Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Testimonials

Accounts Payable Process Flowchart Guide (+ Diagrams & Templates)

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

Like all accounting processes, the complications of the Accounts Payable (AP) process lie in the sheer volume of AP work an accounting firm may have to do for its clients.

Accounting firms often handle hundreds (or more) of accounts payable transactions for clients in a month. This can overwhelm even the most experienced accounting professionals.

The higher the number of AP work an accounting firm does, the higher the chances of error, especially when delegated to new staff.

Meanwhile, a single error in Accounts Payable work can cost your client money and valuable supplier relationships.

This is where Accounts Payable flowcharts come in handy. Flowcharts enable you to present the procedure for completing your Accounts Payable work in a diagram. This makes it easier for new staff members to understand how the tasks in the process fit together.

This article shows how you can create your Accounts Payable flowcharts (with examples to inspire you). Once you’re done creating your flowcharts, you can add the images to your projects in Financial Cents to help your staff complete the process faster and more efficiently.

Benefits of the Accounts Payable Process Flowchart

A. provides clarity and understanding.

The human mind processes visual information better than tabular or textual information.

By representing your workflow steps in a visual form, your staff members will find your standard operating procedures easy to follow. Ultimately, it empowers them to do their best work.

b. Simplifies Complex Process

Accounts Payable flowcharts help you bypass the need to explain complex workflows with many words.

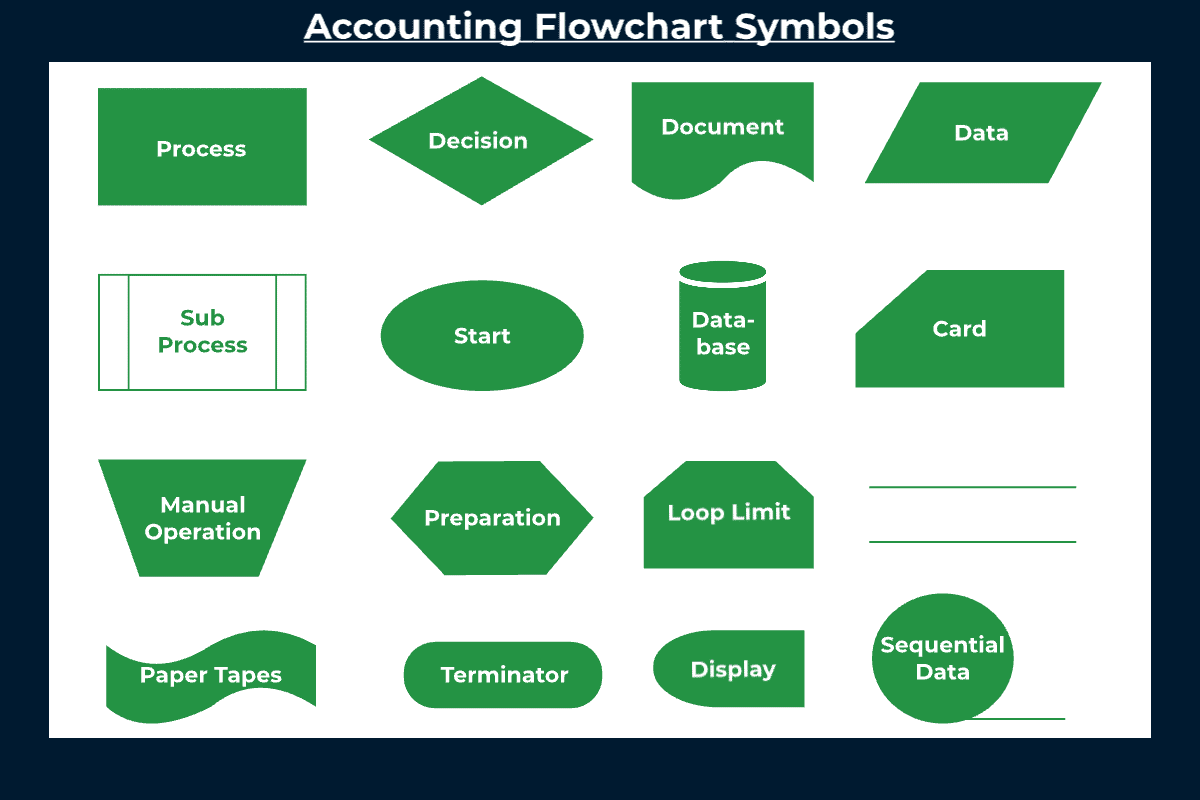

Flowcharts use conventional symbols (like rectangles, arrows, and diamond shapes) to provide context and direction to your workflow steps.

This enables you to communicate complex processes more simply.

c. Improves Efficiency and Optimization

When your AP staff can see the flow of work effortlessly, they won’t waste time figuring out what to do next.

That way, they can focus on completing the process efficiently.

d. Enhances Communication and Collaboration

Accounts Payable flowchart enhances communication and collaboration by helping team members share ideas that enable them to overcome challenges in their AP process.

Flowchart software makes collaboration even better. They allow you to invite your team members to share their thoughts on your AP workflow process.

e. Supports Continuous Improvement

With flowcharts, it is easier to spot the cause of bottlenecks in your Accounts Payable process (like a step that delays the process, a step that can be left out). This makes improving the process much easier.

Recommended

How to optimize your Accounts Payable Workflow: A Step-by-Step Guide

Breakdown of the Accounts Payable Process Flow

I. receive supplier bill.

Your AP work starts when the supplier bills you for the goods or services they delivered to you.

The supplier bill contains information about the transaction: quantity delivered, the amount owed, and payment information, among others.

ii. Data Entry

After receiving the supplier’s bill, it’s time to enter the information into the financial system. You’d want to be careful here; even a small error can affect the outcome of the process.

For example, entering the wrong bank details may result in the wrong supplier being paid.

Interestingly, errors are more likely at this stage due to manual data entry systems. If your AP team enters invoice data manually, someone will lose concentration and enter the wrong information sooner rather than later.

With an accuracy of up to 99% , automated data extraction tools will significantly reduce human errors in your Accounts Payable process.

iii. Matching

This is where you verify the accuracy of the information in the bill by cross-referencing it with the purchase order and the goods or services delivered.

When done well, this task saves your client the error of over or underpayment. Once the information matches, the bill can be sent to the relevant persons for approval.

iv. Discrepancy Resolution

Sometimes, the information on the purchase order and bill and the goods delivered do not match.

Imagine this scenario: your client receives a bill for five desktop computers. Upon delivery, one unit was found to be below standard. So, your client rejected it. However, the supplier is under the impression that five items were delivered.

In such an instance, your client has to resolve the difference in the quantity and amount of products received. That’s what this step helps with.

Once the discrepancy has been resolved, the supplier will issue a fresh bill matching the delivered products.

v. Approval Workflow

When bills have been verified and all errors resolved, they are sent for approval. Depending on a firm and client’s approval workflow, it can be sent to the person or department that received the goods or services.

Some organizations send payments above a certain amount to multiple persons for approval.

A common challenge here is sending the bill to the wrong person or department for approval, causing delays and possible late payments.

vi. Payment Processing

At this point, the supplier and the business (your client) agree on the amount to be paid and the preferred payment system.

Once the payment is due, your client is expected to send the money to the supplier through whatever payment system they agree to use. The most common payment methods are check, ACH, credit card, and electronic payment.

vii. Record keeping

Keeping up-to-date records is good for your client’s operation and regulatory compliance. In the United States, for example, businesses are required to keep transactions like Accounts Payable on file for a minimum of seven (7) years.

On the business side, up-to-date records of Accounts Payable transactions help your client manage their cash flow and payment obligations. This is important for accurate financial statements and possible Internal Revenue Service (IRS) audits.

viii. Reconciliation

This is where you reconcile your client’s accounts to ensure that their outstanding bills and the vendor statements match the Accounts Payable balance in their accounting ledger.

Accounts Payable Process Flowchart Diagrams and Templates

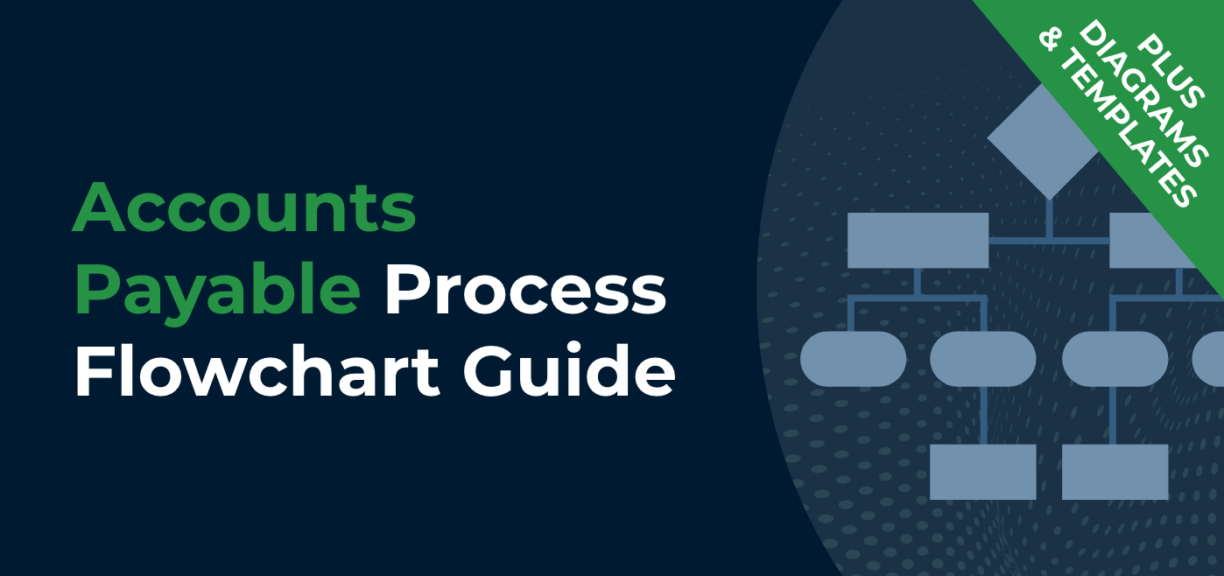

1. accounts payable process flowchart.

Download the editable version here

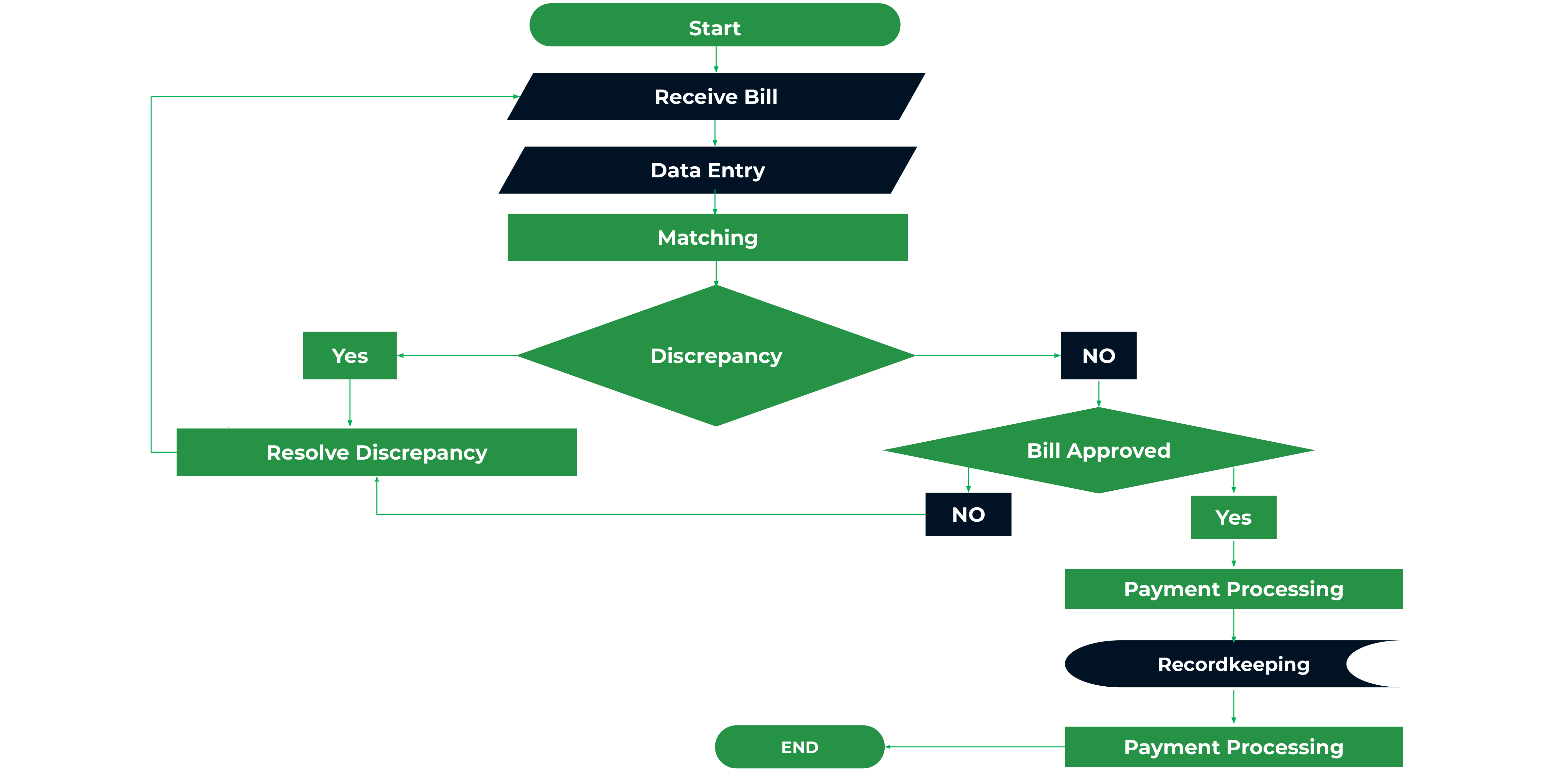

2. Bill Processing Flowchart

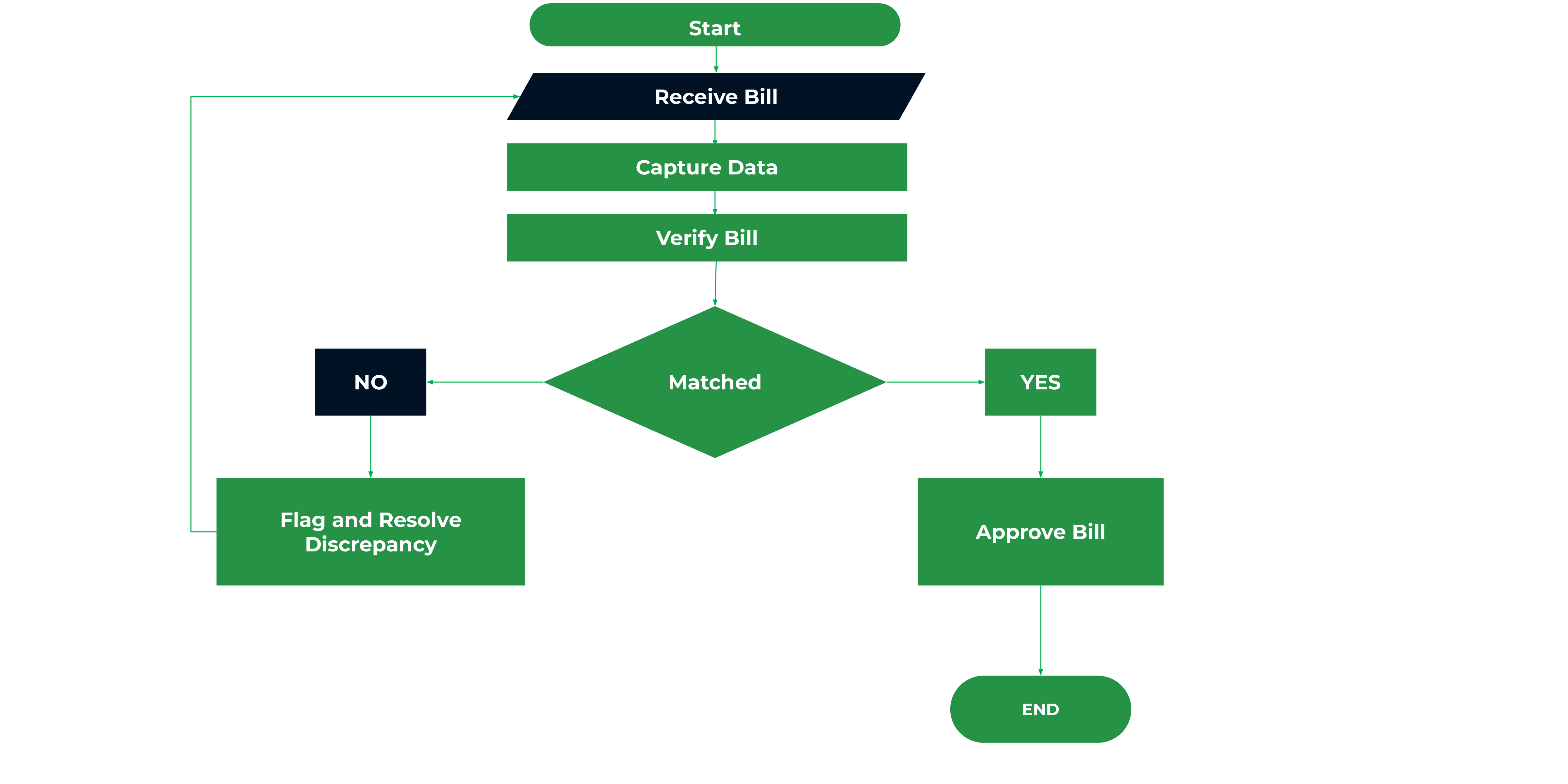

3. Accounts Payable Reconciliation Template

Download the editable version for free here or use our Free Accounts Payable Reconciliation Checklist Template

Here’s what each symbol in an accounting flowchart means so you understand how to use them:

We cover this in more detail in this blog – accounting process flowcharts and diagrams .

How to Create Your Accounts Payable Flowchart

1. define your purpose and scope.

Creating your Accounts Payable flowcharts begins with defining the purpose and scope.

A defined purpose helps you clarify why the flowcharts are necessary in the first place. It also helps your team members value it as much as you do.

You also need to understand and communicate the scope of your flowcharts. The scope will guide you in providing sufficient details while keeping it simple enough to avoid overwhelming your staff members.

2. Map Out the Core Processes

This is where you list all the tasks in your Accounts Payable workflow in their order of performance.

Doing this will keep you from missing important steps.

3. Choose Your Tools – Pen and Paper or Tools such as PowerPoint, Flowchart Software, Etc.

This is where you determine your tool of choice for the flowcharts. You can use the good old pen and paper, but being a manual system, it requires a lot of time and effort to create flowcharts at scale.

You could also use the SmartArt or the Shape Library in MS PowerPoint. However, these methods are limited and lack the flexibility to create quick and accurate flowcharts.

Flowchart software makes the process of creating flowcharts easier in many ways.

- First, they provide templates you can customize to suit your workflow needs in a few clicks. That means you wouldn’t bother about arranging the shapes.

- They enable you to share feedback on the flowchart you have created with team members.

- You can share flowcharts in documents via email or in shared cloud drives with your team members.

4. Format Tasks by Type and Correspond Them with the Correct Symbol.

Attach shapes to the steps you mapped out in the second step. For example, all action steps should be represented by a rectangle shape.

5. Build Your Flowchart

If you prefer to use pencil and paper, go ahead and draw the corresponding shapes and connect them with flows (lines or arrows).

If you’re using flowchart software, go to the flowchart library to drag and drop the shapes for the tasks (like process, oval, decision, and document shapes) in the process.

Once you’ve added them, arrange them in chronological order. Connect the shapes with the directional lines or arrows.

6. Review and Update Periodically

This is where you check your workflow flowchart for missing or redundant steps. You can do this periodically as the passage of time gives you a better perspective on the process.

If you use flowchart software, you can invite others to help you review the process for efficiency and accuracy.

Manage Your Accounts Payable Flowcharts Alongside Your Accounts Payable Projects in Financial Cents

Accounting project management is most effective when the accounting teams can access most, if not all, of the resources they need to manage client work from start to finish.

With the number of productivity tools coming into the market every month, the ability to use as many tools as possible from one place will determine how efficient your firm becomes.

For example, Financial Cents project management features enable you to add the Accounts Payable flowcharts you’ve created elsewhere to your projects.

You can add the images to the Financial Cents projects, link the shared cloud drives in the resources, and/or add them to the files sections.

This saves your team the stress of jumping between multiple apps to access the resources they need to get work done.

Instantly download this blog article as a PDF

Subscribe to newsletter.

We're talking high-value articles, expert interviews, actionable guides, and events.

The 10 Best Client Portals for Accountants

This article reviews the top 10 client portals for accountants to help you choose a suitable solution and avoid the pressure and…

Mar 28, 2024

Introducing ReCats: A Better Way to Manage the Chaos of Uncategorized Transactions

Uncategorized transactions are a headache for accountants and bookkeepers. Fortunately, ReCats, Financial Cents’ latest feature, solves this problem. Here’s all you need…

Mar 22, 2024

- Preferences

Accounts Payable Process - PowerPoint PPT Presentation

Accounts Payable Process

Accounts payable process by donna woodward and leslie foos donna woodward accounting technician ext-7018 general fund payables letters a-n capital projects fund ... – powerpoint ppt presentation.

- By Donna Woodward and Leslie Foos

- General Fund Payables Letters A-N

- Capital Projects Fund Payables

- Transportation Vehicle Fund Payables

- Revolving Fund

- General Fund Payables Letters O-Z

- ASB Fund Payables

- Investments

- Bank Statements

- Receive invoices from vendor

- Send invoices to school/department that is receiving goods

- Prepare invoices for payment after we have received signed invoice, signed blue purchase order, or signed packing slip.

- Write okay to pay, initial and date

- Date should be the date you received the goods or

- Todays date when signing for conferences, classes, etc.

- Send approved invoice, signed blue purchase order (if final payment), and/or packing slip to Accounts Payable .

- Please try to always send the original signature.

- Do not staple several invoices together as accounts payable may miss the ones stapled underneath.

- Remember, when you are signing off on the invoice, you are signing for receipt of goods not for approval to use budget. Authorization for budget was given at time of administrators signature on requisition request.

- Please inform Accounts Payable about the problem and what has been done to correct it

- Has Vendor been contacted?

- Has merchandise been returned?

- Is credit going to be issued?

- Are they sending a replacement?

- Accounts Payable cant short pay invoices for items being returned or damaged items. We will pay invoice when credit is received.

- When item is being returned to the vendor, please complete shipping form 25B.

- Return Authorization Form 25B (See Attachment A) is located on the S-Drive under Purchasing Procedures and Forms.

- Determine who is paying for the return.

- Vendor -They should issue a call tag for return shipping.

- School District

- Contact the vendor to obtain a Return Authorization Number (RMA) and instructions on how and where to return the merchandise.

- If the vendor does not require a RMA, document name and phone number that authorized the return on the Return Authorization Form 25B.

- Insert a completed copy of Form 25B in each package to be returned to the vendor. Document on the form how many boxes you are sending.

- Seal box securely.

- Mark the outside of the box with the RMA, (if provided).

- Attach customer call tag receipt on the original form 25B (white) and document date of UPS pick up.

- If the original purchase was by purchase order retain the second copy (yellow) in building files and send original (white copy) to Accounts Payable.

- If the purchase was via the procurement card, file a second copy (yellow) with the credit card receipts and forward the original Form 25B to Accounts Payable.

- Insert a copy (pink) of Form 25B in package to be returned.

- Fill out UPS label(s) one per package.

- Forward package(s) with original Form 25B taped lightly to the box to the warehouse via district courier.

- Warehouse will forward the white copy with the tracking number attached to Accounts Payable.

- If the original purchase was by purchase order retain the second (yellow) copy in the building files.

- If the original purchase was via procurement card, file the second copy (yellow) with the credit card receipts and attach to statement when credit is received.

- Please send invoices daily or at least weekly.

- If an invoice needs to be paid in a specific check run, it must be received in accounting by the bookkeeper cut off date.

- Definition After bookkeeper cut off and invoice needs to be paid before the next bookkeeper cut off.

- Please email or call Accounts Payable so invoice/purchase order can be located for payment processing.

- Definition Invoice received prior to a purchase order being requested (possibly confirming purchase order)

- If invoice sent to Purchasing as an attachment for a purchase order, please sign off on invoice before sending it to purchasing. This alleviates the invoice being returned to school for an okay to pay.

- Definition Vendor doesnt accept purchase orders and payment will need to be made at time of order.

- If payment document sent to Purchasing as an attachment for a purchase order, please sign off on it before you send it to purchasing. This alleviates the invoice being returned to school for an okay to pay.

- Please let Accounts Payable know if this is a rush payment.

- Procurement card can be used for payment if vendor accepts credit cards.

- Order Form must be sent to Purchasing.

- Supply account code.

- On KCDA- only use multiple account codes on one order if each account code is less than 50.00.

- Definition Any price, quantity, or product change after vendor has received order.

- Note change on requisition form or purchase order. Make a copy and have budget administrator sign and date the copy.

- Send original signed copy to Purchasing.

- Definition Monetary increase to the original open Purchase Order.

- Note change on Purchase Order. Make a copy and have budget administrator sign and date the copy.

- Prior approval is required from a Budget Administrator before a purchase may be made. A suggestion for this is to complete a Request for Purchase Form 68 ADM.

- Receipts must be attached per the following guidelines

- Only original receipts are acceptable.

- Credit card receipts should include the itemized register tape.

- A cash register tape should be itemized.

- For postage reimbursements, submit a postal receipt or an envelope marked postage due.

- Receipts that should be reimbursed on other forms are not reimbursed on petty cash such as parking, ferry and gas.

- Mark receipts paid when you reimburse the employee for it.

- Replenishment of the petty cash fund is required at least once a month or more often if necessary.

- Non-curricular food purchases (including petty cash) should have a completed yellow Open PO For Food (Attachment D) form attached to the receipt.

- Subscriptions should be paid when ordered and invoiced. Most companies require payment before subscription begins.

- Please remind your staff that when they cancel a registration they should let the bookkeeper know so they can contact Accounts Payable.

- Are there cancellation fees?

- How will cancellation fees be handled by vendor?

- Sign off on packing slip that lists all of the items received so it can be used as okay to pay when invoice is received.

- Throughout the year, please close any purchase orders that will not be used again during the current school year.

- Send invoices and credit memos to Accounts Payable to be entered into the system even if they zero out.

- When signing off on the final packing slip or invoice, send the blue copy of the purchase order with them.

- Several stores register receipts are the invoice that Accounts Payable pay from. Send the receipts to accounting for payment.

- Radio Shack

- Rose Crafts

- Scott Mclendons

- If school receives invoice and/or statement directly from vendor, please forward to Accounts Payable.

- In June before you leave for summer, close any purchase orders that will not be used again.

- Remind staff in June to turn in all receipts, packing slips, travel reimbursement (Attachment E), petty cash receipts, and mileage reimbursements (Attachment F) before they leave for the summer.

- For invoices that you are signing off on in August or September, give the date that items were received at your school or at least the month.

- All travel and mileage occurring prior to August 31 will be paid from the current years budget and should be turned in for reimbursement by the first bookkeeper cutoff in September.

- All food consumed and services that are received prior to August 31 will be paid from the current years budget. That includes any events that occur prior to August 31 for the next school year.

- All petty cash receipts dated prior to August 31 need to be reimbursed by the first bookkeeper cutoff in September. You will start a new reimbursement sheet for receipts dated on or after September 1.

- Accounts Payable A-N, Revolving Fund

- Donna Woodward x7018

- Accounts Payable O-Z, ASB Fund

- Leslie Foos x7019

- Vendor Numbers

- Angie Witt x7020

- Christine Nystrom x7023 (Backup)

- Account Codes or Budget

- Kelly Hawkins x7015

- Accounts Receivable

- Dina McVey x7016

- Carrie Lee x7017

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Introduction to Accounts Payable

Published by Eliseo Dennington Modified over 9 years ago

Similar presentations

Presentation on theme: "Introduction to Accounts Payable"— Presentation transcript:

Presented by The Office of International Programs.

Event Coordinators Networks 4 th Annual Workshop: Rising to the Next Level Policies and Best Practices in Meeting & Event Procurement Ajay Patel & Sharon.

UW-Whitewater Procurement Card Travel Program. Travel Procurement Card Program The Travel Procurement Card is a payment tool available to individual employees.

MURC Purchase Card (P-Card). Policy & Procedure Manual Read thoroughly Covers most questions P-cards are a privilege that may be revoked for violations.

Southern Methodist University

Purchasing Overview This card is only for orders under $5000. $5000 and above will be processed by Materiel Management. All procurement regulations.

P-Card User Guide Standard Profile July RCNJ-BOA Purchasing Card User Guide – Standard Profile Ramapo College and Bank of America VISA Procurement.

Procurement Card Policies and Guidelines Arkansas Tech University.

Travel Rules & Forms.

BUSINESS TRAVEL AND EXPENSE REPORTING AND POLICIES

TRAINING YSU TRAVEL GUIDE UPDATES & CHANGES 2014.

Event Coordinator’s Network

The University of Texas System Administration Travel Policy Travel Services And Accounting & Purchasing Services.

Business & Travel Expense Policy: An Overview

Commonwealth Travel Why are we here? New travel policy New travel agent New online booking tool.

WELCOME This presentation is intended for Registered Student Organizations (RSOs) with members who plan to travel and expect to be reimbursed.

Effective November 1, History April 2012-New statewide travel regulations issued by the State Accounting Office UGA worked with the Board of Regents.

IRS Regulations - $.560 per mile (eff 1/1/14) From official travel base or point of departure – whichever is closer to destination Multiple destinations.

WAKULLA COUNTY Travel & Expense Procedures Manual Workshop September 2, 2008.

Financial Services Travel Training June 24, 2014.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

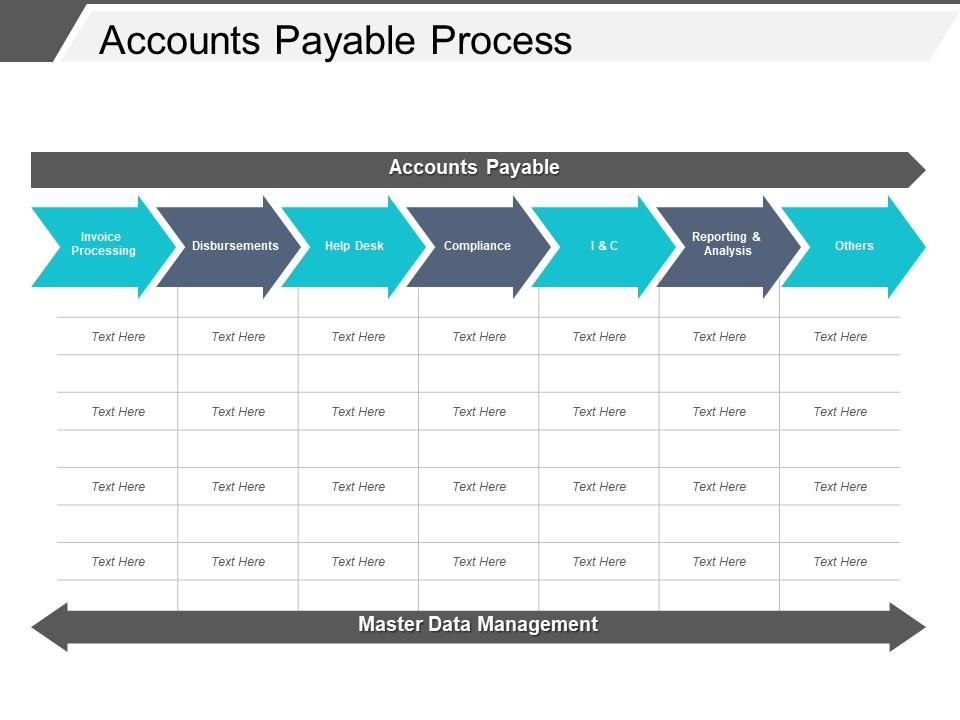

Accounts payable process powerpoint slide backgrounds

Define the critical business procedure with our accounts payable process PowerPoint slide. It works as a business tool which represents the accounting entry of your organization’s obligation to pay in a stipulated period of time. Thus, in accordance to the same, your business can manage their credit structure. It allows your business entity to manage all its payable obligations in an effective manner. You can even represent the process with this account payable process flow chart Presentation diagram. It starts from the stage of receiving invoice, recording the transaction in the company ledger. Then to the stage of making the payments to the vendors within the prescribed period of time till the final stage of knocking out the expenses from the account payable account. You can likewise recognize the measures of your business growth prospects with this PPT diagram. Thus, just snap below and Start working over this professional yet simply accounts payable process steps PPT layout. Establish a direct connection with our Accounts Payable Process Powerpoint Slide Backgrounds. The audience will get fully engaged.

These PPT Slides are compatible with Google Slides

Compatible With Google Slides

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

Want Changes to This PPT Slide? Check out our Presentation Design Services

Get Presentation Slides in WideScreen

Get This In WideScreen

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

- Add a user to your subscription for free

You must be logged in to download this presentation.

Do you want to remove this product from your favourites?

PowerPoint presentation slides

Introducing accounts payable process PowerPoint slide. Well-structured and researched PowerPoint template best suitable for the financial analysts and business specialists. Provides ample space with Presentation graphic which allows to add the heading and subheading. Completely editable background texts, style, colors, figures etc. PPT image is also proficient with Google Slides and other software systems. Offers swift and smooth downloading procedure. One may even easily embed the company name or trademark, logo etc.

People who downloaded this PowerPoint presentation also viewed the following :

- Diagrams , Finance , Business Slides , Financials , Flat Designs , Strategic Planning Analysis

- Accounts Payable ,

- Financial statements ,

- Bookkeeping

Accounts payable process powerpoint slide backgrounds with all 5 slides:

Get through admirably with our Accounts Payable Process Powerpoint Slide Backgrounds. The audience will find your ideas completely absorbing.

Ratings and Reviews

by Cliff Jimenez

June 28, 2021

by Edison Rios

June 27, 2021

Accounts Payable Invoice Process

Aug 05, 2014

320 likes | 882 Views

Accounts Payable Invoice Process. Overview. BOX-IT (Scan invoices to e-Financials). e-FINANCIALS (AP team review invoice). SUPPLIER (raises invoice). FPM (Invoice is approved by Budget Holder). e-FINANCIALS (AP team send out invoice to FPM). e-FINANCIALS (Payment of invoice).

Share Presentation

- live system

- our payment run

- fpm finance process manager

- andover sp10

- team leader

- finance dept

Presentation Transcript

Overview BOX-IT (Scan invoices to e-Financials) e-FINANCIALS (AP team review invoice) SUPPLIER (raises invoice) FPM (Invoice is approved by Budget Holder) e-FINANCIALS (AP team send out invoice to FPM) e-FINANCIALS (Payment of invoice)

Budget Code • When ordering goods or requesting a service from new or existing suppliers please ensure you provide them with your budget code and the account code • If you are unsure of what your budget code is please liaise with your service manager or management accountant

Invoice Address • ALL invoices need to be billed and posted to the following address (and not to the site address or Finance dept-HQ): CNWL NHS FOUNDATION TRUST PO BOX 1947 ANDOVER SP10 9FD

Invoice Address • The PO BOX address is of our scanning partner BOX-IT who scan all our invoices onto our finance system • If invoices are directly sent to the site please inform the supplier of the PO BOX address and ask them to re-issue and resend the invoice

No Budget Code and Incorrect Address • If an invoice does not state the cost centre, we are unable to establish who is responsible for the order or service • If the invoice is sent to the incorrect address this will never show as outstanding on our system • Both of the above causes delays in processing payment

FPM / E-Invoicing • FPM=Finance Process Manager • FPM is our electronic invoice approval system • Invoices are sent out by the AP team to FPM users • Users will receive an email notification • Users login to FPM to verify/approve the invoice

FPM / E-Invoicing Verifiers Team leader/Ward Manager receives an Automated email: Invoices in FPM Transaction Workbench are waiting for verification and submitting to Approver. Verifiers can also approve invoices if they have budget.

Budget Holders FPM / E-Invoicing Service Manager/Approver receives invoice from Verifier in their Approvers Workbench and approves it or forwards it to another FPM user. All approvers will have a limit to their budget and can not approve invoices above that limit

Processing Payment • Once an invoice is approved by the budget holder it is ready to be processed for payment • Our payment run is every Wednesday morning – invoices need to be approved by close of pay Tuesday to ensure they are paid on time • Suppliers receive funds in their accounts on the Friday

Benefits of FPM • Suppliers will receive payment quickly • FPM retains invoices (archived, searchable) • Live system quick turnover of invoices • FPM users can keep track of what is being ordered in their department (FPM history) • Invoices approved and paid electronically, saves paper chasing/time

- More by User

Accounts Payable

Accounts Payable Navigating the System Agenda Introduction Non-Resident Alien Info-Susan Caldwell Object Coding Purchase Order Payments Electronic Check Request Check Request Payments Travel Question & Answer Time! Introduction Federal Internal Revenue Service

2.17k views • 121 slides

Accounts Payable Process

Accounts Payable Process. By Donna Woodward and Leslie Foos . Donna Woodward Accounting Technician Ext-7018. General Fund Payables Letters A-N Capital Projects Fund Payables Transportation Vehicle Fund Payables Revolving Fund Warehouse. Leslie Foos Accounting Technician Ext-7019.

853 views • 41 slides

Accounts payable

Lynne Hendrickson Heather Carter-Devine Renee Pfingsten Carolyn Spell. Accounts payable. http://www.montana.edu/wwwbu/accounting.html. UBS Forms. Print full GID PO Box for departmental addresses Be aware of new remit addresses

400 views • 19 slides

Accounts Payable. SAP Best Practices. Purpose, Benefits, and Key Process Steps. Purpose This scenario deals with posting accounting data for vendors in Accounts Payable. Benefits The Accounts Payable are also an integral part of the purchasing system.

1.23k views • 7 slides

Accounts Payable. Completing the Procurement Cycle at Framingham State University. INVOICES. All invoices must be addressed to: Accounts Payable Here’s why! Review and validation Vendor relationship maintenance Timely payment policy of Mass/OSC

405 views • 11 slides

Accounts Payable . And. Workflow. Imaging . To Be Vision and 1st Quartile. Implemented 4/1/2000 To Be Vision 1st Quartile ‘97 Baseline (Steady State) ( Benchmark) Cost per Invoice $5.07 $2.83 $2.55 Currently at $4.70 (+or-). Zeke the Cost Cutter.

308 views • 15 slides

Accounts Payable. March 4, 2013. Agenda. AP Introductions How a check is produced at UGA Vendor Registration System Unified Vendor Database Demo UGAMart System Demo (Receiving, Comments) Electronic Check Request System Demo Q&A’s submitted prior to session

383 views • 24 slides

Accounts Payable. Lynne Hendrickson Heather Carter-Devine Renee Pfingsten Carolyn Spell. BPA PROCESS. Vendor Name & Address Remit PO Box for departmental addresses Print full GID Box for ACH or Check. Priority BPAs. Please notate on the BPA “ Rush ” or “ Special ”

316 views • 17 slides

Accounts Payable. Changes to Forms & Procedure. Many factors must be considered when designing procedures at Boise State University. Vendor Information Form (W9). ALL payments are reportable. Some require withholding. IRS Compliance required of AP = TIN match, EPLS check, 1099 reporting

367 views • 24 slides

Accounts Payable. Heather Carter Lynne Hendrickson. BPA’S. Pay the current invoice Include adding machine tape Remit information-Department name, Invoice numbers, Account numbers Department contact information Last 4 digits of the GID number. VENDORS.

267 views • 7 slides

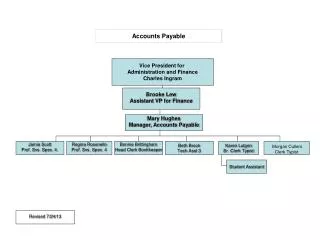

Accounts Payable. Vice President for Administration and Finance Charles Ingram. Brooke Lew Assistant VP for Finance. Mary Hughes Manager, Accounts Payable. Jamie Scott Prof. Svs. Spec. 4. Regina Rosenello Prof. Svs. Spec. 4. Bonnie Brittingham Head Clerk Bookkeeper. Beth Brook

191 views • 1 slides

Accounts Payable. Procurement-To-Pay Tutorial. What we do. Expenditure Review Department/Vendor Relations Voucher Processing Payment Processing Audit -1099 Reporting -Duplicate Transactions -Stale-dated Payments Document Imaging Forms Distribution Limited Purchase Orders

1.08k views • 84 slides

Accounts Payable. Agenda. Vendors AP Terms, Roles, Workflow Exercises Available Resources. Vendors. NYS Vendor File. The NYS Vendor File is a centralized database of all vendors: entities that provide goods or services to, have an ongoing relationship with, and

720 views • 54 slides

Accounts Payable Training Accounts Payable

Accounts Payable Training Accounts Payable. Updated 10/20/2010 by Kevin Glaspie. AP Staff. Terri Thomas 1-1836 AP Manager Stephanie Kontour 1-2387 Kevin Glaspie 1-2565. AP Mission.

630 views • 27 slides

Accounts Payable. FD-201 November 6, 2014. Getting Started. Approved systems for generating BPAs are: APEX Benefits – vendor info interfaces with Banner Catbooks / Agbooks Benefits – comprehensive system, does more than just BPAs Handwritten Excel

489 views • 20 slides

Accounts Payable. San Antonio Independent School District 2018-2019. Accounts Payable. Toni Nelson Assist Director-Financial Services 554-8640 Arlene Loya A,F,N,W,Z Learning Zone 554-8643 Alice Alcorta B,K,Q,R,U, School Mart (Travel N-Z) 554-8648 Tenisha Capers D,H,I,Y,L 554-8647

535 views • 52 slides

Accounts Payable. Section 3 - Enter New Invoices. Now that all vendors are set up, you may enter new invoices. Just to be clear: You can only enter invoices In M3. You may not enter any amounts using statements, collection letters, other correspondences, etc.

345 views • 31 slides

Accounts Payable. Section 6 – Attach Invoice Image & Submit Batch Report. Attach Image. Now that we have entered an invoice, We are now using the “Attach Images” feature at M3. This wonderful feature eliminates the old- fashioned practice of xeroxing invoices,

322 views • 28 slides

Accounts Payable. Section 5 – Use Tax. In most states, vendors are responsible for paying use tax when they buy taxable goods and services for use and the seller does not charge sales tax, or does not charge the correct amount of sales tax. However, different states have different

137 views • 9 slides

IMAGES

VIDEO

COMMENTS

The slides cover bookkeeping, journal entries, ledger, payment process flow, etc. This PPT Bundle provides the accounts payable department with the right tools to help them function. Download now! Download this template . Template 2: Accounts Payable Flowchart PowerPoint Presentation . This PPT Template helps you visualize the accounts payable ...

Download our Accounts Payable MS PowerPoint and Google Slides presentation template to describe the outstanding obligations or commitments a company holds with its suppliers for received goods and services awaiting payment. Usage. ... (Accounts Payable Process Overview). You can also illustrate the common problems and the functional ...

This is a accounts payable best practices ppt powerpoint presentation styles graphics pictures. The topics discussed in this diagram are accounting, three way match, three document. This is a completely editable PowerPoint presentation, and is available for immediate download. Slide 1 of 2.

Accounts Payable Process Flow Chart. This slide consists of a basic process of financial accounting which is followed by accounts payable department to verify invoices against orders and make payment to avoid delays. The key elements are purchase order acceptance, approval, sending purchase order email to vendor etc. Want Changes to This PPT Slide?

Presenting this set of slides with name processes of accounting cycle puzzle circular process financial ppt powerpoint presentation complete deck. The topics discussed in these slides are cycle puzzle, circular process, financial, trial balance, cash flow. This is a completely editable PowerPoint presentation and is available for immediate ...

Accounts Payable Process Flow Powerpoint Ppt Template Bundles. Slide 1 of 5. 0414 accounts payable flowchart powerpoint presentation. Slide 1 of 2. Account payable dashboard with total income and expense. Slide 1 of 6. Process Flow For Generating Accounts Payable Invoice. Slide 1 of 6. Accounts Payable Process Flow For Businesses.

7 Accounts Payable - Critical Success Factors These are a summary of the key business requirements, which must be met to achieve the objectives. Single supplier database Staff trained in AP process and have clear roles and responsibilities Payment terms defined and agreed with supplier Effective communication and feedback mechanisms in place to handle queries Establish and maintain good ...

Accounts Payable Process Flowchart Diagrams and Templates 1. Accounts Payable Process Flowchart. Download the editable version here. 2. Bill Processing Flowchart. Download the editable version here. 3. Accounts Payable Reconciliation Template. Download the editable version for free here or use our Free Accounts Payable Reconciliation Checklist ...

and send original (white copy) to Accounts. Payable. If the purchase was via the procurement card, file a second copy (yellow) with the credit card. receipts and forward the original Form 25B to. Accounts Payable. 15. SKSD is responsible for return shipment. Insert a copy (pink) of Form 25B in package to be.

This is a invoice capture and workflow for accounts payable excellence ppt powerpoint presentation summary slide. The topics discussed in this diagram are accounting, three way match, three document. This is a completely editable PowerPoint presentation, and is available for immediate download. Slide 1 of 5.

Accounts Payable Process found in: Account receivable and payable process multiple touch points, Accounts payable process improvement ideas ppt powerpoint presentation inspiration design templates cpb, 0414 accounts payable.. ... End to end process accounts payable ppt presentation pictures graphic tips cpb. Animated . Slide 1 of 2 Process ...

This product ( Financial Processes in Accounts Payable) is a 16-slide PPT PowerPoint presentation (PPT), which you can download immediately upon purchase. This presentation is a training material on Best Practice Financial Processes in Accounts Payable. This presentation is prepared aims. • to maximise processing efficiency.

This alleviates the invoice being returned to school for an okay to pay. • Please let Accounts Payable know if this is a rush payment. • Procurement card can be used for payment if vendor accepts credit cards. Blanket (Requisition) Orders • Order Form must be sent to Purchasing. • Supply account code.

Presentation Transcript. Introduction • What is Accounts Payable ? • Accounts Payable Process • Invoice processing • Payment processing • Review. Accounts Payable Money owed to supplier or vendor for goods and services rendered. AP Process Flow • Purchase Order Issued to Vendor on meeting the requisites.

Download ppt "Introduction to Accounts Payable". Role of Accounts Payable Accounts Payable is responsible for examining all accounts, claims, and demands against the University of Georgia, and for making payment of all the University's legally incurred obligations for materials and services other than payrolls.

The versatile compatibility means you can deliver your presentation in numerous ways. You can select Microsoft PowerPoint, Google Slides, or Apple Keynote as your preferred platform. You won't experience any technical issues! This Accounts Payable PowerPoint template is fully customizable and comes in different themes. It has stunning HD graphics.

The stages in this process are Provide Accounting, Payroll Services, Accounts Payable Services. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience. Slide 1 of 6. Accounts Payable Process Flow Chart For Raw Material Procurement.

PowerPoint presentation slides: Introducing accounts payable process PowerPoint slide. Well-structured and researched PowerPoint template best suitable for the financial analysts and business specialists. Provides ample space with Presentation graphic which allows to add the heading and subheading. Completely editable background texts, style ...

Benefits of FPM • Suppliers will receive payment quickly • FPM retains invoices (archived, searchable) • Live system quick turnover of invoices • FPM users can keep track of what is being ordered in their department (FPM history) • Invoices approved and paid electronically, saves paper chasing/time. Accounts Payable Invoice Process.