- Collectives

- With Profit

- Unit Linked

- Growth Tips

- Assigning Bonds

Investment Bond Assignment

Published / last updated on 23/09/2021.

Assignment of an Investment Bond.

What is an Assignment?

It is a change of ownership of a life insurance investment bond, or capital redemption bond, or segments of either type of investment bond. The change of ownership should be supported by a proper legal document – a deed of assignment.

When you assign an investment bond the person you have assigned it to becomes the beneficial owner, as if they had owned the bond from day one i.e. the start date of the investment.

What are the Benefits of Assigning?

No Capital Gains Tax: It is possible to gift an investment bond to an adult child without causing a capital gains tax charge. Gifting other types of investment would be a disposal for capital gains tax purposes.

No Initial Income Tax Charge: An assignment does not trigger a chargeable event and does not give rise to an income tax charge, provided the assignment is not for money or money’s worth. If you are making a gift then that is not for money or money’s worth.

Transfer to a Trust: It is possible to transfer an investment bond to an individual or to a trust for inheritance tax planning without causing an income tax or capital gains tax charge.

Minimise Income Tax: Providing an outright gift is made it’s possible to minimise income tax on encashment by putting the investment bond or segments of the investment bond into the hands of a taxpayer who will pay a lower rate of tax on encashment (or indeed no further tax the enchasment keeps the person still in the Basic Rate Tax Bracket used Top Slicing Rules )

Inheritance Tax Planning: The assignment is technically a gift for Inheritance Tax purposes. Any gift you make is taken into account for Inheritance Tax purposes. If you survive for 7 years after making the gift then the full value of the bonds should fall outside your estate for Inheritance Tax calculation purposes.

Other Tax Planning Opportunities when Assigning a Bond

University Funding - A policyholder can assign an investment bond to an adult child to cover university costs at a time when the child’s personal allowance is unused and/or there would be no further tax to pay on an onshore investment bond because any gain, or top-sliced gain, would be within the basic rate tax bracket (assuming the student is a non, lower or basic rate taxpayer). By assigning your bonds they can use them for themselves if needed and when needed to provide financial assistance through university. It may even be that you gradually assign bonds over to fund education.

Efficient Income Planning - Assigning the policy to a lower rate tax payer within your family when/if income or capital needs as again, similar to the above, you can control tax liabilities.

Disadvantages of Assignment

The bond is now owned by another person. You lose control, it is not your money anymore.

If this new person/owner dies then the full value of the bond could be taken into account for inheritance tax if you have not used a trust.

If this new owner divorces then the full value of the bonds could be taken into account in any divorce settlement.

Insurance investment bonds represent one of the most flexible investment products available in the market and have been so since 1968 (when the relvant tax law came into force).

They are tax efficient in terms of real investment fund gains being offset against expenses and losses by the insurer within the fund meaning that lower taxes may be paid by the fund itself and then you owners can benefit from zero or lower taxation depending upon their own tax status.

In your hand they are free of capital gains tax.

In your hand, you can withdraw up to 5% per year of the original investment without an immediate liability to income tax. There may be a liability if you withdraw more and you are a higher rate tax payer ( top sliciing relief ). If you are a basic rate tax payer and any full encashment does not take you over the high rate tax threshold, then there is no further tax liability. In addition, the 5% per year withdrawal does not affect age allowance (the additional personal income tax allowance currently available (but stopping in 2015 for the over 65’s).

Currently, insurance bonds may not be included in any care fees funding means test.

Finally, as mentioned above, bonds can easily have ownership changes by deed of assigment or be placed in trust (as they are life insurance fund investments) – this can be excellent for tax and estate planning.

Getting Advice on Assignment

Insurance Investment Bonds may be advantageous for people in retirement when income planning, inheritance tax planning and care fees planning. They can be excellent tools for school fees and university fees planning as well as a way for higher rate tax payers to invest today and receive income or growth without incurring an immediate higher rate tax liability with options to keep for when you are a lower rate tax payer in retirement or assign ownership to others who may be nil, lower and basic rate tax payers. Contact the team for insurance bond assignment help .

Ask Financial Questions for Free

RISK FREE CONTACT. By contacting us, you confirm you have read and agree to our terms and conditions of: business, security, membership and purchases, refunds, usage and privacy. WE HATE SPAM , We probably get much more than you do. We too are consumers and we treat you how we wish to be treated when we buy goods and services. We do not pass your details to any other firm, they are confidential. If we do contact you, there is always an "unsubscribe" option at the top to change your preference at any time.

Assignment of an Investment Bond

Table of Contents

What is an Assignment? It is a change of ownership of a life insurance investment bond or capital redemption bond or assignment of policy ‘segments’ of either type of investment bond. The change of ownership is supported by a proper legal document – a deed of assignment.

When you assign an investment bond or policy segment the person you have assigned it to becomes the beneficial owner, as if they had owned the bond from day one i.e. the start date of the investment.

What are the Benefits of Assigning?

No Capital Gains Tax : It is possible to gift an investment bond to an adult child without causing a capital gains tax charge. Gifting other types of investment would be a disposal for capital gains tax purposes.

No Initial Income Tax Charge: An assignment does not trigger a chargeable event and does not give rise to an income tax charge, provided the assignment is not for money or money’s worth. If you are making a gift then that is not for money or money’s worth.

Transfer to a Trust: It is possible to transfer an investment bond to an individual or to a trust for inheritance tax planning without causing an income tax or capital gains tax charge.

Minimise Income Tax: Providing an outright gift is made it’s possible to minimise income tax on encashment by putting the investment bond or segments of the investment bond into the hands of a taxpayer who will pay a lower rate of tax on encashment.

Inheritance Tax Planning: The assignment is technically a gift for Inheritance Tax purposes. Any gift you make is taken into account for Inheritance Tax purposes. If you survive for 7 years after making the gift then the full value of the bonds should fall outside your estate for Inheritance Tax calculation purposes.

Other Tax Planning Opportunities when Assigning a Bond

University Funding – A policyholder can assign an investment bond to an adult child to cover university costs at a time when the child’s personal allowance is unused and/or there would be no further tax to pay on an onshore investment bond because any gain, or top-sliced gain, would be within the basic rate tax bracket (assuming the student is a non, lower or basic rate taxpayer). By assigning your bonds they can use them for themselves if needed and when needed to provide financial assistance through university. It may even be that you gradually assign bonds over to fund education.

Efficient Income Planning – Assigning the policy to a lower rate tax payer within your family when/if income or capital needs as again, similar to the above, you can control tax liabilities.

Disadvantages of Assignment

The bond is now owned by another person. You lose control, it is not your money anymore.

If this new person/owner dies then the full value of the bond could be taken into account for inheritance tax if you have not used a trust.

If this new owner divorces then the full value of the bonds could be taken into account in any divorce settlement.

Insurance investment bonds represent one of the most flexible investment products available in the market and have been so since 1968 (when the relvant tax law came into force).

They are tax efficient in terms of the underlying assets growing free of any deduction of capital gains tax or income tax, they also attract both time apportionment relief and top slicing relief.

Currently, insurance bonds may not be included in any means tests (for example, for care home fee’s).

Finally, as mentioned above, bonds can easily have ownership changes by deed of assigment or be placed in trust (as they are life insurance fund investments) – this can offer excellent opportunities for tax and estate planning.

- In The Press

- Company News

- Global Outlook

- Income Streams

- Money Management

- Offshore Investments

- The Economy

- Wealth Building

Recent Posts

- Expat Investment Guidance for Overseas Residents in 2024

- Comparing Capital Gains Tax Regimes in Popular European Expat Destinations

- Buying Property in Canada: Reviewing the Average Costs for Expat Buyers

- Property Tax in France: Paying Taxes on Residential and Investment Properties

- Chase Buchanan Wealth Management Partners With Your Overseas Home at Free Virtual Event

Previous Post QROPS Trust based vs Contract Based

Comments are closed.

- Chase Buchanan Insurance Agents & Advisors

- Free Guides

- Brand Ambassadors

- Regulations

- Terms of use

- Data Protection and Privacy

- Risk Disclosure and Warnings Notice

- Company Documentation

- Client Login

Our Offices

- Belgium Office

- Canada Office

- Canary Islands Office

- Cyprus Office

- Malta Office

- Portugal Office

- Spain Office

- UK Administration Centre

© 2024 Chase Buchanan. Wealth and Investment Management. Chase Buchanan Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission with CIF Licence 287/15. Chase Buchanan Ltd offer services in the EU on a cross border basis as per the provisions of MiFID. Managed by Woya Digital

- Meet the Team

- Corporate Brochure

- Investments

- Financial Planning

- UK Lifetime Allowance

- Standard Fund Threshold

- SIPPS v QROPS

- UK Pensions Transfers

- US Connected Persons

- Education Fees Planning

- Life and Critical Illness Insurance

- Corporate Services

- Expat Tax Guide – Belgium

- Expat Tax Guide – Cyprus

- Expat Tax Guide – France

- Expat Tax Guide – Malta

- Expat Tax Guide – Portugal

- Expat Tax Guide – Spain

- Residency Guide – Cyprus

- Residency Guide – France

- Residency Guide – Portugal

- Residency Guide – Spain

- Guide to Retiring in the EU

- International Pension Transfers

- Irish Pension Transfers

- Education Fee Planning

- Health, Income & Life Protection

- Investment Scams Guide

- Moving Abroad Checklist

- Offshore Investment

- Retirement Planning

- SIPPs v QROPs

- UK Lifetime Allowance Guide

- Canary Islands

- United Kingdom

All rights reserved Chase Buchanan.

Assignment or Appointment

Explains how the ability to move the tax on a chargeable gain can be a valuable tax planning tool.

One of the advantages of investment bonds is the ability to move the tax point away from the original owner to another. This strategic planning benefit can be used with investment bonds held individually or within a trust and coupled with an effective exit strategy can help reduce the tax payable on a chargeable gain.

Individually held bonds

An assignment is a process whereby one person, the assignor, transfers assets to another person, the assignee, who becomes the new owner of the assets.

This mechanism allows the tax point of an investment bond to be deflected away from the original owner to a new owner. The benefit of being able to assign, or change policy ownership, is that the transaction is not a chargeable event for the purposes of income tax, provided that it is a genuine gift and has not been assigned for money or money’s worth.

Where an assignment is made as part of a divorce settlement HMRC will only treat the assignment as a gift if it is specifically mentioned in the court order. If it is not mentioned then the assignment would be treated as a gift for money or money’s worth, making it a chargeable event.

It could be that the new owner pays tax at a lower rate, or better still, is a non-taxpayer. As the new owner they would have the authority to surrender the policy and pay tax (if applicable) on the chargeable gain, at their marginal rate of income tax.

Remember, if the new owner is an individual the assignment would be a potentially exempt transfer for inheritance tax purposes, unless it is covered by any available exemptions. If the new owner is a trust the assignment would either be a potentially exempt transfer or a chargeable lifetime transfer, depending on whether the trust is absolute or discretionary.

If the assignment is between a married couple or civil partners and the proceeds benefit both of the original owners and not just the new owner, HMRC might look at the overall transaction rather than the individual steps and apply tax accordingly.

There are no time constraints on the new owner to surrender the bond. If the surrender is deferred following assignment, additional years of top-slicing relief could accumulate and potentially mitigate the tax liability, when it is ultimately surrendered. Additionally, if dealing with an offshore bond, the timing aspect should focus on the appropriate tax year to surrender so that the bond gain can soak up what remains of the new policy owner’s personal allowance, starting rate band for savings income and personal savings allowance.

Investment bonds held by trustees

Even where an investment bond is held under a trust the trustees still have the ability to assign ownership from themselves to a beneficiary, rather than surrendering the bond within the trust and distributing cash.

Where an investment bond is held in a discretionary trust, any chargeable gain is assessed on the settlor if the chargeable event occurs while the settlor is alive at any point in the tax year and is UK resident.

If the settlor cannot be taxed because they died in a previous tax year or they are non-UK resident, the chargeable gain is assessed on a UK trust. This means that a UK trust could potentially pay up to 45% tax on an offshore bond gain or 25% on an onshore bond gain.

Moving the tax point to a beneficiary can result in a better tax position because that beneficiary could potentially be a lower taxpayer, have sufficient personal allowances to soak up any gains and be entitled to use top-slicing relief.

When dealing with a discretionary trust the trustees have two options; they can either assign legal ownership to the beneficiary for them to hold individually or use a deed of appointment to create a bare trust.

Where the beneficiary is over 18 and so can legally own an investment bond, the trustees can complete an assignment. As the trustees are distributing rights under the trust it is not a chargeable event for the purposes of income tax but there could potentially be an inheritance tax exit charge.

The beneficiary then becomes the legal owner of the bond meaning that any chargeable gains would be taxed at their marginal rate of tax.

Where there are minor beneficiaries who cannot legally own an investment bond, instead of assigning the bond the trustees can execute a deed of appointment to create a bare trust. The trustees remain the owners of the bond but the impact of the appointment is to effectively carve out the policies for the minor beneficiaries. Any chargeable gain under a bare trust is assessed on the beneficiary, so this moves the tax point to the minor beneficiary.

However, remember that if the parents of a minor beneficiary establish a trust, any distribution to that minor beneficiary (whilst unmarried or in a civil partnership) which results in a chargeable gain exceeding £100 in the tax year will all be taxed on the parent.

- The ability to assign or appointinvestment bonds to newowners can be a valuabletax planning tool.

- The assignment or appointment is usually not achargeable event which gives owners the opportunityto plan suitable exit strategies.

- The ability to move the tax point allows anysubsequent chargeable gains to be assessedon a lower or non-taxpayer.

This document is based on Canada Life’s understanding of applicable UK tax legislation and current HM Revenue & Custom’s practice, as at May 2019 and could be subject to change in the future. It is provided for professional advisers only. Any recommendations are the adviser’s sole responsibility.

Drafting a Deed of Assignment

I have been instructed to prepare a Deed of Assignment in respect of two investment bonds put into effect in 2015. It is now clear they were incorrectly set up by the financial adviser, so that the Trustee has the benefit personally, rather than holding as Trustee. My question is, do I need to make any reference to this in the Deed?

Changes to investment bonds is typically undertaken with the provider. They usually have they’re own paperwork.

I’d contact the provider first, I’m assuming you wish to make changes to the beneficiaries.

Richard Bishop PFEP

Hi Richard.

Thanks for responding. In this case its the insurance company that referred the matter to us, I can only think its perhaps because it was their mistake initially and they are paying our costs that they have asked us to do it.

Gail Weston

Is this a bigger issue than just drafting a deed of assignment?

If the 2015 assignment effectively gave the bonds to the intended trustee personally, might not the assignment into trust be considered a settlement by them for IHT purposes, etc.?

If the 2015 assignment had the wrong effect I wonder if it should be remedied by an application to court for rectification. If the original transaction is not rectified, the mere completion of a new deed of assignment may fully utilise the “trustee’s” IHT nil rate band, significantly inhibiting their ability to conduct any IHT planning themselves. Should they die within 7 years of the new deed, their estate will be penalised if their nil rate band is no longer available as a result of what happens now.

I suggest it would be appropriate to contact HMRC before any documents are executed, to see if it will agree to look through the proposed deed to the original intention. This may seem over cautious, but I understand HMRC consistently asserts that it will not accept “rectification” of a mistake without a court order.

Paul Saunders FCIB TEP

Independent Trust Consultant

Providing support and advice to fellow professionals

Thank you. It was for that reason I thought we must have to do something to show the trustee is not making a settlement personally, but I wondered if the error could somehow be referred to in a Deed of Assignment so that it was clear.

Another member pointed out that a trust doesn’t have to be in writing (other than land) and suggested the legal owner might execute a Declaration of Trust to confirm how she holds the bonds, but making it clear that the trust was established when the bonds were first assigned to her. Could that work? Thank you for responding. I do very little trust work, but I know enough to know when to be wary and I think I might now refer this on to someone else!

Gail Weston WMB Law Ltd

What trusts would she arguably hold the bonds upon? The relevant trusts would have to have been at least ascertainable at the time of acquisition of the bonds. The only one of the vital Three Certainties here seems to have been the subject-matter. It is a stretch to conclude that she originally acquired as trustee unless she did so knowingly as such and beyond a vague understanding (e.g. as a constructive trustee, when it would be a key part of the analysis to be able to identify the beneficiary also). If it appears so definitively that she took originally as beneficiary, however mistakenly, retrospection is not an option. In law the Trustee is just not a trustee at all it would seem.

The remedy the law provides is rectification which is discretionary, but awarded or denied according to established principle, and subject to evidence about the nature of the mistake alleged. As Paul says, HMRC’s practice is to insist on a court order— but rarely to intervene in the process and to abide by the outcome. This is reasonable because an order will bind all persons interested, including the bond provider, whereas if HMRC just took a unilateral view (second-guessing the court’s discretion) that in theory might be successfully challenged and it might not even bind the taxpayer.

A bond provider will be reluctant to pay out anyone other than the apparent legal owner or their assignee, to obtain a good discharge. Asserting that the bonds are really held on some trust is likely to spook them. Here the matter is referred by them and, without prejudice as to culpability, indicates some kind of notice of a possible trust with at least a resultant strong doubt on their part about whom to pay. An assignment apparently fixes that but is not retrospective. It still involves their taking a view that the “Trustee” has the right to act as assignor but the assignee may be the only person or persons who might otherwise contest her personal entitlement.

It is not clear whether there is recourse against the financial adviser or bond provider (or admission of liability or creditworthiness) or precisely whose mistake is alleged to be operative and why, or the value at stake. Indeed it is not clear who is your client and what are your instructions. The bond provider may be paying and be the client for the mechanical drafting but it seems the “Trustee” is the likely client for the advice as the intending assignor. Is there a conflict?

Jack Harper

Thank you for your response. Sorry, I probably should have given more detail. The Trustee is my client. She was referred to me by a Wealth Management Company, who are paying her costs. She holds on the trusts of her late sisters Will for minor beneficiaries and took advice from them the company on where to invest. The trust funds were subsequently invested in two Bonds with that Company, but the clients new adviser has now spotted that apparently the Bonds were set up as though she herself was the owner and beneficiary, instead of holding as Trustee.

In those circumstances there must be a strong inference that she is a constructive trustee of the bonds. She has used trust funds to subscribe for the bonds. Equity would not permit her to hold them otherwise than on the existing Will trusts. If she is the sole trustee an assignment is somewhat over the top. Although you can assign to yourself in a different capacity here she would be a trustee on both sides, constructive as assignor and appointed as assignee. I suggest all she needs is to receive positive legal advice that she needs to do nothing and why. Even appointing a co-trustee just for a meaningful assignment seems excessive if the Will trust is not one of land and if is not considered desirable otherwise e.g. to secure trusteeship succession.

In agreement with Jack, as the individual knows the terms on which they are supposed to be holding the bonds (here, the trusts which are set out in the Will), the individual can execute a Declaration of Trust stating that. Similarly, I would recommend a second trustee - indeed, the terms of some Will trusts require there to be two trustees for the exercise of certain powers. If a second trustee is going to be added, the Deed of Assignment (from “Trustee A” to “Trustee A and Trustee B” could set out initially that Trustee A holds the bonds on the trusts of the Will, before the assignment to A&B “… to hold on the terms of those trusts…” (or similar). It is worth being absolutely sure that, at the time of the original investment, there was no intention that the bonds (or the funds used to invest in them) should belong beneficially to A. Gail says that this was not the intention, but any evidence of that (eg correspondence, attendance notes, etc) would be useful to keep should the position be queried in the future.

Paul Davidoff New Quadrant

I would only add to Paul’s sound comments and action plan that if she used trust funds to subscribe she would hold the bonds as a constructive trustee even if she had had the actual intention of benefiting personally

Thank you both. That way makes sense to me. There was never any intention of benefitting personally. Until learning otherwise, she believed the trust funds were rightly invested for her nieces. As you suggest I will see what paperwork exists from the end of the administration period and proceed as you suggest.

Many thanks. Gail Weston

Deed of Assignment (for Intellectual Property)

In the realm of intellectual property, a Deed of Assignment is a formal legal document used to transfer all rights, title, and interest in intellectual property from the assignor (original owner) to the assignee (new owner). This is crucial for the correct transfer of patents, copyrights, trademarks, and other IP rights. The deed typically requires specific legal formalities, sometimes notarization, to ensure it is legally enforceable.

To be legally effective a deed of assignment must contain:

- Title of the Document : It should clearly be labeled as a "Deed of Assignment" to identify the nature of the document.

- Date : The date on which the deed is executed should be clearly mentioned.

- Parties Involved : Full names and addresses of both the assignor (the party transferring the rights) and the assignee (the party receiving the rights). This identifies the parties to the agreement.

- Recitals : This section provides the background of the transaction. It typically includes details about the ownership of the assignor and the intention behind the assignment.

- Definition and Interpretation : Any terms used within the deed that have specific meanings should be clearly defined in this section.

- Description of the Property or Rights : A detailed description of the property or rights being assigned. For intellectual property, this would include details like patent numbers, trademark registrations , or descriptions of the copyrighted material.

- Terms of Assignment : This should include the extent of the rights being transferred, any conditions or limitations on the assignment, and any obligations the assignor or assignee must fulfill as part of the agreement.

- Warranties and Representations : The assignor typically makes certain warranties regarding their ownership of the property and the absence of encumbrances or third-party claims against it.

- Governing Law : The deed should specify which jurisdiction's laws govern the interpretation and enforcement of the agreement.

- Execution and Witnesses : The deed must be signed by both parties, and depending on jurisdictional requirements, it may also need to be witnessed and possibly notarized.

- Schedules or Annexures : If there are detailed lists or descriptions (like a list of patent numbers or property descriptions), these are often attached as schedules to the main body of the deed.

Letter of Assignment (for Trademarks and Patents)

This is a less formal document compared to the Deed of Assignment and is often used to record the assignment of rights or licensing of intellectual property on a temporary or limited basis. While it can outline the terms of the assignment, it may not be sufficient for the full transfer of legal title of IP rights. It's more commonly used in situations like assigning the rights to use a copyrighted work or a trademark license.

For example, company X allows company Y to use their trademark for specific products in a specific country for a specific period.

At the same time, company X can use a Letter of Assignment to transfer a trademark to someone. In this case, it will be similar to the Deed of Assignment.

Intellectual Property Sales Agreement

An IP Sales Agreement is a detailed contract that stipulates the terms and conditions of the sale of intellectual property. It covers aspects such as the specific rights being sold, payment terms, warranties regarding the ownership and validity of the IP, and any limitations or conditions on the use of the IP. This document is essential in transactions involving the sale of IP assets.

However, clients usually prefer to keep this document confidential and prepare special deeds of assignment or letter of assignment for different countries.

IP Transfer Declaration

In the context of intellectual property, a Declaration is often used to assert ownership or the originality of an IP asset. For example, inventors may use declarations in patent applications to declare their invention is original, or authors may use it to assert copyright ownership. It's a formal statement, sometimes required by IP offices or courts.

When assigning a trademark, the Declaration can be a valid document to function as a proof of the transfer. For example, a director of company X declares that the company had sold its Intellectual Property to company Y.

Merger Document

When companies or entities with significant IP assets merge, an IP Merger Document is used. This document outlines how the intellectual property owned by the merging entities will be combined or managed. It includes details about the transfer, integration, or handling of patents, copyrights, trademarks, and any other intellectual property affected by the merger.

In all these cases, the precise drafting of documents is critical to ensure that IP rights are adequately protected and transferred. Legal advice is often necessary to navigate the complexities of intellectual property laws.

This site uses cookies to store information on your computer.

Some cookies on this site are essential, and the site won't work as expected without them. These cookies are set when you submit a form, login or interact with the site by doing something that goes beyond clicking on simple links.

We also use some non-essential cookies to anonymously track visitors or enhance your experience of the site. If you're not happy with this, we won't set these cookies but some nice features of the site may be unavailable.

By using our site you accept the terms of our Privacy Policy .

- Why Use Us?

- Chargeable events

- Top Slicing Relief

- Unit Linked Bonds

- With Profit Bonds

- Distribution Bonds

- Offshore Bonds Tax Treatment

- UK Expat Investors

- Non UK Residents Offshore Bonds

- Non domiciled UK residents

- Offshore bonds for companies

- Offshore Investment Bonds for Spanish Residents

- Offshore Investment Bonds for French Residents

- Interactive Risk Questionnaire

- Request an Investment Bond Quote

- 10 Steps to Taking Out a Bond

- Portfolio Construction

- Multi Manager Funds

- Factors which affect the price of corporate bonds

- Frequently Asked Questions

- Attitude to Investment Risk

- Ethical funds for Onshore Investment Bonds

- Ethical funds for Offshore Investment Bonds

- Investment Bonds Explained

- Request a Callback

Choose your own investment bonds »

Research and buy investment bonds at discounted prices.

- Discounted charges

- Cheaper than going direct

- Leading edge service including chargeable event calculations, assistance with portfolio construction and advice if required

Get a FREE Quote »

Request a comprehensive free quote to find out more and make an informed decision when purchasing an investment bond.

Home > Using investment bonds for tax planning

Using investment bonds for tax planning

Investment bonds can be highly versatile investment vehicles and can provide invaluable opportunities for tax planning. Taxation mitigation strategies involving investment bonds are explored below and they include use of assignment, pension funding and segmentation.

Assigning a bond to a spouse

Where the policyholder is a higher-rate taxpayer and the spouse is a basic rate or non-taxpayer, it creates a valuable tax planning opportunity. This is because the investment bond can be transferred by means of a deed of assignment by the higher rate taxpayer to the non taxpaying spouse without triggering a “ chargeable event “. This would mean that further liability to tax can be avoided following the assignment.

Care needs to be taken since the deed of assignment needs to be executed before any chargeable event takes place. It is also essential that the assignment is not for money or money’s worth.

Making a pension contribution to reduce tax from a bond

To mitigate chargeable gains arising from surrendering an investment bond, making a personal pension contribution can reduce taxable income prior to performing the ‘top-slicing calculations’ , which determine to what extent higher rate tax is due on any chargeable gain. The pension contribution can move the top-sliced gain from being subject to higher rate tax to below the extended basic rate tax limit. The grossed up pension contribution can extend the basic rate tax band so that after top-slicing , a chargeable event gain can fall into the basic rate tax band. It is also possible to use a pension contribution to move a top-sliced gain down from the additional rate of income tax to the higher rate.

Here are the four steps you would need to take to reduce tax incurred from triggering a chargeable event from an investment bond surrender by making a pension contribution:

- Identify all taxable income assessable to the higher rate tax bands.

- Calculate the top sliced gain from the investment bond.

- Work out the pension contribution needed to move some or all of the top sliced gain into the lower tax band.

- Make sure the personal pension contribution is made in the same tax year as the bond gain is taxed.

Segmentation of investment bonds to reduce taxable gains

In some circumstances, it may be more tax efficient to fully surrender individual segments held within an investment bond rather than take cumulative withdrawals across all segments of the bond. Where cumulative 5% allowances are exceeded then the chargeable gain which results is determined by the amount originally invested, as opposed to the current valuation of the investment bond. In this scenario, you could find that a chargeable gain occurs even if the investment has made a loss. A significant partial withdrawal in excess of the 5% cumulative allowance can create a chargeable event gain which could have been avoided by surrendering segments from the bond instead.

The difference between surrendering segments of an investment bond as against using thee cumulative 5% yearly allowances can be seen using the following scenario:

A policyholder invested £200,000 into an investment bond three years ago. The investment bond was split into 100 segments, so each segment was worth £2,000. If the bondholder chose to withdraw 5% from each segment, this would equate to £100 per segment, and would total £10,000 of the amount originally invested.

If the bondholder wishes to withdraw £100,000 when the bond is worth £220,000, there are two ways they could do this:

1. Taking 5% cumulative withdrawals

If the bondholder were to take a partial surrender across all segments, the chargeable gain would be calculated as:

£100,000 – £30,000 (3 years of £10,000) = £70,000 The “top sliced gain” would be £70,000/3 = £23,333.33

In this example, the current valuation of the bond is irrelevant since we are using the amount originally invested to determine the cumulative 5% withdrawals.

2. Full surrender of segments

Alternatively, the bondholder could surrender in full sufficient segments to release the required £100,000. Using the current valuation at the time of encashment, each segment is valued at £2,200. Surrendering in full 46 segments would yield £101,200, slightly more than the £100,000 required.

The chargeable gain for each segment is the current valuation per segment (£2,200) less the original value of each segment when the investment bond was first taken out (£2,000) = £200

The full surrender of 46 segments gives a chargeable gain of 46 x £200 = £9,200.

This is then divided by the number of full policy years the segments were in force, which is 3 to give a Top Slice of £3,066.66.

You can see, therefore, that there is a significant difference in tax efficiency between the two methods of withdrawing 5% cumulative withdrawals against surrendering in full enough segments to release the required amount.

It is possible to combine surrendering segments with taking 5% per annum cumulative withdrawals from an investment bond to achieve maximum tax efficiency when making a partial or full surrender. For more on this, please refer to our worked example of how to combine surrendering segments with 5% per annum cumulative withdrawals .

Avoiding the Personal Allowance Trap

Under current rules, the personal allowance is reduced at the rate of £1 for every £2 an individual’s taxable income exceeds £100,000 a year, until it reduces to nothing. Withdrawals from the bond do not count towards the £100,000 threshold, but any chargeable gains (ie on death, full surrender or withdrawals in excess of the cumulative 5% yearly allowances) will be added to income when a chargeable event gain arises. Any profit made (including the 5% withdrawals) will be added to the income in that final year. Depending on how much the profit is and how much your income is, this could reduce or eliminate your Personal Allowance in the year you cash in your bond.

Please note it is only the Personal Allowance in the year of encashment which may be adversely effected, taking 5% withdrawals from the bond each year does not count as income which could reduce the Personal Allowance provided the 5% yearly withdrawals have not exceeded 20 years, in which case they could count against your Personal Allowance from year 21 onwards.

Care needs to be taken when surrendering or partially surrendering an investment bond and it may be necessary to make partial surrenders in different tax years or wait until your taxable income does not jeopardise any personal allowance once gains are added.

Investment bonds can be used to preserve the Personal Allowance for those with income in excess of £100,000 seekers who would see their Personal Allowance reduced if they invested in alternative assets outside of a bond wrapper, such as deposit funds paying them interest in excess of the savings allowance or dividend income in excess of the dividend allowance from unit trusts or OEICs outside an ISA or bond. Since both deposit funds and unit trusts/ OEICs are available within investment bonds, this presents tax planning opportunities to those who are looking to mitigate income tax.

Investment Bond Products

Research & buy investment bonds, investment considerations, contact axxis financial planning.

Phone: 01483 825609 Email: [email protected]

- | Sitemap

- | Terms & Conditions

- | Contact Us

© Axxis Financial Ltd 2013 - 2024 . A web creation by LBDesign .

- Pensions Pensions funding Annual allowance Contributions Salary sacrifice Retirement benefits Taking benefits Transitional protections Pension death benefits Lump sum & death benefit allowance Death benefits Transfers DB to DC DC to DC Workplace pensions Auto-enrolment Investments Pension scheme investments Overseas Transfers, Funding & Taking benefits Other pensions info Divorce State pensions Contracting out Employment rights Compensation schemes

- Investments Investment bonds ISAs OEICs & unit trusts

- Personal taxation CGT Income tax Residence & Domicile Tax and Budget summaries

- IHT & Estate Planning Inheritance tax Power of attorney & Long-term care Trusts & taxation

- abrdn adviser site

- IHT & Estate Planning

- Trusts & taxation

Taxation of bonds in trust

For financial advisers - compiled by our team of experts, qualified in pensions, taxation, trusts and wealth transfer.

6 April 2024

- Bonds in trust do not follow the normal trust taxation rules

- The 45% trust rate will only apply if the settlor is dead or non-UK resident

- The settlor can reclaim any tax they are liable for from the trustees

- Assigning to a beneficiary can avoid tax at the trust or settlor’s rates of tax

- Gains on absolute trusts are generally looked through and taxed upon the beneficiary

Jump to the following sections of this guide:

Who is assessable on bond gains within a trust.

- Gains during the settlor’s lifetime

- Gains after the settlor’s death

Assigning to beneficiaries

- Absolute trusts

Parental settlements

Reporting taxable gains from investment bonds in trust.

Investment bonds held in trust don’t follow the usual trust taxation rules. The chargeable event rules determine who is assessable on any gains. This will typically be the settlor of the trust during their lifetime. However, the trustees may be liable if the settlor is deceased or is not UK resident in the year of assessment.

These special rules don’t apply to absolute trusts where the trust is generally looked through and the gains assessed on the beneficiaries.

Of course, other trusts may have the option of assigning the bond or segments of it to a beneficiary rather than pay cash to them. This doesn’t create a chargeable event. And all future gains will be taxed upon the beneficiary.

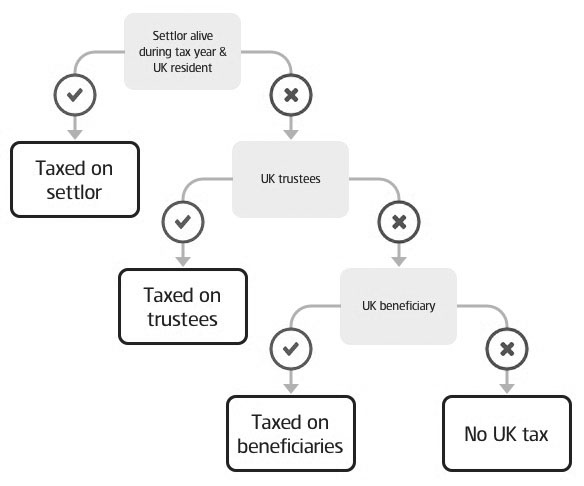

Liability for any tax will depend upon whether the settlor is still alive and UK resident in the tax year of assessment. The diagram outlines who is assessable for gains arising within the trust (excluding absolute trusts).

Gains during the settlor’s lifetime

The settlor will be assessed on chargeable gains if alive and UK resident at the time of the chargeable event. The gain and tax liability will be calculated as if the settlor owned the bond and normal top slicing rules will apply. Additionally, the settlor remains assessable throughout the tax year of their death. For example, if the trustees surrender the bond after the settlor's death but in the same tax year, the executors will enter any taxable gain on the deceased individual’s self-assessment tax return. The tax payable will depend on whether the investment bond is onshore or offshore.

On a joint settlor trust where the first settlor died in a previous tax year, only a share of the gain for the last settlor to die can be assessed on them in the tax year of death (as above), the remaining half will be taxed at the trust rate with no top slicing relief.

The settlor (or executors, where the chargeable event occurs in the tax year of death) has the right to reclaim any tax payable from the trustees. Failure to reclaim the tax will mean the value remains within the settlor's estate for IHT. If the settlor doesn't wish to reclaim the tax, they should notify the trustees of their intentions. This may be a transfer of value for IHT purposes unless it's covered by an available exemption.

Gains after the settlor’s death

Trustees will be taxed on chargeable gains that arise:

- after the tax year of the settlor's death (unless the 'dead settlor' rules apply), or

- when the settlor is non UK resident.

If the settlor is dead and the bond is being cashed in a tax year after their death, the full gain will be taxed at the trustee rate of tax (currently 45%).

If the bond is onshore, the trustees will also receive a credit of 20% against their liability meaning they will have a further 25% to pay on the gains made.

From 6 April 2024 the £1,000 standard rate band will be abolished. Trustees will have no tax to pay on gains less than *£500. If the gain is more than £500 it will be taxed at the trustee rate of 45% (25% for onshore bonds).

*If the settlor has created other trusts, the amount available is the higher of £100 or £500 divided by the total number of existing trusts.

Trustees cannot use top slicing or time apportionment relief to reduce the tax payable on the gain.

There may be some older cases where the gain escapes tax completely. This applies where the trust and bond were set up and the settlor died before 17 March 1998. This was known as the ‘dead settlor’ rule.

Joint settlors

Where there is more than one settlor, each will be assessed separately on their share of the gain.

- If an existing bond was assigned into the trust, each settlor will be deemed to have an equal share. This is because it is the rights to the policy that are transferred to the trust and each joint owner has equal rights to the proceeds.

- If each settlor added cash to the trust and the bond was purchased by the trustees, gains will be assessed proportionately based on their contribution to the trust.

If there is only one surviving settlor, a gain may be apportioned between the surviving settlor at their marginal rates and the trustees at 45%.

Gains taxable upon the beneficiary

It is often preferable for gains to be assessed upon the beneficiary(ies) as they may pay tax at a lower rate than the trustees or settlor. And if there is more than one beneficiary there may be more allowances and tax bands available to spread the liability.

Assigning the bond to a beneficiary allows the bond to be cashed in at the beneficiaries’ tax rate. Once the bond (or segments of the bond) is assigned, the beneficiaries are treated as if they have always owned it and top slicing relief for the entire period is available to them.

Alternatively it may be possible to appoint benefits absolutely, if assignment is not possible (for example, where the beneficiaries are minors). This is normally done by using a deed. Unlike an assignment, the trustees will still own the bond but the gains will be taxed at the beneficiaries’ rates in the same way as an absolute trust (see below).

It’s important to remember that appointments of capital out of a trust (e.g. on assignment to a beneficiary) will be an exit from the trust - triggering an IHT exit charge. Typically this will only be the case if there was an IHT charge when the trust was set up, or at the previous 10 year anniversary.

Absolute (bare) trusts are generally looked through with chargeable gains assessable upon the beneficiary.

The beneficiaries will be taxed in the same way as an individual who owns an investment bond outright. The tax payable will depend on whether the investment bond is onshore or offshore, and the beneficiary’s rate of tax.

Where there is more than one beneficiary, each will be assessed proportionately on any bond gain based on their share of the trust fund.

If an absolute trust has been set up by parents for the benefit of their minor children, any gains are likely to be taxed on the parents. Only gains below a £100 limit each tax year would be taxed as the child’s income. If the gain is more than £100, the whole gain is taxed as the parent’s income. If there are joint settlors, this £100 limit is doubled. The limit is also for each child beneficiary of the trust.

Non-UK trusts

Beneficiaries may be liable if they receive a payment from a non-UK resident trust. If the settlor is deceased or non-UK resident and there are no UK resident trustees, it's the UK beneficiaries who will be liable but only to the extent that they actually benefit under the trust from the gain. But there will be no top slicing relief available.

Where an individual is responsible for reporting gains, they should enter these on their self-assessment return.

If the trustees are liable to tax on the gain they should complete a self-assessment form. The trust must have previously registered with HMRC by 5 October of the tax year following the year of the assessment. However, absolute trusts are not required to register as the beneficiary is liable for the tax.

Issued by a member of abrdn group, which comprises abrdn plc and its subsidiaries.

Any links to websites, other than those belonging to the abrdn group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on abrdn’s understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of abrdn group.

Full product and service provider details are described on the legal information.

abrdn plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

www.abrdn.com

© 2024 abrdn plc. All rights reserved.

CII/PFS accredited CPD related modules

Understanding the taxation of investment bonds in trust

Related content

- Bypass trusts

- Multiple trusts - same day additions, related settlements and Rysaffe planning

- Who pays the tax on bond gains within a trust - decision tree

- Rising IHT - how trusts can help

- Print this entry »

BAA successfully places Class B bond; Moscow Vnukovo increases airline charges

UK 's unlisted BAA announced it has successfully placed a GBP400 million Sterling Class B bond, with a 2018 maturity and a fixed annual interest coupon of 6.25%. The company generated an initial order book of more than GBP1 billion and was able to price inside initial price guidance at 375 basis points over gilts. BAA plans to use the proceeds of the bond issue to refinance part of its existing bank debt, lengthening the group's debt maturity profile.

Meanwhile, Russia 's Federal Tariff Service ( FTS ) increased Moscow Vnukovo International Airport airline charges.

- Take-off and landing charges: increased by 7% to EUR3.92 (RUB154.10) per ton;

- Parking charges: 5% against the take-off and landing charge per hour (for passenger aircraft parked more than three hours after landing and freighter aircraft parked more than six hours after landing);

- Security charges: increased by 16% to EUR3.54 (RUB139.40) per ton;

- Domestic terminal charges: EUR1.16 (RUB45.50) per passenger, or EUR1.91 (RUB75.00) for international services;

- Passenger handling charge: EUR3.23 (RUB127.00) per passenger for domestic services, EUR3.66 (RUB144.00) for international services.

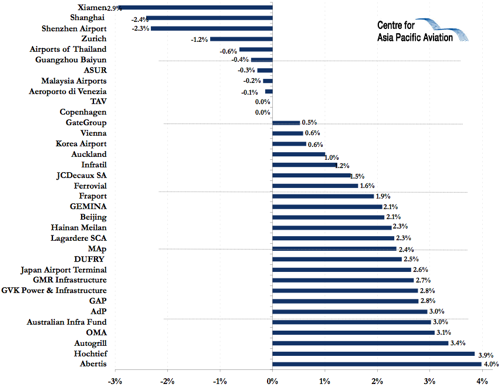

Other European airport operators that lost ground yesterday included Zurich (-1.2%) and Aeroporto di Venezia (-0.1%). Meanwhile, Fraport (+1.9%) and Gemina (+2.1%) shares gained.

Abertis shares gained 4% on Wednesday (01-Sep-2010) after Actividades de Construccion & Servicios SA and CVC Capital Partners Ltd agreed to hold their stakes in Abertis for at least three years.

Selected airports daily share price movements (% change): 01-Sep-2010

Source: Centre for Asia Pacific Aviation & Yahoo! Finance

Want More Analysis Like This?

Rosatom Starts Production of Rare-Earth Magnets for Wind Power Generation

TVEL Fuel Company of Rosatom has started gradual localization of rare-earth magnets manufacturing for wind power plants generators. The first sets of magnets have been manufactured and shipped to the customer.

In total, the contract between Elemash Magnit LLC (an enterprise of TVEL Fuel Company of Rosatom in Elektrostal, Moscow region) and Red Wind B.V. (a joint venture of NovaWind JSC and the Dutch company Lagerwey) foresees manufacturing and supply over 200 sets of magnets. One set is designed to produce one power generator.

“The project includes gradual localization of magnets manufacturing in Russia, decreasing dependence on imports. We consider production of magnets as a promising sector for TVEL’s metallurgical business development. In this regard, our company does have the relevant research and technological expertise for creation of Russia’s first large-scale full cycle production of permanent rare-earth magnets,” commented Natalia Nikipelova, President of TVEL JSC.

“NovaWind, as the nuclear industry integrator for wind power projects, not only made-up an efficient supply chain, but also contributed to the development of inter-divisional cooperation and new expertise of Rosatom enterprises. TVEL has mastered a unique technology for the production of magnets for wind turbine generators. These technologies will be undoubtedly in demand in other areas as well,” noted Alexander Korchagin, Director General of NovaWind JSC.

For reference:

TVEL Fuel Company of Rosatom incorporates enterprises for the fabrication of nuclear fuel, conversion and enrichment of uranium, production of gas centrifuges, as well as research and design organizations. It is the only supplier of nuclear fuel for Russian nuclear power plants. TVEL Fuel Company of Rosatom provides nuclear fuel for 73 power reactors in 13 countries worldwide, research reactors in eight countries, as well as transport reactors of the Russian nuclear fleet. Every sixth power reactor in the world operates on fuel manufactured by TVEL. www.tvel.ru

NovaWind JSC is a division of Rosatom; its primary objective is to consolidate the State Corporation's efforts in advanced segments and technological platforms of the electric power sector. The company was founded in 2017. NovaWind consolidates all of the Rosatom’s wind energy assets – from design and construction to power engineering and operation of wind farms.

Overall, by 2023, enterprises operating under the management of NovaWind JSC, will install 1 GW of wind farms. http://novawind.ru

Elemash Magnit LLC is a subsidiary of Kovrov Mechanical Plant (an enterprise of the TVEL Fuel Company of Rosatom) and its main supplier of magnets for production of gas centrifuges. The company also produces magnets for other industries, in particular, for the automotive

industry. The production facilities of Elemash Magnit LLC are located in the city of Elektrostal, Moscow Region, at the site of Elemash Machine-Building Plant (a nuclear fuel fabrication facility of TVEL Fuel Company).

Rosatom is a global actor on the world’s nuclear technology market. Its leading edge stems from a number of competitive strengths, one of which is assets and competences at hand in all nuclear segments. Rosatom incorporates companies from all stages of the technological chain, such as uranium mining and enrichment, nuclear fuel fabrication, equipment manufacture and engineering, operation of nuclear power plants, and management of spent nuclear fuel and nuclear waste. Nowadays, Rosatom brings together about 350 enterprises and organizations with the workforce above 250 K. https://rosatom.ru/en/

U.S. Added Less New Wind Power in 2021 Than the Previous Year — Here’s Why

Airborne Wind Energy Developer Kitemill Prepares for 24HOUR Operation and Multi-Device Demonstrations

Vietnam's Largest Wind Power Plant Starts Operational

Developer Lines up Support for Vietnam Wind Build

Vietnam Plans to Double Wind Power Generation by 2030

Trung Nam Group Inaugurates Wind Power Plant in Vietnam

IMAGES

VIDEO

COMMENTS

Deed of Assignment: INF1122 12223 Page 2 of 4 Section 1 - Deed of assignment - continued Now this deed witnesseth as follows: 1. The Assignor hereby assigns unto the Assignee the Policy and all monies receivable thereunder and all benefits secured thereby to hold the same unto the Assignee and his/her executors, administrators and assigns ...

An assignment refers to the process whereby you transfer the ownership of an investment bond or capital redemption bond, or segments of either product. As this constitutes a legal transfer of ownership to another person, an assignment is completed with a formal legal document called a deed of assignment. You may assign an investment bond or ...

What is an Assignment? It is a change of ownership of a life insurance investment bond, or capital redemption bond, or segments of either type of investment bond. The change of ownership should be supported by a proper legal document - a deed of assignment. When you assign an investment bond the person you have assigned it to becomes the ...

What is an Assignment? It is a change of ownership of a life insurance investment bond or capital redemption bond or assignment of policy 'segments' of either type of investment bond. The change of ownership is supported by a proper legal document - a deed of assignment. When you assign an investment bond or policy segment the person you ...

Deed of Assignment General notes ... If you're considering using this document in connection with a bond, endowment, whole of life policy or immediate life annuity, please note that it's important also to complete a Tax Residence Self Certification form (IN06062 or IN06064) for each new party who is signing. You can obtain the form

An assignment is a process whereby one person, the assignor, transfers assets to another person, the assignee, who becomes the new owner of the assets. This mechanism allows the tax point of an investment bond to be deflected away from the original owner to a new owner. The benefit of being able to assign, or change policy ownership, is that ...

This Deed of Assignment is made on the: M. M. Y. Y. Parties to the Assignment. The 'Assignor(s') is / are (enter name(s) of the plan owner(s) here in block capitals): Plan Owner 1. Plan Owner 2. The 'Assignee(s') is / are (enter the name(s) and address(es) of the individual(s) to whom the Assignor(s) is / are transferring the ownership ...

Deed of Assignment - For use with a Collective Investment Bond (CIB) ... Bond account number: The unique reference allocated to you to reflect your ownership of the Collective Investment Bond s: ie ic idualP vol ndi I Refers to the individual policies within the bond. The bond initially consists of 1000 individual policies.

A Deed of Assignment of Investment Bonds can be a valuable tool for those seeking to minimise Inheritance Tax (IHT) and protect their assets from care home fees. This legal document is used to transfer ownership of investment bonds from one individual to another, typically as part of an estate planning strategy. ...

Trusts Discussion. gail.w (gailweston) July 9, 2021, 9:19am 1. I have been instructed to prepare a Deed of Assignment in respect of two investment bonds put into effect in 2015. It is now clear they were incorrectly set up by the financial adviser, so that the Trustee has the benefit personally, rather than holding as Trustee.

The form covers the situation of an assignment of a policy by: An absolute owner to another person absolutely, e.g. where no trust is involved. An absolute owner to trustees of an existing trust. Trustees to a beneficiary, to satisfy the interest of the beneficiary in the trust fund, if: the person is a beneficiary under an absolute trust, or.

DEED OF ASSIGNMENT For use with a policy issued under Isle of Man or English law. This deed should be used with ex-Quilter products or the following range of product types only: Swedish Executive Portfolio, Executive Investment Bonds/Portfolios/Accounts (including European and Spanish Collective

4 min. In the realm of intellectual property, a Deed of Assignment is a formal legal document used to transfer all rights, title, and interest in intellectual property from the assignor (original owner) to the assignee (new owner). This is crucial for the correct transfer of patents, copyrights, trademarks, and other IP rights.

Where the policyholder is a higher-rate taxpayer and the spouse is a basic rate or non-taxpayer, it creates a valuable tax planning opportunity. This is because the investment bond can be transferred by means of a deed of assignment by the higher rate taxpayer to the non taxpaying spouse without triggering a " chargeable event ". This would ...

Life assurance policies (including investment bonds) ... In such a case, in addition to a deed of assignment, notice to the trustees of the existing trust must be given. Land/real property. Where land is transferred to a trust, the proper method of transfer will be a Land Transfer Form and entry in the Land Registry. Where the land is still ...

DEED OF ASSIGNMENT USE AND COMPLETION OF THIS FORM This form has only been designed for life policies and trust forms. The form covers the situation of an assignment of a policy by: 1. an absolute owner to another person absolutely i.e. no trust is involved 2. an absolute owner to trustees of an existing trust 3.

Investment bonds held in trust don't follow the usual trust taxation rules. The chargeable event rules determine who is assessable on any gains. ... This is normally done by using a deed. Unlike an assignment, the trustees will still own the bond but the gains will be taxed at the beneficiaries' rates in the same way as an absolute trust ...

UK's unlisted BAA announced it has successfully placed a GBP400 million Sterling Class B bond, with a 2018 maturity and a fixed annual interest coupon of 6.25%. The company generated an initial order book of more than GBP1 billion and was able to price inside initial price guidance at 375 basis points over gilts.

Welcome to the 628DirtRooster website where you can find video links to Randy McCaffrey's (AKA DirtRooster) YouTube videos, community support and other resources for the Hobby Beekeepers and the official 628DirtRooster online store where you can find 628DirtRooster hats and shirts, local Mississippi honey and whole lot more!

Find detailed information on Basic Chemical Manufacturing companies in Elektrostal, Russian Federation, including financial statements, sales and marketing contacts, top competitors, and firmographic insights.

06 Nov 2020 by Rosatom. TVEL Fuel Company of Rosatom has started gradual localization of rare-earth magnets manufacturing for wind power plants generators. The first sets of magnets have been manufactured and shipped to the customer. In total, the contract between Elemash Magnit LLC (an enterprise of TVEL Fuel Company of Rosatom in Elektrostal ...