- Architecture and Design

- Asian and Pacific Studies

- Business and Economics

- Classical and Ancient Near Eastern Studies

- Computer Sciences

- Cultural Studies

- Engineering

- General Interest

- Geosciences

- Industrial Chemistry

- Islamic and Middle Eastern Studies

- Jewish Studies

- Library and Information Science, Book Studies

- Life Sciences

- Linguistics and Semiotics

- Literary Studies

- Materials Sciences

- Mathematics

- Social Sciences

- Sports and Recreation

- Theology and Religion

- Publish your article

- The role of authors

- Promoting your article

- Abstracting & indexing

- Publishing Ethics

- Why publish with De Gruyter

- How to publish with De Gruyter

- Our book series

- Our subject areas

- Your digital product at De Gruyter

- Contribute to our reference works

- Product information

- Tools & resources

- Product Information

- Promotional Materials

- Orders and Inquiries

- FAQ for Library Suppliers and Book Sellers

- Repository Policy

- Free access policy

- Open Access agreements

- Database portals

- For Authors

- Customer service

- People + Culture

- Journal Management

- How to join us

- Working at De Gruyter

- Mission & Vision

- De Gruyter Foundation

- De Gruyter Ebound

- Our Responsibility

- Partner publishers

Your purchase has been completed. Your documents are now available to view.

A Systematic Overview of Blockchain Research

Blockchain has been receiving growing attention from both academia and practices. This paper aims to investigate the research status of blockchain-related studies and to analyze the development and evolution of this latest hot area via bibliometric analysis. We selected and explored 2451 papers published between 2013 and 2019 from the Web of Science Core Collection database. The analysis considers different dimensions, including annual publications and citation trends, author distribution, popular research themes, collaboration of countries (regions) and institutions, top papers, major publication journals (conferences), supportive funding agencies, and emerging research trends. The results show that the number of blockchain literature is still increasing, and the research priorities in blockchain-related research shift during the observation period from bitcoin, cryptocurrency, blockchain, smart contract, internet of thing, to the distributed ledger, and challenge and the inefficiency of blockchain. The findings of this research deliver a holistic picture of blockchain research, which illuminates the future direction of research, and provides implications for both academic research and enterprise practice.

1 Introduction

With the era of bitcoin, digital cash denoted as BTC makes it possible to store and transmit value through the bitcoin network [ 1 ] . And therewith, blockchain, the technology underlying bitcoin, which adopts a peer-to-peer network to authenticate transactions, has been gaining growing attention from practices, especially Libra, a global currency and financial infrastructure launched by Facebook, and digital currency electronic payment. Currently, blockchain is also an increasingly important topic in the academic field. Blockchain research has considerably progressed, attracting attention from researchers, practitioners, and policy-makers [ 2 , 3 , 4 , 5 , 6 , 7 , 8 , 9 ] .

Considering the huge potential benefits that blockchain would bring in various aspects of industries, for instance, finance and economy [ 10 , 11 , 12 ] , internet of things [ 13 , 14 , 15 ] , energy [ 16 , 17 ] , supply chain [ 18 , 19 ] , and other areas. It is often compared with the Internet and is even referred to as a new form of the Internet. As a result, the number of publications in the blockchain is growing rapidly. According to an initial search on the Web of Science Core Collection, over 2000 scientific papers published are related to blockchain.

Under the circumstances where the number of research publications in the blockchain is quickly increasing, although studies have tried to provide some insights into the blockchain research via literature reviews [ 20 , 21 , 22 , 23 , 24 ] . Comprehensive scientometric analysis of academic articles published in influential journals are beneficial to the further development of blockchain research. This research conducts a bibliometric visualization review and attempts to deliver an overview of the research in this fast-growing field.

The objectives of this research are as follows. First, we intend to build an overview of the distribution of blockchain-related research by time, authors, journals, institutions, countries (regions), and areas in the blockchain academic community. Second, we probe the key research topics of blockchain study, for which purpose, we conduct keyword co-occurrence analysis. Third, we picture the intellectual structure of blockchain study based on co-citation analysis of articles and author co-citation analysis. Finally, we identify the direction for the evolution of blockchain study. We adopt Citespace to detect and visualize emerging trends in blockchain study. To achieve these targets, we posed the following research questions:

Q1: What is the distribution pattern of blockchain publications and citations over recent years? Q2: Which are the main international contributing countries (regions) and institutions in blockchain research, and the collaboration network among them? Q3: What are the characteristics of the authorship distribution pattern? Q4: What are the key blockchain subjects based on the number of publications? Q5: Which are the major journals or conferences for blockchain-related research? Q6: Which are the most influential papers in blockchain research based on the number of citations? Q7: Who are the most influential authors in blockchain research according to the author co-citation network? Q8: What are the research trends in blockchain? Q9: What are the most supportive funding agencies for blockchain research?

Our intended contributions in this research are twofold. First, it is an attempt of adopting co-citation analysis to provide comprehensive and up-to-date developing trends in the lasted hot area, blockchain. Second, this study depicts a state-of-the-art blockchain research development and gives enlightenment on the evolution of blockchain. The findings of this research will be illuminating for both academic researchers, entrepreneurs, as well as policymakers.

The rest of the article is organized as follows. The literature review mainly summarizes related work. The “Data and methodology” section describes the data source and methodological process. The “Results” section presents the main results based on the bibliometric analysis as well as statistical analysis. “Conclusions and implications” conclude this research provides answers to the aforementioned research questions and poses directions for further work.

2 Literature Review

Scientometric analysis, also known as bibliometric network visualization analysis has been widely adopted in numerous areas to identify and visualize the trends in certain fields. For instance, Bonilla, et al. analyzed the development of academic research in economics in Latin America based on a scientometric analysis [ 25 ] . Li, et al. conducted research on emerging trends in the business model study using co-citation analysis [ 26 ] . Gaviriamarin, et al. applied bibliometric analysis to analyze the publications on the Journal of Knowledge Management [ 27 ] .

Since the birth of bitcoin, as the foundation of which, blockchain has gained an increasing amount of attention in academic research and among practices. The research papers focus on the blockchain are quite abundant and are continuing to emerge. Among a host of papers, a few studies investigate the research trend of blockchain-based on a bibliometric analysis [ 22 , 23 , 28 , 29 , 30 ] .

Table 1 presents a summary of these bibliometric studies that summarized some findings on blockchain research, yet very few investigated the co-citation network and the evolution of popular topics in a timeline view. The number of papers these articles analyzed is relatively small, which may be because they used simple retrieval formula in searching blockchain-related articles, and it could pose a threat to bibliometric analysis. Therefore, this research aims to conduct a comprehensive analysis of the status of blockchain research, which is beneficial to future research and practices.

An overview of existing bibliometric studies on blockchain research

Note: NP = number of publications; WOS = Web of Science Core Collection; CNKI = China National Knowledge Infrastructure Databases; EI = EI Compendex, an engineering bibliographic database published by Elsevier; Scopus = Elsevier’s abstract and citation database.

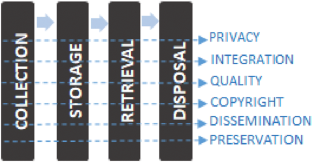

3 Data and Methodology

This section elaborates steps to conduct a comprehensive bibliometric-based analysis: 1) data collection, 2) methodological process. The overall approach and methodology are shown in Figure 1 , the details could be seen as follows.

Research methodology

3.1 Data and Collection

As the leading database for science and literature, the Web of Science Core Collection has been widely used in bibliometrics analysis. It gives access to multidisciplinary information from over 18,000 high impact journals and over 180,000 conference proceedings, which allows for in-depth exploration of the complete network of citations in any field.

For the sake of acquiring enough articles that are relative to the blockchain, we select keywords from Wikipedia and industry information of blockchain, and some existing research literature [ 1 , 20 , 23 , 30 ] . Moreover, in consideration of that, there are a host of blockchain research papers in various fields, in fact, although some papers use keywords in abstract or the main body, blockchain is not the emphasis of the researches. Therefore, in order to get more accurate research results, we choose to conduct a title search instead of a topic search. Table 2 presents the retrieval results with different keywords in the titles, we find that among publications that are relative to the blockchain, the number of Proceeding Papers is the biggest, which is closely followed by articles, and a few reviews. Based on the comparison of five search results in Table 2 . In addition, for accuracy and comprehensiveness, we manually go through the abstract of all the papers form conducting a title search, and choose papers that are related to blockchain. Finally, a dataset with 2451 articles is used in the subsequent analysis.

The dataset we choose has good representativeness, although it may not completely cover all papers on the blockchain, it contains core papers, and in bibliometric analysis, core papers are enough to provide a holistic view for a comprehensive overview of blockchain research.

Blockchain research article characteristics by year from 2013 to 2019

Note: Document type include: Article(A), Proceedings Paper(P), Review(R); Timespan = 2013 ∼ 2019, download in May 31, 2019; Indexes = SCI-EXPANDED, SSCI, A&HCI, CPCI-S, CPCI-SSH, ESCI, CCR-EXPANDED, IC.

3.2 Methodological Process

The bibliometric approach has received increasing attention in many research domains. In this study, the methodological process mainly includes three methods: 1) descriptive statistical analysis, 2) article co-citation, author co-citation, and cluster analysis on co-cited articles; 3) time-zone analysis on co-cited keywords.

Descriptive statistical analysis displays an overall status of the research development in the target field, which mainly presents an overview by publication years, document types, the research area of published journals, number of citations, and in terms of most cited paper, influential author, institutions and countries. Co-citation analysis helps to identify the frequency of co-cited papers and authors and provides crucial insights into the intellectual structure of certain research fields [ 31 ] . Time-zone analysis helps to understand the flow of information and research trends in the target area [ 32 ] .

Various visualization tools have been designed and developed as computer software such as Citespace and VOSviewer. In this study, we use Citespace for co-citation analysis and timezone analysis, VOSviewer is adopted for social network analysis and visualization, we also apply other tools such as Excel and Tableau for basic statistical analysis and the visualization of the bibliometric results. Notably, in Citespace, core nodes are displayed as “citation tree-rings”, which contain abundant information of an article, for instance, the color of a citation ring denotes the year of corresponding citations, and the rule of colors in Citespace is the oldest in dark blue and newest in light orange with a spectrum of colors in between, the thickness of a ring is proportional to the number of citations in a time slice [ 33 ] . Figure 2 illustrates the details of the citation tree-rings. In addition, Citespace adopts a time-slicing mechanism to produce a synthesized network visualization [ 34 ] .

![research and analysis of blockchain data Figure 2 Citation tree-rings[33]](https://www.degruyter.com/document/doi/10.21078/JSSI-2021-205-34/asset/graphic/j_JSSI-2021-205-34_fig_002.jpg)

Citation tree-rings [ 33 ]

4.1 Distribution by Publication Year

Table 3 illustrates several characteristics of blockchain-related publications sorted by the year of publication. The annual number of articles and countries has been growing continuously since the proposing of Nakamoto’s paper in 2008 [ 1 ] , and the first blockchain research paper was published in 2013. By examining the published papers over time, there were only eight articles published in 2013. Afterward, with a continuous increase, a peak of 1,148 articles was published in 2018, and the number of publications is likely to grow ever since. Meanwhile, the annual number of countries taking part in blockchain research has also rapidly increased from 6 to 93 between 2013 and 2017, whereas the average number of Times Cited for single articles declined from 34.00 to 1.73 between 2013 and 2018. Over the observation period, 97 countries took part in the research on the blockchain with a sample of 44 in the H-index of our paper.

Statistical description of Blockchain research article from 2013 to 2019

Note: NP = number of publications; No.CO = number of countries; AV.TC = average number of Times Cited.

Figure 3 presents the cumulative numbers of published articles and citations from 2013 to 2019. There was a drastic increase in the number of papers published annually after 2016. As for the cumulative number of citations, there was no citation of blockchain literature before 2013, and 272 citations in 2013. By 2018, this number has grown over 10,000, which implies a widespread influence and attention of blockchain study in recent years.

Cumulative growth in blockchain publications and citations, 2013–2019

The exponential growth is a typical characteristic of the development of research fields [ 35 ] . The model can be expressed as:

where C is the cumulative number of articles or citations, Y is the publication or citation year, α , and β are parameters. In this study period, the cumulative articles and citations in the filed grow exponentially by R articles 2 = 0.9463 and R citations 2 = 0.8691 respectively. This shows that the research quantity curve of the blockchain is like an exponential function, which means the attention of academic circles on the blockchain has been increasing in recent years.

4.2 Distribution and International Collaboration Among Countries/Regions

A total of 97 countries/areas have participated in blockchain research during the observation period. Table 4 shows the number of articles for each country (region) contributing to publications. Remarkably, an article may be written by several authors from different countries/areas, therefore, the sum of articles published by each country is large than the total number of articles. As can be seen from Table 4 , the USA and China play leading roles amongst all countries/areas observed, with publications of 532 (20.94%) and 489 (19.24%) articles respectively, followed by the UK, which published 214 (8.42%) articles.

Blockchain research country (region) ranked by number of articles (top 25)

Note: NP = number of publications; No.TC = number of total Times Cited; AV.TC = average number of Times Cited; No.CA = number of Citing Articles.

From the perspective of citations, according to country/area distribution in Table 4 , we also find that USA-authored papers were cited by 1,810 papers with 3,709 (36.57%) citations, accounting for 36.57% of total citations. Meanwhile, articles from the USA also have a very high average number of citations per paper with a frequency of 6.97, which ranks third among the top 25 countries/ areas. Interestingly, the articles from Austria and Singapore appeared with the highest average number of citations per paper, with a frequency of 7.44 and 7.16 respectively, whereas the number of publications from these two countries was relatively low compared with the USA. The second was China, following the USA, papers were cited by 753 articles with 1,357 (13.38%) citations. Although the number of articles from China is close to the USA, the average number of citations per paper is lower with a frequency of 2.78. The subsequent countries include the UK, Germany, and Italy. The results indicate that the USA is the most influential country in blockchain.

International collaboration in science research is both a reality and a necessity [ 36 ] . A network consisting of nodes with the collaborating countries (regions) during the observation period is shown in Figure 4 . The network is created with the VOS viewer in which the thickness of the linking lines between two countries (regions) is directly proportional to their collaboration frequency. We can see from Figure 4 that the USA has the closest collaborative relationships with China, the UK, Australia, Germany, and Canada. China has the closest collaborative relationships with the USA, Australia, Singapore, UK, and South Korea. UK has the closest collaborative relationships with the USA, China, France, and Switzerland. Overall, based on the collaboration network, collaboration mainly emerges in highly productive countries (regions).

International collaboration network of the top 25 countries (territories), 2013–2019

4.3 Institution Distribution and Collaboration

A total of 2,190 institutions participated in blockchain-related research, and based on the number of publications, the top 25 of the most productive institutions are shown in Table 5 . Chinese Academy of Sciences had the highest number of publications with 43 papers, followed by the University of London with 42 papers, and Beijing University of Posts Telecommunications ranked third with 36 papers. The subsequent institutions included the University of California System and the Commonwealth Scientific Industrial Research Organization (CSIRO). In terms of the number of total Times Cited, Cornell University is cited most with 499 citations, and the average number of Times Cited is 20.79. Massachusetts Institute of Technology followed closely with 407 citations and with an average number of Times Cited of 22.61. The University of California System ranks third with 258 citations and an average number of Times Cited of 8.06. ETH Zurich ranked fourth with 257 citations and an average number of Times Cited of 10.28. It is notable that the National University of Singapore also had a high average number of Times Cited of 12.56. These results indicate that most of the influential institutions are mainly in the USA and Europe and Singapore. The number of publications from institutions in China is large, whereas few of the papers are highly recorded in average Times Cited. Papers from the National University of Defense Technology China took the highest of average Times Cited of 7.79.

Blockchain research country (territory) ranked by number of articles (top 25)

To further explore data, the top 186 institutions with at least 5 articles each are chosen for collaboration network analysis. The collaboration network map is shown in Figure 5 , the thickness of linking lines between two institutions is directly proportional to their collaboration frequency. As seen from the cooperation network in the Chinese Academy of Sciences, Cornell University, Commonwealth Scientific Industrial Research Organization (CSIRO), University of Sydney, and ETH Zurich cooperated widely with other institutions. This shows that collaboration between institutions may boost the research of blockchain which echoes with extant research that proposes with-institution collaboration and international collaboration may all contribute to article quality [ 37 ] .

Collaboration network for institutions, 2013–2019

4.4 Authorship Distribution

The total number of authors who contribute to the publications of blockchain is 5,862. Remarkably, an article may be written by several authors from different countries (regions) or institutions. Therefore, the total number of authors is bigger than the total number of articles. In fact, during the observation period, the average number of authors per paper is 2.4 articles. Reveals the distribution of the number of authors with different numbers of papers. As seen from the results, most of the authors had a tiny number of papers, i.e., among 5,862 authors, 4,808 authors have only one paper, 662 authors have two papers, and 213 authors have three papers.

According to the participation number of articles, the most productive author in the blockchain is Choo, Kim-Kwang Raymond from Univ Texas San Antonio, who took part in 14 articles in blockchain, followed by Marchesi, Michele from Univ of Cagliari, who took part in 13 articles related to blockchain. The third most productive author is Bouri, Elie from the Holy Spirit University of Kaslik, and David Roubaud from Montpellier Business School. Miller, Andrew, Shetty, Sachin, and Xu, Xiwei ranked fourth, who took part in 10 articles related to blockchain.

The distribution of number of author with different numbers of articles

Note: No.AU = number of author; No.AR = number of articles.

Figure 6 displays the collaboration network for authors. The thickness of the linking lines between the two authors is directly proportional to their collaboration frequency. As we can see from Figure 6 , it indicates the most productive authors cooperate widely with others.

Collaboration network for authors, 2013–2019

4.5 Distribution of Subject Categories

Table 7 presents the top 25 blockchain categories ranked in terms of the number of articles published. As can be seen from Table 7 , among the top 10 categories, six are related to the Computer Science field, which indicates that blockchain-related researches are more abundant in the field of Computer Science compared with other research fields. Besides, there are also publications in the category of Business & Economics with 385 records.

The top 25 blockchain categories ranked by the number of publications

Figure 7 illustrates the betweenness centrality network of papers of the above categories by using Citespace after being simplified with Minimum Spanning Tree network scaling, which remains the most prominent connections. We can see from Figure 7 , the centrality of Computer Science, Engineering Electrical Electronic, Telecommunications, Engineering, and Business & Economics are notable.

Categories involved in blockchain, 2013–2019

4.6 Journal Distribution

The research of blockchain is published in 1,206 journals (conferences), the top 25 journals (conferences) are displayed in Table 8 . Blockchain research papers are concentrated in these top journals (conferences) and with a concentration ratio of nearly 20%. The major blockchain research journals include Lecture Notes in Computer Science, IEEE Access, Economics Letters, Future Generation Computer Systems, and Finance Research Letters, with more than 20 articles in each one. Meanwhile, the major blockchain research conferences include IEEE International Conference on Hot Information-Centric Networking, International Conference on Parallel and Distributed Systems Proceedings, International Conference on New Technologies Mobility, and Security, and Financial Cryptography and Data Security, with at least 14 articles published in each of these.

The top 25 blockchain publication journals (conferences)

Note: NP = number of papers; No.TC = number of total Times Cited; Italic represents conference.

4.7 Intellectual Structure of Blockchain

Since the notion of co-citation was introduced, there are a host of researchers have adopted the visualization of co-citation relationships. The work is followed by White and Griffith [ 38 ] , who identified the intellectual structure of science, researches then broaden the unit of analysis from articles to authors [ 39 , 40 ] . There are two major types of co-citation analysis, namely, article cocitation analysis and author co-citation analysis, which are commonly adopted to visualize the intellectual structure of the research field. In this study, we explore the intellectual structure of blockchain by using both article co-citation analysis and author co-citation analysis. We apply Citespace to analyze and visualize the intellectual structure [ 41 ] .

In this study, mining spanning trees was adopted to present the patterns in the author cocitation network, a visualization of the network of author co-citation is demonstrated in Figure 8 . In the visualization of the co-citation network, pivot points are highlighted with a purple ring, and landmark nodes are identified with a large radius. From Figure 8 , there are six pivot nodes and landmark nodes: Nakamoto S, Buterin V, Eyal I, Wood G, Swan M, Christidis K. These authors truly played crucial roles during the development of blockchain research. Table 9 shows the ranking of author citation counts, as well as their prominent publications.

Network of author co-citation, 2013–2019

The top 15 co-cited author ranked by citation counts

Nakamoto S, as the creator of bitcoin, authored the bitcoin white paper, created and deployed bitcoin’s original reference implementation, is not surprised at the top of the co-citation count ranking, and has 1,202 citations in our dataset. Buterin V, a Russian-Canadian programmer, and writer primarily are known as a co-founder of ethereum and as a co-founder of Bitcoin Magazine, follows Nakamoto S, receives 257 citations. Eyal I, an assistant professor in technion, is a third of the ranking, with a representative article is “majority is not enough: Bitcoin mining is vulnerable”. Wood G, the ethereum founder, and free-trust technologist ranks fourth with 244 citations. The other core author with high citations includes Swan M, Christidis K, Bonneau J, Szabo N, Zyskind G, Castro M, and Meiklejohn S, with more than 150 citations of each person, and the typical publications of there are present in Table 9 .

To further investigate the features of the intellectual structure of blockchain research, we conducted an article co-citation analysis, using cluster mapping of co-citation articles networks to complete a visualization analysis of the evolution in the research field of blockchain. According to the article co-citation network, we adopted Citespace to divide the co-citation network into several clusters of co-cited articles. The visualization of clusters of co-cited articles is displayed in Figure 9 .

Clusters of co-cited articles, 2013–2019

As we mentioned earlier in the “Data and Methodology” section, the colors of citation rings and links are corresponding to the different time slices. Therefore, the deeper purple cluster (Cluster #1) is relatively old, and the prominent clusters (Cluster #0 and #2) are more recent. Cluster #0 is the youngest and Cluster #1 is the oldest. Cluster labels are identified based on burst terms extracted from titles, abstracts, keywords of bibliographic records [ 26 , 41 ] . Table 10 demonstrates six predominant clusters by the number of members in each cluster.

Results show that the research priorities of the clusters keep changing during the observation period. From the earlier time (Cluster # 1), bitcoin and bitcoin network are the major priorities of researchers, then some researchers changed the focuses onto cryptocurrency in blockchain research. Notably, more researchers are most interested in blockchain technology and public ledger recently.

According to the characteristics of pivot nodes and landmark nodes in the co-citation article network. The landmark and pivot nodes in co-citation articles are shown in Figure 10 , Five pivot nodes are Nakamoto S [ 1 ] , Wood G [ 44 ] , Kosba A [ 51 ] , Eyal I [ 12 ] and Maurer B [ 55 ] . The main landmark nodes are Christidis K [ 45 ] . Swan M [ 2 ] , Zyskind G [ 48 ] Nakamoto S [ 1 ] , Kosba A [ 51 ] , Notably, some nodes can be landmark and pivot at the same time.

Landmark and pivot nodes, 2013–2019

Summary of the largest 6 blockchain clusters

Details of the largest cluster (Cluster #0, top10)

Details of the largest cluster (Cluster #1, top10)

Details of the largest cluster (Cluster #2, top10)

As seen from Table 10 , Cluster #0 is the largest cluster, containing 36 nodes, for the sake of obtaining more information about these clusters, we explored the details of the largest clusters. Table 11 illustrates the details of the Cluster 0#.

We also explored Cluster #1 and #2 in more detail. Table 12 and Table 13 present the details of Cluster #1 and Cluster #2 respectively, it is notable that the most active citation in Cluster #1 is “bitcoin: A peer-to-peer electronic cash system”, and the most active citation in Cluster #2 is “bitcoin: Economics, technology, and governance”. The core members of Cluster #1 and Cluster #2 deliver milestones of blockchain research related to the bitcoin system and cryptocurrency.

Table 14 lists the first 10 most cited blockchain research articles indexed by the Web of Science. These articles are ranked according to the total number of citations during the observation period. Among these articles, the publication of “blockchains and smart contracts for the internet of things” by Christidis is identified as the most cited paper of 266 citations. The paper also has the highest average number of citations per year.

The top 10 cited blockchain articles

4.8 Keywords Co-Citation Analysis

According to Callon, et al. [ 77 ] co-word analysis is a useful way of examining the evolution of science. In our study, among 2,451 articles related to blockchain, we obtained 4,834 keywords, 594 keywords appeared 3 times, 315 keywords appeared 5 times, and 130 keywords appeared 10 times. Table 15 presents the most important keywords according to frequency. As seen, ‘blockchain’ ranks first with an occurrence frequency of 1,105, followed by ‘bitcoin’ of 606. The other high occurrence frequency keywords include: ‘cryptocurrency’, ‘smart contract’, and ‘iot’ (internet of thing).

The top 25 keywords ranked by frequency

For the sake of further exploration of the relation amongst the major keywords in blockchain research papers, we adopted the top 315 keywords with a frequency no less than 5 times for co-occurrence network analysis. The keywords co-occurrence network is illustrated in Figure 11 . In a co-occurrence network, the size of the node represents the frequency of the keywords co-occurrence with other keywords. The higher the co-occurrence frequency of the two keywords, the closer the relationship between them.

The keywords co-occurrence network, 2013–2019

We can see from Figure 11 , the size of blockchain and bitcoin are the largest among all keywords. This means, in general, blockchain and bitcoin have more chances to co-occurrence with other keywords. Besides, blockchain is closer with a smart contract, iot, Ethereum, security, internet, and privacy, whereas bitcoin is closer with digital currency and cryptocurrency.

Figure 12 displays the time-zone view of co-cited keywords, which puts nodes in order from left to right according to their years being published. The left-sided nodes were published in the last five years, and on the right-hand side, they were published in recent two years. Correspondingly, some pivot nodes of keywords are listed in the boxes. We hope to show the evolution of blockchain in general and the changes of focuses in blockchain study.

The time-zone view of co-cited keywords, 2013–2019

The results suggest that, in 2013, when blockchain research begins to surface, bitcoin dominated the blockchain research field. Reasonably, the bitcoin is the first cryptocurrency based on blockchain technology, and the influential essays include quantitative analysis of the full bitcoin transaction graph [ 54 ] ; a fistful of bitcoins: Characterizing payments among men with no

names [ 50 ] ; and bitcoin meets google trends and Wikipedia: Quantifying the relationship between phenomena of the internet era [ 69 ] . Afterward, as various altcoins appeared, cryptocurrency and digital currency are widely discussed in blockchain-related research. The high-citation article is Zerocash: Decentralized anonymous payments from bitcoin [ 74 ] and privacy, which is the prominent characteristic of cryptocurrency. In 2015, blockchain and smart contract become a hotspot, the core publications include blockchain: A blueprint for a new economy [ 2 ] ; decentralizing privacy: Using blockchain to protect personal data [ 48 ] ; at the same time, some researchers also focus on the volatility and mining of cryptocurrency. In 2016, a growing number of researchers focus on the internet of things. The most popular article is blockchains and smart contracts for the internet of things [ 45 ] . In 2017, distributed ledger and blockchain technology become a research focus point. From 2018 onward, research focus on the challenge, and the inefficiency of blockchain appear.

4.9 Funding Agencies of Blockchain-Related Research

Based on all 2451 funding sources we analyzed in this study, the National Natural Science Foundation of China (NSFC) has supported the biggest number of publications with 231 papers, followed by the National Key Research and Development Program of China, which supported the publication of 88 papers. Comparatively, the National Science Foundation of the USA has only supported 46 papers. It is remarkable that the “Ministry of Science and Technology Taiwan” supported 22 papers, which is more than the European Union. Table 16 illustrates the top 20 funding agencies for blockchain research ranked by the number of supported papers. The results indicate that China is one of the major investing countries in Blockchain research with the biggest number of supporting articles.

The top 20 funding agencies of blockchain-related research

5 Conclusions and Implications

5.1 conclusions.

This research comprehensively investigates blockchain-related publications based on the Web of Science Core Collection and provides a quick overview of blockchain research. In this study, a coherent comprehensive bibliometric evaluation framework is adopted to investigate the hot and promising blockchain domain. We outline the core development landscape of blockchain, including the distribution of publications over time, by authors, journals, categories, institutions, countries (territories), intellectual structure, and research trends in the blockchain academic community. Combining the results of statistical analysis and co-cited articles, authors, and keywords, we formulate the answers to the following research questions:

RQ1 What is the distribution pattern of blockchain publications and citations over recent years?

The published blockchain papers significantly increased since 2013, when the first blockchain paper was published. An increasing number of articles were published since. In 2018, 1,148 articles were published at the peak, and the number of publications is likely to continuously grow. As for the cumulative number of citations, there were only 272 citations in 2013. By 2018 this number has grown to more than 10,000, which implies a widespread influence and attention attracted by blockchain study in recent years.

RQ2 Which are the main international contributing countries (regions) and institutions in blockchain research, as well as collaboration networks among them?

A total of 97 countries (regions) participated in blockchain research during the observation period. USA and China play the leading roles among all countries (regions), with publications of 532 (20.94%) and 489 (19.24%) articles respectively, followed by the UK, Germany, Italy, and Australia. From the aspect of citations, USA-authored papers were cited by 1,810 papers with 3,709 (36.57%) citations, accounting for 36.57% of total citations. Articles from the USA also have a very high average number of citations per paper with a frequency of 6.97. Although the number of articles from China is close to the USA, the average number of citations per paper is lower with a frequency of 2.78. The results indicate that the USA is the most influential country in the field of blockchain.

A total of 2,190 institutions participated in blockchain-related research. Among them, the Chinese Academy of Sciences has the highest number of publications with 43 papers, followed by the University of London, Beijing University of Posts Telecommunications, University of California System, Commonwealth Scientific Industrial Research Organization (CSIRO), Beihang University, University of Texas System, ETH Zurich. In respect of the number of total Times Cited and the average number of Times Cited, Cornell University is cited the most with 499 citations, and the average number of Times Cited is 20.79. followed by the Massachusetts Institute of Technology, University of California System, and ETH Zurich. The number of publications forms institutions in China is large, whereas few papers own high average Times Cited.

In terms of collaboration networks among different institutions, we found that the Chinese Academy of Sciences, Cornell University, Commonwealth Scientific Industrial Research Organization (CSIRO), University of Sydney, and ETH Zurich cooperated widely with other institutions.

RQ3 What are the characteristics of the authorship distribution?

The total number of authors who contribute to the publications of blockchain is 5,862. the average number of authors per paper is 2.4. Among 5,862 authors, 4,808 authors have only one paper, 662 authors have two papers, and 213 authors have three papers. Based on the number of participated papers, the most productive author in the field of blockchain is Choo, Kim-Kwang Raymond from Univ Texas San Antonio, who participated in 14 articles in the field of blockchain, followed by Marchesi M, Bouri E, David R, Miller A, Shetty S and Xu X.

RQ4 What are the core blockchain subjects and journals based on the number of publications?

Blockchain-related researches are more abundant in the field of Computer Science compared with other categories. Other major fields include Engineering, Business & Economics, Telecommunications, and Business & Economics.

RQ5 What are the major journals or conferences for blockchain-related research?

The research of blockchain is published in 1,206 journals (conferences), the major blockchain research journals include Lecture Notes In Computer Science, IEEE Access, Economics Letters, Future Generation Computer Systems, and Finance Research Letters. Meanwhile, the major blockchain research conferences include IEEE International Conference on Hot Information-Centric Networking, International Conference on Parallel and Distributed Systems Proceedings, International Conference on New Technologies Mobility and Security, and Financial Cryptography and Data Security.

RQ6 What are the most influential papers in blockchain research based on the number of citations?

Ranked by the total number of citations during the observation period, the publication: “blockchains and smart contracts for the internet of things” by Christidis and Devetsikiotis [ 45 ] is identified as the most cited paper with 266 citations, which also has a highest average number of citation per year, followed by decentralizing privacy: Using blockchain to protect personal data [ 48 ] with 169 citations and 33.80 average number of citations per year.

According to the number of times co-cited, the top five influential publications are as follows: Bitcoin: A peer-to-peer electronic cash system [ 1 ] , A next-generation smart contract and decentralized application platform [ 42 ] , Majority is not enough: Bitcoin mining is vulnerable [ 12 ] , Ethereum: A secure decentralised generalised transaction ledger [ 44 ] , Blockchain: Blueprint for a new economy [ 2 ] .

RQ7 Who are the most influential authors in blockchain research according to the author co-citation network?

Some authors played a crucial role during the development of blockchain research, Nakamoto S, as the creator of Bitcoin, and the author of the bitcoin white paper, created and deployed bitcoin’s original reference, therefore is not surprised at the top of the co-citation count ranking and got 1,202 citations in our dataset. Buterin V, a Russian-Canadian, programmer, and writer, primarily known as a co-founder of Ethereum and as a co-founder of Bitcoin Magazine who follows Nakamoto S and receives 257 citations. Other core authors with high citations include Eyal I, Wood G, Swan M, Christidis K, Bonneau J, Szabo N, Zyskind G, Castro M, and Meiklejohn S.

According to co-cited articles clusters, the research priorities in blockchain-related research keep changing during the observation period. Bitcoin and bitcoin network are the main priorities of researchers, then some researchers changed to focus on cryptocurrency in blockchain research.

RQ8 What are the research trends of blockchain?

The research priorities in blockchain-related research evolve during the observation period. As early as 2013, when the research on blockchain first appears, bitcoin dominated the blockchain research field. Then only one year later, as various altcoins begin to appear, cryptocurrency and digital currency are widely discussed in blockchain-related research. In 2015, blockchain and smart contracts become a hotspot till 2016 when a growing body of researches begin to focus on the internet of things. In 2017, distributed ledger and blockchain technology become the research focal point. From 2018 onward, research focus on the challenge and inefficiency of blockchain.

RQ9 What are the most supportive funding agencies of blockchain research?

The most supportive funding agency of blockchain research is the National Natural Science Foundation of China (NSFC) which has supported the publication of 231 papers. The results indicate that China is one of the major investing countries in Blockchain research with the biggest number of supporting articles.

Given the potential power of blockchain, it is noticeable that governments, enterprises, and researchers all pay increasing attention to this field. The application of blockchain in various industries, the supervision of cryptocurrencies, the newly rising central bank digital currency and Libra, are becoming the central issues of the whole society.

In our research, we conducted a comprehensive exploration of blockchain-related research via a bibliometrics analysis, our results provide guidance and implications for academic research and practices. First, the findings present a holistic view of research in the blockchain domain which benefits researchers and practitioners wanting to quickly obtain a visualized overview of blockchain research. Second, according to our findings of the evolution and trends in blockchain research, researchers could better understand the development and status of blockchain, which is helpful in choosing valuable research topics, the distributed ledger, the discussions on the inefficiency and challenges of blockchain technology, the supervision of cryptocurrencies, the central bank digital currency are emerging research topics, which deserve more attention from the academic community.

5.2 Limitations and Future Work

As with any research, the design employed incorporates limitations that open avenues for future research. First, this study is based on 2,451 articles retrieved from the Web of Science of Core Collection, although the Web of Science of Core Collection is truly a powerful database for bibliometric analysis, we can’t ignore the limitation brought by a unique data source. Future research can deal with this limitation by merging the publications from other sources, for instance, Scopus, CNKI, as well as patent database and investment data of blockchain, and it could help to validate the conclusion. Second, we mainly adopt the frequency indicator to outline the state-of-the art of blockchain research, although the frequency is most commonly used in the bibliometric analysis, and we also used H-index, citation to improve our analysis, some other valuable indicators are ignored, such as sigma and between centrality, therefore, it’s beneficial to combine those indicators in future research. Besides, it should be noted that, in co-citation analysis, a paper should be published for a certain period before it is cited by enough authors [ 26 ] , the newest published papers may not include in co-citation analysis, it’s also an intrinsic drawback of bibliometric methods.

Supported by the National Natural Science Foundation of China (71872171), and the Open Project of Key

Laboratory of Big Data Mining and Knowledge Management, Chinese Academy of Sciences

[1] Nakamoto S. Bitcoin: A peer-to-peer electronic cash system. https://bitcoin.org/bitcoin.eps 2008. Search in Google Scholar

[2] Swan M. Blockchain: Blueprint for a new economy. O’Reilly, 2015. Search in Google Scholar

[3] Weber I, Xu X, Riveret R, et al. Untrusted business process monitoring and execution using blockchain. Business Process Management, 2016: 329–347. 10.1007/978-3-319-45348-4_19 Search in Google Scholar

[4] Mettler M. Blockchain technology in healthcare: The revolution starts here. International Conference on E-health Networking, Applications and Services, 2016: 1–3. 10.1109/HealthCom.2016.7749510 Search in Google Scholar

[5] Paech P. The governance of blockchain financial networks. Modern Law Review, 2016, 80(6): 1073–1110. 10.1111/1468-2230.12303 Search in Google Scholar

[6] Yue X, Wang H, Jin D, et al. Healthcare data gateways: Found healthcare intelligence on blockchain with novel privacy risk control. Journal of Medical Systems, 2016, 40(10): 1–8. 10.1007/s10916-016-0574-6 Search in Google Scholar PubMed

[7] Maupin J. Mapping the global legal landscape of blockchain and other distributed ledger technologies. https://ssrn.com/abstract=2930077 2017. 10.2139/ssrn.2930077 Search in Google Scholar

[8] Sachin K, Angappa G, Himanshu A. Understanding the blockchain technology adoption in supply chains. International Journal of Production Research, 2018: 1–25. Search in Google Scholar

[9] Tasca P, Tessone C J. A taxonomy of blockchain technologies: Principles of identification and classification. Ledger, 2019, 4: 140. 10.5195/ledger.2019.140 Search in Google Scholar

[10] Catalini C, Gans J S. Some simple economics of the blockchain. Communications of the ACM, 2016, 63(7): 80–90. 10.3386/w22952 Search in Google Scholar

[11] Csoka P, Herings P J. Decentralized clearing in financial networks. Management Science, 2017, 64(5): 4681–4699. 10.1287/mnsc.2017.2847 Search in Google Scholar

[12] Eyal I. Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer, 2017, 50(9): 38–49. 10.1109/MC.2017.3571042 Search in Google Scholar

[13] Huckle S, Bhattacharya R, White M, et al. Internet of things, blockchain and shared economy applications. Procedia Computer Science, 2016: 461–466. 10.1016/j.procs.2016.09.074 Search in Google Scholar

[14] Bahga A, Madisetti V K. Blockchain platform for industrial internet of things. Journal of Software Engineering and Applications, 2016, 9(10): 533–546. 10.4236/jsea.2016.910036 Search in Google Scholar

[15] Dorri A, Kanhere S S, Jurdak R. Towards an optimized blockchain for IoT. IEEE/ACM Second International Conference on Internet-of-Things Design and Implementation (IoTDI), 2017: 173–178. 10.1145/3054977.3055003 Search in Google Scholar

[16] Aitzhan N Z, Svetinovic D. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Transactions on Dependable and Secure Computing, 2018, 15(5): 840–852. 10.1109/TDSC.2016.2616861 Search in Google Scholar

[17] Mengelkamp E, Notheisen B, Beer C, et al. A blockchain-based smart grid: Towards sustainable local energy markets. Computer Science — Research and Development, 2018: 207–214. 10.1007/s00450-017-0360-9 Search in Google Scholar

[18] Korpela K, Hallikas J, Dahlberg T. Digital supply chain transformation toward blockchain integration. Hawaii International Conference on System Sciences, 2017: 1–10. 10.24251/HICSS.2017.506 Search in Google Scholar

[19] Toyoda K, Mathiopoulos P T, Sasase I, et al. A novel blockchain-based product ownership management system (POMS) for anti-counterfeits in the post supply chain. IEEE Access, 2017: 17465–17477. 10.1109/ACCESS.2017.2720760 Search in Google Scholar

[20] Yuan Y, Wang F Y. Blockchain: The state of the art and future trends. Acta Automatica Sinica, 2016, 42(4): 481–494. Search in Google Scholar

[21] Yli-Huumo J, Ko D, Choi S, et al. Where is current research on blockchain technology? — A systematic review. PLoS One, 2016, 11(10): e0163477. 10.1371/journal.pone.0163477 Search in Google Scholar PubMed PubMed Central

[22] Zeng S, Ni X. A bibliometric analysis of blockchain research. IEEE Intelligent Vehicles Symposium, 2018: 102–107. 10.1109/IVS.2018.8500606 Search in Google Scholar

[23] Miau S, Yang J. Bibliometrics-based evaluation of the blockchain research trend: 2008–2017. Technology Analysis & Strategic Management, 2018, 30(9): 1029–1045. 10.1080/09537325.2018.1434138 Search in Google Scholar

[24] Hawlitschek F, Notheisen B, Teubner T. The limits of trust-free systems: A literature review on blockchain technology and trust in the sharing economy. Electronic Commerce Research and Applications, 2018: 50–63. 10.1016/j.elerap.2018.03.005 Search in Google Scholar

[25] Bonilla C A, Merigo J M, Torres-Abad C. Economics in Latin America: A bibliometric analysis. Scientometrics, 2015, 105(2): 1239–1252. 10.1007/s11192-015-1747-7 Search in Google Scholar

[26] Li X, Qiao H, Wang S. Exploring evolution and emerging trends in business model study: A co-citation analysis. Scientometrics, 2017, 111(2): 869–887. 10.1007/s11192-017-2266-5 Search in Google Scholar

[27] GaviriamarinM,Merigo JM, Popa S. Twenty years of the journal of knowledge management: A bibliometric analysis. Journal of Knowledge Management, 2018, 22(8): 1655–1687. 10.1108/JKM-10-2017-0497 Search in Google Scholar

[28] Faming W, Meijuan Z. Bibliometric analysis on the research hotspots of blockchain in China. Journal of Intelligence, 2017, 36(12): 69–74. Search in Google Scholar

[29] Mu-Nan L. Analyzing intellectual structure of related topics to blockchain and bitcoin: From co-citation clustering and bibliographic coupling perspectives. Acta Automatica Sinica, 2017, 43(9): 1501–1519. Search in Google Scholar

[30] Dabbagh M, Sookhak M, Safa N S. The evolution of blockchain: A bibliometric study. IEEE Access, 2019: 19212–19221. 10.1109/ACCESS.2019.2895646 Search in Google Scholar

[31] Chen C, Ibekwesanjuan F, Hou J. The structure and dynamics of co citation clusters: A multiple perspective co-citation analysis. Journal of the Association for Information Science and Technology, 2010, 61(7): 1386–1409. Search in Google Scholar

[32] Chen C. Visualizing scientific paradigms: An introduction. Journal of the Association for Information Science and Technology, 2003, 54(5): 392–393. 10.1002/asi.10224 Search in Google Scholar

[33] Chen C. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. Journal of the Association for Information Science and Technology, 2006, 57(3): 359–377. 10.1002/asi.20317 Search in Google Scholar

[34] Chen C, Morris S A. Visualizing evolving networks: Minimum spanning trees versus pathfinder networks. IEEE Symposium on Information Visualization, 2003: 67–74. Search in Google Scholar

[35] Guan J, Ma N. China’s emerging presence in nanoscience and nanotechnology: A comparative bibliometric study of several nanoscience giants. Research Policy, 2007, 36(6): 880–886. 10.1016/j.respol.2007.02.004 Search in Google Scholar

[36] Wagner C S, Leydesdorff L. Network structure, self-organization, and the growth of international collaboration in science. Research Policy, 2005, 34(10): 1608–1618. 10.1016/j.respol.2005.08.002 Search in Google Scholar

[37] He Z, Geng X, Campbellhunt C. Research collaboration and research output: A longitudinal study of 65 biomedical scientists in a New Zealand University. Research Policy, 2009, 38(2): 306–317. 10.1016/j.respol.2008.11.011 Search in Google Scholar

[38] White H D, Griffith B C. Author cocitation: A literature measure of intellectual structure. Journal of the American Society for Information Science, 1981, 32(3): 163–171. 10.1002/asi.4630320302 Search in Google Scholar

[39] Chen C. Searching for intellectual turning points: Progressive knowledge domain visualization. Proceedings of the National Academy of Sciences of the United States of America, 2004: 5303–5310. 10.1073/pnas.0307513100 Search in Google Scholar PubMed PubMed Central

[40] Borner K, Chen C, Boyack K W. Visualizing knowledge domains. The Artist and Journal of Home Culture, 2005, 37(1): 179–255. 10.1002/aris.1440370106 Search in Google Scholar

[41] Chen C. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. Journal of the Association for Information Science and Technology, 2006, 57(3): 359–377. 10.1002/asi.20317 Search in Google Scholar

[42] Buterin V. A next-generation smart contract and decentralized application platform. https://ethereum.org/en/whitepaper/ 2014. Search in Google Scholar

[43] Eyal I, Sirer E G. Majority is not enough: Bitcoin mining is vulnerable. International Conference on Financial Cryptography and Data Security, 2014: 436–454. 10.1145/3212998 Search in Google Scholar

[44] Wood G. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Project Yellow Paper, 2014, 151: 1–32. Search in Google Scholar

[45] Christidis K, Devetsikiotis M. Blockchains and smart contracts for the internet of things. IEEE Access, 2016: 2292–2303. 10.1109/ACCESS.2016.2566339 Search in Google Scholar

[46] Bonneau J, Miller A, Clark J, et al. Sok: Research perspectives and challenges for bitcoin and cryptocurrencies. IEEE Symposium on Security and Privacy, 2015: 104–121. 10.1109/SP.2015.14 Search in Google Scholar

[47] Szabo N. Formalizing and securing relationships on public networks. First Monday, 1997. 10.5210/fm.v2i9.548 Search in Google Scholar

[48] Zyskind G, Nathan O, Pentland A. Decentralizing privacy: Using blockchain to protect personal data. IEEE Security and Privacy Workshops, 2015: 180–184. 10.1109/SPW.2015.27 Search in Google Scholar

[49] Castro M, Liskov B. Practical byzantine fault tolerance and proactive recovery. ACM Transactions on Computer Systems (TOCS), 2002, 20(4): 398–461. 10.1145/571637.571640 Search in Google Scholar

[50] Meiklejohn S, Pomarole M, Jordan G, et al. A fistful of bitcoins: Characterizing payments among men with no names. Internet Measurement Conference, 2013: 127–140. 10.1145/2504730.2504747 Search in Google Scholar

[51] Kosba A, Miller A, Shi E, et al. Hawk: The blockchain model of cryptography and privacy-preserving smart contracts. IEEE Symposium on Security and Privacy, 2016: 839–858. 10.1109/SP.2016.55 Search in Google Scholar

[52] Reid F, Harrigan M. An analysis of anonymity in the bitcoin system. Security and Privacy in Social Networks, 2013: 197–223. 10.1109/PASSAT/SocialCom.2011.79 Search in Google Scholar

[53] Luu L, Narayanan V, Zheng C, et al. A secure sharding protocol for open blockchains. ACM SIGSAC Conference on Computer and Communications Security, 2016: 17–30. 10.1145/2976749.2978389 Search in Google Scholar

[54] Ron D, Shamir A. Quantitative analysis of the full bitcoin transaction graph. International Conference on Financial Cryptography and Data Security, 2013: 6–24. 10.1007/978-3-642-39884-1_2 Search in Google Scholar

[55] Maurer B, Nelms T C, Swartz L. When perhaps the real problem is money itself? The practical materiality of bitcoin. Social Semiotics, 2013, 23(2): 261–277. 10.1080/10350330.2013.777594 Search in Google Scholar

[56] Tschorsch F, Scheuermann B. Bitcoin and beyond: A technical survey on decentralized digital currencies. IEEE Communications Surveys & Tutorials, 2016, 18(3): 2084–2123. 10.1109/COMST.2016.2535718 Search in Google Scholar

[57] Radziwill N. Blockchain revolution: How the technology behind bitcoin is changing money, business, and the world. The Quality Management Journal, 2018, 25(1): 64–65. 10.1080/10686967.2018.1404373 Search in Google Scholar

[58] Azaria A, Ekblaw A, Vieira T, et al. Medrec: Using blockchain for medical data access and permission management. International Conference on Open and Big Data (OBD), 2016: 25–30. 10.1109/OBD.2016.11 Search in Google Scholar

[59] Narayanan A, Bonneau J, Felten E, et al. Bitcoin and cryptocurrency technologies: A comprehensive introduction. Princeton University Press, 2016. Search in Google Scholar

[60] Miers I, Garman C, Green M, et al. Zerocoin: Anonymous distributed e-cash from bitcoin. IEEE Symposium on Security and Privacy, 2013: 397–411. 10.1109/SP.2013.34 Search in Google Scholar

[61] Ober M, Katzenbeisser S, Hamacher K. Structure and anonymity of the bitcoin transaction graph. Future Internet, 2013, 5(2): 237–250. 10.3390/fi5020237 Search in Google Scholar

[62] Moore T, Christin N. Beware the middleman: Empirical analysis of bitcoin-exchange risk. International Conference on Financial Cryptography and Data Security, 2013: 25–33. 10.1007/978-3-642-39884-1_3 Search in Google Scholar

[63] Androulaki E, Karame G O, Roeschlin M, et al. Evaluating user privacy in bitcoin. International Conference on Financial Cryptography and Data Security, 2013: 34–51. 10.1007/978-3-642-39884-1_4 Search in Google Scholar

[64] Barber S, Boyen X, Shi E, et al. Bitter to better — How to make bitcoin a better currency. International International Conference on Financial Cryptography and Data Security, 2012: 399–414. 10.1007/978-3-642-32946-3_29 Search in Google Scholar

[65] Böhme R, Christin N, Edelman B, et al. Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 2015, 29(2): 213–238. 10.1257/jep.29.2.213 Search in Google Scholar

[66] Cheah E T, Fry J. Speculative bubbles in bitcoin markets? An empirical investigation into the fundamental value of bitcoin. Economics Letters, 2015, 130: 32–36. 10.1016/j.econlet.2015.02.029 Search in Google Scholar

[67] Urquhart A. The inefficiency of bitcoin. Economics Letters, 2016, 148: 80–82. 10.1016/j.econlet.2016.09.019 Search in Google Scholar

[68] Dyhrberg A H. Bitcoin, gold and the dollar — A GARCH volatility analysis. Finance Research Letters, 2016, 16: 85–92. 10.1016/j.frl.2015.10.008 Search in Google Scholar

[69] Ciaian P, Rajcaniova M, Kancs D A. The economics of bitcoin price formation. Applied Economics, 2016, 48(19): 1799–1815. 10.1080/00036846.2015.1109038 Search in Google Scholar

[70] Kristoufek L. BitCoin Meets Google Trends and Wikipedia: Quantifying the relationship between phenomena of the internet era. Scientific Reports, 2013, 3(1): 3415–3415. 10.1038/srep03415 Search in Google Scholar PubMed PubMed Central

[71] Dwyer G P. The economics of bitcoin and similar private digital currencies. Journal of Financial Stability, 2015, 17: 81–91. 10.1016/j.jfs.2014.11.006 Search in Google Scholar

[72] Nadarajah S, Chu J. On the inefficiency of bitcoin. Economics Letters, 2017, 150: 6–9. 10.1016/j.econlet.2016.10.033 Search in Google Scholar

[73] Katsiampa P. Volatility estimation for bitcoin: A comparison of GARCH models. Economics Letters, 2017, 158: 3–6. 10.1016/j.econlet.2017.06.023 Search in Google Scholar

[74] Bouri E, Gupta R, Tiwari A K, et al. Does bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters, 2017, 23: 87–95. 10.1016/j.frl.2017.02.009 Search in Google Scholar

[75] Sasson E B, Chiesa A, Garman C, et al. Zerocash: Decentralized anonymous payments from bitcoin. IEEE Symposium on Security and Privacy, 2014: 459–474. 10.1109/SP.2014.36 Search in Google Scholar

[76] Garay J, Kiayias A, Leonardos N. The bitcoin backbone protocol: Analysis and applications. International Conference on the Theory and Applications of Cryptographic Techniques, 2015: 281–310. 10.1007/978-3-662-46803-6_10 Search in Google Scholar

[77] Callon M, Courtial J P, Laville F. Co-word analysis as a tool for describing the network of interactions between basic and technological research: The case of polymer chemistry. Scientometrics, 1991, 22(1): 155–205. 10.1007/BF02019280 Search in Google Scholar

© 2021 Walter de Gruyter GmbH, Berlin/Boston

This work is licensed under the Creative Commons Attribution 4.0 International License.

- X / Twitter

Supplementary Materials

Please login or register with De Gruyter to order this product.

Journal and Issue

Articles in the same issue.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Data Descriptor

- Open access

- Published: 07 April 2022

Deciphering Bitcoin Blockchain Data by Cohort Analysis

- Yulin Liu 1 , 4 na1 ,

- Luyao Zhang ORCID: orcid.org/0000-0002-1183-2254 1 , 2 na1 &

- Yinhong Zhao 1 , 3 na1

Scientific Data volume 9 , Article number: 136 ( 2022 ) Cite this article

7893 Accesses

9 Citations

18 Altmetric

Metrics details

- Interdisciplinary studies

- Research data

Bitcoin is a peer-to-peer electronic payment system that has rapidly grown in popularity in recent years. Usually, the complete history of Bitcoin blockchain data must be queried to acquire variables with economic meaning. This task has recently become increasingly difficult, as there are over 1.6 billion historical transactions on the Bitcoin blockchain. It is thus important to query Bitcoin transaction data in a way that is more efficient and provides economic insights. We apply cohort analysis that interprets Bitcoin blockchain data using methods developed for population data in the social sciences. Specifically, we query and process the Bitcoin transaction input and output data within each daily cohort. This enables us to create datasets and visualizations for some key Bitcoin transaction indicators, including the daily lifespan distributions of spent transaction output (STXO) and the daily age distributions of the cumulative unspent transaction output (UTXO). We provide a computationally feasible approach for characterizing Bitcoin transactions that paves the way for future economic studies of Bitcoin.

Similar content being viewed by others

Modeling innovation in the cryptocurrency ecosystem

Giordano De Marzo, Francesco Pandolfelli & Vito D. P. Servedio

Blockchain vehicles for efficient Medical Record management

Anuraag A. Vazirani, Odhran O’Donoghue, … Edward Meinert

Statistical detection of selfish mining in proof-of-work blockchain systems

Sheng-Nan Li, Carlo Campajola & Claudio J. Tessone

Background & Summary

Bitcoin is a peer-to-peer electronic payment system that has rapidly grown in popularity in recent years 1 , 2 , 3 , 4 . As a distributed ledger technology (DLT), Bitcoin records newly generated transactions in a decentralized way, eliminating the need for intermediaries like banks and reducing transaction costs 5 , 6 , 7 .

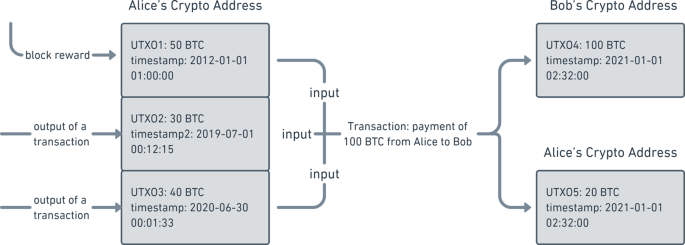

Bitcoin relies on recording the unspent transaction outputs (UTXO) to efficiently verify newly generated transactions 8 , 9 , 10 , 11 . An illustrative example of UTXO is shown in Fig. 1 . A UTXO can be generated either as block rewards or outputs of transactions. Block rewards are newly minted bitcoins (BTC) distributed to miners for their work to maintain the network, such as routing transactions and validating blocks. In fact, all UTXOs can be dated back to block rewards. The timestamp is recorded when a UTXO is generated. A UTXO is spent and converted into a spent transaction output (STXO) when it is used as the input of a transaction. A timestamp is again recorded when the UTXO is spent, and each UTXO can be spent only once. Such a unique feature allows us to calculate the age of each UTXO and the lifespan of each STXO as we do in population data. Take Fig. 1 as an example. As of July 1, 2020, UTXOs 1–3 are 8.5-years, 1-year, and 1-day old, respectively. Immediately after Alice’s payment to Bob on January 1, 2021, UTXOs 1–3 are converted to STXOs with ages of 9 years, 1.5 years, and 0.5 years and 1-day old, respectively.

An example of UTXO birth and death. UTXOs 1, 2, and 3 were spent in a transaction taking place between Alice and Bob and were transformed to UTXOs 4 and 5. UTXOs 1, 2, and 3 became STXOs after the transaction.

Noticing the unique structure of the Bitcoin blockchain data, we apply cohort analysis 12 , 13 , 14 , 15 , 16 , originally developed for population data, to analyze it. To continue the analogy with the population data, we say a UTXO is born when it is generated as block rewards or the output of a transaction, and we say a UTXO is dead when it is spent as the input of another transaction. In this way, all UTXOs generated on the same day form a daily birth cohort, and all UTXOs spent on the same day form a daily death cohort. We define the age of a UTXO as the difference between “now” (the date on which we are working) and the time when it was born. We define the lifespan of an STXO as the difference between the time when the STXO was dead and the time when it was born. Thus, all UTXOs within an age range form an age cohort, and all STXOs within a lifespan range form a lifespan cohort. With this framework, we naturally replicate in Bitcoin blockchain data a trinity of birth, death, and age cohorts using population cohort analysis.

Usually, we need to query the complete history of Bitcoin blockchain data to acquire variables with economic meaning. With over 1.6 billion historical transactions on the Bitcoin blockchain, it has become increasingly difficult and computationally intensive now to download the complete Bitcoin blockchain records. It is thus important to query Bitcoin transaction data in a way that is more efficient and provides economic insights 17 . Cohort analysis provides a new perspective from which we can analyze data within each cohort separately before integrating them into a time series.

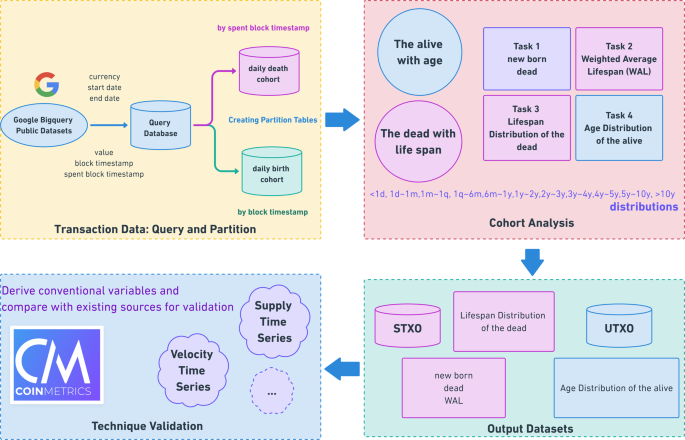

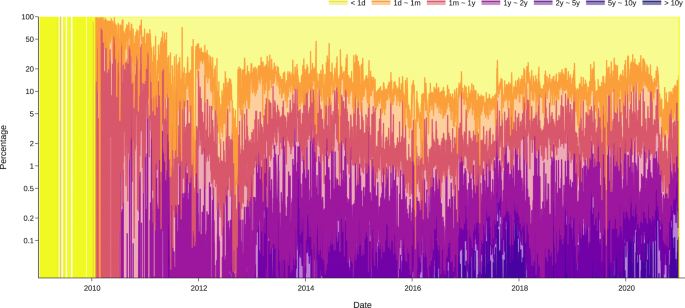

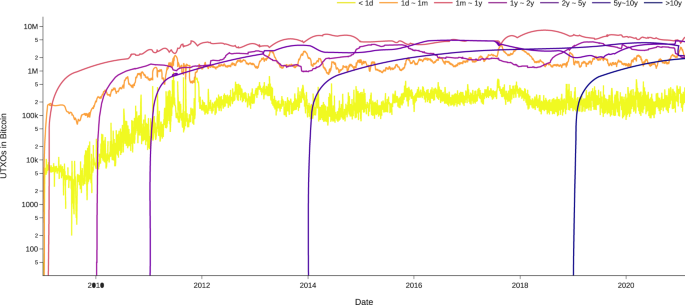

Our workflow is displayed in Fig. 2 . We query and process Bitcoin transaction input and output data within each daily cohort. By doing so, we successfully create datasets and visualizations for some key Bitcoin transactions indicators, including the daily lifespan distributions of STXOs as percentages (Fig. 3 ) and the cumulative daily age distributions of UTXOs (Fig. 4 ). These visualizations can be used to study the functions of bitcoin (BTC) as a currency. The three functions of a currency include acting as a store of value, unit of account, and medium of exchange. For example, Fig. 4 shows the number of BTCs in UTXOs (i.e., BTCs that have not been spent) by age distribution. By the end of 2020, approximately 2 million BTCs had not been transacted for more than 10 years. In the past 5–10 years, 2–5 years, and 1–2 years, approximately 2 million, 4.5 million, and 3 million BTCs, respectively, remained inactive. This equals approximately 11.5 million BTCs not having been transacted for more than 1 year. These BTCs serve as a time deposit and act as a store of value. Moreover, approximately 5 million BTCs are alive for 1 month to 1 year. These BTCs are similar to a demand deposit. Frequently transacted BTCs are those with ages between 1 day and 1 month (2 million) and less than 1 day (0.2 million). These BTCs act as a medium of exchange.

Workflow of cohort analysis on BTC UTXO data.

Lifespan distribution of BTC STXOs. The figure shows the log percentage of spent transaction outputs with different lifespans in each day until Feb. 2021. For example, by Feb. 2021, the STXOs with lifespans of less than one day accounted for 80% of all STXOs, while those with lifespans between 1 day and 1 month accounted for another 15%.

Number of BTC UTXOs by age. The figure shows the total cumulative unspent transaction outputs by age. For example, by Feb. 2021, there were approximately 200k UTXOs less than 1 day old used as the medium of exchange and approximately 2 million UTXOs more than 10 years old lost or used as store of value.

Our final datasets include one dataset that characterizes STXOs and one that characterizes UTXOs, which are both smaller than 1 MB. Moreover, cohort analysis keeps data querying and processing to a minimum for future updates and enables automated updates. We thus provide a computationally feasible approach for characterizing BTC transactions, which paves the way for future economic studies of Bitcoin. Our methods can be generally applied to other cryptocurrencies that adopt UTXO protocols, including Litecoin, Dash, Zcash, Dogecoin, and Bitcoin Cash.

While the Bitcoin transaction output data are publicly available on its blockchain, we find the size of the raw data (approximately 1.3 TB) overwhelming to process, even with cloud computing platforms. To improve the efficiency of computation, we first retrieve the data relevant to the study to create a more manageable data table of only 45 GB. By partitioning this data table into daily birth and death cohorts, we can analyze the STXOs and UTXOs in each cohort separately to summarize the daily characteristics of transaction outputs and create visualizations based on the cohort summary. Our method can be adapted to the creation of future blocks — we only need to process the transaction output data from the latest cohort and append the summary to the current version.

Creating partitioned tables

Our primary workplace is Google Colaboratory (Colab), a Jupyter Notebook hosted environment from Google, and BigQuery, a data warehouse from Google Cloud Platform. We first query the columns of interest from the public dataset crypto-bitcoin on BigQuery 18 , which includes the input and output data of Bitcoin. We then join the data queried from input and output data to create a data table that includes the value of UTXO ( value ), the timestamp when the UTXO was created ( block_timestamp ), and the timestamp when the UTXO was spent as an input of another transaction ( spent_block_timestamp ) (this column is left null if the transaction output is unspent). As the UTXO in a transaction is counted in satoshi (1 satoshi = 10 −8 BTCs), the actual number of BTCs in a UTXO can be computed by # UTXO = value *10 −8 , where the value represents the number of BTCs in satoshi. We rely on this derived data table (1.6 billion rows, 45 GB) to conduct further analysis.

To save the cost of the query, we create two partitioned tables based on the derived data table, one by the date in block_timestamp and one by the date in spent_block_timestamp . This means that the data entries are partitioned either by the date when the UTXOs were created or by the date when the UTXOs were spent. In this way, the program queries only the entries with timestamps in a specific range, which saves a notable amount of computational power. This step can significantly improve query performance and reduce query cost 19 .

Querying and processing cohort data

The data structure of partitioned tables coincides with our need to process cohort data. The table partitioned by date in block_timestamp naturally divides the derived data into birth cohorts that include the segment of transaction outputs created on the same date, and the table partitioned by date in spent_block_timestamp divides the derived data into death cohorts that include the segment of transaction outputs spent on the same date.

We query and process each birth cohort and each death cohort with a loop program following the procedure described in Fig. 2 . For each specific date after 2009-01-03, when the first block of Bitcoin was created, the birth cohort data and the death cohort data of that date are queried and imported to Colab from BigQuery. As in Task 1, we compute the total number of BTCs in UTXOs created and spent on that date by summing the number of BTCs in UTXOs in the birth cohort data and the death cohort data respectively. Task 2 focuses on the weighted average lifespan (WAL) on the date, defined as the average lifespan (the difference between the time when the output was spent and the time when the output was created) weighted by the number of BTCs contained in the transaction outputs. WAL can be computed from the death cohort data by the formula:

where Lifespan = spent_block_timestamp-block_timestamp .

As in Task 3, we compute the distribution of lifespan with death cohort data on that date by first categorizing UTXOs based on lifespan and then summing the number of BTCs in UTXOs in each category. In Task 4, we apply a more complicated partitioning method to compute the age distribution for each specific date. The age of a UTXO is defined as age = working_date_block_timestamp , where working date means the date of interest for the data cohort being studied. Each UTXO that remains alive on a specific date must satisfy both conditions: a) its block_timestamp must be smaller than the end of the working date, which means that the UTXO was created sometime before or on the date, and b) its spent_block_timestamp must either be null, which means the UTXO was not spent before 2021-02-10, or be larger than the end of the working date, which means that the UTXO was spent sometime after the working date but before 2021-02-10. Thus, we cannot simply interpret this information as either birth or death cohort data. Instead, we must first query the data needed to compute the age distribution for a twelve-month or six-month period depending on the size of the data in each year and then split the queried data into daily cohorts in the Python program. We compute the age distribution of each daily cohort by categorizing the age of each UTXO and summing up the number of BTCs in UTXOs in each category.

Visualizing the time series

The result of our analysis is condensed into time-series data that include the number of BTCs in UTXOs created and spent, the weighted average lifespan, the lifespan distribution, and the age distribution on each date from 2009-01-03 to 2021-02-10. Many visualizations can potentially be generated from this informative time series. For example, BTC token velocity, which we define below as the number of BTCs spent in the last 30 days divided by the circulating supply of BTCs, can be computed by

Our method can be adapted to the creation of future blocks. The time-series data for the past dates are not subject to changes as new blocks are created. As time goes on, we need only query and process the latest data cohorts to extend the time series. We will update the visualizations according to the latest development of Bitcoin, and researchers may easily repeat our work in part or in whole based on their needs.

Data Records

The final data records are stored and published on the Harvard Dataverse 20 . The records consist of the UTXO and the STXO datasets in csv format. Data ranges from 2009-01-03 to 2021-02-10, and the data frequency is daily ( n = 4421). The timezone used in the data is UTC + 0. In addition to examining Bitcoin, we apply the same cohort analysis to five other cryptocurrencies and generate twelve datasets in total. Detailed information on these data files is presented in Appendix. We also provide supplementary figures in Appendix.

Technical Validation

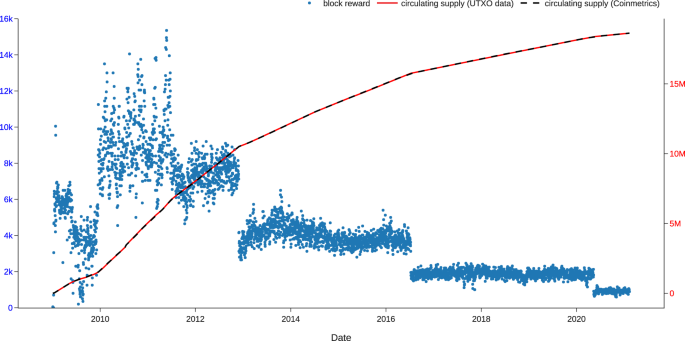

To further verify the validity of our methods, we use our data to calculate other variables, including block reward and circulating supply of BTCs, and check whether the results are consistent with descriptions in the Bitcoin white paper 1 and external data sources. We compute the circulating supply of BTC by computing the cumulative net new UTXOs with the formula

Figure 5 visualizes the block rewards and the circulating supply. Block rewards are the BTC awarded to the miner who wins the right to record a block of transactions by proof-of-work. Supply of the BTCs originates from the block rewards, so the cumulative sum of block rewards is the total number of BTCs in UTXOs, i.e., the circulating supply of BTC. The Bitcoin block reward was initially set at 50 BTCs per block in 2009, which means approximately 7,200 newly minted BTCs every 24 hours. The block reward halves every 210,000 blocks, roughly every four years, until the total BTC supply reaches 21 million 1 . As of the time of writing, the daily block reward amounts to approximately 900, and the circulating BTC supply is 18.9 million.