Size of Government and Intervention in the Economy Essay

Introduction, size of government, intervention in the economy, reference list.

The size of the government has become a sensitive issue in the last couple of years. The debate stems from the high cost of running the government. There have been concerns that a big government adds to the wage bill and does not help in service provision (Messmore, 2007). This paper will analyze the issue of government intervention in the economy while at the same time review the essence of the big government.

The emergence of an administrative state and the question of a big government reflects the phases, which countries go through. For example, the principle of administrative states was positive for managing the economy and, at the same time, offering direction to the nation (Gregg, 2004).

On the other hand, there have been different opinions on the state of a big government and how the latter could be an obstacle towards meaningful growth. It is necessary to note that government intervention is real and should not be underestimated. The economy requires a great deal of intervention in order for various elements to function properly.

The role of government in terms of intervening in the economy cannot be underestimated. There are many issues that surround the economy and, consequently, require urgent intervention by the government. For example, the question of social security is an important aspect that should be incorporated into any economy (Russell, 1935).

Social security means that citizens would be in a position of being cushioned against hard economic times during their working years and after retirement. Thus, the government is much needed in terms of developing a comprehensive social security mechanism that addresses the needs of citizens. This shows that, at some point, the government has to intervene in running the economy.

The second merit of a legislation such as the one mentioned above is that the population develops a savings culture. For example, social security requires that every citizen contributes to a fund upon which the funds are utilized at a later date. When most people embark on such a culture, the idea of saving becomes realistic.

From an economic point of view, a nation with a savings culture makes considerable progress in the long run as compared to regions where such funds do not exist. Social security can be described from the perspective of a fund that caters for the wellbeing of citizens.

Social security programs have been described as major drivers of progressivism. For example, when social security programs are unveiled, the government is able to initiate a considerable amount of economic development (Dreier & Flacks, 2003).

Progressivism entails making the right transition in relation to economic and social reforms. In this regard, the social security fund can be viewed as a social and economic tool that bolsters aspirations of any country (Halpin & Williams, 2010). In addition, these kinds of programs are important for estimating short- and long-term outlook of the country.

Economists believe that minimal government intervention is required for raising the economic prospects. However, little as well as no government intervention is not good and would lead to disastrous consequences.

In summary, it can be mentioned that social security programs are vital in terms of enhancing economic and social development of any country. As long as social security programs are firmly in place, there is every need to believe that the welfare of the people has been taken to account. Nothing beats a strong welfare system in any country.

Dreier, P., & Flacks, D. (2003). Patriotism and progressivism. Peace Review , 15 (4), 397-404.

Gregg, S. (2004). Markets, morality, and civil society. The Intercollegiate Review , 23-30.

Halpin, J., & Williams, C.P. (2010). Progressive traditions: The progressive intellectual tradition in America . Web.

Messmore, R. (2007). A moral case against big government: How government shapes the character, vision, and virtue of citizens. Web.

Russell, B. (1935). The case for socialism . Web.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 20). Size of Government and Intervention in the Economy. https://ivypanda.com/essays/size-of-government-and-intervention-in-the-economy/

"Size of Government and Intervention in the Economy." IvyPanda , 20 Feb. 2024, ivypanda.com/essays/size-of-government-and-intervention-in-the-economy/.

IvyPanda . (2024) 'Size of Government and Intervention in the Economy'. 20 February.

IvyPanda . 2024. "Size of Government and Intervention in the Economy." February 20, 2024. https://ivypanda.com/essays/size-of-government-and-intervention-in-the-economy/.

1. IvyPanda . "Size of Government and Intervention in the Economy." February 20, 2024. https://ivypanda.com/essays/size-of-government-and-intervention-in-the-economy/.

Bibliography

IvyPanda . "Size of Government and Intervention in the Economy." February 20, 2024. https://ivypanda.com/essays/size-of-government-and-intervention-in-the-economy/.

- Progressivism in the American Reform Period

- American Progressivism and Woodrow Wilson

- Administrative Progressivism in Relation to Online Learning

- Progressivism: Causes and Effects

- The History of Education and Progressivism

- Progressivism in American History

- The Progressive Era Significance

- Theodore Roosevelt and Contradictions of Imperialism

- Impact of philosopher to the educational process and purpose

- Progressive Ideology by President Roosevelt

- The Risks and Benefits of Outsourcing in Indonesia

- Hong Kong Economic Modernization

- India and Singapore’s Hard and Soft Infrastructure

- RMB's Depreciation Effect on the US MNCs

- Analyzing the Health Care System of Cuba

- Search Search Please fill out this field.

Why Do Governments Intervene?

- How Do Governments Respond?

The Federal Reserve System

- Achieving Financial Stability

- Government Policy FAQs

The Bottom Line

- Government & Policy

What Impact Does Economics Have on Government Policy?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Economic conditions often inform the policy changes that governments elect to enact. Specifically in the United States, government policy has always had a large amount of influence on economic growth, the creation of new business entities, and the success of financial markets.

In the broadest sense, a country's economic activity reflects what people, businesses, and governments want to buy and what they want to sell. Because the U.S. has a capitalist economy that relies on the principles of a free market, theoretically, it is primarily the decisions of consumers and producers that mold the economy.

Key Takeaways

- Economic conditions often inform the policy changes that governments elect to enact.

- In the U.S., government policy has always had a large amount of influence on economic growth and the creation of new business entities.

- For those in political power, having a track record of economic growth is often an important consideration (especially if they are in a position of seeking re-election).

- To ensure strong economic growth, there are two main ways that the federal government may respond to economic activity: fiscal policy and monetary policy.

- In the U.S., the Federal Reserve System directs the country's monetary policy.

The government may decide to regulate some aspects of economic activity in order to engineer economic growth or prevent negative economic conditions in the future. In general, a government's active role in responding to and influencing the economic circumstances of a country is for the purpose of preserving and furthering the economic interests of the general public.

For those in political power, having a track record of economic growth is often an important consideration (especially if they are in a position of seeking re-election). In the U.S., many studies have shown that the economy is a major factor that affects how people vote (specifically in the U.S. presidential election). Strong economic growth typically translates to high job creation, stronger wage growth, better financial market performance, and higher corporate profits.

How Do Governments Respond to Economic Activity?

To ensure strong economic growth, there are two main ways that the federal government may respond to economic activity: fiscal policy and monetary policy .

Monetary Policy

One of the most common ways that a government may attempt to influence a country's economic activities is by adjusting the cost of borrowing money. This is most often done by lowering or raising the federal funds rate , a target interest rate that impacts short-term rates on debt such as consumer loans and credit cards. The Federal Reserve increases the federal funds rate to constrict economic growth and decreases the federal funds rate to encourage economic growth.

Another form of monetary policy is the act of the Federal Reserve buying and selling government securities. When the Fed buys a security from a bank, it increases the money supply by injecting funds into that bank. Alternatively, it can sell securities to remove cash and decrease the money supply.

Monetary Policy Example

In response to the COVID-19 pandemic, the Federal Reserve quickly reduced the federal funds rate to 0%. By setting prevailing interest rates very low, the Federal Reserve attempted to support economic activity, maximize employment, and meet price stability goals.

Fiscal Policy

The government may also enact policies that adjust spending, change tax rates, or introduce tax incentives. In regard to government budgets, the government identifies whether or not it wants to spend more money than it anticipates collecting. This process of evaluating public spending aims to promote economic prosperity or cool an overheated economy.

Instead of focusing on how the government spends money, common fiscal policy revolves around how the government collects money. Offering tax incentives, additional tax credits, or lowering tax rates decreases the economic burden on citizens and promotes economic growth. Striking down favorable tax laws or increasing taxes slows economic activity.

Fiscal Policy Example

In response to the COVID-19 pandemic, the Federal government awarded economic impact payments (i.e. stimulus checks) to qualifying Americans. The government directly sent eligible individuals money to promote economic activity and encourage household spending.

Fiscal and monetary policies are both intended to either slow down or ramp up the speed of the economy's rate of growth. This, in turn, can impact the level of prices and the employment rate in the country. However, there are subtle differences between these two types of government action.

Differences Between Government Policies

Change in the money supply or how easy credit is to obtain

Adjustment in federal funds interest rates or money supply

Set by Central Bank

Heavily independent of the political process

Impacts debt industries like housing market

Change in how the existing monetary supply is utilized

Adjustments in government spending and tax rates

Set by Federal Government

Heavily integrated with political process

Impacts government budgets/net deficits

In the U.S., the Federal Reserve System directs the country's monetary policy. The Federal Reserve System—also called "the Fed"—is the central bank of the United States. Established in 1913 by Congress, the Fed controls the money supply and actively uses policy to respond to and influence economic conditions.

The Fed adjusts the interest rate that banks charge to borrow from one another. (This cost is then passed onto consumers.) The Fed may lower the interest rate to keep borrowing cheap, ensure that credit is widely available, and boost consumer (and business) confidence. Conversely, the Fed may decide to raise interest rates in a strong economy, or in response to inflation concerns—the increase in prices that occurs when people have more to spend than what's available to buy.

In the two ways governments can intervene in the economy, you'll note that monetary policy is set by the Federal Reserve, an independent entity technically not part of the Federal government. On the other hand, fiscal policy requires political intervention and majority approval (for items not issued by executive order by the President).

Achieving Financial Stability in the U.S. Economy

Prior to the creation of the Fed in 1913, the U.S. had experienced several severe economic disruptions as a result of massive bank failures and business bankruptcies. As an institution, the Fed was tasked with ensuring financial stability in the U.S. economy.

After the Great Depression , the greatest threat to the stability of the U.S. economy was recessionary periods: periods of slow economic growth and high unemployment rates. In combination, these two factors created a sustained period of decline in the gross domestic product (GDP). In response to this, the government increased its own spending, cut taxes (in order to encourage consumers to spend more), and increased the money supply (which also encouraged more spending).

Beginning in the 1970s, a different economic reality emerged. This expansionary economy with substantial money supply growth led to a sustained period of a high level of inflation. In response to these economic factors, the U.S. government started focusing less on combating recession and more on controlling inflation. Thus, the government enacted policies that limited government spending, reduced tax cuts, and limited growth in the money supply.

At this time, the government also shifted away from its reliance on fiscal policy—the manipulation of government revenues to influence the economy. The fiscal policy did not prove effective at addressing high levels of inflation, high levels of unemployment , and vast government deficits. Instead, the government turned to monetary policy—controlling the nation's money supply through such devices as interest rates—in order to regulate the overall pace of economic activity.

Since the 1970s, the two main goals of the Fed have been to achieve maximum employment in the U.S. and to maintain a stable inflation rate. This dual mandate is difficult to achieve; by combating one of the goals, it becomes more difficult to fight the other.

While outside events may influence economic activity, governments use economic means to enact changes as they see fit. This may include changes to tax policy, adjustments to the federal funds rate, fluctuations in the money supply, or alternations to government spending.

Should the Government Intervene in the Economy?

Whether or not the government should intervene in the economy is a deeply-rooted philosophical question. Some believe it is the government's responsibility to protect its citizens from economic hardship. Others believe the natural course of free markets and free trade will self-regulate as it is supposed to.

Why Might the Government Intervene in the Economy?

The government has an inherent interest in protecting the well-being of its citizens. Due to prevailing conditions in the world, the government might see fit to enact certain legislation to preserve the quality of life for its citizens. The government might also enact legislation to promote economic well-being and equity across different socioeconomic classes.

What Are Some Ways the Government Intervenes in the Economy?

The government has two primary ways of interacting with the economy. Through monetary policy, the government controls prevailing interest rates and makes obtaining debt easier or harder. Through fiscal policy, the government controls spending levels and how to allocate resources.

Keynesian economic theory holds that governments should hold their citizens out of a recession. Governments do this by enacting monetary and fiscal policies. By having a central bank (i.e. the Federal Reserve), the United States has the ability to manipulate economic policy in an attempt to intervene when appropriate.

U.S. Department of State. " U.S. 2022 Midterm Elections: Role of the Economy in Elections ."

Sage Publications. " Economic Perceptions and Voting Behavior in US Presidential Elections ."

Federal Reserve Board. " Monetary Policy Principles and Practice ."

Federal Reserve Board. " Federal Reserve issues FOMC statement, March 15, 2020 ."

Internal Revenue Service. " Economic Impact Payments: What You Need to Know ."

Federal Reserve Board. " What Is the Purpose of the Federal Reserve System? "

Federal Reserve History. " The Great Inflation ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-168701692-0bca0d25eb564072815026f1b2ebc2e9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

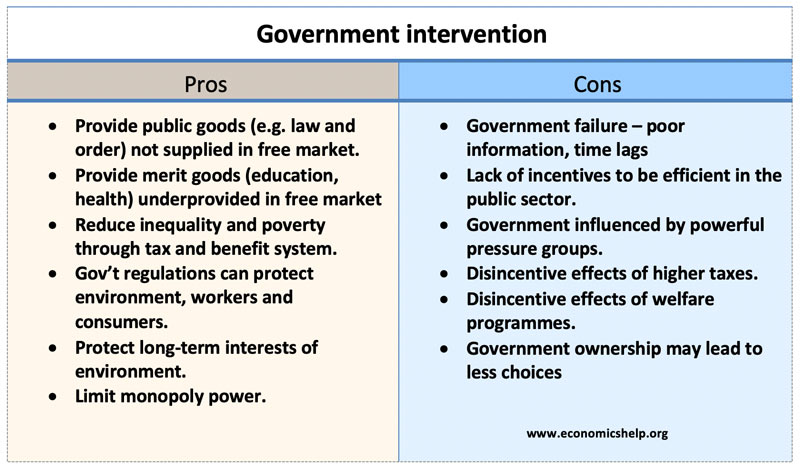

Pros and cons of government intervention

A key economic debate is the extent to which should governments intervene in the economy?

- At one extreme, free-market economists/libertarians, argue that government intervention should be limited to all but the most basic services, such as the protection of private property and the maintenance of law and order.

- At the other extreme, Marxist economists argue that the government should intervene in all areas of the economy to ensure the most efficient and equitable distribution of resources.

In between, most economists believe it is a question of balance, with the government intervening in areas where the market fails to provide a desirable outcome. Main areas of government intervention include:

- Provide public goods (e.g. national defense) from general taxation

- Provide basic health care and education standards.

- Environmental regulation and protection.

- Limit the power of monopolies.

- Regulation on worker rights.

Reasons for Government intervention

- Equality . In a free market, there is likely to be significant inequality and poverty. This is not due to a meritocracy, but it could be due to unfair advantages of circumstances (inherited wealth, superior education). Governments can intervene to provide a basic security net – unemployment benefit, minimum income for those who are sick and disabled. This increases net economic welfare and enables individuals to escape the worst poverty. This government intervention can also prevent social unrest from extremes of inequality.

- Public goods . Public goods tend not to be provided in a free market because there is no financial incentive for firms to provide goods that people can enjoy for free. Governments can provide national defence, law and order and pay for it out of general taxation. Looking after the environment is also a public good, there are an increasing number of areas, where a government is needed to deal with issues such as forest fires, rising sea levels and pressure on water supplies.

- Education . Merit goods are under-consumed in free-market because people underestimate the personal benefits and/or ignore the external benefits. This leads to an underprovision of health care and education. Government intervention to provide free education can lead to a significant improvement in the quality of life for people who are educated. There are also many positive externalities to the rest of society. A well-educated society can improve labour productivity and economic growth.

- Shift consumer behaviour . The consumption of demerit goods like alcohol, tobacco and opiates can cause personal costs and significant social costs (e.g. crime). If the government identifies damaging goods, they can slowly change consumer behaviour – such as using higher tax, advertising campaigns and behavioural economics , e.g. making cigarettes difficult to buy with unappealing packets. Long-term government campaigns to reduce smoking in the UK and US have been effective in reducing smoking rates – something that has helped to increase life-expectancy.

- Environment . The environment is an area with a significant need of government intervention. The free market ignores external costs of business on the environment. It also fails to consider long-term considerations. For example, market forces may lead to the burning of fossil fuels, which cause increasing environmental problems around the world – which will get worse in the future. Given the potential costs to future generations, there needs to be government action to shift behaviour to renewable energy which doesn’t cause these environmental costs. Also, the environment involves many issues where private ownership does not apply. If pollution causes a worsening air quality, then this affects everyone on the planet, but market mechanisms do not provide an opportunity to deal with the issue. (If someone pollutes your back-garden, you can sue them. But, if air quality deteriorates, who takes action?

- Monopoly power. In a free market, firms can gain monopoly power to charge high prices to consumers and monopsony power to pay lower wages to workers. This increases inequality and deadweight welfare loss . Government intervention to limit mergers and monopoly power can lead to increased economic welfare.

- Strategic planning on infrastructure . Another limitation of the free market is to underinvest in quasi-public goods like roads and railways. This can lead to transport bottlenecks. Governments can plan for future transport trends and invest in the roads and railways which are needed for the future.

Disadvantages of government intervention

- Government failure . Government failure is a term to describe how government intervention can cause its own problems. For example, the government may take decisions for short-term political consideration which lead to an inefficient outcome. For example, government tariffs to protect domestic industry spark off a trade war, where the economy contracts.

- Lack of incentives . In the free market, individuals have a profit incentive to innovate and cut costs, but in the public sector, this incentive is not there. Therefore, it can lead to inefficient production. For example, state-owned industries have frequently been inefficient, overstaffed and produce goods not demanded by consumers.

- Political pressure groups . Milton Friedman once quipped ‘There is nothing as permanent as a temporary government bailout.’ He was referring to farming subsidies. Introduced in the 1930s during the Great Depression to alleviate a farming recession. After the Second World War, no government dared to remove subsidies because farmers were a powerful pressure group who wanted to keep the subsidies.

- Less choice . Often government intervention in the economy (e.g. nationalisation of industries) has been associated with less choice. Government produced services have a monopoly. Command economies, often had very little choice as government decided what to produce. Choice is an important element of economic freedom and being able to maximise individual welfare. (Not all government intervention leads to less choice.

- Impact of personal freedom. An increasing aspect of government intervention is through efforts to shift consumer behaviour – e.g. reduce congestion, improve health through reducing smoking rates and a healthier lifestyle. This includes taxes, behavioural influences and regulations. Sometimes people can feel this is overbearing on their individual choice.

Example of government intervention in health care

Pros of intervention.

- The government can provide universal health care so no-one dies due to lack of affordability.

- Universal government health care is fair.

- Health care is considered a human right and intrinsic to good quality of life

- Better health care can improve long-term labour productivity as workers with better health can work for longer and take less time off due to sickness.

- Government health care can prevent the stress and costs of going bankrupt from medical bills. In the US where the private sector has large role, unexpected medical bills cause bankruptcy. (66% of bankruptcy-related to health costs – CNBC )

- Economies of scale in government provision. The government can bulk buy medicines, supplies and also offer specialised services.

- The government can provide medicines at cost rather than for the inflated prices of the private sector.

- The government can ration health care to where it is actually needed and helpful. Under a system of private insurance where someone else is paying, millions may be spent on treatments with only very marginal improvements on the quality of life. Government health care has to use resources where it is needed. The private sector may push treatments like plastic surgery which are of doubtful value.

- It is argued the private sector have a profit incentive to cut costs and be more efficient. However, in health care, this is not the case. Doctors and nurses are not motivated like profit as in other sectors. Cutting costs may involve cutting the quality of care.

- If firms don’t have to provide private health care costs, it will reduce the costs of employing workers.

Cons of intervention

- Government provision may reduce the choice of individuals who prefer to choose their private insurers and doctor.

- The private sector may have profit incentives to cut costs and offer innovative new treatments that would be desired.

- With government provision, services may be limited by tax revenue. It is more likely that services will be rationed leading to longer waiting lists and some treatments not available.

- Government health care will require higher tax. Higher income tax may lead to lower incentives to work (though whilst taxes will rise, health insurance costs will be lower.)

- Government Intervention in Markets

- Market Failure

11 thoughts on “Pros and cons of government intervention”

Can I get the possible effects of a government intervening in the labour Market by imposing a minimum wage

thank you very much🙏🏽🙏🏽

Thank you I appreciate🙏🙏🙏🙏

Really helpful with my Foundations economic studies. Recommend for my other colleague to use it too.

Thank you Gurame

Very helpful. Thank you for providing me with this useful information that I needed for my economics class. Much appreciated.

Thank you so much, this article was well put together, and I appreciate the step by step, easy to understand format. Have a good one.

“GOVERNMENT” Should not get invoked with the poor! Governments requires numerous hundred thousand dollar a year employees and pension and health benefits forever, for people working w/ an gov-Agency! Give it to the Salvation Army & charity groups!!

Comments are closed.

- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical Literature

- Classical Reception

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Archaeology

- Greek and Roman Papyrology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Agriculture

- History of Education

- History of Emotions

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Variation

- Language Families

- Language Evolution

- Language Reference

- Language Acquisition

- Lexicography

- Linguistic Theories

- Linguistic Typology

- Linguistic Anthropology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Modernism)

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Culture

- Music and Media

- Music and Religion

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Science

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Lifestyle, Home, and Garden

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Society

- Law and Politics

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Clinical Neuroscience

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Oncology

- Medical Toxicology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Medical Ethics

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Games

- Computer Security

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Neuroscience

- Cognitive Psychology

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business History

- Business Ethics

- Business Strategy

- Business and Technology

- Business and Government

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic Methodology

- Economic History

- Economic Systems

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Natural Disasters (Environment)

- Social Impact of Environmental Issues (Social Science)

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- International Political Economy

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Theory

- Political Behaviour

- Political Economy

- Political Institutions

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Politics and Law

- Public Policy

- Public Administration

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Developmental and Physical Disabilities Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

- < Previous chapter

- Next chapter >

9 Government Intervention in the Economy

Author Webpage

- Published: September 1998

- Cite Icon Cite

- Permissions Icon Permissions

Discusses the attitudes of Western European publics towards economic liberalism and economic interventionism during the past few decades. While beliefs about the desirability of state intervention in the economy, and of state ownership of public assets are central to modern political ideologies, there is scant evidence that interventionism and liberalism constitute opposite positions in the public mind. Questions of whether governments should practice economic interventionism, or whether assets should be removed into government ownership, tend to be answered not in terms of philosophical principle, but in terms of whether the government is felt to be worthy of the powers entrusted to it. Interventionism tends to be supported by those who lose out under laissez‐faire economies, by women, by young people, and by old people. These tendencies can be explained by the fact that, on the whole, it is middle‐aged men who tend to profit most from the liberal capitalist system.

Signed in as

Institutional accounts.

- GoogleCrawler [DO NOT DELETE]

- Google Scholar Indexing

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

Institutional access

- Sign in with a library card Sign in with username/password Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Sign in through your institution

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Sign in with a library card

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

- Skip to primary navigation

- Skip to main content

- Skip to footer

Better Knowledge. Your Insight Is Sharper

Government Intervention: Examples, Reasons, and Impacts

Updated on April 10, 2022 by Ahmad Nasrudin

What’s it : Government intervention refers to the government’s deliberate actions to influence resource allocation and market mechanisms. It can take many forms, from regulations, taxes, subsidies, to monetary and fiscal policy. In some cases, the government also sets maximum and minimum price limits on the market.

Government intervention and the economic system

Broadly speaking, the significance of the intervention depends on the economic system adopted by a country.

Under a command economy system , government intervention is highly significant. The government determines what is best for the economy and society. It allocates resources and determines the production and distribution of goods.

The private sector’s role is minimal or even zero. Under a command economy system, the market mechanism does not work.

In contrast, a free-market economy operates in reverse compared to a command economy. The free market system emphasizes the minimization of intervention. The private sector plays a significant in the allocation of economic resources.

The market operates freely through a supply and demand mechanism. This mechanism directs the allocation of resources more efficiently than the command economy system. Under this system, the government’s role is usually limited to enforcing rules to recognize and protect private property ownership.

Furthermore, under a mixed economy system , interventions are more diverse than in a market economy, but not as extreme as a command economy. The government has a role, and so does the private sector.

The significance of the roles of the government and the private sector also varies between countries. Some countries, such as China and Cuba, are more inclined towards a command economy. The government plays a significant role. Meanwhile, in countries such as the United States and the United Kingdom, the private sector plays a more dominant role in managing economic resources.

Reasons for government intervention in the economy

The government intervenes in the economy with several objectives, such as:

Redistributing income and wealth. For example, the government launched various welfare programs such as unemployment insurance, health, and free education. It sustains the quality of life of those who are economically disadvantaged. Taxation is also another avenue for redistribution of income.

Providing public goods . Examples of public goods are public parks, infrastructure, and national defense. The private sector often does not want to provide it because it is unprofitable. Hence, the government took a role.

Promoting fair competition . Through antimonopoly regulations, the government prevents unfair competition practices such as collusion and predatory pricing.

Securing and spurring the domestic economy. For example, the government set trade barriers to protect domestic industries from competing imported products. So, they continue to grow and create more jobs.

Protecting people . For example, the government launched a consumer protection policy, quality requirements, occupational safety, and the environment.

Changing consumer behavior . Intervention is one way to reduce the impact of negative externalities. For example, the government could increase taxes on products such as alcoholic beverages and tobacco.

Preserving the environment . Without government regulations and policies, companies are more likely to ignore external costs to the environment. They overexploit natural resources or allow waste to flow into the environment without further treatment. Such practices certainly jeopardize the long-term sustainability of the economy.

Achieving macroeconomic goals. The four macroeconomic goals are sustainable economic growth, full employment, low inflation, and balance of payments equilibrium.

Ways of government intervention

Government intervention takes many forms, from the micro to the macro level. In this article, I try to group them into the following categories:

Economic policy

Regulations, price controls.

The economic policy falls into two main categories:

Supply-side policy

- Demand-side policy

The government designs supply-side policies to influence aggregate supply in the economy. Typically, these policies focus on increasing production efficiency, either in product markets or factor markets (e.g., labor market).

In the product market, the government promotes competition by launching antimonopoly, deregulation , and privatization policies. Competition forces producers to be more efficient and innovative to stay in the market and make a profit.

Furthermore, in the labor market, the government is trying to improve labor mobility and quality. That is through various programs such as education, training, and reduction of union power.

Demand-side policies

Demand-side policies consist of fiscal policy and monetary policy. The government is responsible for the fiscal policy through changes in its spending and taxes. Meanwhile, monetary policy is under the responsibility of the central bank or monetary authority. It seeks to influence the money supply in the economy. Both affect the economy through their effect on aggregate demand.

To stimulate economic growth, the government and the central bank adopted expansionary policies. That is usually during a weak economy, such as an economic recession. The options are to:

- Increase government spending

- Lower taxes

- Cut policy rates

- Open market operations through central bank purchases of government securities

- Lower the reserve requirement ratio

Meanwhile, to avoid high inflationary pressure, both implement a contractionary policy. High inflation endangers economic stability and can lead to hyperinflation. Among the options for implementing a contractionary policy are:

- Reducing government spending

- Lifting taxes

- Raising the policy rate

- Open market operations by selling government securities

- Raising the reserve requirement ratio

The government ensures that economic activities run healthily. Several regulations aim to encourage business activity. While others, to control business activities and avoid unwanted results or negative externalities.

There are many variations of government regulations, and each affects economic activity in different ways. The following are several categories of government regulations:

Employment . The government issues rules, regulations, and laws regarding wages, fair recruitment, and workforce health and safety.

Environment . For example, the government launches various regulations regarding the environmental impact of company operations on the surrounding environment, such as environmental safety standards and waste management.

Consumer protection . The focus is to protect consumers from unfair practices related to price rules, health and safety standards, and product descriptions.

Competition . It is in the government’s interest to promote fair competition. These types of rules and regulations include antitrust and merger and takeover regulations. This category includes deregulation, namely eliminating regulations or restrictions such as limits on foreign investors’ share ownership.

Information and reporting . An example of these rules and regulations are accounting standards and the security of consumers’ personal information.

Taxes are the main source of government revenue. The government uses it to finance several programs and to pay off debts. In addition to government operations, the government uses taxes to increase economic capital by providing public goods such as roads, bridges, trains, public parks, and national defense. This economic capital is vital for increasing the production capacity of the economy in the long run.

The government collects taxes from taxpayers, which come from the household and business sectors. The government can impose it directly on taxpayers, such as through income tax and profit tax. Or, it is indirectly as in sales tax and value-added tax.

Tax is a means of redistribution of income. Also, taxes affect the financial behavior of businesses and households. For example, an increase in taxes reduces household disposable income . Therefore, households tend to spend less on goods and services.

Under a price control policy, the government sets price limits for certain goods and services. The two forms of price control are:

Price ceiling

Price floor.

Price ceilings limit the maximum prices for goods and services. Suppliers cannot charge a price higher than that price. The purpose of a price ceiling is to protect consumers by ensuring it is affordable to as many consumers as possible. An example is the rental price of residential property.

To be effective, the government sets a price ceiling below the free-market equilibrium price.

Setting a price ceiling has the following implications:

Bringing up the shortage . Due to lower prices, more consumers are asking for it. Conversely, lower prices make fewer producers willing to supply. Therefore, the market will experience excess demand (shortage), where the quantity demanded exceeds the quantity supplied.

Less efficient and decreasing economic surplus. Economic surplus is the sum of consumer surplus and producer surplus. Due to lower prices, the producer surplus will decrease. They get less profit. Meanwhile, even though consumers get lower prices, however, they face a shortage. Supply decreases because producers supply fewer goods.

Rationing . Because of the shortage, consumers have a more challenging time finding goods. Suppose it goes on for a long time. In that case, the government may need to ration goods to ensure their availability for as many consumers as possible.

Raising a black market. The black market thrives on shortages. The producer may sell at a higher than the ceiling on the black market. Likewise, some consumers who already own goods will sell back to other consumers at a higher price to profit.

It is the minimum price that can be charged for a good or service. Its purpose is to protect suppliers of goods or services.

The most quoted example of a price floor is the minimum wage. In this case, individuals act as suppliers of labor services, while companies are buyers. With the minimum wage, workers make enough money from their jobs to meet their basic needs.

To be effective, the government sets the price floor above the equilibrium price. Because prices are higher, more and more suppliers are willing to supply goods and services. On the other hand, the quantity demanded is less because the price becomes more expensive for consumers. As a result, the market will experience an excess supply, where the quantity supplied exceeds the quantity demanded.

The government also provides subsidies to households or companies. Examples include fuel oil, public health care, education, research and development, fertilizers, and raw materials subsidies. Soft loans also fall into this category.

The provision of subsidies reduces the burden on households. They spend less money on these goods and services, enabling a better standard of living.

For companies, subsidies reduce production costs. It stimulates them to produce more. Also, they can sell at a lower price, making the product more competitive in the market.

Disagreements among economists

Some economists view government intervention as necessary. However, they are still arguing about how much the government should intervene and how they should intervene. In macroeconomics, both gave rise to schools of thought: Keynesian economics and Neoclassical economics.

Keynesian views that the government should intervene. When there is a disequilibrium, the economy will not move towards the new equilibrium by itself.

Take the case when the economy is depressed. Among the solutions to getting out of the economic depression is stimulating government spending, which is a part of aggregate demand.

As we know, aggregate demand consists of household consumption, business investment , government spending, and net exports. Net exports are beyond the control of the domestic economy because they depend on global economic conditions. Thus, the main options for stimulating aggregate demand are through consumption, investment, and government spending.

But, during the economic depression, business profits worsen as demand falls. Likewise, household income drops due to high levels of unemployment. Therefore, it is almost impossible to increase consumption and investment during the depression.

Thus, a more sensible option would be to increase government spending. The budget depends more on discretionary government policies than on economic conditions.

In contrast, Neoclassical economists view government intervention should be minimal. The market mechanism will work and direct the economy towards equilibrium. According to Neoclassical economists, supply and demand are the main factors that determine goods, output, and income in an economy. So, government intervention will only make the economy no better.

Negative effects of government intervention

Although the aim is positive to build the economy and society’s prosperity, interventions often result in unintended consequences. The following are the opposing sides of government intervention in the economy:

Government failure . It happens when the intervention doesn’t produce better results. The market becomes inefficient in allocating resources. The government may also consider short-term effects rather than the long-term. For example, trade barriers protect domestic industries. But, it also disincentives producers to be more innovative and more efficient. Likewise, in the case of production subsidies.

Increased costs . For example, companies have to spend more money to meet product safety and health standards. They also bear the cost of further processing the production waste.

Fewer options . In an extreme case is the command economy. The government decides what to produce and how to distribute it.

Discrimination policy. Intervention may be beneficial for some, but detrimental for others. Take competition policy, for example. The government may favor state-owned companies over private companies. Likewise, in a bailout, the government used tax revenues to save the big banks instead of all the banks.

5 NEW ARTICLES

Private Savings: Formula and Explanation

What's it: Private savings equal to the sum of household and business savings. And savings

How to Handle and Resolve Stakeholder Conflicts

Stakeholders have different interests and goals, which are often contradictory. Stakeholder

Where Do Comparative Advantages Come From?

The comparative advantage stems from the ability to produce goods and services at low opportunity

What are the Benefits of International Trade?

Increased access to cheaper and more varied goods and services is key benefits of international

What is the Capital Budgeting Process?

In simple terms, the capital budgeting process involves generating ideas, making proposals about

5 TRENDING ARTICLES

- Small Business: Characteristics, Importance, Disadvantages

- Why is the Business Environment Important? What are the Factors?

- Business Size: Definition, Measurement, Classification

- What Are the Effects of Industrialization? [Positive and Negative Impacts]

- Shamrock Organization: How it Works, Advantages and Disadvantages

EXPLORE MORE

Thursday, May 10, 2007

Government intervention in the macro economy..

- Supply Side Policies.

- Interventionist . Government intervention to overcome market failure. For example, spending on education and training to reduce occupational immobilities.

- Market Oriented supply side polices : This occurs when the government reduces regulations and enables market to work more freely. For example, reducing the power of trades unions and minimum wages can reduce labour market inflexibility's.

- They will take a long time, e.g. increasing education standards.

- May be subject to government failure. e.g. spending on education misplaced.

- Promoting free markets may increase inequality. E.g. removing trades unions may lead to worker exploitation.

- Supply side policies UK

- Fiscal Policy - changing the level of government spending and taxation in the economy. It will effect the government's budget and fiscal position.

- Monetary Policy - Influencing the supply and demand for money. In the UK monetary policy revolves around changing interest rates, which are set by the MPC (Bank of England).

- The government could pursue deflationary fiscal policy. This involves increasing tax rate and / or cutting spending.

- The MPC could increase interest rates. This is known as a tightening of monetary policy. Note, in the UK the government no longer sets monetary policy, the Bof E is independent.

- Government can introduce Expansionary Fiscal Policy. This involves cutting taxes and / or increasing spending, AD should increase.

- The MPC can cut interest rates.

- It is difficult to control predict future economic trends, therefore, it can be difficult to know how much to change tax rates / interest rates.

- Time Lags, Interest rates can take upto 18 months to have an effects.

- Crowding out. Expansionary fiscal policy may increase government spending, but, reduce private sector spending.

- Depends on Confidence. For example, a cut in income tax may not increase AD, if confidence is low.

Post a Comment

Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema. Learn more →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Government Intervention

Government intervention is regulatory action taken by government that seek to change the decisions made by individuals, groups and organisations about social and economic matters.

Government intervention is any action carried out by the government that affects the market with the objective of changing the free market equilibrium / outcome.

- Share on Facebook

- Share on Twitter

- Share by Email

Edexcel A-Level Economics (A) Theme 1 Knowledge Organiser

Exam Support

In the News Teaching Activity – growing obesity and its health costs (Mar 2024)

7th March 2024

In the News Teaching Activity – will the government’s latest dental policies get to the root of the NHS dentist shortage problem? (Feb 2024)

15th February 2024

In the News Teaching Activity – Lack of competition in the baby milk formula market is adding to the cost-of-living crisis (Dec 2023)

4th December 2023

Government Intervention - Australia Bans Imported Disposable Vapes

28th November 2023

Is the sugar tax cutting teeth extractions among the young?

17th November 2023

Government Intervention - Price paid for UK offshore power to rise by 66%

16th November 2023

4.1.8.9 Government Intervention - Maximum Prices (AQA A-Level Economics Teaching PowerPoint)

Teaching PowerPoints

4.1.8.9 Government Intervention - Minimum Prices (AQA A-Level Economics Teaching PowerPoint)

Market failure and government failure: could a tax curb meat’s health and environmental problems.

Study Notes

1.4.1 Maximum Prices (Edexcel A-Level Economics Teaching PowerPoint)

1.4.1 minimum prices (edexcel a-level economics teaching powerpoint), 1.4.1 government intervention in markets (edexcel), 1.1.6 free market economies, mixed economy and command economy, 1.3.2 externalities and government intervention (edexcel a-level economics teaching powerpoint), in the news teaching activity: vaping and negative externalities (sept 2023).

11th September 2023

Government Intervention - Is it Time for a Meat Tax?

France to spend €200m on destroying excess wine as demand falls.

27th August 2023

What are unintended consequences in economics?

What are economic incentives and why are they important, government intervention - evaluating uk steel subsidies.

Topic Videos

Revision Session on Government Intervention

3rd May 2023

De-Merit Goods - Australia to ban recreational vaping

Norway's salmon tax - a leap towards sustainability.

4th April 2023

De-merit goods - should the government toughen gambling laws?

29th March 2023

Economic Development - Do Buffer Stocks Work?

Market failure and government intervention - the row over london’s ultra-low emission zone.

7th March 2023

Can buffer stock schemes help to promote economic growth and development in low income countries?

Should home insulation in the uk be subsidised.

16th February 2023

Government Intervention - What is a Pigouvian Tax?

Significance of ped with indirect taxes, uk bus price cap scheme is extended.

19th December 2022

New Zealand legislates to ban cigarettes for future generations

15th December 2022