, emails, or WhatsApp messages retargeting the customers. In the event the customer returns, they can start the journey where they left off.

In conclusion, one of India's leading private banks modernized and expedited its digital presence and provided an enhanced experience for its customers using Oracle NoSQL Database.

More information

Oracle NoSQL Database is a multi-model, multi-region database designed to provide a highly-available, scalable, flexible, high-performant, and reliable data management solution to meet today's most demanding workloads. It is well-suited for high volume and velocity workloads, like the Internet of Things, customer 360, online contextual advertising, fraud detection, mobile application, user personalization, and online gaming. Developers can use a single application interface to build applications that run in on-premise and cloud environments quickly. Visit NoSQL Database Cloud Service page to learn more.

Michael Brey

Director of nosql development.

Previous Post

Power Your Event-Driven Applications with Oracle NoSQL Database Cloud Service – Part 1

Power your event-driven applications with oracle nosql database cloud service – part 2.

- Analyst Reports

- Cloud Economics

- Corporate Responsibility

- Diversity and Inclusion

- Security Practices

- What is Customer Service?

- What is ERP?

- What is Marketing Automation?

- What is Procurement?

- What is Talent Management?

- What is VM?

- Try Oracle Cloud Free Tier

- Oracle Sustainability

- Oracle COVID-19 Response

- Oracle and SailGP

- Oracle and Premier League

- Oracle and Red Bull Racing Honda

- US Sales 1.800.633.0738

- How can we help?

- Subscribe to Oracle Content

- © 2024 Oracle

- Privacy / Do Not Sell My Info

Performance Management Case Study

In collaboration with mckinsey & company.

Redefining Performance Management at DBS Bank

How lofty ambitions and innovative metrics sharpened customer focus, march 26, 2019, by: david kiron and barbara spindel, introduction.

In 2008, the year David Gledhill went to work for DBS Bank, few would have predicted that within a decade the Singapore-based bank would be racking up an impressive slate of honors. Nonetheless, DBS was the first recipient of Euromoney ’s Best Digital Bank Award in 2016; it received that distinction again in 2018 and, that same year, was also named Global Finance ’s Best Bank in the World.

Just a decade ago, however, DBS, beset by long lines at branches and ATMs, high turnover among relationship managers, and a plodding credit card application process, had the worst customer satisfaction scores of all the banks in Singapore. Chief data and transformation officer Paul Cobban, who came aboard in 2009, recalls that “it was almost embarrassing to tell people at dinner parties” that he worked for the bank “because DBS had such a bad reputation.”

Executives did not simply change their performance management systems to achieve these goals. They redefined the meaning and measurement of performance.

Soon after Cobban joined, a newly arranged management team, with the support of tech-savvy CEO Piyush Gupta, turned things around by thinking of DBS as more of a tech startup than a bank. Gledhill, DBS’s CIO, says, “Our future competition wasn’t going to come from just banks, but from a lot of cool technology companies that were going into finance.” DBS, in Gledhill’s words, committed to becoming “digital to the core,” and he and his team initiated a thoroughgoing culture change to support digital innovation.

Company Background

DBS Bank was established by Singapore’s government in 1968 as the Development Bank of Singapore Limited. (It became known as DBS in 2003.) Still headquartered in the island nation, the multinational financial services group, with a workforce of over 26,000, has expanded throughout China, Southeast Asia, and South Asia, and currently has 280 branches in 18 markets. With its focus in recent years on reimagining banking as a seamless and streamlined digital experience (it has made banking mobile-only, paperless, and branchless in some of its markets), DBS’s mission is embodied in the slogan “Live more, bank less.”

Gledhill finds that operating in Singapore has distinct advantages. He cites the country’s “advanced IT infrastructure and strong intellectual property regulatory frameworks,” which encourage and protect technological innovation, and he points out that 80 of the world’s top 100 tech companies have a presence on the island. He also mentions Singapore’s highly skilled and highly educated pool of talent. “Together with supportive government initiatives to further Singapore’s digital agenda,” Gledhill says, “we believe we are definitely in the right place to fulfill our digital ambitions.”

The Foundational Years: 2009 to 2014

When Gledhill, Cobban, and the rest of their team joined DBS, they immediately set about changing the culture of the company. In the wake of the 2008 financial crisis, DBS was determined to differentiate itself from Western banks by emphasizing that it provided, in Cobban’s words, “a special brand of Asian service.” The qualities of this service were embodied in the acronym RED: respectful, easy to deal with, and dependable. The hope was that living up to these qualities would improve the company’s customer satisfaction scores, which Cobban recalls were “rock-bottom.”

Under the umbrella of RED, they created cross-functional teams called PIEs (process improvement events). The goal was to come up with processes that could be implemented within one week and that would address the bank’s biggest service problems — say, the time it took to replace a lost credit card — often by improving speed and eliminating waste. Cobban recalls, “I said, ‘What can you actually change within a short time frame?’ And that was it from an incentive point of view. It made people realize if they put some effort in now, they can see major results. Even to this day, I’m not quite sure how this happened, but we unlocked the enthusiasm, the energy, of the bottom of the company.”

Removing operational barriers lifted the ambition of employees across the organization without the use of incentives.

Notably, the PIEs helped effect a culture shift in the organization by enabling rapid, visible improvements to a wide range of operational processes. Removing operational barriers lifted the ambition of employees across the organization without the use of incentives. “We create a mechanism that anybody can participate in,” Cobban says. “We make it a very low bar to participate, and we did not expect everyone to be successful.”

In addition to improving organizational processes, the new team ensured that the company’s focus was squarely on the customer. In 2009, in what Cobban calls “in hindsight a moment of genius,” the management team invented the measure of the customer hour, a unit of wait time for a customer (a customer waiting for a credit card for an hour equals one customer hour), and used the PIE concept to eliminate as many customer hours as possible. Cobban hoped to be able to take 10 million customer hours out of the bank and ended up taking out 250 million. The process, Cobban says, “was really focused on making the customer’s life better,” a goal that unlike, say, increasing the bank’s profits, gave DBS employees a shared sense of purpose. (Google, Cobban notes, has since adapted DBS’s customer hours concept.) The shift in focus entailed an accompanying shift in the meaning of performance, as the previous measures of success were no longer relevant.

The final innovation was to upgrade DBS’s technological capabilities. “We had to build resilience into our platforms and data centers,” Gledhill says. “Our securities and monitoring operations needed revamping. But more important was the need around insourcing. We built our own technology DNA around the company so that we could really start to look and act more like a technology company. We fixed our application stack and got rid of our legacy systems to build an environment on which we would really start to scale.” The company, which was 85% outsourced in 2009, was 90% self-managed by 2018.

Looking back on the new management team’s early successes, Cobban jokes that “we were so bad, it was easy to improve within that first year.” The team wasn’t yet aspiring to compete with tech companies, but it was laying the groundwork for doing so. Gledhill was still, at that point, “thinking about ‘world class’ as being world-class among banks.” He sees the team’s initial actions, which included experimenting with agile practices, as integral to DBS’s later successes, noting that “our foundational years from 2009 to 2014 were critical building blocks where we fixed the basics to be able to move fast.” The changes to DBS’s approach to performance during this period both responded to and helped drive the company’s digital transformation. Soon, however, the company articulated a new and ambitious goal that led to a major shift in its performance management.

Project GANDALF: 2014 to the Present

Around 2014, Gupta and Gledhill began to see DBS’s competition as tech companies — like Google, Amazon, Netflix, Alibaba, LinkedIn, and Facebook — rather than other banks. They set their sights on joining that pantheon as a world-class tech company. The initials of the tech giants together spell GANALF. The company goal was to add a D to the acronym, for DBS, to spell GANDALF, the wizard of J.R.R. Tolkien’s The Hobbit and The Lord of the Rings novels. “That aspiration, more than any single piece of technology or anything else,” Gledhill declares, “really galvanized people to a completely new level of performance and thinking.” The CIO adds that the company “made it fun as well.”

5 Focus Areas for DBS Bank’s Digital Transformation

The GANDALF goal led to a shift in the company’s approach to performance management, which DBS explicitly used to drive its transformation toward becoming a digital leader. The company quantified what it wanted to achieve and measured itself continually against its goals through its management scorecard and key performance indicators. The effort was enterprise-wide and aligned the business and technology sides. “It’s a partnership with HR in terms of reimagining the training and tools and the programs that we want to run,” Gledhill says. “It’s working with our marketing folks to figure out how we shape and sell our message. It’s working with the other business leaders to get them on board. So, it becomes a culture shift more than anything else, which has to affect all parts of the organization. Everybody has to shift the way they operate.”

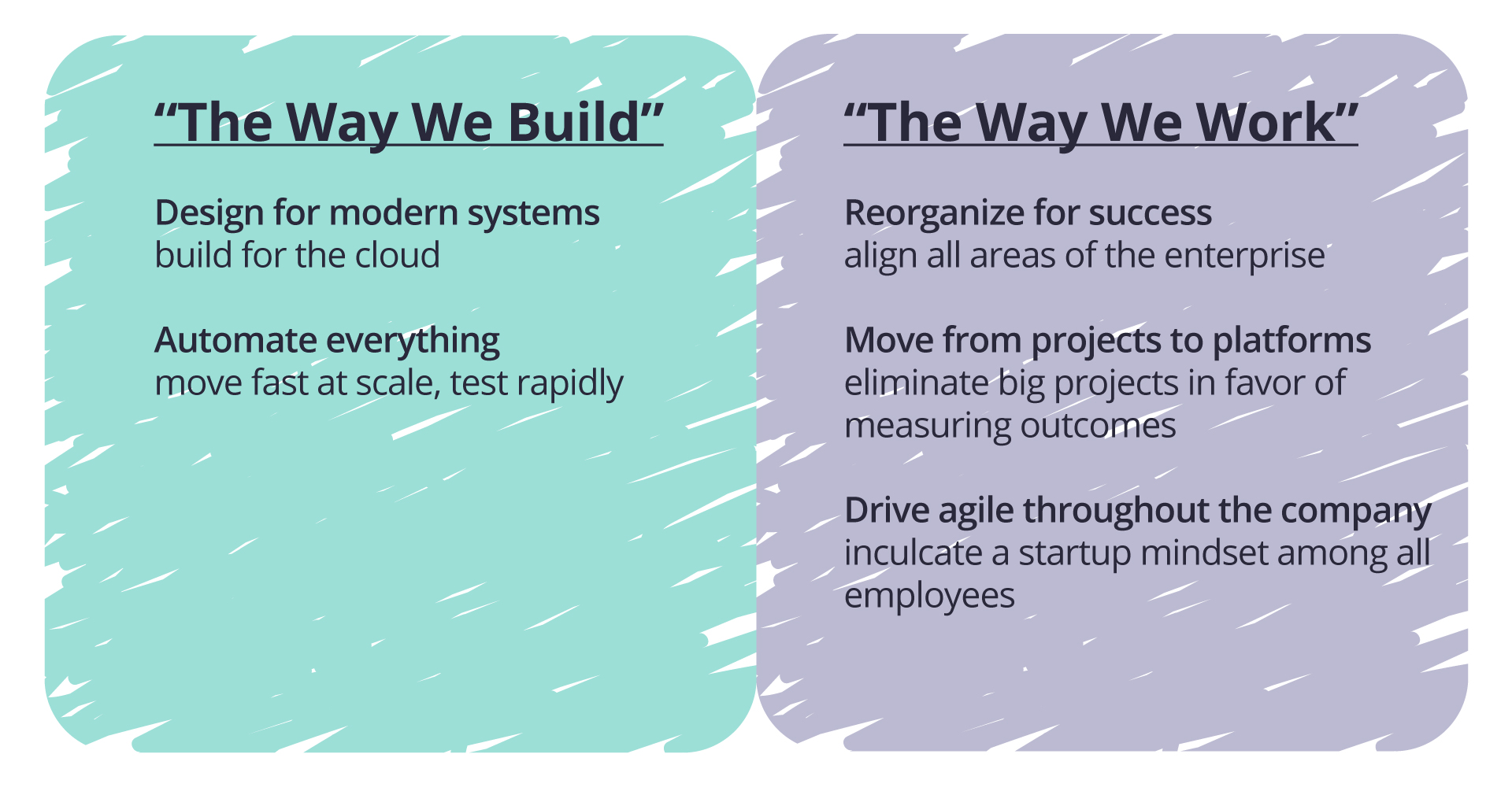

To disrupt itself and join the digital elite, DBS took the following steps:

1. Gave new meaning to “performance.” Once the PIEs had resolved the customer satisfaction problems related to basic issues like length of wait time for customer center calls, they evolved into a set of programs focused more holistically on the customer. Cobban recalls, “We realized we now need to take friction out of the customer journey — it’s a lot faster than it used to be, but still there’s quite a lot of friction. This deep understanding of what customers really need is pivotal to what we built in.” DBS turned to human-centered design thinking to solve customer problems, running more than 500 “customer journey projects.” Employees are invited to create solutions and pitch them to senior staff. That might mean designing apps that don’t consume too much battery power because in a digital age, being “respectful,” part of the RED mandate, means being conscious of the importance of a customer’s battery life.

In 2017, in another move that greatly altered the company’s conception of performance, DBS developed a method for measuring the financial impact of digitization. Called the digital value capture (DVC), the data quickly and quantitatively demonstrated the importance of migrating customers to digital banking. “Through DVC, we noted that, compared to a traditional customer, a digital customer brings in twice the income, with 1.5, 2, and 3.6 times higher deposit, loan, and investment balances, respectively. A digital customer, on average, also costs 57% less to acquire and is more engaged, with 16 times more self-initiated transactions,” Gledhill notes. DVC data served multiple purposes: It created a new mandate for DBS employees, it was shared with investors, and it helped develop the enterprise’s business plan.

2. Used performance management to drive digital transformation. The company uses a balanced scorecard approach to measure performance, and digital transformation now comprises a significant part of the scorecard. As Gledhill explains, “Because we are really pushing this digital agenda, our scorecard has changed. We want to drive people to push digital adoption of the customers. And so 20% of our scorecard — so 20% of the bank’s performance, which ultimately defines how much we get paid — is focused on digital transformation.” The scorecard’s metrics are very precise. Gledhill continues, “We have very specific measures in there about the percent of customers we acquired digitally, about the shift from manual channel to electronic channel, execution for transactions, and how much we engage. So, acquire, transact, engage. Every business and every product within every business has targets about how it has to shift its customer base to those electronic channels. So, the scorecard is very tightly aligned to digital.”

“With most people, it was very liberating because it set an aspiration of something they’d completely, to that point, failed to imagine, and it was fun.” — David Gledhill

3. Changed the culture that supports performance management. In addition to providing a unifying sense of purpose to the organization, the GANDALF goal has focused DBS on its company culture. Through a process called Culture by Design, DBS has been extremely precise about codifying the culture it wants to establish: one that gives its 26,000-person workforce the feel of a startup. The acronym ABCDE details the characteristics of the culture: Agile (adapting more quickly), Be a learning organization (adopt new ways of approaching the business), Customer-obsessed (understanding customers’ pain points), Data-driven (using data holistically to transform internal processes), and Experiment and take risks (encouraging the 4D process: discover, define, develop, and deliver).

“Once we defined these key characteristics, we started reinforcing them by making aspects of these traits and behaviors a requirement for everyone,” Cobban explains. “We continue to reinforce these characteristics throughout the bank through multiple learning and collaboration programs. We focus on identifying ‘blockers’ to our cultural innovation and set about targeted countermeasures to address them.”

For instance, the company’s meetings, according to Cobban, were frequently ineffective. Problems included “people being late, unprepared, poor agenda, too many people in the meeting, too many meetings generally.” A program called Meeting MOJO was conceived to overcome this particular blocker. Under MOJO, every meeting now has a meeting owner (MO) who in turn appoints a joyful observer (JO). The MO, according to Cobban, ensures that the meeting has a clear agenda, that it starts and ends on time, and that there is “equal share of voice” throughout the discussion. At the end of the meeting, the JO provides feedback to the MO about whether the meeting was a success according to those criteria. “The results have been dramatic,” Cobban says. “More of our meetings start and finish on time, and they now have more structure and engage more attendees.”

“If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.” — Paul Cobban

In addition, in 2017, DBS launched DigiFY, a mobile learning platform and online course intended to transform the company’s bankers into digital bankers. The program imparts skills in seven categories: agile; data-driven; digital business models; digital communications; digital technologies; journey thinking; and risk and controls. By the time employees achieve mastery in the three-part course, they are qualified to teach its precepts to their coworkers. Once the company decided it required digital bankers, it methodically set about defining, creating, supporting, measuring, and developing them.

As Cobban explains, all these changes took place within a traditional performance management system; what’s more, they were divorced from financial incentives. “We have not set out to change the culture of performance management directly through compensation. My experience is that it’s not effective in shaping a company,” he says. “Our performance approach is very conventional. We have an annual appraisal process. We have KPIs that we need to meet. If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.”

Creating Buy-In at the Customer Center

Improvements to the customer center at DBS exemplify the shifts taking place within the organization at large. Beginning in 2014-2015, at the customer center as well as throughout the enterprise as a whole, performance management was used to drive the digital agenda. DBS’s head of customer center Geeta Sreeraman states that while the center, like most contact centers is “a highly KPI-driven environment;” the KPIs were very aligned to the bank strategy. “And our focus was, and continues to be,” she adds, “how do we participate in this whole digital transformation?” The answer was to use technology to engage the staff, improve efficiency, and enhance the customer experience.

A top priority was changing the mindset of the 500-plus customer care representatives. This was accomplished in part by enlisting the employees to collaborate in the creation of the unit’s KPIs. “We don’t want a top-down KPI that doesn’t account for their challenges,” Sreeraman says. The “culture of cocreation,” she observes, resulted in “a lot more buy-in.” Moreover, management regularly reviews and refines the unit’s metrics as the nature of engaging with customers changes. For instance, DBS customers increasingly use chat to handle simple banking issues. As customers turn to phone calls as a last resort to address more complex technical problems, KPIs related to the average time of a phone call are of lesser relevance. Metrics relating to first-contact resolution and customer satisfaction become more critical.

By the time customers do make phone calls, then, there is a strong possibility that they’re experiencing a problem that they were unable to solve using self-service online tools. DBS began using speech analytics not to punish poor performance but to understand both the challenges faced by call center staff and customer pain points. “A lot of our high-emotion calls were because of confusion,” Sreeraman says. If, for instance, the analytic tools revealed that callers were frustrated because they couldn’t access their bank statements, the company specifically trained employees to assist customers in accessing their statements online. (This solution had the added benefit of supporting DBS’s agenda to get its customers to go digital.) Similarly, if an urgent problem arises, the company can figure it out more quickly by registering an increase in negative emotions associated with calls.

Access to data enabled innovations at the customer care center. “We enhanced our internal data capabilities to make sure that we capture real-time data through dashboards,” Sreeraman says, adding that the data also facilitates any “real-time management that we need to do.” As part of having a transparent and open culture, an in-house mobile engagement app called Alive makes performance data available 24 hours a day. Managers can see which employees need additional support and which are in a position to stretch themselves. The app is also used to encourage employees to manage their own performance. They can “benchmark their performance with the rest of the cohort to assess if they are on track to meet their objectives,” Sreeraman says. Employees are encouraged to take responsibility: to self-assess, seek feedback from managers, and set SMART (specific, measurable, achievable, realistic, and time-bound) goals. This “self-driven” performance management, she says, is “where we are headed right now.”

As DBS’s recent accolades suggest, the bank has been successful in aligning its performance management system, its KPIs, and its culture with an ambitious digital transformation agenda. Of course, work remains to be done. Gledhill is interested in applying principles of performance management to the company’s teams; he also wants to deploy machine learning and advanced analytics tools to further optimize customer interactions. But as he measures DBS against the tech giants, reflecting on the audacious goal of putting the D in GANDALF, he is confident that the company will continue to make progress. “I would say we’re a long way away from some of the advanced tools and techniques these guys use, but here’s the point,” he reasons. “If this is always your North Star, you will always progressively move closer and closer to it. That’s how we look at it.”

David Gledhill

group chief information officer and head of group technology and operations

David Gledhill is group chief information officer as well as head of group technology and operations at DBS Bank. In 2017, he was the recipient of the MIT Sloan CIO Leadership Award, becoming the first CIO from an Asian company to have won. Prior to joining DBS in 2008, he worked for 20 years at JP Morgan.

Paul Cobban

chief data and transformation officer, technology and operations group

Paul Cobban is chief data and transformation officer, technology and operations, at DBS. He joined DBS in 2009 as managing director for business transformation, and was chief operating officer of technology and operations from 2013 to 2017.

Prior to joining DBS, Cobban held a variety of roles at Standard Chartered Bank, and he also worked at JP Morgan UK as an IT project manager and at IBM as a programmer and project manager.

Geeta Sreeraman

head of customer center, Singapore, technology and operations

Geeta Sreeraman is head of the customer center at DBS Bank, where she leads a team of 600 employees. Since joining DBS in 2011, she has held various senior positions, from managing relations with regulatory bodies to leading the development of the department. Under her leadership, her group has won many accolades, include Best Contact Centre at the Annual Contact Centre Association of Singapore Awards. She started her career as a relationship manager for Citibank India.

Banking On Technology-Enabled Performance Management

By Peter Cappelli

The DBS Bank example is a good illustration of how to pull off organizational change, especially a big one. The key is to use many different levers to get employees to behave differently. In this case, performance management is one of those.

It is useful to think of organizational change as similar to trying to get an individual employee to behave differently, but you have to do it at scale. There are all kinds of reasons we keep doing things the same way, but the most important is arguably that change is both unsettling and, in many cases, risky, especially if what we have been doing has been working pretty well for us.

It helps to have a powerful need for change. Some people refer to this as a burning platform — a pressure that is big enough that we cannot simply ignore it. DBS wasn’t failing; it just wasn’t very good. The pressure had to come from someplace else.

The success of DBS seems to have come from two initiatives. The first was empowerment. We’ve long known that employees can be engaged to work hard and creatively on projects for which they are responsible and that they own. The Singapore work culture is generally quite top-down, so the decision to empower teams to take on projects is more radical than it sounds. I suspect the employees responded to it with even more energy than they might elsewhere.

The second initiative relates to performance management, specifically the creation of measures of success. It is hard to engage people in anything if they do not know how they are doing, and it is especially difficult to improve if you cannot measure whether you are doing better: Imagine trying to improve your golf game if you went to the driving range and could never see where the ball went. The truly innovative initiative at DBS was to create a measure of performance — hours of customer time — that had face validity (we can see why it is good for business and for customers to bank faster), will stay in place over time, and is comparable across parts of the bank.

Paul Cobban says that the bank’s performance appraisal system is very conventional, but the management team did make changes in it that drove behavior in a different direction. That began with new organizational measures, a balanced scorecard, and new measures of individual behaviors that the team wanted employees to execute. We should not underestimate the importance of training on those behaviors because a big cause of resistance to change is employees who aren’t sure whether they will be able to hit the new goals, so they often do not try. Good training goes a long way toward taking that fear away.

Even with all these efforts, organizational changes typically fail. They are working at DBS in part because the leaders smartly let the new practices drive culture changes and aligned efforts to move employees in a new direction. DBS leaders provided a compelling vision of becoming a digital company, empowered employees to act on that vision, measured how they are doing, and gave them the skills to succeed. As with any successful change, it is a lot more work to make it happen than it sounds from a story. The key element here is leadership commitment: Put time and sustained resources into the effort and see it through to a conclusion.

Peter Cappelli is the George W. Taylor Professor of Management at The Wharton School and director of Wharton’s Center for Human Resources. He is also a research associate at the National Bureau of Economic Research in Cambridge, Massachusetts, served as senior advisor to the Kingdom of Bahrain for employment policy from 2003-2005, and since 2007 is a distinguished scholar of the Ministry of Manpower for Singapore.

About the Authors

David Kiron is the executive editor of MIT Sloan Management Review ’s Big Ideas Initiative, which brings ideas from the world of thinkers to the executives and managers who use them.

Barbara Spindel is a writer and editor specializing in culture, history, and politics. She holds a Ph.D. in American studies.

Contributors

Michael Fitzgerald, Carolyn Ann Geason, Allison Ryder, and Karina van Berkum

Acknowledgments

David Gledhill, CIO, DBS Bank

Paul Cobban, chief data and transformation officer, DBS Bank

Geeta Sreeraman, head of customer center, DBS Bank

More Like This

Add a comment cancel reply.

You must sign in to post a comment. First time here? Sign up for a free account : Comment on articles and get access to many more articles.

Payment disputes in banking: A pathway to deeper customer relationships

Card-related payment disputes between customer and merchant occur in fewer than 1 percent of transactions, but these moments can have an outsized impact on bank-customer relationships. The cornerstone of these relationships is customer trust—that their deposits are safe, and that they can dispute a charge or transaction and get a quick, factual answer.

Stay current on your favorite topics

For customers, disputes can be a source of frustration and inconvenience. For banks, disputes are expensive to resolve. If banks treat disputes simply as issues to be minimized, they can miss the silver lining: the opportunity to strengthen their relationships with customers.

This point is particularly important today. Globally, customers continue to move away from cash and checks toward electronic payments (Exhibit 1). Overall, this trend is a positive development for banks and card issuers, but as card transactions grow, so does the number of disputable transactions (and the incidence of fraud), putting pressure on dispute processes that often are already overextended, and leading to increasesi operating costs of hundreds of millions of dollars.

As they benefit from growth in credit- and debit-card use, in other words, banks and card providers must ensure that the customer experience is not degraded. A number of banks are therefore rethinking the way they manage disputes with an eye toward maintaining and even strengthening their trust-based customer relationships—all while processing disputes more cost efficiently and at lower regulatory risk.

Complex operating models and other obstacles

Today, most banks face a number of costly obstacles as they seek to address a rising number of card disputes:

- Complex operating models. Most banks’ traditional, budget-controlled functional structures lack a clear, end-to-end chain of responsibility for the disputes experience. The operating model’s complexity obscures distinct ownership of the client experience, and in some cases there is a definitive separation among the functions required to take in and resolve disputes (the call center, dispute research, and the back office). This disjointed model leads to more customer pain points and delays in time-to-credit and overall dispute resolution. To exacerbate matters, most dispute organizations are scattered geographically—some US-based banks have as many as 15 dispute-resolution locations—which intensifies operational complexity.

- Overprocessing of disputes. Banks and issuers usually process all disputes above $25, regardless of dollar amount, customer, or the merchant’s dispute history, and apply the same process across the board. This lack of triage allows dispute volume to rise and puts pressure on dispute teams to process disputes quickly to save costs and avoid regulatory infractions.

- Long, complex research process. In most banks, the dispute process involves multiple IT systems and tends to be driven by the technology the bank has rather than the technology it needs. In some cases, banks must turn to third parties to conduct additional research on fraud.

- Ineffective quality assurance. At some banks, the process of reviewing dispute decisions is overly focused on checking regulatory boxes rather than on the overall accuracy of the decision. Banks and issuers thus miss the opportunity to catch and fix incorrect decisions. This problem is especially prevalent at larger institutions, where intense regulatory scrutiny often inadvertently makes compliance a higher priority than quality control. Instead, leading banks are now embedding regulatory processes into more effective dispute processes.

- Inadequate performance management. Process complexity of the kind that characterizes dispute resolution at most banks results in highly variable individual performance. As mentioned, banks are often overly focused on preventing regulatory violations at the expense of performance. McKinsey has seen differences in productivity of more than two and a half times between the top and bottom quartiles of dispute-research analysts who process disputes. Limited use of metrics, a lack of individual and team performance targets, and a dearth of fact-based coaching to improve individual performance and identify problems all exacerbate the problem.

- Over-reliance on the case-management system. Years ago, many institutions implemented case-management systems for dispute resolution with the expectation that the technology would drive down costs. However, most realized only marginal improvements in efficiency and speed of resolution. In McKinsey’s experience, case-management systems deliver full value only when they can integrate effectively with the various systems used to investigate disputes—fraud prevention, ATM, and transaction history systems, for example—and can follow a streamlined process to resolve them. Typically, the handle time for resolving a case does not go beyond an hour, but it can take up to five days to provide an answer to the customer.

- Increasing regulatory focus. Customer-protection regulations—such as Regulations E and Z in the US—tighten the timelines for banks to resolve disputes and raise the pressure on teams to process disputes and provide credit faster. However, while providing credit faster alleviates one pain point, many firms see it as a simply a Band-Aid, leaving the underlying issue unresolved.

Would you like to learn more about our Financial Services Practice ?

Simpler, smarter processing.

New insights, tools, and capabilities are emerging that enable banks to address many of the obstacles they currently face in the dispute-resolution arena. An integrated, next-generation operating model based on these new capabilities improves the customer experience (providing 100 percent of customers with real-time, provisional credit decisions), reduces costs (with efficiency gains of 30 percent or more) and financial losses (by up to 5 to 7 percent), and lowers regulatory risk (reducing customer-impacting errors by 80 percent). To achieve these results, banks and card issuers can focus on five imperatives (Exhibit 2):

1. Digitize the dispute-resolution process

Digitizing the dispute process dramatically reduces the time and effort required for a customer to file a dispute and for the bank to take in the dispute. Best-in-class institutions are simplifying their intake process by taking a customer-centric view, to the point where customers can file disputes in a couple of minutes on their mobile devices, compared with the ten minutes it takes to do so speaking on the phone. Banks are also streamlining the research process by providing a set of questions that customers must answer up front. Call-center agents and customers no longer have to plow through a questionnaire to understand or explain the dispute.

2. Redesign the process with lean principles

Traditionally, banks have sought to improve the dispute process through technology investments and process tweaks, leading to only marginal gains. Only banks that have conducted a “zero-based” design of the entire dispute process have achieved dramatic change. Designing a new dispute process from scratch is the only way to truly simplify dispute research policies and requirements. Some banks have increased productivity quickly by categorizing disputes according to their complexity (number of transactions, number of different systems required to decision, for example).

3. Apply advanced analytics

Some banks and issuers are leveraging advanced analytics and machine learning (in which computers “learn” patterns from examples and apply the insights to new data) to predict disputes and fraud (for example, by letting customers know when a suspicious transaction has occurred and giving them the option to decline it). While fraud detection has leveraged neural networks for the last two decades, the next generation of models is substantially more powerful, leveraging more data within shorter time spans. These processes work by using dozens to hundreds of variables to determine whether provisional or final immediate credit is the optimal strategy for resolving a particular dispute. Banks are also using analytics to estimate the amount of effort required to research a dispute, based on the customer’s history and the merchant profile. The value of such an approach is significant; consider that one regional US bank was conducting a complete research process for all disputes before providing provisional credit, despite the fact that it approved final credit in 98 percent of cases. Advanced analytics can also dramatically improve the customer experience by expediting time-to-funds, and it frees up research capacity to focus on more complex and higher-impact disputes.

Putting customer experience at the heart of next-generation operating models

4. employ intelligent process automation.

Intelligent process automation (IPA), or robotics, automates aspects of the end-to-end dispute-processing value chain. IPA can reduce dispute-resolution cycle times, boost operational efficiency, and improve overall customer experience. The most common use cases include:

- Fraud prevention. Advanced analytics can flag potentially fraudulent transactions and address them before they become disputes. For example, McKinsey has worked with QuantumBlack to develop a model that uses machine learning and a random forest model to flag potential fraud cases based on 13 months of transaction history.

- Intake review. Natural-language processing and machine learning can identify the type of dispute (fraudulent vs. nonfraudulent, PIN-based vs. non-PIN-based).

- Dispute management. Advanced analytics can separate complex disputes from simple ones and assign them to the appropriate analyst. For example, a US bank used an algorithm to identify complex disputes and matched disputes to analysts based on analysts’ skill sets and the other disputes they were working on that day. The result was less “context changing” and significantly increased productivity.

- Dispute processing. Banks use robotics to collect information automatically and prepare cases for human processing.