Trending News

Related Practices & Jurisdictions

- Financial Institutions & Banking

- Securities & SEC

- All Federal

On November 30, 2018, the SEC adopted Rule 139b under the Securities Act of 1933, substantially as proposed, establishing a safe harbor under which unaffiliated broker-dealers may publish and distribute research reports on “covered investment funds”—registered investment companies, BDCs and certain commodity- or currency-based trusts or funds—without such publication or distribution being deemed an offer of securities. Establishing this new safe harbor was mandated by the Fair Access to Investment Research Act of 2017.

Rule 139b permits two types of research reports: (1) issuer-specific research reports and (2) industry reports. Each type of research report must be published or distributed in a broker-dealer’s “regular course of business.” In addition—in a change from the proposal—final Rule 139b requires any performance information included in a research report to be presented in accordance with certain standardized requirements (e.g., mutual fund performance must be presented according to the requirements of Rule 482). For issuer-specific research reports, a fund must have been subject to periodic reporting requirements for at least 12 months and be current in its reporting. Funds included in an industry report must also be subject to periodic reporting requirements but there is no 12-month reporting history requirement.

To help implement Rule 139b, the SEC also adopted Rule 24b-4 under the Investment Company Act of 1940, which frees a Rule 139b research report from SEC filing requirements if it is subject to the content requirements of FINRA or another self-regulatory organization, as well as an amendment to Rule 101 of Regulation M.

The new rules and amendments will be effective 30 days after publication in the Federal Register. The adopting release is available here.

Current Legal Analysis

More from vedder price, upcoming legal education events.

Sign Up for e-NewsBulletins

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

“Covered Investment Fund” Research Begins January 14, 2019

The Securities and Exchange Commission (“SEC”) has traditionally recognized the value of market and issuer research to the investment decision-making process. The federal securities laws regulate issuer and market communications under general antifraud and specific rules. Congress adopted the Fair Access to Investment Research Act (“FAIR Act”) in 2017 to place research about “covered investment funds” on equal regulatory footing with the publication and distribution of research historically permitted for public operating companies. Congress directed the SEC in the FAIR Act to adopt implementing rules, and the SEC adopted Rule 139b under the Securities Act of 1933 (“1933 Act”) for this purpose. This rule became effective on January 14, 2019.

Rule 139b covers two types of research reports—issuer-specific reports and industry reports. This Alert: (i) describes the scope of the new SEC rule for covered investment fund “research reports”; (ii) summarizes the current regulatory landscape that would be expected to apply in coordination with the rule; and (iii) discusses the conditions for issuer-specific and industry research reports to rely on the rule.

Who Is Impacted By Rule 139b?

Broker-Dealers

Rule 139b applies to certain broker-dealers that seek to publish and distribute research reports about covered investment funds for which they may be, or may be deemed to be, participating in an offering. Broker-dealers relying on this non-exclusive safe harbor may permissibly publish and distribute eligible research reports without the report being deemed to be an impermissible offer to sell, or an offer for sale, of a security in violation of Section 5 of the 1933 Act. [1]

Rule 139b, however, does not extend to a research report published and distributed by a covered investment fund itself, directly or indirectly, by an “affiliate” of the fund, or by a broker-dealer that is an adviser to the fund or that is an “affiliated person” of an adviser to the fund. [2] The FAIR Act itself included this limitation on the scope of the Rule 139b safe harbor, and the SEC incorporated it in its implementing regulations to prevent issuers from circumventing Section 5 ( e.g. , by issuing research reports in lieu of prospectuses) and to mitigate the potential for a broker-dealer’s conflict of interest with respect to a covered investment fund resulting in a biased research report. These affiliate and affiliated person restrictions are technical and would require careful consideration to ensure compliance.

Under Rule 139b, to determine “affiliates” of an investment fund, a broker-dealer must look to, among other things, the definition of “affiliate” in Rule 405 under the 1933 Act, which makes any person that directly or indirectly controls a fund, is controlled by a fund, or is under the common control of a fund an affiliate. Control for these purposes, and as defined by Rule 405, means the direct or indirect power to direct or cause the direction of the management and policies of a fund whether through the ownership of voting securities, by contract, or otherwise. Thus, for example, an “affiliate” of an investment fund would almost surely include its adviser and could include a broker-dealer that provided it with seed funding, even if the broker-dealer was not otherwise affiliated with the fund’s sponsor or adviser.

The safe harbor also is not available to a broker-dealer that is an “affiliated person,” as defined in Section 2(a)(3) of the Investment Company Act of 1940 (“1940 Act”), of any adviser to the covered investment fund. Section 2(a)(3) provides an extremely technical and broad definition of “affiliated person.” Among other things, the definition includes any investment adviser to an investment company ( i.e. , investment fund), including a third-party sub-adviser. The affiliation of a third-party sub-adviser raises the question whether an affiliated broker-dealer of the sub-adviser would be captured in the affiliation restrictions, and the SEC did clarify the potential effects the affiliation restrictions may have on broker-dealers affiliated with third-party sub-advisers. Additionally, a broker-dealer that owns as little as five percent of the voting equity of an investment fund’s adviser or third-party sub-adviser would be an “affiliated person” of each, as the case may be, and, therefore, also unable to rely on the Rule 139b safe harbor.

Participation by an investment fund or its adviser in the review of a research report also could disqualify reliance on the safe harbor on the theory that, if either played such a prominent role in reviewing or approving the research, the fund or adviser could be deemed to have indirectly published and distributed the research report. Alternatively, a reading of the SEC’s analysis in the adopting release to Rule 139b suggests that a fund’s or an affiliate’s participation in the review and approval of material for a report could “entangle” the fund or affiliate in the production of the report or otherwise cause them to “adopt” the report outside of the protection of the safe harbor. By invoking the doctrines of entanglement and adoption from other areas of the federal securities laws, the rule divorces the fund and its adviser from the research report publication and distribution process, which runs counter to the traditional process by which funds and their advisers develop, produce, and distribute fund marketing materials. Thus, the effect of the SEC’s guidance presumably is to mitigate the potential for covered research reports becoming primarily another type of fund marketing or advertising.

Covered Investment Funds

Although a “covered investment fund” may not permissibly publish and distribute a research report about its securities or its industry sector in reliance on the safe harbor, or otherwise participate in the publication of such a report, it is obviously impacted by Rule 139b because it can be the subject of a Rule 139b report, individually or collectively as part of an industry. The safe harbor defines a “covered investment fund” to include: (i) an investment company (or series or class thereof) that has filed a registration statement under the 1933 Act, which the SEC has declared effective; (ii) a business development company (“BDC”) that that has filed a registration statement under the 1933 Act, which the SEC has declared effective; and (iii) a trust or other person (1) that is issuing securities in a registered offering that are listed for trading on a national securities exchange; (2) whose assets consist primarily of commodities, currencies, or derivatives that reference commodities or currencies; and (3) whose registration statement discloses that its securities are purchased or redeemed for a ratable share of its assets.

Stated less technically, an eligible research report may cover mutual funds, closed-end funds, exchange-traded funds (“ETFs”), currency and commodity exchange-traded products (“ETPs”), and BDCs. A “covered investment fund,” however, would exclude investment companies that are solely registered pursuant to the 1940 Act (and not the 1933 Act), such as certain master funds in a master-feeder structure. Nevertheless, according to SEC estimates, more than 11,000 issuers, representing over $20 trillion in market value, theoretically could become the subject of research reports under the Rule 139b regulatory regime, although the market-value conditions of the rule discussed below may reduce the potential universe of investment funds that may be practicably covered.

What Is a “Research Report?”

The federal securities laws currently include various definitions of the term “research report.” Rule 139b defines a “research report” to mean a written communication (a writing, printing, graphic communication, or radio or television broadcast) that includes information, opinions, or recommendations with respect to securities of an issuer or an analysis of a security of an issuer, regardless if the communication provides sufficient information on which to base an investment decision. The Rule 139b definition parallels similar definitions in Rules 137, 138, and 139 under the 1933 Act. These 1933 Act rules form the historical basis for the permissible publication and distribution of research reports on operating companies. Rule 139b is modeled after Rule 139, with adjustments in recognition of differences between investment funds and operating companies.

The definition prescribed by Rule 139b, however, differs from that prescribed elsewhere. For example, this definition in Rule 139b contrasts with the definition in Regulation Analyst Certification (“Regulation AC”) under the Securities Exchange Act of 1934 (“1934 Act”) and with the definition prescribed by the debt and equity research rules of the Financial Industry Regulatory Authority (“FINRA”). Regulation AC defines a “research report” to mean a written communication (including electronic communications) that includes an analysis of a security or an issuer, which conveys information reasonably sufficient for an investor to base an investment decision . Similarly, FINRA Rules 2241 (equity research rule) and 2242 (debt research rule) define a “research report” as a report that includes, among other things, information sufficient to form the basis of an investment decision. Rule 139b expressly omits this “reasonable basis” condition, thus arguably covering a broader universe of securities and market analysis than Regulation AC and the FINRA research rules may cover. The SEC, however, stated its expectation that most covered investment fund research reports would be expected to trigger compliance with FINRA’s research rules, and Regulation AC, presumably because the report would be expected to form the basis for an investment decision. In light of the SEC’s position, consideration of conflicts disclosure prescribed by Regulation AC and FINRA research rules may need to be incorporated in research reports in reliance on Rule 139b, as discussed below.

EXISTING REGULATORY LANDSCAPE AND INTERPLAY WITH RULE 139B

Regulation AC

Regulation AC was adopted in 2003 and regulates primarily the publication and distribution of research by certain market participants—namely, investment banks and their research analysts, which may have investment-banking and sales and trading business relationships with issuers they cover in the research process. At its core, Regulation AC is intended to manage conflicts of interest in the research process by requiring prominent certifications in research reports subject to Regulation AC regarding the independence of the analyst’s views contained in the report. More specifically, Regulation AC requires express certification that no part of the compensation of the analyst primarily responsible for preparing the report was, is, or will be, directly or indirectly, related to the specific recommendation or views contained in the research report; or, if part or all of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views contained in the research report, the certification must disclose the source and amount of the analyst’s compensation, the purpose of compensation, and the conflicts of interest that the compensation may raise—namely that such a compensation structure may influence the recommendation in the research report.

Regulation AC principally governs the debt and equity research functions of broker-dealers and their research analysts. It may be read to extend, however, to affiliates of a broker-dealer that provide debt and equity research, particularly to the extent that the affiliate and broker-dealer have overlapping officers or research employees. To the extent that an authoring broker-dealer does not trigger the affiliation restrictions, Rule 139b does not expressly prohibit a broker-dealer, and presumably its research analysts by extension, from publishing and distributing eligible research reports simply because the broker-dealer receives revenue-sharing and similar distribution payments, or the analyst receives bonuses or compensation that may be tied to his or her research activities. Regulation AC may require that the report’s content be supplemented to include appropriate conflicts disclosure.

If, however, an authoring broker-dealer reasonably concludes that a research report could not form a reasonable basis to make an investment decision, notwithstanding the SEC’s position otherwise, Regulation AC would not be specifically triggered, although considerations under general antifraud and/or FINRA rules may require conflicts disclosure in any event, particularly disclosures relevant to compensation paid to an authoring broker-dealer or its research analyst. Thus, an authoring broker-dealer would need to consider and evaluate potential conflicts raised by compensation structures to determine the extent to which conflicts may need to be disclosed, either as expressly prescribed by Regulation AC, or disclosed more generally to comply with principles of antifraud disclosure or relevant FINRA rules, as discussed below.

FINRA Rules

FINRA also has adopted comprehensive regulations governing the equity and debt research process that, like Regulation AC, are intended to manage potential conflicts of interest raised by a full-service broker-dealer’s research, trading, and investment-banking activities. FINRA’s research rules are technical and require complex structural compliance to ensure the independence of the research process. Thus, an evaluation of these research rules would be a necessary predicate to engaging in the investment fund research process to ensure conflicts are vetted and disclosed, as well as that the process ensures the independence of the research to the extent required.

Even if a Rule 139b research report may be viewed as not providing a reasonable basis on which to make an investment decision, which would trigger application of FINRA’s research rules, other FINRA rules would nonetheless apply to the report. For example, covered investment fund research reports would be subject to FINRA’s advertising rules (FINRA Rule 2210), which require fair and balanced communications to the public and that public communications be based on fair dealing and good faith. The general content standards incorporate FINRA’s basic business conduct rule of just and equitable principles of trade and high standards of commercial honor (FINRA Rule 2010). Arguably, these general principles of fair dealing would call for conflicts disclosure, even in the absence of specific conflicts disclosure prescribed by Rule 139b or other regulations, such as FINRA’s research rules or Regulation AC. Further, of course, the general antifraud provisions throughout the federal securities laws would require disclosure of all material information and prohibit the omission of material information in covered investment fund research reports.

Investment Company Communications

The permissible publication and distribution of fund information has long pre-dated the FAIR Act and the adoption of Rule 139b. Investment company communications are regulated under general antifraud, and specific regulations pursuant to the 1933 Act, the 1940 Act, the Investment Advisers Act of 1940 (“Advisers Act”), and FINRA advertising rules to the extent fund shares are distributed by a FINRA member firm. For instance, Section 34(b) of the 1940 Act, [3] Section 206 of the Advisers Act, and Rule 206(4)-1 under the Advisers Act generally apply to all forms of communications distributed by an investment company or its adviser, including fund advertisements and sales literature. These requirements generally require that fund materials not mislead or omit material facts. A fund distributor seeking to publish and distribute investment company research would need to keep these investment company-specific principles in mind, but further must not impermissibly entangle the fund or its adviser(s) in the research process, such that the affiliation restrictions of Rule 139b are violated and as a consequence the fund and/or adviser(s) are viewed as indirectly publishing and distributing the research outside of protection from potential Section 5 violations.

Rule 482 under Regulation C of the 1933 Act also figures prominently in the existing regulatory regime for investment company communications. Section 5(b)(1) of the 1933 Act prohibits the delivery of any prospectus in connection with any security for which a registration statement has been filed unless the prospectus complies with Section 10 of the 1933 Act. Advertising that satisfies Rule 482 under the 1933 Act is deemed to be an “omitting prospectus,” the effect of which means that an investment company may distribute a Rule 482 advertisement after the registration statement has been filed, but before it has been declared effective. For an open-end fund seeking to publish performance information, Rule 482 prescribes the precise method by which performance must be uniformly presented. Rule 139b incorporates the requirements of Rule 482’s standardized performance to the extent an open-end investment company research report includes performance information. [4] Similarly, a research report containing performance for a closed-end fund would need to comply with Form N-2, the registration form for a closed-end fund that prescribes the permissible method of presenting performance information.

CONDITIONS OF RULE 139b

Rule 139b applies to issuer-specific and industry research reports and prescribes conditions for both. For purposes of Rule 139b, an issuer-specific research report constitutes a report about one specific unaffiliated covered investment fund. An industry report, by contrast, would be a report regarding multiple covered investment funds of the same type or same investment focus, which are covered uniformly, giving no fund(s) greater prominence over others. Alternatively, an industry report could be a comprehensive list of investment funds currently recommended by the publishing broker-dealer (excluding any that triggered the safe harbor’s affiliation restrictions), so long as the report gives no greater prominence to one fund or funds over others included in the report.

The Safe Harbor Applies to Seasoned Issuers

Similar to the 1933 Act’s safe harbor for operating companies (Rule 139), Rule 139b prescribes for issuer-specific and industry reports conditions restricting research to seasoned issuers based on the fund’s reporting pursuant to the 1940 Act or, if not 1940 Act registered, the public reporting provisions of the 1934 Act (Section 13 or Section 15(d)). For issuer-specific research reports, the safe harbor adds a 12-month minimum reporting period (and timely filing condition), either under the reporting provisions of the 1940 Act or the public company reporting provisions of the 1934 Act, and specific market value measures, similar in concept to the public-float requirements for operating companies in Rule 139, to ensure a significant market following for the particular fund. Rule 139b, therefore, currently sets the market value or net asset value, depending on the construct of the fund, at $75 million. [5] The market value condition is subject to a quarterly “re up” to ensure eligibility of continued coverage. These conditions effectively make new funds and/or small funds ineligible for coverage in reliance on Rule 139b and place a heavy duty on an authoring broker-dealer to ensure a fund’s eligibility for coverage.

The Safe Harbor Applies Solely to Broker-Dealers That Publish and Distribute Research in the Regular Course of Business and at Specified Times during the Coverage Process

The safe harbor requires a broker-dealer authoring an issuer-specific or industry research report to publish and distribute the report in its “regular course of business.” This condition applies to issuer-specific and industry reports, but does not explicitly require that the authoring broker-dealer have established a traditional research department. The SEC stated expressly that a broker-dealer that published “research reports” pursuant to Rule 482 or that has otherwise previously published research in reliance on Rule 139 would satisfy the “regular course of business” condition to the extent research was prepared in reliance on Rule 139b. Further, according to the SEC, the “regular course of business” requirement also could be satisfied if a broker-dealer, at the time of reliance on the safe harbor, had published at least one previous report or one report following a discontinuance of coverage.

In addition to imposing the “course of business” requirement on broker-dealers publishing research reports, broker-dealers generally may not avail themselves of the safe harbor with respect to issuer-specific research reports that represent the initiation of coverage or re-initiation of coverage following discontinuance. An exception to this limitation is available for any report pertaining to a covered investment fund that has a class of securities in substantially continuous distribution. This exception should allow for reports that rely on Rule 139b to cover open-end funds, such as mutual funds and ETFs, and other types of funds that conduct offerings that functionally engage in a continuous offering, such as potentially to interval or tender-offer closed-end investment companies or certain ETPs. [6]

Conforming Rules and Amendments

Rule 24b-4 under the 1940 Act

The SEC also adopted Rule 24b-4 under the 1940 Act to clarify that an authoring broker-dealer’s “research report” in reliance on Rule 139b will not be subject to the filing requirements prescribed by Section 24(b) of the 1940 Act to the extent that the report is subject to content standards of FINRA Rule 2210, noted above.

Regulation M under the 1934 Act

The SEC also adopted conforming amendments to Rule 101 of Regulation M to recognize an exception for research reports published and distributed by a “distribution participant” in reliance on Rule 139b from the prohibitions of Rule 101 during the distribution period of an issuer’s securities.

[1] The safe harbor protects a research report from being an offer for sale or an offer to sell a security for purposes of Section 5(c) of the 1933 Act, but requires that the covered investment fund in the first instance have an effective registration statement. Inasmuch as Section 5(c) of the 1933 Act applies to the period of an offering that precedes the filing of a registration statement, however, it is not altogether clear how the Section 5(c) protection is intended for research reports authored in reliance on Rule 139b. Purportedly, Rule 139b also protects the delivery of eligible research from being deemed a non-conforming prospectus for purposes of Section 10 of the 1933 Act, inasmuch as the SEC expressly stated in regard to an analogous rule (Rule 139) that a broker-dealer’s publication and distribution of eligible research reports would not be a non-conforming prospectus in violation of Section 5 of the 1933 Act.

[2] The affiliation restrictions do not necessarily prohibit a third-party distributor of a fund’s shares (or one who may become a distributor) from publishing and distributing a research report about the fund, although other provisions of the securities laws may require disclosure of potential conflicts relevant to a third-party distributor’s research, as discussed below.

[3] Rule 34b-1 under the 1940 Act applies to supplemental sales literature for investment companies and, like Rule 482 discussed below, prescribes standardized performance requirements.

[4] A report could include non-standardized performance, but only if standardized performance, as required by Rule 482, were also included and deviations between the two explained.

[5] With few potential exceptions, only traditional mutual funds are permitted to base this calculation on net asset value.

[6] Although many ETPs operate in a manner that is substantially the same as ETFs, because they are not registered investment companies, SEC rules preclude them from registering an unlimited number of shares (like ETFs do). As a result, when registering, ETPs must specify (and pay for) a specific number of shares to be registered; and, when they run out of shares, they must register (and pay for) additional shares. Certain large ETPs qualify to register additional shares pursuant to filings that go automatically effective. Smaller ETPs, however, do not. Accordingly, from time to time, these ETPs have been required to suspend sales of their shares. See, e.g. , John Spence, Fueling a Losing Bet , Market Watch (Jan. 4, 2010) (“Over the summer the [United States Natural Gas Fund L.P.] temporarily halted the creation of new shares as it waited for regulatory approval to issue new shares after it ran out. “), https://www.marketwatch.com/story/natural-gas-etf-burned-investors-in-2009-2010-01-04 . Under Rule 139b, if such an ETP is the subject of an issuer-specific research report, its suspension of share sales may jeopardize the ability of the report’s publishing broker-dealer to rely on the rule as it may call into question whether the ETP ( i.e. , the covered investment fund) fits within the allowance for funds engaged in a continuous offering.

Latest Posts

- The Committee on Foreign Investment in the United States Sharpens Its Enforcement Edge: Proposed Regulatory Revisions Expand Penalty Authority

- PFAS Regulation Continues to Take Center Stage: EPA Releases Final Drinking Water Standards

- Doing Business in Australia

- ESG–Australia – Consultation Material for the 5th Edition of the Corporate Governance Council Principles and Recommendations Released

- The SEC Limits the Internet Adviser Exemption

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

Published In:

K&l gates llp on:.

"My best business intelligence, in one easy email…"

17 CFR § 230.139b - Publications or distributions of covered investment fund research reports by brokers or dealers distributing securities.

- Table of Popular Names

(a) Registered offerings. Under the conditions of paragraph (a)(1) or (2) of this section, the publication or distribution of a covered investment fund research report by a broker or dealer that is not an investment adviser to the covered investment fund and is not an affiliated person of the investment adviser to the covered investment fund shall be deemed for purposes of sections 2(a)(10) and 5(c) of the Act not to constitute an offer for sale or offer to sell a security that is the subject of an offering pursuant to a registration statement of the covered investment fund that is effective, even if the broker or dealer is participating or may participate in the registered offering of the covered investment fund's securities. This section does not affect the availability of any other exemption or exclusion from sections 2(a)(10) or 5(c) of the Act available to the broker or dealer.

(1) Issuer-specific research reports.

(i) At the date of reliance on this section:

(A) The covered investment fund:

(1) Has been subject to the reporting requirements of section 30 of the Investment Company Act of 1940 (the “Investment Company Act”) ( 15 U.S.C. 80a–29 ) for a period of at least 12 calendar months and has filed in a timely manner all of the reports required, as applicable, to be filed for the immediately preceding 12 calendar months on Forms N–CSR (§§ 249.331 and 274.128 of this chapter), N–PORT ( § 274.150 of this chapter), N–MFP ( § 274.201 of this chapter), and N–CEN (§§ 249.330 and 274.101 of this chapter) pursuant to section 30 of the Investment Company Act ; or

(2) If the covered investment fund is not a registered investment company under the Investment Company Act , has been subject to the reporting requirements of section 13 or section 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) ( 15 U.S.C. 78m or 78o(d) ) for a period of at least 12 calendar months and has filed in a timely manner all of the reports required to be filed for the immediately preceding 12 calendar months on Forms 10–K ( § 249.310 of this chapter) and 10–Q (§ 249.308a of this chapter), or 20–F (§ 249.220f of this chapter) pursuant to section 13 or section 15(d) of the Exchange Act ; and

(B) At the time of the broker's or dealer's initial publication or distribution of a research report on the covered investment fund (or reinitation thereof), and at least quarterly thereafter;

(1) If the covered investment fund is of the type defined in paragraph (c)(2)(i) of this section, the aggregate market value of voting and non-voting common equity held by affiliates and non- affiliates equals or exceeds the aggregate market value specified in General Instruction I.B.1 of Form S–3 ( § 239.13 of this chapter);

(2) If the covered investment fund is of the type defined in paragraph (c)(2)(ii) of this section, the aggregate market value of voting and non-voting common equity held by non-affiliates equals or exceeds the aggregate market value specified in General Instruction I.B.1 of Form S–3 ( § 239.13 of this chapter); or

(3) If the covered investment fund is a registered open-end investment company (other than an exchange-traded fund) its net asset value (inclusive of shares held by affiliates and non- affiliates ) equals or exceeds the aggregate market value specified in General Instruction I.B.1 of Form S–3 ( § 239.13 of this chapter); and

(ii) The broker or dealer publishes or distributes research reports in the regular course of its business and, in the case of a research report regarding a covered investment fund that does not have a class of securities in substantially continuous distribution , such publication or distribution does not represent the initiation of publication of research reports about such covered investment fund or its securities or reinitiation of such publication following discontinuation of publication of such research reports .

(2) Industry reports.

(i) The covered investment fund is subject to the reporting requirements of section 30 of the Investment Company Act or, if the covered investment fund is not a registered investment company under the Investment Company Act , is subject to the reporting requirements of section 13 or section 15(d) of the Exchange Act ;

(ii) The covered investment fund research report:

(A) Includes similar information with respect to a substantial number of covered investment fund issuers of the issuer 's type (e.g., money market fund, bond fund, balanced fund, etc.), or investment focus (e.g., primarily invested in the same industry or sub-industry, or the same country or geographic region); or

(B) Contains a comprehensive list of covered investment fund securities currently recommended by the broker or dealer (other than securities of a covered investment fund that is an affiliate of the broker or dealer, or for which the broker or dealer serves as investment adviser (or for which the broker or dealer is an affiliated person of the investment adviser));

(iii) The analysis regarding the covered investment fund issuer or its securities is given no materially greater space or prominence in the publication than that given to other covered investment fund issuers or securities; and

(iv) The broker or dealer publishes or distributes research reports in the regular course of its business and, at the time of the publication or distribution of the research report (in the case of a research report regarding a covered investment fund that does not have a class of securities in substantially continuous distribution), is including similar information about the issuer or its securities in similar reports.

(3) Disclosure of standardized performance. In the case of a research report about a covered investment fund that is a registered open-end management investment company or a trust account (or series or class thereof), any quotation of the issuer 's performance must be presented in accordance with the conditions of paragraphs (d), (e), and (g) of § 230.482 . In the case of a research report about a covered investment fund that is a registered closed-end investment company , any quotation of the issuer 's performance must be presented in a manner that is in accordance with instructions to item 4.1(g) of Form N–2 ( §§ 239.14 and 274.11a–1 of this chapter), provided, however , that other historical measures of performance may also be included if any other measurement is set out with no greater prominence than the measurement that is in accordance with the instructions to item 4.1(g) of Form N–2.

(b) Self-regulatory organization rules. A self-regulatory organization shall not maintain or enforce any rule that would prohibit the ability of a member to publish or distribute a covered investment fund research report solely because the member is also participating in a registered offering or other distribution of any securities of such covered investment fund; or to participate in a registered offering or other distribution of securities of a covered investment fund solely because the member has published or distributed a covered investment fund research report about such covered investment fund or its securities. For purposes of section 19(b) of the Exchange Act ( 15 U.S.C. 78s(b) ), this paragraph (b) shall be deemed a rule under that Act .

(c) Definitions. For purposes of this section:

(1) Affiliated person has the meaning given the term in section 2(a) of the Investment Company Act .

(2) Covered investment fund means:

(i) An investment company (or a series or class thereof) registered under, or that has filed an election to be treated as a business development company under, the Investment Company Act and that has filed a registration statement under the Act for the public offering of a class of its securities, which registration statement has been declared effective by the Commission ; or

(ii) A trust or other person:

(A) Issuing securities in an offering registered under the Act and which class of securities is listed for trading on a national securities exchange;

(B) The assets of which consist primarily of commodities, currencies, or derivative instruments that reference commodities or currencies, or interests in the foregoing; and

(C) That provides in its registration statement under the Act that a class of its securities are purchased or redeemed, subject to conditions or limitations, for a ratable share of its assets.

(3) Covered investment fund research report means a research report published or distributed by a broker or dealer about a covered investment fund or any securities issued by the covered investment fund, but does not include a research report to the extent that the research report is published or distributed by the covered investment fund or any affiliate of the covered investment fund, or any research report published or distributed by any broker or dealer that is an investment adviser (or any affiliated person of an investment adviser) for the covered investment fund.

(4) Exchange-traded fund has the meaning given the term in General Instruction A to Form N–1A ( §§ 239.15A and 274.11A of this chapter).

(5) Investment adviser has the meaning given the term in section 2(a) of the Investment Company Act .

(6) Research report means a written communication , as defined in § 230.405 that includes information, opinions, or recommendations with respect to securities of an issuer or an analysis of a security or an issuer , whether or not it provides information reasonably sufficient upon which to base an investment decision.

- Investment Company Act of 1940

- Securities Exchange Act of 1934

SEC proposal paves way for research reports on investment companies

- Medium Text

This article was produced by Thomson Reuters Regulatory Intelligence and initially posted on June 8. Regulatory Intelligence provides a single source for regulatory news, analysis, rules and developments, with global coverage of more than 400 regulators and exchanges. Follow Regulatory Intelligence compliance news on Twitter: @thomsonreuters

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

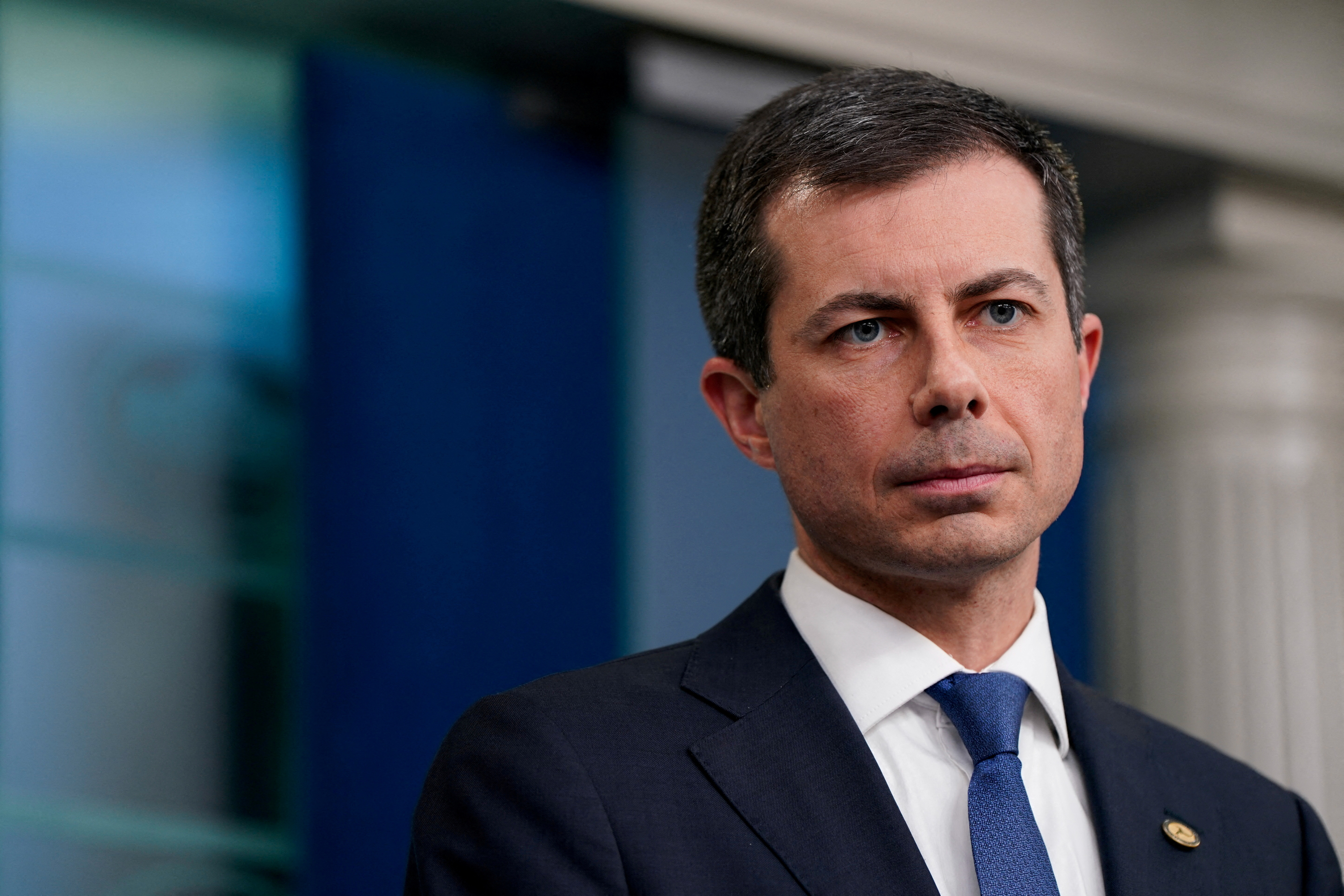

Buttigieg says Boeing must meet FAA quality plan before raising 737 MAX output

U.S. Transportation Secretary Pete Buttigieg said on Wednesday that Boeing must meet a government mandate to address systemic quality-control issues within 90 days before it will be able to boost 737 MAX production.

- Contributors

Safe Harbor for the Distribution of Research Reports

Brian D. Hirshberg is counsel and J. Paul Forrester and Anna T. Pinedo are partners at Mayer Brown LLP. This post is based on their recent Mayer Brown memorandum.

On November 30, 2018, the Securities and Exchange Commission (the “Commission”) adopted a new rule [1] establishing a non-exclusive research report safe harbor (“Rule 139b”) for unaffiliated brokers or dealers that publish or distribute research reports [2] regarding qualifying investment funds. The Commission took this action in furtherance of the mandate of the Fair Access to Investment Research Act of 2017 (the “FAIR Act”). The FAIR Act required that the Commission expand the Rule 139 safe harbor for research reports in order to cover research reports on investment funds.

The research safe harbor is now available to research reports regarding qualifying mutual funds, exchange-traded funds, registered closed-end funds, business development companies (“BDCs”) [3] and similar covered investment funds. Under the new safe harbor, the publication or distribution of a research report would not be deemed to constitute an “offer” under the Securities Act of 1933, as amended (the “Securities Act”), of the qualifying covered investment fund’s securities. The safe harbor is available even if the broker-dealer is participating in or may participate in a registered offering of the covered investment fund’s securities. Adoption of this safe harbor reduces obstacles that previously prevented investors from accessing research reports on investment funds.

Issuer-Specific Research Reports

An unaffiliated broker-dealer may release an issuer-specific research report in reliance on the Rule 139b safe harbor if the covered investment fund meets the specified reporting history and timeliness requirements. Consistent with the condition in Rule 139, the covered investment fund must be subject to the public company reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for at least 12 months prior to reliance on the safe harbor, and must also have timely filed its periodic reports (including those on Forms 10-K and 10-Q) with the Commission during such time period.

The public reporting history and timeliness requirements prevent the safe harbor from being extended to research reports relating to newly public funds and require the relying broker-dealer to confirm the timeliness of the covered investment fund’s Exchange Act filings. In the adopting release, the Commission acknowledged that a broker-dealer may rely on the lack of a Form 12b-25 filing (Notification of a Late Filing) as confirmation that a fund’s filings are timely unless the broker-dealer is actually aware through other means that the issuer has not in fact made timely Exchange Act filings.

The covered investment fund must also have a minimum public market value (or net asset value for mutual funds) of at least $75 million (consistent with Form S-3’s eligibility requirement). BDCs and closed-end funds are not permitted to satisfy the float requirement using a net asset value calculation. The requirement must be satisfied upon the initiation of research coverage and quarterly thereafter so long as the broker-dealer is continuing to issue research on the fund. Importantly, the adopted rule does not require that the market value or net asset value be calculated to exclude affiliate holdings for most covered investment funds. [4] Unfortunately, the presence of a minimum public float requirement prevents the safe harbor from being used in the case of smaller public issuers and non-traded BDCs and, as a consequence, impedes an investor’s fair access to investment research covering such issuers. [5]

Consistent with Rule 139, the research report must be published or distributed by the broker-dealer in its regular course of business. The Commission noted that a broker-dealer can satisfy the regular course of business requirement if at the time of reliance on the safe harbor it has previously distributed or published at least one research report about the covered issuer or its securities. However, unlike Rule 139, the research report may represent the initiation or re-initiation of research covering the investment fund so long as such fund’s securities are in substantially continuous distribution. The Commission’s adopting release notes that the substantially continuous distribution threshold is an analysis based on a given issuer’s particular facts and circumstances without providing any meaningful additional clarity.

Industry Research Reports

Similar to the issuer-specific research report requirement, the Rule 139b safe harbor requires each covered investment fund that is included in an industry research report to be subject to the public reporting requirements of the Exchange Act (or Section 30 of the Investment Company Act of 1940, as amended, for registered investment companies). The regular course of business requirement for issuer-specific research reports described above similarly applies to industry research reports.

The industry research report safe harbor is also conditioned on certain content requirements. In particular, industry research reports either must include similar information about a substantial number of covered investment funds of the same type or investment focus or alternatively contain a comprehensive list of covered investment fund securities currently recommended by the broker-dealer. The industry research report is required to include similar information about a substantial number of issuers either of the same type (e.g., exchange traded-funds or mutual funds that are large cap funds, bond funds, balanced funds or money market funds) or investment focus (e.g., primarily invested in the same industry or sub-industry, or the same country or geographic region).

Also, the industry research report safe harbor is conditioned on a presentation requirement. Under Rule 482b, analysis of any covered investment fund included in an industry research report cannot be given materially greater space or prominence in the publication than that given to any other covered investment fund issuer or its securities.

If fund performance information is included in a research report, it must be presented in accordance with certain standardized presentation requirements dependent on the type of investment fund covered. For research reports that include registered open-end fund performance, the Commission requires that fund performance be presented according to the presentment and timeliness requirements of Rule 482 (closed-end funds may comply with the requirements of Form N-2 instead of Rule 482).

A broker-dealer cannot include any covered investment fund that is an affiliate of the broker-dealer or for which the broker-dealer serves as an investment adviser in an industry research report. Additionally, a broker-dealer may not selectively apply the Rule 139b safe harbor to certain aspects of an industry research report. The safe harbor must apply to the entirety of the report. [6]

Small Business Credit Availability Act

In addition to the change described above, the Commission is also expected to adopt BDC-related communication and disclosure reforms in the near term. On March 23, 2018, Congress passed the Small Business Credit Availability Act (the “Act”). Included in the Act are various changes to the federal securities laws and regulations that are intended to provide BDCs with the ability to rely on more flexible communication and offering rules currently only available to operating companies. Among the changes contemplated by the Act were changes to the research safe harbors. The changes to the research safe harbors in Rules 138 and 139 were broader than those adopted in Rule 139b. It will be interesting to see whether the Commission reviews these again.

1 See the adopting release (“Adopting Release”) at https://www.sec.gov/rules/final/2018/33-10580.pdf . (go back)

2 The term “research report” in Rule 139b is defined as a written communication that includes information, opinions or recommendations with respect to securities of an issuer or an analysis of a security of an issuer, whether or not it provides information reasonably sufficient upon which to base an investment decision. (go back)

3 Section 2(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”), already provides a safe harbor for broker-dealers with respect to research reports about “emerging growth companies,” as defined in Section 2(a)(19) of the Securities Act. See footnote 6 of the Adopting Release. (go back)

4 Unlike Rule 139, Rule 139b does not permit affiliates of covered investment funds to rely on the safe harbor. (go back)

5 If a smaller issuer does not satisfy the public float requirement, a broker-dealer participating in a securities offering may consider a Rule 482 communication. (go back)

6 Broker-dealers that are unable to rely on Rule 139b for the entirety of the research report may consider a Rule 482 communication that is styled as an industry report. (go back)

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Back to Submissions

Covered Investment Fund Research Reports, File Number S7-11-18

SIFMA and SIFMA AMG provided comments to the SEC on the SEC’s proposal to adopt Rule 139b under the Securities Act of 1933, which would establish a safe harbor for covered investment fund research. If adopted, among other things, the Proposal would allow a broker-dealer to publish or distribute a “covered investment fund research report” without such report being considered an offer for sale or offer to sell the covered investment fund’s securities for purposes of sections 2(a)(10) and 5(c) of the Securities Act, subject to conditions.

SIFMA appreciates the Commission’s efforts to implement the Fair Access to Investment Research Act of 2017 (the FAIR Act) by establishing a safe harbor for covered investment fund research; however, SIFMA believes that in some respects the Proposal may not be entirely consistent with Congress’s desire to ensure that investors have the benefit of broadly available investment research. As described below, SIFMA believes that elements of the Proposal would impose unnecessary and unduly burdensome conditions to rely on the safe harbor, as well as overly restrictive interpretations of certain other proposed requirements.

See also: SEC Proposed Rules, Covered Investment Fund Research Reports (May 23, 2018)

Submitted To

Submitted by, sifma and sifma amg.

July 9, 2018

Via Electronic Mail ( [email protected] )

Mr. Brent J. Fields, Secretary U.S. Securities and Exchange Commission 100 F Street, NE Washington, DC 20549-1090

Re: Covered Investment Fund Research Reports ║ File Number S7-11-18

Dear Mr. Fields:

The Securities Industry and Financial Markets Association (“SIFMA”)1 jointly with the Asset Management Group of the Securities Industry and Financial Markets Association (“SIFMA AMG,”2 referred to herein together with SIFMA as “SIFMA”) appreciate the opportunity to provide comments to the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) on its proposal (the “Proposal”)3 to adopt Rule 139b under the Securities Act of 1933 (the “Securities Act”), which would establish a safe harbor for covered investment fund research. If adopted, among other things, the Proposal would allow a brokerdealer to publish or distribute a “covered investment fund research report” without such report being considered an offer for sale or offer to sell the covered investment fund’s securities for purposes of sections 2(a)(10) and 5(c) of the Securities Act, subject to conditions.

I. INTRODUCTION

The Commission was directed to adopt a safe harbor for covered investment fund research pursuant to the Fair Access to Investment Research Act of 2017 (the “FAIR Act”).4 Specifically, the FAIR Act requires the Commission to establish a safe harbor for covered investment fund research by revising Rule 139 under the Securities Act, which is an existing safe harbor that applies to research on corporate and certain other issuers. In recent years, through the FAIR Act and other laws and initiatives, Congress has clearly indicated its view that the publication and distribution of research should be encouraged and not overly restricted. With respect to covered investment funds, the House of Representatives Committee on Financial Services (the “HFS Committee”) Report accompanying the FAIR Act explained that, because research that covers open-end funds and exchange-traded funds (“ETFs”) does not benefit from Rule 139 and other existing safe harbors, “broker-dealers do not publish research regarding ETFs, depriving investors of useful information when deciding whether to invest in this product.” Congress was concerned that this situation “inhibits the free flow of investment research” and enacted the FAIR Act to fix this problem.

Congress has also taken other recent actions intended to encourage the free flow of investment research. For example, in the Jumpstart Our Business Startups Act (“JOBS Act”), Congress explicitly prohibited the Commission and FINRA from adopting or maintaining any rule or regulation that would prohibit a broker-dealer from publishing or distributing any research report with respect to the securities of an emerging growth company within any prescribed period of time following the initial public offering date of the emerging growth company or within any prescribed period of time prior to the expiration date of a lock-up agreement. In addition, an interest in Congress to stimulate research coverage for smaller issuers was one of the driving forces behind proposed legislation that likely led to the Commission’s own tick size pilot.5 As recently as June 21, 2018, the HFS Committee considered and unanimously passed a bill that would require the Commission to “conduct a study to evaluate the issues affecting the provision of and reliance upon investment research into small issuers, including emerging growth companies and companies considering initial public offerings” and to make “recommendations to increase the demand for, volume of, and quality of investment research” on such issuers.6

Continue Reading >

1 SIFMA brings together the shared interest of hundreds of securities firms, banks and asset managers. SIFMA’s mission is to support a strong financial industry, investor opportunity, capital formation, job creation and economic growth, while building trust and confidence in the financial markets. SIFMA, with offices in New York and Washington, D.C., is the U.S. regional member of the Global Financial Markets Association. For more information, visit www.sifma.org.

2 SIFMA AMG brings the asset management community together to provide views on policy matters and to create industry best practices. SIFMA AMG’s members represent U.S. and multinational asset management firms whose combined global assets under management exceed $39 trillion. The clients of SIFMA AMG member firms include, among others, tens of millions of individual investors, registered investment companies, endowments, public and private pension funds, UCITS and private equity funds.

3 Covered Investment Fund Research Reports, Securities Act Release No. 10498 (May 23, 2018), 83 Fed. Reg. 26788 (June 8, 2018) (the “Proposing Release”).

4 Fair Access to Investment Research Act of 2017, Public Law No. 115-66, 131 Stat. 1196 (2017).

5 See Small Cap Liquidity Reform Act of 2013, H.R. 3448, 113th Cong. (2014) (bill that passed the House of Representatives that would have required the Commission to enact a tick size pilot program and report to Congress on, among other things, the extent to which wider tick sizes “are increasing liquidity and active trading by incentivizing … research coverage….”); H.R. Rep. No. 113-342 (2014) (HFS Committee report accompanying H.R. 3448 quoting committee testimony that a tick size pilot could lead to “increased research coverage to better inform and educate investors on both the opportunities and risks.”).

6 See, e.g., Improving Investment Research for Small and Emerging Issuers Act, H.R. 6139, 115th Cong. (2018).

More Submissions

Potential reevaluation of certain asset managers’ passive investments in fdic-supervised institutions (sifma amg).

SIFMA AMG provided comments to the Federal Deposit Insurance Corporation (FDIC) on their consideration of various proposals to revise the…

Regulations to Address Margin Adequacy and To Account for the Treatment of Separate Accounts by Futures Commission Merchants (SIFMA AMG)

SIFMA AMG provided comments to the U.S. Commodity Futures Trading Commission (CFTC) on their withdrawal and proposal of a new…

Access to Americans’ Bulk Sensitive Personal Data and Government-Related Data by Countries of Concern

SIFMA provided comments to the U.S. Department of Justice, National Security Division on the proposed rulemaking concerning bulk data transfers…

We use cookies to provide our site visitors a valuable experience as well as relevant content and services. Please carefully review our Privacy Policy and Terms of Use ; by using this website, you agree to the information set forth therein.

- Get 7 Days Free

Invesco Ltd

Invesco earnings: continued positive flows marred by lower adjusted revenue and profitability.

There was little in narrow-moat Invesco's first-quarter results that would alter our long-term view of the firm. We are leaving our $17 per share fair value estimate in place and view the company's shares as being modestly undervalued relative to the April 23 trading price.

Free Trial of Morningstar Investor

Get our analysts’ objective, in-depth, and continuous investment coverage of IVZ so you can make buy / sell decisions free of market noise.

Sponsor Center

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Is Vanguard Total Bond Market Index Investor (VBMFX) a Strong Mutual Fund Pick Right Now?

If you've been stuck searching for Index funds, consider Vanguard Total Bond Market Index Investor ( VBMFX Quick Quote VBMFX - Free Report ) as a possibility. While this fund is not tracked by the Zacks Mutual Fund Rank, we were able to examine other factors like performance, volatility, and cost.

History of Fund/Manager

Vanguard Group is based in Malvern, PA, and is the manager of VBMFX. Since Vanguard Total Bond Market Index Investor made its debut in December of 1986, VBMFX has garnered more than $599.36 million in assets. The fund is currently managed by Joshua Barrickman who has been in charge of the fund since February of 2013.

Performance

Investors naturally seek funds with strong performance. This fund carries a 5-year annualized total return of 0.24%, and is in the middle third among its category peers. If you're interested in shorter time frames, do not dismiss looking at the fund's 3 -year annualized total return of -2.58%, which places it in the middle third during this time-frame.

It is important to note that the product's returns may not reflect all its expenses. Any fees not reflected would lower the returns. Total returns do not reflect the fund's [%] sale charge. If sales charges were included, total returns would have been lower.

When looking at a fund's performance, it is also important to note the standard deviation of the returns. The lower the standard deviation, the less volatility the fund experiences. VBMFX's standard deviation over the past three years is 7.13% compared to the category average of 12.8%. The fund's standard deviation over the past 5 years is 6.14% compared to the category average of 13.4%. This makes the fund less volatile than its peers over the past half-decade.

Risk Factors

The fund has a 5-year beta of 1, so investors should note that it is hypothetically as volatile as the market at large. Another factor to consider is alpha, as it reflects a portfolio's performance on a risk-adjusted basis relative to a benchmark-in this case, the S&P 500. Over the past 5 years, the fund has a negative alpha of -0.12. This means that managers in this portfolio find it difficult to pick securities that generate better-than-benchmark returns.

As competition heats up in the mutual fund market, costs become increasingly important. Compared to its otherwise identical counterpart, a low-cost product will be an outperformer, all other things being equal. Thus, taking a closer look at cost-related metrics is vital for investors. In terms of fees, VBMFX is a no load fund. It has an expense ratio of 0.15% compared to the category average of 0.87%. So, VBMFX is actually cheaper than its peers from a cost perspective.

This fund requires a minimum initial investment of $0, while there is no minimum for each subsequent investment.

Fees charged by investment advisors have not been taken into considiration. Returns would be less if those were included.

Bottom Line

For additional information on this product, or to compare it to other mutual funds in the Index, make sure to go to www.zacks.com/funds/mutual-funds for additional information. If you are more of a stock investor, make sure to also check out our Zacks Rank, and our full suite of tools we have available for novice and professional investors alike.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

VANGUARD TOTAL BOND MKT INDEX (VBMFX) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

IMAGES

VIDEO

COMMENTS

The covered investment fund must have a $75 million minimum public market value at the initial publication or distribution of a covered investment research report (or reinitiation thereof) and on a quarterly basis thereafter. For most covered investment funds, this calculation need not be calculated net of affiliates.

Overview. The Commission is adopting a new rule under the Securities Act of 1933 to establish a safe harbor for an unaffiliated broker or dealer participating in a securities offering of a covered investment fund to publish or distribute a covered investment fund research report. If the conditions in the rule are satisfied, the publication or ...

Issuer-Specific Research Reports. a. Reporting History and Timeliness Requirements. In order for a broker-dealer to include a covered investment fund in a research report published or distributed in reliance on the rule 139b safe harbor, the fund must meet certain reporting history and timeliness requirements.

However, a covered investment fund research report excludes research published or distributed by the covered investment fund itself, any affiliate of a covered investment fund, or any broker-dealer that is an investment adviser (or an affiliated person of an investment adviser) to the covered investment fund.12

The FAIR Act and Securities Act Rule 139b define "covered investment fund research report" to exclude a research report to the extent that the report is published or distributed by the covered investment fund, any affiliate of the covered investment fund, or any broker or dealer that is an investment adviser (or an affiliated person of an ...

Rule 139b defines covered investment fund to include BDCs as well as registered investment companies and certain commodity- or currency-based trusts or funds. A covered investment fund research report must be published by an independent broker-dealer and, therefore, is defined as a research report published or distributed by a broker-dealer ...

Establishing this new safe harbor was mandated by the Fair Access to Investment Research Act of 2017. Rule 139b permits two types of research reports: (1) issuer-specific research reports and (2 ...

In the case of a research report about a covered investment fund that is a registered closed-end investment company, any quotation of the issuer's performance must be presented in a manner that is in accordance with instructions to item 4.1(g) of Form N-2 (§§ 239.14 and 274.11a-1 of this chapter), provided, however, that other historical ...

Because covered investment fund research reports would no longer be required to be filed with the Commission pursuant to section 24(b), Start Printed Page 26806 proposed rule 24b-4 could have the effect of narrowing the types of communications that would be filed with FINRA (under current FINRA rule 2210) regarding registered investment ...

on investment funds. Issuer-Specific Research Reports An unaffiliated broker-dealer may release an issuer-specific research report in reliance on the Rule 139b safe harbor if the covered investment fund meets the specified reporting history and timeliness requirements. Consistent with the condition in Rule 139, the covered investment fund must ...

(16) "Covered investment fund research report" has the meaning given that term in paragraph (c)(3) of Securities Act Rule 139b. (b) Identifying and Managing Conflicts of Interest (1) A member must establish, maintain and enforce written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to:

2 The safe harbor does not apply to issuer-specific research reports regarding investment funds that are not actively traded. 3 Covered Investment Fund Research Reports, SEC Rel. Nos. 33-10580; 34-84710; IC-33311 (Nov. 30, 2018) ("Adopting Release").

a covered investment fund research report that is published or distributed by a broker or dealer, other than a broker or dealer that is an investment adviser to the fund or an affiliated person of the investment adviser to the fund— (1) shall be deemed, for purposes of sections 2(a)(10) and

Covered Investment Funds. Although a "covered investment fund" may not permissibly publish and distribute a research report about its securities or its industry sector in reliance on the safe ...

In the case of a research report about a covered investment fund that is a registered closed-end investment company, any quotation of the issuer's performance must be presented in a manner that is in accordance with instructions to item 4.1(g) of Form N-2 (§§ 239.14 and 274.11a-1 of this chapter), provided, however, that other historical ...

In addition, the SEC proposed a new Investment Company Act provision, Rule 24b-4, which would exempt covered investment fund research reports from filing requirements, except when such reports are ...

The research safe harbor is now available to research reports regarding qualifying mutual funds, exchange-traded funds, registered closed-end funds, business development companies ("BDCs") and similar covered investment funds. Under the new safe harbor, the publication or distribution of a research report would not be deemed to constitute ...

13 Covered Investment Fund Research Reports, Securities Act Release No. 33-10580 (Nov. 30, 2018). This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising ...

139b, as covered investment fund research reports.2 For purposes of the PRA, we estimate that 10% of the rule 482 and rule 34b-1 communications currently filed by broker-dealers with FINRA (approximately 48,341) could be considered as rule 139b covered investment fund research reports. We estimate that broker-dealers will publish

If adopted, among other things, the Proposal would allow a broker-dealer to publish or distribute a "covered investment fund research report" without such report being considered an offer for sale or offer to sell the covered investment fund's securities for purposes of sections 2(a)(10) and 5(c) of the Securities Act, subject to conditions.

Illiquid Funds. For illiquid funds, 16 returns and metrics are required. This information is calculated since inception of the private fund, through the end of the quarter covered by the quarterly statement: Fund-level with the impact of subscription facilities: Net internal rate of return (IRR) Gross IRR; Net multiple of invested capital (MOIC ...

research report would be deemed not to be an offer for sale or offer to sell the covered investment fund's securities for purposes of sections 2(a)(10) and 5(c) of the Securities Rule 139b Act. also adopted the FAIR Act's definitions of "covered investment fund," "covered investment fund research report," and "research report ...

Well, one fund that you should consider investigating is American Funds Growth Fund of America R6 (RGAGX Quick Quote RGAGX - Free Report) . RGAGX has a Zacks Mutual Fund Rank of 3 (Hold), which is ...

Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools. Discover actionable insights today.

If you have been looking for Allocation Balanced funds, a place to start could be Oakmark Equity and Income Investor (OAKBX Quick Quote OAKBX - Free Report) .OAKBX holds a Zacks Mutual Fund Rank ...

Digital asset investment products saw outflows for the second consecutive week totalling US$206m, with trading volumes in ETPs dipping slightly at US$18bn. ... More from James Butterfill and CoinShares Research Blog. ... Digital Asset Fund Flows Weekly Report. Hesitancy amongst investors led to record net outflows of US$942m.

reports: (1) that the aggregate market value or net asset value of the covered investment fund "held by non-affiliates of the covered investment fund" equal at least $75 million; and (2) that the covered investment fund have "timely filed" all of its required reports for the prior 12 months.

This fund requires a minimum initial investment of $0, while there is no minimum for each subsequent investment. Fees charged by investment advisors have not been taken into considiration. Returns ...

The Securities and Exchange Commission ("SEC") has traditionally recognized the value of market and issuer research to the investment decision-making…

International Assets Investment Management LLC acquired a new position in shares of BlackRock Debt Strategies Fund, Inc. (NYSE:DSU - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission.The institutional investor acquired 73,435 shares of the financial services provider's stock, valued at approximately $792,000.