- Search Search Please fill out this field.

- Understand Consolidated Financials

Reporting Requirements

- Cost and Equity Methods

Company Examples

The bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Consolidated Financial Statements: Requirements and Examples

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Companies often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively. However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries.

Private companies have very few requirements for financial statement reporting, but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP) . If a company reports internationally, it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS) . Both GAAP and IFRS have some specific guidelines for companies that choose to report consolidated financial statements with subsidiaries.

Key Takeaways

- Consolidated financial statements are strictly defined as statements collectively aggregating a parent company and subsidiaries.

- GAAP and IFRS include provisions that help to create the framework for consolidated subsidiary financial statement reporting.

- If a company doesn’t use consolidated subsidiary financial statement reporting, it may account for its subsidiary ownership using the cost or equity methods.

Investopedia / Michela Buttignol

Understanding Consolidated Financial Statements

The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet , income statement , and cash flow statement reporting. The decision to file consolidated financial statements with subsidiaries is usually made on a year-to-year basis and is often chosen because of tax or other advantages that arise. The criteria for filing a consolidated financial statement with subsidiaries is primarily based on the amount of ownership the parent company has in the subsidiary.

Generally, 50% or more ownership in another company defines it as a subsidiary and gives the parent company the opportunity to include the subsidiary in a consolidated financial statement. In some cases, less than 50% ownership may be allowed if the parent company shows that the subsidiary’s management is heavily aligned with the decision-making processes of the parent company.

If a company has ownership in subsidiaries but does not choose to include a subsidiary in complex consolidated financial statement reporting, then it will usually account for the subsidiary ownership using the cost method or the equity method .

Private companies will usually make the decision to create consolidated financial statements that include subsidiaries on an annual basis. This annual decision is usually influenced by the tax advantages a company may obtain from filing a consolidated vs. unconsolidated income statement for a tax year.

Public companies usually choose to create consolidated or unconsolidated financial statements for a longer period of time. If a public company wants to change from consolidated to unconsolidated, it may need to file a change request. Changing from consolidated to unconsolidated may also raise concerns with investors or complications with auditors, so filing consolidated subsidiary financial statements is usually a long-term financial accounting decision. There are, however, some situations where a corporate structure change may call for a changing of consolidated financials, such as a spinoff or acquisition.

Private companies have very few requirements for financial statement reporting, but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP). If a company reports internationally, it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS). Both GAAP and IFRS have some specific guidelines for entities that choose to report consolidated financial statements with subsidiaries.

Generally, a parent company and its subsidiaries will use the same financial accounting framework for preparing both separate and consolidated financial statements. Companies that choose to create consolidated financial statements with subsidiaries require a significant investment in financial accounting infrastructure due to the accounting integrations needed to prepare final consolidated financial reports.

There are some key provisional standards that companies using consolidated subsidiary financial statements must abide by. The primary one mandates that the parent company or any of its subsidiaries cannot transfer cash, revenue, assets, or liabilities among companies to unfairly improve results or decrease taxes owed. Depending on the accounting guidelines used, standards may differ for the amount of ownership that is required to include a company in consolidated subsidiary financial statements.

Consolidated financial statements report the aggregate reporting results of separate legal entities. The final financial reporting statements remain the same in the balance sheet, income statement, and cash flow statement. Each separate legal entity has its own financial accounting processes and creates its own financial statements. These statements are then comprehensively combined by the parent company to final consolidated reports of the balance sheet, income statement, and cash flow statement. Because the parent company and its subsidiaries form one economic entity, investors, regulators, and customers find consolidated financial statements helpful in gauging the overall position of the entire entity.

Ownership Accounting: Cost and Equity Methods

There are primarily three ways to report ownership interest between companies. The first way is to create consolidated subsidiary financial statements. The cost and equity methods are two additional ways companies may account for ownership interests in their financial reporting. Overall, ownership is usually based on the total amount of equity owned. If a company owns less than 20% of another company's stock, it will usually use the cost method of financial reporting. If a company owns more than 20% but less than 50%, it will usually use the equity method .

Berkshire Hathaway Inc. (BRK.A, BRK.B) and Coca-Cola (KO) are two company examples. Berkshire Hathaway is a holding company with ownership interests in many different companies. It uses a hybrid consolidated financial statements approach, as seen in its financials. For example, its consolidated financial statement breaks out its businesses by Insurance and Other, then Railroad, Utilities , and Energy. Its ownership stake in publicly traded company Kraft Heinz (KHC) is accounted for through the equity method.

Coca-Cola is a global company with many subsidiaries. It has subsidiaries around the world that help it to support its global presence in many ways. Each of its subsidiaries contributes to its food retail goals with subsidiaries in the areas of bottling, beverages, brands, and more.

What Is Consolidated vs. Separate Financial Statement?

A separate financial statement reports on the finances of a single entity. A consolidated financial statement reports on the entirety of a company with detailed information about each subsidiary.

How Do Consolidated Financial Statements Work?

Consolidated financial statements report a parent company's financial health and include financial information from its subsidiaries.

What Are the Requirements for Consolidated Financial Statements?

If a parent company has 50% or more ownership in another company, that other company is considered a subsidiary and should be included in the consolidated financial statement. This also applies if the parent company has less than 50% ownership but still has a controlling interest in that company.

Consolidated financial statements include the aggregated financial data for a parent company and its subsidiaries. Private companies have more flexibility with financial statements than public companies, which must adhere to GAAP standards.

Financial Accounting Standards Board. " S99 SEC Materials ."

Berkshire Hathaway via U.S. Securities and Exchange Commission. " Form 10-Q ."

Coca-Cola. " Form 10-K, Exhibit 21.1 ." Click on Documents, then EX-21.1.

:max_bytes(150000):strip_icc():format(webp)/whollyownedsubsidiary.asp-final-d5a14f7bbd454e3b9922d066bd95650b.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Consolidated Financial Statements (IFRS 10)

Last updated: 29 December 2023

Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a single economic entity. These statements are prepared in accordance with IFRS 10.

The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the entities involved. A parent is an entity that exercises control over one or more entities. An entity controlled by a parent is referred to as a subsidiary. A parent, together with all its subsidiaries, forms a group. The notion of ‘control’ is central to this arrangement. Let’s delve deeper.

According to IFRS 10.6-8, an investor controls an investee (another entity) if it has:

- Power over the investee,

- Exposure , or rights, to variable returns from its involvement with the investee, and

- The ability to use its power over the investee to affect the amount of the investor’s returns ( principal vs agent consideration).

The presence of control should be reassessed whenever relevant facts or circumstances change (IFRS 10.8;B80-B85). IFRS 10 provides a comprehensive definition of control, ensuring that no entity controlled by the reporting entity is omitted from its consolidated financial statements. This is particularly crucial when an entity’s operations are not directed through voting rights. The criteria for determining control, as stated above, are elaborated on in the sections that follow.

Are you tired of the constant stream of IFRS updates? I know it's tough. That's why I've created Reporting Period – a once-a-month digest for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one concise, readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. Subscribe for free, enjoy a spam-free experience, and remember, you can opt out anytime with a single click.

Power arises from rights that give the investor current ability to direct relevant activities of an investee. Power typically comes from voting rights attached to shares, but it can also originate from other sources, such as contractual arrangements (IFRS 10.10-13), especially when the key decision-making is predetermined at the incorporation of the investee (referred to as ‘ structured entities ‘, ‘special purpose entities’, or ‘variable interest entities’).

Relevant activities

‘Relevant activities’ are operations that significantly impact the investee’s returns. IFRS 10.B11 provides examples of such activities, including:

- Sale and purchase of goods or services,

- Management of financial assets,

- Selection, acquisition, or disposal of assets,

- Research and development of new products or processes, and

- Decisions related to funding structure or obtaining financing.

Majority of voting rights

Possession of the majority of the voting rights generally gives an investor power over the investee in situations where the investee’s relevant activities are directed by a vote of the majority shareholder, or when a majority of the members of the investee’s governing body that directs the relevant activities are appointed by a vote of the majority shareholder (IFRS 10.B35). In fact, for typical entities that are controlled through voting rights, possessing the majority of these rights is sufficient for a parent to ascertain that it controls the investee.

However, there may be situations where an investor with majority voting rights lacks the practical ability to exercise them. Such rights are considered non-substantive (see IFRS 10.B22-B25) and do not provide the investor with power over the investee (IFRS 10.B36-B37).

Minority of voting rights

An investor can exert power over an investee without possessing the majority of the voting rights, a situation often called ‘de facto control’. Such control can be exercised through (IFRS 10.B38-50):

- Investor’s voting rights (e.g., when other vote holders are dispersed and unable to collectively outvote the investor),

- A contractual arrangement between the investor and other vote holders,

- Rights derived from other contractual arrangements,

- Potential voting rights.

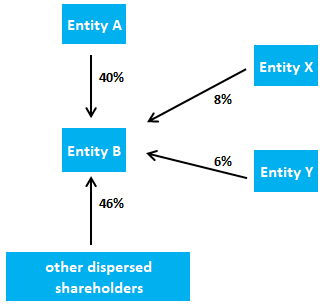

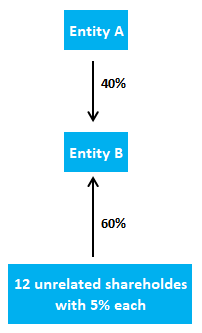

Consider an example where Entity A holds a 40% interest in Entity B:

Example: Minority of the voting rights vs power over the investee

Scenario #1

Entity B is listed on a stock exchange. Two large investors hold more than 5% of the voting rights each, with the remaining shares dispersed among unknown individual shareholders.

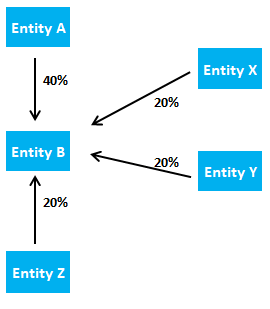

Scenario #2

Entity B is a privately-owned company with the following shareholding structure:

Scenario #3

Entity B is a privately-owned company with a different shareholding structure:

In Scenario 1, Entity A has power over Entity B (assuming the criteria of IFRS 10.B35 are met) since the other shareholders are too dispersed to collectively outvote Entity A. Conversely, in Scenario 2, Entity A does not have power over Entity B, as other shareholders could potentially unite and outvote Entity A. This conclusion remains valid even if Entities X, Y, and Z have been passive investors so far.

Determining whether Entity A has power over Entity B in Scenario 3 is more complex. Here, other factors need to be assessed as per IFRS 12.B42(b)-(d), such as the level of active participation of other shareholders at annual general meetings, regardless of whether they vote in line with Entity A.

If, after considering all available evidence, it is still unclear whether the investor has power over the investee, the investor should not consolidate the investee (IFRS 12.B46, BC110).

Potential voting rights

Potential voting rights, which could stem from convertible instruments, options, or other mechanisms, grant the holder the right to obtain voting rights of an investee. They are considered when assessing control only if they are substantive (IFRS 10.B22-B25). Potential voting rights are covered in IFRS 12.B47-50. It’s crucial to understand that potential voting rights can confer power to a minority shareholder as well as strip power from a majority shareholder.

Multiple parties with decision-making rights

In situations where two or more unrelated investors each have unilateral decision-making rights over different activities of an investee that significantly affect the investee’s returns, control belongs to the investor who has the ability to direct the most consequential activities of the investee. Thus, power is assigned to the party most closely resembling the controlling entity (IFRS 10.BC85-BC92).

In cases where multiple parties have unilateral decision-making rights over different activities, it may be possible that each party controls only certain assets or a ‘ring-fenced’ segment of a larger entity. That portion of an investee should be consolidated as if it were a separate entity or a ‘silo’. Guidelines for such situations can be found in IFRS 10.B76-B79.

Purpose and design of the investee

When assessing control, the purpose and design of the investee should be taken into account. An investee may be structured in such a way that voting rights are not the primary determinant of control (IFRS 10.B5-B8;B51-B54). This criterion is particularly applicable in assessing control over ‘special purpose entities’ or ‘ structured entities ‘, i.e., entities designed so that voting or similar rights do not primarily dictate who controls the entity. For instance, voting rights might pertain only to administrative tasks, while the relevant activities are directed by contractual agreements. Structured entities often engage in restricted activities, have a clear and specific objective, and require subordinate financial support (IFRS 12.B21-B22).

Protective rights

Protective rights are structured to safeguard the interests of an investor or another party such as a creditor. Importantly, these rights do not give power over the investee (IFRS 10.14). IFRS 10.B28 provides examples of protective rights:

- Lender’s right to restrict the borrower from undertaking activities that could significantly alter the borrower’s credit risk to the lender’s disadvantage,

- Lender’s right to seize the borrower’s assets if the borrower fails to meet specified loan repayment conditions,

- The right of a non-controlling interest holder in an investee to approve capital expenditure exceeding the routine business requirements, or to approve the issuance of equity or debt instruments.

The presence of protective rights does not preclude another party from having control over an investee. Veto rights are often protective in nature, but not always. For instance, if the veto pertains to modifications in relevant activities that significantly affect investee returns for the investor’s benefit, it could be considered as a source of power over the investee (IFRS 10.B15d). This concept also applies to scenarios involving bankruptcy proceedings or covenant breaches.

Bankruptcy proceedings or breach of covenants

The Interpretations Committee deliberated the question of reassessing control when facts and circumstances change, altering the nature of previously protective rights (e.g., a covenant breach in a loan arrangement that results in borrower default). The necessity to reassess control whenever relevant facts and circumstances change is emphasized in IFRS 10.8;B80-B85. The Committee noted that IFRS 10 does not exempt any rights from this requirement. Thus, a covenant breach, resulting in rights becoming exercisable, denotes a change in facts and circumstances.

Consequently, a protective right can transition to a power-conferring right upon becoming exercisable. This situation commonly arises when evaluating control over entities encountering financial difficulties and entering bankruptcy proceedings. In such cases, creditors often acquire the right to direct the entity’s relevant activities for their benefit (i.e., debt repayment), which could lead to the conclusion that control over the investee has transferred to them.

Franchise agreements

Franchise agreements are detailed in IFRS 10.B29-B33. Generally, a franchisor does not have power over the franchisee, as the franchisor’s rights aim to protect the franchise brand rather than direct activities significantly impacting the franchisee’s returns.

Exposure, or rights, to variable returns

An investor is deemed to be exposed or possesses rights to variable returns from their involvement with an investee when their returns have the potential to fluctuate based on the investee’s performance (IFRS 10.15). While only one investor can control an investee, it’s possible for other parties, such as non-controlling interest holders, to benefit from the investee’s returns (IFRS 10.16).

Variable returns may include (IFRS 10.B57):

- Dividends, interest, and other distributions of economic benefits,

- Changes in the value of the investor’s investment in an investee,

- Fees for servicing an investee’s assets or liabilities,

- Fees and potential losses from providing credit or liquidity support,

- Access to future liquidity an investor gains from their involvement with the investee,

- Residual interests in the investee’s assets and liabilities upon its liquidation,

- Tax benefits,

- Reputational risk (IFRS 10.BC37-BC39),

- Returns that aren’t accessible to other interest holders, such as benefits of synergy, procurement of scarce products, access to proprietary knowledge, or limitation of certain operations or assets to enhance the value of the investor’s other assets.

As we observe, credit risk is a factor when considering variable returns, which means fixed-interest financing also results in exposure to variable returns.

Link between power and returns (principal vs agent)

A parent company must be able to use its power to affect the returns from an investee. Entities serving as agents do not control an investee (IFRS 10.17-18). Conversely, if another party with decision-making rights serves as an agent for the entity, the entity controls the investee. During control assessment, decision-making rights delegated to an agent are treated as if they were directly held by the investor. These principal-agent relationships are common in industries like asset management, real estate, and construction.

IFRS 10.B60 details factors determining whether a decision-maker is purely an agent:

- Extent and independence of the decision-making authority over the investee (IFRS 10.B62-B63),

- Removal (‘kick-out’) rights and restrictive rights held by other parties (IFRS 10.B64-B67),

- Remuneration entitled to the decision-maker, and its size and variability relative to the expected returns from the investee’s activities (IFRS 10.B68-B70),

- Decision-maker’s exposure to variability of returns from other interests held in the investee (IFRS 10.B71-B72).

Additionally, relationships between parties also require consideration (IFRS 10.B73-B75).

When an investor holds decision-making rights but perceives itself as an agent, it should evaluate whether it has significant influence over the investee.

Consolidated financial statements

Consolidated financial statements of a group should be prepared applying uniform accounting policies (IFRS 10.19,B86-B87). Each parent entity is required to prepare consolidated financial statements unless exemptions outlined in IFRS 10 are applicable.

Consolidation procedures are typically executed via specialised software wherein subsidiaries input their data for consolidation. As per IFRS 10.B93, the period between the financial statement dates of the subsidiary and the group should not exceed three months. Consequently, if a subsidiary’s reporting date differs from that of the parent company, it needs to provide additional information to ensure that this time gap does not influence the consolidated financial statements.

Consolidation of a subsidiary initiates when control is gained and concludes when control is lost (IFRS 10.20,B88).

Non-controlling interest

Non-controlling interest (NCI) should be presented within equity in the consolidated statement of the financial position, separate from the equity attributable to owners of the parent (IFRS 10.22). NCI represents the existing interest in a subsidiary that is not directly or indirectly attributable to a parent. For instance, if a parent owns 80% of the shares in a subsidiary, the residual 20% is the NCI. This was formerly referred to as ‘minority interest’, a term still occasionally used by accounting practitioners.

A parent entity, in presenting consolidated financial statements, should allocate the profit or loss and total comprehensive income between the owners of the parent and the non-controlling interests. Non-controlling interests can maintain a negative balance due to cumulative losses attributed to them (IFRS 10.B94), even in the absence of an obligation to invest further to cover these losses (IFRS 10.BCZ160-BCZ167). The allocation of profit or loss and total comprehensive income should solely rely on existing ownership interests, without considering the potential execution or conversion of potential voting rights and other derivatives (IFRS 10.B89-B90).

Changes in a parent’s ownership interest in a subsidiary that don’t result in loss of control are treated as equity transactions. These changes don’t impact the profit or loss, recognised assets (including goodwill), or liabilities (IFRS 10.23,B96,BCZ168–BCZ179). Prior to the introduction of IFRS 10, the acquisition of a non-controlling interest often led to the parent recognising additional goodwill (prohibited under IFRS 10).

Example: Acquisition of non-controlling interest

Our starting point is an example provided in IFRS 3 for the calculation of goodwill. Following the acquisition of the Target Company (TC), Acquirer Company (AC) recognised $16.8m of non-controlling interest (NCI). Assuming that after a year, AC acquires the remaining 20% shareholding in TC for $30m (entirely paid in cash). For simplicity, we will also assume that the value of NCI remained constant after the acquisition date (usually, NCI changes due to dividend payments, profit generated by TC, etc.).

The entries made in the consolidated financial statements of TC are as follows:

As seen above, despite AC paying more than the previously reported amount of NCI in the consolidated statement of the financial position, there is no impact on profit or loss.

Loss of control

When a parent company loses control of a subsidiary, IFRS 10.25, B98-B99 stipulate the following accounting approach:

- Derecognise all assets (including goodwill ) and liabilities of the former subsidiary at their carrying amount,

- Derecognise the non-controlling interest,

- Recognise the received consideration at fair value,

- Recognise any retained investment in the former subsidiary at fair value,

- Recognise any resulting difference as a gain or loss in profit or loss attributable to the parent.

Furthermore, when control of a subsidiary is lost, all amounts previously recognised in OCI concerning that subsidiary should be accounted for as if the parent had directly disposed of the related assets or liabilities. This means these amounts should be transferred to P/L as a reclassification adjustment (for instance, in the case of foreign currency translation ) or directly to retained earnings (IFRS 10.B99).

Additionally, accounting for a former subsidiary becoming a joint operation is discussed in IFRS 11.

Scope of IFRS 10

IFRS 10 is applicable to all entities acting as a parent, except for those meeting the scope exemption criteria detailed in IFRS 10.4-4B. Consequently, a parent company controlling a subgroup, which is consolidated at a higher level under IFRS and not publicly listed, is not required to prepare consolidated financial statements if all the conditions in IFRS 10.4(a) are fulfilled. There are different perspectives regarding the applicability of this exemption by a subsidiary whose parent prepares consolidated financial statements under local GAAP that align closely with IFRS (e.g., ‘IFRS as adopted by the EU’). In my view, this exemption can be applied provided that any discrepancies with IFRS as issued by the IASB are negligible.

One of the conditions for exemption pertains to the non-controlling interests being notified and not opposing the non-preparation of consolidated financial statements. IFRS 10 does not impose a time limit for non-controlling interests to raise objections. Therefore, to err on the side of caution, it’s best to actively seek the approval of non-controlling interests for an exemption from preparing consolidated financial statements.

Note that local laws might mandate the presentation of consolidated financial statements even if an IFRS 10 exemption applies.

In the past, under IFRS and certain local GAAPs, prominent exemptions from consolidation were related to subsidiaries when control was temporary, the subsidiary’s activities differed significantly from the parent, or there were long-term restrictions on the transfer of funds to the parent. IFRS 10 currently does not incorporate these exemptions from consolidation.

When control (or significant influence ) is shared among two or more investors, the investee is not a subsidiary, and other relevant IFRS standards should be applied (i.e., IFRS 11 , IAS 28 , or IFRS 9 ). IFRS 3 covers the accounting for business combinations (i.e., gaining control of one or more businesses).

Exemption for investment entities

Investment entities are granted additional exemptions from consolidation (and business combination accounting). They are required to measure all of their subsidiaries at fair value through profit or loss according to IFRS 9 (IFRS 10.4B and IFRS 10.31-33). An investment entity (IFRS 10.27) is an entity that:

- Secures funds from one or more investors with the intention of offering those investors investment management services,

- Commits to its investor(s) that its business purpose is solely to invest funds for returns from capital appreciation, investment income, or both, and

- Measures and evaluates the performance of substantially all of its investments on a fair value basis.

Guidance on determining whether an entity is an investment entity can be found in IFRS 10.28, B85A-W, IE1-IE15. The accounting implications of an entity becoming or ceasing to be an investment entity are detailed in IFRS 10.B100-B101.

Exemption for employee benefit plans

IFRS 10.4A specifies that IFRS 10 does not apply to post-employment benefit plans or other long-term employee benefit plans to which IAS 19 is applicable. However, the phrasing isn’t entirely clear as to whether this exemption relates to financial statements prepared by employee benefit plans or to employers who need to consider whether such plans should be consolidated. It’s widely accepted in practice that this exemption pertains to the latter case. In other words, employers are not required to assess whether employee benefit plans should be treated as subsidiaries and thus need to be consolidated.

Subsidiaries acquired exclusively with a view to resale

There is no consolidation exemption for subsidiaries acquired solely for resale. Nevertheless, these can be classified as held for sale and discontinued operations under IFRS 5, which can considerably simplify the determination of fair value and consolidation. Specifically, the acquirer would not need to measure individual assets and liabilities at fair value, as all assets and liabilities will be presented in one line (one line for assets and another for liabilities). Any breakdown of these assets and liabilities is not required (IFRS 5.39). P/L consolidation will also be presented in a single line, representing discontinued operations. Example 13 accompanying IFRS 5 illustrates this approach. More discussion on the classification of assets and disposal groups acquired solely for resale can be found under IFRS 5.

IFRS 12 is an exhaustive standard that encapsulates all disclosure requirements relating to interests in other entities. In addition, paragraphs IAS 7.39 and onwards encompass substantial disclosure requirements regarding cash flows from changes in ownership interests in subsidiaries and other businesses.

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

The Method of Reporting a Minority Interest in Consolidated Financial Statements

- Small Business

- Finances & Taxes

- Financial Statements

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Cost Method & Equity Method

Journal entries in the equity method of accounting for investments, how to report corporate investments in stocks and mutual funds.

- Fully Adjusted Equity Method Vs. Complete Equity Method

- How to Prepare a Consolidated Cash Flow Statement

If your company holds substantial ownership interests in other businesses, you might need to prepare consolidated financial statements that combine the profits, losses and other financial activities of your company and its subsidiaries. And if you own less than 100 percent in any of these businesses, the amounts attributed to minority interest holders must also be disclosed. Under generally accepted accounting principles, or GAAP, there is a specific method of reporting these minority interests on consolidated financial statements.

When Consolidated Financial Statements Are Required

Under the general financial accounting rule, the determining factor for whether consolidated financial statements comes down to the level of control your company has over each business it has an ownership interest in. Sufficient control exists if you hold a majority of all voting rights in a company -- meaning you control more than 50 percent of the votes. The requisite control usually exists if you own more than 50 percent of an incorporated business's outstanding common stock. If consolidated financial statements are necessary, you'll need to account for the minority interest of each company included in the consolidation.

Minority Or Noncontrolling Interests

When one entity or person possesses the requisite majority control, all other business investors or owners make up the minority, or non-controlling, interest. For example, suppose you hold 70 percent of the outstanding voting shares in a corporation. Controlling more than 70 percent of shareholder votes requires you to prepare consolidated financial statements that include 100 percent of the corporation's income, losses and assets, as well as all other items that are disclosed on financial statements. But since you don't own 100 percent of the corporation, GAAP also requires you to report the amounts attributed to the 30-percent ownership of minority interest holders.

Consolidated Balance Sheet Reporting

Your consolidated balance sheet will already include all of the subsidiary's assets and liabilities, so it isn't necessary, nor is it correct, to report your investment in the subsidiary on the consolidated balance sheet. A consolidated balance sheet must disclose the minority interest holders' total share of the subsidiary's net assets. To illustrate, suppose the subsidiary has $100,000 in net assets -- which is reflected on your consolidated balance sheet. Thirty percent, or $30,000, of those net assets technically belongs to minority interest holders and must be disclosed on the consolidated balance sheet. This is done by reporting $30,000 on a line, such as “Minority interest in net assets,” before the equity section of the consolidated balance sheet.

Consolidated Income Statement Reporting

Like the balance sheet, your consolidated income statement also includes 100 percent of the subsidiary's revenue and expenses. To compute consolidated net income, however, GAAP requires that you subtract the income or loss attributed to minority interest holders and disclose that amount on a line such as, “Net income attributable to the non-controlling interest.” In other words, if the subsidiary reports net income of $100,000, the full amount is included in the consolidated income statement but you'll disclose that $30,000 of it is attributed to minority shareholders.

- Cengage Learning: Recognizing a Minority Interest in Consolidated Financial Statements

Michael Marz has worked in the financial sector since 2002, specializing in wealth and estate planning. After spending six years working for a large investment bank and an accounting firm, Marz is now self-employed as a consultant, focusing on complex estate and gift tax compliance and planning.

Related Articles

Is minority interest an asset or a liability, accounting for increase in ownership of subsidiary, examples of consolidation in advanced accounting, what is a consolidated balance sheet, what is the difference between consolidated & individual company financial statements, what is taxable on a dividend, consolidation vs. equity method of accounting, accounting rules for consolidation, financial statement consolidation rules, most popular.

- 1 Is Minority Interest an Asset or a Liability?

- 2 Accounting for Increase in Ownership of Subsidiary

- 3 Examples of Consolidation in Advanced Accounting

- 4 What Is a Consolidated Balance Sheet?

Consolidated Financial Statements:

Oct 07, 2011

210 likes | 953 Views

Consolidated Financial Statements:. Income Taxes, Cash Flows, and Installment Acquisitions. Income Taxes in Business Combinations and Consolidations. Accounting for income taxes in consolidated financial statements may be subdivided into the following three sections:

Share Presentation

- deferred income tax liability

- installment acquisitions

- intercompany sales

- subsidiaries prior accounting standards

Presentation Transcript

Consolidated Financial Statements: Income Taxes, Cash Flows, and Installment Acquisitions © 2003 The McGraw-Hill Companies, Inc., All Rights Reserved

Income Taxes in Business Combinations and Consolidations Accounting for income taxes in consolidated financial statements may be subdivided into the following three sections: • Income taxes attributable to current fair values of a combinee’s identifiable net assets. • Income taxes attributable to undistributed earnings of subsidiaries. • Income taxes attributable to unrealized and realized intercompany profits. Chapter 9

Income Taxes Attributable to Current Fair Values of a Combinee’s Identifiable Net Assets A business combination requiring a revaluation of the combinee’s identifiable assets under financial accounting may result in the following: • Meet the requirements for a tax-free corporate reorganization under the Internal Revenue Code. • A new income tax basis may not be required. • A temporary difference may result between provisions for depreciation and amortization in the financial statements and income tax returns. Chapter 9

Income Taxes Attributable to Undistributed Earnings of Subsidiaries Prior Accounting Standards for income taxes attributable to undistributed earnings of subsidiaries relating to deferred income tax liability were revised in 1992 as under: • To be recognized for an excess of the financial reporting carrying amount of an investment in a domestic subsidiary over its tax basis if the excess arose in fiscal years beginning December 15, 1992. • Need not be recognized for an excess of the financial reporting carrying amount over the tax basis of an investment in a foreign subsidiary if the excess essentially permanent in duration. Chapter 9

Income Taxes Attributable to Intercompany Profits • Federal income tax laws permit an affiliated group of corporations to file consolidated tax return. • Intercompany profits and losses are eliminated. Note: If a parent company and its subsidiaries do not qualify for the “affiliated group” status or elect to file separate tax returns, the provisions of FASB Statement No. 109, “Accounting for Income Taxes” for the recognition of deferred tax asses and liabilities apply. Chapter 9

Affiliated Group for Federal Income Tax Affiliated group for federal Income tax means one or more chains of includible corporation connected through stock ownership with a common parent corporation if: • Stock possessing at least 80 percent of both, voting power of all classes of stock and each class of nonvoting stock of each of the including corporations (except the common parent corporation) is owned directly by one or more of the other includible corporations. • The common parent corporation owns directly stock possessing at least 80 percent of the voting power of all classes of stock and at least 80 percent of each class of the nonvoting stock of at least one of the other includible corporations. Chapter 9

Illustration ABC Corp sold goods worth $12000 to it’s subsidiary Sub Corp at a gross profit of 20% of sales. The following journal entry will be passed for elimination of working paper: Intercompany Sales – ABC 12000 Intercompany Cost of Goods sold - ABC 9600 Cost of Goods Sold – Sub 1600 Inventories – Sub 800 Chapter 9

Consolidated Statement of Cash Flows Consolidated financial statement issued by publicly owned companies include a statement of cash flows which may present the following problems: • Depreciation and amortization expense. • Cash dividends. • Cash acquisition. • Cash Sale of part of Investment in subsidiary. Chapter 9

Cash Flow Difficulties Relating to Depreciation and Amortization Expense While preparing consolidated statement of cash flows: • Depreciation and amortization expense, based on current fair values of assets including any goodwill of subsidiaries on the date of business combination is added to consolidated income. • Net income applicable to minority interest is included in the computation of net cash provided by operating activities as 100% of the cash of all subsidiaries is included in a consolidated balance sheet. Chapter 9

Cash Flow Difficulties Relating to Cash Dividends • Reported cash flows from financing activities include cash dividends paid by parent company and partially owned subsidiary companies to minority stockholders. • Cash dividend paid by subsidiaries to the parent company have no effect on the consolidated statement of cash flows. Note: Dividend paid to minority stockholders that are material in amount may be disclosed separately in the consolidated statement of cash flows. Chapter 9

Cash Flow Difficulties Relating to Cash Acquisition Cash acquisition of additional shares of common stock by the parent company has the following effects: • Acquisition directly from the subsidiary: No change in the amount of consolidated cash, hence not reported. • Acquisition from Minority Stockholders: Reduces consolidated cash, hence reported in the cash flows from investing activities section. Chapter 9

Cash Flow Difficulties Relating to Cash Sale of part of Investment in subsidiary • A cash sale of a portion of an investment in the subsidiary company increases consolidated cash flow and is required to be reported in the cash flows from investing activities section. • A gain/loss from such a sale is represented as an adjustment of consolidated net income of the parent company and its subsidiaries and is reflected in the net cash flow from operating activities. Chapter 9

Installment Acquisition of Subsidiary • A parent company may obtain control of a subsidiary in: • A series of installment acquisitions of the subsidiary’s common stock. • In a single transaction constituting a business combination. • Installment acquisitions require application of accounting standards applicable to influenced investees and controlled subsidiaries. Chapter 9

Installment Acquisition of Subsidiary During the installment acquisition process the fair value of the subsidiary’s identifiable net asset is determined: • On the day the parent company attains control of the subsidiary. • By the equity method of accounting enabling the investor to influence the operating and financial policies of the investee in accordance with the generally accepted accounting principles. Note: Generally, the presumed common stock investment for exercising significant operating and financial influence over the investee is 20%. Chapter 9

- More by User

Financial Statements

Financial Statements Andrew Graham Queens University School of Policy Studies Two Lectures Cash Flows Income Statement S/H Equity Stmt Balance Sheet Comp. Inc. The Road to Financial Statement Enlightenment Should I stop and ask for directions? Warning! All numbers are not the same!

1.88k views • 112 slides

Consolidated Financial Statements

Consolidated Financial Statements. prepared from separate financial statements of acquiring (parent) and acquired (subsidiaries) companies using consolidation worksheet procedure present assets and liabilities of two companies as if they were single accounting entity

3.1k views • 53 slides

The Reporting Entity and Consolidated Financial Statements

Consolidated Financial Statements. Consolidated financial statements present the financial position and results of operations for a parent (controlling entity) and one or more subsidiaries (controlled entities) as if the individual entities actually were a single company or entity.. Consolidated Financial Statements.

944 views • 39 slides

Consolidated Financial Statements: Issues in IFRS

Consolidated Financial Statements: Issues in IFRS. Asish K Bhattacharyya. Measurement Of Subsidiary’s Assets and Liabilities At Fair Value.

656 views • 14 slides

IAS-27 Consolidated Financial Statements

IAS-27 Consolidated Financial Statements. Scope. This standard shall be applied- In preparation of consolidated financial statement for a group of a entities under the control of a parent.

2.01k views • 65 slides

Financial Statements. Chapter 2 MSCM8615. Purpose of Financial Statements. To better inform interested stakeholders about the financial health of the church/diocese and how its funds are being used These statements are audited/reviewed by independent public accounting firms

617 views • 7 slides

FINANCIAL STATEMENTS

Premier Insurance Limited. Caring for You……………Since 1952. FINANCIAL STATEMENTS. IGNORE & REGRET. Premier Insurance Limited. Caring for You……………Since 1952. KYC. KNOW YOUR CLIENT FINANCIAL STATEMENTS INFORMATION TREASUREHOUSE. Premier Insurance Limited. Caring for You……………Since 1952.

299 views • 9 slides

Consolidated Financial Statements under IFRS

Objective of IAS 27 . The standard applies tothe preparation and presentation of consolidated financial statements for a group of entities under the control of a parent.accounting for investments in subsidiaries, joint ventures and associates when an entity presents separate financial statements.Consolidated financial statements are the financial statements of a group presented as those of a single entity..

526 views • 20 slides

Consolidated Financial Statements. Simple Group (Subs +Associates) Balance Sheet & Income Statements. Syllabus Requirement. Group / Consolidated Financial Statements Balance Sheet & Income Statement in accordance with relevant IFRs / IASs.

308 views • 0 slides

Financial Statements. Business Management. Today’s Objectives. Interpret basic financial statements, including cash flow, income statement, and a balance sheet. Prepare a budget to include short-term and long-term expenditures. Financial Statements. Income Statement Cash Flow Statement

487 views • 19 slides

CONSOLIDATED STATEMENTS General Concepts

CONSOLIDATED STATEMENTS General Concepts. Same GAAP as separate statements Only external transactions Specific consolidation mechanics depend on Parent’s accounting for investment in subsidiary. CONSOLIDATION MECHANICS. Consolidation workpapers No “set of books” for consolidated entity

900 views • 69 slides

Consolidated Financial Statements and Accounting for Investments in Subsidiaries

Consolidated Financial Statements and Accounting for Investments in Subsidiaries. Background Regulatory Framework The Financial Statement prepared for a group of companies is govern by the Companies Act No 17 of 1982 and

953 views • 57 slides

An Introduction to Consolidated Financial Statements Pertemuan 17-18

An Introduction to Consolidated Financial Statements Pertemuan 17-18. Matakuliah : Akuntansi Keuangan Lanjutan I Tahun : 2010. Consolidated Income Statements. Intercompany transactions are eliminated to prevent double counting of revenues and expenses.

337 views • 10 slides

An Introduction to Consolidated Financial Statements

An Introduction to Consolidated Financial Statements. Business Combinations Consummated Through Stock Acquisitions. Business combination. One or more companies become subsidiaries of a common parent corporation. The Reporting Entity. Parent Financial Statements _____ _____ _____ _____

619 views • 43 slides

An Introduction to Consolidated Financial Statements. Chapter 3. Learning Objective 1. Recognize the benefits and limitations of consolidated financial statements. Business Combinations Consummated Through Stock Acquisitions. Business combination. One or more companies

1.13k views • 51 slides

Concepts of Consolidated Financial Statements

Parent. Subsidiary. Consolidated financial statements are prepared. 2- 1. Concepts of Consolidated Financial Statements. CONSOLIDATED FINANCIAL STATEMENTS “Economic Substance Over Legal Form”. Conditions for consolidation Majority control Parent company owns more than 50% of voting stock

558 views • 25 slides

Financial Statements. Income Statements Revenues Expenses (expired costs) Timing of recording at time of sale at time of use fixed and variable Non Cash Items. Financial Statements. Prepare an Income Statement Revenues Sales Costs Operating Non Cash (Depreciation)

462 views • 11 slides

Consolidated Financial Statements. Many corporations are composed of numerous separate companies and, in turn, prepare consolidated financial statements. Consolidated Financial Statements.

1.21k views • 85 slides

Ch3 An Introduction to Consolidated Financial Statements

Ch3 An Introduction to Consolidated Financial Statements. Parent–subsidiary Relationship. a parent–subsidiary relationship is created Acquire controlling interest in voting stock Usually more than 50% May have control through indirect ownership(Ch9). Consolidated financial statements.

588 views • 44 slides

Financial Statements. Learning Objectives. What are the different financial statements? How do they differ from each other? What is their purpose? How are they constructed?. Purpose of Financial Statements.

690 views • 28 slides

AI Summary to Minimize your effort

AS 21 Consolidated Financial Statements

Updated on : May 17th, 2021

AS 21 Consolidated Financial Statements should be applied in preparing and presenting consolidated financial statements for a group of enterprises under the sole control of a parent enterprise.

Applicability of AS 21 Consolidated Financial Statements

This standard must be applied when accounting for investment in subsidiaries in a separate financial statement of the parent.

It is to be noted that while preparing a consolidated financial statement, other standards also stay relevant in a similar manner as for standalone statements.

This accounting standard doesn’t deal with:

- Accounting methods for amalgamations and effects on consolidation, which includes goodwill which arises on an amalgamation

- Accounting for investments in JVs (joint ventures)

- Accounting for investments in associates

Presentation of Consolidated Financial Statements

A parent company presenting its consolidated financial statements must present these statements along with its standalone financial statements.

The users of financial statements of a parent company are typically concerned with and are required to be educated about, the results of operations and financial position of not only the company itself but also of that group together.

This requirement is served by offering the users of financial statements –

- Standalone financial statements of a parent; and

- Consolidated financial statements that provide financial information about the business group as that of a lone enterprise without respect to the legal restrictions of the distinct legal entities

Scope of Consolidated Financial Statements

A parent company that presents its consolidated financial statements must consolidate all of its subsidiaries, foreign as well as domestic. Where a company doesn’t have any subsidiary, however, has associates and/or joint ventures such company also needs to prepare consolidated financial statements as per Accounting Standard 23 – Accounting for Associates in Consolidated Financial Statements and Accounting Standard 27 – Financial Reporting of Interests in JVs respectively.

Exclusion of Subsidiaries

A Subsidiary must be excluded from the consolidation when:

- control is planned to be temporary since the subsidiary was taken over and was held exclusively for disposal in the near future, or

- the subsidiary is operating under severe long-standing restrictions that considerably impair the subsidiary’s ability to transfer funds to its parent

In a consolidated financial statement, investments in such subsidiaries must be accounted for as per AS 13 – Accounting for Investments. Reasons for which a subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements.

Consolidation Procedures

While preparing a consolidated financial statement, the parent company’s financial statements and its subsidiaries must be combined line by line by totaling together similar items such as assets, liabilities, income, and expenses.

For consolidating financial statements in a way to present financial information about a group as that of a lone enterprise, the below-motioned steps must be taken:

- Eliminate the cost to the parent of its investment made in each of its subsidiaries and such parent’s equity portion of each of its subsidiaries, at the date when the investment in such subsidiaries are made

- any additional cost to the parent company of the investment in the subsidiary over the parent company’s share of the equity of subsidiary, at the date on which the investment in such subsidiary is done, must be shown as goodwill for recognizing as the asset in its consolidated financial statements

- when the cost to the parent of the investment in the subsidiary is lower than the parent company’s share of the equity of subsidiary, a date on which the investment in such subsidiary is done, the difference must be treated as the capital reserve in its consolidated financial statements

- a portion of minority interests in net income of the consolidated subsidiary for reporting period must be recognized and adjusted against income of the group for arriving at the net income which is attributable to owners of such parent company; and

- a portion of minority interests in net assets of the consolidated subsidiaries must be recognized and provided for in consolidated balance sheet distinctly from the equity and liabilities of the parent company.

- amount of equity which is attributable to the minorities at the date on which such investment in the subsidiary is done; and

- minorities’ share of the movements in equity from the date the relationship of parent-subsidiary came in to force

- Where carrying investment amount in a subsidiary is different from the cost, such carrying amount is to be considered for the above calculations.

Accounting for Investments in the Subsidiaries in Separate Financial Statement of the Parent

In a parent company’s separate financial statements, the investments made in subsidiaries must be accounted for as per AS 13 – Accounting for Investments.

Disclosures in the Financial Statements

Following disclosures must be made w.r.t. AS 21 Consolidated Financial Statements:

- in the consolidated financial statements the list of all the subsidiaries of the parent company which includes the name, country of residence or incorporation, the share of ownership interest and, in case different, the share of voting power held

- In case the consolidation of a particular subsidiary hasn’t been made according to the grounds permissible in the accounting standard, reasons for which such subsidiary isn’t included in the consolidation must be disclosed in such consolidated financial statements

- type of relationship between a parent and its subsidiary, whether direct control or indirect control through the subsidiaries

- effect of acquisition and disposal of the subsidiaries on the financial position at the date of reporting results for the reporting period and on corresponding amounts for the preceding period; and

- Name of the subsidiary(s) of which reporting date(s) is different

Major Differences between AS 21 and Ind AS 110

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

IMAGES

VIDEO

COMMENTS

A consolidated financial statement is maintained to help parent companies and their subsidiaries to have a ready reference of all the units' financial status consolidated at one place. A parent company, when it owns a significant stake in another company, the latter is called a subsidiary. Even if both have separate legal entities and both ...

Presentation of non-consolidated participations 43 7. Disclosure of companies in which the Group holds a permanent direct or indirect significant participation 45 ... If a financial group publishes consolidated financial statements, all entities within the scope of consolidation are exempt from preparing a cash flow statement in their statutory ...

International Financial Reporting Standard 10 Consolidated Financial Statements (IFRS 10) is set out in paragraphs 1-33 and Appendices A-D. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard.

18.3 General consolidation presentation and disclosure principles. Consolidated financial statements include the accounts of a reporting entity and all other legal entities in which it holds a controlling financial interest (i.e., subsidiaries of the reporting entity). ASC 810-10-10-1 and S-X 3A-02 affirm the fundamental principle in US GAAP ...

The presentation of a consolidated group may require certain adjustments for transactions occurring between the reporting entity and its subsidiaries. As a general rule, the amounts reported in consolidated financial statements should reflect the economic effects of only those transactions between the consolidated reporting entity and third ...

IFRS 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. IFRS 10 was issued in May 2011 and applies to annual periods beginning on or after 1 January 2013.

Consolidated financial statements are the combined financial statements of a parent company and its subsidiaries . Because consolidated financial statements present an aggregated look at the ...

Consolidated financial statements of a group should be prepared applying uniform accounting policies (IFRS 10.19,B86-B87). ... Note that local laws might mandate the presentation of consolidated financial statements even if an IFRS 10 exemption applies. In the past, under IFRS and certain local GAAPs, prominent exemptions from consolidation ...

11 Joint Arrangements and IFRS 12 Disclosures. The views expressed in this presentation are those of the presenter, not necessarily those of the IFRS Foundation or the IASB. Slides can be downloaded by clicking on the button below the slides window. To ask a question, type into the designated text box on your screen and click ―submit‖.

1 January 2005. Effective date of IAS 27 (2003) 25 June 2005. Exposure Draft of Proposed Amendments to IFRS 3 and IAS 27. 10 January 2008. Revised IAS 27 (2008) issued. 22 May 2008. IAS 27 amended for Cost of a Subsidiary in the Separate Financial Statements of a Parent on First-time Adoption of IFRSs. 22 May 2008.

Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Classification of Liabilities as Current or Non-current—Deferral of Effective Date, which amended IAS 1, was approved for issue by all 14 members of the International Accounting Standards Board. Hans Hoogervorst.

The weighted average duration of the defined benefit obligation at 31 December 2021 is 23.3 years (2020: 23.2 years). IAS 19.142 IAS 1.125(a) IAS 19.67 IAS 19.147(c) 80 Illustrative Corporation Group: IFRS Example Consolidated Financial Statements - 31 December 2021. Notes to the consolidated financial statements.

FSP 6.2 was updated to include a summary of recently-issued FASB guidance that affects the statement of cash flows.; FSP 6.5.2 was updated to clarify guidance on the definition of cash equivalents.; FSP 6.5.3 was updated to clarify guidance on the presentation and disclosure of amounts generally described as restricted cash or restricted cash equivalents.

IFRS 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. IFRS 10 was issued in May 2011 and applies to annual periods beginning on or after 1 January 2013 (IASB ...

Notes to the consolidated financial statements 16. Appendix I 185. Presentation of comprehensive income - Two-statement approach 185. Acknowledgements 187. Keeping you informed 188 ... For example, IFRS does not require the presentation of separate financial statements for the parent entity, and this guide includes only consolidated financial ...

Consolidated Income Statement The. Learning Objective 9 Amortize. Effect of Amortization. Effect of Amortization. Effect of Amortization. Cash Receivables, net Inventories Other current. Accounts payable Notes payable Common. Consolidated financial statement - Download as a PDF or view online for free.

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

Controlling more than 70 percent of shareholder votes requires you to prepare consolidated financial statements that include 100 percent of the corporation's income, losses and assets, as well as ...

Consolidated Financial Statements under IFRS. Objective of IAS 27 . The standard applies tothe preparation and presentation of consolidated financial statements for a group of entities under the control of a parent.accounting for investments in subsidiaries, joint ventures and associates when an entity presents separate financial statements.Consolidated financial statements are the financial ...

AS 21 Consolidated Financial Statements must be employed for preparing and presenting consolidated financial statements for parent-controlled groups. Applicable in accounting for investment in subsidiaries. Excludes accounting for amalgamations, JVs, and associates. Presentation must include both standalone and consolidated statements.

18.8 Combined financial statements. Publication date: 30 Sep 2023. us Financial statement presentation guide. If a reporting entity concludes that consolidated financial statements are not required, it may still be appropriate to bring together the balance sheet, income statement, equity, and cash flow accounts of two or more affiliated ...

Insights ›. Illustrative Ind AS consolidated financial statements - March 2023. This publication is intended to help preparers in the preparation and presentation of consolidated financial statements in accordance with Indian Accounting Standards (Ind AS) and Schedule III to the Companies Act, 2013 by illustrating a format for consolidated ...

31.4.1 Investments in noncontrolled entities. A parent company's investment in a noncontrolled entity is accounted for on the same basis applied in preparing the consolidated financial statements. Therefore, investments measured at fair value or accounted for using the equity method should be accounted for in a similar manner in the parent ...

Presentation of the independent auditor's report on the financial statements and consolidated annual report of the Company. 2.1. Shareholders of the Company were presented with the independent ...