Lessons learned from the breadth of economic policies during the pandemic

The COVID-19 pandemic resulted in the sharpest and most synchronized reduction in global economic activity in history. The U.S. economy experienced a V-shaped recovery of a type not seen in recent recessions. The rapid recovery was due to two factors. First, the recession itself was caused by a shock associated with COVID-19; as that shock retreated—and people learned to better live with the pandemic—the economy was poised to recover quickly, just as it typically does after natural disasters. Second, the policy response protected household incomes and kept many businesses intact so that they were in a position to resume more normal levels of economic activity when it was safe to do so.

Recession Remedies podcast episode: What should we learn from the economic policy response to COVID-19?

Real disposable personal incomes actually rose in 2020 and 2021 as transfer payments from the government vastly exceeded lost incomes from other sources. As a result, poverty, after accounting for taxes and transfers, fell in 2020 to the lowest level since the data series began in 1967. Initially, observers and policymakers worried that a cascade of bankruptcies and defaults could precipitate a financial crisis. But improvements to make the financial system more resilient in the wake of the global financial crisis and the policy response to the COVID-19 crisis quickly addressed potential issues.

The economy experienced major side effects from the pandemic and associated policy response, most notably the highest inflation rate in 40 years, far outpacing the increase in wages and leading to the largest real wage declines in decades. Ultimately, the economic policy response to the COVID-19 recession should be judged not just by its consequences in the spring of 2020, not what happened over the next two years, but also by the longer-term effects, and whether the response will prove to have contributed to a stronger and more sustainable economy going forward.

Evidence on the COVID-19 economic policy response

- The initial fiscal response in the U.S. was large. It waned in mid-2020 and then surged again in late 2020 and early 2021.

- Economic Impact Payments, Unemployment Insurance, forbearance programs on mortgages and student loans, and an enhanced CTC played the largest roles in lifting household finances, while businesses received support largely through grants and subsidized loans.

- Even after the initial substantial fiscal assistance, observers generally expected a much slower economic recovery from the second quarter 2020 trough than actually came to pass.

- The U.S. government incurred substantial debt. Moreover, inflationary pressures and the efforts to moderate those pressures might bring an end to the expansion.

- The U.S. fiscal response appears to have been larger than any other country.

Lessons learned from the breadth of economic policies during the pandemic

Policymakers should take the lesson from the past two years that vigorous fiscal and monetary policy can boost income for most households and disproportionately for lower-income households and can speed economic recoveries. However, doing too much can have serious downsides that might be difficult to mitigate.

Macroeconomic support for an economy deep in recession with many underused resources can increase output and employment with little effect on inflation. But as the economy gets closer to its capacity, additional macroeconomic support will feed increasingly into inflation instead of improvements in output and employment. Going forward, the magnitude and timing of the response should be improved through more automatic stabilizers, and the targeting of the response should be as well. The good news is such responses can be implemented efficiently if policies are developed in advance of a crisis.

Policymakers should take the lesson from the past two years that vigorous fiscal and monetary policy can boost income for most households and disproportionately for lower-income house-holds and can speed economic recoveries.

It is important to draw lessons not just from what happened, but also from what did not happen during the COVID-19 recession: for example, there was no financial crisis in the United States or worldwide. The initial, robust response by monetary policy-makers was critical to keeping the financial sector on an even keel. Better preparation in the form of more robust and stress-tested balance sheets for banks prior to the recession also helped.

The preexisting social safety net is inadequate in the face of recessions: it is not generous enough and has too many gaps, which is why it needed to be supplemented by policy action both in the Great Recession and to a much greater degree in the COVID-19 recession. Additional automatic stabilizers are likely part of the answer but are unlikely to be sufficient to avoid the need for well-timed and wise discretionary fiscal responses in the future.

It is still not clear what policies would work better in the United States to lessen the impact of a GDP decline on employment and preserve worker attachment to their employers. Job retention schemes were heavily utilized in European countries compared to state-based work sharing programs in the U.S.—these programs should be explored in greater detail for future downturns.

For more information or to speak with the authors, contact:

Marie Wilken

202-540-7738

[email protected]

About the Authors

Wendy edelberg, director – the hamilton project, jason furman, former brookings expert, timothy geithner, president – warburg pincus.

- Media Relations

- Terms and Conditions

- Privacy Policy

- Search Menu

- Advance Articles

- Editors' Choice

- Call for Papers

- Author Guidelines

- Open Access Options

- Self-Archiving Policy

- Why Publish

- About Economic Policy

- About the Centre for Economic Policy Research

- About the Center for Economic Studies, CESifo Group

- About the Fondation Nationale des Sciences Politiques

- Editorial Board

- Advertising and Corporate Services

- Journals Career Network

- Dispatch Dates

- Journals on Oxford Academic

- Books on Oxford Academic

Managing Editors

Ghazala Azmat

Roberto Galbiati

Isabelle Mejean

Moritz Schularick

About the journal

Economic Policy provides timely and authoritative analyses of the choices confronting policymakers. The subject matter ranges from the study of how individual markets can and should work to the broadest interactions ...

High Inflation in the Eurozone

The invited policy session of the 76th Economic Policy panel meeting featured Ricardo Reis presenting new research on inflation in the Eurozone in the second half 2022. The study lays out warning signs for what could go wrong – and the five ways in which the central bank could fail to bring it back to target.

Access the recording

Covid, school closures and children’s futures

As the Covid-19 pandemic swept across the world in the spring of 2020, schools were shut down and millions of children faced major learning losses while their parents struggled to combine work, childcare and home education. At the invited policy session of the spring 2022 Economic Policy Panel meeting, Nicola Fuchs-Schündeln presented a new study of the likely long-term impact of those closures on children’s future livelihoods and wellbeing.

Download the article

Highly Cited Articles

We are delighted to announce Economic Policy' s latest Impact Factor. To celebrate, we have curated a free selection of the most cited papers published in recent years. Use this collection to support your current research, or get up to date with important discussions in the field.

Read the papers

Special Issues

The Covid outbreak in 2019 marked the start of the biggest epidemic since the Spanish Flu exactly one century prior. It constituted a major public health disaster that quickly triggered an important economic crisis as well. Countries, firms and populations had to adapt to the situation, changing the basic organization of life and production. The crisis affected so many aspects of life that Economic Policy decided to dedicate two special issues to cover its full extent.

Read Volume 37, Issue 109, January 2022

Read Volume 37, Issue 110, April 2022

Editors' Choice

Latest articles.

Recommend to your library

Fill out our simple online form to recommend Economic Policy to your library.

Recommend now

JEL Codes explained

Articles from Oxford Journals economics titles are classified according to the system used by the Journal of Economic Literature (commonly known as 'JEL codes').

Email alerts

Register to receive table of contents email alerts as soon as new issues of Economic Policy are published online.

Related Titles

- Recommend to Your Librarian

Affiliations

- Online ISSN 1468-0327

- Print ISSN 0266-4658

- Copyright © 2024 CEPR, CESifo, Sciences Po

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Institutional account management

- Rights and permissions

- Get help with access

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

Macro Economic Essays

These are a collection of essays written for my economic blogs.

Exchange Rate Essays

- Effects of a falling Dollar

- Why Dollar keeps falling

- Discuss Policies to Stop the Dollar Falling

- Does Devaluation Cause Inflation?

- Benefits and Costs of Falling Dollar

- Reasons for Falling Dollar

- The Dollar as the World’s Reserve Currency

Economic Growth Essays

- Evaluate Benefits of Economic Growth

- Essays on Recessions

- Causes of Recessions

- Problems of Recovering from a Recession

- What can Increase Long-Run Economic Growth?

- Discuss Effect of a fall in the Savings Ratio

Inflation Essays

- Discuss the Difficulties of Controlling Inflation

- Should the aim of the Government be to Attain Low Inflation?

- Explain What Can Cause a Sustained Increase in the Rate of Inflation

- Reasons for low inflation in the UK

- Inflation Explained

- Difficulties of Inflation targeting

- Hyperinflation

Unemployment Essays

- Explain what is meant by Natural Rate of Unemployment?

- Should the Main Macro Economic Aim of the Government be Full Employment?

- The True Level of Unemployment in the UK

- What explains low inflation and low unemployment in the UK?

Demand Side Policies

- Discuss effect of Expansionary demand-side policies on Balance of Payments and Environment

- Effects of a Falling Stock Market

- How do Mortgage Defaults affect and Economy?

- Discuss the effect of increased Government spending on education

- Phillips Curve – Trade-off between Inflation and Unemployment

Development Economics

- Why Growth may not benefit developing countries

- Does Aid Increase Economic Welfare?

- Problems of Free Trade for Developing Economies

Fiscal Policy

- Will US Economy benefit from Tax Cuts?

- Can Fiscal Policy solve Unemployment?

- Explain Reasons for UK Current Account Deficit

- Benefits of Globalisation for Developing and Developed Countries

Monetary Policy

- Discuss Effects of an Increase in Interest Rates

- How MPC set Interest Rates

- Benefits of High-Interest Rates (and recessions)

- Who Sets interest rates – Markets or Bank of England?

Economic History

- Economics of the 1920s

- What Caused Wall Street Crash of 1929?

- UK economy under Mrs Thatcher

- Economy of the 1970s

- Lawson Boom of the 1980s

- UK recession of 1991

- The great recession 2008-13

General Economic Essays

- The Dismal Science

- Difference Between Economists and Non Economists

- War and Recessions

- The Economics of Fear

- The Economics of Happiness

- Can UK and US avoid Recession?

- 3 Of the Worst Economic Policies

- Overvalued Housing Markets

- What Went Wrong with US Economy?

- Problem with Bailing out financial sector

- Problems of Personal Debt

- Problem of Inflation

- National Debt in the UK

- How To Survive a Recession

- Can A recession be a good thing?

Chinese Economy

- Problems of Chinese Economic Growth

- Should we worry about a strong China

- Chinese Growth and Costs of Growth

- Chinese Interest Rates and Economic Growth

Model essays

- A2 model essays

- AS model essays

- Top 10 Reasons For Studying Economics

- Inflation explained by Victor Borge

- Funny Exam Answers

- Humorous look at Subprime crisis

Selected Essays on Economic Policy

- © 2001

- G. C. Harcourt 0

Jesus College, Cambridge, UK University of Adelaide, Australia

You can also search for this author in PubMed Google Scholar

4383 Accesses

29 Citations

1 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (24 chapters)

Front matter, introduction, ‘the end of a perfect day’: ‘horses for courses’ and policy proposals.

G. C. Harcourt

Background to Policy Recommendations

Theoretical controversy and social significance: an evaluation of the cambridge controversies, eric russell, 1921–77: a great australian political economist, on theories and policies, the mixed economy, taxation reform and investment incentives, investment allowances for primary producers.

- A. D. Barton

Taxation and Business Surplus

- J. W. Bennett

Investment and Initial Allowances as Fiscal Devices

Investment-decision criteria, investment incentives and the choice of technique, accounting conventions and policy, the quantitative effect of basing company taxation on replacement costs, incomes policy and the measurement of profits, the measurement of the rate of profit and the bonus scheme for managers in the soviet union, package deals, the social consequences of inflation, policy and responses for australia.

- economic policy

About this book

Authors and affiliations, jesus college, cambridge, uk, university of adelaide, australia, about the author, bibliographic information.

Book Title : Selected Essays on Economic Policy

Authors : G. C. Harcourt

DOI : https://doi.org/10.1057/9780230510562

Publisher : Palgrave Macmillan London

eBook Packages : Palgrave Economics & Finance Collection , Economics and Finance (R0)

Copyright Information : G.C. Harcourt 2001

Hardcover ISBN : 978-0-333-94632-9 Published: 26 January 2001

Softcover ISBN : 978-1-349-42636-2 Published: 26 January 2001

eBook ISBN : 978-0-230-51056-2 Published: 26 January 2001

Edition Number : 1

Number of Pages : XVI, 354

Topics : History of Economic Thought/Methodology , Economic Theory/Quantitative Economics/Mathematical Methods , International Political Economy , Economic Policy , Public Policy

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Economic Policies Employed by Governments Essay

Introduction.

The main aim of the economic policies adopted by a government is to attain a sustainable superior rate of economic growth so as to accumulate national income and wealth, as well as attain superior living standards for its people. In order to achieve its economic goals, a government’s economic policy (ies) should be a combination of macroeconomic reforms, macroeconomic policies, as well as a constructive/conducive international economic environment (Mankiw, 2012).

The purpose of this paper is to discuss the various economic policies employed by governments in order to improve economic growth.

Governments mainly use fiscal and monetary policies; monetary policy influences the supply, as well as the cost of borrowing within a country, which in effect influences the country’s currency stability, full employment, and non-inflationary growth (Mankiw, 2012).

This policy is carried out by a country’s central bank; in the US, the Federal Reserve Board is the one that conducts this function (Mankiw, 2012). The central bank or Federal Reserve may decrease or increase the rate of interest, which eventually affects business investment. The fluctuations in the rate of borrowing also affect consumption by the private sector, for example the household (Colorado.edu, 2011).

On the other hand, fiscal policy involves the utilization of government influences on revenue collection, as well as expenditure, to control economic effects and policy aims as employed through budgeting. The legislative and executive arms of the government make decisions on fiscal policies; consequently, in the US, fiscal policy decisions are made by the president together with the Congress (Mankiw, 2012).

Fiscal policy decisions revolve around two main items: taxes or government revenue and expenditure (Mankiw, 2012). A reduction in taxes increases the disposable income available to household and businesses, increasing household consumption and investments or savings.

This eventually facilitates increased rate of growth of the GDP; conversely, government expenditure on infrastructure, health, and education among others, directly influences the country’s GDP growth. Increase in the GDP as a result of increase in Consumption, Investment, and Government expenditure improves the standard of living since services or goods are readily available for consumption by the private and public sectors (Colorado.edu, 2011).

For instance, if a country is in recession, the government can cut tax and increase its spending in order to fuel economic activity (Colorado.edu, 2011).

During the 2001 recession, for instance, the US government reduced taxes for three years; from 2001 to 2003, together with a 13% increase in government expenditure (Prithiviraj, 2009). Partially attributable to remarkable fiscal stimulus, the real GDP had grown by 7% by the end of the year 2003 (Prithiviraj, 2009).

A government can also use trade policy to increase economic growth since a country’s openness to foreign investment directly impacts on its economic prosperity. Governments that limit investment through the use of protectionist policies burden the country with superior costs and inefficiencies (Mankiw, 2012).

Equally, free trade enhances economic efficiency, as well as boost living standards of the people; free trade also enhances a country’s chances of gaining benefits of the comparative advantages.

A country can specialize and leverage the natural resources through the use of its distinctive or more effective practices in order to acquire other goods and services that are not internally produced. Through the use of trade and comparative advantages, nations can therefore improve their GDP (Mankiw, 2012).

Government regulation policies also play a crucial role in economic growth since red tape and bureaucracy have a significant effect on the economy of a country. Deregulated markets promote the effective distribution of resources because decisions are made based on the economic factors, but excessive regulation can lead to unnecessary superior costs and unproductive behavior (Mitchell, 2005).

Governments can also promote savings or investment if both the private and public sectors save more, this means money will be available to finance business projects or investments in technology or capital goods which increases productivity, eventually improving the people’s standards of living.

Also, political stability and efficient legal systems promote foreign and domestic investment, thereby increasing productivity as well as creation of wealth for its citizens (Prithiviraj, 2009).

The private sector is independent from government expenditure, and so property rights also play a crucial function in the performance of the economy (Mitchell, 2005). In cases where the government controls or owns the resources, the economic atmosphere is likely to be influenced by the prevailing political forces, and the government then establishes how the resources are distributed and used.

If private property remains unsecured by law and tradition, the resources may be inefficiently used by the owners. Therefore, for any specific level of government expenditure, property right protection affects the performance of the economy and eventually the peoples’ living standards; improve or deteriorate.

Economic growth takes place due to the increase in the amount of products or the quality of resources. Governments must work hard to improve human capital and workforce skills, as well as the knowledge level and the wellbeing of that workforce.

A country with a superior human capital will have a higher performance in terms of productivity and will also be able to adopt more efficient technologies and facilitate specialization in specific areas. A government should be more concerned with improving the workforce skills rather than educational qualifications because the skills are the powerful economic growth drivers (Mitchell, 2005).

In a nutshell therefore, economic policies are meant to encourage economic growth rate in the long-term by dealing with structural issues that may be obstacle(s) to future prospects for that economy.

Colorado.edu. (2011). Business cycle, aggregate demand and aggregate supply . Web.

Mankiw, N. G. (2012). Principles of macroeconomics (6 th ). Ohio: South-Western, Cengage Learning.

Mitchell, D. (2005). The impact of government spending on economic growth . Web.

Prithiviraj, S. (2009). Issues of economic growth and government policies promoting economic growth . Web.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, January 11). Economic Policies Employed by Governments. https://ivypanda.com/essays/economic-growth/

"Economic Policies Employed by Governments." IvyPanda , 11 Jan. 2024, ivypanda.com/essays/economic-growth/.

IvyPanda . (2024) 'Economic Policies Employed by Governments'. 11 January.

IvyPanda . 2024. "Economic Policies Employed by Governments." January 11, 2024. https://ivypanda.com/essays/economic-growth/.

1. IvyPanda . "Economic Policies Employed by Governments." January 11, 2024. https://ivypanda.com/essays/economic-growth/.

Bibliography

IvyPanda . "Economic Policies Employed by Governments." January 11, 2024. https://ivypanda.com/essays/economic-growth/.

- GDP Components

- Gross Domestic Product (GDP)

- Fiscal Policy and Sovereign Debt Crises

- Fiscal Policy in Spain

- Fiscal Policy and Stimulus

- Australia’s Fiscal Policy

- Gross Domestic Product (GDP) of the United Kingdom

- Fiscal Policy through Taxation

- What is meant by fiscal policy?

- Nominal and Real GDP Growth Rates

- Coca-Cola: Global Economic Interdependence

- Debt Crisis in Europe

- What Caused the 2008 Financial Crisis in the USA?

- Evaluating the Causes of Decline in Union Density in Australia and Most Western Economies

- Karl Marx's Take on Work Process

Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema. Learn more →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Economics Revision Essay Plans

Last updated 17 Dec 2019

- Share on Facebook

- Share on Twitter

- Share by Email

This series of resources provides revision essay plans for a wide variety of essay topics, including synoptic questions.

For the 2019 papers check out our collection of videos on building A* evaluation into your answers

Have you tried our series of more than 50 Quizlet revision activities? Click here to access!

Essay Plan: Limits on Monopoly Power

Topic Videos

Chains of Reasoning and Evaluation: Fuel Prices in the UK

Exam Support

EU Customs Union Membership (Revision Essay Plan)

Practice Exam Questions

Market for Electric Vehicles (Revision Essay Plan)

Mergers and consumer welfare (revision essay plan), air pollution and policies to control (revision essay plan), policies to improve competitiveness (revision essay plan), economic effects of higher interest rates (revision essay plan), current account deficit & policies (revision essay plan), unemployment and policy trade-offs (revision essay plan), case for cutting the national debt (revision essay plan), micro-finance (2019 revision update), essay on advertising and economic welfare, essay on oligopoly and collusion, policies to control inflation.

Study Notes

Why is high inflation a problem?

Revision essay: exchange rate depreciation and macroeconomic objectives, to what extent should full-employment be the main macro policy objective, housing supply (revision essay plan), minimum alcohol pricing (revision essay plan), oligopoly and collusion (revision essay plan), building confidence in writing synoptic 25 mark essays (edexcel), behavioural and neo-classical economics (revision essay plan), barriers to entry and economic profit (revision essay plan), micro and macro impact of a plastic tax (revision essay plan), edge revision webinar: market failure and government intervention, farm subsidies (revision essay plan), competitiveness of the uk motor industry (revision essay plan), labour migration (revision essay plan), financial market failure (revision essay plan), tariff on chinese steel (revision essay plan), policies to improve food affordability (revision essay plan), reducing a trade deficit (revision essay plan), museums and government subsidy (revision essay plan), fiscal policy and inequality (revision essay plan), globalisation and inequality (revision essay plan), economic inactivity (revision essay plan), competition and consumer welfare (essay technique video), essay plan: is the euro the main cause of the crisis in greece and italy, china: successes and failures essay plan, our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Economic Policy

- Filtering by:

7 facts about Americans and taxes

A majority of U.S. adults say they’re bothered a lot by the feeling that some corporations (61%) and some wealthy people (60%) don’t pay their fair share.

Americans’ Top Policy Priority for 2024: Strengthening the Economy

Growing shares of Republicans rate immigration and terrorism as top priorities for the president and Congress this year.

Congress has long struggled to pass spending bills on time

If Congress passes the Oct. 1 deadline without either a new set of spending bills or a continuing resolution, nonessential operations would be forced to shut down.

What the data says about food stamps in the U.S.

The food stamp program is one of the larger federal social welfare initiatives, and in its current form has been around for nearly six decades.

Inflation, Health Costs, Partisan Cooperation Among the Nation’s Top Problems

Democrats hold the edge on many issues, but more Americans agree with Republicans on the economy, crime and immigration. Inflation remains the top concern for Republicans and Republican-leaning independents, with 77% saying it is a very big problem. For Democrats and Democratic leaners, gun violence is the top concern, with about 81% saying it is a very big problem.

Economic ratings are poor – and getting worse – in most countries surveyed

Majorities of adults in 18 of 24 countries surveyed this spring rate their nation’s economic situation poorly.

Who pays, and doesn’t pay, federal income taxes in the U.S.?

Since 2000, there has been a downward trend in average effective tax rates for all but the richest taxpayers.

Most U.S. bank failures have come in a few big waves

After two of the largest U.S. banks collapsed in March, some have started to wonder if a new widespread banking crisis is coming.

Top tax frustrations for Americans: The feeling that some corporations, wealthy people don’t pay fair share

61% of adults now say that the feeling that some corporations don’t pay their fair share bothers them a lot. 60% say this about some wealthy people.

5 facts about the U.S. national debt

As concern about federal spending rises among both Democrats and Republicans, here’s a primer on the national debt of the United States.

REFINE YOUR SELECTION

Research teams.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Social Sciences

© 2024 Inquiries Journal/Student Pulse LLC . All rights reserved. ISSN: 2153-5760.

Disclaimer: content on this website is for informational purposes only. It is not intended to provide medical or other professional advice. Moreover, the views expressed here do not necessarily represent the views of Inquiries Journal or Student Pulse, its owners, staff, contributors, or affiliates.

Home | Current Issue | Blog | Archives | About The Journal | Submissions Terms of Use :: Privacy Policy :: Contact

Need an Account?

Forgot password? Reset your password »

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 17 April 2024

The economic commitment of climate change

- Maximilian Kotz ORCID: orcid.org/0000-0003-2564-5043 1 , 2 ,

- Anders Levermann ORCID: orcid.org/0000-0003-4432-4704 1 , 2 &

- Leonie Wenz ORCID: orcid.org/0000-0002-8500-1568 1 , 3

Nature volume 628 , pages 551–557 ( 2024 ) Cite this article

77k Accesses

3413 Altmetric

Metrics details

- Environmental economics

- Environmental health

- Interdisciplinary studies

- Projection and prediction

Global projections of macroeconomic climate-change damages typically consider impacts from average annual and national temperatures over long time horizons 1 , 2 , 3 , 4 , 5 , 6 . Here we use recent empirical findings from more than 1,600 regions worldwide over the past 40 years to project sub-national damages from temperature and precipitation, including daily variability and extremes 7 , 8 . Using an empirical approach that provides a robust lower bound on the persistence of impacts on economic growth, we find that the world economy is committed to an income reduction of 19% within the next 26 years independent of future emission choices (relative to a baseline without climate impacts, likely range of 11–29% accounting for physical climate and empirical uncertainty). These damages already outweigh the mitigation costs required to limit global warming to 2 °C by sixfold over this near-term time frame and thereafter diverge strongly dependent on emission choices. Committed damages arise predominantly through changes in average temperature, but accounting for further climatic components raises estimates by approximately 50% and leads to stronger regional heterogeneity. Committed losses are projected for all regions except those at very high latitudes, at which reductions in temperature variability bring benefits. The largest losses are committed at lower latitudes in regions with lower cumulative historical emissions and lower present-day income.

Similar content being viewed by others

Climate damage projections beyond annual temperature

Investment incentive reduced by climate damages can be restored by optimal policy

Climate economics support for the UN climate targets

Projections of the macroeconomic damage caused by future climate change are crucial to informing public and policy debates about adaptation, mitigation and climate justice. On the one hand, adaptation against climate impacts must be justified and planned on the basis of an understanding of their future magnitude and spatial distribution 9 . This is also of importance in the context of climate justice 10 , as well as to key societal actors, including governments, central banks and private businesses, which increasingly require the inclusion of climate risks in their macroeconomic forecasts to aid adaptive decision-making 11 , 12 . On the other hand, climate mitigation policy such as the Paris Climate Agreement is often evaluated by balancing the costs of its implementation against the benefits of avoiding projected physical damages. This evaluation occurs both formally through cost–benefit analyses 1 , 4 , 5 , 6 , as well as informally through public perception of mitigation and damage costs 13 .

Projections of future damages meet challenges when informing these debates, in particular the human biases relating to uncertainty and remoteness that are raised by long-term perspectives 14 . Here we aim to overcome such challenges by assessing the extent of economic damages from climate change to which the world is already committed by historical emissions and socio-economic inertia (the range of future emission scenarios that are considered socio-economically plausible 15 ). Such a focus on the near term limits the large uncertainties about diverging future emission trajectories, the resulting long-term climate response and the validity of applying historically observed climate–economic relations over long timescales during which socio-technical conditions may change considerably. As such, this focus aims to simplify the communication and maximize the credibility of projected economic damages from future climate change.

In projecting the future economic damages from climate change, we make use of recent advances in climate econometrics that provide evidence for impacts on sub-national economic growth from numerous components of the distribution of daily temperature and precipitation 3 , 7 , 8 . Using fixed-effects panel regression models to control for potential confounders, these studies exploit within-region variation in local temperature and precipitation in a panel of more than 1,600 regions worldwide, comprising climate and income data over the past 40 years, to identify the plausibly causal effects of changes in several climate variables on economic productivity 16 , 17 . Specifically, macroeconomic impacts have been identified from changing daily temperature variability, total annual precipitation, the annual number of wet days and extreme daily rainfall that occur in addition to those already identified from changing average temperature 2 , 3 , 18 . Moreover, regional heterogeneity in these effects based on the prevailing local climatic conditions has been found using interactions terms. The selection of these climate variables follows micro-level evidence for mechanisms related to the impacts of average temperatures on labour and agricultural productivity 2 , of temperature variability on agricultural productivity and health 7 , as well as of precipitation on agricultural productivity, labour outcomes and flood damages 8 (see Extended Data Table 1 for an overview, including more detailed references). References 7 , 8 contain a more detailed motivation for the use of these particular climate variables and provide extensive empirical tests about the robustness and nature of their effects on economic output, which are summarized in Methods . By accounting for these extra climatic variables at the sub-national level, we aim for a more comprehensive description of climate impacts with greater detail across both time and space.

Constraining the persistence of impacts

A key determinant and source of discrepancy in estimates of the magnitude of future climate damages is the extent to which the impact of a climate variable on economic growth rates persists. The two extreme cases in which these impacts persist indefinitely or only instantaneously are commonly referred to as growth or level effects 19 , 20 (see Methods section ‘Empirical model specification: fixed-effects distributed lag models’ for mathematical definitions). Recent work shows that future damages from climate change depend strongly on whether growth or level effects are assumed 20 . Following refs. 2 , 18 , we provide constraints on this persistence by using distributed lag models to test the significance of delayed effects separately for each climate variable. Notably, and in contrast to refs. 2 , 18 , we use climate variables in their first-differenced form following ref. 3 , implying a dependence of the growth rate on a change in climate variables. This choice means that a baseline specification without any lags constitutes a model prior of purely level effects, in which a permanent change in the climate has only an instantaneous effect on the growth rate 3 , 19 , 21 . By including lags, one can then test whether any effects may persist further. This is in contrast to the specification used by refs. 2 , 18 , in which climate variables are used without taking the first difference, implying a dependence of the growth rate on the level of climate variables. In this alternative case, the baseline specification without any lags constitutes a model prior of pure growth effects, in which a change in climate has an infinitely persistent effect on the growth rate. Consequently, including further lags in this alternative case tests whether the initial growth impact is recovered 18 , 19 , 21 . Both of these specifications suffer from the limiting possibility that, if too few lags are included, one might falsely accept the model prior. The limitations of including a very large number of lags, including loss of data and increasing statistical uncertainty with an increasing number of parameters, mean that such a possibility is likely. By choosing a specification in which the model prior is one of level effects, our approach is therefore conservative by design, avoiding assumptions of infinite persistence of climate impacts on growth and instead providing a lower bound on this persistence based on what is observable empirically (see Methods section ‘Empirical model specification: fixed-effects distributed lag models’ for further exposition of this framework). The conservative nature of such a choice is probably the reason that ref. 19 finds much greater consistency between the impacts projected by models that use the first difference of climate variables, as opposed to their levels.

We begin our empirical analysis of the persistence of climate impacts on growth using ten lags of the first-differenced climate variables in fixed-effects distributed lag models. We detect substantial effects on economic growth at time lags of up to approximately 8–10 years for the temperature terms and up to approximately 4 years for the precipitation terms (Extended Data Fig. 1 and Extended Data Table 2 ). Furthermore, evaluation by means of information criteria indicates that the inclusion of all five climate variables and the use of these numbers of lags provide a preferable trade-off between best-fitting the data and including further terms that could cause overfitting, in comparison with model specifications excluding climate variables or including more or fewer lags (Extended Data Fig. 3 , Supplementary Methods Section 1 and Supplementary Table 1 ). We therefore remove statistically insignificant terms at later lags (Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ). Further tests using Monte Carlo simulations demonstrate that the empirical models are robust to autocorrelation in the lagged climate variables (Supplementary Methods Section 2 and Supplementary Figs. 4 and 5 ), that information criteria provide an effective indicator for lag selection (Supplementary Methods Section 2 and Supplementary Fig. 6 ), that the results are robust to concerns of imperfect multicollinearity between climate variables and that including several climate variables is actually necessary to isolate their separate effects (Supplementary Methods Section 3 and Supplementary Fig. 7 ). We provide a further robustness check using a restricted distributed lag model to limit oscillations in the lagged parameter estimates that may result from autocorrelation, finding that it provides similar estimates of cumulative marginal effects to the unrestricted model (Supplementary Methods Section 4 and Supplementary Figs. 8 and 9 ). Finally, to explicitly account for any outstanding uncertainty arising from the precise choice of the number of lags, we include empirical models with marginally different numbers of lags in the error-sampling procedure of our projection of future damages. On the basis of the lag-selection procedure (the significance of lagged terms in Extended Data Fig. 1 and Extended Data Table 2 , as well as information criteria in Extended Data Fig. 3 ), we sample from models with eight to ten lags for temperature and four for precipitation (models shown in Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ). In summary, this empirical approach to constrain the persistence of climate impacts on economic growth rates is conservative by design in avoiding assumptions of infinite persistence, but nevertheless provides a lower bound on the extent of impact persistence that is robust to the numerous tests outlined above.

Committed damages until mid-century

We combine these empirical economic response functions (Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ) with an ensemble of 21 climate models (see Supplementary Table 5 ) from the Coupled Model Intercomparison Project Phase 6 (CMIP-6) 22 to project the macroeconomic damages from these components of physical climate change (see Methods for further details). Bias-adjusted climate models that provide a highly accurate reproduction of observed climatological patterns with limited uncertainty (Supplementary Table 6 ) are used to avoid introducing biases in the projections. Following a well-developed literature 2 , 3 , 19 , these projections do not aim to provide a prediction of future economic growth. Instead, they are a projection of the exogenous impact of future climate conditions on the economy relative to the baselines specified by socio-economic projections, based on the plausibly causal relationships inferred by the empirical models and assuming ceteris paribus. Other exogenous factors relevant for the prediction of economic output are purposefully assumed constant.

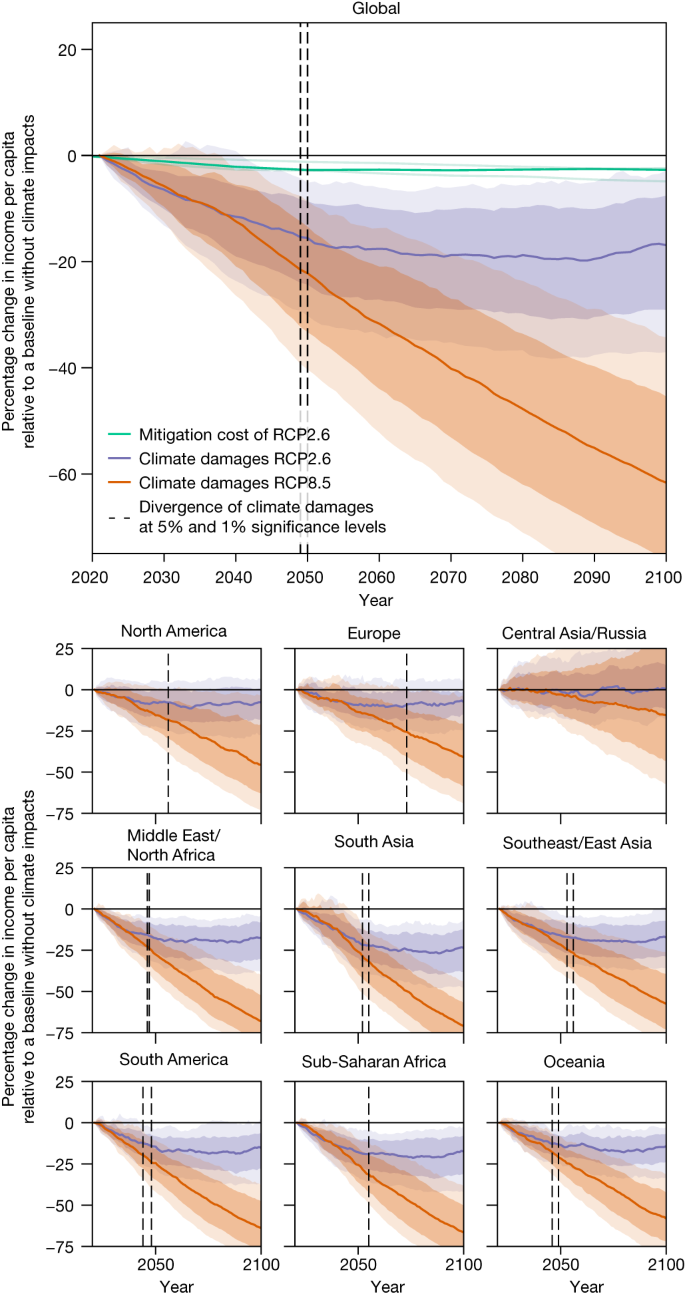

A Monte Carlo procedure that samples from climate model projections, empirical models with different numbers of lags and model parameter estimates (obtained by 1,000 block-bootstrap resamples of each of the regressions in Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ) is used to estimate the combined uncertainty from these sources. Given these uncertainty distributions, we find that projected global damages are statistically indistinguishable across the two most extreme emission scenarios until 2049 (at the 5% significance level; Fig. 1 ). As such, the climate damages occurring before this time constitute those to which the world is already committed owing to the combination of past emissions and the range of future emission scenarios that are considered socio-economically plausible 15 . These committed damages comprise a permanent income reduction of 19% on average globally (population-weighted average) in comparison with a baseline without climate-change impacts (with a likely range of 11–29%, following the likelihood classification adopted by the Intergovernmental Panel on Climate Change (IPCC); see caption of Fig. 1 ). Even though levels of income per capita generally still increase relative to those of today, this constitutes a permanent income reduction for most regions, including North America and Europe (each with median income reductions of approximately 11%) and with South Asia and Africa being the most strongly affected (each with median income reductions of approximately 22%; Fig. 1 ). Under a middle-of-the road scenario of future income development (SSP2, in which SSP stands for Shared Socio-economic Pathway), this corresponds to global annual damages in 2049 of 38 trillion in 2005 international dollars (likely range of 19–59 trillion 2005 international dollars). Compared with empirical specifications that assume pure growth or pure level effects, our preferred specification that provides a robust lower bound on the extent of climate impact persistence produces damages between these two extreme assumptions (Extended Data Fig. 3 ).

Estimates of the projected reduction in income per capita from changes in all climate variables based on empirical models of climate impacts on economic output with a robust lower bound on their persistence (Extended Data Fig. 1 ) under a low-emission scenario compatible with the 2 °C warming target and a high-emission scenario (SSP2-RCP2.6 and SSP5-RCP8.5, respectively) are shown in purple and orange, respectively. Shading represents the 34% and 10% confidence intervals reflecting the likely and very likely ranges, respectively (following the likelihood classification adopted by the IPCC), having estimated uncertainty from a Monte Carlo procedure, which samples the uncertainty from the choice of physical climate models, empirical models with different numbers of lags and bootstrapped estimates of the regression parameters shown in Supplementary Figs. 1 – 3 . Vertical dashed lines show the time at which the climate damages of the two emission scenarios diverge at the 5% and 1% significance levels based on the distribution of differences between emission scenarios arising from the uncertainty sampling discussed above. Note that uncertainty in the difference of the two scenarios is smaller than the combined uncertainty of the two respective scenarios because samples of the uncertainty (climate model and empirical model choice, as well as model parameter bootstrap) are consistent across the two emission scenarios, hence the divergence of damages occurs while the uncertainty bounds of the two separate damage scenarios still overlap. Estimates of global mitigation costs from the three IAMs that provide results for the SSP2 baseline and SSP2-RCP2.6 scenario are shown in light green in the top panel, with the median of these estimates shown in bold.

Damages already outweigh mitigation costs

We compare the damages to which the world is committed over the next 25 years to estimates of the mitigation costs required to achieve the Paris Climate Agreement. Taking estimates of mitigation costs from the three integrated assessment models (IAMs) in the IPCC AR6 database 23 that provide results under comparable scenarios (SSP2 baseline and SSP2-RCP2.6, in which RCP stands for Representative Concentration Pathway), we find that the median committed climate damages are larger than the median mitigation costs in 2050 (six trillion in 2005 international dollars) by a factor of approximately six (note that estimates of mitigation costs are only provided every 10 years by the IAMs and so a comparison in 2049 is not possible). This comparison simply aims to compare the magnitude of future damages against mitigation costs, rather than to conduct a formal cost–benefit analysis of transitioning from one emission path to another. Formal cost–benefit analyses typically find that the net benefits of mitigation only emerge after 2050 (ref. 5 ), which may lead some to conclude that physical damages from climate change are simply not large enough to outweigh mitigation costs until the second half of the century. Our simple comparison of their magnitudes makes clear that damages are actually already considerably larger than mitigation costs and the delayed emergence of net mitigation benefits results primarily from the fact that damages across different emission paths are indistinguishable until mid-century (Fig. 1 ).

Although these near-term damages constitute those to which the world is already committed, we note that damage estimates diverge strongly across emission scenarios after 2049, conveying the clear benefits of mitigation from a purely economic point of view that have been emphasized in previous studies 4 , 24 . As well as the uncertainties assessed in Fig. 1 , these conclusions are robust to structural choices, such as the timescale with which changes in the moderating variables of the empirical models are estimated (Supplementary Figs. 10 and 11 ), as well as the order in which one accounts for the intertemporal and international components of currency comparison (Supplementary Fig. 12 ; see Methods for further details).

Damages from variability and extremes

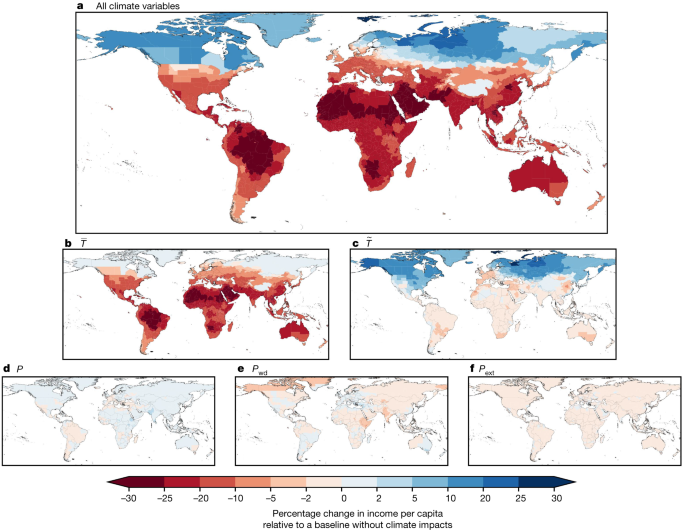

Committed damages primarily arise through changes in average temperature (Fig. 2 ). This reflects the fact that projected changes in average temperature are larger than those in other climate variables when expressed as a function of their historical interannual variability (Extended Data Fig. 4 ). Because the historical variability is that on which the empirical models are estimated, larger projected changes in comparison with this variability probably lead to larger future impacts in a purely statistical sense. From a mechanistic perspective, one may plausibly interpret this result as implying that future changes in average temperature are the most unprecedented from the perspective of the historical fluctuations to which the economy is accustomed and therefore will cause the most damage. This insight may prove useful in terms of guiding adaptation measures to the sources of greatest damage.

Estimates of the median projected reduction in sub-national income per capita across emission scenarios (SSP2-RCP2.6 and SSP2-RCP8.5) as well as climate model, empirical model and model parameter uncertainty in the year in which climate damages diverge at the 5% level (2049, as identified in Fig. 1 ). a , Impacts arising from all climate variables. b – f , Impacts arising separately from changes in annual mean temperature ( b ), daily temperature variability ( c ), total annual precipitation ( d ), the annual number of wet days (>1 mm) ( e ) and extreme daily rainfall ( f ) (see Methods for further definitions). Data on national administrative boundaries are obtained from the GADM database version 3.6 and are freely available for academic use ( https://gadm.org/ ).

Nevertheless, future damages based on empirical models that consider changes in annual average temperature only and exclude the other climate variables constitute income reductions of only 13% in 2049 (Extended Data Fig. 5a , likely range 5–21%). This suggests that accounting for the other components of the distribution of temperature and precipitation raises net damages by nearly 50%. This increase arises through the further damages that these climatic components cause, but also because their inclusion reveals a stronger negative economic response to average temperatures (Extended Data Fig. 5b ). The latter finding is consistent with our Monte Carlo simulations, which suggest that the magnitude of the effect of average temperature on economic growth is underestimated unless accounting for the impacts of other correlated climate variables (Supplementary Fig. 7 ).

In terms of the relative contributions of the different climatic components to overall damages, we find that accounting for daily temperature variability causes the largest increase in overall damages relative to empirical frameworks that only consider changes in annual average temperature (4.9 percentage points, likely range 2.4–8.7 percentage points, equivalent to approximately 10 trillion international dollars). Accounting for precipitation causes smaller increases in overall damages, which are—nevertheless—equivalent to approximately 1.2 trillion international dollars: 0.01 percentage points (−0.37–0.33 percentage points), 0.34 percentage points (0.07–0.90 percentage points) and 0.36 percentage points (0.13–0.65 percentage points) from total annual precipitation, the number of wet days and extreme daily precipitation, respectively. Moreover, climate models seem to underestimate future changes in temperature variability 25 and extreme precipitation 26 , 27 in response to anthropogenic forcing as compared with that observed historically, suggesting that the true impacts from these variables may be larger.

The distribution of committed damages

The spatial distribution of committed damages (Fig. 2a ) reflects a complex interplay between the patterns of future change in several climatic components and those of historical economic vulnerability to changes in those variables. Damages resulting from increasing annual mean temperature (Fig. 2b ) are negative almost everywhere globally, and larger at lower latitudes in regions in which temperatures are already higher and economic vulnerability to temperature increases is greatest (see the response heterogeneity to mean temperature embodied in Extended Data Fig. 1a ). This occurs despite the amplified warming projected at higher latitudes 28 , suggesting that regional heterogeneity in economic vulnerability to temperature changes outweighs heterogeneity in the magnitude of future warming (Supplementary Fig. 13a ). Economic damages owing to daily temperature variability (Fig. 2c ) exhibit a strong latitudinal polarisation, primarily reflecting the physical response of daily variability to greenhouse forcing in which increases in variability across lower latitudes (and Europe) contrast decreases at high latitudes 25 (Supplementary Fig. 13b ). These two temperature terms are the dominant determinants of the pattern of overall damages (Fig. 2a ), which exhibits a strong polarity with damages across most of the globe except at the highest northern latitudes. Future changes in total annual precipitation mainly bring economic benefits except in regions of drying, such as the Mediterranean and central South America (Fig. 2d and Supplementary Fig. 13c ), but these benefits are opposed by changes in the number of wet days, which produce damages with a similar pattern of opposite sign (Fig. 2e and Supplementary Fig. 13d ). By contrast, changes in extreme daily rainfall produce damages in all regions, reflecting the intensification of daily rainfall extremes over global land areas 29 , 30 (Fig. 2f and Supplementary Fig. 13e ).

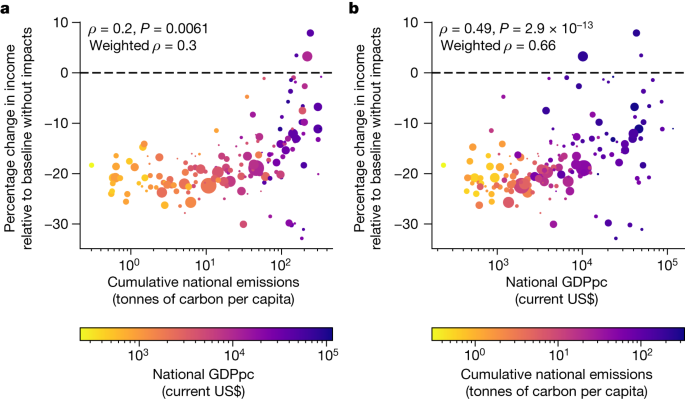

The spatial distribution of committed damages implies considerable injustice along two dimensions: culpability for the historical emissions that have caused climate change and pre-existing levels of socio-economic welfare. Spearman’s rank correlations indicate that committed damages are significantly larger in countries with smaller historical cumulative emissions, as well as in regions with lower current income per capita (Fig. 3 ). This implies that those countries that will suffer the most from the damages already committed are those that are least responsible for climate change and which also have the least resources to adapt to it.

Estimates of the median projected change in national income per capita across emission scenarios (RCP2.6 and RCP8.5) as well as climate model, empirical model and model parameter uncertainty in the year in which climate damages diverge at the 5% level (2049, as identified in Fig. 1 ) are plotted against cumulative national emissions per capita in 2020 (from the Global Carbon Project) and coloured by national income per capita in 2020 (from the World Bank) in a and vice versa in b . In each panel, the size of each scatter point is weighted by the national population in 2020 (from the World Bank). Inset numbers indicate the Spearman’s rank correlation ρ and P -values for a hypothesis test whose null hypothesis is of no correlation, as well as the Spearman’s rank correlation weighted by national population.

To further quantify this heterogeneity, we assess the difference in committed damages between the upper and lower quartiles of regions when ranked by present income levels and historical cumulative emissions (using a population weighting to both define the quartiles and estimate the group averages). On average, the quartile of countries with lower income are committed to an income loss that is 8.9 percentage points (or 61%) greater than the upper quartile (Extended Data Fig. 6 ), with a likely range of 3.8–14.7 percentage points across the uncertainty sampling of our damage projections (following the likelihood classification adopted by the IPCC). Similarly, the quartile of countries with lower historical cumulative emissions are committed to an income loss that is 6.9 percentage points (or 40%) greater than the upper quartile, with a likely range of 0.27–12 percentage points. These patterns reemphasize the prevalence of injustice in climate impacts 31 , 32 , 33 in the context of the damages to which the world is already committed by historical emissions and socio-economic inertia.

Contextualizing the magnitude of damages

The magnitude of projected economic damages exceeds previous literature estimates 2 , 3 , arising from several developments made on previous approaches. Our estimates are larger than those of ref. 2 (see first row of Extended Data Table 3 ), primarily because of the facts that sub-national estimates typically show a steeper temperature response (see also refs. 3 , 34 ) and that accounting for other climatic components raises damage estimates (Extended Data Fig. 5 ). However, we note that our empirical approach using first-differenced climate variables is conservative compared with that of ref. 2 in regard to the persistence of climate impacts on growth (see introduction and Methods section ‘Empirical model specification: fixed-effects distributed lag models’), an important determinant of the magnitude of long-term damages 19 , 21 . Using a similar empirical specification to ref. 2 , which assumes infinite persistence while maintaining the rest of our approach (sub-national data and further climate variables), produces considerably larger damages (purple curve of Extended Data Fig. 3 ). Compared with studies that do take the first difference of climate variables 3 , 35 , our estimates are also larger (see second and third rows of Extended Data Table 3 ). The inclusion of further climate variables (Extended Data Fig. 5 ) and a sufficient number of lags to more adequately capture the extent of impact persistence (Extended Data Figs. 1 and 2 ) are the main sources of this difference, as is the use of specifications that capture nonlinearities in the temperature response when compared with ref. 35 . In summary, our estimates develop on previous studies by incorporating the latest data and empirical insights 7 , 8 , as well as in providing a robust empirical lower bound on the persistence of impacts on economic growth, which constitutes a middle ground between the extremes of the growth-versus-levels debate 19 , 21 (Extended Data Fig. 3 ).

Compared with the fraction of variance explained by the empirical models historically (<5%), the projection of reductions in income of 19% may seem large. This arises owing to the fact that projected changes in climatic conditions are much larger than those that were experienced historically, particularly for changes in average temperature (Extended Data Fig. 4 ). As such, any assessment of future climate-change impacts necessarily requires an extrapolation outside the range of the historical data on which the empirical impact models were evaluated. Nevertheless, these models constitute the most state-of-the-art methods for inference of plausibly causal climate impacts based on observed data. Moreover, we take explicit steps to limit out-of-sample extrapolation by capping the moderating variables of the interaction terms at the 95th percentile of the historical distribution (see Methods ). This avoids extrapolating the marginal effects outside what was observed historically. Given the nonlinear response of economic output to annual mean temperature (Extended Data Fig. 1 and Extended Data Table 2 ), this is a conservative choice that limits the magnitude of damages that we project. Furthermore, back-of-the-envelope calculations indicate that the projected damages are consistent with the magnitude and patterns of historical economic development (see Supplementary Discussion Section 5 ).

Missing impacts and spatial spillovers

Despite assessing several climatic components from which economic impacts have recently been identified 3 , 7 , 8 , this assessment of aggregate climate damages should not be considered comprehensive. Important channels such as impacts from heatwaves 31 , sea-level rise 36 , tropical cyclones 37 and tipping points 38 , 39 , as well as non-market damages such as those to ecosystems 40 and human health 41 , are not considered in these estimates. Sea-level rise is unlikely to be feasibly incorporated into empirical assessments such as this because historical sea-level variability is mostly small. Non-market damages are inherently intractable within our estimates of impacts on aggregate monetary output and estimates of these impacts could arguably be considered as extra to those identified here. Recent empirical work suggests that accounting for these channels would probably raise estimates of these committed damages, with larger damages continuing to arise in the global south 31 , 36 , 37 , 38 , 39 , 40 , 41 , 42 .

Moreover, our main empirical analysis does not explicitly evaluate the potential for impacts in local regions to produce effects that ‘spill over’ into other regions. Such effects may further mitigate or amplify the impacts we estimate, for example, if companies relocate production from one affected region to another or if impacts propagate along supply chains. The current literature indicates that trade plays a substantial role in propagating spillover effects 43 , 44 , making their assessment at the sub-national level challenging without available data on sub-national trade dependencies. Studies accounting for only spatially adjacent neighbours indicate that negative impacts in one region induce further negative impacts in neighbouring regions 45 , 46 , 47 , 48 , suggesting that our projected damages are probably conservative by excluding these effects. In Supplementary Fig. 14 , we assess spillovers from neighbouring regions using a spatial-lag model. For simplicity, this analysis excludes temporal lags, focusing only on contemporaneous effects. The results show that accounting for spatial spillovers can amplify the overall magnitude, and also the heterogeneity, of impacts. Consistent with previous literature, this indicates that the overall magnitude (Fig. 1 ) and heterogeneity (Fig. 3 ) of damages that we project in our main specification may be conservative without explicitly accounting for spillovers. We note that further analysis that addresses both spatially and trade-connected spillovers, while also accounting for delayed impacts using temporal lags, would be necessary to adequately address this question fully. These approaches offer fruitful avenues for further research but are beyond the scope of this manuscript, which primarily aims to explore the impacts of different climate conditions and their persistence.

Policy implications

We find that the economic damages resulting from climate change until 2049 are those to which the world economy is already committed and that these greatly outweigh the costs required to mitigate emissions in line with the 2 °C target of the Paris Climate Agreement (Fig. 1 ). This assessment is complementary to formal analyses of the net costs and benefits associated with moving from one emission path to another, which typically find that net benefits of mitigation only emerge in the second half of the century 5 . Our simple comparison of the magnitude of damages and mitigation costs makes clear that this is primarily because damages are indistinguishable across emissions scenarios—that is, committed—until mid-century (Fig. 1 ) and that they are actually already much larger than mitigation costs. For simplicity, and owing to the availability of data, we compare damages to mitigation costs at the global level. Regional estimates of mitigation costs may shed further light on the national incentives for mitigation to which our results already hint, of relevance for international climate policy. Although these damages are committed from a mitigation perspective, adaptation may provide an opportunity to reduce them. Moreover, the strong divergence of damages after mid-century reemphasizes the clear benefits of mitigation from a purely economic perspective, as highlighted in previous studies 1 , 4 , 6 , 24 .

Historical climate data

Historical daily 2-m temperature and precipitation totals (in mm) are obtained for the period 1979–2019 from the W5E5 database. The W5E5 dataset comes from ERA-5, a state-of-the-art reanalysis of historical observations, but has been bias-adjusted by applying version 2.0 of the WATCH Forcing Data to ERA-5 reanalysis data and precipitation data from version 2.3 of the Global Precipitation Climatology Project to better reflect ground-based measurements 49 , 50 , 51 . We obtain these data on a 0.5° × 0.5° grid from the Inter-Sectoral Impact Model Intercomparison Project (ISIMIP) database. Notably, these historical data have been used to bias-adjust future climate projections from CMIP-6 (see the following section), ensuring consistency between the distribution of historical daily weather on which our empirical models were estimated and the climate projections used to estimate future damages. These data are publicly available from the ISIMIP database. See refs. 7 , 8 for robustness tests of the empirical models to the choice of climate data reanalysis products.

Future climate data

Daily 2-m temperature and precipitation totals (in mm) are taken from 21 climate models participating in CMIP-6 under a high (RCP8.5) and a low (RCP2.6) greenhouse gas emission scenario from 2015 to 2100. The data have been bias-adjusted and statistically downscaled to a common half-degree grid to reflect the historical distribution of daily temperature and precipitation of the W5E5 dataset using the trend-preserving method developed by the ISIMIP 50 , 52 . As such, the climate model data reproduce observed climatological patterns exceptionally well (Supplementary Table 5 ). Gridded data are publicly available from the ISIMIP database.

Historical economic data

Historical economic data come from the DOSE database of sub-national economic output 53 . We use a recent revision to the DOSE dataset that provides data across 83 countries, 1,660 sub-national regions with varying temporal coverage from 1960 to 2019. Sub-national units constitute the first administrative division below national, for example, states for the USA and provinces for China. Data come from measures of gross regional product per capita (GRPpc) or income per capita in local currencies, reflecting the values reported in national statistical agencies, yearbooks and, in some cases, academic literature. We follow previous literature 3 , 7 , 8 , 54 and assess real sub-national output per capita by first converting values from local currencies to US dollars to account for diverging national inflationary tendencies and then account for US inflation using a US deflator. Alternatively, one might first account for national inflation and then convert between currencies. Supplementary Fig. 12 demonstrates that our conclusions are consistent when accounting for price changes in the reversed order, although the magnitude of estimated damages varies. See the documentation of the DOSE dataset for further discussion of these choices. Conversions between currencies are conducted using exchange rates from the FRED database of the Federal Reserve Bank of St. Louis 55 and the national deflators from the World Bank 56 .

Future socio-economic data

Baseline gridded gross domestic product (GDP) and population data for the period 2015–2100 are taken from the middle-of-the-road scenario SSP2 (ref. 15 ). Population data have been downscaled to a half-degree grid by the ISIMIP following the methodologies of refs. 57 , 58 , which we then aggregate to the sub-national level of our economic data using the spatial aggregation procedure described below. Because current methodologies for downscaling the GDP of the SSPs use downscaled population to do so, per-capita estimates of GDP with a realistic distribution at the sub-national level are not readily available for the SSPs. We therefore use national-level GDP per capita (GDPpc) projections for all sub-national regions of a given country, assuming homogeneity within countries in terms of baseline GDPpc. Here we use projections that have been updated to account for the impact of the COVID-19 pandemic on the trajectory of future income, while remaining consistent with the long-term development of the SSPs 59 . The choice of baseline SSP alters the magnitude of projected climate damages in monetary terms, but when assessed in terms of percentage change from the baseline, the choice of socio-economic scenario is inconsequential. Gridded SSP population data and national-level GDPpc data are publicly available from the ISIMIP database. Sub-national estimates as used in this study are available in the code and data replication files.

Climate variables

Following recent literature 3 , 7 , 8 , we calculate an array of climate variables for which substantial impacts on macroeconomic output have been identified empirically, supported by further evidence at the micro level for plausible underlying mechanisms. See refs. 7 , 8 for an extensive motivation for the use of these particular climate variables and for detailed empirical tests on the nature and robustness of their effects on economic output. To summarize, these studies have found evidence for independent impacts on economic growth rates from annual average temperature, daily temperature variability, total annual precipitation, the annual number of wet days and extreme daily rainfall. Assessments of daily temperature variability were motivated by evidence of impacts on agricultural output and human health, as well as macroeconomic literature on the impacts of volatility on growth when manifest in different dimensions, such as government spending, exchange rates and even output itself 7 . Assessments of precipitation impacts were motivated by evidence of impacts on agricultural productivity, metropolitan labour outcomes and conflict, as well as damages caused by flash flooding 8 . See Extended Data Table 1 for detailed references to empirical studies of these physical mechanisms. Marked impacts of daily temperature variability, total annual precipitation, the number of wet days and extreme daily rainfall on macroeconomic output were identified robustly across different climate datasets, spatial aggregation schemes, specifications of regional time trends and error-clustering approaches. They were also found to be robust to the consideration of temperature extremes 7 , 8 . Furthermore, these climate variables were identified as having independent effects on economic output 7 , 8 , which we further explain here using Monte Carlo simulations to demonstrate the robustness of the results to concerns of imperfect multicollinearity between climate variables (Supplementary Methods Section 2 ), as well as by using information criteria (Supplementary Table 1 ) to demonstrate that including several lagged climate variables provides a preferable trade-off between optimally describing the data and limiting the possibility of overfitting.

We calculate these variables from the distribution of daily, d , temperature, T x , d , and precipitation, P x , d , at the grid-cell, x , level for both the historical and future climate data. As well as annual mean temperature, \({\bar{T}}_{x,y}\) , and annual total precipitation, P x , y , we calculate annual, y , measures of daily temperature variability, \({\widetilde{T}}_{x,y}\) :

the number of wet days, Pwd x , y :

and extreme daily rainfall:

in which T x , d , m , y is the grid-cell-specific daily temperature in month m and year y , \({\bar{T}}_{x,m,{y}}\) is the year and grid-cell-specific monthly, m , mean temperature, D m and D y the number of days in a given month m or year y , respectively, H the Heaviside step function, 1 mm the threshold used to define wet days and P 99.9 x is the 99.9th percentile of historical (1979–2019) daily precipitation at the grid-cell level. Units of the climate measures are degrees Celsius for annual mean temperature and daily temperature variability, millimetres for total annual precipitation and extreme daily precipitation, and simply the number of days for the annual number of wet days.

We also calculated weighted standard deviations of monthly rainfall totals as also used in ref. 8 but do not include them in our projections as we find that, when accounting for delayed effects, their effect becomes statistically indistinct and is better captured by changes in total annual rainfall.

Spatial aggregation

We aggregate grid-cell-level historical and future climate measures, as well as grid-cell-level future GDPpc and population, to the level of the first administrative unit below national level of the GADM database, using an area-weighting algorithm that estimates the portion of each grid cell falling within an administrative boundary. We use this as our baseline specification following previous findings that the effect of area or population weighting at the sub-national level is negligible 7 , 8 .

Empirical model specification: fixed-effects distributed lag models

Following a wide range of climate econometric literature 16 , 60 , we use panel regression models with a selection of fixed effects and time trends to isolate plausibly exogenous variation with which to maximize confidence in a causal interpretation of the effects of climate on economic growth rates. The use of region fixed effects, μ r , accounts for unobserved time-invariant differences between regions, such as prevailing climatic norms and growth rates owing to historical and geopolitical factors. The use of yearly fixed effects, η y , accounts for regionally invariant annual shocks to the global climate or economy such as the El Niño–Southern Oscillation or global recessions. In our baseline specification, we also include region-specific linear time trends, k r y , to exclude the possibility of spurious correlations resulting from common slow-moving trends in climate and growth.

The persistence of climate impacts on economic growth rates is a key determinant of the long-term magnitude of damages. Methods for inferring the extent of persistence in impacts on growth rates have typically used lagged climate variables to evaluate the presence of delayed effects or catch-up dynamics 2 , 18 . For example, consider starting from a model in which a climate condition, C r , y , (for example, annual mean temperature) affects the growth rate, Δlgrp r , y (the first difference of the logarithm of gross regional product) of region r in year y :

which we refer to as a ‘pure growth effects’ model in the main text. Typically, further lags are included,